Mortgage Accountant Resume Examples

Jul 18, 2024

|

12 min read

Ace your mortgage accountant resume: tips for a finance-focused career move.

Rated by 348 people

Mortgage Accounting Specialist

Residential Mortgage Accountant

Commercial Mortgage Accountant

Mortgage Underwriting Accountant

Mortgage Tax Accountant

Mortgage Foreclosure Accountant

Senior Mortgage Accountant

Mortgage Origination Accountant

Mortgage Assurance Accountant

Mortgage Compliance Accountant

Mortgage Accounting Specialist resume sample

- •Led mortgage accounting operations for a $500M loan portfolio, ensuring a 99% accuracy rate in financial reports.

- •Successfully coordinated with lending teams to optimize accounting processes, enhancing efficiency by 20% over 12 months.

- •Developed and implemented internal controls that safeguarded assets and reduced discrepancies in mortgage accounting by 15%.

- •Supported audits by preparing accurate documentation and providing insightful explanations, resulting in zero audit findings.

- •Kept informed on industry trends, applying new regulatory changes to aid compliance and reduce risk exposure by 10%.

- •Produced comprehensive monthly summaries for management, offering insights that informed strategic financial decisions.

- •Conducted in-depth financial statement analysis for mortgage operations, identifying key discrepancies and saving the company $100K annually.

- •Monitored and reconciled bank accounts and general ledger entries, maintaining a 98% reconciliation accuracy across all transactions.

- •Collaborated with cross-functional teams to address and resolve accounting discrepancies, improving process synergy by 30%.

- •Assisted in implementing GAAP-compliant accounting practices that enhanced reporting accuracy by 25%.

- •Supported the accounting team during audits, reducing preparation time by 20% with efficient documentation strategies.

- •Managed loan subsidiary accounting tasks, contributing to a 15% improvement in process efficiency and audit readiness.

- •Facilitated the preparation of financial reports, focusing on accuracy and meeting regulatory submission deadlines.

- •Optimized accounting software usage, lowering data entry errors by 25% through training participation.

- •Generated accurate loan servicing reports that enhanced management's ability to forecast financial performance.

- •Participated in maintaining mortgage records and achieved a 98% reduction in record discrepancies over one year.

- •Assisted in financial analysis projects contributing to a 10% increase in loan processing efficiency.

- •Coordinated accounting processes for new loan originations, improving process speed by 30% without sacrificing accuracy.

- •Helped streamline communication between departments, reducing response times to vendor inquiries by 50%.

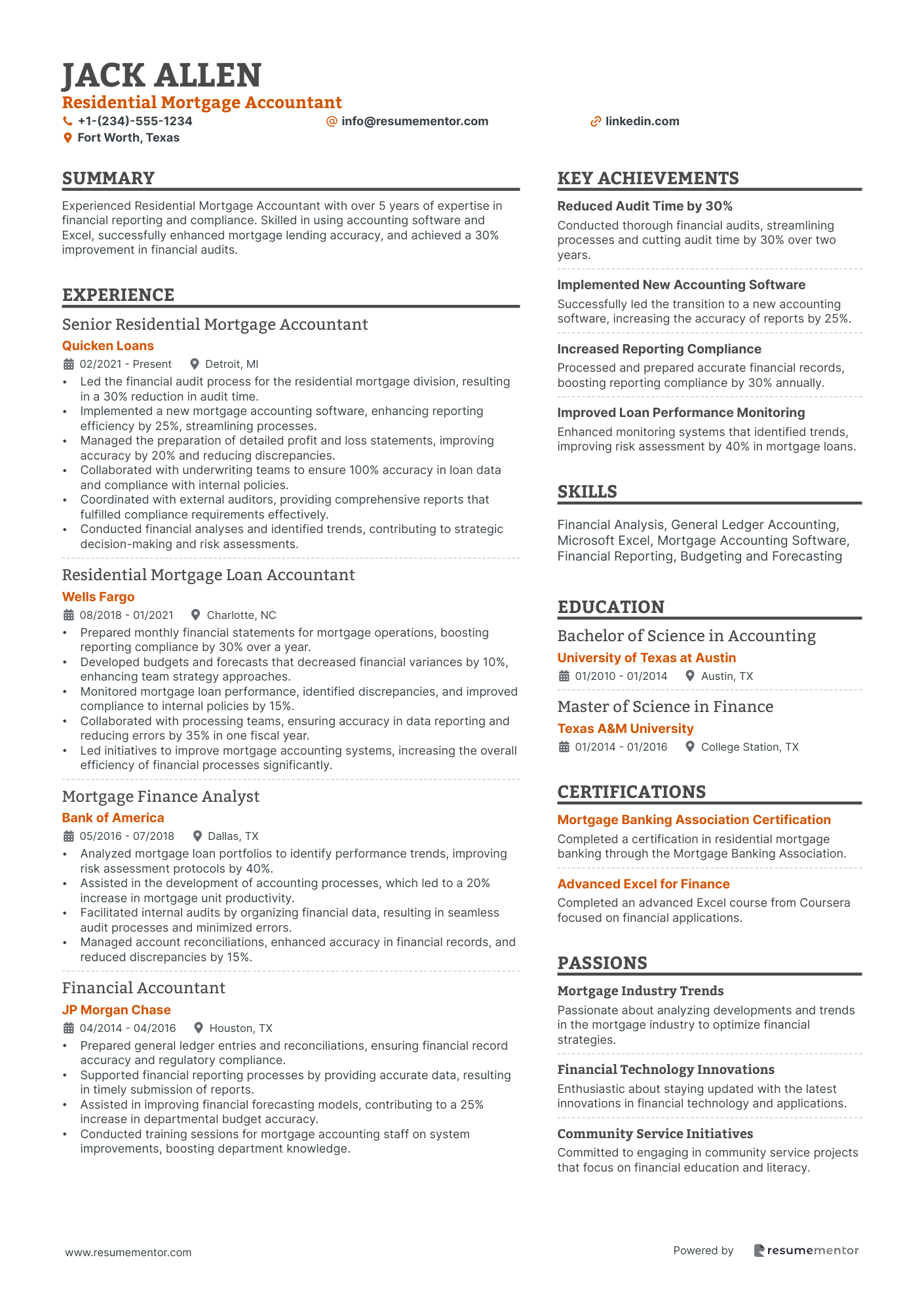

Residential Mortgage Accountant resume sample

- •Led the financial audit process for the residential mortgage division, resulting in a 30% reduction in audit time.

- •Implemented a new mortgage accounting software, enhancing reporting efficiency by 25%, streamlining processes.

