Financial Management Analyst Resume Examples

Jul 18, 2024

|

12 min read

Crafting Your Financial Management Analyst Resume: Tips for Banking on Success

Rated by 348 people

Asset Management Financial Analyst

Strategic Financial Planning Analyst

Risk and Compliance Financial Analyst

Capital Markets Financial Analyst

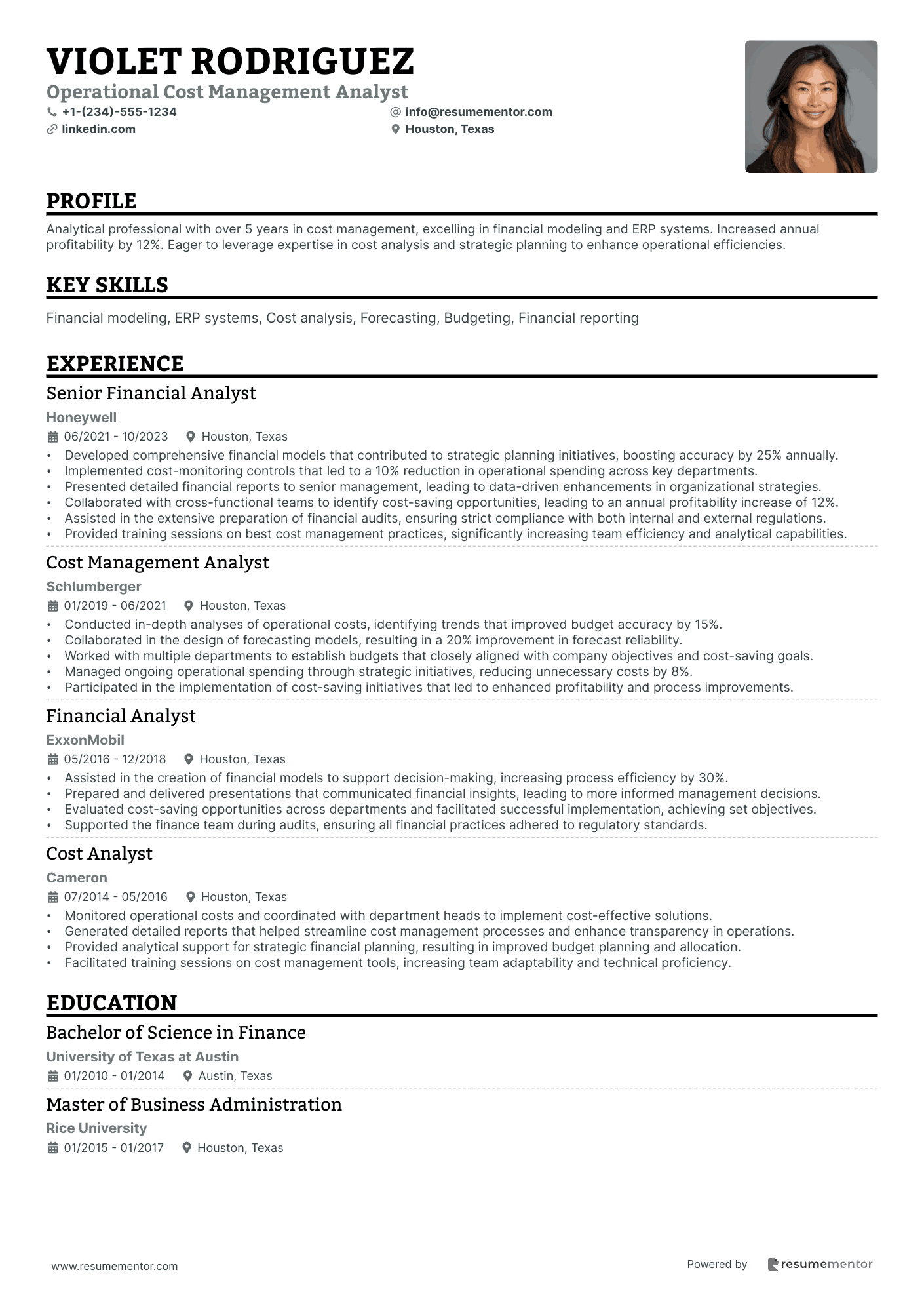

Operational Cost Management Analyst

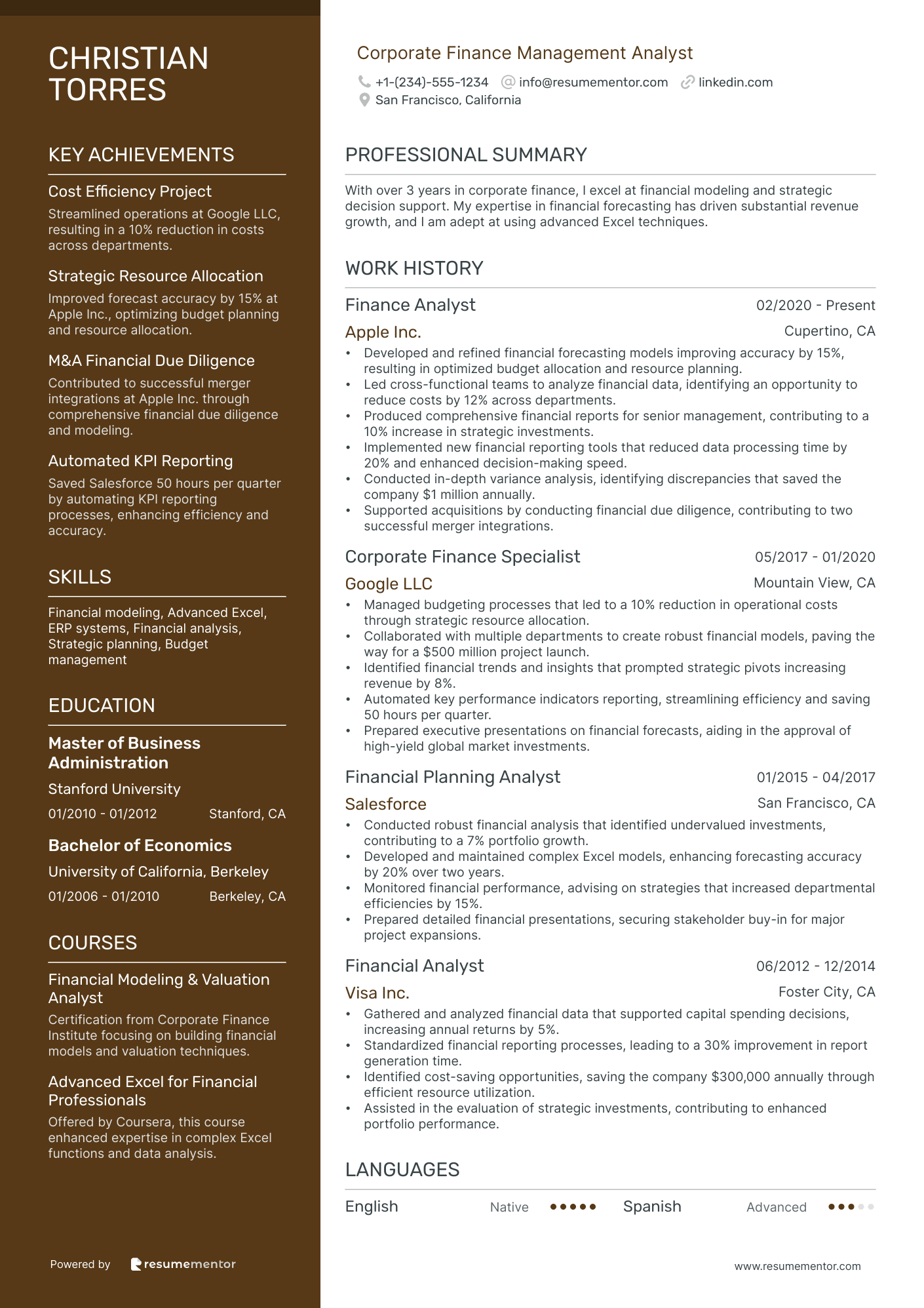

Corporate Finance Management Analyst

