Fund Accountant Resume Examples

Jul 18, 2024

|

12 min read

Make your fund accountant resume stand out: tips and examples for your job search success. Here’s how you can balance the books and your career goals in one polished document.

Rated by 348 people

Hedge Fund Accountant

Private Equity Fund Accountant

Real Estate Investment Fund Accountant

Mutual Fund Accountant

Derivatives Fund Accountant

Venture Capital Fund Accountant

Fixed Income Fund Accountant

Cryptocurrency Fund Accountant

Commodity Fund Accountant

Pension Fund Accountant

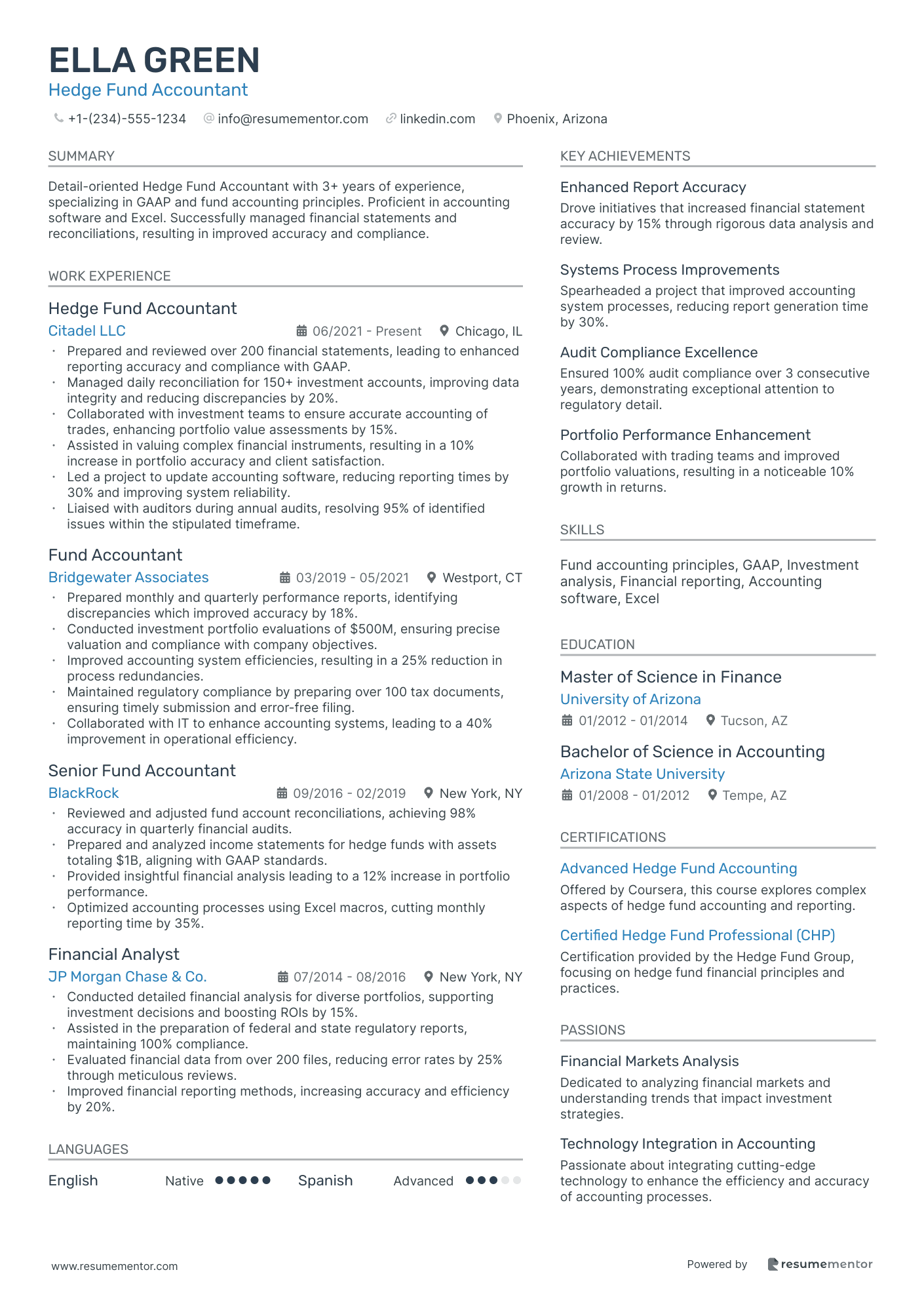

Hedge Fund Accountant resume sample

- •Prepared and reviewed over 200 financial statements, leading to enhanced reporting accuracy and compliance with GAAP.

- •Managed daily reconciliation for 150+ investment accounts, improving data integrity and reducing discrepancies by 20%.

- •Collaborated with investment teams to ensure accurate accounting of trades, enhancing portfolio value assessments by 15%.

- •Assisted in valuing complex financial instruments, resulting in a 10% increase in portfolio accuracy and client satisfaction.

- •Led a project to update accounting software, reducing reporting times by 30% and improving system reliability.

- •Liaised with auditors during annual audits, resolving 95% of identified issues within the stipulated timeframe.

- •Prepared monthly and quarterly performance reports, identifying discrepancies which improved accuracy by 18%.

- •Conducted investment portfolio evaluations of $500M, ensuring precise valuation and compliance with company objectives.

- •Improved accounting system efficiencies, resulting in a 25% reduction in process redundancies.

- •Maintained regulatory compliance by preparing over 100 tax documents, ensuring timely submission and error-free filing.

- •Collaborated with IT to enhance accounting systems, leading to a 40% improvement in operational efficiency.

- •Reviewed and adjusted fund account reconciliations, achieving 98% accuracy in quarterly financial audits.

- •Prepared and analyzed income statements for hedge funds with assets totaling $1B, aligning with GAAP standards.

- •Provided insightful financial analysis leading to a 12% increase in portfolio performance.

- •Optimized accounting processes using Excel macros, cutting monthly reporting time by 35%.

- •Conducted detailed financial analysis for diverse portfolios, supporting investment decisions and boosting ROIs by 15%.

- •Assisted in the preparation of federal and state regulatory reports, maintaining 100% compliance.

- •Evaluated financial data from over 200 files, reducing error rates by 25% through meticulous reviews.

- •Improved financial reporting methods, increasing accuracy and efficiency by 20%.

Private Equity Fund Accountant resume sample

- •Led the preparation of quarterly financial statements for multiple funds, improving accuracy by 20% through enhanced processes.

- •Oversaw capital calls totaling $200 million per quarter, maintaining 100% compliance with deadlines and regulatory standards.

- •Managed monthly account reconciliations and journal entries, reducing errors by 15% through implementing standardized procedures.

- •Collaborated in a cross-functional team to streamline financial reporting, resulting in a 25% reduction in turnaround time.

- •Coordinated annual external audits, achieving a 10% decrease in audit adjustments by enhancing internal control measures.

- •Improved cash management processes, increasing fund liquidity tracking accuracy and enhancing investment decision timeliness.

- •Prepared and reviewed capital account statements for stakeholders, increasing transparency and investor satisfaction by 15%.

- •Facilitated monthly closing processes, maintaining an average completion time of 5 days with zero major discrepancies.

- •Assessed portfolio investment valuations, employing rigorous financial analysis techniques to ensure pricing integrity.

- •Supported the launch of a new fund, coordinating fund accounting setups and policies that complied with SEC guidelines.

- •Responded to numerous investor inquiries, providing timely and accurate information to boost investor confidence in fund operations.

- •Performed detailed account reconciliations, leading to a 10% improvement in monthly financial accuracy and accountability.

- •Assisted with distribution processes, ensuring precise and timely capital outflow to fund partners, praised for flawless execution.

- •Tracked and analyzed cash flows for multiple projects, enhancing forecasting accuracy by 20% through improved data analysis.

- •Engaged in special projects aimed at improving operational efficiency, gaining recognition for initiative and results orientation.

- •Conducted intensive financial modeling and analysis, supporting key investment decisions with data-driven insights.

- •Streamlined reporting processes, achieving a 30% reduction in report preparation time through system automation.

- •Collaborated with product teams to align financial strategies with business objectives, boosting efficiency by 12%.

- •Engaged with internal stakeholders to identify and address accounting discrepancies, improving reporting reliability.

Real Estate Investment Fund Accountant resume sample

- •Managed financial statements for over 10 real estate funds, ensuring compliance with GAAP and boosting accuracy by 15%.

