Financial Risk Analyst Resume Examples

Jul 18, 2024

|

12 min read

Build a stellar financial risk analyst resume: secure your dream job by showcasing your expertise and skills in financial risk management, while keeping it as balanced as a well-diversified portfolio.

Rated by 348 people

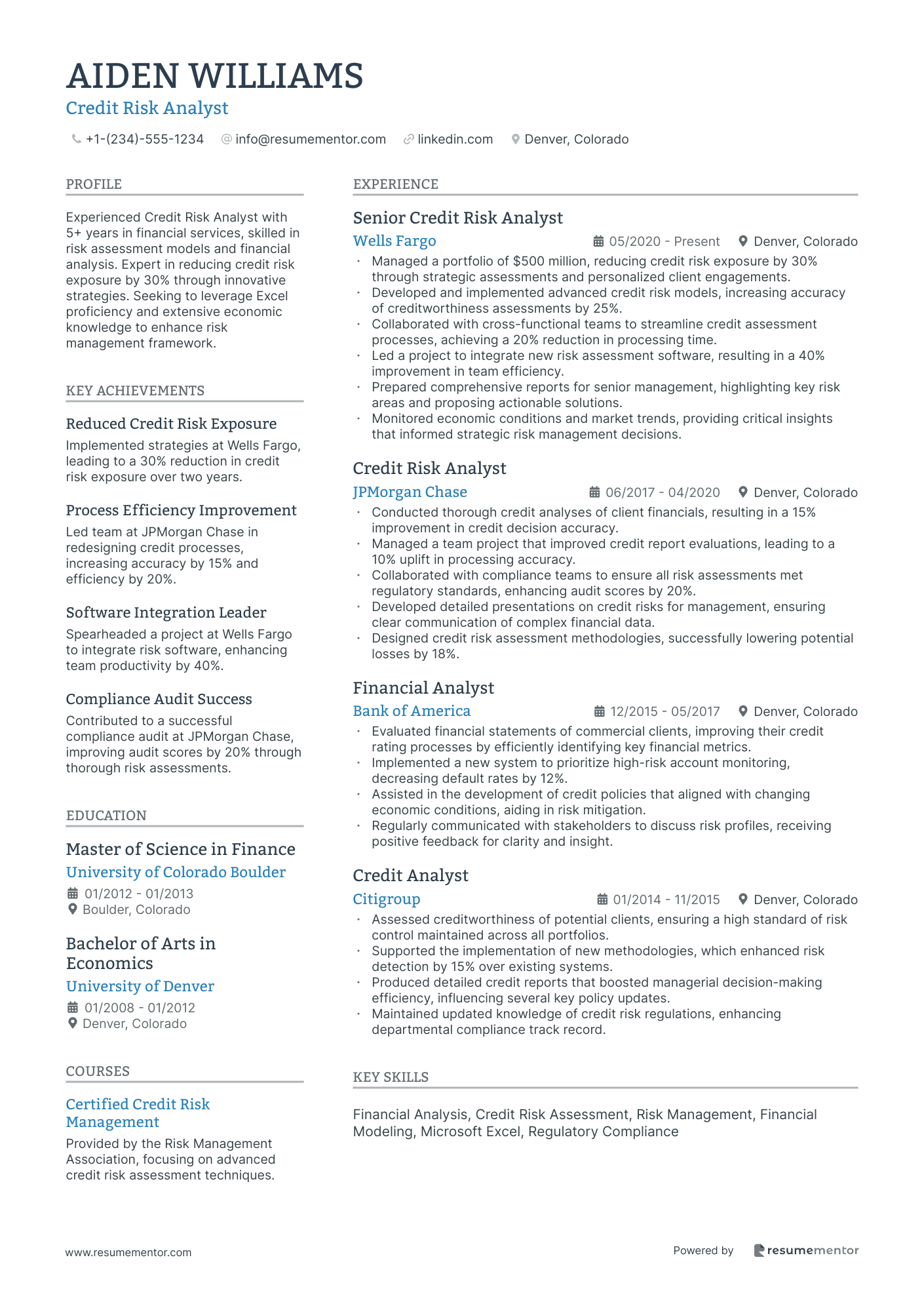

Credit Risk Analyst

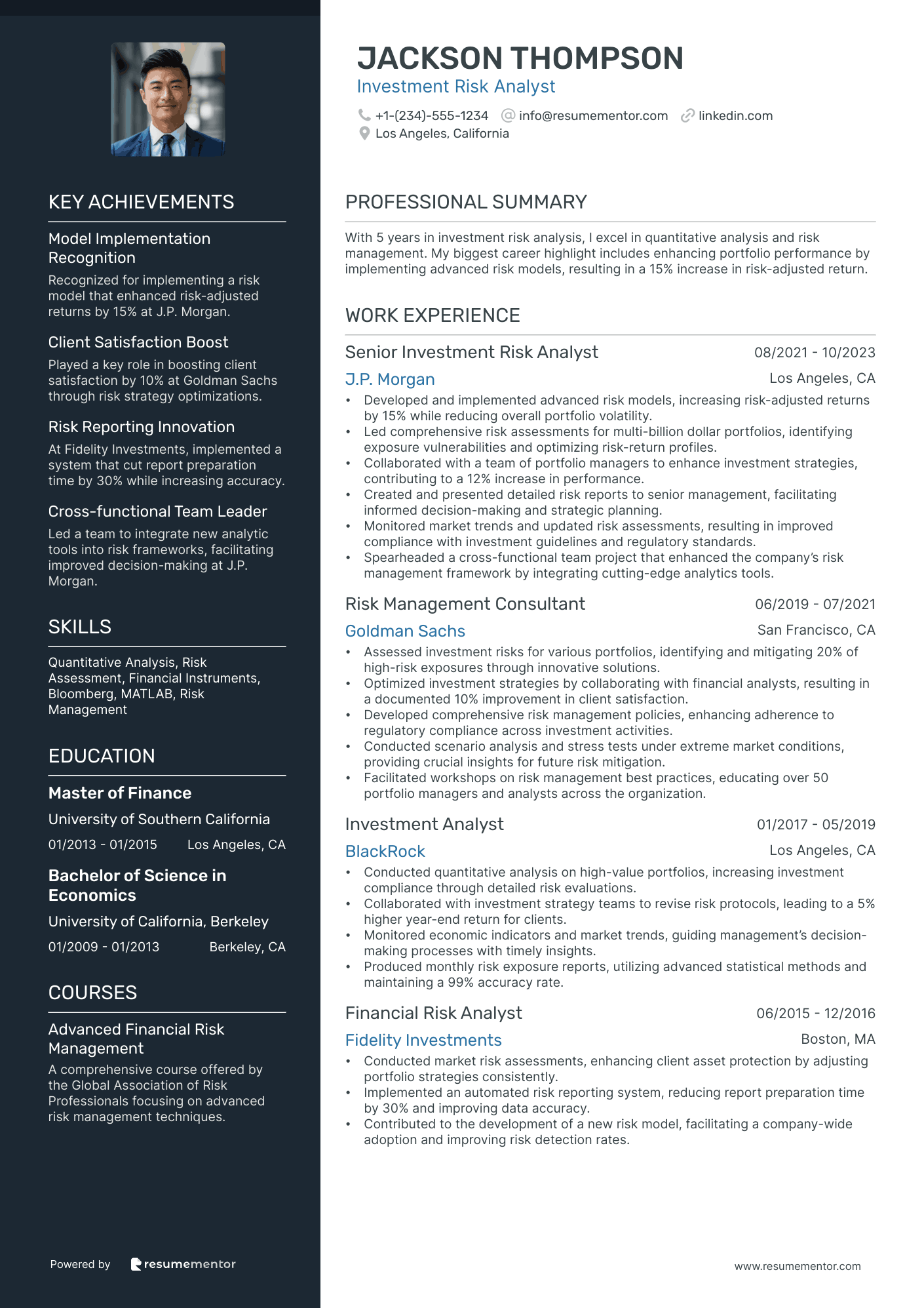

Investment Risk Analyst

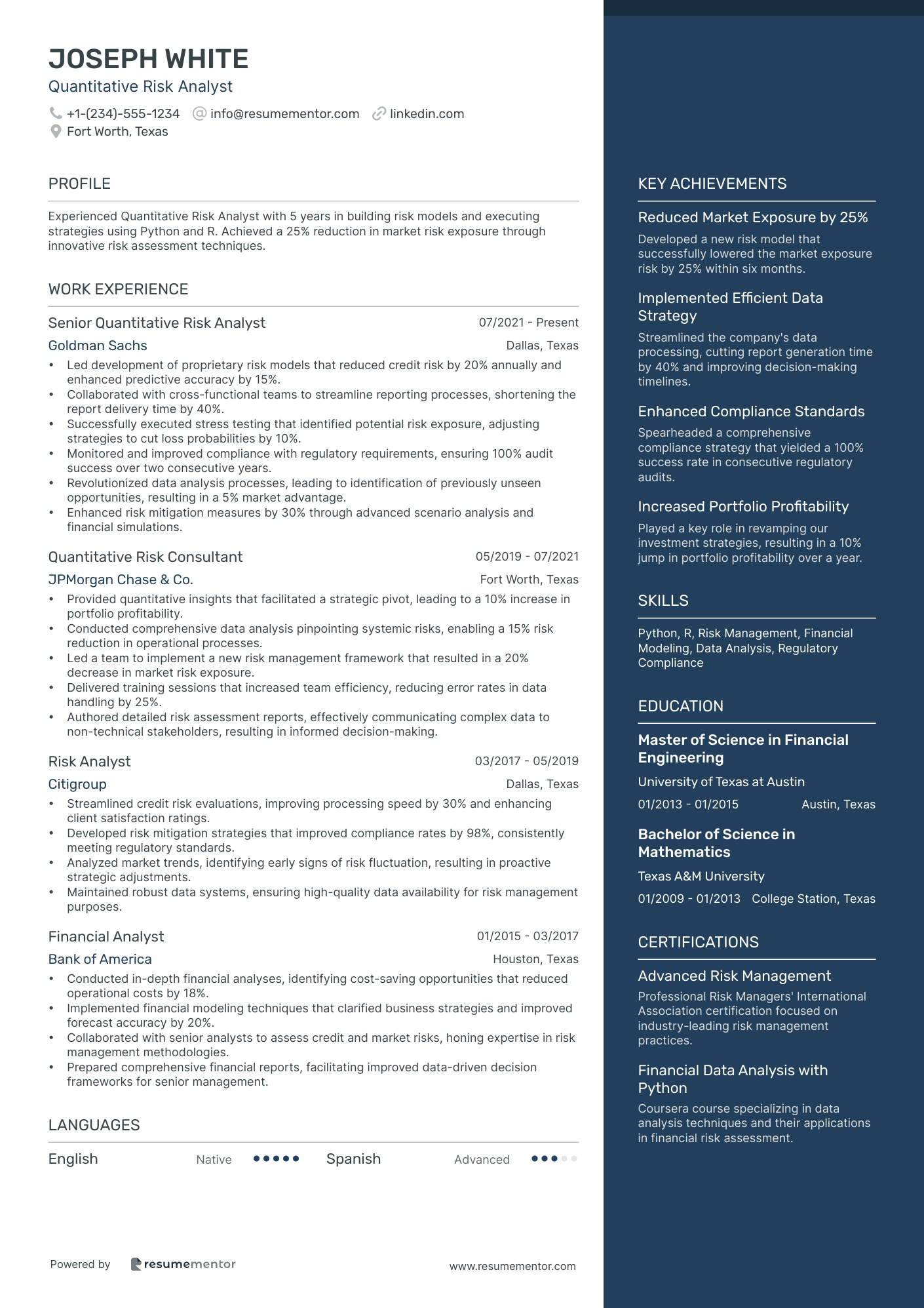

Quantitative Risk Analyst

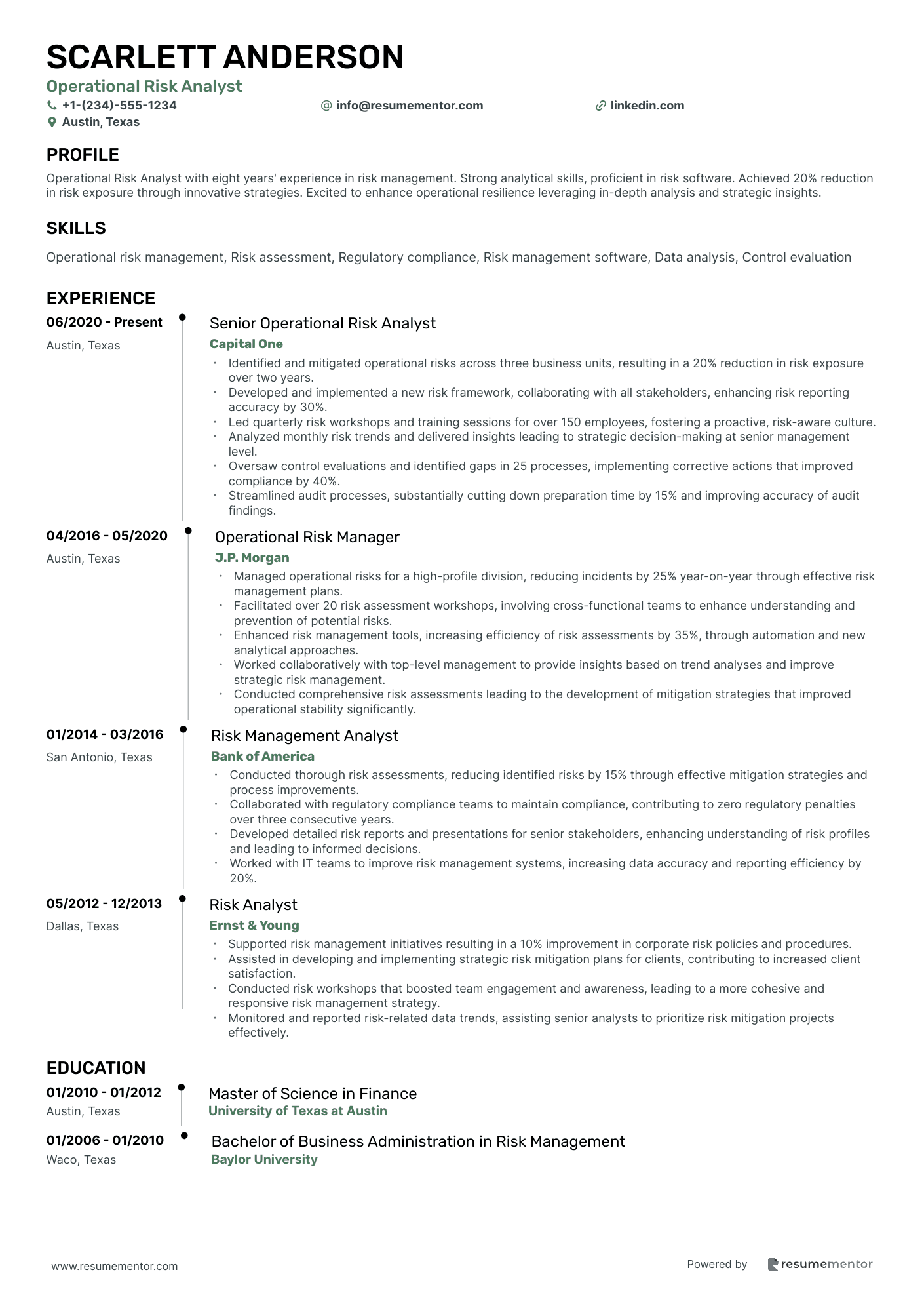

Operational Risk Analyst

Enterprise Risk Analyst

Risk & Compliance Analyst

Market Risk Analyst

Liquidity Risk Analyst

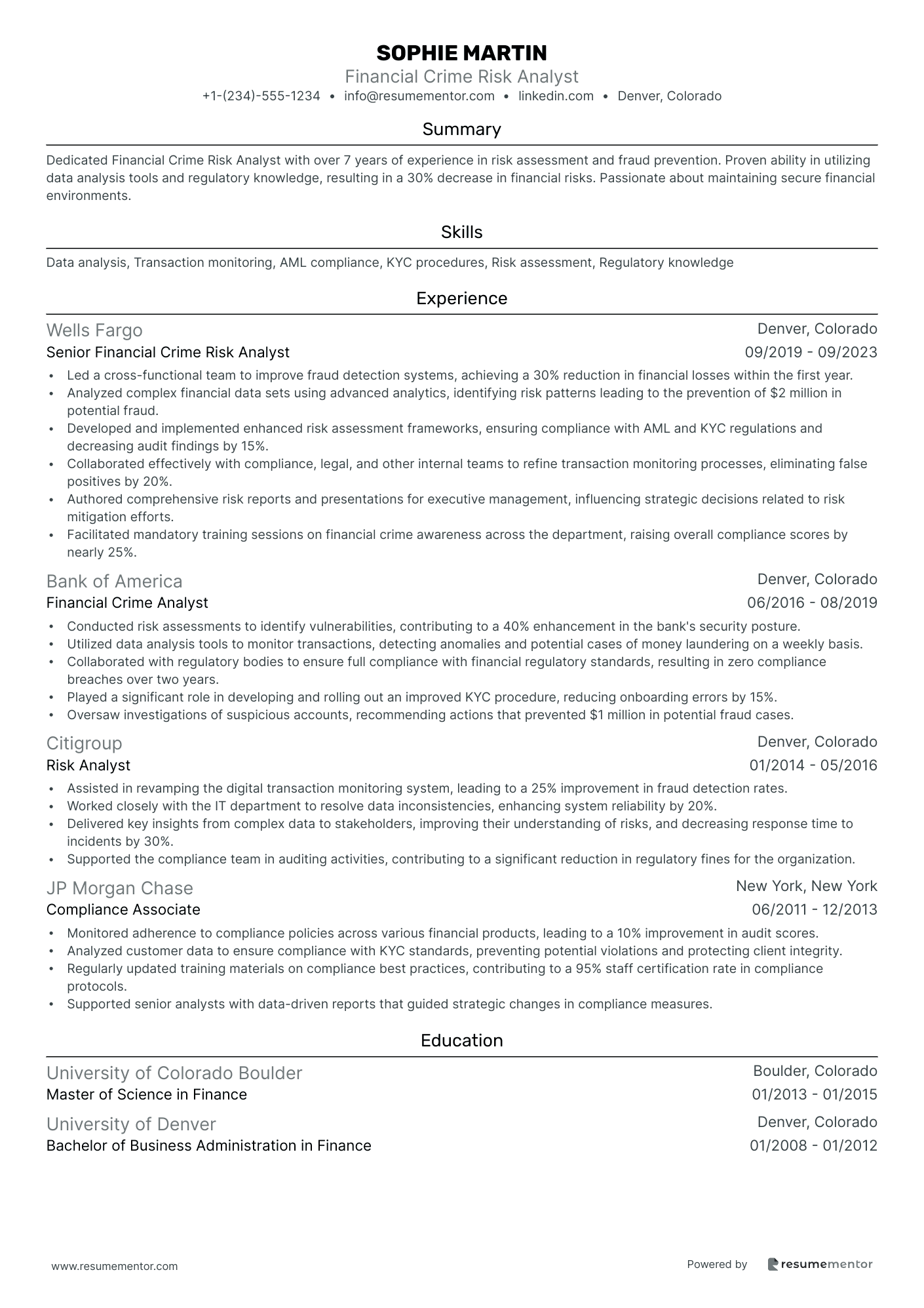

Financial Crime Risk Analyst

Model Risk Analyst

Credit Risk Analyst resume sample

- •Managed a portfolio of $500 million, reducing credit risk exposure by 30% through strategic assessments and personalized client engagements.

- •Developed and implemented advanced credit risk models, increasing accuracy of creditworthiness assessments by 25%.

- •Collaborated with cross-functional teams to streamline credit assessment processes, achieving a 20% reduction in processing time.

- •Led a project to integrate new risk assessment software, resulting in a 40% improvement in team efficiency.

- •Prepared comprehensive reports for senior management, highlighting key risk areas and proposing actionable solutions.

- •Monitored economic conditions and market trends, providing critical insights that informed strategic risk management decisions.

- •Conducted thorough credit analyses of client financials, resulting in a 15% improvement in credit decision accuracy.

- •Managed a team project that improved credit report evaluations, leading to a 10% uplift in processing accuracy.

- •Collaborated with compliance teams to ensure all risk assessments met regulatory standards, enhancing audit scores by 20%.

- •Developed detailed presentations on credit risks for management, ensuring clear communication of complex financial data.

- •Designed credit risk assessment methodologies, successfully lowering potential losses by 18%.

- •Evaluated financial statements of commercial clients, improving their credit rating processes by efficiently identifying key financial metrics.

- •Implemented a new system to prioritize high-risk account monitoring, decreasing default rates by 12%.

- •Assisted in the development of credit policies that aligned with changing economic conditions, aiding in risk mitigation.

- •Regularly communicated with stakeholders to discuss risk profiles, receiving positive feedback for clarity and insight.

