Phone Banking Resume Examples

Jul 18, 2024

|

12 min read

Crafting a phone banking resume that rings true: tips to highlight your skills and experience. Maximize your chances of landing the job by focusing on key qualities and making your resume a real 'call' to action.

Rated by 348 people

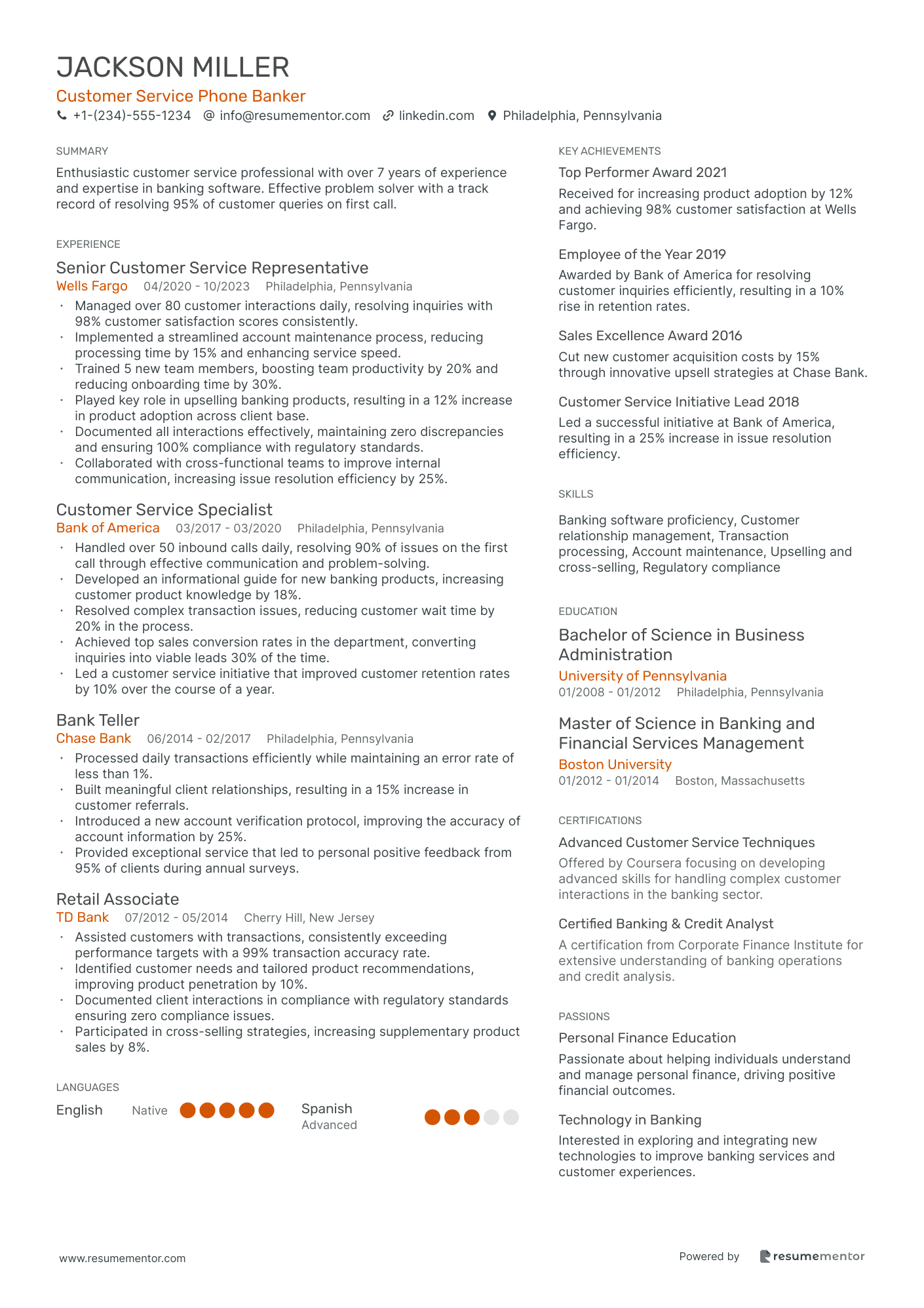

Customer Service Phone Banker

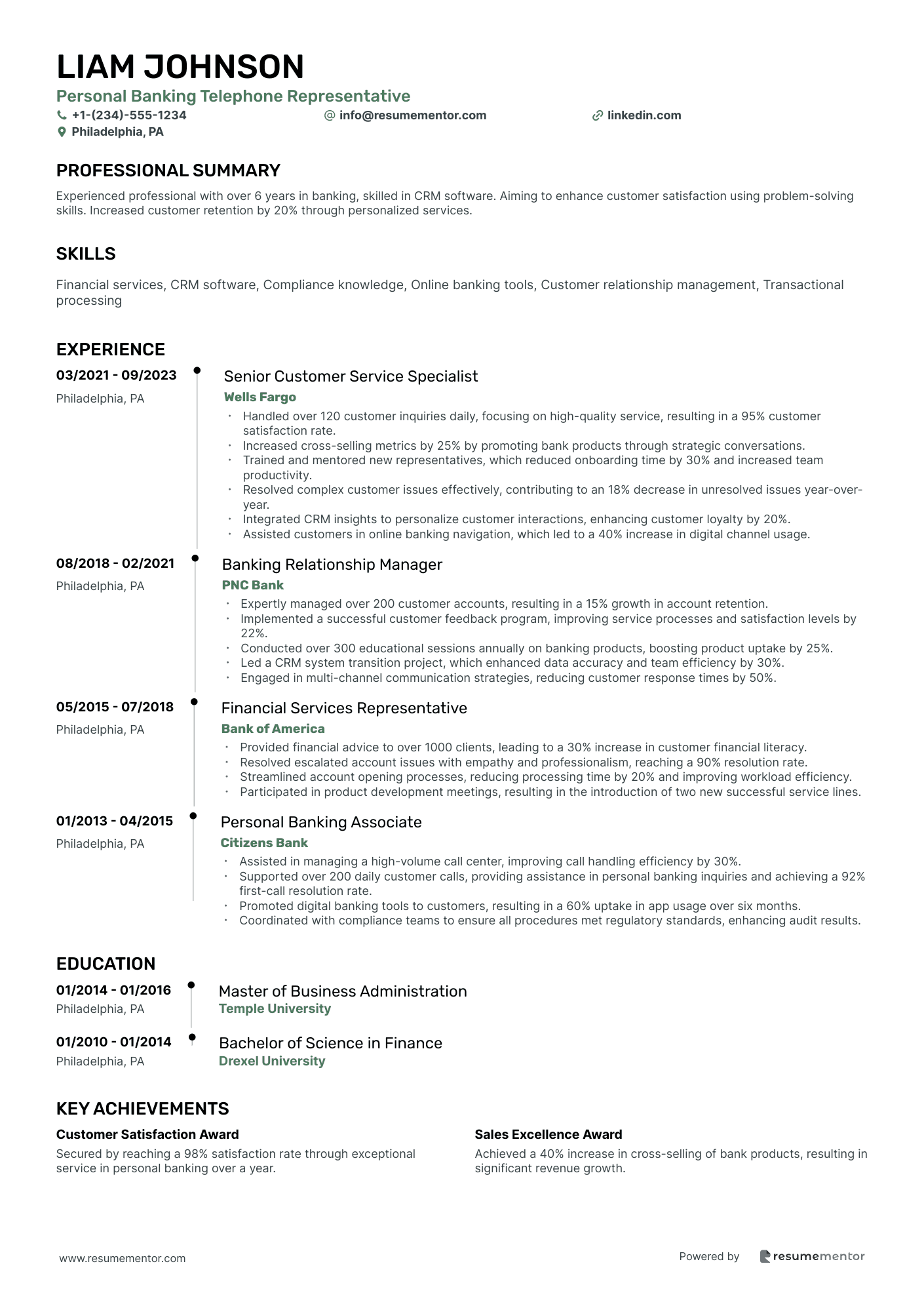

Personal Banking Telephone Representative