- •Facilitated month-end and year-end closings, streamlining processes that reduced closing time by 25% through automation.

- •Reconciled investment accounts and uncovered discrepancies, leading to recovery of $500,000 in fund transactions.

- •Prepared capital calls and investor reporting packages with 100% compliance to fund agreements, enhancing investor trust.

- •Collaborated with asset managers to align financial insights with property-level operations, increasing fund performance by 12%.

- •Improved accounting systems, increasing accuracy by 20% and supporting efficient reporting across multiple funds.

- •Developed comprehensive financial reports for 8 investment funds, enhancing decision-making through detailed analysis.

- •Led annual audit processes, ensuring all documentation was accurate, leading to unqualified audit opinions consistently.

- •Improved compliance monitoring, resulting in zero non-compliance incidents over a two-year period.

- •Prepared detailed analysis for fund management, resulting in a 15% improvement in forecasting accuracy.

- •Introduced process improvements that optimized fund performance reporting speed by 30% across all portfolios.

- •Created financial models that assisted in forecasting future property-level cash flows, improving accuracy by 25%.

- •Implemented a standardized reporting system, reducing errors in financial reporting by 18%.

- •Assisted in regulatory compliance reviews, ensuring zero breaches and maintaining industry standards continually.

- •Provided financial insights that contributed to achieving a balanced portfolio, enhancing return rates by 10%.

- •Analyzed and interpreted financial data from multiple real estate projects, improving strategic decisions by providing actionable insights.

- •Collaborated with cross-functional teams to ensure successful completion of real estate transactions, increasing capital deployment efficiency by 20%.

- •Developed detailed periodic reports for stakeholders, enhancing transparency and communication effectiveness by 15%.

- •Conducted market analysis supporting strategies that boosted return on investment by 8% annually.

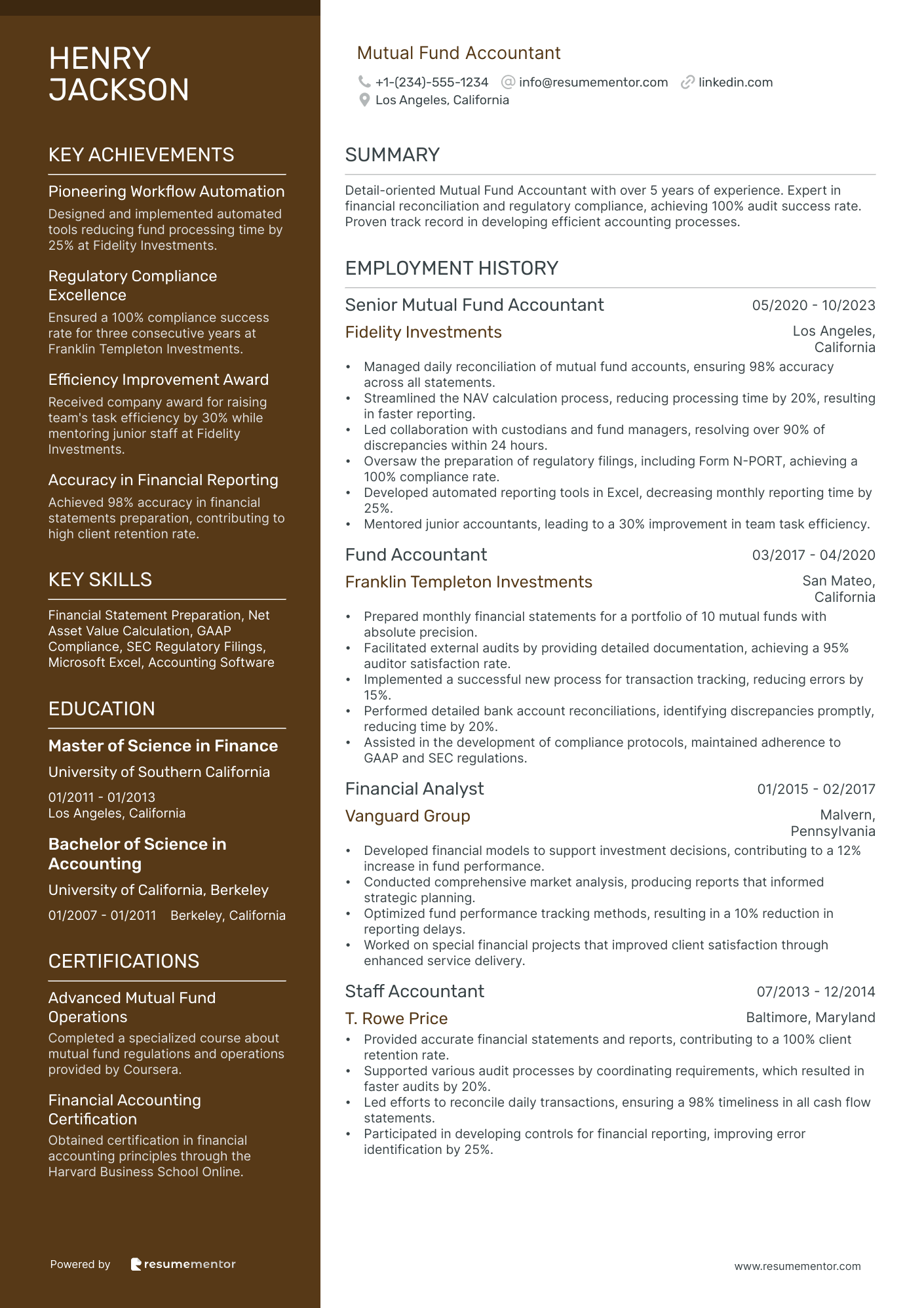

Mutual Fund Accountant resume sample

- •Managed daily reconciliation of mutual fund accounts, ensuring 98% accuracy across all statements.

- •Streamlined the NAV calculation process, reducing processing time by 20%, resulting in faster reporting.

- •Led collaboration with custodians and fund managers, resolving over 90% of discrepancies within 24 hours.

- •Oversaw the preparation of regulatory filings, including Form N-PORT, achieving a 100% compliance rate.

- •Developed automated reporting tools in Excel, decreasing monthly reporting time by 25%.

- •Mentored junior accountants, leading to a 30% improvement in team task efficiency.

- •Prepared monthly financial statements for a portfolio of 10 mutual funds with absolute precision.

- •Facilitated external audits by providing detailed documentation, achieving a 95% auditor satisfaction rate.

- •Implemented a successful new process for transaction tracking, reducing errors by 15%.

- •Performed detailed bank account reconciliations, identifying discrepancies promptly, reducing time by 20%.

- •Assisted in the development of compliance protocols, maintained adherence to GAAP and SEC regulations.

- •Developed financial models to support investment decisions, contributing to a 12% increase in fund performance.

- •Conducted comprehensive market analysis, producing reports that informed strategic planning.

- •Optimized fund performance tracking methods, resulting in a 10% reduction in reporting delays.

- •Worked on special financial projects that improved client satisfaction through enhanced service delivery.

- •Provided accurate financial statements and reports, contributing to a 100% client retention rate.

- •Supported various audit processes by coordinating requirements, which resulted in faster audits by 20%.

- •Led efforts to reconcile daily transactions, ensuring a 98% timeliness in all cash flow statements.

- •Participated in developing controls for financial reporting, improving error identification by 25%.

