Investment Representative Resume Examples

Jul 18, 2024

|

12 min read

"Crafting a standout investment representative resume: how to bank on your skills and experience for a career boost"

Rated by 348 people

Investment Analysis Representative

Equity Investment Specialist

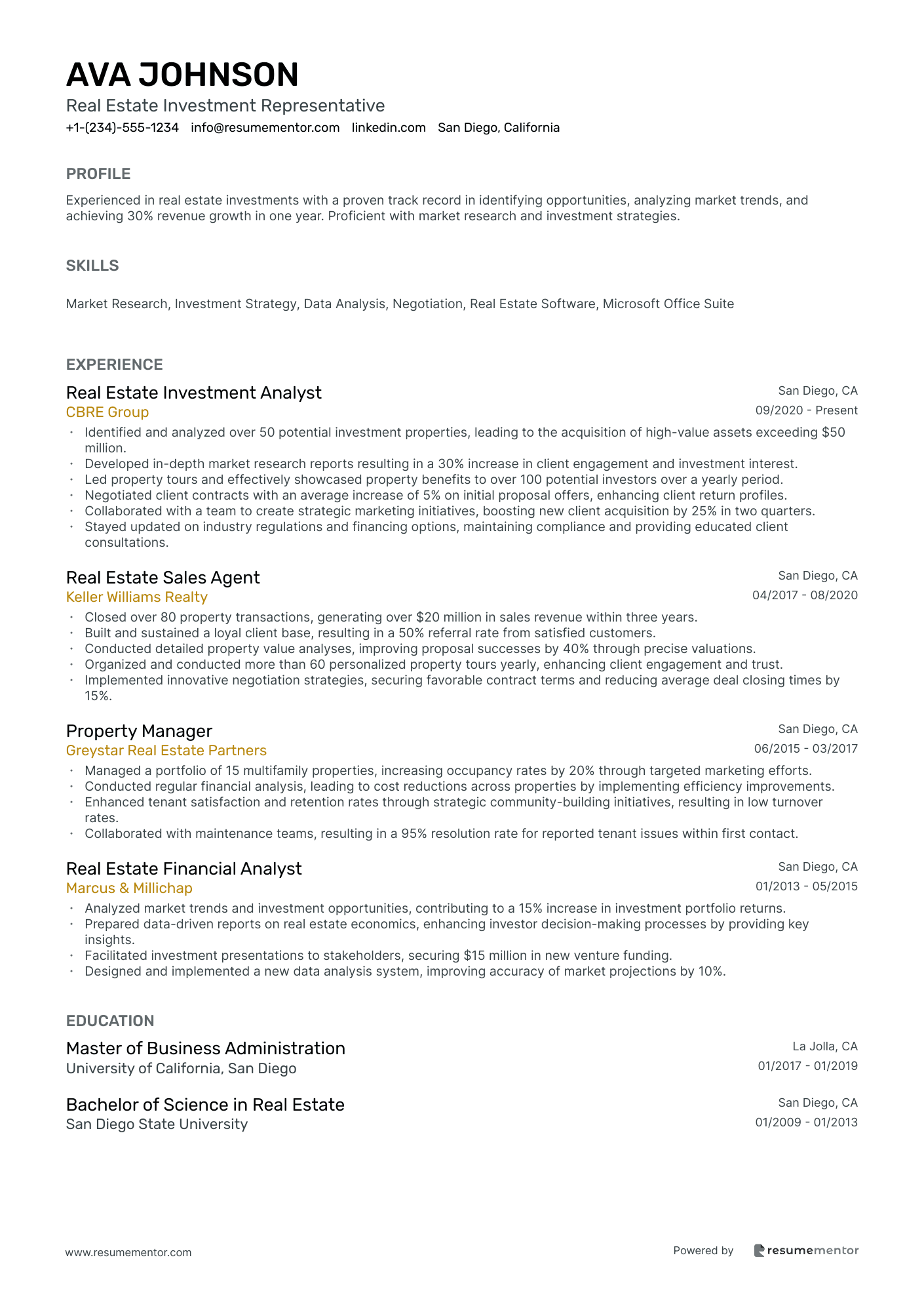

Real Estate Investment Representative

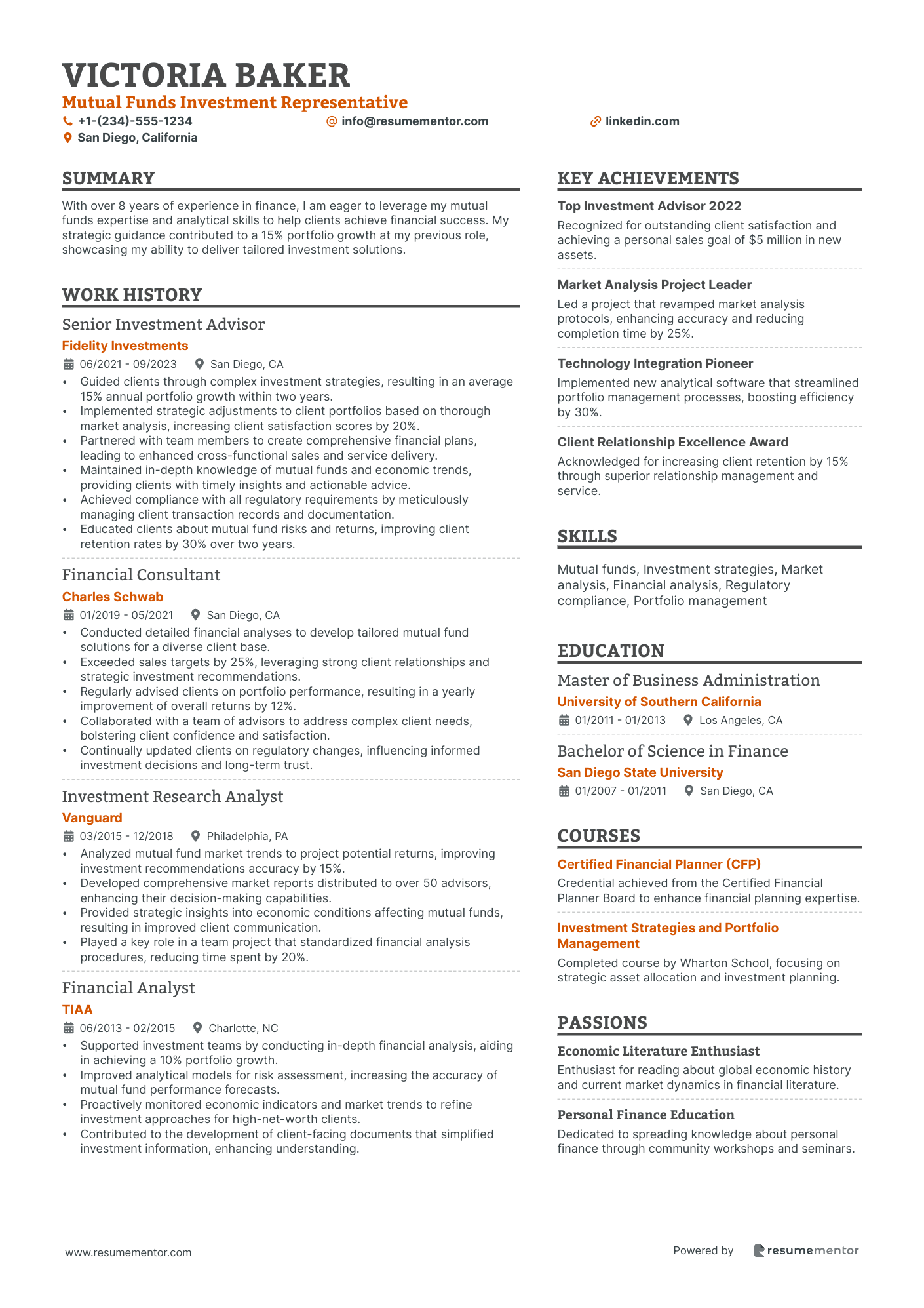

Mutual Funds Investment Representative

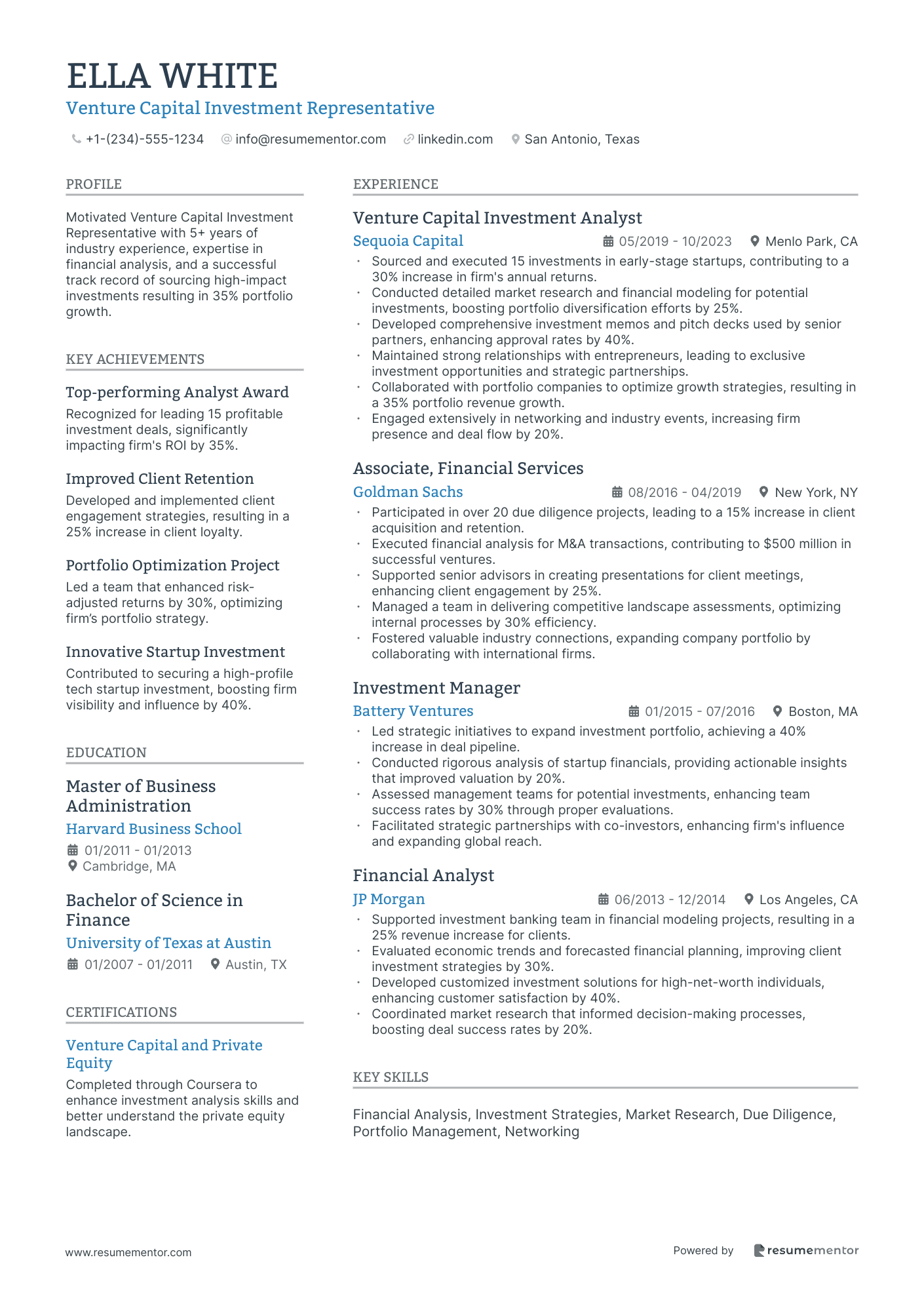

Venture Capital Investment Representative

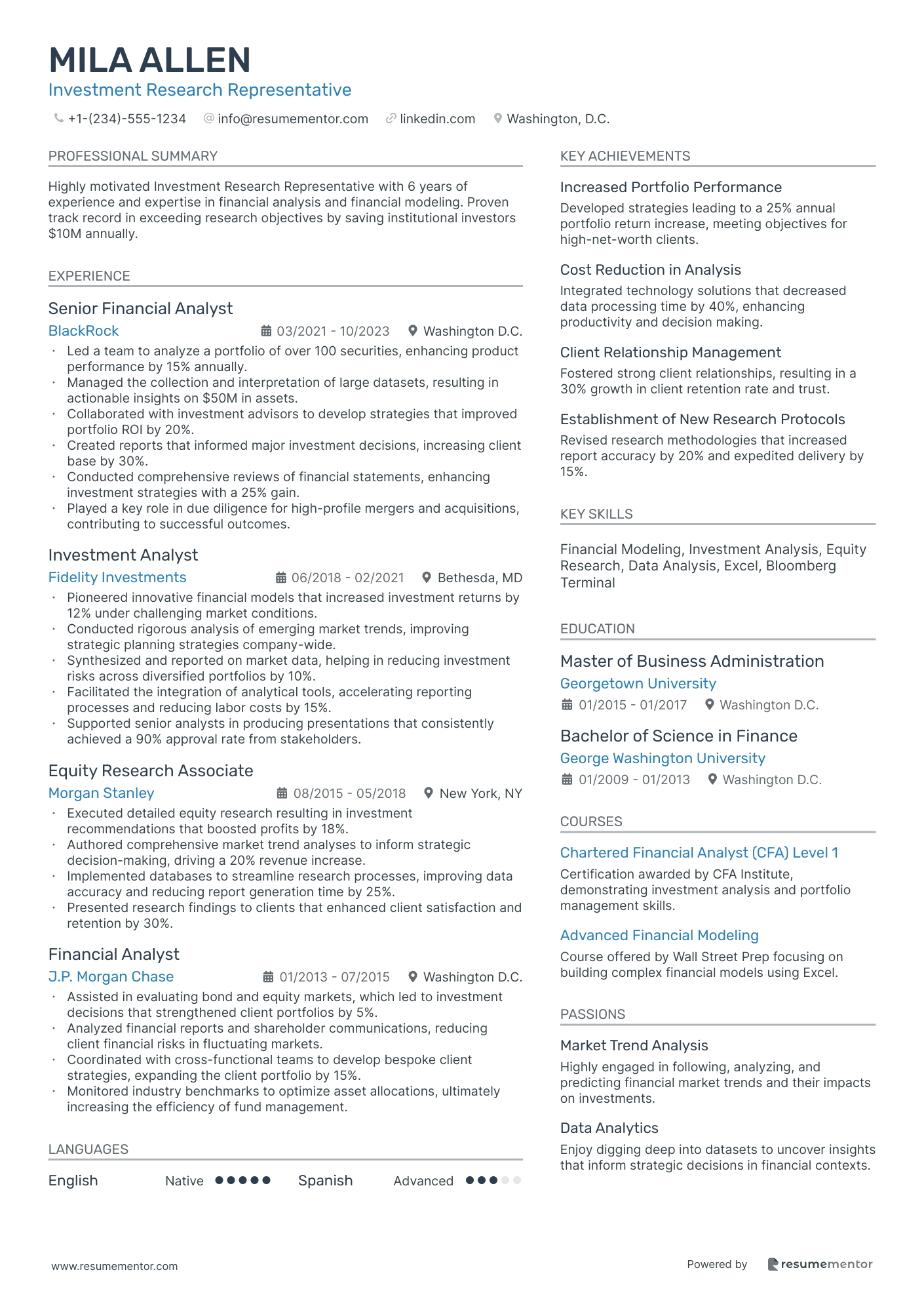

Investment Research Representative

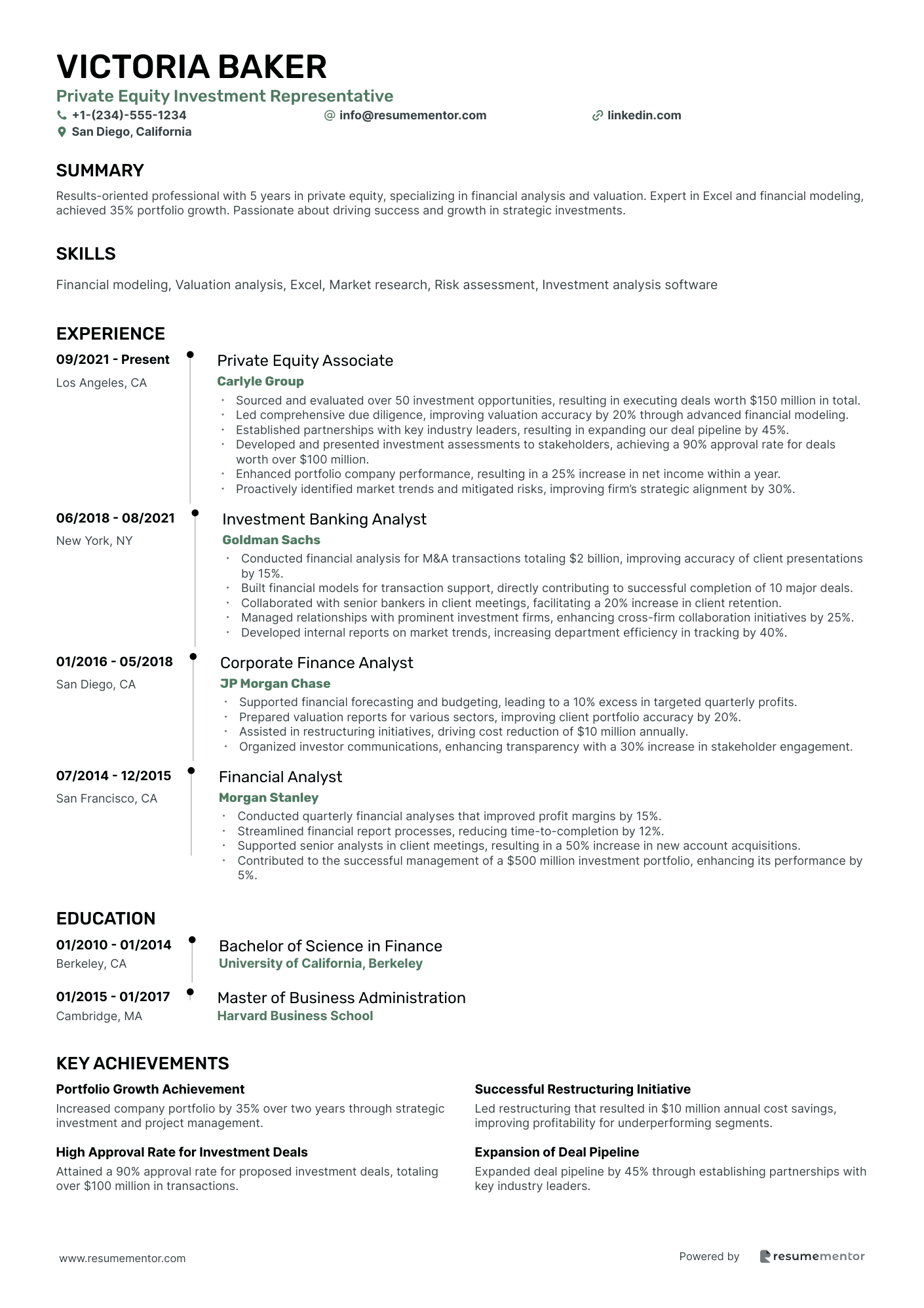

Private Equity Investment Representative

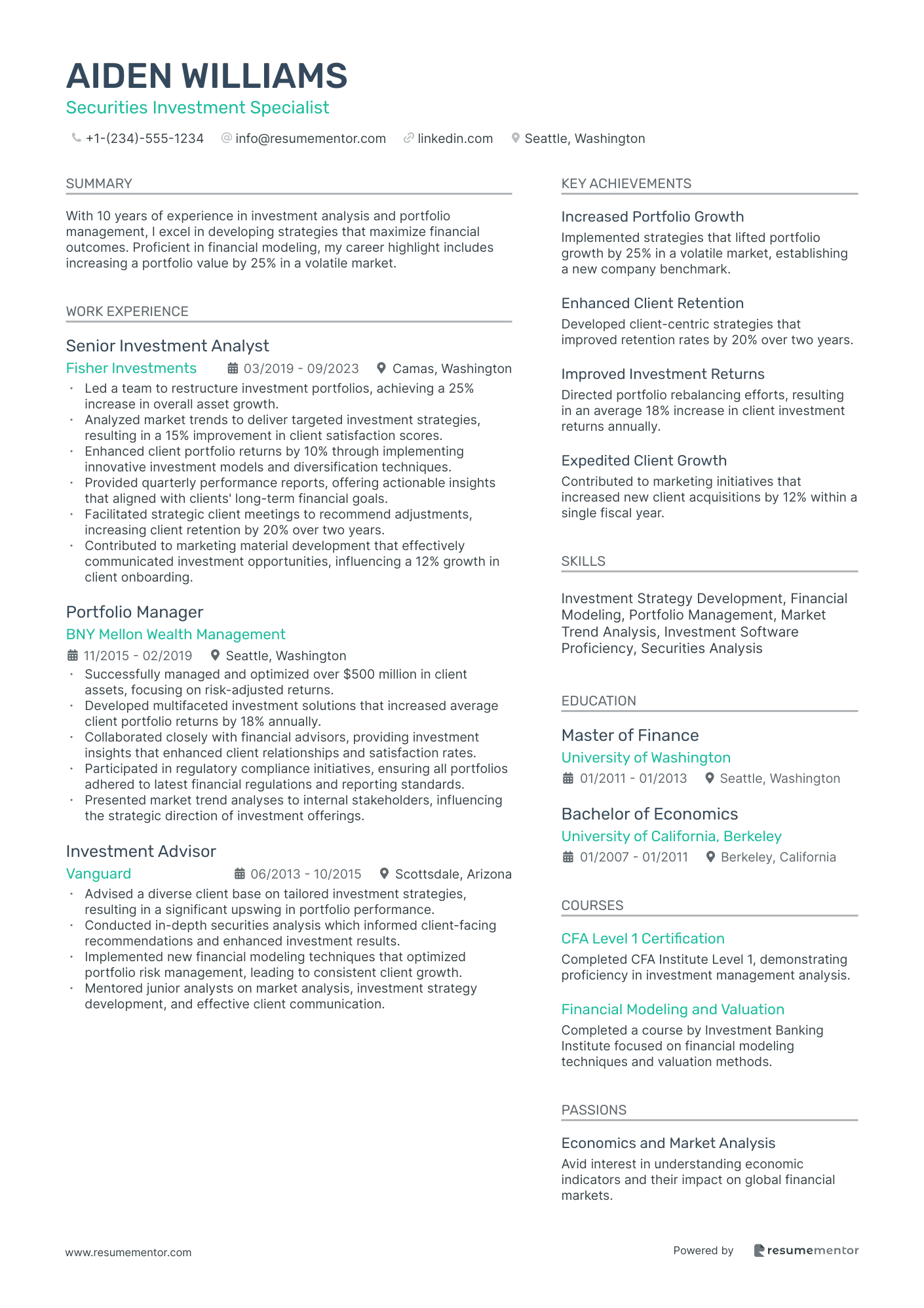

Securities Investment Specialist

