Investment Banking Resume Examples

Jul 18, 2024

|

12 min read

"Master your investment banking resume: Unlock key steps to get hired and make your career soar, one ‘investment’ in your skills at a time."

Rated by 348 people

Investment Banking Analyst

Private Equity Investment Banker

Investment Banking Operations Specialist

Mergers and Acquisitions Investment Banker

Investment Banking Risk Manager

Investment Banking Compliance Officer

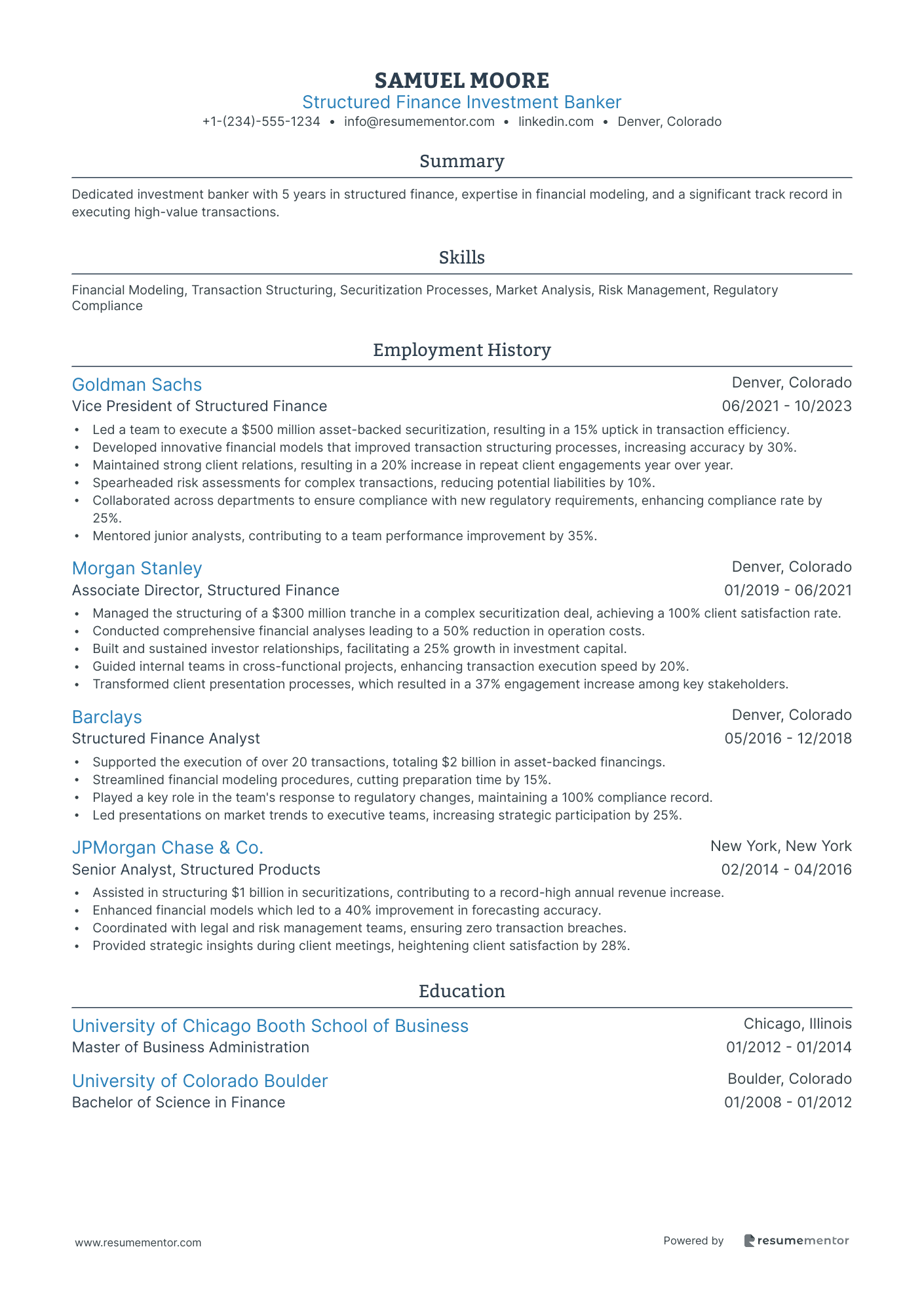

Structured Finance Investment Banker

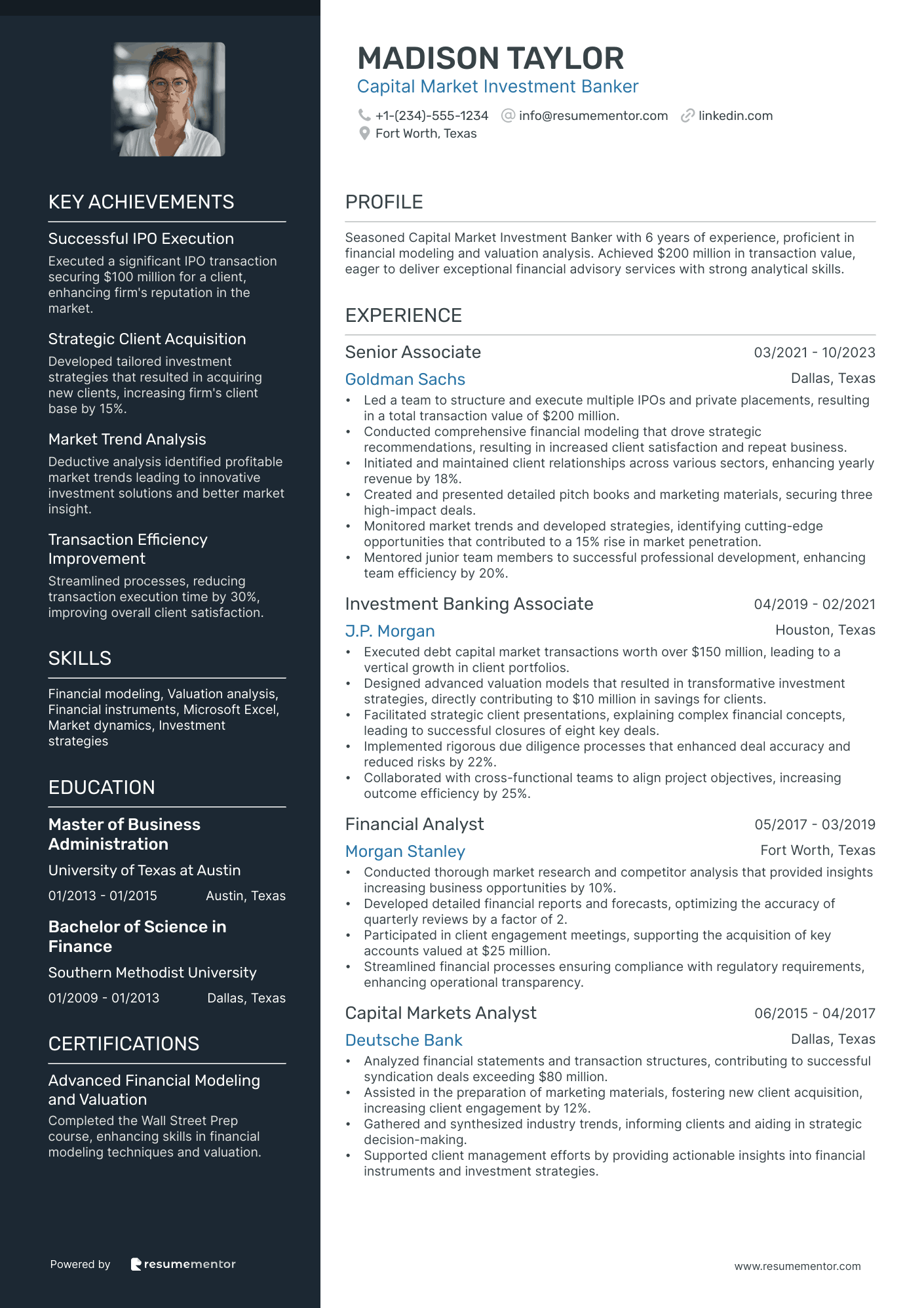

Capital Market Investment Banker

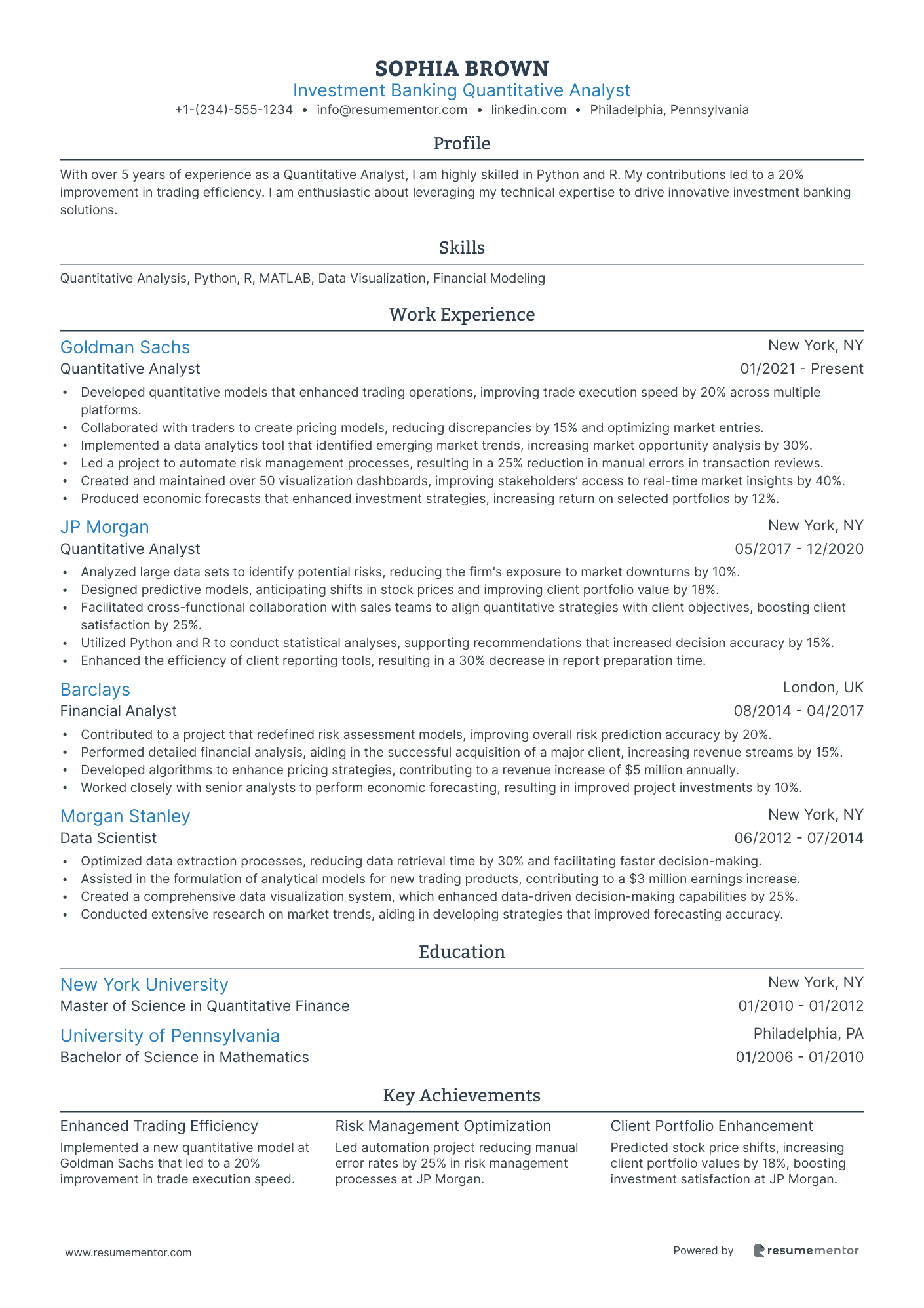

Investment Banking Quantitative Analyst

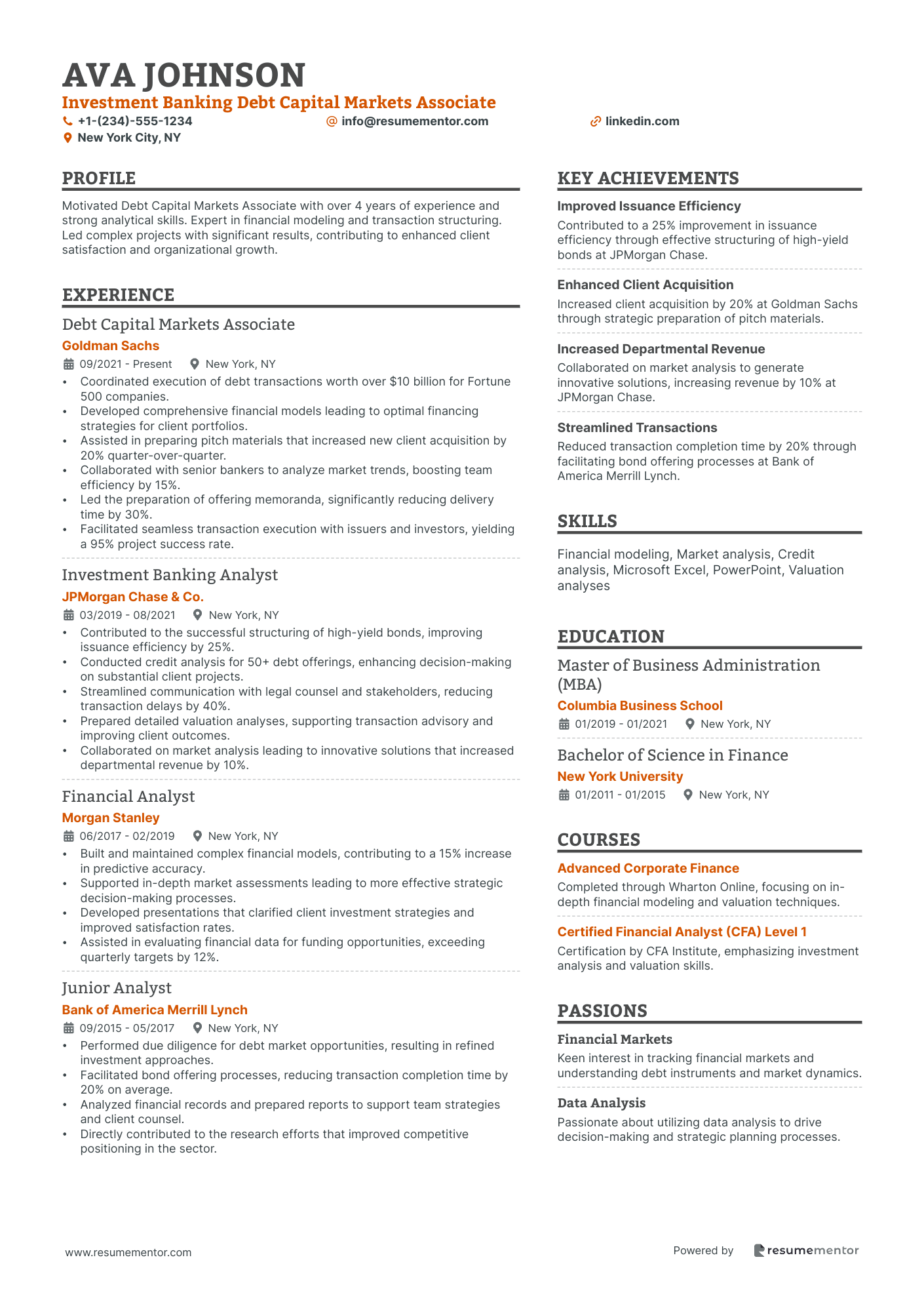

Investment Banking Debt Capital Markets Associate

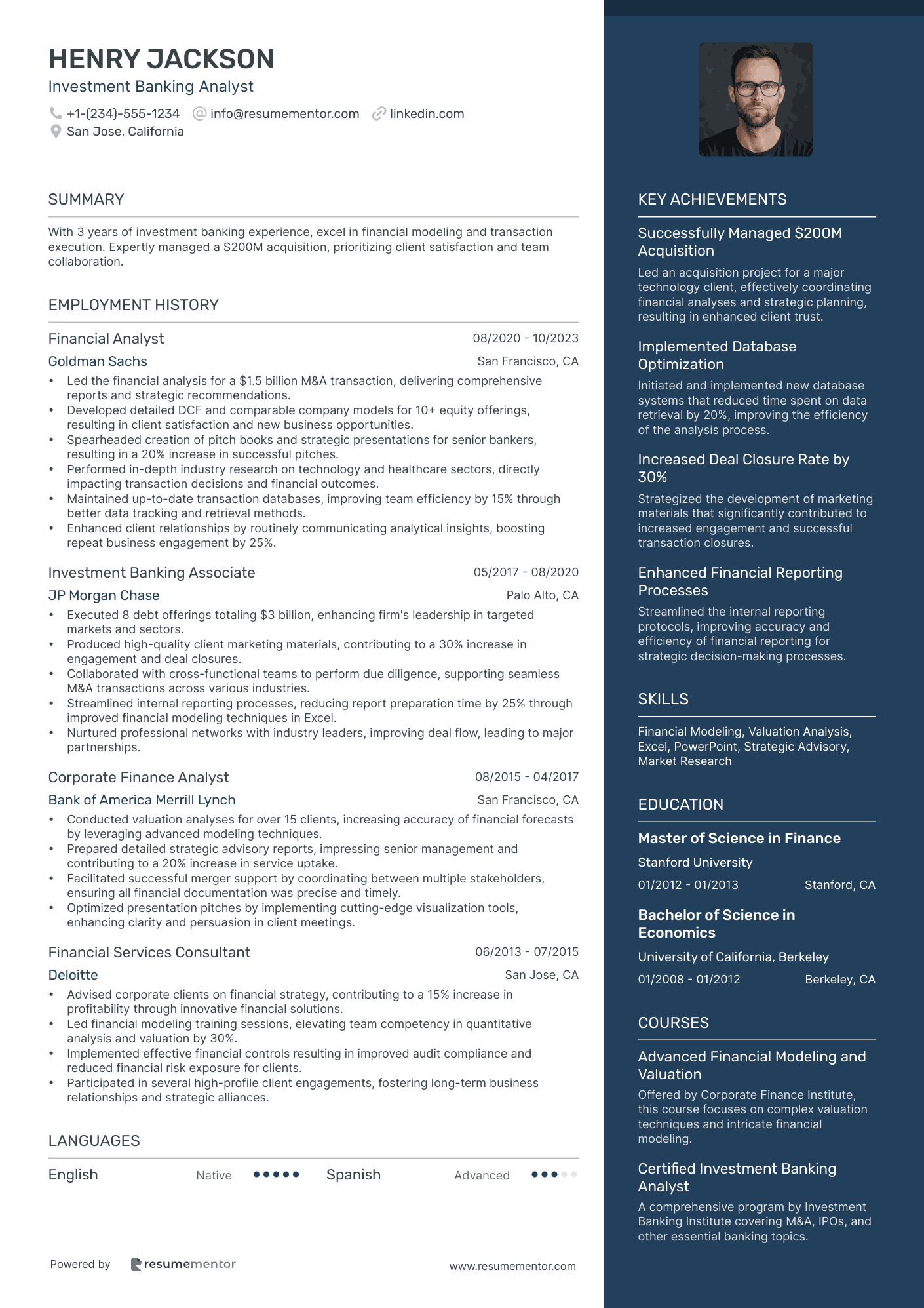

Investment Banking Analyst resume sample

- •Led the financial analysis for a $1.5 billion M&A transaction, delivering comprehensive reports and strategic recommendations.

- •Developed detailed DCF and comparable company models for 10+ equity offerings, resulting in client satisfaction and new business opportunities.

- •Spearheaded creation of pitch books and strategic presentations for senior bankers, resulting in a 20% increase in successful pitches.

- •Performed in-depth industry research on technology and healthcare sectors, directly impacting transaction decisions and financial outcomes.

- •Maintained up-to-date transaction databases, improving team efficiency by 15% through better data tracking and retrieval methods.

- •Enhanced client relationships by routinely communicating analytical insights, boosting repeat business engagement by 25%.

- •Executed 8 debt offerings totaling $3 billion, enhancing firm's leadership in targeted markets and sectors.

