Payroll Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Balance your career: A comprehensive guide on how to write a payroll accountant resume that adds up, showcasing your skills and expertise to keep those paychecks accurate and on time."

Rated by 348 people

Senior Payroll Accountant

International Payroll Accountant

Certified Payroll Professional Accountant

Payroll and Benefits Accountant

Payroll Tax Accountant

Corporate Payroll Accountant

Staff Payroll Accountant

Payroll Compliance Accountant

Payroll Systems Accountant

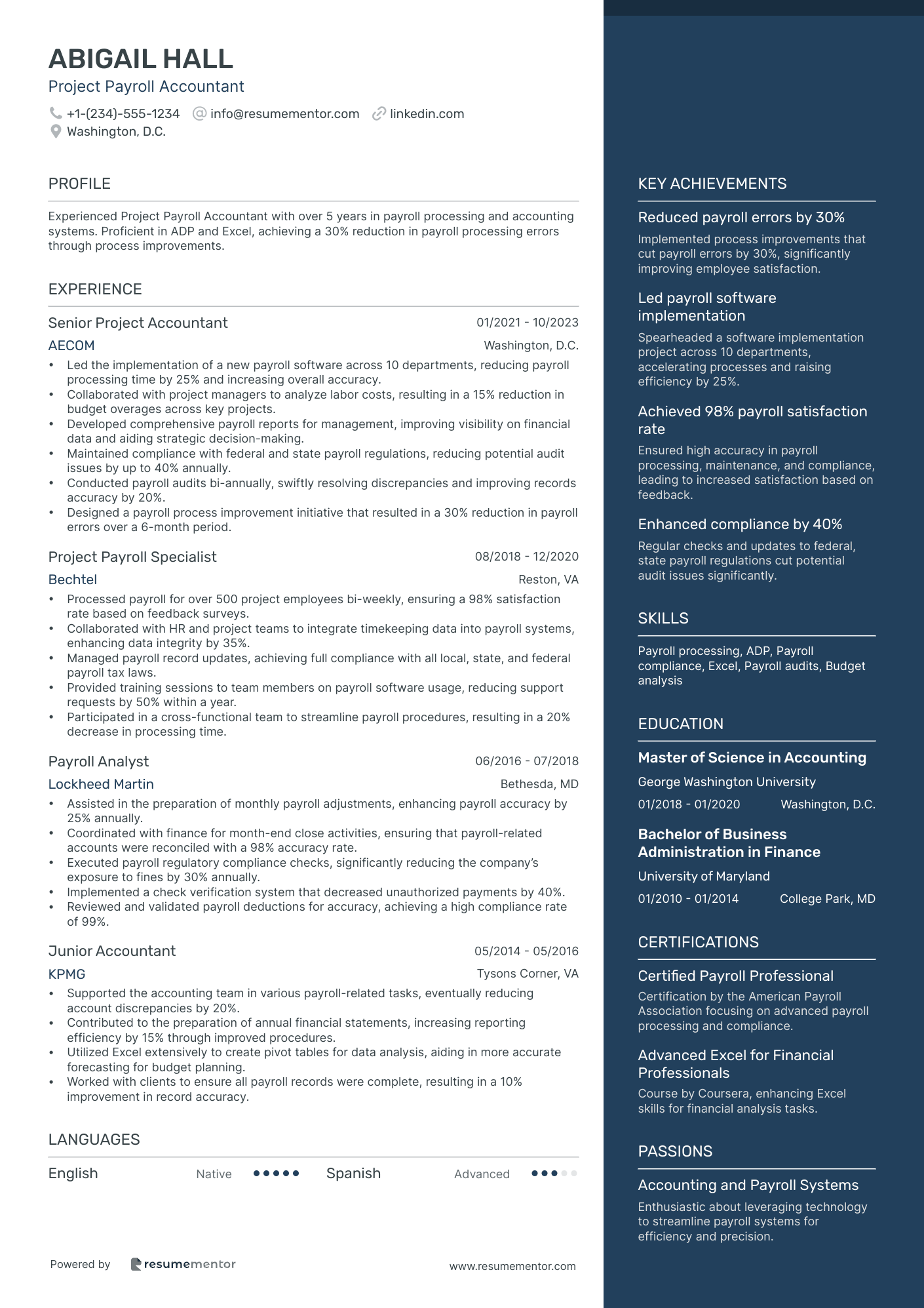

Project Payroll Accountant

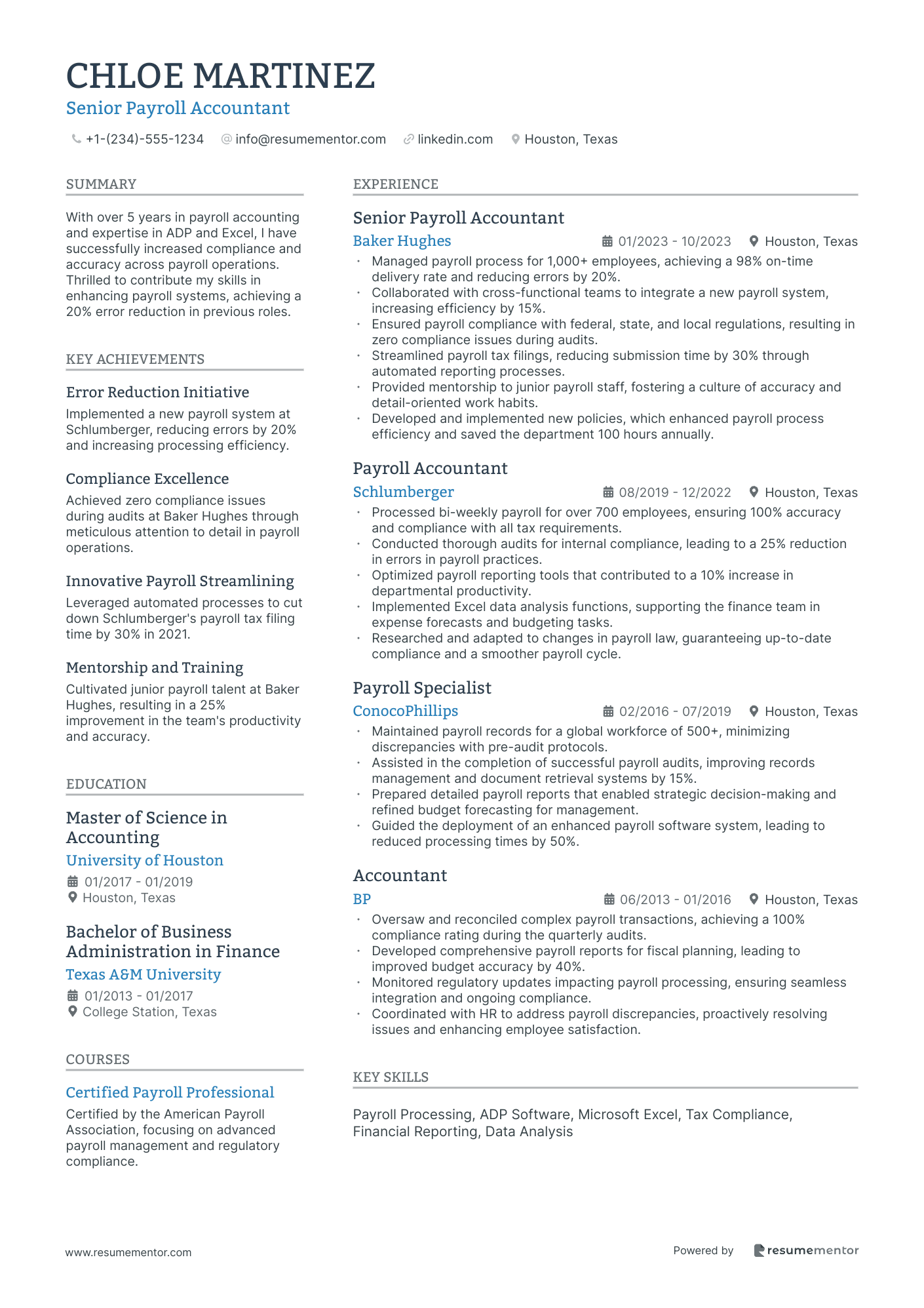

Senior Payroll Accountant resume sample

- •Managed payroll process for 1,000+ employees, achieving a 98% on-time delivery rate and reducing errors by 20%.

- •Collaborated with cross-functional teams to integrate a new payroll system, increasing efficiency by 15%.

- •Ensured payroll compliance with federal, state, and local regulations, resulting in zero compliance issues during audits.

- •Streamlined payroll tax filings, reducing submission time by 30% through automated reporting processes.

- •Provided mentorship to junior payroll staff, fostering a culture of accuracy and detail-oriented work habits.

- •Developed and implemented new policies, which enhanced payroll process efficiency and saved the department 100 hours annually.

- •Processed bi-weekly payroll for over 700 employees, ensuring 100% accuracy and compliance with all tax requirements.

