Financial Reporting Analyst Resume Examples

Jul 18, 2024

|

12 min read

Gain the competitive edge in your financial reporting analyst resume: tips to audit your skills, clean up your experience, and balance your accomplishments effectively.

Rated by 348 people

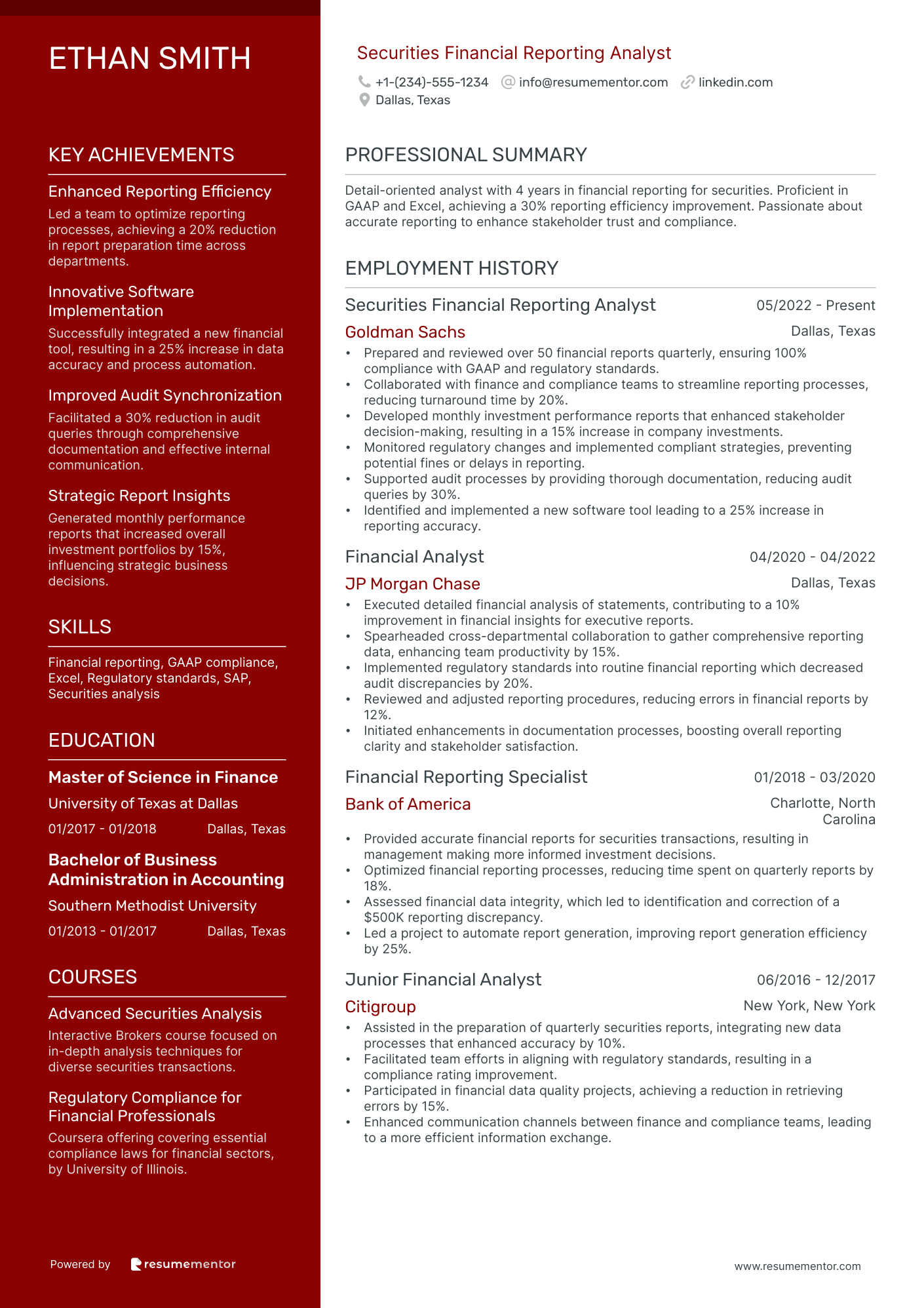

Securities Financial Reporting Analyst

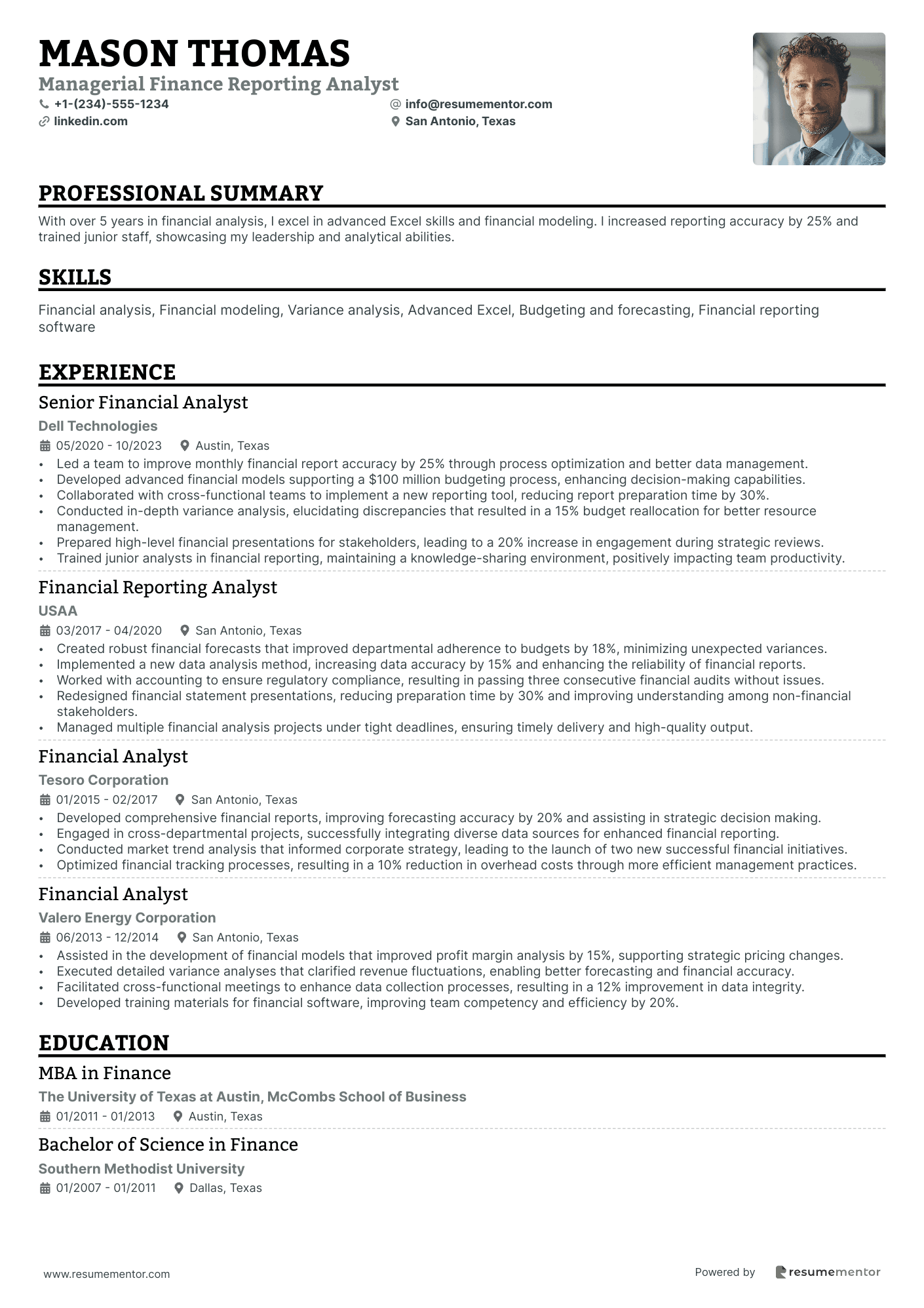

Managerial Finance Reporting Analyst

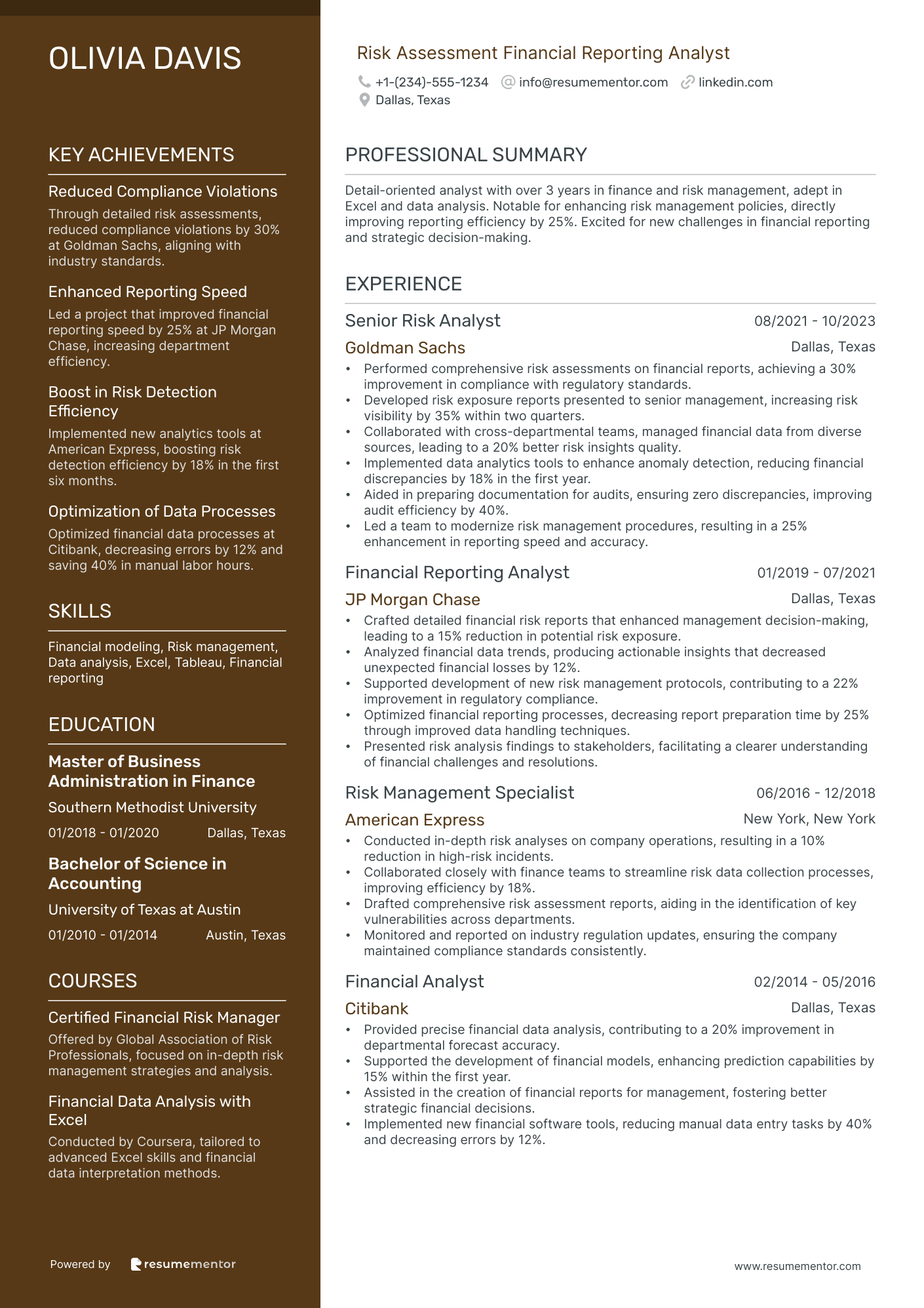

Risk Assessment Financial Reporting Analyst

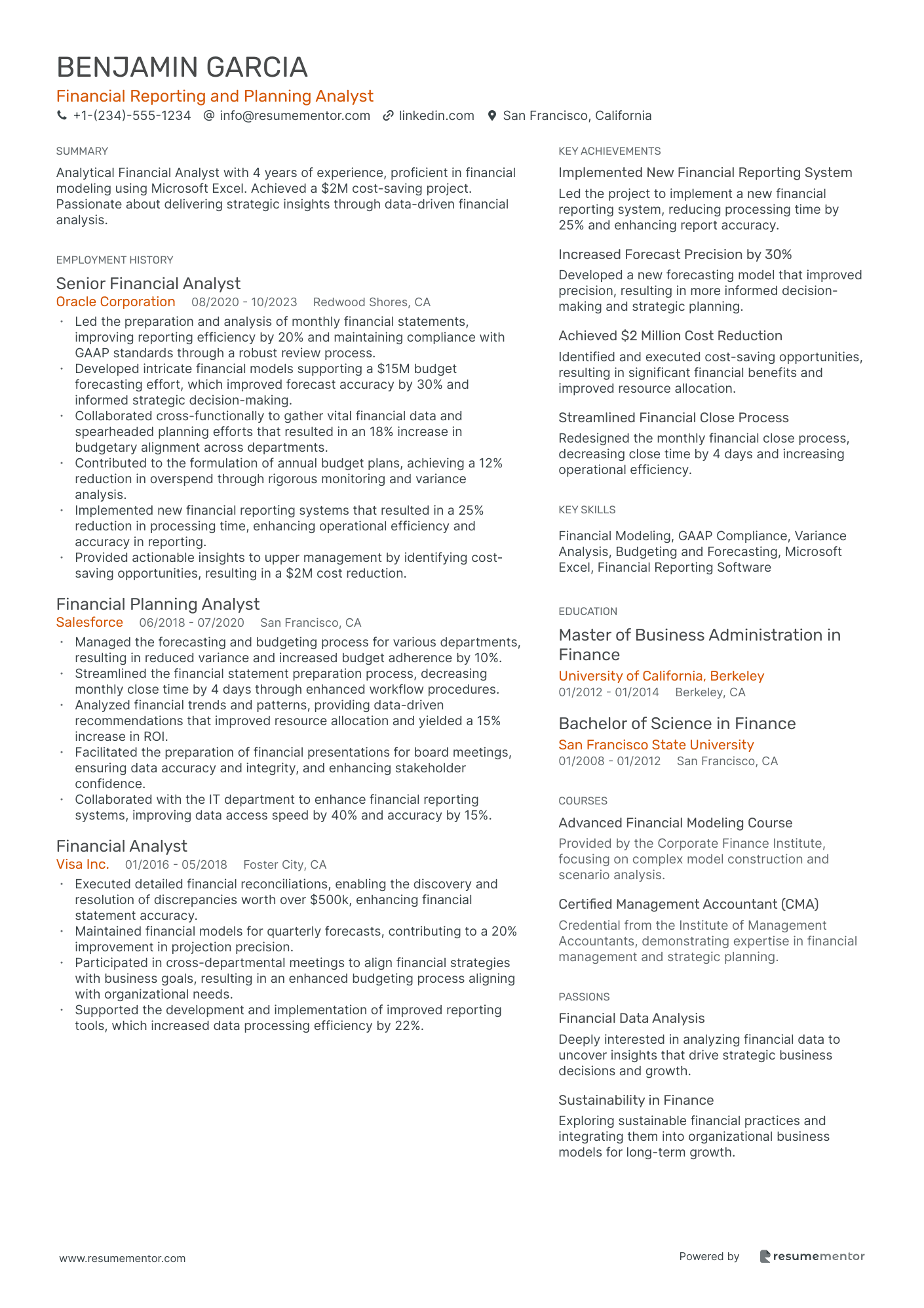

Financial Reporting and Planning Analyst

Senior Financial Reporting Analyst

Investment Financial Reporting Analyst

Regulatory Compliance Financial Reporting Analyst

Junior Financial Reporting Analyst

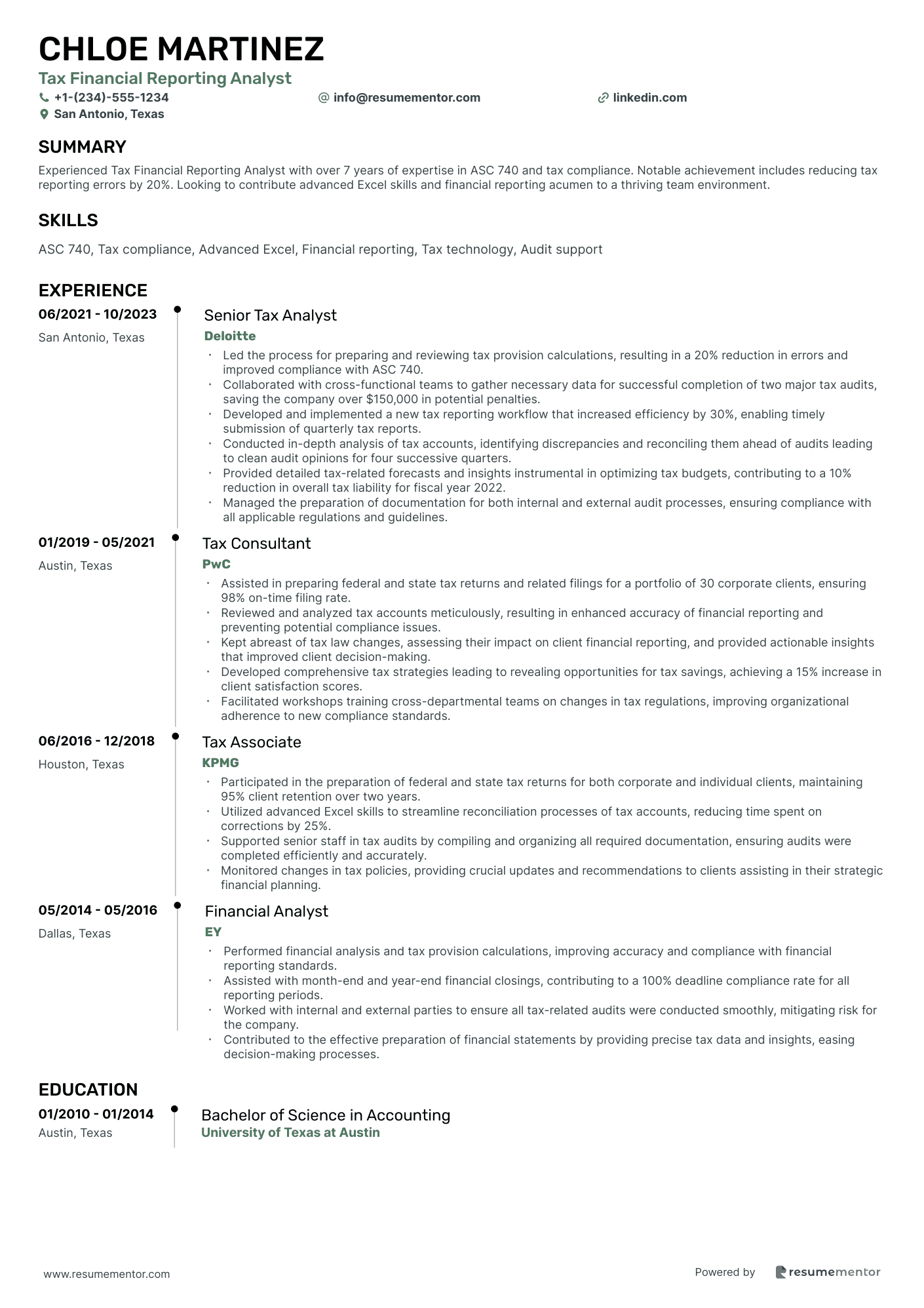

Tax Financial Reporting Analyst

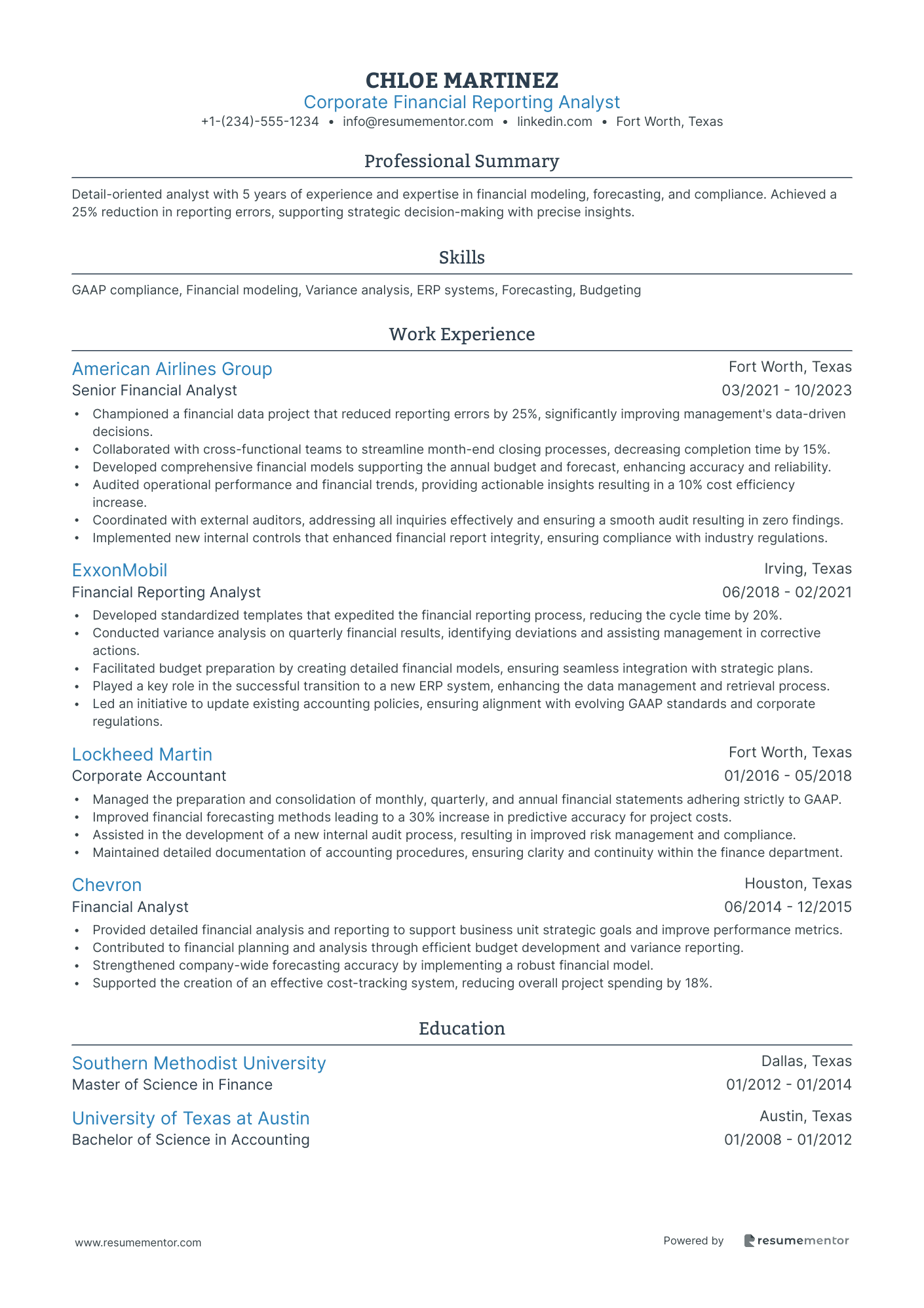

Corporate Financial Reporting Analyst

Securities Financial Reporting Analyst resume sample

- •Prepared and reviewed over 50 financial reports quarterly, ensuring 100% compliance with GAAP and regulatory standards.

- •Collaborated with finance and compliance teams to streamline reporting processes, reducing turnaround time by 20%.

- •Developed monthly investment performance reports that enhanced stakeholder decision-making, resulting in a 15% increase in company investments.

- •Monitored regulatory changes and implemented compliant strategies, preventing potential fines or delays in reporting.

- •Supported audit processes by providing thorough documentation, reducing audit queries by 30%.

- •Identified and implemented a new software tool leading to a 25% increase in reporting accuracy.

- •Executed detailed financial analysis of statements, contributing to a 10% improvement in financial insights for executive reports.

- •Spearheaded cross-departmental collaboration to gather comprehensive reporting data, enhancing team productivity by 15%.

- •Implemented regulatory standards into routine financial reporting which decreased audit discrepancies by 20%.

- •Reviewed and adjusted reporting procedures, reducing errors in financial reports by 12%.

