Loan Officer Resume Examples

Jul 18, 2024

|

12 min read

Master the art of creating an impressive loan officer resume that stands out—get hired in a heartbeat! Learn top tips and avoid common mistakes to ensure your resume gets a nod from every recruiter.

Rated by 348 people

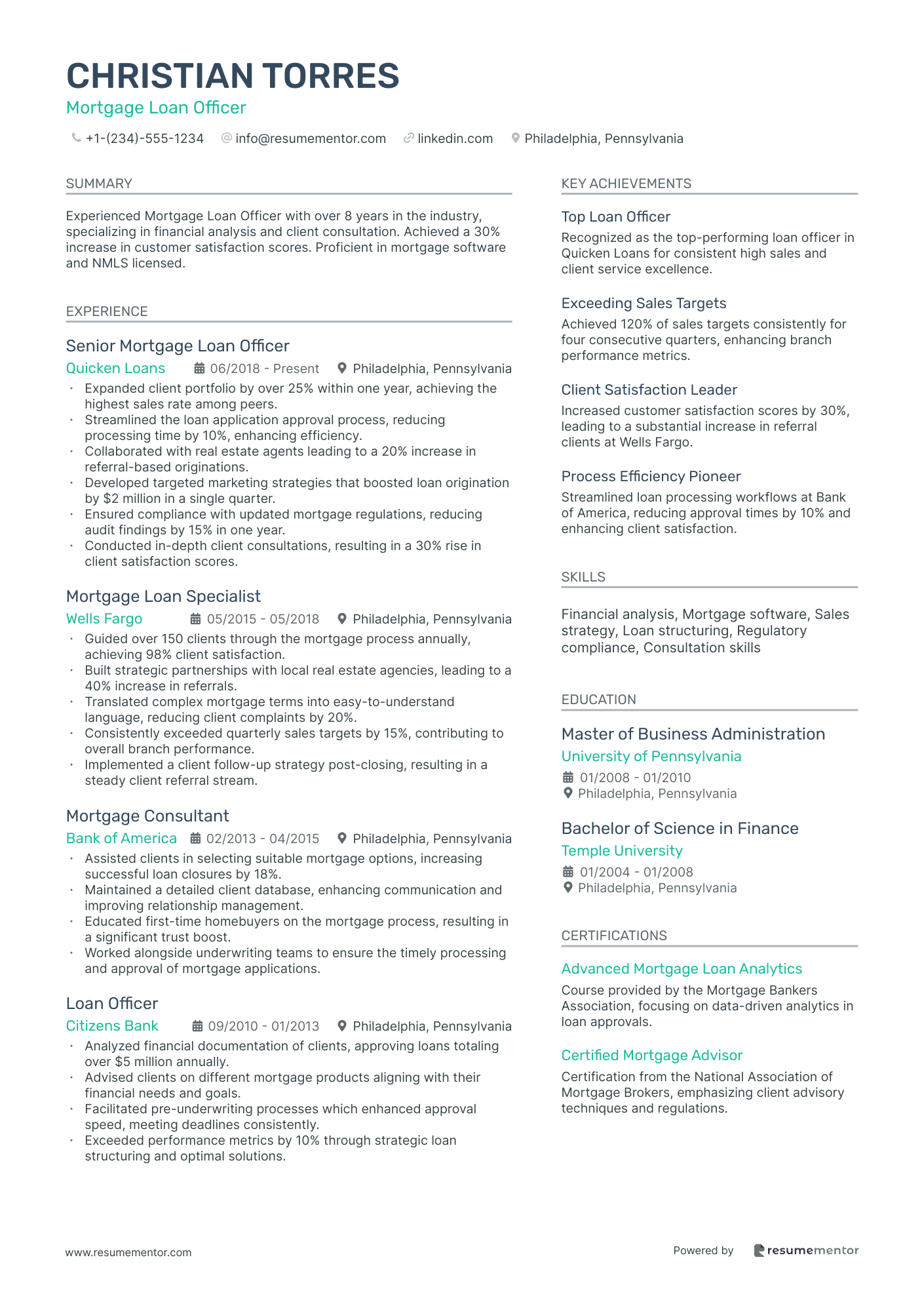

Mortgage Loan Officer

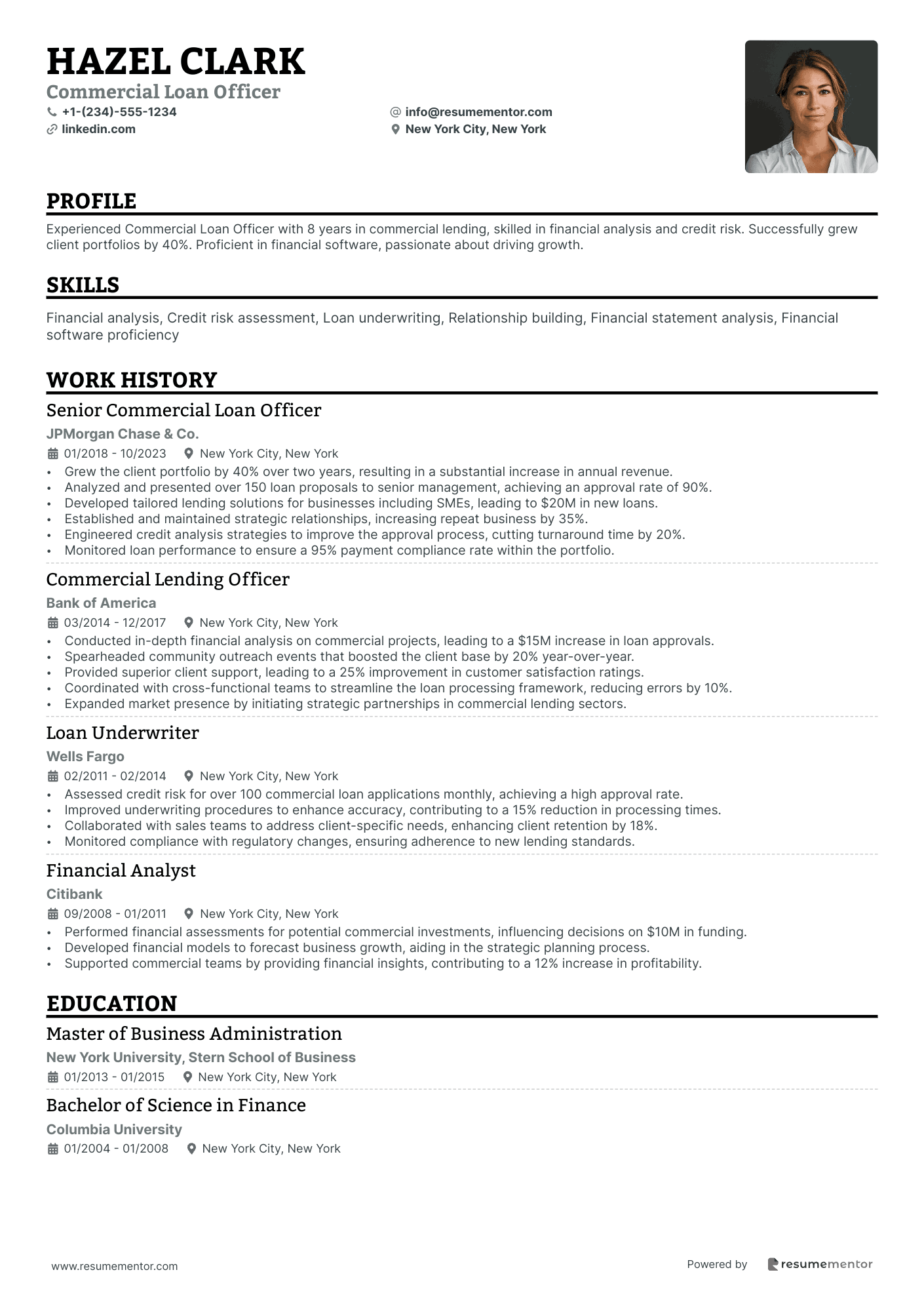

Commercial Loan Officer

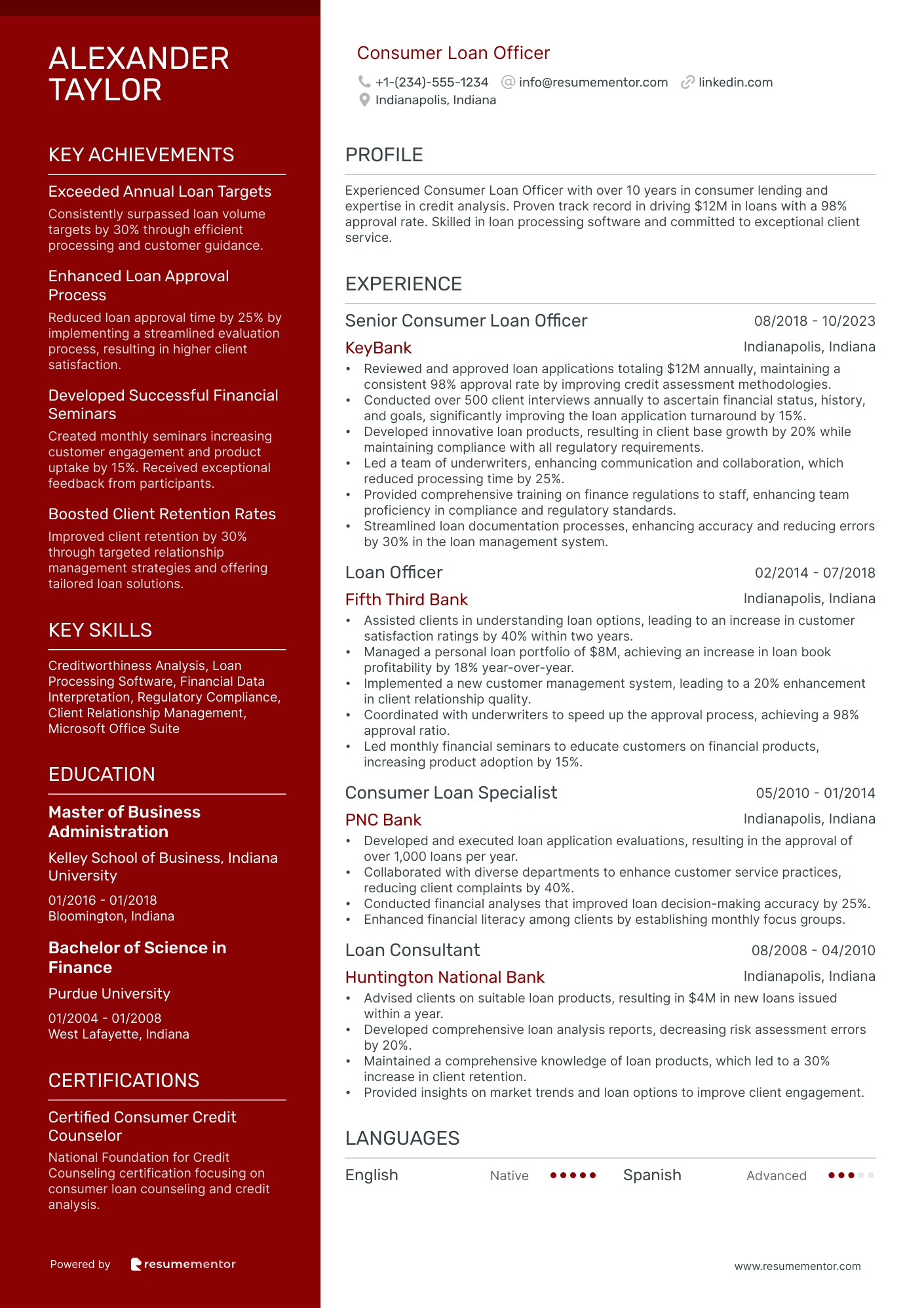

Consumer Loan Officer

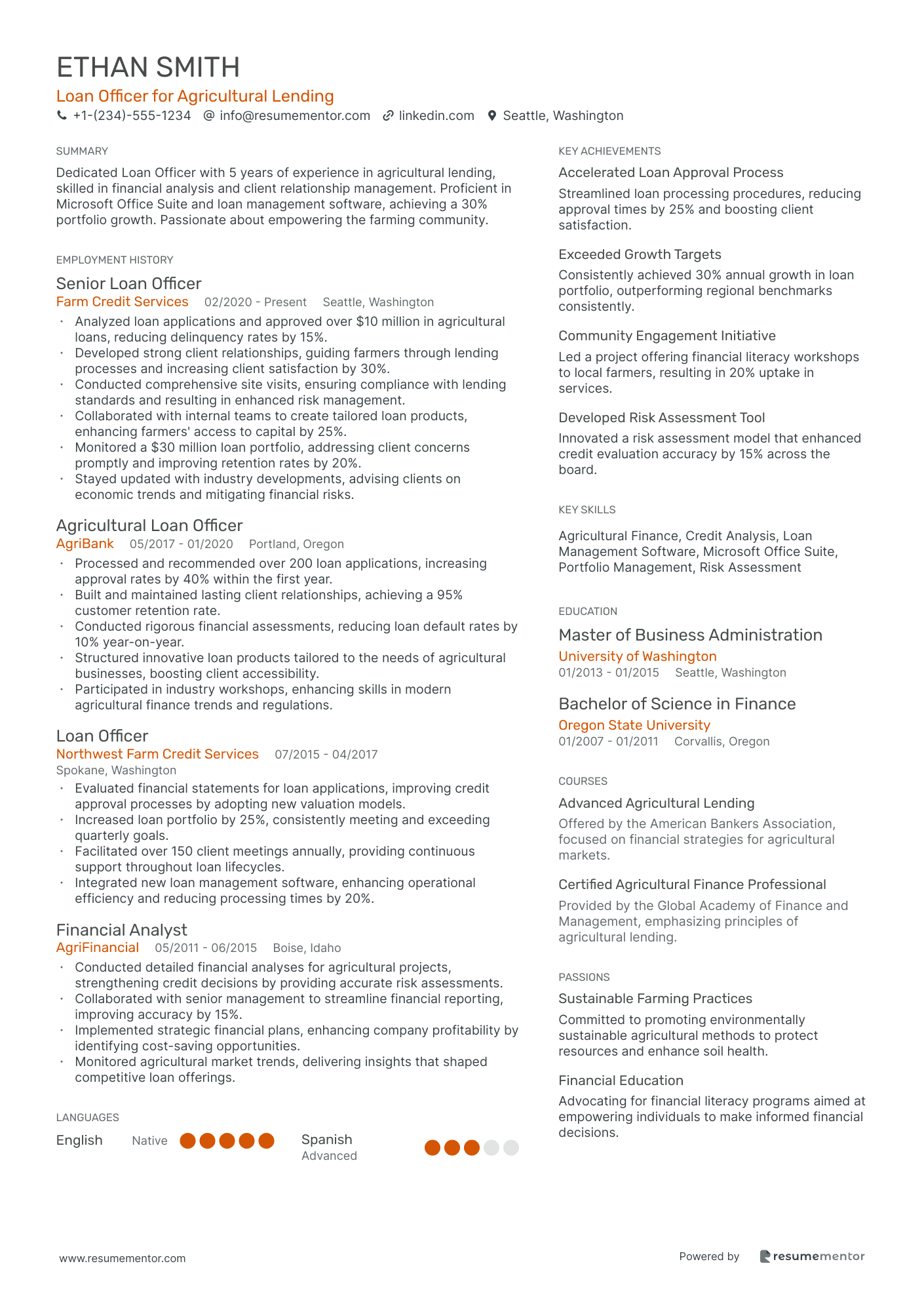

Loan Officer for Agricultural Lending

Business Loan Officer

Equipment Financing Loan Officer

Home Equity Loan Officer

Auto Loan Officer

Personal Loan Officer

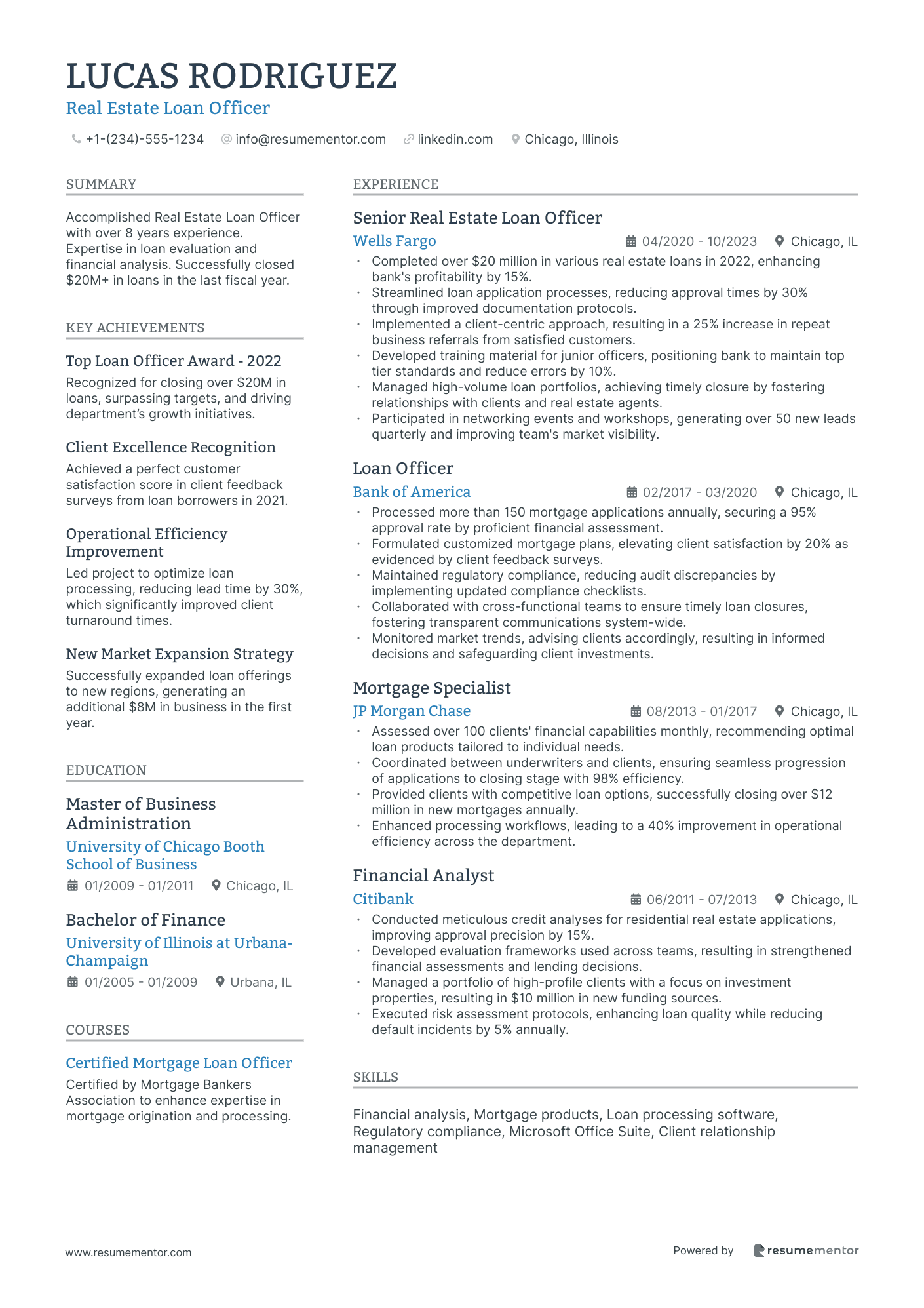

Real Estate Loan Officer

Mortgage Loan Officer resume sample

- •Expanded client portfolio by over 25% within one year, achieving the highest sales rate among peers.

- •Streamlined the loan application approval process, reducing processing time by 10%, enhancing efficiency.

- •Collaborated with real estate agents leading to a 20% increase in referral-based originations.

- •Developed targeted marketing strategies that boosted loan origination by $2 million in a single quarter.

- •Ensured compliance with updated mortgage regulations, reducing audit findings by 15% in one year.

- •Conducted in-depth client consultations, resulting in a 30% rise in client satisfaction scores.

- •Guided over 150 clients through the mortgage process annually, achieving 98% client satisfaction.

- •Built strategic partnerships with local real estate agencies, leading to a 40% increase in referrals.

- •Translated complex mortgage terms into easy-to-understand language, reducing client complaints by 20%.

- •Consistently exceeded quarterly sales targets by 15%, contributing to overall branch performance.

- •Implemented a client follow-up strategy post-closing, resulting in a steady client referral stream.

- •Assisted clients in selecting suitable mortgage options, increasing successful loan closures by 18%.

- •Maintained a detailed client database, enhancing communication and improving relationship management.

- •Educated first-time homebuyers on the mortgage process, resulting in a significant trust boost.

- •Worked alongside underwriting teams to ensure the timely processing and approval of mortgage applications.

- •Analyzed financial documentation of clients, approving loans totaling over $5 million annually.

- •Advised clients on different mortgage products aligning with their financial needs and goals.

- •Facilitated pre-underwriting processes which enhanced approval speed, meeting deadlines consistently.

- •Exceeded performance metrics by 10% through strategic loan structuring and optimal solutions.

Commercial Loan Officer resume sample

