Mortgage Consultant Resume Examples

Jul 18, 2024

|

12 min read

"Unlock career doors with a winning mortgage consultant resume: Craft your best first impression in the mortgage industry with this easy guide. Secure your dream role and handle the competition with skill and confidence."

Rated by 348 people

Residential Mortgage Consultant

Commercial Mortgage Advisor

Mortgage Equity Specialist

Investment Property Mortgage Consultant

Mortgage Refinancing Expert

Mortgage Product Development Advisor

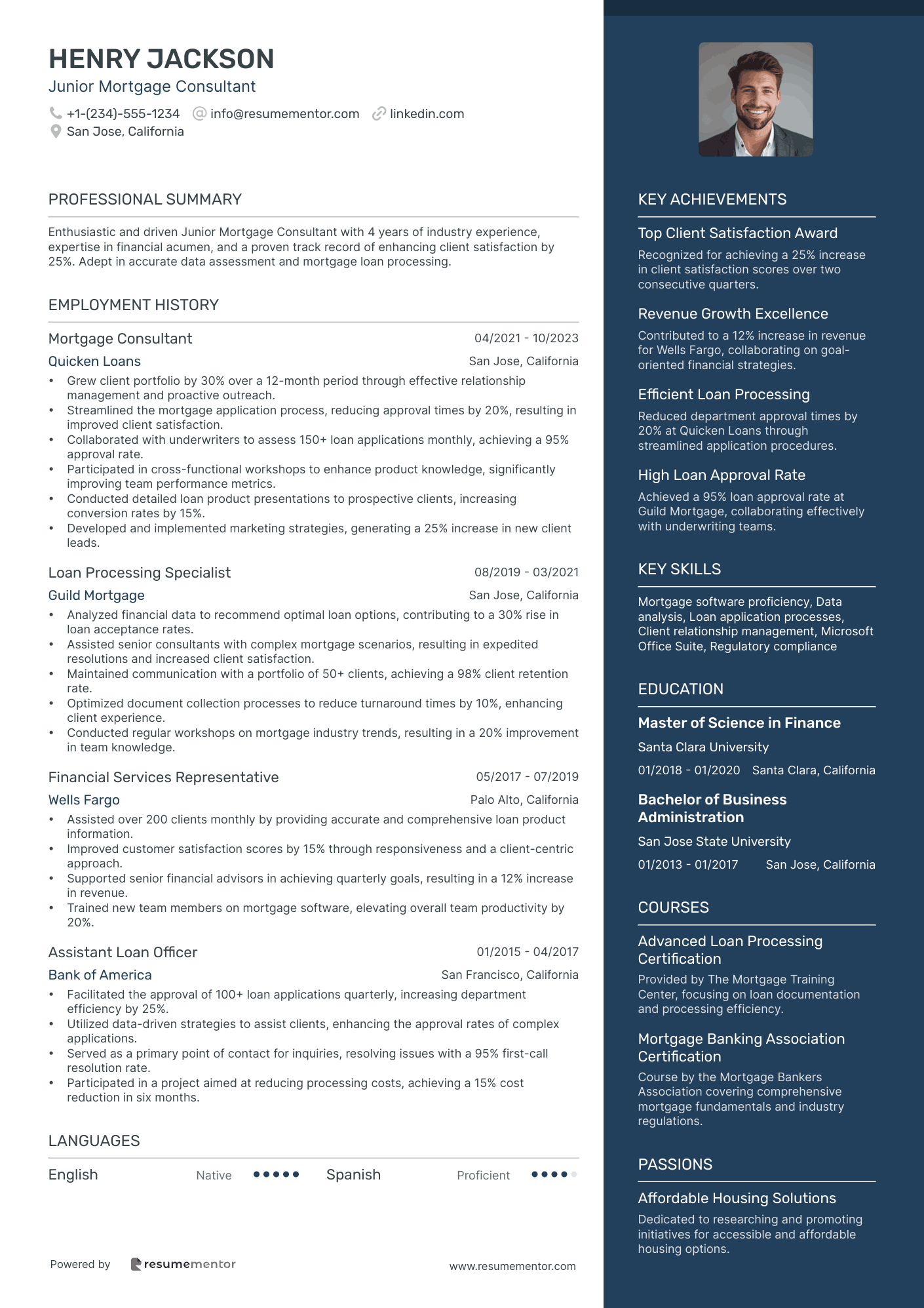

Junior Mortgage Consultant

First-Time Homebuyer Mortgage Consultant

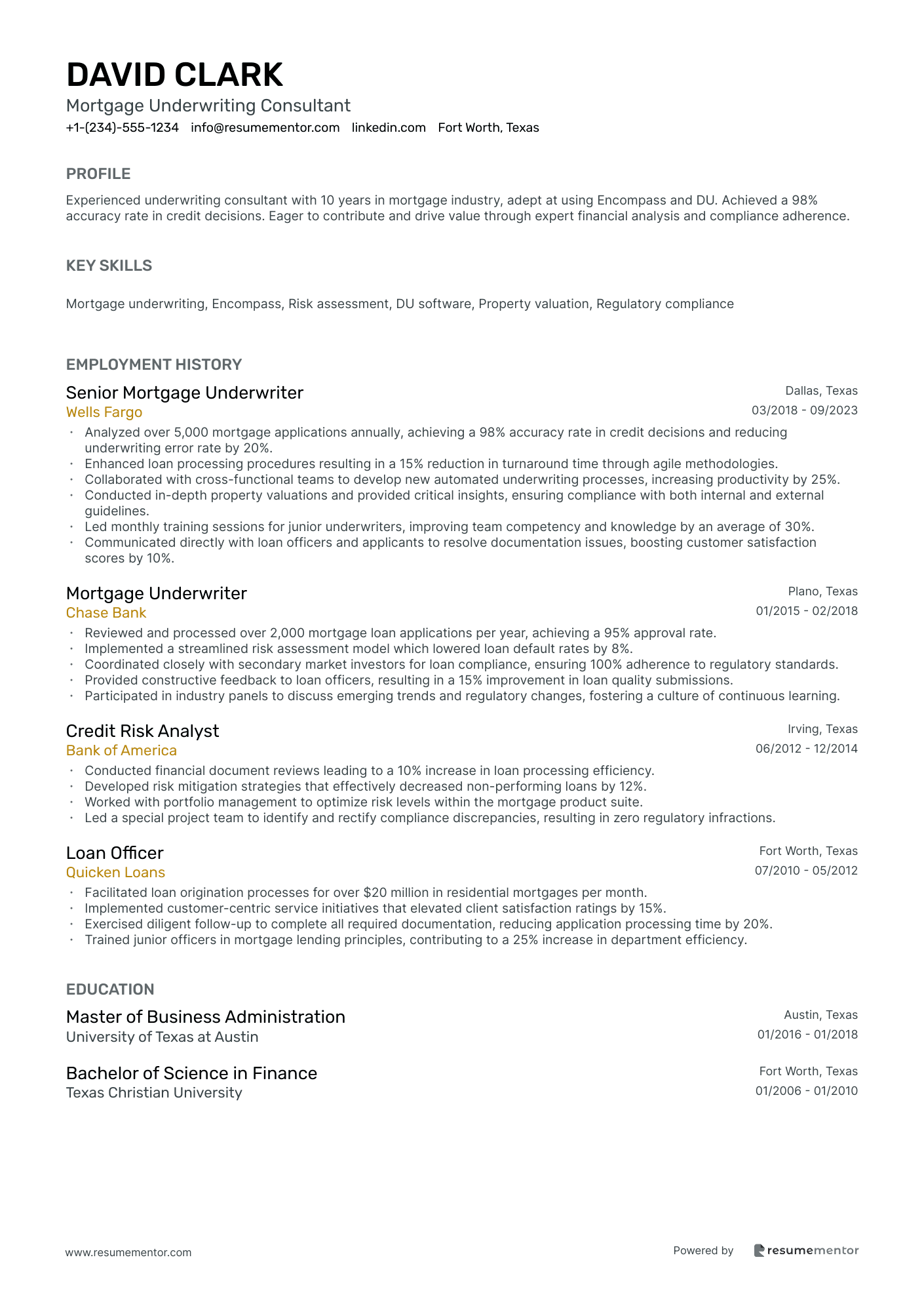

Mortgage Underwriting Consultant

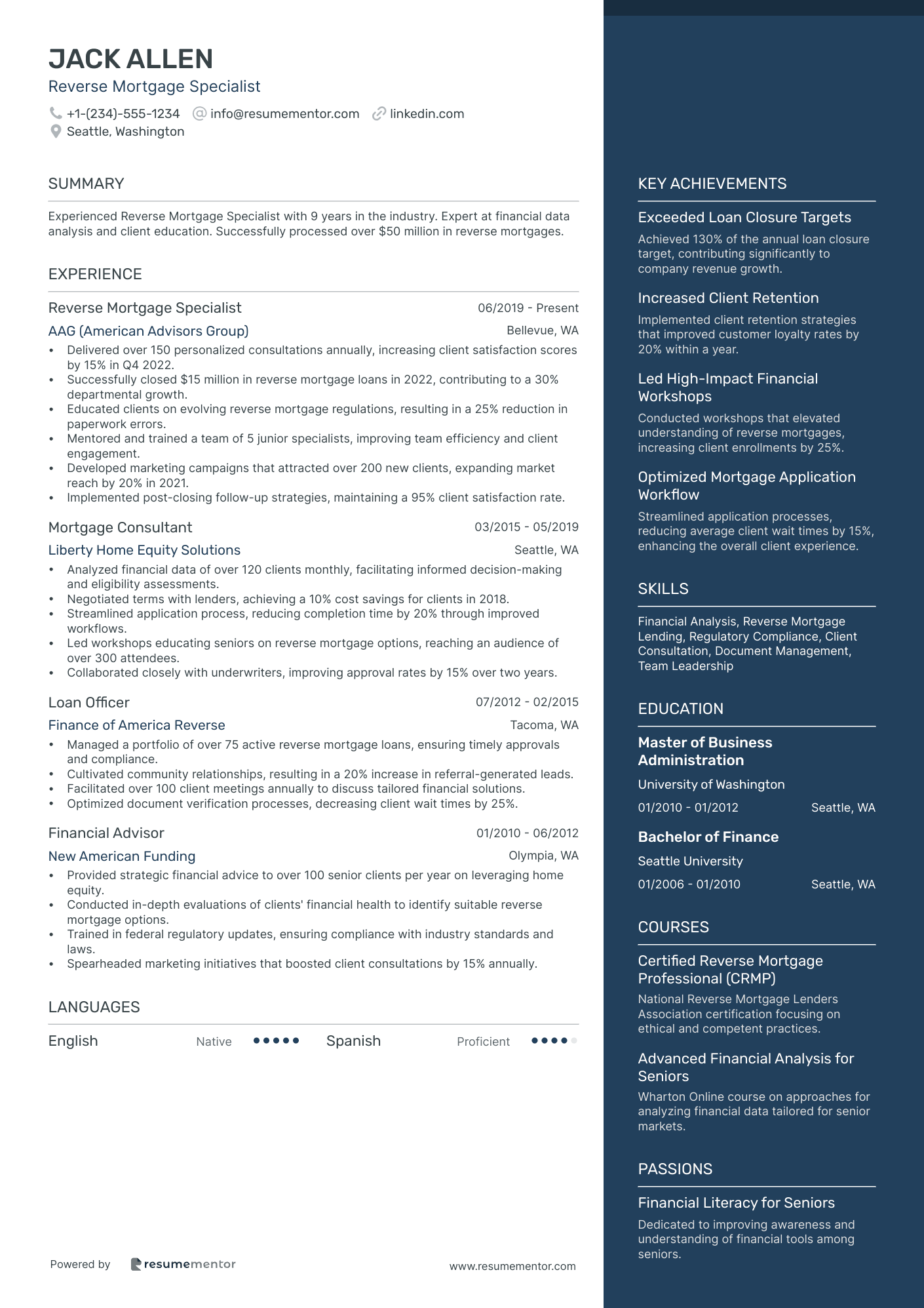

Reverse Mortgage Specialist

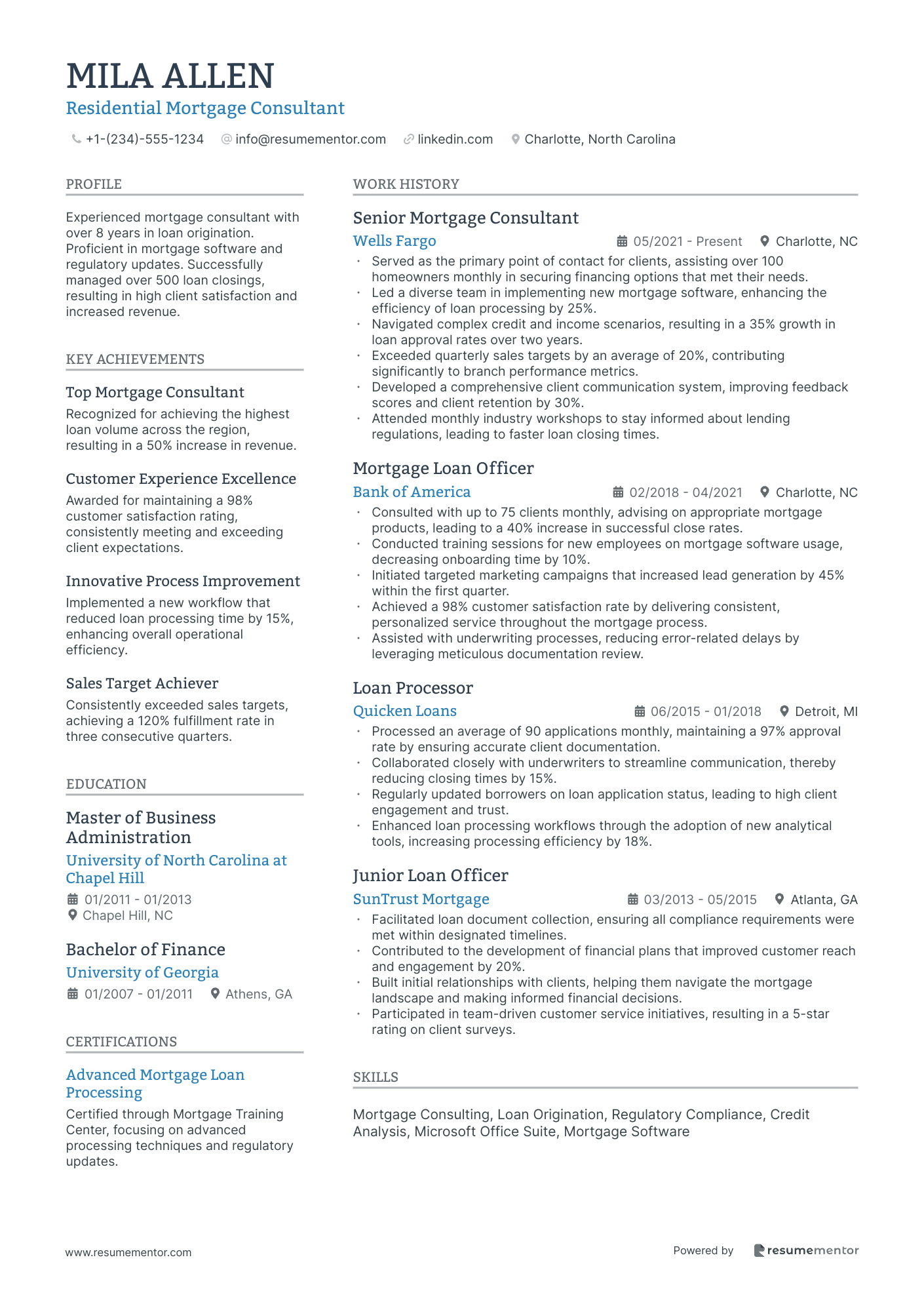

Residential Mortgage Consultant resume sample

- •Served as the primary point of contact for clients, assisting over 100 homeowners monthly in securing financing options that met their needs.