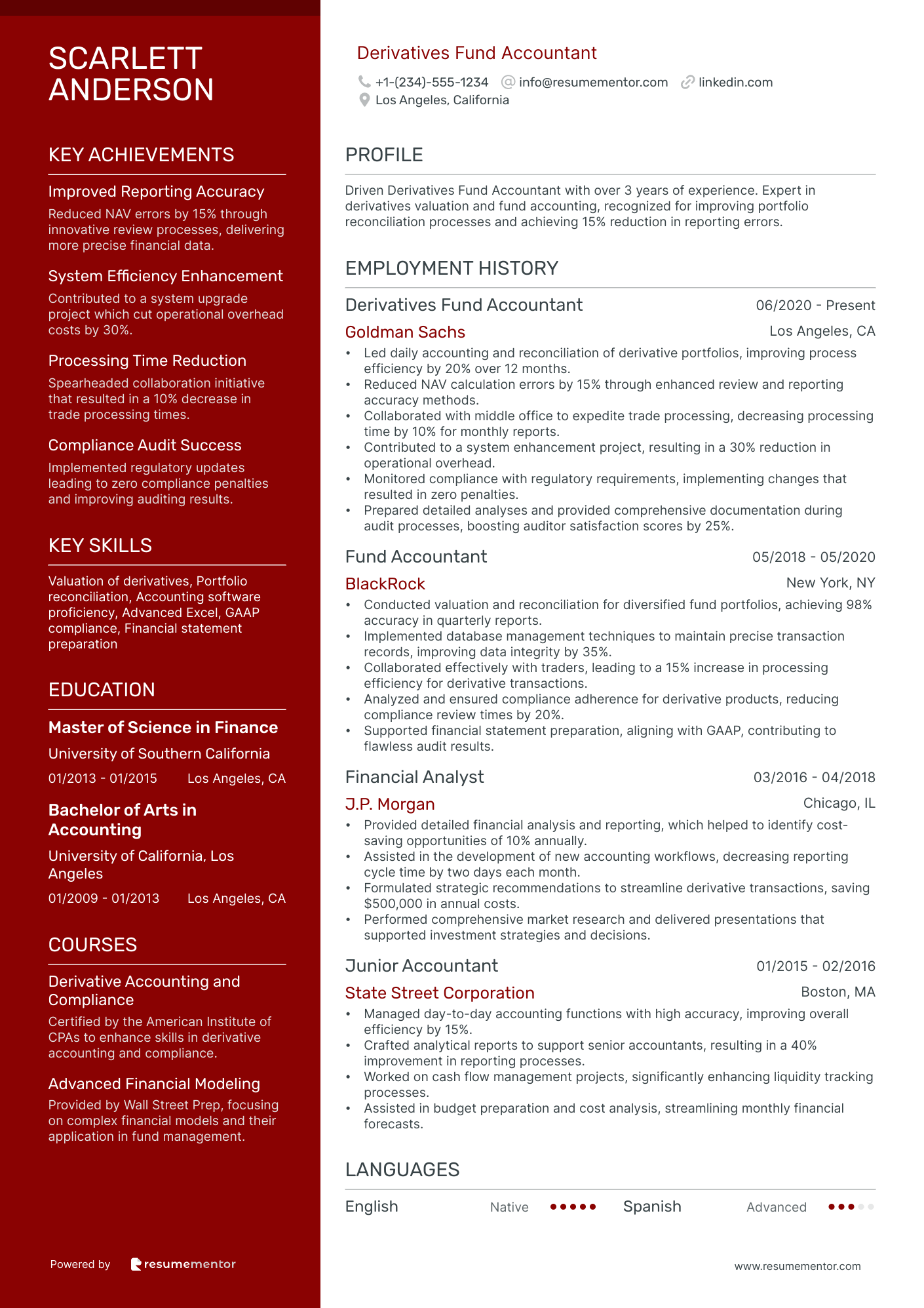

Derivatives Fund Accountant resume sample

- •Led daily accounting and reconciliation of derivative portfolios, improving process efficiency by 20% over 12 months.

- •Reduced NAV calculation errors by 15% through enhanced review and reporting accuracy methods.

- •Collaborated with middle office to expedite trade processing, decreasing processing time by 10% for monthly reports.

- •Contributed to a system enhancement project, resulting in a 30% reduction in operational overhead.

- •Monitored compliance with regulatory requirements, implementing changes that resulted in zero penalties.

- •Prepared detailed analyses and provided comprehensive documentation during audit processes, boosting auditor satisfaction scores by 25%.

- •Conducted valuation and reconciliation for diversified fund portfolios, achieving 98% accuracy in quarterly reports.

- •Implemented database management techniques to maintain precise transaction records, improving data integrity by 35%.

- •Collaborated effectively with traders, leading to a 15% increase in processing efficiency for derivative transactions.

- •Analyzed and ensured compliance adherence for derivative products, reducing compliance review times by 20%.

- •Supported financial statement preparation, aligning with GAAP, contributing to flawless audit results.

- •Provided detailed financial analysis and reporting, which helped to identify cost-saving opportunities of 10% annually.

- •Assisted in the development of new accounting workflows, decreasing reporting cycle time by two days each month.

- •Formulated strategic recommendations to streamline derivative transactions, saving $500,000 in annual costs.

- •Performed comprehensive market research and delivered presentations that supported investment strategies and decisions.

- •Managed day-to-day accounting functions with high accuracy, improving overall efficiency by 15%.

- •Crafted analytical reports to support senior accountants, resulting in a 40% improvement in reporting processes.

- •Worked on cash flow management projects, significantly enhancing liquidity tracking processes.

- •Assisted in budget preparation and cost analysis, streamlining monthly financial forecasts.

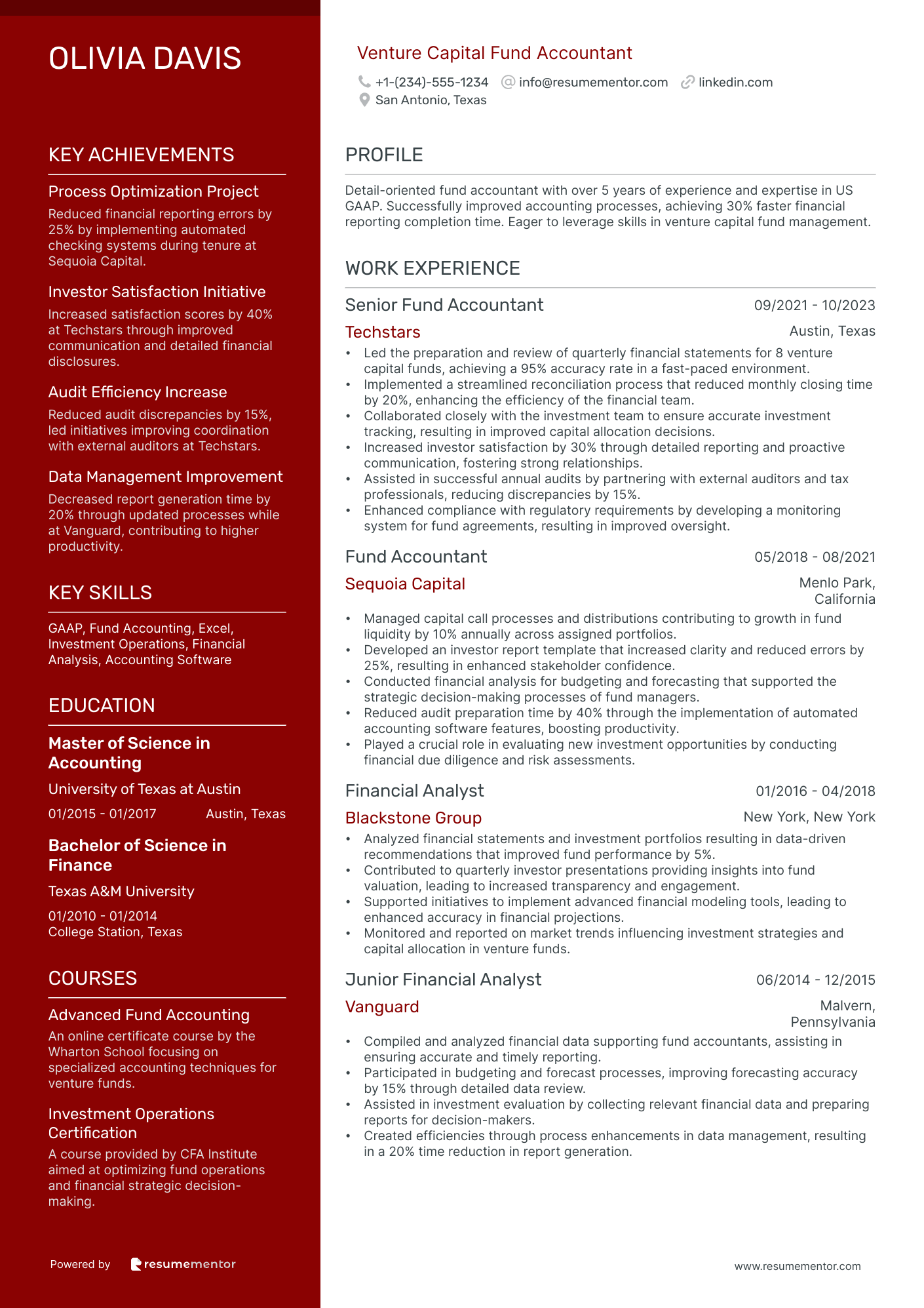

Venture Capital Fund Accountant resume sample

- •Led the preparation and review of quarterly financial statements for 8 venture capital funds, achieving a 95% accuracy rate in a fast-paced environment.