- •Assessed creditworthiness of potential clients, ensuring a high standard of risk control maintained across all portfolios.

- •Supported the implementation of new methodologies, which enhanced risk detection by 15% over existing systems.

- •Produced detailed credit reports that boosted managerial decision-making efficiency, influencing several key policy updates.

- •Maintained updated knowledge of credit risk regulations, enhancing departmental compliance track record.

Investment Risk Analyst resume sample

- •Developed and implemented advanced risk models, increasing risk-adjusted returns by 15% while reducing overall portfolio volatility.

- •Led comprehensive risk assessments for multi-billion dollar portfolios, identifying exposure vulnerabilities and optimizing risk-return profiles.

- •Collaborated with a team of portfolio managers to enhance investment strategies, contributing to a 12% increase in performance.

- •Created and presented detailed risk reports to senior management, facilitating informed decision-making and strategic planning.

- •Monitored market trends and updated risk assessments, resulting in improved compliance with investment guidelines and regulatory standards.

- •Spearheaded a cross-functional team project that enhanced the company’s risk management framework by integrating cutting-edge analytics tools.

- •Assessed investment risks for various portfolios, identifying and mitigating 20% of high-risk exposures through innovative solutions.

- •Optimized investment strategies by collaborating with financial analysts, resulting in a documented 10% improvement in client satisfaction.

- •Developed comprehensive risk management policies, enhancing adherence to regulatory compliance across investment activities.

- •Conducted scenario analysis and stress tests under extreme market conditions, providing crucial insights for future risk mitigation.

- •Facilitated workshops on risk management best practices, educating over 50 portfolio managers and analysts across the organization.

- •Conducted quantitative analysis on high-value portfolios, increasing investment compliance through detailed risk evaluations.

- •Collaborated with investment strategy teams to revise risk protocols, leading to a 5% higher year-end return for clients.

- •Monitored economic indicators and market trends, guiding management’s decision-making processes with timely insights.

- •Produced monthly risk exposure reports, utilizing advanced statistical methods and maintaining a 99% accuracy rate.

- •Conducted market risk assessments, enhancing client asset protection by adjusting portfolio strategies consistently.