- •Conducted thorough audits for internal compliance, leading to a 25% reduction in errors in payroll practices.

- •Optimized payroll reporting tools that contributed to a 10% increase in departmental productivity.

- •Implemented Excel data analysis functions, supporting the finance team in expense forecasts and budgeting tasks.

- •Researched and adapted to changes in payroll law, guaranteeing up-to-date compliance and a smoother payroll cycle.

- •Maintained payroll records for a global workforce of 500+, minimizing discrepancies with pre-audit protocols.

- •Assisted in the completion of successful payroll audits, improving records management and document retrieval systems by 15%.

- •Prepared detailed payroll reports that enabled strategic decision-making and refined budget forecasting for management.

- •Guided the deployment of an enhanced payroll software system, leading to reduced processing times by 50%.

- •Oversaw and reconciled complex payroll transactions, achieving a 100% compliance rating during the quarterly audits.

- •Developed comprehensive payroll reports for fiscal planning, leading to improved budget accuracy by 40%.

- •Monitored regulatory updates impacting payroll processing, ensuring seamless integration and ongoing compliance.

- •Coordinated with HR to address payroll discrepancies, proactively resolving issues and enhancing employee satisfaction.

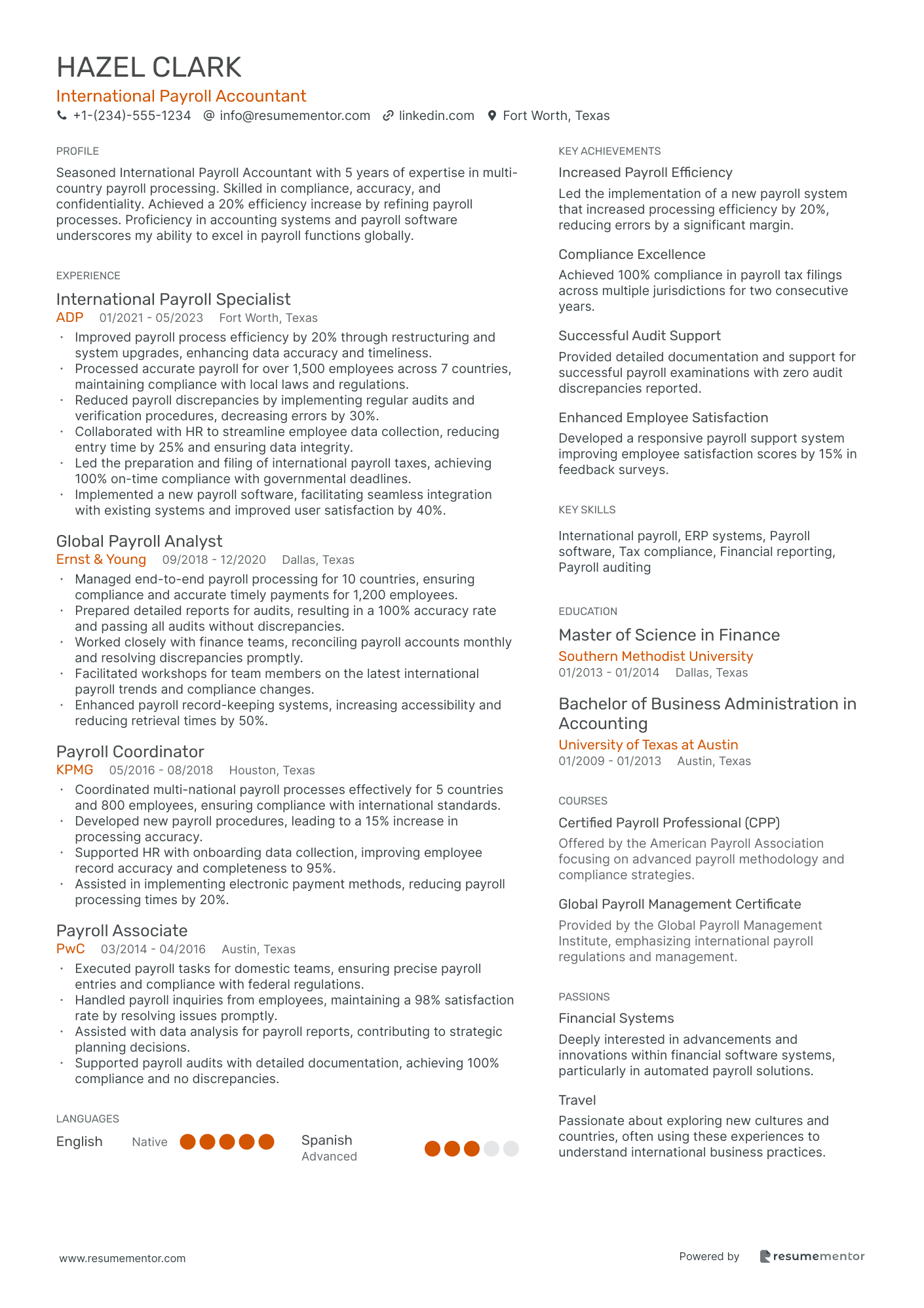

International Payroll Accountant resume sample

- •Improved payroll process efficiency by 20% through restructuring and system upgrades, enhancing data accuracy and timeliness.

- •Processed accurate payroll for over 1,500 employees across 7 countries, maintaining compliance with local laws and regulations.

- •Reduced payroll discrepancies by implementing regular audits and verification procedures, decreasing errors by 30%.

- •Collaborated with HR to streamline employee data collection, reducing entry time by 25% and ensuring data integrity.

- •Led the preparation and filing of international payroll taxes, achieving 100% on-time compliance with governmental deadlines.

- •Implemented a new payroll software, facilitating seamless integration with existing systems and improved user satisfaction by 40%.

- •Managed end-to-end payroll processing for 10 countries, ensuring compliance and accurate timely payments for 1,200 employees.

- •Prepared detailed reports for audits, resulting in a 100% accuracy rate and passing all audits without discrepancies.

- •Worked closely with finance teams, reconciling payroll accounts monthly and resolving discrepancies promptly.

- •Facilitated workshops for team members on the latest international payroll trends and compliance changes.

- •Enhanced payroll record-keeping systems, increasing accessibility and reducing retrieval times by 50%.

- •Coordinated multi-national payroll processes effectively for 5 countries and 800 employees, ensuring compliance with international standards.

- •Developed new payroll procedures, leading to a 15% increase in processing accuracy.

- •Supported HR with onboarding data collection, improving employee record accuracy and completeness to 95%.

- •Assisted in implementing electronic payment methods, reducing payroll processing times by 20%.

- •Executed payroll tasks for domestic teams, ensuring precise payroll entries and compliance with federal regulations.

- •Handled payroll inquiries from employees, maintaining a 98% satisfaction rate by resolving issues promptly.

- •Assisted with data analysis for payroll reports, contributing to strategic planning decisions.

- •Supported payroll audits with detailed documentation, achieving 100% compliance and no discrepancies.

Certified Payroll Professional Accountant resume sample

- •Processed multi-state payroll for over 500 employees, ensuring 100% compliance with federal and state regulations.

- •Implemented new payroll software, resulting in a 25% reduction in payroll processing errors and increased operational efficiency.

- •Collaborated with HR to integrate payroll data with onboarding processes, enhancing employee experience and payroll accuracy.

- •Prepared detailed payroll reports, contributing to informed financial decisions across management teams.

- •Conducted regular payroll audits, identifying discrepancies and facilitating corrective actions which improved compliance rates.

- •Spearheaded a project to enhance payroll data security, ensuring compliance with organizational and legal standards.

- •Verified and validated payroll data inputs, improving accuracy in payroll systems by 30%.

- •Responded efficiently to employee payroll inquiries, enhancing employee satisfaction and trust in payroll processes.

- •Assisted in the preparation of year-end payroll tax filings, ensuring accurate and timely submission of W-2s.

- •Developed customized payroll reporting tools for management, improving payroll data accessibility and analysis.

- •Stayed updated with payroll legislation changes to maintain adherence to tax laws, reducing compliance risks.

- •Managed payroll records for 300+ employees, ensuring secure storage and legal compliance.

- •Streamlined payroll data entry processes, effectively decreasing the time required for payroll calculations by 15%.

- •Collaborated with internal teams to improve payroll-related employee onboarding processes.

- •Analyzed payroll expenditures and produced comprehensive reports that informed executive decisions.

- •Supported payroll processing tasks for a variety of industries, ensuring all processes met compliance standards.

- •Contributed to the financial reporting team, assisting in the creation of budget forecasts.

- •Participated in payroll data audits to improve record accuracy and compliance.

- •Enhanced payroll inquiries response system, resulting in a 20% increase in employee satisfaction.

