Investment Banking Assiciate Resume Examples

Jul 18, 2024

|

12 min read

Secure your future: learn how to write an investment banking associate resume that stands out. Get tips and tricks to highlight your financial skills and experience to leave a lasting impression.

Rated by 348 people

Investment Banking Mergers & Acquisitions Associate

Private Equity Investment Associate

Investment Banking Structured Finance Associate

Investment Banking Associate in Debt Capital Markets

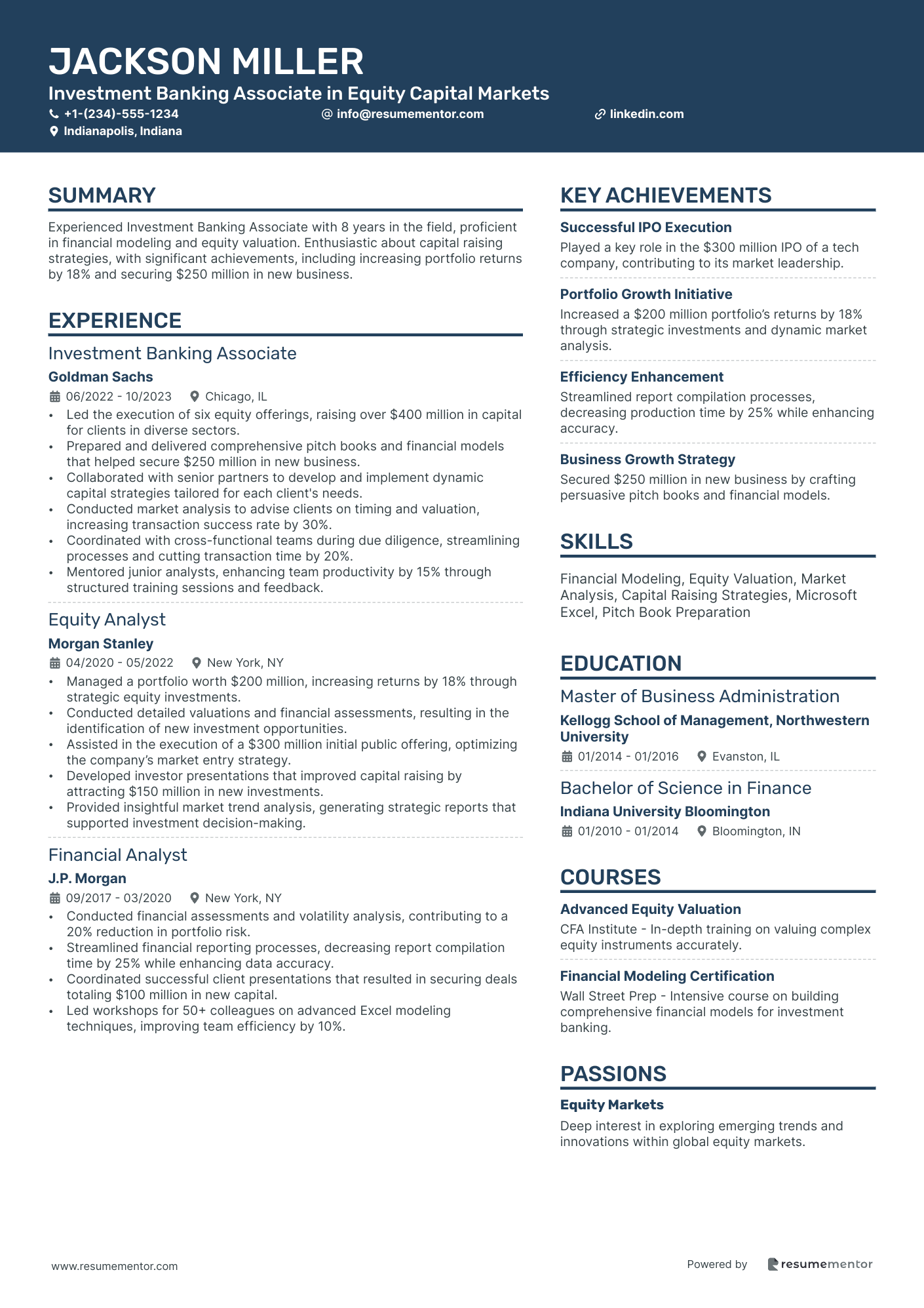

Investment Banking Associate in Equity Capital Markets

Associate in Technology Investment Banking

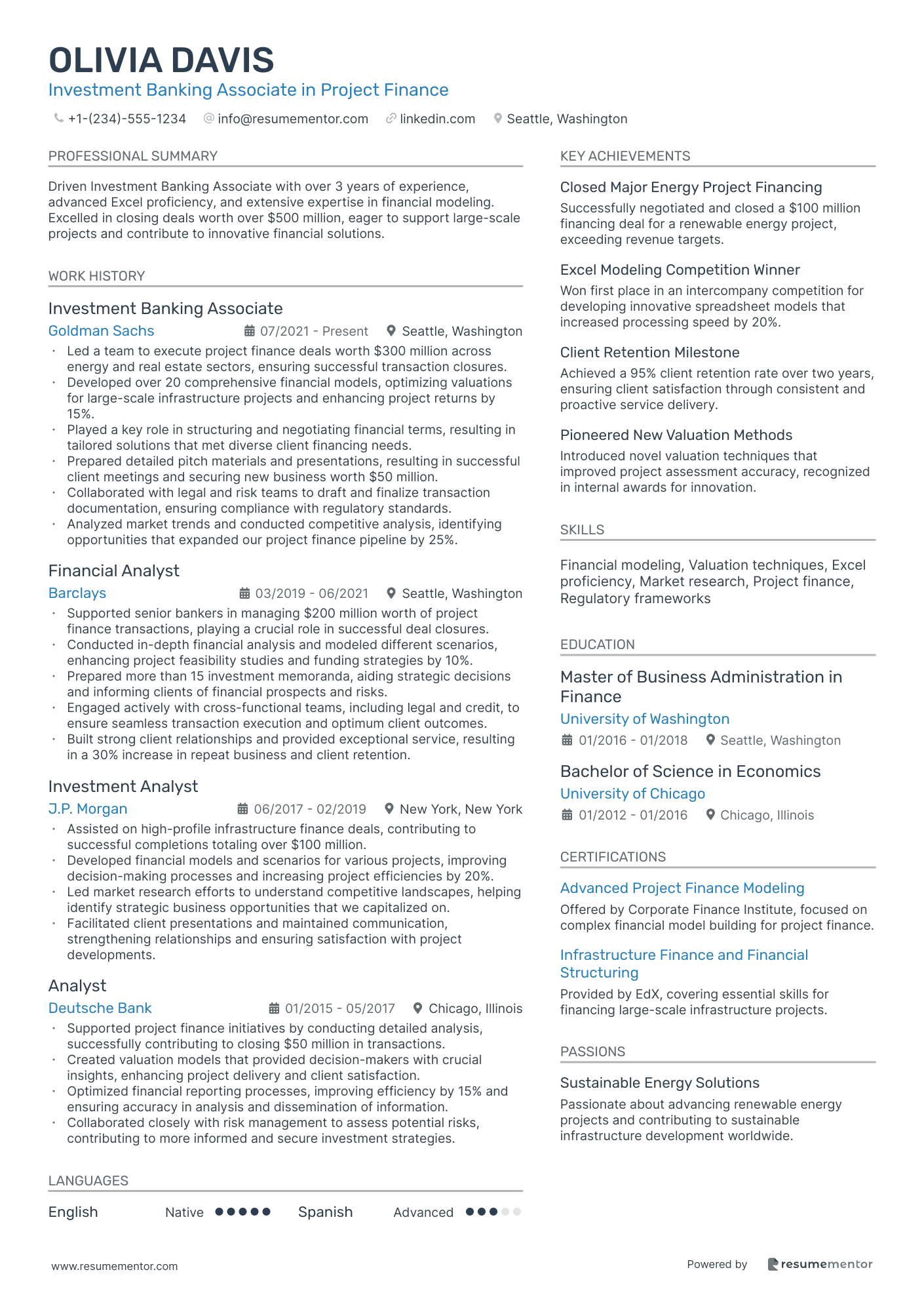

Investment Banking Associate in Project Finance

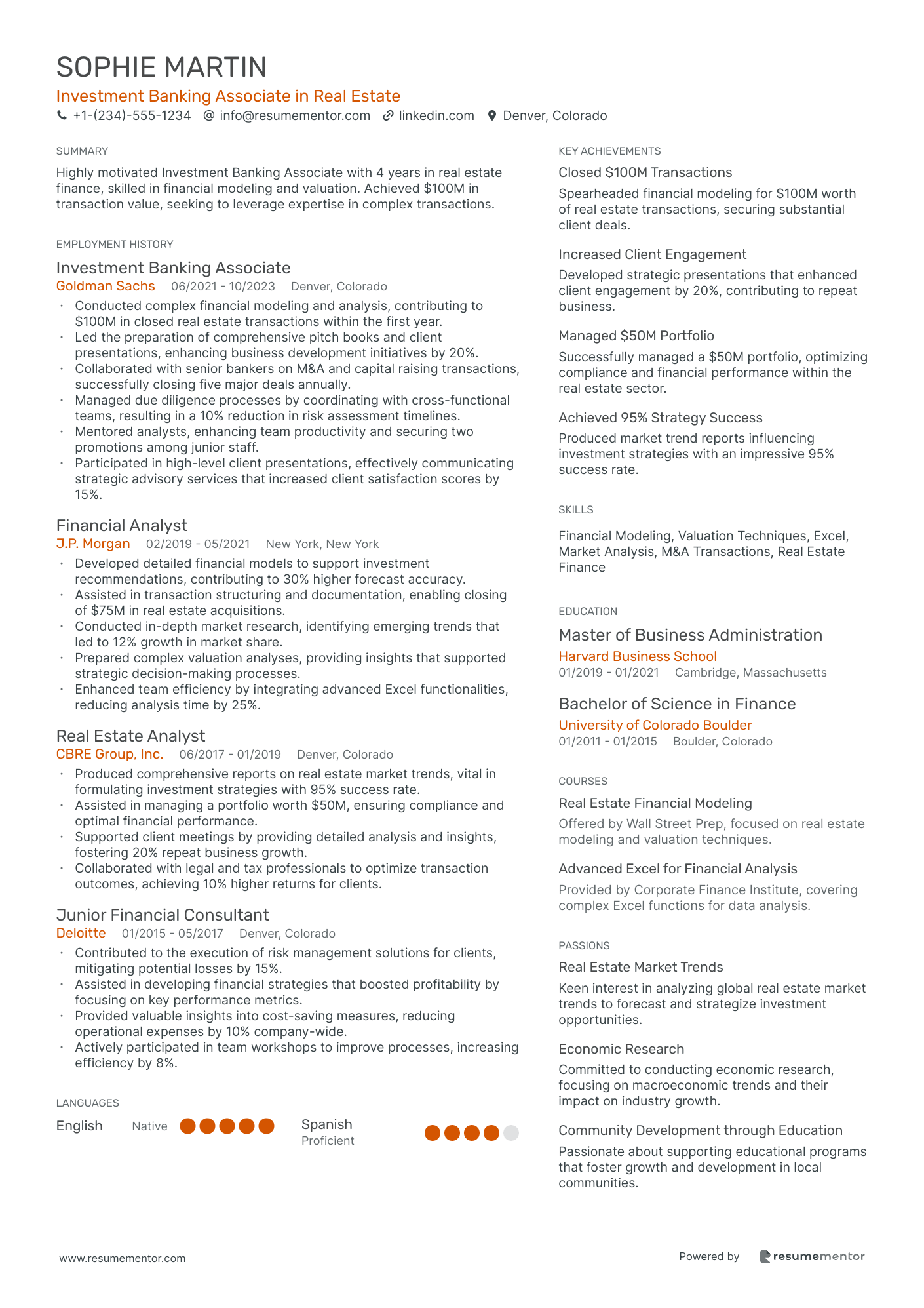

Investment Banking Associate in Real Estate

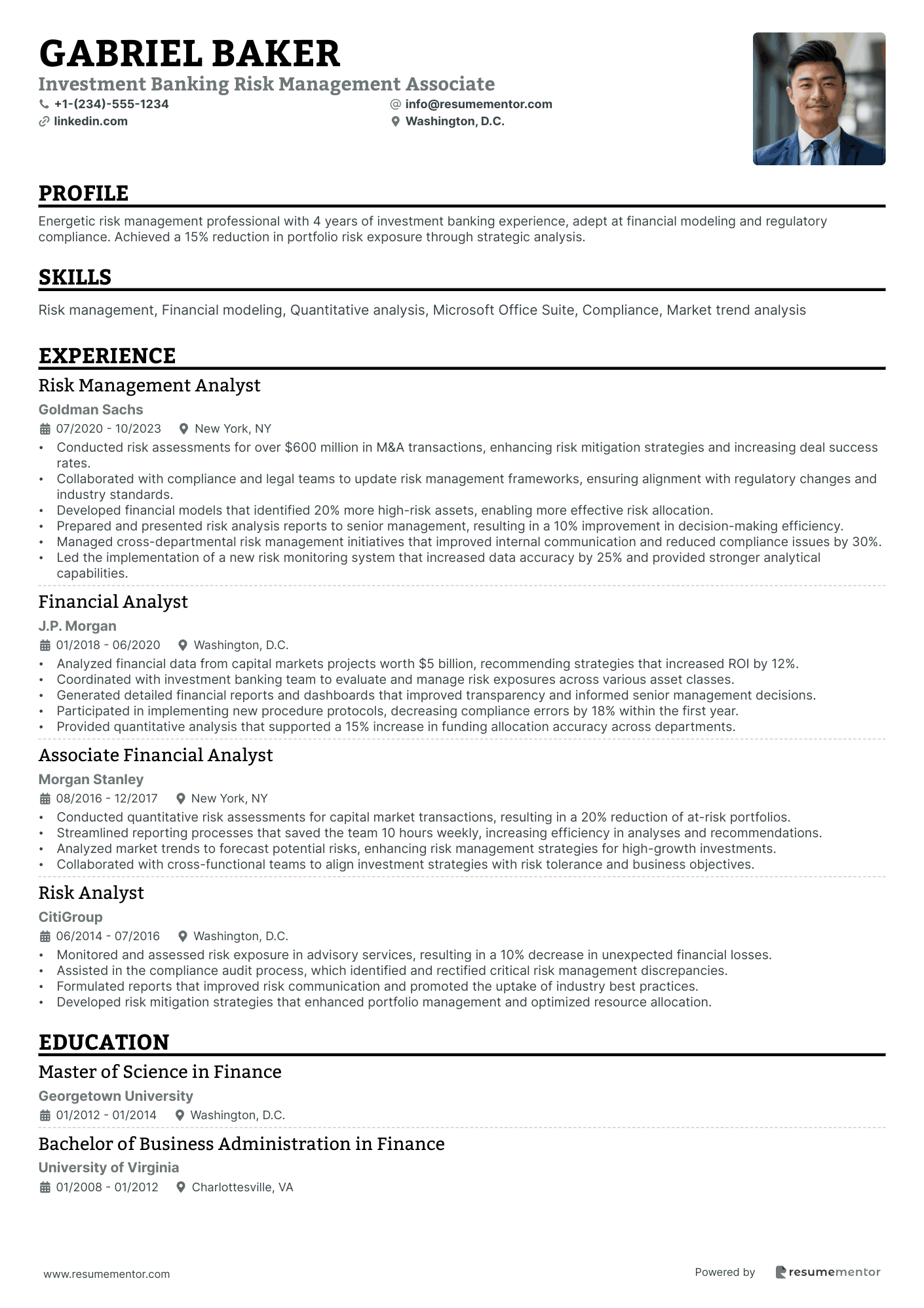

Investment Banking Risk Management Associate

Associate Director in Healthcare Investment Banking

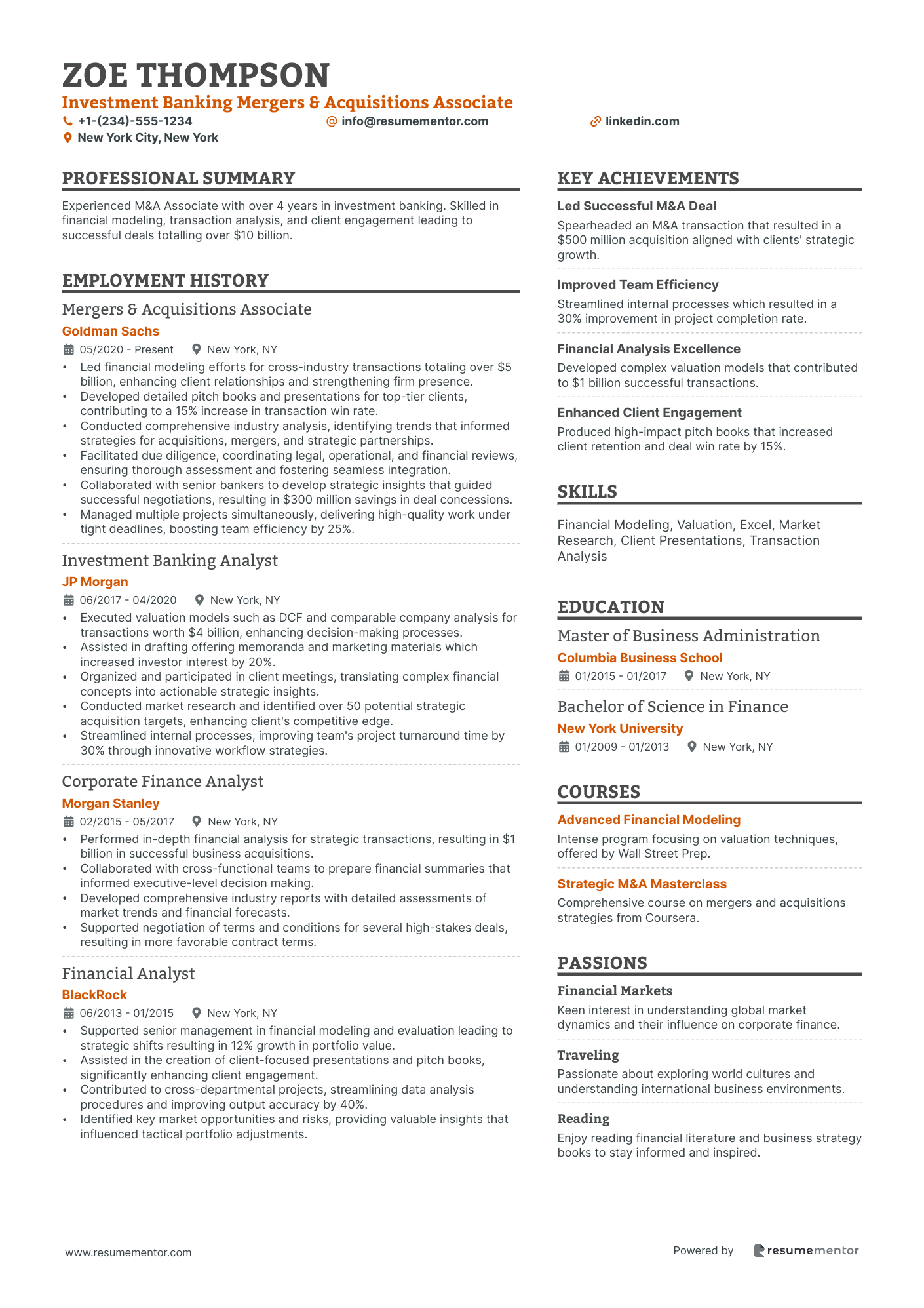

Investment Banking Mergers & Acquisitions Associate resume sample

- •Led financial modeling efforts for cross-industry transactions totaling over $5 billion, enhancing client relationships and strengthening firm presence.

