Payroll & Payment Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Crafting the perfect payroll accountant resume: tips to account for your success and deposits into your dream job — learn key resume tips and highlight your skills effectively for a standout payroll and payment accountant resume."

Rated by 348 people

Accounts Payable & Payroll Specialist

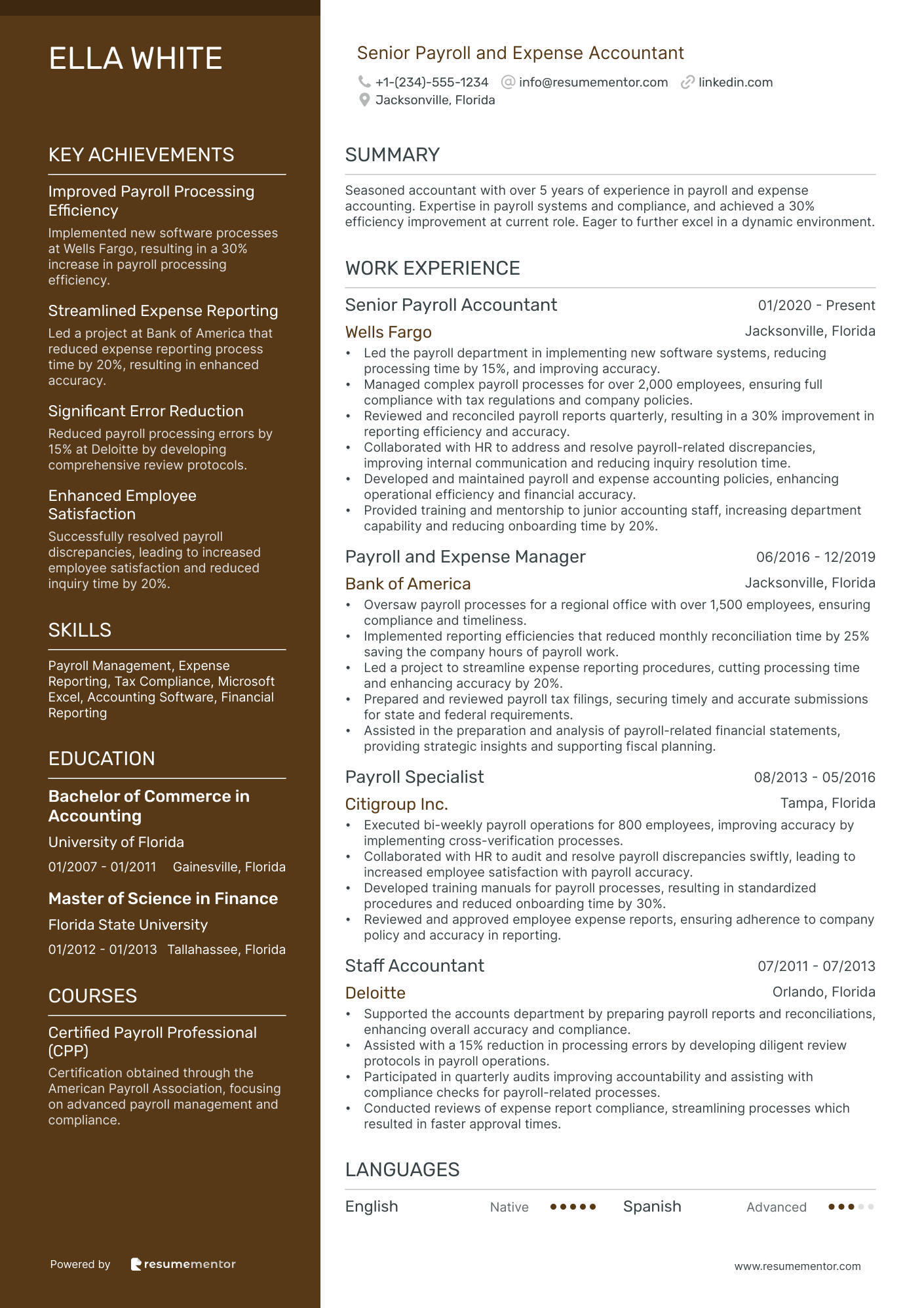

Senior Payroll and Expense Accountant

Payroll and Tax Compliance Accountant

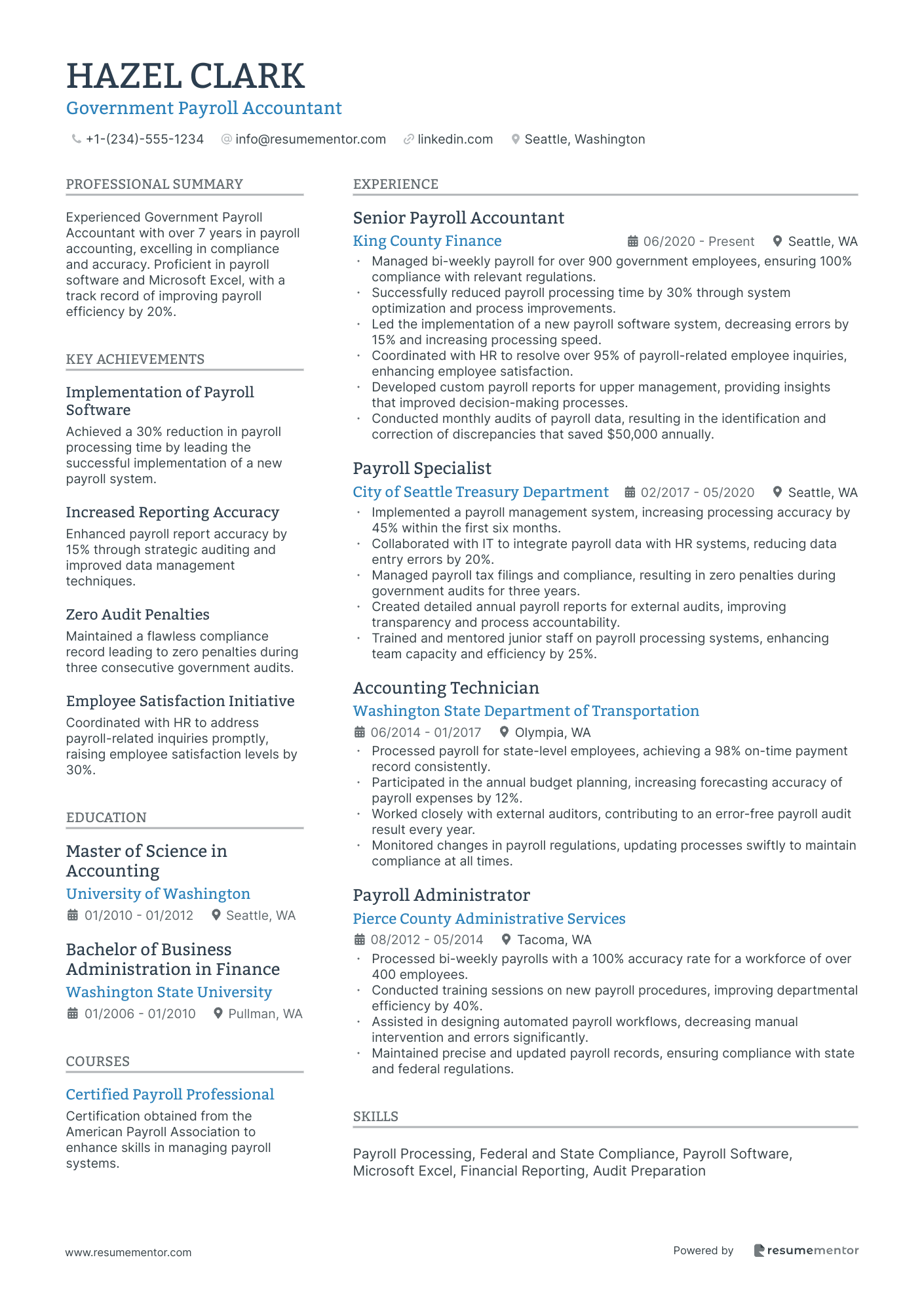

Government Payroll Accountant

Non-profit Payroll Accountant

Construction Industry Payroll Accountant

Payroll Reconciliation Accountant

Accounts Payable & Payroll Specialist resume sample

- •Led a team in optimizing accounts payable processes, reducing invoice processing times by 25% and improving accuracy.

- •Implemented a new automated expense reporting system that decreased manual entry errors by 40%, enhancing efficiency.

- •Collaborated with vendors to resolve payment discrepancies smoothly, maintaining strong professional relationships.

- •Supported month-end closing processes, contributing to a 20% reduction in closing time through improved reconciliations.

- •Managed a complex payroll system for over 500 employees, resulting in timely and accurate payroll processing.

- •Conducted in-depth training sessions for new team members, increasing team productivity by 15% within the first quarter.

- •Accurately processed over 1,000 invoices monthly, achieving a 95% on-time payment rate for vendors.

- •Resolved over 95% of vendor inquiries within 72 hours by developing an efficient inquiry logging system.

- •Conducted audits on payroll records, identifying discrepancies that led to improved compliance measures.

- •Reviewed and optimized documentation retention strategies, ensuring complete compliance with federal guidelines.

- •Assisted with the annual audit, providing accurate records that facilitated a seamless audit process.

- •Efficiently processed bi-weekly payroll for 300 employees, ensuring all state and federal regulations were followed.

- •Developed and maintained relationships with third-party payroll services, improving the overall satisfaction rate by 20%.

