Fresher Banking Resume Examples

Jul 18, 2024

|

12 min read

Craft a standout banking resume as a fresher: secure your future in finance with these tips. Learn how to format, what to include, and the do's and don'ts to ensure you're the "interest" of your next employer.

Rated by 348 people

Entry-Level Investment Banking Analyst

Junior Retail Banking Associate

Trainee Commercial Banking Specialist

Fresher Banking Operations Analyst

Entry-Level Private Banking Assistant

Fresher Financial Services Consultant

Junior Corporate Banking Analyst

Trainee Equity Research Analyst

Fresher Asset Management Specialist

Junior Risk and Compliance Analyst in Banking

Entry-Level Investment Banking Analyst resume sample

- •Developed comprehensive financial models that contributed to securing funding worth $25 million for client acquisitions.

- •Created detailed pitch books for senior management, resulting in a 15% increase in successful client presentations.

- •Conducted due diligence for over 10 mergers & acquisitions, improving transaction efficiency by 20%.

- •Collaborated with cross-functional teams to prepare presentations that enhanced the decision-making process for client portfolios.

- •Managed multiple projects and consistently delivered report insights, improving client advisory sessions by 30%.

- •Assisted in preparing industry analysis that enhanced competitive positioning and strategic planning for clients.

- •Led valuation and financial modeling efforts, contributing to a 100% increase in new business profit margins.

- •Analyzed financial statements and market trends to support investment strategies, resulting in stronger client portfolios.

- •Prepared investment documents that enhanced understanding of financial forecasts, contributing to strategic client projects.

- •Coordinated with senior analysts to develop market insights, resulting in a 25% improvement in forecast accuracy.

- •Implemented new procedures for data analysis that expedited report generation by 40%.

- •Supported senior analysts in financial statement analysis that improved due diligence efficiency by 15%.

- •Engaged in client presentations, enhancing proposal acceptance rates by providing robust financial evidence.

- •Assisted in competitor analysis, which informed strategic outcomes for high-profile financial transactions.

- •Prepared financial models that were integral to strategic planning, aiding in the closure of key deals.

- •Provided research support for mergers & acquisitions, contributing to $2 billion in deal closures.

- •Participated in developing presentations that enhanced senior management's financial decision-making.

- •Collaborated with team members to complete competitive analysis, informing significant strategic plans.

- •Ensured high-quality deliverables that supported client's confidence, leading to increased engagement rates.

Junior Retail Banking Associate resume sample

- •Consistently achieved a customer satisfaction rate of over 95% by addressing inquiries and resolving customer complaints efficiently.

- •Increased branch sales by 15% through the proactive promotion of financial products and services tailored to client needs.

- •Led a project to implement new customer feedback systems, resulting in a 20% improvement in service delivery metrics.

- •Managed daily cash transactions totaling over $50,000 by maintaining accurate records and adhering to bank security protocols.

- •Developed and trained a team of three new hires, enhancing their product knowledge and customer service skills through mentoring and workshops.

- •Participated in branch operations, including preparing financial reports that increased operational transparency by 10%.

- •Increased product awareness by 25% through conducting educational seminars about new banking products and services.

- •Collaborated with team members to surpass quarterly sales targets by 10%, driving the branch revenue upwards.

- •Improved efficiency of customer account management by designing a streamlined tracking system, reducing errors by 15%.

- •Resolved customer issues with a 96% satisfaction score by providing efficient and effective solutions.

- •Leveraged cross-selling techniques to increase referral rates by 18%, directly contributing to enhanced branch performance.

- •Assisted in increasing branch customer base by 12% through personalized customer interactions and follow-ups.

- •Streamlined everyday banking operations by digitizing paper forms, boosting productivity by 20%.

- •Received 'Employee of the Month' recognition for achieving the highest customer satisfaction scores in the branch.

- •Participated in community outreach programs, enhancing bank visibility which led to a 15% increase in new accounts.

- •Supported sales targets by assisting in customer engagements and promoting new financial solutions.

- •Improved transaction accuracy by developing a detailed record-keeping system resulting in higher efficiency.

- •Participated in team meetings that fostered cross-functional collaboration leading to streamlined processes.

- •Enhanced client experiences by providing tailored advice, leading to a 10% increase in return customers.

Trainee Commercial Banking Specialist resume sample

- •Analyzed financial statements for over 50 clients monthly, providing insights that helped improve overall financial performance by 15%.

- •Streamlined processes for loan approvals, reducing approval time by 30%, resulting in enhanced client satisfaction.

- •Collaborated with product teams to launch a new investment product, contributing to a 25% increase in new customer acquisition.

- •Developed comprehensive risk assessment reports leading to a 20% reduction in non-performing loans.

- •Conducted market research and competitive analysis, identifying new business opportunities, achieving a 15% growth in market share.

- •Led a cross-functional team to enhance customer onboarding experience, boosting client retention rate by 10%.

- •Managed a portfolio of commercial clients, enhancing client relationships, leading to a 20% increase in client satisfaction scores.

- •Designed credit solutions that contributed to a portfolio growth of $50 million in assets within one year.

- •Conducted detailed market analysis to identify potential business clients, increasing client base by 25% in two years.

- •Implemented new financial models to assess credit risk, improving accuracy of risk assessment by 15%.

- •Delivered comprehensive client-focused financial reviews, leading to tailored solutions and increased client trust and loyalty.

- •Assessed loan applications and developed client-specific financial solutions, resulting in a 30% approval rate for new clients.

- •Worked collaboratively with teams to resolve client issues swiftly, enhancing the overall client experience, which resulted in increased client retention.

- •Conducted financial analyses and assessed risk for loan portfolios, reducing defaults by 20%.

- •Presented detailed financial reports to senior management, aiding in strategic planning and decision-making processes.

- •Supported the preparation of monthly financial reports, increasing reporting accuracy by 10% year-on-year.

- •Analyzed variances to budget for 10 departments, advising on cost-saving strategies, resulting in a 5% reduction in expenses.

- •Updated and maintained financial documentation, improving documentation accuracy by 15%.

- •Contributed to financial audits by supplying necessary data, ensuring timely audit completions.

