Financial Planning Analyst Resume Examples

Jul 18, 2024

|

12 min read

Craft a stellar financial planning analyst resume and bank on your skills to land your dream job. Learn how to showcase your experience, highlight key achievements, and make your application stand out.

Rated by 348 people

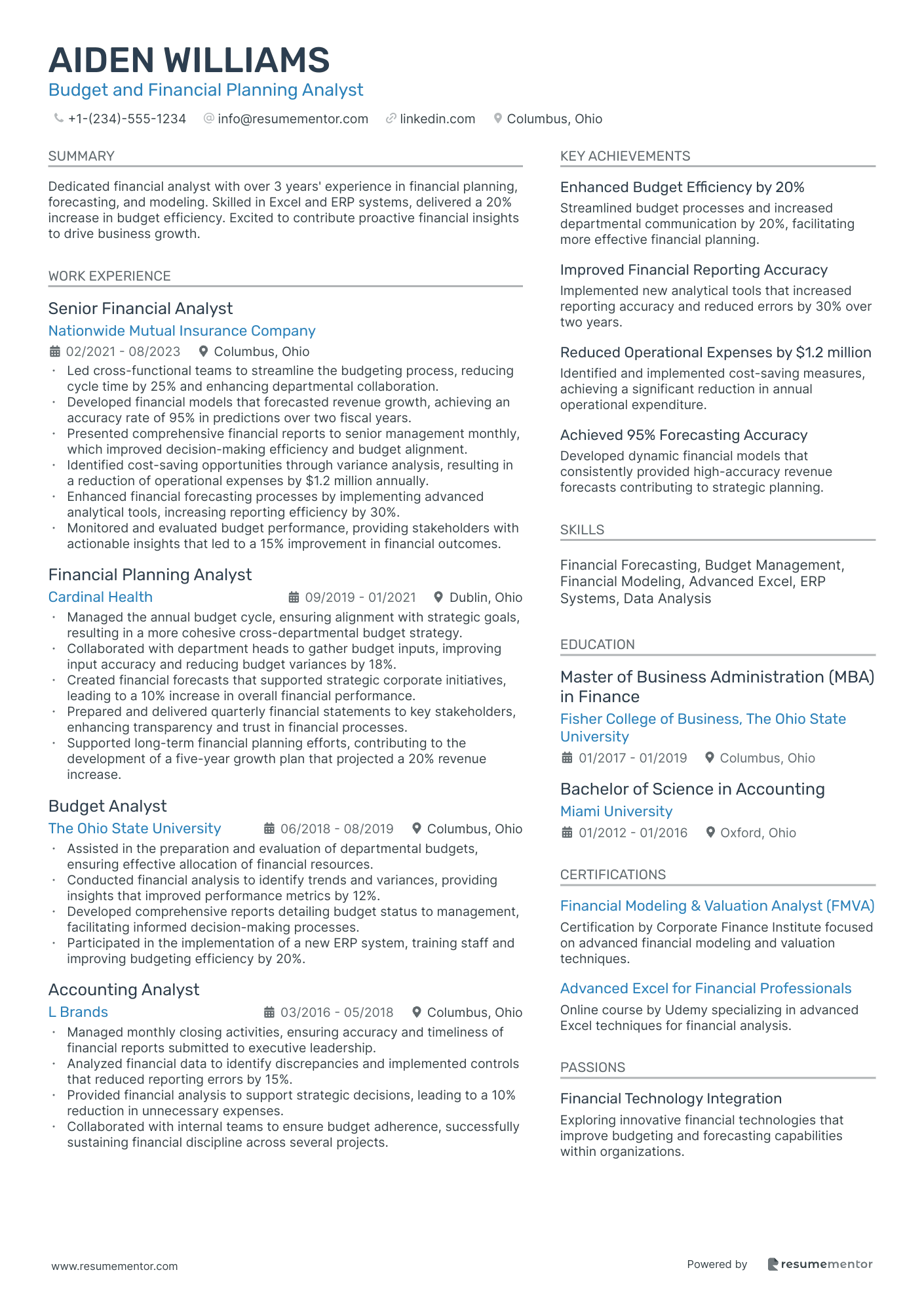

Budget and Financial Planning Analyst

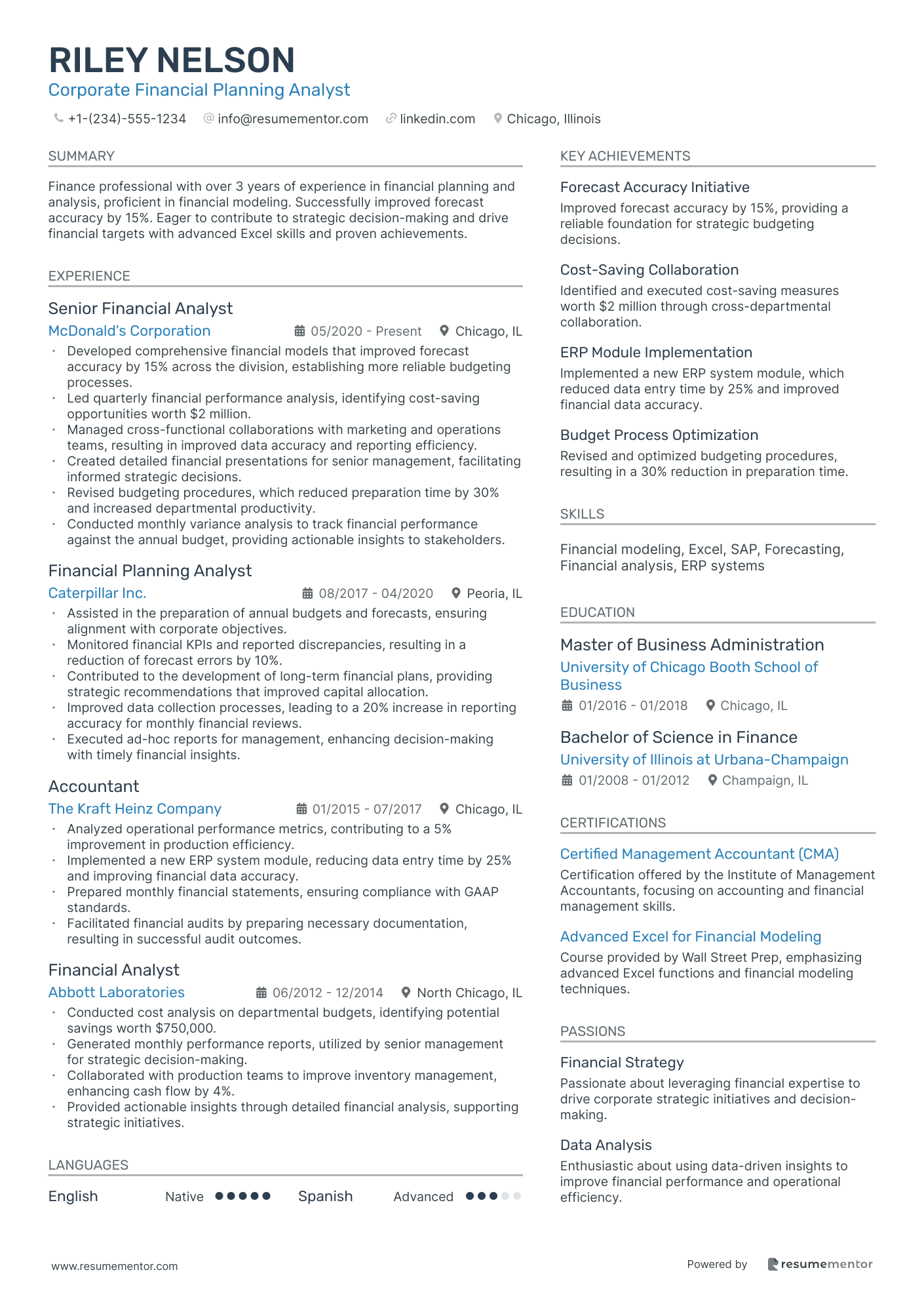

Corporate Financial Planning Analyst

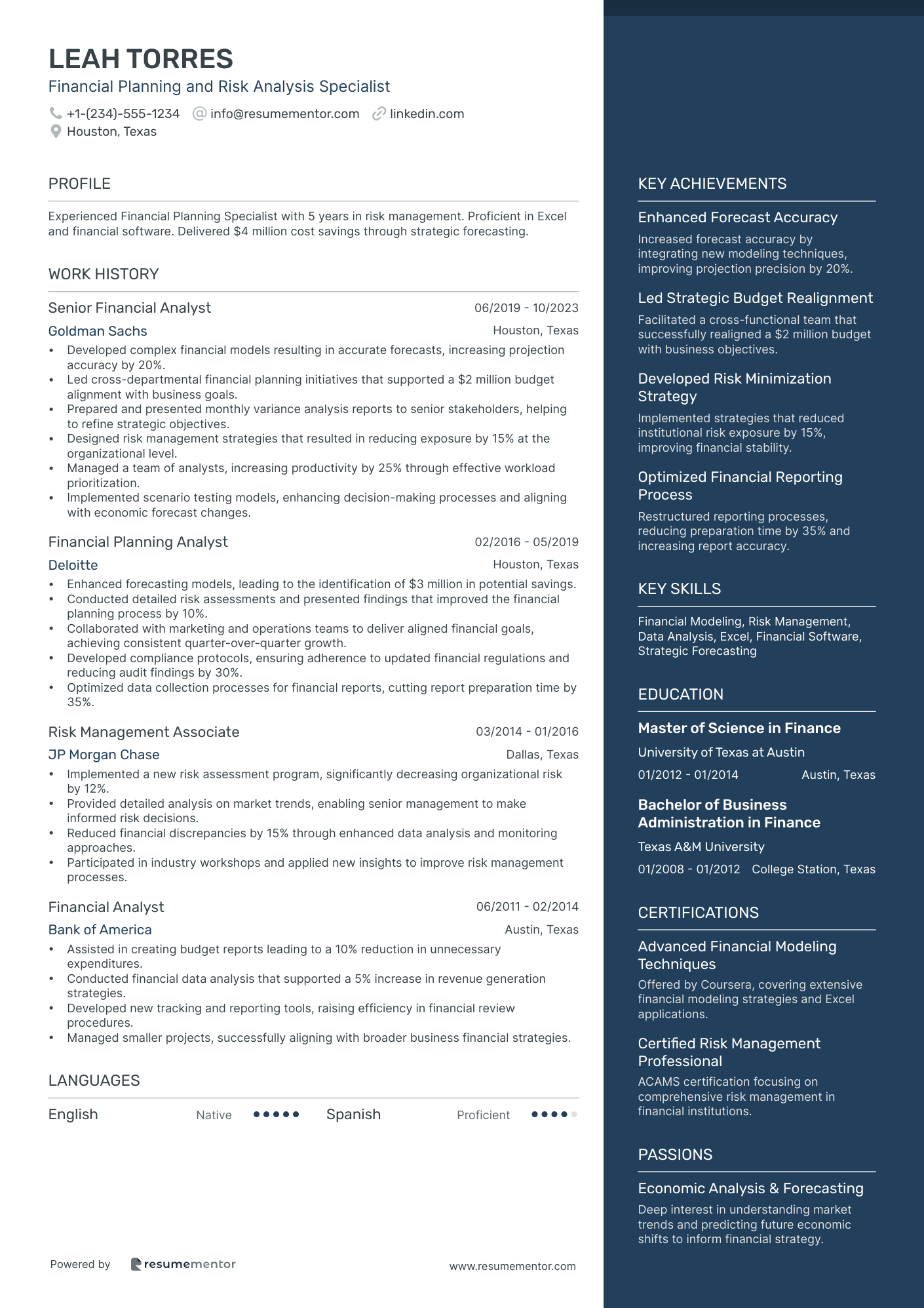

Financial Planning and Risk Analysis Specialist

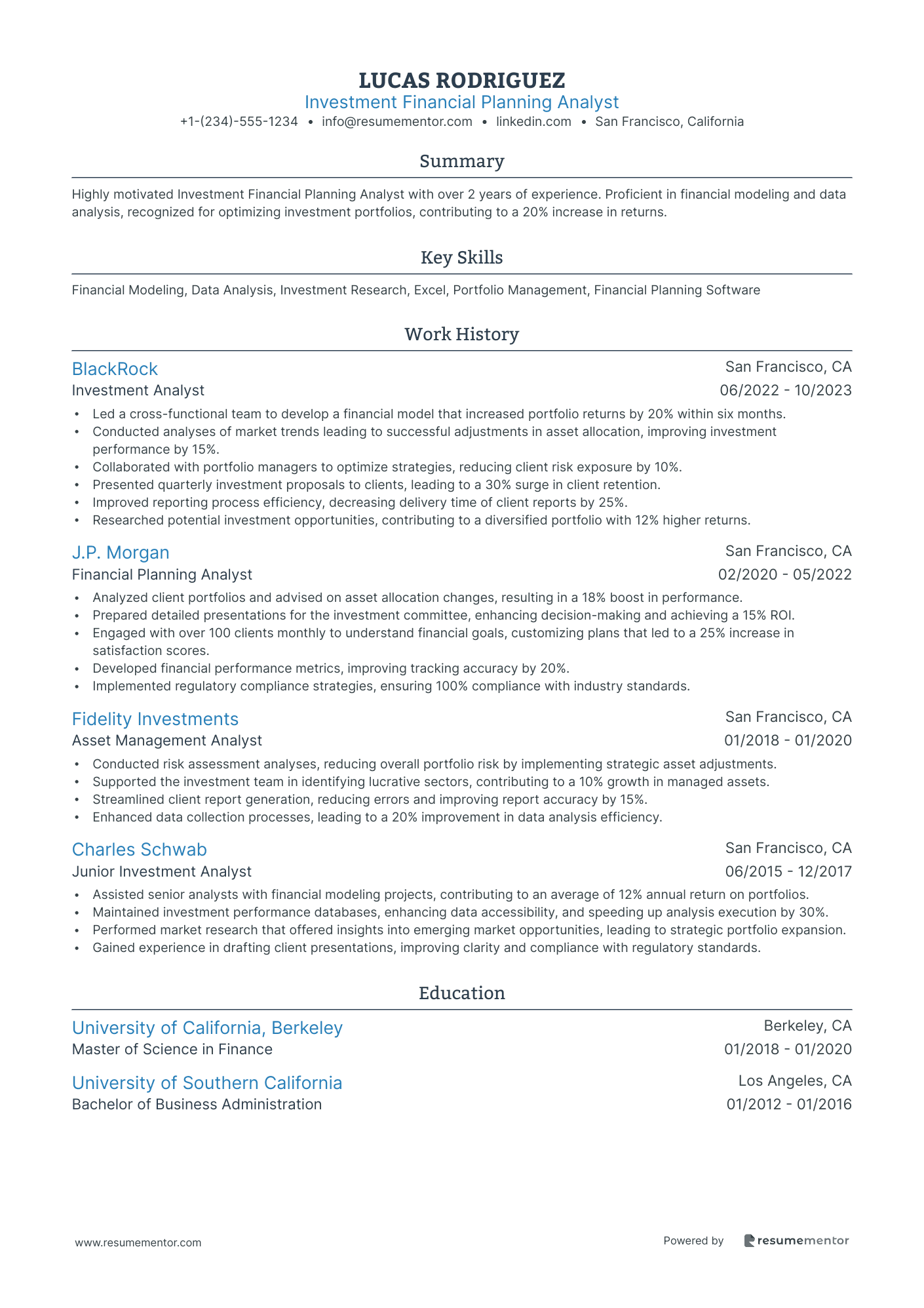

Investment Financial Planning Analyst

Retirement Financial Planning Analyst

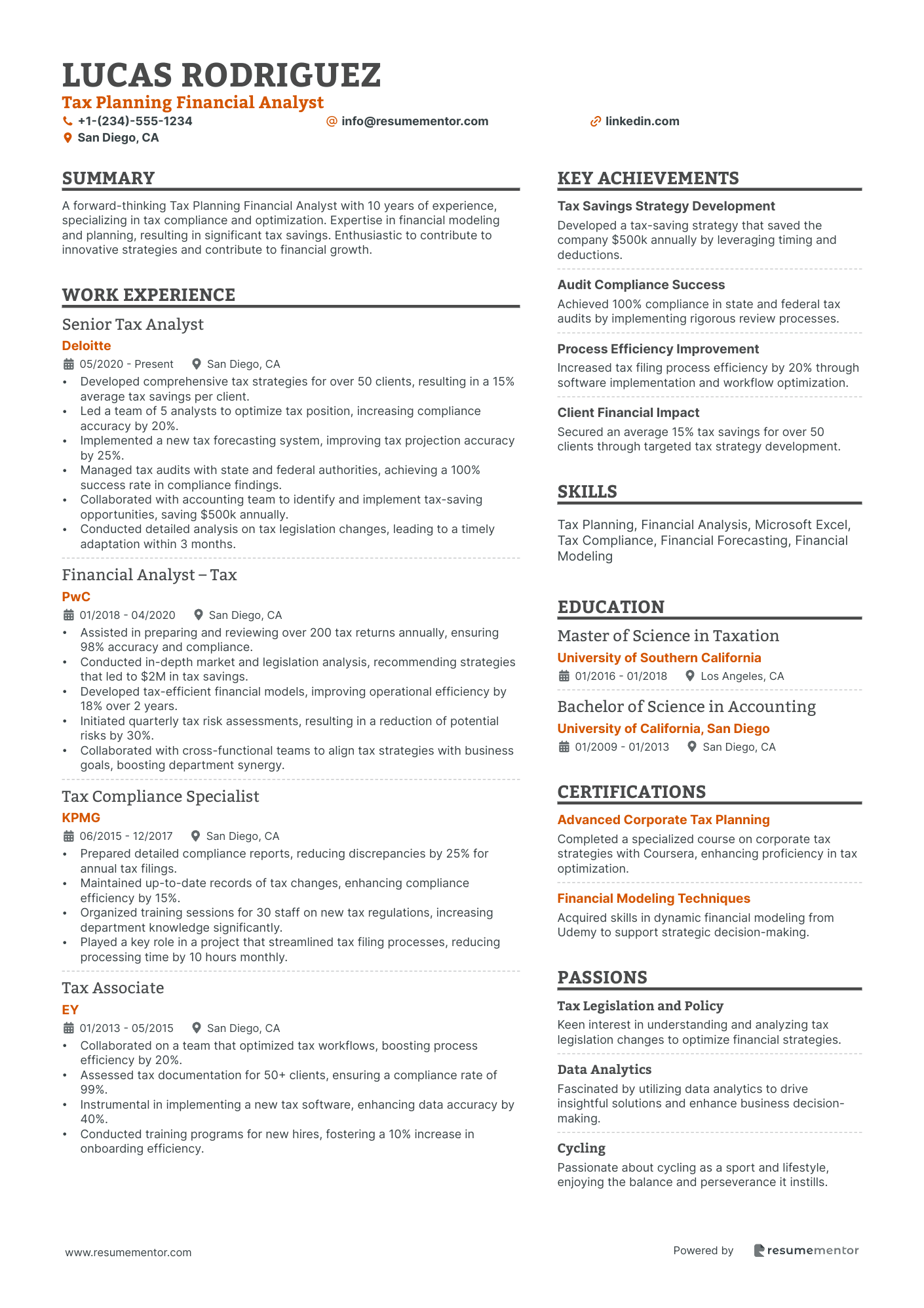

Tax Planning Financial Analyst

Financial Planning and Forecasting Analyst

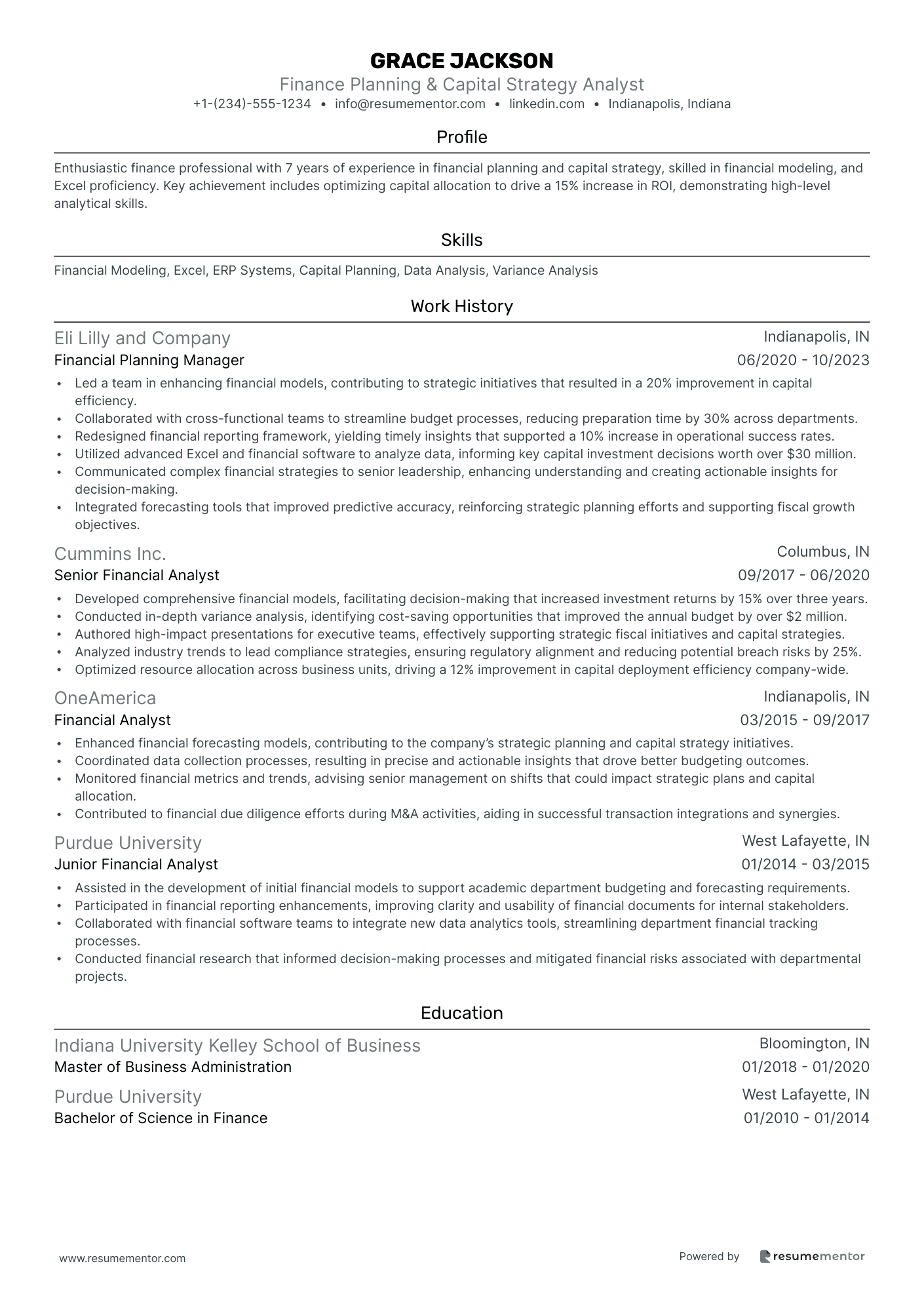

Finance Planning & Capital Strategy Analyst

Financial Planning and Analysis Operations Specialist

Budget and Financial Planning Analyst resume sample

- •Led cross-functional teams to streamline the budgeting process, reducing cycle time by 25% and enhancing departmental collaboration.

- •Developed financial models that forecasted revenue growth, achieving an accuracy rate of 95% in predictions over two fiscal years.

- •Presented comprehensive financial reports to senior management monthly, which improved decision-making efficiency and budget alignment.

- •Identified cost-saving opportunities through variance analysis, resulting in a reduction of operational expenses by $1.2 million annually.

- •Enhanced financial forecasting processes by implementing advanced analytical tools, increasing reporting efficiency by 30%.

- •Monitored and evaluated budget performance, providing stakeholders with actionable insights that led to a 15% improvement in financial outcomes.