- •Developed detailed pitch books and presentations for top-tier clients, contributing to a 15% increase in transaction win rate.

- •Conducted comprehensive industry analysis, identifying trends that informed strategies for acquisitions, mergers, and strategic partnerships.

- •Facilitated due diligence, coordinating legal, operational, and financial reviews, ensuring thorough assessment and fostering seamless integration.

- •Collaborated with senior bankers to develop strategic insights that guided successful negotiations, resulting in $300 million savings in deal concessions.

- •Managed multiple projects simultaneously, delivering high-quality work under tight deadlines, boosting team efficiency by 25%.

- •Executed valuation models such as DCF and comparable company analysis for transactions worth $4 billion, enhancing decision-making processes.

- •Assisted in drafting offering memoranda and marketing materials which increased investor interest by 20%.

- •Organized and participated in client meetings, translating complex financial concepts into actionable strategic insights.

- •Conducted market research and identified over 50 potential strategic acquisition targets, enhancing client's competitive edge.

- •Streamlined internal processes, improving team's project turnaround time by 30% through innovative workflow strategies.

- •Performed in-depth financial analysis for strategic transactions, resulting in $1 billion in successful business acquisitions.

- •Collaborated with cross-functional teams to prepare financial summaries that informed executive-level decision making.

- •Developed comprehensive industry reports with detailed assessments of market trends and financial forecasts.

- •Supported negotiation of terms and conditions for several high-stakes deals, resulting in more favorable contract terms.

- •Supported senior management in financial modeling and evaluation leading to strategic shifts resulting in 12% growth in portfolio value.

- •Assisted in the creation of client-focused presentations and pitch books, significantly enhancing client engagement.

- •Contributed to cross-departmental projects, streamlining data analysis procedures and improving output accuracy by 40%.

- •Identified key market opportunities and risks, providing valuable insights that influenced tactical portfolio adjustments.

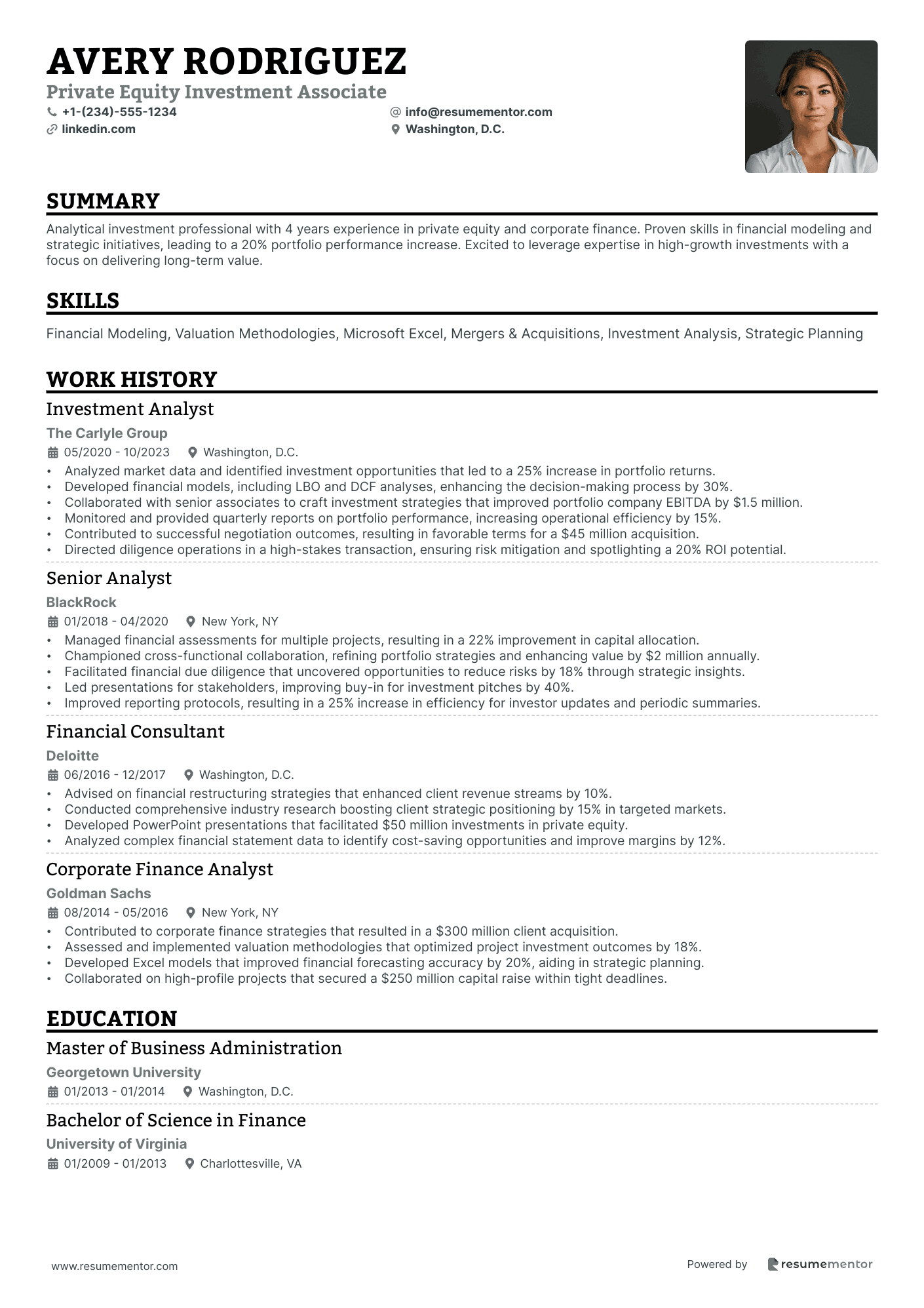

Private Equity Investment Associate resume sample

- •Analyzed market data and identified investment opportunities that led to a 25% increase in portfolio returns.