- •Grew the client portfolio by 40% over two years, resulting in a substantial increase in annual revenue.

- •Analyzed and presented over 150 loan proposals to senior management, achieving an approval rate of 90%.

- •Developed tailored lending solutions for businesses including SMEs, leading to $20M in new loans.

- •Established and maintained strategic relationships, increasing repeat business by 35%.

- •Engineered credit analysis strategies to improve the approval process, cutting turnaround time by 20%.

- •Monitored loan performance to ensure a 95% payment compliance rate within the portfolio.

- •Conducted in-depth financial analysis on commercial projects, leading to a $15M increase in loan approvals.

- •Spearheaded community outreach events that boosted the client base by 20% year-over-year.

- •Provided superior client support, leading to a 25% improvement in customer satisfaction ratings.

- •Coordinated with cross-functional teams to streamline the loan processing framework, reducing errors by 10%.

- •Expanded market presence by initiating strategic partnerships in commercial lending sectors.

- •Assessed credit risk for over 100 commercial loan applications monthly, achieving a high approval rate.

- •Improved underwriting procedures to enhance accuracy, contributing to a 15% reduction in processing times.

- •Collaborated with sales teams to address client-specific needs, enhancing client retention by 18%.

- •Monitored compliance with regulatory changes, ensuring adherence to new lending standards.

- •Performed financial assessments for potential commercial investments, influencing decisions on $10M in funding.

- •Developed financial models to forecast business growth, aiding in the strategic planning process.

- •Supported commercial teams by providing financial insights, contributing to a 12% increase in profitability.

Consumer Loan Officer resume sample

- •Reviewed and approved loan applications totaling $12M annually, maintaining a consistent 98% approval rate by improving credit assessment methodologies.

- •Conducted over 500 client interviews annually to ascertain financial status, history, and goals, significantly improving the loan application turnaround by 15%.

- •Developed innovative loan products, resulting in client base growth by 20% while maintaining compliance with all regulatory requirements.

- •Led a team of underwriters, enhancing communication and collaboration, which reduced processing time by 25%.

- •Provided comprehensive training on finance regulations to staff, enhancing team proficiency in compliance and regulatory standards.

- •Streamlined loan documentation processes, enhancing accuracy and reducing errors by 30% in the loan management system.

- •Assisted clients in understanding loan options, leading to an increase in customer satisfaction ratings by 40% within two years.