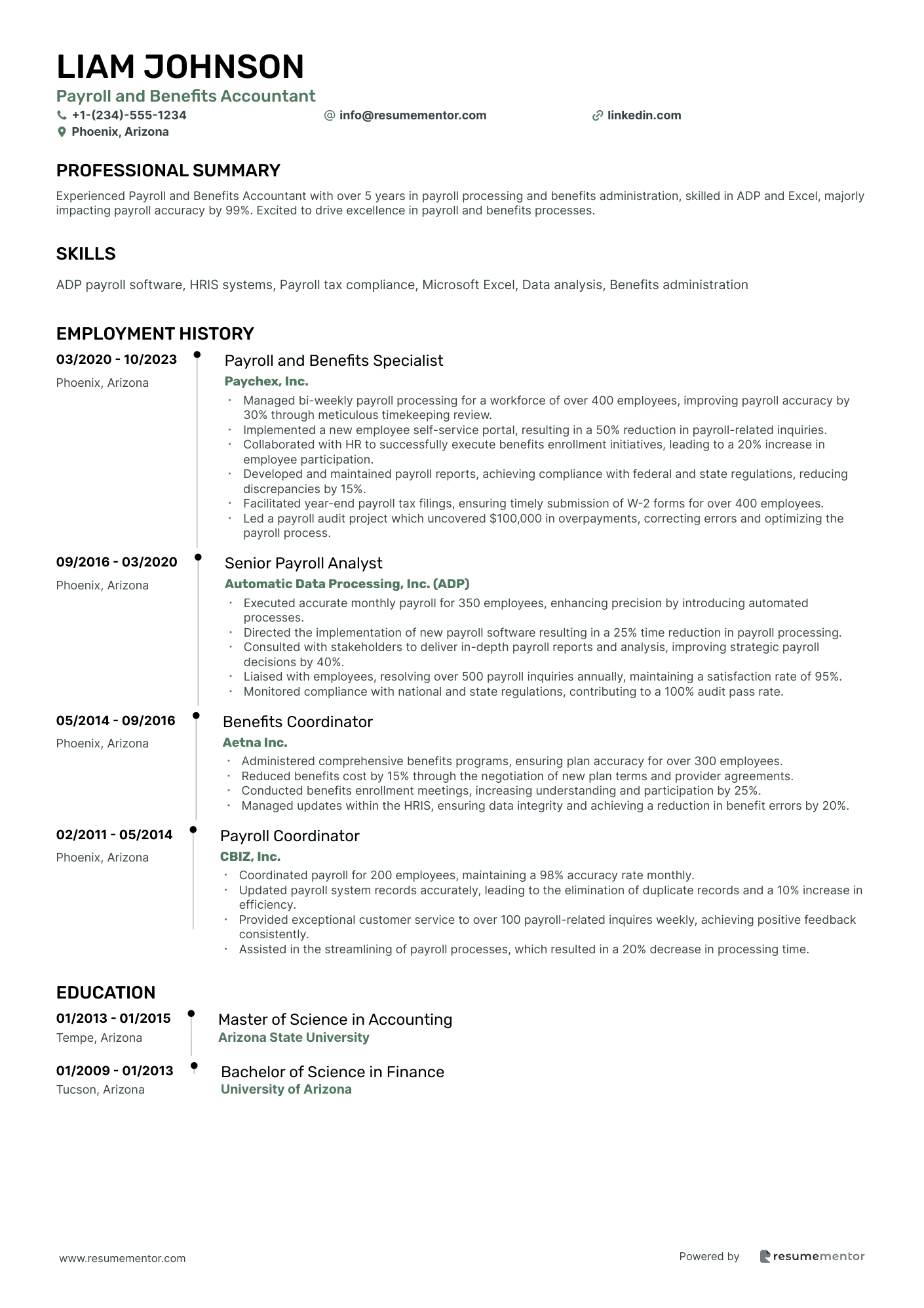

Payroll and Benefits Accountant resume sample

- •Managed bi-weekly payroll processing for a workforce of over 400 employees, improving payroll accuracy by 30% through meticulous timekeeping review.

- •Implemented a new employee self-service portal, resulting in a 50% reduction in payroll-related inquiries.

- •Collaborated with HR to successfully execute benefits enrollment initiatives, leading to a 20% increase in employee participation.

- •Developed and maintained payroll reports, achieving compliance with federal and state regulations, reducing discrepancies by 15%.

- •Facilitated year-end payroll tax filings, ensuring timely submission of W-2 forms for over 400 employees.

- •Led a payroll audit project which uncovered $100,000 in overpayments, correcting errors and optimizing the payroll process.

- •Executed accurate monthly payroll for 350 employees, enhancing precision by introducing automated processes.

- •Directed the implementation of new payroll software resulting in a 25% time reduction in payroll processing.

- •Consulted with stakeholders to deliver in-depth payroll reports and analysis, improving strategic payroll decisions by 40%.

- •Liaised with employees, resolving over 500 payroll inquiries annually, maintaining a satisfaction rate of 95%.

- •Monitored compliance with national and state regulations, contributing to a 100% audit pass rate.

- •Administered comprehensive benefits programs, ensuring plan accuracy for over 300 employees.

- •Reduced benefits cost by 15% through the negotiation of new plan terms and provider agreements.

- •Conducted benefits enrollment meetings, increasing understanding and participation by 25%.

- •Managed updates within the HRIS, ensuring data integrity and achieving a reduction in benefit errors by 20%.

- •Coordinated payroll for 200 employees, maintaining a 98% accuracy rate monthly.

- •Updated payroll system records accurately, leading to the elimination of duplicate records and a 10% increase in efficiency.

- •Provided exceptional customer service to over 100 payroll-related inquires weekly, achieving positive feedback consistently.

- •Assisted in the streamlining of payroll processes, which resulted in a 20% decrease in processing time.

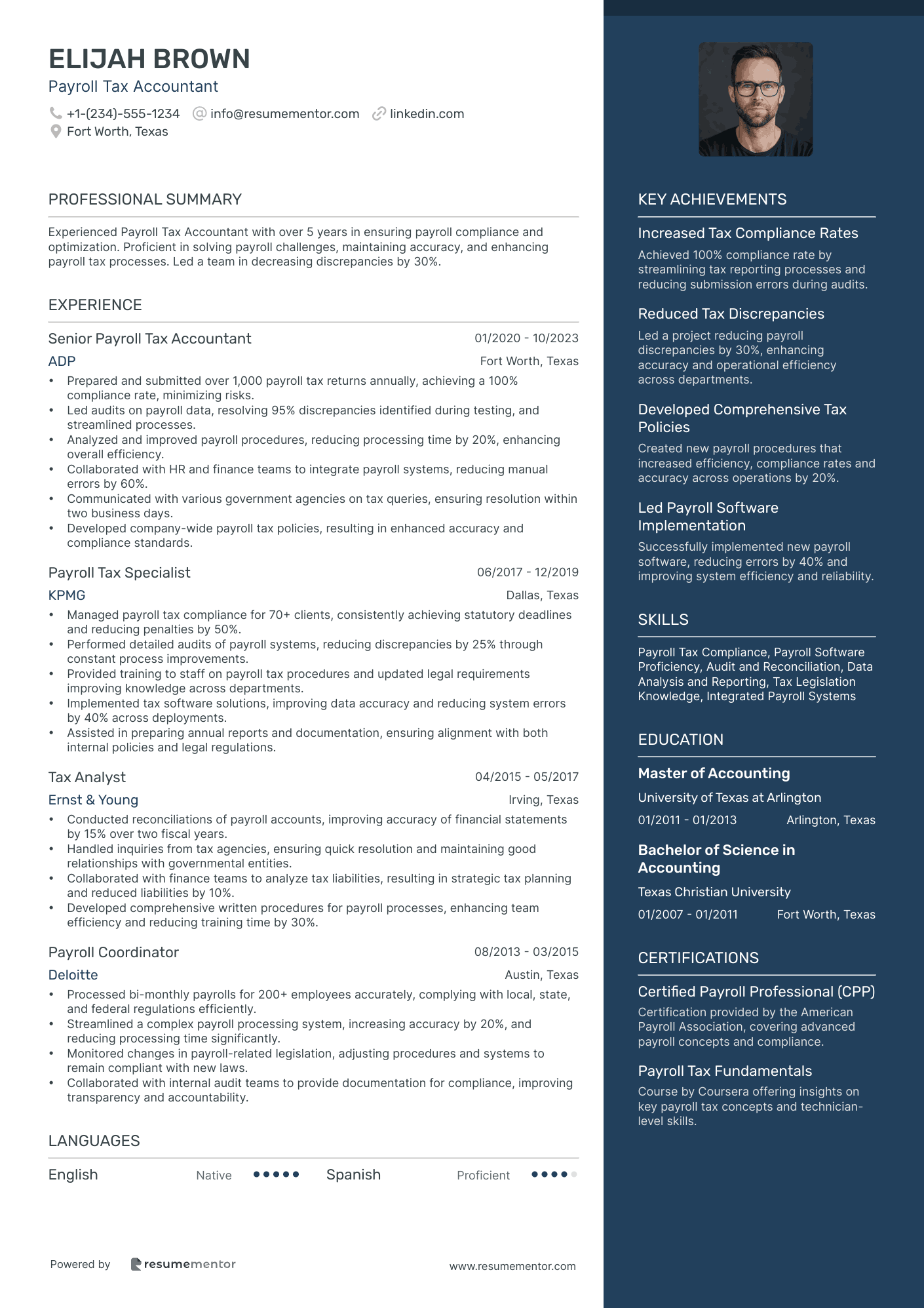

Payroll Tax Accountant resume sample

- •Prepared and submitted over 1,000 payroll tax returns annually, achieving a 100% compliance rate, minimizing risks.

