Investment Banking Intern Resume Examples

Jul 18, 2024

|

12 min read

Get the job: ace your investment banking intern resume with these tips "worth their weight in gold". Discover how to highlight your skills, experience, and education to catch recruiters' eyes with ease.

Rated by 348 people

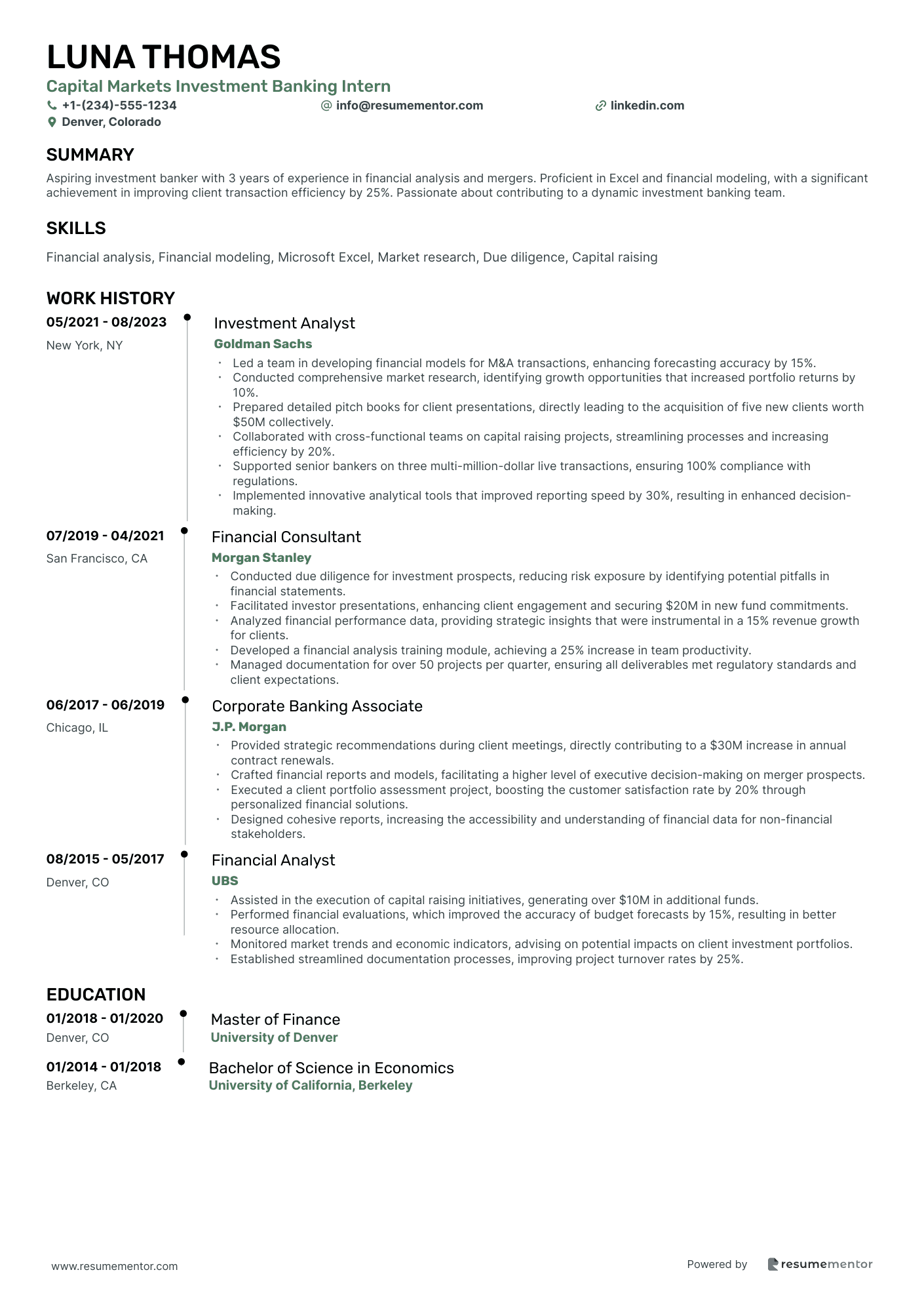

Capital Markets Investment Banking Intern

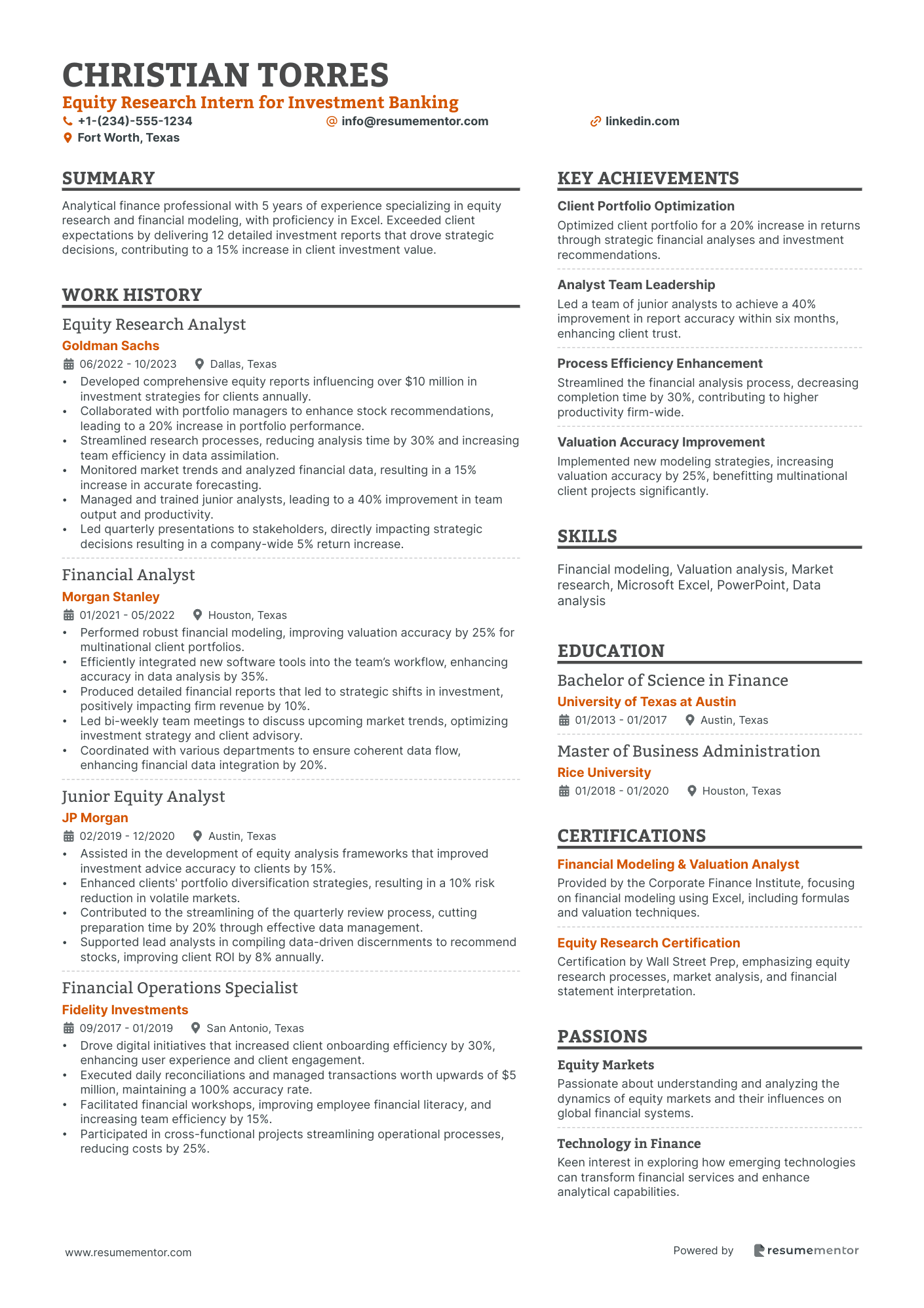

Equity Research Intern for Investment Banking

Risk Management Investment Banking Intern

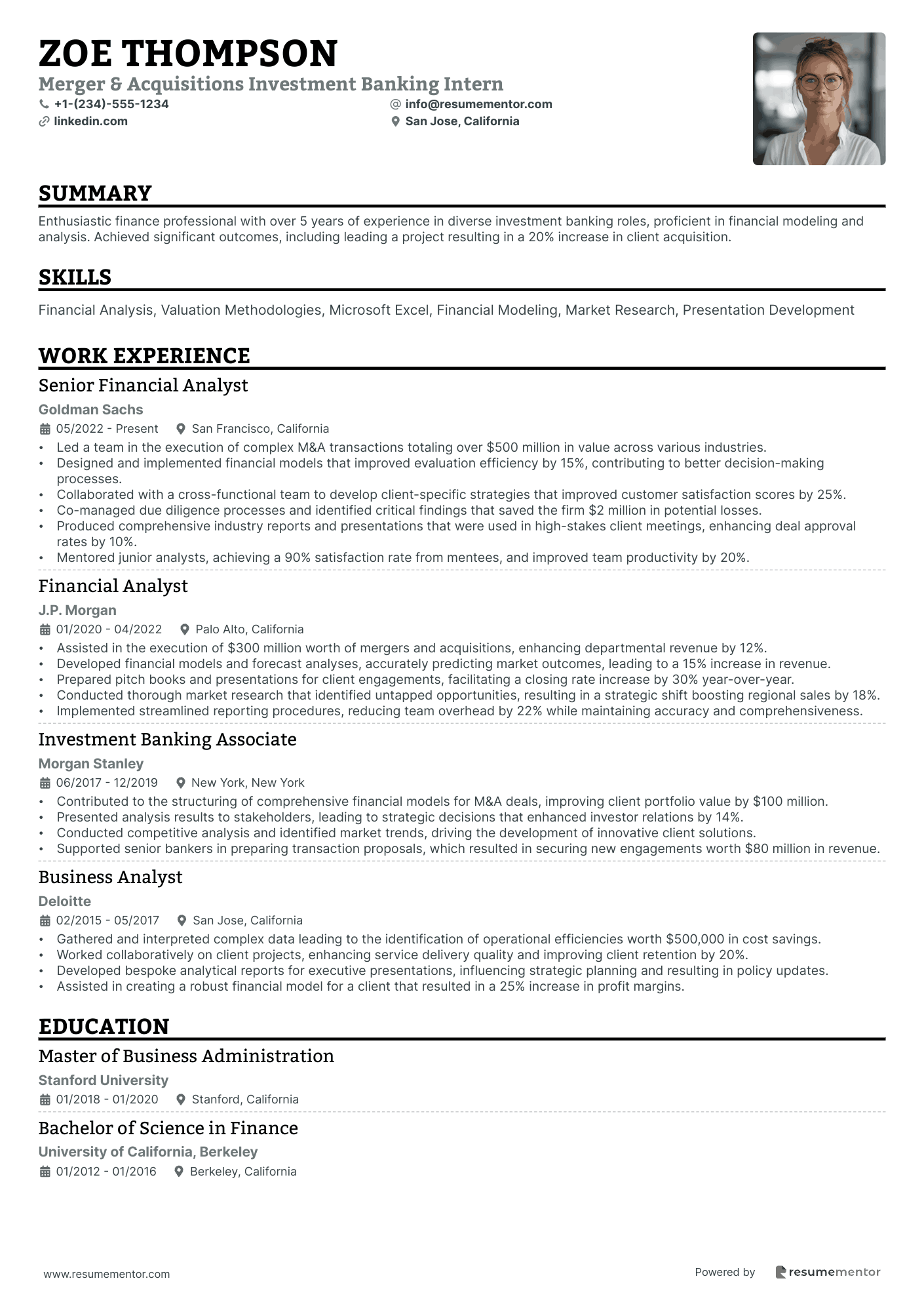

Merger & Acquisitions Investment Banking Intern