- •Implemented an automated risk reporting system, reducing report preparation time by 30% and improving data accuracy.

- •Contributed to the development of a new risk model, facilitating a company-wide adoption and improving risk detection rates.

Quantitative Risk Analyst resume sample

- •Led development of proprietary risk models that reduced credit risk by 20% annually and enhanced predictive accuracy by 15%.

- •Collaborated with cross-functional teams to streamline reporting processes, shortening the report delivery time by 40%.

- •Successfully executed stress testing that identified potential risk exposure, adjusting strategies to cut loss probabilities by 10%.

- •Monitored and improved compliance with regulatory requirements, ensuring 100% audit success over two consecutive years.

- •Revolutionized data analysis processes, leading to identification of previously unseen opportunities, resulting in a 5% market advantage.

- •Enhanced risk mitigation measures by 30% through advanced scenario analysis and financial simulations.

- •Provided quantitative insights that facilitated a strategic pivot, leading to a 10% increase in portfolio profitability.

- •Conducted comprehensive data analysis pinpointing systemic risks, enabling a 15% risk reduction in operational processes.

- •Led a team to implement a new risk management framework that resulted in a 20% decrease in market risk exposure.

- •Delivered training sessions that increased team efficiency, reducing error rates in data handling by 25%.

- •Authored detailed risk assessment reports, effectively communicating complex data to non-technical stakeholders, resulting in informed decision-making.

- •Streamlined credit risk evaluations, improving processing speed by 30% and enhancing client satisfaction ratings.

- •Developed risk mitigation strategies that improved compliance rates by 98%, consistently meeting regulatory standards.

- •Analyzed market trends, identifying early signs of risk fluctuation, resulting in proactive strategic adjustments.

- •Maintained robust data systems, ensuring high-quality data availability for risk management purposes.

- •Conducted in-depth financial analyses, identifying cost-saving opportunities that reduced operational costs by 18%.

- •Implemented financial modeling techniques that clarified business strategies and improved forecast accuracy by 20%.

- •Collaborated with senior analysts to assess credit and market risks, honing expertise in risk management methodologies.

- •Prepared comprehensive financial reports, facilitating improved data-driven decision frameworks for senior management.

