Financial Representative Resume Examples

Jul 18, 2024

|

12 min read

Unlock your potential: Craft a financial representative resume that balances numbers and narrative. Get hired by showcasing your analytical skills, client management, and financial expertise to stand out in a crowded job market.

Rated by 348 people

Financial Services Consultant

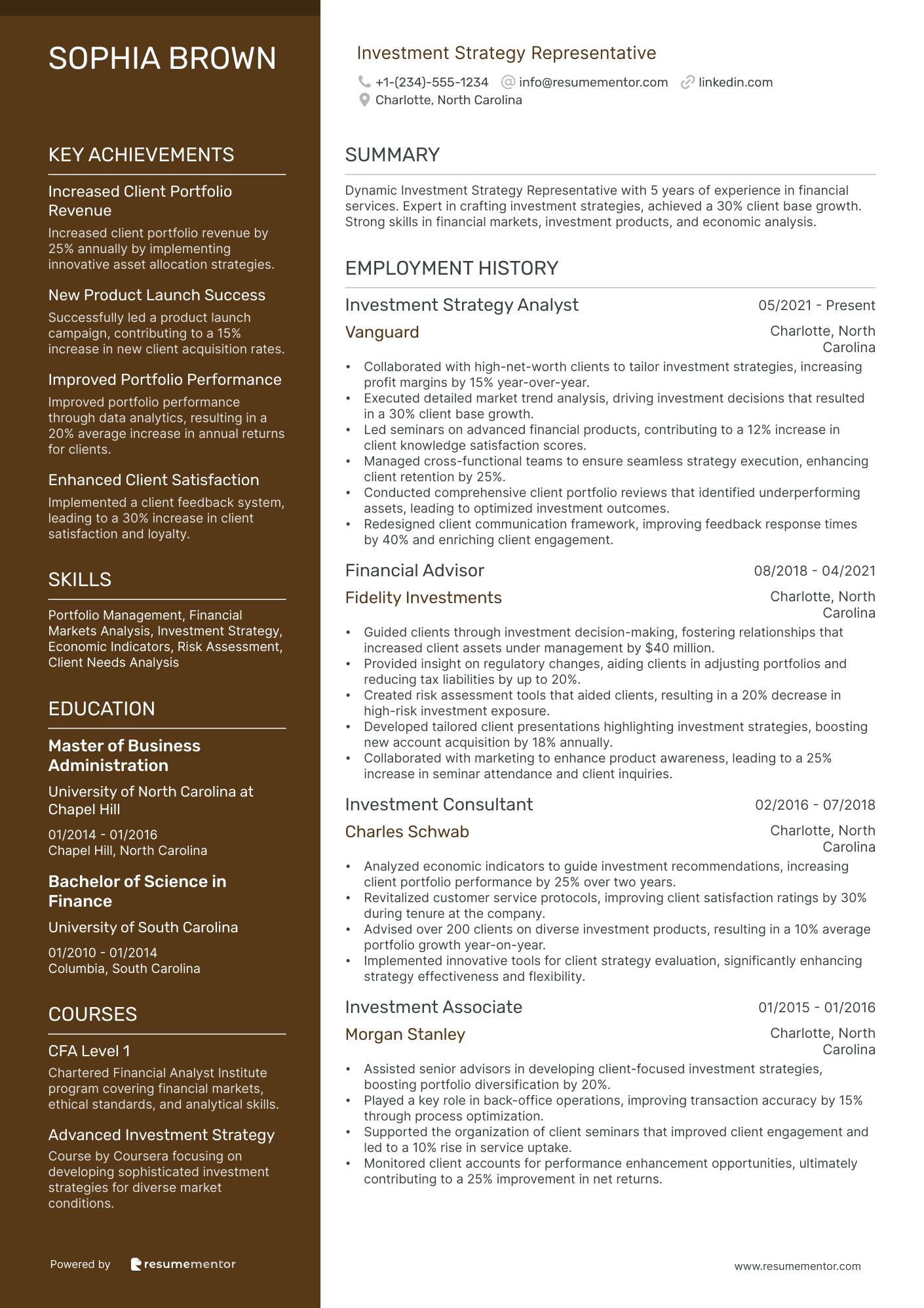

Investment Strategy Representative

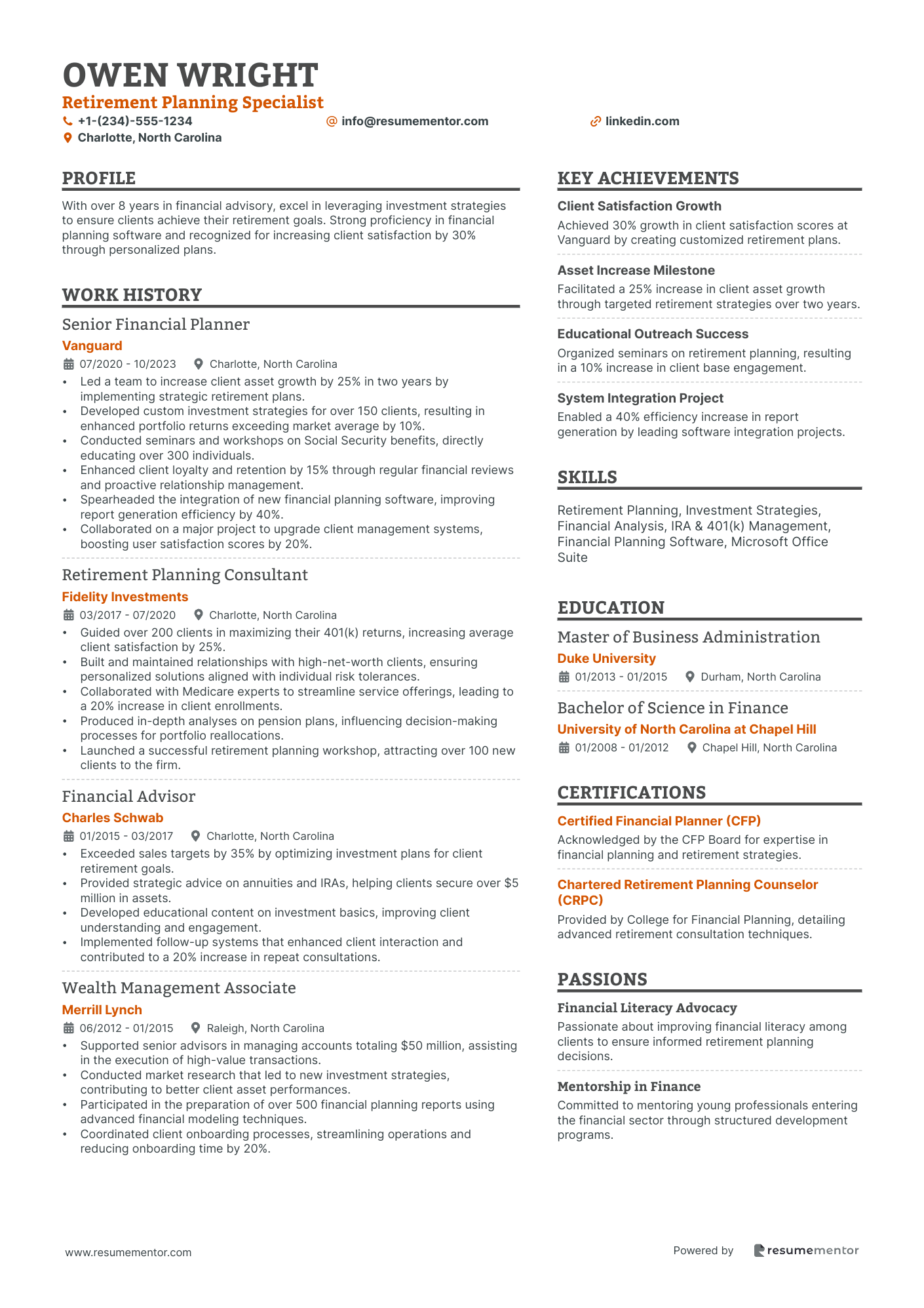

Retirement Planning Specialist

Insurance Financial Representative

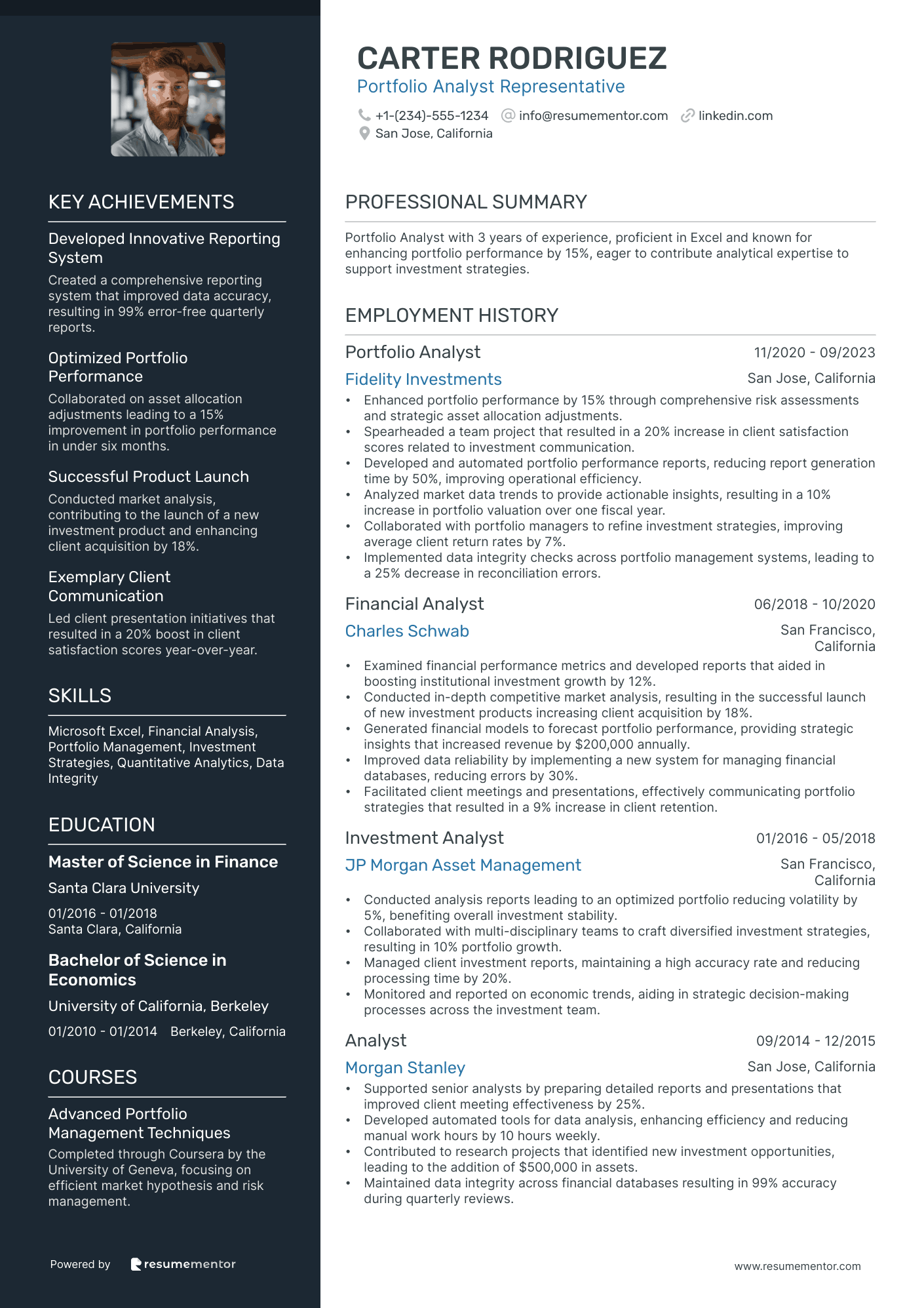

Portfolio Analyst Representative

Equity Trading Consultant

Mortgage Financial Advisor