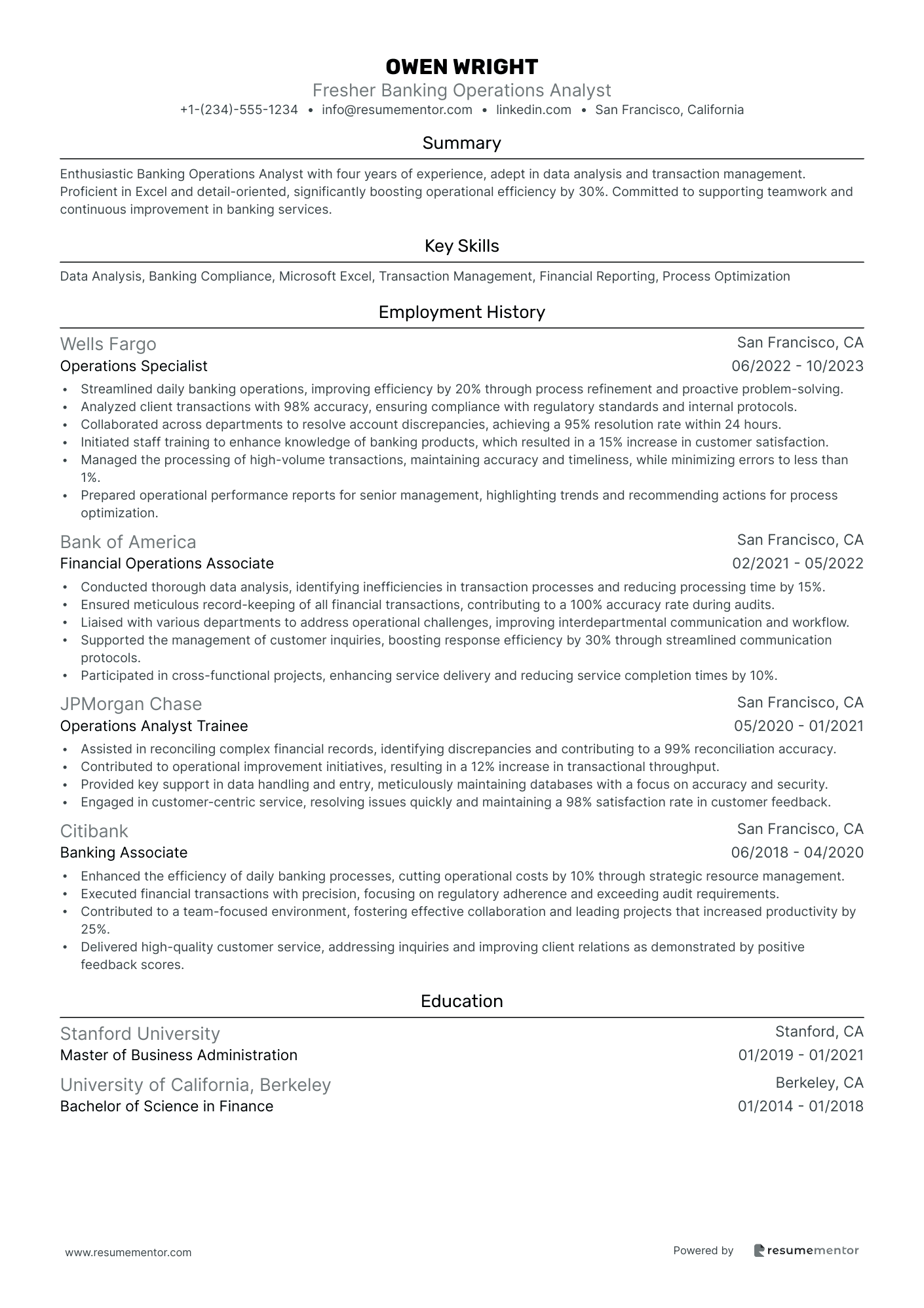

Fresher Banking Operations Analyst resume sample

- •Streamlined daily banking operations, improving efficiency by 20% through process refinement and proactive problem-solving.

- •Analyzed client transactions with 98% accuracy, ensuring compliance with regulatory standards and internal protocols.

- •Collaborated across departments to resolve account discrepancies, achieving a 95% resolution rate within 24 hours.

- •Initiated staff training to enhance knowledge of banking products, which resulted in a 15% increase in customer satisfaction.

- •Managed the processing of high-volume transactions, maintaining accuracy and timeliness, while minimizing errors to less than 1%.

- •Prepared operational performance reports for senior management, highlighting trends and recommending actions for process optimization.

- •Conducted thorough data analysis, identifying inefficiencies in transaction processes and reducing processing time by 15%.

- •Ensured meticulous record-keeping of all financial transactions, contributing to a 100% accuracy rate during audits.

- •Liaised with various departments to address operational challenges, improving interdepartmental communication and workflow.

- •Supported the management of customer inquiries, boosting response efficiency by 30% through streamlined communication protocols.

- •Participated in cross-functional projects, enhancing service delivery and reducing service completion times by 10%.

- •Assisted in reconciling complex financial records, identifying discrepancies and contributing to a 99% reconciliation accuracy.

- •Contributed to operational improvement initiatives, resulting in a 12% increase in transactional throughput.

- •Provided key support in data handling and entry, meticulously maintaining databases with a focus on accuracy and security.

- •Engaged in customer-centric service, resolving issues quickly and maintaining a 98% satisfaction rate in customer feedback.

- •Enhanced the efficiency of daily banking processes, cutting operational costs by 10% through strategic resource management.

- •Executed financial transactions with precision, focusing on regulatory adherence and exceeding audit requirements.

- •Contributed to a team-focused environment, fostering effective collaboration and leading projects that increased productivity by 25%.

- •Delivered high-quality customer service, addressing inquiries and improving client relations as demonstrated by positive feedback scores.

