Financial Counselor Resume Examples

Jul 18, 2024

|

12 min read

Crafting a winning financial counselor resume: Count on these tips to make your qualifications shine and nab that dream job.

Rated by 348 people

Personal Finance Advisor

Investment Guidance Counselor

Corporate Financial Consultant

Education Funding Counselor

Mortgage Finance Advisor

Estate Planning Financial Consultant

Tax Optimization Financial Advisor

Business Loan Financial Counselor

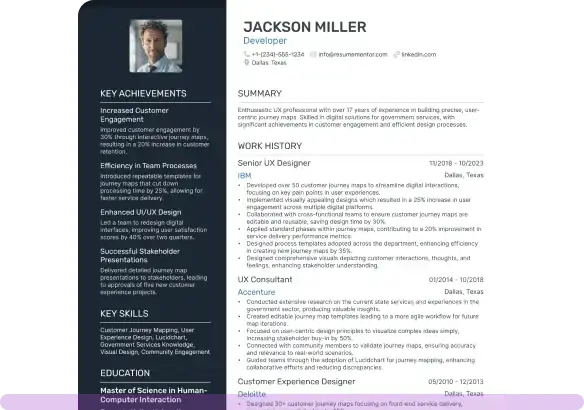

Personal Finance Advisor resume sample

- •Advised a portfolio of 150 clients on investment strategies, resulting in a 25% growth in client assets within a year.

- •Developed comprehensive financial plans that increased client satisfaction scores by 30% over 12 months.

- •Conducted quarterly financial reviews, which demonstrated an improvement of client financial literacy by 40%.

- •Collaborated with legal and tax professionals to create robust estate plans for high-net-worth clients, securing funds worth $50M.

- •Utilized financial planning software to optimize client asset allocation, improving investment returns by an average of 15%.

- •Proactively attended industry seminars to stay current on market trends, resulting in a 10% boost in product offerings.

- •Successfully managed investment portfolios totaling $200M, increasing overall client portfolio performance by 18%.

- •Led a team of four junior advisors, improving team client retention rates by 20% through enhanced relationship management.

- •Pioneered a client education program about financial literacy, leading to a 35% increase in client participation.

- •Facilitated bespoke retirement planning sessions that attracted 150 new clients, expanding the client base by 15%.

- •Implemented a comprehensive client communication strategy, decreasing missed client follow-ups by 50%.

- •Conducted thorough market research to support annual investment reviews, leading to a 12% increase in client recommendations.

- •Contributed to the development of a predictive analytics model that enhanced investment decision-making by 15%.

- •Participated in a cost-efficiency project, saving the company an estimated $250K annually in operational costs.

- •Streamlined data reporting processes, decreasing report creation time by 40% while increasing accuracy and insights.

- •Guided over 100 clients in comprehensive retirement plans, achieving retirement fund goals for 85% of them.

- •Co-designed a retirement financial planning tool that improved client engagement by 30% during the first year of implementation.

- •Provided seminars and workshops on retirement strategies, increasing client attendance by 25% annually.

- •Monitored and adapted client plans based on changing market conditions, resulting in a stable 10% year-on-year growth in assets.