- •Produced high-quality client marketing materials, contributing to a 30% increase in engagement and deal closures.

- •Collaborated with cross-functional teams to perform due diligence, supporting seamless M&A transactions across various industries.

- •Streamlined internal reporting processes, reducing report preparation time by 25% through improved financial modeling techniques in Excel.

- •Nurtured professional networks with industry leaders, improving deal flow, leading to major partnerships.

- •Conducted valuation analyses for over 15 clients, increasing accuracy of financial forecasts by leveraging advanced modeling techniques.

- •Prepared detailed strategic advisory reports, impressing senior management and contributing to a 20% increase in service uptake.

- •Facilitated successful merger support by coordinating between multiple stakeholders, ensuring all financial documentation was precise and timely.

- •Optimized presentation pitches by implementing cutting-edge visualization tools, enhancing clarity and persuasion in client meetings.

- •Advised corporate clients on financial strategy, contributing to a 15% increase in profitability through innovative financial solutions.

- •Led financial modeling training sessions, elevating team competency in quantitative analysis and valuation by 30%.

- •Implemented effective financial controls resulting in improved audit compliance and reduced financial risk exposure for clients.

- •Participated in several high-profile client engagements, fostering long-term business relationships and strategic alliances.

Private Equity Investment Banker resume sample

- •Led a $500 million acquisition deal, coordinating with cross-functional teams and resulting in a 20% increase in client revenue.

- •Developed complex financial models that improved decision-making process efficiency by 30% for large-scale transactions.

- •Managed a team of analysts to collaboratively prepare detailed pitch books, facilitating three successful equity financing rounds.

- •Cultivated strong client relationships through strategic networking, enhancing client retention by 15% over two years.

- •Collaborated closely with regulatory bodies during due diligence phases, ensuring compliance and project approval within four months.

- •Executed thorough market research and analysis, directly contributing to a 25% growth in investment opportunities identified.

- •Assisted in the execution of $300 million in leveraged buyouts, coordinating due diligence and financial structuring.

- •Enhanced investor presentations with in-depth industry research, aiding a client's international expansion plan.

- •Performed comprehensive valuation analyses, supporting the closure of a $200 million high-profile M&A transaction.

- •Monitored and analyzed market trends, providing senior bankers with actionable insights for strategic decisions.

- •Fostered relationships with private equity stakeholders, enabling a $150 million capital infusion project.

- •Created over 50 financial models per year, driving strategic recommendations that improved company ROI by 12%.

- •Supported senior bankers with preparation of transaction documents for high-stakes investor meetings.

- •Conducted diligence on acquisition targets, critically assessing financial health and strategic fit.

- •Streamlined several financial reporting processes, reducing turnaround time by 25% and increasing accuracy.

