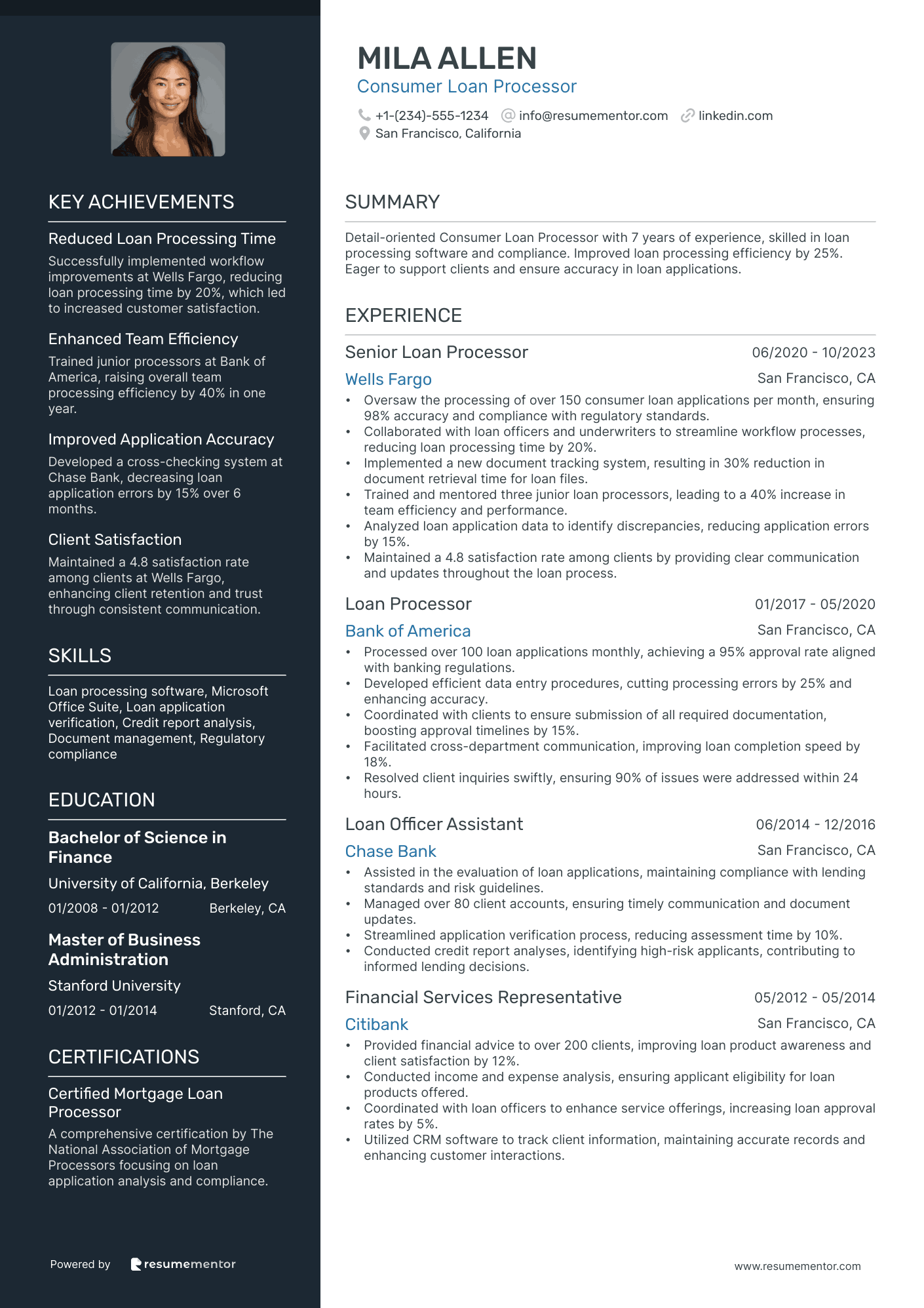

Loan Processor Resume Examples

Jul 18, 2024

|

12 min read

Unlock your career potential: Craft the perfect loan processor resume and ensure your skills truly measure up to industry standards. Learn tips and tricks to stand out and get hired in the competitive mortgage loan industry.

Rated by 348 people

Mortgage Loan Processor

Commercial Loan Processor

Consumer Loan Processor

Auto Loan Processor

Home Equity Loan Processor

Senior Mortgage Loan Processor

Junior Consumer Loan Processor

Reverse Mortgage Loan Processor

Loan Processing Team Lead

Loan Processing Specialist.

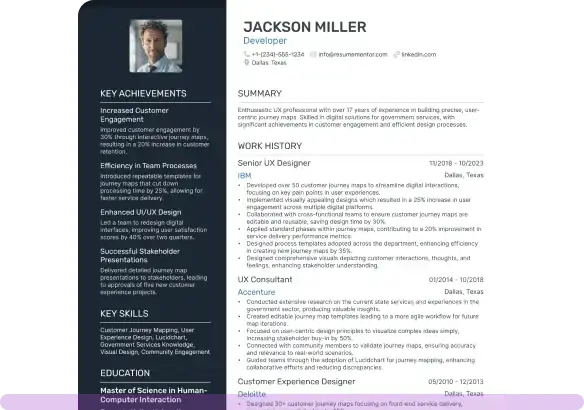

Mortgage Loan Processor resume sample

- •Processed over 100 loan applications per month, maintaining an accuracy rate of 98%, significantly reducing processing times.

- •Collaborated with loan officers on complex problem-solving initiatives, achieving a 20% increase in loan approval rates.

- •Streamlined documentation collection process, resulting in a 30% decrease in required follow-up from borrowers.

- •Enhanced borrower education, leading to a 15% reduction in application errors annually.

- •Developed and implemented a compliance checklist that increased adherence to regulatory guidelines by 25%.

- •Introduced new communication protocols, improving lender-borrower interaction efficiency by 40%.

- •Reviewed and verified borrower documentation for over 50 loan applications monthly, ensuring compliance with regulatory standards.

- •Resolved discrepancies in loan files within 48 hours, leading to a 10% increase in loan processing speed.

- •Facilitated communications between borrowers and underwriters, boosting customer satisfaction scores by 15%.

- •Managed the order and review of third-party services, reducing costs by 10% through vendor negotiations.

- •Advised borrowers on mortgage product options, resulting in a 25% increase in customer inquiries regarding additional products.

- •Completed processing of over 300 loans annually, maintaining a 95% customer satisfaction rate.

- •Initiated protocol changes that reduced document review times by 20%, significantly enhancing departmental productivity.

- •Implemented a borrower outreach program, decreasing overdue document submissions by 40%.

- •Consistently met deadlines in a high-volume environment, contributing to the team's 10% annual increase in processed loans.

- •Assisted in processing over 200 loan applications during peak seasons, maintaining high accuracy levels.

- •Coordinated with title insurance companies, ensuring 100% compliance with company policies.

- •Aided in the preparation of loan files for closing, resulting in zero post-closing issues.

- •Engaged in ongoing training to remain updated on evolving mortgage regulations and industry practices.