- •Managed the preparation of detailed profit and loss statements, improving accuracy by 20% and reducing discrepancies.

- •Collaborated with underwriting teams to ensure 100% accuracy in loan data and compliance with internal policies.

- •Coordinated with external auditors, providing comprehensive reports that fulfilled compliance requirements effectively.

- •Conducted financial analyses and identified trends, contributing to strategic decision-making and risk assessments.

- •Prepared monthly financial statements for mortgage operations, boosting reporting compliance by 30% over a year.

- •Developed budgets and forecasts that decreased financial variances by 10%, enhancing team strategy approaches.

- •Monitored mortgage loan performance, identified discrepancies, and improved compliance to internal policies by 15%.

- •Collaborated with processing teams, ensuring accuracy in data reporting and reducing errors by 35% in one fiscal year.

- •Led initiatives to improve mortgage accounting systems, increasing the overall efficiency of financial processes significantly.

- •Analyzed mortgage loan portfolios to identify performance trends, improving risk assessment protocols by 40%.

- •Assisted in the development of accounting processes, which led to a 20% increase in mortgage unit productivity.

- •Facilitated internal audits by organizing financial data, resulting in seamless audit processes and minimized errors.

- •Managed account reconciliations, enhanced accuracy in financial records, and reduced discrepancies by 15%.

- •Prepared general ledger entries and reconciliations, ensuring financial record accuracy and regulatory compliance.

- •Supported financial reporting processes by providing accurate data, resulting in timely submission of reports.

- •Assisted in improving financial forecasting models, contributing to a 25% increase in departmental budget accuracy.

- •Conducted training sessions for mortgage accounting staff on system improvements, boosting department knowledge.

Commercial Mortgage Accountant resume sample

- •Managed accounting processes for 50+ commercial mortgages, improving transaction tracking efficiency by 25% and enhancing data accuracy.

- •Collaborated with underwriting teams to enhance financial analyses, leading to faster approval times for $100M in new mortgage transactions.

- •Developed robust financial reports, aiding senior management's strategic decisions and resulting in a 15% growth in loan portfolio performance.

- •Led a compliance initiative, ensuring adherence to updated regulations, avoiding financial penalties from regulatory bodies.

- •Streamlined reconciliation processes, reducing month-end closing time by 30% through automation and process optimization.

- •Spearheaded cross-departmental workshops to improve staff understanding of financial standards, boosting team productivity by 20%.

- •Oversaw financial records for commercial loans, achieving 98% accuracy and reducing discrepancies in financial statements by 40%.

- •Assisted in preparing and analyzing quarterly financial reports, enhancing stakeholder insights into business performance.

- •Conducted regular variance analyses, identifying trends leading to a 10% improvement in forecasting precision.

- •Responded to auditor inquiries and facilitated annual audits, leading to clean audit reports with zero major findings.

- •Collaborated with external partners to ensure timely and accurate loan servicing, maintaining 100% compliance with service level agreements.

- •Monitored loan performance and financial risks, developing models that improved risk assessment accuracy by 25%.

- •Facilitated training sessions on new analytical tools, improving team efficiency and knowledge of advanced financial metrics.

- •Implemented financial software upgrades, reducing operational downtimes and ensuring compliance with evolving tax regulations.

- •Collaborated in a project to redesign amortization schedules, resulting in improved customer satisfaction and reduced churn by 15%.

- •Prepared detailed financial statements for commercial loans, achieving 95% consistency with regulatory standards.

- •Performed financial reconciliation for loan disbursements and receipts, enhancing data integrity by 30%.

- •Conducted market research for improved loan terms, supporting the negotiation of favorable rates for clients.

- •Supported audits by providing extensive documentation, ensuring clarity and transparency in financial reporting.

Mortgage Underwriting Accountant resume sample

- •Assessed and approved over 400 mortgage applications worth $60M, maintaining an approval accuracy rate of 98%, resulting in enhanced client trust.

- •Collaborated with cross-functional teams to resolve discrepancies, leading to a 25% reduction in processing errors.

- •Created detailed monthly financial reports that improved decision-making processes for over 50 team members.

- •Led departmental audits that identified compliance gaps, resulting in a streamlined auditing process within team operations.

- •Implemented new underwriting procedures, increasing documentation efficiency by 30%.

- •Mentored junior accountants, enhancing team skills and leading to a 20% increase in internal promotions.

- •Reviewed and maintained comprehensive mortgage portfolios worth over $40M, exceeding expectations for accuracy and compliance.

- •Performed risk assessments on 300+ loans, contributing to $20M in approved loans annually.

- •Facilitated training sessions that increased team proficiency in mortgage servicing software by 40%.

- •Introduced compliance checklists that reduced federal regulation violations by 15%.

- •Improved processing time for loan disbursements by integrating new financial software tools.

- •Developed financial models for evaluating mortgage application risk, enhancing the team's forecast capabilities by 20%.

- •Reconciled financial statements, achieving 100% accuracy over 18 months.

- •Participated in team efforts to digitize records, reducing paper usage by 35% and increasing accessibility for analyses.

- •Coordinated with auditors to ensure seamless audits, which enhanced compliance credibility with stakeholders.

- •Processed mortgage applications, achieving a 95% approval rate in a high-volume environment.

- •Maintained meticulous records that were praised during compliance audits, suggesting effectiveness in operations.

- •Collaborated with underwriting team to clarify and expedite loan details, contributing to a 15% increase in client satisfaction.

- •Automated accounting entries, reducing manual report preparation time by 25%.