- •Developed financial models, including LBO and DCF analyses, enhancing the decision-making process by 30%.

- •Collaborated with senior associates to craft investment strategies that improved portfolio company EBITDA by $1.5 million.

- •Monitored and provided quarterly reports on portfolio performance, increasing operational efficiency by 15%.

- •Contributed to successful negotiation outcomes, resulting in favorable terms for a $45 million acquisition.

- •Directed diligence operations in a high-stakes transaction, ensuring risk mitigation and spotlighting a 20% ROI potential.

- •Managed financial assessments for multiple projects, resulting in a 22% improvement in capital allocation.

- •Championed cross-functional collaboration, refining portfolio strategies and enhancing value by $2 million annually.

- •Facilitated financial due diligence that uncovered opportunities to reduce risks by 18% through strategic insights.

- •Led presentations for stakeholders, improving buy-in for investment pitches by 40%.

- •Improved reporting protocols, resulting in a 25% increase in efficiency for investor updates and periodic summaries.

- •Advised on financial restructuring strategies that enhanced client revenue streams by 10%.

- •Conducted comprehensive industry research boosting client strategic positioning by 15% in targeted markets.

- •Developed PowerPoint presentations that facilitated $50 million investments in private equity.

- •Analyzed complex financial statement data to identify cost-saving opportunities and improve margins by 12%.

- •Contributed to corporate finance strategies that resulted in a $300 million client acquisition.

- •Assessed and implemented valuation methodologies that optimized project investment outcomes by 18%.

- •Developed Excel models that improved financial forecasting accuracy by 20%, aiding in strategic planning.

- •Collaborated on high-profile projects that secured a $250 million capital raise within tight deadlines.

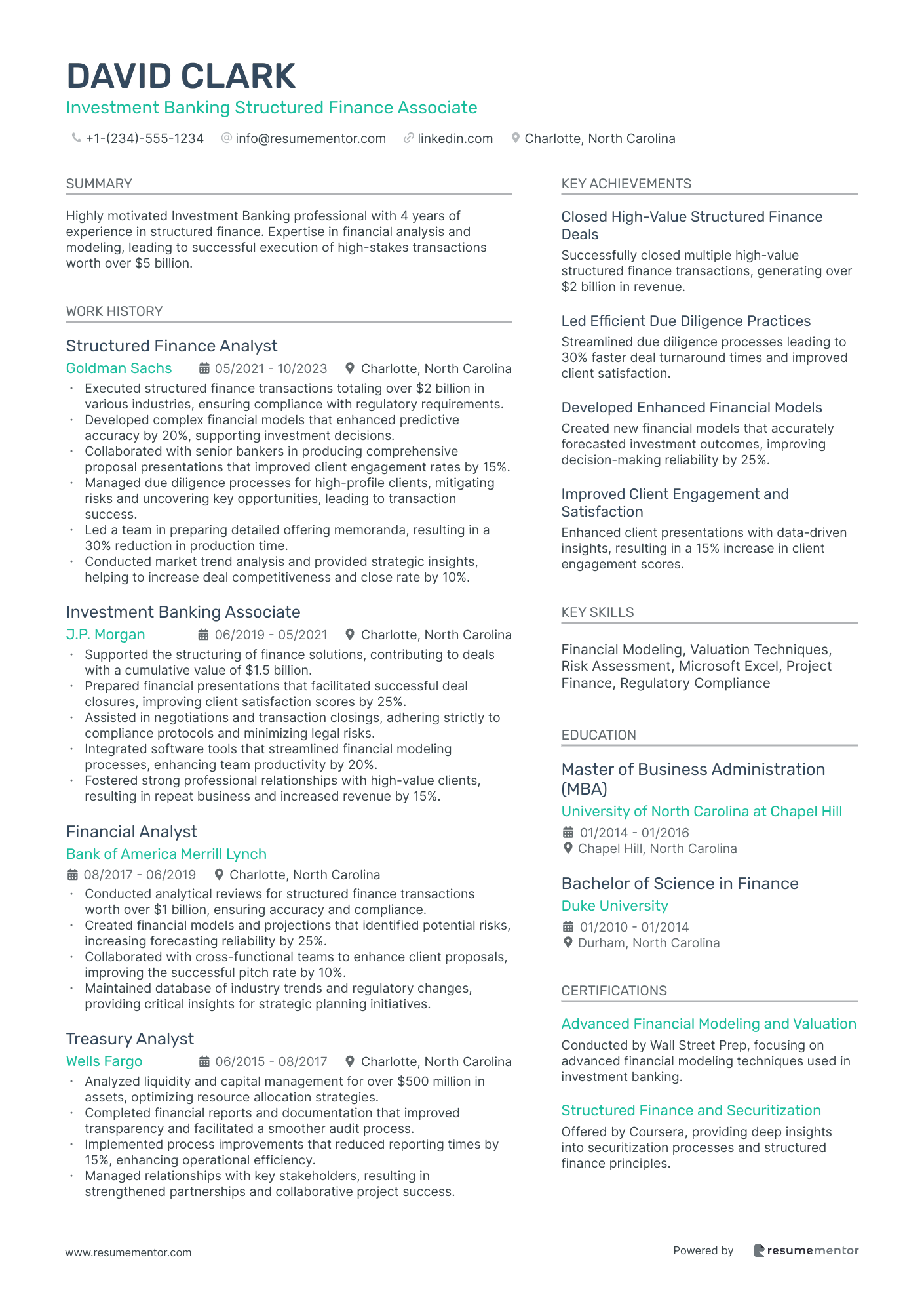

Investment Banking Structured Finance Associate resume sample

- •Executed structured finance transactions totaling over $2 billion in various industries, ensuring compliance with regulatory requirements.

- •Developed complex financial models that enhanced predictive accuracy by 20%, supporting investment decisions.

- •Collaborated with senior bankers in producing comprehensive proposal presentations that improved client engagement rates by 15%.

- •Managed due diligence processes for high-profile clients, mitigating risks and uncovering key opportunities, leading to transaction success.

- •Led a team in preparing detailed offering memoranda, resulting in a 30% reduction in production time.

- •Conducted market trend analysis and provided strategic insights, helping to increase deal competitiveness and close rate by 10%.

- •Supported the structuring of finance solutions, contributing to deals with a cumulative value of $1.5 billion.

- •Prepared financial presentations that facilitated successful deal closures, improving client satisfaction scores by 25%.

- •Assisted in negotiations and transaction closings, adhering strictly to compliance protocols and minimizing legal risks.

- •Integrated software tools that streamlined financial modeling processes, enhancing team productivity by 20%.

- •Fostered strong professional relationships with high-value clients, resulting in repeat business and increased revenue by 15%.

- •Conducted analytical reviews for structured finance transactions worth over $1 billion, ensuring accuracy and compliance.

- •Created financial models and projections that identified potential risks, increasing forecasting reliability by 25%.

- •Collaborated with cross-functional teams to enhance client proposals, improving the successful pitch rate by 10%.

- •Maintained database of industry trends and regulatory changes, providing critical insights for strategic planning initiatives.

- •Analyzed liquidity and capital management for over $500 million in assets, optimizing resource allocation strategies.

- •Completed financial reports and documentation that improved transparency and facilitated a smoother audit process.

- •Implemented process improvements that reduced reporting times by 15%, enhancing operational efficiency.

- •Managed relationships with key stakeholders, resulting in strengthened partnerships and collaborative project success.