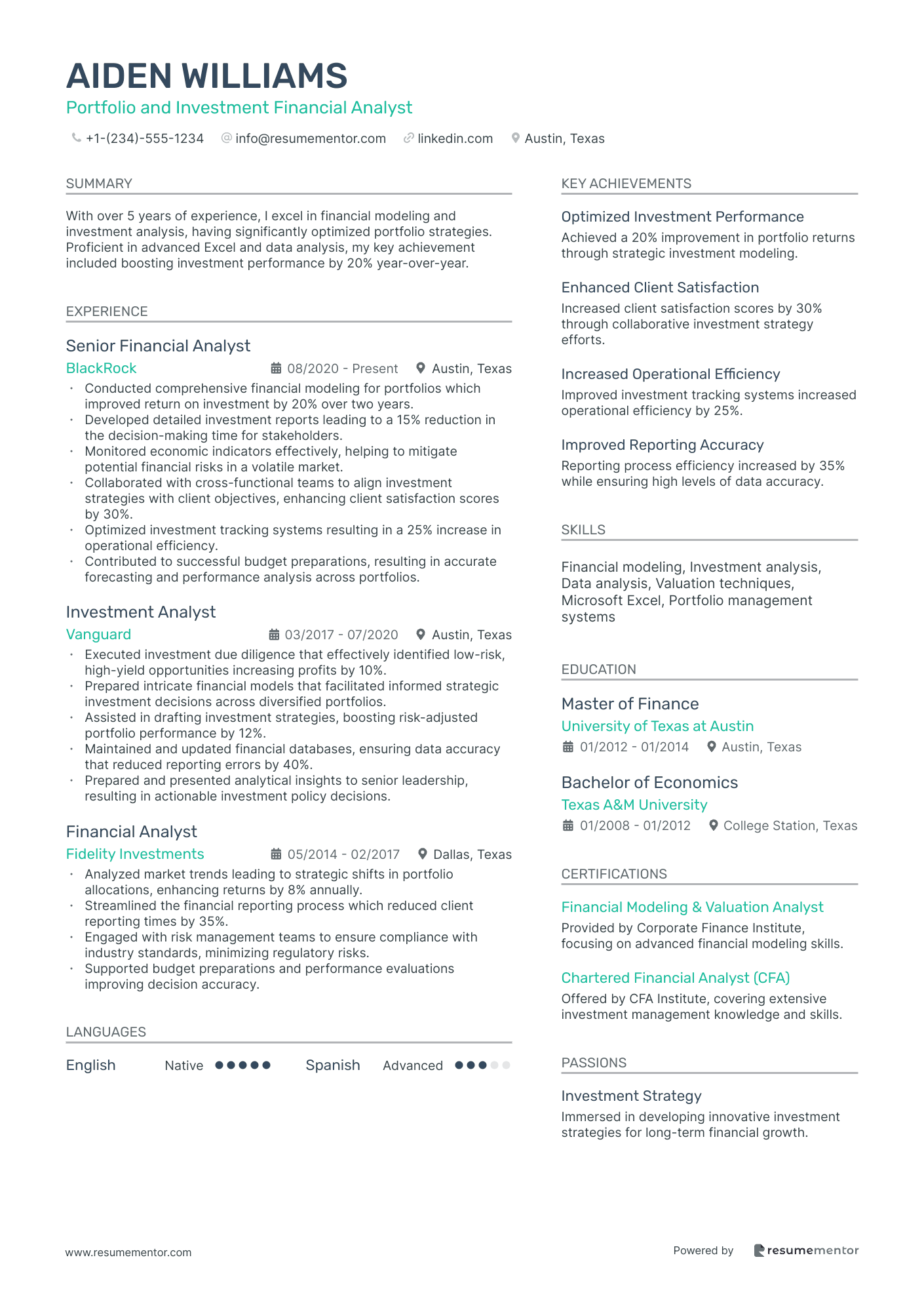

Portfolio and Investment Financial Analyst

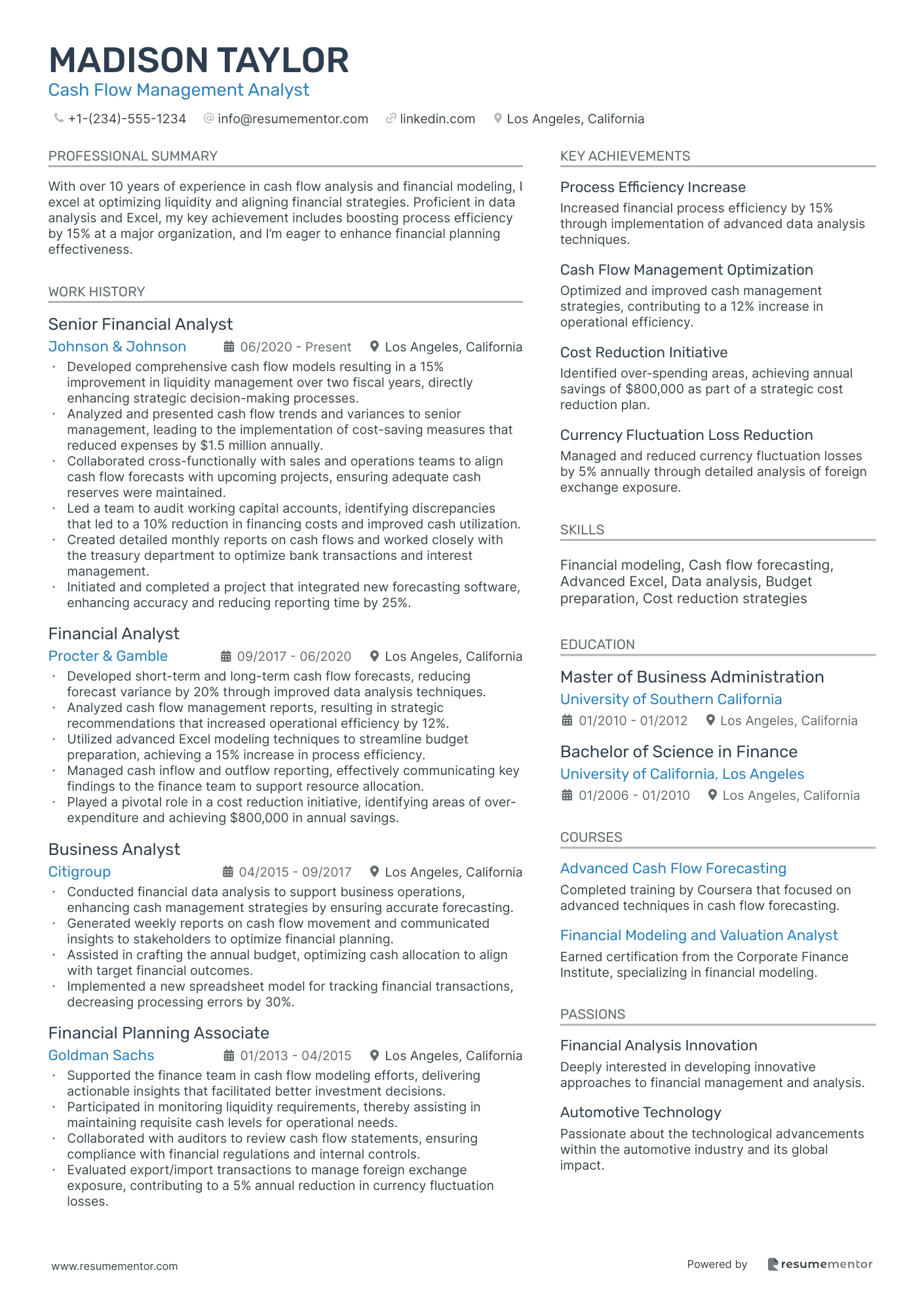

Cash Flow Management Analyst

Mergers and Acquisitions Financial Analyst

Budget and Forecasting Financial Analyst

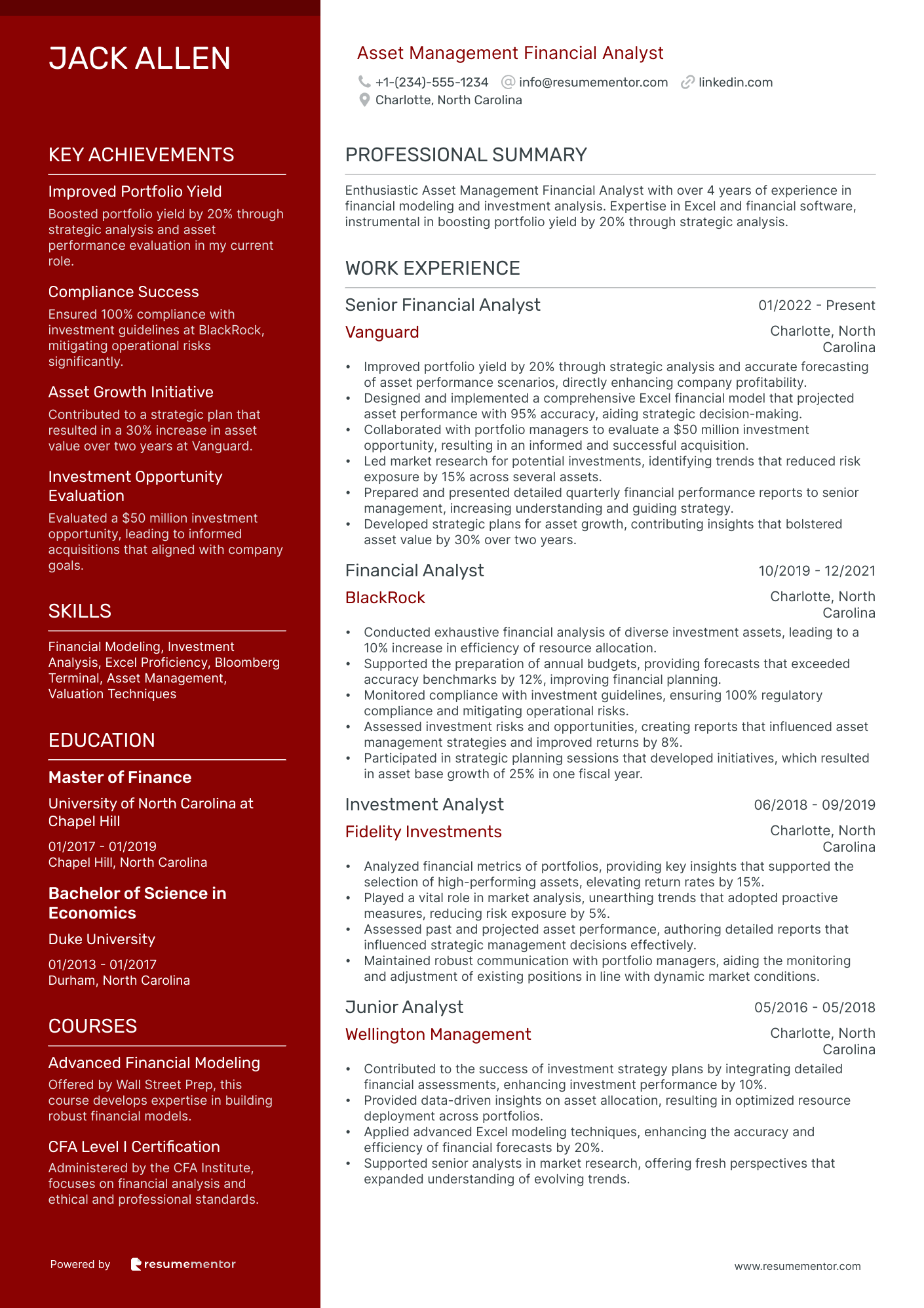

Asset Management Financial Analyst resume sample

- •Improved portfolio yield by 20% through strategic analysis and accurate forecasting of asset performance scenarios, directly enhancing company profitability.