- •Led audits on payroll data, resolving 95% discrepancies identified during testing, and streamlined processes.

- •Analyzed and improved payroll procedures, reducing processing time by 20%, enhancing overall efficiency.

- •Collaborated with HR and finance teams to integrate payroll systems, reducing manual errors by 60%.

- •Communicated with various government agencies on tax queries, ensuring resolution within two business days.

- •Developed company-wide payroll tax policies, resulting in enhanced accuracy and compliance standards.

- •Managed payroll tax compliance for 70+ clients, consistently achieving statutory deadlines and reducing penalties by 50%.

- •Performed detailed audits of payroll systems, reducing discrepancies by 25% through constant process improvements.

- •Provided training to staff on payroll tax procedures and updated legal requirements improving knowledge across departments.

- •Implemented tax software solutions, improving data accuracy and reducing system errors by 40% across deployments.

- •Assisted in preparing annual reports and documentation, ensuring alignment with both internal policies and legal regulations.

- •Conducted reconciliations of payroll accounts, improving accuracy of financial statements by 15% over two fiscal years.

- •Handled inquiries from tax agencies, ensuring quick resolution and maintaining good relationships with governmental entities.

- •Collaborated with finance teams to analyze tax liabilities, resulting in strategic tax planning and reduced liabilities by 10%.

- •Developed comprehensive written procedures for payroll processes, enhancing team efficiency and reducing training time by 30%.

- •Processed bi-monthly payrolls for 200+ employees accurately, complying with local, state, and federal regulations efficiently.

- •Streamlined a complex payroll processing system, increasing accuracy by 20%, and reducing processing time significantly.

- •Monitored changes in payroll-related legislation, adjusting procedures and systems to remain compliant with new laws.

- •Collaborated with internal audit teams to provide documentation for compliance, improving transparency and accountability.

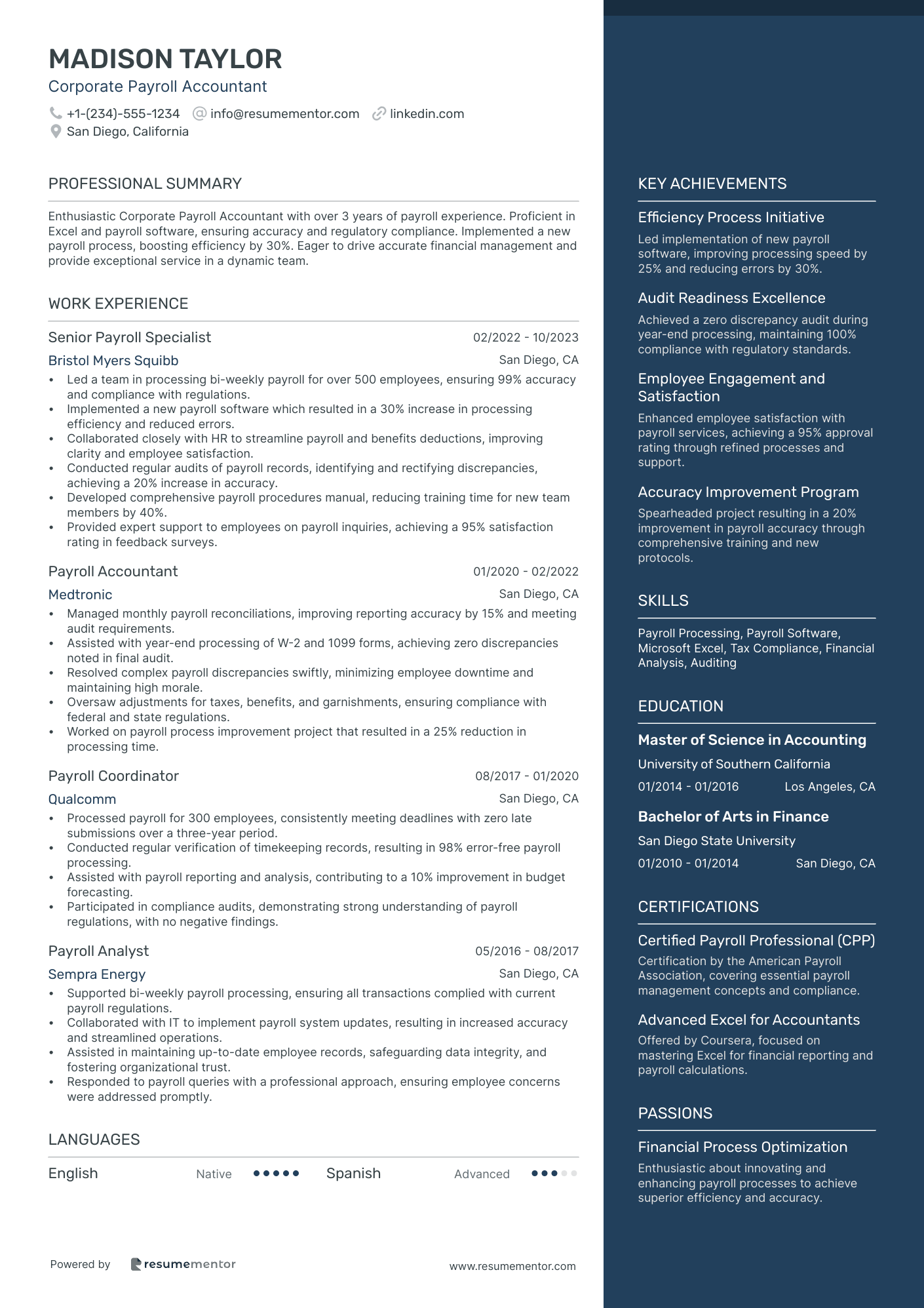

Corporate Payroll Accountant resume sample

- •Led a team in processing bi-weekly payroll for over 500 employees, ensuring 99% accuracy and compliance with regulations.

- •Implemented a new payroll software which resulted in a 30% increase in processing efficiency and reduced errors.

- •Collaborated closely with HR to streamline payroll and benefits deductions, improving clarity and employee satisfaction.

- •Conducted regular audits of payroll records, identifying and rectifying discrepancies, achieving a 20% increase in accuracy.

- •Developed comprehensive payroll procedures manual, reducing training time for new team members by 40%.

- •Provided expert support to employees on payroll inquiries, achieving a 95% satisfaction rating in feedback surveys.

- •Managed monthly payroll reconciliations, improving reporting accuracy by 15% and meeting audit requirements.

- •Assisted with year-end processing of W-2 and 1099 forms, achieving zero discrepancies noted in final audit.

- •Resolved complex payroll discrepancies swiftly, minimizing employee downtime and maintaining high morale.

- •Oversaw adjustments for taxes, benefits, and garnishments, ensuring compliance with federal and state regulations.

- •Worked on payroll process improvement project that resulted in a 25% reduction in processing time.

- •Processed payroll for 300 employees, consistently meeting deadlines with zero late submissions over a three-year period.

- •Conducted regular verification of timekeeping records, resulting in 98% error-free payroll processing.

- •Assisted with payroll reporting and analysis, contributing to a 10% improvement in budget forecasting.

- •Participated in compliance audits, demonstrating strong understanding of payroll regulations, with no negative findings.

- •Supported bi-weekly payroll processing, ensuring all transactions complied with current payroll regulations.

- •Collaborated with IT to implement payroll system updates, resulting in increased accuracy and streamlined operations.

- •Assisted in maintaining up-to-date employee records, safeguarding data integrity, and fostering organizational trust.

- •Responded to payroll queries with a professional approach, ensuring employee concerns were addressed promptly.

