General Accountant Resume Examples

Jul 18, 2024

|

12 min read

Balancing Your Skills and Experience: A User-Friendly Guide to Crafting the Perfect General Accountant Resume

Rated by 348 people

Tax Accountant

Corporate Financial Accountant

Budgeting and Forecasting Accountant

Fixed Asset Accountant

Payroll Accountant

Management Accountant

Forensic Accountant

Public Sector Accountant

Cost Accountant

Project Accountant

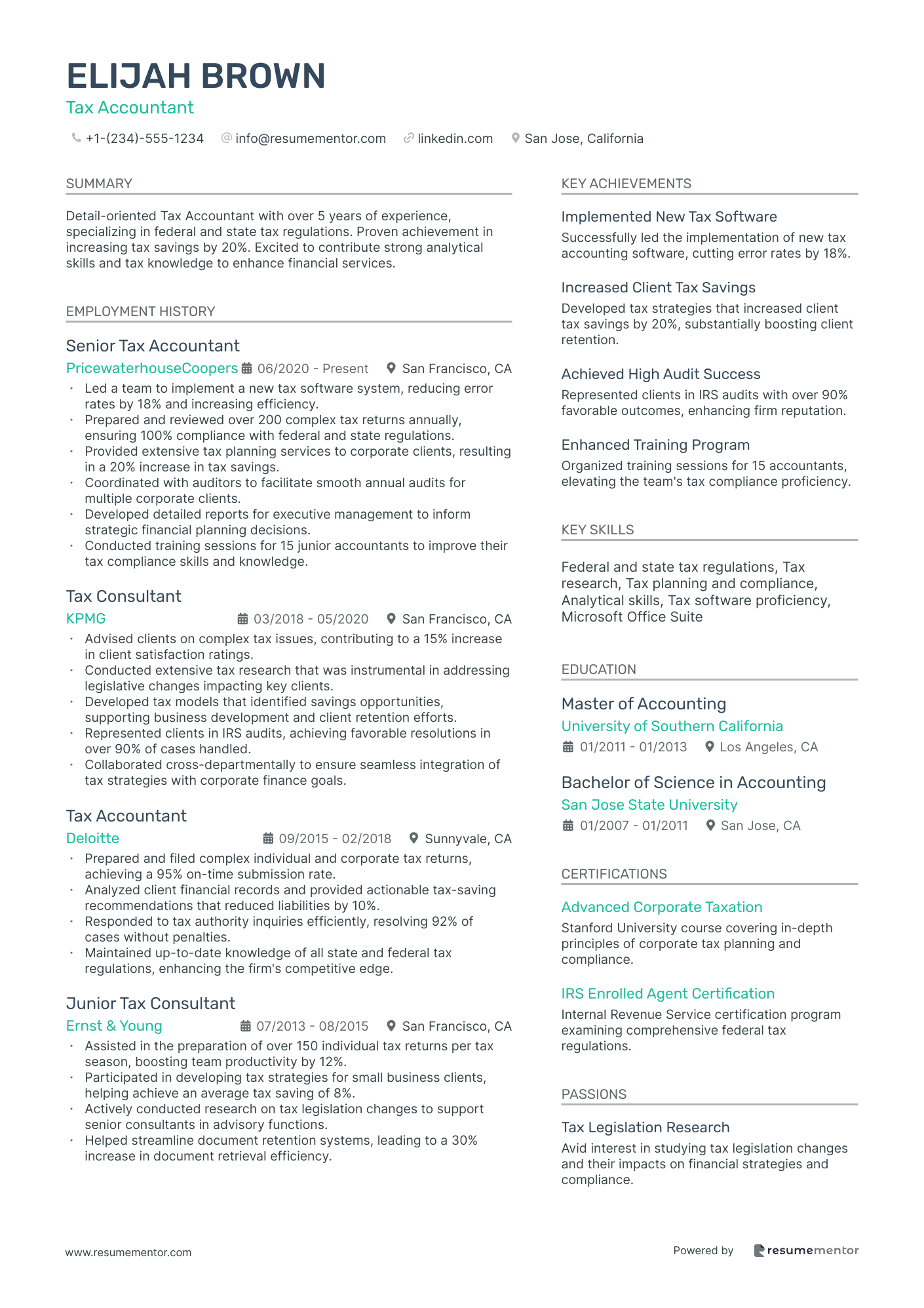

Tax Accountant resume sample

- •Led a team to implement a new tax software system, reducing error rates by 18% and increasing efficiency.

- •Prepared and reviewed over 200 complex tax returns annually, ensuring 100% compliance with federal and state regulations.

- •Provided extensive tax planning services to corporate clients, resulting in a 20% increase in tax savings.

- •Coordinated with auditors to facilitate smooth annual audits for multiple corporate clients.

- •Developed detailed reports for executive management to inform strategic financial planning decisions.

- •Conducted training sessions for 15 junior accountants to improve their tax compliance skills and knowledge.

- •Advised clients on complex tax issues, contributing to a 15% increase in client satisfaction ratings.

- •Conducted extensive tax research that was instrumental in addressing legislative changes impacting key clients.

- •Developed tax models that identified savings opportunities, supporting business development and client retention efforts.

- •Represented clients in IRS audits, achieving favorable resolutions in over 90% of cases handled.

- •Collaborated cross-departmentally to ensure seamless integration of tax strategies with corporate finance goals.

- •Prepared and filed complex individual and corporate tax returns, achieving a 95% on-time submission rate.

- •Analyzed client financial records and provided actionable tax-saving recommendations that reduced liabilities by 10%.

- •Responded to tax authority inquiries efficiently, resolving 92% of cases without penalties.

- •Maintained up-to-date knowledge of all state and federal tax regulations, enhancing the firm's competitive edge.

- •Assisted in the preparation of over 150 individual tax returns per tax season, boosting team productivity by 12%.

- •Participated in developing tax strategies for small business clients, helping achieve an average tax saving of 8%.

- •Actively conducted research on tax legislation changes to support senior consultants in advisory functions.

- •Helped streamline document retention systems, leading to a 30% increase in document retrieval efficiency.