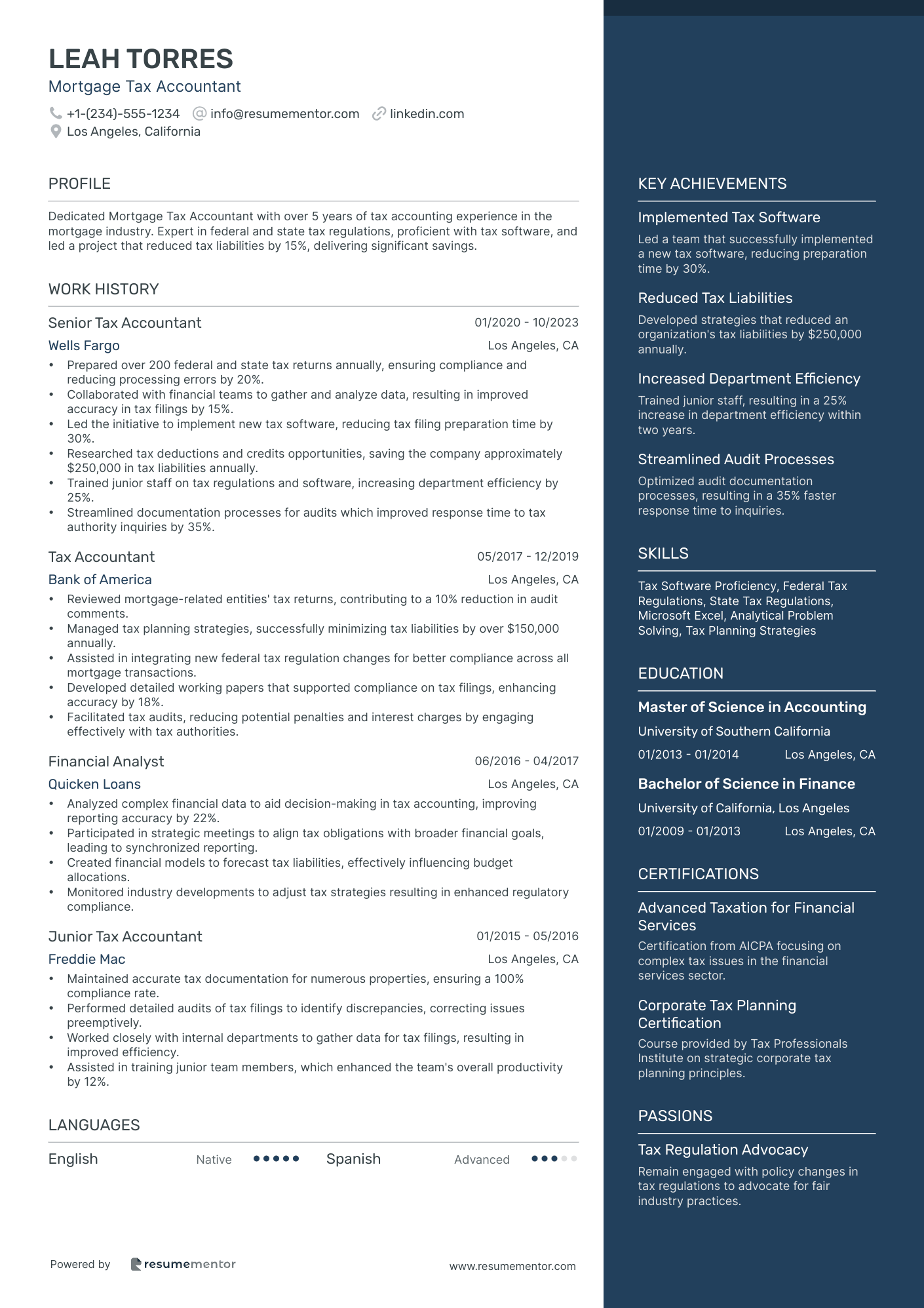

Mortgage Tax Accountant resume sample

- •Prepared over 200 federal and state tax returns annually, ensuring compliance and reducing processing errors by 20%.

- •Collaborated with financial teams to gather and analyze data, resulting in improved accuracy in tax filings by 15%.

- •Led the initiative to implement new tax software, reducing tax filing preparation time by 30%.

- •Researched tax deductions and credits opportunities, saving the company approximately $250,000 in tax liabilities annually.

- •Trained junior staff on tax regulations and software, increasing department efficiency by 25%.

- •Streamlined documentation processes for audits which improved response time to tax authority inquiries by 35%.

- •Reviewed mortgage-related entities' tax returns, contributing to a 10% reduction in audit comments.

- •Managed tax planning strategies, successfully minimizing tax liabilities by over $150,000 annually.

- •Assisted in integrating new federal tax regulation changes for better compliance across all mortgage transactions.

- •Developed detailed working papers that supported compliance on tax filings, enhancing accuracy by 18%.

- •Facilitated tax audits, reducing potential penalties and interest charges by engaging effectively with tax authorities.

- •Analyzed complex financial data to aid decision-making in tax accounting, improving reporting accuracy by 22%.

- •Participated in strategic meetings to align tax obligations with broader financial goals, leading to synchronized reporting.

- •Created financial models to forecast tax liabilities, effectively influencing budget allocations.

- •Monitored industry developments to adjust tax strategies resulting in enhanced regulatory compliance.

- •Maintained accurate tax documentation for numerous properties, ensuring a 100% compliance rate.

- •Performed detailed audits of tax filings to identify discrepancies, correcting issues preemptively.

- •Worked closely with internal departments to gather data for tax filings, resulting in improved efficiency.

- •Assisted in training junior team members, which enhanced the team's overall productivity by 12%.