- •Initiated enhancements in documentation processes, boosting overall reporting clarity and stakeholder satisfaction.

- •Provided accurate financial reports for securities transactions, resulting in management making more informed investment decisions.

- •Optimized financial reporting processes, reducing time spent on quarterly reports by 18%.

- •Assessed financial data integrity, which led to identification and correction of a $500K reporting discrepancy.

- •Led a project to automate report generation, improving report generation efficiency by 25%.

- •Assisted in the preparation of quarterly securities reports, integrating new data processes that enhanced accuracy by 10%.

- •Facilitated team efforts in aligning with regulatory standards, resulting in a compliance rating improvement.

- •Participated in financial data quality projects, achieving a reduction in retrieving errors by 15%.

- •Enhanced communication channels between finance and compliance teams, leading to a more efficient information exchange.

Managerial Finance Reporting Analyst resume sample

- •Led a team to improve monthly financial report accuracy by 25% through process optimization and better data management.

- •Developed advanced financial models supporting a $100 million budgeting process, enhancing decision-making capabilities.

- •Collaborated with cross-functional teams to implement a new reporting tool, reducing report preparation time by 30%.

- •Conducted in-depth variance analysis, elucidating discrepancies that resulted in a 15% budget reallocation for better resource management.

- •Prepared high-level financial presentations for stakeholders, leading to a 20% increase in engagement during strategic reviews.

- •Trained junior analysts in financial reporting, maintaining a knowledge-sharing environment, positively impacting team productivity.

- •Created robust financial forecasts that improved departmental adherence to budgets by 18%, minimizing unexpected variances.

- •Implemented a new data analysis method, increasing data accuracy by 15% and enhancing the reliability of financial reports.