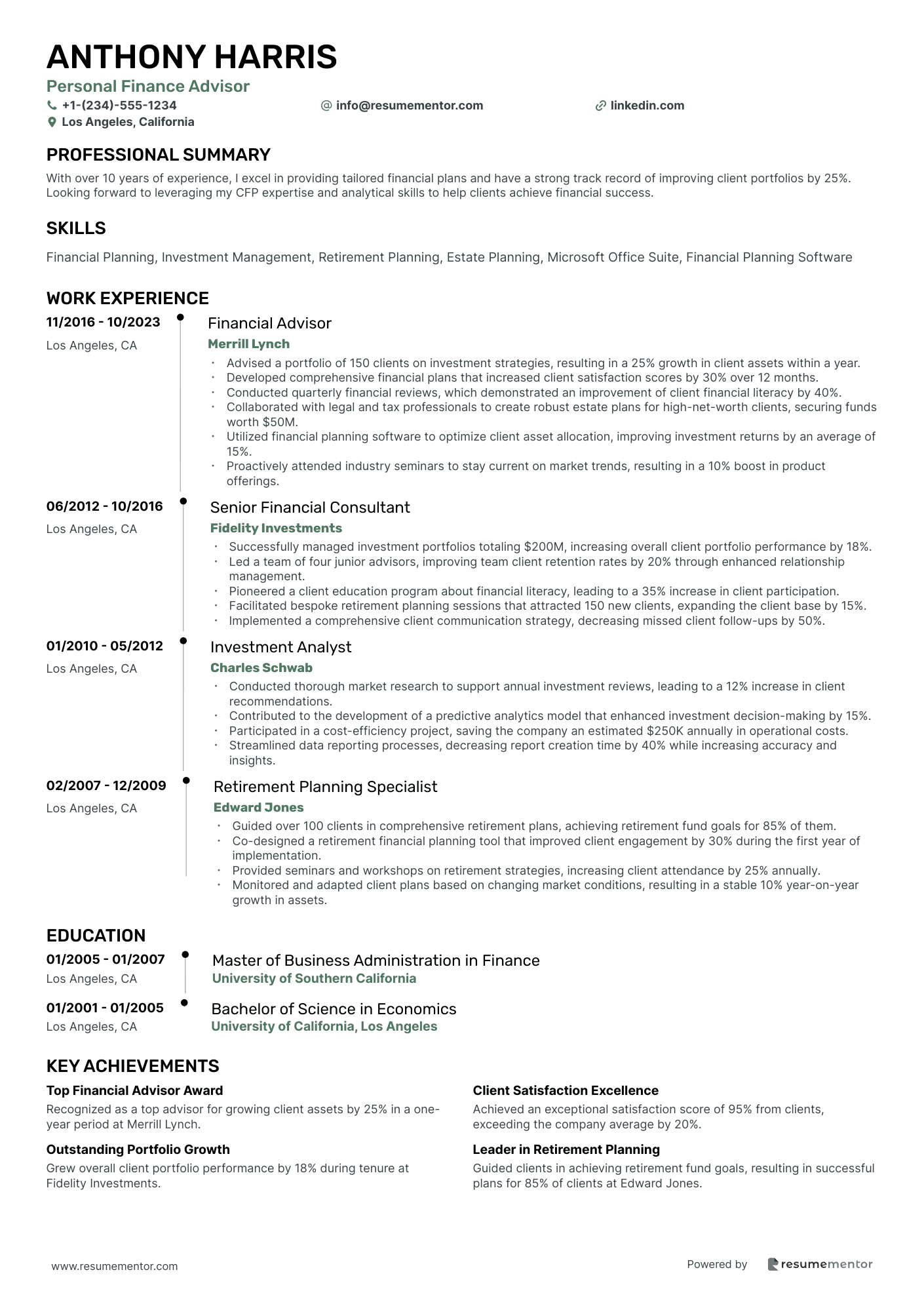

Investment Guidance Counselor resume sample

- •Implemented a client-centric advisory model, leading to a 30% increase in client retention over 2 years.

- •Developed tailored investment plans, achieving a 40% growth in the average client portfolio value within a year.

- •Conducted in-depth market research to provide clients with actionable insights, resulting in informed investment decisions.

- •Led a team of junior advisors in enhancing client communication strategies, driving a 25% improvement in client satisfaction scores.

- •Prepared and presented comprehensive investment reports, elevating client understanding and trust in financial strategies.

- •Collaborated with the financial planning team to create holistic financial solutions, enhancing portfolio performance for clients.

- •Advised on diverse financial products, contributing to a 50% increase in cross-sell rates over a 3-year period.

- •Delivered client-focused investment seminars, resulting in a 35% uptick in client engagement and new account openings.

- •Managed a portfolio of high-net-worth clients, increasing cumulative portfolio value by 45% through strategic advisory.

- •Implemented risk management techniques, effectively minimizing clients' exposure to market volatility.

- •Maintained up-to-date knowledge of regulatory changes, ensuring 100% compliance across client portfolios.

- •Assisted in the development of investment theses, contributing to a 20% improvement in portfolio performance metrics.

- •Conducted rigorous analysis of financial markets, supporting fund managers in identifying lucrative investment opportunities.

- •Created detailed financial models to forecast market trends, aiding in the decision-making process of senior management.

- •Developed quarterly performance reports, enhancing investor relations and portfolio transparency at multiple client meetings.

- •Supported senior financial advisors in executing strategies that increased client portfolios by an average of 25% annually.

- •Scheduled and led client meetings to gather essential financial information, improving advisory efficacy and client satisfaction.

- •Created educational materials on financial literacy, enhancing client knowledge and investment confidence.

- •Monitored investment portfolios, offering insights to mitigate risks and optimize returns for clients.

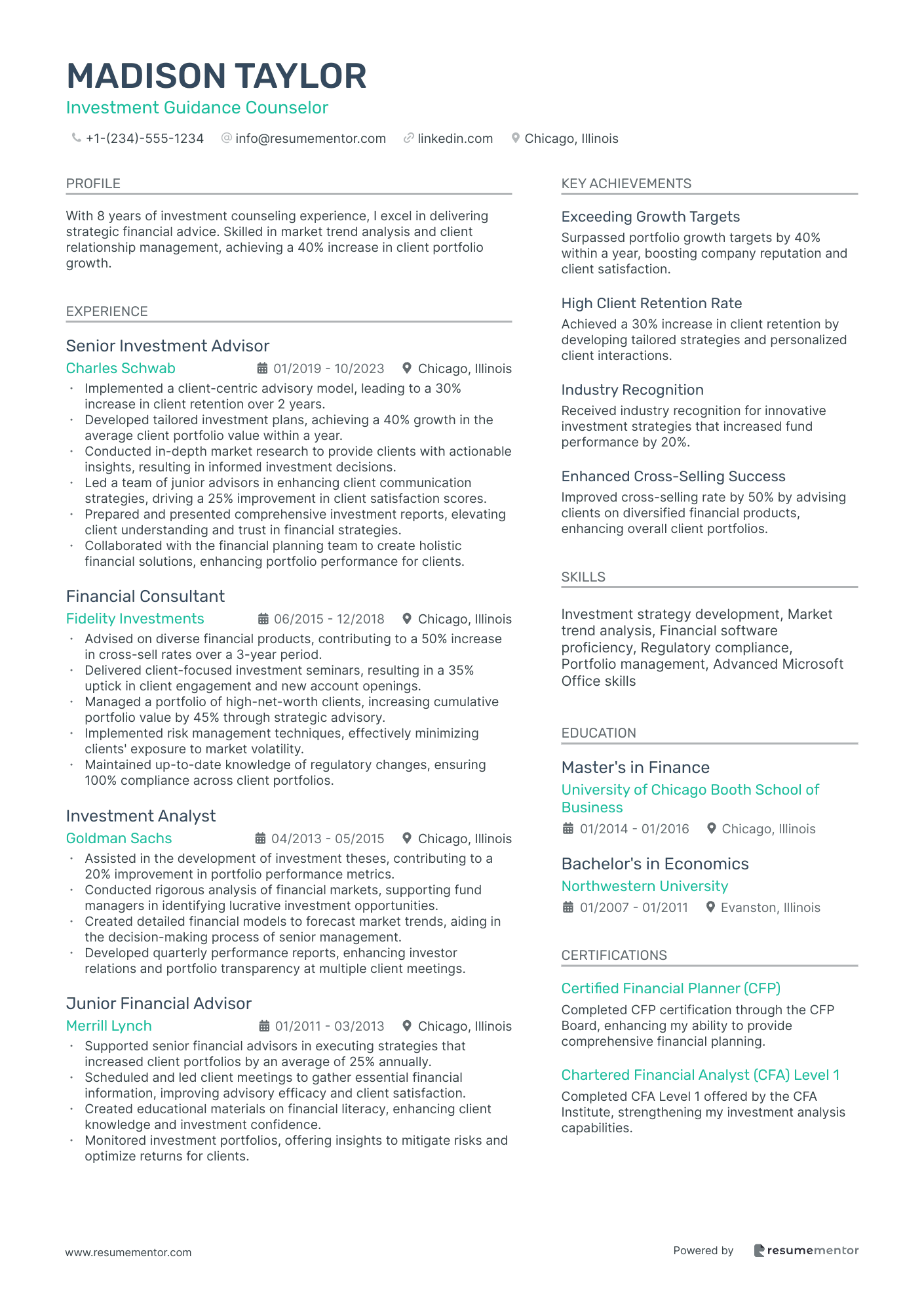

Corporate Financial Consultant resume sample

- •Spearheaded financial models and strategic plans which resulted in a 15% revenue growth over two years.