- •Managed a personal loan portfolio of $8M, achieving an increase in loan book profitability by 18% year-over-year.

- •Implemented a new customer management system, leading to a 20% enhancement in client relationship quality.

- •Coordinated with underwriters to speed up the approval process, achieving a 98% approval ratio.

- •Led monthly financial seminars to educate customers on financial products, increasing product adoption by 15%.

- •Developed and executed loan application evaluations, resulting in the approval of over 1,000 loans per year.

- •Collaborated with diverse departments to enhance customer service practices, reducing client complaints by 40%.

- •Conducted financial analyses that improved loan decision-making accuracy by 25%.

- •Enhanced financial literacy among clients by establishing monthly focus groups.

- •Advised clients on suitable loan products, resulting in $4M in new loans issued within a year.

- •Developed comprehensive loan analysis reports, decreasing risk assessment errors by 20%.

- •Maintained a comprehensive knowledge of loan products, which led to a 30% increase in client retention.

- •Provided insights on market trends and loan options to improve client engagement.

Loan Officer for Agricultural Lending resume sample

- •Analyzed loan applications and approved over $10 million in agricultural loans, reducing delinquency rates by 15%.

- •Developed strong client relationships, guiding farmers through lending processes and increasing client satisfaction by 30%.

- •Conducted comprehensive site visits, ensuring compliance with lending standards and resulting in enhanced risk management.

- •Collaborated with internal teams to create tailored loan products, enhancing farmers' access to capital by 25%.

- •Monitored a $30 million loan portfolio, addressing client concerns promptly and improving retention rates by 20%.

- •Stayed updated with industry developments, advising clients on economic trends and mitigating financial risks.

- •Processed and recommended over 200 loan applications, increasing approval rates by 40% within the first year.

- •Built and maintained lasting client relationships, achieving a 95% customer retention rate.

- •Conducted rigorous financial assessments, reducing loan default rates by 10% year-on-year.

- •Structured innovative loan products tailored to the needs of agricultural businesses, boosting client accessibility.

- •Participated in industry workshops, enhancing skills in modern agricultural finance trends and regulations.

- •Evaluated financial statements for loan applications, improving credit approval processes by adopting new valuation models.

- •Increased loan portfolio by 25%, consistently meeting and exceeding quarterly goals.