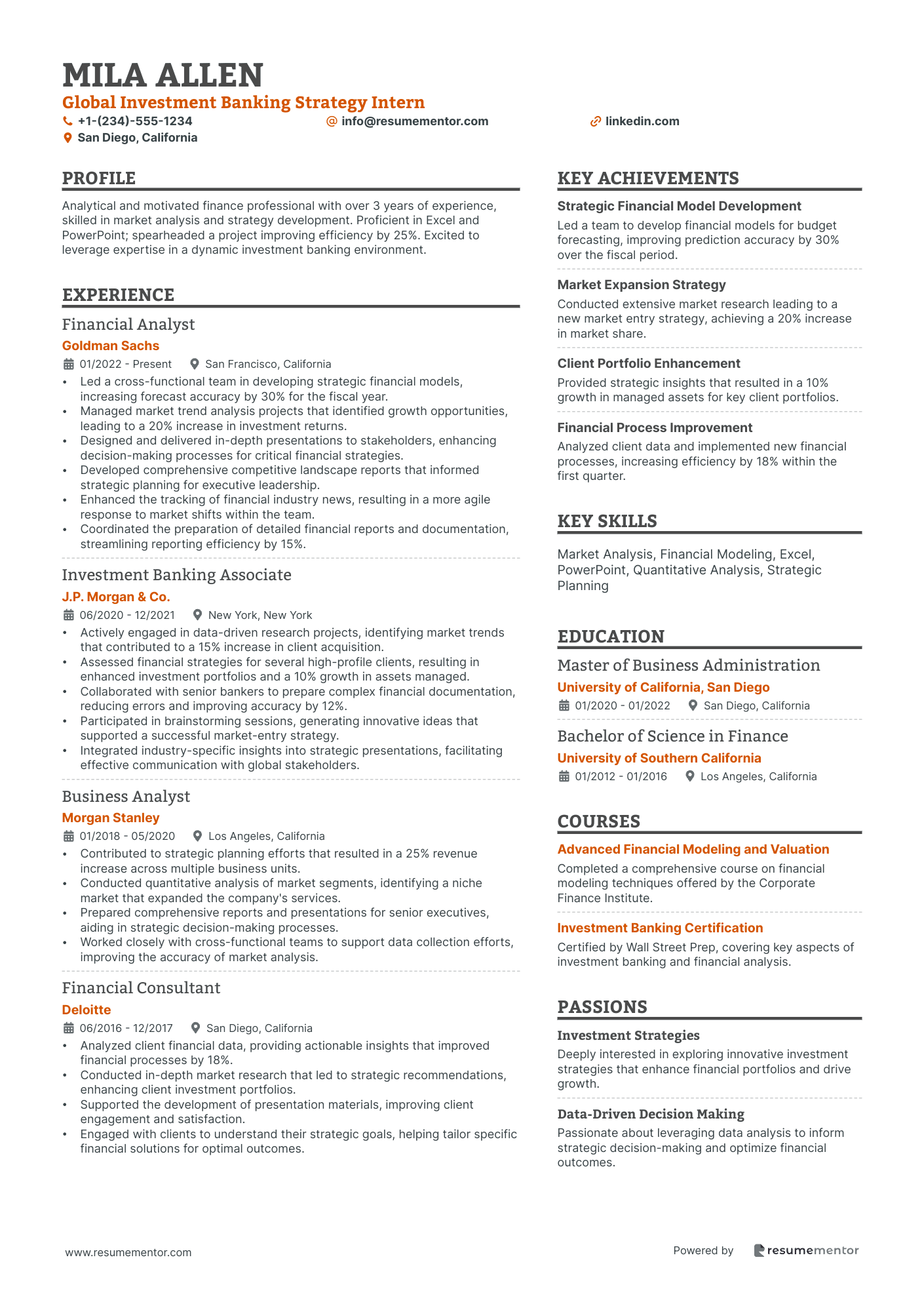

Global Investment Banking Strategy Intern

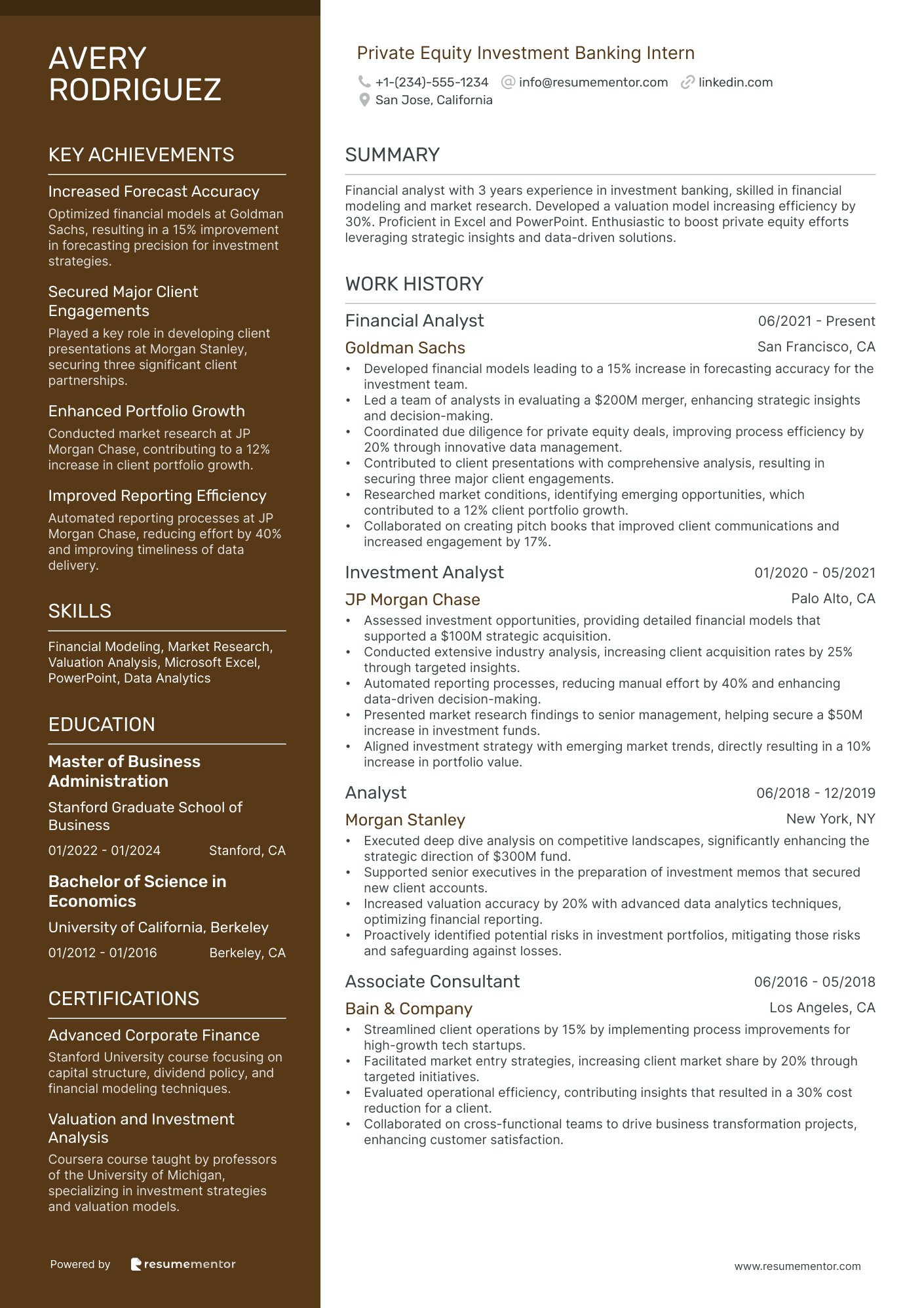

Private Equity Investment Banking Intern

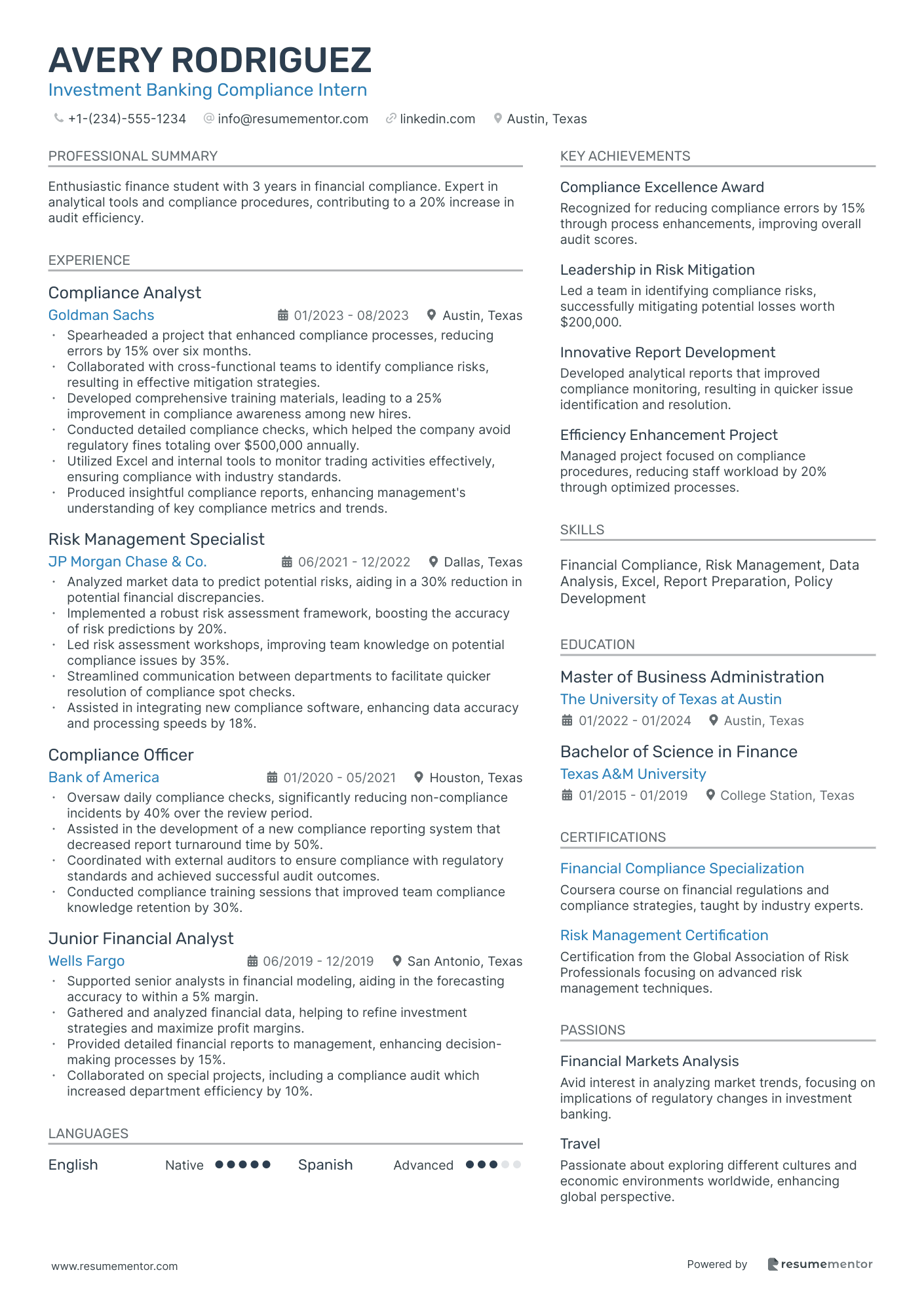

Investment Banking Compliance Intern

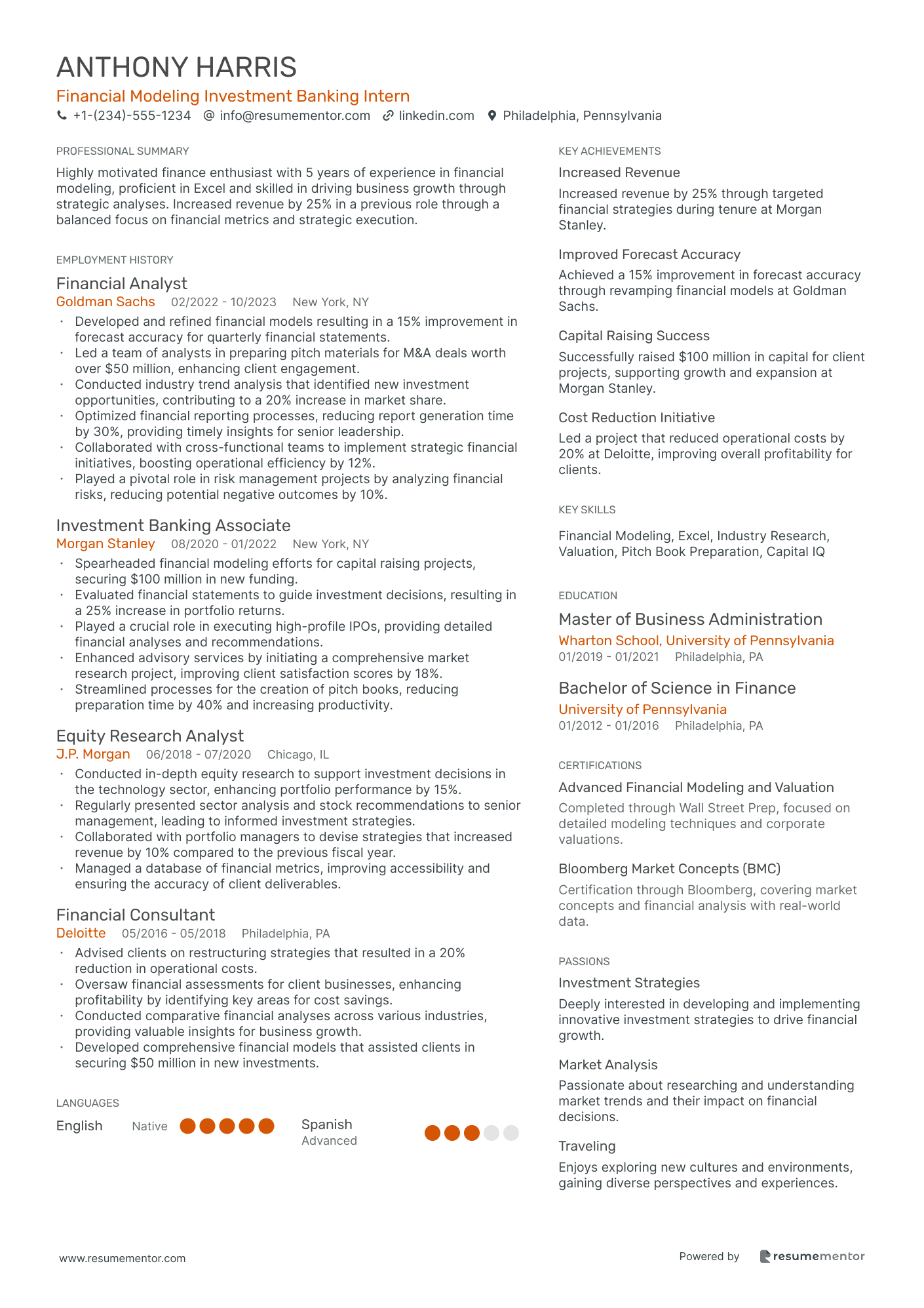

Financial Modeling Investment Banking Intern

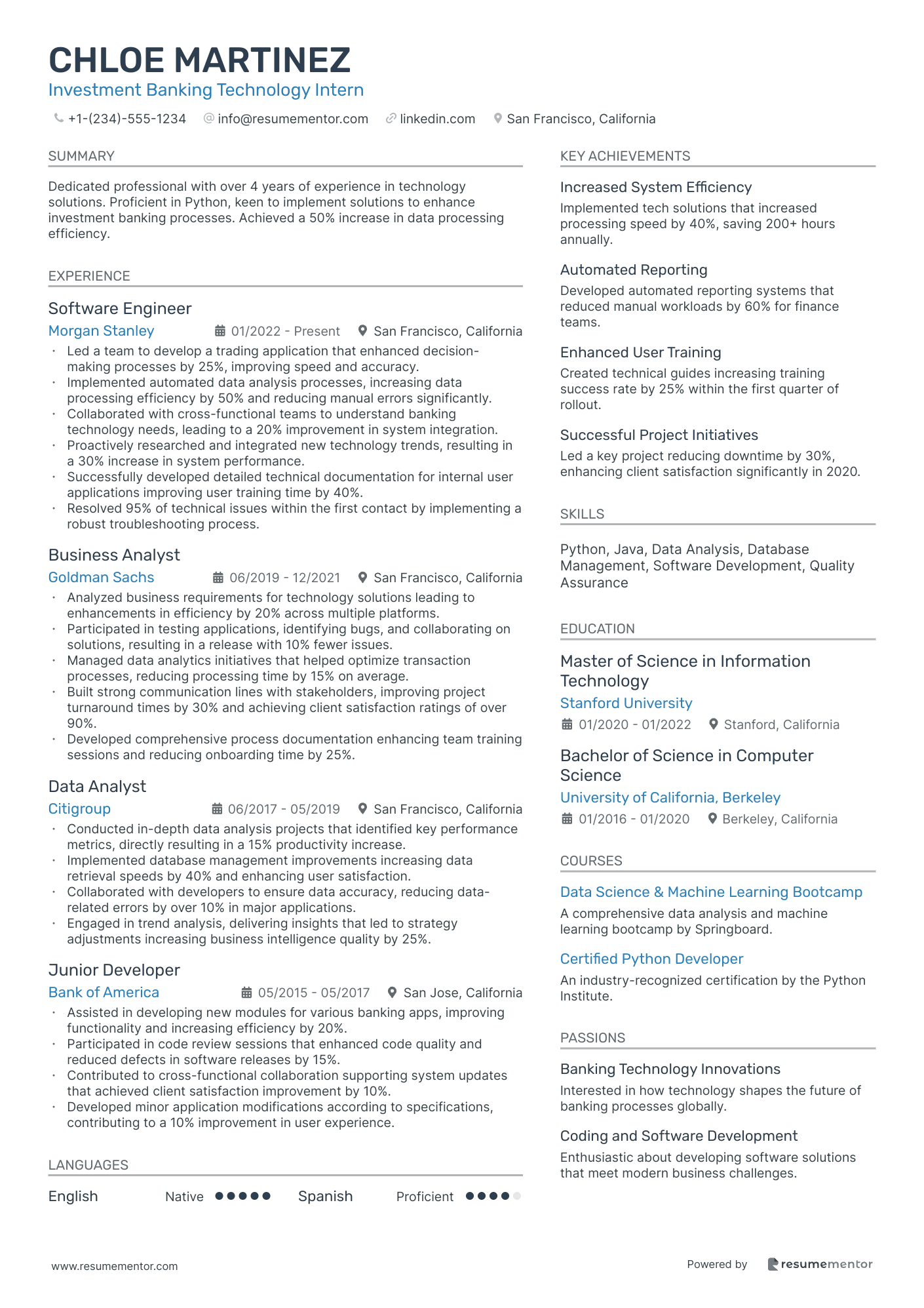

Investment Banking Technology Intern

Real Estate Investment Banking Intern

Capital Markets Investment Banking Intern resume sample

- •Led a team in developing financial models for M&A transactions, enhancing forecasting accuracy by 15%.

- •Conducted comprehensive market research, identifying growth opportunities that increased portfolio returns by 10%.

- •Prepared detailed pitch books for client presentations, directly leading to the acquisition of five new clients worth $50M collectively.

- •Collaborated with cross-functional teams on capital raising projects, streamlining processes and increasing efficiency by 20%.

- •Supported senior bankers on three multi-million-dollar live transactions, ensuring 100% compliance with regulations.

- •Implemented innovative analytical tools that improved reporting speed by 30%, resulting in enhanced decision-making.

- •Conducted due diligence for investment prospects, reducing risk exposure by identifying potential pitfalls in financial statements.

- •Facilitated investor presentations, enhancing client engagement and securing $20M in new fund commitments.

- •Analyzed financial performance data, providing strategic insights that were instrumental in a 15% revenue growth for clients.

- •Developed a financial analysis training module, achieving a 25% increase in team productivity.