- •Designed and implemented a comprehensive Excel financial model that projected asset performance with 95% accuracy, aiding strategic decision-making.

- •Collaborated with portfolio managers to evaluate a $50 million investment opportunity, resulting in an informed and successful acquisition.

- •Led market research for potential investments, identifying trends that reduced risk exposure by 15% across several assets.

- •Prepared and presented detailed quarterly financial performance reports to senior management, increasing understanding and guiding strategy.

- •Developed strategic plans for asset growth, contributing insights that bolstered asset value by 30% over two years.

- •Conducted exhaustive financial analysis of diverse investment assets, leading to a 10% increase in efficiency of resource allocation.

- •Supported the preparation of annual budgets, providing forecasts that exceeded accuracy benchmarks by 12%, improving financial planning.

- •Monitored compliance with investment guidelines, ensuring 100% regulatory compliance and mitigating operational risks.

- •Assessed investment risks and opportunities, creating reports that influenced asset management strategies and improved returns by 8%.

- •Participated in strategic planning sessions that developed initiatives, which resulted in asset base growth of 25% in one fiscal year.

- •Analyzed financial metrics of portfolios, providing key insights that supported the selection of high-performing assets, elevating return rates by 15%.

- •Played a vital role in market analysis, unearthing trends that adopted proactive measures, reducing risk exposure by 5%.

- •Assessed past and projected asset performance, authoring detailed reports that influenced strategic management decisions effectively.

- •Maintained robust communication with portfolio managers, aiding the monitoring and adjustment of existing positions in line with dynamic market conditions.

- •Contributed to the success of investment strategy plans by integrating detailed financial assessments, enhancing investment performance by 10%.

- •Provided data-driven insights on asset allocation, resulting in optimized resource deployment across portfolios.

- •Applied advanced Excel modeling techniques, enhancing the accuracy and efficiency of financial forecasts by 20%.

- •Supported senior analysts in market research, offering fresh perspectives that expanded understanding of evolving trends.

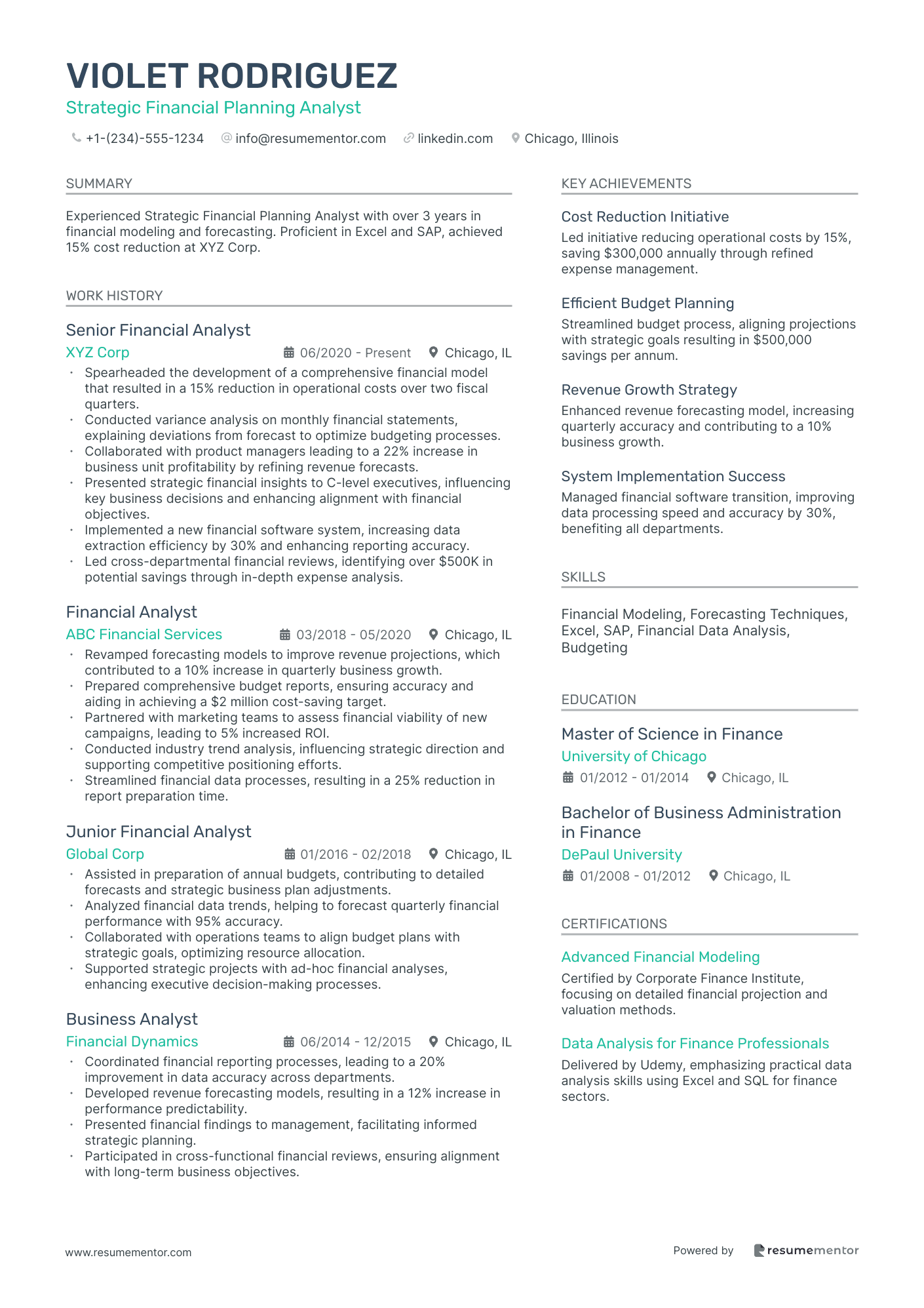

Strategic Financial Planning Analyst resume sample

- •Spearheaded the development of a comprehensive financial model that resulted in a 15% reduction in operational costs over two fiscal quarters.

- •Conducted variance analysis on monthly financial statements, explaining deviations from forecast to optimize budgeting processes.

- •Collaborated with product managers leading to a 22% increase in business unit profitability by refining revenue forecasts.

- •Presented strategic financial insights to C-level executives, influencing key business decisions and enhancing alignment with financial objectives.

- •Implemented a new financial software system, increasing data extraction efficiency by 30% and enhancing reporting accuracy.

- •Led cross-departmental financial reviews, identifying over $500K in potential savings through in-depth expense analysis.

- •Revamped forecasting models to improve revenue projections, which contributed to a 10% increase in quarterly business growth.

- •Prepared comprehensive budget reports, ensuring accuracy and aiding in achieving a $2 million cost-saving target.

- •Partnered with marketing teams to assess financial viability of new campaigns, leading to 5% increased ROI.

- •Conducted industry trend analysis, influencing strategic direction and supporting competitive positioning efforts.

- •Streamlined financial data processes, resulting in a 25% reduction in report preparation time.

- •Assisted in preparation of annual budgets, contributing to detailed forecasts and strategic business plan adjustments.

- •Analyzed financial data trends, helping to forecast quarterly financial performance with 95% accuracy.

- •Collaborated with operations teams to align budget plans with strategic goals, optimizing resource allocation.

- •Supported strategic projects with ad-hoc financial analyses, enhancing executive decision-making processes.

- •Coordinated financial reporting processes, leading to a 20% improvement in data accuracy across departments.

- •Developed revenue forecasting models, resulting in a 12% increase in performance predictability.

- •Presented financial findings to management, facilitating informed strategic planning.

- •Participated in cross-functional financial reviews, ensuring alignment with long-term business objectives.