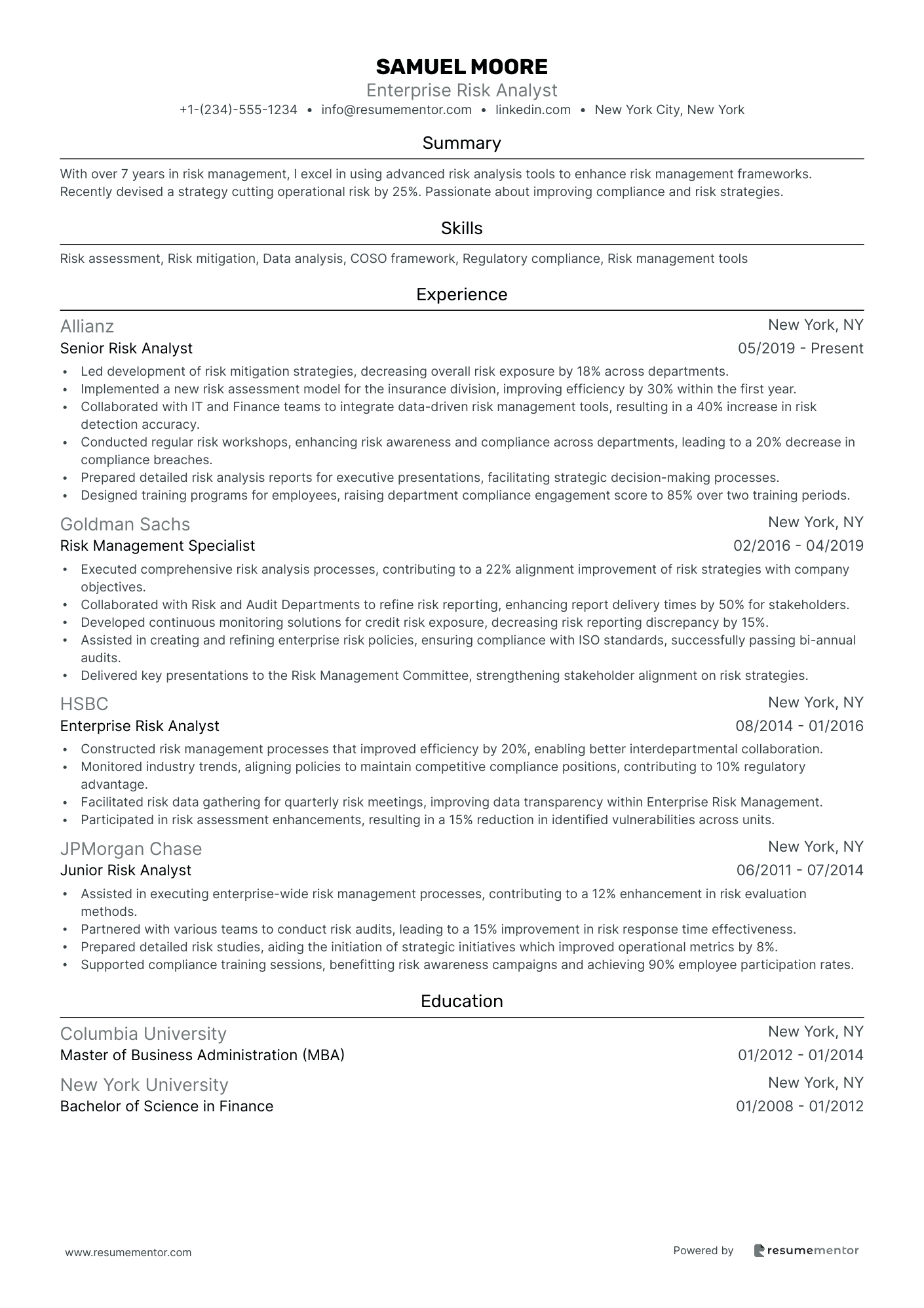

Enterprise Risk Analyst resume sample

- •Led development of risk mitigation strategies, decreasing overall risk exposure by 18% across departments.

- •Implemented a new risk assessment model for the insurance division, improving efficiency by 30% within the first year.

- •Collaborated with IT and Finance teams to integrate data-driven risk management tools, resulting in a 40% increase in risk detection accuracy.

- •Conducted regular risk workshops, enhancing risk awareness and compliance across departments, leading to a 20% decrease in compliance breaches.

- •Prepared detailed risk analysis reports for executive presentations, facilitating strategic decision-making processes.

- •Designed training programs for employees, raising department compliance engagement score to 85% over two training periods.

- •Executed comprehensive risk analysis processes, contributing to a 22% alignment improvement of risk strategies with company objectives.

- •Collaborated with Risk and Audit Departments to refine risk reporting, enhancing report delivery times by 50% for stakeholders.

- •Developed continuous monitoring solutions for credit risk exposure, decreasing risk reporting discrepancy by 15%.

- •Assisted in creating and refining enterprise risk policies, ensuring compliance with ISO standards, successfully passing bi-annual audits.

- •Delivered key presentations to the Risk Management Committee, strengthening stakeholder alignment on risk strategies.

- •Constructed risk management processes that improved efficiency by 20%, enabling better interdepartmental collaboration.

- •Monitored industry trends, aligning policies to maintain competitive compliance positions, contributing to 10% regulatory advantage.

- •Facilitated risk data gathering for quarterly risk meetings, improving data transparency within Enterprise Risk Management.

- •Participated in risk assessment enhancements, resulting in a 15% reduction in identified vulnerabilities across units.

- •Assisted in executing enterprise-wide risk management processes, contributing to a 12% enhancement in risk evaluation methods.

- •Partnered with various teams to conduct risk audits, leading to a 15% improvement in risk response time effectiveness.

- •Prepared detailed risk studies, aiding the initiation of strategic initiatives which improved operational metrics by 8%.

- •Supported compliance training sessions, benefitting risk awareness campaigns and achieving 90% employee participation rates.

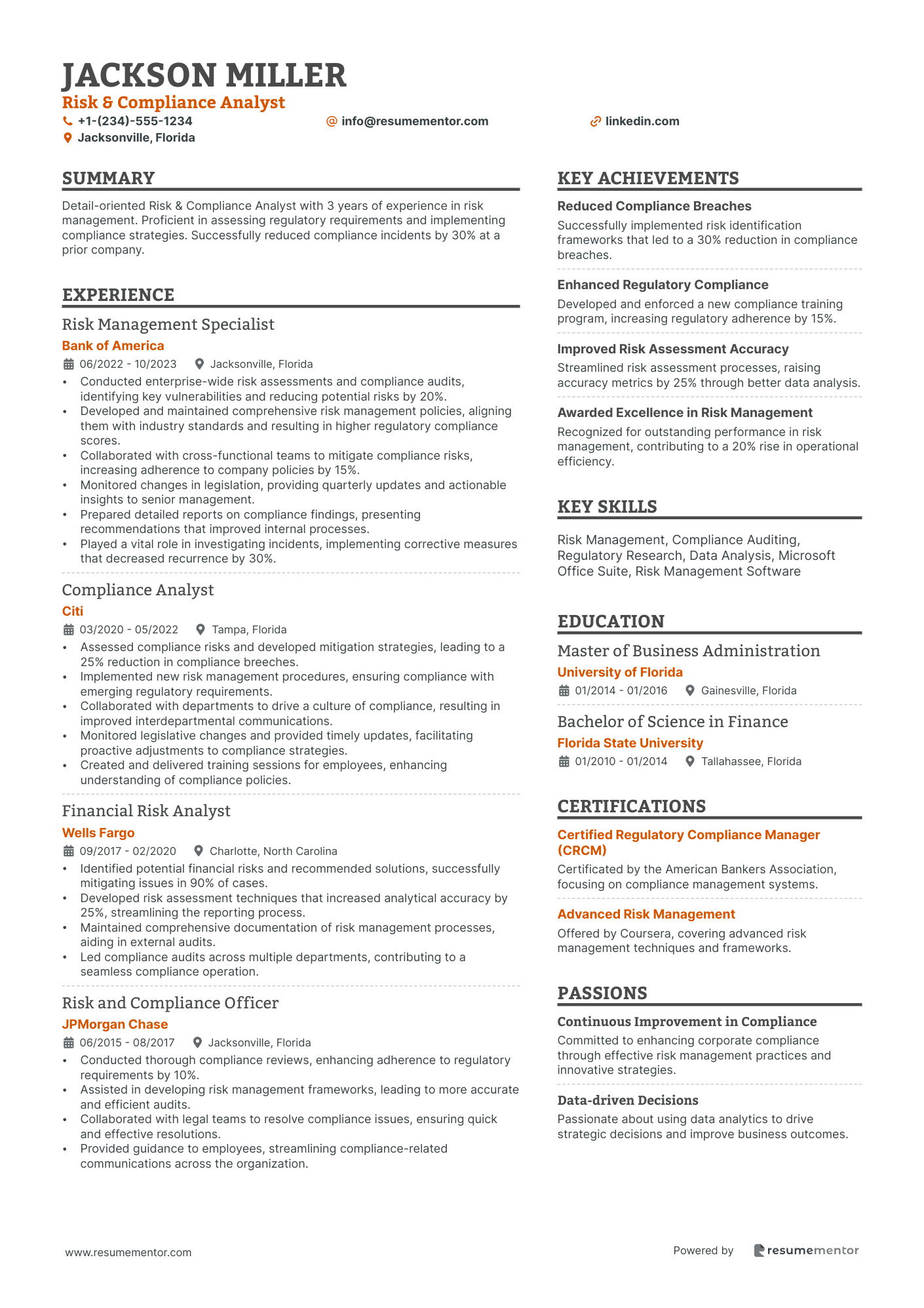

Risk & Compliance Analyst resume sample

- •Conducted enterprise-wide risk assessments and compliance audits, identifying key vulnerabilities and reducing potential risks by 20%.