- •Led a diverse team in implementing new mortgage software, enhancing the efficiency of loan processing by 25%.

- •Navigated complex credit and income scenarios, resulting in a 35% growth in loan approval rates over two years.

- •Exceeded quarterly sales targets by an average of 20%, contributing significantly to branch performance metrics.

- •Developed a comprehensive client communication system, improving feedback scores and client retention by 30%.

- •Attended monthly industry workshops to stay informed about lending regulations, leading to faster loan closing times.

- •Consulted with up to 75 clients monthly, advising on appropriate mortgage products, leading to a 40% increase in successful close rates.

- •Conducted training sessions for new employees on mortgage software usage, decreasing onboarding time by 10%.

- •Initiated targeted marketing campaigns that increased lead generation by 45% within the first quarter.

- •Achieved a 98% customer satisfaction rate by delivering consistent, personalized service throughout the mortgage process.

- •Assisted with underwriting processes, reducing error-related delays by leveraging meticulous documentation review.

- •Processed an average of 90 applications monthly, maintaining a 97% approval rate by ensuring accurate client documentation.

- •Collaborated closely with underwriters to streamline communication, thereby reducing closing times by 15%.

- •Regularly updated borrowers on loan application status, leading to high client engagement and trust.

- •Enhanced loan processing workflows through the adoption of new analytical tools, increasing processing efficiency by 18%.

- •Facilitated loan document collection, ensuring all compliance requirements were met within designated timelines.

- •Contributed to the development of financial plans that improved customer reach and engagement by 20%.

- •Built initial relationships with clients, helping them navigate the mortgage landscape and making informed financial decisions.

- •Participated in team-driven customer service initiatives, resulting in a 5-star rating on client surveys.

Commercial Mortgage Advisor resume sample

- •Led a team to develop innovative solutions, enhancing loan approval rates by 25% through detailed financial analysis.

- •Managed a $50 million commercial portfolio, achieving a 98% client satisfaction rate by providing tailored financial strategies.

- •Negotiated loan terms with multiple lenders, securing favorable rates and terms for clients in over 80 transactions annually.

- •Developed partnerships with five major banks, resulting in increased access to competitive loan products for clients.

- •Conducted market research and created comprehensive reports, leading to identification of 15 new financing opportunities each quarter.

- •Mentored junior advisors, improving team performance by 30% through knowledge sharing and collaborative projects.

- •Processed and evaluated over 100 commercial mortgage applications annually, maintaining a 95% approval rate.

- •Built strategic networks with regional lenders, increasing client access to diverse financing products by 40%.

- •Implemented a new financial analysis model, reducing evaluation time by 20% and improving accuracy of assessments.

- •Provided expertise in complex financial scenarios, leading to successful closure of high-value real estate transactions.

- •Exceeded sales targets by 30% in consecutive quarters through proactive client engagement and customized advisory services.

- •Analyzed financial statements and credit reports for over 200 clients, ensuring compliance with lending criteria.

- •Contributed to market trend analyses that forecasted economic shifts, aiding investment planning for the advisory team.

- •Developed customized loan proposals, directly impacting the success rate of loan applications by 15%.

- •Streamlined document submission process, decreasing processing time by 10% and improving client experience.

- •Provided insight into customer financing needs through data-driven analysis, resulting in strategic expansion plans.

- •Collaborated in cross-departmental projects to improve financial reporting systems, enhancing data accuracy by 15%.

- •Delivered presentations to stakeholders, conveying complex analytical findings in understandable terms for strategic decision making.

- •Assisted in over 50 financial reviews quarterly, leading to improved assessment accuracy and decision-turnaround time.

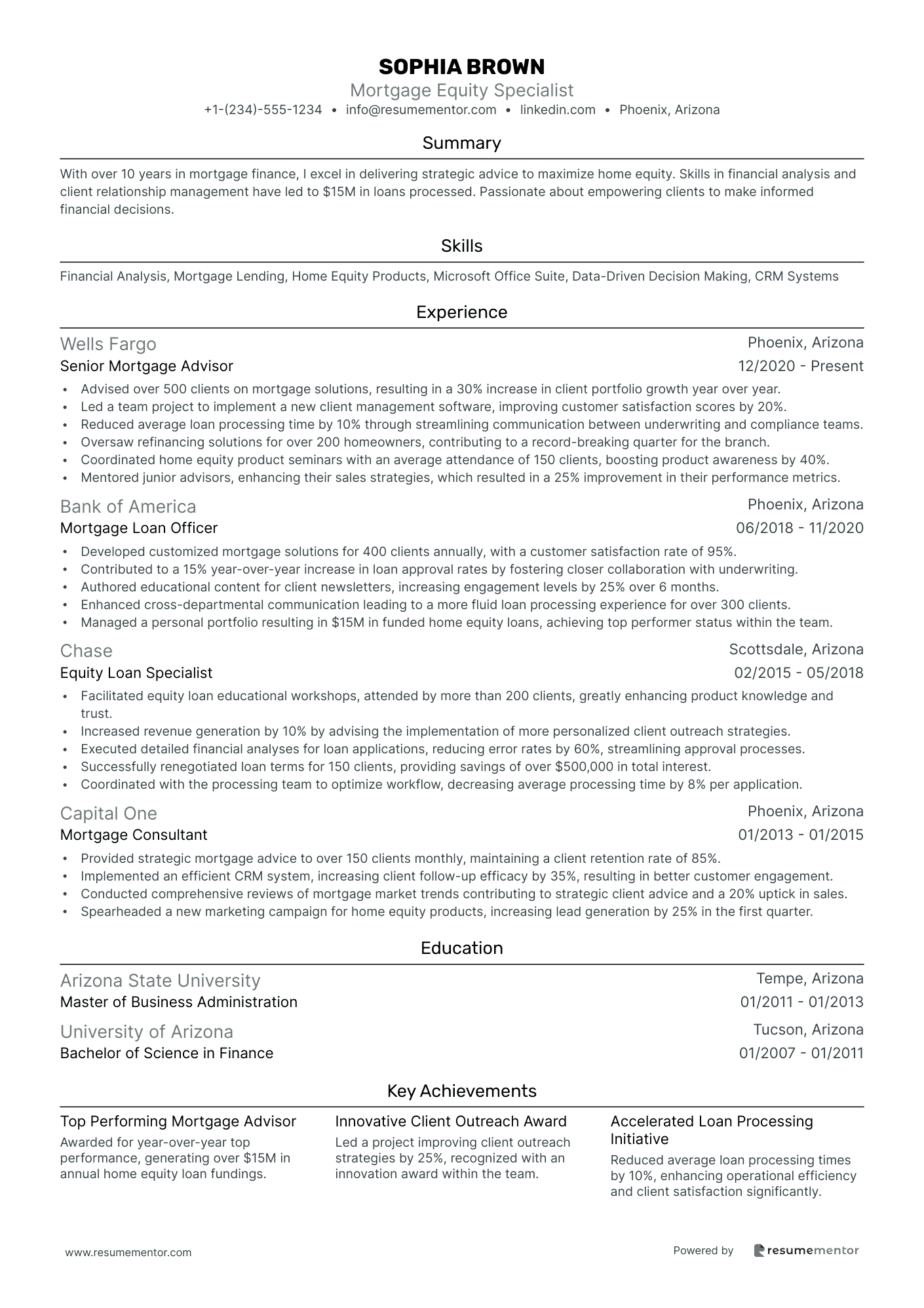

Mortgage Equity Specialist resume sample

- •Advised over 500 clients on mortgage solutions, resulting in a 30% increase in client portfolio growth year over year.

- •Led a team project to implement a new client management software, improving customer satisfaction scores by 20%.