- •Introduced a payroll compliance program that enhanced adherence to local tax regulations by 30%.

- •Facilitated employee training sessions on payroll procedures, improving user satisfaction scores by 25%.

- •Managed and processed payroll records for 150 employees, achieving 100% accuracy in payroll submissions.

- •Reduced accounts payable backlog by 30% within six months by implementing a structured priority system.

- •Built a report tracking system, resulting in a 15% enhancement in report generation speed for monthly reports.

- •Coordinated with the finance team to streamline payments, decreasing overall pay cycle time by 10%.

Senior Payroll and Expense Accountant resume sample

- •Led the payroll department in implementing new software systems, reducing processing time by 15%, and improving accuracy.

- •Managed complex payroll processes for over 2,000 employees, ensuring full compliance with tax regulations and company policies.

- •Reviewed and reconciled payroll reports quarterly, resulting in a 30% improvement in reporting efficiency and accuracy.

- •Collaborated with HR to address and resolve payroll-related discrepancies, improving internal communication and reducing inquiry resolution time.

- •Developed and maintained payroll and expense accounting policies, enhancing operational efficiency and financial accuracy.

- •Provided training and mentorship to junior accounting staff, increasing department capability and reducing onboarding time by 20%.

- •Oversaw payroll processes for a regional office with over 1,500 employees, ensuring compliance and timeliness.

- •Implemented reporting efficiencies that reduced monthly reconciliation time by 25% saving the company hours of payroll work.

- •Led a project to streamline expense reporting procedures, cutting processing time and enhancing accuracy by 20%.

- •Prepared and reviewed payroll tax filings, securing timely and accurate submissions for state and federal requirements.

- •Assisted in the preparation and analysis of payroll-related financial statements, providing strategic insights and supporting fiscal planning.

- •Executed bi-weekly payroll operations for 800 employees, improving accuracy by implementing cross-verification processes.

- •Collaborated with HR to audit and resolve payroll discrepancies swiftly, leading to increased employee satisfaction with payroll accuracy.

- •Developed training manuals for payroll processes, resulting in standardized procedures and reduced onboarding time by 30%.

- •Reviewed and approved employee expense reports, ensuring adherence to company policy and accuracy in reporting.

- •Supported the accounts department by preparing payroll reports and reconciliations, enhancing overall accuracy and compliance.

- •Assisted with a 15% reduction in processing errors by developing diligent review protocols in payroll operations.

- •Participated in quarterly audits improving accountability and assisting with compliance checks for payroll-related processes.

- •Conducted reviews of expense report compliance, streamlining processes which resulted in faster approval times.

Payroll and Tax Compliance Accountant resume sample

- •Managed payroll processing for over 500 employees, ensuring compliance with federal and state regulations, which reduced payroll discrepancies by 20%.

- •Developed and implemented tax compliance strategies that resulted in a 30% increase in efficiency during tax audits appointments.

- •Conducted comprehensive audits of payroll and tax records, identifying and correcting errors that saved the company $50,000 annually.

- •Coordinated the preparation and filing of federal, state, and local tax returns, maintaining a 100% on-time submission record.

- •Delivered detailed monthly and quarterly financial reports concerning payroll and taxation, improving reporting accuracy by 25%.

- •Collaborated with cross-functional teams to integrate new payroll software, enhancing data accuracy and reducing processing time by 10%.

- •Oversaw federal and state tax compliance for over 300 employees, ensuring adherence to regulatory changes and reducing penalties by 15%.

- •Designed and implemented a protocol for regular payroll audits, resulting in a 25% reduction in errors.

- •Provided expert guidance on complex taxation issues, resolving 95% of inquiries within 24 hours.

- •Managed year-end processes, including the preparation of W-2s and 1099s for submission to relevant authorities accurately and on time.

- •Contributed to the company’s transition to a new payroll software, training staff and improving usage rates by 50%.

- •Processed payroll for 250 employees while ensuring timely and accurate payments, enhancing trust and satisfaction levels.

- •Maintained comprehensive payroll records, implementing data integrity checks that improved record accuracy by 18%.

- •Liaised with HR and finance departments to streamline payroll integration, which resulted in a 10% increase in efficiency.

- •Prepared financial documentation for internal and external audits, achieving an error-free rate for two consecutive years.

- •Assisted in the processing of payroll for a diverse employee base, ensuring compliance with local, state, and federal regulations.

- •Updated employee records and resolved payroll discrepancies quickly and efficiently, maintaining trust among staff members.

- •Aided in the accurate preparation and filing of tax returns, contributing to a reduction in audit occurrences.

- •Supported financial report preparation, which improved the timeliness and accuracy of monthly close procedures.

Government Payroll Accountant resume sample

- •Managed bi-weekly payroll for over 900 government employees, ensuring 100% compliance with relevant regulations.

