Junior Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Learn how to write a junior accountant resume that counts: essential tips to showcase your skills, education, and experience effectively to potential employers in the finance industry."

Rated by 348 people

Junior Tax Accountant

Junior Financial Accountant

Junior Audit Accountant

Junior Cost Accountant

Junior Project Accountant

Junior Forensic Accountant

Junior Public Accountant

Junior Systems Accountant

Junior Government Accountant

Junior Tax Accountant resume sample

- •Led the preparation of corporate tax returns, achieving a 98% on-time submission rate over two fiscal years.

- •Analyzed extensive financial data, resulting in a 15% increase in process efficiency by identifying key patterns.

- •Developed tax strategies that optimized client deductions, saving an average of $10,000 annually per client.

- •Collaborated with senior accountants to streamline tax compliance processes, enhancing team productivity by 20%.

- •Researched and resolved complex tax issues, reducing audit risks by 25% through comprehensive solutions.

- •Maintained meticulous tax records, ensuring regulatory compliance and reducing submission errors by 30%.

- •Assisted in preparing federal and state tax returns, contributing to accurate filing for over 200 clients.

- •Reviewed financial documents, noticing discrepancies that saved clients an average of $5,000 each annually.

- •Supported audits by organizing and presenting thorough documentation, enhancing compliance by 18%.

- •Integrated new tax regulations into existing systems, ensuring up-to-date compliance and reducing penalties by 12%.

- •Collaborated on a project that improved tax software functionality, speeding up transaction processing by 25%.

- •Engaged in the preparation and analysis of financial data for tax purposes, aiding in process accuracy enhancements.

- •Participated in a team project that succeeded in reducing tax filing time by 40% through procedural improvements.

- •Provided insights on tax regulations, contributing to a 20% improvement in client advisory outcomes.

- •Maintained updated company tax databases, increasing document retrieval efficiency by 30% over six months.

- •Assisted with financial analysis, resulting in identifying significant cost-reduction opportunities for internal projects.

- •Collaborated in a team to refine data organization processes, enhancing overall workflow speed by 15%.

- •Collected financial documents for audits, reducing retrieval time noticeably and promoting efficient compliance.

- •Contributed to a project optimizing client billing cycles, which improved payment timeliness by 20%.

Junior Financial Accountant resume sample

- •Led a team to identify cost-saving initiatives, reducing company expenses by 15% within one year.

- •Developed financial models for forecasting, increasing accuracy in revenue projections by 25%.

- •Implemented new reconciliation processes, decreasing errors by 30% resulting in a streamlined monthly close.

- •Coordinated with cross-functional teams to resolve discrepancies, improving report accuracy by 20%.

- •Automated monthly reporting, cutting down report preparation time by 40% and enhancing efficiency.

- •Provided data analysis for strategic planning, leading to a 10% growth in quarterly revenue.

- •Assisted in preparation of monthly close activities, contributing to a 10% reduction in close cycle time.

- •Streamlined budget preparation methods, resulting in a 20% increase in accuracy and efficiency.

- •Managed the execution of a new financial reporting process, enhancing transparency across departments.

- •Conducted variance analyses, helping reduce discrepancies in financial reports by up to 15%.

- •Supported external audits by organizing necessary documentation, improving responsiveness to auditing queries.

- •Collaborated with clients to streamline accounting processes, improving financial report delivery by 30%.

- •Advised client teams on compliance with GAAP standards, enhancing audit readiness significantly.

- •Designed financial solutions that increased clients' operational efficiency by 15% across various sectors.

- •Facilitated workshops for client teams, boosting their understanding of financial tools and techniques by 25%.

- •Contributed to the preparation of financial statements, aiding in the successful completion of year-end audits.

- •Reconciled financial discrepancies by collecting and analyzing account information, improving accuracy by 18%.

- •Delivered detailed reports that increased financial transparency within the organization.

- •Supported the implementation of new accounting software, enhancing data collection efficiency by 25%.

Junior Audit Accountant resume sample

- •Conducted audits for mid-sized and large clients, identifying discrepancies, and offering solutions, resulting in optimized compliance rates by over 20%.

- •Evaluated internal control structures and proposed enhancements, achieving a 15% reduction in audit errors through improved systems.

- •Managed audit evidence collection and analyzed financial data to ensure validity, enhancing the accuracy of audit reporting by 30%.

- •Collaborated with senior auditors to strategize audit plans, successfully increasing audit efficiency by streamlining processes.

- •Led audit documentation efforts, maintaining thorough records and working papers, contributing to high-quality audit outcomes.

- •Communicated effectively with stakeholders to clarify findings and recommendations, earning a consistent 95% client satisfaction rate.

- •Assisted in the preparation of financial statements for various clients, ensuring accuracy and compliance with GAAP standards.

- •Performed analytical procedures to detect unusual trends, contributing to the identification of potential areas of financial risk.

- •Prepared comprehensive audit reports providing actionable insights, resulting in a 10% enhancement of client trust in audit processes.

- •Supported internal audits by examining and assessing control processes, successfully maintaining audit consistency across teams.