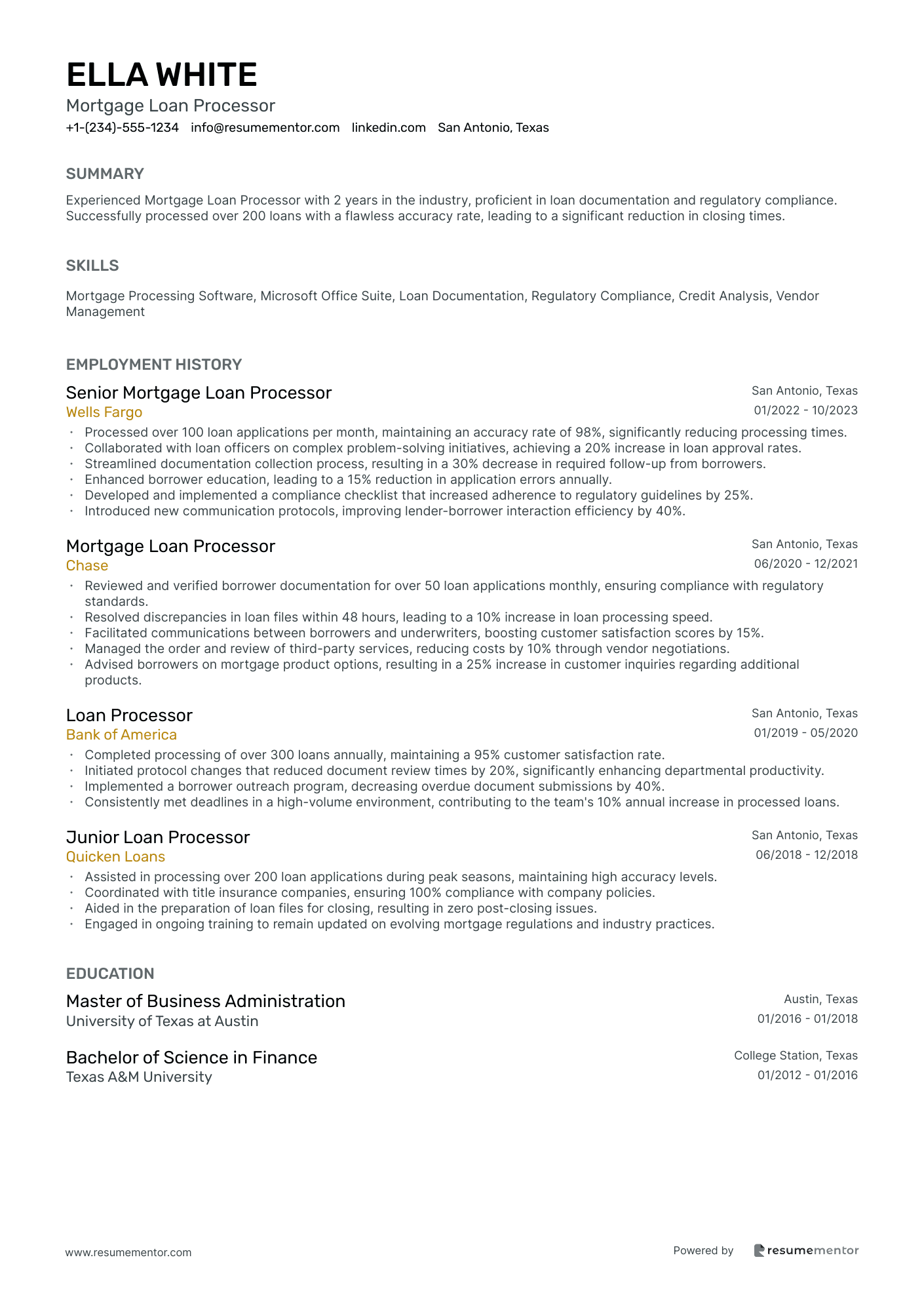

Commercial Loan Processor resume sample

- •Managed processing of over 500 commercial loan applications annually, ensuring 100% compliance with regulatory standards.

- •Collaborated with a team of 10 officers to streamline loan procedures, increasing processing efficiency by 30%.

- •Developed and maintained a tracking system for loan documentation, reducing data entry errors by 15%.

- •Conducted detailed credit analysis for high-value loan requests, contributing to 20% increase in approved loan volumes.

- •Enhanced client communication processes, resulting in a 25% increase in client satisfaction ratings.

- •Organized monthly training sessions for junior processors, boosting team's performance metrics by 10%.

- •Reviewed and completed over 300 commercial loan applications yearly, maintaining a 98% approval rate and ensuring policy adherence.

- •Led a key project to digitalize client interaction, improving data retrieval times by 40%.

- •Prepared comprehensive credit risk assessments, resulting in a more accurate prediction of loan default risks.

- •Streamlined documentation processes for underwriting, reducing loan turnaround time by 20%.

- •Provided exceptional support to senior underwriters, which led to an increase in department productivity by 15%.

- •Facilitated a reduction in loan processing times by 25% through effective coordination with cross-functional teams.

- •Processed high volumes of loan applications, averaging 20 new applications weekly, while ensuring minimal errors.

- •Implemented new methodologies in loan file maintenance, improving regulatory compliance adherence by 12%.

- •Assisted clients with comprehensive guidance through loan processes, achieving a client retention rate increase of 10%.

- •Provided critical financial analysis for client loan packages leading to an increase in application approval rates by 20%.

- •Supported senior financial officers in the development of loan terms that optimized client and bank interests.

- •Organized and maintained comprehensive loan documents, aiding in an administrative accuracy boost of 15%.

- •Developed effective communication strategies with clients that led to an expedited document collection process by 30%.

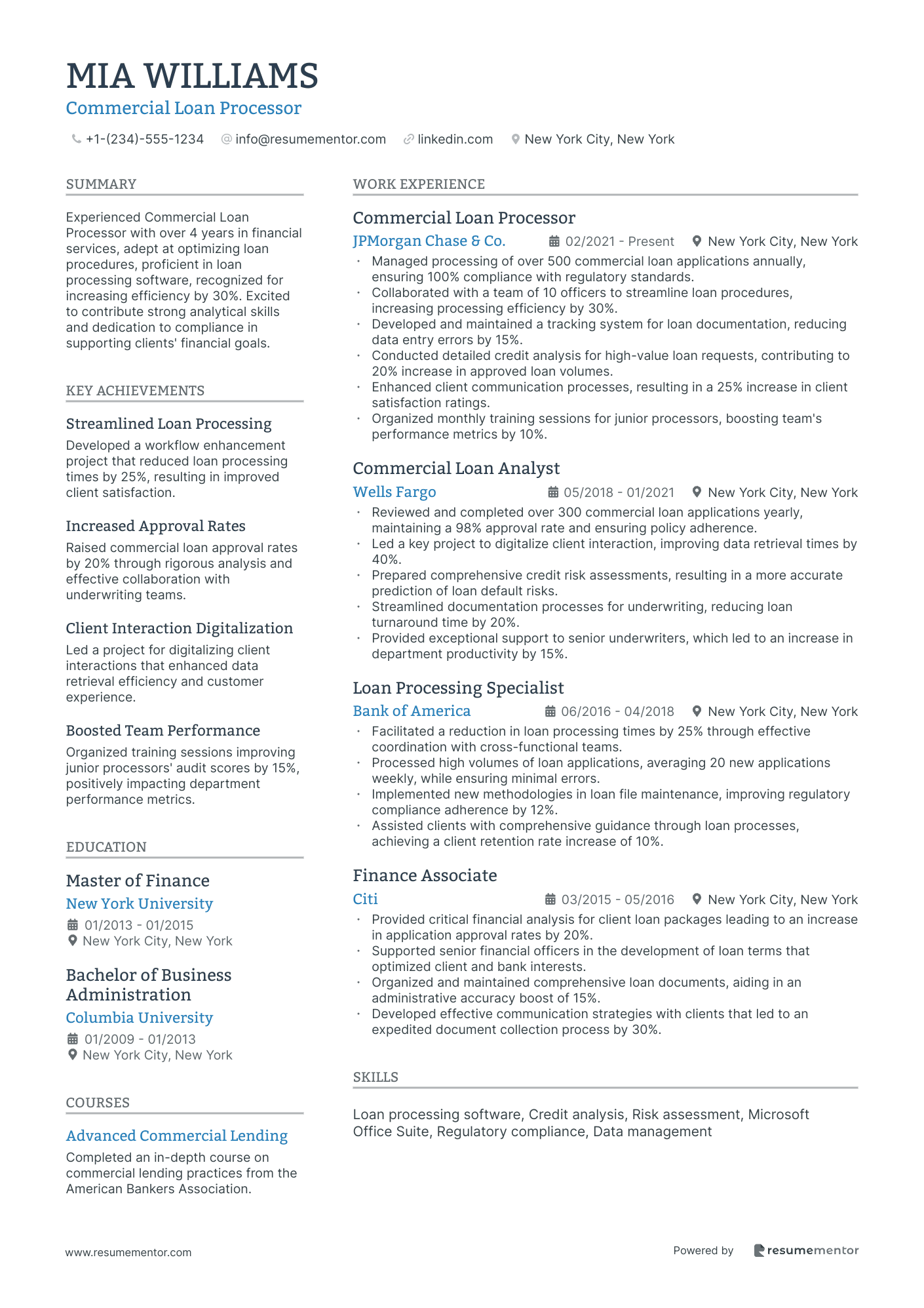

Consumer Loan Processor resume sample

- •Oversaw the processing of over 150 consumer loan applications per month, ensuring 98% accuracy and compliance with regulatory standards.