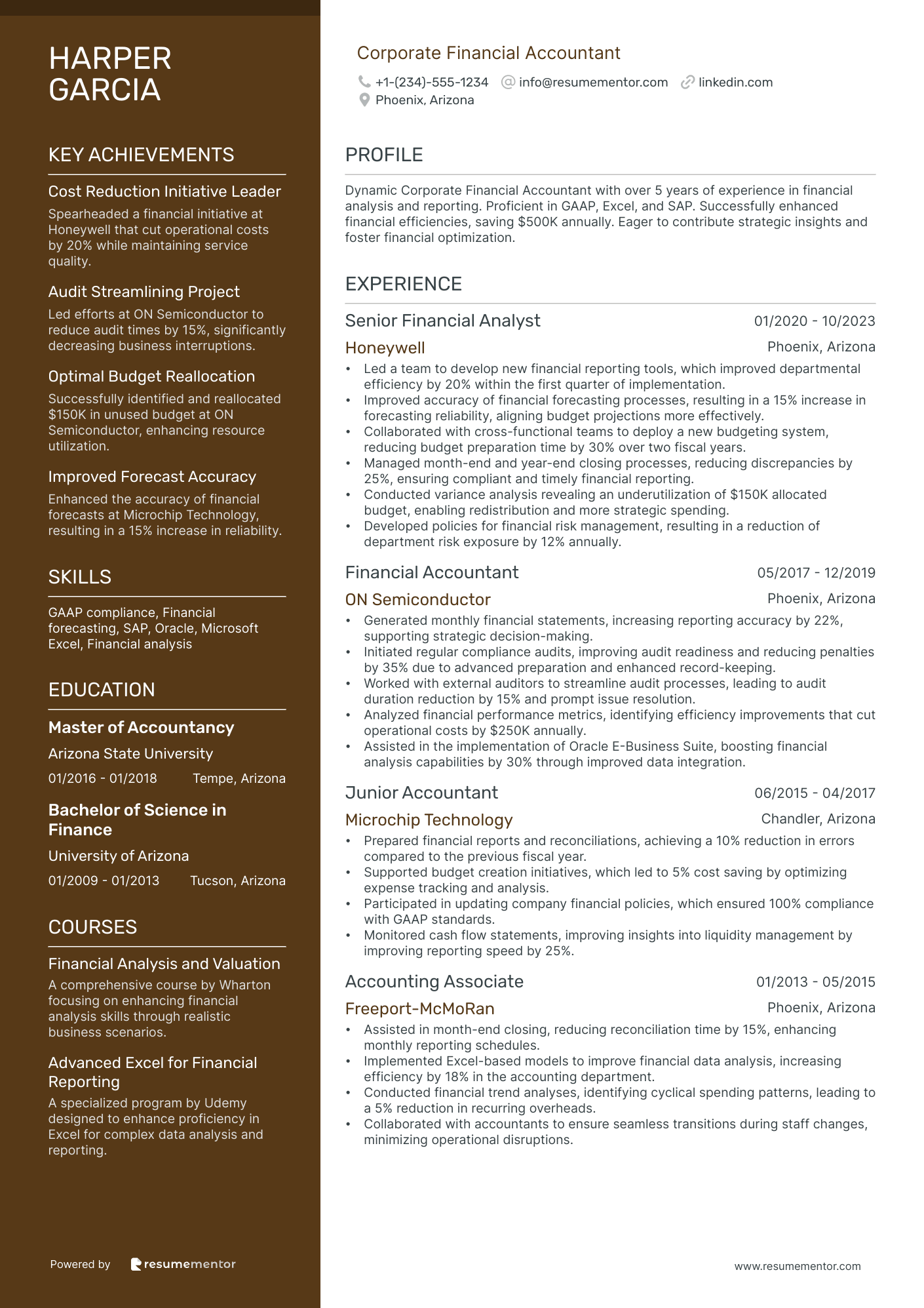

Corporate Financial Accountant resume sample

- •Led a team to develop new financial reporting tools, which improved departmental efficiency by 20% within the first quarter of implementation.

- •Improved accuracy of financial forecasting processes, resulting in a 15% increase in forecasting reliability, aligning budget projections more effectively.

- •Collaborated with cross-functional teams to deploy a new budgeting system, reducing budget preparation time by 30% over two fiscal years.

- •Managed month-end and year-end closing processes, reducing discrepancies by 25%, ensuring compliant and timely financial reporting.

- •Conducted variance analysis revealing an underutilization of $150K allocated budget, enabling redistribution and more strategic spending.

- •Developed policies for financial risk management, resulting in a reduction of department risk exposure by 12% annually.

- •Generated monthly financial statements, increasing reporting accuracy by 22%, supporting strategic decision-making.

- •Initiated regular compliance audits, improving audit readiness and reducing penalties by 35% due to advanced preparation and enhanced record-keeping.

- •Worked with external auditors to streamline audit processes, leading to audit duration reduction by 15% and prompt issue resolution.

- •Analyzed financial performance metrics, identifying efficiency improvements that cut operational costs by $250K annually.

- •Assisted in the implementation of Oracle E-Business Suite, boosting financial analysis capabilities by 30% through improved data integration.

- •Prepared financial reports and reconciliations, achieving a 10% reduction in errors compared to the previous fiscal year.

- •Supported budget creation initiatives, which led to 5% cost saving by optimizing expense tracking and analysis.

- •Participated in updating company financial policies, which ensured 100% compliance with GAAP standards.

- •Monitored cash flow statements, improving insights into liquidity management by improving reporting speed by 25%.

- •Assisted in month-end closing, reducing reconciliation time by 15%, enhancing monthly reporting schedules.

- •Implemented Excel-based models to improve financial data analysis, increasing efficiency by 18% in the accounting department.

- •Conducted financial trend analyses, identifying cyclical spending patterns, leading to a 5% reduction in recurring overheads.

- •Collaborated with accountants to ensure seamless transitions during staff changes, minimizing operational disruptions.