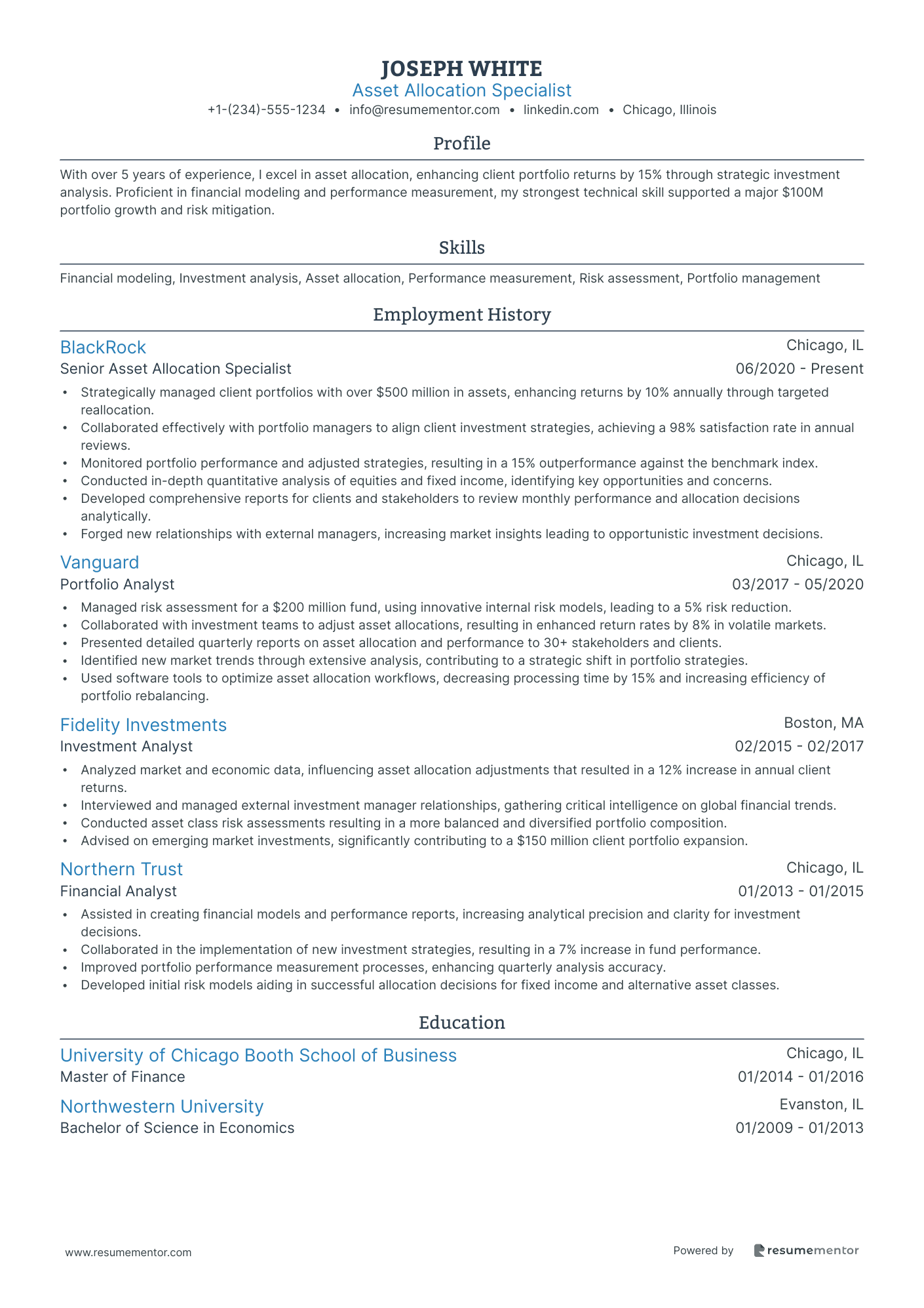

Asset Allocation Specialist

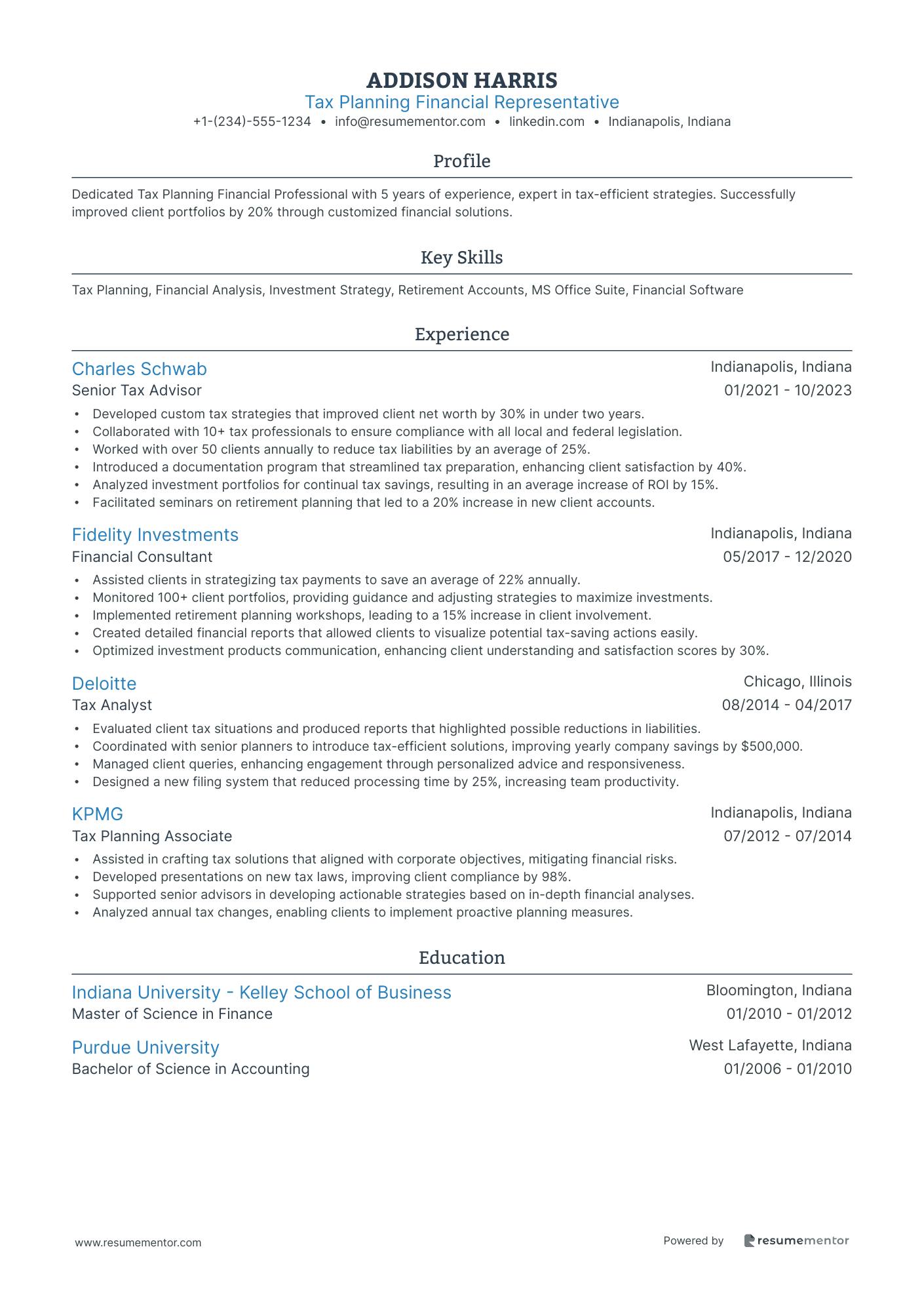

Tax Planning Financial Representative

Financial Services Consultant resume sample

- •Led a team of five to develop comprehensive financial strategies, resulting in a 25% increase in client portfolio values within two years.

