Lease Accountant Resume Examples

Jul 18, 2024

|

12 min read

Nail your next job: A guide to crafting the perfect lease accountant resume that leases you in the best light. Learn how to highlight your skills and experience to stand out in today's competitive job market.

Rated by 348 people

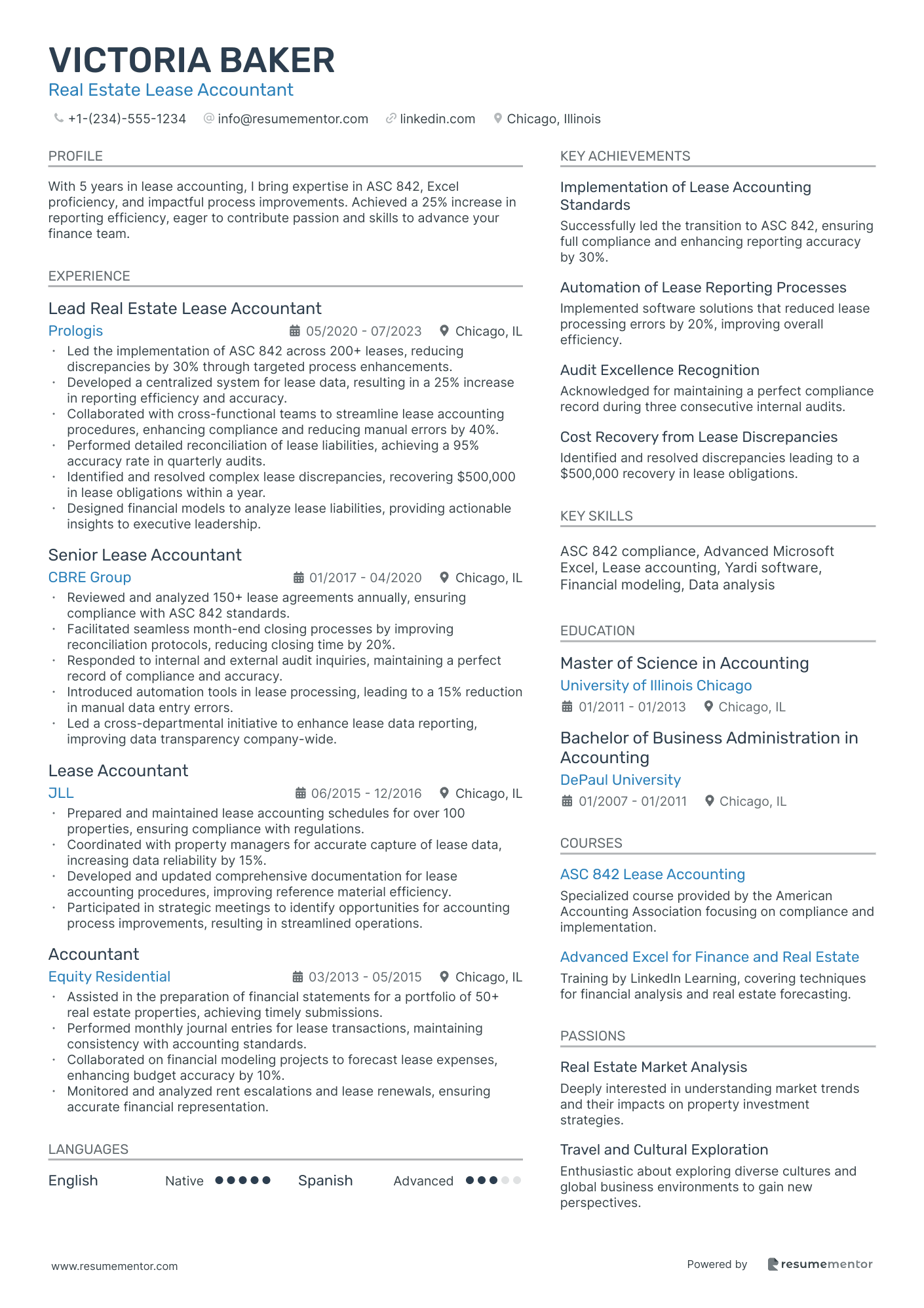

Real Estate Lease Accountant

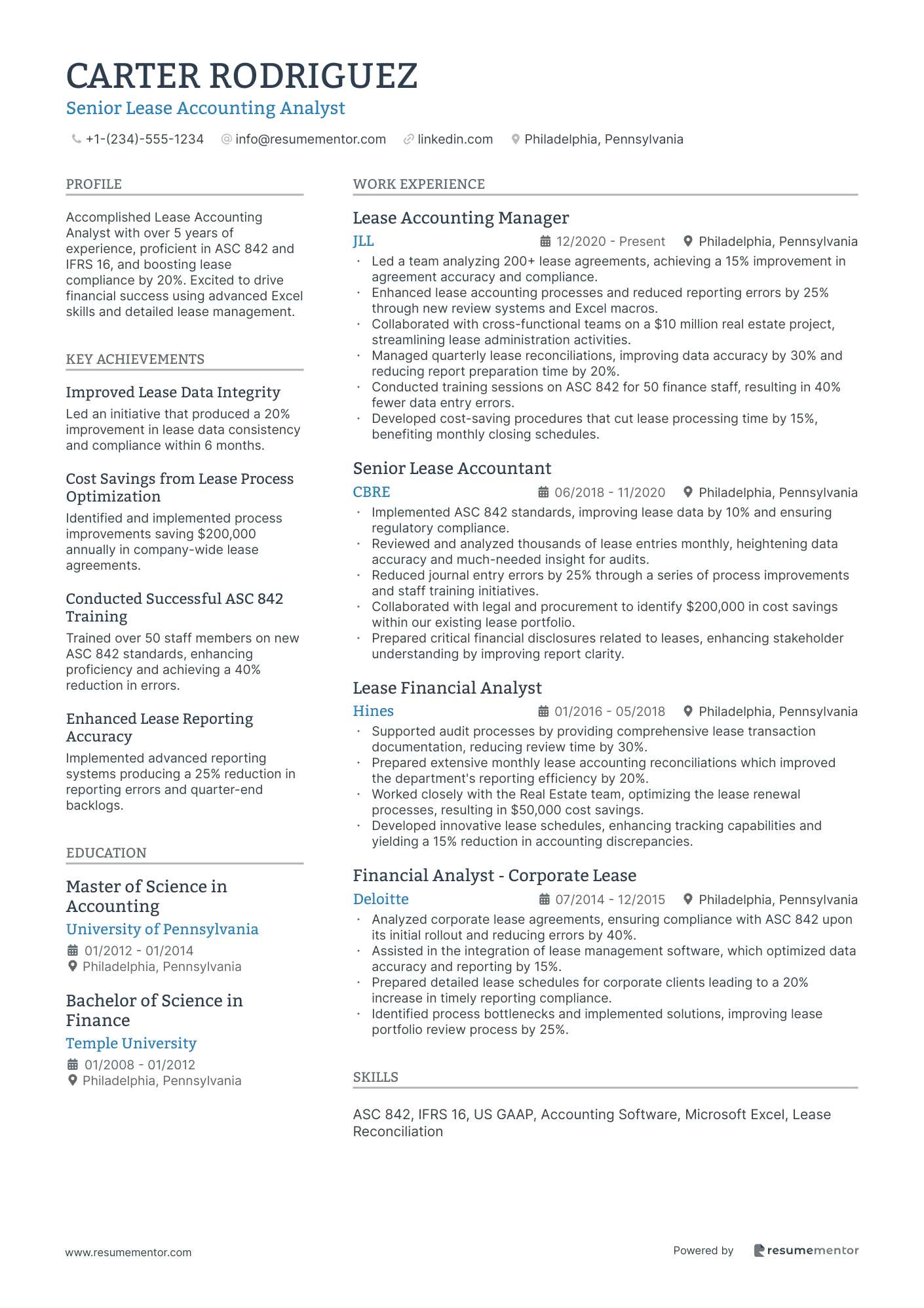

Senior Lease Accounting Analyst

Equipment Lease Accountant

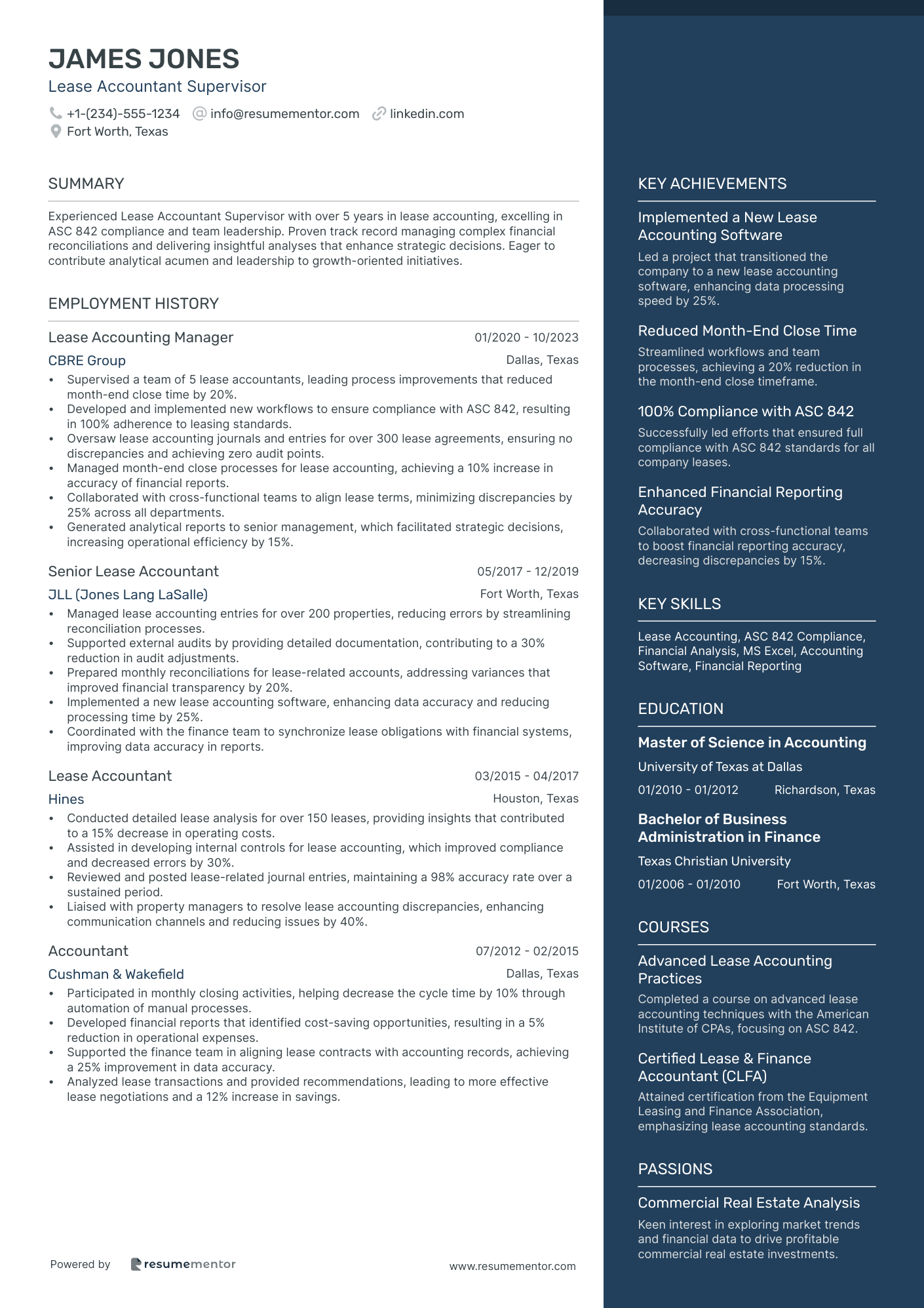

Lease Accountant Supervisor

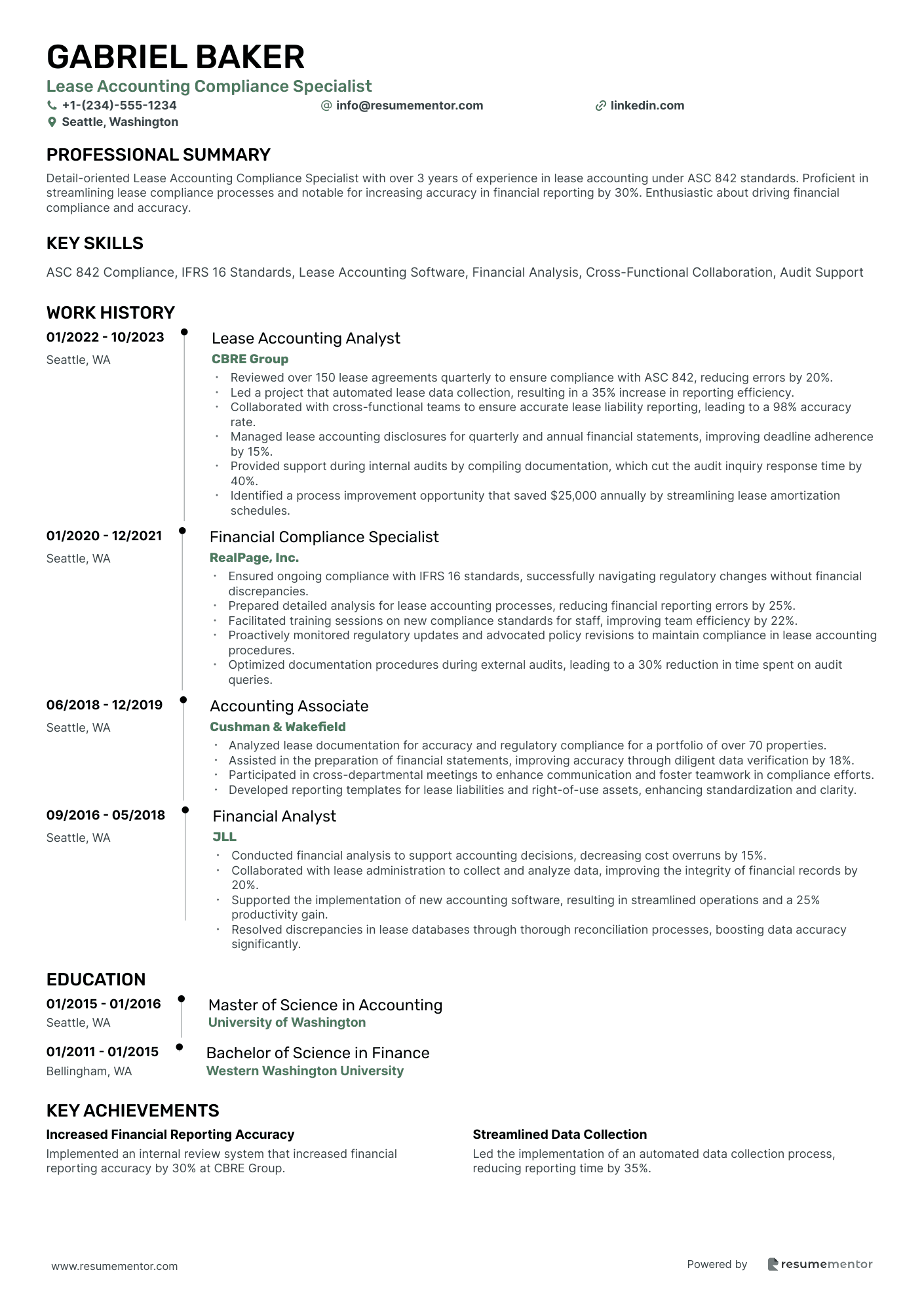

Lease Accounting Compliance Specialist

Commercial Property Lease Accountant

Lease Accountant for Retail Operations

Lease Account Reconciliation Specialist

Accountant for Leasehold Management

Lease Audit Accountant

Real Estate Lease Accountant resume sample

- •Led the implementation of ASC 842 across 200+ leases, reducing discrepancies by 30% through targeted process enhancements.

- •Developed a centralized system for lease data, resulting in a 25% increase in reporting efficiency and accuracy.

- •Collaborated with cross-functional teams to streamline lease accounting procedures, enhancing compliance and reducing manual errors by 40%.

- •Performed detailed reconciliation of lease liabilities, achieving a 95% accuracy rate in quarterly audits.

- •Identified and resolved complex lease discrepancies, recovering $500,000 in lease obligations within a year.

- •Designed financial models to analyze lease liabilities, providing actionable insights to executive leadership.