- •Managed the annual budget cycle, ensuring alignment with strategic goals, resulting in a more cohesive cross-departmental budget strategy.

- •Collaborated with department heads to gather budget inputs, improving input accuracy and reducing budget variances by 18%.

- •Created financial forecasts that supported strategic corporate initiatives, leading to a 10% increase in overall financial performance.

- •Prepared and delivered quarterly financial statements to key stakeholders, enhancing transparency and trust in financial processes.

- •Supported long-term financial planning efforts, contributing to the development of a five-year growth plan that projected a 20% revenue increase.

- •Assisted in the preparation and evaluation of departmental budgets, ensuring effective allocation of financial resources.

- •Conducted financial analysis to identify trends and variances, providing insights that improved performance metrics by 12%.

- •Developed comprehensive reports detailing budget status to management, facilitating informed decision-making processes.

- •Participated in the implementation of a new ERP system, training staff and improving budgeting efficiency by 20%.

- •Managed monthly closing activities, ensuring accuracy and timeliness of financial reports submitted to executive leadership.

- •Analyzed financial data to identify discrepancies and implemented controls that reduced reporting errors by 15%.

- •Provided financial analysis to support strategic decisions, leading to a 10% reduction in unnecessary expenses.

- •Collaborated with internal teams to ensure budget adherence, successfully sustaining financial discipline across several projects.

Corporate Financial Planning Analyst resume sample