- •Managed documentation for over 50 projects per quarter, ensuring all deliverables met regulatory standards and client expectations.

- •Provided strategic recommendations during client meetings, directly contributing to a $30M increase in annual contract renewals.

- •Crafted financial reports and models, facilitating a higher level of executive decision-making on merger prospects.

- •Executed a client portfolio assessment project, boosting the customer satisfaction rate by 20% through personalized financial solutions.

- •Designed cohesive reports, increasing the accessibility and understanding of financial data for non-financial stakeholders.

- •Assisted in the execution of capital raising initiatives, generating over $10M in additional funds.

- •Performed financial evaluations, which improved the accuracy of budget forecasts by 15%, resulting in better resource allocation.

- •Monitored market trends and economic indicators, advising on potential impacts on client investment portfolios.

- •Established streamlined documentation processes, improving project turnover rates by 25%.

Equity Research Intern for Investment Banking resume sample

- •Developed comprehensive equity reports influencing over $10 million in investment strategies for clients annually.

- •Collaborated with portfolio managers to enhance stock recommendations, leading to a 20% increase in portfolio performance.

- •Streamlined research processes, reducing analysis time by 30% and increasing team efficiency in data assimilation.

- •Monitored market trends and analyzed financial data, resulting in a 15% increase in accurate forecasting.

- •Managed and trained junior analysts, leading to a 40% improvement in team output and productivity.

- •Led quarterly presentations to stakeholders, directly impacting strategic decisions resulting in a company-wide 5% return increase.

- •Performed robust financial modeling, improving valuation accuracy by 25% for multinational client portfolios.

- •Efficiently integrated new software tools into the team’s workflow, enhancing accuracy in data analysis by 35%.

- •Produced detailed financial reports that led to strategic shifts in investment, positively impacting firm revenue by 10%.

- •Led bi-weekly team meetings to discuss upcoming market trends, optimizing investment strategy and client advisory.

- •Coordinated with various departments to ensure coherent data flow, enhancing financial data integration by 20%.

- •Assisted in the development of equity analysis frameworks that improved investment advice accuracy to clients by 15%.

- •Enhanced clients' portfolio diversification strategies, resulting in a 10% risk reduction in volatile markets.

- •Contributed to the streamlining of the quarterly review process, cutting preparation time by 20% through effective data management.

- •Supported lead analysts in compiling data-driven discernments to recommend stocks, improving client ROI by 8% annually.

- •Drove digital initiatives that increased client onboarding efficiency by 30%, enhancing user experience and client engagement.

- •Executed daily reconciliations and managed transactions worth upwards of $5 million, maintaining a 100% accuracy rate.

- •Facilitated financial workshops, improving employee financial literacy, and increasing team efficiency by 15%.

- •Participated in cross-functional projects streamlining operational processes, reducing costs by 25%.

Risk Management Investment Banking Intern resume sample

- •Led a cross-functional team to refine risk assessment procedures, enhancing accuracy by 15%.

- •Developed models to assess credit risk, resulting in a 20% reduction in potential loss scenarios.

- •Wrote comprehensive reports on market trends and risk indicators, contributing to long-term strategic planning.

- •Collaborated with investment teams to evaluate financial products, reducing exposure to high-risk assets by 25%.

- •Performed monthly audits of risk controls, leading to the identification and rectification of 10 critical vulnerabilities.

- •Organized training sessions on risk management tools, boosting team efficiency by 30%.

- •Executed data analysis projects to support risk control improvements, which elevated operational efficiency by 12%.

- •Designed a risk reporting system that streamlined the identification of potential threats, decreasing response times by 40%.

- •Assessed various investment strategies for vulnerabilities, alerting to potential risk factors in emerging markets.

- •Managed regulatory compliance updates, ensuring adherence to new industry standards within deadlines.

- •Facilitated the integration of a new financial analysis tool, increasing data accuracy and risk detection capabilities.

- •Analyzed quarterly financial reports to highlight risk variances, providing critical inputs for decision-making.

- •Improved risk assessment strategies through comprehensive research, resulting in more balanced investment portfolios.

- •Helped draft an internal guide on evaluating financial product risks, improving team understanding by 15%.

- •Supported senior analysts in creating presentations on risk management strategies for executive stakeholders.

- •Assisted in developing financial models for prospective investment opportunities, projecting potential returns and risks.

- •Collaborated in cross-departmental meetings to align on risk mitigation strategies, enhancing communication flow.

- •Supported risk data management efforts, ensuring databases were up-to-date and reflective of latest figures.

- •Participated in workshops to learn about financial regulations, improving reporting accuracy by remaining informed.

Merger & Acquisitions Investment Banking Intern resume sample

- •Led a team in the execution of complex M&A transactions totaling over $500 million in value across various industries.

- •Designed and implemented financial models that improved evaluation efficiency by 15%, contributing to better decision-making processes.

- •Collaborated with a cross-functional team to develop client-specific strategies that improved customer satisfaction scores by 25%.

- •Co-managed due diligence processes and identified critical findings that saved the firm $2 million in potential losses.

- •Produced comprehensive industry reports and presentations that were used in high-stakes client meetings, enhancing deal approval rates by 10%.

- •Mentored junior analysts, achieving a 90% satisfaction rate from mentees, and improved team productivity by 20%.

- •Assisted in the execution of $300 million worth of mergers and acquisitions, enhancing departmental revenue by 12%.

- •Developed financial models and forecast analyses, accurately predicting market outcomes, leading to a 15% increase in revenue.

- •Prepared pitch books and presentations for client engagements, facilitating a closing rate increase by 30% year-over-year.

- •Conducted thorough market research that identified untapped opportunities, resulting in a strategic shift boosting regional sales by 18%.

- •Implemented streamlined reporting procedures, reducing team overhead by 22% while maintaining accuracy and comprehensiveness.

- •Contributed to the structuring of comprehensive financial models for M&A deals, improving client portfolio value by $100 million.

- •Presented analysis results to stakeholders, leading to strategic decisions that enhanced investor relations by 14%.

- •Conducted competitive analysis and identified market trends, driving the development of innovative client solutions.

- •Supported senior bankers in preparing transaction proposals, which resulted in securing new engagements worth $80 million in revenue.

- •Gathered and interpreted complex data leading to the identification of operational efficiencies worth $500,000 in cost savings.

- •Worked collaboratively on client projects, enhancing service delivery quality and improving client retention by 20%.

- •Developed bespoke analytical reports for executive presentations, influencing strategic planning and resulting in policy updates.

- •Assisted in creating a robust financial model for a client that resulted in a 25% increase in profit margins.

Global Investment Banking Strategy Intern resume sample

- •Led a cross-functional team in developing strategic financial models, increasing forecast accuracy by 30% for the fiscal year.

- •Managed market trend analysis projects that identified growth opportunities, leading to a 20% increase in investment returns.

- •Designed and delivered in-depth presentations to stakeholders, enhancing decision-making processes for critical financial strategies.

- •Developed comprehensive competitive landscape reports that informed strategic planning for executive leadership.

- •Enhanced the tracking of financial industry news, resulting in a more agile response to market shifts within the team.

- •Coordinated the preparation of detailed financial reports and documentation, streamlining reporting efficiency by 15%.

- •Actively engaged in data-driven research projects, identifying market trends that contributed to a 15% increase in client acquisition.

- •Assessed financial strategies for several high-profile clients, resulting in enhanced investment portfolios and a 10% growth in assets managed.

- •Collaborated with senior bankers to prepare complex financial documentation, reducing errors and improving accuracy by 12%.

- •Participated in brainstorming sessions, generating innovative ideas that supported a successful market-entry strategy.

- •Integrated industry-specific insights into strategic presentations, facilitating effective communication with global stakeholders.

- •Contributed to strategic planning efforts that resulted in a 25% revenue increase across multiple business units.

- •Conducted quantitative analysis of market segments, identifying a niche market that expanded the company's services.

- •Prepared comprehensive reports and presentations for senior executives, aiding in strategic decision-making processes.

- •Worked closely with cross-functional teams to support data collection efforts, improving the accuracy of market analysis.

- •Analyzed client financial data, providing actionable insights that improved financial processes by 18%.