- •Reviewed and analyzed 150+ lease agreements annually, ensuring compliance with ASC 842 standards.

- •Facilitated seamless month-end closing processes by improving reconciliation protocols, reducing closing time by 20%.

- •Responded to internal and external audit inquiries, maintaining a perfect record of compliance and accuracy.

- •Introduced automation tools in lease processing, leading to a 15% reduction in manual data entry errors.

- •Led a cross-departmental initiative to enhance lease data reporting, improving data transparency company-wide.

- •Prepared and maintained lease accounting schedules for over 100 properties, ensuring compliance with regulations.

- •Coordinated with property managers for accurate capture of lease data, increasing data reliability by 15%.

- •Developed and updated comprehensive documentation for lease accounting procedures, improving reference material efficiency.

- •Participated in strategic meetings to identify opportunities for accounting process improvements, resulting in streamlined operations.

- •Assisted in the preparation of financial statements for a portfolio of 50+ real estate properties, achieving timely submissions.

- •Performed monthly journal entries for lease transactions, maintaining consistency with accounting standards.

- •Collaborated on financial modeling projects to forecast lease expenses, enhancing budget accuracy by 10%.

- •Monitored and analyzed rent escalations and lease renewals, ensuring accurate financial representation.

Senior Lease Accounting Analyst resume sample

- •Led a team analyzing 200+ lease agreements, achieving a 15% improvement in agreement accuracy and compliance.

- •Enhanced lease accounting processes and reduced reporting errors by 25% through new review systems and Excel macros.

- •Collaborated with cross-functional teams on a $10 million real estate project, streamlining lease administration activities.

- •Managed quarterly lease reconciliations, improving data accuracy by 30% and reducing report preparation time by 20%.

- •Conducted training sessions on ASC 842 for 50 finance staff, resulting in 40% fewer data entry errors.

- •Developed cost-saving procedures that cut lease processing time by 15%, benefiting monthly closing schedules.

- •Implemented ASC 842 standards, improving lease data by 10% and ensuring regulatory compliance.

- •Reviewed and analyzed thousands of lease entries monthly, heightening data accuracy and much-needed insight for audits.

- •Reduced journal entry errors by 25% through a series of process improvements and staff training initiatives.

- •Collaborated with legal and procurement to identify $200,000 in cost savings within our existing lease portfolio.

- •Prepared critical financial disclosures related to leases, enhancing stakeholder understanding by improving report clarity.

- •Supported audit processes by providing comprehensive lease transaction documentation, reducing review time by 30%.

- •Prepared extensive monthly lease accounting reconciliations which improved the department's reporting efficiency by 20%.