- •Successfully reduced payroll processing time by 30% through system optimization and process improvements.

- •Led the implementation of a new payroll software system, decreasing errors by 15% and increasing processing speed.

- •Coordinated with HR to resolve over 95% of payroll-related employee inquiries, enhancing employee satisfaction.

- •Developed custom payroll reports for upper management, providing insights that improved decision-making processes.

- •Conducted monthly audits of payroll data, resulting in the identification and correction of discrepancies that saved $50,000 annually.

- •Implemented a payroll management system, increasing processing accuracy by 45% within the first six months.

- •Collaborated with IT to integrate payroll data with HR systems, reducing data entry errors by 20%.

- •Managed payroll tax filings and compliance, resulting in zero penalties during government audits for three years.

- •Created detailed annual payroll reports for external audits, improving transparency and process accountability.

- •Trained and mentored junior staff on payroll processing systems, enhancing team capacity and efficiency by 25%.

- •Processed payroll for state-level employees, achieving a 98% on-time payment record consistently.

- •Participated in the annual budget planning, increasing forecasting accuracy of payroll expenses by 12%.

- •Worked closely with external auditors, contributing to an error-free payroll audit result every year.

- •Monitored changes in payroll regulations, updating processes swiftly to maintain compliance at all times.

- •Processed bi-weekly payrolls with a 100% accuracy rate for a workforce of over 400 employees.

- •Conducted training sessions on new payroll procedures, improving departmental efficiency by 40%.

- •Assisted in designing automated payroll workflows, decreasing manual intervention and errors significantly.

- •Maintained precise and updated payroll records, ensuring compliance with state and federal regulations.

Non-profit Payroll Accountant resume sample

- •Managed payroll for over 200 employees, achieving a 99% accuracy rate through meticulous data verification and processing.

- •Streamlined payroll processing time by 30% through implementation of a new software, ensuring timely payments to all employees.

- •Collaborated with HR on benefits management, reducing benefit-related queries by 20% resulting in improved employee satisfaction.

- •Assisted in the preparation of the organization's annual tax filings, ensuring compliance with all relevant tax regulations.

- •Developed and presented payroll reports to management that provided insights on expense trends, aiding in strategic financial planning.

- •Resolved payroll discrepancies within 48 hours, maintaining a high level of employee satisfaction and trust.

- •Executed payroll for 150+ employees, achieving zero errors through rigorous review and verification processes.

- •Led a team in a project to upgrade payroll system software, resulting in a 40% enhancement of processing speed.

- •Ensured compliance with local, state, and federal payroll laws, mitigating the risk of fines and legal issues.

- •Produced monthly payroll expense forecasts, aiding in budget planning and reducing unforeseen discrepancies by 15%.

- •Provided training for junior payroll staff, improving departmental efficiency and employee performance.

- •Processed bi-weekly payroll for approximately 100 employees, achieving a 95% satisfaction rate in payroll related queries.

- •Reconciled payroll accounts monthly, identifying and rectifying discrepancies efficiently to meet audit standards.

- •Maintained up-to-date employee records, resulting in improved accuracy and compliance in payroll reporting.

- •Collaborated closely with HR to manage staff deductions and other benefits, streamlining processes to reduce processing errors.

- •Supported senior accountant in the analysis and reporting of payroll data, enhancing reporting accuracy by 20%.

- •Assisted in the preparation of annual audit materials, ensuring compliance with accounting standards and practices.

- •Monitored changes in payroll legislation, integrating new procedures into organizational practices to maintain compliance.

- •Conducted monthly payroll reconciliations, resolving discrepancies in a timely manner and ensuring accurate financial records.

Construction Industry Payroll Accountant resume sample

- •Led a team to process payroll for over 500 employees, achieving a 99% accuracy rate in payroll delivery.

- •Implemented a payroll audit system that reduced discrepancies by 30%, greatly enhancing payroll precision.

- •Collaborated with HR to streamline benefits management, saving the company approximately $50,000 annually.

- •Developed and integrated new payroll software, reducing processing time by 40%, and improving productivity.

- •Calculated and filed payroll taxes and quarterly reports for a large workforce, consistently meeting deadlines.

- •Managed employee inquiries efficiently, resulting in a 25% decrease in payroll-related complaints.

- •Processed weekly and bi-weekly payroll for both hourly and salaried employees in accordance with regulations.

- •Ensured full compliance with prevailing wage laws, resulting in zero compliance issues during audits.

- •Conducted regular payroll reviews to identify discrepancies, reducing errors by 20% annually.

- •Managed payroll software transition, training staff and ensuring a smooth changeover with minimal disruption.

- •Assisted in month-end reconciliation of payroll accounts, improving financial reporting accuracy.

- •Reviewed and verified payroll for over 150 employees, maintaining compliance with all legal standards.

- •Improved timesheet data accuracy by introducing a new validation process, reducing manual corrections by 15%.