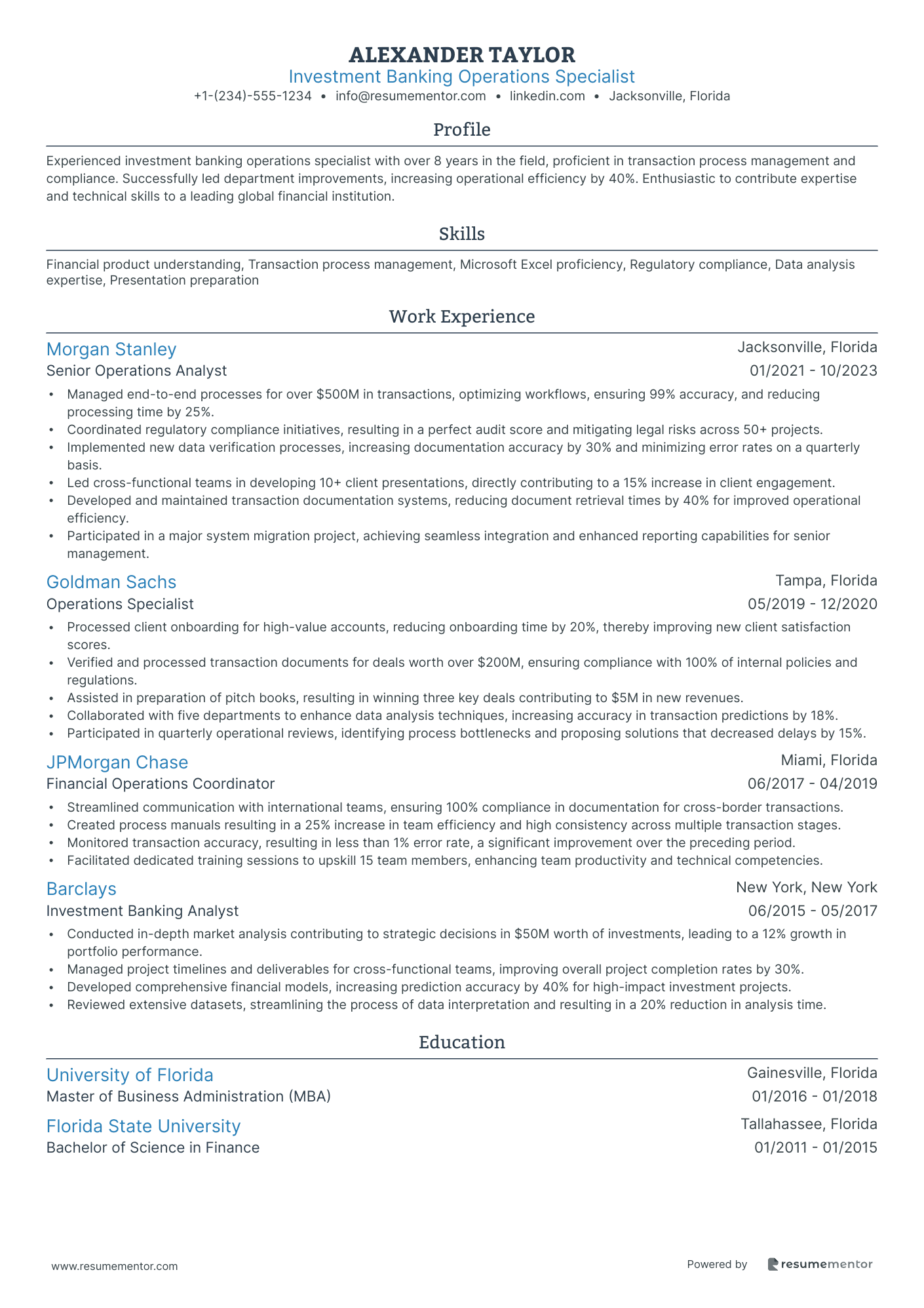

Investment Banking Operations Specialist resume sample

- •Managed end-to-end processes for over $500M in transactions, optimizing workflows, ensuring 99% accuracy, and reducing processing time by 25%.

- •Coordinated regulatory compliance initiatives, resulting in a perfect audit score and mitigating legal risks across 50+ projects.

- •Implemented new data verification processes, increasing documentation accuracy by 30% and minimizing error rates on a quarterly basis.

- •Led cross-functional teams in developing 10+ client presentations, directly contributing to a 15% increase in client engagement.

- •Developed and maintained transaction documentation systems, reducing document retrieval times by 40% for improved operational efficiency.

- •Participated in a major system migration project, achieving seamless integration and enhanced reporting capabilities for senior management.

- •Processed client onboarding for high-value accounts, reducing onboarding time by 20%, thereby improving new client satisfaction scores.

- •Verified and processed transaction documents for deals worth over $200M, ensuring compliance with 100% of internal policies and regulations.

- •Assisted in preparation of pitch books, resulting in winning three key deals contributing to $5M in new revenues.

- •Collaborated with five departments to enhance data analysis techniques, increasing accuracy in transaction predictions by 18%.

- •Participated in quarterly operational reviews, identifying process bottlenecks and proposing solutions that decreased delays by 15%.

- •Streamlined communication with international teams, ensuring 100% compliance in documentation for cross-border transactions.

- •Created process manuals resulting in a 25% increase in team efficiency and high consistency across multiple transaction stages.

- •Monitored transaction accuracy, resulting in less than 1% error rate, a significant improvement over the preceding period.

- •Facilitated dedicated training sessions to upskill 15 team members, enhancing team productivity and technical competencies.

- •Conducted in-depth market analysis contributing to strategic decisions in $50M worth of investments, leading to a 12% growth in portfolio performance.

- •Managed project timelines and deliverables for cross-functional teams, improving overall project completion rates by 30%.

- •Developed comprehensive financial models, increasing prediction accuracy by 40% for high-impact investment projects.

- •Reviewed extensive datasets, streamlining the process of data interpretation and resulting in a 20% reduction in analysis time.

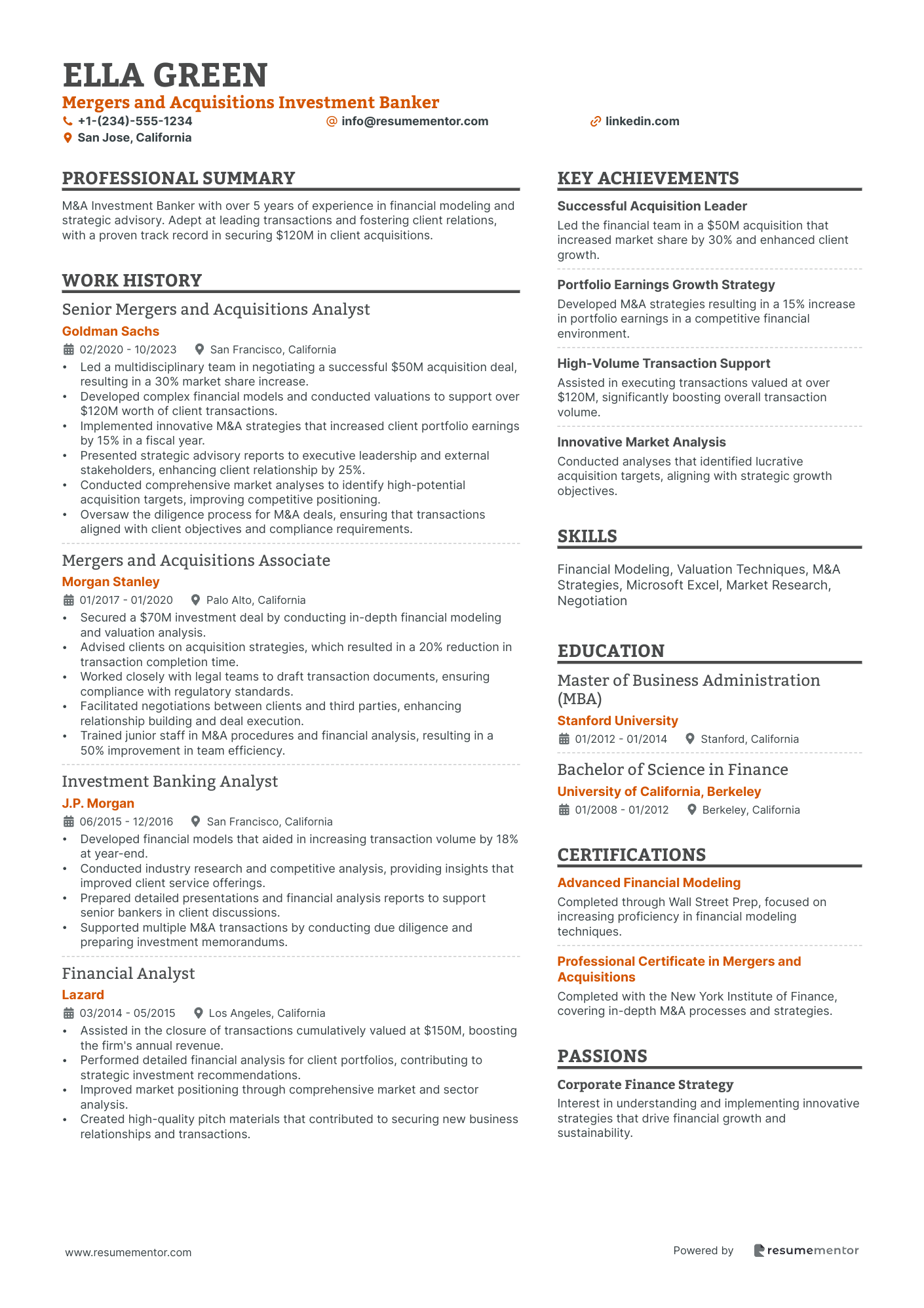

Mergers and Acquisitions Investment Banker resume sample

- •Led a multidisciplinary team in negotiating a successful $50M acquisition deal, resulting in a 30% market share increase.