- •Reduced average loan processing time by 10% through streamlining communication between underwriting and compliance teams.

- •Oversaw refinancing solutions for over 200 homeowners, contributing to a record-breaking quarter for the branch.

- •Coordinated home equity product seminars with an average attendance of 150 clients, boosting product awareness by 40%.

- •Mentored junior advisors, enhancing their sales strategies, which resulted in a 25% improvement in their performance metrics.

- •Developed customized mortgage solutions for 400 clients annually, with a customer satisfaction rate of 95%.

- •Contributed to a 15% year-over-year increase in loan approval rates by fostering closer collaboration with underwriting.

- •Authored educational content for client newsletters, increasing engagement levels by 25% over 6 months.

- •Enhanced cross-departmental communication leading to a more fluid loan processing experience for over 300 clients.

- •Managed a personal portfolio resulting in $15M in funded home equity loans, achieving top performer status within the team.

- •Facilitated equity loan educational workshops, attended by more than 200 clients, greatly enhancing product knowledge and trust.

- •Increased revenue generation by 10% by advising the implementation of more personalized client outreach strategies.

- •Executed detailed financial analyses for loan applications, reducing error rates by 60%, streamlining approval processes.

- •Successfully renegotiated loan terms for 150 clients, providing savings of over $500,000 in total interest.

- •Coordinated with the processing team to optimize workflow, decreasing average processing time by 8% per application.

- •Provided strategic mortgage advice to over 150 clients monthly, maintaining a client retention rate of 85%.

- •Implemented an efficient CRM system, increasing client follow-up efficacy by 35%, resulting in better customer engagement.

- •Conducted comprehensive reviews of mortgage market trends contributing to strategic client advice and a 20% uptick in sales.

- •Spearheaded a new marketing campaign for home equity products, increasing lead generation by 25% in the first quarter.

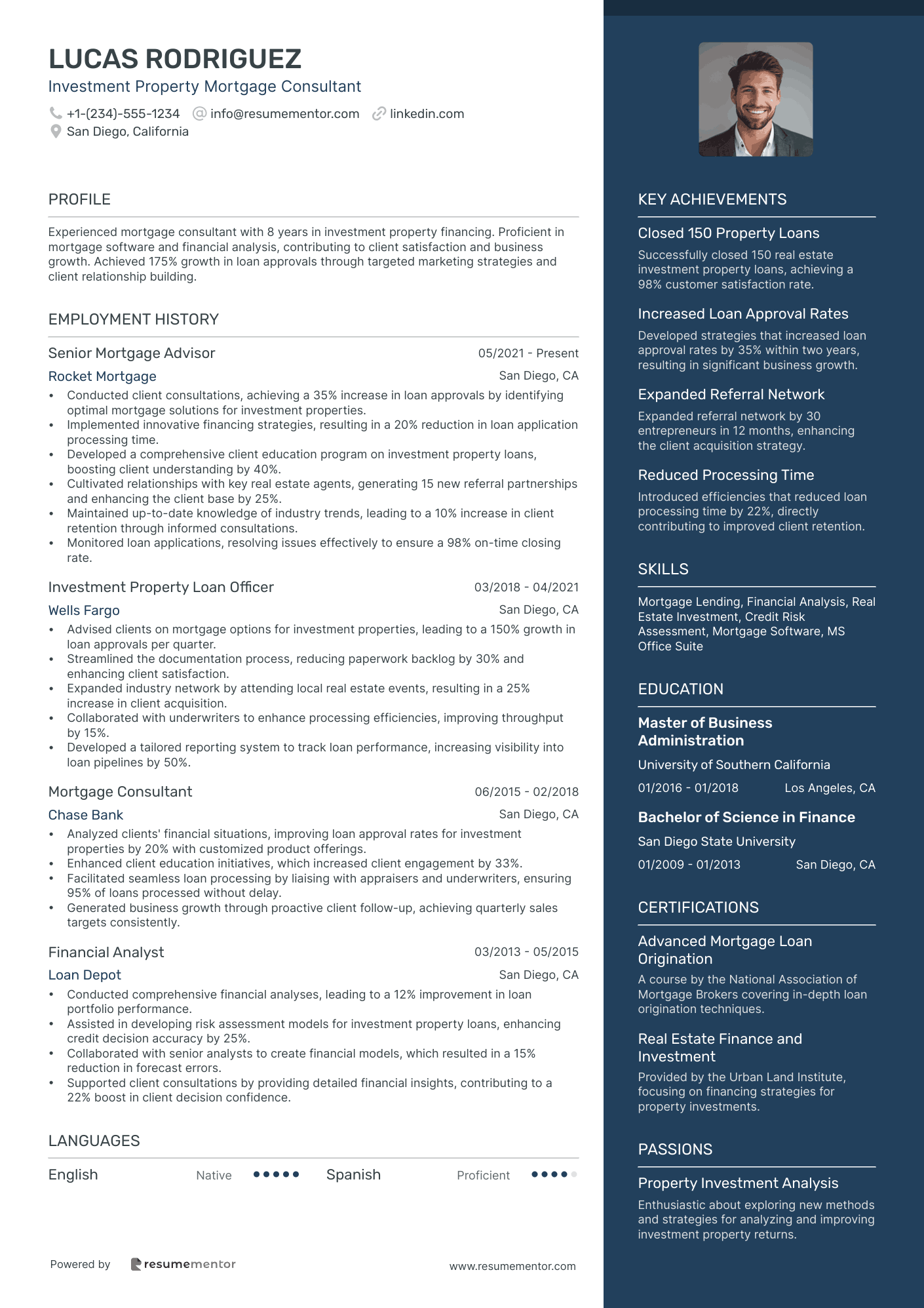

Investment Property Mortgage Consultant resume sample

- •Conducted client consultations, achieving a 35% increase in loan approvals by identifying optimal mortgage solutions for investment properties.

- •Implemented innovative financing strategies, resulting in a 20% reduction in loan application processing time.

- •Developed a comprehensive client education program on investment property loans, boosting client understanding by 40%.

- •Cultivated relationships with key real estate agents, generating 15 new referral partnerships and enhancing the client base by 25%.

- •Maintained up-to-date knowledge of industry trends, leading to a 10% increase in client retention through informed consultations.

- •Monitored loan applications, resolving issues effectively to ensure a 98% on-time closing rate.

- •Advised clients on mortgage options for investment properties, leading to a 150% growth in loan approvals per quarter.

- •Streamlined the documentation process, reducing paperwork backlog by 30% and enhancing client satisfaction.

- •Expanded industry network by attending local real estate events, resulting in a 25% increase in client acquisition.

- •Collaborated with underwriters to enhance processing efficiencies, improving throughput by 15%.

- •Developed a tailored reporting system to track loan performance, increasing visibility into loan pipelines by 50%.

- •Analyzed clients' financial situations, improving loan approval rates for investment properties by 20% with customized product offerings.

- •Enhanced client education initiatives, which increased client engagement by 33%.

- •Facilitated seamless loan processing by liaising with appraisers and underwriters, ensuring 95% of loans processed without delay.

- •Generated business growth through proactive client follow-up, achieving quarterly sales targets consistently.

- •Conducted comprehensive financial analyses, leading to a 12% improvement in loan portfolio performance.

- •Assisted in developing risk assessment models for investment property loans, enhancing credit decision accuracy by 25%.

- •Collaborated with senior analysts to create financial models, which resulted in a 15% reduction in forecast errors.

- •Supported client consultations by providing detailed financial insights, contributing to a 22% boost in client decision confidence.

