Investment Banking Analyst Resume Examples

Jul 18, 2024

|

12 min read

Build your rock-solid investment banking analyst resume with these tips.

Rated by 348 people

Mergers and Acquisitions Investment Analyst

Equity Capital Markets Analyst

Investment Banking Risk Analyst

Fixed Income Investment Analyst

Investment Banking Operations Analyst

Structured Finance Investment Analyst

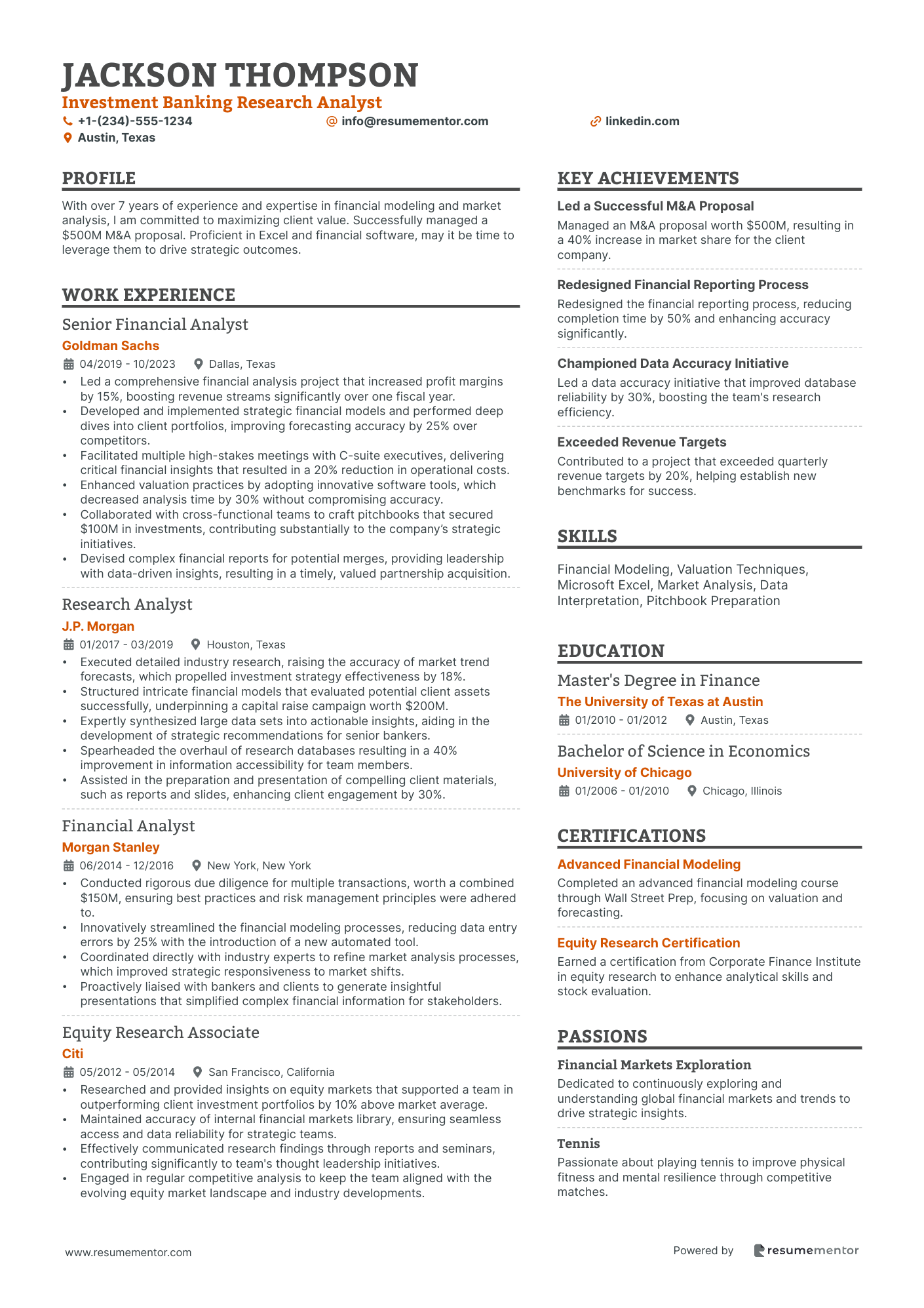

Investment Banking Research Analyst

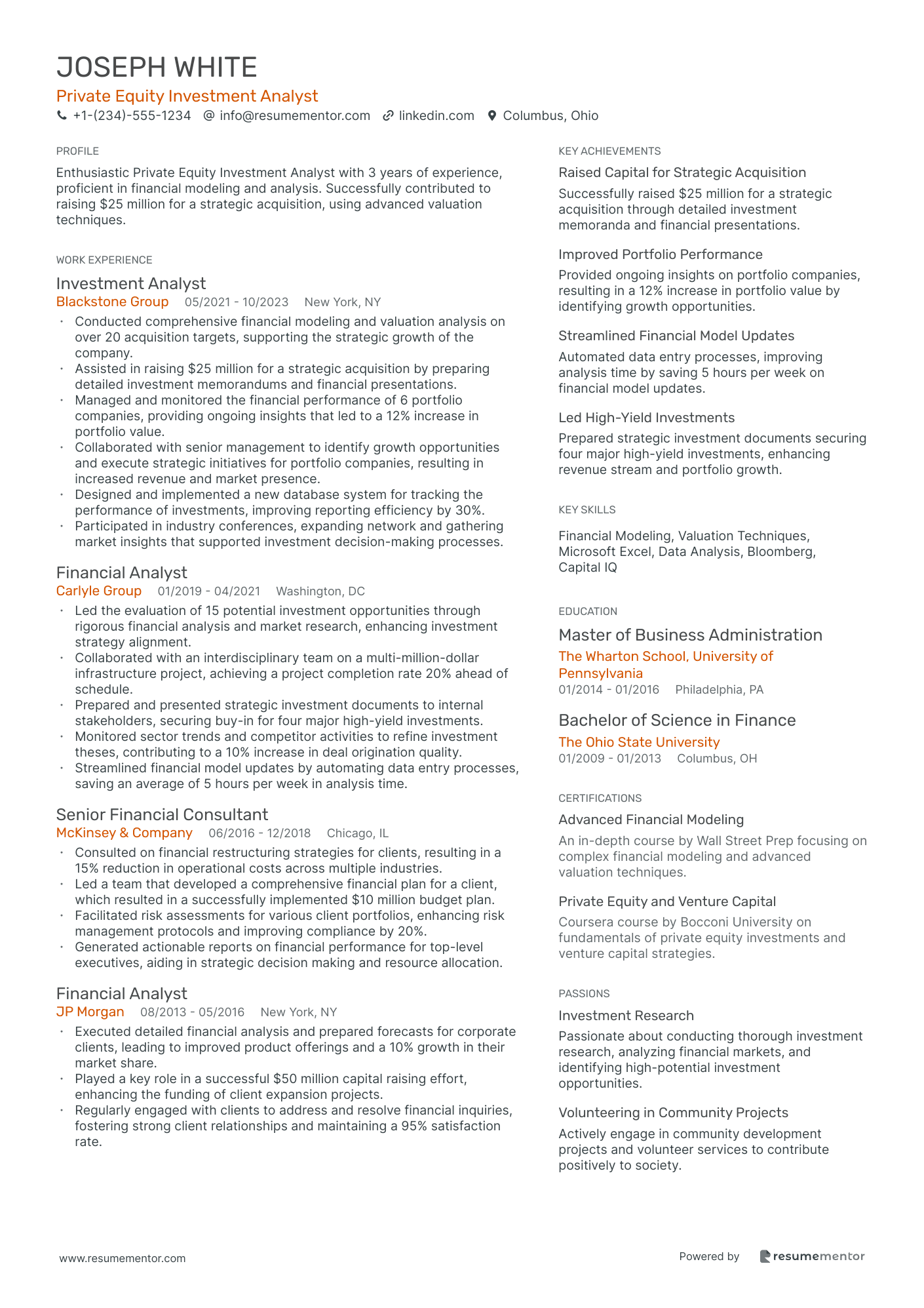

Private Equity Investment Analyst

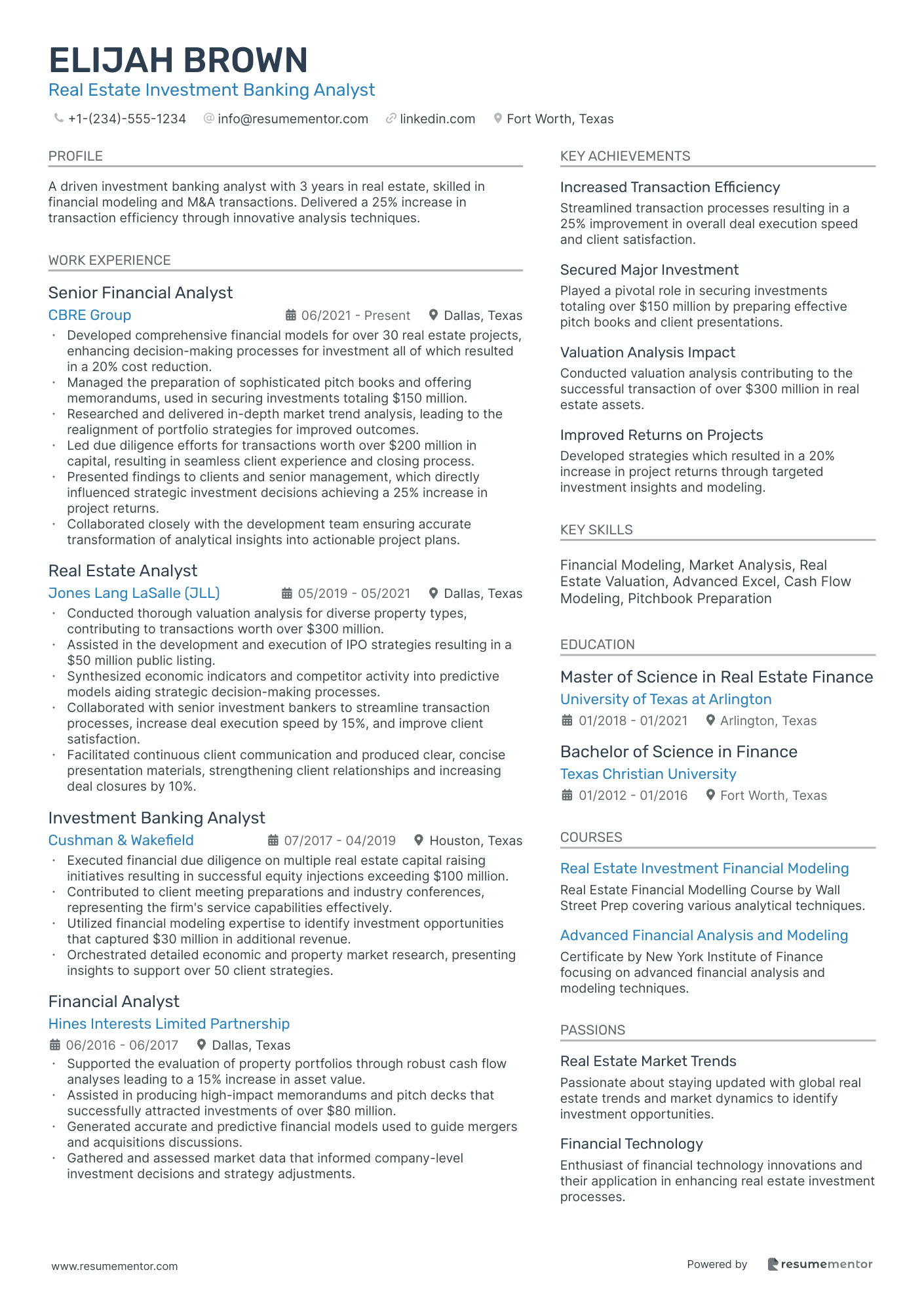

Real Estate Investment Banking Analyst

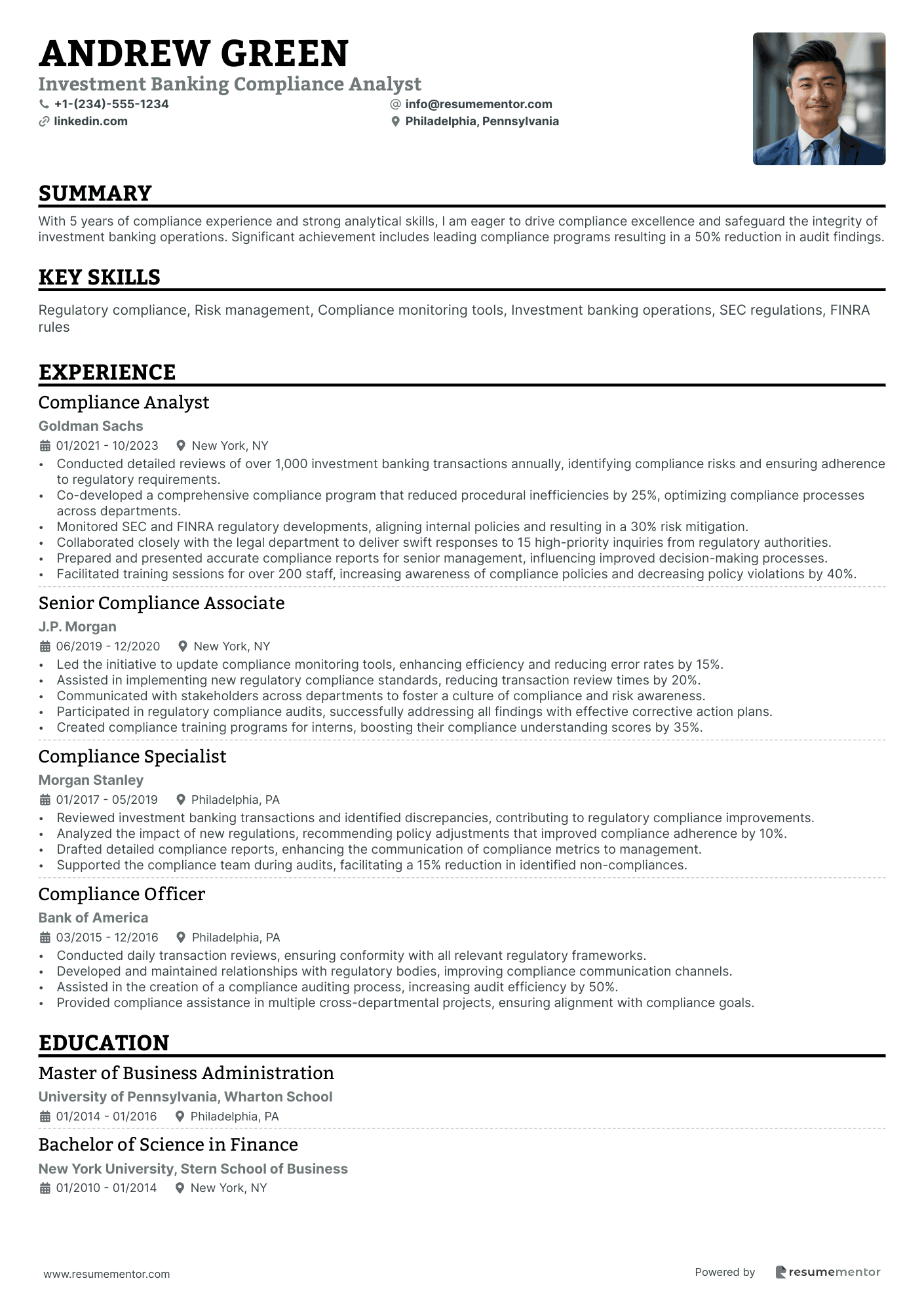

Investment Banking Compliance Analyst

Mergers and Acquisitions Investment Analyst resume sample

- •Led financial valuation analysis for M&A transactions exceeding $200 million, influencing acquisition strategy and resource allocation.

- •Collaborated with cross-functional teams to conduct due diligence for a $150 million acquisition, enhancing understanding of financial synergies.

- •Authored comprehensive market research documentation, identifying trends that contributed to a strategic acquisition valued at $75 million.

- •Developed financial models to assess company performance post-acquisition, improving the forecast accuracy by 20%.

- •Facilitated the integration process of acquired companies, aligning operational strategies, resulting in a 15% cost reduction.

- •Presented findings to senior stakeholders, clearly articulating complex data that supported decision-making processes.

- •Conducted DCF and comparable company analyses to evaluate potential acquisitions, contributing to over $100 million in closed deals.

- •Monitored existing investment performance, providing strategic insights that enhanced portfolio growth by 10%.

- •Participated in drafting investment proposals, presenting competitive landscapes to senior management effectively.

- •Analyzed financial statements and identified potential risks and opportunities, ensuring successful due diligence processes.