- •Worked collaboratively with audit teams to resolve client file issues, enhancing audit processes by reducing resolution times by 25%.

- •Drafted precise audit documentation, including workpapers and checklists, to support senior accountants in audits.

- •Evaluated financial data and formulated clear audit findings, helping to maintain a consistent quality of audit engagements.

- •Conducted account reconciliations to support audit conclusions, reinforcing the accuracy of financial reporting.

- •Monitored updates in industry regulations to ensure compliance, helping team members to stay informed and prepared for audits.

- •Contributed to audit planning efforts, ensuring the effective allocation of team resources to critical areas of concern.

- •Assisted in the execution of audit testing procedures, contributing to the detection of discrepancies within client financial records.

- •Coordinated the collection of audit evidence and documentation, resulting in a streamlined review process.

- •Supported communication efforts with clients to provide strategic solutions and detailed audit outcomes.

Junior Cost Accountant resume sample

- •Developed cost reduction initiatives that lowered total project costs by 10% without compromising quality standards.

- •Streamlined data collection for cost reports, significantly improving reporting accuracy and reducing preparation time by 30%.

- •Collaborated effectively with project managers, resulting in precise cost tracking and expense forecasting contributions.

- •Performed comprehensive audits of financial records to ensure compliance, supporting enhanced policy adherence.

- •Led a team to improve cost accounting processes, resulting in a 25% increase in reporting efficiency.

- •Prepared detailed budget analyses, helping maintain spending within 5% of budgetary constraints.

- •Conducted variance analysis for projects resulting in budget adherence accuracy improvements by 20%.

- •Helped implement a new financial forecasting model that improved forecast accuracy by 18%.

- •Assisted in monthly close processes, improved reconciliation time by 40%, adding value to financial data integrity.

- •Supported project managers in financial assessment of new initiatives, resulting in an additional revenue stream worth $500k annually.

- •Reviewed cost data regularly and provided insights that contributed to a 12% reduction in overhead expenditures.

- •Oversaw accounts payable operations efficiently by streamlining processes, reducing payment cycle time by 15%.

- •Executed vendor payment verifications resulting in a 100% compliance rate with company policies.

- •Generated financial reports analyzed by management for strategic decision-making, contributing valuable cost-saving insights.

- •Maintained accurate records of all financial transactions enhancing systematic efficiency by 20%.

- •Prepared financial statements, providing comprehensive financial data for annual audits that improved transparency.

- •Facilitated monthly reconciliation of accounts improving accuracy of financial records by 95%.

- •Worked alongside auditors to enhance audit process efficiency, leading to a reduced audit time by 20%.

- •Supported accounting team in daily operations, contributing to the overall improvement of financial data accuracy.

Junior Project Accountant resume sample

- •Reduced project report processing time by 20% through the implementation of a streamlined project accounting process.

- •Managed project budgets totaling over $5 million, ensuring financial accuracy and compliance with company procedures.

- •Collaborated with project managers to develop financial insights that resulted in improved project performance.

- •Conducted thorough audits across all project accounts, maintaining a 95% compliance rate with internal controls.

- •Assisted in month-end closing activities, ensuring all project financials were accurate and updated.

- •Implemented a tracking system for invoicing that improved accounts receivable processing by 30%.

- •Contributed to the preparation of project budgets and financial forecasts for projects valued at over $10 million.

- •Processed invoices and managed accounts leading to a 15% reduction in outstanding payments in the first quarter.

- •Maintained detailed project documentation, ensuring all financial records were up-to-date and accurate.

- •Supported project teams by providing precise financial reports that aided strategic decision-making.

- •Automated invoice processing tasks that resulted in a 25% efficiency improvement in project billing cycles.

- •Analyzed financial data and trends that facilitated strategic recommendations leading to a 10% revenue increase.

- •Prepared financial statements and variance analysis leading to enhanced project financial oversight.

- •Ensured compliance with industry regulations and internal audit policies, maintaining a zero-infraction record.

- •Developed financial models that improved project cost forecasting accuracy by 15%.

- •Processed over 200 vendor invoices monthly, maintaining an error rate below 2% through rigorous verification methods.

- •Assisted in project revenue management, contributing to a net increase in project profitability by 5%.

- •Developed a monthly expenditure tracking system that enhanced visibility into project budget allocations.

- •Collaborated with cross-functional teams, ensuring the accurate reflection of financials in interim reports.

Junior Forensic Accountant resume sample

- •Analyzed financial statements and uncovered fraudulent activities resulting in financial restitution of $500,000 for a major client.

- •Led team of 4 analysts in examining complex financial transactions, improving accuracy by 30% through detailed reporting.

- •Collaborated with legal teams to prepare evidence for court, contributing to successful litigation outcomes in 80% of cases.

- •Managed and organized client files, ensuring 100% compliance with industry regulations and auditing standards.

- •Developed presentations for client meetings, effectively communicating investigation findings, boosting client satisfaction rates by 15%.

- •Participated in ongoing training sessions, increasing team proficiency in the latest forensic accounting tools by 25%.

- •Identified financial discrepancies in client financial records, leading to discovery of a $1.2 million embezzlement case.