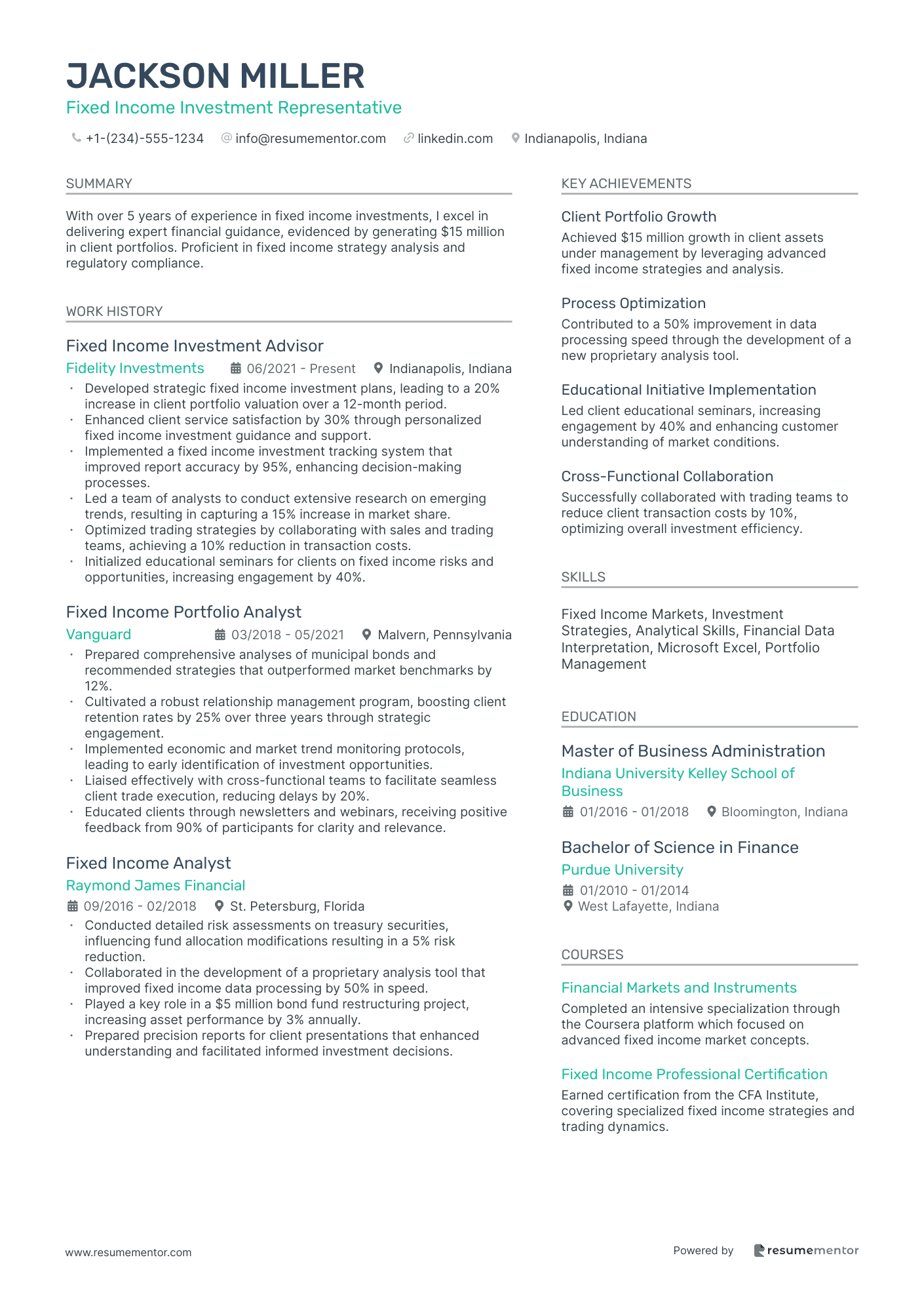

Fixed Income Investment Representative

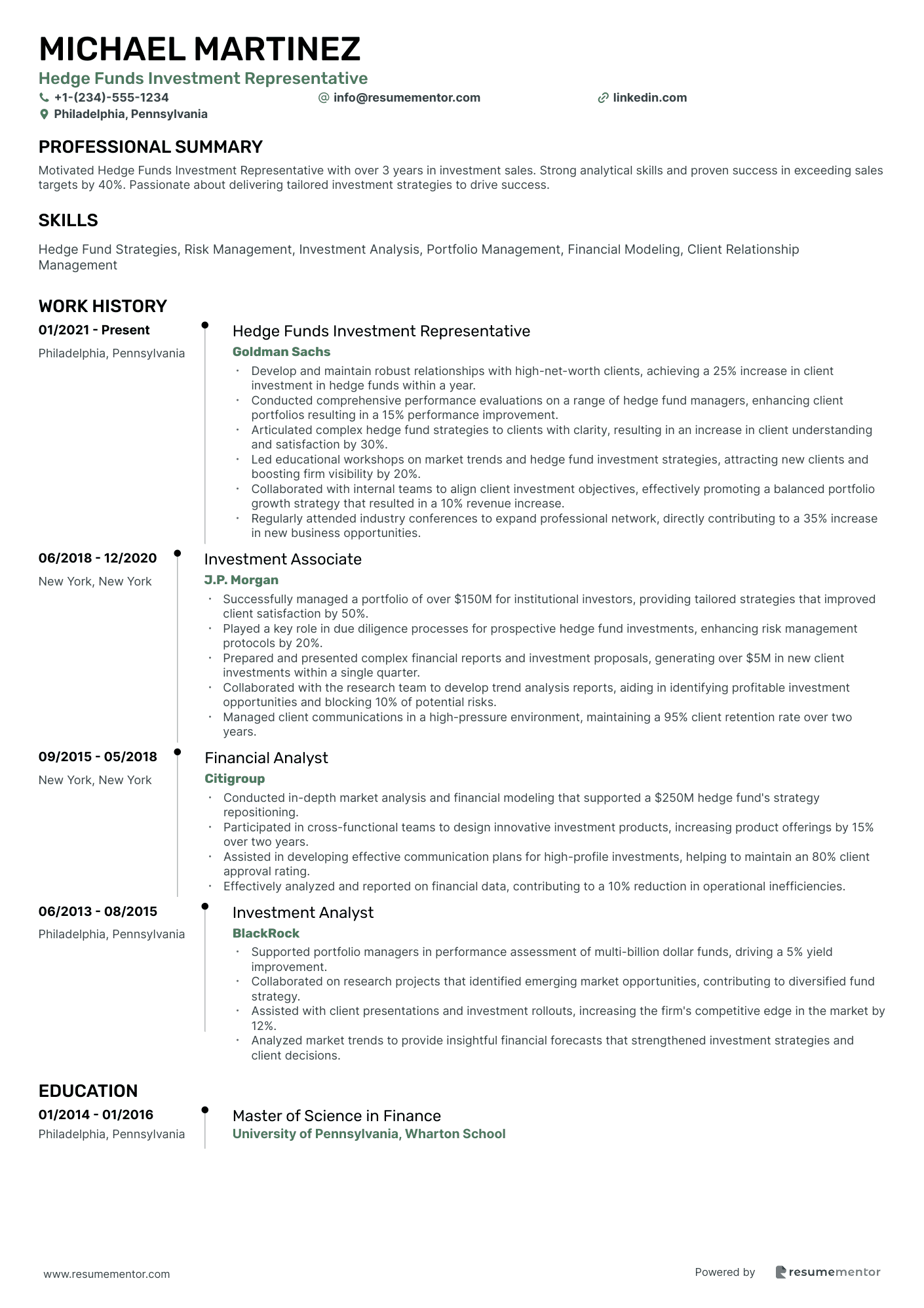

Hedge Funds Investment Representative

Investment Analysis Representative resume sample

- •Led analysis on a portfolio resulting in a 20% increase in return by optimizing asset allocation strategies.

- •Collaborated with a 5-member team to evaluate real estate investments, reaching a record $50M in managed assets.

- •Developed financial models using Excel to assess equity performance, resulting in a 15% improvement in forecasting accuracy.

- •Facilitated weekly presentations to portfolio managers, improving stakeholder understanding of financial markets by 30%.

- •Conducted due diligence on alternative investments that yielded an average return of 12% annually.

- •Designed an investment risk scoring model that reduced decision-making time by 40%.

- •Monitored and analyzed performance in fixed income markets, boosting portfolio yield by 8% using strategic insights.

- •Crafted comprehensive reports on market trends which increased understanding of regulatory impacts by 25%.

- •Collaborated with traders to enhance investment strategies, leading to a 10% growth in trading revenues.

- •Assisted in developing analytical tools that decreased analysis time by 30% for investment opportunities.

- •Evaluated alternative investments, expanding portfolio diversity with a 5% risk-adjusted return enhancement.

- •Conducted detailed equity market research that contributed to decision-making for a $100M fund.

- •Streamlined data analysis processes, reducing report preparation time by 35% and improving data accuracy.

- •Evaluated financial statements for client portfolios, improving investment decision efficiency by 20%.

- •Provided ongoing performance updates and actionable insights, enhancing client portfolio results by 5%.

Equity Investment Specialist resume sample

- •Led a team in analysing large-cap stock portfolios, achieving a 20% annual return, exceeding benchmark by 5%.

- •Developed and implemented a successful equity trading strategy that increased investment returns by 30% over 18 months.

- •Created over 30 comprehensive equity research reports quarterly, contributing to informed investment decisions.