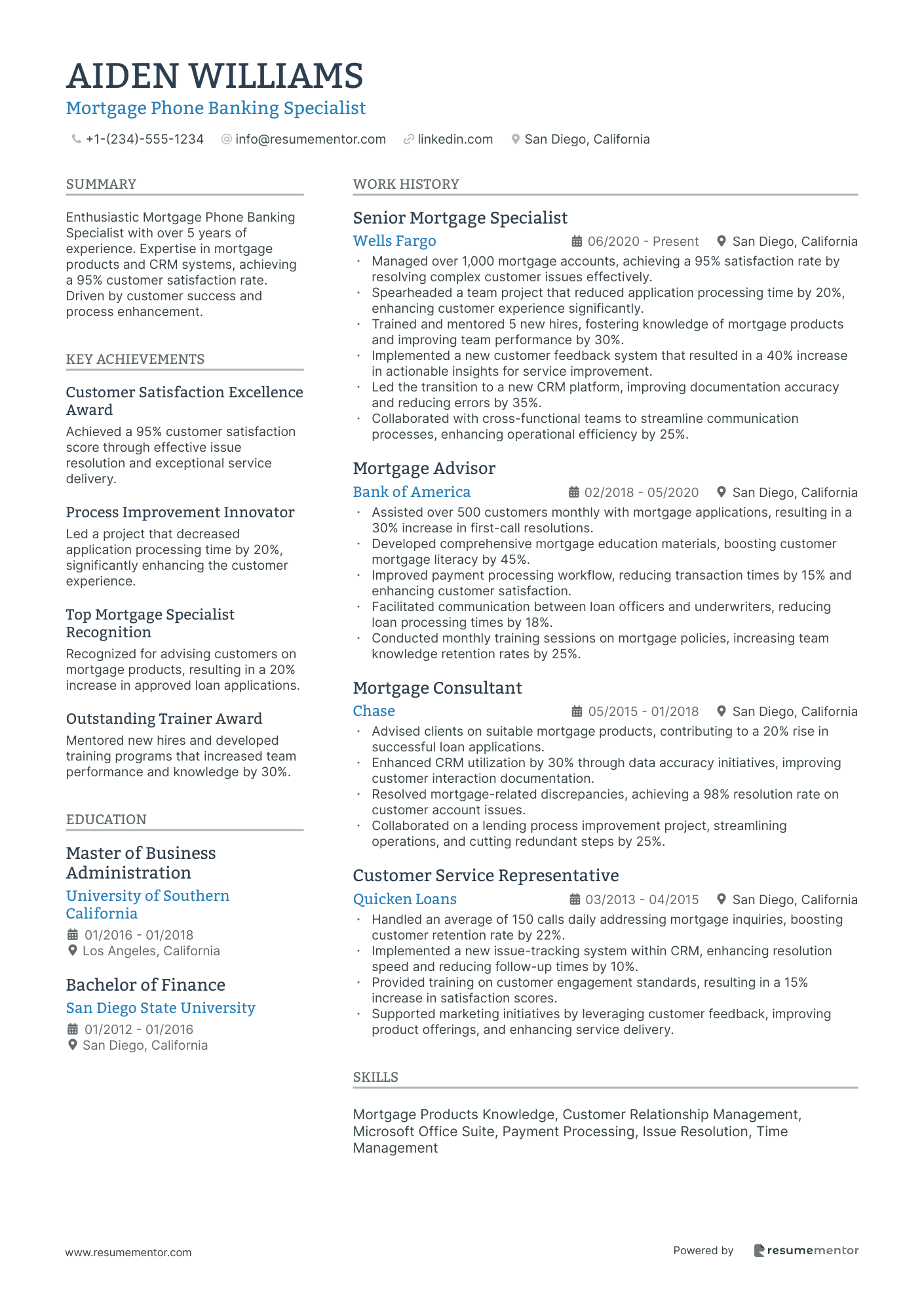

Mortgage Phone Banking Specialist

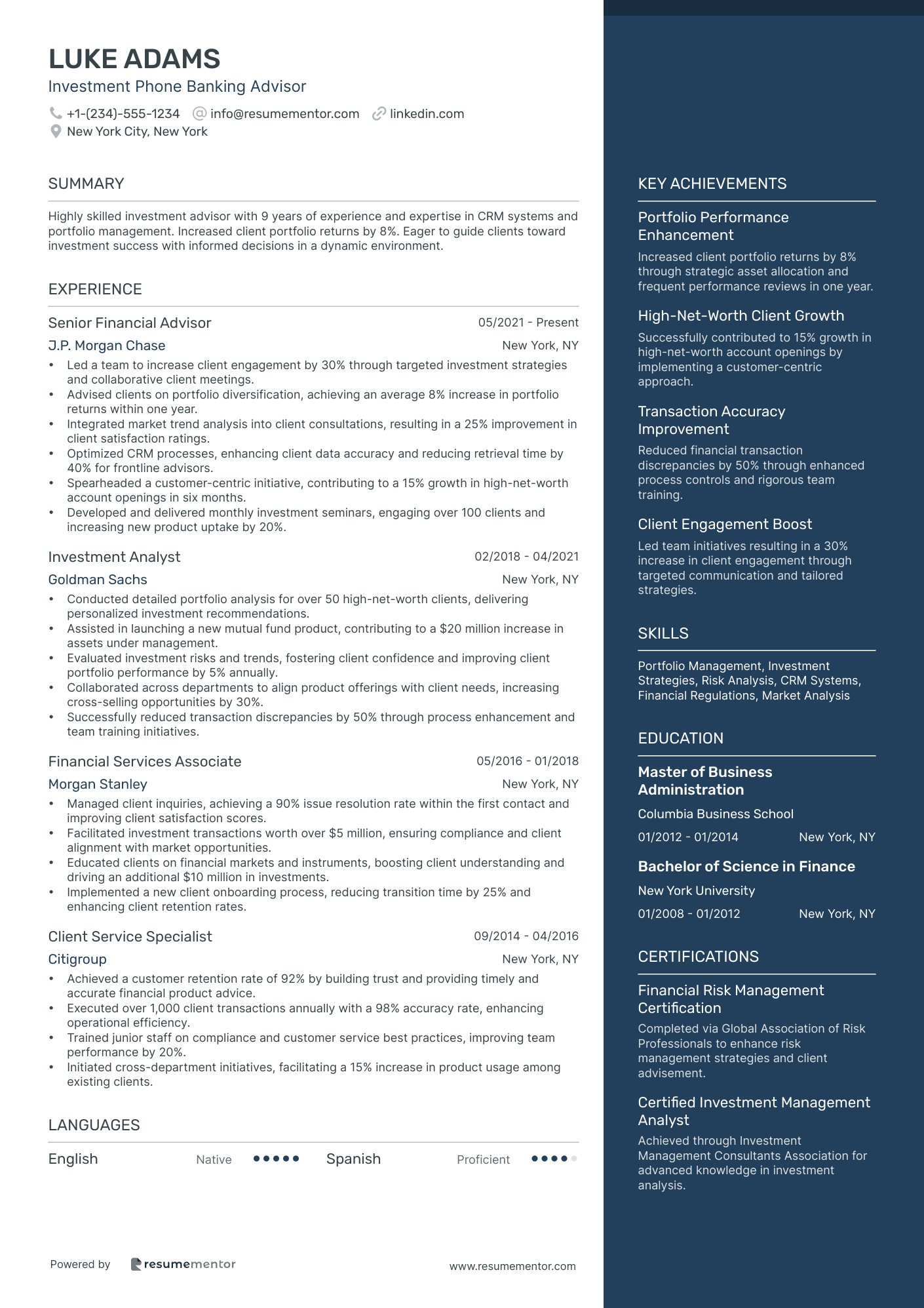

Investment Phone Banking Advisor

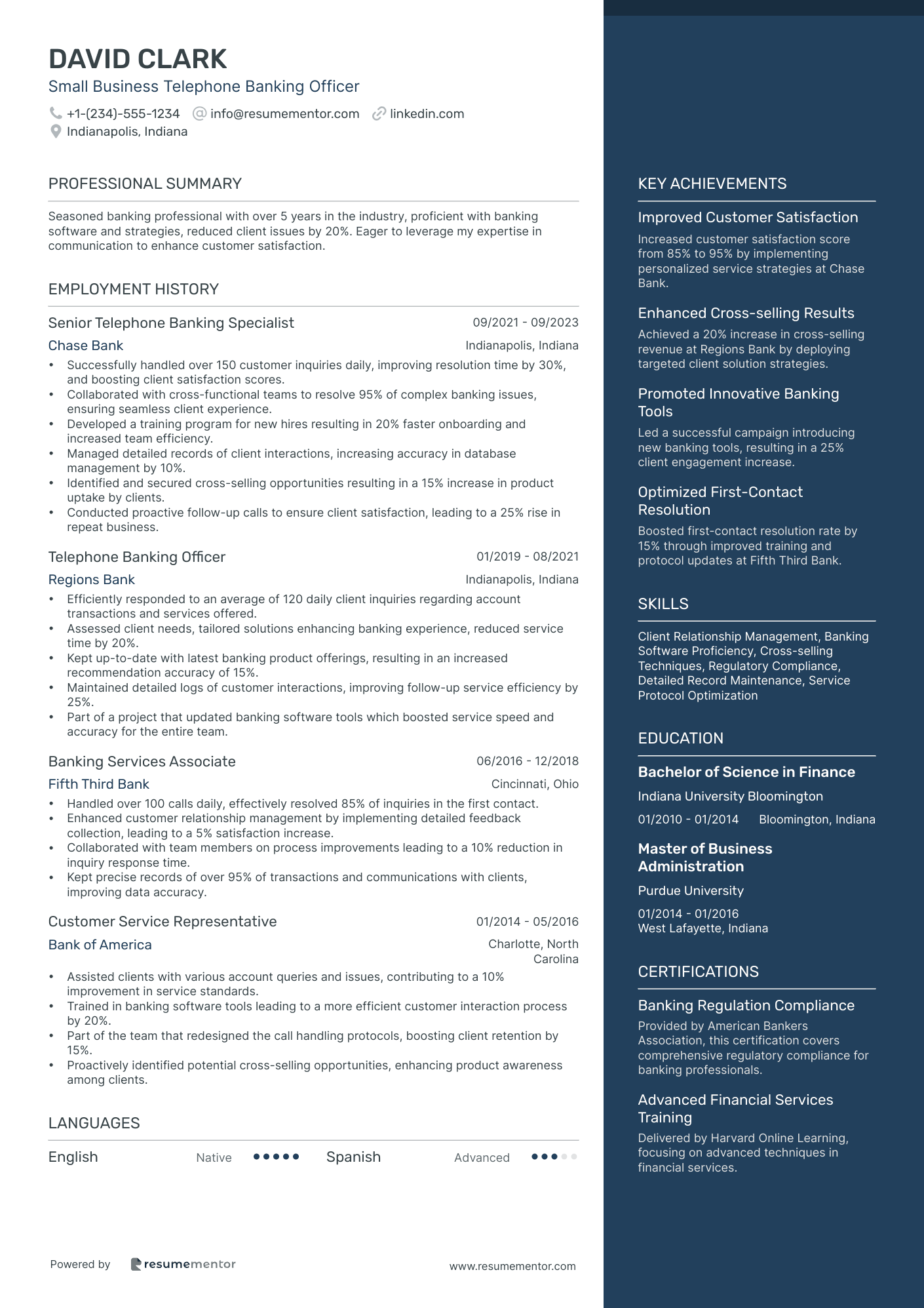

Small Business Telephone Banking Officer

Commercial Phone Banking Representative

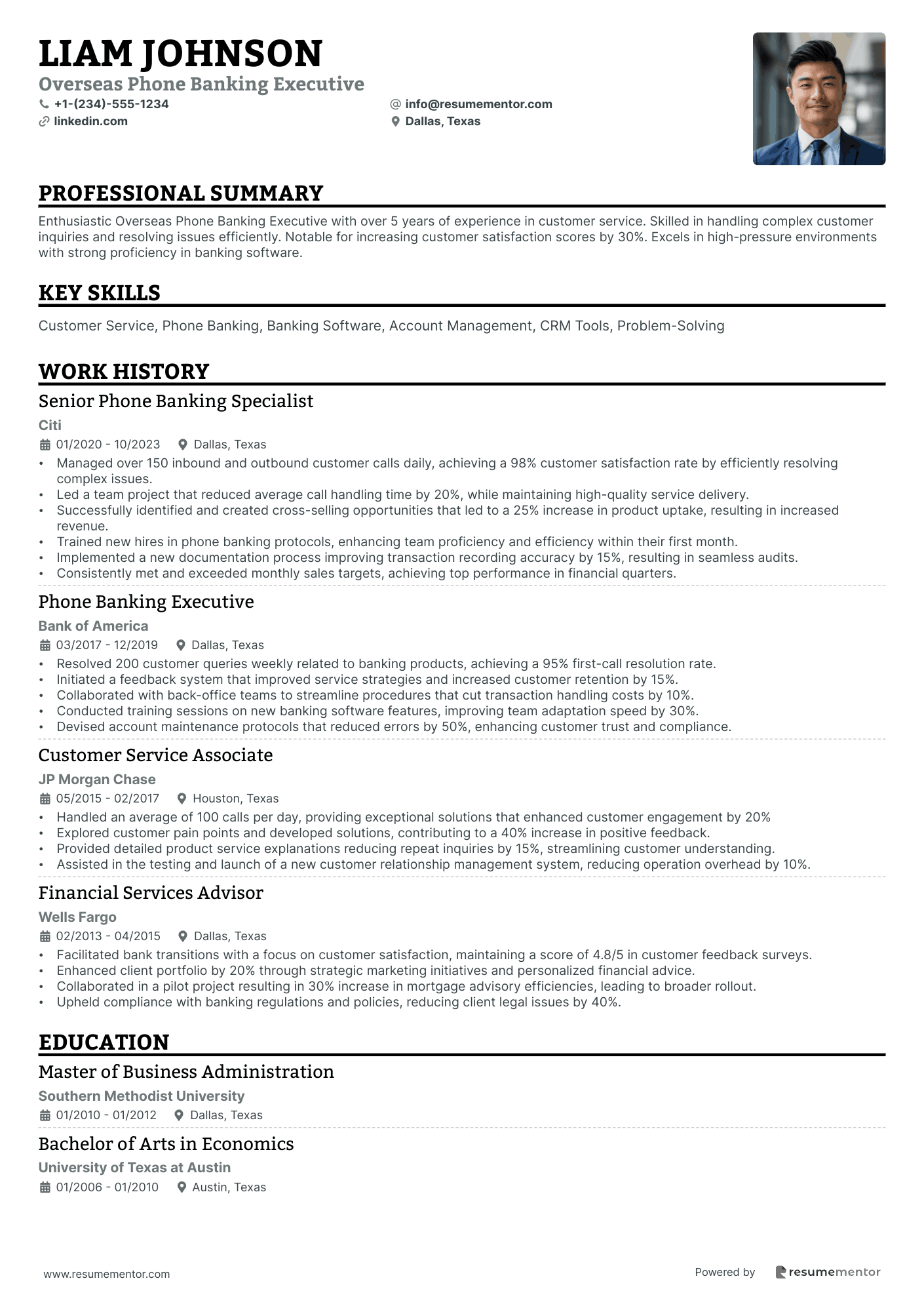

Overseas Phone Banking Executive

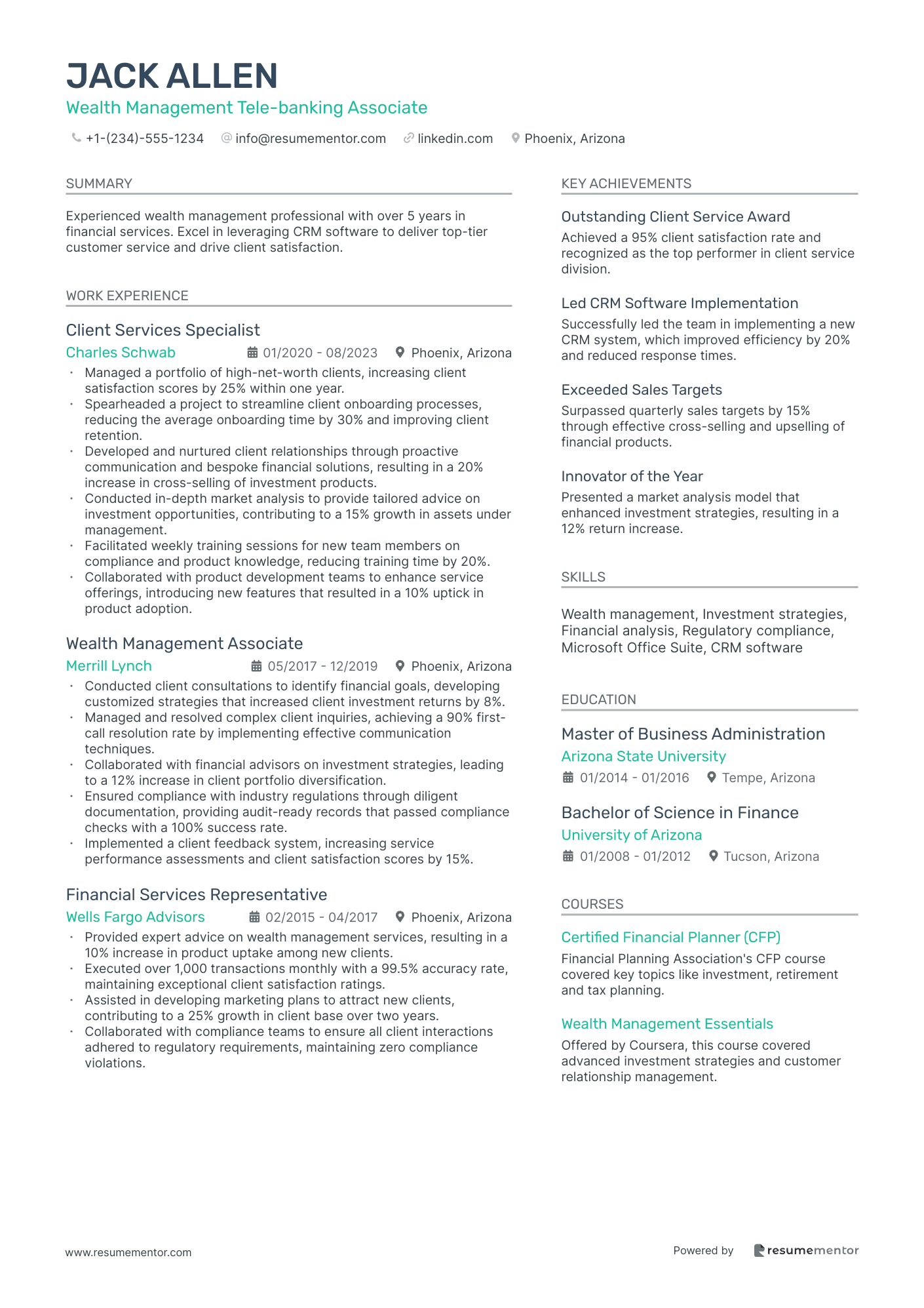

Wealth Management Tele-banking Associate