- •Developed complex financial models and conducted valuations to support over $120M worth of client transactions.

- •Implemented innovative M&A strategies that increased client portfolio earnings by 15% in a fiscal year.

- •Presented strategic advisory reports to executive leadership and external stakeholders, enhancing client relationship by 25%.

- •Conducted comprehensive market analyses to identify high-potential acquisition targets, improving competitive positioning.

- •Oversaw the diligence process for M&A deals, ensuring that transactions aligned with client objectives and compliance requirements.

- •Secured a $70M investment deal by conducting in-depth financial modeling and valuation analysis.

- •Advised clients on acquisition strategies, which resulted in a 20% reduction in transaction completion time.

- •Worked closely with legal teams to draft transaction documents, ensuring compliance with regulatory standards.

- •Facilitated negotiations between clients and third parties, enhancing relationship building and deal execution.

- •Trained junior staff in M&A procedures and financial analysis, resulting in a 50% improvement in team efficiency.

- •Developed financial models that aided in increasing transaction volume by 18% at year-end.

- •Conducted industry research and competitive analysis, providing insights that improved client service offerings.

- •Prepared detailed presentations and financial analysis reports to support senior bankers in client discussions.

- •Supported multiple M&A transactions by conducting due diligence and preparing investment memorandums.

- •Assisted in the closure of transactions cumulatively valued at $150M, boosting the firm's annual revenue.

- •Performed detailed financial analysis for client portfolios, contributing to strategic investment recommendations.

- •Improved market positioning through comprehensive market and sector analysis.

- •Created high-quality pitch materials that contributed to securing new business relationships and transactions.

Investment Banking Risk Manager resume sample

- •Developed comprehensive risk management frameworks which accounted for a 30% improvement in risk identification processes.

- •Conducted market risk assessments for transactions exceeding $500 million, ensuring full compliance with international regulatory guidelines.

- •Collaborated with trading teams to evaluate and mitigate risk for high-value deals, directly contributing to a margin increase of 15%.

- •Prepared and presented detailed risk analyses to senior management, influencing key decision-making and aligning strategic objectives.

- •Implemented an advanced risk reporting system, reducing error rates in risk forecasts by 40% and boosting team productivity.

- •Led team in successful stress testing for portfolio worth $2 billion, ensuring resilience and identifying potential weaknesses.

- •Executed risk assessments for complex financial instruments, resulting in a 20% reduction in high-risk trades.

- •Contributed to the development of standard operating procedures that improved compliance with regulatory frameworks by 25%.

- •Supported data automation efforts that enhanced the accuracy of risk data by 35%, reducing reporting time by 20%.

- •Trained junior analysts in risk assessment techniques, promoting a culture of risk awareness across the department.

- •Monitored market trends and analyzed their impact on investment portfolios, optimizing performance and reducing risk exposure.

- •Analyzed daily market data to identify emerging risks, providing timely insights that led to a 10% reduction in risk.

- •Developed predictive models for risk forecasting, increasing the accuracy of projections by 18%.

- •Liaised with stakeholders to assess risk exposure in strategic initiatives, supporting company growth through risk-optimized investments.

- •Assisted in the development of risk mitigation strategies, reducing operational risks by 12% over two years.

- •Conducted qualitative and quantitative risk assessments for financial products, enhancing portfolio resilience by 15%.

- •Prepared comprehensive risk reports that improved the visibility of risk factors for senior management by 30%.

- •Collaborated with compliance teams to ensure all risk practices adhered to industry standards and regulations.

- •Implemented risk tracking systems that led to a 25% improvement in reporting accuracy.

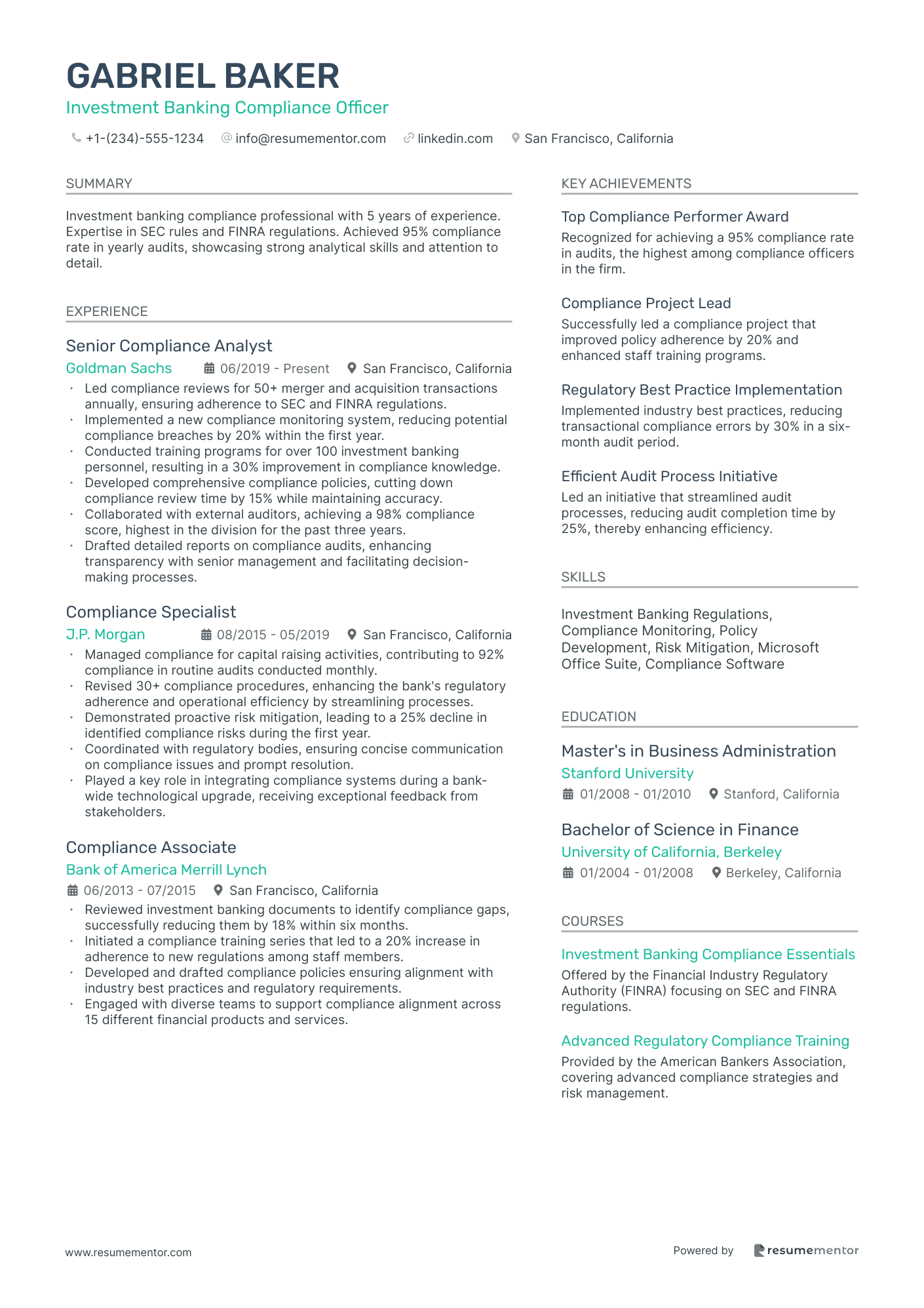

Investment Banking Compliance Officer resume sample

- •Led compliance reviews for 50+ merger and acquisition transactions annually, ensuring adherence to SEC and FINRA regulations.

- •Implemented a new compliance monitoring system, reducing potential compliance breaches by 20% within the first year.

- •Conducted training programs for over 100 investment banking personnel, resulting in a 30% improvement in compliance knowledge.

- •Developed comprehensive compliance policies, cutting down compliance review time by 15% while maintaining accuracy.

- •Collaborated with external auditors, achieving a 98% compliance score, highest in the division for the past three years.

- •Drafted detailed reports on compliance audits, enhancing transparency with senior management and facilitating decision-making processes.

- •Managed compliance for capital raising activities, contributing to 92% compliance in routine audits conducted monthly.

- •Revised 30+ compliance procedures, enhancing the bank's regulatory adherence and operational efficiency by streamlining processes.

- •Demonstrated proactive risk mitigation, leading to a 25% decline in identified compliance risks during the first year.