- •Collaborated with international analysts to enhance investment strategies, resulting in an optimized global equity allocation.

- •Delivered detailed market trend analyses to senior portfolio managers, driving strategic shifts for high-value equities.

- •Streamlined research workflow, enhancing efficiency by 25%, through the integration of technology and updated methodologies.

- •Conducted in-depth financial analysis on equities, contributing to an annual portfolio growth of 15%.

- •Maintained financial models that supported strategies leading to increased client investment confidence by 12%.

- •Presented thorough equity analysis forecasts to clients, enhancing client retention and acquisition by 10%.

- •Consistently monitored economic developments, leading to timely strategic adjustments and portfolio risk mitigation.

- •Participated in over 10 industry conferences annually, expanding both professional knowledge and network significantly.

- •Collaborated with asset managers in evaluating equities, improving client investment portfolios by 18%.

- •Optimized data analysis tools, resulting in a 20% improvement in research efficiency and accuracy.

- •Supported the development of investment pitch books, contributing to successful client engagements.

- •Engaged in regular peer reviews of financial models, fostering a culture of continuous learning and improvement.

- •Assisted in the analysis of equity markets, generating actionable insights that improved decision-making processes.

- •Managed large datasets to create performance evaluation reports, enhancing transparency and client relations.

- •Led training sessions on valuation techniques, elevating team competency in financial modeling.

- •Contributed to the development of sustainable investment strategies, focusing on long-term risk-adjusted returns.

Real Estate Investment Representative resume sample

- •Identified and analyzed over 50 potential investment properties, leading to the acquisition of high-value assets exceeding $50 million.

- •Developed in-depth market research reports resulting in a 30% increase in client engagement and investment interest.

- •Led property tours and effectively showcased property benefits to over 100 potential investors over a yearly period.

- •Negotiated client contracts with an average increase of 5% on initial proposal offers, enhancing client return profiles.

- •Collaborated with a team to create strategic marketing initiatives, boosting new client acquisition by 25% in two quarters.

- •Stayed updated on industry regulations and financing options, maintaining compliance and providing educated client consultations.

- •Closed over 80 property transactions, generating over $20 million in sales revenue within three years.

- •Built and sustained a loyal client base, resulting in a 50% referral rate from satisfied customers.

- •Conducted detailed property value analyses, improving proposal successes by 40% through precise valuations.

- •Organized and conducted more than 60 personalized property tours yearly, enhancing client engagement and trust.

- •Implemented innovative negotiation strategies, securing favorable contract terms and reducing average deal closing times by 15%.

- •Managed a portfolio of 15 multifamily properties, increasing occupancy rates by 20% through targeted marketing efforts.

- •Conducted regular financial analysis, leading to cost reductions across properties by implementing efficiency improvements.

- •Enhanced tenant satisfaction and retention rates through strategic community-building initiatives, resulting in low turnover rates.

- •Collaborated with maintenance teams, resulting in a 95% resolution rate for reported tenant issues within first contact.

- •Analyzed market trends and investment opportunities, contributing to a 15% increase in investment portfolio returns.

- •Prepared data-driven reports on real estate economics, enhancing investor decision-making processes by providing key insights.

- •Facilitated investment presentations to stakeholders, securing $15 million in new venture funding.

- •Designed and implemented a new data analysis system, improving accuracy of market projections by 10%.

Mutual Funds Investment Representative resume sample

- •Guided clients through complex investment strategies, resulting in an average 15% annual portfolio growth within two years.

- •Implemented strategic adjustments to client portfolios based on thorough market analysis, increasing client satisfaction scores by 20%.

- •Partnered with team members to create comprehensive financial plans, leading to enhanced cross-functional sales and service delivery.

- •Maintained in-depth knowledge of mutual funds and economic trends, providing clients with timely insights and actionable advice.

- •Achieved compliance with all regulatory requirements by meticulously managing client transaction records and documentation.

- •Educated clients about mutual fund risks and returns, improving client retention rates by 30% over two years.

- •Conducted detailed financial analyses to develop tailored mutual fund solutions for a diverse client base.

- •Exceeded sales targets by 25%, leveraging strong client relationships and strategic investment recommendations.

- •Regularly advised clients on portfolio performance, resulting in a yearly improvement of overall returns by 12%.

- •Collaborated with a team of advisors to address complex client needs, bolstering client confidence and satisfaction.

- •Continually updated clients on regulatory changes, influencing informed investment decisions and long-term trust.

- •Analyzed mutual fund market trends to project potential returns, improving investment recommendations accuracy by 15%.

- •Developed comprehensive market reports distributed to over 50 advisors, enhancing their decision-making capabilities.

- •Provided strategic insights into economic conditions affecting mutual funds, resulting in improved client communication.

- •Played a key role in a team project that standardized financial analysis procedures, reducing time spent by 20%.

- •Supported investment teams by conducting in-depth financial analysis, aiding in achieving a 10% portfolio growth.

- •Improved analytical models for risk assessment, increasing the accuracy of mutual fund performance forecasts.

- •Proactively monitored economic indicators and market trends to refine investment approaches for high-net-worth clients.

- •Contributed to the development of client-facing documents that simplified investment information, enhancing understanding.

Venture Capital Investment Representative resume sample

- •Sourced and executed 15 investments in early-stage startups, contributing to a 30% increase in firm's annual returns.

- •Conducted detailed market research and financial modeling for potential investments, boosting portfolio diversification efforts by 25%.

- •Developed comprehensive investment memos and pitch decks used by senior partners, enhancing approval rates by 40%.

- •Maintained strong relationships with entrepreneurs, leading to exclusive investment opportunities and strategic partnerships.

- •Collaborated with portfolio companies to optimize growth strategies, resulting in a 35% portfolio revenue growth.

- •Engaged extensively in networking and industry events, increasing firm presence and deal flow by 20%.

- •Participated in over 20 due diligence projects, leading to a 15% increase in client acquisition and retention.

- •Executed financial analysis for M&A transactions, contributing to $500 million in successful ventures.

- •Supported senior advisors in creating presentations for client meetings, enhancing client engagement by 25%.

- •Managed a team in delivering competitive landscape assessments, optimizing internal processes by 30% efficiency.

- •Fostered valuable industry connections, expanding company portfolio by collaborating with international firms.

- •Led strategic initiatives to expand investment portfolio, achieving a 40% increase in deal pipeline.

- •Conducted rigorous analysis of startup financials, providing actionable insights that improved valuation by 20%.

- •Assessed management teams for potential investments, enhancing team success rates by 30% through proper evaluations.

- •Facilitated strategic partnerships with co-investors, enhancing firm's influence and expanding global reach.

- •Supported investment banking team in financial modeling projects, resulting in a 25% revenue increase for clients.

- •Evaluated economic trends and forecasted financial planning, improving client investment strategies by 30%.

- •Developed customized investment solutions for high-net-worth individuals, enhancing customer satisfaction by 40%.

- •Coordinated market research that informed decision-making processes, boosting deal success rates by 20%.

Investment Research Representative resume sample

- •Led a team to analyze a portfolio of over 100 securities, enhancing product performance by 15% annually.

- •Managed the collection and interpretation of large datasets, resulting in actionable insights on $50M in assets.

- •Collaborated with investment advisors to develop strategies that improved portfolio ROI by 20%.

- •Created reports that informed major investment decisions, increasing client base by 30%.

- •Conducted comprehensive reviews of financial statements, enhancing investment strategies with a 25% gain.

- •Played a key role in due diligence for high-profile mergers and acquisitions, contributing to successful outcomes.

- •Pioneered innovative financial models that increased investment returns by 12% under challenging market conditions.

- •Conducted rigorous analysis of emerging market trends, improving strategic planning strategies company-wide.

- •Synthesized and reported on market data, helping in reducing investment risks across diversified portfolios by 10%.

- •Facilitated the integration of analytical tools, accelerating reporting processes and reducing labor costs by 15%.

- •Supported senior analysts in producing presentations that consistently achieved a 90% approval rate from stakeholders.

- •Executed detailed equity research resulting in investment recommendations that boosted profits by 18%.

- •Authored comprehensive market trend analyses to inform strategic decision-making, driving a 20% revenue increase.

- •Implemented databases to streamline research processes, improving data accuracy and reducing report generation time by 25%.