- •Designed and delivered financial workshops that enhanced client education and improved satisfaction scores by 30%.

- •Analyzed client financial needs, leading to the implementation of customized plans that boosted new client acquisition by 15%.

- •Collaborated with legal and compliance departments to ensure all client documentation met regulatory standards, resulting in a 100% compliance pass rate.

- •Utilized advanced financial software to create detailed models aiding clients in decision-making processes, enhancing client engagement and trust.

- •Participated in regional networking events, expanding professional connections and increasing prospective client leads by 20%.

- •Provided strategic investment advice to over 100 clients, leading to an average portfolio growth of 12% annually.

- •Managed clients' portfolios and recommended financial products adapted to market changes, improving client retention by 10%.

- •Conducted regular market trend analyses, enhancing the accuracy of financial forecasts and client strategy adjustments.

- •Facilitated clients' understanding of complex financial products through personalized consultations, improving their decision confidence.

- •Trained junior advisors on effective client relationship management, contributing to a 40% increase in team performance metrics.

- •Performed in-depth risk assessments and financial data analysis, improving the accuracy of investment projections by 18%.

- •Supported senior consultants in creating custom financial models, which contributed to a 22% improvement in client revenue.

- •Developed client-specific reports using advanced analytical tools, aiding in critical investment decisions and strategies.

- •Ensured all financial recommendations were compliant with financial legislation, maintaining a 100% regulatory compliance rate.

- •Assessed financial conditions to develop strategic plans, directly increasing client satisfaction ratings by 15%.

- •Educated clients on diverse financial products and markets to facilitate informed investment choices and increased portfolio diversification.

- •Built long-lasting client relationships through effective communication and continuous service support, enhancing client loyalty.

- •Collaborated with cross-functional teams to deliver a premium client experience, resulting in a 20% increase in referral business.

Investment Strategy Representative resume sample

- •Collaborated with high-net-worth clients to tailor investment strategies, increasing profit margins by 15% year-over-year.

- •Executed detailed market trend analysis, driving investment decisions that resulted in a 30% client base growth.

- •Led seminars on advanced financial products, contributing to a 12% increase in client knowledge satisfaction scores.

- •Managed cross-functional teams to ensure seamless strategy execution, enhancing client retention by 25%.

- •Conducted comprehensive client portfolio reviews that identified underperforming assets, leading to optimized investment outcomes.

- •Redesigned client communication framework, improving feedback response times by 40% and enriching client engagement.

- •Guided clients through investment decision-making, fostering relationships that increased client assets under management by $40 million.

- •Provided insight on regulatory changes, aiding clients in adjusting portfolios and reducing tax liabilities by up to 20%.

- •Created risk assessment tools that aided clients, resulting in a 20% decrease in high-risk investment exposure.

- •Developed tailored client presentations highlighting investment strategies, boosting new account acquisition by 18% annually.

- •Collaborated with marketing to enhance product awareness, leading to a 25% increase in seminar attendance and client inquiries.

- •Analyzed economic indicators to guide investment recommendations, increasing client portfolio performance by 25% over two years.

- •Revitalized customer service protocols, improving client satisfaction ratings by 30% during tenure at the company.

- •Advised over 200 clients on diverse investment products, resulting in a 10% average portfolio growth year-on-year.

- •Implemented innovative tools for client strategy evaluation, significantly enhancing strategy effectiveness and flexibility.

- •Assisted senior advisors in developing client-focused investment strategies, boosting portfolio diversification by 20%.

- •Played a key role in back-office operations, improving transaction accuracy by 15% through process optimization.

- •Supported the organization of client seminars that improved client engagement and led to a 10% rise in service uptake.

- •Monitored client accounts for performance enhancement opportunities, ultimately contributing to a 25% improvement in net returns.

Retirement Planning Specialist resume sample

- •Led a team to increase client asset growth by 25% in two years by implementing strategic retirement plans.

- •Developed custom investment strategies for over 150 clients, resulting in enhanced portfolio returns exceeding market average by 10%.

- •Conducted seminars and workshops on Social Security benefits, directly educating over 300 individuals.

- •Enhanced client loyalty and retention by 15% through regular financial reviews and proactive relationship management.

- •Spearheaded the integration of new financial planning software, improving report generation efficiency by 40%.

- •Collaborated on a major project to upgrade client management systems, boosting user satisfaction scores by 20%.

- •Guided over 200 clients in maximizing their 401(k) returns, increasing average client satisfaction by 25%.

- •Built and maintained relationships with high-net-worth clients, ensuring personalized solutions aligned with individual risk tolerances.

- •Collaborated with Medicare experts to streamline service offerings, leading to a 20% increase in client enrollments.

- •Produced in-depth analyses on pension plans, influencing decision-making processes for portfolio reallocations.

- •Launched a successful retirement planning workshop, attracting over 100 new clients to the firm.

- •Exceeded sales targets by 35% by optimizing investment plans for client retirement goals.

- •Provided strategic advice on annuities and IRAs, helping clients secure over $5 million in assets.

- •Developed educational content on investment basics, improving client understanding and engagement.

- •Implemented follow-up systems that enhanced client interaction and contributed to a 20% increase in repeat consultations.

- •Supported senior advisors in managing accounts totaling $50 million, assisting in the execution of high-value transactions.

- •Conducted market research that led to new investment strategies, contributing to better client asset performances.

- •Participated in the preparation of over 500 financial planning reports using advanced financial modeling techniques.

- •Coordinated client onboarding processes, streamlining operations and reducing onboarding time by 20%.

Insurance Financial Representative resume sample

- •Improved client satisfaction by 25% through policy adjustments after conducting regular financial needs analyses.

- •Increased regional sales by 30% through personalized insurance product presentations targeting diverse client demographics.

- •Developed long-term relationships with over 150 clients, resulting in a 20% increase in policy renewals.

- •Successfully qualified 90% of client applications, streamlining the underwriting processes across all insurance lines.

- •Collaborated with financial planners to design cross-sector financial strategies, boosting service offerings by 40%.

- •Utilized industry software to efficiently organize client data, enhancing service response time by 15%.

- •Spearheaded digital marketing campaigns, increasing client acquisition rates by 35% over a fiscal year.

- •Provided comprehensive financial assessments to over 100 clients annually, 60% of whom reported increased financial security.

- •Trained a team of 5 junior advisors, elevating their performance and contributing to a 20% increase in team-wide sales.

- •Implemented a follow-up system that reduced policy lapse rates by 15%, enhancing client retention.