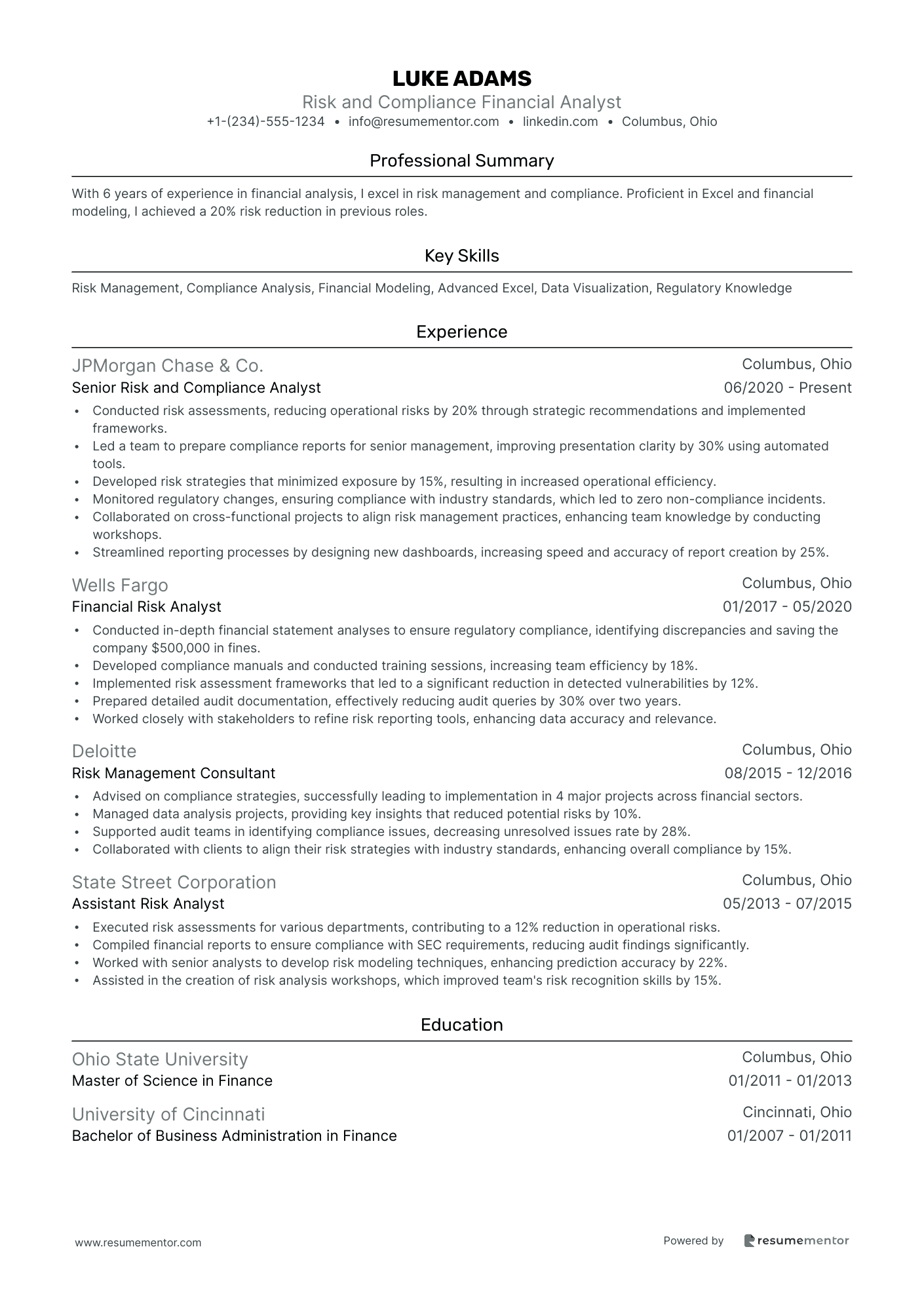

Risk and Compliance Financial Analyst resume sample

- •Conducted risk assessments, reducing operational risks by 20% through strategic recommendations and implemented frameworks.

- •Led a team to prepare compliance reports for senior management, improving presentation clarity by 30% using automated tools.

- •Developed risk strategies that minimized exposure by 15%, resulting in increased operational efficiency.

- •Monitored regulatory changes, ensuring compliance with industry standards, which led to zero non-compliance incidents.

- •Collaborated on cross-functional projects to align risk management practices, enhancing team knowledge by conducting workshops.

- •Streamlined reporting processes by designing new dashboards, increasing speed and accuracy of report creation by 25%.

- •Conducted in-depth financial statement analyses to ensure regulatory compliance, identifying discrepancies and saving the company $500,000 in fines.

- •Developed compliance manuals and conducted training sessions, increasing team efficiency by 18%.

- •Implemented risk assessment frameworks that led to a significant reduction in detected vulnerabilities by 12%.

- •Prepared detailed audit documentation, effectively reducing audit queries by 30% over two years.

- •Worked closely with stakeholders to refine risk reporting tools, enhancing data accuracy and relevance.

- •Advised on compliance strategies, successfully leading to implementation in 4 major projects across financial sectors.

- •Managed data analysis projects, providing key insights that reduced potential risks by 10%.

- •Supported audit teams in identifying compliance issues, decreasing unresolved issues rate by 28%.

- •Collaborated with clients to align their risk strategies with industry standards, enhancing overall compliance by 15%.

- •Executed risk assessments for various departments, contributing to a 12% reduction in operational risks.

- •Compiled financial reports to ensure compliance with SEC requirements, reducing audit findings significantly.

- •Worked with senior analysts to develop risk modeling techniques, enhancing prediction accuracy by 22%.

- •Assisted in the creation of risk analysis workshops, which improved team's risk recognition skills by 15%.

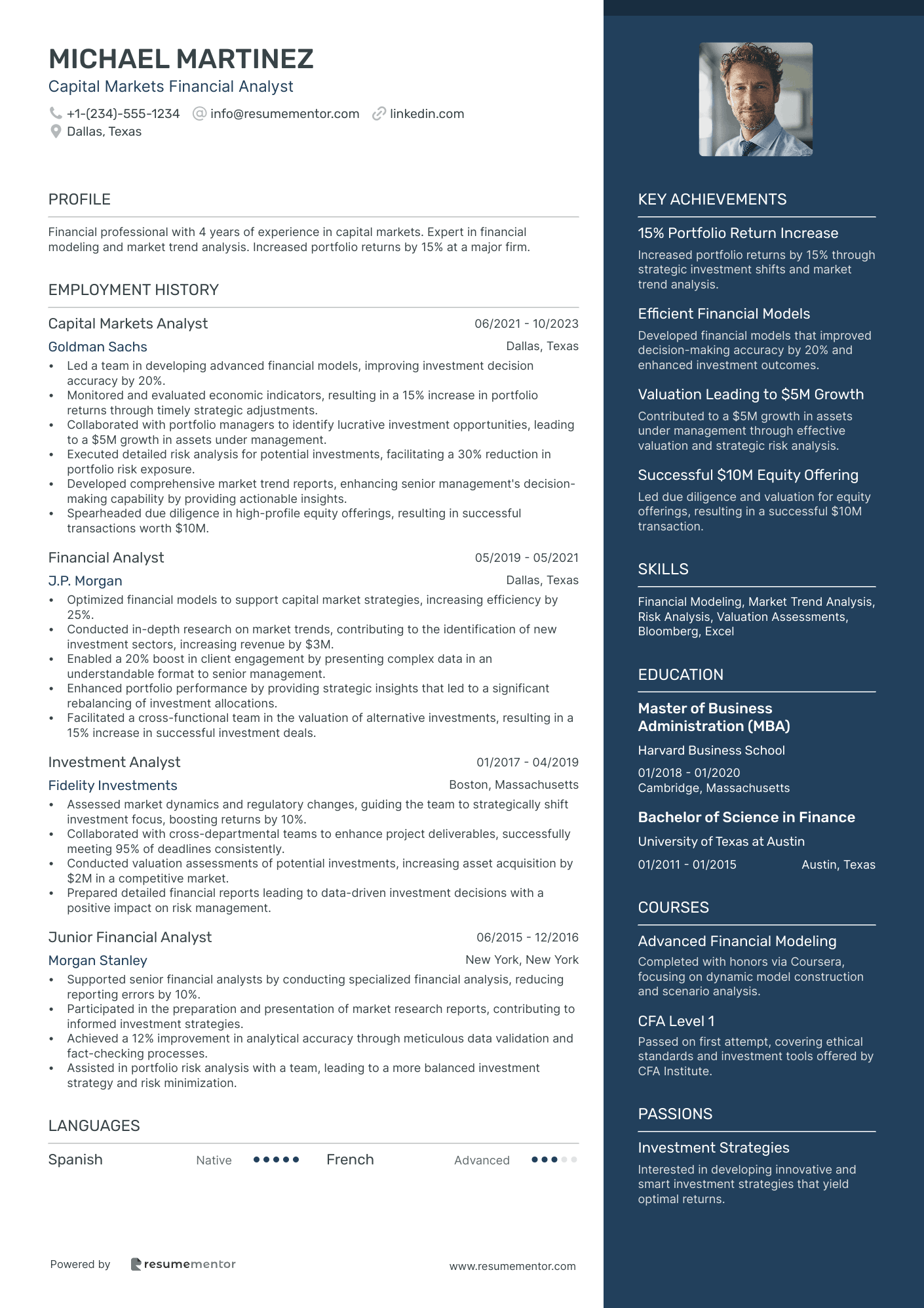

Capital Markets Financial Analyst resume sample

- •Led a team in developing advanced financial models, improving investment decision accuracy by 20%.

- •Monitored and evaluated economic indicators, resulting in a 15% increase in portfolio returns through timely strategic adjustments.

- •Collaborated with portfolio managers to identify lucrative investment opportunities, leading to a $5M growth in assets under management.

- •Executed detailed risk analysis for potential investments, facilitating a 30% reduction in portfolio risk exposure.