- •Prepared comprehensive reports on investigative findings, enhancing client understanding of financial irregularities by 40%.

- •Collaborated with senior accountants on 10 high-profile cases, contributing to a 20% increase in investigation efficiency.

- •Utilized advanced accounting software to streamline data analysis, reducing processing time by over 15 hours per case.

- •Maintained meticulous records of all investigations, supporting compliance and documentation efforts with 96% accuracy.

- •Assisted in financial audits, uncovering $750,000 in previously unreported expenses through detailed transaction analysis.

- •Coordinated with cross-functional teams to ensure financial data alignment, improving process efficiency by 15%.

- •Developed financial models for risk assessment, enhancing predictive accuracy by 20% for future fraud detection.

- •Engaged with clients to understand needs and concerns, resulting in improved customer feedback scores by 10%.

- •Reviewed accounting documents and identified irregularities leading to a 5% reduction in financial errors.

- •Provided support in financial reconciliations and audits, ensuring 100% accuracy in all reported figures.

- •Assisted in the preparation of financial statements, improving monthly close process efficiency by 20%.

- •Organized and maintained electronic financial records, supporting seamless departmental operations.

Junior Public Accountant resume sample

- •Led a team in preparing financial statements for clients, resulting in 15% reduction in error rates.

- •Enhanced audit efficiency by 20% through improved workflow processes and careful planning of engagements.

- •Successfully filed over 250 tax returns annually with 100% compliance, improving client retention.

- •Executed detailed account reconciliations, contributing to timely month-end closings for 15 clients monthly.

- •Collaborated effectively with senior accountants to address complex client issues, enhancing service satisfaction.

- •Maintained exceptional accuracy in financial record-keeping, contributing to a recognized audit success rate.

- •Participated in over 10 audit engagements resulting in multiple client referrals and increased business.

- •Developed efficient strategies for account analysis, improving accuracy of audits by 30%.

- •Assisted in tax preparation, ensuring 100% regulatory compliance across diverse client portfolios.

- •Provided continuous support and learning opportunities for junior team members, fostering a strong team dynamic.

- •Contributed to financial statement preparations and reconciliations to support month-end closures.

- •Analyzed financial data and trends to support strategic decision-making, raising operational efficiency by 10%.

- •Assisted in the development of financial models that identified cost-saving opportunities worth $200,000 annually.

- •Conducted comprehensive account reconciliations, enhancing daily financial operations.

- •Collaborated with cross-functional teams to deliver projects, significantly improving team productivity.

- •Prepared accurate financial reports and documents for internal and external audits, boosting audit efficiency.

- •Streamlined account reconciliation processes, resulting in a 25% faster monthly accounting cycle.

- •Participated in tax filing procedures ensuring compliance and timely submissions for 50+ clients.

- •Implemented best practices for record maintenance, improving data retrieval times by 40%.