- •Implemented a streamlined reconciliation process that reduced monthly closing time by 20%, enhancing the efficiency of the financial team.

- •Collaborated closely with the investment team to ensure accurate investment tracking, resulting in improved capital allocation decisions.

- •Increased investor satisfaction by 30% through detailed reporting and proactive communication, fostering strong relationships.

- •Assisted in successful annual audits by partnering with external auditors and tax professionals, reducing discrepancies by 15%.

- •Enhanced compliance with regulatory requirements by developing a monitoring system for fund agreements, resulting in improved oversight.

- •Managed capital call processes and distributions contributing to growth in fund liquidity by 10% annually across assigned portfolios.

- •Developed an investor report template that increased clarity and reduced errors by 25%, resulting in enhanced stakeholder confidence.

- •Conducted financial analysis for budgeting and forecasting that supported the strategic decision-making processes of fund managers.

- •Reduced audit preparation time by 40% through the implementation of automated accounting software features, boosting productivity.

- •Played a crucial role in evaluating new investment opportunities by conducting financial due diligence and risk assessments.

- •Analyzed financial statements and investment portfolios resulting in data-driven recommendations that improved fund performance by 5%.

- •Contributed to quarterly investor presentations providing insights into fund valuation, leading to increased transparency and engagement.

- •Supported initiatives to implement advanced financial modeling tools, leading to enhanced accuracy in financial projections.

- •Monitored and reported on market trends influencing investment strategies and capital allocation in venture funds.

- •Compiled and analyzed financial data supporting fund accountants, assisting in ensuring accurate and timely reporting.

- •Participated in budgeting and forecast processes, improving forecasting accuracy by 15% through detailed data review.

- •Assisted in investment evaluation by collecting relevant financial data and preparing reports for decision-makers.

- •Created efficiencies through process enhancements in data management, resulting in a 20% time reduction in report generation.

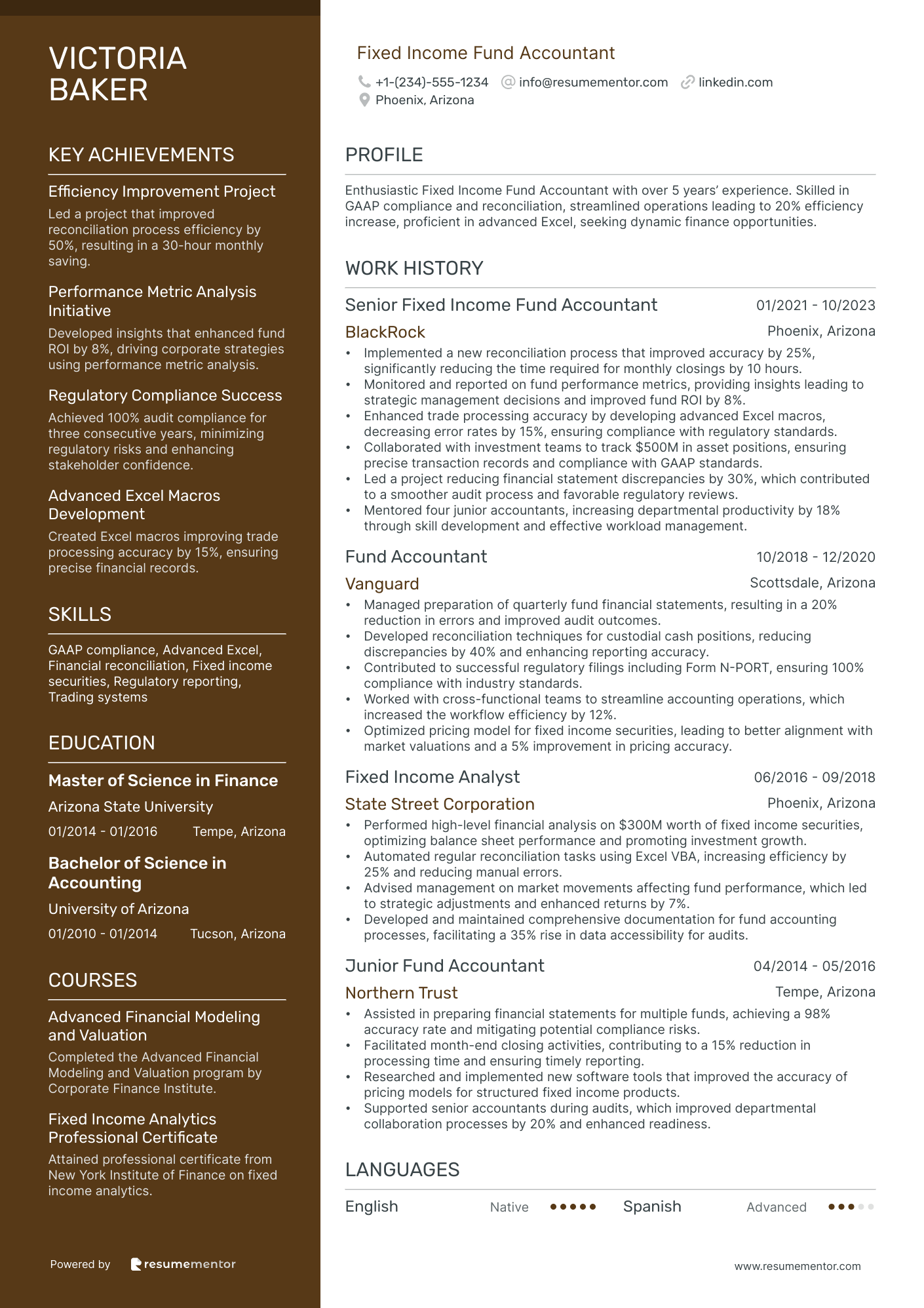

Fixed Income Fund Accountant resume sample

- •Implemented a new reconciliation process that improved accuracy by 25%, significantly reducing the time required for monthly closings by 10 hours.

- •Monitored and reported on fund performance metrics, providing insights leading to strategic management decisions and improved fund ROI by 8%.

- •Enhanced trade processing accuracy by developing advanced Excel macros, decreasing error rates by 15%, ensuring compliance with regulatory standards.

- •Collaborated with investment teams to track $500M in asset positions, ensuring precise transaction records and compliance with GAAP standards.

- •Led a project reducing financial statement discrepancies by 30%, which contributed to a smoother audit process and favorable regulatory reviews.

- •Mentored four junior accountants, increasing departmental productivity by 18% through skill development and effective workload management.

- •Managed preparation of quarterly fund financial statements, resulting in a 20% reduction in errors and improved audit outcomes.

- •Developed reconciliation techniques for custodial cash positions, reducing discrepancies by 40% and enhancing reporting accuracy.

- •Contributed to successful regulatory filings including Form N-PORT, ensuring 100% compliance with industry standards.

- •Worked with cross-functional teams to streamline accounting operations, which increased the workflow efficiency by 12%.

- •Optimized pricing model for fixed income securities, leading to better alignment with market valuations and a 5% improvement in pricing accuracy.

- •Performed high-level financial analysis on $300M worth of fixed income securities, optimizing balance sheet performance and promoting investment growth.

- •Automated regular reconciliation tasks using Excel VBA, increasing efficiency by 25% and reducing manual errors.

- •Advised management on market movements affecting fund performance, which led to strategic adjustments and enhanced returns by 7%.

- •Developed and maintained comprehensive documentation for fund accounting processes, facilitating a 35% rise in data accessibility for audits.

- •Assisted in preparing financial statements for multiple funds, achieving a 98% accuracy rate and mitigating potential compliance risks.

- •Facilitated month-end closing activities, contributing to a 15% reduction in processing time and ensuring timely reporting.

- •Researched and implemented new software tools that improved the accuracy of pricing models for structured fixed income products.

- •Supported senior accountants during audits, which improved departmental collaboration processes by 20% and enhanced readiness.