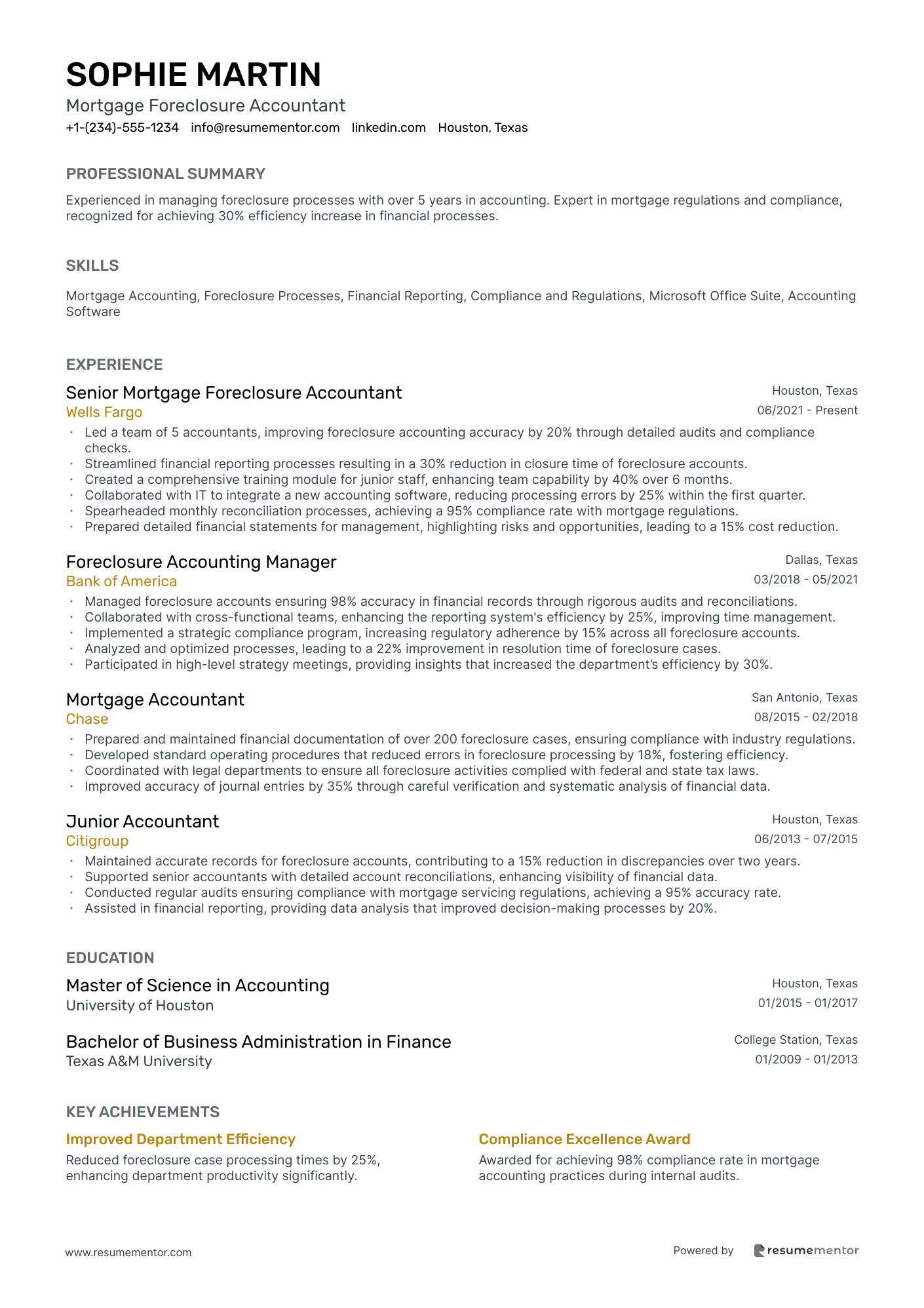

Mortgage Foreclosure Accountant resume sample

- •Led a team of 5 accountants, improving foreclosure accounting accuracy by 20% through detailed audits and compliance checks.

- •Streamlined financial reporting processes resulting in a 30% reduction in closure time of foreclosure accounts.

- •Created a comprehensive training module for junior staff, enhancing team capability by 40% over 6 months.

- •Collaborated with IT to integrate a new accounting software, reducing processing errors by 25% within the first quarter.

- •Spearheaded monthly reconciliation processes, achieving a 95% compliance rate with mortgage regulations.

- •Prepared detailed financial statements for management, highlighting risks and opportunities, leading to a 15% cost reduction.

- •Managed foreclosure accounts ensuring 98% accuracy in financial records through rigorous audits and reconciliations.

- •Collaborated with cross-functional teams, enhancing the reporting system's efficiency by 25%, improving time management.

- •Implemented a strategic compliance program, increasing regulatory adherence by 15% across all foreclosure accounts.

- •Analyzed and optimized processes, leading to a 22% improvement in resolution time of foreclosure cases.

- •Participated in high-level strategy meetings, providing insights that increased the department’s efficiency by 30%.

- •Prepared and maintained financial documentation of over 200 foreclosure cases, ensuring compliance with industry regulations.

- •Developed standard operating procedures that reduced errors in foreclosure processing by 18%, fostering efficiency.

- •Coordinated with legal departments to ensure all foreclosure activities complied with federal and state tax laws.

- •Improved accuracy of journal entries by 35% through careful verification and systematic analysis of financial data.

- •Maintained accurate records for foreclosure accounts, contributing to a 15% reduction in discrepancies over two years.

- •Supported senior accountants with detailed account reconciliations, enhancing visibility of financial data.

- •Conducted regular audits ensuring compliance with mortgage servicing regulations, achieving a 95% accuracy rate.

- •Assisted in financial reporting, providing data analysis that improved decision-making processes by 20%.

Senior Mortgage Accountant resume sample

- •Managed and oversaw daily mortgage accounting operations, improving efficiency by streamlining processes, which resulted in a 20% time savings.

- •Produced accurate and compliant financial statements and reports monthly, reducing report discrepancies by 25%.

- •Developed a cross-functional collaboration strategy with loan servicing, enhancing compliance and reducing issue resolution time by 15%.

- •Led a team in analyzing financial trends, recommending actionable insights that resulted in a 10% increase in profitability.

- •Facilitated the audit preparation, ensuring a successful and clean audit by organizing documentation 2 weeks ahead of schedule.

- •Guided and mentored a team of 3 junior accountants, elevating team performance and cohesion.

- •Led daily operations in mortgage accounting, achieving a 95% compliance rate with GAAP standards.

- •Conducted precise reconciliations of mortgage accounts, successfully resolving discrepancies within 48 hours.

- •Collaborated with the operations team to overhaul accounting methodologies, reducing errors by 30%.

- •Analyzed and identified growth opportunities, contributing to a strategic plan that increased revenue by $2M annually.

- •Supported regulatory filings, achieving a 100% success rate in submissions over three consecutive years.

- •Handled all facets of mortgage accounting, consistently meeting a 100% on-time submission rate for financial statements.

- •Streamlined loan servicing processes, decreasing the loan processing time by 10%.

- •Contributed to a team-oriented environment by sharing industry best practices and achieving a 15% increase in overall efficiency.

- •Developed procedures for auditing and compliance checks, maintaining excellent regulatory standing.

- •Prepared detailed financial analysis reports supporting the mortgage division, enhancing decision-making processes.

- •Collaborated with senior management to establish goals, enhancing revenue by 12% by optimizing resource allocation.

- •Supported month-end close processes, increasing accuracy across financial reporting by 15%.

- •Engaged in presentations of financial data trends and forecasts, contributing to strategic planning.

Mortgage Origination Accountant resume sample

- •Managed comprehensive accounting operations for mortgage origination, boosting transaction accuracy by 20% through enhanced reconciliation methods.

- •Formulated and reviewed financial statements, improving report preparation efficiency by 25% over six months.

- •Facilitated cross-functional collaboration with mortgage teams, ensuring 100% compliance with regulatory standards across $200M in loan transactions.

- •Executed thorough document audits, identifying and correcting discrepancies to enhance data integrity for regulatory filings.

- •Spearheaded the enhancement of processing escrow account transactions, improving timeliness by 30%.

- •Supported internal audit processes by maintaining organized and accessible records, resulting in rapid issue resolution.