- •Collaborated with cross-functional teams to implement cost-saving measures, achieving a $3 million annual cost reduction.

- •Designed and executed comprehensive budgets, leading to a 10% improvement in financial accuracy.

- •Developed detailed financial forecasts and variance analyses, enhancing decision-making processes.

- •Mentored a team of junior analysts, improving team efficiency by 20%.

- •Assessed financial risks and developed mitigation strategies that decreased risk impact by 35%.

- •Analyzed complex financial data to provide clients with actionable insights, improving client satisfaction scores by 25%.

- •Presented financial reports and strategic recommendations to senior management, enhancing decision accuracy by 15%.

- •Contributed to project management tasks for a $10 million client initiative, resulting in timely and below-budget project completion.

- •Conducted economic and financial trend analysis, supporting over 50 client engagements in identifying growth opportunities.

- •Provided training and guidance to new team members, fostering a collaborative and educated environment.

- •Prepared detailed financial statements and analyses, assisting year-end audits and improving accuracy by 20%.

- •Automated financial processes resulting in a 30% increase in reporting efficiency across departments.

- •Conducted financial health assessments leading to successful risk mitigation for clients, reducing risk exposure by 40%.

- •Assisted in developing forecasting processes which streamlined client strategic planning cycles by 15%.

- •Supported the development of financial presentations for client meetings, improving clarity of information by 25%.

- •Conducted thorough market research and analysis, contributing to a 10% increase in client acquisition.

- •Assisted in the creation of innovative financial models, laying the foundation for strategic client initiatives.

- •Collaborated with audit teams to ensure compliance, maintaining a client satisfaction rate above 95%.

Education Funding Counselor resume sample

- •Conducted over 150 one-on-one counseling sessions each semester, improving client satisfaction scores by 30%.

- •Guided students in understanding the FAFSA process, leading to 95% completion rate among participants.

- •Developed and delivered 20+ financial literacy workshops, reaching 300+ students annually.

- •Implemented a follow-up support system, reducing aid-related issues by 25% during academic year.

- •Collaborated with faculty to create tailored financial plans, resulting in increased student retention by 10%.

- •Managed comprehensive records and reports, achieving 100% compliance with institutional policies.

- •Provided personalized financial aid guidance to over 400 students, increasing funding success by 20%.

- •Assisted students in securing over $2 million in grants and scholarships, enhancing educational access.

- •Delivered monthly presentations on financial options to groups of 100+ students and parents.

- •Monitored changes in state and federal aid policies, ensuring up-to-date guidance to clients.

- •Developed strategic partnerships with local organizations to expand access to financial resources.

- •Managed the financial aid portfolio for 500+ students, achieving record-level award satisfaction at 92%.

- •Supervised a team of 4 advisors, leading to a 15% improvement in processing efficiency.

- •Executed comprehensive training sessions on financial aid software, improving team accuracy by 20%.

- •Collaborated with departments to align funding strategies with institutional goals and student needs.

- •Developed content and resources for a new online portal, enhancing student self-service options.

- •Coordinated financial aid processes for 800+ applicants annually, with a 95% satisfaction rate.

- •Assisted in administering $5 million in financial aid funds, supporting student success and retention.

- •Led initiative to revamp application process, reducing processing time by 2 weeks.

- •Developed and conducted seminars on maximizing scholarship opportunities for 200+ students.

Mortgage Finance Advisor resume sample

- •Led a team that closed over 250 mortgage loans monthly, resulting in a 20% increase in team sales growth.

- •Implemented a training program on financial literacy that increased client satisfaction ratings by 30%.

- •Enhanced client onboarding process, reducing mortgage application time by 15% and improving document accuracy.

- •Created strong partnerships with 5 key real estate firms, boosting referral business by 25%.

- •Conducted monthly workshops on mortgage products, educating over 100 clients and prospects.

- •Streamlined credit analysis procedures, resulting in a 10% reduction in processing time.

- •Advised over 300 clients per year, enabling informed decisions on mortgage solutions and closing loans worth $50M annually.

- •Improved client retention by introducing personalized financial assessments, increasing repeat business by 18%.

- •Launched an internal compliance check program, reducing loan rejections due to documentation errors by 20%.

- •Facilitated partnerships with legal advisors to streamline mortgage documentation processes.

- •Regularly exceeded monthly sales targets by 10% by identifying client-centric financing strategies.

- •Assessed credit profiles and income documents for over 500 clients annually, maintaining a high approval rate.

- •Coordinated with underwriters to expedite loan processing, reducing approval timelines by 25%.

- •Conducted market analysis to predict lending trends, resulting in strategic adjustments to product offerings.

- •Introduced new client outreach strategies, doubling the clientele base within a year.

- •Provided expert advice on mortgage options, closing 150+ successful loan applications annually.

- •Strengthened client relationships by offering tailored loan and refinancing solutions.

- •Facilitated client understanding of financial products, boosting customer satisfaction scores by 40%.

- •Developed a comprehensive documentation checklist, decreasing client document submission errors by 30%.