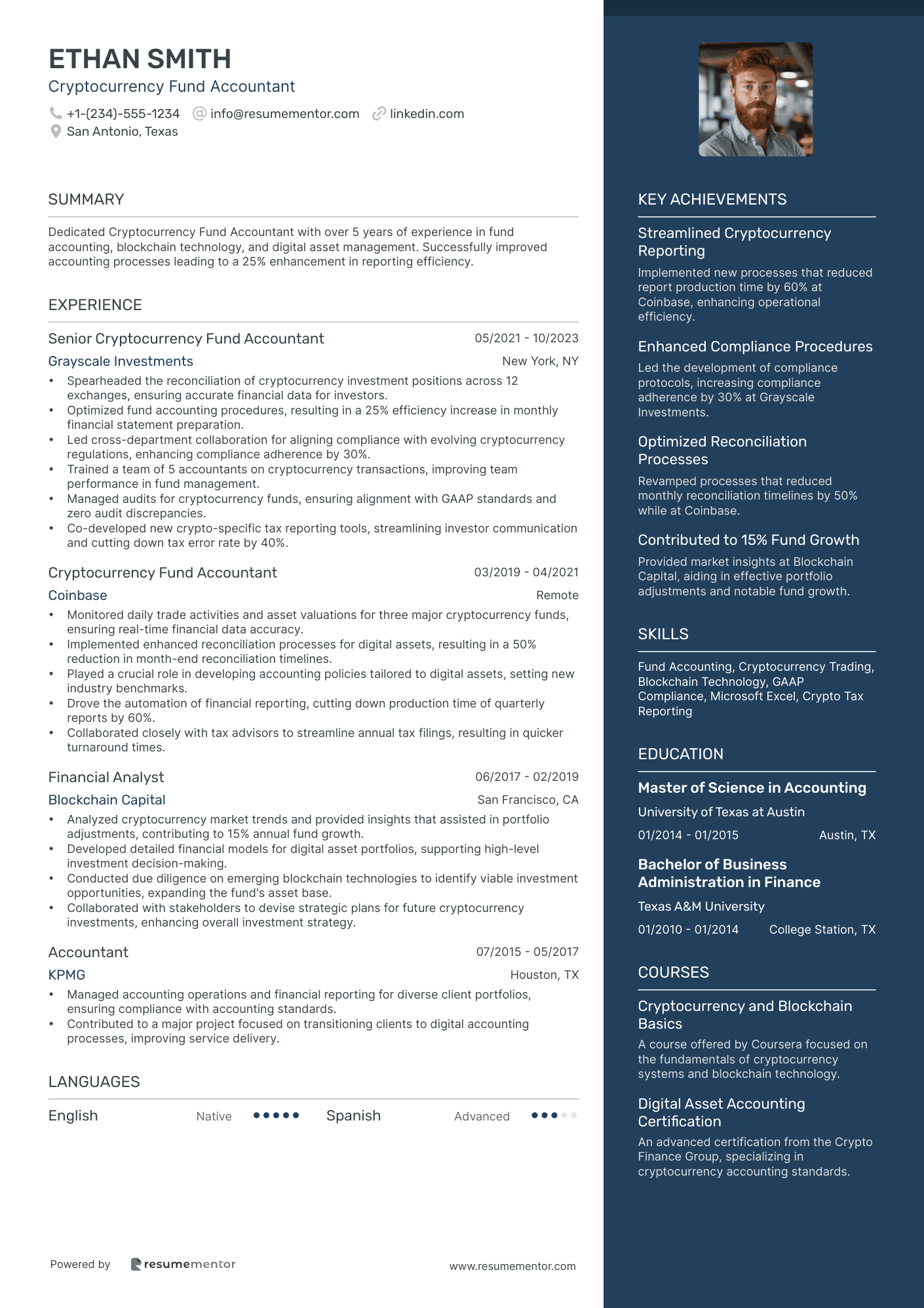

Cryptocurrency Fund Accountant resume sample

- •Spearheaded the reconciliation of cryptocurrency investment positions across 12 exchanges, ensuring accurate financial data for investors.

- •Optimized fund accounting procedures, resulting in a 25% efficiency increase in monthly financial statement preparation.

- •Led cross-department collaboration for aligning compliance with evolving cryptocurrency regulations, enhancing compliance adherence by 30%.

- •Trained a team of 5 accountants on cryptocurrency transactions, improving team performance in fund management.

- •Managed audits for cryptocurrency funds, ensuring alignment with GAAP standards and zero audit discrepancies.

- •Co-developed new crypto-specific tax reporting tools, streamlining investor communication and cutting down tax error rate by 40%.

- •Monitored daily trade activities and asset valuations for three major cryptocurrency funds, ensuring real-time financial data accuracy.

- •Implemented enhanced reconciliation processes for digital assets, resulting in a 50% reduction in month-end reconciliation timelines.

- •Played a crucial role in developing accounting policies tailored to digital assets, setting new industry benchmarks.

- •Drove the automation of financial reporting, cutting down production time of quarterly reports by 60%.

- •Collaborated closely with tax advisors to streamline annual tax filings, resulting in quicker turnaround times.

- •Analyzed cryptocurrency market trends and provided insights that assisted in portfolio adjustments, contributing to 15% annual fund growth.

- •Developed detailed financial models for digital asset portfolios, supporting high-level investment decision-making.

- •Conducted due diligence on emerging blockchain technologies to identify viable investment opportunities, expanding the fund's asset base.

- •Collaborated with stakeholders to devise strategic plans for future cryptocurrency investments, enhancing overall investment strategy.

- •Managed accounting operations and financial reporting for diverse client portfolios, ensuring compliance with accounting standards.

- •Contributed to a major project focused on transitioning clients to digital accounting processes, improving service delivery.

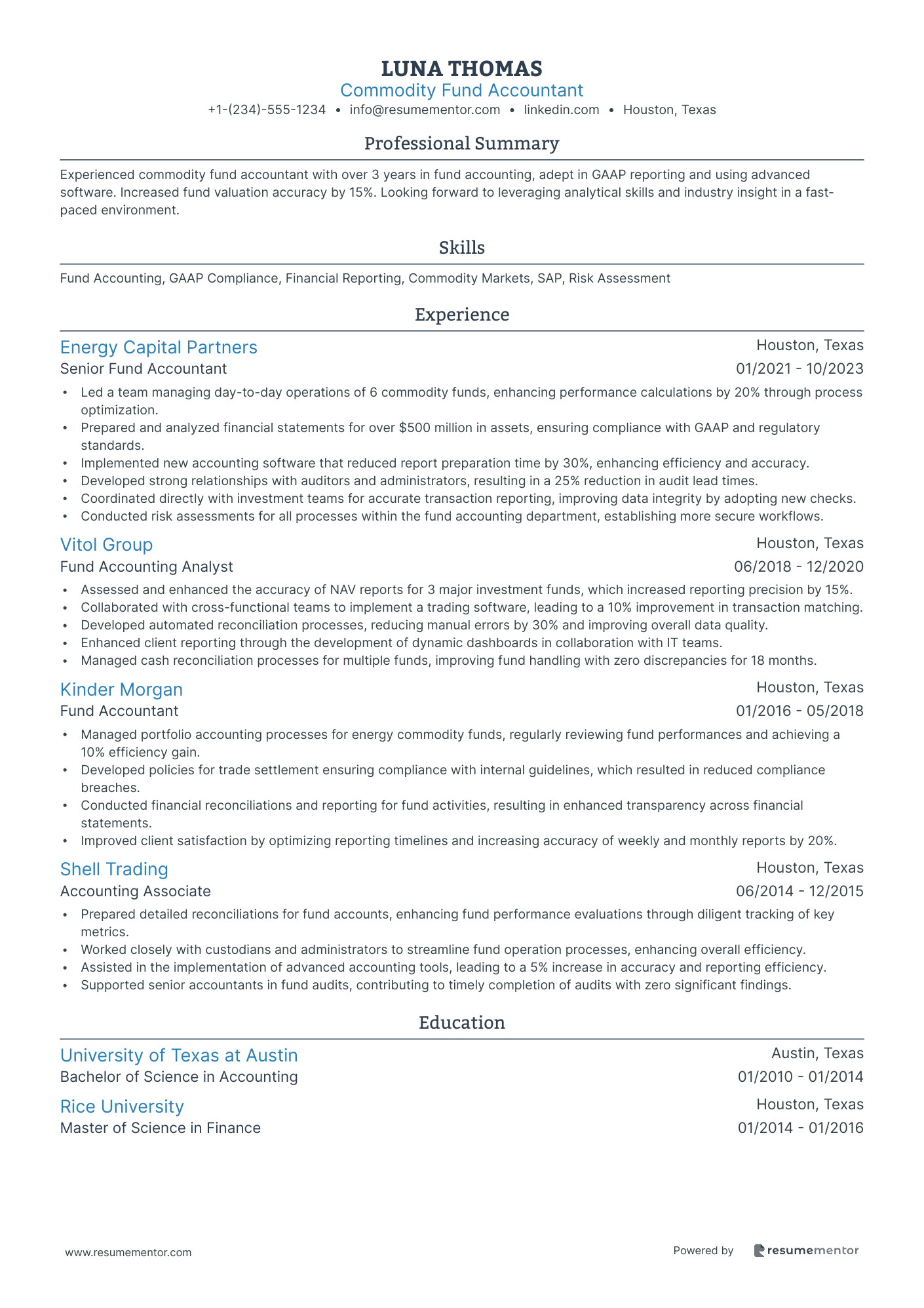

Commodity Fund Accountant resume sample

- •Led a team managing day-to-day operations of 6 commodity funds, enhancing performance calculations by 20% through process optimization.