- •Facilitated over 150 client meetings annually, providing continuous support throughout loan lifecycles.

- •Integrated new loan management software, enhancing operational efficiency and reducing processing times by 20%.

- •Conducted detailed financial analyses for agricultural projects, strengthening credit decisions by providing accurate risk assessments.

- •Collaborated with senior management to streamline financial reporting, improving accuracy by 15%.

- •Implemented strategic financial plans, enhancing company profitability by identifying cost-saving opportunities.

- •Monitored agricultural market trends, delivering insights that shaped competitive loan offerings.

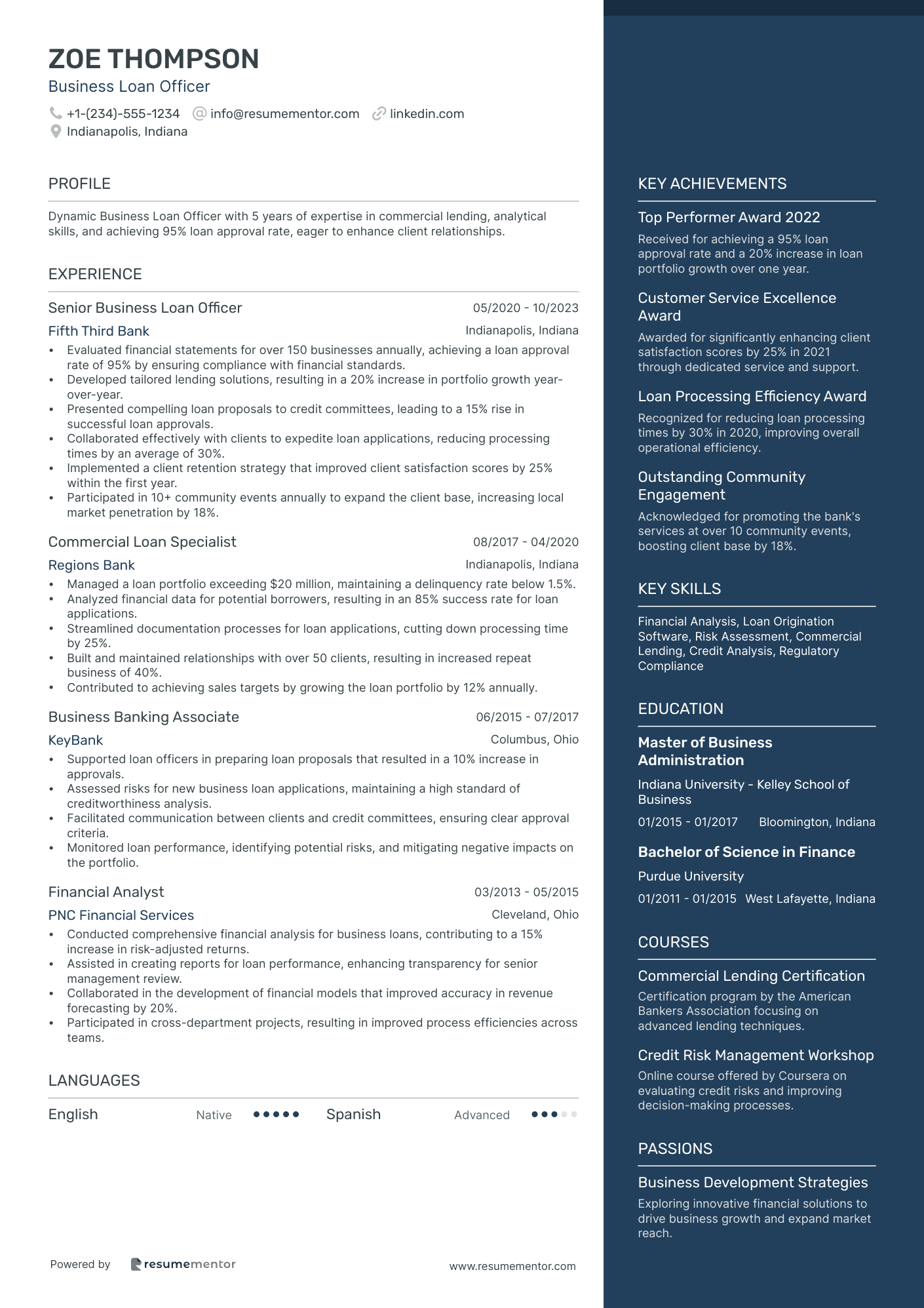

Business Loan Officer resume sample

- •Evaluated financial statements for over 150 businesses annually, achieving a loan approval rate of 95% by ensuring compliance with financial standards.

- •Developed tailored lending solutions, resulting in a 20% increase in portfolio growth year-over-year.

- •Presented compelling loan proposals to credit committees, leading to a 15% rise in successful loan approvals.

- •Collaborated effectively with clients to expedite loan applications, reducing processing times by an average of 30%.

- •Implemented a client retention strategy that improved client satisfaction scores by 25% within the first year.

- •Participated in 10+ community events annually to expand the client base, increasing local market penetration by 18%.

- •Managed a loan portfolio exceeding $20 million, maintaining a delinquency rate below 1.5%.

- •Analyzed financial data for potential borrowers, resulting in an 85% success rate for loan applications.

- •Streamlined documentation processes for loan applications, cutting down processing time by 25%.

- •Built and maintained relationships with over 50 clients, resulting in increased repeat business of 40%.

- •Contributed to achieving sales targets by growing the loan portfolio by 12% annually.

- •Supported loan officers in preparing loan proposals that resulted in a 10% increase in approvals.

- •Assessed risks for new business loan applications, maintaining a high standard of creditworthiness analysis.

- •Facilitated communication between clients and credit committees, ensuring clear approval criteria.

- •Monitored loan performance, identifying potential risks, and mitigating negative impacts on the portfolio.

- •Conducted comprehensive financial analysis for business loans, contributing to a 15% increase in risk-adjusted returns.

- •Assisted in creating reports for loan performance, enhancing transparency for senior management review.

- •Collaborated in the development of financial models that improved accuracy in revenue forecasting by 20%.

- •Participated in cross-department projects, resulting in improved process efficiencies across teams.