- •Coordinated with regulatory bodies, ensuring concise communication on compliance issues and prompt resolution.

- •Played a key role in integrating compliance systems during a bank-wide technological upgrade, receiving exceptional feedback from stakeholders.

- •Reviewed investment banking documents to identify compliance gaps, successfully reducing them by 18% within six months.

- •Initiated a compliance training series that led to a 20% increase in adherence to new regulations among staff members.

- •Developed and drafted compliance policies ensuring alignment with industry best practices and regulatory requirements.

- •Engaged with diverse teams to support compliance alignment across 15 different financial products and services.

- •Monitored investment banking transactions to ensure regulatory compliance, achieving a 90% reduction in non-compliance notifications.

- •Assisted in the implementation of policy revisions that increased regulatory adherence by 25% in the first year of implementation.

- •Prepared detailed compliance reports that were integral to executive meetings, improving strategic compliance planning.

- •Worked closely with legal teams to address compliance issues effectively, enhancing interdepartmental collaboration.

Structured Finance Investment Banker resume sample

- •Led a team to execute a $500 million asset-backed securitization, resulting in a 15% uptick in transaction efficiency.

- •Developed innovative financial models that improved transaction structuring processes, increasing accuracy by 30%.

- •Maintained strong client relations, resulting in a 20% increase in repeat client engagements year over year.

- •Spearheaded risk assessments for complex transactions, reducing potential liabilities by 10%.

- •Collaborated across departments to ensure compliance with new regulatory requirements, enhancing compliance rate by 25%.

- •Mentored junior analysts, contributing to a team performance improvement by 35%.

- •Managed the structuring of a $300 million tranche in a complex securitization deal, achieving a 100% client satisfaction rate.

- •Conducted comprehensive financial analyses leading to a 50% reduction in operation costs.

- •Built and sustained investor relationships, facilitating a 25% growth in investment capital.

- •Guided internal teams in cross-functional projects, enhancing transaction execution speed by 20%.

- •Transformed client presentation processes, which resulted in a 37% engagement increase among key stakeholders.

- •Supported the execution of over 20 transactions, totaling $2 billion in asset-backed financings.

- •Streamlined financial modeling procedures, cutting preparation time by 15%.

- •Played a key role in the team's response to regulatory changes, maintaining a 100% compliance record.

- •Led presentations on market trends to executive teams, increasing strategic participation by 25%.

- •Assisted in structuring $1 billion in securitizations, contributing to a record-high annual revenue increase.

- •Enhanced financial models which led to a 40% improvement in forecasting accuracy.

- •Coordinated with legal and risk management teams, ensuring zero transaction breaches.

- •Provided strategic insights during client meetings, heightening client satisfaction by 28%.

Capital Market Investment Banker resume sample

- •Led a team to structure and execute multiple IPOs and private placements, resulting in a total transaction value of $200 million.

- •Conducted comprehensive financial modeling that drove strategic recommendations, resulting in increased client satisfaction and repeat business.

- •Initiated and maintained client relationships across various sectors, enhancing yearly revenue by 18%.

- •Created and presented detailed pitch books and marketing materials, securing three high-impact deals.

- •Monitored market trends and developed strategies, identifying cutting-edge opportunities that contributed to a 15% rise in market penetration.

- •Mentored junior team members to successful professional development, enhancing team efficiency by 20%.

- •Executed debt capital market transactions worth over $150 million, leading to a vertical growth in client portfolios.

- •Designed advanced valuation models that resulted in transformative investment strategies, directly contributing to $10 million in savings for clients.

- •Facilitated strategic client presentations, explaining complex financial concepts, leading to successful closures of eight key deals.

- •Implemented rigorous due diligence processes that enhanced deal accuracy and reduced risks by 22%.

- •Collaborated with cross-functional teams to align project objectives, increasing outcome efficiency by 25%.

- •Conducted thorough market research and competitor analysis that provided insights increasing business opportunities by 10%.

- •Developed detailed financial reports and forecasts, optimizing the accuracy of quarterly reviews by a factor of 2.

- •Participated in client engagement meetings, supporting the acquisition of key accounts valued at $25 million.

- •Streamlined financial processes ensuring compliance with regulatory requirements, enhancing operational transparency.

- •Analyzed financial statements and transaction structures, contributing to successful syndication deals exceeding $80 million.

- •Assisted in the preparation of marketing materials, fostering new client acquisition, increasing client engagement by 12%.

- •Gathered and synthesized industry trends, informing clients and aiding in strategic decision-making.

- •Supported client management efforts by providing actionable insights into financial instruments and investment strategies.

Investment Banking Quantitative Analyst resume sample

- •Developed quantitative models that enhanced trading operations, improving trade execution speed by 20% across multiple platforms.

- •Collaborated with traders to create pricing models, reducing discrepancies by 15% and optimizing market entries.

- •Implemented a data analytics tool that identified emerging market trends, increasing market opportunity analysis by 30%.

- •Led a project to automate risk management processes, resulting in a 25% reduction in manual errors in transaction reviews.

- •Created and maintained over 50 visualization dashboards, improving stakeholders’ access to real-time market insights by 40%.

- •Produced economic forecasts that enhanced investment strategies, increasing return on selected portfolios by 12%.

- •Analyzed large data sets to identify potential risks, reducing the firm's exposure to market downturns by 10%.

- •Designed predictive models, anticipating shifts in stock prices and improving client portfolio value by 18%.

- •Facilitated cross-functional collaboration with sales teams to align quantitative strategies with client objectives, boosting client satisfaction by 25%.

- •Utilized Python and R to conduct statistical analyses, supporting recommendations that increased decision accuracy by 15%.

- •Enhanced the efficiency of client reporting tools, resulting in a 30% decrease in report preparation time.

- •Contributed to a project that redefined risk assessment models, improving overall risk prediction accuracy by 20%.

- •Performed detailed financial analysis, aiding in the successful acquisition of a major client, increasing revenue streams by 15%.

- •Developed algorithms to enhance pricing strategies, contributing to a revenue increase of $5 million annually.

- •Worked closely with senior analysts to perform economic forecasting, resulting in improved project investments by 10%.

- •Optimized data extraction processes, reducing data retrieval time by 30% and facilitating faster decision-making.

- •Assisted in the formulation of analytical models for new trading products, contributing to a $3 million earnings increase.

- •Created a comprehensive data visualization system, which enhanced data-driven decision-making capabilities by 25%.

- •Conducted extensive research on market trends, aiding in developing strategies that improved forecasting accuracy.

Investment Banking Debt Capital Markets Associate resume sample

- •Coordinated execution of debt transactions worth over $10 billion for Fortune 500 companies.

- •Developed comprehensive financial models leading to optimal financing strategies for client portfolios.

- •Assisted in preparing pitch materials that increased new client acquisition by 20% quarter-over-quarter.

- •Collaborated with senior bankers to analyze market trends, boosting team efficiency by 15%.

- •Led the preparation of offering memoranda, significantly reducing delivery time by 30%.

- •Facilitated seamless transaction execution with issuers and investors, yielding a 95% project success rate.

- •Contributed to the successful structuring of high-yield bonds, improving issuance efficiency by 25%.

- •Conducted credit analysis for 50+ debt offerings, enhancing decision-making on substantial client projects.

- •Streamlined communication with legal counsel and stakeholders, reducing transaction delays by 40%.

- •Prepared detailed valuation analyses, supporting transaction advisory and improving client outcomes.

- •Collaborated on market analysis leading to innovative solutions that increased departmental revenue by 10%.

- •Built and maintained complex financial models, contributing to a 15% increase in predictive accuracy.

- •Supported in-depth market assessments leading to more effective strategic decision-making processes.

- •Developed presentations that clarified client investment strategies and improved satisfaction rates.

- •Assisted in evaluating financial data for funding opportunities, exceeding quarterly targets by 12%.

- •Performed due diligence for debt market opportunities, resulting in refined investment approaches.

- •Facilitated bond offering processes, reducing transaction completion time by 20% on average.

- •Analyzed financial records and prepared reports to support team strategies and client counsel.

- •Directly contributed to the research efforts that improved competitive positioning in the sector.

Navigating the world of investment banking is like sailing through a sea of complex numbers and tight deadlines. Your analytical prowess and financial expertise make you stand out in this field. Yet, putting these skills into a compelling resume can feel daunting. You're adept at managing intricate details like mergers and financial modeling, but distilling these experiences into a document requires a different approach.