- •Developed and maintained comprehensive risk management policies, aligning them with industry standards and resulting in higher regulatory compliance scores.

- •Collaborated with cross-functional teams to mitigate compliance risks, increasing adherence to company policies by 15%.

- •Monitored changes in legislation, providing quarterly updates and actionable insights to senior management.

- •Prepared detailed reports on compliance findings, presenting recommendations that improved internal processes.

- •Played a vital role in investigating incidents, implementing corrective measures that decreased recurrence by 30%.

- •Assessed compliance risks and developed mitigation strategies, leading to a 25% reduction in compliance breeches.

- •Implemented new risk management procedures, ensuring compliance with emerging regulatory requirements.

- •Collaborated with departments to drive a culture of compliance, resulting in improved interdepartmental communications.

- •Monitored legislative changes and provided timely updates, facilitating proactive adjustments to compliance strategies.

- •Created and delivered training sessions for employees, enhancing understanding of compliance policies.

- •Identified potential financial risks and recommended solutions, successfully mitigating issues in 90% of cases.

- •Developed risk assessment techniques that increased analytical accuracy by 25%, streamlining the reporting process.

- •Maintained comprehensive documentation of risk management processes, aiding in external audits.

- •Led compliance audits across multiple departments, contributing to a seamless compliance operation.

- •Conducted thorough compliance reviews, enhancing adherence to regulatory requirements by 10%.

- •Assisted in developing risk management frameworks, leading to more accurate and efficient audits.

- •Collaborated with legal teams to resolve compliance issues, ensuring quick and effective resolutions.

- •Provided guidance to employees, streamlining compliance-related communications across the organization.

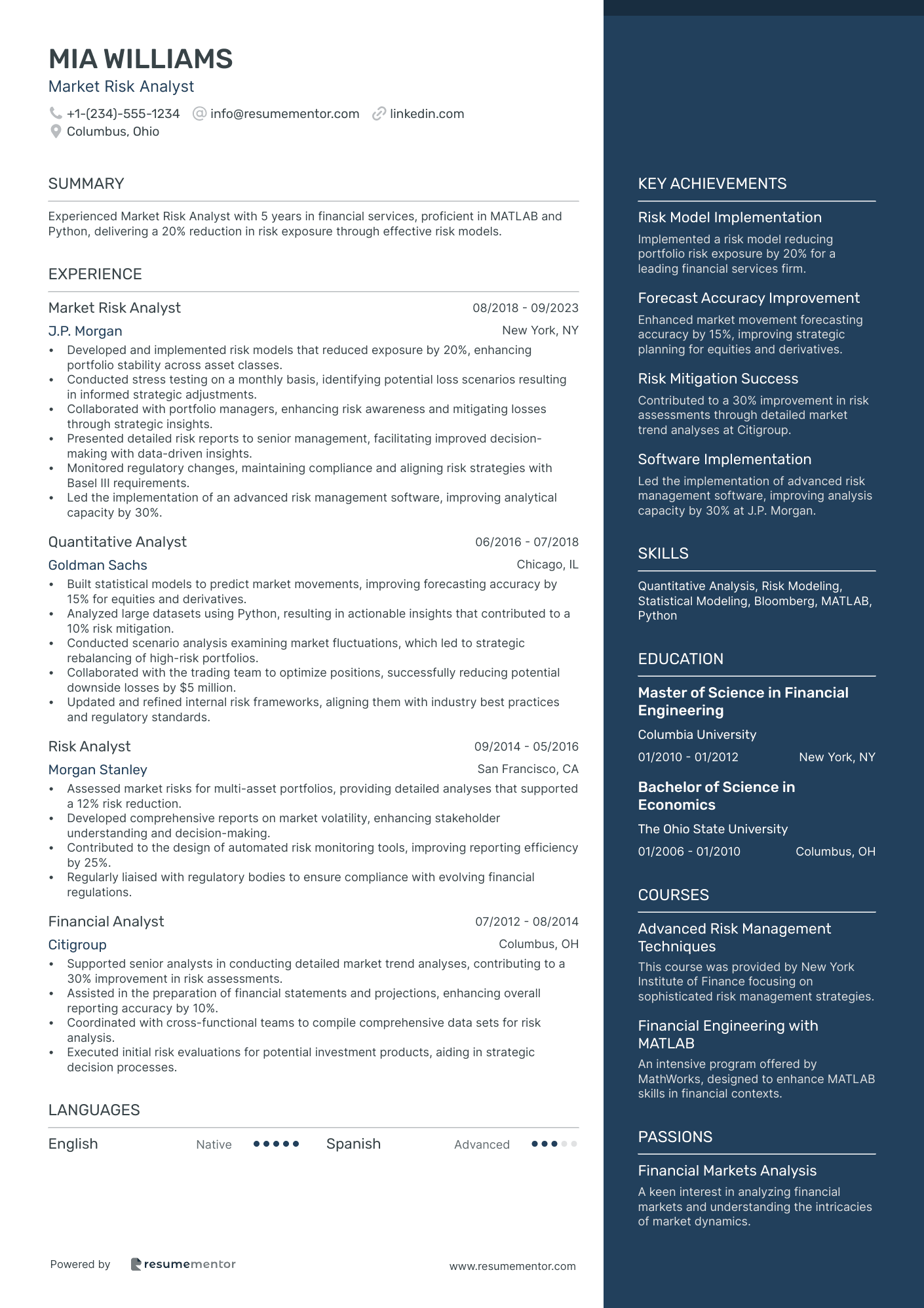

Market Risk Analyst resume sample

- •Developed and implemented risk models that reduced exposure by 20%, enhancing portfolio stability across asset classes.

- •Conducted stress testing on a monthly basis, identifying potential loss scenarios resulting in informed strategic adjustments.

- •Collaborated with portfolio managers, enhancing risk awareness and mitigating losses through strategic insights.

- •Presented detailed risk reports to senior management, facilitating improved decision-making with data-driven insights.

- •Monitored regulatory changes, maintaining compliance and aligning risk strategies with Basel III requirements.

- •Led the implementation of an advanced risk management software, improving analytical capacity by 30%.

- •Built statistical models to predict market movements, improving forecasting accuracy by 15% for equities and derivatives.

- •Analyzed large datasets using Python, resulting in actionable insights that contributed to a 10% risk mitigation.

- •Conducted scenario analysis examining market fluctuations, which led to strategic rebalancing of high-risk portfolios.

- •Collaborated with the trading team to optimize positions, successfully reducing potential downside losses by $5 million.

- •Updated and refined internal risk frameworks, aligning them with industry best practices and regulatory standards.

- •Assessed market risks for multi-asset portfolios, providing detailed analyses that supported a 12% risk reduction.

- •Developed comprehensive reports on market volatility, enhancing stakeholder understanding and decision-making.

- •Contributed to the design of automated risk monitoring tools, improving reporting efficiency by 25%.

- •Regularly liaised with regulatory bodies to ensure compliance with evolving financial regulations.

- •Supported senior analysts in conducting detailed market trend analyses, contributing to a 30% improvement in risk assessments.

- •Assisted in the preparation of financial statements and projections, enhancing overall reporting accuracy by 10%.

- •Coordinated with cross-functional teams to compile comprehensive data sets for risk analysis.

- •Executed initial risk evaluations for potential investment products, aiding in strategic decision processes.