- •Developed comprehensive market trend reports, enhancing senior management's decision-making capability by providing actionable insights.

- •Spearheaded due diligence in high-profile equity offerings, resulting in successful transactions worth $10M.

- •Optimized financial models to support capital market strategies, increasing efficiency by 25%.

- •Conducted in-depth research on market trends, contributing to the identification of new investment sectors, increasing revenue by $3M.

- •Enabled a 20% boost in client engagement by presenting complex data in an understandable format to senior management.

- •Enhanced portfolio performance by providing strategic insights that led to a significant rebalancing of investment allocations.

- •Facilitated a cross-functional team in the valuation of alternative investments, resulting in a 15% increase in successful investment deals.

- •Assessed market dynamics and regulatory changes, guiding the team to strategically shift investment focus, boosting returns by 10%.

- •Collaborated with cross-departmental teams to enhance project deliverables, successfully meeting 95% of deadlines consistently.

- •Conducted valuation assessments of potential investments, increasing asset acquisition by $2M in a competitive market.

- •Prepared detailed financial reports leading to data-driven investment decisions with a positive impact on risk management.

- •Supported senior financial analysts by conducting specialized financial analysis, reducing reporting errors by 10%.

- •Participated in the preparation and presentation of market research reports, contributing to informed investment strategies.

- •Achieved a 12% improvement in analytical accuracy through meticulous data validation and fact-checking processes.

- •Assisted in portfolio risk analysis with a team, leading to a more balanced investment strategy and risk minimization.

Operational Cost Management Analyst resume sample

- •Developed comprehensive financial models that contributed to strategic planning initiatives, boosting accuracy by 25% annually.

- •Implemented cost-monitoring controls that led to a 10% reduction in operational spending across key departments.

- •Presented detailed financial reports to senior management, leading to data-driven enhancements in organizational strategies.

- •Collaborated with cross-functional teams to identify cost-saving opportunities, leading to an annual profitability increase of 12%.

- •Assisted in the extensive preparation of financial audits, ensuring strict compliance with both internal and external regulations.

- •Provided training sessions on best cost management practices, significantly increasing team efficiency and analytical capabilities.

- •Conducted in-depth analyses of operational costs, identifying trends that improved budget accuracy by 15%.

- •Collaborated in the design of forecasting models, resulting in a 20% improvement in forecast reliability.

- •Worked with multiple departments to establish budgets that closely aligned with company objectives and cost-saving goals.

- •Managed ongoing operational spending through strategic initiatives, reducing unnecessary costs by 8%.

- •Participated in the implementation of cost-saving initiatives that led to enhanced profitability and process improvements.

- •Assisted in the creation of financial models to support decision-making, increasing process efficiency by 30%.

- •Prepared and delivered presentations that communicated financial insights, leading to more informed management decisions.

- •Evaluated cost-saving opportunities across departments and facilitated successful implementation, achieving set objectives.

- •Supported the finance team during audits, ensuring all financial practices adhered to regulatory standards.

- •Monitored operational costs and coordinated with department heads to implement cost-effective solutions.

- •Generated detailed reports that helped streamline cost management processes and enhance transparency in operations.

- •Provided analytical support for strategic financial planning, resulting in improved budget planning and allocation.

- •Facilitated training sessions on cost management tools, increasing team adaptability and technical proficiency.

Corporate Finance Management Analyst resume sample

- •Developed and refined financial forecasting models improving accuracy by 15%, resulting in optimized budget allocation and resource planning.

- •Led cross-functional teams to analyze financial data, identifying an opportunity to reduce costs by 12% across departments.

- •Produced comprehensive financial reports for senior management, contributing to a 10% increase in strategic investments.

- •Implemented new financial reporting tools that reduced data processing time by 20% and enhanced decision-making speed.

- •Conducted in-depth variance analysis, identifying discrepancies that saved the company $1 million annually.

- •Supported acquisitions by conducting financial due diligence, contributing to two successful merger integrations.

- •Managed budgeting processes that led to a 10% reduction in operational costs through strategic resource allocation.

- •Collaborated with multiple departments to create robust financial models, paving the way for a $500 million project launch.

- •Identified financial trends and insights that prompted strategic pivots increasing revenue by 8%.

- •Automated key performance indicators reporting, streamlining efficiency and saving 50 hours per quarter.

- •Prepared executive presentations on financial forecasts, aiding in the approval of high-yield global market investments.

- •Conducted robust financial analysis that identified undervalued investments, contributing to a 7% portfolio growth.

- •Developed and maintained complex Excel models, enhancing forecasting accuracy by 20% over two years.

- •Monitored financial performance, advising on strategies that increased departmental efficiencies by 15%.

- •Prepared detailed financial presentations, securing stakeholder buy-in for major project expansions.

- •Gathered and analyzed financial data that supported capital spending decisions, increasing annual returns by 5%.

- •Standardized financial reporting processes, leading to a 30% improvement in report generation time.

- •Identified cost-saving opportunities, saving the company $300,000 annually through efficient resource utilization.

- •Assisted in the evaluation of strategic investments, contributing to enhanced portfolio performance.

Portfolio and Investment Financial Analyst resume sample

- •Conducted comprehensive financial modeling for portfolios which improved return on investment by 20% over two years.

- •Developed detailed investment reports leading to a 15% reduction in the decision-making time for stakeholders.

- •Monitored economic indicators effectively, helping to mitigate potential financial risks in a volatile market.

- •Collaborated with cross-functional teams to align investment strategies with client objectives, enhancing client satisfaction scores by 30%.

- •Optimized investment tracking systems resulting in a 25% increase in operational efficiency.

- •Contributed to successful budget preparations, resulting in accurate forecasting and performance analysis across portfolios.

- •Executed investment due diligence that effectively identified low-risk, high-yield opportunities increasing profits by 10%.

- •Prepared intricate financial models that facilitated informed strategic investment decisions across diversified portfolios.

- •Assisted in drafting investment strategies, boosting risk-adjusted portfolio performance by 12%.

- •Maintained and updated financial databases, ensuring data accuracy that reduced reporting errors by 40%.

- •Prepared and presented analytical insights to senior leadership, resulting in actionable investment policy decisions.

- •Analyzed market trends leading to strategic shifts in portfolio allocations, enhancing returns by 8% annually.

- •Streamlined the financial reporting process which reduced client reporting times by 35%.

- •Engaged with risk management teams to ensure compliance with industry standards, minimizing regulatory risks.

- •Supported budget preparations and performance evaluations improving decision accuracy.

Cash Flow Management Analyst resume sample

- •Developed comprehensive cash flow models resulting in a 15% improvement in liquidity management over two fiscal years, directly enhancing strategic decision-making processes.

- •Analyzed and presented cash flow trends and variances to senior management, leading to the implementation of cost-saving measures that reduced expenses by $1.5 million annually.

- •Collaborated cross-functionally with sales and operations teams to align cash flow forecasts with upcoming projects, ensuring adequate cash reserves were maintained.

- •Led a team to audit working capital accounts, identifying discrepancies that led to a 10% reduction in financing costs and improved cash utilization.

- •Created detailed monthly reports on cash flows and worked closely with the treasury department to optimize bank transactions and interest management.

- •Initiated and completed a project that integrated new forecasting software, enhancing accuracy and reducing reporting time by 25%.

- •Developed short-term and long-term cash flow forecasts, reducing forecast variance by 20% through improved data analysis techniques.

- •Analyzed cash flow management reports, resulting in strategic recommendations that increased operational efficiency by 12%.

- •Utilized advanced Excel modeling techniques to streamline budget preparation, achieving a 15% increase in process efficiency.

- •Managed cash inflow and outflow reporting, effectively communicating key findings to the finance team to support resource allocation.

- •Played a pivotal role in a cost reduction initiative, identifying areas of over-expenditure and achieving $800,000 in annual savings.

- •Conducted financial data analysis to support business operations, enhancing cash management strategies by ensuring accurate forecasting.

- •Generated weekly reports on cash flow movement and communicated insights to stakeholders to optimize financial planning.

- •Assisted in crafting the annual budget, optimizing cash allocation to align with target financial outcomes.

- •Implemented a new spreadsheet model for tracking financial transactions, decreasing processing errors by 30%.

- •Supported the finance team in cash flow modeling efforts, delivering actionable insights that facilitated better investment decisions.

- •Participated in monitoring liquidity requirements, thereby assisting in maintaining requisite cash levels for operational needs.

- •Collaborated with auditors to review cash flow statements, ensuring compliance with financial regulations and internal controls.

- •Evaluated export/import transactions to manage foreign exchange exposure, contributing to a 5% annual reduction in currency fluctuation losses.