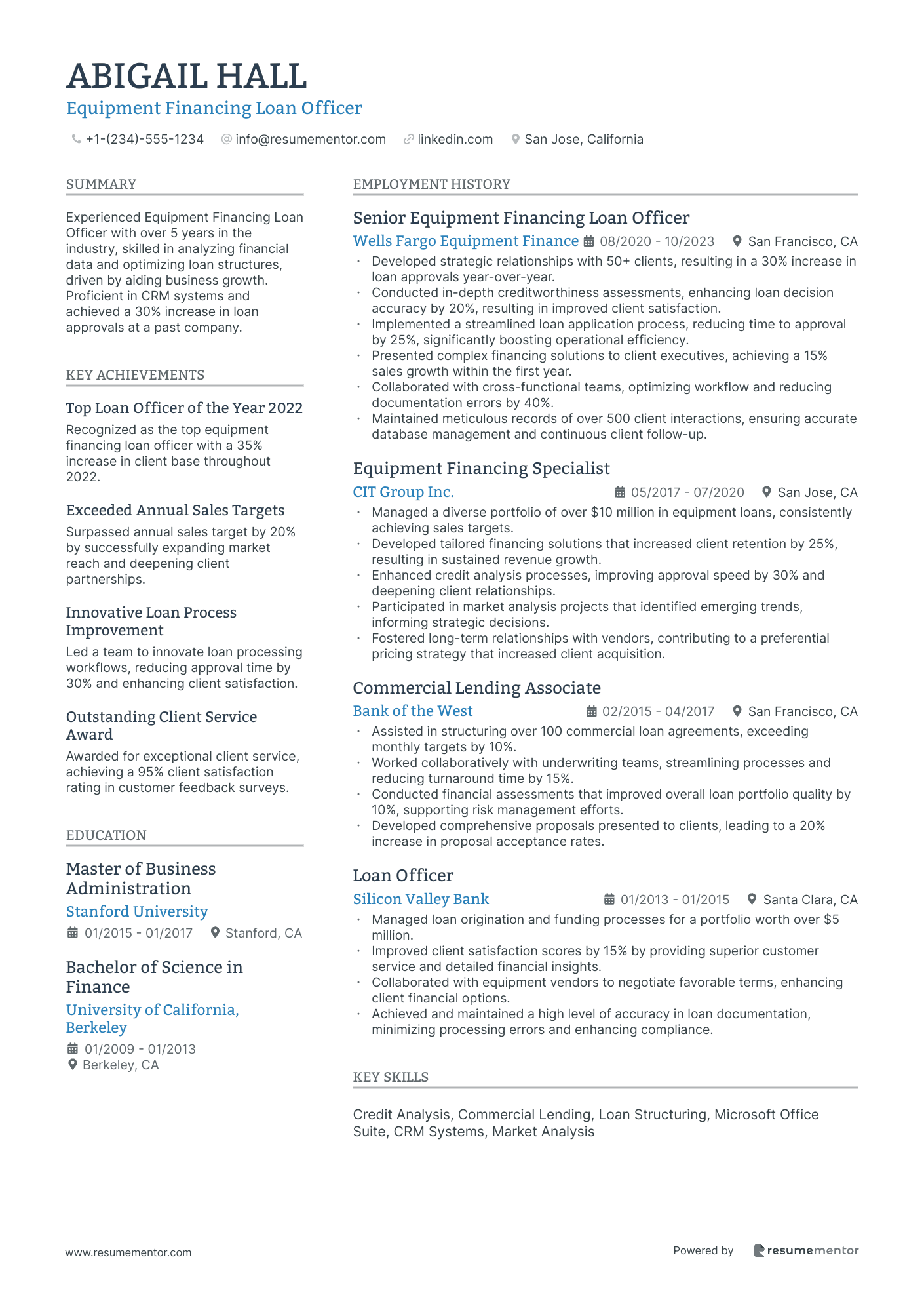

Equipment Financing Loan Officer resume sample

- •Developed strategic relationships with 50+ clients, resulting in a 30% increase in loan approvals year-over-year.

- •Conducted in-depth creditworthiness assessments, enhancing loan decision accuracy by 20%, resulting in improved client satisfaction.

- •Implemented a streamlined loan application process, reducing time to approval by 25%, significantly boosting operational efficiency.

- •Presented complex financing solutions to client executives, achieving a 15% sales growth within the first year.

- •Collaborated with cross-functional teams, optimizing workflow and reducing documentation errors by 40%.

- •Maintained meticulous records of over 500 client interactions, ensuring accurate database management and continuous client follow-up.

- •Managed a diverse portfolio of over $10 million in equipment loans, consistently achieving sales targets.

- •Developed tailored financing solutions that increased client retention by 25%, resulting in sustained revenue growth.

- •Enhanced credit analysis processes, improving approval speed by 30% and deepening client relationships.

- •Participated in market analysis projects that identified emerging trends, informing strategic decisions.

- •Fostered long-term relationships with vendors, contributing to a preferential pricing strategy that increased client acquisition.

- •Assisted in structuring over 100 commercial loan agreements, exceeding monthly targets by 10%.

- •Worked collaboratively with underwriting teams, streamlining processes and reducing turnaround time by 15%.

- •Conducted financial assessments that improved overall loan portfolio quality by 10%, supporting risk management efforts.

- •Developed comprehensive proposals presented to clients, leading to a 20% increase in proposal acceptance rates.

- •Managed loan origination and funding processes for a portfolio worth over $5 million.

- •Improved client satisfaction scores by 15% by providing superior customer service and detailed financial insights.

- •Collaborated with equipment vendors to negotiate favorable terms, enhancing client financial options.

- •Achieved and maintained a high level of accuracy in loan documentation, minimizing processing errors and enhancing compliance.

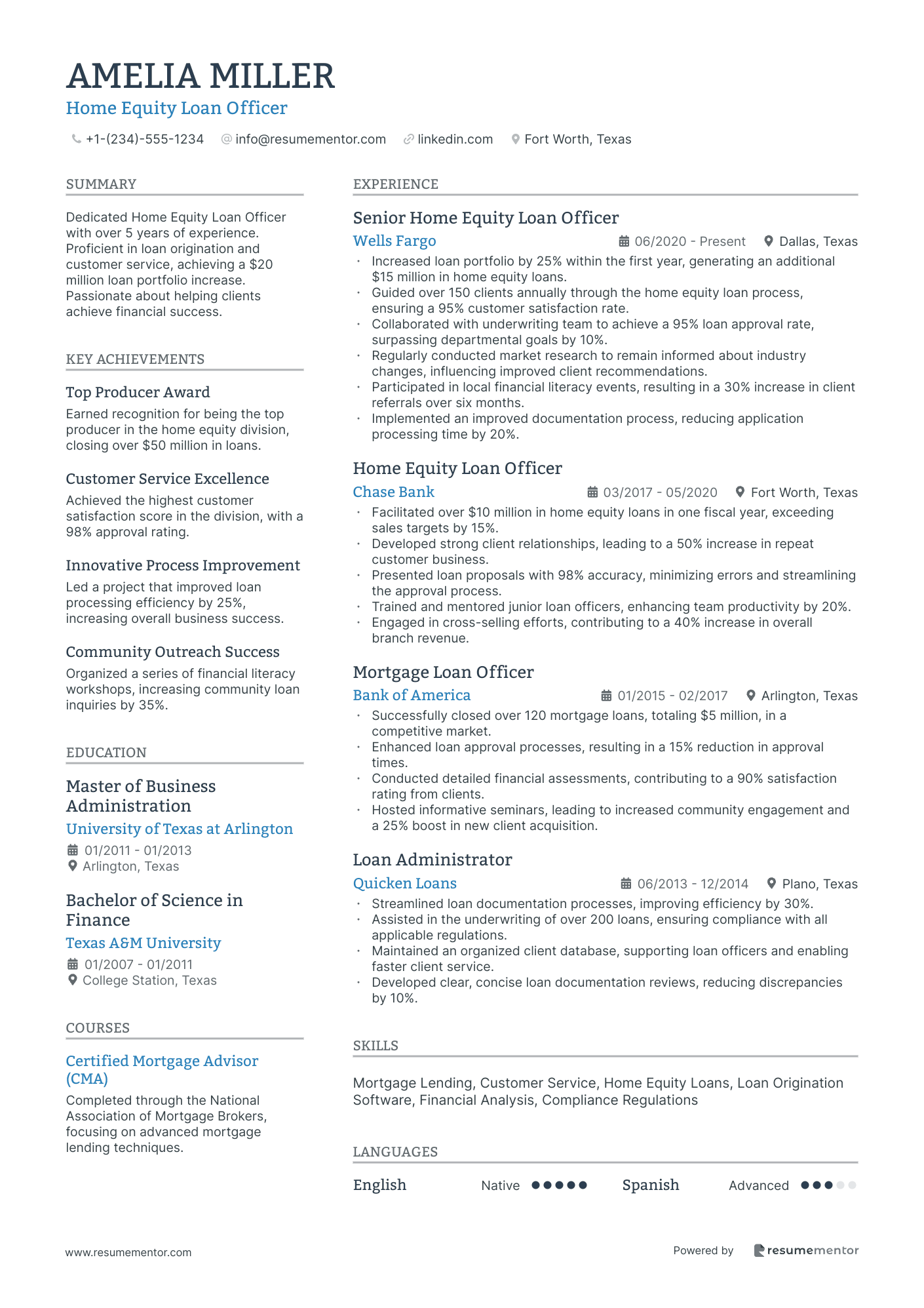

Home Equity Loan Officer resume sample

- •Increased loan portfolio by 25% within the first year, generating an additional $15 million in home equity loans.

- •Guided over 150 clients annually through the home equity loan process, ensuring a 95% customer satisfaction rate.

- •Collaborated with underwriting team to achieve a 95% loan approval rate, surpassing departmental goals by 10%.

- •Regularly conducted market research to remain informed about industry changes, influencing improved client recommendations.

- •Participated in local financial literacy events, resulting in a 30% increase in client referrals over six months.

- •Implemented an improved documentation process, reducing application processing time by 20%.

- •Facilitated over $10 million in home equity loans in one fiscal year, exceeding sales targets by 15%.

- •Developed strong client relationships, leading to a 50% increase in repeat customer business.

- •Presented loan proposals with 98% accuracy, minimizing errors and streamlining the approval process.

- •Trained and mentored junior loan officers, enhancing team productivity by 20%.

- •Engaged in cross-selling efforts, contributing to a 40% increase in overall branch revenue.

- •Successfully closed over 120 mortgage loans, totaling $5 million, in a competitive market.

- •Enhanced loan approval processes, resulting in a 15% reduction in approval times.

- •Conducted detailed financial assessments, contributing to a 90% satisfaction rating from clients.

- •Hosted informative seminars, leading to increased community engagement and a 25% boost in new client acquisition.

- •Streamlined loan documentation processes, improving efficiency by 30%.

- •Assisted in the underwriting of over 200 loans, ensuring compliance with all applicable regulations.

- •Maintained an organized client database, supporting loan officers and enabling faster client service.

- •Developed clear, concise loan documentation reviews, reducing discrepancies by 10%.