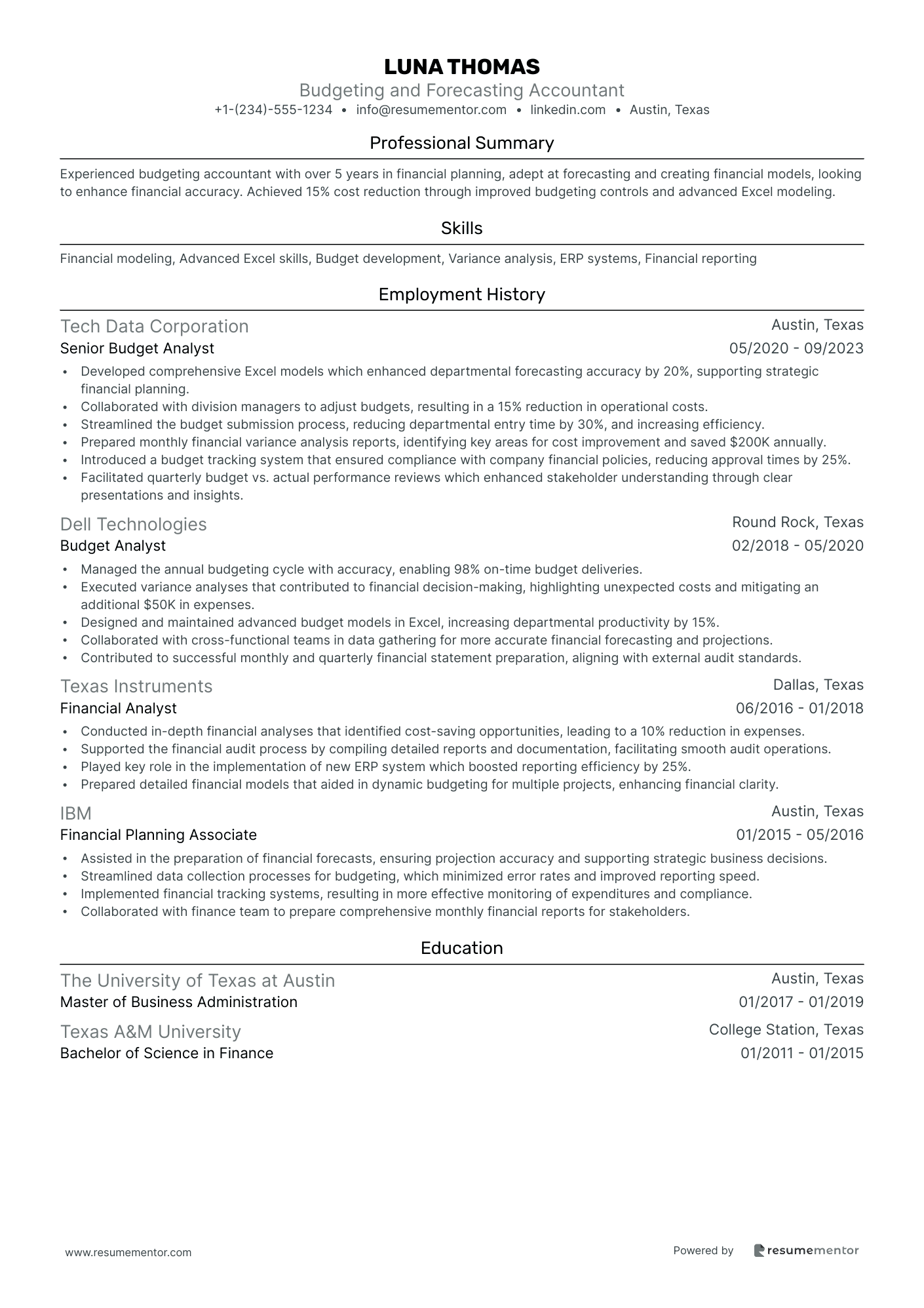

Budgeting and Forecasting Accountant resume sample

- •Developed comprehensive Excel models which enhanced departmental forecasting accuracy by 20%, supporting strategic financial planning.

- •Collaborated with division managers to adjust budgets, resulting in a 15% reduction in operational costs.

- •Streamlined the budget submission process, reducing departmental entry time by 30%, and increasing efficiency.

- •Prepared monthly financial variance analysis reports, identifying key areas for cost improvement and saved $200K annually.

- •Introduced a budget tracking system that ensured compliance with company financial policies, reducing approval times by 25%.

- •Facilitated quarterly budget vs. actual performance reviews which enhanced stakeholder understanding through clear presentations and insights.

- •Managed the annual budgeting cycle with accuracy, enabling 98% on-time budget deliveries.

- •Executed variance analyses that contributed to financial decision-making, highlighting unexpected costs and mitigating an additional $50K in expenses.

- •Designed and maintained advanced budget models in Excel, increasing departmental productivity by 15%.

- •Collaborated with cross-functional teams in data gathering for more accurate financial forecasting and projections.

- •Contributed to successful monthly and quarterly financial statement preparation, aligning with external audit standards.

- •Conducted in-depth financial analyses that identified cost-saving opportunities, leading to a 10% reduction in expenses.

- •Supported the financial audit process by compiling detailed reports and documentation, facilitating smooth audit operations.

- •Played key role in the implementation of new ERP system which boosted reporting efficiency by 25%.

- •Prepared detailed financial models that aided in dynamic budgeting for multiple projects, enhancing financial clarity.

- •Assisted in the preparation of financial forecasts, ensuring projection accuracy and supporting strategic business decisions.

- •Streamlined data collection processes for budgeting, which minimized error rates and improved reporting speed.

- •Implemented financial tracking systems, resulting in more effective monitoring of expenditures and compliance.

- •Collaborated with finance team to prepare comprehensive monthly financial reports for stakeholders.