- •Worked with accounting to ensure regulatory compliance, resulting in passing three consecutive financial audits without issues.

- •Redesigned financial statement presentations, reducing preparation time by 30% and improving understanding among non-financial stakeholders.

- •Managed multiple financial analysis projects under tight deadlines, ensuring timely delivery and high-quality output.

- •Developed comprehensive financial reports, improving forecasting accuracy by 20% and assisting in strategic decision making.

- •Engaged in cross-departmental projects, successfully integrating diverse data sources for enhanced financial reporting.

- •Conducted market trend analysis that informed corporate strategy, leading to the launch of two new successful financial initiatives.

- •Optimized financial tracking processes, resulting in a 10% reduction in overhead costs through more efficient management practices.

- •Assisted in the development of financial models that improved profit margin analysis by 15%, supporting strategic pricing changes.

- •Executed detailed variance analyses that clarified revenue fluctuations, enabling better forecasting and financial accuracy.

- •Facilitated cross-functional meetings to enhance data collection processes, resulting in a 12% improvement in data integrity.

- •Developed training materials for financial software, improving team competency and efficiency by 20%.

Risk Assessment Financial Reporting Analyst resume sample

- •Performed comprehensive risk assessments on financial reports, achieving a 30% improvement in compliance with regulatory standards.

- •Developed risk exposure reports presented to senior management, increasing risk visibility by 35% within two quarters.

- •Collaborated with cross-departmental teams, managed financial data from diverse sources, leading to a 20% better risk insights quality.

- •Implemented data analytics tools to enhance anomaly detection, reducing financial discrepancies by 18% in the first year.

- •Aided in preparing documentation for audits, ensuring zero discrepancies, improving audit efficiency by 40%.