- •Developed comprehensive financial models that improved forecast accuracy by 15% across the division, establishing more reliable budgeting processes.

- •Led quarterly financial performance analysis, identifying cost-saving opportunities worth $2 million.

- •Managed cross-functional collaborations with marketing and operations teams, resulting in improved data accuracy and reporting efficiency.

- •Created detailed financial presentations for senior management, facilitating informed strategic decisions.

- •Revised budgeting procedures, which reduced preparation time by 30% and increased departmental productivity.

- •Conducted monthly variance analysis to track financial performance against the annual budget, providing actionable insights to stakeholders.

- •Assisted in the preparation of annual budgets and forecasts, ensuring alignment with corporate objectives.

- •Monitored financial KPIs and reported discrepancies, resulting in a reduction of forecast errors by 10%.

- •Contributed to the development of long-term financial plans, providing strategic recommendations that improved capital allocation.

- •Improved data collection processes, leading to a 20% increase in reporting accuracy for monthly financial reviews.

- •Executed ad-hoc reports for management, enhancing decision-making with timely financial insights.

- •Analyzed operational performance metrics, contributing to a 5% improvement in production efficiency.

- •Implemented a new ERP system module, reducing data entry time by 25% and improving financial data accuracy.

- •Prepared monthly financial statements, ensuring compliance with GAAP standards.

- •Facilitated financial audits by preparing necessary documentation, resulting in successful audit outcomes.

- •Conducted cost analysis on departmental budgets, identifying potential savings worth $750,000.