- •Managed and updated databases for market trends, improving the team’s decision-making efficiency by 25%.

- •Supported the execution of valuation projects, using financial analysis to provide recommendations worth $50 million.

- •Collaborated on market research projects that identified new industry trends, contributing to strategic planning sessions.

- •Prepared detailed reports on precedent transactions, enhancing the accuracy of future deal assessments.

- •Streamlined financial reporting processes, reducing analysis time by 30%, thereby improving departmental productivity.

- •Assisted in preparing financial models for potential acquisitions, providing critical support valued at $35 million.

- •Contributed to competitive analysis summaries, aiding senior analysts in strategic decision-making processes.

- •Coordinated with teams across disciplines to ensure coherent due diligence processes in international markets.

- •Updated data management systems, improving access to critical financial information by 40%.

Equity Capital Markets Analyst resume sample

- •Led the preparation of equity transaction documents, including a $150M private placement, ensuring regulatory compliance.

- •Collaborated with senior management to develop financial models for IPOs, enhancing decision-making processes and achieving financial targets.

- •Coordinated the due diligence process for multiple offerings, facilitating smooth communication among internal and external stakeholders.

- •Analyzed market trends and competitor strategies, contributing insights that informed a strategic shift in our client engagement approach.

- •Monitored equity market developments and reported to stakeholders, supporting investment strategies and enhancing market responsiveness.

- •Drafted compelling investor presentations and offering materials resulting in increased investor interest and engagement.

- •Conducted detailed valuation analyses for equity transactions, directly contributing to a $120M follow-on offering.