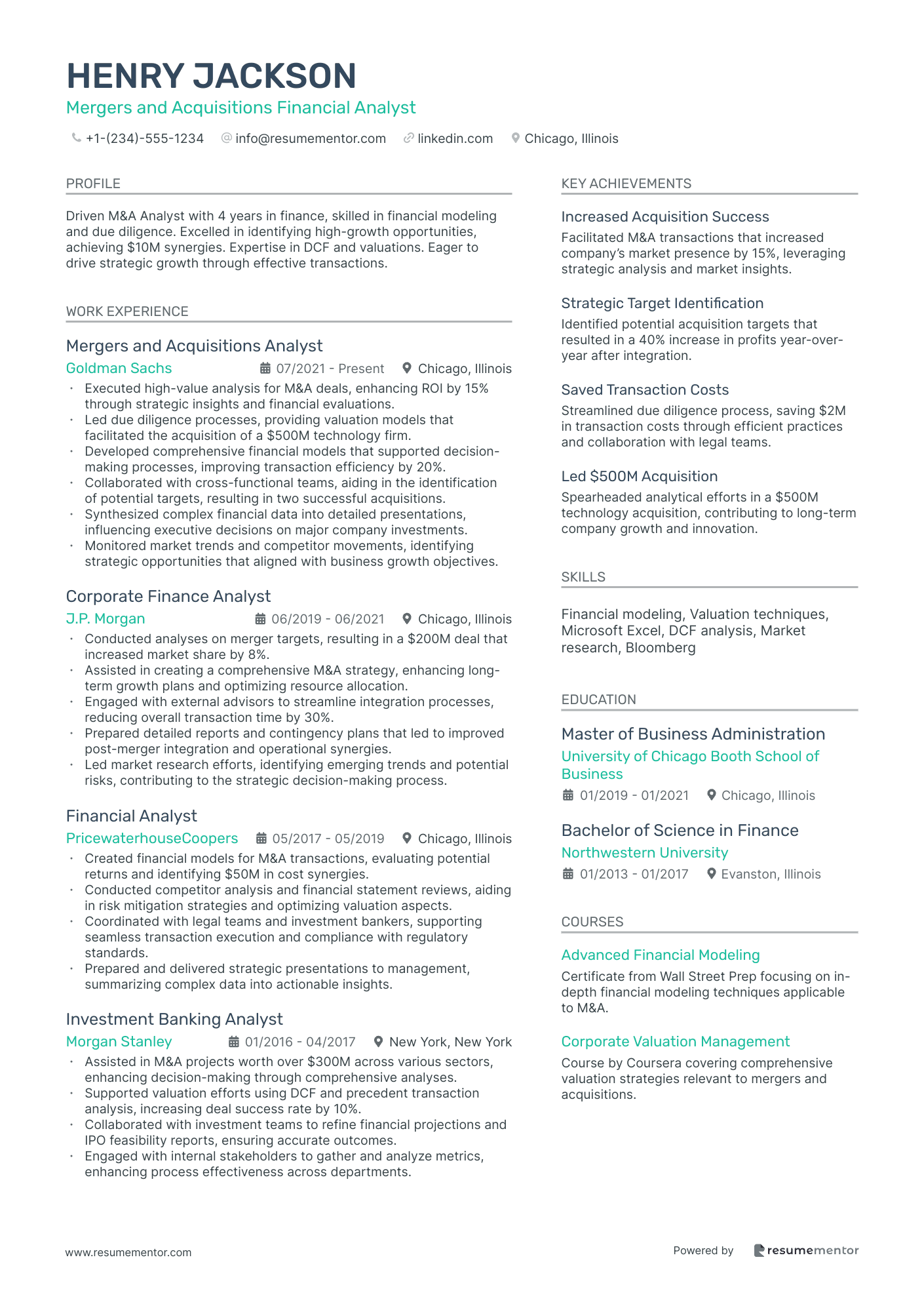

Mergers and Acquisitions Financial Analyst resume sample

- •Executed high-value analysis for M&A deals, enhancing ROI by 15% through strategic insights and financial evaluations.

- •Led due diligence processes, providing valuation models that facilitated the acquisition of a $500M technology firm.

- •Developed comprehensive financial models that supported decision-making processes, improving transaction efficiency by 20%.

- •Collaborated with cross-functional teams, aiding in the identification of potential targets, resulting in two successful acquisitions.

- •Synthesized complex financial data into detailed presentations, influencing executive decisions on major company investments.

- •Monitored market trends and competitor movements, identifying strategic opportunities that aligned with business growth objectives.

- •Conducted analyses on merger targets, resulting in a $200M deal that increased market share by 8%.

- •Assisted in creating a comprehensive M&A strategy, enhancing long-term growth plans and optimizing resource allocation.

- •Engaged with external advisors to streamline integration processes, reducing overall transaction time by 30%.

- •Prepared detailed reports and contingency plans that led to improved post-merger integration and operational synergies.

- •Led market research efforts, identifying emerging trends and potential risks, contributing to the strategic decision-making process.

- •Created financial models for M&A transactions, evaluating potential returns and identifying $50M in cost synergies.

- •Conducted competitor analysis and financial statement reviews, aiding in risk mitigation strategies and optimizing valuation aspects.

- •Coordinated with legal teams and investment bankers, supporting seamless transaction execution and compliance with regulatory standards.

- •Prepared and delivered strategic presentations to management, summarizing complex data into actionable insights.

- •Assisted in M&A projects worth over $300M across various sectors, enhancing decision-making through comprehensive analyses.

- •Supported valuation efforts using DCF and precedent transaction analysis, increasing deal success rate by 10%.

- •Collaborated with investment teams to refine financial projections and IPO feasibility reports, ensuring accurate outcomes.

- •Engaged with internal stakeholders to gather and analyze metrics, enhancing process effectiveness across departments.

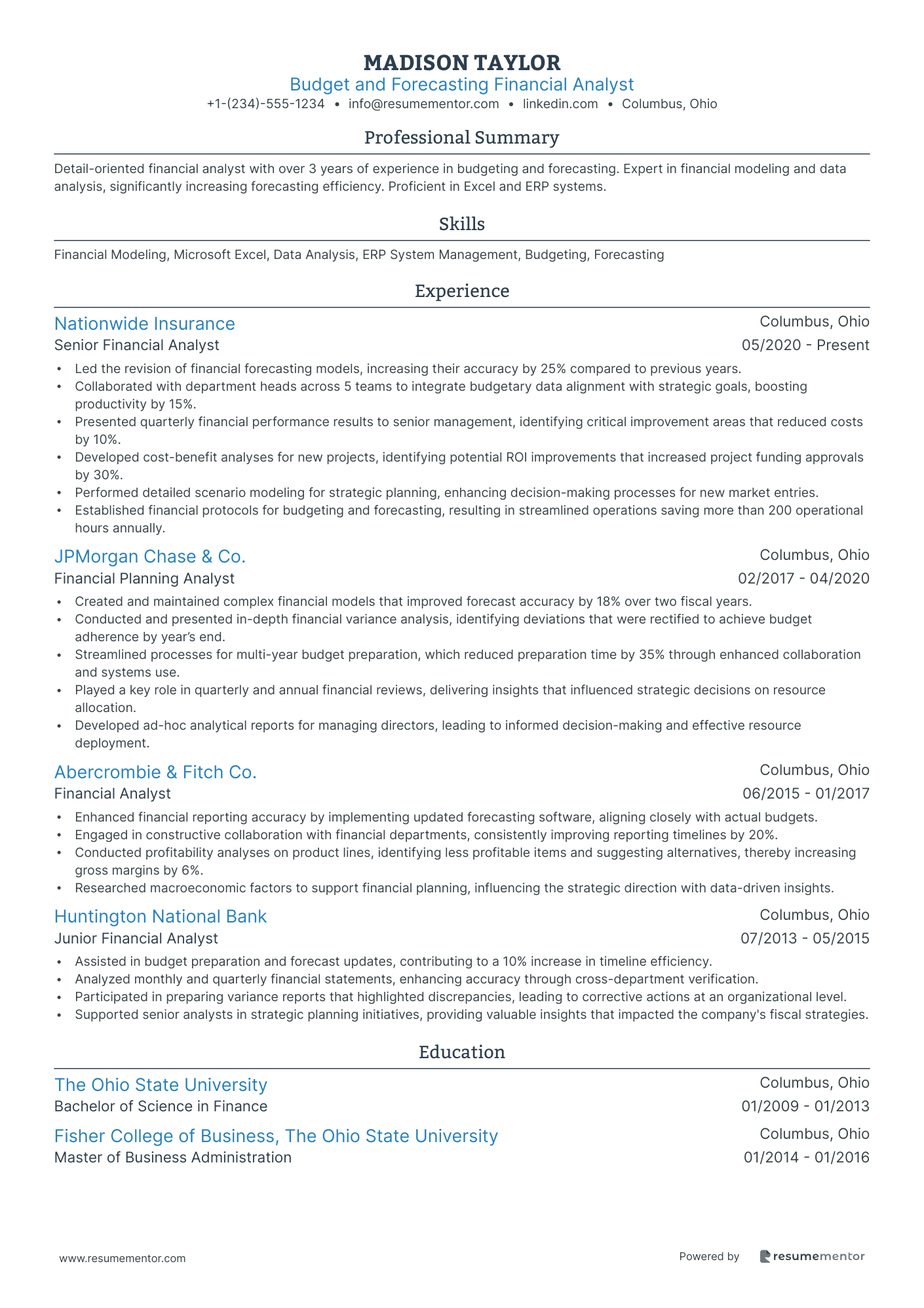

Budget and Forecasting Financial Analyst resume sample

- •Led the revision of financial forecasting models, increasing their accuracy by 25% compared to previous years.

- •Collaborated with department heads across 5 teams to integrate budgetary data alignment with strategic goals, boosting productivity by 15%.

- •Presented quarterly financial performance results to senior management, identifying critical improvement areas that reduced costs by 10%.

- •Developed cost-benefit analyses for new projects, identifying potential ROI improvements that increased project funding approvals by 30%.

- •Performed detailed scenario modeling for strategic planning, enhancing decision-making processes for new market entries.