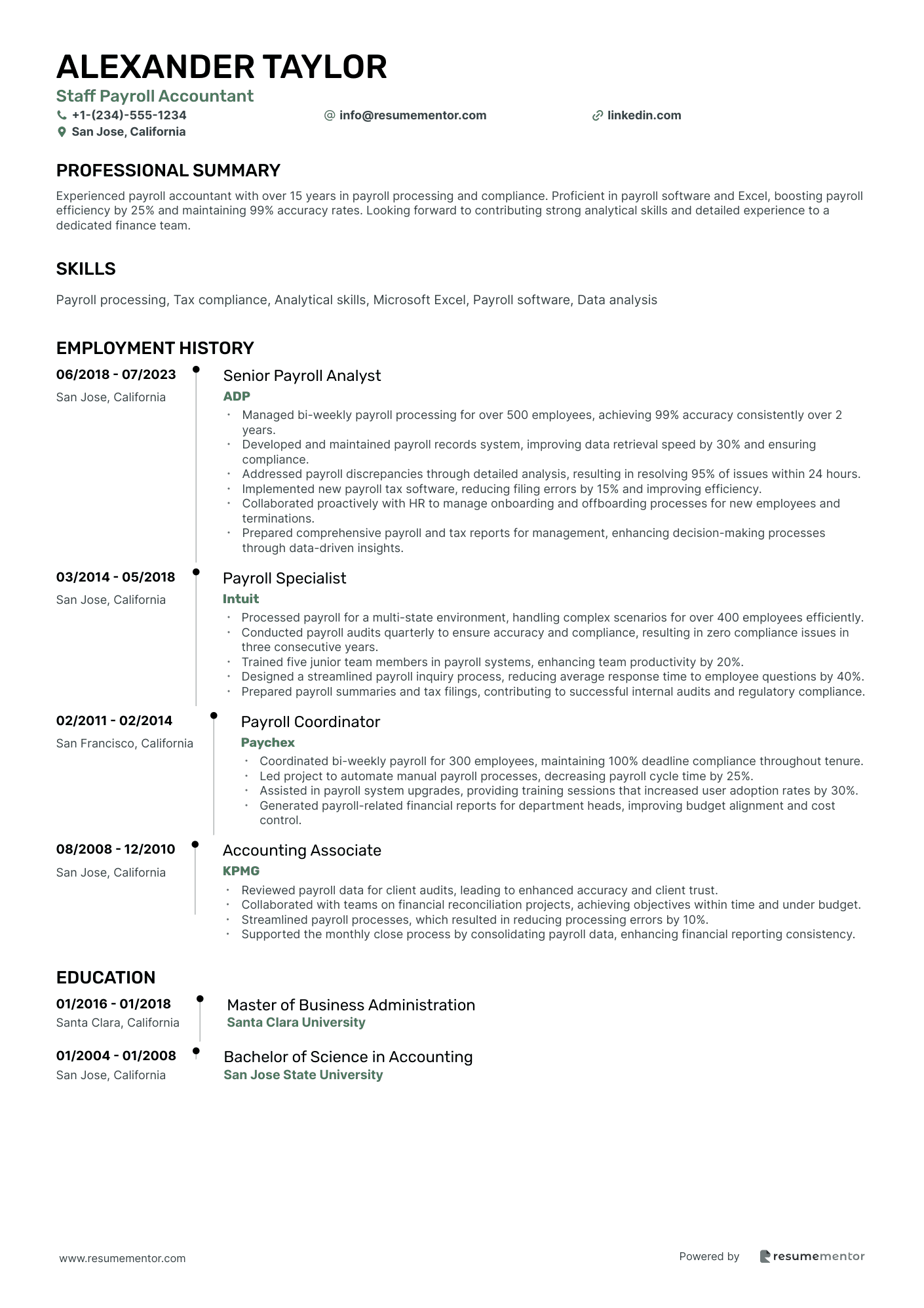

Staff Payroll Accountant resume sample

- •Managed bi-weekly payroll processing for over 500 employees, achieving 99% accuracy consistently over 2 years.

- •Developed and maintained payroll records system, improving data retrieval speed by 30% and ensuring compliance.

- •Addressed payroll discrepancies through detailed analysis, resulting in resolving 95% of issues within 24 hours.

- •Implemented new payroll tax software, reducing filing errors by 15% and improving efficiency.

- •Collaborated proactively with HR to manage onboarding and offboarding processes for new employees and terminations.

- •Prepared comprehensive payroll and tax reports for management, enhancing decision-making processes through data-driven insights.

- •Processed payroll for a multi-state environment, handling complex scenarios for over 400 employees efficiently.

- •Conducted payroll audits quarterly to ensure accuracy and compliance, resulting in zero compliance issues in three consecutive years.

- •Trained five junior team members in payroll systems, enhancing team productivity by 20%.

- •Designed a streamlined payroll inquiry process, reducing average response time to employee questions by 40%.

- •Prepared payroll summaries and tax filings, contributing to successful internal audits and regulatory compliance.

- •Coordinated bi-weekly payroll for 300 employees, maintaining 100% deadline compliance throughout tenure.

- •Led project to automate manual payroll processes, decreasing payroll cycle time by 25%.

- •Assisted in payroll system upgrades, providing training sessions that increased user adoption rates by 30%.

- •Generated payroll-related financial reports for department heads, improving budget alignment and cost control.

- •Reviewed payroll data for client audits, leading to enhanced accuracy and client trust.

- •Collaborated with teams on financial reconciliation projects, achieving objectives within time and under budget.

- •Streamlined payroll processes, which resulted in reducing processing errors by 10%.

- •Supported the monthly close process by consolidating payroll data, enhancing financial reporting consistency.

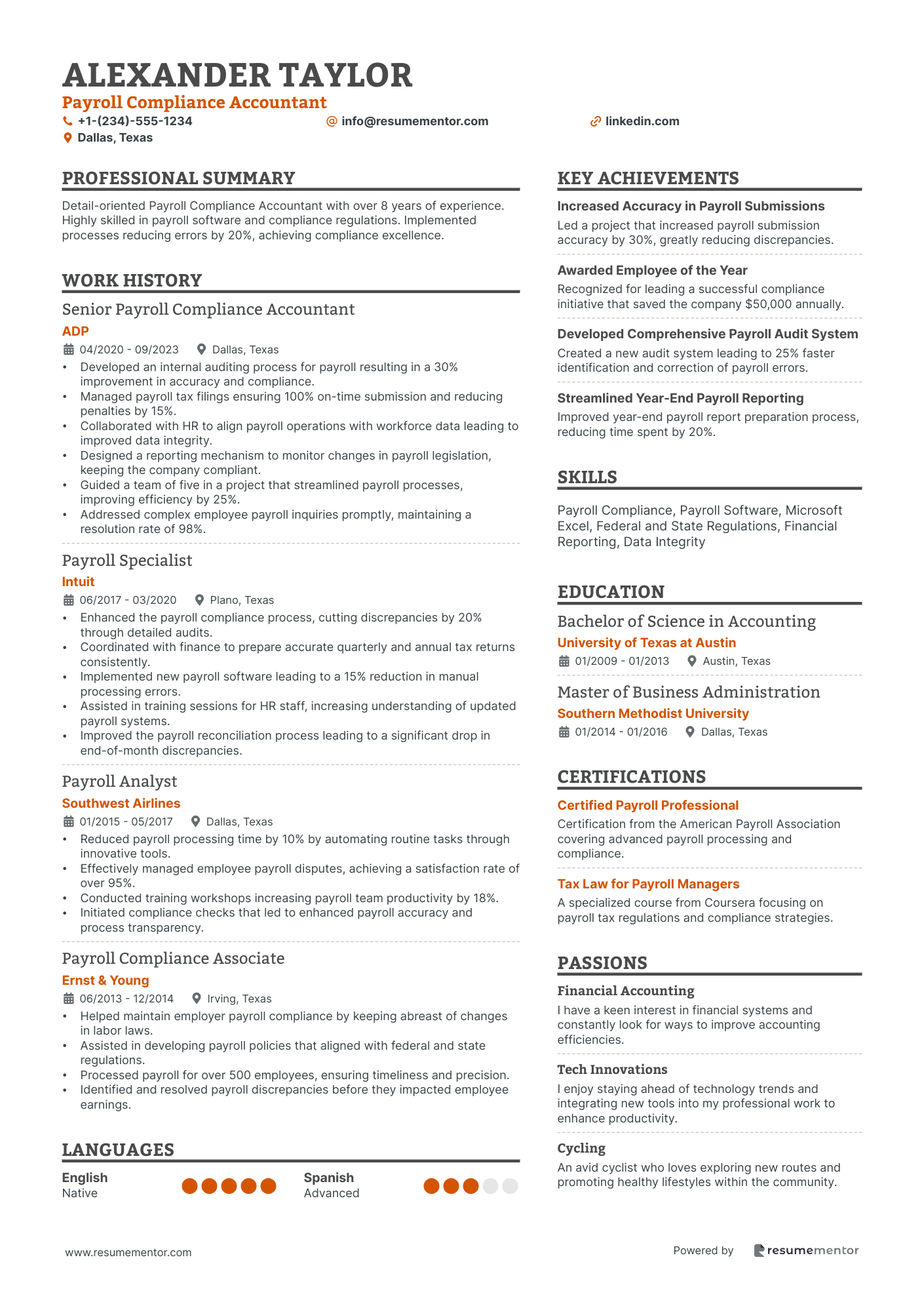

Payroll Compliance Accountant resume sample

- •Developed an internal auditing process for payroll resulting in a 30% improvement in accuracy and compliance.

- •Managed payroll tax filings ensuring 100% on-time submission and reducing penalties by 15%.

- •Collaborated with HR to align payroll operations with workforce data leading to improved data integrity.

- •Designed a reporting mechanism to monitor changes in payroll legislation, keeping the company compliant.