- •Developed comprehensive financial models that improved the accuracy of forecasting potential equity raising successes.

- •Created persuasive pitch materials for potential clients, resulting in a 20% increase in successful pitching outcomes.

- •Worked closely with cross-functional teams to ensure timely execution of transaction processes and minimized risks.

- •Presented market research findings in client meetings, providing strategic insights and supporting project approvals.

- •Assisted in the valuation and pricing strategies for IPOs, lending support to raise over $90M in equity capital.

- •Compiled reports on equity market dynamics, providing analytical support for capital raising initiatives.

- •Worked with senior analysts to review financial statements, improving the accuracy of financial projections.

- •Managed a range of research projects, enhancing the team's understanding of industry trends and opportunities.

- •Participated in the structuring of equity-related finance deals, contributing to a notable $80M equity raise.

- •Conducted comprehensive financial analyses that supported transaction pricing and structuring decisions.

- •Prepared detailed equity raising opportunity models, providing key insights that influenced investor engagement.

- •Coordinated with various teams to streamline the due diligence process, enhancing operational efficiency.

Investment Banking Risk Analyst resume sample

- •Led risk assessment for high-value M&A transactions, increasing security measures by 33% and reducing potential losses.

- •Collaborated with cross-functional teams to implement risk frameworks, improving decision-making efficiency by 25%.

- •Analyzed market trends impacting leveraged buyouts, recommending strategic changes that resulted in a 22% risk reduction.

- •Monitored performance of risk management initiatives, providing insights that led to a 15% improvement in compliance adherence.

- •Assisted in the development of risk models, enhancing analytical accuracy and reducing error rates by 10%.