- •Oversaw accounting records related to loan transactions and fees, increasing monthly reconciliation accuracy by 15%.

- •Led a team in implementing a new accounting software, reducing manual entry errors by 40%.

- •Directed financial data analysis to provide actionable insights, resulting in a 10% reduction in processing time.

- •Provided comprehensive support for external audits, maintaining a 98% pass rate through meticulous record-keeping.

- •Coordinated with legal and compliance teams to maintain up-to-date knowledge of mortgage accounting practices.

- •Analyzed mortgage origination trends, providing reports that enhanced strategic decision making for loan officers by 18%.

- •Developed financial models to forecast origination trends, resulting in a 25% increase in forecast accuracy.

- •Collaborated with accounting teams to refine journal entries, which reduced closing times by 2 days monthly.

- •Initiated process improvement strategies that elevated data processing speed and reliability.

- •Reported and managed loan transactions, contributing to a 10% year-over-year improvement in financial reporting accuracy.

- •Supported policy compliance by verifying documentation accuracy, which reduced regulatory penalties by 30%.

- •Optimized fee processing workflows, streamlining operations and cutting processing time by 15%.

- •Provided detailed financial reports that informed executive decisions and improved budget allocations.

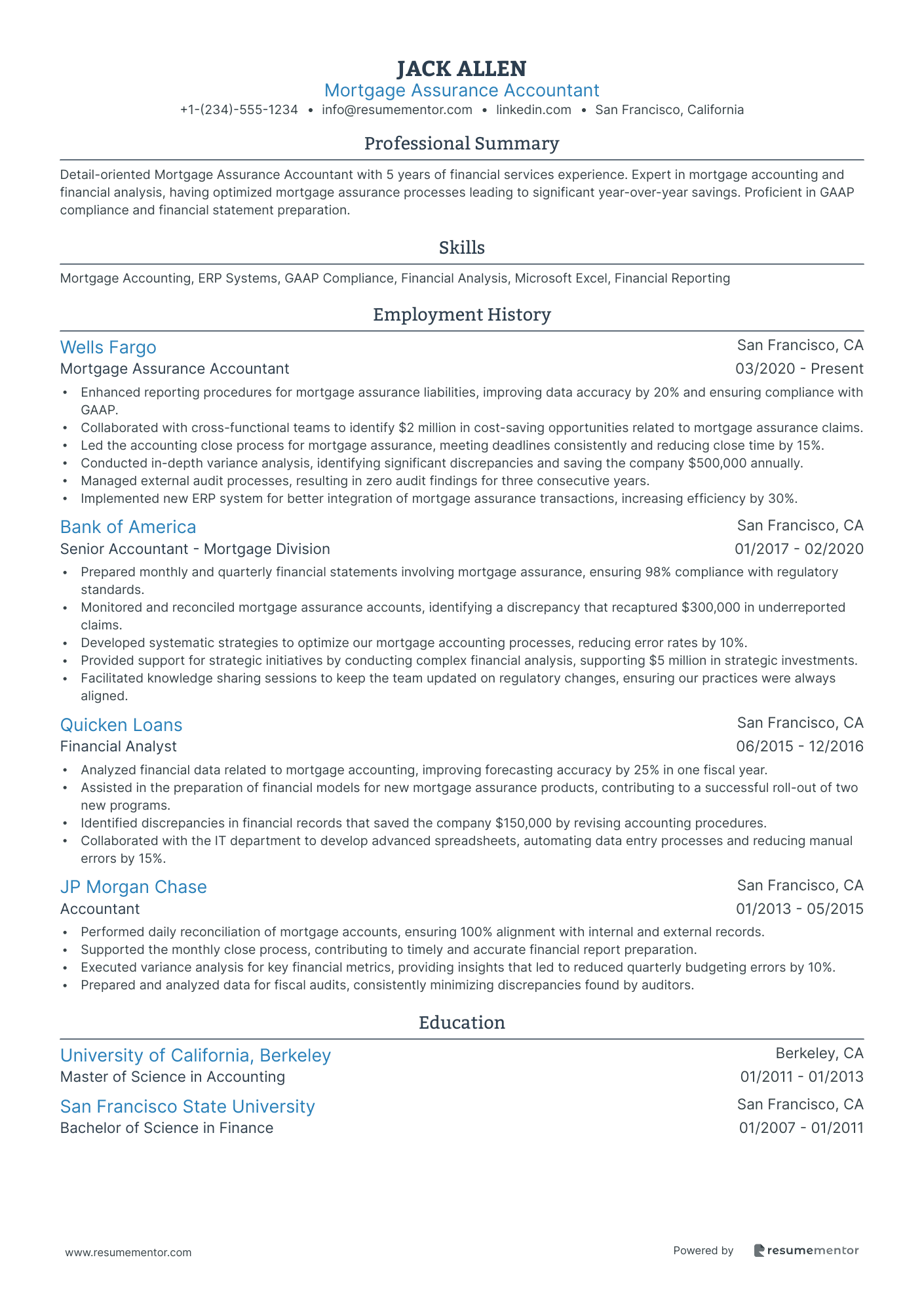

Mortgage Assurance Accountant resume sample

- •Enhanced reporting procedures for mortgage assurance liabilities, improving data accuracy by 20% and ensuring compliance with GAAP.

- •Collaborated with cross-functional teams to identify $2 million in cost-saving opportunities related to mortgage assurance claims.

- •Led the accounting close process for mortgage assurance, meeting deadlines consistently and reducing close time by 15%.

- •Conducted in-depth variance analysis, identifying significant discrepancies and saving the company $500,000 annually.

- •Managed external audit processes, resulting in zero audit findings for three consecutive years.

- •Implemented new ERP system for better integration of mortgage assurance transactions, increasing efficiency by 30%.

- •Prepared monthly and quarterly financial statements involving mortgage assurance, ensuring 98% compliance with regulatory standards.

- •Monitored and reconciled mortgage assurance accounts, identifying a discrepancy that recaptured $300,000 in underreported claims.

- •Developed systematic strategies to optimize our mortgage accounting processes, reducing error rates by 10%.

- •Provided support for strategic initiatives by conducting complex financial analysis, supporting $5 million in strategic investments.

- •Facilitated knowledge sharing sessions to keep the team updated on regulatory changes, ensuring our practices were always aligned.

- •Analyzed financial data related to mortgage accounting, improving forecasting accuracy by 25% in one fiscal year.

- •Assisted in the preparation of financial models for new mortgage assurance products, contributing to a successful roll-out of two new programs.

- •Identified discrepancies in financial records that saved the company $150,000 by revising accounting procedures.