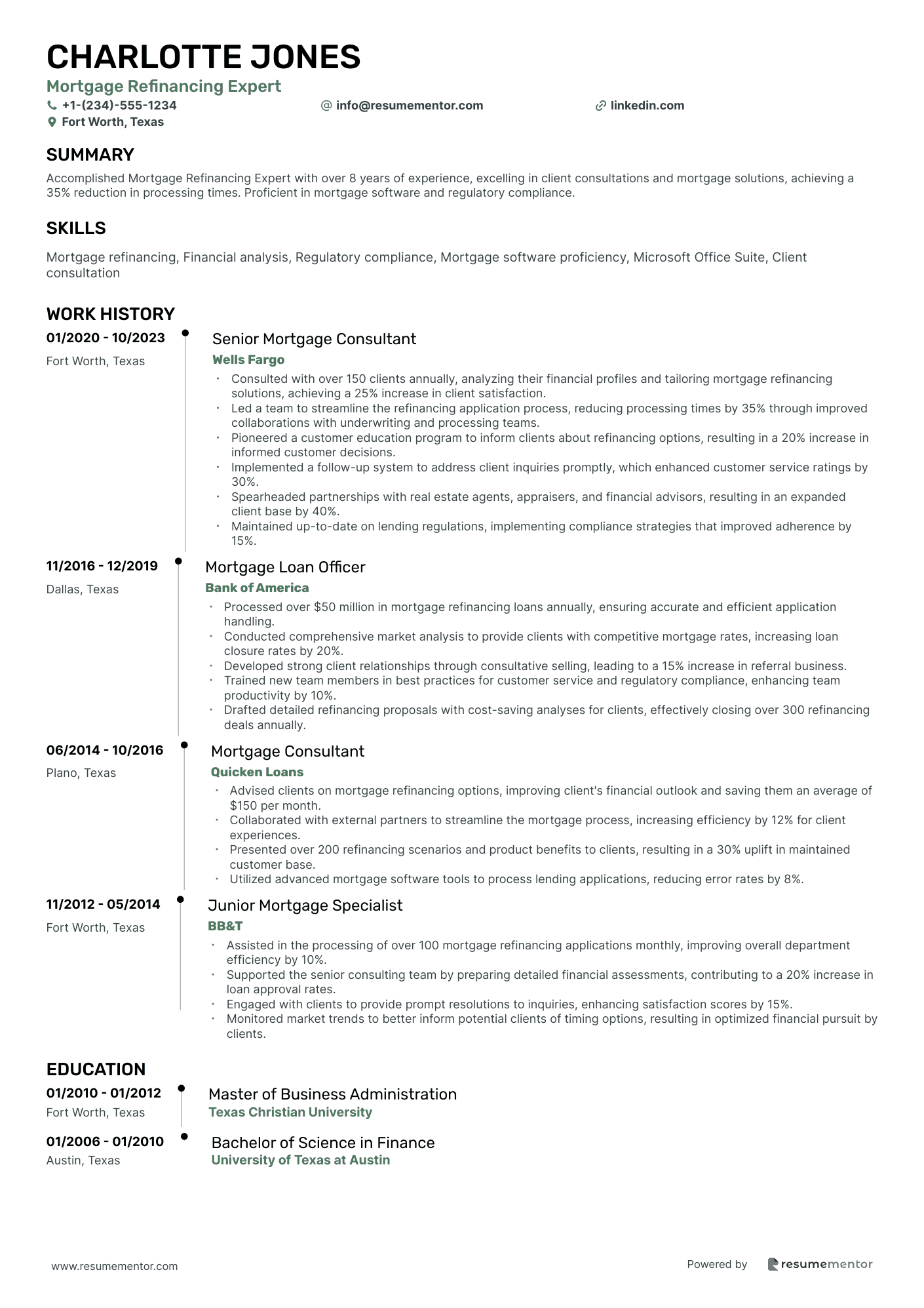

Mortgage Refinancing Expert resume sample

- •Consulted with over 150 clients annually, analyzing their financial profiles and tailoring mortgage refinancing solutions, achieving a 25% increase in client satisfaction.

- •Led a team to streamline the refinancing application process, reducing processing times by 35% through improved collaborations with underwriting and processing teams.

- •Pioneered a customer education program to inform clients about refinancing options, resulting in a 20% increase in informed customer decisions.

- •Implemented a follow-up system to address client inquiries promptly, which enhanced customer service ratings by 30%.

- •Spearheaded partnerships with real estate agents, appraisers, and financial advisors, resulting in an expanded client base by 40%.

- •Maintained up-to-date on lending regulations, implementing compliance strategies that improved adherence by 15%.

- •Processed over $50 million in mortgage refinancing loans annually, ensuring accurate and efficient application handling.

- •Conducted comprehensive market analysis to provide clients with competitive mortgage rates, increasing loan closure rates by 20%.

- •Developed strong client relationships through consultative selling, leading to a 15% increase in referral business.

- •Trained new team members in best practices for customer service and regulatory compliance, enhancing team productivity by 10%.

- •Drafted detailed refinancing proposals with cost-saving analyses for clients, effectively closing over 300 refinancing deals annually.

- •Advised clients on mortgage refinancing options, improving client's financial outlook and saving them an average of $150 per month.

- •Collaborated with external partners to streamline the mortgage process, increasing efficiency by 12% for client experiences.

- •Presented over 200 refinancing scenarios and product benefits to clients, resulting in a 30% uplift in maintained customer base.

- •Utilized advanced mortgage software tools to process lending applications, reducing error rates by 8%.

- •Assisted in the processing of over 100 mortgage refinancing applications monthly, improving overall department efficiency by 10%.

- •Supported the senior consulting team by preparing detailed financial assessments, contributing to a 20% increase in loan approval rates.

- •Engaged with clients to provide prompt resolutions to inquiries, enhancing satisfaction scores by 15%.

- •Monitored market trends to better inform potential clients of timing options, resulting in optimized financial pursuit by clients.

Mortgage Product Development Advisor resume sample

- •Led the redesign of five mortgage products, boosting market share by 15% and increasing customer satisfaction metrics by 25%.

- •Conducted comprehensive market analysis resulting in targeted product enhancements that aligned with current mortgage lending trends.

- •Collaborated with cross-functional teams to launch two innovative mortgage products, increasing new customer acquisition by 30%.

- •Developed and implemented training programs for over 100 sales team members, enhancing product knowledge and increasing sales efficiency by 40%.

- •Monitored regulatory changes, ensuring all product offerings remained compliant, resulting in zero compliance penalties over two years.

- •Managed a $20M budget for product development projects, optimizing resource allocation for maximum operational efficiency.

- •Streamlined product evaluation processes, reducing review time by 25% and improving deployment speed for three new mortgage products.

- •Analyzed competitors' mortgage products, contributing to strategic positioning adjustments that increased competitiveness by 15%.

- •Collaborated with IT and operations teams to automate product reporting, enhancing accuracy and timeliness of data for decision-making.

- •Facilitated feedback sessions with clients, using insights to guide future product developments and enhancements.

- •Assisted in documentation and compliance checks for mortgage products, ensuring regulatory adherence and reducing audit discrepancies by 30%.

- •Conducted market surveys and analyzed trends to inform product adjustments, resulting in a 12% increase in customer retention rates.

- •Partnered with marketing to design and implement sales campaigns that contributed to a 20% rise in product inquiries.

- •Prepared detailed competitor analysis and insights to support senior management in strategic product decision-making.

- •Assisted in rolling out a series of new product features, enhancing product value proposition and customer engagement.

- •Provided expert financial advice to clients, increasing client portfolio value by 10% within the first year of tenure.

- •Collaborated with product teams to tailor mortgage solutions, improving product suitability and client satisfaction by 18%.

- •Implemented process improvements that reduced loan processing times by 15%, enhancing overall customer experience.

- •Conducted staff training sessions, equipping team members with the knowledge needed to improve customer interactions and resolve issues effectively.

Junior Mortgage Consultant resume sample

- •Grew client portfolio by 30% over a 12-month period through effective relationship management and proactive outreach.

- •Streamlined the mortgage application process, reducing approval times by 20%, resulting in improved client satisfaction.

- •Collaborated with underwriters to assess 150+ loan applications monthly, achieving a 95% approval rate.

- •Participated in cross-functional workshops to enhance product knowledge, significantly improving team performance metrics.

- •Conducted detailed loan product presentations to prospective clients, increasing conversion rates by 15%.