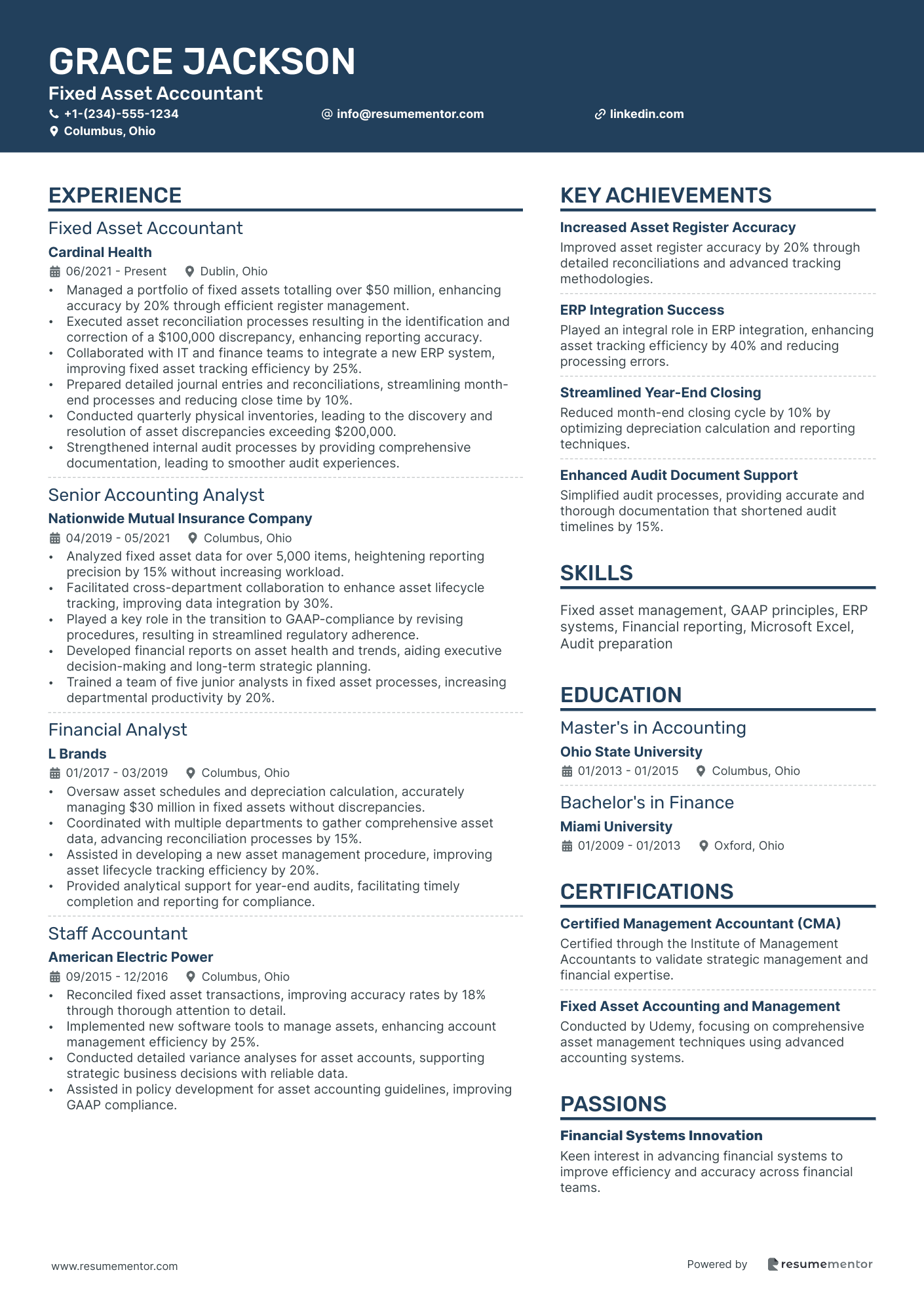

Fixed Asset Accountant resume sample

- •Managed a portfolio of fixed assets totalling over $50 million, enhancing accuracy by 20% through efficient register management.

- •Executed asset reconciliation processes resulting in the identification and correction of a $100,000 discrepancy, enhancing reporting accuracy.

- •Collaborated with IT and finance teams to integrate a new ERP system, improving fixed asset tracking efficiency by 25%.

- •Prepared detailed journal entries and reconciliations, streamlining month-end processes and reducing close time by 10%.

- •Conducted quarterly physical inventories, leading to the discovery and resolution of asset discrepancies exceeding $200,000.

- •Strengthened internal audit processes by providing comprehensive documentation, leading to smoother audit experiences.

- •Analyzed fixed asset data for over 5,000 items, heightening reporting precision by 15% without increasing workload.

- •Facilitated cross-department collaboration to enhance asset lifecycle tracking, improving data integration by 30%.

- •Played a key role in the transition to GAAP-compliance by revising procedures, resulting in streamlined regulatory adherence.

- •Developed financial reports on asset health and trends, aiding executive decision-making and long-term strategic planning.

- •Trained a team of five junior analysts in fixed asset processes, increasing departmental productivity by 20%.

- •Oversaw asset schedules and depreciation calculation, accurately managing $30 million in fixed assets without discrepancies.

- •Coordinated with multiple departments to gather comprehensive asset data, advancing reconciliation processes by 15%.

- •Assisted in developing a new asset management procedure, improving asset lifecycle tracking efficiency by 20%.

- •Provided analytical support for year-end audits, facilitating timely completion and reporting for compliance.

- •Reconciled fixed asset transactions, improving accuracy rates by 18% through thorough attention to detail.

- •Implemented new software tools to manage assets, enhancing account management efficiency by 25%.

- •Conducted detailed variance analyses for asset accounts, supporting strategic business decisions with reliable data.

- •Assisted in policy development for asset accounting guidelines, improving GAAP compliance.

Payroll Accountant resume sample

- •Managed a bi-weekly payroll process for over 400 employees, achieving a 99.9% accuracy rate in processing payroll.

- •Developed detailed payroll reports for management, resulting in more informed financial decisions and improved compliance.

- •Implemented payroll system enhancements that reduced processing time by 15% and increased employee satisfaction ratings.

- •Collaborated with HR to ensure correct and timely updates to employee records, enhancing data integrity and compliance.

- •Conducted internal audits of payroll records, identifying discrepancies and resolving 100% of issues promptly.

- •Responded to employee payroll inquiries efficiently, reducing inquiries by 25% through improved communication and resources.

- •Processed payroll for 300+ staff, achieving 98% satisfaction on payroll queries and issues resolution.

- •Improved tax compliance, reducing errors in W-2 forms by 30% via rigorous checking and collaboration with the tax department.

- •Led the transition to a new payroll software, resulting in streamlined operations and 20% faster payroll processing time.

- •Calculated complex bonuses and deductions, ensuring precise alignment with company policies and regulations.

- •Provided training to new payroll team members, enhancing service level and efficiency by 15% within a 6-month period.

- •Processed bi-monthly payroll for 250 employees, consistently maintaining a 98% on-time rate and resolving delays.

- •Collaborated with the finance team to integrate payroll data into the overall financial reporting and audit processes.

- •Reduced payroll discrepancies by 40% through enhanced verification processes and regular updates to payroll procedures.

- •Managed year-end payroll activities, ensuring accurate and timely issuance of W-2 forms to all employees involved.

- •Assisted in processing payroll for 100 employees, ensuring compliance with local, state, and federal regulations.

- •Maintained payroll records and calendared tasks, resulting in improved record accuracy and reduced administrative errors.

- •Participated in payroll system upgrades, providing feedback and testing new functionalities to ensure smooth transitions.

- •Collaborated with team members to resolve payroll discrepancies, achieving a 90% reduction in processing errors.

Management Accountant resume sample

- •Led the preparation and presentation of monthly management accounts, reducing reporting errors by 15% over a year.

- •Enhanced annual budgeting process by introducing a new analysis model, improving stakeholder satisfaction scores by 20%.

- •Facilitated the implementation of an automated reporting system, resulting in a 30% reduction in reporting time.

- •Collaborated with department heads to provide financial insights, successfully aiding 5 business units to make data-driven decisions.