- •Guided a team of five in a project that streamlined payroll processes, improving efficiency by 25%.

- •Addressed complex employee payroll inquiries promptly, maintaining a resolution rate of 98%.

- •Enhanced the payroll compliance process, cutting discrepancies by 20% through detailed audits.

- •Coordinated with finance to prepare accurate quarterly and annual tax returns consistently.

- •Implemented new payroll software leading to a 15% reduction in manual processing errors.

- •Assisted in training sessions for HR staff, increasing understanding of updated payroll systems.

- •Improved the payroll reconciliation process leading to a significant drop in end-of-month discrepancies.

- •Reduced payroll processing time by 10% by automating routine tasks through innovative tools.

- •Effectively managed employee payroll disputes, achieving a satisfaction rate of over 95%.

- •Conducted training workshops increasing payroll team productivity by 18%.

- •Initiated compliance checks that led to enhanced payroll accuracy and process transparency.

- •Helped maintain employer payroll compliance by keeping abreast of changes in labor laws.

- •Assisted in developing payroll policies that aligned with federal and state regulations.

- •Processed payroll for over 500 employees, ensuring timeliness and precision.

- •Identified and resolved payroll discrepancies before they impacted employee earnings.

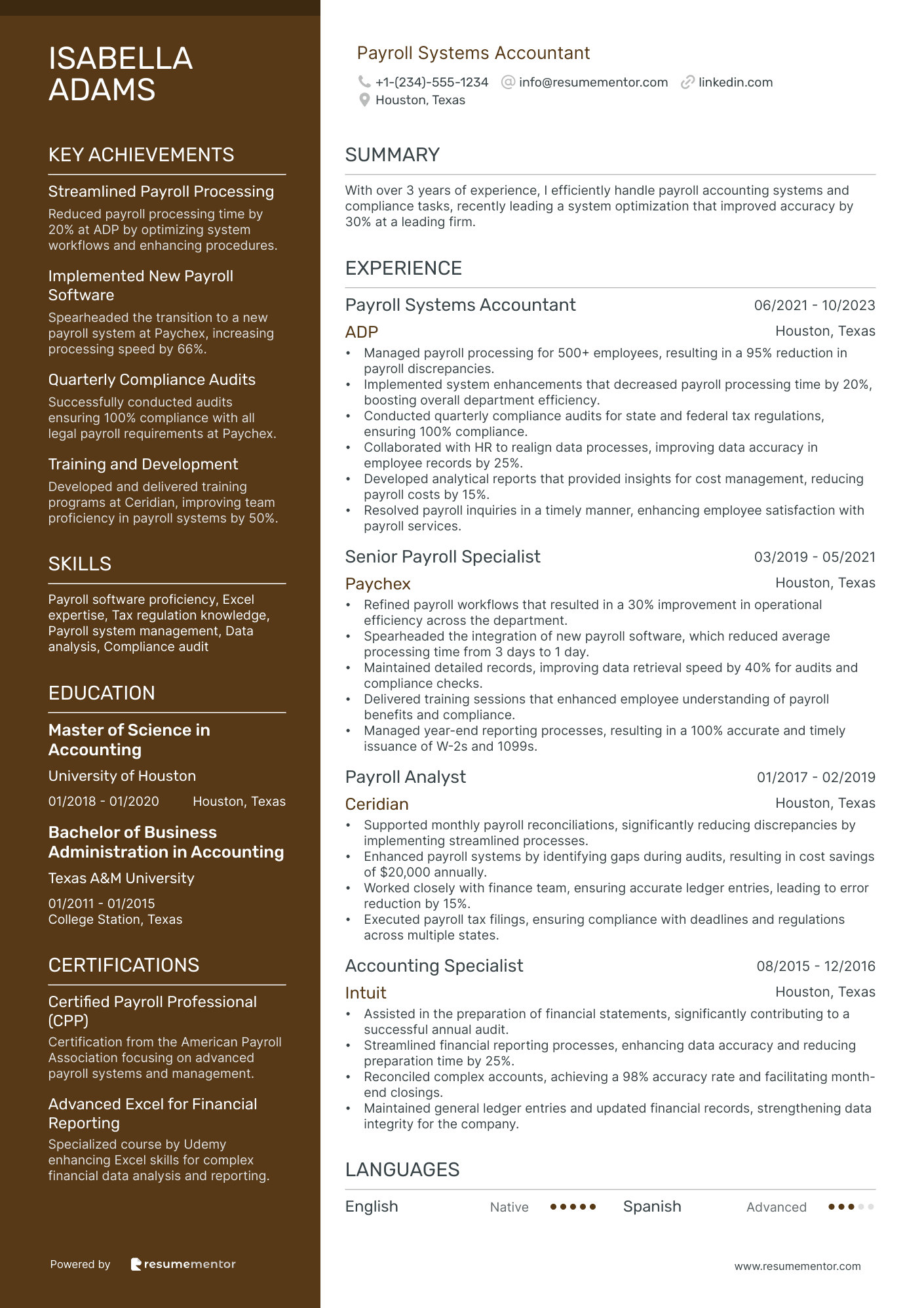

Payroll Systems Accountant resume sample

- •Managed payroll processing for 500+ employees, resulting in a 95% reduction in payroll discrepancies.

- •Implemented system enhancements that decreased payroll processing time by 20%, boosting overall department efficiency.

- •Conducted quarterly compliance audits for state and federal tax regulations, ensuring 100% compliance.

- •Collaborated with HR to realign data processes, improving data accuracy in employee records by 25%.

- •Developed analytical reports that provided insights for cost management, reducing payroll costs by 15%.

- •Resolved payroll inquiries in a timely manner, enhancing employee satisfaction with payroll services.

- •Refined payroll workflows that resulted in a 30% improvement in operational efficiency across the department.

- •Spearheaded the integration of new payroll software, which reduced average processing time from 3 days to 1 day.

- •Maintained detailed records, improving data retrieval speed by 40% for audits and compliance checks.

- •Delivered training sessions that enhanced employee understanding of payroll benefits and compliance.

- •Managed year-end reporting processes, resulting in a 100% accurate and timely issuance of W-2s and 1099s.

- •Supported monthly payroll reconciliations, significantly reducing discrepancies by implementing streamlined processes.

- •Enhanced payroll systems by identifying gaps during audits, resulting in cost savings of $20,000 annually.

- •Worked closely with finance team, ensuring accurate ledger entries, leading to error reduction by 15%.

- •Executed payroll tax filings, ensuring compliance with deadlines and regulations across multiple states.

- •Assisted in the preparation of financial statements, significantly contributing to a successful annual audit.

- •Streamlined financial reporting processes, enhancing data accuracy and reducing preparation time by 25%.

- •Reconciled complex accounts, achieving a 98% accuracy rate and facilitating month-end closings.

- •Maintained general ledger entries and updated financial records, strengthening data integrity for the company.

Project Payroll Accountant resume sample

- •Led the implementation of a new payroll software across 10 departments, reducing payroll processing time by 25% and increasing overall accuracy.

- •Collaborated with project managers to analyze labor costs, resulting in a 15% reduction in budget overages across key projects.

- •Developed comprehensive payroll reports for management, improving visibility on financial data and aiding strategic decision-making.

- •Maintained compliance with federal and state payroll regulations, reducing potential audit issues by up to 40% annually.

- •Conducted payroll audits bi-annually, swiftly resolving discrepancies and improving records accuracy by 20%.

- •Designed a payroll process improvement initiative that resulted in a 30% reduction in payroll errors over a 6-month period.

- •Processed payroll for over 500 project employees bi-weekly, ensuring a 98% satisfaction rate based on feedback surveys.

- •Collaborated with HR and project teams to integrate timekeeping data into payroll systems, enhancing data integrity by 35%.

- •Managed payroll record updates, achieving full compliance with all local, state, and federal payroll tax laws.

- •Provided training sessions to team members on payroll software usage, reducing support requests by 50% within a year.

- •Participated in a cross-functional team to streamline payroll procedures, resulting in a 20% decrease in processing time.

- •Assisted in the preparation of monthly payroll adjustments, enhancing payroll accuracy by 25% annually.

- •Coordinated with finance for month-end close activities, ensuring that payroll-related accounts were reconciled with a 98% accuracy rate.

- •Executed payroll regulatory compliance checks, significantly reducing the company’s exposure to fines by 30% annually.

- •Implemented a check verification system that decreased unauthorized payments by 40%.

- •Reviewed and validated payroll deductions for accuracy, achieving a high compliance rate of 99%.

- •Supported the accounting team in various payroll-related tasks, eventually reducing account discrepancies by 20%.

- •Contributed to the preparation of annual financial statements, increasing reporting efficiency by 15% through improved procedures.

- •Utilized Excel extensively to create pivot tables for data analysis, aiding in more accurate forecasting for budget planning.

- •Worked with clients to ensure all payroll records were complete, resulting in a 10% improvement in record accuracy.