- •Worked closely with the Real Estate team, optimizing the lease renewal processes, resulting in $50,000 cost savings.

- •Developed innovative lease schedules, enhancing tracking capabilities and yielding a 15% reduction in accounting discrepancies.

- •Analyzed corporate lease agreements, ensuring compliance with ASC 842 upon its initial rollout and reducing errors by 40%.

- •Assisted in the integration of lease management software, which optimized data accuracy and reporting by 15%.

- •Prepared detailed lease schedules for corporate clients leading to a 20% increase in timely reporting compliance.

- •Identified process bottlenecks and implemented solutions, improving lease portfolio review process by 25%.

Equipment Lease Accountant resume sample

- •Managed over $50 million in equipment lease portfolios, consistently achieving 98% accuracy in all financial reports.

- •Developed a new lease valuation methodology leading to a 15% reduction in valuation time for the finance team.

- •Led a cross-functional team to improve lease classification processes, reducing errors by 22% and enhancing compliance.

- •Collaborated with procurement to streamline documentation processes, resulting in a 30% faster lease approval cycle.

- •Trained junior accountants on ASC 842 standards, improving their compliance accuracy scores by 40%.

- •Implemented a new auditing procedure that reduced discrepancies in lease records by 15%.

- •Maintained lease schedules exceeding $20 million annually, achieving compliance with ASC 842 standards.

- •Prepared detailed monthly financial reports that contributed to a 10% increase in departmental audit efficiency.

- •Analyzed lease agreements that strengthened financial accuracy, minimizing errors in financial statements by 12%.

- •Collaborated with the finance team to optimize lease payment workflows, improving cash flow efficiency by 18%.

- •Supported external audit processes with comprehensive document provision, resulting in quicker audit cycles by 20%.

- •Processed monthly journal entries, ensuring a 95% accuracy rate in record-keeping for leased assets and liabilities.

- •Conducted detailed audits of lease records contributing to a 30% reduction in inconsistencies identified by upper management.

- •Contributed to the implementation of new accounting software, reducing month-end closing process time by 20%.

- •Assisted in monthly reconciliations of lease accounts, maintaining a consistent reduction in discrepancies.

- •Oversaw the accounting of small-equipment leases totaling $10 million, ensuring compliance with relevant standards.

- •Optimized equipment lease schedules, increasing transparency and accessibility for the audit and compliance teams.

- •Collaborated with internal stakeholders to streamline lease review processes, resulting in a 25% time efficiency gain.

- •Provided support during external audits by preparing and verifying all pertinent leasing documentation.

Lease Accountant Supervisor resume sample

- •Supervised a team of 5 lease accountants, leading process improvements that reduced month-end close time by 20%.

- •Developed and implemented new workflows to ensure compliance with ASC 842, resulting in 100% adherence to leasing standards.

- •Oversaw lease accounting journals and entries for over 300 lease agreements, ensuring no discrepancies and achieving zero audit points.

- •Managed month-end close processes for lease accounting, achieving a 10% increase in accuracy of financial reports.

- •Collaborated with cross-functional teams to align lease terms, minimizing discrepancies by 25% across all departments.

- •Generated analytical reports to senior management, which facilitated strategic decisions, increasing operational efficiency by 15%.

- •Managed lease accounting entries for over 200 properties, reducing errors by streamlining reconciliation processes.

- •Supported external audits by providing detailed documentation, contributing to a 30% reduction in audit adjustments.

- •Prepared monthly reconciliations for lease-related accounts, addressing variances that improved financial transparency by 20%.

- •Implemented a new lease accounting software, enhancing data accuracy and reducing processing time by 25%.

- •Coordinated with the finance team to synchronize lease obligations with financial systems, improving data accuracy in reports.

- •Conducted detailed lease analysis for over 150 leases, providing insights that contributed to a 15% decrease in operating costs.

- •Assisted in developing internal controls for lease accounting, which improved compliance and decreased errors by 30%.

- •Reviewed and posted lease-related journal entries, maintaining a 98% accuracy rate over a sustained period.

- •Liaised with property managers to resolve lease accounting discrepancies, enhancing communication channels and reducing issues by 40%.

- •Participated in monthly closing activities, helping decrease the cycle time by 10% through automation of manual processes.

- •Developed financial reports that identified cost-saving opportunities, resulting in a 5% reduction in operational expenses.

- •Supported the finance team in aligning lease contracts with accounting records, achieving a 25% improvement in data accuracy.

- •Analyzed lease transactions and provided recommendations, leading to more effective lease negotiations and a 12% increase in savings.

Lease Accounting Compliance Specialist resume sample

- •Reviewed over 150 lease agreements quarterly to ensure compliance with ASC 842, reducing errors by 20%.

- •Led a project that automated lease data collection, resulting in a 35% increase in reporting efficiency.

- •Collaborated with cross-functional teams to ensure accurate lease liability reporting, leading to a 98% accuracy rate.

- •Managed lease accounting disclosures for quarterly and annual financial statements, improving deadline adherence by 15%.

- •Provided support during internal audits by compiling documentation, which cut the audit inquiry response time by 40%.

- •Identified a process improvement opportunity that saved $25,000 annually by streamlining lease amortization schedules.

- •Ensured ongoing compliance with IFRS 16 standards, successfully navigating regulatory changes without financial discrepancies.

- •Prepared detailed analysis for lease accounting processes, reducing financial reporting errors by 25%.

- •Facilitated training sessions on new compliance standards for staff, improving team efficiency by 22%.

- •Proactively monitored regulatory updates and advocated policy revisions to maintain compliance in lease accounting procedures.

- •Optimized documentation procedures during external audits, leading to a 30% reduction in time spent on audit queries.

- •Analyzed lease documentation for accuracy and regulatory compliance for a portfolio of over 70 properties.

- •Assisted in the preparation of financial statements, improving accuracy through diligent data verification by 18%.

- •Participated in cross-departmental meetings to enhance communication and foster teamwork in compliance efforts.

- •Developed reporting templates for lease liabilities and right-of-use assets, enhancing standardization and clarity.

- •Conducted financial analysis to support accounting decisions, decreasing cost overruns by 15%.

- •Collaborated with lease administration to collect and analyze data, improving the integrity of financial records by 20%.

- •Supported the implementation of new accounting software, resulting in streamlined operations and a 25% productivity gain.

- •Resolved discrepancies in lease databases through thorough reconciliation processes, boosting data accuracy significantly.

Commercial Property Lease Accountant resume sample

- •Prepared and maintained financial records for a portfolio of 150 commercial leases, ensuring accounting compliance and increasing accuracy by 15%.