- •Prepared detailed reports and presentations, effectively communicating risk strategies to senior management and stakeholders.

- •Conducted detailed risk assessments for corporate debt issuances, enhancing investor confidence by 27%.

- •Streamlined data analysis processes, achieving a 20% reduction in assessment time while maintaining accuracy.

- •Regularly updated compliance protocols, aligning with industry regulations and reducing compliance breaches by 15%.

- •Developed strategic risk mitigation plans for complex transactions, reducing potential financial exposure by 18%.

- •Presented findings to regulatory bodies, positively influencing regulatory outcomes and reinforcing corporate compliance.

- •Analyzed financial data sets to support risk assessments, contributing to a 20% improvement in transaction evaluations.

- •Collaborated with compliance teams to ensure risk policies met new regulatory standards, reducing non-compliance risks.

- •Optimized Excel-based financial models, enhancing analytical efficiency and saving 15% of analysis time.

- •Assisted in compiling stakeholder reports, resulting in clearer communication and informed decision-making processes.

- •Supported senior analysts in assessing transaction risk factors, leading to a 10% enhancement in risk evaluation accuracy.

- •Contributed to risk model improvements, assisting in achieving a 12% reduction in modeling errors.

- •Maintained thorough records of risk management initiatives, ensuring consistency and tracking of performance metrics.

- •Participated in team meetings, contributing insights that helped refine risk management strategies and objectives.

Fixed Income Investment Analyst resume sample

- •Led a team to assess credit risks, resulting in a 12% increase in portfolio returns and optimized risk management.

- •Utilized advanced Excel and Bloomberg functionalities to build financial models, achieving 95% accuracy in forecasts.

- •Developed reports analyzing market trends, enhancing strategic planning by providing actionable insights to the portfolio team.

- •Collaborated with portfolio managers to create new asset allocation strategies, boosting overall returns by 8% year-over-year.

- •Monitored evolving economic scenarios and informed the investment decisions that protected $500 million in client assets.

- •Implemented scenario analysis techniques leading to improved decision-making processes and strengthening client relations.

- •Conducted comprehensive analysis of fixed income securities, resulting in a strategic rebalancing that enhanced portfolio performance by 10%.

- •Created extensive presentations on market trends, which were used by senior management to inform spin-off strategies.

- •Assisted portfolio managers in implementing credit analysis strategies, minimizing negative yield fluctuations by 15%.

- •Enhanced financial model accuracy by introducing new quantitative methods, resulting in more effective forecasting under volatile conditions.

- •Collaborated with cross-functional teams to integrate market news into daily operations, strengthening response efficiency and investment outcomes.

- •Analyzed global fixed income portfolios, leading to the overachievement of expected benchmarks by 15% in two consecutive years.

- •Conducted cost-benefit analyses, providing the basis for strategic divestments that improved portfolio liquidity by 20%.

- •Streamlined data collection methodologies, increasing the efficiency of the research team and decreasing processing times by 30%.

- •Interacted with regulatory bodies to ensure full compliance, reducing potential penalties by $200,000 annually.

- •Supported senior analysts in conducting market research, contributing to an increase in client acquisition by 25%.

- •Developed detailed financial reports that were used to attract high-value clientele and retain existing ones.

- •Improved process efficiency by redesigning data analysis procedures, reducing operational expenses by 18%.

- •Coordinated with sales teams on investment opportunities, promoting products that enhanced customer satisfaction scores by 15%.

Investment Banking Operations Analyst resume sample

- •Managed over 50 transaction lifecycles, including mergers and acquisitions, ensuring all processes met corporate standards.

- •Conducted valuation analysis for deals valued at approximately $300 million, enhancing the decision-making process by providing detailed financial forecasts.

- •Processed over 100 client transaction documents, maintaining a 99% accuracy rate, resulting in improved client satisfaction.

- •Liaised with compliance and legal departments to ensure all transactions adhered to regulatory requirements, reducing potential compliance issues by 30%.

- •Updated operational workflows, resulting in a 20% improvement in transaction processing efficiency across the team.

- •Prepared bi-weekly reports for senior management review, highlighting project timelines and achieved milestones.

- •Analyzed financial data for over 30 client projects, contributing to developing strategies that elevated portfolio returns by 15%.

- •Assisted in structuring deals worth upwards of $200 million, streamlining the valuation process with advanced data modeling.

- •Played a key role in preparing client presentations, which translated into a 25% boost in successful pitch conversions.

- •Facilitated communication between finance and compliance departments for seamless transaction approvals, enhancing workflow transparency.

- •Led a project to integrate a new software tool, reducing data processing time by 30% and improving overall data handling accuracy.

- •Managed client documentation processes for 40 transactions monthly, ensuring regulatory compliance and cutting error rates by 25%.

- •Coordinated with different departments to facilitate timely approvals, reducing transaction timelines by 20%.

- •Developed a workflow tracker that ensured all project timelines were met, with a 95% on-time completion rate.

- •Identified process inefficiencies leading to a 15% improvement in documentation handling time.

- •Assisted in conducting financial analysis for restructuring projects amounting to $100 million.

- •Supported the development of financial models and term sheets, improving transaction structuring efficiency by 10%.

- •Tracked project milestones and provided regular updates, contributing to maintaining a 98% client satisfaction rate.

- •Conducted data analysis that informed significant strategic decisions, aiding in improving overall operational effectiveness.

Structured Finance Investment Analyst resume sample

- •Led analysis of structured finance transactions including ABS and MBS, enhancing investment accuracy by 35% within the first year.

- •Developed and implemented advanced financial models, resulting in improved portfolio performance metrics by reducing risk exposure by 25%.

- •Prepared comprehensive reports and presentations for stakeholders, leading to better-informed decision-making and improved client satisfaction.

- •Monitored market trends and regulatory changes, contributing to strategic portfolio adjustments that increased profitability by 20%.

- •Collaborated with cross-functional teams to ensure thorough due diligence processes, optimizing deal structuring and execution strategies.

- •Enhanced financial databases and tools to maintain 100% accuracy and compliance with industry regulations, strengthening data integrity.

- •Conducted detailed assessments of CLOs and MBS, improving investment strategy effectiveness by identifying key risk factors.

- •Developed investment presentations that contributed to securing $10M in new investments by providing clear risk and return analyses.

- •Analyzed economic indicators affecting the financial landscape, allowing timely strategic responses that benefited the investment portfolio.

- •Assisted in the development of investment methodologies that optimized asset allocation, achieving a diversification increase by 15%.

- •Managed financial modeling processes, ensuring robust assessments that underpinned high-stakes investment decisions with precision and insight.

- •Monitored and analyzed market risks associated with structured finance products, contributing to risk mitigation strategies that lowered exposure by 18%.