- •Led a team to modernize risk management procedures, resulting in a 25% enhancement in reporting speed and accuracy.

- •Crafted detailed financial risk reports that enhanced management decision-making, leading to a 15% reduction in potential risk exposure.

- •Analyzed financial data trends, producing actionable insights that decreased unexpected financial losses by 12%.

- •Supported development of new risk management protocols, contributing to a 22% improvement in regulatory compliance.

- •Optimized financial reporting processes, decreasing report preparation time by 25% through improved data handling techniques.

- •Presented risk analysis findings to stakeholders, facilitating a clearer understanding of financial challenges and resolutions.

- •Conducted in-depth risk analyses on company operations, resulting in a 10% reduction in high-risk incidents.

- •Collaborated closely with finance teams to streamline risk data collection processes, improving efficiency by 18%.

- •Drafted comprehensive risk assessment reports, aiding in the identification of key vulnerabilities across departments.

- •Monitored and reported on industry regulation updates, ensuring the company maintained compliance standards consistently.

- •Provided precise financial data analysis, contributing to a 20% improvement in departmental forecast accuracy.

- •Supported the development of financial models, enhancing prediction capabilities by 15% within the first year.

- •Assisted in the creation of financial reports for management, fostering better strategic financial decisions.

- •Implemented new financial software tools, reducing manual data entry tasks by 40% and decreasing errors by 12%.

Financial Reporting and Planning Analyst resume sample

- •Led the preparation and analysis of monthly financial statements, improving reporting efficiency by 20% and maintaining compliance with GAAP standards through a robust review process.

- •Developed intricate financial models supporting a $15M budget forecasting effort, which improved forecast accuracy by 30% and informed strategic decision-making.

- •Collaborated cross-functionally to gather vital financial data and spearheaded planning efforts that resulted in an 18% increase in budgetary alignment across departments.

- •Contributed to the formulation of annual budget plans, achieving a 12% reduction in overspend through rigorous monitoring and variance analysis.

- •Implemented new financial reporting systems that resulted in a 25% reduction in processing time, enhancing operational efficiency and accuracy in reporting.

- •Provided actionable insights to upper management by identifying cost-saving opportunities, resulting in a $2M cost reduction.

- •Managed the forecasting and budgeting process for various departments, resulting in reduced variance and increased budget adherence by 10%.

- •Streamlined the financial statement preparation process, decreasing monthly close time by 4 days through enhanced workflow procedures.

- •Analyzed financial trends and patterns, providing data-driven recommendations that improved resource allocation and yielded a 15% increase in ROI.

- •Facilitated the preparation of financial presentations for board meetings, ensuring data accuracy and integrity, and enhancing stakeholder confidence.

- •Collaborated with the IT department to enhance financial reporting systems, improving data access speed by 40% and accuracy by 15%.

- •Executed detailed financial reconciliations, enabling the discovery and resolution of discrepancies worth over $500k, enhancing financial statement accuracy.

- •Maintained financial models for quarterly forecasts, contributing to a 20% improvement in projection precision.

- •Participated in cross-departmental meetings to align financial strategies with business goals, resulting in an enhanced budgeting process aligning with organizational needs.

- •Supported the development and implementation of improved reporting tools, which increased data processing efficiency by 22%.

- •Assisted in the preparation and analysis of financial reports, contributing to a 15% improvement in financial accuracy and compliance.

- •Developed budget models to track performance, aiding in a 20% reduction in unnecessary expenditures through enhanced monitoring.

- •Participated in the investigation and resolution process for financial discrepancies, fostering a culture of continuous improvement and accountability.

- •Supported strategic planning initiatives by providing critical financial analyses that informed decision-making processes.

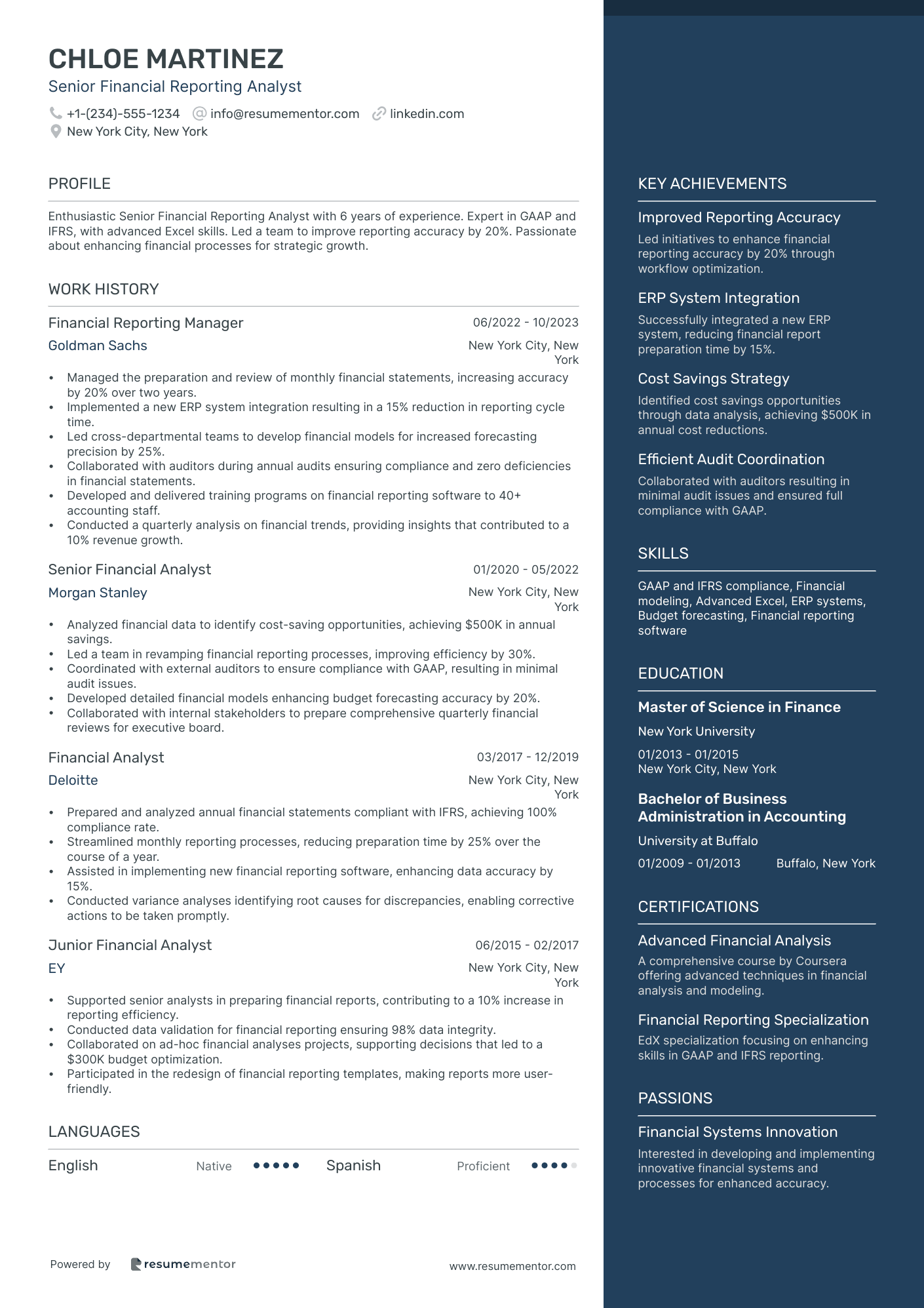

Senior Financial Reporting Analyst resume sample

- •Managed the preparation and review of monthly financial statements, increasing accuracy by 20% over two years.

- •Implemented a new ERP system integration resulting in a 15% reduction in reporting cycle time.

- •Led cross-departmental teams to develop financial models for increased forecasting precision by 25%.

- •Collaborated with auditors during annual audits ensuring compliance and zero deficiencies in financial statements.

- •Developed and delivered training programs on financial reporting software to 40+ accounting staff.

- •Conducted a quarterly analysis on financial trends, providing insights that contributed to a 10% revenue growth.

- •Analyzed financial data to identify cost-saving opportunities, achieving $500K in annual savings.

- •Led a team in revamping financial reporting processes, improving efficiency by 30%.

- •Coordinated with external auditors to ensure compliance with GAAP, resulting in minimal audit issues.

- •Developed detailed financial models enhancing budget forecasting accuracy by 20%.

- •Collaborated with internal stakeholders to prepare comprehensive quarterly financial reviews for executive board.

- •Prepared and analyzed annual financial statements compliant with IFRS, achieving 100% compliance rate.

- •Streamlined monthly reporting processes, reducing preparation time by 25% over the course of a year.

- •Assisted in implementing new financial reporting software, enhancing data accuracy by 15%.

- •Conducted variance analyses identifying root causes for discrepancies, enabling corrective actions to be taken promptly.

- •Supported senior analysts in preparing financial reports, contributing to a 10% increase in reporting efficiency.

- •Conducted data validation for financial reporting ensuring 98% data integrity.

- •Collaborated on ad-hoc financial analyses projects, supporting decisions that led to a $300K budget optimization.

- •Participated in the redesign of financial reporting templates, making reports more user-friendly.