- •Led monthly reconciliations of tenant accounts, reducing errors by 20% and improving efficiency of closing processes by 10%.

- •Collaborated with property management teams to resolve discrepancies, resulting in a 95% on-time rent collection rate.

- •Developed financial reports including variance analysis and rent rolls, providing insights that supported strategic leasing decisions.

- •Assisted in annual budgeting and forecasting, contributing to a 30% improvement in budget accuracy across managed properties.

- •Coordinated special projects that improved internal lease audit processes, enhancing compliance with ASC 842 standards.

- •Analyzed financial aspects of commercial leases, providing insights that increased operational efficiency and reduced financial discrepancies by 18%.

- •Facilitated the implementation of new accounting software system, enhancing data accuracy and reducing data entry time by 25%.

- •Designed tenant occupancy reports which aided in optimizing lease renewals, contributing to a 10% increase in retention rates.

- •Conducted variance analysis, leading to cost-saving measures that reduced departmental expenditure by $200,000 annually.

- •Examined lease agreements for critical terms, ensuring proper execution and resulting in a 22% decrease in contractual errors.

- •Administered financial records and reconciled tenant accounts, improving accuracy of lease documentation by 30%.

- •Collaborated with property management to ensure rent invoices were accurately distributed and collected timely, increasing collection rates by 12%.

- •Prepared monthly and quarterly financial summaries, enhancing stakeholders' understanding of financial performance across properties.

- •Reviewed and interpreted lease agreements, ensuring rigorous compliance with ASC 842 accounting standards.

- •Researched market trends and prepared competitive analysis reports for commercial real estate investments.

- •Assisted with lease negotiation processes, contributing to favorable terms that boosted portfolio profitability by 15%.

- •Managed property financial statements, providing detailed analysis that informed strategic business decisions.

- •Maintained organized documentation of leases and provided administrative support during audits and compliance reviews.

Lease Accountant for Retail Operations resume sample

- •Implemented a streamlined lease accounting process that improved reporting timelines by 30%, resulting in faster decision-making for management.

- •Managed and recorded lease liabilities and right-of-use assets for over 150 retail locations, ensuring compliance with ASC 842 standards.

- •Collaborated with cross-functional teams to abstract lease data, improving data accuracy by 25% and enhancing reporting insights.

- •Processed and allocated $12 million in lease payments annually, ensuring compliance with lease terms and optimal cash flow management.

- •Assisted in the preparation of comprehensive monthly financial statements related to lease expenses, enhancing clarity and decision-making.

- •Conducted periodic audits of lease agreements, improving compliance and reducing errors by 15%, contributing to successful audit outcomes.

- •Reviewed and analyzed lease agreements, identifying key financial components, leading to a 20% reduction in discrepancies.

- •Collaborated with the Legal team to verify lease terms, improving compliance, and contributing to accurate financial reporting.

- •Prepared and maintained detailed lease accounting records for retail clients, enhancing their operational insights and financial control.

- •Supported external audits, providing accurate documentation that resulted in a 100% clean audit report.

- •Played a key role in annual budgeting and forecasting processes, improving the precision of financial plans for lease expenses.

- •Analyzed financial and operational data for over 200 retail properties, leading to the optimization of resource allocations and cost reductions.

- •Developed comprehensive reports on lease obligations and costs, providing executives with critical data for strategic planning.

- •Collaborated with accounting teams to integrate new lease standards, resulting in increased compliance and accuracy in financial reporting.

- •Introduced analytics tools to process lease-related data, reducing manual efforts by 40% and increasing team productivity.

- •Prepared lease payment and expense allocation processes, improving accuracy in financial records by 20%.

- •Supported the implementation of new accounting software that streamlined lease management and enhanced reporting capabilities.

- •Assisted in the abstraction of lease agreements, ensuring accurate reflection of terms in the accounting system.

- •Engaged in daily coordination with corporate teams, fostering communication and ensuring the timely execution of accounting tasks.

Lease Account Reconciliation Specialist resume sample

- •Led the reconciliation of over 500 lease accounts monthly, decreasing outstanding discrepancies by 30% within the first year.

- •Collaborated cross-functionally with property management to achieve a 20% reduction in error rates, enhancing financial statement accuracy.

- •Implemented a new reconciliation tracking system, improving documentation efficiency and reducing reporting time by 25%.

- •Analyzed and identified risk areas in account processes, contributing to the development of more robust financial controls.

- •Mentored junior team members, guiding them to improve their reconciliation skills, which boosted overall team productivity by 15%.

- •Successfully managed a month-end closing project that streamlined procedures, resulting in a 35% faster close time.

- •Resolved complex discrepancies in lease accounts, recovering $50,000 in missed revenue over a six-month period.

- •Developed analytical reports for lease account reconciliations, enhancing transparency and strategic decision-making.

- •Facilitated interdepartmental collaboration, leading to a 40% improvement in data accuracy and reporting timeliness.

- •Provided support for system migrations, ensuring all lease data was accurately transferred, resulting in seamless operations.

- •Drafted policies for reconciliation processes that were implemented company-wide, improving overall compliance.

- •Conducted in-depth financial analysis of lease terms, saving the company over $100,000 by identifying unnecessary expenditure.

- •Enhanced financial reporting accuracy by standardizing reconciliation processes, driving a 25% reduction in discrepancies.

- •Managed communications with external auditors, which streamlined the audit process and ensured full compliance.

- •Built financial models for potential lease modifications, aiding executives in strategic planning and budgeting.

- •Assisted in the reconciliation of lease-related financial statements, improving data integrity by 20%.

- •Streamlined documentation processes, cutting down report preparation time by 15% on average.

- •Supported lease account audits, providing detailed analysis, which resulted in the identification of key improvement areas.

- •Monitored contract compliance, ensuring no violations which contributed to company maintaining strong partnerships.

Accountant for Leasehold Management resume sample

- •Managed the accounting functions of over 150 leasehold properties, resulting in a 15% increase in data accuracy.

- •Prepared comprehensive financial statements monthly, resulting in improved stakeholder satisfaction through enhanced transparency.

- •Implemented new internal controls, reducing discrepancies by 25% and improving audit outcomes.

- •Collaborated with the property management team, resolving over 90% of discrepancies within one month.

- •Provided detailed variance analysis and quarterly forecasts, enhancing predictive accuracy by 18%.

- •Ensured tax compliance and timely submissions, saving the company $40,000 in fines and penalties annually.