- •Built comprehensive financial models for risk evaluation, which enhanced the bank's decision-making capabilities and drove strategic objectives.

- •Streamlined data analysis processes, resulting in a 30% reduction in turnaround time for investment assessments.

- •Collaborated with a diverse team to support deal structuring efforts, strengthening the portfolio with high-quality asset acquisitions.

- •Supported structured finance transaction processes, enhancing the accuracy and efficiency of financial models used in asset evaluations.

- •Contributed to portfolio management by providing detailed analytical insights, leading to improved asset performance by 22%.

- •Assisted in preparing investment reports that highlighted emerging financial trends, aiding in the development of robust investment strategies.

- •Collaborated in cross-departmental projects, resulting in innovative financial solutions that increased client satisfaction by 25%.

Investment Banking Research Analyst resume sample

- •Led a comprehensive financial analysis project that increased profit margins by 15%, boosting revenue streams significantly over one fiscal year.

- •Developed and implemented strategic financial models and performed deep dives into client portfolios, improving forecasting accuracy by 25% over competitors.

- •Facilitated multiple high-stakes meetings with C-suite executives, delivering critical financial insights that resulted in a 20% reduction in operational costs.

- •Enhanced valuation practices by adopting innovative software tools, which decreased analysis time by 30% without compromising accuracy.

- •Collaborated with cross-functional teams to craft pitchbooks that secured $100M in investments, contributing substantially to the company’s strategic initiatives.

- •Devised complex financial reports for potential merges, providing leadership with data-driven insights, resulting in a timely, valued partnership acquisition.

- •Executed detailed industry research, raising the accuracy of market trend forecasts, which propelled investment strategy effectiveness by 18%.

- •Structured intricate financial models that evaluated potential client assets successfully, underpinning a capital raise campaign worth $200M.

- •Expertly synthesized large data sets into actionable insights, aiding in the development of strategic recommendations for senior bankers.

- •Spearheaded the overhaul of research databases resulting in a 40% improvement in information accessibility for team members.

- •Assisted in the preparation and presentation of compelling client materials, such as reports and slides, enhancing client engagement by 30%.

- •Conducted rigorous due diligence for multiple transactions, worth a combined $150M, ensuring best practices and risk management principles were adhered to.

- •Innovatively streamlined the financial modeling processes, reducing data entry errors by 25% with the introduction of a new automated tool.

- •Coordinated directly with industry experts to refine market analysis processes, which improved strategic responsiveness to market shifts.

- •Proactively liaised with bankers and clients to generate insightful presentations that simplified complex financial information for stakeholders.

- •Researched and provided insights on equity markets that supported a team in outperforming client investment portfolios by 10% above market average.

- •Maintained accuracy of internal financial markets library, ensuring seamless access and data reliability for strategic teams.

- •Effectively communicated research findings through reports and seminars, contributing significantly to team's thought leadership initiatives.

- •Engaged in regular competitive analysis to keep the team aligned with the evolving equity market landscape and industry developments.

Private Equity Investment Analyst resume sample

- •Conducted comprehensive financial modeling and valuation analysis on over 20 acquisition targets, supporting the strategic growth of the company.

- •Assisted in raising $25 million for a strategic acquisition by preparing detailed investment memorandums and financial presentations.

- •Managed and monitored the financial performance of 6 portfolio companies, providing ongoing insights that led to a 12% increase in portfolio value.

- •Collaborated with senior management to identify growth opportunities and execute strategic initiatives for portfolio companies, resulting in increased revenue and market presence.

- •Designed and implemented a new database system for tracking the performance of investments, improving reporting efficiency by 30%.

- •Participated in industry conferences, expanding network and gathering market insights that supported investment decision-making processes.

- •Led the evaluation of 15 potential investment opportunities through rigorous financial analysis and market research, enhancing investment strategy alignment.

- •Collaborated with an interdisciplinary team on a multi-million-dollar infrastructure project, achieving a project completion rate 20% ahead of schedule.

- •Prepared and presented strategic investment documents to internal stakeholders, securing buy-in for four major high-yield investments.

- •Monitored sector trends and competitor activities to refine investment theses, contributing to a 10% increase in deal origination quality.

- •Streamlined financial model updates by automating data entry processes, saving an average of 5 hours per week in analysis time.

- •Consulted on financial restructuring strategies for clients, resulting in a 15% reduction in operational costs across multiple industries.

- •Led a team that developed a comprehensive financial plan for a client, which resulted in a successfully implemented $10 million budget plan.

- •Facilitated risk assessments for various client portfolios, enhancing risk management protocols and improving compliance by 20%.

- •Generated actionable reports on financial performance for top-level executives, aiding in strategic decision making and resource allocation.

- •Executed detailed financial analysis and prepared forecasts for corporate clients, leading to improved product offerings and a 10% growth in their market share.

- •Played a key role in a successful $50 million capital raising effort, enhancing the funding of client expansion projects.

- •Regularly engaged with clients to address and resolve financial inquiries, fostering strong client relationships and maintaining a 95% satisfaction rate.

Real Estate Investment Banking Analyst resume sample

- •Developed comprehensive financial models for over 30 real estate projects, enhancing decision-making processes for investment all of which resulted in a 20% cost reduction.

- •Managed the preparation of sophisticated pitch books and offering memorandums, used in securing investments totaling $150 million.

- •Researched and delivered in-depth market trend analysis, leading to the realignment of portfolio strategies for improved outcomes.

- •Led due diligence efforts for transactions worth over $200 million in capital, resulting in seamless client experience and closing process.

- •Presented findings to clients and senior management, which directly influenced strategic investment decisions achieving a 25% increase in project returns.

- •Collaborated closely with the development team ensuring accurate transformation of analytical insights into actionable project plans.

- •Conducted thorough valuation analysis for diverse property types, contributing to transactions worth over $300 million.

- •Assisted in the development and execution of IPO strategies resulting in a $50 million public listing.

- •Synthesized economic indicators and competitor activity into predictive models aiding strategic decision-making processes.

- •Collaborated with senior investment bankers to streamline transaction processes, increase deal execution speed by 15%, and improve client satisfaction.

- •Facilitated continuous client communication and produced clear, concise presentation materials, strengthening client relationships and increasing deal closures by 10%.

- •Executed financial due diligence on multiple real estate capital raising initiatives resulting in successful equity injections exceeding $100 million.

- •Contributed to client meeting preparations and industry conferences, representing the firm's service capabilities effectively.

- •Utilized financial modeling expertise to identify investment opportunities that captured $30 million in additional revenue.

- •Orchestrated detailed economic and property market research, presenting insights to support over 50 client strategies.

- •Supported the evaluation of property portfolios through robust cash flow analyses leading to a 15% increase in asset value.

- •Assisted in producing high-impact memorandums and pitch decks that successfully attracted investments of over $80 million.