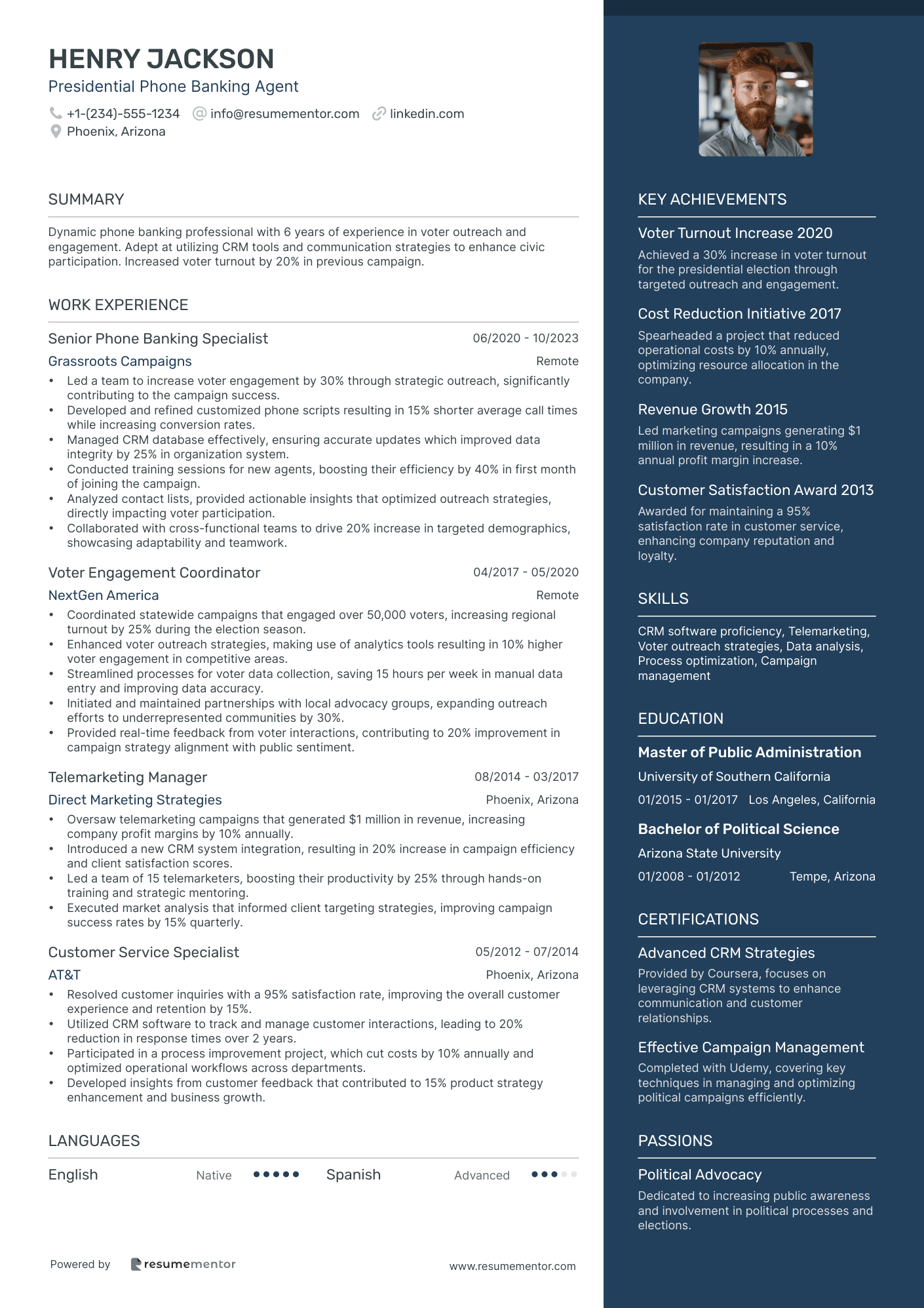

Presidential Phone Banking Agent

Corporate Phone Banking Specialist

Customer Service Phone Banker resume sample

- •Managed over 80 customer interactions daily, resolving inquiries with 98% customer satisfaction scores consistently.

- •Implemented a streamlined account maintenance process, reducing processing time by 15% and enhancing service speed.

- •Trained 5 new team members, boosting team productivity by 20% and reducing onboarding time by 30%.

- •Played key role in upselling banking products, resulting in a 12% increase in product adoption across client base.

- •Documented all interactions effectively, maintaining zero discrepancies and ensuring 100% compliance with regulatory standards.

- •Collaborated with cross-functional teams to improve internal communication, increasing issue resolution efficiency by 25%.

- •Handled over 50 inbound calls daily, resolving 90% of issues on the first call through effective communication and problem-solving.

- •Developed an informational guide for new banking products, increasing customer product knowledge by 18%.

- •Resolved complex transaction issues, reducing customer wait time by 20% in the process.

- •Achieved top sales conversion rates in the department, converting inquiries into viable leads 30% of the time.