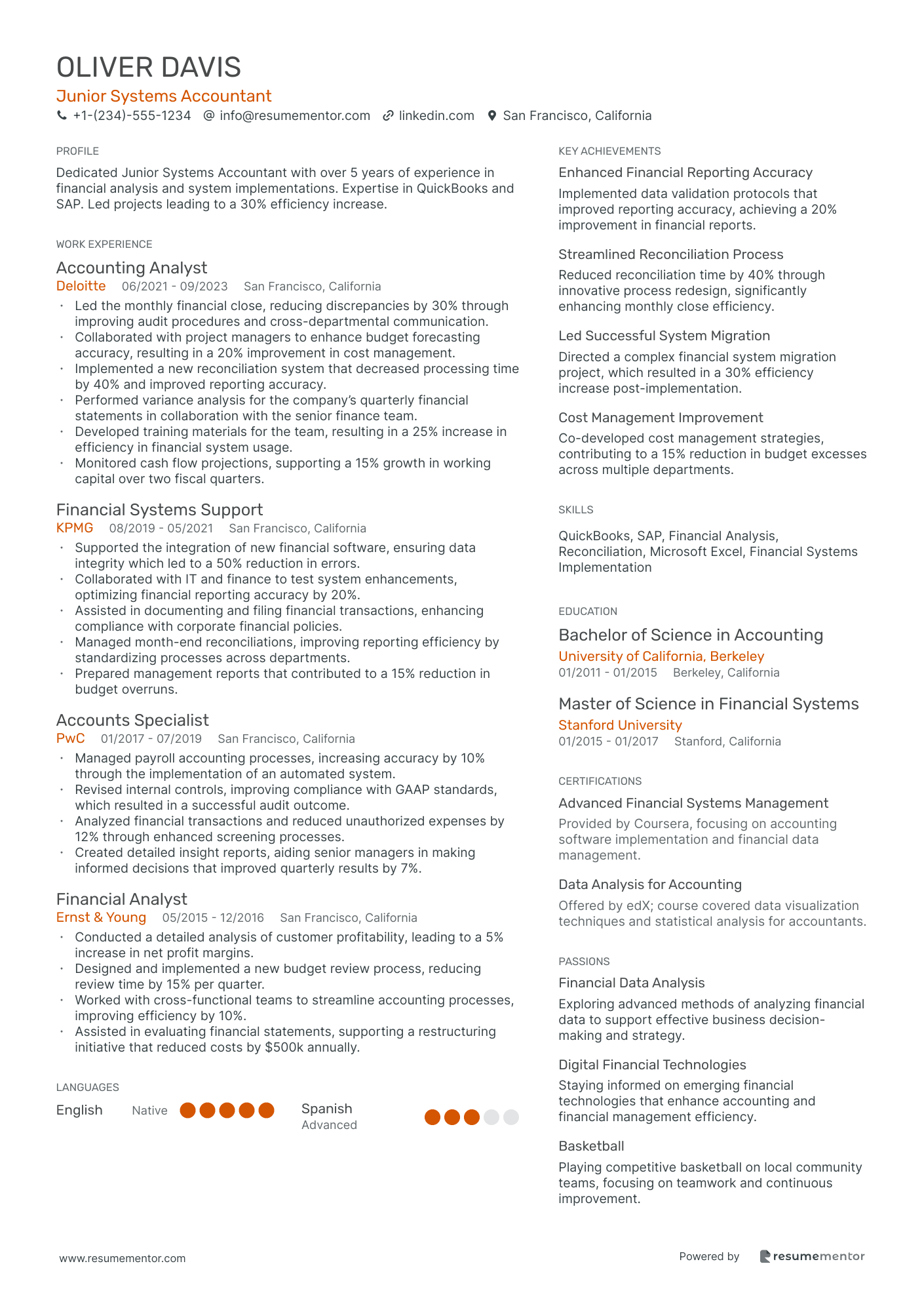

Junior Systems Accountant resume sample

- •Led the monthly financial close, reducing discrepancies by 30% through improving audit procedures and cross-departmental communication.

- •Collaborated with project managers to enhance budget forecasting accuracy, resulting in a 20% improvement in cost management.

- •Implemented a new reconciliation system that decreased processing time by 40% and improved reporting accuracy.

- •Performed variance analysis for the company’s quarterly financial statements in collaboration with the senior finance team.

- •Developed training materials for the team, resulting in a 25% increase in efficiency in financial system usage.

- •Monitored cash flow projections, supporting a 15% growth in working capital over two fiscal quarters.

- •Supported the integration of new financial software, ensuring data integrity which led to a 50% reduction in errors.

- •Collaborated with IT and finance to test system enhancements, optimizing financial reporting accuracy by 20%.

- •Assisted in documenting and filing financial transactions, enhancing compliance with corporate financial policies.

- •Managed month-end reconciliations, improving reporting efficiency by standardizing processes across departments.

- •Prepared management reports that contributed to a 15% reduction in budget overruns.

- •Managed payroll accounting processes, increasing accuracy by 10% through the implementation of an automated system.

- •Revised internal controls, improving compliance with GAAP standards, which resulted in a successful audit outcome.

- •Analyzed financial transactions and reduced unauthorized expenses by 12% through enhanced screening processes.

- •Created detailed insight reports, aiding senior managers in making informed decisions that improved quarterly results by 7%.

- •Conducted a detailed analysis of customer profitability, leading to a 5% increase in net profit margins.

- •Designed and implemented a new budget review process, reducing review time by 15% per quarter.

- •Worked with cross-functional teams to streamline accounting processes, improving efficiency by 10%.

- •Assisted in evaluating financial statements, supporting a restructuring initiative that reduced costs by $500k annually.