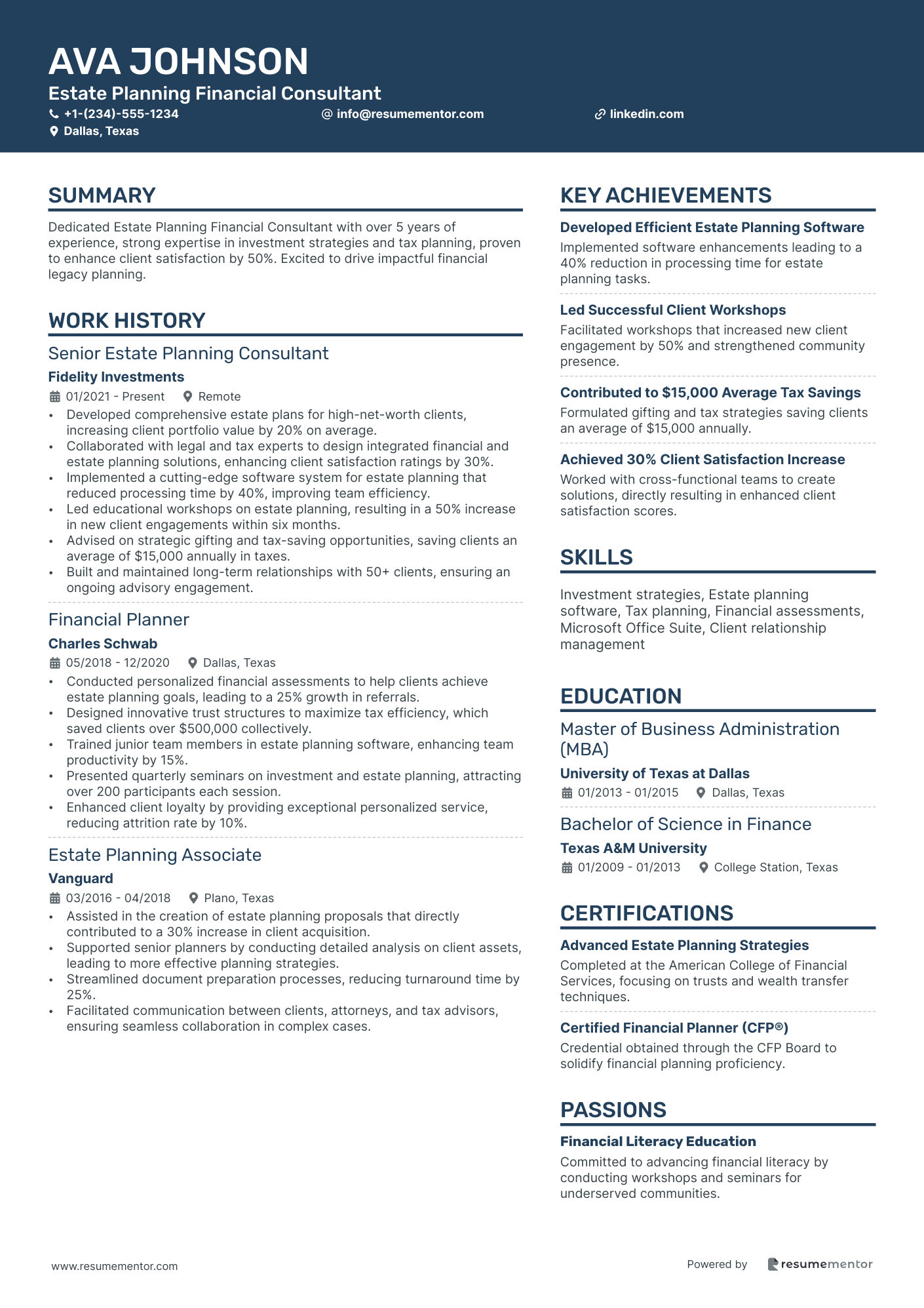

Estate Planning Financial Consultant resume sample

- •Developed comprehensive estate plans for high-net-worth clients, increasing client portfolio value by 20% on average.

- •Collaborated with legal and tax experts to design integrated financial and estate planning solutions, enhancing client satisfaction ratings by 30%.

- •Implemented a cutting-edge software system for estate planning that reduced processing time by 40%, improving team efficiency.

- •Led educational workshops on estate planning, resulting in a 50% increase in new client engagements within six months.

- •Advised on strategic gifting and tax-saving opportunities, saving clients an average of $15,000 annually in taxes.

- •Built and maintained long-term relationships with 50+ clients, ensuring an ongoing advisory engagement.

- •Conducted personalized financial assessments to help clients achieve estate planning goals, leading to a 25% growth in referrals.

- •Designed innovative trust structures to maximize tax efficiency, which saved clients over $500,000 collectively.

- •Trained junior team members in estate planning software, enhancing team productivity by 15%.

- •Presented quarterly seminars on investment and estate planning, attracting over 200 participants each session.

- •Enhanced client loyalty by providing exceptional personalized service, reducing attrition rate by 10%.

- •Assisted in the creation of estate planning proposals that directly contributed to a 30% increase in client acquisition.

- •Supported senior planners by conducting detailed analysis on client assets, leading to more effective planning strategies.

- •Streamlined document preparation processes, reducing turnaround time by 25%.

- •Facilitated communication between clients, attorneys, and tax advisors, ensuring seamless collaboration in complex cases.

- •Conducted thorough financial analysis to support estate planning decisions, resulting in optimized asset allocations for clients.

- •Collaborated on cross-departmental teams to improve data analysis methods, increasing report accuracy by 15%.

- •Managed financial reporting for 10+ client accounts, ensuring compliance with industry regulations.

- •Enhanced analytical models used for estate planning, improving efficiency in financial projections.