- •Delivered educational seminars on asset protection to local community groups, reaching over 500 attendees in two years.

- •Led a team of 10 representatives to achieve a 40% increase in quarterly sales figures over three consecutive quarters.

- •Streamlined insurance sales processes, resulting in a 30% reduction in client onboarding time.

- •Initiated partnerships with local businesses, increasing cross-sales of property insurance products by 20%.

- •Analyzed market trends to adapt sales strategies, contributing to a 25% rise in customer base within two years.

- •Managed a portfolio of over 200 clients, achieving a 95% retention rate through strategic insurance solutions.

- •Collaborated with financial analysts to develop robust client dashboards, enhancing quarterly financial evaluations.

- •Implemented data-driven reporting tools that improved policy tracking efficiency by 20%.

Portfolio Analyst Representative resume sample

- •Enhanced portfolio performance by 15% through comprehensive risk assessments and strategic asset allocation adjustments.

- •Spearheaded a team project that resulted in a 20% increase in client satisfaction scores related to investment communication.

- •Developed and automated portfolio performance reports, reducing report generation time by 50%, improving operational efficiency.

- •Analyzed market data trends to provide actionable insights, resulting in a 10% increase in portfolio valuation over one fiscal year.

- •Collaborated with portfolio managers to refine investment strategies, improving average client return rates by 7%.

- •Implemented data integrity checks across portfolio management systems, leading to a 25% decrease in reconciliation errors.

- •Examined financial performance metrics and developed reports that aided in boosting institutional investment growth by 12%.

- •Conducted in-depth competitive market analysis, resulting in the successful launch of new investment products increasing client acquisition by 18%.

- •Generated financial models to forecast portfolio performance, providing strategic insights that increased revenue by $200,000 annually.

- •Improved data reliability by implementing a new system for managing financial databases, reducing errors by 30%.

- •Facilitated client meetings and presentations, effectively communicating portfolio strategies that resulted in a 9% increase in client retention.

- •Conducted analysis reports leading to an optimized portfolio reducing volatility by 5%, benefiting overall investment stability.

- •Collaborated with multi-disciplinary teams to craft diversified investment strategies, resulting in 10% portfolio growth.

- •Managed client investment reports, maintaining a high accuracy rate and reducing processing time by 20%.

- •Monitored and reported on economic trends, aiding in strategic decision-making processes across the investment team.

- •Supported senior analysts by preparing detailed reports and presentations that improved client meeting effectiveness by 25%.

- •Developed automated tools for data analysis, enhancing efficiency and reducing manual work hours by 10 hours weekly.

- •Contributed to research projects that identified new investment opportunities, leading to the addition of $500,000 in assets.

- •Maintained data integrity across financial databases resulting in 99% accuracy during quarterly reviews.

Equity Trading Consultant resume sample

- •Executed equity trades worth over $500 million annually, optimizing client portfolios and increasing yearly returns by 15%.

- •Developed client-specific trading strategies that improved market entry and exit points by 30%, resulting in enhanced client satisfaction.

- •Collaborated with cross-functional teams to identify market opportunities, leading to successful investment decisions and $100 million in new assets.

- •Monitored regulatory changes and advised clients accordingly, ensuring full compliance while maintaining trading efficiency.

- •Implemented innovative trading tools and techniques that increased trading desk efficiency by 25%.

- •Prepared detailed monthly performance reports for institutional clients, aiding in strategic planning and informed decision-making.

- •Analyzed and executed over 3,000 equity trades monthly with a 98% accuracy rate, significantly reducing client risk exposure.

- •Contributed to the development of proprietary trading algorithms that increased profitability by 20% over a one-year period.

- •Built sustainable client relationships through strategic communication, resulting in a 40% increase in repeat business.

- •Collaborated with the analytics team to refine trading models, improving forecast accuracy by 15%.

- •Led training sessions for junior analysts, enhancing overall team proficiency in market analysis.

- •Facilitated the execution of client equity trades, consistently surpassing efficiency targets by 10%.

- •Researched and provided insights into emerging markets, contributing to a diversified client portfolio and asset growth.

- •Developed weekly market trend reports that improved decision-making amongst senior traders and client advisors.

- •Worked closely with compliance to align trading activities with the latest industry regulations.

- •Assisted in executing trades valued at over $100 million, meeting stringent deadlines and accuracy criteria.

- •Supported the trading team by analyzing daily market trends, increasing trading efficiency by 20%.

- •Managed client queries with a focus on building trust and enhancing client experience, leading to a 30% boost in client retention.

- •Collaborated with senior traders to develop innovative trading strategies, improving trade execution speed by 15%.

Mortgage Financial Advisor resume sample

- •Developed personalized mortgage solutions for over 200 clients annually, increasing customer satisfaction scores by 15%.

- •Implemented a new client onboarding process reducing time to close mortgages by 20%.

- •Led a team project resulting in a 30% increase in cross-selling mortgage products.

- •Advised clients on financial planning, resulting in 120% annual achievement of sales targets.

- •Collaborated with underwriters and real estate agents, achieving a 98% approval rate on loan applications.

- •Facilitated client education on mortgage options, resulting in enhanced customer loyalty.

- •Conducted detailed financial assessments and provided tailored mortgage advice to clients, achieving a 90% customer retention rate.

- •Introduced process improvements that led to a 25% decrease in mortgage application processing times.

- •Increased mortgage sales revenue by 18% annually through strategic marketing initiatives.

- •Developed an innovative client referral program boosting new client base by 20%.

- •Trained junior mortgage officers, resulting in team-wide productivity improvements.

- •Provided in-depth financial counseling to clients, achieving a 25% growth in investment portfolio size.

- •Streamlined data entry procedures leading to a 30% reduction in time spent on administrative tasks.

- •Successfully negotiated better loan terms for clients, increasing overall satisfaction scores.

- •Participated in community investment projects by advising on mortgage product options.

- •Processed 100+ loan applications monthly ensuring 95% accuracy in documentation.

- •Assisted in creating marketing materials, which increased client interest by 15%.

- •Executed detailed audits of loan processes enhancing compliance by 20%.

- •Cultivated strong relationships with repeat clients, resulting in valuable referral sources.

Asset Allocation Specialist resume sample

- •Strategically managed client portfolios with over $500 million in assets, enhancing returns by 10% annually through targeted reallocation.

- •Collaborated effectively with portfolio managers to align client investment strategies, achieving a 98% satisfaction rate in annual reviews.

- •Monitored portfolio performance and adjusted strategies, resulting in a 15% outperformance against the benchmark index.

- •Conducted in-depth quantitative analysis of equities and fixed income, identifying key opportunities and concerns.