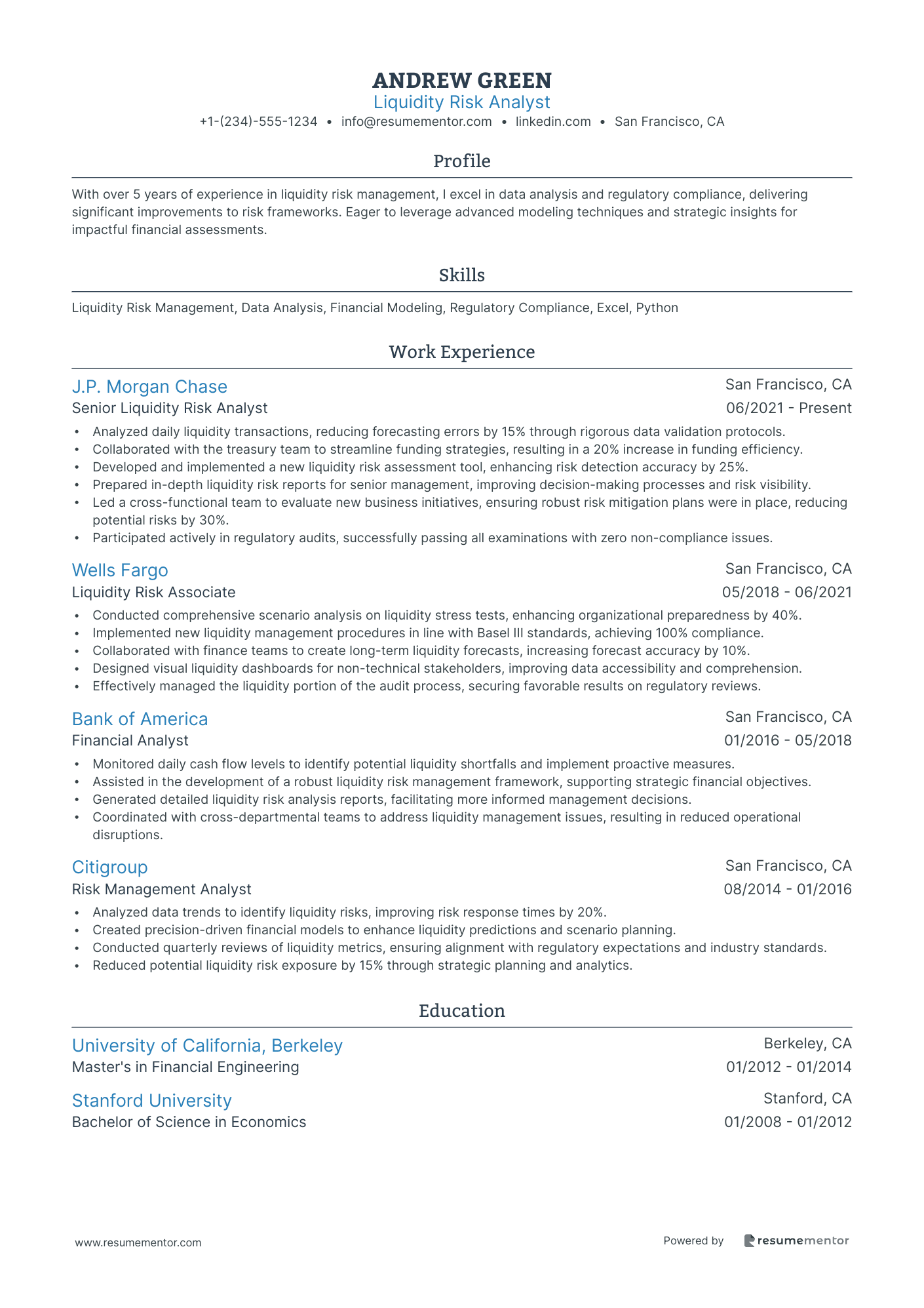

Liquidity Risk Analyst resume sample

- •Analyzed daily liquidity transactions, reducing forecasting errors by 15% through rigorous data validation protocols.

- •Collaborated with the treasury team to streamline funding strategies, resulting in a 20% increase in funding efficiency.

- •Developed and implemented a new liquidity risk assessment tool, enhancing risk detection accuracy by 25%.

- •Prepared in-depth liquidity risk reports for senior management, improving decision-making processes and risk visibility.

- •Led a cross-functional team to evaluate new business initiatives, ensuring robust risk mitigation plans were in place, reducing potential risks by 30%.

- •Participated actively in regulatory audits, successfully passing all examinations with zero non-compliance issues.

- •Conducted comprehensive scenario analysis on liquidity stress tests, enhancing organizational preparedness by 40%.

- •Implemented new liquidity management procedures in line with Basel III standards, achieving 100% compliance.

- •Collaborated with finance teams to create long-term liquidity forecasts, increasing forecast accuracy by 10%.

- •Designed visual liquidity dashboards for non-technical stakeholders, improving data accessibility and comprehension.

- •Effectively managed the liquidity portion of the audit process, securing favorable results on regulatory reviews.

- •Monitored daily cash flow levels to identify potential liquidity shortfalls and implement proactive measures.

- •Assisted in the development of a robust liquidity risk management framework, supporting strategic financial objectives.

- •Generated detailed liquidity risk analysis reports, facilitating more informed management decisions.

- •Coordinated with cross-departmental teams to address liquidity management issues, resulting in reduced operational disruptions.

- •Analyzed data trends to identify liquidity risks, improving risk response times by 20%.

- •Created precision-driven financial models to enhance liquidity predictions and scenario planning.

- •Conducted quarterly reviews of liquidity metrics, ensuring alignment with regulatory expectations and industry standards.

- •Reduced potential liquidity risk exposure by 15% through strategic planning and analytics.

Financial Crime Risk Analyst resume sample

- •Led a cross-functional team to improve fraud detection systems, achieving a 30% reduction in financial losses within the first year.

- •Analyzed complex financial data sets using advanced analytics, identifying risk patterns leading to the prevention of $2 million in potential fraud.

- •Developed and implemented enhanced risk assessment frameworks, ensuring compliance with AML and KYC regulations and decreasing audit findings by 15%.

- •Collaborated effectively with compliance, legal, and other internal teams to refine transaction monitoring processes, eliminating false positives by 20%.

- •Authored comprehensive risk reports and presentations for executive management, influencing strategic decisions related to risk mitigation efforts.

- •Facilitated mandatory training sessions on financial crime awareness across the department, raising overall compliance scores by nearly 25%.

- •Conducted risk assessments to identify vulnerabilities, contributing to a 40% enhancement in the bank's security posture.

- •Utilized data analysis tools to monitor transactions, detecting anomalies and potential cases of money laundering on a weekly basis.

- •Collaborated with regulatory bodies to ensure full compliance with financial regulatory standards, resulting in zero compliance breaches over two years.

- •Played a significant role in developing and rolling out an improved KYC procedure, reducing onboarding errors by 15%.

- •Oversaw investigations of suspicious accounts, recommending actions that prevented $1 million in potential fraud cases.

- •Assisted in revamping the digital transaction monitoring system, leading to a 25% improvement in fraud detection rates.

- •Worked closely with the IT department to resolve data inconsistencies, enhancing system reliability by 20%.

- •Delivered key insights from complex data to stakeholders, improving their understanding of risks, and decreasing response time to incidents by 30%.

- •Supported the compliance team in auditing activities, contributing to a significant reduction in regulatory fines for the organization.

- •Monitored adherence to compliance policies across various financial products, leading to a 10% improvement in audit scores.

- •Analyzed customer data to ensure compliance with KYC standards, preventing potential violations and protecting client integrity.

- •Regularly updated training materials on compliance best practices, contributing to a 95% staff certification rate in compliance protocols.

- •Supported senior analysts with data-driven reports that guided strategic changes in compliance measures.

Model Risk Analyst resume sample

- •Evaluated over 50 financial models annually, ensuring a compliance improvement rate of 15% across multiple departments.

- •Collaborated with model developers to enhance design frameworks, reducing assumptions inaccuracies by 20%.

- •Developed and implemented monthly risk metrics, identifying potential exposures and decreasing overall model risk by 25%.

- •Conducted robust backtesting procedures, which led to a 10% increase in model prediction accuracy over previous periods.

- •Prepared comprehensive reports and conducted presentations for senior management, leading to higher data-driven decision-making.

- •Enhanced model governance processes, streamlining the compliance review process, reducing bottlenecks by 30%.

- •Validated complex quantitative models, leading to an enhancement in compliance standards by 12%.

- •Managed the performance monitoring of key financial models, contributing to a decrease in model failure rates by 8%.

- •Mentored junior analysts in statistical analysis software, improving team efficiency by 15%.

- •Streamlined model risk assessment methodologies, cutting down the analysis time by 20% per project cycle.

- •Compiled insights from industry trends and regulatory changes, aiding in strategic positioning and decision-making.

- •Assessed financial models for accuracy and compliance, leading to a 10% improvement in regulatory adherence.

- •Developed financial risk metrics that resulted in a 5% risk reduction across critical business units.

- •Conducted thorough reviews of model documentation, enhancing overall quality and reducing errors by 7%.

- •Worked with cross-functional teams to mitigate model risk effectively, fostering a more resilient model framework.