- •Collaborated with loan officers and underwriters to streamline workflow processes, reducing loan processing time by 20%.

- •Implemented a new document tracking system, resulting in 30% reduction in document retrieval time for loan files.

- •Trained and mentored three junior loan processors, leading to a 40% increase in team efficiency and performance.

- •Analyzed loan application data to identify discrepancies, reducing application errors by 15%.

- •Maintained a 4.8 satisfaction rate among clients by providing clear communication and updates throughout the loan process.

- •Processed over 100 loan applications monthly, achieving a 95% approval rate aligned with banking regulations.

- •Developed efficient data entry procedures, cutting processing errors by 25% and enhancing accuracy.

- •Coordinated with clients to ensure submission of all required documentation, boosting approval timelines by 15%.

- •Facilitated cross-department communication, improving loan completion speed by 18%.

- •Resolved client inquiries swiftly, ensuring 90% of issues were addressed within 24 hours.

- •Assisted in the evaluation of loan applications, maintaining compliance with lending standards and risk guidelines.

- •Managed over 80 client accounts, ensuring timely communication and document updates.

- •Streamlined application verification process, reducing assessment time by 10%.

- •Conducted credit report analyses, identifying high-risk applicants, contributing to informed lending decisions.

- •Provided financial advice to over 200 clients, improving loan product awareness and client satisfaction by 12%.

- •Conducted income and expense analysis, ensuring applicant eligibility for loan products offered.

- •Coordinated with loan officers to enhance service offerings, increasing loan approval rates by 5%.

- •Utilized CRM software to track client information, maintaining accurate records and enhancing customer interactions.

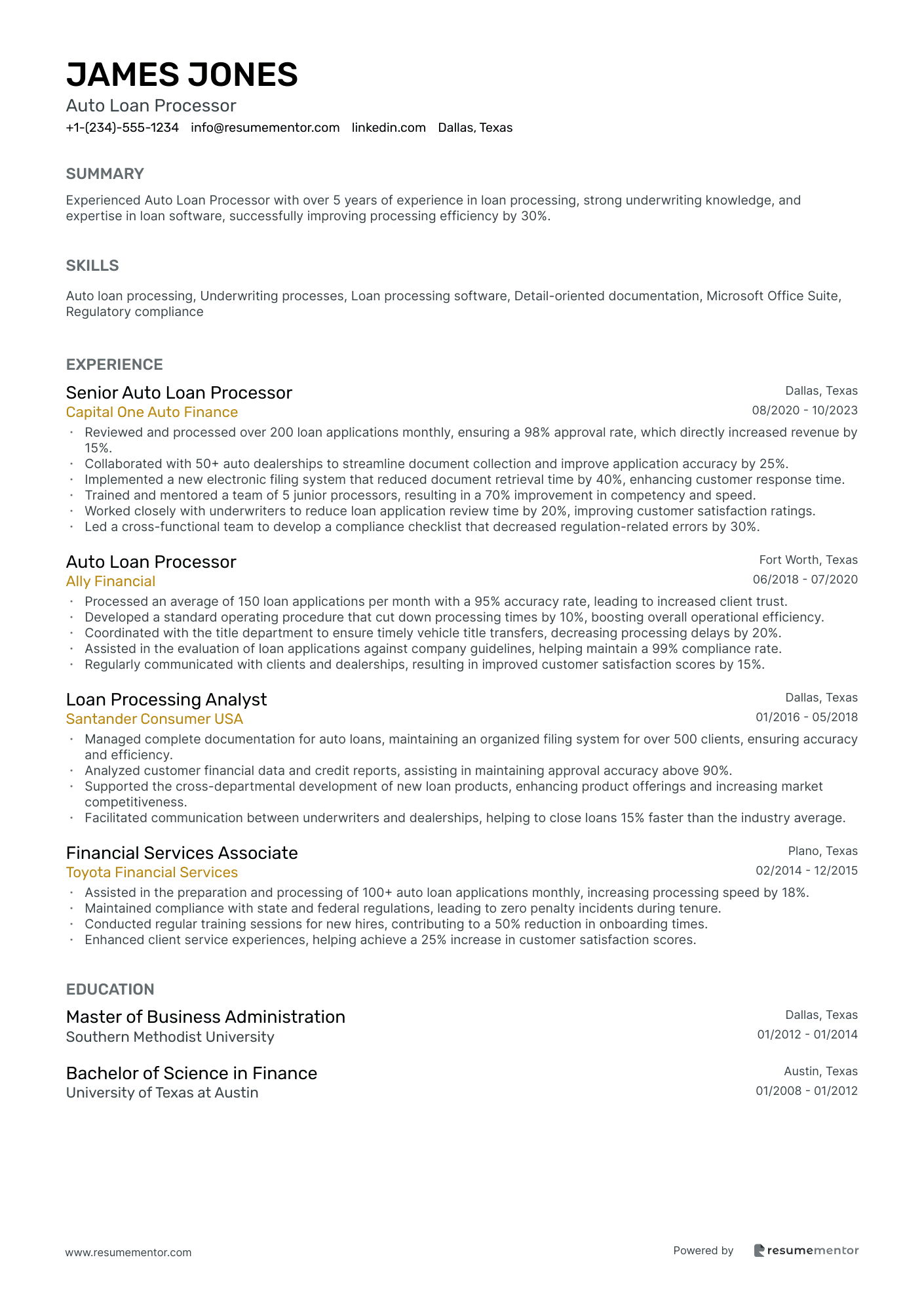

Auto Loan Processor resume sample

- •Reviewed and processed over 200 loan applications monthly, ensuring a 98% approval rate, which directly increased revenue by 15%.

- •Collaborated with 50+ auto dealerships to streamline document collection and improve application accuracy by 25%.

- •Implemented a new electronic filing system that reduced document retrieval time by 40%, enhancing customer response time.

- •Trained and mentored a team of 5 junior processors, resulting in a 70% improvement in competency and speed.

- •Worked closely with underwriters to reduce loan application review time by 20%, improving customer satisfaction ratings.

- •Led a cross-functional team to develop a compliance checklist that decreased regulation-related errors by 30%.

- •Processed an average of 150 loan applications per month with a 95% accuracy rate, leading to increased client trust.

- •Developed a standard operating procedure that cut down processing times by 10%, boosting overall operational efficiency.

- •Coordinated with the title department to ensure timely vehicle title transfers, decreasing processing delays by 20%.

- •Assisted in the evaluation of loan applications against company guidelines, helping maintain a 99% compliance rate.

- •Regularly communicated with clients and dealerships, resulting in improved customer satisfaction scores by 15%.

- •Managed complete documentation for auto loans, maintaining an organized filing system for over 500 clients, ensuring accuracy and efficiency.

- •Analyzed customer financial data and credit reports, assisting in maintaining approval accuracy above 90%.

