Insurance Sales Resume Examples

Jul 18, 2024

|

12 min read

Craft your insurance sales resume to sell yourself effectively: Tips to help you stand out.

Rated by 348 people

Life Insurance Sales Agent

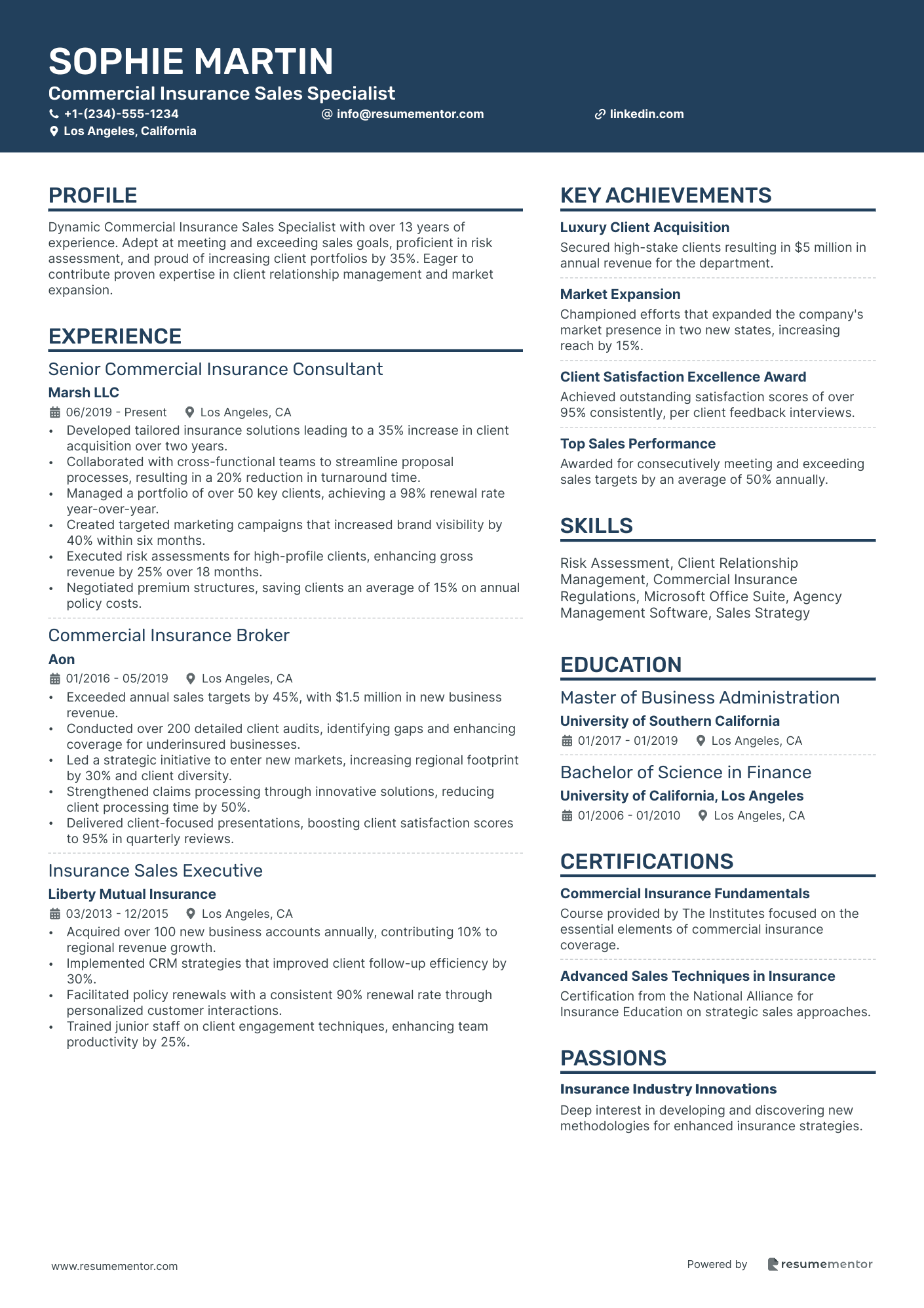

Commercial Insurance Sales Specialist

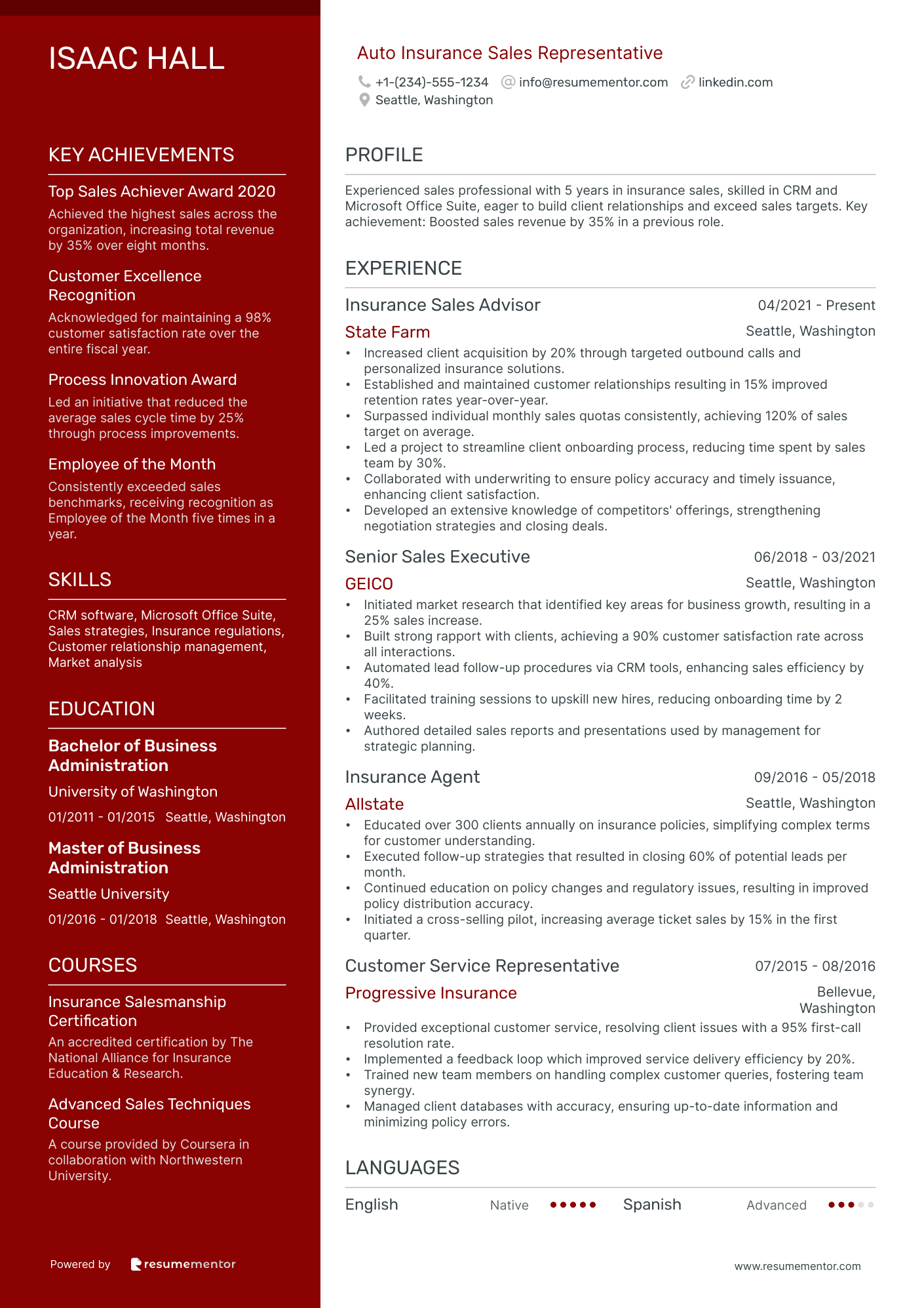

Auto Insurance Sales Representative

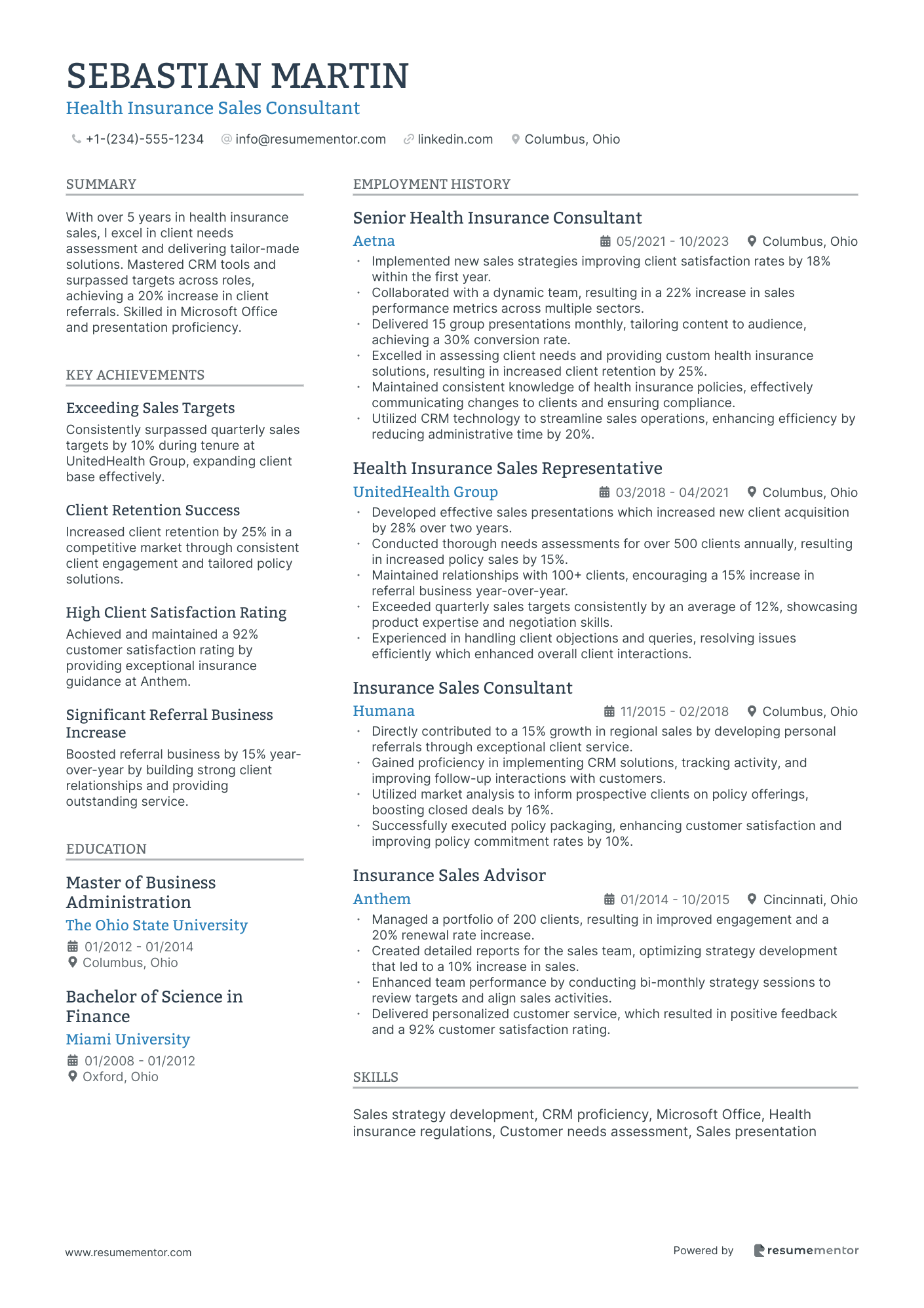

Health Insurance Sales Consultant

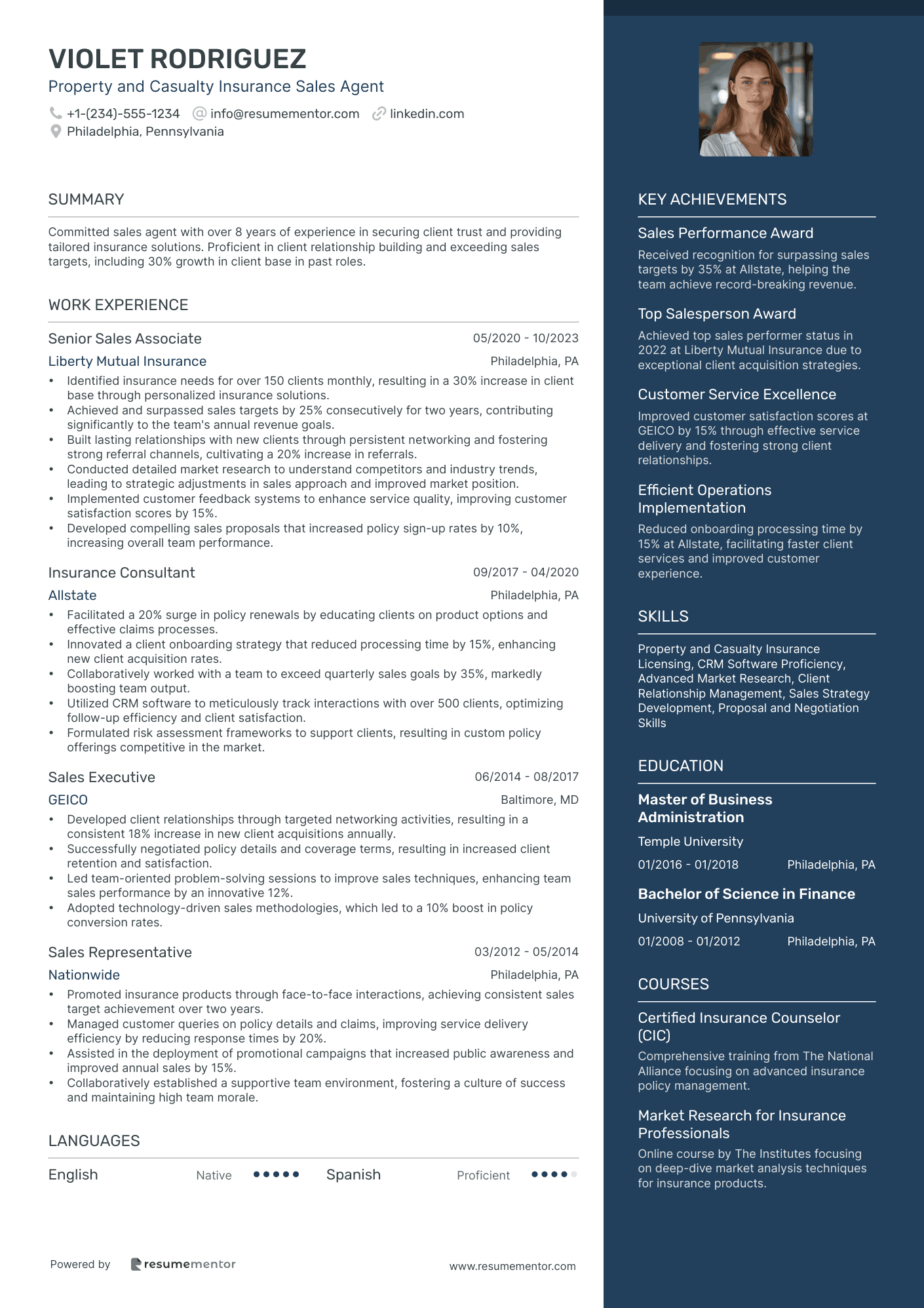

Property and Casualty Insurance Sales Agent

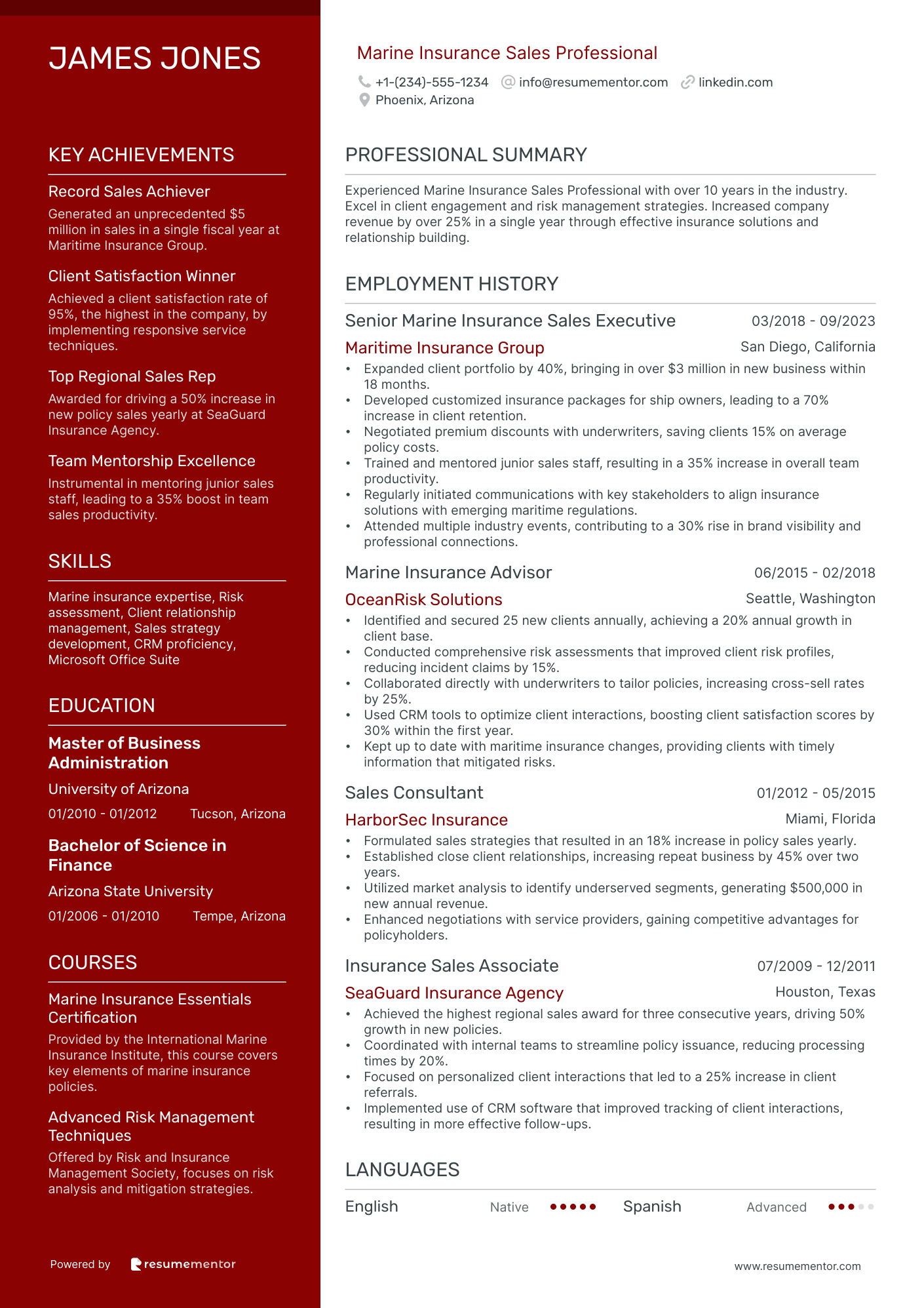

Marine Insurance Sales Professional

Group Insurance Sales Executive

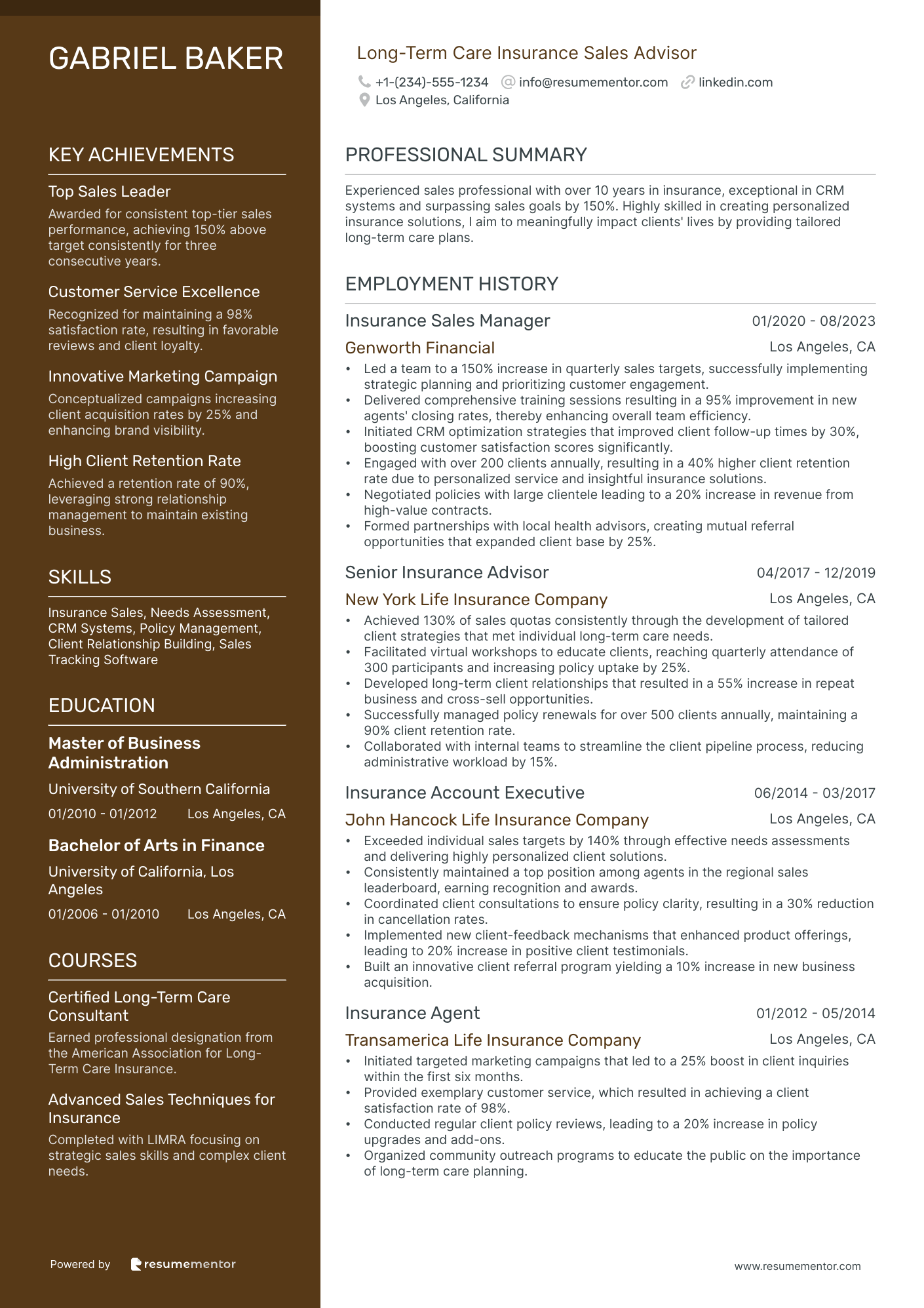

Long-Term Care Insurance Sales Advisor

Travel Insurance Sales Manager

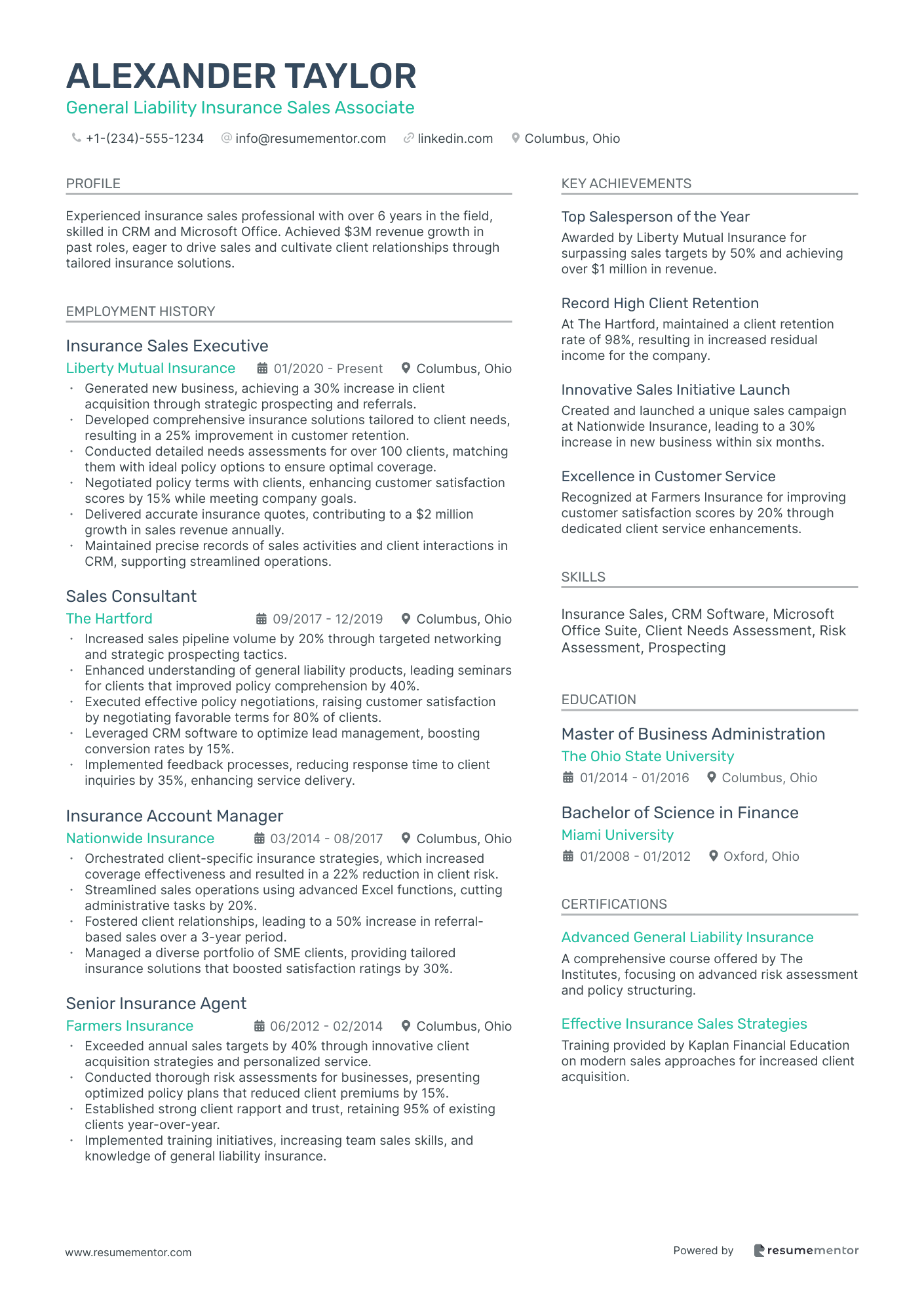

General Liability Insurance Sales Associate

Life Insurance Sales Agent resume sample

- •Managed a sales team to achieve monthly sales targets, culminating in a 120% increase in regional revenue within two years.

- •Implemented a referral program that boosted new client acquisitions by 35%, enhancing business growth and customer reach.

- •Conducted comprehensive training, resulting in a 30% improvement in team members' closing rates through enhanced product knowledge and selling techniques.

- •Orchestrated client relationship management strategies, achieving a 45% increase in client retention rates and solidifying long-term partnerships.