- •Generated monthly performance reports, utilized by senior management for strategic decision-making.

- •Collaborated with production teams to improve inventory management, enhancing cash flow by 4%.

- •Provided actionable insights through detailed financial analysis, supporting strategic initiatives.

Financial Planning and Risk Analysis Specialist resume sample

- •Developed complex financial models resulting in accurate forecasts, increasing projection accuracy by 20%.

- •Led cross-departmental financial planning initiatives that supported a $2 million budget alignment with business goals.

- •Prepared and presented monthly variance analysis reports to senior stakeholders, helping to refine strategic objectives.

- •Designed risk management strategies that resulted in reducing exposure by 15% at the organizational level.

- •Managed a team of analysts, increasing productivity by 25% through effective workload prioritization.

- •Implemented scenario testing models, enhancing decision-making processes and aligning with economic forecast changes.

- •Enhanced forecasting models, leading to the identification of $3 million in potential savings.

- •Conducted detailed risk assessments and presented findings that improved the financial planning process by 10%.

- •Collaborated with marketing and operations teams to deliver aligned financial goals, achieving consistent quarter-over-quarter growth.

- •Developed compliance protocols, ensuring adherence to updated financial regulations and reducing audit findings by 30%.

- •Optimized data collection processes for financial reports, cutting report preparation time by 35%.

- •Implemented a new risk assessment program, significantly decreasing organizational risk by 12%.