- •Generated accurate and predictive financial models used to guide mergers and acquisitions discussions.

- •Gathered and assessed market data that informed company-level investment decisions and strategy adjustments.

Investment Banking Compliance Analyst resume sample

- •Conducted detailed reviews of over 1,000 investment banking transactions annually, identifying compliance risks and ensuring adherence to regulatory requirements.

- •Co-developed a comprehensive compliance program that reduced procedural inefficiencies by 25%, optimizing compliance processes across departments.

- •Monitored SEC and FINRA regulatory developments, aligning internal policies and resulting in a 30% risk mitigation.

- •Collaborated closely with the legal department to deliver swift responses to 15 high-priority inquiries from regulatory authorities.

- •Prepared and presented accurate compliance reports for senior management, influencing improved decision-making processes.

- •Facilitated training sessions for over 200 staff, increasing awareness of compliance policies and decreasing policy violations by 40%.

- •Led the initiative to update compliance monitoring tools, enhancing efficiency and reducing error rates by 15%.

- •Assisted in implementing new regulatory compliance standards, reducing transaction review times by 20%.

- •Communicated with stakeholders across departments to foster a culture of compliance and risk awareness.

- •Participated in regulatory compliance audits, successfully addressing all findings with effective corrective action plans.

- •Created compliance training programs for interns, boosting their compliance understanding scores by 35%.

- •Reviewed investment banking transactions and identified discrepancies, contributing to regulatory compliance improvements.

- •Analyzed the impact of new regulations, recommending policy adjustments that improved compliance adherence by 10%.

- •Drafted detailed compliance reports, enhancing the communication of compliance metrics to management.

- •Supported the compliance team during audits, facilitating a 15% reduction in identified non-compliances.

- •Conducted daily transaction reviews, ensuring conformity with all relevant regulatory frameworks.

- •Developed and maintained relationships with regulatory bodies, improving compliance communication channels.

- •Assisted in the creation of a compliance auditing process, increasing audit efficiency by 50%.

- •Provided compliance assistance in multiple cross-departmental projects, ensuring alignment with compliance goals.

As an investment banking analyst diving into the financial world, your resume is your brand and gateway to opportunity. Your love for numbers and the complexities of finance must shine through in a resume that mirrors your skills and ability to handle demanding tasks. Though organizing your accomplishments and expertise into a cohesive document can feel daunting, its impact is immense.

The fast pace and relentless demands of your role might make it easy to underestimate the power of a well-structured resume. Here, a strong resume template becomes your ally, helping you effectively highlight your analytical prowess and financial insights. This structure not only saves you time but ensures your accomplishments don’t get lost in the shuffle.

Your resume should weave together the story of your contributions, illustrating your command of Excel, your finesse in financial modeling, and your skill in transforming complex data into clear presentations. Avoiding clutter is key to letting your strengths shine through every line.

In the investment banking arena, excelling goes beyond crunching numbers; it involves showcasing your critical thinking and capacity to thrive under pressure. A well-designed resume bridges the gap between your ambition and opportunity, setting the stage for the dynamic career you aspire to build.

Key Takeaways

- A well-structured resume is crucial for standing out in the fast-paced and competitive field of investment banking, where showcasing both technical abilities in financial modeling and analytical skills is vital.

- Including quantifiable achievements in your work experience section, such as percentages and outcomes, effectively highlights your impact and adds credibility to your resume.

- Opting for a clean, professional reverse-chronological format ensures that your most recent experiences are highlighted, which aligns well with industry expectations and hiring practices.

- Skills like financial modeling, valuation techniques, Excel proficiency, and communication should be prominently listed to demonstrate both the technical and soft skills required for the role.

- Additional sections, such as relevant certifications, volunteer work, or language skills, can personalize your resume and position you as a well-rounded and compelling candidate.

What to focus on when writing your investment banking analyst resume

An investment banking analyst resume should convey your financial expertise and analytical skills clearly to the recruiter. This means highlighting your ability to analyze data, understand markets, and contribute to important financial decisions. Demonstrate this through your experience with financial modeling, valuation techniques, and market research, which are essential in this field.

How to structure your investment banking analyst resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile. These details are crucial, as they make it easy for the recruiter to reach you for further discussions. Ensure your email address is professional and consider using an email signature that includes links to your LinkedIn or professional portfolio—small but significant details leave a strong impression.

- Professional Summary: Follow with a concise statement summarizing your strengths in financial analysis, investment strategies, and analytical abilities. This sets the tone for the rest of your resume. Think of it as your elevator pitch—highlight what makes you a compelling candidate, using active language that reflects your enthusiasm and commitment to the role.

- Education: Your educational background is next, listing degrees such as a Bachelor's in Finance, Economics, or related fields. Be sure to include any honors or relevant coursework in advanced mathematics or econometrics, as these underline your academic strengths. If you participated in any finance societies or clubs, mention them to show your proactive involvement in the field.

- Experience: Delve into your work history, focusing on internships or roles in finance. Use bullet points to detail your experiences with financial modeling, mergers and acquisitions, and market analysis, all of which demonstrate your practical application of skills. Quantify your achievements where possible—specific figures and outcomes are impressive and clearly convey your impact.

- Technical Skills: Highlight your proficiency in Excel, financial software like Bloomberg Terminal, and programming skills in Python or SQL. These skills are valued and expected in the field, reaffirming your technical capability. Being able to solve complex problems using these tools is a vital part of the analyst role, so emphasize your competence with examples of past projects.

- Certifications and Training: If you have certifications like CFA Level I or have attended financial modeling workshops, include them here. These emphasize your commitment to growing your expertise. Continual learning is crucial in finance, and certifications reflect your dedication to staying informed in a rapidly evolving sector.

To enhance your resume further, consider adding sections like "Awards and Honors," "Professional Affiliations," or "Languages." These optional sections can provide additional insights into your skills and experiences, adding depth and highlighting unique aspects of your background—below, we'll cover each section more in-depth and focus on how to format your resume for maximum impact.

Which resume format to choose

Crafting an investment banking analyst resume requires a keen eye for detail, and choosing the right format is paramount. The reverse-chronological format is ideal for this industry because it places your most recent and relevant experience at the top. This allows potential employers to quickly assess how your background aligns with the fast-paced, ever-evolving world of investment banking.

Your font selection is more than just an aesthetic choice; it speaks to your professionalism. Opt for modern fonts like Rubik, Lato, or Montserrat, which convey a sense of freshness and clear readability. While the font choice might seem minor, it complements the content by making it approachable and ensuring that important details are easily digestible for the reader.

File type is another critical consideration. Always save your resume as a PDF. This format preserves your layout and ensures that what you see is what the employer sees, no matter what device they use. In the precision-oriented field of finance, maintaining the integrity of your document reflects your commitment to quality.