- •Collaborated with the IT department to develop advanced spreadsheets, automating data entry processes and reducing manual errors by 15%.

- •Performed daily reconciliation of mortgage accounts, ensuring 100% alignment with internal and external records.

- •Supported the monthly close process, contributing to timely and accurate financial report preparation.

- •Executed variance analysis for key financial metrics, providing insights that led to reduced quarterly budgeting errors by 10%.

- •Prepared and analyzed data for fiscal audits, consistently minimizing discrepancies found by auditors.

Mortgage Compliance Accountant resume sample

- •Reviewed and analyzed over 200 mortgage loans monthly to ensure compliance, resulting in a 20% reduction in discrepancies.

- •Developed compliance reports and submitted documentation to regulatory agencies, achieving a 95% on-time submission rate.

- •Monitored regulatory changes, updating company policies and procedures to maintain alignment with new compliance laws.

- •Collaborated with underwriting teams, enhancing process efficiency, thereby reducing compliance errors by 15%.

- •Conducted quarterly compliance audits, identifying and addressing potential risk areas before regulatory violations occurred.

- •Implemented a staff training program on compliance topics, improving team compliance knowledge by 40%.

- •Led compliance assessments, uncovering critical improvement areas that enhanced regulatory adherence by 25%.

- •Prepared detailed compliance documentation for external audits, contributing to a successful audit pass rate of 98%.

- •Collaborated with operations and underwriting to refine procedures, reducing compliance processing time by 30%.

- •Streamlined compliance reporting, improving report accuracy and speed by 50% and 20% respectively.

- •Assisted in regulatory examinations preparation, contributing to a smooth process with no major compliance findings.

- •Conducted compliance reviews of mortgage applications, maintaining a compliance rate above 90% during tenure.

- •Contributed to policy revisions to ensure adherence to new regulations, resulting in improved risk management.

- •Facilitated interdepartmental communication, leading to a 10% increase in compliance workflow efficiency.

- •Developed compliance training materials that were utilized company-wide, enhancing regulatory comprehension.

- •Performed document audits ensuring compliance with RESPA and TILA, contributing to a 97% compliance score.

- •Assisted in the analysis of compliance data, providing insights that improved reporting accuracy by 15%.

- •Supported compliance training sessions, increasing staff understanding of mortgage compliance standards by 30%.

- •Maintained compliance records and documentation, aiding in a seamless regulatory inspection process.

Crafting your mortgage accountant resume can feel like navigating a complex loan agreement, where your financial expertise and attention to detail must shine through on paper. Instead of just listing tasks, it's crucial to align your experience and skills with the qualities potential employers seek in a candidate.

In this process, using a resume template can be a game-changer. A template offers a well-structured framework that allows you to effectively highlight your achievements and financial expertise, ensuring your resume remains clean and easy to read.

Communicating the depth of your experience within just two pages can be challenging. It's easy to get lost between everyday tasks and the significant achievements that truly set you apart, like managing loan portfolios or ensuring regulatory compliance. However, each section of your resume should serve as an opportunity to showcase how you solve complex problems and add value to a financial institution.

By following these guidelines, you enhance your resume's impact, increasing your chances of landing that next big role. Let's embark on creating a resume that truly opens doors for you.

Key Takeaways

- When writing a mortgage accountant resume, it's crucial to effectively communicate your financial expertise and attention to detail, aligning your skills and achievements with the job description.

- Start with a strong professional summary and follow with well-organized sections such as contact information, work experience, education, skills, and certifications.

- Emphasize quantifiable achievements in the experience section to demonstrate the impact you've made in previous roles, using action verbs and focusing on problem-solving and compliance.

- Choose a reverse-chronological format with modern fonts to ensure your most recent experiences are highlighted, and always save the document as a PDF for consistency.

- Incorporate additional sections, like languages, hobbies, and volunteer work, to showcase a well-rounded profile, enhancing your resume's appeal to potential employers.

What to focus on when writing your mortgage accountant resume

Your mortgage accountant resume should clearly communicate your financial expertise and keen attention to detail, forming the foundation of your professional profile. Build on this by highlighting your ability to manage mortgage accounting tasks efficiently, showcasing proficiency in industry-specific software and demonstrating strong analytical skills. Through this lens, emphasize your problem-solving abilities and your deep understanding of financial compliance.

How to structure your mortgage accountant resume

- Contact Information — Begin by placing your contact information prominently at the top of your resume. This should include your full name, phone number, professional email address, and LinkedIn profile if applicable. Ensuring it's easy to find allows recruiters to reach you quickly.

- Professional Summary — Follow with a compelling professional summary. This segment should succinctly encapsulate your core mortgage accounting skills, experience level, and a few notable achievements. Tailoring it to the job description can make a significant impression on employers.

- Work Experience — Share a detailed account of your work experience. For each role, include job titles, company names, locations, and dates of employment. Highlight specific achievements, such as how you enhanced process efficiencies or executed cost-saving measures, making your experience stand out quantitatively.

- Education — Include your educational background, focusing on degrees relevant to the financial field. Supply details like the institution's name, degree obtained, and graduation date. Education helps validate your expertise and readiness for advanced responsibilities in mortgage accounting.

- Skills — Clearly identify key skills that define an effective mortgage accountant. These may include familiarity with financial software like QuickBooks, expertise in mortgage-specific programs, analytical prowess, and a solid grounding in compliance regulations. Chosen skills should reflect both your competencies and the job's requirements.

- Certifications — Don’t overlook certifications, as they bolster your professional credibility. List any relevant certifications like Certified Mortgage Banker (CMB) or CPA that highlight your dedication to career development and adherence to industry standards.

Having reviewed the essential components, we will next explore each section in greater depth to ensure your resume is polished and comprehensive.

Which resume format to choose

Crafting the perfect resume format is crucial for your success as a mortgage accountant. Opting for a straightforward, professional style ensures that your strengths are clearly highlighted. Among the available formats, the reverse-chronological layout stands out as the best choice. This format aligns with the preferences of recruiters who value seeing your most recent experiences and achievements first, offering a transparent view of your career trajectory.

Enhance your resume's visual appeal with modern fonts like Lato, Montserrat, or Raleway. These fonts improve readability while giving your document a contemporary and polished appearance. By steering clear of more traditional fonts like Arial or Times New Roman, you emphasize a modern approach that resonates with today's job market trends.

Once you've refined your content and design, always save your resume as a PDF. This step is vital as it locks in your formatting and design, ensuring a consistent presentation across any device or platform. This reliability in the way your resume looks allows recruiters to focus on your qualifications without distraction.