- •Prepared and analyzed financial statements for over $500 million in assets, ensuring compliance with GAAP and regulatory standards.

- •Implemented new accounting software that reduced report preparation time by 30%, enhancing efficiency and accuracy.

- •Developed strong relationships with auditors and administrators, resulting in a 25% reduction in audit lead times.

- •Coordinated directly with investment teams for accurate transaction reporting, improving data integrity by adopting new checks.

- •Conducted risk assessments for all processes within the fund accounting department, establishing more secure workflows.

- •Assessed and enhanced the accuracy of NAV reports for 3 major investment funds, which increased reporting precision by 15%.

- •Collaborated with cross-functional teams to implement a trading software, leading to a 10% improvement in transaction matching.

- •Developed automated reconciliation processes, reducing manual errors by 30% and improving overall data quality.

- •Enhanced client reporting through the development of dynamic dashboards in collaboration with IT teams.

- •Managed cash reconciliation processes for multiple funds, improving fund handling with zero discrepancies for 18 months.

- •Managed portfolio accounting processes for energy commodity funds, regularly reviewing fund performances and achieving a 10% efficiency gain.

- •Developed policies for trade settlement ensuring compliance with internal guidelines, which resulted in reduced compliance breaches.

- •Conducted financial reconciliations and reporting for fund activities, resulting in enhanced transparency across financial statements.

- •Improved client satisfaction by optimizing reporting timelines and increasing accuracy of weekly and monthly reports by 20%.

- •Prepared detailed reconciliations for fund accounts, enhancing fund performance evaluations through diligent tracking of key metrics.

- •Worked closely with custodians and administrators to streamline fund operation processes, enhancing overall efficiency.

- •Assisted in the implementation of advanced accounting tools, leading to a 5% increase in accuracy and reporting efficiency.

- •Supported senior accountants in fund audits, contributing to timely completion of audits with zero significant findings.

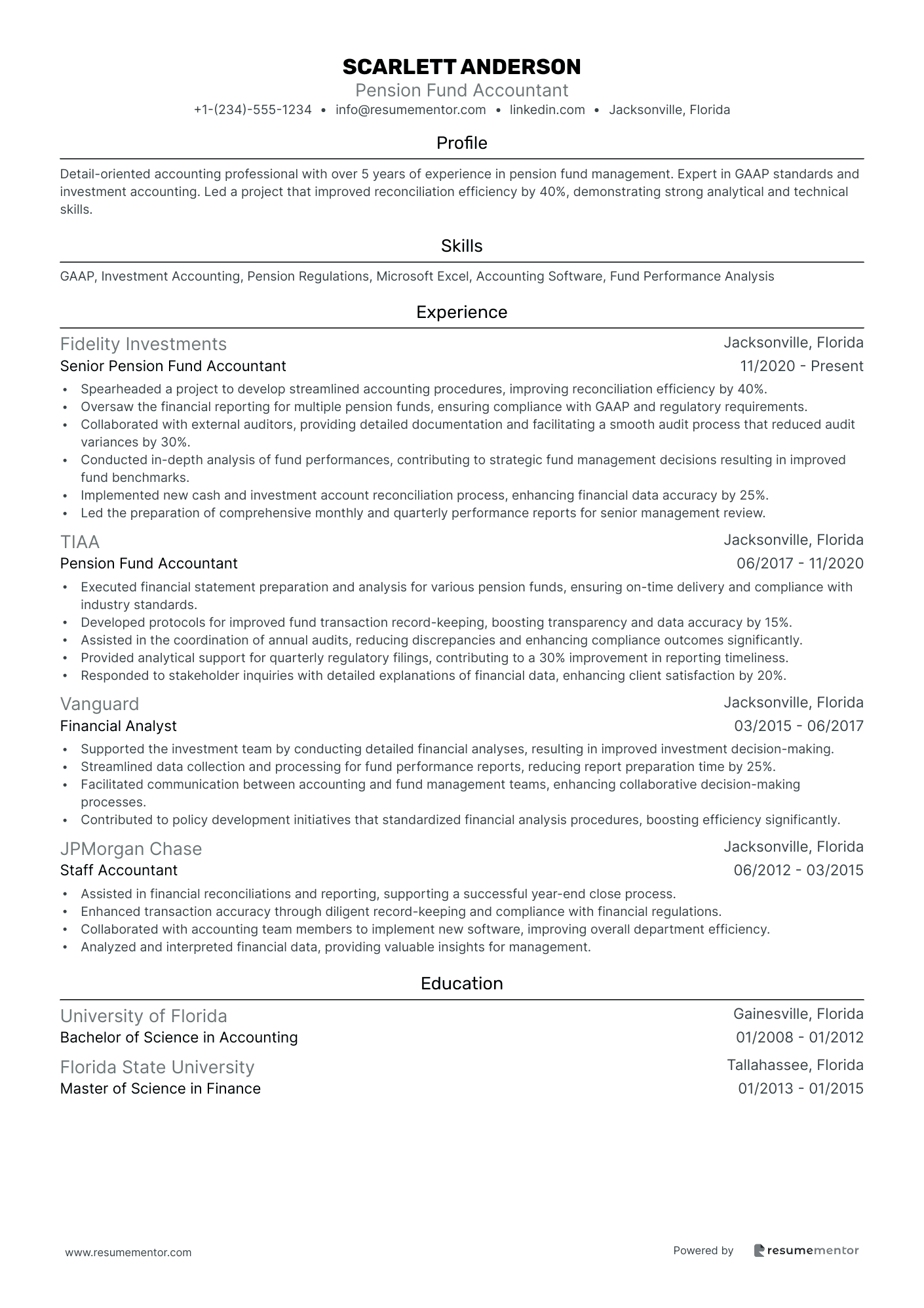

Pension Fund Accountant resume sample

- •Spearheaded a project to develop streamlined accounting procedures, improving reconciliation efficiency by 40%.

- •Oversaw the financial reporting for multiple pension funds, ensuring compliance with GAAP and regulatory requirements.

- •Collaborated with external auditors, providing detailed documentation and facilitating a smooth audit process that reduced audit variances by 30%.

- •Conducted in-depth analysis of fund performances, contributing to strategic fund management decisions resulting in improved fund benchmarks.

- •Implemented new cash and investment account reconciliation process, enhancing financial data accuracy by 25%.

- •Led the preparation of comprehensive monthly and quarterly performance reports for senior management review.

- •Executed financial statement preparation and analysis for various pension funds, ensuring on-time delivery and compliance with industry standards.

- •Developed protocols for improved fund transaction record-keeping, boosting transparency and data accuracy by 15%.

- •Assisted in the coordination of annual audits, reducing discrepancies and enhancing compliance outcomes significantly.

- •Provided analytical support for quarterly regulatory filings, contributing to a 30% improvement in reporting timeliness.

- •Responded to stakeholder inquiries with detailed explanations of financial data, enhancing client satisfaction by 20%.

- •Supported the investment team by conducting detailed financial analyses, resulting in improved investment decision-making.

- •Streamlined data collection and processing for fund performance reports, reducing report preparation time by 25%.

- •Facilitated communication between accounting and fund management teams, enhancing collaborative decision-making processes.

- •Contributed to policy development initiatives that standardized financial analysis procedures, boosting efficiency significantly.

- •Assisted in financial reconciliations and reporting, supporting a successful year-end close process.

- •Enhanced transaction accuracy through diligent record-keeping and compliance with financial regulations.

- •Collaborated with accounting team members to implement new software, improving overall department efficiency.

- •Analyzed and interpreted financial data, providing valuable insights for management.