- •Assisted with year-end payroll processes, ensuring all employee records were accurate and up-to-date.

- •Collaborated with the IT department to enhance payroll systems functionality, leading to faster data processing.

- •Accurately processed payroll for a construction workforce of 100 employees, maintaining high efficiency.

- •Developed a streamlined payroll data entry process, reducing entry time by 25% through software optimization.

- •Assisted in transitioning to a new payroll system, ensuring data integrity and minimal downtime during implementation.

- •Supported the accounting department with payroll tax filings, ensuring compliance with state and federal laws.

Payroll Reconciliation Accountant resume sample

- •Led a team that improved payroll accuracy by 25% through implementation of new reconciliation protocols.

- •Analyzed payroll discrepancies, resulting in 30% faster resolution times for payroll issues.

- •Collaborated on a cross-departmental project which optimized payroll data flow, enhancing efficiency by 15%.

- •Prepared comprehensive reports on payroll metrics, successfully presenting findings to senior management.

- •Conducted monthly payroll audits which ensured 100% compliance with regulatory standards.

- •Implemented a payroll training program for new hires, increasing department productivity by 10%.

- •Streamlined payroll reconciliation processes, reducing monthly reconciliation times by 20%.

- •Developed analytical tools that reduced payroll discrepancies by 15% across the board.

- •Worked closely with HR to align payroll processes with new benefits programs, improving employee satisfaction scores.

- •Prepared detailed payroll expenditure reports for quarterly reviews, facilitating better budget planning.

- •Participated in the implementation of a new payroll software, improving data accuracy and processing speed by 30%.

- •Conducted thorough payroll reviews, detecting errors and discrepancies promptly and reducing payroll issues by 18%.

- •Assisted in transition to new payroll software, training 10 staff members in new procedures.

- •Collaborated with accounting department to reconcile payroll accounts, achieving zero month-end discrepancies.

- •Utilized advanced Excel skills to automate payroll reports, decreasing report generation time by 40%.

- •Managed payroll for over 300 employees, maintaining a 99% accuracy rate in payroll processing.

- •Handled complex payroll transactions, including bonuses and tax withholding adjustments.

- •Maintained updated payroll records in accordance with legal requirements and company protocols.

- •Generated detailed payroll reports for management review, aiding in strategic decision-making.

As a payroll and payment accountant, your ability to manage financial data is essential to any organization, but turning that expertise into a standout resume can be challenging. Crafting a compelling resume is like balancing the books; both require precision and clarity. It's crucial to ensure your skills and experience capture the attention of potential employers right away, reflecting your ability to handle complex numbers with ease and accuracy. Yet, distilling your extensive technical expertise into concise points that highlight your qualifications can feel overwhelming.

This is where a proven resume template becomes invaluable, offering a structured format that can save you time and stress. By using a template, you can organize your skills, experience, and accomplishments clearly, ensuring that every detail stands out. This approach lets you focus on personalizing the content to reflect your unique background and expertise. Templates from recommended sources can provide the perfect starting point for creating a polished resume.

A structured format helps you better communicate the value you bring—whether it's streamlining payroll processes, managing compliance, or boosting efficiency—making it clear why you're a strong candidate. As you embark on your job search, remember that your resume is your introduction to potential employers, a chance to highlight your strengths and open the door to new opportunities.

Key Takeaways

- Creating a standout resume as a payroll and payment accountant involves showcasing your ability to manage financial data with precision and clarity.

- Using a structured template helps organize skills, experience, and accomplishments, allowing you to focus on personalizing the content.

- A reverse-chronological format is recommended to highlight career progression and longest-held roles, with key achievements detailed through quantifiable outcomes.

- Important sections to include are contact information, a professional summary, work experience, skills, education, and certifications to make a comprehensive presentation.

- Incorporating additional sections like language skills, volunteer work, hobbies, and books can enhance your resume by highlighting a well-rounded professional profile.

What to focus on when writing your payroll & payment accountant resume

A payroll and payment accountant resume should clearly convey your ability to manage employee compensation and payment processing while adhering to relevant laws. This demonstrates to recruiters that you are detail-oriented and capable of maintaining financial integrity.

How to structure your payroll & payment accountant resume

- Contact Information — Always ensure that your contact information is current and easily accessible to make it straightforward for employers to reach you. Include your full name and make sure your phone number and email address are professional. Adding a LinkedIn profile helps portray a modern professional image, demonstrating active engagement in your industry.

- Professional Summary — Craft a compelling snapshot of your experience that captures the essence of who you are as a payroll and payment accountant. Highlight your expertise in payroll processing, benefits administration, and handling taxes. Mention any notable software experience like ADP or QuickBooks, which shows your readiness to contribute from day one.