- •Supported the cross-departmental development of new loan products, enhancing product offerings and increasing market competitiveness.

- •Facilitated communication between underwriters and dealerships, helping to close loans 15% faster than the industry average.

- •Assisted in the preparation and processing of 100+ auto loan applications monthly, increasing processing speed by 18%.

- •Maintained compliance with state and federal regulations, leading to zero penalty incidents during tenure.

- •Conducted regular training sessions for new hires, contributing to a 50% reduction in onboarding times.

- •Enhanced client service experiences, helping achieve a 25% increase in customer satisfaction scores.

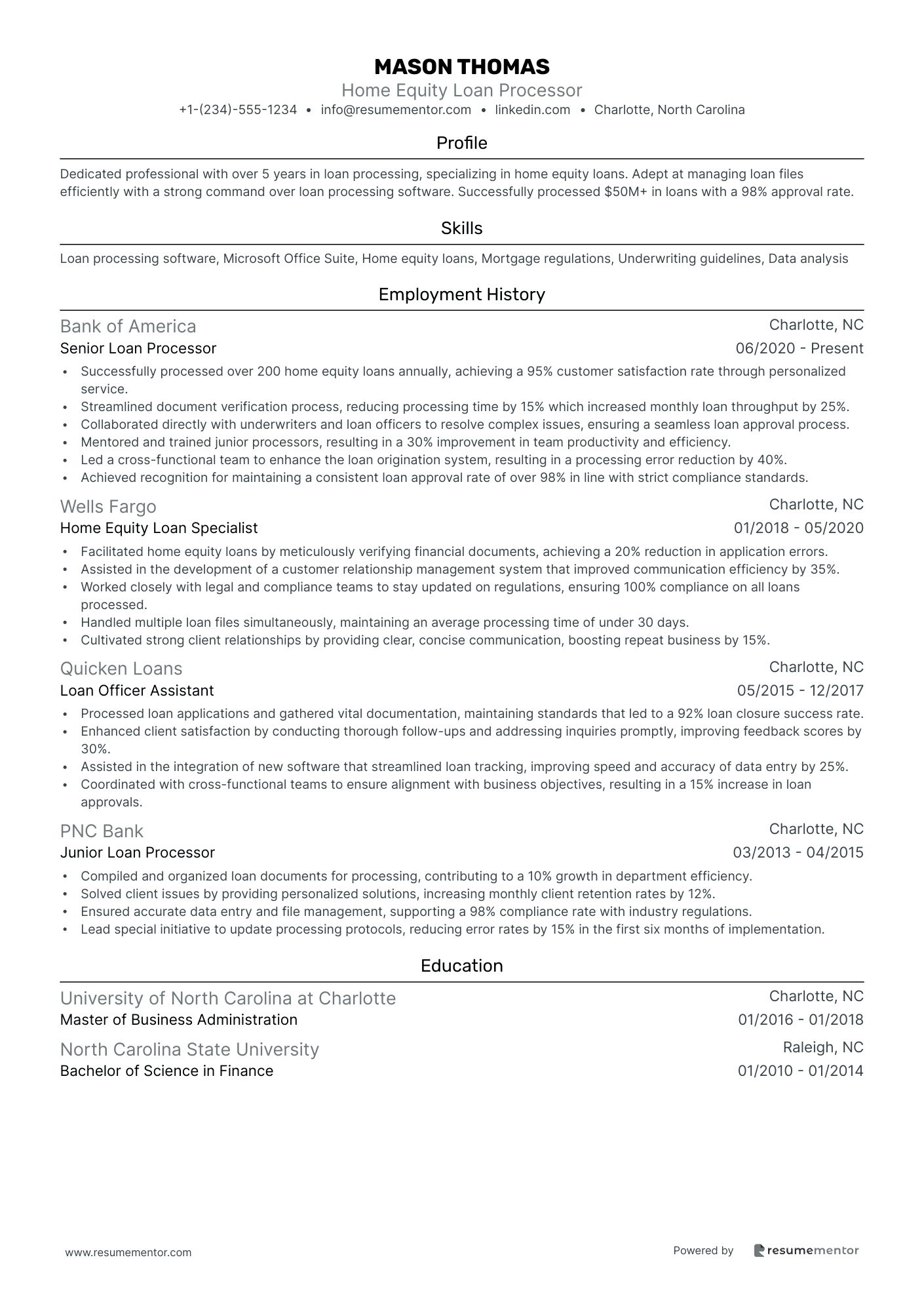

Home Equity Loan Processor resume sample

- •Successfully processed over 200 home equity loans annually, achieving a 95% customer satisfaction rate through personalized service.

- •Streamlined document verification process, reducing processing time by 15% which increased monthly loan throughput by 25%.

- •Collaborated directly with underwriters and loan officers to resolve complex issues, ensuring a seamless loan approval process.

- •Mentored and trained junior processors, resulting in a 30% improvement in team productivity and efficiency.

- •Led a cross-functional team to enhance the loan origination system, resulting in a processing error reduction by 40%.

- •Achieved recognition for maintaining a consistent loan approval rate of over 98% in line with strict compliance standards.

- •Facilitated home equity loans by meticulously verifying financial documents, achieving a 20% reduction in application errors.

- •Assisted in the development of a customer relationship management system that improved communication efficiency by 35%.

- •Worked closely with legal and compliance teams to stay updated on regulations, ensuring 100% compliance on all loans processed.

- •Handled multiple loan files simultaneously, maintaining an average processing time of under 30 days.

- •Cultivated strong client relationships by providing clear, concise communication, boosting repeat business by 15%.

- •Processed loan applications and gathered vital documentation, maintaining standards that led to a 92% loan closure success rate.

- •Enhanced client satisfaction by conducting thorough follow-ups and addressing inquiries promptly, improving feedback scores by 30%.

- •Assisted in the integration of new software that streamlined loan tracking, improving speed and accuracy of data entry by 25%.

- •Coordinated with cross-functional teams to ensure alignment with business objectives, resulting in a 15% increase in loan approvals.

- •Compiled and organized loan documents for processing, contributing to a 10% growth in department efficiency.

- •Solved client issues by providing personalized solutions, increasing monthly client retention rates by 12%.

- •Ensured accurate data entry and file management, supporting a 98% compliance rate with industry regulations.

- •Lead special initiative to update processing protocols, reducing error rates by 15% in the first six months of implementation.

Senior Mortgage Loan Processor resume sample

- •Led a team to process over 1,200 mortgage loan applications annually, increasing efficiency by 25% through process optimization.

- •Developed and implemented a cross-functional communication plan that reduced document submission errors by 30% within the first year.

- •Facilitated the successful onboarding and training of 5 junior processors, raising their performance to meet company standards.

- •Conducted quality control checks resulting in the identification and resolution of discrepancies pre-underwriting, reducing delays by 15%.

- •Maintained compliance with all regulatory requirements, passing all audit reviews with zero noted violations during each assessment.

- •Improved client satisfaction by 20% through proactive communication and issue resolution, enhancing overall service experience.

- •Successfully processed 1,000+ mortgage applications per year, ensuring 98% accuracy and compliance with regulatory standards.

- •Collaborated with underwriters and loan officers to minimize processing times, reducing loan approval process by 2 days on average.

- •Introduced a documentation tracking system that cut data entry errors by 20%, improving processing accuracy.

- •Participated in the development of a streamlined processing workflow, improving productivity by 15% across the mortgage department.

- •Conducted comprehensive reviews of income, assets, and appraisals, maintaining an approval rate above industry average.

- •Managed a portfolio of high-value clients, ensuring delivery of premium processing service and maintaining a 95% customer retention rate.

- •Reviewed loan files and supporting documents with a 98% accuracy rate before submission to underwriting.

- •Assisted in developing training materials for processor development workshops, enhancing team knowledge base.

- •Reduced processing time for long-term clients by 10% through personalized service plans and improved document management.