Navigating the world of fund accounting can sometimes feel like sailing through turbulent waters, but your financial expertise and keen analytical skills equip you to steer your career ship. A standout resume should be your tool to shape this journey. Yet, translating your complex experiences into a clear document presents a real challenge.

This is where the struggle often lies: effectively communicating your successes in a way that's instantly understandable. You need to balance showcasing your financial acumen with creating an easily digestible format. A well-crafted resume serves as a compass, guiding potential employers to appreciate your value.

To help you achieve this, a structured layout can work wonders. Using a resume template ensures that your experience and skills light up the page clearly and professionally. Whether you're a seasoned accountant or just starting out, resume templates can help focus your resume on what truly matters: demonstrating your capability to handle complex funds and financial statements.

Dive into the process with confidence, knowing your resume can illuminate your unique talents to potential employers. Let this document be more than just a summary; it’s your bridge to new opportunities and a platform to connect with those who will value your skill set.

Key Takeaways

- A standout fund accountant resume should clearly demonstrate your financial expertise and ability to handle complex financial data, balancing technical skills with an easily readable format.

- Utilizing a resume template helps organize content in a professional manner, allowing you to highlight key skills such as fund reconciliation, financial reporting, and industry compliance effectively.

- Choosing a reverse chronological resume format is crucial as it showcases job progression and highlights relevant experience in financial management, enhancing employer assessment.

- Including quantifiable achievements in the experience section through strong action verbs and specific figures effectively illustrates your contributions and aligns with recruiters' priorities.

- A comprehensive skills section should highlight both hard and soft skills essential to fund accounting, while the education and certifications sections further establish qualifications and industry competence.

What to focus on when writing your fund accountant resume

A fund accountant resume should convey your strong financial acumen and precise accounting skills to the recruiter. This document needs to clearly demonstrate your ability to handle complex financial data while adhering to industry regulations, showcasing your expertise in investment and fund management.

How to structure your fund accountant resume

- Contact Information—Start with your name, phone number, email, and LinkedIn profile. It’s crucial to keep this section simple yet professional, as it’s the first impression you’ll make. Ensure that each detail is current and formatted correctly to make it easy for the recruiter to contact you.

- Professional Summary—Offer a brief snapshot of your fund accounting experience, encapsulating your key strengths such as fund reconciliation, financial reporting, and industry compliance. This section should capture attention quickly, reflecting your suitability for the role in just a few lines and setting the tone for the rest of your resume.

- Work Experience—Include details of your previous roles, focusing on achievements in fund management and financial analysis that underline your reliability and accuracy in reporting. Use clear, action-oriented language to describe your contributions and impact, which helps the recruiter see the value you bring to the table.

- Skills—List targeted skills essential to fund accounting, like NAV calculations and risk assessment, along with proficiency in accounting software such as QuickBooks or SAP. This section should highlight both your technical and analytical prowess, making your resume stand out in a competitive field.

- Education—Detail your educational background, mentioning degrees, certifications, and relevant courses such as a bachelor’s degree in finance or CPA certification. This section should demonstrate a strong theoretical foundation, reassuring the recruiter of your deep understanding of accounting principles.

- Technical Proficiencies—Emphasize your familiarity with crucial software and tools used in fund accounting, like Bloomberg Terminal, Excel, and Oracle Financials. Showing these technical skills places you in a favorable position, underscoring your capability to handle complex accounting tasks efficiently.

Including optional sections such as awards, volunteer experience, or professional affiliations can provide additional insights into your commitment and expertise in the field. Now that we've covered the key components, let’s explore each resume section in more depth to bring clarity and impact to your application.

Which resume format to choose

Choosing the right format for your fund accountant resume is essential, and a reverse chronological format is particularly effective. This format emphasizes your job progression and highlights your relevant experience in financial management, allowing employers to quickly assess your suitability for the role. Your most recent positions are front and center, which is key in a detail-oriented field like fund accounting.

Fonts play a surprisingly important role in presenting a professional image. Opt for modern and clean fonts such as Montserrat, Raleway, or Lato. These fonts offer a contemporary feel that aligns with the modern financial environment and ensures your resume is easily readable, which can leave a positive impression on hiring managers.

To ensure your resume looks the same on any device or software, always save it as a PDF. PDFs maintain your layout and formatting, crucial in preventing any unintended alterations. This consistency demonstrates the meticulous attention to detail expected from a fund accountant.

Finally, consider your margins. Stick to one-inch margins on all sides to create a clean, organized look. This ample white space improves readability and helps direct focus to your key achievements and skills. By carefully selecting format, font, and file type, you're crafting a fund accountant resume that's both professional and compelling.

How to write a quantifiable resume experience section

The experience section of a fund accountant resume is crucial because it highlights your expertise and accomplishments, making you stand out to potential employers. It should focus on the most relevant aspects of the role, structured in reverse chronological order to show your most recent job first. Keeping your experience to the last 10-15 years ensures the content remains relevant and impactful. Highlight job titles that align with your career aspirations, ensuring that your resume matches the job ad by emphasizing the skills and keywords listed there. Strong action words like "managed," "analyzed," and "optimized" effectively convey your achievements.

To make your experience section shine, each bullet point should focus on quantifiable achievements. This means showcasing the results you brought to your past organizations through concrete examples. Here's an example:

- •Reduced month-end close processes by 20%, enhancing efficiency and timeliness of reporting.

- •Managed a $500 million portfolio, achieving a 15% increase in ROI through strategic analysis and adjustments.

- •Collaborated with cross-functional teams to implement new accounting software, reducing error rates by 30%.

- •Conducted quarterly audits that improved compliance standards and decreased regulatory discrepancies by 25%.

This experience section is effective because it connects your responsibilities with impactful results. Each bullet point uses strong action verbs and specific figures to illustrate your contributions. By aligning with the skills and expectations of fund accountants, you ensure your resume resonates with potential employers. Tailoring it to match industry priorities like efficiency, accuracy, and compliance further bolsters its appeal. Recruiters can easily recognize the value you bring, making your resume not only cohesive but also compelling. The concise and structured presentation helps capture attention and leaves a lasting impression.

Training and Development Focused resume experience section

A training and development-focused fund accountant resume experience section should effectively highlight your role in fostering a culture of learning and growth. Begin by thinking about moments where you helped others understand the nuances of fund accounting, either through direct teaching or by leading training sessions. Ensure your descriptions emphasize the positive impacts you've made, rather than just listing tasks, by showcasing any initiatives you’ve implemented that boosted team skills or efficiency. Consistently use clear, straightforward language to convey your leadership role in nurturing talent and supporting your colleagues' development.

Make your achievements stand out by including specific numbers and results where possible, illustrating the difference your efforts have made. Describe how your contributions improved both the skills of individual team members and the overall work environment. By doing so, you demonstrate not only your accounting acumen but also your ability to enhance a team's capabilities, which can be a valuable asset to any organization.

Senior Fund Accountant

ABC Investments

January 2020 - Present

- Led weekly training sessions for new interns, boosting their understanding of complex fund accounting tasks.

- Developed a comprehensive training manual that reduced onboarding time by 20%.

- Mentored junior accountants, resulting in a 30% improvement in their productivity.

- Organized monthly workshops on updated regulatory compliance, ensuring all team members were fully informed.

Innovation-Focused resume experience section

An innovation-focused fund accountant resume experience section should effectively showcase your ability to drive meaningful improvements and change. Start by highlighting instances where you initiated new processes, technologies, or strategies, which led to enhanced efficiency, compliance, or profitability. Clearly articulate the positive outcomes of your actions to help potential employers see you as someone who adds value by actively enhancing operations, rather than just fulfilling a role.

Use clear and impactful language that emphasizes your contributions. Incorporating quantifiable impacts is especially compelling, so include details of projects or initiatives that reflect your skill in improving systems or enhancing financial reporting accuracy. Structuring your achievements with bullet points creates a straightforward and engaging format that leaves no doubt about your capability to thrive in an innovative environment.

Fund Accountant

Innovative Financial Group

June 2020 - Present

- Spearheaded the introduction of automated accounting software, reducing manual processing time by 45%.

- Developed and implemented a new reconciliation process, resulting in a 30% reduction in discrepancies.

- Led a team to streamline data reporting, shortening financial close by two days each month.

- Coordinated with IT to enhance data security measures, cutting potential data breach incidents by 20%.