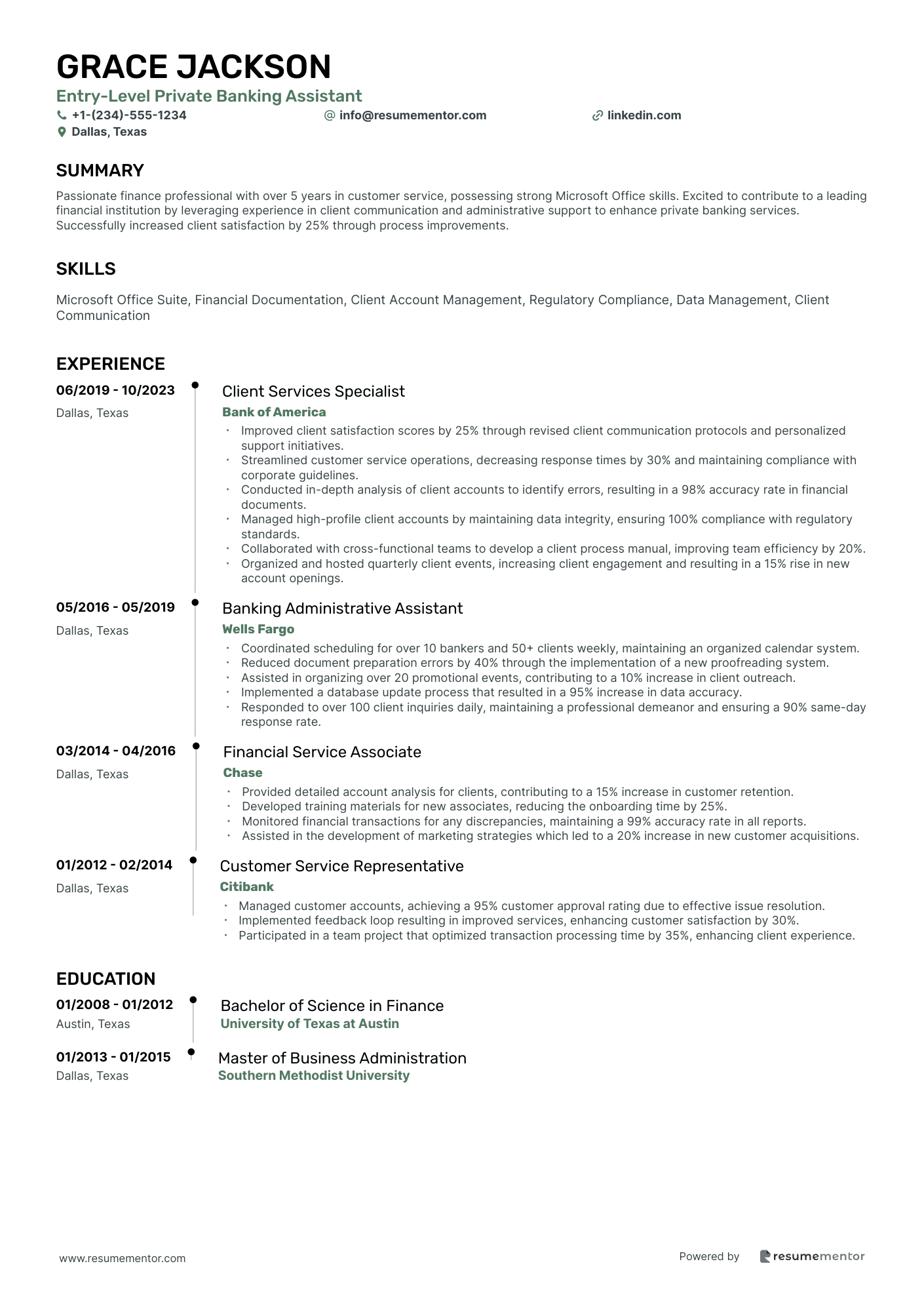

Entry-Level Private Banking Assistant resume sample

- •Improved client satisfaction scores by 25% through revised client communication protocols and personalized support initiatives.

- •Streamlined customer service operations, decreasing response times by 30% and maintaining compliance with corporate guidelines.

- •Conducted in-depth analysis of client accounts to identify errors, resulting in a 98% accuracy rate in financial documents.

- •Managed high-profile client accounts by maintaining data integrity, ensuring 100% compliance with regulatory standards.

- •Collaborated with cross-functional teams to develop a client process manual, improving team efficiency by 20%.

- •Organized and hosted quarterly client events, increasing client engagement and resulting in a 15% rise in new account openings.

- •Coordinated scheduling for over 10 bankers and 50+ clients weekly, maintaining an organized calendar system.

- •Reduced document preparation errors by 40% through the implementation of a new proofreading system.

- •Assisted in organizing over 20 promotional events, contributing to a 10% increase in client outreach.

- •Implemented a database update process that resulted in a 95% increase in data accuracy.

- •Responded to over 100 client inquiries daily, maintaining a professional demeanor and ensuring a 90% same-day response rate.

- •Provided detailed account analysis for clients, contributing to a 15% increase in customer retention.

- •Developed training materials for new associates, reducing the onboarding time by 25%.

- •Monitored financial transactions for any discrepancies, maintaining a 99% accuracy rate in all reports.

- •Assisted in the development of marketing strategies which led to a 20% increase in new customer acquisitions.

- •Managed customer accounts, achieving a 95% customer approval rating due to effective issue resolution.

- •Implemented feedback loop resulting in improved services, enhancing customer satisfaction by 30%.

- •Participated in a team project that optimized transaction processing time by 35%, enhancing client experience.