- •Led a customer service initiative that improved customer retention rates by 10% over the course of a year.

- •Processed daily transactions efficiently while maintaining an error rate of less than 1%.

- •Built meaningful client relationships, resulting in a 15% increase in customer referrals.

- •Introduced a new account verification protocol, improving the accuracy of account information by 25%.

- •Provided exceptional service that led to personal positive feedback from 95% of clients during annual surveys.

- •Assisted customers with transactions, consistently exceeding performance targets with a 99% transaction accuracy rate.

- •Identified customer needs and tailored product recommendations, improving product penetration by 10%.

- •Documented client interactions in compliance with regulatory standards ensuring zero compliance issues.

- •Participated in cross-selling strategies, increasing supplementary product sales by 8%.

Personal Banking Telephone Representative resume sample

- •Handled over 120 customer inquiries daily, focusing on high-quality service, resulting in a 95% customer satisfaction rate.

- •Increased cross-selling metrics by 25% by promoting bank products through strategic conversations.

- •Trained and mentored new representatives, which reduced onboarding time by 30% and increased team productivity.

- •Resolved complex customer issues effectively, contributing to an 18% decrease in unresolved issues year-over-year.

- •Integrated CRM insights to personalize customer interactions, enhancing customer loyalty by 20%.

- •Assisted customers in online banking navigation, which led to a 40% increase in digital channel usage.

- •Expertly managed over 200 customer accounts, resulting in a 15% growth in account retention.

- •Implemented a successful customer feedback program, improving service processes and satisfaction levels by 22%.

- •Conducted over 300 educational sessions annually on banking products, boosting product uptake by 25%.

- •Led a CRM system transition project, which enhanced data accuracy and team efficiency by 30%.

- •Engaged in multi-channel communication strategies, reducing customer response times by 50%.

- •Provided financial advice to over 1000 clients, leading to a 30% increase in customer financial literacy.

- •Resolved escalated account issues with empathy and professionalism, reaching a 90% resolution rate.

- •Streamlined account opening processes, reducing processing time by 20% and improving workload efficiency.

- •Participated in product development meetings, resulting in the introduction of two new successful service lines.

- •Assisted in managing a high-volume call center, improving call handling efficiency by 30%.

- •Supported over 200 daily customer calls, providing assistance in personal banking inquiries and achieving a 92% first-call resolution rate.

- •Promoted digital banking tools to customers, resulting in a 60% uptake in app usage over six months.

- •Coordinated with compliance teams to ensure all procedures met regulatory standards, enhancing audit results.

Mortgage Phone Banking Specialist resume sample

- •Managed over 1,000 mortgage accounts, achieving a 95% satisfaction rate by resolving complex customer issues effectively.

- •Spearheaded a team project that reduced application processing time by 20%, enhancing customer experience significantly.

- •Trained and mentored 5 new hires, fostering knowledge of mortgage products and improving team performance by 30%.

- •Implemented a new customer feedback system that resulted in a 40% increase in actionable insights for service improvement.

- •Led the transition to a new CRM platform, improving documentation accuracy and reducing errors by 35%.

- •Collaborated with cross-functional teams to streamline communication processes, enhancing operational efficiency by 25%.

- •Assisted over 500 customers monthly with mortgage applications, resulting in a 30% increase in first-call resolutions.

- •Developed comprehensive mortgage education materials, boosting customer mortgage literacy by 45%.

- •Improved payment processing workflow, reducing transaction times by 15% and enhancing customer satisfaction.

- •Facilitated communication between loan officers and underwriters, reducing loan processing times by 18%.

- •Conducted monthly training sessions on mortgage policies, increasing team knowledge retention rates by 25%.

- •Advised clients on suitable mortgage products, contributing to a 20% rise in successful loan applications.

- •Enhanced CRM utilization by 30% through data accuracy initiatives, improving customer interaction documentation.

- •Resolved mortgage-related discrepancies, achieving a 98% resolution rate on customer account issues.

- •Collaborated on a lending process improvement project, streamlining operations, and cutting redundant steps by 25%.

- •Handled an average of 150 calls daily addressing mortgage inquiries, boosting customer retention rate by 22%.

- •Implemented a new issue-tracking system within CRM, enhancing resolution speed and reducing follow-up times by 10%.

- •Provided training on customer engagement standards, resulting in a 15% increase in satisfaction scores.

- •Supported marketing initiatives by leveraging customer feedback, improving product offerings, and enhancing service delivery.

Investment Phone Banking Advisor resume sample

- •Led a team to increase client engagement by 30% through targeted investment strategies and collaborative client meetings.

- •Advised clients on portfolio diversification, achieving an average 8% increase in portfolio returns within one year.

- •Integrated market trend analysis into client consultations, resulting in a 25% improvement in client satisfaction ratings.

- •Optimized CRM processes, enhancing client data accuracy and reducing retrieval time by 40% for frontline advisors.

- •Spearheaded a customer-centric initiative, contributing to a 15% growth in high-net-worth account openings in six months.

- •Developed and delivered monthly investment seminars, engaging over 100 clients and increasing new product uptake by 20%.

- •Conducted detailed portfolio analysis for over 50 high-net-worth clients, delivering personalized investment recommendations.

- •Assisted in launching a new mutual fund product, contributing to a $20 million increase in assets under management.

- •Evaluated investment risks and trends, fostering client confidence and improving client portfolio performance by 5% annually.

- •Collaborated across departments to align product offerings with client needs, increasing cross-selling opportunities by 30%.

- •Successfully reduced transaction discrepancies by 50% through process enhancement and team training initiatives.

- •Managed client inquiries, achieving a 90% issue resolution rate within the first contact and improving client satisfaction scores.

- •Facilitated investment transactions worth over $5 million, ensuring compliance and client alignment with market opportunities.

- •Educated clients on financial markets and instruments, boosting client understanding and driving an additional $10 million in investments.

- •Implemented a new client onboarding process, reducing transition time by 25% and enhancing client retention rates.

- •Achieved a customer retention rate of 92% by building trust and providing timely and accurate financial product advice.

- •Executed over 1,000 client transactions annually with a 98% accuracy rate, enhancing operational efficiency.

- •Trained junior staff on compliance and customer service best practices, improving team performance by 20%.

- •Initiated cross-department initiatives, facilitating a 15% increase in product usage among existing clients.

Small Business Telephone Banking Officer resume sample

- •Successfully handled over 150 customer inquiries daily, improving resolution time by 30%, and boosting client satisfaction scores.

- •Collaborated with cross-functional teams to resolve 95% of complex banking issues, ensuring seamless client experience.