- •Conducted in-depth market research that led to strategic recommendations, enhancing client investment portfolios.

- •Supported the development of presentation materials, improving client engagement and satisfaction.

- •Engaged with clients to understand their strategic goals, helping tailor specific financial solutions for optimal outcomes.

Private Equity Investment Banking Intern resume sample

- •Developed financial models leading to a 15% increase in forecasting accuracy for the investment team.

- •Led a team of analysts in evaluating a $200M merger, enhancing strategic insights and decision-making.

- •Coordinated due diligence for private equity deals, improving process efficiency by 20% through innovative data management.

- •Contributed to client presentations with comprehensive analysis, resulting in securing three major client engagements.

- •Researched market conditions, identifying emerging opportunities, which contributed to a 12% client portfolio growth.

- •Collaborated on creating pitch books that improved client communications and increased engagement by 17%.

- •Assessed investment opportunities, providing detailed financial models that supported a $100M strategic acquisition.

- •Conducted extensive industry analysis, increasing client acquisition rates by 25% through targeted insights.

- •Automated reporting processes, reducing manual effort by 40% and enhancing data-driven decision-making.

- •Presented market research findings to senior management, helping secure a $50M increase in investment funds.

- •Aligned investment strategy with emerging market trends, directly resulting in a 10% increase in portfolio value.

- •Executed deep dive analysis on competitive landscapes, significantly enhancing the strategic direction of $300M fund.

- •Supported senior executives in the preparation of investment memos that secured new client accounts.

- •Increased valuation accuracy by 20% with advanced data analytics techniques, optimizing financial reporting.

- •Proactively identified potential risks in investment portfolios, mitigating those risks and safeguarding against losses.

- •Streamlined client operations by 15% by implementing process improvements for high-growth tech startups.

- •Facilitated market entry strategies, increasing client market share by 20% through targeted initiatives.

- •Evaluated operational efficiency, contributing insights that resulted in a 30% cost reduction for a client.

- •Collaborated on cross-functional teams to drive business transformation projects, enhancing customer satisfaction.

Investment Banking Compliance Intern resume sample

- •Spearheaded a project that enhanced compliance processes, reducing errors by 15% over six months.

- •Collaborated with cross-functional teams to identify compliance risks, resulting in effective mitigation strategies.

- •Developed comprehensive training materials, leading to a 25% improvement in compliance awareness among new hires.

- •Conducted detailed compliance checks, which helped the company avoid regulatory fines totaling over $500,000 annually.

- •Utilized Excel and internal tools to monitor trading activities effectively, ensuring compliance with industry standards.

- •Produced insightful compliance reports, enhancing management's understanding of key compliance metrics and trends.

- •Analyzed market data to predict potential risks, aiding in a 30% reduction in potential financial discrepancies.

- •Implemented a robust risk assessment framework, boosting the accuracy of risk predictions by 20%.

- •Led risk assessment workshops, improving team knowledge on potential compliance issues by 35%.

- •Streamlined communication between departments to facilitate quicker resolution of compliance spot checks.

- •Assisted in integrating new compliance software, enhancing data accuracy and processing speeds by 18%.

- •Oversaw daily compliance checks, significantly reducing non-compliance incidents by 40% over the review period.

- •Assisted in the development of a new compliance reporting system that decreased report turnaround time by 50%.

- •Coordinated with external auditors to ensure compliance with regulatory standards and achieved successful audit outcomes.

- •Conducted compliance training sessions that improved team compliance knowledge retention by 30%.

- •Supported senior analysts in financial modeling, aiding in the forecasting accuracy to within a 5% margin.

- •Gathered and analyzed financial data, helping to refine investment strategies and maximize profit margins.

- •Provided detailed financial reports to management, enhancing decision-making processes by 15%.

- •Collaborated on special projects, including a compliance audit which increased department efficiency by 10%.

Financial Modeling Investment Banking Intern resume sample

- •Developed and refined financial models resulting in a 15% improvement in forecast accuracy for quarterly financial statements.

- •Led a team of analysts in preparing pitch materials for M&A deals worth over $50 million, enhancing client engagement.

- •Conducted industry trend analysis that identified new investment opportunities, contributing to a 20% increase in market share.

- •Optimized financial reporting processes, reducing report generation time by 30%, providing timely insights for senior leadership.

- •Collaborated with cross-functional teams to implement strategic financial initiatives, boosting operational efficiency by 12%.

- •Played a pivotal role in risk management projects by analyzing financial risks, reducing potential negative outcomes by 10%.

- •Spearheaded financial modeling efforts for capital raising projects, securing $100 million in new funding.

- •Evaluated financial statements to guide investment decisions, resulting in a 25% increase in portfolio returns.

- •Played a crucial role in executing high-profile IPOs, providing detailed financial analyses and recommendations.

- •Enhanced advisory services by initiating a comprehensive market research project, improving client satisfaction scores by 18%.

- •Streamlined processes for the creation of pitch books, reducing preparation time by 40% and increasing productivity.

- •Conducted in-depth equity research to support investment decisions in the technology sector, enhancing portfolio performance by 15%.

- •Regularly presented sector analysis and stock recommendations to senior management, leading to informed investment strategies.

- •Collaborated with portfolio managers to devise strategies that increased revenue by 10% compared to the previous fiscal year.

- •Managed a database of financial metrics, improving accessibility and ensuring the accuracy of client deliverables.

- •Advised clients on restructuring strategies that resulted in a 20% reduction in operational costs.

- •Oversaw financial assessments for client businesses, enhancing profitability by identifying key areas for cost savings.

- •Conducted comparative financial analyses across various industries, providing valuable insights for business growth.

- •Developed comprehensive financial models that assisted clients in securing $50 million in new investments.

Real Estate Investment Banking Intern resume sample

- •Conducted in-depth financial valuation of multifamily properties, supporting a successful $5 million acquisition project.

- •Developed comprehensive financial models improving forecasting accuracy by 20%, aiding decision making in high-value transactions.

- •Collaborated with cross-functional teams to create detailed reports, leading to 15% enhanced client satisfaction.

- •Reviewed and analyzed real estate market trends resulting in a strategic investment savings of 10% annually.

- •Prepared investment memorandums contributing to a client’s portfolio expansion by 25%, meeting all due diligence standards.

- •Successfully integrated new financial databases that increased data retrieval efficiency by 30% within the department.

- •Assisted in preparing pitch books that secured $3 million in new investments for multifamily developments.

- •Managed due diligence for 5 major property deals totaling over $10 million, enhancing process efficiency by 25%.

- •Conducted market research analyzed in investor presentations, resulting in a 40% project funding increase.

- •Streamlined database updates reducing data entry errors by 15% across transactions.

- •Participated in investor meetings delivering insights that led to a joint venture agreement with a 20% ROI forecast.

- •Coordinated financial modeling exercises that improved project valuation outcomes by 15% within the first quarter.

- •Conducted detailed analyses supporting strategic initiatives that increased asset efficiency by $1 million annually.

- •Enhanced team productivity through the development of Excel tools, decreasing analysis time by 20%.

- •Reviewed corporate financial statements ensuring compliance with legal standards, reducing errors by 10%.

- •Analyzed multifamily asset portfolios leading to new investment strategies that increased annual returns by 5%.

- •Prepared comprehensive market analysis reports that improved client decision-making in high-value projects.

- •Assisted in client interaction sessions contributing to a portfolio value increase of $500,000 over 6 months.

As you step into the fast-paced world of investment banking, your resume is your gateway to opportunity. This crucial document can feel like a daunting puzzle to assemble, especially in such a competitive industry. You need to convey your analytical skills, raw potential, and relevant accomplishments all in one shot. It's not just about listing experiences; it's about weaving the story of your journey in the financial universe.

Navigating this process may seem like a maze, but with the right approach, it becomes manageable. The key is to balance your enthusiasm with relevant technical expertise, ensuring each word on your resume has purpose. A structured format can transform your ideas into a polished and professional document. To simplify the process, consider exploring these resume templates as your starting point.

This resume is more than a list of qualifications—it's your chance to leave a lasting impression in a crowded field. Think of it as your personalized business pitch that opens doors to exciting prospects and sets you on your career path.