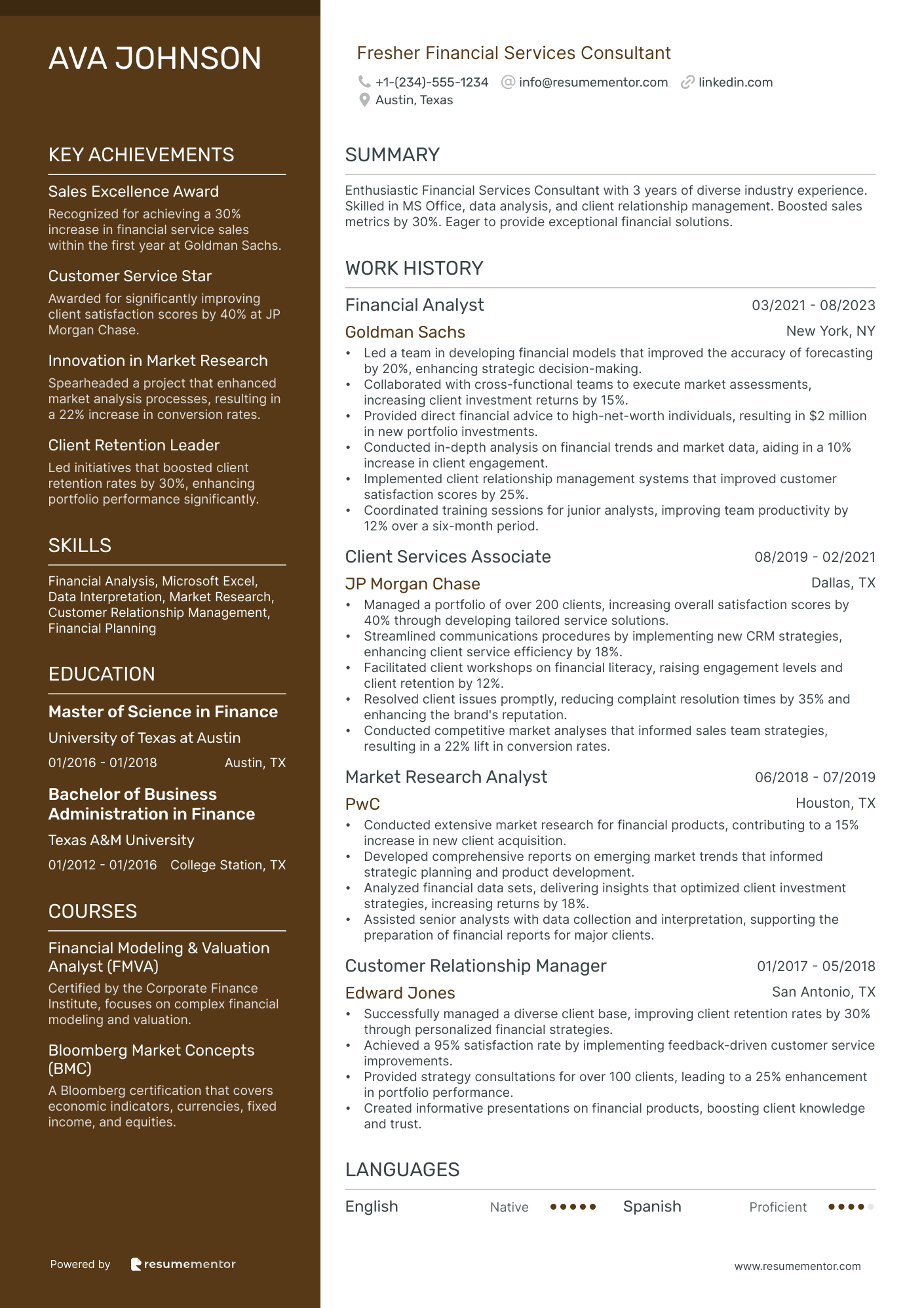

Fresher Financial Services Consultant resume sample

- •Led a team in developing financial models that improved the accuracy of forecasting by 20%, enhancing strategic decision-making.

- •Collaborated with cross-functional teams to execute market assessments, increasing client investment returns by 15%.

- •Provided direct financial advice to high-net-worth individuals, resulting in $2 million in new portfolio investments.

- •Conducted in-depth analysis on financial trends and market data, aiding in a 10% increase in client engagement.

- •Implemented client relationship management systems that improved customer satisfaction scores by 25%.

- •Coordinated training sessions for junior analysts, improving team productivity by 12% over a six-month period.

- •Managed a portfolio of over 200 clients, increasing overall satisfaction scores by 40% through developing tailored service solutions.

- •Streamlined communications procedures by implementing new CRM strategies, enhancing client service efficiency by 18%.

- •Facilitated client workshops on financial literacy, raising engagement levels and client retention by 12%.

- •Resolved client issues promptly, reducing complaint resolution times by 35% and enhancing the brand's reputation.

- •Conducted competitive market analyses that informed sales team strategies, resulting in a 22% lift in conversion rates.

- •Conducted extensive market research for financial products, contributing to a 15% increase in new client acquisition.

- •Developed comprehensive reports on emerging market trends that informed strategic planning and product development.

- •Analyzed financial data sets, delivering insights that optimized client investment strategies, increasing returns by 18%.

- •Assisted senior analysts with data collection and interpretation, supporting the preparation of financial reports for major clients.

- •Successfully managed a diverse client base, improving client retention rates by 30% through personalized financial strategies.

- •Achieved a 95% satisfaction rate by implementing feedback-driven customer service improvements.

- •Provided strategy consultations for over 100 clients, leading to a 25% enhancement in portfolio performance.

- •Created informative presentations on financial products, boosting client knowledge and trust.