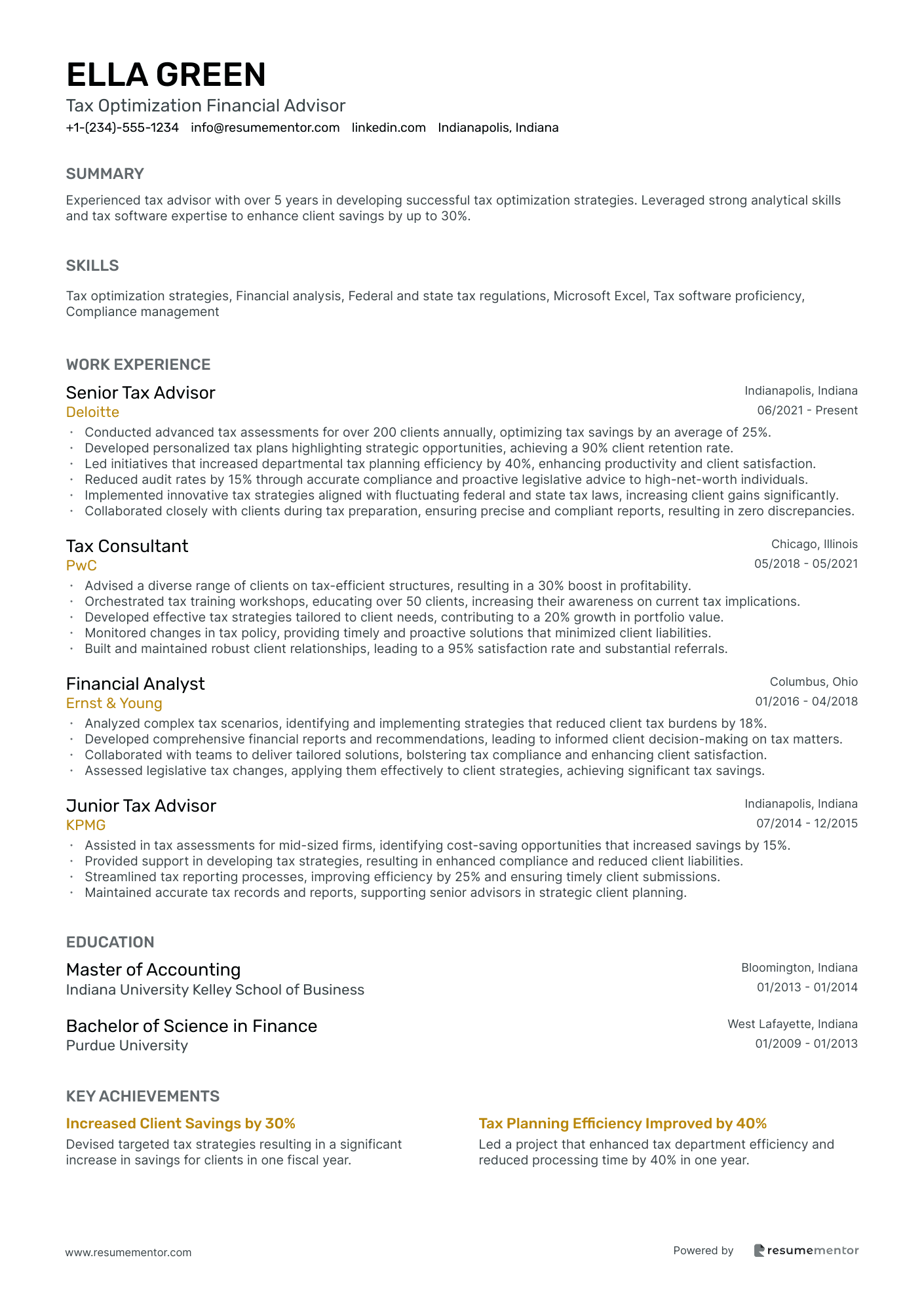

Tax Optimization Financial Advisor resume sample

- •Conducted advanced tax assessments for over 200 clients annually, optimizing tax savings by an average of 25%.

- •Developed personalized tax plans highlighting strategic opportunities, achieving a 90% client retention rate.

- •Led initiatives that increased departmental tax planning efficiency by 40%, enhancing productivity and client satisfaction.

- •Reduced audit rates by 15% through accurate compliance and proactive legislative advice to high-net-worth individuals.

- •Implemented innovative tax strategies aligned with fluctuating federal and state tax laws, increasing client gains significantly.

- •Collaborated closely with clients during tax preparation, ensuring precise and compliant reports, resulting in zero discrepancies.

- •Advised a diverse range of clients on tax-efficient structures, resulting in a 30% boost in profitability.

- •Orchestrated tax training workshops, educating over 50 clients, increasing their awareness on current tax implications.

- •Developed effective tax strategies tailored to client needs, contributing to a 20% growth in portfolio value.

- •Monitored changes in tax policy, providing timely and proactive solutions that minimized client liabilities.

- •Built and maintained robust client relationships, leading to a 95% satisfaction rate and substantial referrals.

- •Analyzed complex tax scenarios, identifying and implementing strategies that reduced client tax burdens by 18%.

- •Developed comprehensive financial reports and recommendations, leading to informed client decision-making on tax matters.

- •Collaborated with teams to deliver tailored solutions, bolstering tax compliance and enhancing client satisfaction.

- •Assessed legislative tax changes, applying them effectively to client strategies, achieving significant tax savings.

- •Assisted in tax assessments for mid-sized firms, identifying cost-saving opportunities that increased savings by 15%.

- •Provided support in developing tax strategies, resulting in enhanced compliance and reduced client liabilities.

- •Streamlined tax reporting processes, improving efficiency by 25% and ensuring timely client submissions.

- •Maintained accurate tax records and reports, supporting senior advisors in strategic client planning.

Business Loan Financial Counselor resume sample

- •Conducted comprehensive financial assessments, contributing to a 25% improvement in client funding success rates.

- •Led educational workshops on business financing options, boosting client awareness by 30% annually.

- •Reviewed and optimized client loan applications, reducing application processing time by 15%.

- •Developed strategies to improve client credit scores, resulting in better loan terms for 80% of clients.

- •Collaborated with internal teams to streamline the loan process, enhancing client satisfaction by 20%.

- •Maintained accurate and regulatory-compliant client records, facilitating trust and transparency.

- •Educated clients on diverse loan products, leading to a 15% increase in loan uptake.

- •Assisted over 150 clients annually in preparing successful loan applications with a 95% approval rate.

- •Created an educational series on credit improvement, directly benefiting 200 local small businesses.

- •Enhanced the accuracy of loan documentation through stringent checks, ensuring zero application rejections.