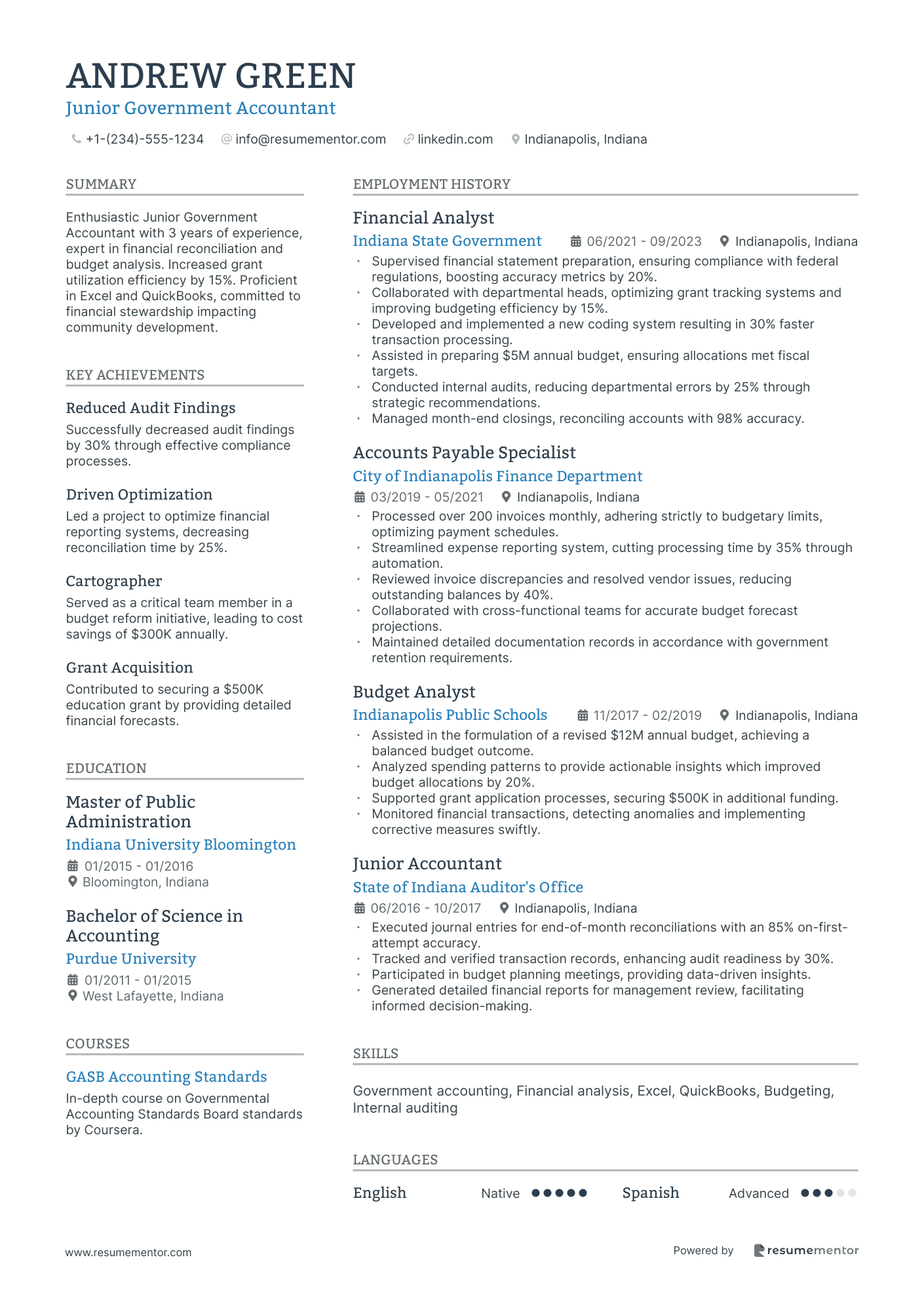

Junior Government Accountant resume sample

- •Supervised financial statement preparation, ensuring compliance with federal regulations, boosting accuracy metrics by 20%.

- •Collaborated with departmental heads, optimizing grant tracking systems and improving budgeting efficiency by 15%.

- •Developed and implemented a new coding system resulting in 30% faster transaction processing.

- •Assisted in preparing $5M annual budget, ensuring allocations met fiscal targets.

- •Conducted internal audits, reducing departmental errors by 25% through strategic recommendations.

- •Managed month-end closings, reconciling accounts with 98% accuracy.

- •Processed over 200 invoices monthly, adhering strictly to budgetary limits, optimizing payment schedules.

- •Streamlined expense reporting system, cutting processing time by 35% through automation.

- •Reviewed invoice discrepancies and resolved vendor issues, reducing outstanding balances by 40%.

- •Collaborated with cross-functional teams for accurate budget forecast projections.

- •Maintained detailed documentation records in accordance with government retention requirements.

- •Assisted in the formulation of a revised $12M annual budget, achieving a balanced budget outcome.

- •Analyzed spending patterns to provide actionable insights which improved budget allocations by 20%.

- •Supported grant application processes, securing $500K in additional funding.

- •Monitored financial transactions, detecting anomalies and implementing corrective measures swiftly.

- •Executed journal entries for end-of-month reconciliations with an 85% on-first-attempt accuracy.

- •Tracked and verified transaction records, enhancing audit readiness by 30%.

- •Participated in budget planning meetings, providing data-driven insights.

- •Generated detailed financial reports for management review, facilitating informed decision-making.

Creating a standout resume can feel overwhelming when you’re new to the role of a junior accountant. As you start your journey, you're like a ship setting sail into the bustling sea of the finance world. To navigate this competitive market successfully, it's crucial to present your grasp of accounting principles and numerical skills in a way that makes you shine.

A carefully crafted resume acts as your bridge to the opportunities you're targeting. Your expertise in financial statements, ability to manage accounts, and proficiency with accounting software are key areas to highlight. Employers are on the lookout for candidates who are not just skilled but also eager to contribute and develop further.

This is where a resume template becomes invaluable. A well-organized layout highlights your accounting abilities and achievements, making them instantly visible to potential employers. Using a template helps you weave your educational accomplishments and internships into a compelling narrative, laying a strong foundation for your career.

Think of your resume as more than just a document; it’s your first handshake in the professional world. Construct it thoughtfully so it conveys your potential and aspirations clearly. Dive in, and you’ll be on your way to crafting a resume that not only earns you an interview but also launches your career in the right direction.

Key Takeaways

- Highlight your proficiency with accounting principles and numerical skills, showcasing your ability to manage financial statements and use accounting software.

- Employ a well-organized resume template to visually emphasize your abilities, education, and internships, providing a solid narrative for potential employers.

- Choose a reverse-chronological format to place recent experiences at the forefront, ensuring your most relevant skills and internships shine.