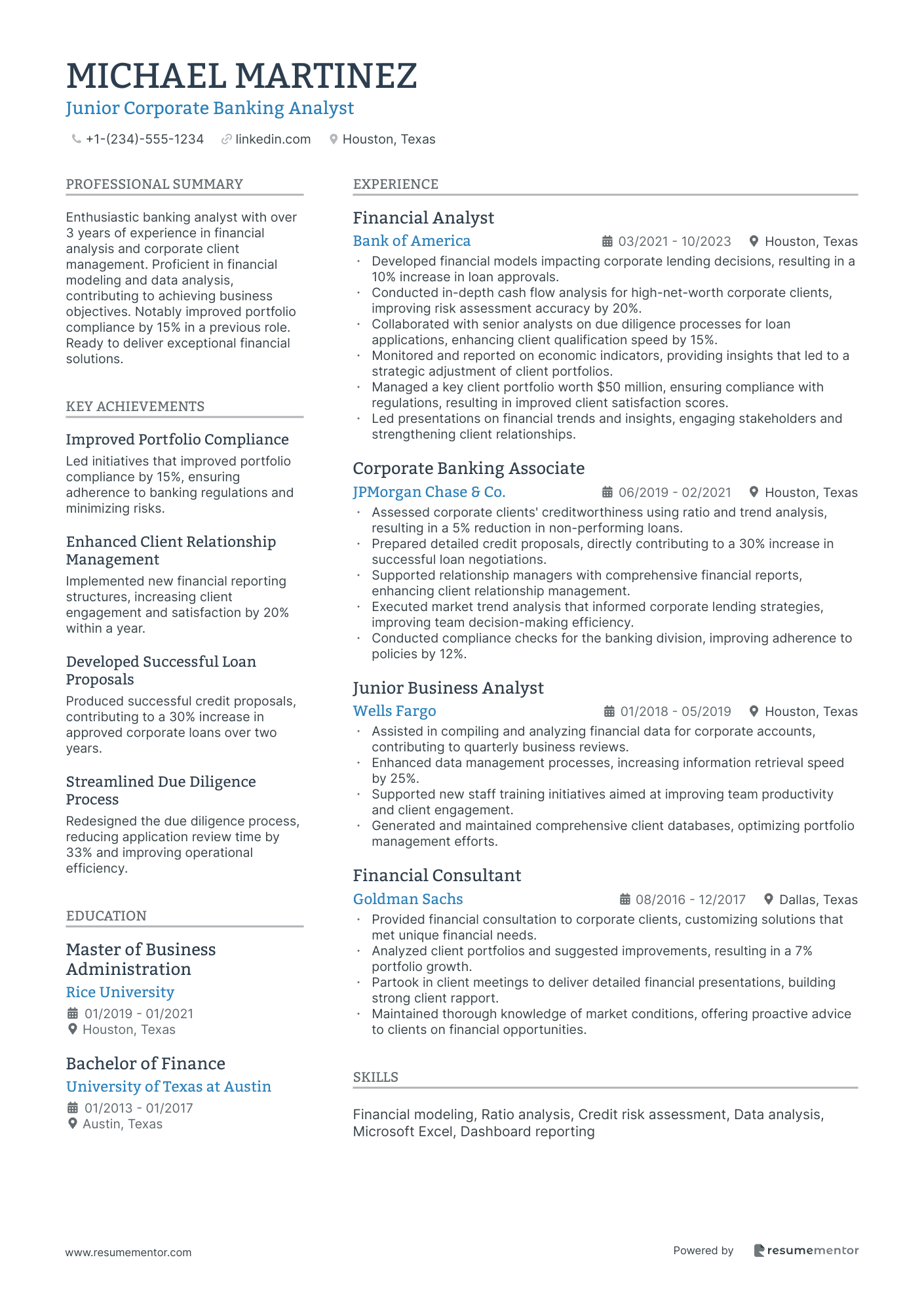

Junior Corporate Banking Analyst resume sample

- •Developed financial models impacting corporate lending decisions, resulting in a 10% increase in loan approvals.

- •Conducted in-depth cash flow analysis for high-net-worth corporate clients, improving risk assessment accuracy by 20%.

- •Collaborated with senior analysts on due diligence processes for loan applications, enhancing client qualification speed by 15%.

- •Monitored and reported on economic indicators, providing insights that led to a strategic adjustment of client portfolios.

- •Managed a key client portfolio worth $50 million, ensuring compliance with regulations, resulting in improved client satisfaction scores.

- •Led presentations on financial trends and insights, engaging stakeholders and strengthening client relationships.

- •Assessed corporate clients' creditworthiness using ratio and trend analysis, resulting in a 5% reduction in non-performing loans.

- •Prepared detailed credit proposals, directly contributing to a 30% increase in successful loan negotiations.

- •Supported relationship managers with comprehensive financial reports, enhancing client relationship management.

- •Executed market trend analysis that informed corporate lending strategies, improving team decision-making efficiency.

- •Conducted compliance checks for the banking division, improving adherence to policies by 12%.

- •Assisted in compiling and analyzing financial data for corporate accounts, contributing to quarterly business reviews.

- •Enhanced data management processes, increasing information retrieval speed by 25%.

- •Supported new staff training initiatives aimed at improving team productivity and client engagement.

- •Generated and maintained comprehensive client databases, optimizing portfolio management efforts.

- •Provided financial consultation to corporate clients, customizing solutions that met unique financial needs.

- •Analyzed client portfolios and suggested improvements, resulting in a 7% portfolio growth.

- •Partook in client meetings to deliver detailed financial presentations, building strong client rapport.

- •Maintained thorough knowledge of market conditions, offering proactive advice to clients on financial opportunities.

Trainee Equity Research Analyst resume sample

- •Led a financial modeling project that increased gross profit margins by 15%, demonstrating advanced analytical skills.

- •Collaborated with cross-functional teams to improve data gathering efficiency, leading to a 20% reduction in report preparation time.

- •Developed a comprehensive financial analysis tool that optimized asset management decisions, resulting in a 10% increase in ROI.

- •Analyzed industry trends and competitor performance to assist senior analysts in strategic decision-making.

- •Conducted quarterly performance reviews that identified cost-saving opportunities, reducing expenses by approximately $500,000 annually.

- •Built strong relationships with key stakeholders, enhancing communication flow within the analysis team.

- •Utilized Excel and VBA to automate financial reports, cutting down analysis time by 30%.

- •Conducted fundamental analysis on 30+ publicly traded companies to assist in strategic investment recommendations.

- •Prepared detailed investment reports, garnering positive feedback from senior management for clarity and insight.

- •Effectively communicated complex financial information to stakeholders, leading to more informed decision-making.

- •Participated actively in team discussions to brainstorm innovative research methodologies.

- •Executed thorough quantitative analysis of portfolios, leading to allocations that improved performance by 8%.

- •Assisted in the development of quantitative models forecasting market trends for better strategic planning.

- •Designed interactive dashboards for real-time financial analysis, resulting in faster data-driven decisions.

- •Trained team members on new analytical tools, enhancing team productivity by 15%.

- •Researched and evaluated investment opportunities, assisting in the diversification of client portfolios.

- •Spent time updating and maintaining an extensive database of financial models, ensuring data accuracy.

- •Contributed to white papers on market dynamics that educated clients and internal stakeholders.

- •Applied advanced Excel skills to enhance quality and efficiency of financial forecasting models.

Fresher Asset Management Specialist resume sample

- •Developed and implemented operational processes, improving portfolio management efficiency by 15% through better data integration.

- •Collaborated with asset managers to strategize investments, leading to a 12% increase in client portfolio returns year-over-year.

- •Enhanced data accuracy and integrity in asset management databases, resulting in more reliable performance tracking.

- •Prepared detailed investment reports, providing senior management with actionable insights into market trends and developments.

- •Conducted comprehensive market research, supporting strategic decisions that aligned with client risk profiles and goals.

- •Participated actively in client meetings, effectively presenting investment strategies and enhancing client satisfaction by 10%.