- •Provided detailed analysis on market trends, enabling senior management to make informed risk decisions.

- •Reduced financial discrepancies by 15% through enhanced data analysis and monitoring approaches.

- •Participated in industry workshops and applied new insights to improve risk management processes.

- •Assisted in creating budget reports leading to a 10% reduction in unnecessary expenditures.

- •Conducted financial data analysis that supported a 5% increase in revenue generation strategies.

- •Developed new tracking and reporting tools, raising efficiency in financial review procedures.

- •Managed smaller projects, successfully aligning with broader business financial strategies.

Investment Financial Planning Analyst resume sample

- •Led a cross-functional team to develop a financial model that increased portfolio returns by 20% within six months.

- •Conducted analyses of market trends leading to successful adjustments in asset allocation, improving investment performance by 15%.

- •Collaborated with portfolio managers to optimize strategies, reducing client risk exposure by 10%.

- •Presented quarterly investment proposals to clients, leading to a 30% surge in client retention.

- •Improved reporting process efficiency, decreasing delivery time of client reports by 25%.

- •Researched potential investment opportunities, contributing to a diversified portfolio with 12% higher returns.

- •Analyzed client portfolios and advised on asset allocation changes, resulting in a 18% boost in performance.

- •Prepared detailed presentations for the investment committee, enhancing decision-making and achieving a 15% ROI.

- •Engaged with over 100 clients monthly to understand financial goals, customizing plans that led to a 25% increase in satisfaction scores.

- •Developed financial performance metrics, improving tracking accuracy by 20%.

- •Implemented regulatory compliance strategies, ensuring 100% compliance with industry standards.

- •Conducted risk assessment analyses, reducing overall portfolio risk by implementing strategic asset adjustments.

- •Supported the investment team in identifying lucrative sectors, contributing to a 10% growth in managed assets.

- •Streamlined client report generation, reducing errors and improving report accuracy by 15%.

- •Enhanced data collection processes, leading to a 20% improvement in data analysis efficiency.

- •Assisted senior analysts with financial modeling projects, contributing to an average of 12% annual return on portfolios.

- •Maintained investment performance databases, enhancing data accessibility, and speeding up analysis execution by 30%.

- •Performed market research that offered insights into emerging market opportunities, leading to strategic portfolio expansion.

- •Gained experience in drafting client presentations, improving clarity and compliance with regulatory standards.

Retirement Financial Planning Analyst resume sample

- •Led a team to overhaul retirement planning processes, which increased client satisfaction rates by 25%.

- •Developed tax-efficient retirement strategies resulting in an average client savings growth of 18% annually.

- •Created detailed financial reports and presentations, improving client understanding of their portfolios by 35%.

- •Collaborated with cross-functional teams to align client retirement goals with market opportunities, enhancing portfolio performance by 30%.

- •Streamlined communication procedures, reducing client response time by 40% and boosting engagement rates.

- •Designed educational materials for retirement workshops, leading to a 50% increase in client event participation.

- •Analyzed retirement income projections, increasing long-term client savings by 20% through strategic investments.

- •Developed retirement investment strategies tailored to client needs, resulting in a 40% increase in customer retention.

- •Collaborated with tax advisors to optimize client tax savings, achieving an average 15% improvement in net income.

- •Monitored regulatory changes, incorporating them into client retirement plans, reducing compliance risks by 30%.

- •Built strong relationships with clients, achieving a 95% satisfaction rate through regular follow-ups and updates.

- •Prepared 50+ comprehensive retirement plans each quarter, ensuring alignment with client financial goals.

- •Conducted workshops and seminars, increasing participant financial literacy and driving a 30% increase in service uptake.

- •Utilized financial planning software to model various retirement scenarios, improving client decision-making.

- •Promoted cross-department collaboration, leading to a 25% enhancement in client portfolio value within a year.

- •Provided personalized financial advice, resulting in 20% growth in client base within the first year.

- •Managed a portfolio of high-net-worth clients, achieving a 35% increase in their annual returns.

- •Presented retirement solutions that reduced client risk exposure by 25%, enhancing long-term stability.

- •Created retirement income models taking into account pensions and social security, aligning with future financial goals.

Tax Planning Financial Analyst resume sample

- •Developed comprehensive tax strategies for over 50 clients, resulting in a 15% average tax savings per client.

- •Led a team of 5 analysts to optimize tax position, increasing compliance accuracy by 20%.

- •Implemented a new tax forecasting system, improving tax projection accuracy by 25%.

- •Managed tax audits with state and federal authorities, achieving a 100% success rate in compliance findings.

- •Collaborated with accounting team to identify and implement tax-saving opportunities, saving $500k annually.

- •Conducted detailed analysis on tax legislation changes, leading to a timely adaptation within 3 months.

- •Assisted in preparing and reviewing over 200 tax returns annually, ensuring 98% accuracy and compliance.

- •Conducted in-depth market and legislation analysis, recommending strategies that led to $2M in tax savings.

- •Developed tax-efficient financial models, improving operational efficiency by 18% over 2 years.

- •Initiated quarterly tax risk assessments, resulting in a reduction of potential risks by 30%.

- •Collaborated with cross-functional teams to align tax strategies with business goals, boosting department synergy.

- •Prepared detailed compliance reports, reducing discrepancies by 25% for annual tax filings.

- •Maintained up-to-date records of tax changes, enhancing compliance efficiency by 15%.

- •Organized training sessions for 30 staff on new tax regulations, increasing department knowledge significantly.

- •Played a key role in a project that streamlined tax filing processes, reducing processing time by 10 hours monthly.

- •Collaborated on a team that optimized tax workflows, boosting process efficiency by 20%.

- •Assessed tax documentation for 50+ clients, ensuring a compliance rate of 99%.

- •Instrumental in implementing a new tax software, enhancing data accuracy by 40%.

- •Conducted training programs for new hires, fostering a 10% increase in onboarding efficiency.

Financial Planning and Forecasting Analyst resume sample

- •Led a 5-member team to optimize financial forecasting models, achieving a 15% increase in forecasting accuracy over two years.

- •Collaborated with product managers to refine revenue models, contributing to a $10 million year-over-year sales growth.

- •Implemented robust variance analysis processes to identify discrepancies, resulting in corrective actions that improved cost efficiency by 8%.

- •Spearheaded a cross-departmental initiative that streamlined financial reporting timelines, reducing them by 30% across the board.

- •Developed dynamic dashboards using advanced Excel techniques, enhancing transparency and real-time financial reporting for senior leadership.

- •Revamped the annual budgeting workflow, accelerating deadlines and increasing departmental engagement by 25%.

- •Engineered sophisticated financial models for a $50 million retail project, facilitating strategic investment decisions.

- •Drove the budgeting process for 7 departments, achieving a 95% adherence rate to approved budgets.

- •Analyzed weekly sales performance data, providing actionable insights that enhanced gross margin by 3% over a 6-month period.

- •Assessed the financial viability of 10 potential new store locations, leading to a data-driven expansion strategy.

- •Automated financial reporting processes, cutting down the time spent on manual reporting by 35%.

- •Conducted scenario analysis for new product lines, forecasting potential outcomes and supporting strategic launch decisions.

- •Refined cash flow forecasts, increasing accuracy and enabling more strategic capital deployment.