- •Developed comprehensive reports for clients and stakeholders to review monthly performance and allocation decisions analytically.

- •Forged new relationships with external managers, increasing market insights leading to opportunistic investment decisions.

- •Managed risk assessment for a $200 million fund, using innovative internal risk models, leading to a 5% risk reduction.

- •Collaborated with investment teams to adjust asset allocations, resulting in enhanced return rates by 8% in volatile markets.

- •Presented detailed quarterly reports on asset allocation and performance to 30+ stakeholders and clients.

- •Identified new market trends through extensive analysis, contributing to a strategic shift in portfolio strategies.

- •Used software tools to optimize asset allocation workflows, decreasing processing time by 15% and increasing efficiency of portfolio rebalancing.

- •Analyzed market and economic data, influencing asset allocation adjustments that resulted in a 12% increase in annual client returns.

- •Interviewed and managed external investment manager relationships, gathering critical intelligence on global financial trends.

- •Conducted asset class risk assessments resulting in a more balanced and diversified portfolio composition.

- •Advised on emerging market investments, significantly contributing to a $150 million client portfolio expansion.

- •Assisted in creating financial models and performance reports, increasing analytical precision and clarity for investment decisions.

- •Collaborated in the implementation of new investment strategies, resulting in a 7% increase in fund performance.

- •Improved portfolio performance measurement processes, enhancing quarterly analysis accuracy.

- •Developed initial risk models aiding in successful allocation decisions for fixed income and alternative asset classes.

Tax Planning Financial Representative resume sample

- •Developed custom tax strategies that improved client net worth by 30% in under two years.

- •Collaborated with 10+ tax professionals to ensure compliance with all local and federal legislation.

- •Worked with over 50 clients annually to reduce tax liabilities by an average of 25%.

- •Introduced a documentation program that streamlined tax preparation, enhancing client satisfaction by 40%.

- •Analyzed investment portfolios for continual tax savings, resulting in an average increase of ROI by 15%.

- •Facilitated seminars on retirement planning that led to a 20% increase in new client accounts.

- •Assisted clients in strategizing tax payments to save an average of 22% annually.

- •Monitored 100+ client portfolios, providing guidance and adjusting strategies to maximize investments.

- •Implemented retirement planning workshops, leading to a 15% increase in client involvement.

- •Created detailed financial reports that allowed clients to visualize potential tax-saving actions easily.

- •Optimized investment products communication, enhancing client understanding and satisfaction scores by 30%.

- •Evaluated client tax situations and produced reports that highlighted possible reductions in liabilities.

- •Coordinated with senior planners to introduce tax-efficient solutions, improving yearly company savings by $500,000.

- •Managed client queries, enhancing engagement through personalized advice and responsiveness.

- •Designed a new filing system that reduced processing time by 25%, increasing team productivity.

- •Assisted in crafting tax solutions that aligned with corporate objectives, mitigating financial risks.

- •Developed presentations on new tax laws, improving client compliance by 98%.

- •Supported senior advisors in developing actionable strategies based on in-depth financial analyses.

- •Analyzed annual tax changes, enabling clients to implement proactive planning measures.

Creating a resume as a financial representative can feel like navigating a complex maze. While your skills with numbers and knowledge of financial products are extensive, articulating them clearly on paper is another challenge. A standout resume is your key to unlocking interview opportunities in a competitive market, where it's important to present your achievements and potential effectively.

This is where having a clear and structured format becomes essential. A resume template provides that framework, ensuring your skills and experiences are highlighted logically and compellingly. By using a structured template, you can transform your detailed financial background into an engaging narrative of your career.

This guidance also helps you sidestep common pitfalls, particularly when balancing technical details with approachable language. Templates show you what employers value, such as impressive sales numbers and client growth metrics, helping you tailor your resume to their expectations.

Think of your resume as your professional business card—it introduces you long before you meet potential employers. It should capture attention with clarity, relevance, and a touch of your personality. By using a resume template, you turn your application into more than just a piece of paper—it’s your first step toward your next career opportunity. Dive into various options to discover the right fit for your journey.

Key Takeaways

- A financial representative resume should clearly convey expertise in finance and client relationship building, using a structured template to highlight skills and experiences logically.

- Focus on including sections such as contact information, professional summary, work experience, education, skills, and professional affiliations to ensure a comprehensive overview of qualifications.

- The reverse-chronological resume format works best for showcasing recent and relevant experiences, while modern fonts like Raleway or Lato can enhance professionalism.

- Incorporate quantifiable achievements in the experience section to demonstrate impact, using strong action verbs and tailoring to specific job descriptions.

- Supplement the resume with optional sections like languages or volunteer work to add depth and personalize your application further for potential financial representative roles.

What to focus on when writing your financial representative resume

A financial representative resume should seamlessly convey your expertise in finance alongside your ability to build strong client relationships. Your skills in financial analysis and customer service should naturally highlight your capacity for providing excellent financial advice. This way, your resume effectively communicates your extensive experience in the finance industry and your talent for working with numbers and data.

How to structure your financial representative resume

- Contact Information: Start by including your full name, phone number, and a professional email address. This section is critical because it ensures recruiters have the means to contact you easily, setting the tone for professionalism from the very top of your resume—an essential aspect as we move into more intricate details of each section.

- Professional Summary: In a brief paragraph, summarize your experience in the financial industry. This is your first chance to make an impression, so it should grab attention by emphasizing your proven skills in client management and financial planning. By clearly stating your career objectives and achievements, you give recruiters a snapshot of your professional identity, paving the way for the next detailed sections.

- Work Experience: Provide a clear list of your previous job titles, companies, locations, and employment dates. This section is your opportunity to describe your hands-on experience in financial counseling and investment advice. Highlighting significant achievements, such as boosting client portfolio values or receiving awards for outstanding client service, reinforces your professional narrative, leading smoothly into the educational background that supports your experience.

- Education: Following your work experience, detail your educational background. Include your degree(s), major, school name, and graduation date. Mention any relevant coursework or certifications, like a Certified Financial Planner (CFP) designation, which directly ties to your professional expertise and underpins your practical experience outlined earlier.

- Skills: Highlight skills specifically relevant to the financial sector. Mention your expertise with financial software like Excel or QuickBooks, alongside your strong analytical and communication abilities. This section functions as a link between your professional summary and work experience, showcasing the technical capabilities that enable you to perform effectively in your role.

- Professional Affiliations: Wrap up by listing memberships in finance-related organizations, such as the Financial Planning Association. Showing such affiliations helps underline your commitment and dedication to the field, validating the qualifications and experiences mentioned earlier.