- •Monitored market trends to provide clients with tailored financial advice, improving client loyalty by 10%.

- •Facilitated access to appropriate financing for small businesses, achieving a 20% growth in client base.

- •Strengthened client credit understanding by organizing quarterly informational meetings.

- •Aligned client fiscal goals with suitable financing options, effectively diversifying loan portfolios.

- •Implemented improved documentation practices, aiding in compliance and reducing processing errors.

- •Analyzed financial data to recommend over $5 million in financing options, enhancing client growth opportunities.

- •Provided insights on credit analysis, fostering a 10% increase in forecast accuracy.

- •Designed and implemented a new tracking system for loan applications, boosting efficiency by 15%.

- •Supported client financial education initiatives, significantly increasing client financial literacy.

Crafting a standout financial counselor resume can feel like navigating a maze, with so many key skills and achievements to present. Highlighting your financial expertise and client management abilities is essential, yet figuring out where to start can be daunting. You want your resume to impress, but achieving that balance is crucial.

Think of your resume as a financial blueprint, guiding potential employers through your professional story. Just like in counseling, clarity and organization are essential; hiring managers often skim, so making it easy for them is vital. This is where a resume template can truly help, allowing you to arrange your information clearly and cohesively.

When using a resume template, you create a strong foundation, ensuring no critical elements are forgotten. This not only saves you valuable time but also helps you present your accomplishments in the best light. Aligning your achievements with industry values becomes much easier when you have a structured approach.

In doing so, your resume effectively demonstrates how you've solved problems for clients, adding real value to their financial lives. By weaving these successes into a cohesive narrative, you offer a clear picture of your capabilities. Remember, your resume is more than a list of jobs—it's your ticket to opportunities where your financial counseling skills can shine.

Key Takeaways

- A well-structured resume for a financial counselor is essential, with clear emphasis on financial expertise, client management, and specific achievements that align with industry values.

- Utilizing a resume template can help organize information cohesively, allowing for a clear presentation of skills and accomplishments that impress potential employers.

- Choosing the reverse-chronological format for a resume highlights recent and relevant experiences, showcasing continuous growth and expertise in the financial field.

- Including quantifiable results in the experience section and using action-driven language help demonstrate measurable success and align past roles to future potential.

- Additional sections like certifications, volunteer experience, or language skills can boost a resume's appeal by showcasing relevant qualifications and a commitment to professional growth.

What to focus on when writing your financial counselor resume

A financial counselor resume should seamlessly convey your financial expertise and dedication to guiding clients toward achieving their financial goals. It's important for recruiters to recognize your ability to manage intricate aspects, such as financial planning, budgeting, and debt management, which assures them of your capability to provide valuable guidance.

How to structure your financial counselor resume

- Contact Information — This section ensures recruiters can quickly get in touch with you. Consistency in formatting your name, phone number, email address, and LinkedIn profile makes the start of your resume clean and easy to navigate. It's crucial to list contact details that are current and professional, as this sets the tone for a well-organized resume that reflects your attention to detail.

- Professional Summary — Your introduction is where you can immediately capture interest by summarizing your career with a focus on financial counseling. Highlight your ability to craft effective financial strategies and establish trust with clients. An impactful summary ties your experience and ambitions together, providing a snapshot of your value and setting the stage for your detailed experiences.

- Work Experience — This section delves into your professional history with roles that showcase your competencies in financial management. Listing past positions with bullet points allows you to articulate accomplishments effectively, such as increasing client satisfaction or optimizing financial plans. This approach provides concrete examples of your ability to apply your skills in real-world scenarios and solidifies your professional narrative.

- Education — Including your academic background and relevant certifications like Accredited Financial Counselor (AFC) underpins your professional credibility. Your educational achievements lay the foundation for your skills and qualifications, supporting your narrative with formal training that aligns with the field's standards.

- Skills — Focusing on specific competencies vital to financial counseling, like financial analysis and communication, ensures potential employers see the full breadth of your capabilities. This section demonstrates that you possess the essential tools required to effectively serve clients and manage their financial goals.

- Certifications — Certifications like the Certified Financial Planner (CFP) stand as strong endorsements of your dedication and expertise. Including them highlights your commitment to staying updated in the industry and can make you stand out as a skilled, knowledgeable professional.

Consider exploring optional sections like "Volunteer Experience" or "Professional Affiliations" to add depth to your resume—each section we've touched on will be discussed more in-depth below.

Which resume format to choose

As a financial counselor, crafting the right resume format is crucial for making a lasting impression. The reverse-chronological format is beneficial because it emphasizes your most recent and relevant experiences, showcasing your continuous growth and expertise in the industry. Employers in finance often look for a consistent career trajectory, and this format presents your journey clearly.

When it comes to the visual appeal of your resume, choosing modern fonts like Rubik, Lato, or Montserrat can make a difference. These fonts are not only clean and professional but also suggest a fresh approach to your professional presentation, which can appeal to hiring managers who appreciate attention to detail.

To ensure your resume maintains its formatting across all platforms, saving it as a PDF is essential. This file type safeguards your layout and styling, preserving the polished look that you’ve meticulously crafted. Consistency in appearance can often reflect consistency in your work ethic and attention to keeping things organized.

Margins are another subtle yet crucial element of your resume. Stick to 1-inch margins all around to keep your layout neat and easy to read. This balance of text and white space ensures your information is presented clearly, reducing visual clutter and allowing the reader to focus on the content. A well-organized resume with appropriate spacing can convey your ability to manage information effectively—an important skill in financial counseling.

By integrating these elements, your resume will not only narrate your skills and experiences effectively but also reflect a high level of professionalism and attention to detail, qualities that are highly valued in the finance industry.

How to write a quantifiable resume experience section

The experience section of a financial counselor resume is crucial because it showcases your expertise and achievements in a way that resonates with potential employers. To craft this section effectively, focus on presenting clear, quantifiable results alongside action-driven language. Start with your most recent job and include key details like job titles, company names, locations, and employment dates, ensuring you cover the last 10–15 years to demonstrate your career progression. By tailoring your experience to align with the job ad, you highlight the skills and achievements that are most relevant. Use action words such as "developed," "implemented," and "increased" to convey a strong sense of accomplishment and contribution.