- •Presented research findings to clients that enhanced client satisfaction and retention by 30%.

- •Assisted in evaluating bond and equity markets, which led to investment decisions that strengthened client portfolios by 5%.

- •Analyzed financial reports and shareholder communications, reducing client financial risks in fluctuating markets.

- •Coordinated with cross-functional teams to develop bespoke client strategies, expanding the client portfolio by 15%.

- •Monitored industry benchmarks to optimize asset allocations, ultimately increasing the efficiency of fund management.

Private Equity Investment Representative resume sample

- •Sourced and evaluated over 50 investment opportunities, resulting in executing deals worth $150 million in total.

- •Led comprehensive due diligence, improving valuation accuracy by 20% through advanced financial modeling.

- •Established partnerships with key industry leaders, resulting in expanding our deal pipeline by 45%.

- •Developed and presented investment assessments to stakeholders, achieving a 90% approval rate for deals worth over $100 million.

- •Enhanced portfolio company performance, resulting in a 25% increase in net income within a year.

- •Proactively identified market trends and mitigated risks, improving firm’s strategic alignment by 30%.

- •Conducted financial analysis for M&A transactions totaling $2 billion, improving accuracy of client presentations by 15%.

- •Built financial models for transaction support, directly contributing to successful completion of 10 major deals.

- •Collaborated with senior bankers in client meetings, facilitating a 20% increase in client retention.

- •Managed relationships with prominent investment firms, enhancing cross-firm collaboration initiatives by 25%.

- •Developed internal reports on market trends, increasing department efficiency in tracking by 40%.

- •Supported financial forecasting and budgeting, leading to a 10% excess in targeted quarterly profits.

- •Prepared valuation reports for various sectors, improving client portfolio accuracy by 20%.

- •Assisted in restructuring initiatives, driving cost reduction of $10 million annually.

- •Organized investor communications, enhancing transparency with a 30% increase in stakeholder engagement.

- •Conducted quarterly financial analyses that improved profit margins by 15%.

- •Streamlined financial report processes, reducing time-to-completion by 12%.

- •Supported senior analysts in client meetings, resulting in a 50% increase in new account acquisitions.

- •Contributed to the successful management of a $500 million investment portfolio, enhancing its performance by 5%.

Securities Investment Specialist resume sample

- •Led a team to restructure investment portfolios, achieving a 25% increase in overall asset growth.

- •Analyzed market trends to deliver targeted investment strategies, resulting in a 15% improvement in client satisfaction scores.

- •Enhanced client portfolio returns by 10% through implementing innovative investment models and diversification techniques.

- •Provided quarterly performance reports, offering actionable insights that aligned with clients' long-term financial goals.

- •Facilitated strategic client meetings to recommend adjustments, increasing client retention by 20% over two years.

- •Contributed to marketing material development that effectively communicated investment opportunities, influencing a 12% growth in client onboarding.

- •Successfully managed and optimized over $500 million in client assets, focusing on risk-adjusted returns.

- •Developed multifaceted investment solutions that increased average client portfolio returns by 18% annually.

- •Collaborated closely with financial advisors, providing investment insights that enhanced client relationships and satisfaction rates.

- •Participated in regulatory compliance initiatives, ensuring all portfolios adhered to latest financial regulations and reporting standards.

- •Presented market trend analyses to internal stakeholders, influencing the strategic direction of investment offerings.

- •Advised a diverse client base on tailored investment strategies, resulting in a significant upswing in portfolio performance.

- •Conducted in-depth securities analysis which informed client-facing recommendations and enhanced investment results.

- •Implemented new financial modeling techniques that optimized portfolio risk management, leading to consistent client growth.

- •Mentored junior analysts on market analysis, investment strategy development, and effective client communication.

- •Conducted comprehensive economic trend analyses supporting strategic decision-making for one of the firm's key portfolios.

- •Created financial models that accurately projected investment opportunities, positively influencing investment management strategies.

- •Assisted in creating cohesive client presentations, enhancing the firm's ability to communicate complex investment concepts clearly.

- •Supported senior advisors in portfolio management activities, contributing to a 10% growth in portfolio value over two years.

Fixed Income Investment Representative resume sample

- •Developed strategic fixed income investment plans, leading to a 20% increase in client portfolio valuation over a 12-month period.

- •Enhanced client service satisfaction by 30% through personalized fixed income investment guidance and support.

- •Implemented a fixed income investment tracking system that improved report accuracy by 95%, enhancing decision-making processes.

- •Led a team of analysts to conduct extensive research on emerging trends, resulting in capturing a 15% increase in market share.

- •Optimized trading strategies by collaborating with sales and trading teams, achieving a 10% reduction in transaction costs.

- •Initialized educational seminars for clients on fixed income risks and opportunities, increasing engagement by 40%.

- •Prepared comprehensive analyses of municipal bonds and recommended strategies that outperformed market benchmarks by 12%.

- •Cultivated a robust relationship management program, boosting client retention rates by 25% over three years through strategic engagement.

- •Implemented economic and market trend monitoring protocols, leading to early identification of investment opportunities.

- •Liaised effectively with cross-functional teams to facilitate seamless client trade execution, reducing delays by 20%.

- •Educated clients through newsletters and webinars, receiving positive feedback from 90% of participants for clarity and relevance.

- •Conducted detailed risk assessments on treasury securities, influencing fund allocation modifications resulting in a 5% risk reduction.

- •Collaborated in the development of a proprietary analysis tool that improved fixed income data processing by 50% in speed.

- •Played a key role in a $5 million bond fund restructuring project, increasing asset performance by 3% annually.

- •Prepared precision reports for client presentations that enhanced understanding and facilitated informed investment decisions.

- •Assessed and advised on fixed income portfolios, resulting in a 10% increase in asset diversification among high-net-worth clients.

- •Executed client transactions with 100% accuracy, mitigating compliance risks through strict adherence to internal protocols.

- •Managed client relationships, resulting in a 15% increase in client portfolio growth due to tailored investment strategies.

Hedge Funds Investment Representative resume sample

- •Develop and maintain robust relationships with high-net-worth clients, achieving a 25% increase in client investment in hedge funds within a year.

- •Conducted comprehensive performance evaluations on a range of hedge fund managers, enhancing client portfolios resulting in a 15% performance improvement.

- •Articulated complex hedge fund strategies to clients with clarity, resulting in an increase in client understanding and satisfaction by 30%.

- •Led educational workshops on market trends and hedge fund investment strategies, attracting new clients and boosting firm visibility by 20%.

- •Collaborated with internal teams to align client investment objectives, effectively promoting a balanced portfolio growth strategy that resulted in a 10% revenue increase.

- •Regularly attended industry conferences to expand professional network, directly contributing to a 35% increase in new business opportunities.

- •Successfully managed a portfolio of over $150M for institutional investors, providing tailored strategies that improved client satisfaction by 50%.

- •Played a key role in due diligence processes for prospective hedge fund investments, enhancing risk management protocols by 20%.

- •Prepared and presented complex financial reports and investment proposals, generating over $5M in new client investments within a single quarter.

- •Collaborated with the research team to develop trend analysis reports, aiding in identifying profitable investment opportunities and blocking 10% of potential risks.

- •Managed client communications in a high-pressure environment, maintaining a 95% client retention rate over two years.

- •Conducted in-depth market analysis and financial modeling that supported a $250M hedge fund's strategy repositioning.

- •Participated in cross-functional teams to design innovative investment products, increasing product offerings by 15% over two years.

- •Assisted in developing effective communication plans for high-profile investments, helping to maintain an 80% client approval rating.

- •Effectively analyzed and reported on financial data, contributing to a 10% reduction in operational inefficiencies.

- •Supported portfolio managers in performance assessment of multi-billion dollar funds, driving a 5% yield improvement.

- •Collaborated on research projects that identified emerging market opportunities, contributing to diversified fund strategy.

- •Assisted with client presentations and investment rollouts, increasing the firm's competitive edge in the market by 12%.

- •Analyzed market trends to provide insightful financial forecasts that strengthened investment strategies and client decisions.

Crafting a standout investment representative resume is like navigating a turbulent market—you must highlight your financial expertise while ensuring your skills shine. To attract recruiters in a crowded field, your resume should act as a beacon, emphasizing your unique talents. An effective format and structure are crucial here, and that's where a quality resume template comes into play, providing a solid foundation to build upon.