- •Liaised with external auditors, ensuring 100% compliance with national standards during the annual audit cycle.

- •Developed a comprehensive cash flow forecasting system that improved cash management efficiency by 25%.

- •Managed annual forecasting processes, contributing to a 15% increase in forecast accuracy across departments.

- •Implemented regular variance analysis to highlight discrepancies, leading to a 10% cost saving on operational expenses.

- •Improved the accuracy of profit and loss analyses by 20%, enhancing overall financial visibility.

- •Coordinated with cross-functional teams for financial reporting, achieving a 95% timeliness rate in quarterly reports.

- •Pioneered the adoption of new accounting software, improving financial data processing efficiency by 40%.

- •Conducted detailed financial analyses, supporting strategic decisions with a 25% improvement in ROI for key projects.

- •Prepared detailed balance sheet reconciliations, maintaining a less than 2% variance from recorded figures.

- •Designed a robust financial performance monitoring system, aiding in identifying cost-reduction opportunities.

- •Executed monthly financial reviews, contributing to a 15% improvement in financial data accuracy.

- •Assisted in preparing financial reports, contributing to a timely year-end closure with zero discrepancies.

- •Supported budgeting activities by providing accurate data, resulting in a 10% improvement in budget alignment.

- •Implemented process improvements in financial data collection, reducing data entry errors by 25%.

- •Participated in cross-departmental budget meetings, enhancing collaborative efforts for budgetary planning.

Forensic Accountant resume sample

- •Led a complex financial investigation uncovering fraudulent activities worth $1.5M, improving client's internal controls.

- •Implemented a financial discrepancy analysis process, reducing error rates by 25% and enhancing financial transparency.

- •Trained and mentored three junior staff, boosting the overall department efficiency by 15% through improved practices.

- •Collaborated with legal teams and law enforcement on high-stakes cases, exceeding expectations in fraud detection.

- •Developed comprehensive reports and presented findings to stakeholders, contributing to successful litigation outcomes.

- •Conducted audits on high-profile clients, identifying $500K in recoverable revenue through enhanced fraud detection methods.

- •Managed audits for Fortune 500 clients, discovering financial misstatements and recovering $300K in lost revenue.

- •Implemented new analytical frameworks that improved audit accuracy by 30%, leading to more reliable reporting.

- •Collaborated with cross-functional teams to investigate complex financial discrepancies, successfully mitigating risk factors.

- •Audited complex accounting systems across various industries, resulting in enhanced compliance and risk management.

- •Reported investigative findings to senior executives, fostering a culture of transparency and accountability across departments.

- •Developed comprehensive financial models, resulting in optimized budget strategies for clients, increasing efficiency by 20%.

- •Conducted thorough financial reviews, identifying $250K in cost-saving opportunities through improved financial processes.

- •Supported forensic accounting team on critical investigations, enhancing fraud prevention measures leading to enhanced safety.

- •Prepared and analyzed financial statements, providing strategic insights that improved client decision-making processes.

- •Assisted in conducting audits on diverse portfolios, contributing to the detection of $200K in financial irregularities.

- •Enhanced financial reporting accuracy by developing a detailed internal review process, reducing errors by 15%.

- •Supported senior auditors in drafting audit reports, gaining expertise in financial analysis and fraud prevention strategies.

- •Collaborated on audits of multinational corporations, learning best practices and applying them to improve financial analyses.

Public Sector Accountant resume sample

- •Led a team of accountants to streamline month-end close processes, reducing completion time by 25% within the first six months.

- •Implemented new internal controls that decreased accounting errors by 15%, enhancing the accuracy of financial reports for senior management.

- •Oversaw the preparation of financial statements adhering to GAAP and GASB standards, which improved compliance ratings in annual audits.

- •Developed innovative budgeting templates that improved departmental forecasting accuracy, resulting in more efficient resource allocation.

- •Collaborated with the IT department to upgrade financial software, providing a 30% increase in productivity in account reconciliations.

- •Provided financial insights and recommendations during high-level strategy meetings, aiding the city’s financial policy development.

- •Analyzed revenue streams and expenditure reports, offering insights that resulted in a 10% cost-saving initiative across state programs.

- •Monitored financial transactions for grants and public funds to ensure compliance with governmental regulations.

- •Conducted regular financial audits and variance analysis, which led to identifying discrepancies and reducing irregularities by 12%.

- •Trained junior staff on financial reporting best practices, enhancing team efficiency and report accuracy.

- •Facilitated coordination between departments for budget preparation, ensuring alignment with strategic objectives and improving consistency across reports.

- •Prepared monthly financial statements and account reconciliations, maintaining a 98% accuracy rate in financial reporting.

- •Assisted in the preparation of an annual budget of $2 billion, contributing to its approval and effective allocation within the university.

- •Managed general ledger activities and ensured the timely completion of account closures, supporting efficient financial operations.

- •Communicated effectively with department heads to improve transparency in budgetary practices and financial accountability.

- •Supported the senior accountant in maintaining financial records and conducting monthly reconciliations for departmental accounts.

- •Contributed to a significant departmental cost-reduction project, achieving a 5% decrease in operational expenses over two years.

- •Assisted in audit preparations resulting in smoother audit processes and identified areas for policy enhancement.

- •Suggested improvements to the existing invoice processing system, leading to a 20% reduction in processing time.

Cost Accountant resume sample

- •Developed and maintained product cost models, leading to a 7% cost reduction in manufacturing processes.

- •Collaborated with operations teams to monitor inventory levels, achieving a 20% reduction in surplus inventory.

- •Led monthly closing processes, ensuring accurate journal entries, resulting in a 10% decrease in financial discrepancies.

- •Analyzed cost variance reports, identifying inefficiencies, and implemented cost control measures saving $200K annually.

- •Enhanced forecasting accuracy by 15% through improved budgeting methodologies and data collection processes.

- •Presented detailed reports to senior management, providing actionable insights and uncovering a $500K potential cost-saving opportunity.

- •Assisted in the preparation of annual budgets, contributing to a 12% increase in financial efficiency.

- •Conducted in-depth financial analysis to support decision-making, resulting in optimized resource allocation.

- •Improved cost analysis processes, reducing time to produce financial reports by 30%.

- •Worked alongside production teams to establish a new costing model, enhancing profitability by 5%.

- •Supported audit processes with comprehensive documentation, accelerating audit completion by 2 weeks.

- •Analyzed fixed and variable costs, aiding in the identification of a $100K annual cost reduction opportunity.