To further enhance your profile, consider adding optional sections like languages spoken or volunteer work. Including such unique additions can illustrate extra skills or community involvement, adding depth to your professional persona. Now that we’ve covered the importance of each section, we'll delve deeper into how to effectively format your resume, tailoring each section to maximize impact.

Which resume format to choose

Creating a resume as a financial representative requires a format that best presents your expertise and achievements. The reverse-chronological format excels here, placing your most recent experiences at the forefront. This layout not only highlights your career progression but also emphasizes the roles and responsibilities most relevant to potential employers in the financial sector.

Choosing the right font can subtly enhance how your resume is perceived. Opt for Raleway, Lato, or Montserrat. Their modern and clean design conveys professionalism and attention to detail, qualities highly valued in financial roles. While font choice might seem minor, it contributes to the overall first impression your resume makes.

When it comes to filetype, saving your resume as a PDF is crucial. PDFs preserve your document's format, ensuring that it remains consistent and professional when opened on different devices. This reliability is important for hiring managers who need clear, organized information at a glance.

Finally, adhering to standard margins of one inch on all sides keeps your resume looking neat and structured. This margin spacing allows your content to breathe, making it easier to read and more visually inviting. A well-organized document reflects the precision and clarity essential in the financial industry, helping you effectively communicate your capabilities to potential employers.

How to write a quantifiable resume experience section

A compelling financial representative resume experience section seamlessly presents achievements tailored to the job you're targeting. By focusing on measurable successes, you convey your ability to meet business goals and foster strong client relationships. Start with your most recent role, typically covering the last 10 to 15 years unless an older position is particularly relevant. Highlight job titles that align with your desired position, and tailor your resume by incorporating the job ad's keywords and requirements. Use dynamic action words like "boosted," "achieved," "managed," and "reduced" to clearly demonstrate your impact.

Here's a refined resume experience example for a financial representative role:

- •Increased client portfolio by 30% in one year through personalized investment solutions.

- •Boosted customer satisfaction scores by 15% by improving onboarding processes.

- •Managed a $5 million diversified investment fund, exceeding client growth goals by 20%.

- •Cut service claim turnaround time by 25% with streamlined processes.

This experience section is cohesive, linking your quantifiable achievements to the overarching business impacts you achieved. By highlighting significant client portfolio growth and increased satisfaction scores, you demonstrate your ability to align client needs with company objectives effectively. The inclusion of specific numbers, such as a 30% increase in portfolios or managing a $5 million fund, provides concrete proof of your financial expertise. Moreover, focusing on action and results, paired with a tailored approach, ensures your resume not only informs but also persuasively engages potential employers.

Responsibility-Focused resume experience section

A Responsibility-Focused financial representative resume experience section should start by highlighting your most significant achievements and responsibilities in previous roles. Clearly describe how your successes benefited your team or the company overall. It's important to employ strong action verbs and provide quantifiable outcomes to showcase your impact, helping to effectively demonstrate the value you bring to potential employers.

Kick off by listing your job title, workplace, and the dates you were employed. Follow this with a clear description of your job duties, focusing on areas like client management, financial planning, or achieving sales targets. To add depth, include any special projects, awards, or recognitions you've received. This well-rounded approach not only makes your resume stand out but also provides a comprehensive view of your skills and experiences.

Financial Representative

XYZ Financial Services

May 2018 - August 2022

- Managed over 150 client accounts, ensuring a high level of satisfaction and retention.

- Increased portfolio value by 25% through strategic investment advice and personalized service.

- Developed a new client onboarding process that improved time efficiency by 30%.

- Received Employee of the Month award twice for achieving the highest client satisfaction scores.

Skills-Focused resume experience section

A skills-focused financial representative resume experience section should clearly highlight the abilities that distinguish you in the field. By emphasizing client management, financial analysis, and strategic planning, you can demonstrate how these skills contribute to your professional success. Provide context to showcase your effectiveness in managing financial tasks and achieving exceptional results. Recruiters look for concrete evidence, so incorporating quantified achievements can significantly enhance your resume.

Begin each bullet point with an action verb to effectively illustrate your abilities and the impact of your work. Metrics, such as percentage growth in sales or the number of clients served, can provide further emphasis on your accomplishments. Keep your sentences clear and engaging, ensuring they are easy to read. The overall aim is to communicate your exceptional value as a financial representative in a way that stands out to potential employers.

Financial Representative

ABC Financial Services

January 2020 - Present

- Increased portfolio growth by 15% through strategic investment recommendations.

- Enhanced client satisfaction scores by 25% with a customer-focused approach.

- Crafted tailored financial plans for over 50 clients, boosting their financial health.

- Worked with cross-functional teams to streamline financial reporting processes.

Efficiency-Focused resume experience section

An efficiency-focused financial representative resume experience section should clearly demonstrate your skills in enhancing productivity and optimizing operations. Begin by detailing your role and the impact you made, showing how you effectively improved processes and achieved significant outcomes like cost reductions or time savings. By using straightforward language, you can easily convey how your contributions drove the organization's success and met its goals.

To illustrate your efficiency achievements, include specific examples of initiatives you led or supported. Describe a challenge you faced, the action you took, and the results you accomplished, providing real details that highlight the scale of your contributions. Emphasize times when you exceeded targets or introduced innovative solutions that had a lasting impact on productivity. By maintaining a strong focus on efficiency, you can effectively underscore your expertise in this critical area.

Efficiency Specialist

ABC Financial Services

June 2020 - Present

- Improved client account processing time by 30% through the implementation of a new digital management system.

- Reduced operational costs by 15% by negotiating better vendor contracts and optimizing supply chain processes.

- Developed a new training program that increased new employee productivity by 20% within the first three months.

- Streamlined communication processes across departments, reducing project completion times by 25%.

Industry-Specific Focus resume experience section

A financial-focused resume experience section should clearly highlight your achievements and skills in the finance industry. Begin by showcasing specific experiences that relate directly to your role, such as managing portfolios, providing investment advice, or explaining complex concepts to clients. Make sure to use strong action verbs, and always aim to quantify your results, such as the number of accounts managed or the asset value you oversaw, to provide clear evidence of your expertise.

It's crucial to tailor this section to the job you're applying for, focusing on experiences that match the job description. Avoid generic phrases and jargon to maintain clarity and impact. Each bullet point should seamlessly convey the value you have brought in your past roles, illustrating your expertise as a financial representative. By doing this, you effectively draw in hiring managers and present yourself as the ideal candidate for the job.

Financial Representative

XYZ Financial Services

June 2019 - Present

- Managed over 150 client accounts with a total asset value of $200 million.

- Boosted client satisfaction by 20% through personalized financial advice.