- •Oversaw month-end closings, achieving accurate record keeping within 2 business days of month-end 95% of the time.

- •Optimized rent collection processes, increasing cash flow by streamlining procedures for 120 properties.

- •Partnered with tax advisors on property tax calculations, ensuring compliance and saving $25,000 annually.

- •Conducted comprehensive audits of leasehold accounts, enhancing audit readiness and reducing discrepancies by 32%.

- •Developed and presented bi-annual leasehold performance reports to stakeholders, contributing to a 20% improvement in strategic planning.

- •Analyzed leasehold agreements for compliance, improving adherence to accounting standards by 30%.

- •Monitored operating expenses and prepared financial reports, facilitating a 12% reduction in overhead costs.

- •Collaborated on $500K leasehold improvement projects, streamlining the approval process by 20%.

- •Implemented efficient reconciliation methods for lease agreements, decreasing errors by 25%.

- •Executed accurate account reconciliations for over 100 client portfolios, enhancing data integrity by 18%.

- •Supported lease agreement reviews, ensuring compliance and minimizing legal risks.

- •Contributed to a team project reducing financial data errors by 50% in the first year.

- •Regularly updated senior management on leasehold accounting progress, fostering improved decision-making.

Lease Audit Accountant resume sample

- •Led a comprehensive audit of over 150 lease agreements annually, leading to the identification and correction of 30% of discrepancies.

- •Collaborated with procurement teams to streamline lease data collection, improving accuracy by 25% over a two-year period.

- •Implemented changes to lease accounting systems, reducing errors and improving efficiency by 15%, resulting in more timely financial reporting.

- •Assisted in the preparation of detailed leasing activity reports, resulting in a 10% improvement in reporting timelines.

- •Managed lease accounting software updates, ensuring data accuracy and compliance with ASC 842 regulations.

- •Developed strong relationships with key stakeholders, enhancing collaborative efforts that resulted in a 10% increase in department productivity.

- •Conducted in-depth analyses of lease documents, identifying critical discrepancies that saved $500,000 annually.

- •Streamlined communication with external auditors, enhancing the efficiency of the annual audit process by 20%.

- •Engaged in review and implementation of ASC 842 guidelines, contributing to a 50% decrease in compliance issues.

- •Worked closely with real estate teams to ensure the completeness of lease documentation, leading to improved data integrity.

- •Participated in cross-functional projects, enhancing data sharing procedures that resulted in informative financial insights.

- •Led audit teams in reviewing client lease agreements, identifying $1M worth of recoveries through compliance assessments.

- •Managed the extraction and analysis of large datasets, improving audit efficiency by 35% using advanced Excel functionalities.

- •Consulted with clients to enhance internal processes, contributing to a 30% improvement in their reporting accuracy.

- •Coordinated with multiple departments to harmonize audit practices, leading to a smoother and more efficient audit cycle.

- •Processed and verified financial documents, enhancing accuracy by 10% through diligent data validation techniques.

- •Assisted in month-end closing procedures, ensuring the timely and accurate reporting of financial statements.

- •Coordinated with various teams to gather essential data, improving the quality of financial reporting by 20%.

- •Supported internal audits, helping the company maintain compliance with industry regulations and standards.

Navigating the job market as a lease accountant can sometimes feel like solving a complex financial puzzle, where each piece needs to fit perfectly. Employers are on the lookout for candidates with a keen eye for detail, making your resume your golden ticket to highlight your skills. Convincing hiring managers that you possess the necessary expertise is crucial in setting yourself apart from others.

But standing out isn’t easy. Condensing your extensive experience and specialized skills into a compelling story on paper requires precision. It’s not just about listing your qualifications; it’s about conveying your deep understanding of lease accounting standards and your knack for financial analysis in a way that resonates with employers.

This is where the right resume template becomes invaluable. It provides not just structure, but also a clear path to effectively present your achievements and skills. By using a well-crafted resume template, you simplify the writing process and ensure that your strengths leave a lasting impression.

Crafting your lease accountant resume is more than a task—it's an opportunity to showcase your professionalism and attention to detail. With a focused approach, you can create a document that not only meets industry standards but also accentuates what makes you unique. Let’s explore how you can seamlessly articulate your skills and take control of the resume-writing journey with confidence.

Key Takeaways

- Employers look for detail-oriented candidates who can effectively highlight their lease accounting skills, making the resume crucial in distinguishing oneself in the job market.

- It's essential to use a well-crafted resume template that helps succinctly present a professional's knowledge and achievements in lease accounting.

- Key sections of a lease accountant resume include contact information, work experience, skills, education, and technical proficiency, each crucial for showcasing expertise and professionalism.

- The chronological format is recommended for lease accountant resumes as it easily showcases career progression and expertise while ensuring a polished presentation with modern fonts and PDF format.

- Including extra sections such as languages, hobbies, volunteer work, and books read can enrich the resume, offering a fuller personal and professional picture to potential employers.

What to focus on when writing your lease accountant resume

A lease accountant resume should highlight your expertise in managing lease agreements and ensure accurate financial reporting—showcasing your knowledge of accounting standards and demonstrating your ability to handle leases efficiently is crucial.

How to structure your lease accountant resume

- Contact Information: Your contact details should be easy to find and correct. This typically includes your full name, phone number, email, and LinkedIn profile. Keeping this information clear and at the top of the resume ensures potential employers can quickly reach out to you with questions or offers.

- Professional Summary: This is your chance to make a strong first impression. A well-crafted summary can instantly communicate your years of experience, specialized skills in ASC 842 or IFRS 16, and your prowess in lease classification and financial analysis. It's all about painting a picture of your capabilities at a high level.

- Work Experience: Here is where you dive into the specifics of your career. Detail your hands-on experience with lease accounting tasks, such as negotiating favorable lease terms, preparing lease journals that meet compliance standards, and maintaining alignment with current policies. Tailoring your experience to include quantifiable outcomes can give recruiters a clearer picture of your achievements.

- Skills: Directly relate your skills to the demands of a lease accountant. Highlight proficiencies in financial analysis, lease abstraction, and the use of lease administration software like CoStar or LeaseQuery. These skills should support your demonstrated attention to detail and ability to handle complex lease agreements.

- Education: Your educational background should reinforce your readiness for the role. Mention your degrees and any certifications such as CPA, emphasizing coursework or internships related to lease management or financial reporting. This highlights your foundation in accounting and your continuous growth in the field.