- •Assisted in the creation of cost estimation models, improving budgeting accuracy by 10%.

- •Developed inventory cost tracking systems, reducing pricing errors by 20%.

- •Contributed to cross-departmental projects focused on optimizing budget allocations, saving $250K in the first year.

- •Facilitated financial forecasting and variance analysis, supporting a 15% improvement in budgeting techniques.

- •Collaborated with finance teams to optimize data management systems, saving $50K in annual operational costs.

- •Prepared detailed financial reports, enhancing senior management's decision-making capabilities.

- •Led initiatives to streamline financial processes, reducing data entry errors by 25%.

Project Accountant resume sample

- •Managed project budgets and financial plans exceeding $5 million, ensuring accuracy and compliance, which increased project efficiency by 15%.

- •Prepared monthly financial statements and variance analyses that improved financial visibility and informed decision-making for executive management.

- •Collaborated with project managers to reconcile expenses and financial forecasting, reducing billing discrepancies by 20%.

- •Enhanced the accuracy of client billing, achieving a 98% on-time completion rate through rigorous reconciliations and analysis.

- •Implemented a new project costing system that reduced erroneous entries by 30% and saved 15 hours of work weekly.

- •Played a key role during financial audits by providing necessary documents and explanations, resulting in zero audit findings.

- •Conducted financial analyses for multiple infrastructure projects, leading to a 10% cost-saving initiative for the fiscal year.

- •Oversaw accounts payable and receivable, reducing overdue receivables by 35% through targeted follow-up strategies.

- •Revamped financial reporting processes, decreasing monthly report turnaround times by 25%, enhancing stakeholder communications.

- •Actively supported project teams, providing financial insights that facilitated informed decision-making and strategic planning.

- •Negotiated project contracts and scope changes worth over $2 million, securing favorable terms and upholding fiscal responsibility.

- •Prepared comprehensive financial analyses and reports that improved budget forecasts by 15%, supporting executive decision-making.

- •Streamlined the financial documentation process, resulting in 20% faster retrieval and archiving, enhancing audit preparedness.

- •Participated in the development of financial models to assess long-term project viability, leading to strategic reallocations of resources.

- •Engaged with cross-functional teams to develop project-specific financial strategies, improving budget adherence by 10%.

- •Managed the preparation of financial statements, gaining experience that supported a 99% accuracy in financial reporting.

- •Assisted in the financial aspects of projects, contributing to a 12% reduction in financial discrepancies through thorough account reconciliations.

- •Conducted regular audits and maintained project documentation, ensuring compliance with industry regulations and standards.

- •Provided financial support and guidelines to the project teams, improving project execution timeliness by 10%.

In the competitive job market, crafting a resume as a general accountant can feel like navigating a multifaceted spreadsheet. Your skills in financial analysis coupled with precise number-crunching need to stand out, but transforming them into an effective resume isn’t simple. This challenge often involves deciding how to properly highlight your technical expertise and accomplishments without losing clarity.

When piecing together the story of your career, it’s easy to get caught in industry jargon and complexities that muddle your message. To connect with potential employers, your resume must clearly communicate the value you bring, rather than just listing past roles.

Here’s where structure becomes vital. A well-organized resume template can help your key achievements and qualifications shine brightly. Using resume templates can simplify the design process, allowing you to focus on content that matters.

Think of your resume as more than just a document; it’s a bridge to new career opportunities. It’s your chance to step into the next major role in accounting. With a strategic approach, you can weave your career history into a compelling narrative that resonates with employers. Ready to get started? Let’s make your resume as sharp and impactful as your financial reports.

Key Takeaways

- Crafting an effective resume requires highlighting technical expertise and accomplishments clearly without overusing industry jargon.

- A structured resume template enhances the presentation of key achievements and qualifications, with templates available to streamline this process.

- A reverse-chronological format is recommended for organizing work experience, as it emphasizes recent roles and career progression.

- Quantifying achievements in the experience section demonstrates impact, using action-oriented bullet points to align with job requirements.

- The skills section should include a mix of hard and soft skills tailored to the role, ensuring relevance and coherence throughout the resume.

What to focus on when writing your general accountant resume

Your general accountant resume should clearly convey your strong financial expertise to the recruiter, emphasizing your ability to manage various accounting tasks with precision and accuracy. Start with your contact information—ensure your full name, phone number, email address, and LinkedIn profile reflect your current professional persona. Including a personalized LinkedIn profile can showcase your professional network and recommendations.

How to structure your general accountant resume

- Follow up with a professional summary that offers a snapshot of your accounting background—highlight key skills and certifications like CPA or CMA that showcase your commitment to excellence. This summary should be concise yet powerful, leaving a strong first impression by focusing on your core strengths and unique value proposition in accounting.

- Next, delve into your work experience by detailing past roles—provide specifics like company names, locations, job titles, and employment dates. Illustrate your responsibilities with examples such as preparing financial statements or managing budgets, along with measurable accomplishments that demonstrate your impact in those roles. Quantifying achievements with figures like cost savings or efficiency improvements adds significant value.

- Your educational background is equally important—explicitly list your degrees in accounting or finance, clearly stating the institutions and graduation dates. Mention relevant coursework or honors to highlight advanced knowledge or achievement, shaping you as a well-rounded candidate with a strong foundation in financial principles.

- In the skills section, emphasize your proficiency with accounting software like QuickBooks or Excel—highlight additional competencies in financial reporting, tax preparation, and regulatory compliance to underscore your versatility. Make sure these skills reflect both technical ability and a keen understanding of the complexities in financial environments.

- To enhance your credibility, list certifications such as Certified Public Accountant (CPA)—these certifications add weight to your expertise and demonstrate a commitment to staying current within the profession. Optional sections like Volunteer Experience or Professional Associations can further demonstrate your involvement and dedication to accounting.

Now that we’ve outlined the key areas, below we'll cover each section more in-depth to ensure your resume stands out.

Which resume format to choose

A general accountant resume works best with a reverse-chronological format. This setup lets your most recent experience stand out, which is crucial in showing your career progression clearly and effectively. Employers are familiar with this format, making it easier for them to scan through your qualifications and get straight to the skills and expertise that matter in an accounting role.

When choosing fonts, you want something modern yet professional. Raleway, Lato, and Montserrat offer a fresh look without sacrificing readability. They help your resume look current and polished, making a good impression even before the content is read.

For file types, always save your resume as a PDF. PDFs preserve your formatting, ensuring that what you see is what the employer sees, regardless of the device or software they're using. This consistency is key in maintaining a professional appearance.