Leadership-Focused resume experience section

A leadership-focused fund accountant resume experience section should emphasize your ability to guide teams and make effective financial decisions. By showcasing your leadership skills in past roles, you can demonstrate your capacity to drive projects, improve processes, and mentor team members. It's important to articulate the positive impact your leadership had on both your team and the organization as a whole, creating a cohesive narrative throughout the section.

In your bullet points, focus on clear and concise achievements and relevant skills in fund accounting. Action verbs add dynamism and show off your proactive approach. Reflect on how you managed challenges and facilitated changes, providing any measurable results or recognitions to underscore your impact. Keeping your sentences straightforward allows your accomplishments to stand out and ensures a natural flow from one point to the next.

Senior Fund Accountant

FinPartners LLC

June 2018 - Present

- Led a team of 5 accountants in monthly fund processing, improving efficiency by 20%.

- Developed a training program for new hires, reducing onboarding time by 30%.

- Managed a project to automate financial reporting, enhancing accuracy and saving 10 hours per week.

- Recognized for fostering team collaboration, resulting in increased morale and performance.

Achievement-Focused resume experience section

A fund accountant-focused resume experience section should clearly illustrate the tangible impact you have made in your roles. Begin by identifying your major achievements and responsibilities, focusing on results and improvements that demonstrate your value. Use concise action verbs to depict your contributions, integrating numbers when possible to highlight your success. This focused approach ensures employers recognize how effectively you've applied your expertise in the field.

In crafting your resume, offer clear, detailed examples of your accomplishments that align with the job you're seeking. Use bullet points to maintain clarity, mentioning your role, the skills employed, and the positive outcomes these efforts produced. Ensure your descriptions are succinct and straightforward, showing how your experiences meet the job’s requirements. This strategy effectively showcases your achievements as a fund accountant, making your resume both compelling and memorable.

Fund Accountant

ABC Financial Services

June 2019 - Present

- Increased accuracy of financial reports by 30% through new data validation processes.

- Streamlined month-end accounting procedures, reducing closing time by 25%.

- Developed a training program for new team members, boosting team productivity by 15%.

- Managed account reconciliations, improving efficiencies and saving $50,000 annually.

Write your fund accountant resume summary section

A fund accountant-focused resume summary should concisely highlight your unique experiences and skills. This introduction is key to setting you apart from other candidates. A well-crafted summary captures your expertise and the value you bring to potential employers. Start by noting your years of experience, relevant certifications, and specific skills you've honed. Always ensure this aligns with the job description. For instance:

This example is powerful because it gives concrete details about your achievements. It uses strong, descriptive language like "detail-oriented" and mentions measurable successes. Highlighting your proficiency with accounting software indicates your readiness to contribute from day one.

When describing yourself in a resume summary, aim for honesty while strategically emphasizing strengths that match the role's requirements. Use terms such as "team player", "analytical thinker", or "problem solver" to quickly communicate your strengths. It's important to recognize the difference between a summary, a resume objective, and a resume profile. A summary emphasizes past achievements, while a resume objective might be more appropriate if you are switching fields and wish to highlight future aspirations. A resume profile can be broader, focusing on personal traits, and a summary of qualifications usually lists skills without detailed elaboration. This clarity helps employers quickly see how you fit into their organization.

Listing your fund accountant skills on your resume

A skills-focused fund accountant resume should clearly highlight your abilities to ensure employers see your value. Begin by deciding whether to have a separate skills section or integrate your skills within your experience and summary areas. This decision can guide how you highlight your soft and hard skills. Soft skills, like communication and collaboration, show your ability to work well with others, while hard skills are the specific technical abilities you've acquired in fund accounting. These skills serve as crucial keywords, catching the attention of employers and digital systems alike.

Consider this example of a standalone skills section for a fund accountant, presented in JSON format:

This example illustrates how to list skills simply and directly, keeping the focus clear and relevant to fund accounting. The straightforward language ensures that your skills stand out without unnecessary complexity.

Best hard skills to feature on your fund accountant resume

For a fund accountant, showcasing hard skills is essential to highlight your technical expertise. These skills are fundamental in demonstrating your competence and ability to handle key job responsibilities.

Hard Skills

- Fund Accounting

- Financial Analysis

- Portfolio Management

- Reconciliation

- Investment Strategy Development

- Risk Management

- Financial Modeling

- Tax Preparation

- Regulatory Compliance

- Budgeting and Forecasting

- Advanced Microsoft Excel

- General Ledger Accounting

- Data Analysis

- Performance Measurement

- Cost Accounting

Best soft skills to feature on your fund accountant resume

Equally important, soft skills illustrate how well you work with others and adapt to different scenarios. They communicate your interpersonal strengths, problem-solving abilities, and flexibility in handling the diverse demands of the role.

Soft Skills

- Attention to Detail

- Communication Skills

- Time Management

- Problem Solving

- Adaptability

- Analytical Thinking

- Team Collaboration

- Initiative

- Client Orientation

- Multitasking

- Ethical Judgment

- Decision Making

- Interpersonal Skills

- Stress Management

- Negotiation Skills

How to include your education on your resume

The education section is a crucial part of your fund accountant resume. You must tailor this section to highlight relevant education for the position you are applying for. It is recommended to leave out any education that does not pertain to the field of accounting or finance. Including your GPA can be helpful if it strengthens your application, particularly if it is 3.5 or higher. For honors such as cum laude, include them alongside your degree. Your degree should be listed clearly with the title, major, and the name of the institution. Below are examples demonstrating how to present this information effectively.

The second example stands out for a few reasons. It includes a degree directly related to the fund accounting field. The honors distinction, cum laude, succinctly highlights academic excellence. The GPA is clearly stated, showing the applicant’s strong academic performance. This focused education section is well-aligned with the job being applied for, thus increasing the applicant’s chances.

How to include fund accountant certificates on your resume

Including a certificates section in your fund accountant resume is crucial. Certificates add credibility and showcase specialized knowledge, clearly setting you apart from other candidates. List the name of the certificate first. Include the date you obtained it next. Add the issuing organization to provide authenticity. Certificates can also appear in your header. For example, "John Doe, CPA, CFA" immediately highlights key qualifications.

An effective certificate section should be well-organized and relevant to the job.

This example is strong because it lists high-value certifications specific to finance and accounting. The titles and issuers are clear and recognizable, ensuring your qualifications are easily understood. It's concise and pertinent, enhancing readability while boosting your credentials effectively. Including these details helps you stand out in the job market.

Extra sections to include in your fund accountant resume

Crafting a resume for a fund accountant can be simple yet impactful by including diverse sections that highlight your complete profile. These sections can provide a well-rounded view of your skills and personality, giving you an edge.

Language section—Showcase proficiency in multiple languages to demonstrate your ability to communicate in diverse business environments. Include languages you are fluent in to highlight your global collaboration potential.

Hobbies and interests section—List hobbies that reflect analytical thinking and attention to detail, such as chess or Sudoku. These activities can indicate that you have the critical thinking skills important for accounting roles.

Volunteer work section—Highlight volunteer experiences to show your community involvement and teamwork skills. This section can also reflect your dedication and the ethical values you bring to the workplace.

Books section—Mention books related to finance or personal development that you have read to showcase your commitment to continuous learning. This can help illustrate your enthusiasm for the field and your willingness to keep updated with industry trends.

In Conclusion

In conclusion, crafting a standout resume is integral to advancing your career as a fund accountant. Your resume is more than just a record of your experience; it's a reflection of your skills, your understanding of fund management, and your readiness to take on new challenges. Focus on clarity and conciseness in conveying your expertise with complex financial tasks, ensuring that your key strengths shine through. Use a structured format that highlights your most recent roles and achievements, demonstrating both your technical acumen and your contributions to past organizations.

Don’t underestimate the power of a well-tailored resume summary. Briefly showcase your financial knowledge and analytical abilities to reassure employers of your ability to drive results. With the right resume format, including judicious font choices and PDF formatting, your resume will maintain its polished look across all platforms. Lastly, remember that the resume is just one piece of the job application puzzle. It should complement your proactive efforts in networking, professional development, and continued learning.

Every section of your resume, from skills to education, should be strategically crafted to communicate the value you can bring to a potential employer. The use of quantifiable achievements and industry-relevant keywords enhances your resume's effectiveness, making you a compelling candidate in the competitive world of fund accounting. By paying attention to detail and selecting information relevant to the role at hand, you create a powerful tool that serves as your professional calling card. With a clear direction and focused presentation, your resume can open doors to exciting opportunities in the finance industry, placing you on a path to continuous growth and success.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.