- •Analyzed client data to provide personalized insurance solutions, resulting in a 20% rise in customer satisfaction ratings for the company.

- •Collaborated with marketing to develop targeted outreach campaigns, leading to a 40% uptick in qualified leads in one quarter.

- •Engaged in strategic networking events, resulting in securing 50 new high-value clients and growing regional market presence.

- •Performed in-depth assessments of individual and business clients driving a 25% growth in tailored policy sales.

- •Enhanced customer experience by resolving complex inquiries within a 24-hour window, maintaining a 98% satisfaction rate.

- •Partnered with financial advisors to develop holistic life insurance solutions, boosting cross-functional sales by 15% annually.

- •Developed long-term client relations, contributing to a 40% upsell rate on existing policies by understanding client evolving needs.

- •Achieved status as top sales performer for three consecutive years, surpassing annual targets by 30% each year.

- •Designed and implemented individualized insurance plans for diverse client portfolios, resulting in a 20% increase in client base.

- •Streamlined the customer onboarding process, reducing completion time by 15% and improving client satisfaction metrics.

- •Cultivated productive client relationships, achieving a 50% repeat business rate through exceptional service initiatives.

- •Extended customer network through structured outreach efforts, driving a 40% increase in leads and prospects handled.

- •Exemplified superior product knowledge that helped in closing complex sales deals, enhancing company revenue by 25%.

- •Led client meetings to explain insurance offerings, resulting in an excellent conversion rate and overall premium growth by 18%.

- •Contributed to a high-performance sales culture by mentoring junior team members, leading to collective achievement of Q4 sales targets.

Commercial Insurance Sales Specialist resume sample

- •Developed tailored insurance solutions leading to a 35% increase in client acquisition over two years.

- •Collaborated with cross-functional teams to streamline proposal processes, resulting in a 20% reduction in turnaround time.

- •Managed a portfolio of over 50 key clients, achieving a 98% renewal rate year-over-year.

- •Created targeted marketing campaigns that increased brand visibility by 40% within six months.

- •Executed risk assessments for high-profile clients, enhancing gross revenue by 25% over 18 months.

- •Negotiated premium structures, saving clients an average of 15% on annual policy costs.

- •Exceeded annual sales targets by 45%, with $1.5 million in new business revenue.

- •Conducted over 200 detailed client audits, identifying gaps and enhancing coverage for underinsured businesses.

- •Led a strategic initiative to enter new markets, increasing regional footprint by 30% and client diversity.

- •Strengthened claims processing through innovative solutions, reducing client processing time by 50%.

- •Delivered client-focused presentations, boosting client satisfaction scores to 95% in quarterly reviews.

- •Acquired over 100 new business accounts annually, contributing 10% to regional revenue growth.

- •Implemented CRM strategies that improved client follow-up efficiency by 30%.

- •Facilitated policy renewals with a consistent 90% renewal rate through personalized customer interactions.

- •Trained junior staff on client engagement techniques, enhancing team productivity by 25%.

- •Achieved a 120% growth in policy sales by deploying innovative customer acquisition strategies.

- •Conducted risk evaluations that optimized client insurance portfolios, reducing unnecessary expenses by 20%.

- •Advocated for client-focused solutions leading to a 15% increase in customer referrals.

- •Facilitated numerous workshops that improved industry knowledge among clients and increased engagement rates.

Auto Insurance Sales Representative resume sample

- •Increased client acquisition by 20% through targeted outbound calls and personalized insurance solutions.

- •Established and maintained customer relationships resulting in 15% improved retention rates year-over-year.