By equipping yourself with the right resources and guidance, you can refine your message and approach seamlessly. Let's work on crafting a resume that truly reflects the unique value you bring to the table.

Key Takeaways

- Crafting a compelling investment banking intern resume requires balancing enthusiasm with relevant technical expertise to tell a personal business story.

- Utilize a structured format, such as a reverse-chronological layout, and explore resume templates to organize your qualifications effectively.

- Highlight essential hard skills like financial analysis and Excel proficiency, alongside soft skills like communication and team collaboration.

- A strong resume includes a quantifiable experience section that showcases your contributions to projects with measurable outcomes.

- Enhance your resume with sections on education, certificates, and additional activities like volunteering or relevant hobbies to provide a comprehensive profile.

What to focus on when writing your investment banking intern resume

An investment banking intern resume should convey your analytical skills and problem-solving abilities to the recruiter, along with your quantitative proficiency and interest in the financial services industry.

How to structure your investment banking intern resume

- Contact Information — Begin with your contact details, including your full name, phone number, professional email, and LinkedIn profile, so you're easily reachable for any follow-ups. Making sure your information is up-to-date and professional is crucial, as it's the primary way recruiters will contact you.

- Objective Statement — Follow with a concise objective that ties together your passion for investment banking, while pinpointing your motivation for pursuing the role and highlighting key strengths like financial analysis and attention to detail. This statement sets a professional tone and purpose for your resume.

- Education — Next, detail your current or most recent school, degree, major, and expected graduation date. Connect your academic foundation to the field with courses in finance, accounting, or economics, including any honors or achievements that demonstrate academic excellence.

- Work Experience — Build on your education by describing internships or jobs where you've applied skills in financial modeling, valuations, or data analysis. Emphasize your accomplishments with action verbs like "analyzed" or "evaluated," illustrating how your previous experiences have prepared you for a role in investment banking.

- Skills — Complement your work experience with a list of key skills, such as proficiency in Excel, financial modeling, and familiarity with financial software. Highlight any certifications or training that prove your mastery of industry-specific tools, showing your readiness to tackle the role's demands.

- Extracurricular Activities — Conclude with leadership roles in finance clubs or investment societies to reinforce your commitment and ability to work within a team, rounding out your profile. Demonstrating your active participation and leadership in relevant activities shows initiative beyond the classroom.

In the upcoming sections, we will delve deeper into each part of the resume to ensure your application is tailored to the investment banking intern role and structured in a clear, impactful format.

Which resume format to choose

Creating a resume for an investment banking intern is a crucial step toward landing your dream job, and selecting the right format is key. The reverse-chronological format is ideal as it highlights your most recent achievements and experiences. This approach helps recruiters quickly gauge your qualifications and understand your career progression, which is especially important in the fast-paced world of finance.

Once you have the format locked down, consider the choice of fonts to convey professionalism while keeping your resume modern and readable. Options like Rubik, Lato, and Montserrat are excellent because they maintain a clean and contemporary look. These fonts subtly enhance your document's readability without distracting from the content itself, allowing your skills and achievements to take center stage.

Saving your resume as a PDF is essential for maintaining the integrity of your formatting. PDFs ensure consistency in how your document appears across all devices and platforms—a critical detail for investment banking roles where attention to detail is paramount. Unlike Word documents, PDFs eliminate the risk of format mishaps that can come off as unprofessional or careless.

Finally, pay attention to your margins, setting them between 0.5 to 1 inch on all sides. This creates a balanced visual presentation, ensuring there's enough white space to make your resume easy to read without cramming too much information onto one page. These small touches, when combined, make a big difference in presenting a polished and professional resume, ultimately enhancing your prospects in the competitive field of investment banking.

How to write a quantifiable resume experience section

A strong investment banking intern resume experience section effectively highlights your achievements, using quantifiable results that closely align with the job you’re aiming for. Structuring your experience in reverse-chronological order ensures potential employers immediately notice your most relevant work. As an intern, focus on experience from the past four years, showcasing roles that emphasize your finance skills, such as data analysis and collaborative projects. When choosing job titles, pick ones that reflect finance-related work, like financial analyst intern, to best illustrate your background. Tailoring your resume so it aligns with the job description is crucial, as it demonstrates you possess the specific skills and experience employers are seeking. Choosing impactful action words like "analyzed," "developed," and "collaborated" helps convey your accomplishments effectively.

- •Analyzed data from 5 key industries to support financial modeling, resulting in a 10% increase in forecast accuracy.

- •Developed a presentation on market trends which was used in meetings with 3 major clients, enhancing client engagement.

- •Collaborated with a team of 4 interns to assess M&A opportunities, significantly contributing to a successful acquisition proposal.

- •Streamlined data collection processes, reducing report preparation time by 15% and improving team efficiency.

This experience section effectively connects your achievements by showcasing the impact of your work. Each bullet demonstrates a tangible outcome, such as improving forecast accuracy or boosting team efficiency, clearly highlighting how your contributions benefited the organization. By detailing your responsibilities alongside the real-world results, you provide potential employers with a compelling narrative of your impact. Strong action words, combined with measurable results, ensure your experience section is immediately impressive to hiring managers while matching the skills they desire in an investment banking intern. By weaving industry-specific experiences throughout, your resume not only gains depth but also illustrates your dedication to a career in finance. In a competitive field like investment banking, a well-crafted experience section distinctly positions you as a valuable candidate capable of making meaningful contributions.

Innovation-Focused resume experience section

An innovation-focused investment banking intern resume experience section should seamlessly highlight your creative contributions and enhancements to processes. Begin by showcasing projects or tasks where your innovative solutions made a difference, clearly explaining the context, the challenges you faced, and the decisive actions you took. Quantifying your contributions with specific outcomes or metrics helps illustrate your impact. Emphasizing skills like problem-solving, critical thinking, and collaboration underscores your value as a proactive team player.

Each bullet point should concentrate on a specific achievement or responsibility, using clear and action-oriented language to draw attention. By mentioning the tools, technologies, or methods you employed, you paint a vivid picture of how you drove innovation in your tasks. This approach not only highlights your technical skills but also your ability to solve problems proactively in the dynamic environment of investment banking.

Investment Banking Intern

XYZ Bank

June 2023 - August 2023

- Led a team to automate data collection processes, reducing time by 30%

- Implemented a new data visualization tool, enhancing report clarity for stakeholders

- Designed a workflow improvement that increased efficiency by 15%

- Collaborated with senior analysts to identify cost-saving measures, resulting in $50,000 savings

Efficiency-Focused resume experience section

A resume experience section focused on efficiency for an investment banking intern should aim to highlight how you've made processes smoother and boosted productivity. Start by reflecting on moments when you helped improve team workflows or made operations run more efficiently. Clearly explain what you did, using numbers where you can to show your success. This approach will illustrate your initiative and impact, and each bullet point should be short yet descriptive.

By focusing on times when you spotted inefficiencies and proposed effective solutions, you underscore your role in making systems better. Keep your points clear and straightforward, allowing the reader to quickly grasp your accomplishments. This emphasis on efficiency not only showcases your skills but also shows potential employers that you’re a proactive contributor who delivers tangible results.

Investment Banking Intern

Prestige Capital

June 2023 - August 2023

- Created a streamlined reporting process that cut the time for weekly financial reports by 30%.

- Worked with senior analysts to automate data entry tasks, boosting accuracy by 20%.

- Revamped the document filing system to speed up retrieval, saving the team five hours weekly.

- Improved scheduling using a new calendar system, enhancing coordination for meetings and deadlines.

Training and Development Focused resume experience section

A training and development-focused investment banking intern resume experience section should highlight your enthusiasm for learning and applying new skills effectively. Begin with a clear statement of your role and its main purpose, then illustrate how you quickly acquired new skills and contributed to the success of projects. If you participated in any training programs or workshops, describe how they deepened your industry knowledge. Show any achievements or initiatives that came from your training experience to provide tangible evidence of your growth.

For the bullet points, emphasize the skills you gathered and how they related to the company’s objectives. Describe any hands-on tasks you completed that positively influenced project outcomes. Where relevant, mention collaboration with senior team members and how your contributions supported the team’s goals. This approach demonstrates to potential employers that you have a proactive and dedicated attitude in your internship, making you a valuable candidate.