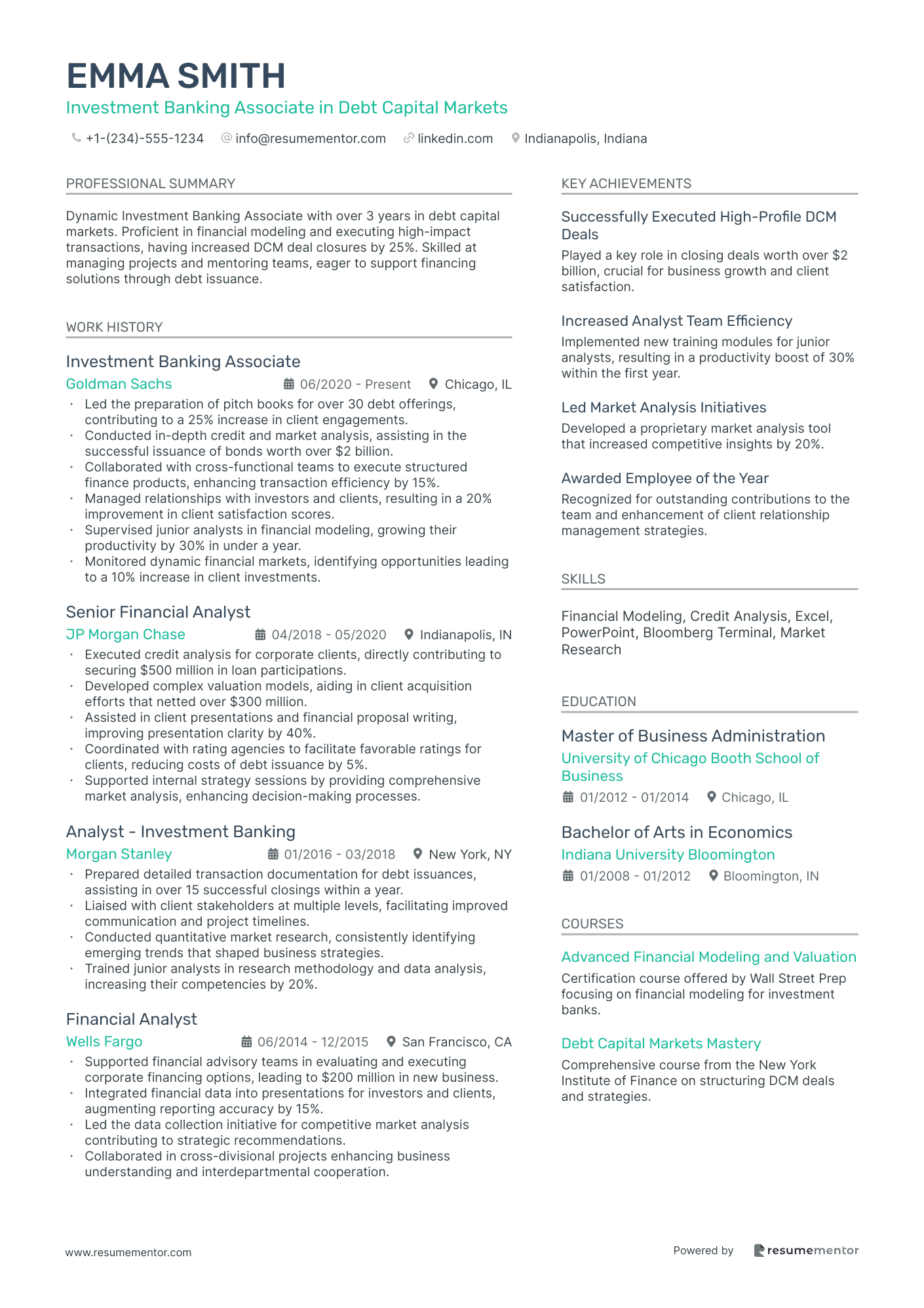

Investment Banking Associate in Debt Capital Markets resume sample

- •Led the preparation of pitch books for over 30 debt offerings, contributing to a 25% increase in client engagements.

- •Conducted in-depth credit and market analysis, assisting in the successful issuance of bonds worth over $2 billion.

- •Collaborated with cross-functional teams to execute structured finance products, enhancing transaction efficiency by 15%.

- •Managed relationships with investors and clients, resulting in a 20% improvement in client satisfaction scores.

- •Supervised junior analysts in financial modeling, growing their productivity by 30% in under a year.

- •Monitored dynamic financial markets, identifying opportunities leading to a 10% increase in client investments.

- •Executed credit analysis for corporate clients, directly contributing to securing $500 million in loan participations.

- •Developed complex valuation models, aiding in client acquisition efforts that netted over $300 million.

- •Assisted in client presentations and financial proposal writing, improving presentation clarity by 40%.

- •Coordinated with rating agencies to facilitate favorable ratings for clients, reducing costs of debt issuance by 5%.

- •Supported internal strategy sessions by providing comprehensive market analysis, enhancing decision-making processes.

- •Prepared detailed transaction documentation for debt issuances, assisting in over 15 successful closings within a year.

- •Liaised with client stakeholders at multiple levels, facilitating improved communication and project timelines.

- •Conducted quantitative market research, consistently identifying emerging trends that shaped business strategies.

- •Trained junior analysts in research methodology and data analysis, increasing their competencies by 20%.

- •Supported financial advisory teams in evaluating and executing corporate financing options, leading to $200 million in new business.

- •Integrated financial data into presentations for investors and clients, augmenting reporting accuracy by 15%.

- •Led the data collection initiative for competitive market analysis contributing to strategic recommendations.

- •Collaborated in cross-divisional projects enhancing business understanding and interdepartmental cooperation.

Investment Banking Associate in Equity Capital Markets resume sample

- •Led the execution of six equity offerings, raising over $400 million in capital for clients in diverse sectors.

- •Prepared and delivered comprehensive pitch books and financial models that helped secure $250 million in new business.

- •Collaborated with senior partners to develop and implement dynamic capital strategies tailored for each client's needs.

- •Conducted market analysis to advise clients on timing and valuation, increasing transaction success rate by 30%.

- •Coordinated with cross-functional teams during due diligence, streamlining processes and cutting transaction time by 20%.

- •Mentored junior analysts, enhancing team productivity by 15% through structured training sessions and feedback.

- •Managed a portfolio worth $200 million, increasing returns by 18% through strategic equity investments.

- •Conducted detailed valuations and financial assessments, resulting in the identification of new investment opportunities.

- •Assisted in the execution of a $300 million initial public offering, optimizing the company’s market entry strategy.

- •Developed investor presentations that improved capital raising by attracting $150 million in new investments.

- •Provided insightful market trend analysis, generating strategic reports that supported investment decision-making.

- •Conducted financial assessments and volatility analysis, contributing to a 20% reduction in portfolio risk.

- •Streamlined financial reporting processes, decreasing report compilation time by 25% while enhancing data accuracy.

- •Coordinated successful client presentations that resulted in securing deals totaling $100 million in new capital.

- •Led workshops for 50+ colleagues on advanced Excel modeling techniques, improving team efficiency by 10%.

- •Executed comprehensive financial due diligence resulting in a $50 million debt restructuring for a mid-size enterprise.

- •Built and maintained financial models that improved the company’s budgeting accuracy by 20%.

- •Assisted in preparing detailed financial proposals that facilitated a $75 million refinancing deal for a major client.

- •Participated in strategic financial planning that contributed to a 15% increase in quarterly profits.

Associate in Technology Investment Banking resume sample

- •Successfully supported a high-profile $300 million merger within the technology sector, contributing to strategic insights and advisory services impacting the client's market positioning.

- •Led the development of complex financial models, improving valuation accuracy by 20% and informing client investment decisions.

- •Created over 50 client presentations, enhancing pitching effectiveness and directly leading to increased client engagements by 15%.

- •Collaborated with senior bankers to implement robust transaction strategies, driving operational efficiency across multiple client engagements.

- •Integrated comprehensive industry research into advisory processes, aligning strategies with market trends and boosting client trust and satisfaction.

- •Directed cross-functional teams in due diligence processes, ensuring precise and timely transaction executions with zero discrepancies.

- •Played a vital role in a successful $150 million capital raise, carrying out detailed financial analysis that resulted in securing key investor commitments.

- •Conducted in-depth financial statement analysis for over 70 clients, influencing strategic investment approaches and decision-making processes.

- •Developed innovative financial models, reducing analysis time by 25% and improving error rate to under 1%.

- •Authored comprehensive market analysis reports, keeping stakeholders informed about major technological trends enhancing strategic planning.

- •Collated vital client information and communication, ensuring seamless transaction processes and strengthening client relationships.

- •Assisted in executing a $200 million acquisition deal, contributing analytical support that facilitated a smooth transaction process.

- •Utilized advanced Excel techniques to streamline financial modeling tasks, enhancing team productivity by 30%.

- •Drafted detailed pitch books and marketing materials, effectively supporting senior bankers in client presentations and securing engagements.

- •Monitored market trends and regulatory updates, integrating insights into client advisory services to maintain competitive advantages.

- •Executed financial modeling for over 40 technology-sector clients, enabling precise forecasts and robust strategic planning.