Here’s an example of how to structure this section:

- •Boosted client portfolio value by 30% over two years with strategic investment advice.

- •Rolled out a new budgeting tool that trimmed client debt by 15% in one year.

- •Crafted personalized financial plans for 100+ clients, achieving an 80% satisfaction rate.

- •Led financial seminars averaging 50 attendees, enhancing client financial literacy by 20%.

This experience section effectively highlights how your actions have led to measurable success, connecting past roles to future potential. Each bullet point focuses on results, using dynamic action words to describe your impact. By listing jobs in reverse chronological order, you naturally emphasize recent and relevant roles, making it easy for employers to see your value. Tailoring your experience to match the job ad ensures you meet employer expectations, directly addressing what they seek in a candidate.

Industry-Specific Focus resume experience section

A financial counselor-focused resume experience section should emphasize your ability to offer financial guidance and support while demonstrating your success in helping clients achieve their financial goals. Begin with your job title, the company's name, and the dates you worked there. Use bullet points to highlight your main achievements and responsibilities, making sure to use strong action verbs to convey your active involvement. Providing specific data or metrics that illustrate how you've improved clients' financial situations will give potential employers concrete evidence of your effectiveness.

Keep your writing clear and cohesive, creating a vivid picture of your contributions in each role. An impactful financial counselor resume should weave together your skills in analyzing financial information, understanding client needs, and crafting personalized financial strategies. To further demonstrate your industry knowledge, include any experience with regulatory compliance. Make sure to also highlight your adaptability, communication, and problem-solving skills. Together, these elements will convey your confidence and proficiency, aligning you with the job you're targeting.

Financial Counselor

ABC Financial Services

June 2018 - Present

- Guided over 200 clients annually to develop tailored budgeting plans, resulting in a 30% increase in successful savings goals.

- Implemented financial education workshops that enhanced client financial literacy scores by 20%.

- Collaborated with colleagues to improve financial counseling practices, leading to a 15% boost in client satisfaction rates.

- Provided compliance support, ensuring all procedures met federal and state regulations.

Responsibility-Focused resume experience section

A responsibility-focused financial counselor resume experience section should clearly highlight your roles and accomplishments, framing them in a way that aligns with the positions you target. Start by emphasizing how you've supported clients in managing their finances, guided them through financial planning, and contributed to improving organizational processes. Use action-focused language to illustrate what you achieved and the positive outcomes for your clients or workplace. Consider detailing specific contributions and their impacts to showcase your expertise and reliability in financial counseling.

When describing your experiences, maintain a balance between being concise and comprehensive. Touch on various aspects of your previous roles, such as leadership or project management, to give a well-rounded view of your abilities. Highlight collaborative skills, whether in teamwork or communicating effectively with clients, as these are crucial in a financial advising role. To enhance your application, tailor your experiences to align with the job description, focusing on key skills like problem-solving, financial analysis, and fostering strong client relationships.

Financial Counselor

Smart Finance Solutions

Jan 2019 - Present

- Guided over 100 clients in crafting personalized financial plans, leading to a 20% rise in their savings.

- Introduced a new budgeting system that improved client efficiency and satisfaction by 30%.

- Worked with a team to conduct financial literacy workshops, boosting community financial awareness.

- Managed and adjusted investment portfolios, achieving an average annual growth of 15% for clients.

Growth-Focused resume experience section

A growth-focused financial counselor resume experience section should effectively highlight how you've driven progress and success in your past roles. Begin by showcasing quantifiable achievements that demonstrate your impact on the workplace. Use dynamic action verbs to clearly convey your role and describe any key strategies you spearheaded that improved efficiency or client satisfaction.

It's essential to weave in specific examples where your contributions led to notable improvements, such as increased client engagement or enhanced financial literacy. Demonstrating your ability to foster relationships and provide influential advice is also key to illustrating your value. Organize these accomplishments with bullet points to ensure potential employers can easily grasp the significance of your work.

Financial Counselor

Bright Future Financial Advisors

June 2018 - October 2022

- Improved client financial literacy by 30% through tailored workshops and educational seminars.

- Increased client engagement rates by 25% with personalized communication strategies.

- Facilitated over 200 successful debt management plans, boosting client credit scores by 40%.

- Collaborated with cross-functional teams to develop financial planning tools, increasing service efficiency by 20%.

Skills-Focused resume experience section

A skills-focused financial counselor resume experience section should highlight the skills that make you stand out as a professional. Start by identifying the core competencies critical to your role, like financial advising, budgeting, or client relationship management. Reflect on specific achievements that showcase these abilities, illustrating how you used them to drive positive results. Use simple and clear language to describe these accomplishments and ensure they align with the job you're targeting, focusing on the skills that match the employer's needs.

When organizing your experience, ensure your achievements are tangible by incorporating numbers or percentages. This strategy helps employers clearly see the impact of your work. For instance, instead of stating that you improved client satisfaction, specify that you increased satisfaction scores by 20%, making your accomplishments both concrete and impressive. By crafting a well-structured and skills-focused experience section, you can effectively demonstrate why you are the ideal candidate for the job.

Senior Financial Counselor

ABC Financial Services

January 2020 - Present

- Guided over 100 clients in creating personalized financial plans, resulting in a 25% increase in savings rate.

- Developed investment strategies that improved client portfolios, achieving an average 15% annual return.

- Conducted financial literacy workshops that improved participant financial confidence by 30%.

- Analyzed client budgets to identify savings opportunities, reducing unnecessary expenses by 40%.

Write your financial counselor resume summary section

A results-focused financial counselor resume summary should grab attention by showcasing your key abilities and achievements. Highlight the skills and accomplishments that have had a real impact on your clients. Concisely summarizing your expertise can make a strong impression on potential employers. Start by mentioning your most significant credential or accomplishment to immediately convey value. Use numbers to effectively illustrate your previous successes and contributions. If you're relatively new to the field, focus on your skills, enthusiasm, and relevant training or certifications.