- •Enhanced profit-and-loss tracking by implementing a standardized framework, which reduced report errors by 40%.

- •Orchestrated inter-departmental communication to align financial objectives with corporate strategy, ensuring goal congruence.

- •Assisted in the development of a complex financial model that forecasted a $100 million revenue stream for a new service segment.

- •Introduced a detailed variance analysis report, providing management with insights that led to a 5% reduction in operational costs.

- •Collaborated with the IT department to integrate ERP systems, enhancing financial data accuracy by 20%.

- •Created comprehensive financial reports that were presented to senior executives, aiding in strategic decision-making.

Finance Planning & Capital Strategy Analyst resume sample

- •Led a team in enhancing financial models, contributing to strategic initiatives that resulted in a 20% improvement in capital efficiency.

- •Collaborated with cross-functional teams to streamline budget processes, reducing preparation time by 30% across departments.

- •Redesigned financial reporting framework, yielding timely insights that supported a 10% increase in operational success rates.

- •Utilized advanced Excel and financial software to analyze data, informing key capital investment decisions worth over $30 million.

- •Communicated complex financial strategies to senior leadership, enhancing understanding and creating actionable insights for decision-making.

- •Integrated forecasting tools that improved predictive accuracy, reinforcing strategic planning efforts and supporting fiscal growth objectives.

- •Developed comprehensive financial models, facilitating decision-making that increased investment returns by 15% over three years.

- •Conducted in-depth variance analysis, identifying cost-saving opportunities that improved the annual budget by over $2 million.

- •Authored high-impact presentations for executive teams, effectively supporting strategic fiscal initiatives and capital strategies.

- •Analyzed industry trends to lead compliance strategies, ensuring regulatory alignment and reducing potential breach risks by 25%.

- •Optimized resource allocation across business units, driving a 12% improvement in capital deployment efficiency company-wide.

- •Enhanced financial forecasting models, contributing to the company’s strategic planning and capital strategy initiatives.

- •Coordinated data collection processes, resulting in precise and actionable insights that drove better budgeting outcomes.

- •Monitored financial metrics and trends, advising senior management on shifts that could impact strategic plans and capital allocation.

- •Contributed to financial due diligence efforts during M&A activities, aiding in successful transaction integrations and synergies.

- •Assisted in the development of initial financial models to support academic department budgeting and forecasting requirements.

- •Participated in financial reporting enhancements, improving clarity and usability of financial documents for internal stakeholders.

- •Collaborated with financial software teams to integrate new data analytics tools, streamlining department financial tracking processes.

- •Conducted financial research that informed decision-making processes and mitigated financial risks associated with departmental projects.

Financial Planning and Analysis Operations Specialist resume sample

- •Led the quarterly financial forecasting process, improving accuracy by 12% through enhanced data collection and analysis.

- •Collaborated with cross-functional teams to create comprehensive monthly financial reports, providing insights that resulted in a 20% increase in budget allocation efficiency.

- •Developed improved financial models to reflect organizational changes, resulting in increased forecasting precision for revenue streams.

- •Supported senior management by preparing detailed financial presentations, leading to informed strategic decisions and a 15% rise in profit margins.

- •Identified process improvement opportunities, streamlining budgeting operations which led to a reduction in preparation time by 30%.

- •Conducted in-depth variance analyses that identified cost-saving measures, achieving a $1.5M reduction in operational expenses.

- •Played a key role in the annual budgeting process, successfully managing a $200M budget across multiple departments.

- •Enhanced data accuracy by 25% in monthly financial forecasts by integrating advanced Excel functions and refinements.

- •Facilitated financial data integration across various platforms, ensuring consistency and reducing discrepancies by 40%.

- •Delivered crucial ad-hoc financial analyses, supporting investment decisions that improved ROI by 18%.

- •Maintained comprehensive documentation of financial procedures, thereby facilitating the development of financial training materials for stakeholders.

- •Conducted detailed KPI analysis which improved decision-making processes by providing clear financial insights.

- •Streamlined the monthly variance reporting process, reducing delivery time by two days, enhancing data dissemination across departments.

- •Collaborated with IT to implement a new financial reporting system, enhancing reporting efficiency by 35%.

- •Authored detailed financial reports that were instrumental in securing a $10M increase in funding for strategic projects.

- •Developed client-specific financial models to enhance predictive analysis, achieving a 22% improvement in forecasting accuracy.

- •Prepared extensive financial presentations and advised executives on cost optimization strategies, reducing overhead costs by 5%.

- •Conducted comprehensive market analyses that informed client investment strategies, leading to a 12% increase in investment returns.

- •Identified training needs in financial procedures, spearheading workshops that increased team proficiency in financial software by 30%.

As a financial planning analyst, you're the navigator in the vast sea of a company's financial future, but translating this expertise into a compelling resume can feel like uncharted waters. This guide will help you highlight your skills while making sure you stand out in the job market.

In the competitive financial sector, it's crucial for your resume to reflect your analytical abilities and your talent for interpreting complex data. A good resume template acts as your compass, organizing your information effectively. By using a resume template, you can streamline the process and focus on emphasizing your strengths without getting lost in the details.

Translating your numerical prowess and strategic insights onto paper requires clarity. It’s essential to demonstrate your skills in financial forecasting, budgeting, and variance analysis, while also proving that you can communicate these insights effectively to non-experts.

Remember, your resume isn’t just a document—it’s a snapshot of your career journey and potential. When tailored thoughtfully, it resonates with hiring managers, making your first impression impactful. Let’s delve into how you can transform your achievements into a cohesive narrative that truly reflects your abilities.

Key Takeaways

- Start your financial planning analyst resume with essential contact details and a powerful professional summary highlighting your expertise and core achievements.

- Detail your work experience in reverse chronological order, emphasizing roles and tasks that showcase your analytical skills and measurable impacts.

- Utilize a chronological resume format to highlight your career growth and use clean, modern fonts like Rubik or Lato, saving your resume as a PDF for consistency.

- Include a well-crafted skills section that lists both hard and soft skills to align with the job's requirements and stand out to both hiring managers and ATS.

- Incorporate additional sections like certifications, education, volunteer work, and personal interests to paint a comprehensive picture of your capabilities and professional journey.

What to focus on when writing your financial planning analyst resume

Your financial planning analyst resume should clearly express your skills in financial analysis and planning, demonstrating your ability to support business decisions. Start with essential contact details like your full name, phone number, email, and LinkedIn profile—take care to ensure everything is polished and up-to-date, as this sets the first impression with potential employers. Your professional summary is your introductory pitch. Here, you should capture your broad expertise in financial planning, budgeting, and analysis while aligning your experiences with the job you are applying for. This section should also include core achievements, such as significant improvements in financial strategy or reporting, tailored to reflect your impact in previous roles.

How to structure your financial planning analyst resume

- Detailing your work experience provides a narrative of your career development—list your roles starting with the most recent, emphasizing tasks that highlight your analytical skills and accomplishments that have had a measurable impact, such as increased forecast accuracy or cost reductions.

- When describing your education, include your degrees and institutions, but don’t forget critical coursework or projects relevant to the job, as well as any academic honors that can add weight to your suitability.