Crafting a standout payroll accountant resume goes beyond listing jobs; it’s about showcasing your unique expertise. As the meticulous caretaker of paychecks, you ensure every number and compliance standard is spot-on. This precision in your work can be difficult to convey clearly on paper.

In today’s competitive job market, your resume serves as your first impression, so it needs to effectively highlight your ability to manage financial details without sounding overly technical. You possess skills in accuracy and regulatory standards, but how do you express these capabilities engagingly and authentically?

Here’s where a well-designed resume template can transform how your expertise is perceived. These templates allow you to spotlight your proficiency in payroll systems, tax regulations, and auditing, while keeping the format visually appealing. You can explore a variety of resume templates to find one that aligns with your professional narrative.

Your resume should reflect your ability to handle sensitive financial data and your knack for balancing books, all while maintaining ethical practices. By presenting yourself as the organized, detail-oriented professional you are, you’ll navigate the complex financial landscapes with ease, leaving a lasting impression that extends beyond the numbers.

Key Takeaways

- Your payroll accountant resume should highlight expertise in managing payroll processes, compliance, and data accuracy, setting you apart from other candidates.

- Your contact information should be clearly visible to facilitate easy communication with recruiters, lending credibility to your profile.

- A tailored professional summary should overview your experience, key skills, and past improvements in payroll accuracy.

- In work experience, emphasize achievements with specific examples and quantify your contributions to showcase effectiveness.

- Listing education and certifications related to payroll accounting can enhance your resume's credibility and showcase your qualifications.

What to focus on when writing your payroll accountant resume

How to structure your payroll accountant resume

- Your payroll accountant resume should clearly highlight your expertise in managing payroll processes efficiently and accurately. Recruiters will be looking for evidence of your skills in handling payroll systems, ensuring compliance with laws, and resolving any issues. It's crucial to emphasize your ability to manage large volumes of payroll data with diligence and precision—effective communication of these skills can set you apart from other candidates.

- Make sure your Contact Information is easy to locate at the top, including your full name, phone number, email address, and LinkedIn profile if applicable. Format your contact details so they're easy to read and remember, as this is the first thing a recruiter will see. Accurate and professional contact information can lend credibility to your profile and make it easier for recruiters to contact you, ensuring your hard work on the resume pays off swiftly.

- In the Professional Summary, briefly share your experience level and specialized skills, such as proficiency with specific payroll software. Tailor your summary to the job you're applying to, showcasing your unique strengths and how you’ve improved payroll accuracy in previous roles. A compelling summary paints a quick picture of your capabilities and sets the tone for the rest of your resume, inviting the recruiter to learn more about your story.

- In the Work Experience section, list past job titles, companies, and dates of employment. Focus on accomplishments like managing multi-state payroll or streamlining payroll processes. Provide specific examples that demonstrate your effectiveness and the impact of your work. Highlighting your contributions and achievements in past roles builds a strong case for your potential future success in a new job.

- The Skills section should mention your understanding of payroll laws and regulations, experience with systems like ADP or QuickBooks, and strengths in data analysis. Instead of a generic list, incorporate context that illustrates how these skills benefit your work. This approach conveys your depth of expertise to the recruiter and helps them visualize your fit for the role.

- For Education, include any degrees in accounting or finance and relevant certifications like Certified Payroll Professional (CPP). Mention any honors or distinctions to underscore your commitment to your field. Education is foundational to your qualifications, and listing it provides a backbone to the technical skills you exhibit.

- Finally, the Certifications section should highlight any additional credentials that enhance your qualifications, such as Advanced Payroll Certification or SHRM certifications. These certifications not only validate your skills but can also give you an edge in specialized areas of payroll accounting.

- To round out your resume, consider adding optional sections like Volunteer Work or Professional Affiliations, which can provide valuable context and depth to your professional story. Now that the key sections have been introduced, we will delve deeper into each one to ensure your resume captures attention for all the right reasons.

Which resume format to choose

Crafting a standout payroll accountant resume means getting the format just right. In the world of accounting, a reverse chronological format is your best choice. It highlights your most recent positions and achievements, giving employers a clear view of your career progression and expertise. This format helps them quickly assess your relevant experience, which is crucial in payroll accounting.

Choosing the right font further enhances your resume's effectiveness. Opt for modern and clean styles such as Rubik, Lato, and Montserrat. These fonts maintain a professional appearance while remaining easy to read, ensuring that potential employers can easily navigate through your qualifications without distraction. The right font contributes to a polished, professional impression, which is essential for conveying your attention to detail—a key trait for any payroll accountant.

To keep your resume looking professional across various devices and operating systems, always save it as a PDF. This file format preserves your layout and design, making sure that your resume appears exactly as you intended it, whether it’s opened on a computer or a mobile device. This preservation of formatting is critical in maintaining the professionalism expected in your field.

Finally, be mindful of margins, which should be about one inch on all sides. This creates a clean, structured look that enhances readability. Well-balanced white space ensures your resume doesn’t look cluttered, conveying your organizational skills. In essence, these details reflect your meticulous nature—an invaluable asset for a payroll accountant.

How to write a quantifiable resume experience section

The experience section in your payroll accountant resume should highlight your achievements and showcase the impact you've made. To organize it effectively, start with your most recent job and work backwards. Focus on the last 10-15 years unless earlier roles are crucial to the job you're applying for. Use job titles that clearly reflect your responsibilities. Tailoring this section to the specific job ad is key; incorporate relevant keywords and use phrasing that mirrors the job description. By using strong action words like "managed," "reduced," or "implemented," you can convey your initiative and the results you've achieved.

Including quantifiable achievements within an organization sets you apart, as these provide concrete evidence of your skills and contributions.

- •Led a payroll team of 5, processing payroll for 1,000+ employees with 99.9% accuracy.

- •Reduced payroll discrepancies by 15% by implementing a new payroll software system.

- •Saved $50,000 annually by optimizing payroll processes and eliminating redundancies.

- •Improved audit compliance by 20% through enhanced verification protocols.

This experience section excels because it weaves a narrative of your professional growth and impact through each bullet point. Highlighting clear results with measurable achievements, it focuses on vital areas such as accuracy, cost savings, and compliance—key responsibilities for any payroll accountant. By tailoring your resume with specific details, you clearly outline the value you can bring to an employer, leaving a strong impression. The figures you share demonstrate your capability to effectively manage complex payroll systems, using concise language and precise data to convey your skill and efficiency.

Result-Focused resume experience section

A result-focused payroll accountant resume experience section should clearly demonstrate how your achievements contribute to the success of the organization. Start by showcasing the tangible results you've delivered, such as implementing systems that streamline processes or improve accuracy. It’s important to use strong, clear action words to describe your tasks, emphasizing the positive impact your efforts have had on the company. This not only highlights your skills but also establishes you as an ideal candidate for the position.

Highlight the skills that underscore your expertise in handling payroll operations, utilizing financial software, and maintaining accurate records. While detailing your responsibilities, focus on the outcomes of your actions. Capture the attention of hiring managers by illustrating how your contributions have advanced company goals or improved financial efficiency. Incorporating quantifiable metrics provides clear proof of your accomplishments and demonstrates the value you bring to the organization.

Payroll Accountant

A-Tech Solutions

June 2018 - Present

- Implemented a new payroll system that slashed processing time by 30%, saving over $50,000 each year.

- Led the shift to a paperless payroll system, boosting compliance and cutting human errors by 20%.

- Managed accurate and timely payroll for 500+ employees, ensuring full compliance with company policies and regulations.

- Created and maintained a detailed payroll database, aiding in precise reporting and budgeting.

Project-Focused resume experience section

A project-focused payroll accountant resume experience section should emphasize projects where your analytical and organizational abilities made a tangible impact. Begin by detailing each project, its duration, your role, and the company you worked for. Concentrate on initiatives that highlight how you streamlined processes, enhanced financial accuracy, and ensured compliance with regulations. By sharing examples such as implementing new payroll systems or managing extensive payroll functions, you demonstrate your ability to improve operations.

Use bullet points to present accomplishments clearly, ensuring the language remains straightforward and active. When possible, include measurable results, such as improvements in percentages, cost savings, or error reductions. This approach showcases how you efficiently tackle challenges, manage time well, and collaborate effectively with other departments. Each bullet point should tie back to your impact on boosting efficiency, maintaining compliance, and driving cost-effectiveness in payroll operations.

Payroll Accountant

XYZ Corporation

January 2020 - Present

- Redesigned payroll system workflow, cutting processing time by 25%

- Implemented automated compliance checks, achieving zero compliance errors

- Collaborated with HR to merge payroll and benefits systems, resulting in smooth data transfers

- Created training materials for staff, enhancing overall team productivity

Efficiency-Focused resume experience section

An efficiency-focused payroll accountant resume experience section should highlight your contributions to streamlining processes and enhancing accuracy. Start each bullet point with a strong action verb that clearly demonstrates your role in improving systems, such as by introducing new software or collaborating with other departments. Focus on showcasing the tangible outcomes of your actions, like cost reductions or improved compliance, to provide a clear picture of your impact.