- •Led a team to analyze financial markets, enhancing investment strategies that outperformed benchmark indices by 5%.

- •Supported asset managers by providing comprehensive research reports on emerging market opportunities in real-time.

- •Improved communication channels, facilitating more efficient collaboration which decreased report turnaround time by 20%.

- •Streamlined performance monitoring practices, which empowered stakeholders with faster insights into investment outcomes.

- •Participated in developing financial models that projected asset growth and helped prioritize investment avenues effectively.

- •Assisted in client portfolio management, contributing to a 7% increase in client satisfaction scores through personalized service approaches.

- •Conducted financial analysis to support asset managers in crafting investment strategies for high-net-worth individuals.

- •Worked with IT specialists to implement a new software that reduced investment analysis timeline by 25%.

- •Maintained updated records and ensured data integrity, which provided a strong foundation for strategic investment decisions.

- •Researched and evaluated fixed income products, developing reports that increased client understanding and satisfaction.

- •Provided detailed performance reports, facilitating informed decision-making and improved investment outcomes for stakeholders.

- •Contributed to a team that restructured investment guidelines, resulting in a clearer alignment with client risk profiles.

- •Monitored global economic trends and reported on potential impacts, enhancing proactive risk management efforts.

Junior Risk and Compliance Analyst in Banking resume sample

- •Developed and implemented new risk management policies that improved regulatory compliance by 20%.

- •Conducted detailed risk assessments identifying potential vulnerabilities, leading to a 15% reduction in potential risks.

- •Collaborated with various business units to ensure understanding and adherence to changing regulatory requirements.

- •Prepared comprehensive compliance reports reviewed by senior management, increasing reporting accuracy by 30%.

- •Assisted in coordinating two regulatory examinations that ensured timely adherence to updated compliance standards.

- •Led training programs educating over 50 staff members on risk management practices, boosting compliance awareness by 25%.

- •Monitored compliance activities resulting in a 10% increase in adherence to local regulations over one year.

- •Supported the preparation and review of 30 compliance documents monthly, enhancing documentation accuracy by 15%.

- •Participated in the review of internal policies, which improved their alignment with industry standards by 20%.

- •Implemented a system for tracking regulatory changes that shortened response time to updates by 40%.

- •Collaborated with auditors conducting internal audits, leading to the identification and rectification of five major compliance gaps.

- •Supported the financial compliance operations, which resulted in a 15% decrease in processing errors.

- •Conducted financial analysis that improved decision-making processes, enhancing profitability by 10%.

- •Assisted in the quarterly risk assessment procedures, providing insights that led to the identification of two critical areas of improvement.

- •Developed financial models that improved investment analysis, contributing to a 25% increase in portfolio performance.

- •Assisted in the development of risk management strategies, leading to a 12% improvement in risk mitigation.

- •Maintained accurate records of compliance activities, which improved report generation by 20%.

- •Participated in cross-functional teams to support regulatory inspections, enhancing compliance response by 15%.

- •Contributed to the development of risk training materials, which increased staff compliance engagement by 30%.

Navigating the world of finance can feel like sailing into uncharted waters, especially as you embark on your career. As a fresher in banking, the path can seem daunting due to the competitive landscape and high expectations. Your resume is your vessel, a chance to steer through the stormy seas of job applications by capturing attention and highlighting your skills confidently.

Balancing your education with relevant experiences is a crucial challenge. It’s important to showcase your technical expertise, like financial modeling or data analysis, because your resume should reflect not only your qualifications but also your ambition to succeed in banking.

A resume template can be your compass, guiding you with structure while offering room for personalization. Templates provide a foundation that ensures your information is organized and easy to navigate—something every recruiter appreciates. To find your ideal template, check out these resume templates.

Focus on presenting your achievements and skills effectively to make a lasting impression. Tailor your resume to feature internships, projects, or coursework relevant to banking, as every word and section carries weight. Keeping it clear, concise, and compelling is key to engaging potential employers.

Approach this task with confidence, knowing the right resume can unlock doors to your future in banking. With careful crafting, your resume can open pathways to exciting opportunities, helping you stand out in the ever-evolving financial sector.

Key Takeaways

- Include clear contact information, a strong objective statement, and emphasize your education and skills relevant to banking.

- Showcase your technical expertise in banking, like financial analysis and software proficiency, along with any internships or relevant experiences.

- Use a chronological resume format with modern fonts and save it as a PDF to maintain consistent formatting.

- Highlight achievements in the experience section with action verbs and quantify accomplishments to give context and impact.

- Include certifications or training to enhance your resume and show your commitment to growing within the industry.

What to focus on when writing your fresher banking resume

Your fresher banking resume needs to make a strong first impression by clearly conveying your enthusiasm and readiness to join the banking world—Recruiters should effortlessly find your full name, phone number, email address, and LinkedIn profile to get in touch with you. This shows your professional approach and attention to detail right from the start.

Combine this with a compelling objective statement that not only expresses your eagerness to pursue a banking career but also highlights specific skills or educational experiences that are particularly valuable for entry-level roles. Choosing strong, clear language here can set the tone for the rest of your resume and capture the recruiter’s interest.

When detailing your educational background, focus on degrees, major courses, and the institution you attended, all of which speak to your foundational knowledge—particularly emphasizing any coursework that directly relates to banking or finance. Including a standout GPA further reinforces your dedication and ability to excel academically.

In the skills section, aim to spotlight abilities such as financial analysis, attention to detail, quantitative skills, familiarity with banking software, and customer service. These skills are crucial as they apply directly to daily tasks and responsibilities in banking, showcasing your preparedness for such roles.

Your internships or relevant experiences should tell a narrative of your practical exposure to the finance world. Clearly describe your role, the responsibilities you undertook, and any achievements that demonstrate your understanding of financial concepts, making recruiters envision your potential contributions to their team.

Including certifications or training can significantly enhance your resume by indicating your proactive approach to furthering your banking knowledge. Certifications like CFA Level I or finance-related courses show your commitment to growing within the industry and keeping pace with market demands.

As you compose your resume, consider how each of these elements comes together to portray a cohesive and compelling picture of you as a candidate. Below, we’ll delve deeper into each section, covering resume format and how to optimize each area of your resume for impact and relevance in the banking field.