Your resume isn't just a list of jobs; it's your first impression. You need to communicate your experience clearly while shining a spotlight on your key achievements. Many struggle to find the sweet spot between detailed job descriptions and the concise style hiring managers prefer. A structured approach can guide you in creating a resume that truly connects with potential employers.

This is where a resume template becomes invaluable, offering a framework to organize your thoughts effectively. Templates allow you to focus on the content of your story without getting bogged down by formatting issues. Check out some resume templates to give yourself a head start. This resource simplifies the process, making it easier to highlight what sets you apart.

Creating an outstanding resume involves framing your financial skills in a way that emphasizes your unique value. Capturing your journey in investment banking means showcasing your contributions and potential. Dive into this guide to effectively translate your professional story, ensuring your resume becomes a powerful tool that opens doors to new opportunities.

Key Takeaways

- A compelling teacher resume effectively communicates not only job responsibilities but showcases key achievements and skills.

- Utilizing a resume template can help in organizing thoughts and ensuring the content is prioritized over formatting issues.

- Emphasize strong analytical skills, attention to detail, and the ability to thrive under pressure, crucial for demonstrating capability in investment banking roles.

- Choosing a reverse-chronological format, modern fonts, and exporting as a PDF contributes to a professional presentation.

- Quantifiable achievements using strong action words enhance the impact of job experience sections, aligning contributions with job requirements.

What to focus on when writing your investment banking resume

An investment banking resume should highlight your strong analytical skills, keen attention to detail, and ability to excel under pressure. This tells recruiters that you are dedicated to the field and ready to make a significant impact.

How to structure your investment banking resume

- Contact Information — Include your full name, phone number, and a professional email address that projects the right impression. Adding a well-maintained LinkedIn profile URL helps bridge your online and on-paper presence. Ensuring these details are clear and easy to find can make it simpler for recruiters to connect with you, setting a professional tone from the outset.

- Professional Summary — Use this section to convey your passion for investment banking. A well-written statement should highlight your unique qualifications, any significant achievements, and your career objectives. By focusing on what sets you apart, you help recruiters quickly grasp your potential fit within their team. This summary should be tailored to each application to align with the specific role you're targeting.

- Education — Share your educational background, highlighting not just your degree(s) and university but also any special honors or relevant courses in finance or economics. Emphasizing your academic strengths helps illustrate your foundational knowledge and preparedness for the demands of investment banking.

- Work Experience — Here, you should detail previous roles with a focus on achievements rather than duties. Highlight specific accomplishments, such as successful projects, deal sizes, and value created. It's crucial to quantify your achievements using metrics that demonstrate your impact, as this shows your ability to drive results in financial analysis, mergers, and acquisitions.

- Technical Skills — This section should spotlight your expertise with specific financial modeling techniques and software tools like Excel or Bloomberg Terminal. Demonstrating proficiency in these areas underscores your technical skills, which are vital for investment banking roles.

- Certifications — Mentioning finance-related certifications, such as CFA, Series 7, or Series 63, shows your dedication to continuous professional growth. These credentials can set you apart, showcasing your commitment and proving that you meet industry standards.

Each of these sections is crucial to crafting a compelling application for an investment banking role. In the next parts, we will delve deeper into each of these sections to fine-tune your resume format and content.

Which resume format to choose

Your investment banking resume needs to exude professionalism through a sleek, modern design. Opting for a reverse-chronological format allows you to highlight your most recent experiences first, showcasing how your career has progressed in a way that appeals to potential employers who value a clear trajectory.

When it comes to choosing fonts, Raleway, Montserrat, and Oswald strike the perfect balance. Each offers a clean, contemporary look that ensures your resume is both stylish and easy to read, which is crucial when making a strong first impression in the competitive finance industry.

Always save your resume as a PDF. This choice is crucial because a PDF keeps your layout consistent across various devices and software, preserving the professional appearance and ensuring that employers see exactly what you’ve intended.

Finally, setting your margins to about one inch on all sides gives your resume a neat and organized appearance, allowing for plenty of white space. This not only enhances readability but also keeps the focus on your achievements and skills, helping you communicate your expertise more effectively. These thoughtful choices come together to create a resume that stands out in the investment banking field.

How to write a quantifiable resume experience section

In your investment banking resume, the experience section should highlight your professional achievements, showing employers how you drive results and add value. Concentrate on quantifiable accomplishments that clearly demonstrate your skills and connect with the job you're applying for. Organize your experience in reverse chronological order, showcasing your most recent and relevant roles first. Typically, include positions from the last 10-15 years that align with the investment banking role. Tailor your resume to each job by aligning your achievements with the job description and employing strong action words like "analyzed," "led," "developed," and "executed" to give your contributions a powerful voice.

Consider this sample experience section:

- •Led financial modeling for a $500 million acquisition, boosting client revenue by 20%.

- •Developed and maintained financial models for 15+ clients, improving decision-making accuracy by 30%.

- •Conducted industry analysis that contributed to securing $200 million in capital financing.

- •Collaborated with teams to execute 10+ IPOs, raising over $1 billion.

This experience section stands out by seamlessly integrating accomplishments with key action verbs, clearly portraying your impact. Starting each bullet point with a strong verb ties your achievements directly to vital investment banking skills, such as financial modeling and industry analysis. This format is easy to follow, with concise descriptions that paint a clear picture of your contributions. By tailoring these details to the specific job ad, you emphasize your relevant qualifications and present a narrative that aligns perfectly with the employer's needs.

Technology-Focused resume experience section

A technology-focused investment banking resume experience section should effectively showcase both your technical expertise and your contributions to the financial sector. Begin by listing your job titles, companies, and the dates you worked at each place, providing recruiters with a clear timeline of your career path. As you craft bullet points under each role, focus on your achievements and the impact you made. These concise statements should highlight your problem-solving abilities, the projects you've managed, and accomplishments tied to technology in finance.

To tie your experiences together, use action-oriented language and quantifiable metrics, illustrating how you've successfully merged technological solutions with financial strategies. Whether you’ve enhanced operational efficiencies, implemented impactful software solutions, or led innovative projects, ensure that these activities clearly demonstrate improvements in performance or efficiency. Your resume should seamlessly convey your unique ability to apply technical knowledge to the banking sector, establishing you as an innovator who effectively drives success in each role you've undertaken.

Senior Analyst

Innovate Bank

June 2020 - Present

- Led a team in overhauling the bank's data processing system, cutting processing time by 30%.

- Implemented new software to improve risk assessment in loan approvals, boosting accuracy by 20%.

- Collaborated with cross-functional teams to integrate AI solutions, increasing revenue forecasting precision.

- Trained new employees on cybersecurity measures, leading to a 50% reduction in security breaches.

Customer-Focused resume experience section

A customer-focused investment banking resume experience section should clearly highlight your strengths in building relationships and delivering exceptional service. Begin by emphasizing your ability to forge strong connections with clients to understand their unique needs and provide tailored financial solutions. Share examples where you communicated complex financial concepts in simple terms, empowering clients to make informed decisions. Illustrate your track record of exceeding client expectations, boosting satisfaction, and driving revenue growth, while maintaining strict adherence to industry regulations.

To make your experience stand out, highlight tangible achievements and your proactive approach in portfolio management. Use specific metrics, like portfolio growth or improved client retention rates, to demonstrate your effectiveness in client service. Ensure your descriptions align with the prospective employer's focus on customer satisfaction and client-centered objectives, bridging your past experiences with their goals.

Investment Banking Analyst

TopTier Banking Group

June 2020 - Present

- Managed a diverse portfolio of high-net-worth clients, achieving a 25% portfolio growth in one year.

- Developed personalized investment strategies that led to a 30% increase in client satisfaction scores.

- Conducted quarterly financial reviews that enhanced client understanding and resulted in a 15% increase in client retention.

- Collaborated with cross-functional teams to deliver integrated financial solutions, boosting client engagement by 20%.

Training and Development Focused resume experience section

A Training and Development Focused resume experience section should effectively showcase your role in enhancing skills and driving learning in a fast-paced investment banking environment. Begin by outlining your position and the period you worked to provide context. Emphasize your key accomplishments, particularly those that reflect your ability to design successful training programs and lead impactful workshops. Showing how your efforts led to improved team performance and met company objectives is crucial, and including metrics can lend credibility to your claims.