- •Generated and increased loan sales volume by 18% through effective lead management and personalized client consultations.

- •Worked closely with applicants to gather necessary documentation, achieving a 100% completion rate on applications.

- •Streamlined communication between clients and processing teams, enhancing approval rates and reducing client wait times.

- •Provided mentorship to junior loan officers contributing to 15% increase in their customer satisfaction scores.

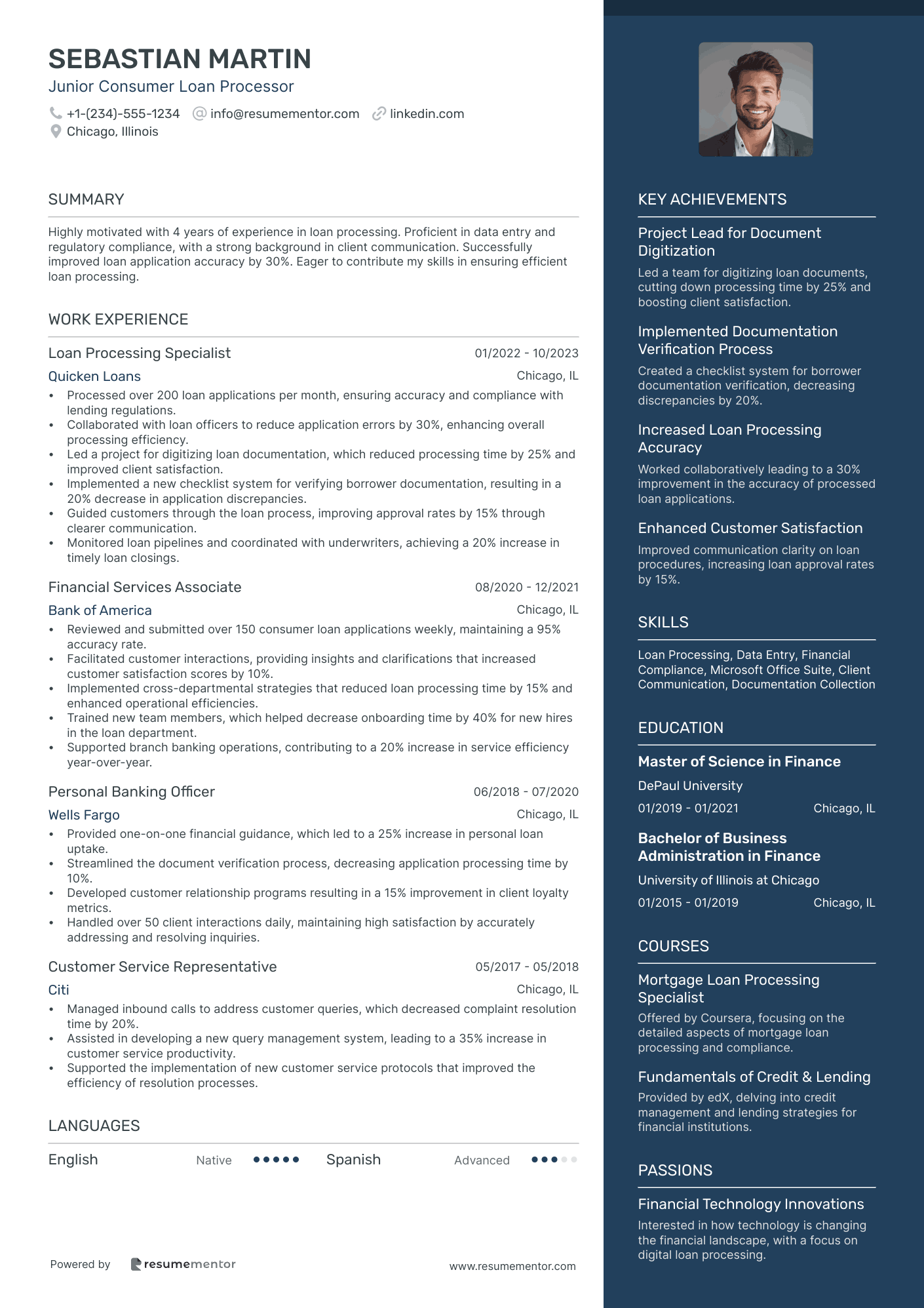

Junior Consumer Loan Processor resume sample

- •Processed over 200 loan applications per month, ensuring accuracy and compliance with lending regulations.

- •Collaborated with loan officers to reduce application errors by 30%, enhancing overall processing efficiency.

- •Led a project for digitizing loan documentation, which reduced processing time by 25% and improved client satisfaction.

- •Implemented a new checklist system for verifying borrower documentation, resulting in a 20% decrease in application discrepancies.

- •Guided customers through the loan process, improving approval rates by 15% through clearer communication.

- •Monitored loan pipelines and coordinated with underwriters, achieving a 20% increase in timely loan closings.

- •Reviewed and submitted over 150 consumer loan applications weekly, maintaining a 95% accuracy rate.

- •Facilitated customer interactions, providing insights and clarifications that increased customer satisfaction scores by 10%.

- •Implemented cross-departmental strategies that reduced loan processing time by 15% and enhanced operational efficiencies.

- •Trained new team members, which helped decrease onboarding time by 40% for new hires in the loan department.

- •Supported branch banking operations, contributing to a 20% increase in service efficiency year-over-year.

- •Provided one-on-one financial guidance, which led to a 25% increase in personal loan uptake.

- •Streamlined the document verification process, decreasing application processing time by 10%.

- •Developed customer relationship programs resulting in a 15% improvement in client loyalty metrics.

- •Handled over 50 client interactions daily, maintaining high satisfaction by accurately addressing and resolving inquiries.

- •Managed inbound calls to address customer queries, which decreased complaint resolution time by 20%.

- •Assisted in developing a new query management system, leading to a 35% increase in customer service productivity.

- •Supported the implementation of new customer service protocols that improved the efficiency of resolution processes.

Reverse Mortgage Loan Processor resume sample

- •Processed over 200 reverse mortgage applications annually, resulting in a 20% increase in loan approvals.

- •Designed a tracking system that improved communication with clients, enhancing customer satisfaction scores by 15%.

- •Implemented a verification procedure that reduced document errors by 30%, streamlining the underwriting process.

- •Collaborated with underwriters to resolve complex mortgage issues, increasing overall team efficiency by 10%.

- •Trained junior processors in reverse mortgage regulations, boosting department knowledge base and compliance rates.

- •Facilitated communication between loan officers and clients, ensuring timely submission of required documentation.

- •Led a team to process mortgage applications with an accuracy rate exceeding 98%, surpassing department benchmarks.

- •Developed training modules for new hires, reducing onboarding time by 25% over one year.

- •Assisted in creating policy manuals that ensured compliance with evolving federal mortgage regulations.

- •Coordinated with IT to implement software updates that improved processing speeds by 18%.

- •Worked closely with clients to resolve inquiries, achieving a customer retention rate of 90% year-over-year.

- •Processed an average of 150 loan applications monthly, achieving a 95% approval rate from underwriting.

- •Implemented a digital document verification process that cut down processing time by 10%.

- •Ensured compliance with federal mortgage regulations, avoiding penalties or legal issues.

- •Participated in cross-department training to improve understanding of full mortgage lifecycle.

- •Conducted detailed audits of loan files, leading to a reduction in application errors by 20%.

- •Collaborated with loan officers to develop strategies that increased closing rates by 12%.

- •Produced weekly reports on loan status, improving department transparency and decision-making.

- •Supported the implementation of a new loan origination system, enhancing overall workflow efficiency.