Lastly, set your margins to one inch on all sides. A well-structured layout with proper margins creates an inviting and easy-to-read document. Adequate white space helps prevent your resume from looking cluttered, ensuring that recruiters can focus on your achievements and skills without distraction. By keeping these elements in mind, you'll have a resume that not only looks great but effectively communicates your qualifications for an accounting position.

How to write a quantifiable resume experience section

The experience section of your general accountant resume is crucial because it connects your professional achievements to the job you're targeting. By focusing on clear, measurable successes, you highlight your ability to make a tangible impact. Start with your most recent position to guide recruiters through your career journey naturally. Including relevant roles like Accountant, Financial Analyst, or Accounting Manager over the past 10-15 years helps paint a complete picture of your experience. Tailor this section using keywords from the job ad to seamlessly demonstrate your alignment with the skills they need. Action words such as "enhanced," "orchestrated," "streamlined," and "managed" further emphasize your proactive and effective approach.

- •Led a team of four in reducing monthly closing process time by 20%, improving efficiency and accuracy.

- •Managed annual budget planning, resulting in a 15% cost reduction through strategic planning.

- •Orchestrated a new financial software implementation that cut reporting errors by 30%.

- •Enhanced financial forecasting accuracy by 25% by developing advanced Excel models.

This experience section effectively aligns your professional achievements with the job's requirements, creating a compelling narrative. Each bullet point uses strong action words, reinforcing the idea that your contributions directly benefited the company. Quantifiable achievements not only showcase your successes but also solidify your credentials by providing concrete evidence of your impact. By tailoring your role description and achievements to match job ads, you make a stronger connection with hiring managers seeking specific talents in accounting.

Project-Focused resume experience section

A project-focused resume experience section for a general accountant should vividly detail the projects where you've made noteworthy contributions. Begin with projects highlighting your role in streamlining processes or implementing innovative tools. Clearly display your results using specific numbers to showcase your achievements. This approach ensures that your responsibilities and accomplishments are directly relevant to the job you're pursuing.

To accomplish this, use strong action verbs to convey your contributions within each project, emphasizing your proactive approach. Bullet points organize information effectively, making it easy for employers to recognize your key achievements. Tailor each entry, connecting your duties with the outcomes, to demonstrate your understanding of the roles you’ve held.

General Accountant

ABC Corporation

June 2020 - May 2023

- Led efforts to streamline the monthly financial close process, cutting completion time by 20%.

- Worked closely with IT to automate recurring tasks, saving over 100 hours each year.

- Performed detailed variance analyses that enhanced budget accuracy by 8%.

- Created and conducted training sessions for more than 15 team members on new accounting software.

Collaboration-Focused resume experience section

A Collaboration-Focused general accountant resume experience section should highlight your skills in team dynamics and effective cooperation. Start by detailing how you've worked with others to achieve common objectives, addressing both challenges and process improvements. By being specific about your role, you can clearly show how your contributions led to measurable successes, emphasizing your ability to thrive in team settings. This approach helps create a compelling narrative that underscores your teamwork capabilities.

Use clear and impactful bullet points with strong action verbs to convey your accomplishments and initiative. Your achievements should align with the position you're targeting, ensuring potential employers readily understand the value you add to a team.

General Accountant

XYZ Corporation

January 2020 - Present

- Worked with cross-functional teams to streamline financial reporting processes, cutting meeting times by 15%.

- Led a team of four in transitioning to new accounting software, providing training and support that boosted efficiency by 20%.

- Facilitated monthly meetings with finance and sales teams to ensure accurate revenue forecasts, enhancing business planning.

- Collaborated with auditors during annual audits to reduce audit time and improve compliance with regulatory standards.

Skills-Focused resume experience section

A skills-focused general accountant resume experience section should clearly highlight your core abilities and achievements that align with the job you are seeking. Start by listing the position you held, the company name, and the dates of employment, setting the stage for a detailed overview of your role. When outlining your responsibilities and accomplishments, focus on those that best showcase how your accounting skills contributed to the company's financial success.

Using strong action verbs and quantifying your results can effectively demonstrate the impact of your work. Keep your sentences clear and connected, emphasizing practical examples where your skills made a difference. Align your accomplishments with what potential employers are looking for, particularly in financial analysis, budgeting, and reporting. Tailor your entries to show how you meet the specific demands of an accounting role, making the section cohesive and compelling.

Senior Accountant

ABC Financial Group

June 2020 - Present

- Streamlined operations by cutting monthly closing process time by 20%.

- Prepared financial statements and reports with GAAP compliance, ensuring accuracy and transparency.

- Provided strategic advice to executives by analyzing budget forecasts, demonstrating leadership in decision-making.

- Increased data accuracy by 30% with the implementation of a new accounting software system, showcasing adaptability and innovation.

Achievement-Focused resume experience section

A general accountant-focused resume experience section should clearly convey the achievements and the impact you’ve made in each role. Start by listing the time frame, job title, and company where you worked, as this sets the stage for highlighting your contributions. Use bullet points for each position to spotlight your accomplishments, focusing on how your actions brought positive changes to the organization. Numbers and percentages can effectively illustrate these changes, providing tangible evidence of your success.

Each bullet should begin with a strong action verb to emphasize the dynamic nature of your contributions. Focus on improvements you made, such as streamlining processes, cutting costs, enhancing team efficiency, or ensuring successful audits. Instead of listing generic duties, showcase what makes your work unique and impactful. This approach allows potential employers to clearly understand the value you’d bring to their company, ensuring you stand out in a competitive field.

Senior Accountant

ABC Corp

January 2018 - December 2020

- Developed and implemented a budget plan that reduced company expenses by 15% over two years.

- Managed monthly financial reporting processes, decreasing report turnaround time by 25%.

- Led a team of accountants through a successful audit with zero discrepancies, enhancing company credibility.

- Introduced a new software solution that improved data accuracy by 30%, facilitating better strategic decisions.

Write your general accountant resume summary section

A detail-focused general accountant resume summary should quickly convey why you're a compelling candidate. With a few lines, you can highlight your skills and achievements, particularly when it comes to handling financial data and maintaining accuracy. By using action verbs, you create a dynamic impression that stands out to potential employers. Take this example for instance:

This summary is effective because it integrates your experience, skills, and specific achievements, demonstrating real results and technical expertise in tools like Excel. The language is clear and strong, emphasizing what sets you apart and the value you offer.