- Craft a quantifiable experience section with action verbs like "analyzed" and "streamlined" to demonstrate the impact of your skills effectively.

- Include certifications to endorse your professional commitment, emphasizing higher proficiency levels and dedication within the field.

What to focus on when writing your junior accountant resume

A junior accountant resume must effectively communicate your qualifications and enthusiasm for the role by focusing on key elements that recruiters care about—this includes demonstrating your ability to handle financial data, support accounting functions, and grow within the field.

How to structure your junior accountant resume

- Contact Information — It's crucial to begin with up-to-date contact details, including your full name, phone number, and professional email address. Including a LinkedIn profile offers a fuller picture of your professional network, highlighting connections relevant to accounting. This sets a clear starting point for communication, reinforcing your professional presence right from the top of your resume.

- Objective Statement — A well-crafted objective statement can grab attention immediately. This is your chance to communicate your career aspirations and specific interest in the field of accounting. Making your enthusiasm for finance clear shows recruiters that you're not just looking for a job, but a long-term career path. It’s the first personal glimpse employers get, setting the stage for your commitment to the profession.

- Education — Detailing your educational background provides essential context about your foundational knowledge. Listing degrees and coursework in accounting or related fields, along with honors received, demonstrates your dedication and ability to succeed academically. This section creates a bridge leading directly to your practical experiences, showcasing a well-rounded competence.

- Experience — Your work experience is where theory meets practice. Including roles that involve data entry, bookkeeping, or preparing financial reports shows you can apply your academic knowledge effectively. Demonstrating how you've handled key accounting tasks in real-world settings builds trust in your capabilities and potential to thrive in a junior accountant role.

- Skills — Highlighting your technical skills specific to accounting software like Microsoft Excel or QuickBooks can underscore your practical abilities. These skills are critical for day-to-day accounting responsibilities, further emphasizing your readiness to contribute to financial analysis and management. This leads naturally to highlighting formal recognition of your skills.

- Certifications — Any certifications, like a CPA or progress toward CPA eligibility, provide a substantial endorsement of your professional commitment and skills. They indicate a higher level of proficiency and dedication, setting you apart from other candidates who may not have the same credentials.

Now that we’ve set the foundation with an overview, the next logical step is to dive deeper into each section of the resume format, looking closely at what makes each component effective and engaging.

Which resume format to choose

Crafting a resume for a junior accountant means focusing on both format and style to create a strong impression. Start with a reverse-chronological layout; this format puts your most recent experiences front and center, allowing you to highlight relevant skills and internships that showcase your readiness for an accounting role. Choosing the right font is important to maintain a professional vibe—fonts like Raleway, Lato, or Montserrat provide a modern look while ensuring your text is easy to read, which can be essential when dealing with detailed financial data. Always save your resume as a PDF to preserve your formatting and design, making sure it looks polished and professional on any screen or when printed. Set your margins to about one inch all around, giving your document a clean, organized appearance that makes it easy for potential employers to focus on your key qualifications and accounting competencies. Combining these elements effectively will help your resume stand out and clearly communicate your skills and potential as a junior accountant.

How to write a quantifiable resume experience section

A great experience section on a junior accountant resume highlights your skills and achievements by focusing on quantifiable accomplishments that demonstrate your impact. Start with the most recent position and go back 5-10 years, ensuring each job title reflects your career progression. Tailor your resume to each job ad by incorporating keywords from the listing, and use action words like "managed," "analyzed," and "improved" to effectively communicate your strengths.

- •Reduced data entry errors by 15% through diligent spreadsheet auditing.

- •Assisted in preparing financial reports that contributed to a 10% increase in client satisfaction.

- •Managed accounts payable/receivable and improved invoice processing time by 20%.

- •Streamlined monthly reconciliations, reducing closing time by 25%.

The experience section above connects your skills to tangible outcomes, making it compelling. The use of active language with words like "reduced," "assisted," "managed," and "streamlined" ties your actions to clear results, illustrating your effectiveness. Each bullet point not only shows improvements in efficiency and accuracy but also highlights how you positively impacted client satisfaction. This integrated approach demonstrates your proactive role in enhancing processes, providing a narrative that aligns perfectly with what potential employers look for in a junior accountant.

Responsibility-Focused resume experience section

A responsibility-focused junior accountant resume experience section should clearly showcase the duties you've handled that align with the job you're pursuing. Start by highlighting key tasks from your previous roles, such as financial reporting and account reconciliation, to demonstrate your relevant experience. Use strong action verbs to describe each responsibility, and quantify achievements when possible to make your contributions stand out. Arrange these responsibilities to create a cohesive narrative of growth and reliability in your professional journey.

Your experience section should effectively highlight your ability to manage essential accounting tasks. Begin with major responsibilities and follow with everyday duties to illustrate your comprehensive skill set and dedication. This layout helps potential employers see the full range of your capabilities. Present this information using a JSON format, detailing your job title, workplace, and bullet points for your key roles. Keep the structure clear and engaging to emphasize your meticulous and professional approach.

Junior Accountant

XYZ Financial Services

June 2021 - Present

- Managed daily financial transactions and maintained accurate financial records for the company.