Pay attention to your margins, maintaining a one-inch space on all sides. This margin size creates a neat and organized presentation, allowing the reader to easily navigate through your information. A clean layout helps emphasize the key points of your career story without overwhelming the eye.

By harmonizing these important elements, your mortgage accountant resume will effectively convey your professionalism and make a memorable impression on potential employers.

How to write a quantifiable resume experience section

The experience section of your mortgage accountant resume is where you highlight your skills and achievements, demonstrating how past roles make you a strong candidate. To create a clear picture of your qualifications, organize this section in reverse chronological order, starting with your most recent job and going back 10-15 years. Focus on showcasing relevant accounting positions, especially those in the mortgage sector. Tailoring each bullet point to the job you're applying for is crucial for making an impact. Strong action verbs like "analyzed," "optimized," and "improved" help convey your contributions effectively. Be sure to include quantifiable achievements that reflect the difference you’ve made.

Here’s an example of what a strong experience section looks like:

- •Reduced discrepancies by 20% through stringent audits and process improvements.

- •Optimized portfolio analysis resulting in a 15% increase in departmental efficiency.

- •Implemented a new reporting system that cut downtime by 30%, enhancing productivity.

- •Trained 5 junior accountants in advanced mortgage accounting functions.

This example effectively highlights your role as a mortgage accountant by detailing quantifiable results that showcase your expertise. By using precise numbers, you provide concrete evidence of your successes, which aligns well with employer expectations. The choice of dynamic verbs illustrates your proactive contributions and ability to influence positive change. Altogether, this cohesive approach ensures your resume captures attention by evidencing real achievements in boosting both efficiency and productivity within your field.

Project-Focused resume experience section

A project-focused mortgage accountant resume experience section should spotlight the breadth of your skills and achievements by detailing key projects you've handled. Begin by listing the projects along with the timeframes you worked on them. Describe your role, ensuring each bullet point illustrates your unique contributions and the meaningful impact they had. This setup ensures that anyone can quickly grasp the value you bring to a team, which is crucial for capturing the interest of prospective employers.

Using energetic and descriptive language, like action verbs such as "managed," "implemented," or "reduced," creates a vivid narrative of your accomplishments. Connect each responsibility or task to the challenges you faced and the tangible results you achieved, showcasing how you can bring about similar benefits in a future role. This seamless integration of your past achievements with potential future contributions maximizes the effectiveness of your experience section, painting a comprehensive picture of your capabilities.

Senior Mortgage Accountant

XYZ Financial Group

March 2019 - July 2023

- Oversaw monthly mortgage account reconciliations, achieving perfect accuracy with a team of four accountants.

- Enhanced the report generation process, cutting delivery time by 30% using advanced Excel techniques.

- Worked closely with IT to introduce a new accounting software, boosting data integrity and slashing errors by 20%.

- Created a detailed training manual for new accountants, shortening onboarding time by 40%.

Industry-Specific Focus resume experience section

A mortgage-focused resume experience section should effectively connect your skills and experiences, demonstrating your proficiency in the mortgage accounting industry. Start by highlighting key experiences that align with the job you're applying for, showcasing your strengths in a way that speaks directly to potential employers. Use clear, action-oriented language to describe your achievements and responsibilities, ensuring each point illustrates the positive results you achieved and your contribution to the team or company. Integrating quantifiable details, like financial analyses and budget management, provides concrete evidence of your impact.

When forming bullet points, strive for clarity and coherence, ensuring each aspect of your responsibilities ties seamlessly into your overall professional narrative. Use data and results to paint a clear picture of your success, creating a compelling case for your capabilities. Tailor each entry to emphasize the skills and experiences most relevant to the roles you're pursuing. Attention to detail in grammar, accuracy, and formatting underscores your precision and reliability in managing complex financial tasks, reflecting your dedication to the field.

Senior Mortgage Accountant

Finance Corp

March 2019 - Present

- Managed loan portfolios worth over $25 million, which directly boosted monthly revenue by 10%.

- Improved the auditing process by streamlining procedures, resulting in a 15% reduction in error rates.

- Led the implementation of new accounting software with cross-functional teams, which enhanced reporting accuracy by 20%.

- Drafted comprehensive financial statements that played a crucial role in quarterly forecasting and budgeting efforts.

Achievement-Focused resume experience section

A mortgage accountant-focused resume experience section should effectively highlight your achievements and the impact they've had in your previous roles. Begin by emphasizing key responsibilities and accomplishments that showcase your contribution to the company's success. It's crucial to use clear action verbs and quantify your achievements, providing tangible evidence of your skills. Instead of simply listing duties, focus on how you've streamlined processes, managed large data sets, or fueled financial growth, allowing employers to see your value at a glance.

In your bullet points, dive into tasks where you excelled and the positive outcomes they generated. Illustrate your experience with handling financial records, processing loan applications, and ensuring compliance with industry standards. Describe any systems or strategies you've implemented that enhanced efficiency or accuracy, accompanied by measurable results. Your entries should not only demonstrate your deep expertise in the field but also underscore your proactive approach to problem-solving.

Mortgage Accountant

ABC Financial Services

January 2018 - March 2023

- Streamlined the loan origination process, cutting processing time by 20% and boosting customer satisfaction.

- Introduced a new auditing system, increasing loan record accuracy by 30%.

- Managed a mortgage portfolio over $50 million, ensuring compliance with regulatory standards.

- Trained and led a team of five junior accountants, increasing departmental productivity by 25%.

Technology-Focused resume experience section

A technology-focused mortgage accountant resume experience section should emphasize your expertise in using tech tools to enhance efficiency and accuracy in your work. Begin by highlighting key tasks you managed, with a particular focus on the technological elements. Make sure to include any software or systems you've implemented or used to streamline accounting processes, underscoring how these tools were advantageous to the company. For example, consider how your skills led to improvements like boosting data accuracy, accelerating financial reporting, or enhancing customer interactions.

Each bullet point should weave a cohesive story about how you tackled a challenge or spearheaded a project using technology, making sure to outline its impact. Keep your descriptions clear and concise, incorporating numbers or outcomes to substantiate your achievements when applicable. Ensure that each point relates directly to your technological skills, illustrating how you contributed to a project's triumph, improved processes, or initiated innovative solutions that significantly benefited the workplace.

Senior Mortgage Accountant

Greenfield Lending Corp

January 2020 - Present

- Implemented a new accounting software that reduced data entry errors by 30%.