- •Implemented new risk control processes that reduced model discrepancies by 5% over a fiscal year.

- •Provided detailed risk assessments for high-priority models, resulting in enhanced accuracy and reliability.

- •Facilitated workshops that brought about a 10% increase in awareness and understanding of model risks.

- •Contributed to the development of risk assessment methodologies, thereby increasing the team's analytical capabilities.

In finance, where every decimal counts, your resume as a financial risk analyst must hit the mark. Balancing your technical expertise in financial modeling with strategic insights is essential to achieving this.

Your resume should clearly communicate your ability to manage and assess risks effectively. Presenting complex financial skills in a simple way can be challenging, yet it's crucial in a competitive job market. Standing out requires a precise presentation of your abilities and experiences.

This is where a resume template can be a valuable tool. A structured format helps organize your credentials to grab the attention of hiring managers, positioning you as the standout candidate. The templates available here ensure you capture all crucial details.

Adopting a strategic approach lets you create a resume that not only highlights your skills but also vividly depicts your career path. This guide will support you in crafting a resume that sets you apart. In a world filled with numbers and opportunities, it's time to rise above. Let’s get started!

Key Takeaways

- Crafting a financial risk analyst resume requires showcasing a balance of technical expertise in financial modeling and strategic insights.

- Utilizing a resume template with a structured format can help organize credentials effectively to capture hiring managers' attention.

- The resume must highlight skills in financial risk identification and management, aligning with regulatory standards to support informed business decisions.

- Choosing the right format, modern fonts, and saving the resume as a PDF are crucial for maintaining a professional presentation.

- Incorporating quantifiable achievements in the experience section can vividly illustrate the candidate's impact and capabilities.

What to focus on when writing your financial risk analyst resume

Your financial risk analyst resume should effectively present your ability to identify and manage financial risks, drawing attention to your skills in data analysis, financial modeling, and alignment with regulatory standards. Demonstrating these capabilities ensures that potential employers recognize your contribution to informed business decisions and a well-rounded skill set.

How to structure your financial risk analyst resume

- Contact Information: Provide your full name, phone number, email address, and LinkedIn profile—ensure these elements appear professional. A cohesive and professional presentation is vital since this is the first impression you'll make. Next, we'll dive deeper into how to craft a compelling professional summary.

- Professional Summary: Include a succinct overview of your experience in risk analysis, highlighting your insights into financial markets. Mention any certifications such as CFA or FRM to build credibility and convey dedication to your field. This introduction will set a clear tone for your resume. In the next section, we'll discuss showcasing your experience.

- Experience: Provide detailed accounts of your previous roles with a focus on risk management initiatives. Use action verbs to underscore your impact, and quantify achievements like risk reduction or financial performance improvements. This practical demonstration of your skills is critical. Next, we'll explore the skills section.

- Skills: Highlight key skills like financial modeling, data analysis, and risk assessment—showcase familiarity with industry-relevant financial software to align with employer expectations. Emphasizing these skills underlines your technical expertise. We will then move on to discuss education credentials.

- Education: Mention your degrees in finance, economics, or related fields, and include the university and graduation date to give your qualifications context and legitimacy. Detailing your educational background adds depth to your expertise. Following this, we'll put the spotlight on certifications.

- Certifications: If you have certifications like CFA (Chartered Financial Analyst) or FRM (Financial Risk Manager), feature them prominently to bolster your qualifications. These certifications testify to your commitment and knowledge. Finally, we will cover additional optional segments for a comprehensive resume.

Which resume format to choose

As a financial risk analyst, crafting a resume that leaves a strong impression begins with selecting the right format. A reverse-chronological format is particularly effective because it places your most recent and relevant job experiences at the forefront, which is essential in demonstrating your career progression and expertise in financial analysis and risk management.

When deciding on fonts, choosing modern options like Rubic, Lato, or Montserrat can enhance the professional appearance of your resume. These fonts are not only easy on the eyes but they also convey a sense of modernity and clarity, lending your resume an updated and streamlined look that can set you apart in a competitive field.

Saving your resume as a PDF is non-negotiable if you want to ensure that your carefully curated content is viewed exactly as intended. This file type preserves formatting, ensuring your document looks consistent across various platforms and devices, which is crucial for maintaining a professional presentation.

Lastly, maintaining one-inch margins across your resume is a simple yet effective way to make your document more readable. This spacing choice creates a clean, organized appearance, allowing potential employers to easily navigate and digest your credentials and achievements. These elements combined will help you craft a resume that is tailored, professional, and engaging for your audience.

How to write a quantifiable resume experience section

Your financial risk analyst resume needs a strong experience section that truly stands out by demonstrating your impact in relevant roles. Showcasing quantifiable achievements gives life to your skills, helping employers see the real value you bring. Begin with your most recent roles and proceed chronologically, giving a solid look at 10 to 15 years of your career trajectory, unless older experiences are highly relevant. This ensures the most pertinent information is highlighted. Include job titles that directly match the position you’re aiming for, tailoring your resume by aligning your accomplishments with the keywords and skills the job ad requests. Incorporating action words like "analyzed," "developed," and "optimized" not only conveys decisiveness but also connects your experience to what potential employers are seeking.

Here's an example of a financial risk analyst resume experience section:

- •Reduced financial risk exposure by 30% through developing and implementing an advanced risk assessment model.

- •Collaborated with cross-functional teams to improve risk reporting processes, cutting reporting time by 20%.

- •Led a team responsible for daily monitoring of financial markets, boosting early detection of potential risks by 15%.

- •Spearheaded a project automating the risk evaluation process, saving the company $200,000 annually.

The effectiveness of this experience section lies in its focus on measurable achievements, seamlessly showing how you’ve made significant differences in previous roles. By linking each bullet point to a clear outcome, you illustrate your capability to make positive impacts, tailored explicitly toward financial risk analysis. The use of relevant action words not only emphasizes your skills but also ensures that your experiences align directly with potential employer needs, leaving them with a well-rounded view of your past successes and the value you can offer in future roles.

Project-Focused resume experience section

A project-focused financial risk analyst resume experience section should spotlight the specific projects you've tackled to highlight your expertise. Share how you've assessed financial risks and offered insights that guided crucial decisions, ensuring each contribution stands out. Quantifying your impact with numbers or percentages is key to making a strong impression, as it vividly illustrates your successes. Fluidly highlight the tools and methods you employed alongside the collaboration with various teams, painting a cohesive picture of your role.

By clearly conveying your knack for financial risk analysis, this section should bring to life your project involvement. Mentioning project names or types, such as how you engaged in data analysis or model creation, helps ground your contributions in real-world applications. Using active language keeps the narrative lively and engaging. Each entry begins with a brief overview, followed by bullet points that delve into your specific accomplishments. This approach ties your skills and contributions together, making your resume compelling to potential employers.

Senior Financial Risk Analyst

XYZ Financial Corporation

Jan 2020 - Present

- Developed a new risk assessment model, reducing potential financial exposure by 20% over two years.

- Collaborated with the IT department to implement a real-time data monitoring system, enhancing decision-making speed.

- Presented findings to senior management, influencing strategic risk mitigation approaches.

- Led a cross-functional team to conduct a risk analysis for a $100M investment project, successfully identifying key vulnerabilities.

Responsibility-Focused resume experience section

A responsibility-focused financial risk analyst resume experience section should clearly showcase how you've effectively managed financial risks and contributed to your company's success. Emphasize tasks where you've honed your analytical and problem-solving skills, using bullet points for a clean and organized presentation. When possible, quantify your results to provide concrete evidence of your achievements. Begin each bullet with a proactive action verb like "evaluated" or "implemented" to convey initiative.

Highlight how your expertise has led to tangible improvements in financial risk management. Include examples of software systems or methodologies you've employed to enhance data analysis, and discuss key projects where you assessed and mitigated risks. Tailor these experiences to align with the job you're pursuing, demonstrating how your actions have driven efficiency and success. The aim is to paint a comprehensive picture of your impact in financial risk management.

Financial Risk Analyst

XYZ Financial Services

January 2020 - Present

- Developed and executed data-driven risk assessments that reduced potential losses by 15%, showcasing a strong understanding of risk factors.

- Collaborated with a cross-functional team to introduce new risk management software, leading to a 30% boost in analytical efficiency and a more streamlined workflow.

- Conducted regular portfolio reviews and recommended adjustments that resulted in a 10% increase in return on investment, underscoring strategic insight.

- Prepared detailed risk reports for senior management, which improved decision-making transparency and expedited the decision-making process.

Growth-Focused resume experience section

A Growth-Focused financial risk analyst resume experience section should highlight how your analyses and strategies have successfully driven company growth while minimizing risks. Begin by sharing specific contributions and achievements that underscore your ability to assess risks and apply financial insights to propel the company forward. Demonstrate your critical thinking and collaboration skills by illustrating how these strengths have improved decision-making processes. Use strong action verbs alongside quantifiable accomplishments to paint a clear picture of your impact.