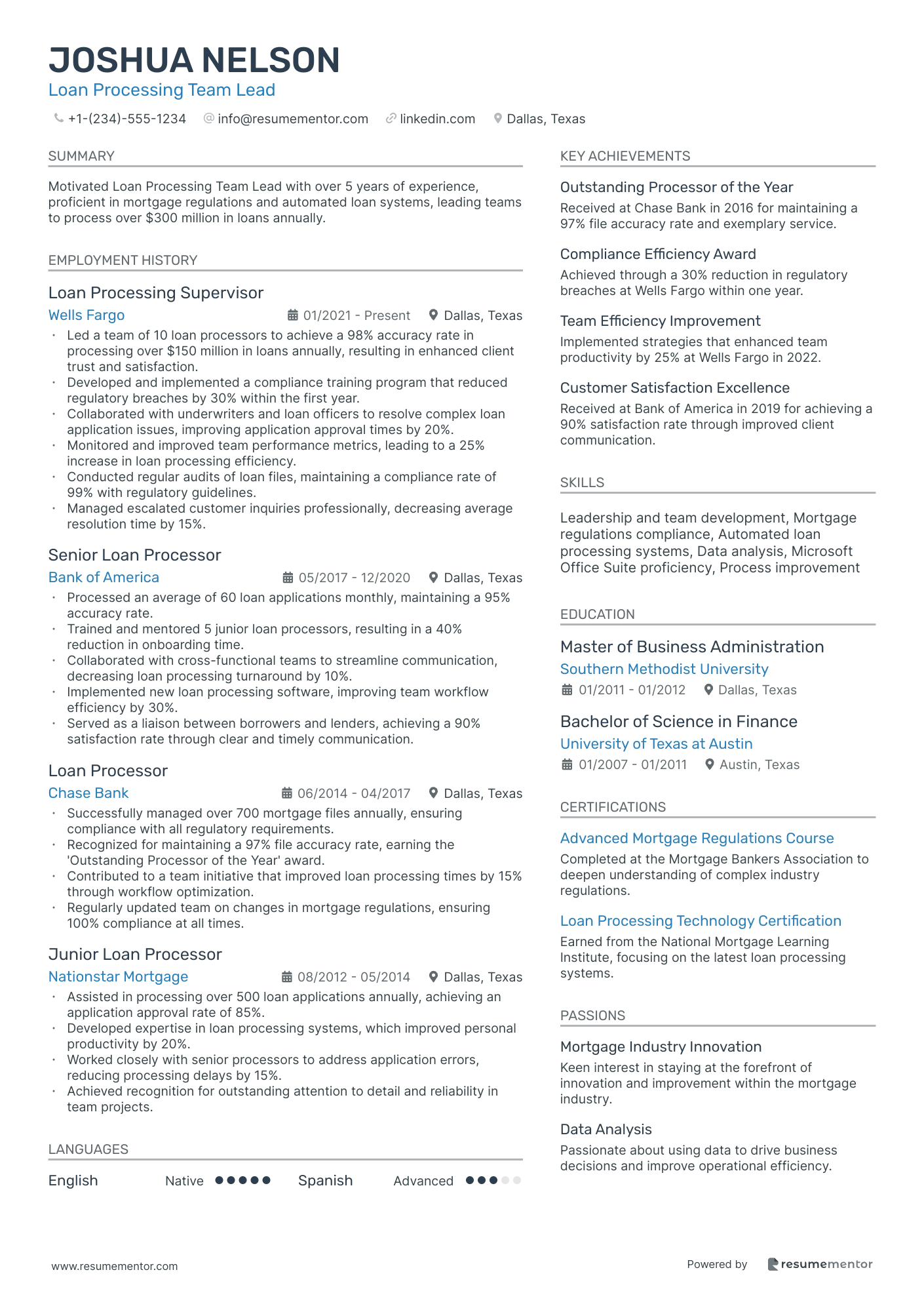

Loan Processing Team Lead resume sample

- •Led a team of 10 loan processors to achieve a 98% accuracy rate in processing over $150 million in loans annually, resulting in enhanced client trust and satisfaction.

- •Developed and implemented a compliance training program that reduced regulatory breaches by 30% within the first year.

- •Collaborated with underwriters and loan officers to resolve complex loan application issues, improving application approval times by 20%.

- •Monitored and improved team performance metrics, leading to a 25% increase in loan processing efficiency.

- •Conducted regular audits of loan files, maintaining a compliance rate of 99% with regulatory guidelines.

- •Managed escalated customer inquiries professionally, decreasing average resolution time by 15%.

- •Processed an average of 60 loan applications monthly, maintaining a 95% accuracy rate.

- •Trained and mentored 5 junior loan processors, resulting in a 40% reduction in onboarding time.

- •Collaborated with cross-functional teams to streamline communication, decreasing loan processing turnaround by 10%.

- •Implemented new loan processing software, improving team workflow efficiency by 30%.

- •Served as a liaison between borrowers and lenders, achieving a 90% satisfaction rate through clear and timely communication.

- •Successfully managed over 700 mortgage files annually, ensuring compliance with all regulatory requirements.

- •Recognized for maintaining a 97% file accuracy rate, earning the 'Outstanding Processor of the Year' award.

- •Contributed to a team initiative that improved loan processing times by 15% through workflow optimization.

- •Regularly updated team on changes in mortgage regulations, ensuring 100% compliance at all times.

- •Assisted in processing over 500 loan applications annually, achieving an application approval rate of 85%.

- •Developed expertise in loan processing systems, which improved personal productivity by 20%.

- •Worked closely with senior processors to address application errors, reducing processing delays by 15%.

- •Achieved recognition for outstanding attention to detail and reliability in team projects.

Loan Processing Specialist. resume sample

- •Reviewed over 300 loan applications monthly, ensuring compliance with state and federal regulations, improving accuracy by 20%.

- •Facilitated communication between loan officers and clients, resulting in a 25% increase in client satisfaction.

- •Implemented a new follow-up system for outstanding loan documents, decreasing processing time by 10%.

- •Trained 5 junior processors, enhancing team efficiency and achieving a 15% reduction in training time.

- •Managed a loan pipeline of 100+ loans daily, ensuring an 85% on-time closing rate.

- •Collaborated with underwriters to identify and resolve issues, increasing loan approval rates by 12%.

- •Supported loan officers by assessing 200 loan applications per month, maintaining a 95% accuracy rate.

- •Coordinated with legal teams to ensure all loan documentation met compliance standards, improving processing reliability.

- •Enhanced data entry processes for loan applications, leading to a 15% reduction in input errors.

- •Liaised with clients to resolve loan inquiries, improving customer communication scores by 30%.

- •Worked on a team implementing new loan software, resulting in a 20% improvement in processing speed.

- •Processed and reviewed mortgage documents for compliance, achieving a 90% first-pass approval rate.

- •Streamlined the document review process, decreasing turn-around time by 15%.

- •Assisted underwriters by preparing detailed loan application reports, enhancing decision-making efficiency.

- •Managed client communications for mortgage applications, boosting client feedback scores by 25%.

- •Assisted with over 250 client files, ensuring thoroughness and accuracy during the application stages.

- •Contributed to a team project that enhanced the customer service strategy, increasing client retention by 18%.

- •Updated loan processing system protocols, improving overall efficiency by 10%.

- •Participated in cross-departmental meetings to align process improvements, reducing redundant tasks by 12%.

Navigating the job market as a loan processor can feel like steering a ship through a foggy sea, where a well-crafted resume serves as your essential compass. To secure a rewarding job in the financial sector, it's crucial to showcase your financial expertise and attention to detail effectively. Highlighting these strengths in a concise way can be challenging, but it's key to standing out.

As a loan processor, every day you juggle complex financial data, communicate with clients, and demonstrate proficiency with various loan processing systems. These skills are the backbone of your professional identity, and your resume should reflect that clearly. This guide is designed to help you articulate these strengths and become the ideal candidate for your intended role.

Using a well-designed resume template can streamline this process. It provides a solid structure, allowing you to focus on what truly matters—capturing your professional journey in a compelling way. This approach ensures your experiences resonate with potential employers and enhance your appeal.