Auto Loan Officer resume sample

- •Evaluated over 1,000 loan applications per year, resulting in a 20% increase in approved applications by identifying underrated applicants.

- •Developed tailored loan solutions, increasing customer satisfaction scores by 30% through personalized and responsive service.

- •Established partnerships with 50+ dealerships, enhancing cross-reference loan opportunities and growing the portfolio by 15% annually.

- •Mentored new loan officers, leading to a 25% reduction in onboarding time through effective training and development programs.

- •Streamlined loan processing times by 40% by implementing new CRM software tools, which improved overall efficiency.

- •Consistently exceeded monthly sales targets by 120% through strategic outreach and relationship management with prospective clients.

- •Increased loan application accuracy by 35% by standardizing assessment protocols and training staff on best practices.

- •Built strong relationships with customers, achieving a 95% customer retention rate through personalized service approaches.

- •Collaborated with financial institutions to facilitate 20% more seamless transactions for customers.

- •Maintained a comprehensive understanding of loan products and compliance regulations, keeping team informed on changes.

- •Achieved a 30% increase in customer referrals through proactive engagement and follow-up strategies.

- •Assessed over 800 auto loan applications and improved approval accuracy by 25% through precise credit analysis.

- •Increased loan closure rates by 15% by ensuring timely documentation and customer follow-ups.

- •Implemented a customer feedback system that improved service rating scores by 20% within six months.

- •Collaborated on marketing campaigns that increased new loan applications by 10% in a fiscal year.

- •Reviewed and processed auto loan documents efficiently, reducing processing errors by 15% annually.

- •Strengthened dealer relationships by presenting monthly financial reports and insights, improving transparency and trust.

- •Assisted with CRM database management, increasing data entry efficiency by 30% through streamlined workflow processes.

- •Contributed to a team effort that exceeded department sales goals by 25% through proactive communication and follow-ups.

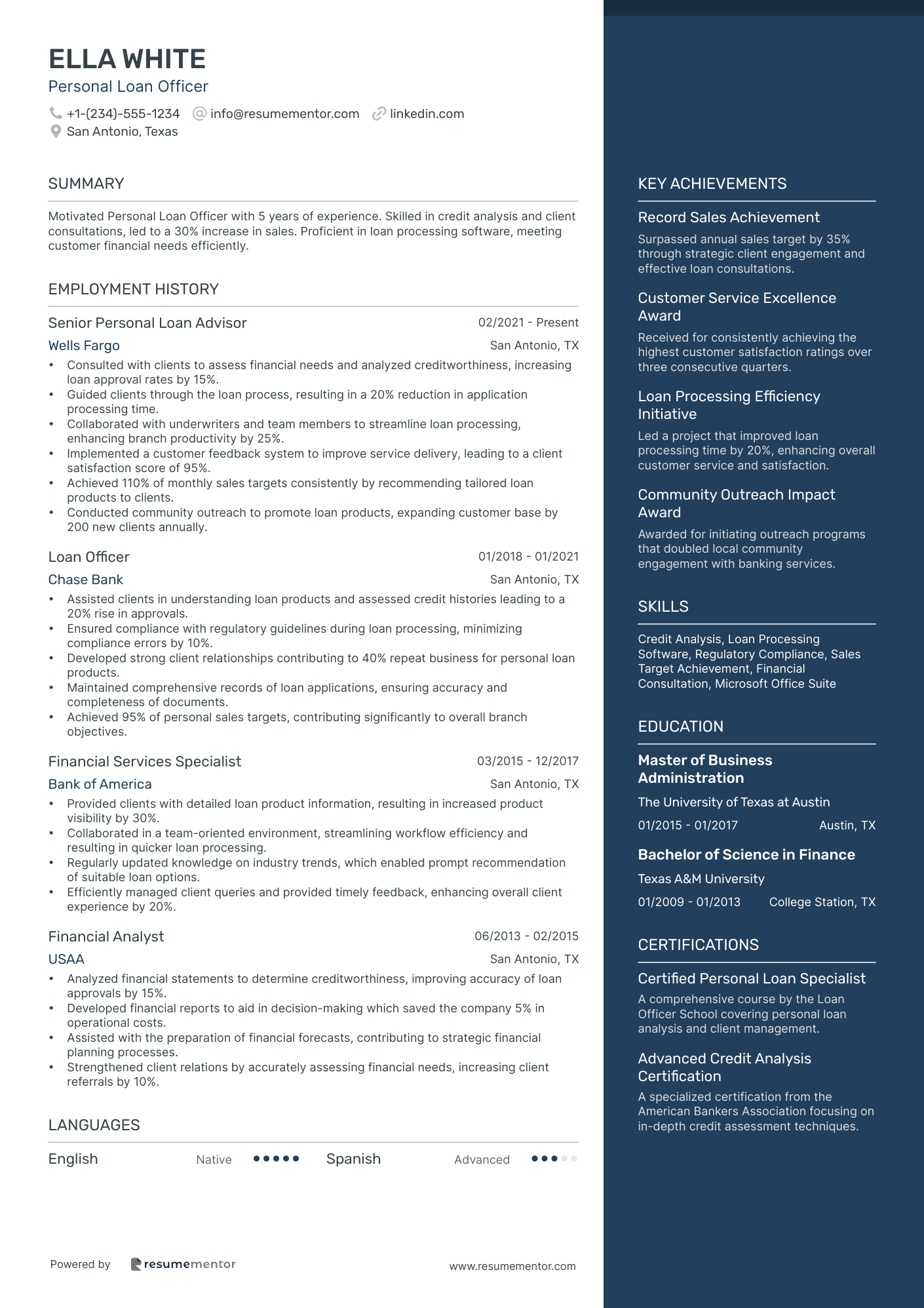

Personal Loan Officer resume sample

- •Consulted with clients to assess financial needs and analyzed creditworthiness, increasing loan approval rates by 15%.

- •Guided clients through the loan process, resulting in a 20% reduction in application processing time.

- •Collaborated with underwriters and team members to streamline loan processing, enhancing branch productivity by 25%.

- •Implemented a customer feedback system to improve service delivery, leading to a client satisfaction score of 95%.

- •Achieved 110% of monthly sales targets consistently by recommending tailored loan products to clients.

- •Conducted community outreach to promote loan products, expanding customer base by 200 new clients annually.

- •Assisted clients in understanding loan products and assessed credit histories leading to a 20% rise in approvals.

- •Ensured compliance with regulatory guidelines during loan processing, minimizing compliance errors by 10%.

- •Developed strong client relationships contributing to 40% repeat business for personal loan products.

- •Maintained comprehensive records of loan applications, ensuring accuracy and completeness of documents.

- •Achieved 95% of personal sales targets, contributing significantly to overall branch objectives.

- •Provided clients with detailed loan product information, resulting in increased product visibility by 30%.

- •Collaborated in a team-oriented environment, streamlining workflow efficiency and resulting in quicker loan processing.

- •Regularly updated knowledge on industry trends, which enabled prompt recommendation of suitable loan options.

- •Efficiently managed client queries and provided timely feedback, enhancing overall client experience by 20%.

- •Analyzed financial statements to determine creditworthiness, improving accuracy of loan approvals by 15%.

- •Developed financial reports to aid in decision-making which saved the company 5% in operational costs.

- •Assisted with the preparation of financial forecasts, contributing to strategic financial planning processes.

- •Strengthened client relations by accurately assessing financial needs, increasing client referrals by 10%.

Real Estate Loan Officer resume sample

- •Completed over $20 million in various real estate loans in 2022, enhancing bank's profitability by 15%.

- •Streamlined loan application processes, reducing approval times by 30% through improved documentation protocols.

- •Implemented a client-centric approach, resulting in a 25% increase in repeat business referrals from satisfied customers.

- •Developed training material for junior officers, positioning bank to maintain top tier standards and reduce errors by 10%.

- •Managed high-volume loan portfolios, achieving timely closure by fostering relationships with clients and real estate agents.

- •Participated in networking events and workshops, generating over 50 new leads quarterly and improving team's market visibility.

- •Processed more than 150 mortgage applications annually, securing a 95% approval rate by proficient financial assessment.

- •Formulated customized mortgage plans, elevating client satisfaction by 20% as evidenced by client feedback surveys.

- •Maintained regulatory compliance, reducing audit discrepancies by implementing updated compliance checklists.

- •Collaborated with cross-functional teams to ensure timely loan closures, fostering transparent communications system-wide.

- •Monitored market trends, advising clients accordingly, resulting in informed decisions and safeguarding client investments.

- •Assessed over 100 clients' financial capabilities monthly, recommending optimal loan products tailored to individual needs.