- •Developed and implemented marketing strategies, generating a 25% increase in new client leads.

- •Analyzed financial data to recommend optimal loan options, contributing to a 30% rise in loan acceptance rates.

- •Assisted senior consultants with complex mortgage scenarios, resulting in expedited resolutions and increased client satisfaction.

- •Maintained communication with a portfolio of 50+ clients, achieving a 98% client retention rate.

- •Optimized document collection processes to reduce turnaround times by 10%, enhancing client experience.

- •Conducted regular workshops on mortgage industry trends, resulting in a 20% improvement in team knowledge.

- •Assisted over 200 clients monthly by providing accurate and comprehensive loan product information.

- •Improved customer satisfaction scores by 15% through responsiveness and a client-centric approach.

- •Supported senior financial advisors in achieving quarterly goals, resulting in a 12% increase in revenue.

- •Trained new team members on mortgage software, elevating overall team productivity by 20%.

- •Facilitated the approval of 100+ loan applications quarterly, increasing department efficiency by 25%.

- •Utilized data-driven strategies to assist clients, enhancing the approval rates of complex applications.

- •Served as a primary point of contact for inquiries, resolving issues with a 95% first-call resolution rate.

- •Participated in a project aimed at reducing processing costs, achieving a 15% cost reduction in six months.

First-Time Homebuyer Mortgage Consultant resume sample

- •Conducted over 100 consultations monthly, providing personalized mortgage solutions aligned with client financial goals, resulting in a 25% increase in client retention.

- •Educated clients on mortgage options, explaining loan types and terms clearly to improve client understanding by over 40% according to surveys.

- •Analyzed credit histories and financials, successfully assessing eligibility for various mortgage programs, resulting in improved approval rates by 15%.

- •Implemented a new feedback system, increasing client satisfaction scores by 30% and enhancing service quality.

- •Collaborated with a team of real estate professionals to streamline the mortgage process, reducing approval time by an average of 3 days.

- •Met and exceeded sales goals continuously, achieving 120% of quarterly targets in 2022.

- •Processed mortgage applications for over 50 first-time homebuyers per month, maintaining a high approval rate of 85%.

- •Enhanced client education programs, leading to a 40% decrease in application errors and smoother processing.

- •Developed strong relationships with local real estate agents, resulting in a 20% increase in client referrals.

- •Tracked and analyzed regulatory changes, ensuring compliance and informed advising, which maintained a 100% audit success rate.

- •Utilized CRM tools to increase client follow-up efficiency, reducing missed opportunities by 10%.

- •Advised over 100 clients on mortgage strategies and financial planning, significantly increasing homeownership success rates.

- •Generated a portfolio increase of 15% by optimizing client financial plans.

- •Designed educational seminars to inform potential homebuyers, resulting in a 20% increase in seminar attendance.

- •Conducted thorough financial analyses, helping 98% of clients improve their credit scores within 6 months.

- •Guided clients through the mortgage application process, increasing successful submission rates by 30%.

- •Participated in local housing events, expanding community presence and client engagement by 20%.

- •Built a digital tool for client self-assessment, improving initial consultation productivity by 25%.

- •Successfully executed marketing campaigns that resulted in a 15% increase in client inquiries.

Mortgage Underwriting Consultant resume sample

- •Analyzed over 5,000 mortgage applications annually, achieving a 98% accuracy rate in credit decisions and reducing underwriting error rate by 20%.

- •Enhanced loan processing procedures resulting in a 15% reduction in turnaround time through agile methodologies.

- •Collaborated with cross-functional teams to develop new automated underwriting processes, increasing productivity by 25%.

- •Conducted in-depth property valuations and provided critical insights, ensuring compliance with both internal and external guidelines.

- •Led monthly training sessions for junior underwriters, improving team competency and knowledge by an average of 30%.

- •Communicated directly with loan officers and applicants to resolve documentation issues, boosting customer satisfaction scores by 10%.

- •Reviewed and processed over 2,000 mortgage loan applications per year, achieving a 95% approval rate.

- •Implemented a streamlined risk assessment model which lowered loan default rates by 8%.

- •Coordinated closely with secondary market investors for loan compliance, ensuring 100% adherence to regulatory standards.

- •Provided constructive feedback to loan officers, resulting in a 15% improvement in loan quality submissions.

- •Participated in industry panels to discuss emerging trends and regulatory changes, fostering a culture of continuous learning.

- •Conducted financial document reviews leading to a 10% increase in loan processing efficiency.

- •Developed risk mitigation strategies that effectively decreased non-performing loans by 12%.

- •Worked with portfolio management to optimize risk levels within the mortgage product suite.

- •Led a special project team to identify and rectify compliance discrepancies, resulting in zero regulatory infractions.

- •Facilitated loan origination processes for over $20 million in residential mortgages per month.

- •Implemented customer-centric service initiatives that elevated client satisfaction ratings by 15%.

- •Exercised diligent follow-up to complete all required documentation, reducing application processing time by 20%.

- •Trained junior officers in mortgage lending principles, contributing to a 25% increase in department efficiency.

Reverse Mortgage Specialist resume sample

- •Delivered over 150 personalized consultations annually, increasing client satisfaction scores by 15% in Q4 2022.

- •Successfully closed $15 million in reverse mortgage loans in 2022, contributing to a 30% departmental growth.

- •Educated clients on evolving reverse mortgage regulations, resulting in a 25% reduction in paperwork errors.

- •Mentored and trained a team of 5 junior specialists, improving team efficiency and client engagement.

- •Developed marketing campaigns that attracted over 200 new clients, expanding market reach by 20% in 2021.

- •Implemented post-closing follow-up strategies, maintaining a 95% client satisfaction rate.

- •Analyzed financial data of over 120 clients monthly, facilitating informed decision-making and eligibility assessments.

- •Negotiated terms with lenders, achieving a 10% cost savings for clients in 2018.

- •Streamlined application process, reducing completion time by 20% through improved workflows.

- •Led workshops educating seniors on reverse mortgage options, reaching an audience of over 300 attendees.

- •Collaborated closely with underwriters, improving approval rates by 15% over two years.

- •Managed a portfolio of over 75 active reverse mortgage loans, ensuring timely approvals and compliance.

- •Cultivated community relationships, resulting in a 20% increase in referral-generated leads.

- •Facilitated over 100 client meetings annually to discuss tailored financial solutions.

- •Optimized document verification processes, decreasing client wait times by 25%.

- •Provided strategic financial advice to over 100 senior clients per year on leveraging home equity.

- •Conducted in-depth evaluations of clients' financial health to identify suitable reverse mortgage options.

- •Trained in federal regulatory updates, ensuring compliance with industry standards and laws.

- •Spearheaded marketing initiatives that boosted client consultations by 15% annually.

As a mortgage consultant, you navigate the complex world of finance like a skilled captain steering through stormy seas, yet crafting a resume might feel like you're setting sail in unfamiliar waters. This crucial document is your first interaction with potential employers, and it's your opportunity to convey the expertise, problem-solving skills, and deal-closing ability that define you professionally.

The challenge often lies in transforming your financial acumen and client management talents into a compelling narrative on paper. It's crucial to clearly communicate your strengths, like analyzing financial data and delivering premium customer service, which are integral to standing out. Essential technical skills, such as loan processing and risk assessment, should seamlessly be woven into your resume.

To simplify this process, consider using a resume template that organizes your achievements and skills effectively. This approach allows hiring managers to easily see what makes you a standout candidate, as you focus on crafting the perfect content instead of getting bogged down by formatting concerns. Explore these resume templates to find one that helps your resume shine.

Ultimately, your resume is more than a list of past roles; it tells the story of your professional journey. Use it to captivate the attention of recruiters seeking someone with your unique blend of skills and experience. By leveraging the right tools and strategies, you’re on the right track to landing your next opportunity.

Key Takeaways

- Tailor the mortgage consultant resume to highlight unique skills and experiences, emphasizing analytical strengths, client relationship management, and the ability to secure beneficial loan terms.