- Technical Proficiency: Detailing your technical skills shows how you meet the technological demands of the role. List your experience with accounting software like SAP or Oracle and proficiency in Excel for financial modeling. This reinforces how you apply your technical skills to produce accurate and insightful financial reports.

Finally, as we delve into the specific requirements of each section, we'll explore how to format your lease accountant resume effectively. Each category will be covered more in-depth to ensure you create a comprehensive and compelling resume that stands out.

Which resume format to choose

Crafting a resume for a lease accountant involves careful attention to structure and presentation. Start by using a chronological format. This approach allows potential employers to easily trace your work history and understand your experience and expertise in the domain of lease accounting, highlighting your professional development over time.

When selecting fonts, focus on readability and modernity. Lato, Montserrat, and Raleway are excellent choices that create a sleek and professional look, steering clear from outdated styles like Arial or Times New Roman. A modern font can subtly communicate your forward-thinking approach and attention to detail.

Always choose PDF as your file format when saving your resume. This choice ensures that your carefully crafted layout remains intact across different devices and operating systems, projecting a polished and consistent image. It's a small detail that can prevent technical mishaps during your job application process.

Maintaining one-inch margins on all sides of your resume is crucial. This spacing keeps your content clear and accessible, avoiding clutter and ensuring nothing vital is trimmed off in any format or output. With these elements working together, your resume will effectively communicate your qualifications and professionalism in the field of lease accounting.

How to write a quantifiable resume experience section

To craft the experience section on your lease accountant resume, focus on achievements and duties that match the job you’re aiming for. This section should effectively highlight your past roles and illustrate how you’ve contributed to the companies you’ve worked for. Using clear bullet points that start with strong action words keeps your experience impactful. Begin with your most recent job, listing previous positions in reverse chronological order, as it typically helps to cover the last 10-15 years. By tailoring your resume to the job ad, you ensure that relevant skills and keywords are prominently highlighted. Consider adjusting job titles to better convey your role and relevance.

- •Cut lease processing time by 35% by developing and rolling out a streamlined accounting procedure.

- •Achieved 99% accuracy in accounting reports for over 500 leases by refining data checks.

- •Led a team that upgraded the lease software, boosting functionality and user satisfaction by 20%.

- •Negotiated deals saving $200,000 annually through strategic vendor talks and audits.

This experience section stands out because it cohesively illustrates your fit for a lease accountant position. By focusing on well-defined achievements, you provide a clear narrative of your impact through quantifiable successes. Each bullet point follows logically, detailing how your actions led to tangible improvements, such as increased accuracy and cost savings. Your experience aligns closely with the job requirements, seamlessly connecting your skills to the potential employer’s needs. These elements together showcase your value in a way that is both compelling and relevant.

Innovation-Focused resume experience section

An innovation-focused lease accountant's resume experience section should show how you bring fresh financial solutions to your work. Highlight projects where you've streamlined processes, enhanced accuracy, and developed strategies that save money or improve compliance. Demonstrating a proactive mindset, use action words to illustrate how you utilize new technologies effectively.

Make sure to detail your role in each project, backing up your impact with data wherever possible. By quantifying achievements like time saved or percentage improvements, you provide a clearer picture of your contributions. Keep your descriptions concise yet descriptive, ensuring each bullet point captures the heart of your innovative impact.

Senior Lease Accountant

Financial Innovations Inc.

June 2019 - Present

- Led a team to implement new accounting software, reducing data entry errors by 30%.

- Created an automated system for lease payment tracking, cutting processing time by 40%.

- Boosted compliance by updating lease accounting policies to reflect the latest standards.

- Worked with IT to introduce a digital audit trail, increasing transparency and accountability.

Customer-Focused resume experience section

A customer-focused lease accountant resume experience section should clearly demonstrate how your work meets client needs and showcases your ability to deliver outstanding service. Start by describing your responsibilities and achievements that highlight your skills in managing customer accounts effectively. Explain how you ensure satisfaction through clear communication, precise lease accounting, and timely project completion, creating a seamless experience for your clients.

Delve into specific examples where you interacted with customers, aiming to showcase your problem-solving skills and dedication to their satisfaction. Emphasize any process improvements that directly benefited the customer, such as streamlining account management or reducing errors in lease reports. Your goal is to illustrate your understanding of a customer-centric approach and your proven track record of success in this area.

Senior Lease Accountant

ABC Leasing Co.

June 2019 - Present

- Led a team of 5 junior accountants, enhancing customer service processes and raising client satisfaction scores by 15%.

- Worked directly with clients to resolve discrepancies, ensuring accurate lease records and swift issue resolution, which reduced error rates by 20%.

- Introduced a new lease management system that boosted report accuracy and strengthened client communication, fostering a more transparent process.

- Negotiated lease agreements, achieving terms that were beneficial for both clients and the company, which improved overall client relations.

Project-Focused resume experience section

A project-focused lease accountant resume experience section should effectively highlight your involvement in managing leasing-related accounting projects. Begin by naming or describing the projects you handled, then delve into your responsibilities using active, engaging language. Illustrate specific achievements by quantifying your successes and detailing the skills you applied to meet your goals. By sharing the challenges you faced and the solutions you provided, you offer potential employers a comprehensive view of your expertise and impact.

Organize your experience section with bullet points that clearly showcase your achievements in lease accounting projects. Include the tools or software you used, the methodologies you adopted, and the tangible benefits you brought to the organization. By using straightforward, results-focused language, you can effectively communicate your accomplishments and demonstrate your potential as a valuable asset to future employers.

Lease Accountant

ABC Leasing Corp.

June 2020 - Present

- Led the integration of a new lease accounting software, reducing processing time by 30%.

- Worked with cross-functional teams to ensure compliance with ASC 842 standards.

- Trained staff on the new system, increasing team efficiency by 20%.

- Provided ongoing support and troubleshooting, achieving an error rate of less than 5%.

Leadership-Focused resume experience section

A leadership-focused lease accountant resume experience section should emphasize your ability to guide teams, lead projects, and ensure precise financial reporting. Begin by listing your job titles in chronological order, showcasing your growth and development as a leader. Focus on how you led initiatives and improved processes, using action words to highlight the positive changes you fostered. Describe the responsibilities you undertook with a clear link to the impact you had on your team and the organization.

By incorporating specific examples of successful projects or leadership outcomes, you can demonstrate your value more effectively. Quantify your achievements to give a clearer picture of your contributions, such as improving the lease reconciliation process for more efficient reporting. This approach ties each aspect of your experience together, painting a cohesive picture of how your leadership skills have driven success and advancement in your career.