- Highlight pivotal skills like financial modeling, proficiency in tools like Excel or SAP, and strategic planning. These should link back to the experiences you detailed earlier, reinforcing your capability to excel in the role.

- Certifications like CFA or CPA can enhance your resume by demonstrating a high level of expertise and commitment to the field.

- Introducing additional elements like awards, publications, or memberships can paint a well-rounded picture of your professional life.

As we move forward to discuss resume format, we will delve into each section more in-depth to ensure your resume is compelling and comprehensive.

Which resume format to choose

Choosing the right resume format is crucial for a financial planning analyst. A chronological format is your best bet because it allows you to highlight your career growth and the progression of skills you've developed over time. This approach shows potential employers a clear timeline of your experience, emphasizing stability and growth, which are valued in the finance sector.

Selecting the right font can enhance the overall impression of your resume. Opt for modern and clean fonts like Rubik, Lato, or Montserrat. These fonts not only keep your resume looking fresh and contemporary but also ensure that your information is easy to read, which is critical when you're detailing complex financial responsibilities and achievements.

Saving your resume as a PDF is a must. This file type preserves your formatting across different devices and platforms, ensuring that your resume looks the same to every potential employer. Consistency is vital, especially when your resume is viewed on various screens by hiring managers, recruiters, or automated systems.

Setting your margins to one inch on all sides provides a balanced and neat layout. This standard margin size offers enough white space, enhancing readability and ensuring that the key details of your background in financial analysis stand out. A well-organized resume can reflect the attention to detail that's essential in financial planning roles.

Together, these elements help create a polished and professional resume that effectively represents your qualifications and positions you as a standout candidate in the financial planning analyst field.

How to write a quantifiable resume experience section

The experience section of your financial planning analyst resume is essential because it highlights your career achievements and skills in a way that shows your growth and contributions. Arrange it in reverse chronological order to put your most recent roles at the top, giving employers an immediate view of your latest experience. Focus on covering the past 10 to 15 years, unless an older position is particularly relevant to the job you're seeking. Ensure your job titles align with the role you're aiming for, and tailor your resume to the job ad by incorporating specific language and keywords. This demonstrates your fit for the position. Strong action verbs like "analyzed," "optimized," and "developed" effectively emphasize your initiative and impact.

Here's a compelling example of an experience section for a financial planning analyst resume:

- •Analyzed budgeting processes, leading to a 15% cost reduction over three years.

- •Developed financial models, boosting forecasting accuracy by 20%.

- •Collaborated with various teams to enhance revenue by 10% year-over-year.

- •Prepared detailed variance reports, cutting reporting errors by 30%.

This experience section flows smoothly by linking clear, action-oriented language with quantifiable achievements. Each bullet point builds on the last by highlighting measurable impacts, showcasing your effectiveness as a financial planning analyst. The consistent use of strong action verbs shows your capacity to make significant contributions. By tailoring the resume to a job ad with relevant titles and language, you directly address the employer’s needs, making you a more compelling candidate. This approach creates a cohesive narrative of your professional journey, focusing on growth and tangible results.

Growth-Focused resume experience section

A growth-focused financial planning analyst resume experience section should effectively highlight your ability to drive company success through specific achievements and measurable results. Focus on key experiences that demonstrate your skills in driving growth by detailing initiatives or strategies where you played a pivotal role. To make the impact clear, include relevant metrics like percentage increases, cost savings, or time reductions.

Begin by briefly outlining your role and the company to set the context, then emphasize how your responsibilities directly contributed to increased revenue or improved efficiencies. Use action verbs to create a dynamic impression and convey your accomplishments with confidence. Presenting these achievements in bullet points ensures they are easy to digest, with each point beginning with a strong action verb, elaborating on the task or project, and finishing with the positive impact to show how you exceeded expectations.

Financial Planning Analyst

XYZ Financial Services

June 2020 - August 2023

- Developed a forecasting model that increased company revenue projections by 15% in one year.

- Implemented a data-driven budgeting process that reduced overhead costs by 10%.

- Collaborated with cross-functional teams to streamline financial reporting, cutting report delivery time by 25%.

- Led a financial analysis that identified new market opportunities, contributing an additional $500K in quarterly revenue.

Problem-Solving Focused resume experience section

A Problem-Solving Focused Financial Planning Analyst resume experience section should shine a light on your talent for identifying challenges and devising effective solutions. Begin by stating the position you held, the company you worked for, and the duration of your employment. Use bullet points to weave a narrative of specific problems you encountered and the methods you used to solve them, highlighting the positive outcomes like increased efficiency, cost savings, or improved accuracy, to illustrate your impact. By keeping your language clear and engaging, you can keep the reader interested.

Highlight achievements that demonstrated innovative approaches or showcased your leadership in overcoming financial challenges. Where possible, quantify your contributions to provide a clear picture of your effectiveness. Align your accomplishments with the skills and experiences the employer desires, showing your proven ability to solve problems within the financial sector. This connection reassures potential employers that you are equipped to contribute positively to their organization.

Financial Planning Analyst

XYZ Corp

June 2019 - Present

- Reduced annual budgeting errors by 20% through implementing a new forecasting model.

- Spearheaded a project that saved $500K by identifying inefficiencies in the expense reporting process.

- Collaborated with IT to develop a financial dashboard that improved data analysis speed by 30%.

- Trained team members on financial modeling techniques, increasing team productivity by 15%.

Result-Focused resume experience section

A result-focused financial planning analyst resume experience section should clearly show how you drive results and support strategic goals. Begin by listing your job title and workplace to give context. Highlight how you've improved financial performance by analyzing key metrics and contributing to business growth. It's important to use bullet points to share specific accomplishments and quantifiable results, such as cost savings or revenue boosts, to demonstrate your impact effectively.

To make your resume stand out, tailor your content to align with the skills and experiences relevant to the job you're pursuing. Employ clear and action-oriented language to describe your responsibilities and achievements. Illustrate how you solved problems, optimized processes, or influenced decisions, using figures and percentages to make your contributions tangible. Present yourself as a strategic thinker by showing how your analyses and actions have led to positive financial outcomes, ultimately making you a valuable asset to any organization.

Financial Planning Analyst

XYZ Corp

June 2020 - Present

- Developed and implemented comprehensive budgeting processes, resulting in a 15% reduction in overall costs.

- Conducted detailed analysis of financial data, guiding executive decision-making and strategic planning.

- Collaborated with cross-functional teams to optimize financial operations, enhancing efficiency by 20%.

- Identified key financial trends and provided actionable insights, supporting a 10% growth in revenue.

Technology-Focused resume experience section

A technology-focused Financial Planning Analyst resume experience section should effectively showcase how your technical skills have driven financial success. Start by clearly listing your job titles and previous workplaces, which sets the scene for your achievements. Use strong action verbs to describe how you have utilized technology in your role, emphasizing your experience with tools and methodologies like data analytics, financial modeling software, and automation processes. This approach demonstrates your ability to blend financial expertise with technical proficiency, a vital combination in today's digital workplace.