- Organize the resume with clear sections: contact information, professional summary, work experience, education, and skills, using templates to streamline the process.

- Choose a reverse-chronological format for quick comprehension of your career path and use professional fonts like Raleway, Lato, or Montserrat for clarity.

- Quantify achievements with concrete metrics to demonstrate problem-solving and value delivery, ensuring alignment with potential employers' needs.

- Include any certificates, extra sections like languages or volunteer work, and personalization to show a well-rounded character and extensive preparation for the role.

What to focus on when writing your mortgage consultant resume

A mortgage consultant resume needs to effectively showcase your unique skills and experiences in navigating the home loan process, emphasizing your ability to foster client relationships and efficiently manage financial tasks. Your resume should capture your analytical strengths and the vital role you play in securing beneficial loan terms for your clients—qualities that are highly valued in the mortgage industry.

How to structure your mortgage consultant resume

- Contact Information: Start by ensuring your full name, phone number, email address, and LinkedIn profile are clearly visible at the top. This allows recruiters easy access to initiate a follow-up, reflecting professionalism and ensuring they can contact you without hassle.

- Professional Summary: This brief overview should distill your most compelling professional experiences and skills as a mortgage consultant. Focus on instances where you've successfully guided clients through the mortgage process, emphasizing your ability to secure favorable outcomes and making a strong case for why you are an asset to potential employers.

- Work Experience: This is the section where you dive into the details of your previous roles. Highlight key responsibilities and achievements that are directly relevant to mortgage consulting. Emphasize experiences where you worked closely with lenders, handled complex loan processing tasks, and led clients to successful financial decisions.

- Education: Here, provide information on your educational background relevant to the mortgage field. Highlight degrees or certifications in finance or real estate, such as a Bachelor's degree or a specific mortgage broker license, that bolster your qualifications and showcase your commitment to your professional development.

- Skills: List the core competencies that make you an effective mortgage consultant. Include technical skills like mortgage underwriting and risk assessment, interpersonal skills like client relationship management, and your in-depth knowledge of federal and state mortgage regulations, all of which are crucial for excelling in this role.

These sections form the backbone of a well-structured resume. Below, we'll explore each section in more depth to ensure your resume stands out in the competitive mortgage consulting field.

Which resume format to choose

Navigating the world of mortgage consulting calls for a resume format that makes an immediate impact. Opting for a reverse-chronological format is a strategic move. This format allows potential employers to quickly understand how your recent experiences and accomplishments align with their specific needs in the mortgage industry.

The choice of font ties directly into how your resume is perceived. Raleway, Lato, and Montserrat stand out as modern and professional choices that enhance readability. Their clean lines and contemporary style help convey a sense of current expertise, essential for a field that values both precision and clarity.

Saving and submitting your resume as a PDF is crucial in preserving its design elements. This ensures that when hiring managers open your document, it's displayed exactly as you intended, maintaining a polished and professional appearance across all devices. Consistency in layout underscores your attention to detail, an important trait for a mortgage consultant.

Setting your margins at about one inch on all sides is more than just a design choice; it’s about ensuring readability. Adequate white space helps prevent your resume from looking cluttered, allowing the content to be the focal point. This thoughtful presentation reflects the organizational skills necessary for effectively managing complex mortgage documentation and communications.

Incorporating these elements will make your mortgage consultant resume a powerful tool in capturing attention and demonstrating your readiness for new opportunities in the industry. The combination of a clear structure, professional design, and meticulous attention to detail showcases your dedication and competence in the field.

How to write a quantifiable resume experience section

A standout experience section for a mortgage consultant resume grabs attention by showcasing your achievements in previous roles and clearly linking them to the job you’re applying for. Start by highlighting significant accomplishments in reverse chronological order, focusing on your most recent positions. This approach gives a clear view of your career path and highlights the impact you've had along the way, keeping it relevant by narrowing down to the last 10-15 years.

Tailoring your resume to the job ad is crucial. This involves using strong action verbs like "secured," "increased," "reduced," and "implemented" to emphasize how you met specific goals. Choose words and accomplishments that directly relate to the role you want, making your job titles and achievements resonate with what employers are seeking. Your experience section should reflect your readiness and capability for the new role, ensuring your resume is aligned with the employer’s needs.

- •Secured a 32% increase in client satisfaction ratings through personalized mortgage solutions.

- •Generated $5 million in annual loan volume, exceeding company targets by 20%.

- •Reduced loan processing time by 15% by implementing a streamlined application process.

- •Developed and coached a team of 10 junior consultants, improving overall team performance by 25%.

This experience section excels by seamlessly connecting your accomplishments with the role you want. Each bullet point not only highlights what you achieved but also illustrates the skills and expertise you’ll bring to the new position. Quantifiable results demonstrate your ability to solve problems and deliver value, appealing to what employers look for in a candidate. The focused bullet points offer a clear narrative of your past successes, crafted to resonate with potential employers who prioritize enhanced performance and client satisfaction.

Industry-Specific Focus resume experience section

A mortgage consultant Industry-Specific Focus-Focused resume experience section should clearly emphasize your specialized skills and contributions to the field. Begin by showcasing your achievements and responsibilities that highlight your expertise, such as assessing clients' financial needs and ensuring their satisfaction, alongside upholding regulatory compliance. Naturally integrate industry-relevant keywords to ensure the language flows smoothly while using active verbs and quantifying your accomplishments to provide a vivid depiction of your capabilities.

As you craft each bullet point, maintain a seamless connection between the details. Explain how your role in loan processing includes analytical work that ensures accuracy and contributes to pivotal financial decisions. Demonstrate your excellent customer service skills through your client interactions, weaving these experiences into a narrative of your professional growth. Connect your successes to company goals to illustrate how your efforts align with industry standards and the organizational mission, underscoring your efficiency and alignment with broader objectives.

Senior Mortgage Consultant

Prime Lending Solutions

January 2018 - Present

- Helped over 200 clients each year choose loan packages that best fit their finances and goals.

- Raised customer satisfaction scores by 15% through tailored, attentive service.

- Kept compliance at 100% with all regulations, minimizing legal risks to the company.

- Created and delivered training for new consultants, increasing team efficiency by 20%.

Skills-Focused resume experience section

A skills-focused mortgage consultant resume experience section should showcase your achievements and core abilities, instead of simply listing tasks. Start by identifying key skills such as client relations, financial analysis, and risk assessment, and frame your accomplishments around these strengths. When you describe each job experience, emphasize how you've put these skills into action to deliver exceptional results. For example, if you've improved customer satisfaction or reduced loan approval times, specify the percentage or time-frame to highlight your effectiveness.

Focus each bullet point on a single achievement or responsibility, ensuring that it is both concise and informative. Use action verbs to inject energy and purpose into your statements, replacing basic terms like "helped" or "assisted" with "led," "developed," or "initiated." This approach not only aligns your skills with what potential employers are looking for but also demonstrates how your past accomplishments have prepared you for future success.

Senior Mortgage Consultant

Bright Future Financial Solutions

Jan 2020 - Present

- Improved loan approval efficiency by 30%, ensuring faster processing for clients by analyzing and streamlining credit evaluation procedures.

- Developed personalized financial plans for over 100 clients annually, enhancing customer satisfaction scores by 40% with exceptional service.

- Established a risk assessment protocol that reduced default rates by 20%, safeguarding company assets and client investments.

- Trained new staff in mortgage consulting techniques, boosting overall team productivity by 25%.

Result-Focused resume experience section

A result-focused mortgage consultant resume experience section should highlight your key achievements and the value they added to your employer and clients. Instead of listing tasks, focus on the meaningful impacts you made. Identify distinct skills and accomplishments that underscore your expertise, like enhancing processes, achieving successful client interactions, or taking on leadership roles. This approach not only details your responsibilities but also showcases the positive changes you initiated in your workplace.