How to structure your fresher banking resume

- Contact Information: Ensure recruiters can easily reach you by including your full name, phone number, email address, and LinkedIn profile.

- Objective Statement: Craft a strong summary that outlines your career goals and banking-specific skills, setting the tone for your resume.

- Education: Highlight your degrees, relevant courses, and institution, emphasizing coursework related to banking, and include your GPA if it's impressive.

- Skills: Focus on banking-related abilities like financial analysis, attention to detail, quantitative skills, banking software familiarity, and customer service.

- Internships or Relevant Experience: Detail your practical exposure to finance, describing roles and achievements that demonstrate your financial understanding.

- Certifications or Training: Include finance-related certifications or courses, such as CFA Level I, to show your commitment to professional growth.

Which resume format to choose

Building your fresher banking resume involves making thoughtful choices that work together seamlessly. Start by selecting a chronological format. This structure is ideal for showcasing your education and any relevant experiences in a logical sequence, which helps potential employers follow your academic and professional journey with ease. When it comes to fonts, choose modern options like Raleway, Lato, or Montserrat. These fonts are clean and easy to read, contributing to a professional look without distracting from your content.

The next crucial step is saving your resume as a PDF. This ensures that your formatting stays consistent, no matter what device or operating system the employer uses to view it. A poorly formatted resume can distract from your qualifications, so maintaining a neat appearance is key.

Setting one-inch margins on all sides creates a balanced layout and ensures your content is not cramped. This spacing allows the reader's eye to move naturally across your resume, making it inviting and easy to digest. With these elements, you'll present your skills and qualifications clearly, making a strong impression on prospective employers.

How to write a quantifiable resume experience section

In a fresher banking resume, the experience section is your opportunity to highlight relevant skills and achievements. This section should emphasize your capabilities in banking, even from internships or volunteer work, to show potential employers your readiness for the role. Start with the most recent role and work your way back, making it easy for recruiters to see your progression. Highlight achievements that align with the job description, ensuring that your roles and responsibilities reflect what employers want. Tailor each entry to spotlight the skills and experiences they're looking for, using strong action verbs like "managed," "developed," "achieved," and "analyzed" to show your proactive initiative. Adding quantifiable achievements gives your entries more impact.

It's important not just to list jobs but to craft entries that connect with what employers need, demonstrating you have the skills for a successful banking career. Here's a solid example that illustrates this approach:

- •Managed cash transactions worth $15,000 daily, ensuring accuracy and compliance with bank policies.

- •Developed a system to streamline customer service inquiries, reducing wait times by 20%.

- •Assisted in cross-selling banking products, achieving a 10% increase in monthly product sales.

- •Analyzed financial reports, contributing to a department initiative to reduce overhead costs by 5%.

The experience section should effectively use powerful action verbs and include quantifiable achievements to make your accomplishments clear. This example stands out because it highlights both responsibilities and results, such as boosting sales and reducing costs, and ties these points directly to banking objectives. By aligning past roles with your career goals, the experience section becomes a central part of your resume, demonstrating your readiness to contribute to potential employers.

Achievement-Focused resume experience section

A fresher banking-focused resume experience section should highlight your strengths and accomplishments in a cohesive and impactful way. Begin by detailing any internship, part-time job, or volunteer experience related to banking, emphasizing the skills you gained and the contributions you made. Use clear and simple language to describe your role and how your efforts improved operations or achieved specific goals. Instead of merely listing duties, illustrate your impact by showing how these tasks contributed to the workplace's success.

When crafting each experience entry, logically organize your bullet points to connect actions with outcomes. Quantify your achievements with numbers or percentages to provide a clearer picture of your impact. Starting sentences with action verbs can maintain an engaging tone that draws potential employers in. This method helps them envision the value you can bring to their team. Ultimately, ensure your resume presents you as a proactive and results-oriented individual, ready to make a difference.

Banking Intern

Greenfield Bank

June 2021 - August 2021

- Assisted in processing over 200 customer transactions daily, ensuring accuracy and efficiency.

- Collaborated with a team to analyze monthly financial reports, identifying trends that led to a 5% increase in client satisfaction.

- Developed a new filing system to improve document retrieval speed by 25%, enhancing overall productivity.

- Participated in workshops to improve client communication skills, leading to a 10% increase in positive customer feedback.

Skills-Focused resume experience section

A skills-focused fresher banking resume experience section should clearly highlight the abilities you bring to the table. Start by focusing on key skills like analytical prowess, customer service, and familiarity with banking software. Draw from your academic projects, internships, or any part-time work to showcase your capabilities. Each bullet point should provide specific examples of how you've applied these skills, highlighting any positive outcomes like improved performance or enhanced efficiency. By using straightforward language, you create a seamless narrative that underscores your value to potential employers.

Your experience section needs to state your role and the dates clearly, which helps set the context for your achievements. In the bullet points, detail the skills you used and the concrete results you achieved. Don't forget to include soft skills such as communication and problem-solving, which are crucial in banking. This cohesive approach ensures recruiters can quickly grasp your abilities and understand how well you might fit into their team.

Banking Intern

XYZ Bank

June 2022 - August 2022

- Analyzed financial data using bank software, improving data accuracy by 15%.

- Led customer engagement initiatives, leading to a 20% increase in satisfaction scores.

- Assisted in the creation of financial reports, ensuring they met compliance standards.

- Participated in risk management assessments, contributing to the identification of key risk indicators.

Technology-Focused resume experience section

A fresher banking technology-focused resume experience section should emphasize achievements and skills that align with your desired role. Even if you don't have direct work experience, it's important to highlight related projects, internships, or academic accomplishments that showcase your potential. Begin by clearly stating the position or role, followed by a brief context to provide clarity. Use bullet points to detail your contributions or achievements, starting each with an action verb to add energy and engagement. The goal is to demonstrate how your skills connect with the needs of potential employers.

As you write each bullet point, consider what makes your experience unique and how it can add value in a banking technology setting. Perhaps you worked on a project developing a banking app or participated in a coding bootcamp focused on financial technologies. These experiences, when articulated clearly, can help distinguish you from others. Keep your language simple to ensure that your points are easy to follow. Steer clear of excessive jargon and focus on effectively showcasing your potential in the most straightforward way.