- •Established financial protocols for budgeting and forecasting, resulting in streamlined operations saving more than 200 operational hours annually.

- •Created and maintained complex financial models that improved forecast accuracy by 18% over two fiscal years.

- •Conducted and presented in-depth financial variance analysis, identifying deviations that were rectified to achieve budget adherence by year’s end.

- •Streamlined processes for multi-year budget preparation, which reduced preparation time by 35% through enhanced collaboration and systems use.

- •Played a key role in quarterly and annual financial reviews, delivering insights that influenced strategic decisions on resource allocation.

- •Developed ad-hoc analytical reports for managing directors, leading to informed decision-making and effective resource deployment.

- •Enhanced financial reporting accuracy by implementing updated forecasting software, aligning closely with actual budgets.

- •Engaged in constructive collaboration with financial departments, consistently improving reporting timelines by 20%.

- •Conducted profitability analyses on product lines, identifying less profitable items and suggesting alternatives, thereby increasing gross margins by 6%.

- •Researched macroeconomic factors to support financial planning, influencing the strategic direction with data-driven insights.

- •Assisted in budget preparation and forecast updates, contributing to a 10% increase in timeline efficiency.

- •Analyzed monthly and quarterly financial statements, enhancing accuracy through cross-department verification.

- •Participated in preparing variance reports that highlighted discrepancies, leading to corrective actions at an organizational level.

- •Supported senior analysts in strategic planning initiatives, providing valuable insights that impacted the company's fiscal strategies.

As a financial management analyst, you're the navigator of financial seas, steering organizations toward economic health. Your resume is a vital tool in your job hunt, serving as your introduction to potential employers and showcasing your financial insights. Yet, you might find it challenging to translate your technical expertise and achievements into a concise, impactful format. Crafting a resume that effectively communicates your ability to interpret complex financial data and provide strategic growth insights is key.

To simplify the process, consider using a resume template. A structured format not only saves you time but also ensures that your resume looks clean and professional. For this purpose, explore various resume templates that can be adjusted to fit your specific career needs.

Think of your resume as more than just a chronology of jobs. It's your personal marketing tool, telling the story of your career journey and highlighting your unique skills and accomplishments. Make sure it effectively conveys your career path and your future potential.

To make the most impact, tailor your resume for each job application. Focus on the skills and achievements that align with the specific position you’re applying for. This guide will help you craft a resume that sets you apart and showcases your capabilities in financial management analysis, paving the way to securing your desired role.

Key Takeaways

- Utilize a structured resume template to ensure your resume is concise, professional, and easily showcases your financial insights.

- Your resume should act as more than just a work history by highlighting your career trajectory and unique skills such as financial analysis, budget management, and problem-solving abilities.

- Tailor your resume to align with each job application, emphasizing relevant skills and quantifiable achievements that demonstrate your impact in financial management.

- Use a chronological resume format, opting for modern fonts like Rubik or Raleway, and save it as a PDF to maintain format consistency across devices.

- Supplement your core resume sections with optional additions like projects or volunteer work to provide depth and broader context to your professional journey.

What to focus on when writing your financial management analyst resume

Your financial management analyst resume should clearly convey your expertise in financial analysis, budget management, and problem-solving to the recruiter. This means showcasing how your skills in analyzing data and managing financial reports can drive effective decision-making and improve an organization’s financial strategies.

How to structure your financial management analyst resume

- Contact Information — Start with a prominent display of your name, including any relevant professional suffixes. Ensure your phone number is current and your email is professional, typically using a variation of your full name. Linking your LinkedIn profile can also provide recruiters with a broader view of your professional history. Make this section easy to find, as it's the gateway for an employer to contact you.

- Professional Summary — Offer a compelling snapshot of your career by focusing on financial management experience. Distill your years of analytical work and emphasize personal strengths like problem-solving and strategic planning. This summary should be tailored to reflect the requirements of the specific job you are applying for, acting as a preview of what you bring to the table.

- Experience — Outline your previous job roles with an emphasis on specific duties related to financial management. Highlight initiatives you led or contributed to, and illustrate these with quantifiable results, such as increasing efficiency, reducing costs, or improving reporting accuracy. This demonstrates your ability to make a measurable impact in the roles you assume.

- Education — After your experience, detail your educational achievements by listing your degrees, particularly those in finance, economics, or related fields. Include the institutions and any honors received, as these underscore your academic foundation in financial matters.

- Skills — List critical abilities needed for a financial management analyst like financial modeling, data analysis, and proficiency in financial software. Highlight your capability to implement these skills effectively in real-world scenarios, which signals your readiness to tackle complex financial tasks in a professional setting.

- Certifications — Showcase any certifications such as CFA or CPA, as these credentials validate your expertise and commitment to maintaining high standards in the financial industry. Including these can set you apart by demonstrating a higher level of qualification and dedication to your field.

Including optional sections like projects, professional affiliations, or volunteer work can enrich your resume by adding personal depth and displaying contributions beyond traditional roles. Now, let's explore the specific resume format that ties all these sections together, and below we'll cover each section more in-depth.

Which resume format to choose

Choosing the right format for your financial management analyst resume is essential, as it can significantly impact how potential employers perceive your professional journey. A chronological format works best because it highlights your steady career path and progression in the industry, making it easier for employers to see your growth and experience. When it comes to font selection, opt for modern choices like Rubik, Montserrat, or Raleway. These fonts provide a clean, professional appearance without overpowering your content, ensuring that your achievements and qualifications are the focus. For consistency and professional presentation, always save your resume as a PDF. This file type ensures that your resume maintains its layout and formatting, regardless of the device or software used by recruiters. Additionally, using one-inch margins helps create a clean, organized look, providing enough white space to improve readability and prevent the document from appearing cluttered. By carefully considering these elements, your resume will strongly communicate your skills and experience in financial management.

How to write a quantifiable resume experience section

The experience section of your financial management analyst resume is vital for showcasing your professional achievements and skills. By focusing on quantifiable accomplishments and demonstrating their positive impact on previous organizations, you create a compelling narrative of your career. Start with your most recent experience and use a reverse-chronological order to create a logical flow. Highlight your role, workplace, and major achievements using bullet points to ensure clarity and directness. This approach not only underlines your expertise but also solidifies your reliability as a candidate.

As you organize this section, begin with your latest job and consider detailing your experience from the past 10-15 years or limit it to 3-4 significant positions that relate closely to the role you are applying for. Tailoring your resume to the job ad by aligning your job titles and emphasizing industry-specific skills creates a more targeted application. Action words such as "optimized," "developed," and "executed" at the beginning of each bullet point highlight your capabilities and initiative. When responding to a job ad that emphasizes cost-saving initiatives, detailing similar actions from your background showcases your relevance and readiness for the role.

- •Optimized budget management, cutting company expenses by 15% over two years.

- •Developed a forecasting model that improved financial projection accuracy by 20%.

- •Led a team to implement new financial software, boosting data processing speed by 30%.

- •Executed financial analysis for quarterly reports, enhancing stakeholder satisfaction by 10%.

This well-crafted experience section provides a cohesive view of your career accomplishments by linking your past actions to quantifiable outcomes. It emphasizes the tangible benefits you bring with specific improvements shown in percentages, effectively illustrating your value to potential employers. Each bullet point begins with a decisive action word, which seamlessly brings out your proactive nature. The focused content consistently ties back to key skills and achievements that are valued in the financial management field, such as budget optimization and system enhancements, aligning perfectly with employers' expectations. The organized and logical presentation ensures hiring managers can easily grasp the depth and relevance of your experience, significantly boosting the appeal of your resume.

Achievement-Focused resume experience section

A financial-focused financial management analyst resume experience section should highlight your achievements, quantify results, and demonstrate the impact of your work. Begin by identifying key accomplishments from past roles and transforming them into clear, concise bullet points. Start each with a strong action verb, providing both context and outcomes with numbers and percentages to underscore your contributions. This method helps your professional experience stand out to employers.

Be specific about your roles and responsibilities, especially emphasizing creative solutions or efficiencies you implemented in financial processes. Consider highlighting industry-specific skills or tools you're familiar with, like financial modeling software or advanced Excel techniques, to bolster your expertise. Align your experience with the job you're applying for and the skills most valued in the industry, ensuring your resume is both memorable and effective.

Financial Management Analyst

XYZ Financial Solutions

January 2020 - Present

- Boosted forecasting accuracy by 20% through effective trend analysis and data optimization strategies.

- Teamed up with various departments to cut costs by 15%, improving overall financial health.

- Built a solid financial reporting system that enhanced data-driven decision-making and efficiency.

- Simplified budgeting processes, leading to a 25% reduction in time spent on budget creation and review.

Skills-Focused resume experience section

A skills-focused resume experience section for a financial management analyst should effectively highlight how your expertise and accomplishments align with the core demands of the role. Start by identifying key responsibilities and successes that reflect your proficiency in managing budgets, analyzing financial data, and contributing to strategic decisions. Focus on detailing specific achievements that illustrate your capability in these areas, using concise bullet points to show how you addressed challenges, enhanced processes, or delivered cost savings. Each entry should clearly demonstrate the impact of your actions, creating a narrative that ties your experience directly to the role.