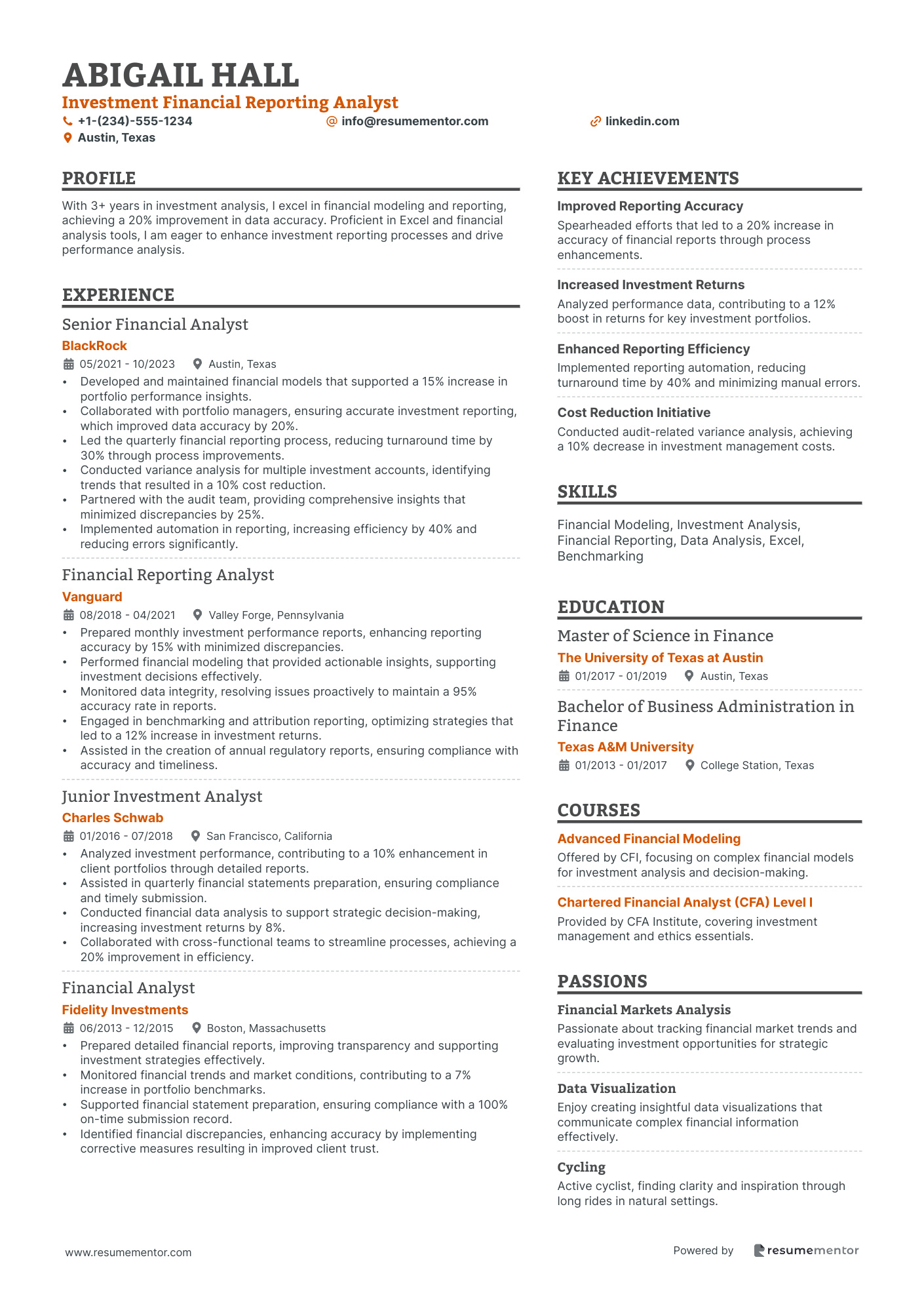

Investment Financial Reporting Analyst resume sample

- •Developed and maintained financial models that supported a 15% increase in portfolio performance insights.

- •Collaborated with portfolio managers, ensuring accurate investment reporting, which improved data accuracy by 20%.

- •Led the quarterly financial reporting process, reducing turnaround time by 30% through process improvements.

- •Conducted variance analysis for multiple investment accounts, identifying trends that resulted in a 10% cost reduction.

- •Partnered with the audit team, providing comprehensive insights that minimized discrepancies by 25%.

- •Implemented automation in reporting, increasing efficiency by 40% and reducing errors significantly.

- •Prepared monthly investment performance reports, enhancing reporting accuracy by 15% with minimized discrepancies.

- •Performed financial modeling that provided actionable insights, supporting investment decisions effectively.

- •Monitored data integrity, resolving issues proactively to maintain a 95% accuracy rate in reports.

- •Engaged in benchmarking and attribution reporting, optimizing strategies that led to a 12% increase in investment returns.

- •Assisted in the creation of annual regulatory reports, ensuring compliance with accuracy and timeliness.

- •Analyzed investment performance, contributing to a 10% enhancement in client portfolios through detailed reports.

- •Assisted in quarterly financial statements preparation, ensuring compliance and timely submission.

- •Conducted financial data analysis to support strategic decision-making, increasing investment returns by 8%.

- •Collaborated with cross-functional teams to streamline processes, achieving a 20% improvement in efficiency.

- •Prepared detailed financial reports, improving transparency and supporting investment strategies effectively.

- •Monitored financial trends and market conditions, contributing to a 7% increase in portfolio benchmarks.

- •Supported financial statement preparation, ensuring compliance with a 100% on-time submission record.

- •Identified financial discrepancies, enhancing accuracy by implementing corrective measures resulting in improved client trust.

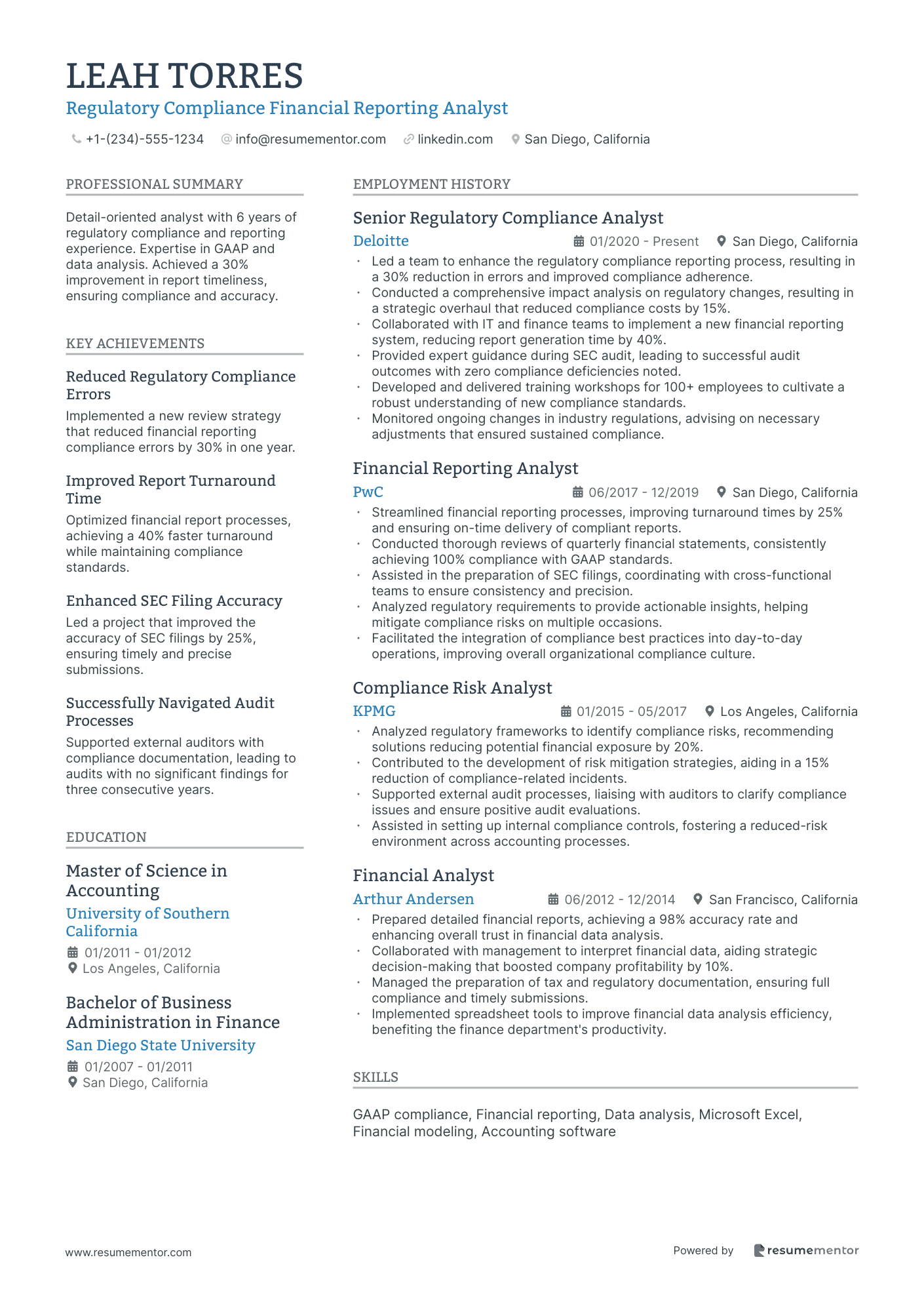

Regulatory Compliance Financial Reporting Analyst resume sample

- •Led a team to enhance the regulatory compliance reporting process, resulting in a 30% reduction in errors and improved compliance adherence.