- •Surpassed individual monthly sales quotas consistently, achieving 120% of sales target on average.

- •Led a project to streamline client onboarding process, reducing time spent by sales team by 30%.

- •Collaborated with underwriting to ensure policy accuracy and timely issuance, enhancing client satisfaction.

- •Developed an extensive knowledge of competitors' offerings, strengthening negotiation strategies and closing deals.

- •Initiated market research that identified key areas for business growth, resulting in a 25% sales increase.

- •Built strong rapport with clients, achieving a 90% customer satisfaction rate across all interactions.

- •Automated lead follow-up procedures via CRM tools, enhancing sales efficiency by 40%.

- •Facilitated training sessions to upskill new hires, reducing onboarding time by 2 weeks.

- •Authored detailed sales reports and presentations used by management for strategic planning.

- •Educated over 300 clients annually on insurance policies, simplifying complex terms for customer understanding.

- •Executed follow-up strategies that resulted in closing 60% of potential leads per month.

- •Continued education on policy changes and regulatory issues, resulting in improved policy distribution accuracy.

- •Initiated a cross-selling pilot, increasing average ticket sales by 15% in the first quarter.

- •Provided exceptional customer service, resolving client issues with a 95% first-call resolution rate.

- •Implemented a feedback loop which improved service delivery efficiency by 20%.

- •Trained new team members on handling complex customer queries, fostering team synergy.

- •Managed client databases with accuracy, ensuring up-to-date information and minimizing policy errors.

Health Insurance Sales Consultant resume sample

- •Implemented new sales strategies improving client satisfaction rates by 18% within the first year.

- •Collaborated with a dynamic team, resulting in a 22% increase in sales performance metrics across multiple sectors.

- •Delivered 15 group presentations monthly, tailoring content to audience, achieving a 30% conversion rate.

- •Excelled in assessing client needs and providing custom health insurance solutions, resulting in increased client retention by 25%.

- •Maintained consistent knowledge of health insurance policies, effectively communicating changes to clients and ensuring compliance.

- •Utilized CRM technology to streamline sales operations, enhancing efficiency by reducing administrative time by 20%.

- •Developed effective sales presentations which increased new client acquisition by 28% over two years.

- •Conducted thorough needs assessments for over 500 clients annually, resulting in increased policy sales by 15%.

- •Maintained relationships with 100+ clients, encouraging a 15% increase in referral business year-over-year.

- •Exceeded quarterly sales targets consistently by an average of 12%, showcasing product expertise and negotiation skills.

- •Experienced in handling client objections and queries, resolving issues efficiently which enhanced overall client interactions.

- •Directly contributed to a 15% growth in regional sales by developing personal referrals through exceptional client service.

- •Gained proficiency in implementing CRM solutions, tracking activity, and improving follow-up interactions with customers.

- •Utilized market analysis to inform prospective clients on policy offerings, boosting closed deals by 16%.

- •Successfully executed policy packaging, enhancing customer satisfaction and improving policy commitment rates by 10%.

- •Managed a portfolio of 200 clients, resulting in improved engagement and a 20% renewal rate increase.

- •Created detailed reports for the sales team, optimizing strategy development that led to a 10% increase in sales.

- •Enhanced team performance by conducting bi-monthly strategy sessions to review targets and align sales activities.

- •Delivered personalized customer service, which resulted in positive feedback and a 92% customer satisfaction rating.

Property and Casualty Insurance Sales Agent resume sample

- •Identified insurance needs for over 150 clients monthly, resulting in a 30% increase in client base through personalized insurance solutions.

- •Achieved and surpassed sales targets by 25% consecutively for two years, contributing significantly to the team's annual revenue goals.

- •Built lasting relationships with new clients through persistent networking and fostering strong referral channels, cultivating a 20% increase in referrals.

- •Conducted detailed market research to understand competitors and industry trends, leading to strategic adjustments in sales approach and improved market position.

- •Implemented customer feedback systems to enhance service quality, improving customer satisfaction scores by 15%.

- •Developed compelling sales proposals that increased policy sign-up rates by 10%, increasing overall team performance.

- •Facilitated a 20% surge in policy renewals by educating clients on product options and effective claims processes.

- •Innovated a client onboarding strategy that reduced processing time by 15%, enhancing new client acquisition rates.

- •Collaboratively worked with a team to exceed quarterly sales goals by 35%, markedly boosting team output.

- •Utilized CRM software to meticulously track interactions with over 500 clients, optimizing follow-up efficiency and client satisfaction.

- •Formulated risk assessment frameworks to support clients, resulting in custom policy offerings competitive in the market.

- •Developed client relationships through targeted networking activities, resulting in a consistent 18% increase in new client acquisitions annually.

- •Successfully negotiated policy details and coverage terms, resulting in increased client retention and satisfaction.

- •Led team-oriented problem-solving sessions to improve sales techniques, enhancing team sales performance by an innovative 12%.

- •Adopted technology-driven sales methodologies, which led to a 10% boost in policy conversion rates.

- •Promoted insurance products through face-to-face interactions, achieving consistent sales target achievement over two years.

- •Managed customer queries on policy details and claims, improving service delivery efficiency by reducing response times by 20%.

- •Assisted in the deployment of promotional campaigns that increased public awareness and improved annual sales by 15%.

- •Collaboratively established a supportive team environment, fostering a culture of success and maintaining high team morale.

Marine Insurance Sales Professional resume sample

- •Expanded client portfolio by 40%, bringing in over $3 million in new business within 18 months.

- •Developed customized insurance packages for ship owners, leading to a 70% increase in client retention.

- •Negotiated premium discounts with underwriters, saving clients 15% on average policy costs.

- •Trained and mentored junior sales staff, resulting in a 35% increase in overall team productivity.

- •Regularly initiated communications with key stakeholders to align insurance solutions with emerging maritime regulations.

- •Attended multiple industry events, contributing to a 30% rise in brand visibility and professional connections.

- •Identified and secured 25 new clients annually, achieving a 20% annual growth in client base.

- •Conducted comprehensive risk assessments that improved client risk profiles, reducing incident claims by 15%.

- •Collaborated directly with underwriters to tailor policies, increasing cross-sell rates by 25%.

- •Used CRM tools to optimize client interactions, boosting client satisfaction scores by 30% within the first year.

- •Kept up to date with maritime insurance changes, providing clients with timely information that mitigated risks.

- •Formulated sales strategies that resulted in an 18% increase in policy sales yearly.

- •Established close client relationships, increasing repeat business by 45% over two years.

- •Utilized market analysis to identify underserved segments, generating $500,000 in new annual revenue.

- •Enhanced negotiations with service providers, gaining competitive advantages for policyholders.

- •Achieved the highest regional sales award for three consecutive years, driving 50% growth in new policies.

- •Coordinated with internal teams to streamline policy issuance, reducing processing times by 20%.

- •Focused on personalized client interactions that led to a 25% increase in client referrals.

- •Implemented use of CRM software that improved tracking of client interactions, resulting in more effective follow-ups.

Group Insurance Sales Executive resume sample

- •Led a team to increase sales of group insurance products by 35% over two years, achieving top performance in the region.

- •Implemented innovative sales strategies, resulting in a 25% increase in new client acquisitions within one year.

- •Successfully negotiated and secured contracts for groups over 500 employees, significantly increasing account revenue.

- •Coached and mentored sales representatives, enhancing the team’s productivity and achieving a 40% improvement in targets met.

- •Established partnerships with 10 top-tier brokerage firms, expanding the company's market reach and credibility.

- •Developed tailored insurance solutions for complex client needs, ensuring customer satisfaction and long-term retention.

- •Enhanced revenue by 30% through strategic sales initiatives and leveraging existing client relationships.

- •Developed and nurtured relationships with key decision-makers in mid-sized firms, resulting in five significant new contracts.

- •Conducted over 50 client seminars and workshops, increasing brand visibility and client knowledge of insurance products.