- Work Experience — Your previous roles should clearly illustrate achievements such as managing payroll cycles effectively, resolving discrepancies, and ensuring timely payments. Focus on quantifiable achievements, such as improving processes that reduce payroll errors or enhance compliance with tax regulations. This section paints a picture of your impact in prior roles.

- Skills — Highlight core skills that align with the payroll and payment accountant role, such as proficiency in payroll software, knowledge of tax regulations, and strong analytical abilities. Emphasize your ability to maintain confidentiality and excellent organizational skills, showcasing your capability to manage complex payroll systems.

- Education — Detail your academic qualifications, focusing on degrees in Accounting, Finance, or related fields. Mention certifications such as Certified Payroll Professional (CPP) that reinforce your expertise. This academic foundation shows your theoretical understanding and readiness to apply it practically.

- Certifications and Training — Include relevant certifications that bolster your expertise and any ongoing training that demonstrates your commitment to professional growth. This continual learning approach highlights your dedication to staying current in your field.

These sections collectively frame your resume. In the next part, we delve deeper into each section to ensure you effectively showcase your qualifications and experience.

Which resume format to choose

For your payroll and payment accountant resume, the reverse-chronological format is your best choice. This format organizes your work history effectively, highlighting your longest-held roles and showcasing your career progression in accounting. It appeals to employers seeking detailed work experience in key financial roles.

Selecting the right font enhances your resume's appearance while ensuring readability. Opt for Rubik, Lato, or Montserrat to give your document a modern and polished feel. These fonts help communicate professionalism without the clutter, making your key information stand out.

Always save your resume as a PDF. This file type ensures that your formatting stays consistent, regardless of whether your document is viewed on a desktop or mobile device, preserving the integrity of your carefully crafted resume.

Maintaining one-inch margins is another essential detail. It keeps your resume looking clean and organized, giving ample space for information without overwhelming the reader. For a payroll and payment accountant, these details ensure that your resume effectively conveys your skills, experience, and professional acumen.

How to write a quantifiable resume experience section

Your resume's experience section is crucial for highlighting your skills as a payroll and payment accountant. You need to share relevant jobs while emphasizing clear, measurable achievements. Structuring it with straightforward job titles and making it easy to skim helps. Tailor your experiences to the job you're targeting by showcasing responsibilities and accomplishments that fit the job ad. Using strong action words helps make your points concise and impactful. Listing jobs in reverse chronological order is best, starting with the most recent. It's usually a good idea to go back 10-15 years to maintain relevance. Clear job titles provide context for each role.

Here's an example that captures these ideas well:

- •Implemented a new payroll system, cutting processing time by 30% while ensuring full compliance.

- •Resolved payroll discrepancies, reducing errors by 15% with improved accuracy measures.

- •Managed bi-weekly payroll processing for thousands of employees, ensuring timely and accurate payments.

- •Developed and led training sessions for new software, boosting team efficiency by 25%.

This experience section works because it highlights quantifiable accomplishments, demonstrating your expertise. The bullet points showcase specific achievements that brought positive change, like cutting processing time and boosting team efficiency. Words like "Implemented," "Resolved," and "Developed" show decisive actions. By focusing on key responsibilities that are relevant to a payroll and payment accountant role, the section speaks directly to potential employers. Presenting your most recent job first and arranging experiences in reverse chronological order ensure that your most relevant experience immediately grabs attention.

Innovation-Focused resume experience section

An innovation-focused payroll and payment accountant resume experience section should highlight your ability to think creatively and make meaningful contributions at work. Begin by showcasing specific improvements you've made, such as enhancing processes or integrating new systems, which led to increased efficiency or cost savings. Use action-oriented language with clear, measurable outcomes to create an engaging narrative.

Then, connect your innovative actions with teamwork and leadership experiences. Perhaps you adopted new accounting software that made payroll tasks quicker, or you devised a reporting method that improved the accuracy of data analysis. These examples should not only display your problem-solving skills but also demonstrate your capacity to influence positive change in a collaborative setting, showcasing your holistic approach to innovation.

Senior Payroll & Payment Accountant

TechCorp Solutions

June 2020 - May 2023

- Spearheaded the implementation of a new payroll software system, reducing processing time by 30%.

- Developed a new reporting metric that increased data accuracy and provided actionable insights for financial forecasting.

- Collaborated with a cross-functional team to identify cost-saving opportunities, resulting in a 15% reduction in operating expenses.

- Led training sessions on new technology solutions, enhancing team productivity and increasing compliance with the latest accounting standards.

Industry-Specific Focus resume experience section

A payroll and payment accountant-focused resume experience section should effectively showcase your expertise and accomplishments in this specialized field. Begin by highlighting your primary responsibilities, illustrating your ability to handle key tasks with precision and compliance. Use strong action verbs in each bullet, ensuring clarity and relevance. Including quantifiable outcomes is crucial, as they provide tangible evidence of your impact and contribution to previous roles.