Understanding various resume sections like summaries, objectives, profiles, and qualifications can help you choose the best one for your situation. A resume objective, ideal for newcomers or career changers, outlines your career ambitions. In contrast, a resume profile combines narrative elements of a summary and an objective. A summary of qualifications uses bullet points to highlight skills and achievements. The choice depends on your circumstances. For an experienced accountant, a summary focusing on accomplishments and impact is often the best fit. Keep in mind who will read your resume and what they value. Tailor each section to highlight your strengths relevantly.

[here was the JSON object 2]

This objective is perfect for entry-level candidates as it matches expectations, shows enthusiasm for applying skills, and emphasizes future contributions. Always consider your audience and the specific job role when deciding between these formats to craft a compelling resume.

Listing your general accountant skills on your resume

A skills-focused general accountant resume should feature an impactful skills section. This part of your resume can either stand alone or be woven into your experience or summary sections. Highlighting your strengths and soft skills demonstrates your ability to engage with others and handle challenges effectively. Meanwhile, your hard skills reflect specific expertise you've gained, such as proficiency with accounting software or financial analysis techniques. Using these skills and strengths as keywords in your resume allows it to stand out to both automated systems and hiring managers.

Here’s an example of a standalone skills section:

This skills section is effective because it clearly lists abilities closely linked to a general accountant's responsibilities. By aligning your skills with standard accounting duties, your resume becomes more appealing to both hiring managers and automated systems. Each listed skill is not only relevant but also showcases your competence confidently and succinctly.

Best hard skills to feature on your general accountant resume

Hard skills demonstrate your technical abilities and specialized knowledge. They show your competence with essential tools and accounting practices that help you perform your task efficiently. Here are the top in-demand hard skills for a general accountant:

Hard Skills

- Financial Reporting

- Excel Proficiency

- Tax Preparation

- Budgeting

- Accounts Reconciliation

- General Ledger Management

- Payroll Processing

- Regulatory Compliance

- Auditing Procedures

- Financial Analysis

- QuickBooks

- Data Entry

- SAP Financial Accounting

- Cost Accounting

- Fixed Asset Management

Best soft skills to feature on your general accountant resume

Soft skills reflect your interpersonal qualities and personal strengths. They emphasize your capability to collaborate well with others and handle responsibilities effectively. Some of the most valued soft skills for general accountants include:

Soft Skills

- Attention to Detail

- Time Management

- Communication

- Problem-Solving

- Adaptability

- Analytical Thinking

- Team Collaboration

- Decision-Making

- Organizational Skills

- Ethical Judgment

- Initiative

- Stress Management

- Leadership

- Critical Thinking

- Customer Service Orientation

How to include your education on your resume

The education section is an essential part of a general accountant's resume. It provides employers with your academic background and demonstrates your qualification for the role. Always tailor your education section to the specific job you're applying for; exclude any irrelevant degrees or courses. When listing your degree, make sure to include the name of the degree, the institution, and the graduation date. If you had a high GPA, you can include it, but only if it's 3.0 or higher. Use a format like "GPA: 3.5/4.0" to make it clear and concise. If you graduated with honors, such as cum laude, make sure to mention it right after your degree.

Here is a wrong example of an education section:

Here is a right example of an education section:

The right example is well-tailored to a general accountant position because it highlights a directly relevant degree in accounting. Including honors like "cum laude" adds prestige and demonstrates academic excellence. Listing a GPA of 3.6/4.0 shows that the candidate performed well in their studies, making them more appealing to employers. Additionally, the absence of unnecessary details like the institution's location keeps the section clean and focused. This streamlined approach enables a potential employer to quickly understand your qualifications.

How to include general accountant certificates on your resume

Including a certifications section on your general accountant resume is crucial. List the name of each certificate prominently. Include the date when it was awarded or is valid. Add the issuing organization for each certification. This section can stand alone or be included in the header for visibility.

For example, in the header, you might write: "Certified Public Accountant (CPA) - AICPA, awarded January 2020."

A good example of a standalone certificates section could look like this:

This example is effective because it clearly lists relevant certifications such as CPA and CMA, which are highly valued for accountants. Each certificate includes the issuing organization, adding credibility. The layout is clean and easy to read, making it simple for hiring managers to see your qualifications at a glance.

Extra sections to include in your general accountant resume

Building a compelling resume as a general accountant involves more than just listing your past jobs and educational achievements. You can also incorporate various sections that highlight your full spectrum of skills, interests, and experiences. These additional sections can add depth to your profile and demonstrate your multifaceted personality to potential employers.

- Language section — Highlight your language proficiency to show your ability to work in diverse environments. Include languages you speak fluently and specify your level of expertise, which is particularly beneficial in global business settings.

- Hobbies and interests section — Share your personal interests to give employers insight into your character and potential cultural fit. Mention hobbies that show skills relevant to accounting, like problem-solving or attention to detail.

- Volunteer work section — Demonstrate your commitment to giving back to the community and your skills in teamwork and leadership. Include volunteer roles where you had responsibilities related to financial management or organization.

- Books section — Indicate your continuous learning and passion for the field by listing industry-related books you’ve read. By sharing relevant titles, you show that you are dedicated to staying updated on best practices and trends in accounting.

Integrating these sections thoughtfully into your resume can enhance your profile beyond just your professional experience and academic background. It offers a more comprehensive view of who you are, which can help you stand out in a competitive job market.

In Conclusion

In conclusion, creating an effective general accountant resume is about more than listing your professional experiences and educational background. It's an opportunity to present yourself as a candidate with a blend of technical skills, personal qualities, and unique experiences that make you stand out in a competitive job market. Craft your resume carefully by focusing on clarity and structure while highlighting your achievements in measurable terms. Choose formats that best showcase your progression, like the reverse-chronological order, and ensure each section, from skills to certifications, is tailored to the job you're seeking.

Use strong action verbs and specific examples to demonstrate your impact in previous roles, whether through process improvements, cost reductions, or enhanced accuracy. Don't shy away from adding sections that capture your personality and interests, such as volunteer work or hobbies related to accounting. These elements provide a fuller picture of you as a candidate, showcasing a multi-dimensional persona that appeals to potential employers. Make sure your resume is visually appealing by using modern fonts and maintaining consistent formatting, especially when saving your document as a PDF.

Ultimately, your resume should serve as a seamless representation of your professional journey and the unique value you bring to a company. By highlighting your skills, achievements, and experiences thoughtfully, you can effectively communicate your readiness and enthusiasm for the role you're applying for. With the aforementioned strategies, you’re well-equipped to make your resume as precise and compelling as the financial reports you excel in producing.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.