- •Collaborated closely with the marketing team, creating promotional campaigns that resulted in a 20% uptick in lead generation.

- •Drove market analysis projects to identify emerging trends, influencing product offerings and increasing competitive market position.

- •Achieved 120% of sales targets, leading the sales team in performance metrics for two consecutive years.

- •Strengthened client relationships through exceptional service and tailored insurance solutions, contributing to a 90% client retention rate.

- •Researched and recommended policy options to clients, achieving their coverage needs while increasing sales by 15%.

- •Led successful cross-departmental collaboration to streamline client service processes, reducing response times by 30%.

- •Surpassed sales goals by 25% through strategic client engagement and targeted sales approaches.

- •Built a robust network of industry contacts and generated over 50 leads monthly, substantially growing client base.

- •Facilitated comprehensive training programs for new hires, improving onboarding efficiency and team performance.

- •Engaged in extensive market analysis to inform product development and sales strategy, enhancing company competitiveness.

Long-Term Care Insurance Sales Advisor resume sample

- •Led a team to a 150% increase in quarterly sales targets, successfully implementing strategic planning and prioritizing customer engagement.

- •Delivered comprehensive training sessions resulting in a 95% improvement in new agents' closing rates, thereby enhancing overall team efficiency.

- •Initiated CRM optimization strategies that improved client follow-up times by 30%, boosting customer satisfaction scores significantly.

- •Engaged with over 200 clients annually, resulting in a 40% higher client retention rate due to personalized service and insightful insurance solutions.

- •Negotiated policies with large clientele leading to a 20% increase in revenue from high-value contracts.

- •Formed partnerships with local health advisors, creating mutual referral opportunities that expanded client base by 25%.

- •Achieved 130% of sales quotas consistently through the development of tailored client strategies that met individual long-term care needs.

- •Facilitated virtual workshops to educate clients, reaching quarterly attendance of 300 participants and increasing policy uptake by 25%.

- •Developed long-term client relationships that resulted in a 55% increase in repeat business and cross-sell opportunities.

- •Successfully managed policy renewals for over 500 clients annually, maintaining a 90% client retention rate.

- •Collaborated with internal teams to streamline the client pipeline process, reducing administrative workload by 15%.

- •Exceeded individual sales targets by 140% through effective needs assessments and delivering highly personalized client solutions.

- •Consistently maintained a top position among agents in the regional sales leaderboard, earning recognition and awards.

- •Coordinated client consultations to ensure policy clarity, resulting in a 30% reduction in cancellation rates.

- •Implemented new client-feedback mechanisms that enhanced product offerings, leading to 20% increase in positive client testimonials.

- •Built an innovative client referral program yielding a 10% increase in new business acquisition.

- •Initiated targeted marketing campaigns that led to a 25% boost in client inquiries within the first six months.

- •Provided exemplary customer service, which resulted in achieving a client satisfaction rate of 98%.

- •Conducted regular client policy reviews, leading to a 20% increase in policy upgrades and add-ons.

- •Organized community outreach programs to educate the public on the importance of long-term care planning.

Travel Insurance Sales Manager resume sample

- •Led a team to achieve a 25% increase in annual sales by implementing targeted coaching programs.

- •Developed and executed sales strategies that resulted in a 30% market penetration increase in targeted sectors.

- •Collaborated with travel agents, leading to a 40% growth in partnership engagements with measurable results.

- •Conducted market trend analysis, leading to the development of two new insurance products.

- •Increased customer satisfaction scores by 15% through improved service delivery and issue resolution processes.

- •Streamlined reporting processes, enhancing sales performance tracking efficiency by 20%.

- •Successfully led a team of sales representatives to surpass sales targets by 35%, the highest in the region.

- •Initiated strategic partnerships with tour operators, resulting in a 50% expansion of our client base.

- •Contributed to a 20% reduction in customer complaints by implementing a comprehensive training program.

- •Drove customer retention rates up by 25% through improved relationship management strategies.

- •Enhanced CRM utilization, improving data accuracy and sales forecasting efficiency by 30%.

- •Achieved a personal sales quota of 120% consistently over three years through effective relationship building.

- •Implemented communication strategies that increased lead conversion rates by 15%.

- •Led product training sessions resulting in a 10% increase in insurance policy understanding among clients.

- •Played a key role in a project that modernized client onboarding processes, reducing onboarding time by 25%.

- •Exceeded sales targets by 20% annually through targeted strategies and effective customer engagement.

- •Contributed to a pilot program that improved customer feedback response times by 40%.

- •Consistently recognized for top performance within a team of ten sales professionals.

- •Assisted in developing promotional campaigns leading to a 15% growth in policy sales.

General Liability Insurance Sales Associate resume sample

- •Generated new business, achieving a 30% increase in client acquisition through strategic prospecting and referrals.

- •Developed comprehensive insurance solutions tailored to client needs, resulting in a 25% improvement in customer retention.

- •Conducted detailed needs assessments for over 100 clients, matching them with ideal policy options to ensure optimal coverage.

- •Negotiated policy terms with clients, enhancing customer satisfaction scores by 15% while meeting company goals.

- •Delivered accurate insurance quotes, contributing to a $2 million growth in sales revenue annually.

- •Maintained precise records of sales activities and client interactions in CRM, supporting streamlined operations.

- •Increased sales pipeline volume by 20% through targeted networking and strategic prospecting tactics.

- •Enhanced understanding of general liability products, leading seminars for clients that improved policy comprehension by 40%.

- •Executed effective policy negotiations, raising customer satisfaction by negotiating favorable terms for 80% of clients.

- •Leveraged CRM software to optimize lead management, boosting conversion rates by 15%.

- •Implemented feedback processes, reducing response time to client inquiries by 35%, enhancing service delivery.

- •Orchestrated client-specific insurance strategies, which increased coverage effectiveness and resulted in a 22% reduction in client risk.

- •Streamlined sales operations using advanced Excel functions, cutting administrative tasks by 20%.

- •Fostered client relationships, leading to a 50% increase in referral-based sales over a 3-year period.

- •Managed a diverse portfolio of SME clients, providing tailored insurance solutions that boosted satisfaction ratings by 30%.

- •Exceeded annual sales targets by 40% through innovative client acquisition strategies and personalized service.

- •Conducted thorough risk assessments for businesses, presenting optimized policy plans that reduced client premiums by 15%.

- •Established strong client rapport and trust, retaining 95% of existing clients year-over-year.

- •Implemented training initiatives, increasing team sales skills, and knowledge of general liability insurance.

Creating an insurance sales resume is like crafting a compelling sales pitch. You understand your skills and experiences, but capturing them effectively on paper can be challenging. In the insurance industry, specifics are crucial—highlighting your talents in building client relationships and closing deals makes all the difference. However, organizing these elements into a cohesive resume often feels like piecing together a complex puzzle.

To truly stand out in a crowded market, your resume must be more than just a document; it’s a reflection of your professional journey. Many grapple with showcasing both their sales prowess and industry knowledge, which can lead to resumes that don't fully represent their capabilities.

This is where a structured template becomes invaluable. Using a resume template provides a solid foundation, allowing you to seamlessly integrate your expertise and maintain a polished appearance. It's akin to having a roadmap, guiding you through the process with ease and ensuring you hit all the right notes.

With the right approach, your application can capture attention, letting you concentrate on what you do best: selling insurance. As you tackle this important step, let a reliable template be your guide in crafting a resume that excites potential employers about the possibility of you joining their team.

Key Takeaways

- An insurance sales resume should highlight sales success, industry knowledge, and client connection skills, making use of a structured template to integrate expertise seamlessly.

- Begin with clear contact information, a professional summary, and key skills such as cold calling and negotiation to showcase comprehensive sales ability.

- Use the reverse-chronological format for work experience, focusing on achievements with quantifiable metrics to demonstrate your impact.

- Choosing a modern, readable font and saving your resume as a PDF helps convey dependability, while adhering to standard margins maintains a clean appearance.