- •Engaged in comprehensive industry research, identifying key trends and advising teams on market-driven opportunities.

- •Facilitated client communication processes, significantly reducing response times and enhancing overall client service efficacy.

- •Supported senior team in a $100 million strategic advisory project, coordinating inter-departmental collaboration to deliver insightful results.

Investment Banking Associate in Project Finance resume sample

- •Led a team to execute project finance deals worth $300 million across energy and real estate sectors, ensuring successful transaction closures.

- •Developed over 20 comprehensive financial models, optimizing valuations for large-scale infrastructure projects and enhancing project returns by 15%.

- •Played a key role in structuring and negotiating financial terms, resulting in tailored solutions that met diverse client financing needs.

- •Prepared detailed pitch materials and presentations, resulting in successful client meetings and securing new business worth $50 million.

- •Collaborated with legal and risk teams to draft and finalize transaction documentation, ensuring compliance with regulatory standards.

- •Analyzed market trends and conducted competitive analysis, identifying opportunities that expanded our project finance pipeline by 25%.

- •Supported senior bankers in managing $200 million worth of project finance transactions, playing a crucial role in successful deal closures.

- •Conducted in-depth financial analysis and modeled different scenarios, enhancing project feasibility studies and funding strategies by 10%.

- •Prepared more than 15 investment memoranda, aiding strategic decisions and informing clients of financial prospects and risks.

- •Engaged actively with cross-functional teams, including legal and credit, to ensure seamless transaction execution and optimum client outcomes.

- •Built strong client relationships and provided exceptional service, resulting in a 30% increase in repeat business and client retention.

- •Assisted on high-profile infrastructure finance deals, contributing to successful completions totaling over $100 million.

- •Developed financial models and scenarios for various projects, improving decision-making processes and increasing project efficiencies by 20%.

- •Led market research efforts to understand competitive landscapes, helping identify strategic business opportunities that we capitalized on.

- •Facilitated client presentations and maintained communication, strengthening relationships and ensuring satisfaction with project developments.

- •Supported project finance initiatives by conducting detailed analysis, successfully contributing to closing $50 million in transactions.

- •Created valuation models that provided decision-makers with crucial insights, enhancing project delivery and client satisfaction.

- •Optimized financial reporting processes, improving efficiency by 15% and ensuring accuracy in analysis and dissemination of information.

- •Collaborated closely with risk management to assess potential risks, contributing to more informed and secure investment strategies.

Investment Banking Associate in Real Estate resume sample

- •Conducted complex financial modeling and analysis, contributing to $100M in closed real estate transactions within the first year.

- •Led the preparation of comprehensive pitch books and client presentations, enhancing business development initiatives by 20%.

- •Collaborated with senior bankers on M&A and capital raising transactions, successfully closing five major deals annually.

- •Managed due diligence processes by coordinating with cross-functional teams, resulting in a 10% reduction in risk assessment timelines.

- •Mentored analysts, enhancing team productivity and securing two promotions among junior staff.

- •Participated in high-level client presentations, effectively communicating strategic advisory services that increased client satisfaction scores by 15%.

- •Developed detailed financial models to support investment recommendations, contributing to 30% higher forecast accuracy.

- •Assisted in transaction structuring and documentation, enabling closing of $75M in real estate acquisitions.

- •Conducted in-depth market research, identifying emerging trends that led to 12% growth in market share.

- •Prepared complex valuation analyses, providing insights that supported strategic decision-making processes.

- •Enhanced team efficiency by integrating advanced Excel functionalities, reducing analysis time by 25%.

- •Produced comprehensive reports on real estate market trends, vital in formulating investment strategies with 95% success rate.

- •Assisted in managing a portfolio worth $50M, ensuring compliance and optimal financial performance.

- •Supported client meetings by providing detailed analysis and insights, fostering 20% repeat business growth.

- •Collaborated with legal and tax professionals to optimize transaction outcomes, achieving 10% higher returns for clients.

- •Contributed to the execution of risk management solutions for clients, mitigating potential losses by 15%.

- •Assisted in developing financial strategies that boosted profitability by focusing on key performance metrics.

- •Provided valuable insights into cost-saving measures, reducing operational expenses by 10% company-wide.

- •Actively participated in team workshops to improve processes, increasing efficiency by 8%.

Investment Banking Risk Management Associate resume sample

- •Conducted risk assessments for over $600 million in M&A transactions, enhancing risk mitigation strategies and increasing deal success rates.

- •Collaborated with compliance and legal teams to update risk management frameworks, ensuring alignment with regulatory changes and industry standards.

- •Developed financial models that identified 20% more high-risk assets, enabling more effective risk allocation.

- •Prepared and presented risk analysis reports to senior management, resulting in a 10% improvement in decision-making efficiency.

- •Managed cross-departmental risk management initiatives that improved internal communication and reduced compliance issues by 30%.

- •Led the implementation of a new risk monitoring system that increased data accuracy by 25% and provided stronger analytical capabilities.

- •Analyzed financial data from capital markets projects worth $5 billion, recommending strategies that increased ROI by 12%.

- •Coordinated with investment banking team to evaluate and manage risk exposures across various asset classes.

- •Generated detailed financial reports and dashboards that improved transparency and informed senior management decisions.

- •Participated in implementing new procedure protocols, decreasing compliance errors by 18% within the first year.

- •Provided quantitative analysis that supported a 15% increase in funding allocation accuracy across departments.

- •Conducted quantitative risk assessments for capital market transactions, resulting in a 20% reduction of at-risk portfolios.

- •Streamlined reporting processes that saved the team 10 hours weekly, increasing efficiency in analyses and recommendations.

- •Analyzed market trends to forecast potential risks, enhancing risk management strategies for high-growth investments.

- •Collaborated with cross-functional teams to align investment strategies with risk tolerance and business objectives.

- •Monitored and assessed risk exposure in advisory services, resulting in a 10% decrease in unexpected financial losses.

- •Assisted in the compliance audit process, which identified and rectified critical risk management discrepancies.

- •Formulated reports that improved risk communication and promoted the uptake of industry best practices.

- •Developed risk mitigation strategies that enhanced portfolio management and optimized resource allocation.

Associate Director in Healthcare Investment Banking resume sample

- •Managed a portfolio of mergers & acquisitions projects contributing to a 30% revenue growth over two fiscal years.

- •Led a team of junior bankers, increasing transaction efficiency by 15% through effective mentoring and strategic guidance.

- •Established key industry relationships, enhancing client retention rate by over 20% year on year.

- •Executed complex financial models and valuations, directly improving decision-making processes and transaction outcomes.

- •Collaborated across teams to deliver successfully on multimillion-dollar projects under tight deadlines.

- •Developed comprehensive presentation materials for clients, resulting in securing $500M in new capital.

- •Conducted in-depth market analysis to support the successful completion of over 12 healthcare transactions.

- •Developed financial analyses and modeling tools that facilitated a 10% increase in operational efficiency.

- •Coordinated with cross-functional teams on strategic consulting projects, resulting in a significant increase in client satisfaction.

- •Increased departmental revenue by leading a strategic transaction that closed at $150M above initial valuation.

- •Actively participated in client meetings, enhancing rapport and contributing to a 15% portfolio expansion.

- •Supported the execution of M&A advisory mandates, contributing to a 22% increase in firm-wide profitability.

- •Developed and maintained client pitch books and transaction marketing materials for healthcare clientele.

- •Conducted detailed industry research to evaluate competitive positioning, enhancing strategic decision outcomes.

- •Facilitated the closing of capital raises totaling $500M, resulting in a strong reputation in capital markets.

- •Assisted in financial modeling and analyses for successful transactions in the healthcare sector.

- •Analyzed regulatory frameworks impacting client transactions, ensuring compliance and mitigating risks.

- •Identified market opportunities through comprehensive research, aiding in client strategy development.

- •Increased team productivity by introducing process improvements and new analysis tools.

Crafting an impactful investment banking associate resume can feel like piecing together a complex financial model. Your resume often serves as your first impression, so getting it right is crucial. While your analytical skills shine in your daily work, translating them into resume language can present a unique challenge. Effectively communicating your financial expertise and accomplishments requires them to be both concise and compelling.

In the fast-paced world of investment banking, where time is money, recruiters are known to scan resumes in mere seconds. This means your resume must quickly highlight your technical skills in finance and showcase how you've added value throughout your career. Utilizing a clean, structured layout helps guide the reader naturally through your story of achievements and skills.