This example clearly demonstrates your experience and expertise using specific metrics and skills, providing a vivid portrayal of your professional strengths. When describing yourself, express confidence and a proactive approach to problem-solving. Use dynamic language that conveys initiative and determination.

Understanding the nuances between different resume components is key. A resume summary reflects your past achievements, giving the employer a snapshot of your career. In contrast, a resume objective focuses on your career goals. Meanwhile, a resume profile provides a more detailed background, and a summary of qualifications offers a quick list of skills and achievements. Grasping these differences enables you to market yourself effectively, depending on your experience and the job you are targeting. Tailoring each application illustrates your genuine interest and helps convey your suitability for the role.

Listing your financial counselor skills on your resume

A skill-focused financial counselor resume should highlight the skills section as a vital piece. This section can stand independently or integrate smoothly into your experience and summary, showing a holistic view of your abilities. Your strengths and soft skills reveal how you interact with clients, portraying your interpersonal abilities. Meanwhile, hard skills signify your technical expertise, demonstrating capabilities like analyzing financial data or managing budgets.

Incorporating skills and strengths as resume keywords can make your application stand out to recruiters. They assure employers that you possess the qualities they’re seeking. Carefully choosing the right skills gives you a competitive edge in the job market.

Here's an example of a standalone skills section:

This skills section example excels by listing relevant abilities clearly and concisely. It emphasizes the core competencies needed for financial counseling, aligning closely with job requirements. The skills highlighted are specific and action-oriented, giving you a distinct advantage.

Best hard skills to feature on your financial counselor resume

Hard skills are essential for a financial counselor’s resume as they demonstrate technical expertise in finance. These skills, like financial analysis, planning, and management, are crucial for standing out professionally. Mastering these skills allows counselors to communicate their proficiency effectively. Here are essential hard skills:

Hard Skills

- Financial Planning

- Investment Strategies

- Retirement Planning

- Risk Assessment

- Tax Optimization

- Budget Management

- Estate Planning

- Portfolio Diversification

- Financial Software Proficiency

- Insurance Planning

- Asset Allocation

- Cash Flow Management

- Debt Management

- Compliance and Regulations

- Economic Forecasting

Best soft skills to feature on your financial counselor resume

Soft skills on a financial counselor’s resume highlight your ability to work well with clients and colleagues, showcasing your communication and interpersonal strengths. These skills show employers you are approachable and knowledgeable, valuable traits that enhance client relations. Here are key soft skills to include:

Soft Skills

- Communication

- Empathy

- Active Listening

- Problem Solving

- Negotiation

- Stress Management

- Adaptability

- Time Management

- Attention to Detail

- Decision Making

- Patience

- Teamwork

- Client Orientation

- Conflict Resolution

- Persuasiveness

How to include your education on your resume

The education section of your financial counselor resume is a crucial part that showcases your academic background. Ensure this section is tailored to the job you’re applying for; irrelevant education details should be omitted to maintain focus and relevance. If your GPA is strong, typically above 3.5, it can be included next to your degree to emphasize academic excellence. When listing honors like cum laude, include them directly after your degree for immediate impact. Clearly state your degree, the institution, and the graduation date in reverse chronological order.

Using the guidelines above, consider these examples:

This example is less effective due to its lack of relevance to the financial field.

This second example is strong because it includes a finance-related degree, an excellent GPA, and cum laude honors. Its relevance to a financial counseling role is clear, making it a standout education section. Remember to be concise and highlight aspects that align with the job.

How to include financial counselor certificates on your resume

Including a certificates section in your financial counselor resume is crucial. List the name of the certificate first. Include the date you earned the certificate. Add the issuing organization to verify its authenticity. This section boosts your credibility and highlights specialized skills.

You can also feature certifications in the header. For example,“Jane Doe, CPA, CFP®.” This immediately shows your qualifications. Ensure your certificates are recent and relevant to financial counseling. Avoid outdated or unrelated certifications.

Here’s an example:

This example is effective because it lists reputable certifications. It includes known issuing organizations, demonstrating qualification and authenticity. These certificates are directly relevant to a financial counselor's role. This makes your resume compelling and competitive.

Extra sections to include in your financial counselor resume

Are you looking to make a strong impression with your financial counselor resume? Including certain sections can showcase your unique skills and experiences, making you stand out to potential employers.

Language section — Highlighting fluency in multiple languages can demonstrate communication skills and global awareness beneficial for understanding diverse client needs.

Hobbies and interests section — Sharing relevant hobbies, such as investing or personal finance management, can showcase your passion for the field and personal commitment to staying informed.

Volunteer work section — Including volunteer experiences, like financial literacy workshops, can illustrate your dedication to community service and professional growth.

Books section — Listing industry-related books you've read can indicate your commitment to continuous learning and staying updated with financial trends.

By thoughtfully adding these sections, you enhance your resume and provide a fuller picture of who you are beyond your professional qualifications. This approach not only strengthens your application but also helps potential employers connect with your values and interests.

In Conclusion

Crafting a standout financial counselor resume is all about telling your professional story in a clear and organized manner. Your resume serves as a blueprint for potential employers, guiding them through your achievements and skills effortlessly. Using a structured template, you can emphasize your financial expertise and client management abilities. Templates also ensure that you present all key elements cohesively, saving time and highlighting your accomplishments effectively. It's crucial to align your achievements with industry values, demonstrating how you've added real value to clients' financial lives. Choosing the right format, such as reverse-chronological, ensures your growth and experience are evident to hiring managers. Keeping the resume visually appealing with modern fonts and neat margins is also important. Integrating quantifiable results into your experience section can convincingly showcase your expertise. Additionally, a strong resume summary can capture attention, focusing on your impact and key skills. Don't forget the importance of the skills section, where specific competencies like financial planning and communication must shine through. Including certifications can further enhance your credibility. Tailor each part of the resume to the job you're targeting, from education to certifications and extra sections like volunteer work or hobbies. This thoughtful assembly of your professional elements will not only narrate your career but also illustrate why you're the ideal candidate for prospective opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.