When illustrating your impact to potential employers, use quantifiable outcomes—like percentages or dollar amounts—to provide clear evidence of your contributions. Ensure each point is concise and stands alone while connecting back to your main achievements. Employ action verbs to emphasize the proactive measures you take in your career and mention any specific technologies or methodologies you have utilized. This cohesive approach keeps employers engaged and gives them a vivid picture of your contributions and potential impact on their organization.

Senior Mortgage Consultant

Home Finance Solutions

March 2018 - Present

- Increased loan approval rate by 25% through improved client education and process streamlining.

- Developed a customer satisfaction program leading to a 15% rise in positive feedback ratings.

- Trained and mentored a team of 5 junior consultants, enhancing team productivity by 30%.

- Implemented new software tools for client management, reducing application time by 20%.

Efficiency-Focused resume experience section

A mortgage consultant efficiency-focused resume experience section should clearly demonstrate how you've improved processes and increased productivity in your roles. Start by thinking about specific ways you've enhanced operations or reduced costs at your past jobs. Use tangible numbers or percentages to highlight these achievements whenever you can. It's crucial to mention any software tools or methods you employed or optimized to boost workflow efficiency, connecting this expertise to the overall success of the business. Your experience section should succinctly convey not just your task-oriented focus, but also your knack for delivering results that positively impact the organization.

When outlining your past experiences, use clear and concise language, organizing them as bullet points for better readability. Each detail should build on the previous one, painting a cohesive picture of your operational effectiveness. The aim is to smoothly convey the impact you made in each role, helping employers quickly understand the unique value you offer. Through this approach, you will effectively show how your contributions have led to more efficient business processes and better outcomes for the organization.

Mortgage Consultant

ABC Financial Services

Jan 2020 - Present

- Implemented a new loan tracking system that decreased processing time by 25%.

- Trained team members on the use of automated tools, increasing team efficiency by 20%.

- Developed a customer service workflow that reduced client response time by 30%.

- Conducted performance analysis and identified bottlenecks, leading to a 15% cost reduction.

Write your mortgage consultant resume summary section

A client-focused mortgage consultant resume summary should effectively enhance your job application by succinctly highlighting your unique skills, experience, and achievements. This section sets the stage for your ability to guide clients, assess their financial needs, and secure the best mortgage deals. A strong summary is both specific and clear, reflecting your expertise in a way that captures a hiring manager's attention. Here's an example to consider:

This example starts by highlighting extensive experience, establishing credibility through specific accomplishments such as saving clients money. The summary positions you as both knowledgeable and ethical, traits crucial in financial roles. Understanding the nuances between a resume summary and similar sections like objectives, profiles, or qualifications summaries is vital. A resume objective, often used for entry-level roles, focuses on your career goals and aspirations. In contrast, a resume profile shines light on personal strengths, while a summary of qualifications lists key achievements. Choosing the right element depends on your career stage and the impression you aim to leave. By using clear, direct language, a well-crafted summary or objective can be your springboard to the next stage of the hiring process.

Listing your mortgage consultant skills on your resume

A skills-focused mortgage consultant resume should effectively highlight what makes you a standout candidate. You can showcase your skills in a dedicated section or integrate them throughout your experience and summary sections. Start by considering your strengths, often reflected in soft skills like communication and empathy, which are crucial for connecting with clients. On the technical side, hard skills are your learned, practical abilities that demonstrate your mortgage expertise.

These skills not only define your capabilities but also serve as essential resume keywords. Using well-chosen keywords increases your resume’s visibility to employers and improves its chances of passing through automated screening tools. To give a clear picture of your competence in mortgage consulting, here's an example of a streamlined skills section formatted in JSON.

This skills section is impactful because it directly aligns with industry demands, making it easier for employers to recognize your value. Including skills that are specific to mortgage consulting ensures your resume stands out in a competitive field.

Best hard skills to feature on your mortgage consultant resume

Hard skills are crucial for showcasing the technical abilities you’ve acquired. They are essential for highlighting your preparedness for the role of a mortgage consultant.

Hard Skills

- Loan Origination

- Mortgage Regulations

- Credit Analysis

- Risk Assessment

- Financial Modeling

- Underwriting

- Interest Rate Calculation

- Regulatory Compliance

- Financial Analysis

- Market Research

- Data Analysis

- Credit Scoring Systems Knowledge

- Loan Processing

- Financial Software Proficiency

- Appraisal Review

Best soft skills to feature on your mortgage consultant resume

Soft skills demonstrate your ability to connect and communicate effectively in any professional environment. They are vital for building strong relationships with clients and colleagues.

Soft Skills

- Communication

- Negotiation

- Problem-Solving

- Empathy

- Customer Service Orientation

- Adaptability

- Attention to Detail

- Organizational Skills

- Teamwork

- Conflict Resolution

- Time Management

- Persuasion

- Leadership

- Decision-Making

- Active Listening

How to include your education on your resume

The education section is a critical part of a mortgage consultant's resume. Tailor it specifically to the job you want. Keep it relevant and focused. List degrees related to finance, business, or economics, and leave out unrelated ones. When noting your degree, include the institution and dates. If your GPA is 3.5 or higher, include it, but state clearly what it signifies within the education system. Cum laude honors should be included to highlight academic excellence.

For example, a wrong education section might look like this:

A more suitable example would be:

The latter clearly demonstrates relevant expertise for a mortgage consultant role. It highlights an applicable degree and honors. The example doesn't clutter with unnecessary information, making the qualifications stand out.

How to include mortgage consultant certificates on your resume

Including a certificates section in your mortgage consultant resume is essential because it showcases your qualifications and expertise. List the name of the certificate clearly so potential employers can quickly recognize it. Include the date you received the certificate to show that your knowledge is current. Add the issuing organization to give credibility to your certification.

For a more prominent display, you can incorporate certificates into your resume header. This makes them immediately visible and emphasizes their importance.

Here’s an example of a standalone certificates section:

This example is good because it lists relevant certifications for a mortgage consultant. It includes both the title and issuer, making it easy for potential employers to recognize the certifications. The dates ensure they are up-to-date. Relevant certificates provide proof of your skills and dedication to the mortgage field.

Extra sections to include in your mortgage consultant resume

When crafting a resume for a mortgage consultant position, it's essential to highlight your skills and experiences while also showcasing your individuality and passions. Including various sections that reflect your personal and professional interests can help you stand out to potential employers. Here’s how to include and benefit from adding key sections:

Language section — Indicate language proficiency levels to show your ability to communicate with diverse clients. Could be critical for reaching non-English speaking customers, enhancing customer service.

Hobbies and interests section — Humanize your resume by highlighting hobbies that reflect your character and work ethic. Demonstrates a well-rounded personality which can foster better client relations.

Volunteer work section — Showcase your commitment to the community and teamwork through relevant volunteer experiences. Highlights your social responsibility and ability to work collaboratively.

Books section — List books you've read that are relevant to financial services or personal development. Shows your eagerness to learn and stay informed about industry trends.

With these sections included, your resume not only illustrates your professional capabilities but also paints a picture of you as a well-rounded individual. Employers appreciate candidates who bring more than just technical skills to the table.

In Conclusion

In conclusion, crafting a precise and effective mortgage consultant resume is a crucial step in advancing your career in the finance sector. Your resume serves as the first impression for hiring managers, communicating not just your professional experience but your unique value proposition. Focus on weaving a narrative that highlights your skills in financial analysis, client management, and market expertise, ensuring each section—from work experience to education—complements the story you wish to tell. Using a structured template can streamline this process, helping you to concentrate on content rather than format. Incorporate quantifiable achievements to clearly demonstrate your impact, turning potential eyes of recruiters toward your accomplishments. The strategic use of fonts and formatting, like reverse-chronological order, can enhance readability and leave a lasting impression. Remember, intently chosen words and numbers that mirror job descriptions can capture an employer's interest. Including sections on certifications and personal attributes can bolster your candidacy, showcasing both technical proficiency and personal flair. Ultimately, a well-crafted resume positions you as the ideal candidate—prepared, polished, and professional—ready to make a formidable impact in the competitive financial consulting arena.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.