Set your resume margins to one inch on all sides to maintain a clean look. This common standard ensures that your resume doesn’t feel cluttered, allowing your achievements and qualifications to shine without overwhelming the reader. The generous spacing also contributes to an organized and professional appearance, further underscoring your attention to detail—a valuable asset in investment banking.

By carefully considering each of these elements—format, font, file type, and margins—you enhance the clarity and professionalism of your resume. These choices collectively highlight your meticulous nature and make your application stand out in the competitive investment banking environment.

How to write a quantifiable resume experience section

The best experience section for an investment banking analyst helps you shine in a crowded field by using quantifiable achievements and results-driven language. This part of your resume not only showcases your skills but also demonstrates your impact in financial analysis and deal-making. Organize your roles in reverse chronological order, focusing on the most recent 5-10 years to highlight your most relevant experience. Tailor your resume to the job ad by incorporating its language and requirements, letting potential employers see how you meet their needs. Opt for job titles that emphasize growth and responsibility. Action verbs like "spearheaded," "optimized," and "secured" effectively convey your impact and drive. Here's an effective example of what your resume experience could look like:

- •Facilitated mergers and acquisitions valued at over $2 billion, increasing client revenue by 25% within one year.

- •Conducted comprehensive market analysis leading to the identification of key investment opportunities, enhancing portfolio performance by 30%.

- •Developed advanced financial models resulting in increased accuracy of financial forecasts by 15%.

- •Streamlined due diligence processes, reducing turnaround time by 40% and improving client satisfaction scores.

This experience section stands out by addressing exactly what hiring managers seek, using measurable achievements to highlight how you drive business success. Each bullet point combines strong action verbs with tangible results, painting a clear and compelling picture of your capabilities. By ensuring your entries are specific and relevant, you make yourself appear as the ideal candidate for the role. Tailoring your experience section to the industry's standards and expectations further demonstrates your understanding and readiness, making your resume an engaging and persuasive read for recruiters.

Industry-Specific Focus resume experience section

A finance-focused investment banking analyst resume experience section should clearly highlight your skills and tasks relevant to the field. Begin by showcasing key projects or assignments where you analyzed financial data, developed reports, and presented findings. Strong action verbs paired with quantified achievements help illustrate the impact of your work within the industry. This approach ensures you are depicting your experience in a way that demonstrates how your skills are effectively applied to investment banking.

Next, organize your experience to emphasize your most significant achievements, using bullet points for clarity and focus. Each point should highlight a specific skill or accomplishment that aligns with potential employers' needs in the industry. Tailoring your responsibilities in this way creates a targeted approach that sets you apart as a candidate with the expertise to contribute to a dynamic financial team.

Investment Banking Analyst

ABC Financial Group

June 2021 - Present

- Contributed to critical decision-making by assisting in the completion of over 10 financial models.

- Enhanced company value proposals by developing detailed industry research reports for client pitches.

- Led to accurate investment assessments by analyzing financial statements for valuation purposes.

- Boosted client acquisition by 15% through supporting senior bankers in conducting market analysis.

Project-Focused resume experience section

A project-focused investment banking analyst resume experience section should clearly illustrate your ability to handle tasks related to analytics, teamwork, and financial reporting. Start by listing skills and achievements that specifically relate to your project experiences. Use strong action verbs to describe your roles and tasks, ensuring each bullet point highlights a unique skill or achievement. This will showcase your strengths in problem-solving and your keen attention to detail, demonstrating how you contributed to a project's success or improved a process. Whenever possible, include quantifiable results to substantiate your claims.

It's important to choose words that effectively convey both your initiative and the outcomes of your efforts. Tailor each bullet point to align with the skills emphasized in the job description, ensuring a cohesive message throughout. Reflect on your past projects and select the most impactful experiences to highlight in this section. For each role, include your job title, workplace, and the dates of employment, followed by compelling bullet points. This approach not only showcases your capabilities but also positions you as a proactive and valuable team member.

Investment Banking Analyst

Top Financial Corp

June 2020 - August 2023

- Supported a team of analysts in creating financial models that forecasted earnings with 95% accuracy.

- Collaborated with the mergers and acquisitions team to analyze risks and opportunities for potential deals.

- Researched and produced detailed reports on industry trends, contributing to the strategic planning process.

- Assisted in the preparation of pitch books that led to successful client acquisition worth over $500 million.

Achievement-Focused resume experience section

A well-crafted investment banking analyst resume experience section should highlight your achievements effectively and cohesively. Begin each bullet point with a strong action verb to emphasize the skills and results you’ve contributed. Focus not just on tasks, but on the outcomes that demonstrate your impact, such as increasing revenue or enhancing processes. Connect your achievements by providing measurable evidence, such as numbers or percentages, to further illustrate your contributions.

Customize your resume to the investment banking sector by showcasing relevant technical skills and industry-specific knowledge. Maintain a straightforward and professional tone, ensuring each bullet point is linked and portrays a meaningful accomplishment. By keeping sentences concise and related, your experiences will be easier to read, allowing potential employers to quickly grasp how you’ve added value to previous organizations and why you are the best fit for the job.

Analyst

XYZ Financial Services

June 2020 - Present

- Led a team in evaluating and executing merger and acquisition transactions worth over $500 million, which contributed to a 20% increase in company revenue by strategically identifying growth opportunities.

- Developed and presented comprehensive industry research reports that supported key investment decisions, resulting in a client acquisition valued at $100 million because of well-informed strategies.

- Streamlined the financial modeling process to cut analysis time by 30%, thereby boosting team efficiency and contributing to more timely project deliveries.

- Collaborated with cross-functional teams to create strategic presentations for high-profile clients, which enhanced client engagement and satisfaction.

Collaboration-Focused resume experience section

A collaboration-focused investment banking analyst resume experience section should emphasize your talent for teamwork and your ability to handle client relationships effectively. Begin by listing roles and companies where collaboration was integral to your success. Demonstrate how you joined forces with others to accomplish goals, highlighting successful projects that resulted from these joint efforts. With each example, explain the soft skills you employed, like communication, negotiation, and problem-solving, which are essential in the banking industry. Showcasing real outcomes from teamwork enhances your resume's impact.

Use bullet points to illustrate specific instances of collaboration during your tenure. Highlight projects you worked on, the teams involved, and the achievements these collaborations produced. Each bullet point should reveal how your individual contributions led to the team's overall success, while also describing new skills or insights you gained. By providing such concrete examples, you convey to future employers your adeptness at navigating complex scenarios in partnership with others, reinforcing your candidacy for roles in investment banking.

Investment Banking Analyst

XYZ Investment Partners

June 2021 - Present

- Worked with a cross-functional team to prepare pitch books for potential IPO clients, leading to a successful client acquisition worth $50 million.