- •Coordinated between underwriters and clients, ensuring seamless progression of applications to closing stage with 98% efficiency.

- •Provided clients with competitive loan options, successfully closing over $12 million in new mortgages annually.

- •Enhanced processing workflows, leading to a 40% improvement in operational efficiency across the department.

- •Conducted meticulous credit analyses for residential real estate applications, improving approval precision by 15%.

- •Developed evaluation frameworks used across teams, resulting in strengthened financial assessments and lending decisions.

- •Managed a portfolio of high-profile clients with a focus on investment properties, resulting in $10 million in new funding sources.

- •Executed risk assessment protocols, enhancing loan quality while reducing default incidents by 5% annually.

Navigating resume writing as a loan officer can feel like finding the right key for a lock. While you excel in understanding finance and customer needs, capturing this on paper can be tricky. It's important to convey your ability to assess risk and make sound financial decisions, as this is what sets you apart. Your resume is your first chance to impress potential employers and make a lasting impact in a competitive job market.

A clear and simple resume format helps you emphasize your expertise in evaluating loan applications and managing client relationships. To achieve this, using a resume template can be beneficial. This tool offers a structured format, making it easier to organize and present your experience resume templates.

Your day-to-day skills like financial analysis and customer service are invaluable as a loan officer. However, translating these talents onto your resume can be daunting. Employers are looking for these skills to stand out plainly and concisely. With the right resume format, your accomplishments shine through, making your application more appealing to hiring managers.

Remember, your resume is more than a list of experiences; it's your professional story. It should reflect your expertise and dedication to helping others find the best loan options. With the right approach, finding the perfect job as a loan officer is within your reach.

Key Takeaways

- Creating a concise and clear resume format is crucial for highlighting skills like financial analysis and customer service, which are vital for loan officers.

- A chronological format is recommended for the finance industry by showcasing career progression and professional achievements effectively.

- When detailing work experience, focus on quantifiable results and accomplishments, and use strong action verbs to emphasize your impact.

- Including sections like certifications and relevant skills, both hard and soft, can enhance your resume’s appeal to hiring managers.

- Additional sections such as language skills, volunteer work, and personal interests can round out your resume, showing your diverse abilities and interests.

What to focus on when writing your loan officer resume

Your loan officer resume should effectively convey your expertise in financial analysis and customer relations, making it easy for recruiters to see your strengths. Highlighting your ability to evaluate loan applications and guide clients shows how you manage loan portfolios successfully.

How to structure your loan officer resume

- Contact Information — Start by providing your full name, phone number, email address, and LinkedIn profile. This ensures that recruiters can contact you without hassle and know where to find more about your professional background. Clear contact information is the first impression, setting the stage for a seamless hiring process.

- Professional Summary — Next, give a concise overview of your career highlights. Emphasize your expertise in loan processing and strong customer service skills to capture interest immediately. A compelling summary acts as a hook, inviting the recruiter to delve deeper into your resume.

- Work Experience — When detailing your job history, focus on roles where you assessed creditworthiness and advised clients on loan options. Using bullet points will help make your accomplishments clear and easy to read, demonstrating your practical impact in past positions. Building this foundation further supports your professional story.

- Education — Include your degrees and any certifications relevant to finance, such as a degree in finance, accounting, or an MLO license. Be sure to add graduation dates to give a complete picture, confirming your educational grounding in relevant areas. This academic backdrop complements your work experience.

- Skills — Highlight skills like financial analysis, customer relations, compliance knowledge, and proficiency with loan software. These demonstrate your ability to excel in the field, providing a quick snapshot of your professional toolkit. Clearly articulated skills paint a picture of your capabilities in action.

- Achievements — Finally, mention any awards or recognitions you've received for outstanding performance. This can underscore your success in loan origination and customer service, adding extra credibility to your candidacy. Noting achievements rounds out your accomplishments, making them tangible. Below, we'll explore each of these resume sections more in-depth from format to specifics, ensuring your resume is both comprehensive and compelling.

Which resume format to choose

Creating a standout loan officer resume starts with selecting a format that best highlights your professional journey. In the finance industry, a chronological format is most effective. It allows you to clearly demonstrate your career progression and showcase any advancements or achievements that speak to your reliability and expertise—qualities that are crucial in lending positions.

Choosing the right font can also make a significant difference in how your resume is perceived. Opt for fonts like Montserrat, Lato, or Raleway for a modern touch. These fonts not only provide a clean and professional look but also ensure readability, which is vital when presenting detailed financial information.

Consistently saving your resume as a PDF is a small but impactful step. It guarantees that your formatting remains as you intended when it's opened by potential employers, ensuring your resume always looks its best, regardless of the device used.

Paying attention to the layout is equally important. One-inch margins all around create a pleasing balance between text and white space, which helps maintain a neat and organized appearance. This balance makes it easier for hiring managers to quickly absorb the key details of your experience and skills.

Together, these choices ensure your resume effectively communicates your strengths as a loan officer, while presenting you as a polished and detail-oriented professional.

How to write a quantifiable resume experience section

A strong loan officer resume experience section grabs the attention of hiring managers by focusing on achievements and results, not just tasks. It should show how you've made a difference at previous jobs with clear, measurable accomplishments to demonstrate your value. Use bullet points for easy reading and structure this section with your most recent roles first, ensuring key details aren’t overlooked. By going back about 10-15 years, you can highlight job titles that align with the role you're targeting now. Tailoring your resume to the job description is crucial because it shows you’re the perfect fit for the position. Incorporating strong action verbs like “facilitated,” “increased,” “managed,” and “analyzed” enhances your abilities and makes them stand out. Here’s how an example could look:

- •Increased loan approval rate by 15% in 2022 through streamlined processing and enhanced client consultations.

- •Managed a portfolio of over 200 clients, contributing to a 25% growth in customer retention.

- •Facilitated training for 10 junior loan officers, elevating team performance by 30% in loan processing efficiency.

- •Analyzed market trends, leading to a 20% increase in loan product competitiveness.

This example clearly stands out by showing quantifiable results that prove your impact in previous roles. Each bullet gives concrete examples of how you've improved outcomes, effectively showcasing your real value to potential employers. Using percentages for improvements not only adds credibility but also makes it easy to visualize your achievements. Tailoring this section to fit the job ad ensures your skills and experience align perfectly with what employers are seeking, putting you ahead in the competitive job market.

Innovation-Focused resume experience section

An innovation-focused loan officer resume experience section should highlight your ability to develop and implement creative solutions that improve client interactions and streamline operations. Begin by identifying moments when you devised fresh approaches or tools that significantly benefited your team or clients. Reflect on any tech-savvy or unique strategies you used and how they led to measurable success. Present this information using active language to effectively communicate your initiative and the positive outcomes you achieved.

Make sure your duties and achievements tell a cohesive story about your innovative skills. Focus on projects where you spearheaded or collaborated on groundbreaking ideas that were successfully implemented. Clearly convey the challenges you faced, the creative solutions you brought to life, and the benefits that resulted. By keeping descriptions concise yet impactful, you ensure that your contributions are well-highlighted while maintaining the reader's interest.

Senior Loan Officer

First National Bank

June 2020 - Present

- Implemented a digital signature platform that reduced processing time by 40%, boosting client satisfaction.

- Developed a data-driven credit assessment tool which increased loan approval accuracy by 25%.

- Led a team to create an online portal for clients, increasing engagement and upsell opportunities by 30%.

- Introduced predictive analytics reporting that enhanced underwriting efficiency by identifying trends and risks.

Collaboration-Focused resume experience section

A collaboration-focused loan officer resume experience section should clearly demonstrate your ability to work effectively with others to achieve common goals. Think back on specific projects where teamwork played a crucial role. Describe your role in these projects and how you contributed to the team's success, highlighting the strategies you used to enhance communication and workflow. This not only emphasizes your collaborative abilities but also showcases how you turned teamwork into tangible outcomes, such as more loan approvals or heightened client satisfaction.

In your bullet points, detail your achievements and responsibilities using active verbs to illustrate your role in various team environments. Whether solving problems, engaging with cross-functional teams, or building strong client relationships, you should convey your ability to work together towards objectives. Include any recognition you received for your collaborative efforts to underscore your dedication to teamwork and shared success.

Senior Loan Officer

XYZ Financial Services

March 2018 - July 2022

- Worked closely with underwriters and credit analysts to optimize loan approval processes, boosting approvals by 20%.

- Led a cross-departmental team to streamline client communication, cutting response time by 30%.

- Facilitated weekly team meetings to discuss progress and challenges, ensuring project milestones were met.

- Collaborated with the IT department to develop a new tool that improved data accuracy, enhancing efficiency by 25%.