- Assisted in preparing monthly financial statements and reports for management review.

- Facilitated regular audits by providing necessary documents and clarifications.

- Reconciled accounts to rectify discrepancies and updated financial spreadsheets consistently.

Project-Focused resume experience section

A project-focused junior accountant resume experience section should effectively showcase your abilities by highlighting relevant projects where you've demonstrated your skills. Focus especially on projects where your contributions to financial analysis, data management, or process improvements made a significant impact. Use concise bullet points for clarity, detailing your role and the outcomes, while emphasizing innovative strategies or cost savings. Including measurable results whenever possible helps convey your accomplishments. Align your language with the skills and experiences the job description emphasizes to make a strong connection.

In crafting each bullet point, concentrate on specific achievements or responsibilities, employing action verbs to maintain clarity. This structured format enables potential employers to quickly grasp the impact you've made. Make sure to choose projects that are both recent and pertinent to the role you're pursuing, organizing them in reverse chronological order for ease of understanding.

Junior Accountant

ABC Corporation

June 2021 - Present

- Analyzed quarterly financial statements to identify trends, helping reduce overhead costs by 10%.

- Developed an Excel model to streamline budgeting, improving accuracy and saving 5 hours monthly.

- Worked with team members to audit internal controls, enhancing compliance with reporting standards.

- Shared findings with senior management, leading to new cost-management strategies being adopted.

Innovation-Focused resume experience section

An innovation-focused junior accountant resume experience section should showcase how you have driven new ideas and improvements in your previous roles. Begin by identifying instances where your contributions resulted in better processes or creative solutions. For each experience, highlight your specific role in these innovations and the positive outcomes they generated. Use active language to clearly convey your involvement and the impact you made.

When laying out your bullet points, ensure they're clear and to the point. This section is where you can demonstrate how your past efforts might benefit a future employer. Highlight specific actions you took, the tools or methods you used, and the successful outcomes you achieved. Tying all your experiences back to an innovation-centered theme will create a coherent and engaging narrative for anyone reading it.

Junior Accountant

TechFin Solutions

June 2022 - Present

- Reduced reporting time by 20% by developing automated financial statement templates.

- Collaborated with IT to integrate AI tools into budget forecasting, improving accuracy by 15%.

- Streamlined monthly reconciliation process, cutting down time by 10 hours per month.

- Led a team to redesign the expense tracking system, increasing user satisfaction score by 25%.

Industry-Specific Focus resume experience section

A junior accountant-focused resume experience section should emphasize your industry-specific skills and highlight your key achievements. Start by describing your role, focusing on responsibilities and accomplishments to show how you've effectively applied your skills in real-world scenarios. Using straightforward language, include specific accounting tasks like financial reporting, bookkeeping, or audits to demonstrate your expertise. By concentrating on the essential requirements of the job you're targeting, you effectively illustrate why you're a great fit for the role.

In your bullet points, emphasize the impact you've made in previous roles by using action verbs and detailed examples. This approach highlights your ability to manage financial data, assist with budgeting, and ensure transaction accuracy. Consider how you've improved processes or contributed to your team's success, making sure to connect these points clearly to your role's requirements. Aligning your past experiences with the needs of the position makes your resume more compelling to hiring managers.

Junior Accountant

ABC Financial Services

June 2021 - Present

- Prepared monthly financial statements and variance analysis for multiple clients, improving report delivery time by 20%.

- Managed accounts payable and receivable, maintaining an error rate below 1% through diligent record-keeping.

- Assisted in annual audits by organizing and verifying financial data, leading to a successful audit completion.

- Collaborated with the finance team to streamline the budgeting process, reducing time spent by 30%.

Write your junior accountant resume summary section

A junior accountant-focused resume should start with a strong summary that captures your core strengths and potential. This section provides employers with a quick look at your key attributes, such as attention to detail, analytical capabilities, and eagerness to learn. Here's an example of how to write it:

This summary effectively ties together your educational background and practical skills, which are crucial for entry-level accountants. By showcasing familiarity with tools like QuickBooks and Excel, you emphasize your readiness to dive into financial tasks. Highlighting your strengths, such as being a quick learner and a team player, paints a picture of someone eager and capable of adding value to a team. Linking these elements together with enthusiastic language demonstrates your preparedness to make a meaningful contribution. Understanding the difference between resume sections complements this focus; while a summary offers a spotlight on your skills and experiences, a resume objective gives insight into your career aspirations. A resume profile blends skills with goals for a general overview. Meanwhile, a summary of qualifications lists capabilities and experiences in concise bullet points. Choose the section that best echoes your current career stage, ensuring it aligns with your growth and ambitions.

Listing your junior accountant skills on your resume

A skills-focused junior accountant resume section should effectively highlight your technical abilities and personal attributes. You can choose to present your skills as a standalone section or seamlessly integrate them into your summary or experience areas, depending on what best showcases your abilities. Strengths and soft skills like communication and problem-solving play a vital role in demonstrating how well you interact with others. On the other hand, hard skills are technical abilities acquired through education and practical experience, such as proficiency with accounting software or an understanding of tax regulations. Including both types of skills in your resume not only highlights your qualifications but also serves as essential keywords, ensuring your application captures the attention of hiring managers.