Contextualize your achievements with data or metrics that showcase your role in the company’s success. Make sure your experience aligns with the broader goals of the organization, confirming your part in fostering growth. Keep your descriptions succinct and focused on outcomes, ensuring that potential employers can easily discern the value you bring.

Senior Financial Risk Analyst

XYZ Financial Services

June 2018 - Present

- Conducted in-depth risk assessments that led to a 15% reduction in operational costs, strengthening overall company performance.

- Collaborated with cross-functional teams to implement risk mitigation strategies, resulting in a 20% increase in revenue and enhancing strategic outcomes.

- Developed a comprehensive risk management framework that boosted decision-making efficiency by 30%, supporting strategic growth objectives.

- Regularly updated risk assessment procedures, directly contributing to a 10% annual profitability growth and ensuring sustainable success.

Collaboration-Focused resume experience section

A collaboration-focused financial risk analyst resume experience section should highlight your teamwork abilities in the realm of financial risk management. Aim to spotlight experiences where working together was crucial in meeting objectives. Write in a clear manner, showing how your cooperative efforts led to better risk assessments, creative strategies, or effective problem-solving. Mention the outcomes of your collaborative work to provide a clear picture of your contributions and impact.

Structure your experiences using bullet points for clarity and ease of reading. Each bullet point should clearly link to the others, showcasing a narrative of your collaborative achievements. Include quantifiable data whenever possible to illustrate the importance of your work. For instance, highlight percentage improvements that resulted from team efforts or financial savings achieved through joint initiatives. This provides convincing proof of your abilities. Here's how you can present this section:

Financial Risk Analyst

XYZ Financial Services

January 2020 - Present

- Partnered with analysts to create a comprehensive risk assessment model, enhancing efficiency by 25%.

- Collaboratively developed a new reporting system with cross-functional teams, reducing errors by 30%.

- Facilitated weekly discussions with risk teams, where shared insights led to a 15% drop in potential financial losses.

- Aligned risk strategies with senior management, resulting in a 20% improvement in mitigation measures.

Write your financial risk analyst resume summary section

A finance-focused financial risk analyst resume summary should efficiently convey your qualifications to potential employers. It acts as a snapshot, allowing them to quickly grasp the value you offer. For those who have just started or are changing fields, a resume objective might be more suitable, as it highlights your career goals. However, if you have experience, you should emphasize key skills and accomplishments that make you a standout candidate.

Consider this example for an experienced financial risk analyst:

This summary effectively highlights the analyst's expertise and specific achievements, which helps in capturing the employer’s interest. Stating proficiency in data analytics tools not only underscores technical skills but also aligns with what many employers seek in this role. Additionally, mentioning a concrete accomplishment gives you added credibility and illustrates your ability to contribute positively to the company.

Summaries differ from resume profiles, which delve deeper and blend personal goals with career achievements. A summary of qualifications tends to be more concise, using bullet points to list skills or achievements without additional context. Tailor your resume sections to align with your career stage and objectives. By maintaining clear and simple language, you ensure your resume is both impactful and easy to understand, thereby effectively showcasing your potential.

Listing your financial risk analyst skills on your resume

A skills-focused financial risk analyst resume should effectively showcase your abilities and qualifications. You can either list your skills separately or weave them into sections like your experience or summary. Highlighting your strengths and soft skills shows your ability to engage with others and adapt to various situations. In contrast, hard skills like financial modeling or data analysis are specific, teachable abilities that demonstrate your technical expertise. Featuring both kinds of skills can attract attention from potential employers and set you apart from other candidates.

Your skills and strengths also serve as resume keywords, essential for getting your resume noticed by software filters and hiring managers on the lookout for particular competencies. Here's an example of a standalone skills section for a financial risk analyst:

This skills section is robust as it includes specific skills essential for a financial risk analyst, showcasing proficiency in key areas such as financial modeling and risk assessment.

Best hard skills to feature on your financial risk analyst resume

In the role of a financial risk analyst, hard skills are indispensable. These skills display your technical prowess and detailed understanding, indicating your ability to assess and manage risks efficiently through the right tools and techniques.

Hard Skills

- Financial Modeling

- Risk Assessment

- Data Analysis

- Statistical Analysis

- SQL Proficiency

- Market Research

- Quantitative Analysis

- Risk Mitigation Strategies

- Knowledge of Regulatory Requirements

- Credit Risk Analysis

- Portfolio Management

- Forecasting

- Excel Advanced Functions

- Scenario Analysis

- Econometrics

Best soft skills to feature on your financial risk analyst resume

Equally vital are the soft skills for a financial risk analyst. They highlight your ability to communicate and collaborate with others, as well as your proficiency in problem-solving. These skills illustrate how you can effectively convey ideas and work within a team to achieve objectives.

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem Solving

- Communication Skills

- Decision Making

- Time Management

- Critical Thinking

- Adaptability

- Teamwork

- Leadership

- Stress Management

- Innovation

- Negotiation

- Conflict Resolution

- Strategic Planning

How to include your education on your resume

The education section of your financial risk analyst resume is a crucial part that showcases your academic background. It should highlight relevant education for the job you’re applying for, leaving out anything that doesn’t pertain to this career path. Presenting your education well means listing degrees, institutions, and dates of attendance clearly. Including your GPA is optional, but if it strengthens your application, add it with specificity, such as, "GPA: 3.8/4.0." Mentioning honors like cum laude can bolster your credentials and should be noted concisely, such as, "Graduated cum laude." Structure degree listings by stating your degree first, followed by the institution and location.

Here's an example of what not to do with your education section:

Now, let’s look at a well-crafted example:

This example works well because it directly ties to the financial risk analyst position, showcasing a relevant degree and a strong GPA from a reputable institution. The focus here is on relevant achievements, making it more appealing to employers.

How to include financial risk analyst certificates on your resume

Including a certificates section in your financial risk analyst resume is vital. Certificates not only validate your skills but also make you stand out. You can even include certificates in your resume header. For instance, listing “CFA Chartered Financial Analyst” next to your name immediately showcases your qualifications.

List the name of each certificate clearly. Include the date you obtained the certificate. Add the issuing organization to provide authenticity. Ensure that the certificates are relevant to financial risk analysis, like CFA or FRM. In this way, your certificates will enhance your resume's credibility.

Here is a concise example of a strong certificates section in JSON format:

This example works well because it features well-known, industry-relevant certificates. Each certificate is clearly labeled with its issuing organization. This gives the recruiter clear proof of your expertise and qualifications.

Extra sections to include in your financial risk analyst resume

Being a financial risk analyst demands a unique blend of analytical skills, industry knowledge, and the ability to communicate complex financial data effectively. Your resume should reflect this multifaceted role, showcasing your technical proficiency and your well-rounded character.

- Language section — Include the languages you speak fluently to highlight your ability to work in diverse markets and communicate with a broader client base. This can demonstrate cultural awareness and boost your appeal to global firms.

- Hobbies and interests section — Showcase your hobbies and interests to give a glimpse into your personality and cultural fit for the workplace. Engaging in activities like chess, which requires strategic thinking, can underscore your analytical skills.

- Volunteer work section — Mention your volunteer activities to show your commitment to social responsibility and community engagement. This signals employers that you possess a well-rounded character and a willingness to contribute beyond personal gain.

- Books section — List financial and risk management books you have read to keep current with industry trends. This highlights your dedication to continuous learning and professional development.

Adding these sections creates a narrative that extends beyond your professional skills, showing you as a versatile and thoughtful candidate.

In Conclusion

In conclusion, crafting a resume as a financial risk analyst demands more than simply listing your skills and experiences. You need to present a clear picture of your professional journey by showcasing your technical expertise, analytical capabilities, and strategic mindset. By leveraging structured resume templates, you can organize your credentials effectively, making sure that every significant detail stands out. An impactful resume will not only highlight your ability to assess and manage risks, but it will also narrate the story of your career evolution. Highlighting accomplishments in a quantifiable manner tells potential employers the tangible value you can add to their firm. Furthermore, using a modern layout, professional fonts, and maintaining clean formatting with consistent margins exemplifies your attention to detail—a critical trait in the finance industry. Finally, by including sections for skills, certifications, and additional activities like languages or volunteer work, you round off your portrayal as a versatile candidate. Celebrate your achievements and ensure your resume speaks to your qualities, positioning yourself as an attractive asset to organizations seeking financial risk management excellence. With these strategic elements in place, you'll be well on your way to making a lasting impression in a dynamic, numbers-driven world.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.