Senior Lease Accountant

ABC Financial Group

2018 - Present

- Led a team of 6 lease accountants, mentoring them to enhance financial precision and work efficiency.

- Implemented a new lease management system, reducing reporting errors by 30%.

- Developed standardized procedures that streamlined lease accounting processes across the company.

- Coordinated with different departments to ensure seamless integration of lease accounting systems.

Write your lease accountant resume summary section

A lease accountant-focused resume should begin with a summary that effectively showcases your expertise and experience. For those with significant experience, consider this example:

Starting with a concise summary grabs attention by highlighting key achievements and core skills like communication and analytical abilities. A summary acts as a quick snapshot of your professional life, aiming to captivate potential employers. If you're new to the field, a resume objective might serve you better, focusing on your career goals and learning ambitions. The primary difference between a summary and an objective is focus—summaries highlight past successes, while objectives express future aspirations. A resume profile provides a blend, combining elements of both summaries and objectives to present a well-rounded view. Alternatively, a summary of qualifications lists top skills in bullet points but lacks narrative cohesion. Understanding which section suits your situation helps in presenting your career highlights effectively. Tailor your choice to best represent your experience and the story you want to convey.

Listing your lease accountant skills on your resume

A skills-focused lease accountant resume section should effectively convey your hard-earned expertise and key personal attributes. When crafting this section, remember that it can stand on its own or be part of other sections like your professional experience or summary. Highlighting your strengths and soft skills is crucial, as these illustrate your ability to work well with others and communicate effectively. Alongside soft skills, hard skills are essential. These specific abilities are gained through training and relate directly to your lease accounting proficiency, such as using financial software or understanding lease accounting standards.

Incorporating both skills and strengths in your resume provides powerful keywords that grab the attention of employers and Applicant Tracking Systems (ATS). So, when you align your skills with the job description, it enhances your resume's relevance and increases your chances of being noticed. Here’s a clear example of how you can structure a standalone skills section for a lease accountant resume:

This section works because it straightforwardly highlights the specific skills needed in lease accounting, aligning them with key responsibilities in the field. This organization makes your resume easy to search and enticing to employers.

Best hard skills to feature on your lease accountant resume

For a lease accountant, mastering hard skills is crucial for successful job performance. These skills, reflecting technical expertise, show employers that you can efficiently handle the demands of lease accounting roles.

Hard Skills

- Lease Accounting Standards

- Financial Analysis

- General Accepted Accounting Principles (GAAP)

- Financial Reporting

- SAP or Oracle Systems

- Microsoft Excel Proficiency

- Budgeting and Forecasting

- Tax Compliance

- Lease Administration Software

- Data Analysis

- Cost Accounting

- Regulatory Compliance

- Internal Controls

- Audit Preparation

- Financial Statement Preparation

Best soft skills to feature on your lease accountant resume

While hard skills highlight what you can do, soft skills reflect how you approach your work. For lease accountants, these emphasize your interpersonal abilities and how you handle challenges and teamwork.

Soft Skills

- Communication

- Problem-Solving

- Adaptability

- Attention to Detail

- Time Management

- Team Collaboration

- Critical Thinking

- Conflict Resolution

- Organizational Skills

- Leadership

- Decision Making

- Stress Management

- Reliability

- Initiative

- Customer Service Orientation

How to include your education on your resume

The education section of your lease accountant resume is vital. It shows hiring managers your qualifications and where you've studied. This section should be relevant to the job you're applying for, so leave out unrelated education. When listing a degree, include the title, school, and graduation date. If your GPA is strong, include it next to your degree. For honors like cum laude, add them after your degree title. Here's an example to avoid and one to replicate.

In this incorrect example, the degree is unrelated to a lease accountant role. Now, let's see a good example.

This example is excellent for several reasons. The degree is directly relevant to accounting, showing specific qualifications for the role. The high GPA and honors distinction make your profile stand out. Tailoring your resume boosts your chance of catching an employer's eye.

How to include lease accountant certificates on your resume

Adding a certificates section to your lease accountant resume is crucial. It shows your skills and qualifications beyond your job experience. You can also list your certificates in the resume header. For example, you can write: "CPA Certified Professional Accountant | IFRS Certification."

To include a certificate section, list the name of each certificate. Include the date you received it. Add the issuing organization to give it credibility.

This example is effective because it highlights relevant certificates for a lease accountant role. Both certifications, CPA and IFRS, show expertise in accounting standards. The example also names the issuing organizations, making the credentials more impressive. Using real years and established institutions gives your resume authenticity. This certificates section adds value and helps you stand out to employers.

Extra sections to include in your lease accountant resume

If you want to craft a resume for a lease accountant, you need to make sure it showcases your skills, experience, and educational background. Additionally, including sections such as language proficiency, hobbies and interests, volunteer work, and books you have read can make a big difference in setting your resume apart. Here’s how you can effectively include these sections:

- Language section—Highlight your proficiency in different languages to show your ability to work in multilingual environments.

- Hobbies and interests section—Include information about your hobbies to give employers a glimpse into your personal life and well-rounded character.

- Volunteer work section—Show your commitment to the community to demonstrate your teamwork and leadership skills outside of work.

- Books section—Mention relevant books you have read to showcase your continuous learning and industry knowledge.

Adding these sections to your resume enriches it and provides a fuller picture of who you are beyond your work history.

In Conclusion

In conclusion, crafting a standout lease accountant resume requires thoughtful attention to detail and strategic presentation. Your resume should serve as a clear reflection of your expertise and professionalism, making it easy for employers to see your value at a glance. Leveraging the right format can guide hiring managers through your work history, emphasizing your growth in the field. By highlighting both your hard and soft skills, you provide a comprehensive view of your capabilities, ensuring you stand out in a competitive job market. Including relevant certifications reinforces your qualifications and commitment to staying current with industry standards. Don’t overlook the significance of additional sections, such as language skills or volunteer work, which can present a well-rounded image to potential employers. Utilizing a modern and clean design ensures your resume remains professional and easy to read. Each element of your resume should work in harmony to tell your unique career story, emphasizing the impact you've made and the expertise you bring to the table. Tailoring your resume to align with the job description not only increases your chances of passing through applicant tracking systems but also captures the attention of hiring managers. Remember, your resume is not just a document; it's a reflection of your professional identity and aspirations. With these insights, you're well-equipped to create a compelling resume that positions you as a top candidate in the lease accounting field.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.