Here’s where using a resume template can make a real difference. It provides a structure that’s designed specifically to present your skills and experience with clarity and professionalism. A well-chosen template organizes sections for your financial accomplishments, technical expertise, and career growth, allowing you to focus on crafting engaging content rather than wrestling with formatting issues.

As you embark on this important process, consider exploring these resume templates to ensure your experiences truly shine. Streamlining your resume with a polished template lets your insights and career trajectory stand out. Ultimately, your resume will be a powerful testament to your expertise and potential, capturing the attention of prospective employers.

Key Takeaways

- Your resume must effectively highlight technical financial skills and demonstrate added value in your career to capture recruiters' attention quickly.

- Utilizing a structured resume template helps clearly present financial accomplishments and technical expertise.

- Selecting a chronological format, along with a clean and modern font, presents experience clearly and professionally.

- Quantifiable achievements using strong action words in your experience section enhance the impression of impact.

- Incorporate additional resume sections like certifications, languages, and volunteer work to offer a holistic view of your qualifications and character.

What to focus on when writing your investment banking assiciate resume

Your investment banking associate resume should seamlessly highlight your expertise in financial analysis and deal execution while showcasing your ability to manage client relationships and lead project teams effectively. Recruiters look for strong analytical skills intertwined with a keen attention to detail and a profound understanding of financial markets—this foundation sets the stage for your resume's key components.

How to structure your investment banking assiciate resume

- Contact Information—Start your resume with your full name, phone number, and email address to ensure immediate accessibility. Including a professional LinkedIn profile offers recruiters an expanded view of your career and serves as an invitation to connect digitally. Ensuring your email address is simple and professional further instills confidence and sets a positive tone.

- Professional Summary—In a concise few sentences, frame your career in investment banking, focusing on your experience, key accomplishments, and career goals. Use this space to capture the core of your professional identity and hint at the value you can bring to a potential employer. This overview should entice recruiters to read further.

- Work Experience—Detail your previous roles with clarity, emphasizing contributions such as successful transactions handled, financial models built, and client relationships strengthened. Quantifying achievements with specific numbers or percentages can enhance the impression of impact. This section is crucial for conveying the real-world application of your skills.

- Education—List your academic background, focusing on degrees, relevant coursework, and any honors received. Mention prestigious institutions and specialized studies in finance or economics that align with the industry demands. Demonstrating a strong academic foundation assures recruiters of your knowledge and commitment to the field.

- Skills—Highlight specific skills like financial modeling, valuations, and understanding of regulatory compliance. Include software proficiency, such as Excel and Bloomberg, which is essential for investment banking. This alignment of skills with industry standards ensures that your technical competencies are evident.

- Certifications—Include relevant certifications like the CFA or FINRA license to underscore your expertise and dedication to professional development. Such credentials differentiate you within the competitive investment banking landscape. Demonstrating continuous learning can be a significant selling point to employers.

Each section outlined above serves a purpose—next, let's explore the resume format to seamlessly integrate these elements and dive deeper into tailoring each section for the investment banking associate role.

Which resume format to choose

Creating a standout investment banking associate resume is essential in the competitive financial industry, where precision and clarity can make all the difference. Start with a chronological format, which effectively highlights your career growth by putting your most relevant experience front and center. This format is particularly useful in investment banking, where your track record and steady progression are key selling points.

When it comes to choosing a font, consider Raleway, Montserrat, or Lato. Each of these options lends a modern and polished look to your resume, helping it stand out from more traditional styles. The choice of font may seem minor, but it contributes to an overall impression of professionalism and attention to detail—traits valued in finance.

As for the format, always save your resume as a PDF. This is crucial because PDFs maintain your document's formatting, ensuring that it appears consistent and professional no matter the device or platform used to view it. Consistency in format reflects your ability to present information clearly, a highly valued skill in banking.

Finally, setting your margins to one inch all around creates a neat and organized layout, allowing recruiters to easily scan through your credentials without the distraction of clutter. Clean margins help to keep the focus on your achievements and skills, enhancing readability and impact.

Together, these elements of format, font, file type, and margins align to support your candidacy by presenting you as an organized and detail-oriented professional, ready to excel in the investment banking world.

How to write a quantifiable resume experience section

An investment banking associate resume should emphasize achievements that are both quantifiable and relevant to the role. By showcasing how your contributions led to project successes or enhanced firm performance, you provide a compelling picture of your value. Organizing the experience section in reverse chronological order helps potential employers see your most recent and relevant roles first, focusing on job titles, companies, dates, and locations. Keeping your history to the past 10-15 years ensures you maintain relevance and align with industry expectations. Tailoring your resume to specific job ads is crucial; aligning your experiences with the required skills makes your application stronger. Action words like "initiated," "executed," "developed," and "analyzed" add clarity and impact, making your achievements stand out.

- •Led the assessment and completion of transactions worth over $500 million, boosting firm revenue by 15%.

- •Developed financial models that cut operational costs by 20% across multiple departments.

- •Coordinated cross-functional teams to ensure seamless execution of M&A processes, improving client satisfaction scores by 30%.

- •Initiated a new client acquisition strategy, expanding the client base by 25% within the first year.

The experience section stands out by clearly linking each achievement to significant contributions, making your impact on the firm's success undeniable. The use of strong action verbs and quantifiable results creates a powerful impression, ensuring your accomplishments are both compelling and easy to understand. By aligning your experiences with industry-specific skills, this section helps employers see how you can replicate these successes, offering valuable insights into your potential role in their organization. Its clear structure and focus on key achievements make it easy for employers to see why you are a strong candidate for investment banking roles.

Achievement-Focused resume experience section

A resume experience section for an achievement-focused investment banking associate should highlight the meaningful successes and contributions you've made in your previous roles. Begin by listing your job titles, workplaces, and employment dates to give a solid overview of your career trajectory. When elaborating on your experiences, concentrate on measurable outcomes that demonstrate your capability to achieve results. Use strong action verbs and include numbers to clearly quantify your accomplishments, making a lasting impression on readers.

In the bullet points, illustrate your involvement in essential projects or deals, demonstrating how your leadership and strategic thinking made a difference. Keep each point straightforward and highlight the clear impacts on your team or company, which will help potential employers understand the value you bring. Ensure your examples align well with the role you're targeting, making them both relevant and engaging. By focusing on clarity and precision, you enable employers to quickly and easily grasp your contributions and potential.

Investment Banking Associate

ABC Capital Partners.

Jan 2020 - Present

- Advised on mergers and acquisitions worth over $1 billion, optimizing transaction structures to increase client returns by 15%.

- Led a team of analysts in developing financial models that supported capital raising efforts, resulting in successful funding rounds exceeding $500 million.

- Implemented innovative risk analysis techniques, which decreased project risks and increased overall profitability by 20%.

- Fostered strong client relationships by providing strategic financial insights, boosting customer satisfaction scores by 30%.

Technology-Focused resume experience section

A technology-focused investment banking associate resume experience section should effectively highlight your specialized skills and accomplishments in the tech sector. Start by stating your role and involvement in notable companies or projects to provide employers with a clear understanding of your background. Emphasize your achievements in managing tech-based financial transactions or advisory roles, using active language to convey your impact. This approach creates a strong narrative that ties together your experience and expertise.

For each job experience, use bullet points to concisely list your accomplishments and responsibilities. Whenever possible, include quantifiable outcomes, such as the size of deals or growth percentages, to demonstrate your contributions. Focus on achievements that show your ability to communicate complex technical ideas to non-technical stakeholders, highlighting your role in bridging the gap between finance and technology. Maintaining clarity and simplicity ensures that this information is easily understood and appealing to potential employers.

Investment Banking Associate

ABC Capital Partners

June 2021 - Present

- Led analysis and valuation of emerging tech companies, guiding strategic decisions worth over $500M.

- Collaborated with a top fintech to enhance financial forecasting, achieving a 15% cost reduction.

- Crafted and presented detailed M&A pitches, securing deals that expanded market reach by 25%.

- Coordinated cross-functional teams in due diligence, ensuring smooth transactions and client satisfaction.

Skills-Focused resume experience section

A skills-focused Investment Banking Associate resume experience section should highlight your best skills and the impact you've made in your previous roles. Start by showing your achievements with numbers whenever possible, as this makes your success more tangible. Use strong action words to convey how your abilities have driven your success and make sure each bullet point is clear and concise. Focus specifically on the technical skills and industry knowledge that are important for the position you want, allowing each bullet to illustrate your capabilities and effectively communicate your strengths to potential employers.