- •Conducted a comprehensive impact analysis on regulatory changes, resulting in a strategic overhaul that reduced compliance costs by 15%.

- •Collaborated with IT and finance teams to implement a new financial reporting system, reducing report generation time by 40%.

- •Provided expert guidance during SEC audit, leading to successful audit outcomes with zero compliance deficiencies noted.

- •Developed and delivered training workshops for 100+ employees to cultivate a robust understanding of new compliance standards.

- •Monitored ongoing changes in industry regulations, advising on necessary adjustments that ensured sustained compliance.

- •Streamlined financial reporting processes, improving turnaround times by 25% and ensuring on-time delivery of compliant reports.

- •Conducted thorough reviews of quarterly financial statements, consistently achieving 100% compliance with GAAP standards.

- •Assisted in the preparation of SEC filings, coordinating with cross-functional teams to ensure consistency and precision.

- •Analyzed regulatory requirements to provide actionable insights, helping mitigate compliance risks on multiple occasions.

- •Facilitated the integration of compliance best practices into day-to-day operations, improving overall organizational compliance culture.

- •Analyzed regulatory frameworks to identify compliance risks, recommending solutions reducing potential financial exposure by 20%.

- •Contributed to the development of risk mitigation strategies, aiding in a 15% reduction of compliance-related incidents.

- •Supported external audit processes, liaising with auditors to clarify compliance issues and ensure positive audit evaluations.

- •Assisted in setting up internal compliance controls, fostering a reduced-risk environment across accounting processes.

- •Prepared detailed financial reports, achieving a 98% accuracy rate and enhancing overall trust in financial data analysis.

- •Collaborated with management to interpret financial data, aiding strategic decision-making that boosted company profitability by 10%.

- •Managed the preparation of tax and regulatory documentation, ensuring full compliance and timely submissions.

- •Implemented spreadsheet tools to improve financial data analysis efficiency, benefiting the finance department's productivity.

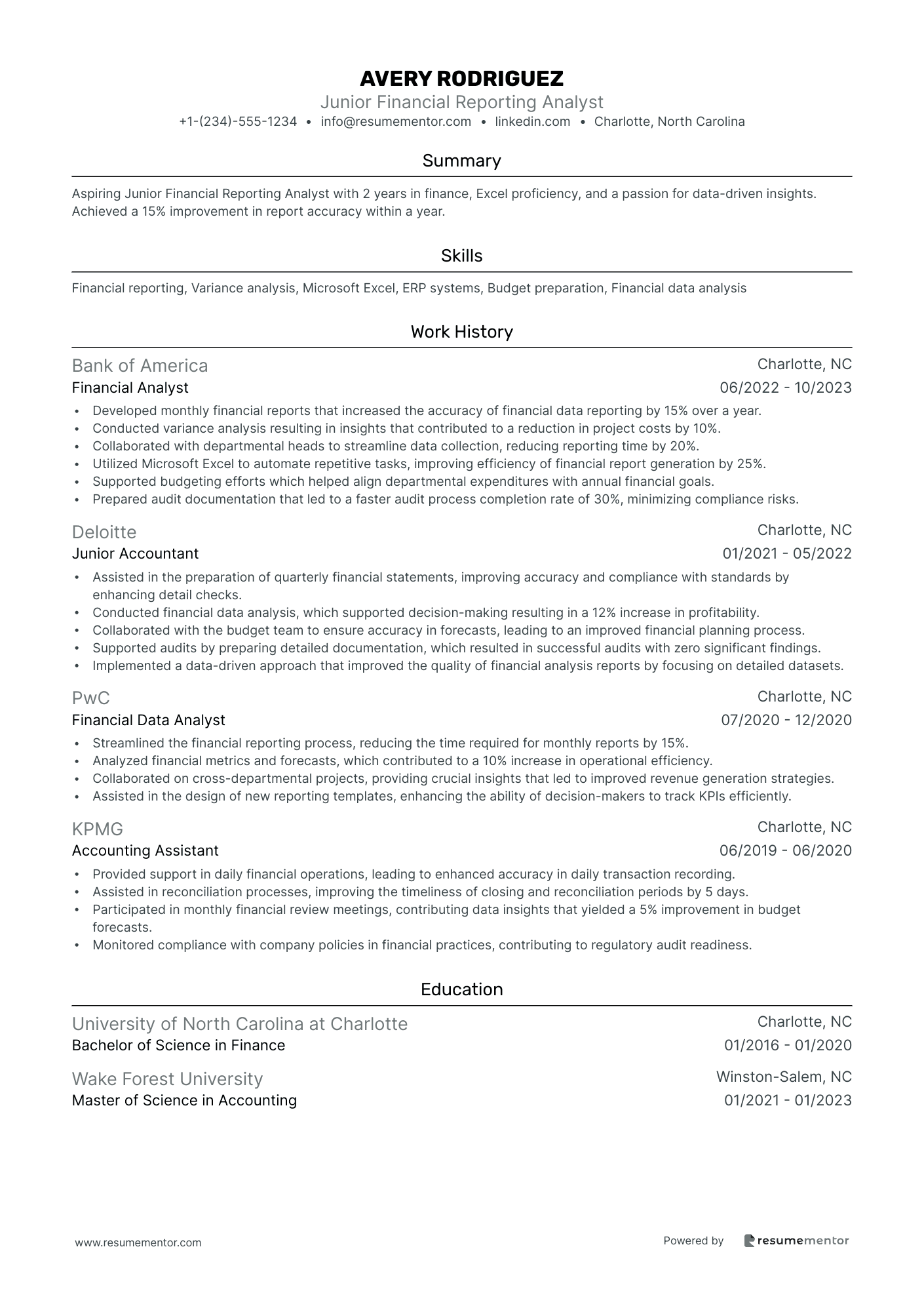

Junior Financial Reporting Analyst resume sample

- •Developed monthly financial reports that increased the accuracy of financial data reporting by 15% over a year.

- •Conducted variance analysis resulting in insights that contributed to a reduction in project costs by 10%.

- •Collaborated with departmental heads to streamline data collection, reducing reporting time by 20%.

- •Utilized Microsoft Excel to automate repetitive tasks, improving efficiency of financial report generation by 25%.

- •Supported budgeting efforts which helped align departmental expenditures with annual financial goals.

- •Prepared audit documentation that led to a faster audit process completion rate of 30%, minimizing compliance risks.

- •Assisted in the preparation of quarterly financial statements, improving accuracy and compliance with standards by enhancing detail checks.

- •Conducted financial data analysis, which supported decision-making resulting in a 12% increase in profitability.

- •Collaborated with the budget team to ensure accuracy in forecasts, leading to an improved financial planning process.

- •Supported audits by preparing detailed documentation, which resulted in successful audits with zero significant findings.

- •Implemented a data-driven approach that improved the quality of financial analysis reports by focusing on detailed datasets.

- •Streamlined the financial reporting process, reducing the time required for monthly reports by 15%.

- •Analyzed financial metrics and forecasts, which contributed to a 10% increase in operational efficiency.

- •Collaborated on cross-departmental projects, providing crucial insights that led to improved revenue generation strategies.

- •Assisted in the design of new reporting templates, enhancing the ability of decision-makers to track KPIs efficiently.

- •Provided support in daily financial operations, leading to enhanced accuracy in daily transaction recording.

- •Assisted in reconciliation processes, improving the timeliness of closing and reconciliation periods by 5 days.

- •Participated in monthly financial review meetings, contributing data insights that yielded a 5% improvement in budget forecasts.

- •Monitored compliance with company policies in financial practices, contributing to regulatory audit readiness.

Tax Financial Reporting Analyst resume sample

- •Led the process for preparing and reviewing tax provision calculations, resulting in a 20% reduction in errors and improved compliance with ASC 740.

- •Collaborated with cross-functional teams to gather necessary data for successful completion of two major tax audits, saving the company over $150,000 in potential penalties.

- •Developed and implemented a new tax reporting workflow that increased efficiency by 30%, enabling timely submission of quarterly tax reports.

- •Conducted in-depth analysis of tax accounts, identifying discrepancies and reconciling them ahead of audits leading to clean audit opinions for four successive quarters.

- •Provided detailed tax-related forecasts and insights instrumental in optimizing tax budgets, contributing to a 10% reduction in overall tax liability for fiscal year 2022.

- •Managed the preparation of documentation for both internal and external audit processes, ensuring compliance with all applicable regulations and guidelines.

- •Assisted in preparing federal and state tax returns and related filings for a portfolio of 30 corporate clients, ensuring 98% on-time filing rate.

- •Reviewed and analyzed tax accounts meticulously, resulting in enhanced accuracy of financial reporting and preventing potential compliance issues.

- •Kept abreast of tax law changes, assessing their impact on client financial reporting, and provided actionable insights that improved client decision-making.

- •Developed comprehensive tax strategies leading to revealing opportunities for tax savings, achieving a 15% increase in client satisfaction scores.

- •Facilitated workshops training cross-departmental teams on changes in tax regulations, improving organizational adherence to new compliance standards.

- •Participated in the preparation of federal and state tax returns for both corporate and individual clients, maintaining 95% client retention over two years.

- •Utilized advanced Excel skills to streamline reconciliation processes of tax accounts, reducing time spent on corrections by 25%.

- •Supported senior staff in tax audits by compiling and organizing all required documentation, ensuring audits were completed efficiently and accurately.