Remember, your resume is more than just a document; it’s your personal brand. Thoughtful crafting can open doors to new opportunities and make you stand out in a competitive market. With the right strategy, you can transform your resume into a powerful tool that highlights your value and propels your career forward.

Key Takeaways

- Effective resumes for loan processors highlight financial expertise and attention to detail, showcasing skills such as handling loan documentation and meeting deadlines.

- The use of a well-designed resume template can help focus on crafting a coherent narrative of your professional journey, making your experiences stand out to employers.

- A chronological format is recommended to highlight work history and career progression, using modern fonts like Raleway and exporting the resume as PDF for consistency across platforms.

- The resume experience section should include specific, measurable achievements and use active language, ensuring relevance to the job description and emphasizing skills such as efficiency and communication.

- Incorporate sections like education, certifications, and additional areas like volunteer work or professional affiliations to present a comprehensive view of your skills and dedication to the field.

What to focus on when writing your loan processor resume

A loan processor resume should clearly highlight your skills in handling loan documentation, demonstrating your keen eye for detail and ability to meet tight deadlines. This helps recruiters recognize your organizational strengths and proficiency with financial software, which are crucial for success in this role.

How to structure your loan processor resume

- Contact Information — Begin with your name, phone number, and professional email address prominently displayed. Ensure this information is current and professional, as it forms the first impression recruiters have of you. Making it easy for them to contact you is a fundamental but essential step in the hiring process.

- Professional Summary — Craft a brief yet compelling statement summarizing your experience in loan processing. Focus on your unique skills and achievements that set you apart in the field. Use clear, active language to convey confidence and expertise, making it easy for recruiters to quickly grasp your professional value.

- Work Experience — Detail your job history in reverse chronological order to provide a clear progression of your career. Highlight roles that involved significant tasks like processing loans and verifying documents, and note any collaborative efforts with clients or financial teams. The emphasis here should be on practical experience that translates directly into the role you’re applying for.

- Skills — This section should cover specific expertise that is directly relevant to loan processing. Include familiarity with loan origination software, a thorough understanding of federal and state regulations, and robust communication skills. Clearly linking these skills to the demands of the job helps reinforce your readiness for the position.

- Education — List your academic credentials, focusing on degrees or certifications that are significant in finance or banking. Additional coursework or relevant workshops can also bolster your application here and show your dedication to professional growth.

- Certifications — Don’t forget vital certifications such as the Mortgage Loan Processor Certification. Including such qualifications distinguishes you from other candidates and demonstrates your commitment to the field.

To further enrich your resume, consider adding sections like Volunteer Experience or Professional Affiliations, which can show a broader commitment to the finance industry. This comprehensive approach ensures you're well prepared to delve deeper into each critical section of your resume below.

Which resume format to choose

A loan processor resume benefits greatly from a chronological format. This style highlights your work history and career progression, making it easy for employers to see how your experience aligns with their needs. It organizes your professional journey in a way that naturally draws attention to your most relevant roles.

The choice of font can enhance this first impression. Selecting modern fonts like Raleway, Lato, or Montserrat ensures clarity and readability, preventing your resume from looking outdated. These fonts are subtle yet impactful, letting your qualifications take center stage.

When it comes to file type, always choose a PDF. This format locks in your carefully adjusted design and layout across all viewing platforms, ensuring that who you are and what you have achieved in your career comes across clearly and professionally.

Maintaining one-inch margins on all sides helps your resume look balanced and clean. This consistent framework not only keeps the text organized but also makes it easy for recruiters to skim through your qualifications without distraction.

Together, these elements—format, font, file type, and margins—create a cohesive and professional resume. They allow your skills and experiences as a loan processor to shine, making it straightforward for potential employers to assess your fit for the role.

How to write a quantifiable resume experience section

Your loan processor resume's experience section is critical for showcasing your skills and achievements to employers. Focus on specific, measurable accomplishments, and tailor each entry to match the job you’re targeting. Structure your experience with clear headings for each role, highlighting recent, relevant positions. This section is the core of your resume, serving as proof of your abilities.

List your roles starting with the most recent to demonstrate career progression. Typically, cover experiences from the last 10-15 years unless earlier roles directly apply to your career goals. Include job titles that closely match your desired position, ensuring relevance. Tailor your resume by aligning duties and achievements with the job description, using strong action verbs like “developed,” “improved,” and “managed” to convey impact and initiative effectively. Here’s how your experience section might look when applying these tips:

- •Boosted loan processing speed by 20% in a year by introducing new software.

- •Managed over 100 loans monthly, achieving a 98% approval rate.

- •Cut processing time by 30% through a streamlined review process.

- •Led five junior processors, increasing team productivity by 15% in two years.

This section excels by linking achievements with real results, showing the candidate's impact in meaningful ways. Specific data like percentages and numbers make the accomplishments clear and credible. Each bullet point builds on key skills, such as efficiency and leadership, ensuring relevance to loan processing. This approach connects directly with job ads, proving to employers that the candidate is well-suited to meet their needs.

Skills-Focused resume experience section

A skills-focused loan processor resume experience section should clearly demonstrate the abilities that set you apart in this field, such as attention to detail and effective communication. To begin, identify the key skills that are vital for a loan processor and highlight your achievements related to these competencies. Instead of simply listing tasks, focus on how your contributions made a positive difference in your previous workplace. Use specific, measurable examples to showcase the tangible results you achieved, painting a compelling picture for potential employers.

For a cohesive and impactful experience section, start with your job title and the company's name. Organize your responsibilities and successes using bullet points for clarity. Begin each point with an action verb, providing concrete evidence of your accomplishments, such as improved processes or increased customer satisfaction. Each bullet should revolve around a particular skill or achievement, making your strengths easy to recognize. Here’s how your experience section might look:

Loan Processor

XYZ Financial Inc.

June 2018 - July 2023

- Processed over 200 loan applications monthly, ensuring quicker turnarounds with 98% accuracy.

- Developed a new tracking system that cut processing time by 15% and boosted workflow efficiency.

- Worked with cross-functional teams to streamline documentation, increasing team productivity by 20%.

- Mentored junior staff, enhancing team skills and reducing error rates by 10%.

Collaboration-Focused resume experience section

A Collaboration-Focused loan processor resume experience section should highlight how effectively you work with team members and different departments to achieve shared objectives. You should showcase your communication skills and the role you played in team projects. It's crucial to illustrate not just what you did, but how your teamwork led to improvements in processes, communication, or overall team performance. Use specific examples to demonstrate your impact while keeping the descriptions straightforward.

Consider instances where teamwork was central to success. For example, recount a time you collaborated with a team to streamline a loan processing system. Explain how your ideas or feedback contributed to better team collaboration or increased process efficiency. This approach will highlight how your teamwork skills have made a positive impact in previous workplaces, and convey how you can bring these strengths to a new role.

Loan Processor

XYZ Financial

January 2021 - Present

- Partnered with underwriters to reduce loan approval time by 30%, enhancing client satisfaction.

- Coordinated with the sales team to ensure timely and accurate information flow, improving process efficiency.

- Contributed to developing a shared platform for loan tracking, which streamlined interdepartmental communication.

- Organized weekly meetings with team members to address challenges and foster a more cohesive approach to problem-solving.

Result-Focused resume experience section

A result-focused loan processor resume experience section should emphasize your ability to achieve significant outcomes. Start by highlighting key skills and specific accomplishments that align with the job requirements. Use active language to describe your tasks, focusing on outcomes rather than just responsibilities. Highlighting achievements with quantifiable results, such as improvements in efficiency or customer satisfaction, effectively demonstrates your capabilities. This approach provides concrete evidence of your successes and paints a clear picture of your role impact.