- Developed custom investment strategies that consistently outperformed the market.

- Led educational workshops to enhance clients’ financial literacy.

Write your financial representative resume summary section

A financial representative-focused resume summary should effectively convey your value to prospective employers. This brief section is your chance to make a strong first impression. A concise, impactful snapshot of your skills and achievements can set you apart. Your goal is to show how you fit the specific role with clear, confident language. For instance, consider the following example:

This example effectively highlights your key achievements and skills. By showcasing specific accomplishments, like revenue growth and portfolio management, you demonstrate your expertise. These measurable outcomes help differentiate you from other candidates. Understanding the distinction between a resume summary and other resume introductions is also crucial. A summary highlights your experience and current value, while an objective focuses on your future goals, ideal if you're breaking into the field.

Conversely, a summary of qualifications emphasizes specific skills and achievements, which is beneficial for those with varied experiences. A resume profile combines elements from all these to give a brief overview of your skills, experience, and goals. Selecting the right style depends on your background and how you connect with the job you want. Tailoring your resume in this way can help you make a compelling impression on potential employers.

Listing your financial representative skills on your resume

A skills-focused financial representative resume should clearly highlight your abilities and qualifications. Including a standalone skills section or integrating your skills into the experience and summary sections can greatly enhance your resume. By showcasing strengths and soft skills such as communication and teamwork, you demonstrate your capabilities in working effectively with others. These qualities complement your hard skills, which include specific abilities you've gained through training or experience, like financial analysis or data management.

Effectively using skills and strengths as keywords throughout your resume can increase its visibility with applicant tracking systems and hiring managers. Strategic placement of these keywords in relevant sections aligns your resume with the job descriptions you're targeting.

Consider this JSON example of a well-structured standalone skills section:

This format works well because it utilizes clear, concise language while directly relating to the responsibilities of a financial representative role. By focusing on relevant skills, potential employers can quickly grasp your qualifications and how you fit their needs.

Best hard skills to feature on your financial representative resume

Hard skills are vital as they showcase your technical proficiency and ability to handle specific tasks within the financial realm. These skills, like financial analysis and data management, convey competence and capability in the industry.

Hard Skills

- Financial Analysis

- Data Management

- Investment Strategy

- Regulatory Compliance

- Risk Assessment

- CRM Software Proficiency

- Portfolio Management

- Financial Forecasting

- Budgeting

- Financial Reporting

- Market Analysis

- Sales Strategies

- Tax Planning

- Wealth Management Systems

- Credit Analysis

Best soft skills to feature on your financial representative resume

Soft skills highlight your interpersonal strengths and the way you approach your work. They communicate your ability to collaborate, communicate, and build relationships effectively—critical attributes for success in the financial industry.

Soft Skills

- Communication

- Teamwork

- Adaptability

- Problem Solving

- Empathy

- Time Management

- Critical Thinking

- Negotiation

- Customer Service

- Conflict Resolution

- Ethical Judgment

- Leadership

- Strategic Planning

- Patience

- Attention to Detail

How to include your education on your resume

The education section of your resume is a crucial part, especially for a financial representative position. This section should highlight academic achievements relevant to the job, avoiding unnecessary or unrelated education details. Start with your most recent or relevant degree, listing the degree type, institution name, and graduation dates. If your GPA is impressive or significant for the job, you should include it; typically, a GPA of 3.5 or higher is worth showing. Honors like cum laude should be mentioned as they demonstrate academic excellence, illustrating your dedication and hard work.

For example, a wrong education section may look like this:

This example is poorly aligned with a financial representative role, focusing on an irrelevant degree. Here is a better example:

This example is effective for a financial representative resume because it presents a relevant finance degree and a strong GPA. The education aligns well with the skills required for the job, indicating a solid foundation in financial principles. By tailoring the section, you demonstrate your fit for the role and make your application more compelling to employers.

How to include financial representative certificates on your resume

Including a certificates section in your financial representative resume is essential because it showcases your qualifications and expertise. List the name of each certificate clearly. Include the date you obtained it to establish the timeline of your professional development. Add the issuing organization to validate the credibility of your achievements.

Certificates can also be included in the header to immediately draw attention. For example, you could write, "John Doe, Certified Financial Planner®". This instantly communicates your professional standing.

A good standalone certificates section might read like this:

Extra sections to include in your financial representative resume

Crafting a standout resume as a financial representative requires focusing on key areas that highlight your skills, experience, and unique personal qualities. Including diverse sections in your resume can make you a more appealing candidate to potential employers.

Language section—Showcase any additional languages you speak to highlight your ability to communicate with a diverse clientele. This could set you apart in a globalized business environment.

Hobbies and interests section—Add personal interests to show your well-rounded personality and team spirit. It offers a human touch and helps interviewers relate to you on a personal level.

Volunteer work section—Demonstrate your commitment to community service and your leadership skills by listing your volunteer experiences. Volunteering as a financial advisor at a non-profit, for example, can illustrate your dedication to supporting others with your financial expertise.

Books section—Include a list of finance-related books you have read to show you are proactive in staying informed. This highlights your eagerness for continual learning and self-improvement in your field.

Tailoring your resume with these elements can provide a fuller picture of who you are and make you a more compelling candidate to employers in the financial industry.

Pair your financial representative resume with a cover letter

In Conclusion

In conclusion, crafting a standout resume is vital for success as a financial representative. Your resume is not just a list of past positions but a narrative of your professional journey tailored to resonate with the financial industry. By using structured templates, you ensure that your skills and achievements are presented logically and compellingly, giving potential employers a clear picture of your capabilities. Highlighting both quantitative successes and the interpersonal skills you've cultivated demonstrates your value across various dimensions of the job. This multi-faceted approach strengthens your application, drawing attention to your ability to analyze financial data and build strong client relationships effectively.

Formatting choices, such as using a modern font and maintaining proper margins, enhance the readability and professionalism of your resume. These elements may seem minor but contribute significantly to the first impression you make. Meanwhile, listing key certifications and educational qualifications underscores your expertise and dedication to continuous professional development. By selecting the reverse-chronological format, you bring your most recent and relevant experiences to the forefront, emphasizing career progression and readiness for new challenges. Your skills section bridges this narrative, showcasing both hard and soft skills that make you a valuable asset to any financial team.

Adding extra sections like languages spoken or volunteer work can further enrich your profile, offering insights into your personal attributes and community involvement. Including a cover letter with your resume offers an opportunity to elaborate on these experiences and express your enthusiasm for the role you’re applying for. Together, these components form a cohesive and compelling application that stands out to potential employers. Tailor each part of your resume with care, and you position yourself as an attractive candidate poised to excel in the competitive financial industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.