Link your accomplishments to measurable results by incorporating numbers and percentages, making your impact immediately clear. For example, you can highlight how developing financial models improved forecasting accuracy or how implementing new software increased efficiency. Throughout, emphasize the technological skills that were pivotal to these successes, such as proficiency with analytics or modeling tools. Keep your descriptions focused on results, allowing hiring managers to quickly appreciate the value you bring by connecting the dots between technology use and financial performance.

Financial Planning Analyst

TechCorp Solutions

January 2020 - Present

- Developed a financial modeling tool that increased forecasting accuracy by 25%.

- Implemented process automation software, reducing report generation time by 30%.

- Analyzed data trends using advanced analytics tools, identifying cost-saving opportunities worth $200,000 annually.

- Collaborated with IT team to integrate financial systems, enhancing cross-departmental data access.

Write your financial planning analyst resume summary section

A well-focused financial planning analyst resume summary should effectively capture the attention of potential employers by showcasing your skills, achievements, and unique value. If you’re experienced, your summary can powerfully convey what you bring to the table. Here’s a refined example:

This summary excels by highlighting your extensive experience and key competencies while showcasing specific achievements. The action-oriented language used here emphasizes your leadership qualities and your results-driven approach. Including numbers, like years of experience, lends credibility and makes your claims more convincing.

To describe yourself effectively in a summary, it's important to use active language that focuses on strengths aligned with the job you desire. As you tailor your summary to the specific position, make sure to emphasize the skills and experiences most relevant to that role.

Understanding the differences between various resume components can guide you in crafting content that fits your career level and goals. A resume summary offers a concise snapshot of your professional expertise, stressing notable achievements and skills. In contrast, a resume objective works best for those at the start of their career, as it outlines your aspirations and what you aim to accomplish. For a more rounded view, a resume profile merges personal and professional attributes, while a summary of qualifications lists your top strengths in a bullet-point format to spotlight key skills.

Listing your financial planning analyst skills on your resume

A skills-focused financial planning analyst resume should strategically highlight your abilities in a way that captures the employer's attention. You can choose to present your skills as a standalone section or weave them into other parts like your work experience or summary. It's essential to differentiate between soft skills, which demonstrate your ability to work with others, and hard skills, which reflect specific expertise such as financial modeling or data analysis. Including these as keywords can make your resume stand out to hiring managers and Applicant Tracking Systems (ATS).

Creating a standalone skills section provides a concise snapshot of your capabilities, allowing employers to quickly assess your expertise. A well-crafted skills section should clearly list abilities tailored to the role of a financial planning analyst, positioning you as an exceptional candidate.

This skills section effectively conveys your technical capabilities essential for a financial planning analyst. By listing relevant skills concisely, it showcases your proficiency in both analytical and managerial aspects, aligning well with job requirements.

Best hard skills to feature on your financial planning analyst resume

Hard skills on your resume emphasize your technical expertise. They demonstrate your ability to handle complex data, conduct thorough analyses, and produce valuable recommendations.

Hard Skills

- Financial Analysis

- Budgeting and Forecasting

- Risk Management

- Strategic Planning

- Financial Modeling

- Data Analysis

- Statistical Software

- Advanced Excel Skills

- Budget Management

- Cost-Benefit Analysis

- Investment Valuation

- Accounting Principles

- KPI Benchmarking

- Variance Analysis

- Business Process Improvement

Best soft skills to feature on your financial planning analyst resume

In addition to technical abilities, soft skills highlight how you communicate and collaborate effectively with others. These skills contribute to successful teamwork and problem-solving, which are crucial in this role.

Soft Skills

- Communication

- Attention to Detail

- Critical Thinking

- Problem Solving

- Adaptability

- Leadership

- Time Management

- Team Collaboration

- Organizational Skills

- Emotional Intelligence

- Conflict Resolution

- Creative Thinking

- Decision-Making

- Customer Service

- Work Ethic

How to include your education on your resume

The education section of your resume is crucial, particularly for a financial planning analyst position. You'll want to tailor this section to the job you're applying for, omitting any irrelevant education that doesn't support your role as a financial analyst. This makes your resume more relevant and compelling for hiring managers. If you choose to include your GPA, make sure it's impressive; typically, a GPA of 3.5 or higher is worth showcasing. When listing your degree, include the name of the degree and the major field of study. Cum laude honors should also be part of the description if applicable, as they emphasize your academic accomplishments.

Here is a poor example:

Here is an outstanding example:

- •Graduated cum laude

The second example is excellent because it emphasizes a relevant degree, "Bachelor of Science in Finance," which directly supports a financial planning analyst role. Including a high GPA demonstrates academic prowess, and listing "cum laude" highlights honors attained, showcasing dedication and expertise. This structured education section powerfully supports your candidacy.

How to include financial planning analyst certificates on your resume

Including a certificates section is a crucial part of your financial planning analyst resume. List the name of each certificate clearly. Include the date you received each certificate. Add the issuing organization to validate the credential. Certificates can also be included in the resume header for quick visibility. For instance, if you have a CFA certification, you could write "John Doe, CFA."

A solid standalone certificates section might look something like this:

This example is effective because it lists relevant certifications in the finance field. The titles and issuing organizations are prestigious and well-known, boosting your resume's credibility. Including the date helps show your career timeline. This approach showcases your qualifications efficiently and comprehensively, enhancing your chances of standing out.

Extra sections to include in your financial planning analyst resume

Financial planning analysts play a crucial role in helping individuals and businesses make informed financial decisions. They analyze financial data, forecast future financial trends, and develop strategies to achieve financial goals. Creating a compelling resume is essential to showcasing your skills and experience to potential employers.

- Include a language section — Highlight proficiency in multiple languages to demonstrate your ability to communicate and collaborate in diverse settings.

- Add a hobbies and interests section — Display your well-rounded personality by sharing hobbies that involve analytical thinking or financial acumen to create a fuller picture of who you are.

- Mention a volunteer work section — Demonstrate your commitment to community service and teamwork by listing volunteer experiences that have enhanced your leadership and financial planning skills.

- List a books section — Show your dedication to continuous learning by including books on finance, business, or related topics that you have read, indicating your proactive approach to professional development.

In Conclusion

In conclusion, crafting an exceptional resume as a financial planning analyst is your gateway to standing out in a competitive job market. Your resume should tell a powerful story of your career, showcasing your abilities to analyze financial data and support business decisions. Start by choosing a clean, modern format that highlights your career trajectory and accomplishments. Make use of a professional template to ensure your resume is organized and eye-catching. Clearly express your proficiency in financial analysis and planning, backed by tangible results and key metrics that demonstrate your impact.

Emphasize both hard skills, such as data analysis and financial modeling, and soft skills, like communication and critical thinking. This blend of skills portrays you as a well-rounded professional capable of tackling complex challenges. The use of action verbs and quantifiable achievements in your experience section will strengthen your case as a results-driven candidate. Don’t forget to include relevant educational accomplishments and certifications, which enhance your credibility and specialization in the field.

Your resume summary should immediately grab attention with a succinct overview of your expertise, using active language to convey your professional identity. Additional sections like skills, certificates, and extra personal achievements can further enrich your resume by providing a comprehensive view of your qualifications and interests. A well-rounded resume reflects your attention to detail—crucial in financial roles—and aligns you with the strategic goals of potential employers. With these elements, you position yourself as a compelling candidate ready to contribute significantly to any organization.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.