Organizing your roles with exact dates and job titles gives context to your experiences, linking them to the companies where you've worked. As you outline your achievements, focus on tasks that demonstrate your efficiency, accuracy, and adherence to industry standards. Align your experience with the job requirements to reflect your understanding of the industry's demands, showcasing how your skills and experiences prepare you to meet the challenges ahead. This coherent approach ensures your resume is structured to convey your value effectively.

Payroll Accountant

ABC Financial Solutions

2020-2023

- Processed payroll for over 500 employees, prioritizing accuracy in deductions and tax compliance, which enhanced trust among stakeholders.

- Led a shift to a cloud-based system, cutting processing time by 30%, seamlessly integrating with existing workflow.

- Worked closely with HR and finance teams to enhance payment reporting efficiency, fostering a collaborative environment.

- Audited records quarterly, boosting error detection rates by 20%, contributing to a culture of precision.

Collaboration-Focused resume experience section

A collaboration-focused payroll and payment accountant resume experience section should clearly highlight your teamwork skills and achievements. Begin by listing clear job titles and dates. Use bullet points to describe tasks and successes, emphasizing how you worked with colleagues, departments, or external partners to enhance processes and ensure accuracy. Keeping your language simple and direct, focus on the specific actions you took and the positive results of your collaborative efforts.

When crafting this section, think of key moments where collaboration led to success. Describe these instances in a way that underscores your value as a team player. Short, precise bullet points are effective for quickly conveying essential information. Emphasize achievements and how teamwork improved efficiency, accuracy, or cost savings. Through this approach, potential employers will be able to see your capacity to foster positive, cooperative work environments.

Payroll & Payment Accountant

Tech Solutions Inc.

June 2019 - July 2023

- Teamed up with HR and IT to streamline payroll processes, cutting processing time by 20%.

- Led a cross-functional team to roll out new payment software, boosting transaction accuracy by 15%.

- Worked with external auditors to fix discrepancies, enhancing financial report accuracy by 30%.

- Organized workshops to improve teamwork on payroll updates, leading to a 25% efficiency increase.

Leadership-Focused resume experience section

A leadership-focused payroll and payment accountant resume experience section should highlight your skills in managing teams and optimizing processes, showcasing your ability to drive significant improvements. Begin by detailing achievements that illustrate your leadership in guiding projects and teams toward specific goals, such as reducing payroll processing times or enhancing the accuracy of financial reports. Clearly connect your accomplishments to the benefits they provided to the organization, using strong action verbs to convey the impact of your leadership in your previous roles.

It's also crucial to quantify your successes to give a clearer picture of their scale. When you highlight moments where you've implemented new systems or streamlined procedures, this shows your commitment to enhancing efficiency. Additionally, mention any collaborations with other departments to underline your ability to lead and communicate effectively with diverse teams. Each bullet point should weave into a cohesive narrative reflecting your leadership style and the positive changes you’ve initiated in the workplace.

Senior Payroll Accountant

ABC Finance Solutions

March 2018 – August 2023

- Led a team of 5 accountants to reduce payroll errors by 30% through implementing a robust cross-check system.

- Streamlined payment processing procedures, cutting processing time by 50%, enhancing productivity.

- Introduced new accounting software that increased the efficiency of payroll reporting and compliance.

- Fostered communication between payroll and HR departments, reducing issues and improving employee satisfaction.

Write your payroll & payment accountant resume summary section

A skills-focused payroll & payment accountant resume summary should seamlessly highlight your expertise and achievements. Think of it as an engaging introduction to your qualifications. An effective example might look like this:

This summary ties together relevant experience, emphasizing your command over financial systems and compliance issues. It connects your ability to drive efficiency with real-world results like cost reduction and data analysis. As you craft your own summary, focus on unique personal qualities such as problem-solving and team efficiency, which bring your role to life. Each detail you include should align directly with what potential employers seek.

Understanding different resume sections is crucial. Opt for a resume summary if you have solid experience, as it compiles your strengths and milestones. A resume objective suits those entering the field, clearly stating their goals. Meanwhile, a summary of qualifications provides a concise list of top attributes. Knowing which section best reflects your career stage and strengths ensures you convey the most compelling narrative.

Listing your payroll & payment accountant skills on your resume

A skills-focused payroll & payment accountant resume should clearly highlight your strengths and abilities. You can choose to make the skills section stand alone or integrate it into parts like your experience and summary. Your strengths, including soft skills such as communication and teamwork, play a crucial role in your effectiveness. Meanwhile, hard skills represent the specific knowledge or tools you need to master for this role, such as proficiency in accounting software and an understanding of tax laws.

These competencies serve as keywords on your resume, increasing its visibility to Applicant Tracking Systems (ATS). Properly selected keywords showcase your qualifications and make you more attractive to employers by fitting the job description well, ensuring your resume stands out among others.