- •Developed a training program for new hires resulting in 20% faster onboarding and increased team efficiency.

- •Managed detailed records of client interactions, increasing accuracy in database management by 10%.

- •Identified and secured cross-selling opportunities resulting in a 15% increase in product uptake by clients.

- •Conducted proactive follow-up calls to ensure client satisfaction, leading to a 25% rise in repeat business.

- •Efficiently responded to an average of 120 daily client inquiries regarding account transactions and services offered.

- •Assessed client needs, tailored solutions enhancing banking experience, reduced service time by 20%.

- •Kept up-to-date with latest banking product offerings, resulting in an increased recommendation accuracy of 15%.

- •Maintained detailed logs of customer interactions, improving follow-up service efficiency by 25%.

- •Part of a project that updated banking software tools which boosted service speed and accuracy for the entire team.

- •Handled over 100 calls daily, effectively resolved 85% of inquiries in the first contact.

- •Enhanced customer relationship management by implementing detailed feedback collection, leading to a 5% satisfaction increase.

- •Collaborated with team members on process improvements leading to a 10% reduction in inquiry response time.

- •Kept precise records of over 95% of transactions and communications with clients, improving data accuracy.

- •Assisted clients with various account queries and issues, contributing to a 10% improvement in service standards.

- •Trained in banking software tools leading to a more efficient customer interaction process by 20%.

- •Part of the team that redesigned the call handling protocols, boosting client retention by 15%.

- •Proactively identified potential cross-selling opportunities, enhancing product awareness among clients.

Commercial Phone Banking Representative resume sample

- •Resolved customer queries on commercial banking services, increasing first-call resolution rates by 20%.

- •Managed fund transfers and loan payments processing, achieving an operational accuracy rate of 99.5%.

- •Guided clients through online banking software, reducing navigation issues by 40%.

- •Identified cross-selling opportunities that resulted in a 25% increase in product uptake.

- •Collaborated effectively with colleagues to maintain a seamless client experience, improving client satisfaction scores by 15%.

- •Adhered to compliance protocols in all transactions, contributing to a spotless regulatory audit report.

- •Delivered exceptional customer service in a high-volume call center, leading to a 95% customer satisfaction rate.

- •Processed an average of 500 customer transactions weekly with accuracy exceeding departmental benchmarks.

- •Analyzed client feedback to implement service enhancements, resulting in a 10% increase in efficiency.

- •Assisted with migration to new banking software, reducing transition time by 30%.

- •Trained new team members on compliance standards, improving team adherence to regulatory requirements.

- •Managed customer accounts and advised on banking products, leading to a 20% increase in account openings.

- •Streamlined the account opening process, reducing wait time by 15% for new clients.

- •Improved cash handling procedures, reducing discrepancies by 50% through team training sessions.

- •Participated in cross-selling campaigns, contributing to a 12% rise in banking service adoption.

- •Processed daily teller transactions, maintaining a consistent accuracy rate over 98%.

- •Contributed to a project redesigning branch layout, resulting in a 25% increase in customer flow.

- •Engaged with customers to promote banking services, boosting service subscriptions by 15%.

- •Enhanced security protocol awareness among staff through regular training sessions.

Overseas Phone Banking Executive resume sample

- •Managed over 150 inbound and outbound customer calls daily, achieving a 98% customer satisfaction rate by efficiently resolving complex issues.

- •Led a team project that reduced average call handling time by 20%, while maintaining high-quality service delivery.

- •Successfully identified and created cross-selling opportunities that led to a 25% increase in product uptake, resulting in increased revenue.

- •Trained new hires in phone banking protocols, enhancing team proficiency and efficiency within their first month.

- •Implemented a new documentation process improving transaction recording accuracy by 15%, resulting in seamless audits.

- •Consistently met and exceeded monthly sales targets, achieving top performance in financial quarters.

- •Resolved 200 customer queries weekly related to banking products, achieving a 95% first-call resolution rate.

- •Initiated a feedback system that improved service strategies and increased customer retention by 15%.

- •Collaborated with back-office teams to streamline procedures that cut transaction handling costs by 10%.

- •Conducted training sessions on new banking software features, improving team adaptation speed by 30%.

- •Devised account maintenance protocols that reduced errors by 50%, enhancing customer trust and compliance.

- •Handled an average of 100 calls per day, providing exceptional solutions that enhanced customer engagement by 20%

- •Explored customer pain points and developed solutions, contributing to a 40% increase in positive feedback.

- •Provided detailed product service explanations reducing repeat inquiries by 15%, streamlining customer understanding.

- •Assisted in the testing and launch of a new customer relationship management system, reducing operation overhead by 10%.

- •Facilitated bank transitions with a focus on customer satisfaction, maintaining a score of 4.8/5 in customer feedback surveys.

- •Enhanced client portfolio by 20% through strategic marketing initiatives and personalized financial advice.

- •Collaborated in a pilot project resulting in 30% increase in mortgage advisory efficiencies, leading to broader rollout.

- •Upheld compliance with banking regulations and policies, reducing client legal issues by 40%.

Wealth Management Tele-banking Associate resume sample

- •Managed a portfolio of high-net-worth clients, increasing client satisfaction scores by 25% within one year.

- •Spearheaded a project to streamline client onboarding processes, reducing the average onboarding time by 30% and improving client retention.

- •Developed and nurtured client relationships through proactive communication and bespoke financial solutions, resulting in a 20% increase in cross-selling of investment products.

- •Conducted in-depth market analysis to provide tailored advice on investment opportunities, contributing to a 15% growth in assets under management.

- •Facilitated weekly training sessions for new team members on compliance and product knowledge, reducing training time by 20%.

- •Collaborated with product development teams to enhance service offerings, introducing new features that resulted in a 10% uptick in product adoption.

- •Conducted client consultations to identify financial goals, developing customized strategies that increased client investment returns by 8%.

- •Managed and resolved complex client inquiries, achieving a 90% first-call resolution rate by implementing effective communication techniques.

- •Collaborated with financial advisors on investment strategies, leading to a 12% increase in client portfolio diversification.

- •Ensured compliance with industry regulations through diligent documentation, providing audit-ready records that passed compliance checks with a 100% success rate.

- •Implemented a client feedback system, increasing service performance assessments and client satisfaction scores by 15%.

- •Provided expert advice on wealth management services, resulting in a 10% increase in product uptake among new clients.

- •Executed over 1,000 transactions monthly with a 99.5% accuracy rate, maintaining exceptional client satisfaction ratings.