- Collaborated with senior analysts and stakeholders to analyze financial models for mergers and acquisitions, enhancing valuation accuracy by 15%.

- Coordinated with legal and compliance teams to ensure regulatory adherence for client transactions involving asset-backed securities.

- Participated in weekly team meetings to brainstorm strategies, improving debt restructuring outcomes for struggling corporations.

Write your investment banking analyst resume summary section

An investment banking-focused resume summary should succinctly convey your skills and experience to grab a hiring manager’s attention. It should quickly demonstrate your analytical abilities and experience in financial modeling to persuade them you’re a strong candidate. Here's how you might structure this:

This summary effectively communicates your key qualifications by swiftly highlighting your technical expertise and ability to thrive in demanding environments. Demonstrating proficiency in financial modeling and valuation makes it apparent that you have the necessary skills. By emphasizing your capability to drive results and analyze markets, you show readiness for the challenges investment banking presents. Describing yourself as detail-oriented and a skilled negotiator can further underline your suitability for the position.

Understanding the purpose of a resume summary versus other elements is crucial. A resume objective, ideal for entry-level roles, focuses on your career goals. In contrast, a resume profile offers a detailed view, serving almost as a mini-biography. Lastly, a summary of qualifications concisely lists achievements or skills, making it suitable for experienced candidates. Selecting the right approach depends on your career stage and what you want to highlight in your application.

Listing your investment banking analyst skills on your resume

A finance-focused investment banking analyst resume should present your skills prominently. You can opt for a dedicated skills section or seamlessly incorporate them into your experience or summary sections. Highlighting your strengths, such as teamwork and effective communication, showcases your valuable soft skills. Hard skills like financial modeling and data analysis further demonstrate the specific abilities you’ve acquired through training and practice.

These skills and strengths also serve as keywords, crucial for grabbing attention during job searches and appealing to applicant tracking systems. They ensure your resume gets noticed and signals your suitability for the role.

Here's an example of a standalone skills section for an investment banking analyst:

This section is effective because it clearly lists relevant skills that are crucial for success in the role. Each skill aligns with the core competencies that employers seek in a qualified investment banking analyst.

Best hard skills to feature on your investment banking analyst resume

To excel as an investment banking analyst, you need hard skills that showcase your ability to manage complex financial tasks. These skills communicate your technical proficiency and readiness for the job.

Hard Skills

- Financial Modeling

- Valuation Techniques

- Data Analysis

- Market Research

- Mergers and Acquisitions

- Excel Proficiency

- Risk Management

- Portfolio Management

- Capital Markets Knowledge

- SQL (Structured Query Language)

- Bloomberg Terminal Proficiency

- Accounting Principles

- Investment Strategy

- Regulatory Compliance

- Financial Reporting

Best soft skills to feature on your investment banking analyst resume

Soft skills are equally important for investment banking analysts, reflecting your ability to work well with others, communicate clearly, and solve problems efficiently.

Soft Skills

- Communication

- Analytical Thinking

- Time Management

- Problem Solving

- Teamwork

- Adaptability

- Decision Making

- Leadership

- Interpersonal Skills

- Negotiation

- Attention to Detail

- Work Ethic

- Stress Management

- Initiative

- Conflict Resolution

How to include your education on your resume

Writing an education section is a crucial part of your investment banking analyst resume. It highlights your academic background and showcases the skills and knowledge you've gained, which can impact your fit for the role. Tailoring this section to the job by including only relevant education strengthens your application and demonstrates focus. For relevant achievements, include your GPA if it's impressive (usually 3.5 or above). Mention honors like "cum laude" if applicable. Clearly state your degree, institution, and graduation date. Avoid unnecessary details that don't add value.

Here’s an example of a poorly done education section:

Now, here’s an example of a well-crafted section:

The second example is effective because it focuses on relevant education and critical academic achievements, like a degree in finance, high GPA, and honors designation. A clear connection to the investment banking field is established, and unnecessary information is omitted, keeping the section concise and targeted.

How to include investment banking analyst certificates on your resume

Adding a certificates section to your investment banking analyst resume is an important step. List the name of each certification. Include the date you earned it. Add the issuing organization for each one. Highlighting certificates in your resume can showcase your expertise and dedication to potential employers. You can even include key certificates in your header to catch the eye immediately.

For example, you could write: "John Doe | CFA Level I | FMVA Certified | john.doe@email.com | 555-555-5555." This format makes your accomplishments clear at a glance.

Here is another example of a standalone certificates section:

This example is effective because it includes highly relevant certificates for an investment banking analyst. CFA Level I and FMVA are well-recognized certifications that demonstrate a solid foundation in finance and valuation skills. Listing the issuing organizations (CFA Institute and Corporate Finance Institute) provides credibility. Such details can make your resume stand out to hiring managers.

Extra sections to include in your investment banking analyst resume

Crafting a strong resume is crucial for standing out in the competitive field of investment banking. Including sections that highlight your languages, hobbies, volunteer work, and favorite books can make your resume more engaging and well-rounded.

Language section — Showcase your language skills to demonstrate cultural competency and adaptability. Detail any languages you speak fluently or proficiently.

Hobbies and interests section — Immerse potential employers in your personality by including hobbies and interests that are relevant to the job or show discipline. Highlighting your extracurricular activities can provide insights into who you are beyond work.

Volunteer work section — Exhibit your dedication and community involvement by detailing volunteer experiences. Highlight any relevant skills or leadership roles you acquired.

Books section — Impress employers by including a list of business or finance books you've read. This can underscore your eagerness to learn and stay updated on industry trends.

Integrating these sections into your investment banking analyst resume can give it a personal touch and make you a more memorable candidate. Customize each section to reflect your unique experiences and attributes.

In Conclusion

In conclusion, crafting an investment banking analyst resume is about showcasing both your technical expertise and your personal story. As you structure your resume, remember it is more than a list—it's a narrative of your journey and aspirations in finance. Each section, from your professional summary to your certifications, should echo your commitment and preparedness for the challenges of investment banking. The incorporation of quantifiable achievements not only highlights your past contributions but also sets a precedent for future potential. Meanwhile, emphasizing your education and additional certifications demonstrates lifelong learning and a pursuit of excellence. Soft skills, like communication and teamwork, alongside hard skills, such as financial modeling, paint a full picture of why you are suited for the industry. The resume should be a reflection of the organized, detail-oriented professional you are. Simultaneously, extra sections like languages, hobbies, and volunteer work offer a glimpse into your character, rendering you a more relatable and appealing candidate. In a competitive field like investment banking, a clear, well-crafted resume not only opens doors but paves the way for a successful career. Thus, by investing time and understanding into developing your resume, you create a powerful tool that connects your career ambitions with real opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.