- Include education and certificates relevant to insurance sales, highlighting your qualifications and ongoing professional development.

What to focus on when writing your insurance sales resume

An insurance sales resume should tell your story of success in sales, demonstrate your knowledge of the insurance industry, and highlight your ability to connect with clients on a personal level. By emphasizing your achievements and customer service skills, you stand out as a candidate.

How to structure your insurance sales resume

- Contact Information: Start with your full name, phone number, email, and LinkedIn profile—ensuring recruiters can easily reach you and cross-reference your professional background. Make sure your LinkedIn profile is up-to-date and aligns with your resume details, as potential employers often use it to gather more insights about your experience.

- Professional Summary: Next, craft a brief overview that captures your sales experience, industry expertise, and career goals—focusing on your consistent success in boosting policy sales and ensuring client satisfaction. Highlight any unique aspects of your sales approach or specific client types you excel with, offering a snapshot of what you bring to the role.

- Skills: Highlight key skills such as cold calling, negotiation, and proficiency in CRM tools—demonstrating a comprehensive ability in sales. Add specific insurance policy knowledge, emphasizing types you frequently work with or any niche markets you're particularly adept at navigating, to showcase a well-rounded capability.

- Work Experience: Then, detail your previous roles in insurance sales, including job titles, company names, and dates—focusing on milestones like sales results, client acquisition efforts, and retention strategies. Use quantifiable metrics wherever possible to underscore your impact, illustrating not just what you've done, but how well you've done it, and your capacity to replicate those results.

- Education: Follow up with your educational background, sharing where you earned your degrees and any relevant insurance certifications or licenses—highlighting your formal preparation for the role. If you have additional training or endorsements that bolster your expertise in specialized insurance areas, mention these as well to demonstrate your continued commitment to professional development.

- Achievements: Conclude with a section on your significant accomplishments, listing awards, increased client base percentages, or consistent success in meeting sales targets—proving your effectiveness and dedication. If you've led successful projects or contributed to team-wide improvements, include those to show leadership skills and a readiness to take initiative.

Understanding resume formats and how to tailor each section to your experience is key; below, we will cover each section more in-depth.

Which resume format to choose

Creating a standout insurance sales resume starts with choosing the right format. In this industry, a reverse-chronological format is your best bet. This structure emphasizes your most recent experience first, making it easy for employers to quickly assess your current capabilities and achievements in sales roles. By clearly outlining your career path, you enable potential employers to understand your progression and successes in the field.

Selecting an appropriate font also plays a role in creating a professional image. Fonts like Rubik, Montserrat, or Lato offer a modern twist while remaining clean and easy to read. This choice can subtly influence how your resume is perceived, conveying attention to detail and contemporary awareness, which are valuable to employers in any sales-driven environment.

Saving your resume as a PDF is crucial. This format preserves your layout and design, ensuring it looks the same on any device or platform. It reflects the dependability and professionalism employers look for in an insurance sales professional.

Standard margins of about 1 inch on all sides are important to maintain a clean and organized appearance. Proper margins lend a sense of balance and readability, helping your content shine without overwhelming the reader. This attention to detail is essential in conveying the meticulous nature required in the insurance sales sector. Keeping these elements in mind will help your resume make a powerful impression.

How to write a quantifiable resume experience section

In the insurance sales industry, having a compelling experience section on your resume is crucial for making an impression. This section should clearly display your achievements related to sales performance and customer satisfaction, emphasizing how your skills and contributions made a difference. Start with your most recent role at the top, using reverse chronological order to guide employers through your career. While it's best to cover the last 10-15 years of your work history, focus on achievements that highlight your relevance to the role you're applying for. Tailor your experience to match the specific job description by mirroring the language and emphasizing the skills valued by the employer.

Choose job titles that accurately describe your responsibilities, and opt for strong action words like "achieved," "boosted," or "expanded" to emphasize what you've accomplished. Tailoring your resume is essential—not only does it align your skills with the job ad, but it also makes your application stand out by demonstrating a direct fit with the role.

- •Increased monthly sales by 30% within the first year, surpassing revenue targets.

- •Developed custom insurance packages to boost client retention by 25%.

- •Mentored junior agents, enhancing team sales performance by 40%.

- •Expanded client base by 15% through targeted outreach campaigns.

This experience section effectively details your contributions in insurance sales by linking your achievements to your impact on the company and role. It is structured for easy reading, beginning with your most relevant experience and aligning closely with the job description to catch the employer's eye.

Every bullet point in this section tells a story of how you excelled in reaching goals and strengthening team performance, both vital traits in insurance sales. By using vibrant action words like "increased," "developed," and "expanded," the narrative remains engaging and showcases your strengths and potential contributions. This approach gears your resume to be a compelling contender for any job you pursue.

Training and Development Focused resume experience section

A Training and Development-focused insurance sales resume experience section should showcase your expertise in creating impactful training programs that drive success. Emphasize your ability to design sessions that not only boost performance but also deliver tangible results. Connect your experience in organizing workshops, seminars, and mentoring initiatives, highlighting how these efforts improved sales outcomes. Demonstrate your adaptability to different learning styles, which enhances understanding and retention. Make sure to use metrics to clearly illustrate the positive impact your contributions had on both team productivity and individual growth.

Each bullet point should flow smoothly, providing clear and compelling evidence of the results achieved through your training expertise. Avoid vague statements, and instead, focus on how your initiatives enhanced performance. Back up your claims with testimonials or metrics. Describe the tools and techniques you used, as well as any innovative strategies you employed to facilitate learning and skill development. Altogether, your section should convey how your training efforts made a significant difference in the effectiveness of insurance sales teams.

Training Manager

SafeLife Insurance

January 2019 - Present

- Developed and led weekly training sessions, boosting team sales performance by 20%.

- Designed a mentorship program that streamlined new hire onboarding and cut turnover by 15%.

- Introduced e-learning modules, enhancing product knowledge and customer engagement strategies.

- Tailored training materials for diverse learning needs, achieving a 25% increase in satisfaction scores.

Achievement-Focused resume experience section

An achievement-focused insurance sales resume experience section should clearly highlight the impact you’ve had in your previous roles. Begin by identifying your standout accomplishments rather than simply listing job duties. This helps to focus on results and quantify them whenever possible, such as showcasing growth in sales, achieving targets, or implementing cost-saving initiatives. Using numbers or percentages will clearly demonstrate the extent of your contributions, ensuring that your actions are relevant to the skills and experiences desired by potential employers.

It's vital to start each bullet point with a strong action verb to immediately capture attention and effectively convey your achievements. Words like "Increased," "Developed," and "Achieved" work well. Follow this with specific details about what you did and the outcomes you achieved. Adding context, such as the challenges you overcame or the strategies implemented, adds depth and appeal to your accomplishments. Each bullet point is an opportunity to highlight your strengths and how they relate to the job, making your experience section powerful and compelling.

Insurance Sales Representative

ABC Insurance Group

June 2018 - September 2021

- Increased annual sales by 35% through targeted marketing strategies and personalized customer service.

- Developed a client referral program that led to a 20% growth in new client acquisition within a year.

- Achieved the position of top salesperson for three consecutive quarters by exceeding monthly sales targets.

- Implemented a customer feedback system that improved customer satisfaction ratings by 40%.

Skills-Focused resume experience section

A skills-focused insurance sales resume experience section should clearly highlight your competencies and achievements, illustrating your expertise in the field. Start by stating your job title, the company name, and your employment dates to set the context. Emphasize any quantitative accomplishments, like boosting sales figures or increasing your client base, to demonstrate your effectiveness. Use strong action verbs such as "achieved," "led," or "managed" to convey a sense of initiative and success.

To provide a comprehensive view of your capabilities, keep your descriptions concise, yet rich in detail. Focus on essential skills, such as managing client relationships, developing effective sales strategies, and adhering to industry regulations. Connect these experiences to show how they prepare you for successful insurance sales. Highlight your knack for assessing client needs, crafting tailored insurance solutions, and navigating the negotiation process to close deals effectively while addressing client concerns along the way.