Example of a standalone skills section in JSON format:

This skills section stands out because it delivers a concise list of significant accounting abilities, directly relevant to the role without added fluff. Including competencies like financial reporting and expertise in accounting software aligns with what employers seek and helps your resume get past Applicant Tracking Systems (ATS) while catching a recruiter's eye.

Best hard skills to feature on your junior accountant resume

As a junior accountant, showcasing hard skills is critical to displaying your competence in fundamental accounting tasks. These abilities highlight your technical expertise and precision.

Hard Skills

- Financial Reporting

- Account Reconciliation

- General Ledger Accounting

- Budgeting and Forecasting

- Accounts Payable Management

- Accounts Receivable Management

- Bank Reconciliations

- Tax Preparation

- Audit Documentation

- Proficiency in Microsoft Excel

- Familiarity with QuickBooks

- Knowledge of ERP Systems

- Data Entry Accuracy

- Financial Analysis

- Understanding of GAAP

Best soft skills to feature on your junior accountant resume

Equally important are the soft skills that help junior accountants excel in teamwork and communication. These skills reflect your adaptability, problem-solving capabilities, and ability to form strong professional relationships.

Soft Skills

- Attention to Detail

- Time Management

- Communication Skills

- Problem-Solving

- Adaptability

- Analytical Thinking

- Team Collaboration

- Organization

- Ethical Judgment

- Initiative

- Interpersonal Skills

- Dependability

- Stress Management

- Prioritization

- Open-mindedness

How to include your education on your resume

An education section is a crucial part of a junior accountant resume. It showcases your academic background and can set you apart from other candidates. This section should be tailored to the job you're applying for. Include only relevant education to make a great impression. If your GPA is strong, include it; otherwise, leave it out. Recognitions like cum laude should also be highlighted to demonstrate your academic excellence. Clearly list each degree, including the institution, location, and date range of attendance. Here's how to effectively present your education:

-

1.

-

2.

The second example is excellent because it lists a degree in Accounting, which is directly related to the junior accountant position. Highlighting the cum laude honor reflects commitment and discipline, while including a high GPA can leave a positive impression. Omitting an unrelated degree ensures the section remains focused and relevant, which is appealing to potential employers.

How to include junior accountant certificates on your resume

Adding a certificates section to your junior accountant resume is crucial. Certificates show your dedication to learning and your expertise in key areas.

List the name of the certificate first. Include the date you earned it. Add the issuing organization to give context and credibility. You can also feature this section in your resume header to catch the reader’s eye quickly. For example, "Certified Public Accountant (CPA), American Institute of CPAs".

Certificates are evidence of your skills and knowledge. They can set you apart from other job candidates. Here is an example of a well-crafted certificates section that fits seamlessly into a junior accountant's resume:

This example works well because it lists relevant certifications that show your capability and commitment to the field. The CPA certification is highly valued and widely recognized. An Excel course demonstrates your practical skills. This combination offers a well-rounded view of your qualifications.

Extra sections to include in your junior accountant resume

Creating a compelling resume is vital for standing out as a junior accountant. While education and work experience are paramount, including other sections like languages, hobbies and interests, volunteer work, and books can boost your profile. Tailoring these sections can showcase your well-rounded personality and diverse skill set, helping you make a stronger impression on potential employers. Here's how to effectively incorporate these sections into your resume:

Language section — Highlight proficiency in languages as it shows communication abilities and can be an asset in diverse workplaces. List languages with fluency levels to give a clear idea of your skills.

Hobbies and interests section — Display personal interests to illustrate traits like teamwork, creativity, and dedication which can be relevant to job performance. Choose hobbies that align with the skills required for accounting.

Volunteer work section — Mention volunteer activities to demonstrate initiative, commitment to community, and leadership abilities. Detail specific roles and achievements to underline your experiences.

Books section — Include books that you've read related to accounting or personal development to show a commitment to learning and self-improvement. Mention specific books to provide context and depth.

These additional sections provide a fuller picture of who you are beyond your professional qualifications. They can make you more relatable and memorable to hiring managers. Incorporate these thoughtfully to create a resume that truly stands out.

In Conclusion

In conclusion, crafting an effective junior accountant resume requires a thoughtful blend of your educational background, practical experience, and personal attributes. As you step into the accounting world, remember that your resume is more than just a record of past experiences. It serves as a personalized introduction to potential employers, illustrating your readiness to jump into the financial sector. Highlighting your technical skills and accomplishments in previous roles shows your ability to apply your knowledge to real-world scenarios. Equally important are your soft skills, which demonstrate how you work with others and handle challenges. Using a well-organized template can make these qualities stand out and present a polished image. Your choice of resume format and focus on quantifiable achievements will help convey your effectiveness. Including relevant certificates and extra sections like hobbies or volunteer work can further enrich your profile, making you more memorable. Ultimately, your resume should be a reflection of your unique journey, showcasing both where you've been and where you're eager to go. With the right approach, you're set to make a lasting impact, securing your place in the accounting field.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.