Here is an example of a standalone skills section for a payroll & payment accountant:

This skills section effectively underscores your essential abilities. It highlights crucial technical skills like "Accounting Software Proficiency" and "Tax Compliance," while also emphasizing important qualities such as "Attention to Detail" and "Analytical Skills," which are key to performing your job proficiently.

Best hard skills to feature on your payroll & payment accountant resume

Hard skills communicate your ability to handle precise financial tasks with accuracy. Essential hard skills for a payroll & payment accountant include:

Hard Skills

- Accounting Software Proficiency

- Payroll Processing

- Tax Compliance Knowledge

- Data Entry Accuracy

- Financial Reporting

- Spreadsheet Expertise

- Reconciliation Skills

- Compliance with Regulatory Requirements

- Benefit Administration Understanding

- Cost Analysis

- Budget Management

- Ledger Maintenance

- Internal Auditing

- Compensation and Benefits Structuring

- Information Systems Knowledge

Best soft skills to feature on your payroll & payment accountant resume

Soft skills should reflect your capacity to work effectively with others and manage tasks efficiently. Key soft skills for success in this role include:

Soft Skills

- Communication Skills

- Team Collaboration

- Problem-Solving Abilities

- Organizational Skills

- Attention to Detail

- Time Management

- Adaptability

- Strong Work Ethic

- Critical Thinking

- Stress Management

- Customer Service Orientation

- Professionalism

- Confidentiality

- Negotiation Skills

- Decision-Making Abilities

How to include your education on your resume

Your resume's education section is more than just a list of degrees; it's a chance to show that your academic background matches the payroll and payment accountant position you're targeting. Focus on relevant coursework or honors that prepare you for the responsibilities of the role. Avoid including any education that doesn’t relate to the job at hand. When listing your degree, include the type of degree and the field of study. If you have a strong GPA, consider featuring it; typically, a GPA above 3.5 is worth noting. Recognizing honors like 'cum laude' can add value, so include them right next to your degree.

Avoid just throwing together dates and titles; instead, create a section that emphasizes your best achievements.

The second example is strong because it directly aligns with the payroll and payment accountant role. It features a relevant degree, highlights academic excellence with 'cum laude', and includes a commendable GPA, making it clear the candidate has the necessary knowledge and skills.

How to include payroll & payment accountant certificates on your resume

Adding a certificates section to your payroll & payment accountant resume is essential, as it highlights your additional qualifications and sets you apart from other candidates. List the name of the certificate, include the date you obtained it, add the issuing organization, and make sure it is relevant to your field. Place this information prominently on your resume; you can even incorporate it into the header for immediate visibility.

For instance, if you are a Certified Payroll Professional, mention this prominently:

This example is good because it directly relates to the job title of payroll & payment accountant. The certificates listed not only enhance credibility but also demonstrate a specific expertise in payroll and accounting. Also, by including the issuance organization, you improve the legitimacy of your credentials.

Extra sections to include in your payroll & payment accountant resume

Crafting a standout resume for a payroll & payment accountant involves strategically highlighting various sections that enhance your professional profile beyond standard qualifications. Here’s how to boost your resume with additional sections:

Language section — Highlight additional languages you speak to show your versatility in multilingual environments. This can be especially useful if you work with international clients or in global companies.

Hobbies and interests section — Add this section to showcase unique skills or soft skills. Interests that demonstrate attention to detail or a passion for finance can make you stand out.

Volunteer work section — Include your volunteer experiences to show your commitment to community and skill in managing financial tasks outside of work. This section can also highlight leadership and teamwork qualities.

Books section — Mention relevant books you’ve read to demonstrate your dedication to continuous learning. This can impress employers with your commitment to staying informed about industry trends.

These sections can make your resume more holistic and appealing to potential employers.

In Conclusion

In conclusion, crafting a compelling payroll and payment accountant resume is a crucial step toward advancing your career in the finance sector. Your resume serves as your professional introduction, providing potential employers with a clear view of your expertise and achievements. Utilizing a structured template allows you to effectively showcase your skills, ensuring that your qualifications instantly capture attention. It's important to highlight not only your technical proficiency with software but also your ability to manage complex financial processes with precision. Including quantifiable achievements in your experience section can further emphasize your ability to drive efficiency and compliance. Additionally, selecting a reverse-chronological format ensures that your career progression and key roles are prominently displayed. Don't forget to feature any relevant certifications prominently, as these credentials underscore your commitment to excellence in the field. Tailor your resume to each job application by aligning your experiences and skills with the specific requirements of the role. By doing so, you demonstrate your adaptability and readiness to contribute to future employers. A well-crafted resume is not just a document; it is a strategic tool that opens doors to new opportunities, sets you apart from other candidates, and propels your career forward.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.