- •Monitored changes in tax policies, providing crucial updates and recommendations to clients assisting in their strategic financial planning.

- •Performed financial analysis and tax provision calculations, improving accuracy and compliance with financial reporting standards.

- •Assisted with month-end and year-end financial closings, contributing to a 100% deadline compliance rate for all reporting periods.

- •Worked with internal and external parties to ensure all tax-related audits were conducted smoothly, mitigating risk for the company.

- •Contributed to the effective preparation of financial statements by providing precise tax data and insights, easing decision-making processes.

Corporate Financial Reporting Analyst resume sample

- •Championed a financial data project that reduced reporting errors by 25%, significantly improving management's data-driven decisions.

- •Collaborated with cross-functional teams to streamline month-end closing processes, decreasing completion time by 15%.

- •Developed comprehensive financial models supporting the annual budget and forecast, enhancing accuracy and reliability.

- •Audited operational performance and financial trends, providing actionable insights resulting in a 10% cost efficiency increase.

- •Coordinated with external auditors, addressing all inquiries effectively and ensuring a smooth audit resulting in zero findings.

- •Implemented new internal controls that enhanced financial report integrity, ensuring compliance with industry regulations.

- •Developed standardized templates that expedited the financial reporting process, reducing the cycle time by 20%.

- •Conducted variance analysis on quarterly financial results, identifying deviations and assisting management in corrective actions.

- •Facilitated budget preparation by creating detailed financial models, ensuring seamless integration with strategic plans.

- •Played a key role in the successful transition to a new ERP system, enhancing the data management and retrieval process.

- •Led an initiative to update existing accounting policies, ensuring alignment with evolving GAAP standards and corporate regulations.

- •Managed the preparation and consolidation of monthly, quarterly, and annual financial statements adhering strictly to GAAP.

- •Improved financial forecasting methods leading to a 30% increase in predictive accuracy for project costs.

- •Assisted in the development of a new internal audit process, resulting in improved risk management and compliance.

- •Maintained detailed documentation of accounting procedures, ensuring clarity and continuity within the finance department.

- •Provided detailed financial analysis and reporting to support business unit strategic goals and improve performance metrics.

- •Contributed to financial planning and analysis through efficient budget development and variance reporting.

- •Strengthened company-wide forecasting accuracy by implementing a robust financial model.

- •Supported the creation of an effective cost-tracking system, reducing overall project spending by 18%.

Navigating the job market as a financial reporting analyst can feel like piecing together a complex puzzle, with your resume serving as the key to unlocking new career opportunities. Crafting it requires precision, as every detail matters. Your financial acumen, attention to detail, and analytical skills are the foundation of your profession, and these strengths need to shine through your resume.

Standing out from other candidates in today's competitive market means presenting your expertise clearly. Clarity and precision are essential allies, allowing a well-structured resume to highlight your skills in financial reporting and analysis while effectively conveying your value to employers.

Using a resume template can ease this process, providing a polished layout that captures the interest of potential employers. It frees you from worrying about formatting and structure, allowing you to focus on showcasing what truly matters. If you're looking for a tool to help spotlight your skills, explore these resume templates to streamline your efforts.

As you embark on this journey, remember that your resume is more than just a piece of paper—it's your professional narrative. Each bullet point builds the path toward your next big opportunity. Craft it thoughtfully, and you'll be on your way to securing that dream role.

Key Takeaways

- Crafting a precise and clear resume is key to standing out as a financial reporting analyst, with an emphasis on showcasing your financial acumen, attention to detail, and analytical strengths.

- Utilizing templates can streamline the resume creation process by taking care of formatting, allowing you to focus on the content that highlights your skills effectively.

- Choose a chronological resume format to clearly showcase your job experience, using modern fonts to present a clean professional appearance, and save your resume as a PDF to maintain formatting integrity.

- A strong experience section is crucial, focusing on quantifiable achievements and how your roles have contributed to the organization's success using precise, action-oriented language.

- Include relevant certifications and education with clear, concise details, and incorporate keywords in the skills section to enhance visibility in the initial screening process.

What to focus on when writing your financial reporting analyst resume

Your financial reporting analyst resume should effectively convey how your skills in data analysis and regulatory compliance translate into valuable business insights. You want to ensure the recruiter sees your capability to support informed decision-making through your analytical prowess.

How to structure your financial reporting analyst resume

- Contact Information — Start with a header that includes your full name, phone number, professional email, and LinkedIn profile. These elements are crucial for easy communication. Use a concise format, listing only your city and state to indicate your location without cluttering the space.

- Professional Summary — Capture your resume's readers immediately with a succinct introduction that emphasizes your financial analytical experience and key strengths. Mention your expertise in areas like GAAP or IFRS to set the tone for what makes you a standout candidate and preview the value you bring.

- Experience — Present your job history in reverse chronological order, focusing on roles that demonstrate your experience in financial reporting. Offer specific achievements related to financial planning, data analysis, and accuracy. This section should illustrate not just what you did, but how you impacted each organization.

- Education — Share your educational background, listing degrees, institutions, and graduation years. Highlight any coursework or projects that specifically relate to finance, accounting, or economics, as these further bolster your professional narrative and align with the job's requirements.

- Skills — Outline your technical proficiencies, such as Excel, SAP, and financial modeling tools, along with strengths in data interpretation and regulatory compliance. This section should reflect the tools and competencies you use to drive your financial analysis work.

- Certifications — Mention any certifications like CPA or CFA, as these not only add to your credibility but also demonstrate a deep commitment to your field. Each certification you include should reinforce your profile as a well-qualified financial reporting analyst.

Below, we'll explore each of these sections in more detail, providing a deeper understanding of how to construct a resume format that resonates with recruiters and aligns with the financial reporting analyst role.

Which resume format to choose

As a financial reporting analyst, crafting a resume that stands out is key to advancing your career. Start with the right format; the chronological style is ideal as it highlights your job experience in a clear and logical way. This lets employers easily trace your growth and achievements in the financial sector.

The choice of font plays a subtle yet important role in your resume's presentation. Opt for modern fonts like Lato, Montserrat, or Raleway, which offer a clean and professional appearance. While the font may seem like a small detail, it helps reinforce your attention to detail and commitment to a polished presentation—traits that are highly valued in finance.

Saving your resume as a PDF is a must. This file type preserves the integrity of your format, ensuring that your resume looks its best on any platform or device an employer might use. A consistent and professional appearance across the board shows that you're thorough and meticulous.

Pay attention to your margins, keeping them at one inch on all sides. This detail maintains a tidy look and ensures that your content is easy to read. A clean layout reflects your organizational skills, an essential aspect of a financial reporting analyst's role.

Each of these elements contributes to a resume that's not only polished but also conveys your professionalism and attention to detail, which are crucial for success in the financial reporting field.

How to write a quantifiable resume experience section

Your experience section is the core of your financial reporting analyst resume. It seamlessly connects your skills and achievements, giving employers a clear view of the value you've added in past roles. Begin with your most recent job, working backward over the last 10-15 years. Pay attention to tailoring this section to the job ad by echoing language and requirements exactly as they appear. Specify job titles to ensure clarity and avoid generic terms. Use action words like "developed," "streamlined," and "enhanced" to give your achievements a standout quality. Focus on quantifiable results, incorporating metrics and outcomes to clearly demonstrate your impact.

- •Increased report accuracy by 25% with automated validation tools.

- •Cut month-end close reporting time by 3 days, boosting efficiency.

- •Developed models to improve forecasting accuracy by 20%, aiding planning.

- •Worked with teams to integrate platforms, raising productivity by 15%.

This experience entry effectively highlights your role in advancing company goals through measurable achievements. Each bullet point quantifies your contribution, seamlessly connecting your skills with tangible results. The format is streamlined yet comprehensive, aligning perfectly with the job’s key requirements and skills. By using strategic action words and tailoring your achievements to reflect the job description, you create a cohesive narrative that underscores your suitability for the role. This concise yet detailed presentation captures attention, clearly illustrating the value you bring and making your resume a standout.

Collaboration-Focused resume experience section

A Collaboration-Focused Financial Reporting Analyst resume experience section should highlight your teamwork abilities and communication skills. Start by listing your job title, company name, and employment dates, then zero in on achievements that illustrate your role in team settings and your support across departments. Use action verbs to describe your impact and back it up with measurable achievements. Each bullet should reflect your involvement in enhancing collaboration across various teams.

Connect your job responsibilities to collaborative efforts by detailing how you actively engaged in cross-department projects, bridging communication gaps. Explain how you helped improve communication strategies, contributing to shared successes. Provide specific examples of how you fostered improved practices, ensuring your experience stands out. Prioritize clarity and impact by maintaining straightforward language.

Financial Reporting Analyst

ABC Financial Services

June 2019 - August 2023

- Worked closely with finance and IT teams to develop a new reporting system, boosting delivery speed by 30%.

- Led weekly cross-departmental meetings to keep financial goals aligned, resulting in a 10% increase in budget efficiency.

- Teamed up with six departments to synchronize financial forecasts, improving accuracy by 15%.

- Explained complex financial data clearly to non-financial teams, aiding better decision making.

Result-Focused resume experience section

A Result-Focused financial reporting analyst resume experience section should clearly demonstrate how your work has positively impacted your team or organization. Start by listing your job title, company name, and employment dates. Then, use bullet points to highlight your achievements with a focus on measurable outcomes. Each bullet should begin with an action verb and showcase the tangible results of your efforts, providing a clear picture of your contributions.