Project Member

University of ABC

June 2021 - August 2021

- Developed a mobile banking app prototype as part of a university project, focusing on user-friendly interfaces and secure transactions.

- Collaborated with a team of 4 classmates, leading the effort in integrating API functionality for real-time data updates.

- Conducted research on cybersecurity threats and implemented basic encryption to safeguard user data within the app.

- Presented the project in a campus tech fair, receiving positive feedback for innovation and design simplicity.

Collaboration-Focused resume experience section

A collaboration-focused banking resume experience section should effectively highlight your teamwork skills and contributions. Start by showcasing any group projects or team experiences from school, volunteer work, or other areas. Clearly articulate your role within these groups and how you contributed to the overall success. Emphasize the communication and teamwork skills you developed and any challenges you helped solve, which illustrate your ability to work collaboratively.

When describing your experience, maintain clarity and focus on your impact, using action verbs like "coordinated," "assisted," or "supported." Rather than simply listing tasks, explain the value you brought to the team's objectives. Incorporate any specific tools or methods, such as project management software, that you used to enhance collaboration. By demonstrating your adaptability and ability to work well with others, even in small-scale projects, you can effectively convey your aptitude for teamwork.

Finance Student

University of Learning

June 2022 - August 2022

- Collaborated with four classmates on a financial analysis project, enhancing teamwork and communication skills.

- Assisted in creating presentations for group meetings, improving public speaking and presentation abilities.

- Supported team members by sharing research findings and study materials, fostering a cooperative work environment.

- Resolved conflicts through active listening and negotiation, ensuring team alignment and project success.

Write your fresher banking resume summary section

A banking-focused fresher resume summary should introduce you as a promising candidate. Crafting a compelling summary sets you apart by giving employers a glimpse of your potential. Highlight your skills, education, and passion for the banking field. Think of it as a brief ad showcasing your top qualities, making sure it matches what employers are looking for. Here’s an example worth considering:

This summary pulls in your education and banking-related skills, making it clear why you’re a fit. Highlighting strengths like financial analysis and teamwork aligns with what the industry demands. It also reflects your enthusiasm and readiness, which makes a positive impression on recruiters. Use active language to describe yourself, focusing on how you can fulfill the job requirements.

Understanding the difference between resume summaries, objectives, profiles, and qualifications can help tailor your message. A summary focuses on skills and achievements, while an objective states where you want to go in your career. Profiles are more detailed, and summaries of qualifications often list key skills. Each has its place, but for fresh candidates, a summary effectively blends skills and career aspirations. Keeping it concise, engaging, and easy to read ensures you quickly capture a recruiter’s attention.

Listing your fresher banking skills on your resume

A skills-focused fresher banking resume should showcase your abilities in a way that catches the attention of hiring managers. You have options for presenting your skills: either in their own section or woven into your experience and summary. Emphasizing strengths like teamwork and communication can demonstrate how well you collaborate with others. Meanwhile, hard skills such as financial analysis or proficiency with banking software highlight your technical expertise.

Using skills and strengths as keywords throughout your resume is a smart strategy. Employers often search for specific terms, and having these on your resume can make it stand out.

Here’s an example of an effective skills section:

This skills section is effective because it clearly highlights relevant skills for the banking industry. It combines technical and interpersonal abilities, painting a picture of a well-rounded candidate. The use of relevant keywords boosts your resume’s visibility to potential employers.

Best hard skills to feature on your fresher banking resume

For someone new to banking, it's key to focus on hard skills that demonstrate handling financial tasks and using banking tools. These skills emphasize precision and technical competence.

Hard Skills

- Financial Analysis

- Customer Account Management

- Data Entry

- Numerical Skills

- MS Excel

- Accounting Software Proficiency

- Risk Assessment

- Regulatory Compliance

- Loan Processing

- Financial Reporting

- Data Analytics

- Cash Handling

- Budgeting

- CRM Software

- Credit Analysis

Best soft skills to feature on your fresher banking resume

In the banking sector, soft skills play a crucial role alongside hard skills. They show how you handle interactions with clients and colleagues. Highlighting these skills emphasizes your interpersonal effectiveness and communication strengths.

Soft Skills

- Communication

- Teamwork

- Problem-Solving

- Attention to Detail

- Time Management

- Adaptability

- Customer Service

- Critical Thinking

- Negotiation

- Empathy

- Leadership

- Conflict Resolution

- Organizational Skills

- Initiative

- Patience

How to include your education on your resume

The education section is one of the most vital parts of your resume, especially as a fresher in the banking sector. This part provides recruiters with insight into your academic background and skills relevant to the job. Tailoring your education section to the specific job you’re applying for is crucial, meaning you should omit any irrelevant education details. When including your GPA, ensure it is listed if it is impressive (generally 3.0 or higher) and relevant for the job. Include honors such as cum laude to highlight academic achievements. The degree should be clearly listed with the name of the institution and the dates attended. Below are examples of how to structure your education section on a resume.

WRONG EXAMPLE:

RIGHT EXAMPLE:

The right example is well-suited for a banking position as it features a related degree and highlights academic excellence with a notable GPA and honors. It is concise and relevant to the field, offering a clear and direct overview of educational accomplishments that align with the qualities sought after in banking roles. This approach helps you stand out by presenting a focused and polished educational background.

In Conclusion

In conclusion, crafting a standout fresher banking resume requires precision, focus, and a keen awareness of what employers are seeking. Your resume is not just a document; it's your professional story, showcasing your readiness to dive into the banking world. By organizing your resume thoughtfully, you ensure that your qualifications are presented in the most favorable light. Selecting the right template helps you maintain a clean and professional format, which is essential in making your resume easy to read and engaging. Remember, your resume should highlight both your academic achievements and practical experiences, painting a comprehensive picture of your capabilities. Tailor your resume to each job application by emphasizing skills and experiences that directly relate to the role. The combination of clear language, well-organized sections, and strong action verbs will capture a recruiter’s attention. In the competitive field of banking, presenting a resume that balances technical skills with your ability to work well in a team is crucial. By integrating these elements, you position yourself as a capable and enthusiastic candidate ready to contribute to any banking team. Ultimately, your resume should act as a bridge, connecting you with potential employers who recognize your potential to thrive in the financial sector. With careful preparation and attention to detail, your banking resume can open the door to a rewarding career.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.