Project-Focused resume experience section

A project-focused loan officer resume experience section should clearly convey your specific contributions and achievements in each role. Start by outlining your responsibilities and how you added value to each project. Emphasize your ability to manage complex tasks and solve problems effectively while building strong client relationships. This approach helps to create a cohesive narrative that highlights your strengths.

When detailing your experience, include the dates, job title, and workplace. Follow this with bullet points, beginning each with an action verb to assertively showcase your achievements. Connect your actions with the outcomes, demonstrating the skills and impact you brought to each project. This method provides a clear and engaging story of your expertise and accomplishments, making it easier for potential employers to see the benefits you can bring to their team.

Senior Loan Officer

ABC Financial Services

May 2020 - September 2023

- Enhanced loan approval rates by 25% through a streamlined client assessment process.

- Cultivated enduring relationships with over 100 clients, boosting customer retention by 30%.

- Directed a team to implement loan processing improvements, cutting processing time by 40%.

- Swiftly resolved complex client issues, increasing satisfaction ratings by 15%.

Problem-Solving Focused resume experience section

A problem-solving-focused loan officer resume experience section should effectively highlight your ability to tackle challenges through clear examples and measurable results. Start by outlining the specific issues you encountered in your previous roles and follow with a description of the steps you took to address them. Ensure your language is straightforward and include tangible metrics to demonstrate the impact of your actions. Use active, decisive language to describe how you confidently handled these challenges, emphasizing your role in the solutions.

Showcase your accomplishments in a way that underscores your expertise in solving problems within a lending context. Highlight transferable skills such as analytical thinking, risk evaluation, and customer service to demonstrate your well-rounded abilities. Organize your experiences to highlight your logical approach, helping potential employers see you as a capable professional who can adeptly manage and resolve complex situations.

Senior Loan Officer

ABC Financial Group

Jan 2020 - Present

- Spotted trends leading to loan defaults and created a risk assessment model, which cut the default rate by 15%.

- Introduced a streamlined loan process, reducing approval time by 30% and boosting client satisfaction.

- Solved client issues by collaborating with underwriting and legal teams, leading to a 25% jump in loan closures.

- Coached team members on solving problems, improving team efficiency by 20%.

Write your loan officer resume summary section

A results-focused loan officer resume summary should effectively capture your key skills and experience, creating a cohesive narrative in just a few sentences. Especially valuable for seasoned professionals, the summary offers a quick look at your career journey. Keep it concise while highlighting your achievements in loan assessments, client communication, and financial analysis. Demonstrating expertise in customizing loans to suit clients' needs can set you apart. Consider this example of a resume summary, presented in JSON format:

This summary provides a quick overview of your accomplishments and skills, clearly showing why you're an ideal candidate. It seamlessly ties your past experiences to potential benefits for a future employer. For those newer to the field, a resume objective might fit better, focusing on future ambitions rather than past achievements. Blending both styles, a resume profile offers a comprehensive view, while a summary of qualifications highlights your top skills in bullet points. Understanding these differences empowers you to align your resume with your career stage and goals, ensuring it resonates with potential employers by clearly defining how your unique skills can fulfill their needs.

Listing your loan officer skills on your resume

A skills-focused loan officer resume should effectively showcase your abilities in a standalone section, or you can seamlessly blend them into your experience or summary sections. Highlighting strengths and soft skills, such as communication and problem-solving, will reveal your interpersonal abilities and personality traits, adding depth to your qualifications. At the same time, hard skills like financial analysis or understanding lending regulations spotlight the specific competencies you've developed through practice and education.

Incorporating skills and strengths into your resume as keywords can help you stand out and ensure that your application passes through applicant tracking systems. They not only highlight what you bring to the table but also emphasize your readiness for the loan officer position. Here’s an example of how to efficiently format a standalone skills section:

This setup effectively communicates your core competencies as a loan officer, giving potential employers a quick overview of your skills. Each skill is selected to align with the role's demands, providing a comprehensive insight into your expertise.

Best hard skills to feature on your loan officer resume

For a loan officer to excel, certain hard skills are crucial. These skills should communicate your technical knowledge and expertise in essential areas of the job:

Hard Skills

- Financial Analysis

- Risk Management

- Customer Relationship Management (CRM) Systems

- Credit Analysis

- Loan Origination Processes

- Mortgage Lending

- Financial Software Proficiency

- Regulatory Compliance

- Data Analysis

- Loan Pricing Models

- Underwriting

- Commercial Lending

- Accounting Practices

- Market Research

- Investment Strategies

Best soft skills to feature on your loan officer resume

Equally vital are the soft skills that demonstrate how you interact with others and manage various situations. For a loan officer, these skills are indispensable:

Soft Skills

- Communication

- Negotiation

- Problem-Solving

- Time Management

- Customer Service

- Attention to Detail

- Empathy

- Adaptability

- Decision-Making

- Conflict Resolution

- Teamwork

- Active Listening

- Persuasiveness

- Initiative

- Patience

How to include your education on your resume

A well-crafted education section is crucial for your loan officer resume. It highlights your academic background and showcases your qualifications. Tailor this section for the position you're applying to by including only relevant education. Details like GPA and honors can add value if they reflect positively on your academic performance. When including a GPA, list it as "GPA: X.XX/4.00" if your score is noteworthy. Honors such as cum laude should be noted directly on the same line as your degree. Here's how a degree should be listed: "Bachelor of Science in Finance." Below is an example of what not to do followed by a strong version, suitable for a loan officer position.

The second example is strong because it directly aligns with the finance field, relevant to a loan officer role. Including a GPA of 3.7 demonstrates academic prowess, making you stand out. The Bachelor of Science in Finance from a reputable institution further underscores your qualifications. There is no unnecessary location detail, focusing attention on pertinent data. This efficient format ensures your education is effectively highlighted on the resume.

How to include loan officer certificates on your resume

Including a certificates section in your loan officer resume is crucial as it showcases your qualifications and expertise. A certificates section highlights your commitment to professional development and industry standards. You can also include your most relevant certificate in the resume header to immediately capture the attention of hiring managers.

List the name of the certificate clearly. Include the date you earned the certificate to show your recent accomplishments. Add the issuing organization to provide credibility. If you choose to add a certificate in the header, place it after your name, for example: "John Doe, Certified Loan Officer".

In the dedicated certificates section, list multiple certificates that show your proficiency and continuous learning. This section should be easy to read and well-organized.

This example stands out because it highlights certificates from reputable organizations like the National Mortgage Licensing System and the American Bankers Association. The titles are relevant, demonstrating your alignment with key loan officer skills. Each entry is complete with the certificate name, date, and issuer, providing a clear and professional overview of your qualifications.

Extra sections to include in your loan officer resume

Creating a standout resume as a loan officer involves more than just listing your job experiences. Including unique sections can highlight your diverse skills and interests, making you a well-rounded candidate. Here's how to do just that.

- Language section — Add language skills to show your ability to serve a diverse clientele and navigate multiple markets. Proficiency in languages like Spanish or Mandarin can set you apart from other candidates.

- Hobbies and interests section — List hobbies and interests to showcase your personality and teamwork skills. Activities like chess or team sports can imply analytical thinking and collaboration.

- Volunteer work section — Include volunteer experiences to demonstrate your community involvement and empathy. Working with non-profits or local charities highlights your commitment to social responsibility.

- Books section — Mention books you’ve read to show your dedication to continuous learning and professional development. Relevant books on finance or personal growth can illustrate your industry knowledge and passion for self-improvement.

Using these sections thoughtfully can give your resume an edge, highlighting you as a talented and well-rounded loan officer.

In Conclusion

In conclusion, crafting an effective loan officer resume requires careful attention to detail and strategic presentation of your skills and experiences. Highlighting your expertise in financial analysis, risk management, and customer relations not only showcases your competencies but also aligns your profile with what recruiters seek. Make your resume compelling by grounding it in clear, quantitative accomplishments and personalizing it to fit the specific job opportunities you're targeting. Choosing the right format, such as a chronological one, effectively communicates your career progression and reliability—key qualities in the finance industry.

Remember to keep your resume clean and professional, with a modern font and consistent formatting. Your resume should not just be a document of past roles but a story of the value you bring to a potential employer. Focus on the soft skills that demonstrate your ability to collaborate, negotiate, and solve problems, as these are essential in the dynamic world of lending. Alongside showcasing your loan processing achievements, consider including less common sections that set you apart, such as language proficiencies or volunteer work.

By thoughtfully constructing your resume with these elements, you not only provide a snapshot of your career achievements but also project a forward-looking narrative that appeals to hiring managers. Ultimately, a well-rounded, quantifiable resume positions you as the ideal candidate in the competitive job market, ensuring your abilities and potential make a noteworthy impression.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.