Instead of merely listing responsibilities, emphasize the value you brought to your role. Describe how you streamlined processes, improved data accuracy, or led successful initiatives that resulted in significant savings. By using straightforward language, ensure each bullet point flows naturally, clearly highlighting how you made a difference. This method effectively communicates your accomplishments and potential for future roles.

Financial Reporting Analyst

XYZ Corp

June 2020 - Present

- Reduced the monthly financial close process by 30% by implementing new reporting tools.

- Enhanced data accuracy by 15% through meticulous analysis and verification methods.

- Led a team of 5 analysts in merging financial systems post-acquisition, saving $200k annually.

- Created a dashboard that improved executive reporting efficiency by 50%.

Project-Focused resume experience section

A project-focused financial reporting analyst resume experience section should emphasize your capability to oversee and analyze financial endeavors effectively. Start by identifying a particular focus that aligns with the job you’re targeting—such as financial forecasting—and underline your key accomplishments in this area. Use clear, action-oriented language, and measure your contributions with quantifiable results like increased accuracy or identified cost savings, illustrating the tangible value you add and aligning your skills with the job’s needs.

As you describe your experience, maintain a flow that links your project management to your analytical skills. Employ strong verbs and concrete examples to depict how you’ve successfully navigated challenges. Tailor each point to resonate specifically with the position, ensuring it highlights the impact you made and the methods you utilized. This approach not only captures the hiring manager’s attention but also reinforces how you could contribute effectively to their team.

Financial Analyst

XYZ Corp

June 2019 - August 2023

- Led a team to develop a forecasting model improving accuracy by 15%.

- Implemented techniques that pinpointed $200k in cost-saving opportunities.

- Worked with various departments to streamline data integration, boosting efficiency.

- Delivered monthly financial reports to leadership, enhancing decision-making.

Problem-Solving Focused resume experience section

A problem-solving-focused financial reporting analyst resume experience section should clearly showcase how you tackle and overcome challenges in your role. Start by outlining the specific problems you faced and the strategic steps you took to resolve them. This transition smoothly into highlighting measurable achievements and outcomes that demonstrate your effectiveness in analyzing complex financial data. Use specific examples to illustrate how your critical thinking and analytical skills led to successful solutions, showing how these efforts positively impacted your organization.

As you build this part of your resume, seamlessly connect these points by emphasizing the improvements you brought to financial reporting systems and processes. Highlight your active role in bringing about these results, as it's crucial to link your problem-solving initiatives to concrete business improvements, such as cost savings, enhanced efficiency, or more accurate reporting. By presenting your ability to address challenges with a strategic approach, you effectively demonstrate your strengths and value as a financial reporting analyst.

Financial Reporting Analyst

TechSolutions Inc.

June 2020 - Present

- Led a team to analyze quarterly financial discrepancies, resulting in an 18% reduction in reporting errors.

- Implemented a new data verification process that saved the company $200,000 annually.

- Collaborated with IT to automate financial reporting, decreasing report preparation time by 30%.

- Developed a comprehensive training program for junior analysts, improving department efficiency by 25%.

Write your financial reporting analyst resume summary section

A well-crafted resume summary for a financial reporting analyst should clearly highlight your qualifications and make a strong impression. You need to focus on your strengths and experiences that specifically relate to the job. This is where your skills, achievements, and relevant experience play an important role. Consider this example:

This summary communicates expertise and measurable results succinctly. By mentioning specific tools like Excel and SAP, it aligns with the key responsibilities of the role. Ensure your summary mirrors the job description by using similar language and highlighting your relevant experience. This helps in making a strong case for your candidacy.

Understanding the distinctions between similar sections in a resume can further refine your approach. A resume summary gives a professional snapshot, ideal for those with experience. If you’re newer to the field or switching careers, a resume objective that emphasizes career goals might suit you better. A resume profile shares similarities with a summary but can focus more on skills and personal traits. On the other hand, a summary of qualifications presents your top achievements or skills quickly. Each section aims to clearly convey why you're a great fit, but they focus on different aspects of your professional journey.

Listing your financial reporting analyst skills on your resume

A skills-focused financial reporting analyst resume should effectively highlight your strengths and abilities to capture the attention of potential employers. Your skills can shine in a dedicated section or be woven into your experience and summary areas to create a cohesive narrative. Emphasizing strengths and soft skills is essential, as they demonstrate your capability to work with others and adapt in various situations. Meanwhile, hard skills highlight the technical expertise and specialized knowledge essential for carrying out job-specific tasks proficiently.

These skills and strengths act as crucial resume keywords, helping your application stand out during the initial screening process. Properly chosen keywords increase the likelihood of your resume reaching the hands of recruiters.

The skills example provided clearly shows essential capabilities for a financial reporting analyst. It is well-organized and directly highlights what hiring managers in this field seek.

Best hard skills to feature on your financial reporting analyst resume

For a financial reporting analyst, hard skills are critical as they represent concrete abilities gained through education and training. These skills are vital for performing accurate financial evaluations, and they demonstrate your competence with industry-specific tools and concepts, ensuring compliance and precision in reporting tasks.

Hard Skills

- Financial Analysis

- Data Visualization

- Advanced Excel Skills

- GAAP Knowledge

- Financial Modeling

- Analytical Thinking

- ERP Systems Experience

- Budgeting and Forecasting

- Variance Analysis

- SQL Proficiency

- Cost Accounting

- Risk Management

- Cash Flow Analysis

- Compliance Reporting

- Auditing Techniques

Best soft skills to feature on your financial reporting analyst resume

Soft skills, contrastingly, are personal attributes that facilitate effective interaction and collaboration. In the role of a financial reporting analyst, showcasing these skills reflects your ability to communicate, problem-solve, and work collaboratively in team settings to achieve successful outcomes.

Soft Skills

- Attention to Detail

- Time Management

- Communication Skills

- Problem-Solving

- Team Collaboration

- Critical Thinking

- Adaptability

- Decision Making

- Leadership

- Initiative

- Organizational Skills

- Negotiation

- Interpersonal Skills

- Stress Management

- Emotional Intelligence

How to include your education on your resume

An education section is a key piece of your resume as a financial reporting analyst. It showcases your academic background and sets the foundation for your professional journey. Tailor this section to the job you’re applying for, ensuring relevance by excluding any unrelated education. Include your GPA if it was notably high or required, but optional if not requested. When listing cum laude honors, include it next to your degree. Clearly state your degree, like "Bachelor of Science in Finance," to make it easy to understand.

Here’s an incorrect example:

And here’s one that’s on point for a financial reporting analyst:

The right example stands out because it's tailored for the financial reporting analyst role. It highlights a relevant degree, B.S. in Finance, and honors like cum laude, showing dedication and academic excellence. Displaying the GPA alongside a high score like 3.8 reflects your strong performance, essential for a finance-oriented position. This approach delivers clarity and relevance to a potential employer.

How to include financial reporting analyst certificates on your resume

Including a certificates section in your resume is crucial, especially for a financial reporting analyst. Certificates help demonstrate your expertise and commitment to the field. List the name of each certificate you have earned. Include the date you obtained the certificate, so employers know it's current. Add the issuing organization to show credibility. This section can also be placed in the header for quick visibility. For instance, if you hold a CFA (Chartered Financial Analyst) certification, it can be listed next to your name and contact information.

A good example of a standalone certificates section is shown below:

This example is strong because it lists relevant certificates that are highly regarded in the financial industry. It also shows the issuing organizations, which ensure the certificates are credible. Each certificate aligns well with the duties of a financial reporting analyst, making it clear you are well-qualified for the role.

Extra sections to include in your financial reporting analyst resume

Crafting a compelling resume involves highlighting your core skills and achievements, but adding extra sections can set you apart. As a financial reporting analyst, it's not just about what you do with numbers; it's also about your other unique qualities. Including extra sections can round out your professional persona, showcasing your diverse capabilities and interests.

Language section—list any additional languages you speak fluently. Demonstrating language skills can indicate your ability to work in diverse, international environments.

Hobbies and interests section—share activities like running, chess, or painting. Showcasing personal interests breaks the ice and can make you more memorable to potential employers.

Volunteer work section—highlight your roles and achievements in volunteer work. Volunteering shows your commitment to community and can demonstrate leadership and teamwork skills.

Books section—list some of the books that have influenced your career or thinking. Including a books section can offer insight into your intellectual interests and continuous learning habits.

In Conclusion

In conclusion, crafting a financial reporting analyst resume requires careful attention to detail and strategic presentation of your skills and achievements. A well-structured resume serves as more than just a list of qualifications; it is a professional narrative that showcases your expertise in financial analysis and your ability to contribute effectively to your future employer's success. Highlighting your education, certifications, and specific accomplishments, framed with action verbs and quantifiable results, demonstrates a clear trajectory of professional growth. Using a clean layout, modern fonts, and saving your resume as a PDF ensure your application presents your strengths consistently across platforms. By tailoring your resume to align with the targeted role, selecting the right format, and emphasizing both hard and soft skills, you provide a comprehensive view of your capabilities. Remember, each section—from the summary to extra details like volunteer work—plays a role in conveying a well-rounded picture of who you are, professionally and personally. A focused and well-crafted resume can unlock new career opportunities, positioning you as a standout candidate in the competitive financial industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.