Navigating common pitfalls, such as the challenge of showcasing your success in client portfolio management, requires clarity. Clear, compelling communication helps potential employers view you as a strategic advisor, not just someone skilled with numbers. It's about conveying your ability to navigate and thrive in complex investment environments.

A well-designed resume template takes your presentation to the next level, ensuring your achievements in driving growth don't go unnoticed. It allows your expertise in investment strategies and client relationship building to shine clearly.

Think of your resume as an investment in your career’s future. By using the right tools and approach, you'll confidently present your abilities, paving the way to securing your dream position. Embrace this chance to turn your career journey into a prosperous path.

Key Takeaways

- Crafting an effective investment representative resume involves emphasizing financial expertise, client relationships, and measurable achievements.

- Clear communication and evidence of successful portfolio management help portray you as a strategic advisor to potential employers.

- The resume should be well-formatted using a chronological structure, maintaining consistency with margins and PDF layout for a professional appearance.

- Highlighting skills, experiences, and certifications relevant to investment roles ensures alignment with job requirements and sets you apart from other candidates.

- Including extra sections like languages, hobbies, volunteer work, and books read can provide a fuller picture of your interests and dedication to the field.

What to focus on when writing your investment representative resume

Your investment representative resume should convey your financial expertise and highlight your ability to build strong client relationships. It’s essential to demonstrate how you manage and grow investment portfolios effectively, showcasing your knowledge of financial products and market trends—these elements should shine through to make your application stand out.

How to structure your investment representative resume

- Contact Information —Include your full name, phone number, and professional email. These details ensure recruiters can reach you easily and verify your professional identity. If you add your LinkedIn profile, make sure it reflects your role in the financial industry, emphasizing your accomplishments and contributions.

- Professional Summary —Your summary acts as the opening statement that sets the tone for your resume. It should concisely capture your career in financial advising and portfolio management. Numbers quantifying your achievements, such as how much you increased client investments, make a persuasive case for your expertise and add credibility.

- Work Experience —This section details the practical application of your skills as an investment representative. Highlight roles where you've managed significant client portfolios, focusing on metrics that showcase your effectiveness, like asset growth percentages or client retention rates. This section serves as solid evidence of your performance capabilities in a competitive market.

- Education —Your educational background reinforces your resume with foundational knowledge. A degree in finance, business, or a related field is essential to establish your credentials. Certifications such as Series 7, Series 63, or Chartered Financial Analyst (CFA) underline your commitment to the field and provide a competitive edge.

- Skills —Your skills section should succinctly list the competencies necessary for an investment representative. Skills like financial planning, market analysis, and client communication should be directly relevant, reinforcing your ability to fulfill job responsibilities. This section connects your practical abilities to the specific needs of potential employers.

- Achievements —Awards or recognitions highlight your dedication and excellence. Specific examples, such as being recognized for outstanding customer service or achieving investment growth goals, provide concrete proof of your impact and success. This leaves a strong, positive impression and emphasizes your qualifications above others.

Each resume section plays a critical role in constructing a comprehensive narrative of your professional journey. In the following sections, we will dive deeper into each element, providing insight into crafting a cohesive and compelling investment representative resume.

Which resume format to choose

When putting together your investment representative resume, the right format sets the stage for success. A chronological format is ideal because it clearly outlines your professional journey, making it easy for employers to see your growth and expertise in the investment industry.

Selecting the right font can subtly enhance your resume's impact. Opt for Rubik, Montserrat, or Lato. These fonts offer a sleek and contemporary appearance, conveying professionalism without distracting from your content. A modern font can help your resume feel current and relevant.

Always save and distribute your resume as a PDF to maintain its layout across different devices and platforms. This consistency in appearance demonstrates attention to detail, which is crucial in finance roles.

Margins, though often overlooked, play a key role in presentation. Keeping margins around 1 inch helps create an organized and readable document. This ensures that your achievements and skills are easy to spot, underscoring your qualifications effectively. By focusing on these elements, your resume will convey the professionalism and attention to detail that are vital in securing a role as an investment representative.

How to write a quantifiable resume experience section

An investment representative resume experience section is key because it highlights your achievements and shows how you excel in similar roles. By structuring your experience section in reverse chronological order, you can focus on your most recent and relevant positions. It's typically best to go back about 10-15 years, or include your last 3-5 jobs, to best showcase your relevant experience. Selecting job titles that directly relate to your target role makes a strong impact. Tailoring your resume to the job ad by aligning your achievements with specific skills and duties mentioned helps you stand out. Using action words like "increased," "managed," and "developed" will make your accomplishments shine. This section presents quantifiable achievements that illustrate a strong track record of success.

Here's an example of a highly effective investment representative experience entry:

- •Increased client portfolio growth by 25% annually through strategic investment recommendations.

- •Managed over 200 multi-asset portfolios, enhancing asset value by $15 million.

- •Conducted quarterly financial seminars resulting in a 40% rise in new client acquisitions.

- •Developed personalized investment plans, improving client satisfaction scores by 30%.

This experience section is compelling because it zeroes in on quantifiable achievements relevant to an investment representative's role. Using clear metrics, such as percentage increases and financial impacts, connects your success and competence directly to potential job requirements. Strong action words paired with alignment to job ad specifics create a seamless narrative of your professional journey, highlighting your fit as an investment representative.

Result-Focused resume experience section

A Result-Focused investment representative resume experience section should effectively highlight your achievements with clear, quantifiable outcomes. Start with straightforward, action-oriented language that vividly illustrates how your efforts have driven positive results for the organization. By focusing on specific outcomes and detailing how you have contributed to company objectives, you allow prospective employers to appreciate the tangible value you bring to your role.

In each bullet point, aim to weave a narrative of your skills and achievements closely tied to the job you desire. When detailing improvements such as client retention rates or portfolio growth, include specific percentages or figures. This method not only showcases your ability to exceed expectations but also gives employers a comprehensive view of your past performance and potential contributions.

Senior Investment Representative

ABC Financial Group

June 2020 - Present

- Increased client portfolio value by 25% over 12 months through strategic investment choices.

- Expanded client base by 15% annually, enhancing company revenue by optimizing customer acquisition strategies.

- Developed personalized financial plans for over 100 clients, contributing to a 30% reduction in client churn.

- Implemented a new digital tool that improved reporting accuracy by 40%, leading to more informed investment decisions.

Collaboration-Focused resume experience section

A collaboration-focused investment representative resume experience section should emphasize how teamwork leads to success. Start by stating the dates and your role in each position, providing details on how you worked alongside others to achieve shared goals. Mention specific teams or departments you interacted with, showing how your collaborative skills led to happier clients, improved team efficiency, or notable project outcomes.

Use action-driven bullet points to clearly illustrate tasks, actions, and results, ensuring your collaboration stands out. Focus on how you facilitated communication and united different ideas to create a cohesive work environment. Highlight your leadership in bridging communication gaps between team members or departments. Structure your sentences carefully to express key achievements without overloading keywords, allowing the reader to easily understand the value you brought through teamwork, showcasing your strong interpersonal abilities and significant contributions to the team's success.

Investment Representative

XYZ Financial Group

June 2019 - Present

- Worked with cross-functional teams to streamline investment processes, cutting client service times by 20%.

- Held weekly meetings with analysts and portfolio managers to share updates and plan portfolios, boosting forecast accuracy by 15%.

- Organized team training sessions for junior representatives, boosting overall team performance metrics by 10%.

- Partnered with client services to quickly resolve complex client inquiries, keeping a 95% client satisfaction rating.

Problem-Solving Focused resume experience section

A problem-solving-focused investment representative resume experience section should highlight your analytical skills and ability to tackle financial challenges. Start by selecting achievements that demonstrate how you identified issues and implemented effective solutions, ensuring these contributions align with the organization's goals and enhance client satisfaction. By using action-oriented language and quantifying results whenever possible, you can clearly show the impact of your problem-solving abilities in the financial sector, helping potential employers see the value you bring to their team.