As you craft these bullet points, aim for clarity and relevance, ensuring each example relates to both your skills and the job. Specify the tools and methods you used, and whenever possible, quantify your achievements to highlight their importance. Include instances where your involvement was crucial in forecasting or strategic planning, as these underscore your value to prospective employers. This approach not only showcases your financial management skills but also paints a picture of how you can contribute to an organization's success. Use the following JSON format to guide your layout:

Financial Management Analyst

XYZ Corporation

June 2018 - Present

- Developed complex financial models to support strategic initiatives, boosting operational efficiency by 10%.

- Streamlined budget management processes, trimming overhead expenses by 15% over two years.

- Led a cross-departmental team to implement a new financial reporting system, enhancing data accuracy and reporting speed by 25%.

- Provided forecasts and reports to senior management, aiding decisions that increased quarterly revenue by 5%.

Responsibility-Focused resume experience section

A responsibility-focused financial management analyst resume experience section should clearly outline your roles and accomplishments to showcase your expertise. Begin by listing your job titles, place of employment, and dates, ensuring the basics are covered. Follow with your achievements by demonstrating how you analyzed financial data, improved efficiency, and supported strategic goals. Start each bullet point with a strong action verb to highlight your contributions, and use quantifiable results like increased revenue or decreased costs to make those contributions stand out.

Keep your language simple and direct for a more effective presentation of your experience. Connect your expertise in tasks such as creating financial models and preparing reports to tangible results, linking them to the skills the employer seeks. By mentioning specific projects or initiatives, you reveal your dedication and capability in finance, sending a clear message of your suitability for the role. This focused and cohesive description is what potential employers value in financial management analysts.

Financial Management Analyst

Tech Solutions Inc.

June 2018 - Present

- Created financial models that improved revenue forecasts by 20%, showcasing analytical skills and precision

- Analyzed financial statements to find cost-saving opportunities, reducing company expenses by over $500,000 annually and optimizing resource use

- Developed and presented quarterly financial reports to senior management, directly impacting their informed decision-making processes

- Worked with departments to create budgets aligned with company goals, leading to a 10% cut in unnecessary spending and fostering strategic growth

Growth-Focused resume experience section

A growth-focused financial management analyst resume experience section should clearly illustrate how you’ve driven financial strategies that support business expansion. Begin by identifying the skills and achievements that closely align with growth objectives, such as analyses leading to cost savings, revenue-boosting strategies, or initiatives for resource optimization. By showcasing tangible results and measurable impacts from your past roles, you weave a compelling story of your success.

Organize your accomplishments with clear bullet points, ensuring you provide specific details about your responsibilities and the financial challenges you overcame. Highlight any innovative solutions you implemented and use action words to demonstrate how your efforts directly influenced growth outcomes. This approach effectively connects your contributions to a company’s financial and strategic goals, illustrating your potential to drive success.

Financial Management Analyst

ABC Financial Group

Jan 2019 - Dec 2022

- Developed a financial model that identified $500K annual savings, which were reinvested into product development.

- Refined budget forecasting process, improving accuracy by 15% and enabling better strategic planning.

- Collaborated with cross-functional teams to redesign company cost structures, resulting in a 10% increase in net profitability over two years.

- Led a project to optimize the capital expenditure plan, enhancing resource allocation efficiency by 20%.

Write your financial management analyst resume summary section

A results-focused financial management analyst resume experience section should clearly convey your strengths and contributions in a concise way. Think of it as an elevator pitch that captures who you are, your expertise, and experiences. If you're someone with relevant experience, a summary will highlight your value. It's important to be concise yet compelling. For example:

This example weaves together your experience, achievements, and technical proficiencies, instantly showcasing what you bring to the table.

For those new to the field, a resume objective can be more effective. It focuses on your aspirations and the fresh perspective you can offer. Consider this variation:

[here was the JSON object 2]

With this objective, you communicate your goals and educational background, setting the stage for your potential impact.

It's essential to distinguish between summary, objective, profile, and summary of qualifications. While summaries and objectives focus on past achievements and future aspirations, a resume profile delves deeper into personal attributes and soft skills. Meanwhile, a summary of qualifications pinpoints specific achievements and skills, designed for quick scanning. Understanding these formats helps tailor your resume, making sure it captures attention swiftly and effectively.

Listing your financial management analyst skills on your resume

A skills-focused financial management analyst resume should highlight your abilities both in a standalone section and woven into areas like experience and summary. Your strengths can include soft skills such as leadership and communication, which are essential for excelling in finance roles. Hard skills, in contrast, are the specific, learned abilities like financial analysis or proficiency with finance software. These skills and strengths serve as crucial keywords for hiring managers, increasing your resume's visibility and helping it stand out.

A well-crafted skills section can effectively showcase your qualifications without overwhelming the reader. Here is an example in JSON format that lists essential skills succinctly:

This concise list of skills underscores your expertise, making it easy for employers to see what you bring to the table.

Best hard skills to feature on your financial management analyst resume

A financial management analyst should possess hard skills that spotlight technical capabilities. These skills demonstrate how you can manage complex financial tasks using analytical tools. Make sure to include these 15 important hard skills:

Hard Skills

- Financial Modeling

- Advanced Excel

- Budgeting and Forecasting

- Risk Management

- Data Analysis

- Financial Reporting

- Investment Analysis

- Cost-Benefit Analysis

- Accounting Software Proficiency

- ERP Systems Knowledge

- Trend Analysis

- Statistical Analysis

- Regulatory Compliance

- Profit and Loss Management

- Derivative Valuation

Best soft skills to feature on your financial management analyst resume

Soft skills demonstrate your interpersonal and leadership qualities, showing that you can work well with others and adapt to varied work environments. Make sure these 15 essential soft skills are evident:

Soft Skills

- Effective Communication

- Problem-Solving

- Critical Thinking

- Time Management

- Team Collaboration

- Leadership

- Adaptability

- Attention to Detail

- Negotiation

- Emotional Intelligence

- Conflict Resolution

- Decision Making

- Creative Thinking

- Initiative

- Stress Management

How to include your education on your resume

The education section is an essential part of your resume, especially for a financial management analyst position. It gives the hiring manager insight into your background and qualifies you for the role. Tailoring this section to the job is crucial; omit any education that does not align with your career goals. When listing your education, include details like your degree, institution, and graduation dates. If your GPA is above 3.0, you might want to include it to highlight your academic achievements. Listing honors such as 'cum laude' can also enhance your credibility. For your degree, use the full title, such as 'Bachelor of Science in Finance,' to prevent any misinterpretations. Avoid trivial details that do not serve the objective of landing an interview.

Here is an incorrect example that shows how not to list your educational background.

This example uses a degree irrelevant to financial management, potentially misleading employers. Below is a correct example in contrast.

This example is tailored and relevant, which strengthens your candidacy for a financial management analyst position. The specified degree, strong GPA, and honors demonstrate academic competence and focus on financial studies. Employing this targeted approach makes your application more compelling.

How to include financial management analyst certificates on your resume

Having a certificates section on your financial management analyst resume is crucial. List the name of your certificate first, as it is the most important. Include the date you earned it to show relevance and recency. Add the issuing organization to establish credibility.

Certificates can also be placed in the header for quick access. For example: "Certified Financial Analyst (CFA) | Certified Public Accountant (CPA)".

Here is an example of a good standalone certificates section:

This example is effective because it includes certificates relevant to the job. Both the CFA and CPA are highly respected in financial management. By listing these, you show your qualifications and dedication to the field. The example is clear, concise, and professional. It gives potential employers an immediate understanding of your skills and achievements.

Extra sections to include in your financial management analyst resume

In your role as a financial management analyst, crafting a well-rounded resume can significantly enhance your chances of landing your dream job. A resume that reflects not only your professional skills and experiences but also personal traits and interests can set you apart from other candidates. Here's how you can include specific sections on your resume.

- Language section — Highlight any additional languages you speak, such as Spanish or Mandarin. Demonstrating language skills can show your ability to work in diverse markets and improve communication with global teams.

- Hobbies and interests section — Share activities you genuinely enjoy, like hiking or playing chess. This helps portray you as a well-rounded individual, which can be appealing to potential employers.

- Volunteer work section — Include experiences such as tutoring kids in mathematics or organizing community events. Engaging in volunteer work showcases your dedication and willingness to contribute to society beyond your professional role.

- Books section — List influential books you’ve read, such as “The Intelligent Investor” by Benjamin Graham. Sharing your reading habits can highlight your commitment to continuous learning and staying updated in your field.

Incorporate these sections thoughtfully to create a comprehensive picture of who you are, both professionally and personally, enhancing your resume's appeal. The balance of skills, interests, and experiences can make you a strong candidate for any role you apply for.

In Conclusion

In conclusion, crafting a standout resume as a financial management analyst requires more than just a list of experiences and skills. Your resume is your personal marketing tool, showcasing not only your professional journey but also your potential to drive financial growth within an organization. By structuring your resume effectively and focusing on key aspects like quantifiable achievements, you can clearly demonstrate your value to potential employers. Tailoring your resume to each job application, highlighting relevant skills, and using action-oriented language can further set you apart in the competitive job market. Don't underestimate the impact of a well-presented education section, featuring pertinent degrees and honors that assert your academic foundation in finance. Additionally, listing certifications like CFA or CPA can significantly enhance your resume's credibility and draw attention to your commitment to excellence in the financial sector. Incorporating extra sections that reflect your personal interests and volunteer endeavors can also create a more holistic picture of your character and values. With these elements combined, your resume will not only open doors to opportunities but also reinforce your role as a strategic asset in any organization.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.