Senior Insurance Sales Agent

ABC Insurance Company

June 2018 - Present

- Increased client portfolio by 25% through targeted marketing and strong relationship management.

- Crafted personalized insurance packages that led to a 40% jump in client retention rates.

- Set up a referral program that boosted new client acquisition by 20% in the first year.

- Surpassed sales targets by up to 30%, earning recognition as Top Sales Performer for two years in a row.

Leadership-Focused resume experience section

A leadership-focused insurance sales resume experience section should effectively showcase your ability to guide teams and drive results. Start by highlighting specific instances where you took charge, such as mentoring new agents, leading projects, or crafting strategies that made a difference. Quantifying your success can make your achievements stand out, whether it’s through percentage increases in sales or the number of team members you managed. Each bullet point should be a clear testament to your leadership skills, showing how you have positively impacted previous roles.

Think about the moments that really defined your leadership journey. For instance, did you successfully lead a challenging project? Or perhaps you helped new team members sharpen their sales skills, resulting in better performance? These narratives are the essence of your experience section. Focus on what actions you took, how you implemented them, and the results that followed. This turns your resume into a compelling narrative that clearly demonstrates the valuable leadership skills you bring to any organization.

Sales Team Leader

Insurance Corp Inc.

June 2018 - July 2022

- Led a team of 15 sales agents, implementing new training programs that boosted sales by 20% within six months.

- Developed and executed a cross-selling strategy that increased quarterly revenue by 15% for three consecutive periods.

- Mentored eight junior agents, achieving a 100% retention rate through effective coaching and professional development initiatives.

- Spearheaded bi-weekly meetings to streamline communication, which improved team productivity by 10% year-over-year.

Write your insurance sales resume summary section

A sales-focused insurance resume summary should clearly highlight your relevant experience, achievements, and skills. This section is your opportunity to express exactly why you're a perfect fit for the role. If you have extensive experience, showcase your expertise and past successes. For those just starting out, emphasize your potential and eagerness to learn. The difference between standing out and getting overlooked often lies in how you present your accomplishments rather than your job duties. Focus on what makes you unique and how you've made a difference in your previous roles. This approach ensures your summary is clear and quickly captures the reader’s attention.

Consider this example of an insurance sales resume summary:

This summary is effective because it pairs experience with measurable results and key skills, creating a strong impression. Unlike a resume objective, which details your career plans, a resume summary focuses on what you've achieved. A resume profile casts a wider net by highlighting personal traits and abilities. Meanwhile, a summary of qualifications presents skills and accomplishments in bullet points for easy reading. Using active language to describe your impact ensures your summary remains engaging. Starting with strong, relevant points tailored to the job can quickly attract a recruiter's attention.

Listing your insurance sales skills on your resume

An insurance-focused resume should effectively highlight your skills, whether in a standalone section or woven into your experience and summary. Your strengths and soft skills, like excellent communication or teamwork abilities, can reveal a lot about your character and how you work with others. Hard skills, on the other hand, are specific abilities you've acquired, such as mastering CRM software or understanding insurance regulations. Including these skills and strengths as keywords can help your resume get noticed by recruiters and Applicant Tracking Systems (ATS), increasing your chances of success.

Here's what a standalone skills section could look like in JSON format:

This example clearly presents your abilities essential for success in insurance sales. Including 8 relevant skills in straightforward language, it allows hiring managers to quickly identify your capabilities. The mix of technical skills, like "CRM Software Proficiency," with industry-specific ones, such as "Insurance Policy Knowledge," demonstrates a well-rounded expertise.

Best hard skills to feature on your insurance sales resume

In insurance sales, hard skills underline your technical competence and understanding of the industry. They convey your proficiency in sales tools and market knowledge, which is critical for your role. Some of the most in-demand hard skills include:

Hard Skills

- Sales Strategies

- Insurance Products Knowledge

- CRM Software Proficiency

- Risk Assessment

- Underwriting Basics

- Policy Analysis

- Lead Generation

- Market Research

- Financial Planning

- Regulatory Compliance

- Claims Processing

- Digital Marketing

- SEO for Insurance Products

- Data Analysis

- Presentation Skills

Best soft skills to feature on your insurance sales resume

Soft skills are crucial for forming client relationships and ensuring effective communication. They reflect your ability to engage with customers and adapt to different environments, essential traits in insurance sales. Key soft skills to highlight are:

Soft Skills

- Communication Skills

- Customer Service

- Negotiation

- Problem-Solving

- Persuasiveness

- Active Listening

- Adaptability

- Teamwork

- Time Management

- Emotional Intelligence

- Conflict Resolution

- Organizational Skills

- Patience

- Stress Management

- Networking Abilities

How to include your education on your resume

An education section is a crucial part of your insurance sales resume as it provides a foundation for your qualifications. Tailoring this section to the specific job you're applying for is important; omit any irrelevant education details. To include your GPA, only list it if it enhances your application, usually if it's above 3.5. For cum laude honors, include it after your degree title. Listing your degree should include the type of degree, institution name, and the dates of attendance.

Wrong example:

Right example:

The second example stands out by aligning directly with the insurance field through a Bachelor of Business Administration. It indicates a strong academic record with a 3.7 GPA and cum laude honors, showing a commitment to excellence. These credentials are relevant to a career in insurance sales, highlighting skills in finance, business practices, and analytical thinking.

How to include insurance sales certificates on your resume

Including a certificates section in your insurance sales resume can significantly boost your credibility. List the name of each certificate clearly and include the date you received it. Add the issuing organization to provide authenticity. You may also include this information in the header of your resume to draw immediate attention. For example, “John Doe, Certified Insurance Sales Professional (CISP), Licensed Insurance Agent, Chartered Life Underwriter (CLU)”.

Here's a detailed example:

This example is strong because it includes certifications directly relevant to insurance sales, such as CISP and CLU. Each entry shows the name, issuing organization, and is positioned in a readable format, enhancing the resume’s professionalism.

Extra sections to include in your insurance sales resume

Crafting a standout resume for an insurance sales position involves more than just listing your work history and qualifications. You want to paint a well-rounded picture of yourself to potential employers. Including sections like languages, hobbies, volunteer work, and books can set you apart and provide deeper insight into your character and skills.

- Language section — Highlight any languages you speak fluently to show your ability to communicate with a diverse client base. This skill improves your marketability and enhances customer relations.

- Hobbies and interests section — Share interests that demonstrate your active lifestyle, teamwork, or leadership. These reveal your personal side, making you more relatable and showing employers that you have a balanced life.

- Volunteer work section — Detail your volunteer experiences to showcase your commitment to giving back to the community. This also reflects your ability to work selflessly and develop skills beyond your professional sphere.

- Books section — Mention books related to personal development, sales, or industry knowledge you've read. This shows your dedication to continuous learning and staying informed about market trends.

In Conclusion

In conclusion, crafting a compelling insurance sales resume is a bit like tailoring the perfect outfit—it needs to fit you well and highlight your best features. Communicating your unique blend of skills and experiences in a way that stands out to potential employers is crucial. We've discussed the role of a structured template to give your resume a polished and cohesive look, making it easier to spotlight your capabilities effectively. By focusing on sections like work experience, skills, and achievements, you can narrate your professional journey and show your potential for success in the insurance industry. Using quantifiable metrics and strong action verbs ensures that your accomplishments leap off the page and leave a lasting impression. Additionally, including details about your education and certifications can emphasize your dedication and qualifications, while extra sections like languages or volunteer work add depth to your profile. Remember, a well-crafted resume is more than just a list of duties—it's a tool that conveys your value, builds your professional story, and excites employers about your future contributions. With these elements in mind, you're well on your way to creating a resume that is not just overlooked, but one that opens doors in your insurance sales career.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.