In detailing your experience, emphasize your ability to analyze and revamp payroll systems to minimize delays. Use specific numbers and percentages to back up your success, helping your achievements stand out. By illustrating improvements in processing times or accuracy rates, your expertise becomes more tangible and convincingly presented.

Payroll Accountant

Bright Solutions Inc.

January 2020 - Present

- Implemented a new payroll system, cutting processing time by 30%.

- Partnered with IT to automate reconciliation tasks, reducing errors by 25%.

- Trained team members in new software, boosting accuracy by 15%.

- Improved report generation processes, saving the finance team 10 hours weekly.

Training and Development Focused resume experience section

A training-focused payroll accountant resume experience section should effectively highlight your ability to boost your colleagues' skills and knowledge. Start by sharing situations where your training initiatives have led to noticeable improvements in efficiency and accuracy within payroll processes. This could include examples of successful training programs you've developed, where the results positively influenced your team or department.

Emphasize your leadership role in guiding and supporting your team, ensuring smooth and effective payroll operations. Use active language and specific examples to illustrate the tangible improvements you've achieved. This approach helps convey not only your responsibilities but also the meaningful changes you've brought to your organization, showcasing your role as a catalyst for development and process enhancement.

Payroll Accountant

XYZ Corporation

June 2020 - Present

- Developed and conducted monthly training sessions for junior payroll accountants, improving processing accuracy by 15%

- Implemented a new payroll software system and trained 50 employees, leading to a 20% reduction in processing time

- Created comprehensive training manuals, increasing staff understanding and efficiency in using payroll systems

- Led a team in organizing annual workshops, enhancing team collaboration and cross-departmental knowledge sharing

Write your payroll accountant resume summary section

A payroll-focused accountant resume summary should effectively showcase your expertise and accomplishments in a way that captivates hiring managers. Crafting this section involves using concise and impactful language to demonstrate why you're the ideal fit for the position. Highlight your experience, proficiency with relevant software, and certifications. Here’s an example that truly connects with what employers seek:

Such a summary is effective because it aligns your experience and skills with key job requirements, emphasizing a track record of success and proficiency with vital tools. Words like "detail-oriented" and "known for" highlight your work ethic and capabilities. When describing yourself, opt for phrases that stress your initiative and achievements, helping you stand out. Choose action verbs and quantifiable outcomes to paint a clear picture of your contributions. Words like "managed" or "led" are more impactful than "responsible for," as they convey leadership.

It's important to understand the nuances between a resume summary, a resume objective, and other related terms. A resume summary provides a quick snapshot of your career, suitable for those with experience. Conversely, a resume objective lays out your career ambitions and what you hope to achieve with a particular employer, making it ideal for entry-level roles. A resume profile blends elements of both by summarizing key skills and intentions. Meanwhile, a summary of qualifications is a bullet-point list highlighting specific skills, perfect for technical roles. Your choice of section depends on your career stage and the job you’re aiming for, ensuring you present the most compelling narrative to potential employers.

Listing your payroll accountant skills on your resume

A skills-focused payroll accountant resume should clearly highlight your abilities in both technical and interpersonal areas. You can choose to feature your skills as a standalone section or integrate them into other areas like your experience or summary sections to create a cohesive narrative. Highlighting your strengths and soft skills will showcase how you interact with others and navigate challenges, such as effective communication and problem-solving. In contrast, hard skills, which are the technical abilities needed to perform specific tasks like managing payroll software and understanding tax regulations, are equally crucial.

These skills and strengths act as vital keywords throughout your resume, catching the attention of hiring managers and applicant tracking systems. By effectively showcasing these keywords, you demonstrate your competencies and enhance your overall resume visibility.

The clarity and relevance of this skills section make it particularly effective. By providing a succinct list of essential skills, you make it easy for hiring professionals to quickly assess your fit for the payroll accountant role.

Best hard skills to feature on your payroll accountant resume

To convey expertise, a payroll accountant's hard skills should emphasize your ability to manage technical tasks and systems efficiently. These skills are essential for indicating your proficiency in handling payroll operations with precision. By highlighting abilities that demonstrate your command of industry standards and tools, you reinforce your professional capability.

Hard Skills

- Payroll processing

- Tax compliance

- Payroll software proficiency (e.g., ADP, QuickBooks)

- Financial reporting

- Data analysis

- Excel proficiency

- General ledger accounting

- Regulatory compliance

- Benefits administration

- Wage garnishments

- Timekeeping systems

- Reconciliation of accounts

- Attention to detail

- Workers' compensation administration

- ERP systems knowledge

Best soft skills to feature on your payroll accountant resume

Your soft skills will illustrate how you work with others and manage your responsibilities effectively. For payroll accountants, showcasing soft skills is crucial, as they reflect your ability to collaborate, communicate clearly, and solve problems, all while maintaining accuracy and confidentiality.

Soft Skills

- Communication

- Attention to detail

- Time management

- Problem-solving

- Teamwork

- Adaptability

- Confidentiality

- Integrity

- Organizational skills

- Decision-making

- Analytical thinking

- Customer service orientation

- Dependability

- Initiative

- Multitasking

How to include your education on your resume

The education section of your payroll accountant resume is critical, showcasing your academic achievements and qualifications. It's important to tailor this section to the job you're applying for, ensuring all education listed is relevant to the position. Including unrelated education can detract from your expertise as a payroll accountant. Your GPA can be featured if it is impressive; list it as "GPA: 3.8/4.0" for clarity. If you graduated with honors like cum laude, include it after your degree, for example, "Bachelor of Science in Accounting, Cum Laude." Clearly list your degree, institution, and dates attended.

Here are examples:

This right example excels because it is specifically tailored for a payroll accountant role. The inclusion of a Bachelor of Science in Accounting clearly highlights relevant knowledge and skills. Listing "Cum Laude" underscores academic excellence, and the GPA reinforces strong academic performance. This format effectively communicates qualifications in a concise manner. How you present your education can make a lasting impression, so focus on being clear and relevant.

How to include payroll accountant certificates on your resume

Including a certificates section in your payroll accountant resume is crucial as it highlights your professional qualifications and commitment to the field. A well-crafted certificates section can make your resume stand out and showcase your expertise. List the name of the certifications you have earned prominently. Include the date you received the certification to give employers a sense of your learning timeline. Add the issuing organization to establish the credibility of your credentials. For an even more impactful presentation, certificates can also be mentioned in the header of your resume.

For example:

Jane Doe, Payroll Accountant Certified Payroll Professional (CPP), American Payroll Association (APA)

This header format immediately draws attention to your key certification and establishes your expertise from the first glance. Here is a good example of a standalone certificates section.

This example is effective because it lists relevant certifications that a payroll accountant should have. The titles are specific and recognized in the industry, the dates help show your recent learning efforts, and the issuing organizations add credibility. Such a section clearly demonstrates your qualifications and helps you stand out to potential employers.

Extra sections to include in your payroll accountant resume

In today's competitive job market, crafting a well-rounded resume is key, especially for positions like a payroll accountant. It's crucial to show not only your technical abilities but also your personal qualities and broader experiences.

- Language section — Highlight your language skills to show versatility and communication competence. Feature fluency or proficiency in relevant languages, such as Spanish or French, to emphasize added value in diverse workplaces.

- Hobbies and interests section — Showcase personal interests that exhibit traits like attention to detail, persistence, or teamwork. Mention activities like chess or marathon running to illustrate these qualities.

- Volunteer work section — Demonstrate commitment and initiative through community service or nonprofit involvement. List experiences such as volunteering at a local shelter, which indicate strong work ethics and people skills.

- Books section — Share books that relate to your profession to underscore your commitment to continual learning. Mention titles like "Financial Intelligence for HR Professionals" to show dedication to staying updated in your field.

These sections help paint a fuller picture of who you are and what you bring to the table, making your resume stand out.

In Conclusion

In conclusion, crafting a compelling payroll accountant resume requires much more than merely listing your previous jobs. Your resume serves as a reflection of your abilities and accomplishments, showcasing your attention to detail and how effectively you can manage complex payroll tasks. Be sure to present your skills in a way that is easy to understand while still highlighting your expertise. A well-designed resume template can help you organize your information and engage potential employers.

Including specific, quantifiable achievements in your experience section allows prospective employers to see the tangible impact of your work. Don't forget to tailor this section to each job you are applying for by using keywords that match the job description. Whether it’s an improvement in payroll accuracy or cost savings, these specific results make your resume stand out.

Your education and certificates are crucial, underscoring your professionalism and dedication to your field. Make sure these are clearly presented to provide a strong foundation for your technical skills. Additionally, consider including extra sections like volunteer work or languages spoken to give potential employers a broader sense of who you are as a candidate.

Overall, your resume should paint a comprehensive picture of your skills, experience, and personal attributes, making it clear why you're the best fit for the position. By strategically highlighting your abilities and achievements, you can make a memorable impression that goes beyond numbers, encouraging employers to take an interest in your professional journey.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.