When crafting this section, organize it around the skills and experiences most relevant to investment banking, such as financial modeling, analytical skills, and deal management. Make sure you clearly emphasize your role and the results you achieved, demonstrating your proficiency in handling complex transactions. Avoid vague statements by highlighting specific contributions to projects or milestones you've achieved. Tailor the section so it matches the specific job you are targeting, ensuring it catches the eye of hiring managers.

Investment Banking Associate

MegaBank Corp

January 2020 - Present

- Developed complex financial models to support new business opportunities, resulting in a 20% increase in deal closure rate.

- Led a team in the execution of multi-million dollar M&A transactions, enhancing department efficiency by 15%.

- Conducted in-depth market analysis and due diligence, directly contributing to strategic decision-making.

- Collaborated with senior executives to streamline client deliverables, improving client satisfaction scores by 25%.

Result-Focused resume experience section

A result-focused investment banking associate resume experience section should effectively convey your achievements and skills in a coherent story. Begin by concentrating on the essential aspects of your roles, with an emphasis on what you accomplished and the success you brought to each position. Employing clear and straightforward language will make your results and impact stand out. As you use active verbs, aim to quantify your successes to showcase your expertise in a relatable way. Providing concrete examples demonstrates your value to potential employers in an easily understandable manner.

When crafting each bullet point, start with strong action verbs that capture attention, and detail the actions you took along with the resulting success. Consider how you contributed to increased revenue, improved efficiencies, or significant deals closed. Be genuine and use numbers and percentages to vividly portray your impact. By allowing your accomplishments to shine through, you highlight the tangible outcomes of your efforts in a flow that’s easy for others to grasp and appreciate.

Investment Banking Associate

XYZ Financial

June 2020 - Present

- Led a team in structuring a $500M M&A transaction, boosting client revenue by 15%.

- Developed and executed financial models that slashed expenses by 10% through smart cost-saving strategies.

- Worked with cross-functional teams to pull off a $200M IPO in just three months.

- Negotiated terms for debt financing that saved clients up to 5% in interest costs.

Write your investment banking assiciate resume summary section

A results-focused investment banking associate resume needs a compelling summary to showcase your expertise. Start by highlighting your key skills and accomplishments, tailored specifically for the role. The resume summary is your first impression, a concise paragraph at the top that captures your professional identity instantly. It's essential to make it specific and impactful, demonstrating both your abilities and your potential for success in the role. Consider the following summary crafted for an investment banking associate:

This example gives a clear view of your experience and key skills while emphasizing terms like "M&A deals" and "financial modeling," which are vital in investment banking. A summary differs from a resume objective because it focuses on past achievements rather than future ambitions.

While a resume objective spells out your career goals, a summary highlights your proven track record. Moreover, a resume profile combines elements of both a summary and an objective, offering a broader view. In contrast, a summary of qualifications lists key skills and achievements in bullet points. For someone with your experience, a summary is more effective, offering a snapshot of your significant contributions. Ensure your summary aligns with the role's needs, keeping it concise yet influential. This positions you as a strong candidate, ensuring that every word adds value.

Listing your investment banking assiciate skills on your resume

A skills-focused resume for an investment banking associate should present your qualifications in a way that seamlessly connects various key areas. Begin with the skills section, which can stand alone or blend into your experience and summary sections effortlessly. Your strengths often radiate through soft skills like leadership and communication, essential for building relationships and guiding projects. Meanwhile, hard skills like financial modeling or data analysis are teachable and can be quantified, showcasing your technical capabilities.

Here's an example of a standalone skills section that hits the mark by providing a clear and relevant list of skills that recruiters value:

This section stands out because it concisely lists essential investment banking skills that align with the role, confirming your expertise and industry relevance.

Best hard skills to feature on your investment banking associate resume

Investment banking associates require hard skills that demonstrate their readiness to handle complex financial tasks. These skills highlight your technical proficiency and your ability to drive value.

Hard Skills

- Financial Modeling

- Valuation Analysis

- Mergers and Acquisitions

- Excel Proficiency

- Financial Statement Analysis

- Market Analysis

- Risk Assessment

- Strategic Planning

- Pitch Book Creation

- Leveraged Buyouts (LBO)

- Data Analysis

- Credit Analysis

- Deal Structuring

- Capital Raising

- Regulatory Compliance

Best soft skills to feature on your investment banking associate resume

In this high-demand role, soft skills emphasize your effectiveness in collaboration and project leadership. They reflect your capacity to navigate a fast-paced environment and handle pressure with grace.

Soft Skills

- Communication

- Leadership

- Problem-Solving

- Teamwork

- Adaptability

- Attention to Detail

- Time Management

- Negotiation

- Conflict Resolution

- Decision-Making

- Creativity

- Empathy

- Networking

- Influencing

- Stress Management

How to include your education on your resume

The education section is an important part of a resume, especially when applying for an investment banking associate position. It provides recruiters with key insights into your academic background. Tailor this section specifically for the job you're applying for, omitting any irrelevant education. When listing your degree, make sure it's relevant to investment banking to showcase your background effectively. If you have a notable GPA, include it. Write it as "GPA: 3.8/4.0" and make sure it's impressive enough to gain attention. Additionally, if you graduated with honors such as "cum laude," include it to highlight your achievements.

Here's how a poorly written education section might look:

In contrast, here's an excellent investment banking associate education section:

The second example focuses on a finance degree from a prestigious institution, indicating relevance to the role. It highlights academic excellence with an impressive GPA and "cum laude" honors. These details are clear and neatly presented, keeping the section concise and compelling. Recruiters will see your qualifications at a glance, reinforcing your candidacy.

How to include investment banking assiciate certificates on your resume

Including a certificates section in your investment banking associate resume is crucial. You can list certifications prominently either in a standalone section or in the header. List the name of the certificate. Include the date you received it. Add the issuing organization. Make sure this section stands out, as recruiters often look for specific qualifications.

For example, in your header, you can write: "John Doe, CFA, CPA." This immediately indicates your certifications. However, for a more detailed view, a separate section effectively highlights your achievements.

A good example is:

This example is good because it lists well-recognized, relevant certificates that add credibility to your qualifications. It clearly names the certification, dates, and issuing organizations. This concise presentation makes it easy for recruiters to see you meet essential requirements for the role.

Extra sections to include in your investment banking assiciate resume

In the fast-paced world of investment banking, showcasing diverse skills and experiences on your resume can set you apart from the competition. As an associate in this dynamic field, your resume should highlight not only your financial acumen but also your unique personal attributes.

Language section — Include proficiency in multiple languages to display your ability to work with diverse teams and international clients. This can be particularly useful for investment banking associates working on global transactions.

Hobbies and interests section — Highlight relevant hobbies like chess or hiking to show your strategic thinking and endurance. These interest areas can reflect your problem-solving abilities and personal determination.

Volunteer work section — Emphasize any finance-related volunteer work to show your commitment to community and social responsibility. This section can provide a more holistic view of you beyond your professional skills.

Books section — List influential books you've read, such as "The Intelligent Investor" by Benjamin Graham, to demonstrate your dedication to ongoing learning in finance. Mentioning well-regarded books can also serve as conversation starters during interviews.

Incorporating these sections into your investment banking associate resume can provide a fuller picture of your capabilities and character. They allow you to connect with potential employers on various levels, beyond just your technical skills.

In Conclusion

In conclusion, crafting a standout investment banking associate resume requires attention to detail and a clear focus on your strengths and achievements. This resume needs to convey your aptitude for managing complex financial tasks and your ability to contribute significantly to your firm's success. Begin by making your first impression count with a compelling summary that highlights your key qualifications and experiences relevant to the role. Within each section, emphasize quantifiable accomplishments to demonstrate your impact and use a clean, structured format that guides the reader seamlessly through your document.

Incorporate both hard and soft skills, ensuring they align with the requirements of the specific job you’re targeting. Hard skills like financial modeling and valuation analysis showcase your technical proficiency, while soft skills such as leadership and communication reflect your ability to work effectively within teams and manage client relationships. Including relevant certifications, like the CFA or CPA, can set you apart in the crowded field by underscoring your expertise and dedication to professional growth.

Moreover, additional sections like language proficiency or a volunteer work section can further enrich your resume, offering a glimpse into your versatility and personal attributes. Remember that each component of your resume serves a purpose in building a cohesive narrative about your professional journey and potential. By presenting an organized, impactful resume, you position yourself as a strong candidate ready to excel in the dynamic world of investment banking. Ultimately, a well-crafted resume will not only capture attention but also inspire confidence in your ability to bring value to a prospective employer.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.