To present this information effectively, organize your experience in a clear and structured manner using bullet points. Detail how you applied your expertise to resolve complex financial scenarios or improve investment outcomes. Consider highlighting cases where your insights led to measurable success, such as increasing portfolio returns or fulfilling client objectives despite challenges. By following this approach, you create a compelling narrative that not only makes your accomplishments stand out but also increases your chances of progressing in the hiring process.

Investment Representative

Financial Trust Advisors

January 2020 - Present

- Enhanced client investment portfolios by assessing market trends and adjusting strategies, leading to a 15% average ROI increase year-over-year.

- Identified underperforming assets and reallocated them, resulting in a 25% improvement in portfolio performance over six months.

- Collaborated with a team to develop a risk management strategy that reduced client exposure by 30%, safeguarding investments during market fluctuations.

- Implemented a personalized client reporting system that improved client satisfaction by providing clear, actionable insights on account performance.

Achievement-Focused resume experience section

A focus on achievements is essential when crafting an investment representative resume experience section. Start by listing your job titles and workplaces, ensuring the dates of employment are clear. Highlight how you've made a positive impact by demonstrating specific metrics, goals you've exceeded, or accolades you've earned. Using clear language and strong action verbs will effectively showcase your successes.

Connect your bullet entries to vividly illustrate your achievements, moving beyond just listing duties. Explain the importance of your actions and the benefits they brought, showing potential employers the value you added. Use numerical data to demonstrate results, like sales increases, percentages, or customer growth. This cohesive approach not only highlights what you did but also effectively communicates your value in previous roles.

Senior Investment Representative

ABC Financial Services

January 2018 - December 2021

- Increased client portfolios by an average of 15% yearly through strategic asset allocation.

- Expanded client base by 30% over three years by conducting market trend analysis and personalized consultations.

- Developed a new client onboarding process that reduced onboarding time by 40% and enhanced customer satisfaction.

- Recognized as 'Top Performer of the Year' in 2020 for consistently exceeding quarterly sales targets by 25%.

Write your investment representative resume summary section

A results-focused investment representative resume summary should spotlight your experience, strengths, and notable achievements. An impressive example could say:

By showcasing your success in the industry, you emphasize essential skills like strategic planning and client engagement. This sets the stage for mentioning achievements such as portfolio growth and client satisfaction, which add credibility to your profile. When crafting this summary, focus on your standout accomplishments and tie them to the job requirements.

Understanding the differences between a resume summary and other components like objectives, profiles, or a summary of qualifications is key. A resume objective states your career aspirations and suits entry-level roles or career transitions, whereas a profile is shorter and broader. A summary of qualifications lists directly relevant skills and experiences. Choose the one that best supports your career narrative. A well-crafted resume summary emphasizes your experience and skills, making a compelling case for your candidacy. It’s concise yet impactful, designed to grab the employer’s interest.

Listing your investment representative skills on your resume

A skills-focused investment representative resume should strategically highlight your abilities to attract attention. This section can be set apart or integrated with your experience or summary sections. Emphasizing your strengths, particularly soft skills like communication and teamwork, is essential. Meanwhile, hard skills are the tangible abilities you've acquired, such as financial analysis or mastering particular software.

These skills and strengths also serve as resume keywords. Recruiters and systems seek these keywords to pinpoint qualified candidates. By incorporating relevant skills and strengths, you ensure your experience aligns with the job requirements and helps you stand out.

Here’s an example of a skills section in JSON format:

This skills section is effective because it captures the essential abilities for an investment representative. By combining technical knowledge with client-focused skills, it presents a comprehensive picture of your capabilities. Its clear format enables recruiters to recognize your strengths immediately.

Best hard skills to feature on your investment representative resume

Your hard skills highlight your technical prowess and knowledge in your field. For investment representatives, these demonstrate your expertise and readiness to handle job responsibilities. They include technical capabilities and industry insights, proving how equipped you are for the role.

Hard Skills

- Financial Analysis

- Portfolio Management

- Investment Strategies

- Risk Assessment

- Client Acquisition

- Retirement Planning

- Financial Software Proficiency

- Market Research

- Regulatory Compliance

- Asset Allocation

- Options and Derivatives Trading

- Tax Planning

- Budget Forecasting

- Performance Evaluation

- Securities Analysis

Best soft skills to feature on your investment representative resume

Soft skills reveal how you engage with clients and team members. As an investment representative, these skills show you can establish trust and deliver a positive client experience. Being approachable, dependable, and an effective team player are key traits to highlight.

Soft Skills

- Communication

- Problem-Solving

- Negotiation

- Empathy

- Time Management

- Adaptability

- Teamwork

- Persuasion

- Leadership

- Attention to Detail

- Decision Making

- Customer Service

- Stress Management

- Active Listening

- Conflict Resolution

How to include your education on your resume

The education section is an important part of your resume, especially when applying for an investment representative job. Tailor this section by including only relevant education that aligns with your career goals. Avoid listing unrelated degrees that do not add value to your application. When listing your degree, clearly state the level, such as Bachelor’s or Master’s, along with your major. If you have a notable GPA, it's acceptable to include it, particularly if it's 3.5 or higher. Always denote your GPA correctly by positioning it as "GPA: 3.8/4.0". Highlight honors such as "cum laude" to demonstrate your academic achievements. Ensure clarity and relevance in your education section to catch the employer's attention.

- •Graduated cum laude

The second example stands out because it presents education relevant to an investment representative’s career. The candidate holds a Bachelor of Science in Finance, which aligns well with financial industry requirements. The inclusion of a high GPA and the honor, "cum laude," underscores the candidate's dedication and success in relevant studies. It highlights both academic performance and targeted education, enhancing the candidate’s appeal for financial roles.

How to include investment representative certificates on your resume

Including a certificates section in your investment representative resume is crucial. Start by listing the name of the certificate. Next, include the date you received the certification. Add the issuing organization to provide credibility to your credentials. This section not only showcases your expertise but also sets you apart from other candidates.

Certificates can also be included in the header, for example: "John Doe, CFA, AAMS, CRPC." This immediately signals your qualifications to the employer. Displaying your certificates prominently can strengthen your resume by highlighting your commitment to the field.

This example is effective because it lists relevant certifications like CFP, CFA, and AAMS, which are highly respected in the finance industry. Each entry includes the name of the certificate, the issuing organization, and implicitly the dates when they were awarded. These details illustrate a commitment to continuing education and adherence to industry standards. This can make your resume more attractive to employers searching for qualified investment representatives.

Extra sections to include in your investment representative resume

Launching into the investment world often requires a blend of expertise, commitment, and unique experiences. As an investment representative, presenting a well-rounded resume can make all the difference in setting you apart from the competition.

Language section — Demonstrate your fluency in multiple languages to show your ability to communicate with diverse clients. Highlight proficiency in languages such as Spanish or Mandarin, which could enhance your global reach.

Hobbies and interests section — Mentioning interests like reading financial journals or participating in investment clubs showcases your passion for the field. This can also help interviewers see you as a well-rounded individual.

Volunteer work section — Detail volunteer activities, such as providing financial literacy classes, to underscore your commitment to community service. This highlights your leadership skills and gives insight into your values.

Books section — Listing influential finance-related books you’ve read, like "The Intelligent Investor" by Benjamin Graham, shows your dedication to continued learning. It can also spark engaging conversations during an interview.

These sections can effectively show your multifaceted skills and interests, giving potential employers a deeper understanding of who you are. This approach ensures you present more than just your work history, highlighting your commitment to personal and professional growth.

In Conclusion

In conclusion, crafting an effective investment representative resume involves more than just listing your past jobs. It's about painting a vivid picture of your professional journey and showcasing your potential to prospective employers. Focus on the highlights of your career, such as measurable successes in portfolio growth and client relationships. Use a clean format and choose a modern, readable font to ensure your document stands out. Each section of your resume—from the professional summary to skill listings—should be thoughtfully curated to align with the specific role you're pursuing. Soft and hard skills, particularly those emphasizing financial analysis, client management, and teamwork, are critical to making a strong impression. Moreover, don't underestimate the power of including relevant certifications, as they not only affirm your dedication to the industry but can also set you apart from the competition. Consider including extras like language proficiency or volunteer work to give a well-rounded view of your abilities and interests. These elements collectively create a resume that not only details past achievements but also clearly signals the value you bring to future opportunities. By meticulously crafting each section, you set yourself up for success, steering your career in the investment field toward new and exciting horizons.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.