Investment Banking Intern

Global Investment Bank

June 2021 - August 2021

- Completed a rigorous training program covering financial modeling and valuation techniques.

- Collaborated with analysts to prepare presentations for potential multimillion-dollar deals.

- Led a mock merger and acquisition project, resulting in a top-ranked presentation.

- Gained proficiency in Microsoft Excel for data analysis and financial forecasting.

Project-Focused resume experience section

A project-focused investment banking intern resume experience section should effectively showcase your role in impactful projects and demonstrate your passion for the finance industry. Begin by presenting your involvement in specific projects, emphasizing how your analytical skills and teamwork played a part in the project's success. Use strong action verbs to detail your contributions and highlight any measurable outcomes that accentuate your impact on the team and project.

Each bullet point should highlight a unique aspect of your role, creating a comprehensive picture of your experience. Explain tasks or analyses you accomplished, ensuring your language is clear and accessible to a broader audience. Mention any software tools or research methods you utilized to illustrate your technical capabilities and ability to manage complex data effectively. Conclude by sharing key insights or skills gained during your internship, demonstrating your readiness to build on this experience in future roles.

Intern

XYZ Investment Bank

June 2023 - August 2023

- Supported a senior analyst in creating financial models for a telecom merger valued at $500M.

- Conducted market research and competitor analysis using Bloomberg Terminal to inform strategic decisions.

- Collaborated with a team of interns to produce a detailed report on industry trends, contributing to client presentations.

- Assisted in preparing pitch books and client presentations, enhancing understanding of the deal process.

Write your investment banking intern resume summary section

A finance-focused investment banking intern resume should start with a compelling summary to set you apart. This summary provides a quick view of who you are and what you bring to the table, with a focus on your skills and achievements. If you have some experience, use this section to highlight your relevant knowledge and strengths. For those new to the field, consider a resume objective, which outlines your career goals and the value you aim to deliver. Here's an example of a strong resume summary for an intern:

This example is effective because it immediately highlights essential qualities like your academic background and relevant skills, which are attractive to employers. The resume summary focuses on current abilities, while a resume objective shifts attention to your future goals. For those with more experience, a resume profile can offer a longer look at your professional history. Meanwhile, a summary of qualifications presents key skills and achievements in bullet points. Selecting the right section type depends on your experience level and career aspirations. Grabbing the reader's attention from the start can make all the difference in securing that sought-after internship.

Listing your investment banking intern skills on your resume

A skills-focused investment banking intern resume should seamlessly integrate both hard and soft skills. You can present your skills as a standalone section or blend them into other areas, such as your experience and summary. Highlighting your strengths and soft skills showcases your ability to collaborate effectively and tackle challenges with ease. Meanwhile, hard skills, like financial analysis or data management, demonstrate your technical expertise and specialized knowledge in the field. These skills and strengths become crucial resume keywords, making your resume more appealing to hiring managers and applicant tracking systems by clearly emphasizing your qualifications.

Skills can be listed as:

This skills section stands out because it efficiently combines essential hard and soft skills necessary for investment banking. It is concise, ensuring clarity while highlighting your ability to meet job demands. By directly linking each skill to job requirements, you impress employers and show your preparedness for this field.

Best hard skills to feature on your investment banking intern resume

To succeed as an investment banking intern, your hard skills should emphasize your technical expertise and pinpoint your proficiency in handling finance-related tasks.

Hard Skills

- Financial Analysis

- Excel Proficiency

- Market Research

- Data Interpretation

- Financial Modeling

- Quantitative Analytics

- PowerPoint Proficiency

- Risk Assessment

- Mergers & Acquisitions Understanding

- Accounting Knowledge

- Corporate Finance

- Valuation Techniques

- Statistical Analysis

- Data Visualization

- SQL

Best soft skills to feature on your investment banking intern resume

In the fast-paced world of investment banking, soft skills demonstrate your ability to work with others and adjust to the demands of the industry effortlessly.

Soft Skills

- Communication

- Team Collaboration

- Problem Solving

- Time Management

- Attention to Detail

- Adaptability

- Critical Thinking

- Resilience

- Multitasking

- Dependability

- Networking

- Initiative

- Professionalism

- Conflict Resolution

- Creativity

How to include your education on your resume

An education section is a crucial part of your investment banking intern resume. It highlights your academic achievements and shows potential employers that you have the educational background for this role. Ensure that your education details are relevant to the job. If a part of your education doesn't relate to investment banking, leave it out.

When including your GPA, it should be done if it's a 3.5 or higher, as it can set you apart from other candidates. If you graduated cum laude or with any honors, listing it can also impressive. Mention your degree clearly, so it's easy for employers to spot. Here's an example of how to get it wrong and right.

The second example is effective because the degree is in Economics, which aligns with the banking field. It includes a strong GPA, indicating academic excellence. The right example highlights important aspects without unnecessary detail, making it concise and focused.

How to include investment banking intern certificates on your resume

A certificates section is an important part of your investment banking intern resume. List the name of each certificate, include the date you earned it, and add the issuing organization. Placing certificates in your resume header can also be a good idea. For example, "Certified Financial Analyst (CFA) - Level I, CFA Institute - June 2022" shows important details in a concise way.

Certificates directly related to finance or banking can make you stand out. Some good examples include CFA Level I, Bloomberg Market Concepts, and Financial Modeling & Valuation Analyst. Each of these shows that you have specific skills and knowledge relevant to investment banking.

An effective standalone certificates section should look like this:

This example is effective because each certificate is clearly listed with its name and issuer. The chosen certificates are relevant and respected in the field of investment banking. This demonstrates your commitment and specialized skills, making you a strong candidate for an internship.

Extra sections to include in your investment banking intern resume

Looking to make a mark in the finance world? If so, crafting an investment banking intern resume that sets you apart is crucial. Here's a guide on how to include certain sections that will enrich your resume and make you stand out to employers.

Language section — Highlight your multilingual skills to show your ability to connect with global clients and colleagues. Demonstrating proficiency in several languages can give you a competitive edge in the globalized world of finance.

Hobbies and interests section — Include activities that show a well-rounded personality and relevant skills like leadership or team collaboration. This allows employers to see a more personal side of you and understand how you might fit into their company culture.

Volunteer work section — Display your community involvement and commitment to social responsibility by detailing your volunteer experiences. This can help illustrate soft skills like empathy, teamwork, and initiative, which are valuable in any professional setting.

Books section — List books you've read related to finance, economics, or personal development to show your eagerness to learn and grow. Sharing your reading habits can demonstrate your passion for the field and a commitment to continuous education.

Incorporating these sections can make your resume more comprehensive and engaging, giving potential employers a fuller picture of who you are beyond just your academic and professional achievements.

In Conclusion

In conclusion, creating an impactful resume for an investment banking internship is a strategic process that calls for careful attention to detail. Your resume serves as a personal narrative, effectively communicating your skills and experiences to potential employers in a concise manner. Start by selecting a clear and professional format, with reverse-chronological order being a popular choice for its ability to showcase your recent accomplishments. Ensure your resume is readable by using modern fonts and maintaining clean formatting, which also includes saving your document as a PDF to prevent any layout issues.

Equally important is your experience section, where using quantifiable achievements and strong action words can distinguish you from other candidates. Tailor this section to mirror the job description, focusing on relevant experiences and skills that pertain directly to the internship. Your education section should underscore your academic achievements, particularly if they align with the fields of finance or economics. Highlighting certifications can further establish your specialized knowledge and commitment to the field.

An effective resume also includes a well-crafted summary that sets the tone for your application, focusing on your strengths and career aspirations. Complementing hard skills like financial modeling with soft skills such as communication and collaboration paints a comprehensive picture of your capabilities. Don’t overlook the extra sections which allow your unique personality and interests to shine through, whether through volunteer work, languages, or hobbies.

Ultimately, the goal is to craft a resume that not only lists your qualifications but also presents you as a well-rounded and motivated candidate eager to contribute to the investment banking industry. With thoughtful preparation and a focus on clarity and relevance, your resume can effectively open doors to exciting career opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.