- Developed automated financial report templates, cutting preparation time by 20 hours per month.

- Led a team to migrate financial data to a cloud-based platform for better data accessibility and security.

- Trained a team of four on advanced spreadsheet functions, increasing their productivity by 25%.

Write your mortgage accountant resume summary section

A mortgage accountant-focused resume should include a compelling summary that significantly boosts your job prospects. This section highlights your professional background, key skills, and achievements, tailored specifically to the role you're targeting. Describe yourself by emphasizing achievements that have provided value to previous employers, such as strong analytical skills, attention to detail, and expertise with financial software. If your experience is extensive, your summary should underline your deep knowledge and problem-solving capabilities, which can set you apart from other candidates.

Understanding the differences between a resume summary, objective, profile, and a summary of qualifications helps refine your message. Each serves to quickly inform the hiring manager but focuses on different aspects of your career journey. A resume summary highlights your achievements and skills, while an objective shares your career goals. A profile blends both, offering a snapshot of your professional persona, whereas a summary of qualifications lists key skills in bullet form. Depending on whether you're seasoned or just starting, you might lean towards a summary or objective. Here’s an example:

This example showcases your professional expertise and impact, making it appealing to employers. If you're early in your career, a resume objective might better express your eagerness to learn and grow. Whether you choose a summary or objective, ensure it is concise and highlights your most relevant skills and achievements to capture the employer’s attention.

Listing your mortgage accountant skills on your resume

A mortgage-focused accountant resume should seamlessly integrate your skills into a dedicated section or weave them into key parts like your experience and summary. Showcasing your strengths and soft skills helps highlight qualities like effective communication and problem-solving, which are important for this role. On the other hand, hard skills, such as financial analysis or proficiency in specific software, demonstrate the technical abilities you've acquired through education or experience. These skills and strengths serve as essential resume keywords, helping your resume stand out to employers who are seeking these particular attributes.

The skills section is effective because it directly focuses on the core competencies needed for mortgage accountants. Each skill is specifically selected, making it easy for hiring managers to immediately recognize your qualifications. By organizing skills into bullet points, it facilitates quick scanning and highlights industry-specific skills that recruiters are actively searching for.

Best hard skills to feature on your mortgage accountant resume

As a mortgage accountant, your hard skills should effectively convey your technical expertise and understanding of the industry. These skills demonstrate your ability to manage complex financial tasks and ensure compliance with regulations.

Hard Skills

- Financial Analysis

- Advanced Excel Skills

- Loan Origination Software

- Tax Preparation

- Budget Management

- Data Validation

- Mortgage Loan Processing

- Risk Management

- Account Reconciliation

- Financial Reporting

- Auditing Techniques

- Compliance Knowledge

- Portfolio Management

- Credit Analysis

- Regulatory Compliance

Best soft skills to feature on your mortgage accountant resume

Soft skills are equally important and should showcase your ability to work well with others while managing the demands of your role. These skills convey your capacity to collaborate effectively and adapt to changing environments.

Soft Skills

- Attention to Detail

- Problem-Solving Abilities

- Effective Communication

- Time Management

- Critical Thinking

- Team Collaboration

- Adaptability

- Organizational Skills

- Interpersonal Skills

- Decision-Making

- Customer Service

- Stress Management

- Leadership

- Negotiation

- Empathy

How to include your education on your resume

The education section is a crucial part of your mortgage accountant resume. It should be tailored to the specific job you're applying for, meaning any education that isn't relevant shouldn't be included. When listing your education, include specific details such as your degree, school name, location, and graduation dates. If you're applying for entry-level positions or roles where your academic background supports the job, consider adding your GPA. This can be especially important if you've earned honors like cum laude, as they highlight your academic achievements. When listing a degree, always include the type of degree, such as Bachelor of Science or Master of Business Administration. Details matter here, so be precise about the title of your degree as it relates to accounting or finance. Here is a wrong and a right example of an education section:

The second example is outstanding because it features education that is directly related to a mortgage accounting role, with a degree in accounting. Listing academic honors like Magna Cum Laude, as well as a high GPA, can impress potential employers. These details collectively demonstrate a solid academic foundation pertinent to the responsibilities of a mortgage accountant.

How to include mortgage accountant certificates on your resume

Adding a certificates section to your mortgage accountant resume is essential. It highlights your qualifications and sets you apart. List the name of the certificate. Include the date you obtained it. Add the issuing organization. Display only relevant certificates.

For example, place a certificate directly in the header of your resume:

John Doe Certified Mortgage Accountant (CMA) Email: john.doe@example.com

Having a dedicated certificates section at the end of your resume can make your qualifications clear. Here’s how a good example looks:

This example is good because it includes certificates relevant to your job as a mortgage accountant. Certificates are issued by known organizations, ensuring trust. The titles clearly show your professional expertise.

Extra sections to include in your mortgage accountant resume

When crafting a resume for a mortgage accountant position, you want to highlight your financial acumen and attention to detail. However, including some personal elements can make you stand out as a well-rounded candidate.

- Language section — Highlight any additional languages you speak because it shows your ability to communicate with a diverse client base.

- Hobbies and interests section — Mention relevant hobbies like reading financial literature or participating in investment clubs, as these activities reflect your passion for the field.

- Volunteer work section — Demonstrate your community involvement by including volunteer work, especially if you have used your accounting skills in these roles.

- Books section — List books you have read related to finance or accounting as this indicates you are devoted to professional development.

By including these sections, you not only show your technical skills but also portray a well-rounded, engaged individual who continuously seeks growth. This approach can make your resume more compelling to potential employers.

In Conclusion

In conclusion, creating a standout mortgage accountant resume demands careful consideration of both format and substance. By focusing on a clear and engaging layout, you ensure that your most relevant experiences and skills are spotlighted effectively. Using a template can provide a reliable structure, allowing you to concentrate more on refining your content and eliminating distractions. Highlighting quantifiable achievements in your work experience section makes a strong impression on potential employers, demonstrating your capacity to enhance efficiency and productivity with concrete examples. Remember, your resume is a reflection of both your professional capabilities and your personal dedication to your career. By integrating skills, education, and certifications cohesively, you paint a comprehensive picture of your expertise and commitment to the field. Paying attention to details like font choice and format consistency contributes to a polished and professional presentation. Always ensure that your document accurately mirrors your career achievements and aspirations, as this authenticity resonates with employers. Ultimately, a well-crafted resume not only captures attention but also opens doors to new and exciting career opportunities in the mortgage accounting industry. Take these insights and compose a resume that truly reflects your professional journey and potential for future success.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.