Organize this section by including your job title, company name, and the dates you worked there. Use bullet points to outline distinct contributions and their results, showcasing a range of skills. Each point should build on the last, reflecting professional growth and a broadening of responsibilities. This strategy ensures your experience comes across as comprehensive and impactful, illustrating your ability to drive results in various areas.

Loan Processor

XYZ Financial Services

January 2020 - Present

- Processed over 150 loan applications monthly, maintaining a 98% approval accuracy rate.

- Implemented a new tracking system that cut application processing time by 25%.

- Worked closely with loan officers to improve customer experience, leading to a 30% rise in positive feedback.

- Trained a team of 5 junior processors, boosting team productivity by 40%.

Technology-Focused resume experience section

A technology-focused loan processor resume experience section should clearly demonstrate how you leverage technology to refine loan processing operations. Start by showcasing specific tools and software that have enhanced your efficiency and reduced errors, helping improve overall client experiences. Avoid using vague statements; instead, provide measurable results that illustrate your achievements. As you craft bullet points, focus on detailing how you've applied technological solutions to address challenges and optimize processes within the loan processing field.

Include details such as the dates, job title, and company name for clarity. Each bullet point should highlight a distinct technological skill or accomplishment. By emphasizing your experience with loan processing software, data analysis, or relevant digital tools, you can provide a complete picture of your capabilities. Keep the language straightforward and centered on quantifiable contributions to weave a cohesive narrative. Here's an example:

Loan Processor

TechLend Financial Services

June 2020 - September 2023

- Enhanced loan approval efficiency by 30% using advanced automation tools.

- Introduced an AI system to reduce document errors by 20%, boosting overall accuracy.

- Led a team of 10 in mastering advanced software, improving productivity by evaluating and refining processes.

- Optimized workflows and reduced loan processing time by 15% through insightful data analysis.

Write your loan processor resume summary section

A loan processor-focused resume summary should make a great first impression by highlighting your key skills and experiences. This part of your resume serves as a quick introduction, designed to grab the hiring manager's attention. For an experienced loan processor, here's how you might craft your summary:

In this summary, the candidate's experience and reliability are front and center. It seamlessly connects their background in ensuring compliance with their strong data handling abilities. Now, if you have less experience, framing your aspirations becomes crucial, as seen in this objective:

[here was the JSON object 2]

This objective highlights the candidate's enthusiasm and potential, naturally linking these qualities to their desire to improve processes and satisfaction. It's important to understand how these sections differ. A summary is best for those with experience, offering a blend of skills and achievements. Newcomers might opt for a resume objective to focus on growth and potential. A resume profile combines elements of both, while a summary of qualifications lists skills without elaborate stories. Choosing the right section helps align your background with job expectations, whether emphasizing experience, ambitions, or specific qualifications.

Listing your loan processor skills on your resume

A skills-focused loan processor resume should effectively highlight your abilities and strengths, whether as a standalone section or integrated with your experience and summary. Highlighting strengths and soft skills, such as attention to detail and communication, showcases how you manage tasks and interact with people. Hard skills are the specific technical abilities you possess, like using loan processing software or understanding financial regulations.

Integrating skills and strengths throughout your resume turns them into essential keywords that resonate with job descriptions, capturing the attention of potential employers. These keywords can help your resume navigate through automated systems that companies use to screen applicants.

Here’s how a concise, impactful standalone skills section could look:

This section is powerful because it lists key abilities plainly and directly, which can be easily recognized by hiring managers and systems.

Best hard skills to feature on your loan processor resume

Loan processors require hard skills that guarantee efficiency and adherence to laws. These abilities underscore your capacity to handle loans, evaluate financial data, and comply with regulations.

Hard Skills

- Loan processing software proficiency

- Financial statement analysis

- Credit analysis

- Data entry accuracy

- Regulatory compliance

- Documentation management

- Mortgage loan documentation

- Underwriting support

- Risk assessment

- Database management

- Microsoft Office Suite

- Electronic Loan Documentation (eDoc)

- Appraisal report review

- Loan application review

- Fraud detection techniques

Best soft skills to feature on your loan processor resume

Equally essential are soft skills, which help loan processors foster productive relationships and ensure clear communication. They demonstrate your ability to collaborate effectively and offer clients a positive experience.

Soft Skills

- Attention to detail

- Effective communication

- Time management

- Problem-solving

- Customer service orientation

- Team collaboration

- Professionalism

- Adaptability

- Decision making

- Empathy

- Conflict resolution

- Patience

- Organizational skills

- Reliability

- Critical thinking

How to include your education on your resume

An education section is an essential part of your resume, especially for roles like a loan processor. This section should be tailored to the specific job you are pursuing. You should only include education that is directly relevant to the position. Adding irrelevant courses can clutter your resume and distract from your qualifications. When listing a degree, provide the full title, the institution, and the dates attended.

Including your GPA can enhance your resume if it's impressive, generally 3.5 or above. Ensure you format it as "GPA: X.XX/4.00." If you graduated with honors, such as cum laude, include this detail next to your degree title. It demonstrates academic excellence and could give you a competitive edge.

Here is a poorly structured standalone education section, which does not align with the role:

Here is a well-crafted example relevant to a loan processor:

This second example is effective because it highlights a degree in finance, pertinent to a loan processor role. Including cum laude and a strong GPA of 3.7 out of 4.0 underscores your academic prowess. Omitting unnecessary location details keeps the focus on your qualifications. This approach ensures a neat presentation emphasizing education that aligns with the job.

How to include loan processor certificates on your resume

Including a certificates section on your loan processor resume can significantly bolster your qualifications and make you stand out. Take the time to ensure this section is clearly presented, as certificates demonstrate your expertise and commitment to professional growth. You can even consider adding relevant certificates in the header for easy visibility.

Start by listing the name of each certificate accurately. Include the date when you received the certificate. Add the issuing organization to give it credibility. These details provide a clear understanding of your education and experience.

Here’s an example of how you can include certificates in the header:

Loan Processor - Certified Mortgage Loan Processor (CMLP), National Association of Mortgage Underwriters, January 2021

Now, for a standalone certificates section, here is a good example:

This example is strong because it includes highly relevant certificates specific to the loan processing field. The titles are clear, the issuing organizations are reputable, and all necessary details are presented. This way of listing your certificates makes it easy for hiring managers to see your qualifications at a glance.

Extra sections to include in your loan processor resume

As a loan processor, you play a crucial role in the financial world, bridging the gap between clients and their loan approvals. Building a strong resume is essential to showcase your qualifications, skills, and experiences to potential employers.

Include a language section—demonstrate multilingual proficiency and improve your communication with diverse clients.

Add a hobbies and interests section—showcase your well-rounded personality and dedication to continuous learning.

Mention volunteer work—highlight your community involvement and commitment to helping others.

List relevant books—reflect your dedication to professional development and staying informed on industry trends.

By adding these sections, you enrich your resume and paint a complete picture of your abilities and passions.

In Conclusion

In conclusion, successfully navigating the competitive job market as a loan processor hinges on crafting a well-organized resume that effectively highlights your unique strengths. This document serves as your personal brand and needs careful attention to detail. It is essential to focus on both hard and soft skills, emphasizing your ability to handle financial data meticulously and communicate effectively. Using templates or guides can help streamline the process, allowing you to focus on capturing your professional journey compellingly. Structure your resume to include key sections such as contact information, a succinct professional summary, detailed work experience, and a variety of skills. Your educational background and certifications should also be prominently displayed, as they underscore your dedication and expertise in the field.

Additionally, consider adding sections like volunteer experience or professional affiliations. These can demonstrate a broader commitment to the finance industry and offer a fuller picture of your capabilities. Whether you are highlighting technological adeptness, collaboration skills, or a results-oriented mindset, your achievements should be quantifiable and relevant. Partnering your resume with a well-written cover letter can further strengthen your application and leave a lasting impression. Together, these steps can transform your resume into a powerful tool that opens doors to exciting opportunities in the financial sector.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.