When detailing your bullet points, highlight leadership and the soft skills necessary to foster growth and innovation. Focus on your experience in creating training materials, conducting insightful sessions, and mentoring junior staff. Maintain straightforward, outcome-focused language that helps potential employers quickly grasp your contributions and the value you can bring to their organization. A clear and organized format ensures that your experience is easy to read and understand.

Senior Training Manager

Global Bank

2019 - 2022

- Created a comprehensive training program that boosted new hire productivity by 30% within the first quarter.

- Led a team of 5 to design engaging workshops, enhancing employee skill sets across departments.

- Coached over 50 employees, resulting in a 15% rise in internal promotions.

- Implemented feedback systems that improved training satisfaction scores by 20%.

Efficiency-Focused resume experience section

An efficiency-focused investment banking resume experience section should clearly convey how you've simplified tasks and increased productivity. Start by highlighting achievements where you've saved time, reduced costs, or improved processes, making operations run more smoothly. Use quantifiable metrics to showcase the real impact of your efforts, helping potential employers quickly grasp the value you brought to previous positions.

Be sure to include specific actions and their outcomes, maintaining a straightforward and direct tone for clarity. Connect each bullet point with a narrative that emphasizes your problem-solving abilities and proactive initiatives. By painting a cohesive picture of your contributions, you'll effectively demonstrate your capability to drive significant improvements in an investment banking environment.

Efficiency Analyst

XYZ Investment Bank

March 2020 - May 2023

- Implemented an automated report generation system, reducing report preparation time by 40%.

- Streamlined financial analysis processes that led to a 20% increase in analyst productivity.

- Coordinated cross-departmental meetings to identify and eliminate workflow bottlenecks, resulting in a 30% decrease in project delays.

- Developed and trained team on a data management protocol, improving data accuracy by 25%.

Write your investment banking resume summary section

A finance-focused investment banking resume summary should quickly convey your value and what makes you unique. Use this section to highlight your skills and achievements, choosing strong, descriptive words like "dedicated," "analytical," and "results-driven" to capture attention. Your goal is to paint a clear picture of your professional strengths, focusing on what sets you apart. Metrics and accomplishments are your allies here; mention successful projects or efficiency improvements to bolster your credibility. For instance, a compelling example might be:

This summary vividly outlines your skills and past achievements using concrete metrics. It’s also key to understand the nuances between resume components to make your application shine. While a resume summary highlights career achievements for experienced candidates, a resume objective is ideal for entry-level applicants, focusing on career goals. A resume profile might offer more personal insight, like work style, while a summary of qualifications concisely lists skills and achievements. Knowing these differences ensures you choose the right format to tell your professional story effectively. Tailor your approach to align with your experience level and the job you’re pursuing.

Listing your investment banking skills on your resume

A skills-focused investment banking resume should effectively highlight what you bring to the table. The skills section is pivotal, serving as your main platform to show potential employers your qualifications. This section can stand alone or be seamlessly integrated into your experience and summary. It’s important to underscore your strengths, which often relate to soft skills like leadership and communication. Conversely, hard skills are the technical abilities you’ve honed, such as financial modeling and Excel proficiency.

These skills are crucial for your resume, as they act as keywords that help you stand out. Employers and applicant tracking systems scan for these keywords to identify ideal candidates. This makes presenting your skills strategically an asset in the initial selection stages.

Here’s an example of an effective standalone skills section:

This skills section is effective because it presents crucial capabilities clearly and relevantly. Each skill listed is particularly pertinent to investment banking, showcasing your aptitude for the role. The clarity of this format benefits applicant tracking systems, improving your odds in the job hunt.

Best hard skills to feature on your investment banking resume

Hard skills underscore your technical expertise, which is essential in investment banking. These skills demonstrate your capability to perform specialized tasks, reflecting your training and knowledge. Here are the most valuable hard skills in this field:

Hard Skills

- Financial Modeling

- Excel Proficiency

- Valuation Techniques

- M&A Analysis (Mergers and Acquisitions)

- Corporate Finance

- Risk Management

- Data Analysis

- Quantitative Analysis

- Strategic Planning

- Capital Markets Knowledge

- Knowledge of Financial Regulations

- Investment Research

- Portfolio Management

- Financial Reporting

- Derivatives Pricing

Best soft skills to feature on your investment banking resume

Soft skills round out your profile, highlighting how you interact with others and solve complex problems. These traits reveal your personal strengths and interpersonal capabilities. Here are crucial soft skills for success in investment banking:

Soft Skills

- Communication

- Leadership

- Teamwork

- Problem-Solving

- Time Management

- Negotiation

- Adaptability

- Attention to Detail

- Analytical Thinking

- Decision-Making

- Critical Thinking

- Interpersonal Skills

- Persuasion

- Resilience

- Emotional Intelligence

How to include your education on your resume

The education section of your investment banking resume is crucial, highlighting your academic background and showing your potential employers the relevant skills you bring to the table. It's important to tailor this section specifically to the job you're applying for, excluding any unrelated educational experiences. Ensure to correctly include your GPA, mention any honors such as cum laude, and clearly list your degrees.

When including your GPA, always be honest and transparent. Display it like this: "GPA: 3.8/4.0" if it's strong and positions you competitively. If you graduated with honors, such as cum laude, include it next to your degree. Clearly list each degree with the school name, location, and graduation dates to offer a comprehensive view.

Here are some examples:

The second example is strong because it highlights a directly relevant degree in finance from a prestigious school, which aligns well with an investment banking role. It also showcases academic excellence with a cum laude honor and a high GPA, positioning the candidate as a top-tier applicant. Tailoring this section can make you stand out and capture the attention of potential employers.

How to include investment banking certificates on your resume

Including a certificates section in your investment banking resume is essential as it highlights your commitment to continuous learning and professional development. List the name of the certificate first to draw attention. Include the date you obtained it to show relevancy. Add the issuing organization to validate the credential.

Certificates can also be included in the header for immediate visibility. For instance, "Jane Doe, CFA Level I, SIE Certified."

Example of a standalone certificates section:

This example is good because it includes highly relevant certifications for investment banking, such as CFA Level I and SIE. Additionally, it shows the issuing organizations, providing credibility. The layout is clear and easy to read, making the information accessible and quickly understood. This approach emphasizes the applicant’s qualifications effectively.

Extra sections to include in your investment banking resume

Creating a refined investment banking resume is essential to make a strong impression on potential employers. By carefully including key sections, you can present a comprehensive picture of your skills, experiences, and interests. Here’s how to incorporate various sections effectively.

Language section — Highlight your fluency in multiple languages which can give you an edge in serving global clients and working in international markets.

Hobbies and interests section — Share hobbies and interests that demonstrate valuable soft skills or stress-management abilities, such as playing chess or engaging in team sports, enhancing your problem-solving and teamwork capabilities.

Volunteer work section — Mention volunteer activities to show your commitment to social responsibility which can convey strong ethical values and community involvement.

Books section — List finance-related books you’ve read to showcase your dedication to continuous learning and staying updated with industry trends and concepts.

Incorporating these sections into your resume can help illustrate a well-rounded personality, appealing to investment banks looking for dynamic and adaptable candidates.

In Conclusion

In conclusion, crafting an effective investment banking resume involves strategically showcasing your unique skills, achievements, and professional experiences. It’s vital to highlight your analytical prowess and financial expertise, traits that are imperative in the investment banking world. Tailoring your resume to each specific job application can make the difference between catching a recruiter's attention and being overlooked. Utilize a professional template to efficiently organize your content, ensuring your document is both visually appealing and easy to read. Remember, while your resume is a tool to present your professional journey, it’s also your story told in a few pages. From highlighting technical proficiencies with tools like Excel to illustrating your ability to close major deals, every section should serve as proof of your potential value to an employer. Emphasize a balance between hard skills like financial modeling and soft skills such as communication, reflecting your ability to collaborate effectively in a team. The education and certifications sections further bolster your credentials, demonstrating your commitment to the field through continuous learning and professional development. Including sections that reflect your holistic character, like languages spoken or volunteer work, might just be what sets you apart in a sea of professionals. Moreover, maintaining a clean format, employing key action words, and focusing heavily on quantifiable achievements can elevate your resume, making it a powerful advocate in your job search.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.