- •Assisted in developing marketing plans to attract new clients, contributing to a 25% growth in client base over two years.

- •Collaborated with compliance teams to ensure all client interactions adhered to regulatory requirements, maintaining zero compliance violations.

- •Supported wealth management teams by performing financial analysis, resulting in more informed decision-making and strategy adjustments.

- •Enhanced client loyalty by developing personalized banking solutions, leading to a 30% improvement in repeat business.

- •Participated in a team project that implemented a new customer relationship management system, increasing operational efficiency by 20%.

- •Managed and coordinated with cross-functional teams to promptly resolve client issues, improving service delivery times by 15%.

Presidential Phone Banking Agent resume sample

- •Led a team to increase voter engagement by 30% through strategic outreach, significantly contributing to the campaign success.

- •Developed and refined customized phone scripts resulting in 15% shorter average call times while increasing conversion rates.

- •Managed CRM database effectively, ensuring accurate updates which improved data integrity by 25% in organization system.

- •Conducted training sessions for new agents, boosting their efficiency by 40% in first month of joining the campaign.

- •Analyzed contact lists, provided actionable insights that optimized outreach strategies, directly impacting voter participation.

- •Collaborated with cross-functional teams to drive 20% increase in targeted demographics, showcasing adaptability and teamwork.

- •Coordinated statewide campaigns that engaged over 50,000 voters, increasing regional turnout by 25% during the election season.

- •Enhanced voter outreach strategies, making use of analytics tools resulting in 10% higher voter engagement in competitive areas.

- •Streamlined processes for voter data collection, saving 15 hours per week in manual data entry and improving data accuracy.

- •Initiated and maintained partnerships with local advocacy groups, expanding outreach efforts to underrepresented communities by 30%.

- •Provided real-time feedback from voter interactions, contributing to 20% improvement in campaign strategy alignment with public sentiment.

- •Oversaw telemarketing campaigns that generated $1 million in revenue, increasing company profit margins by 10% annually.

- •Introduced a new CRM system integration, resulting in 20% increase in campaign efficiency and client satisfaction scores.

- •Led a team of 15 telemarketers, boosting their productivity by 25% through hands-on training and strategic mentoring.

- •Executed market analysis that informed client targeting strategies, improving campaign success rates by 15% quarterly.

- •Resolved customer inquiries with a 95% satisfaction rate, improving the overall customer experience and retention by 15%.

- •Utilized CRM software to track and manage customer interactions, leading to 20% reduction in response times over 2 years.

- •Participated in a process improvement project, which cut costs by 10% annually and optimized operational workflows across departments.

- •Developed insights from customer feedback that contributed to 15% product strategy enhancement and business growth.

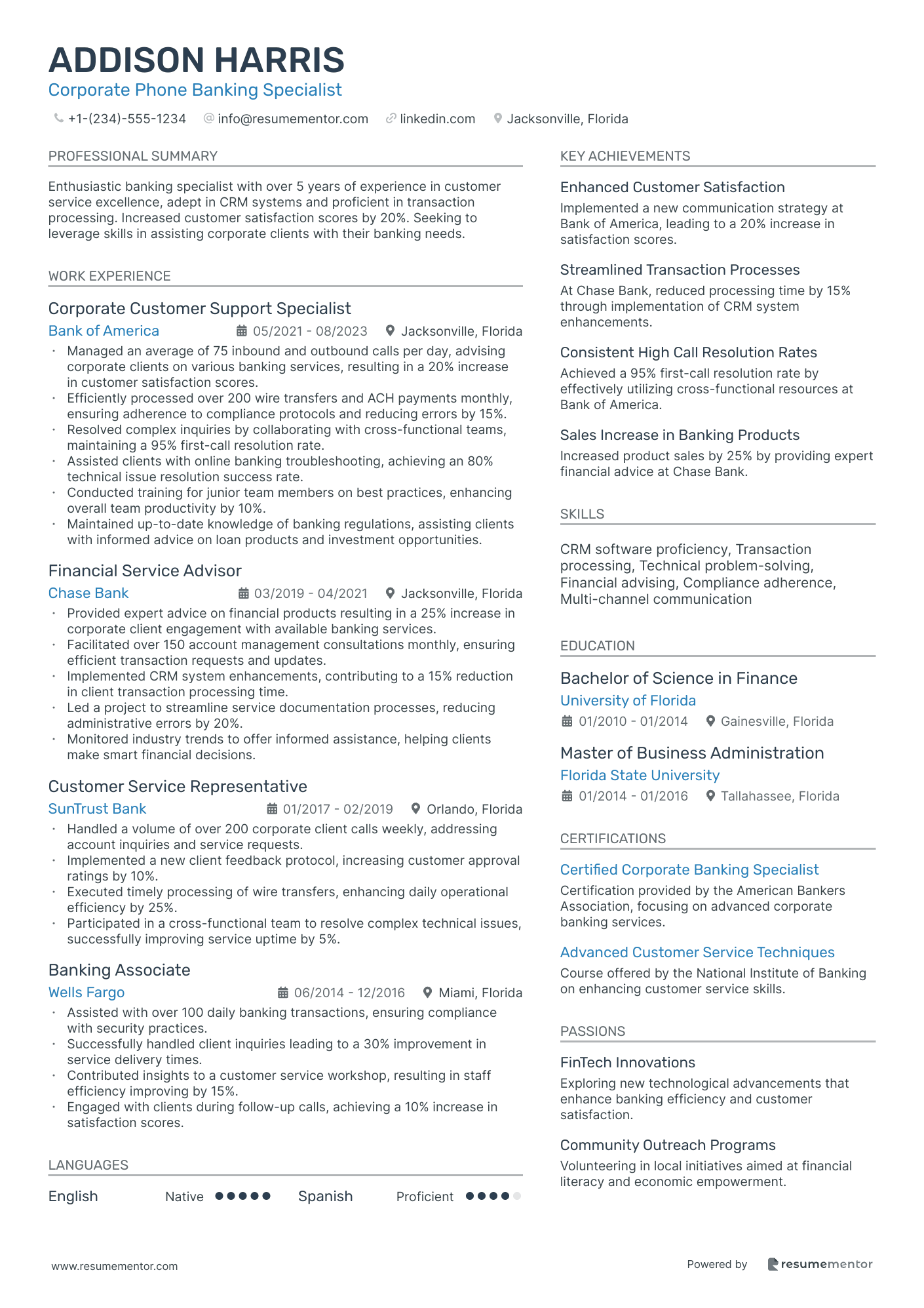

Corporate Phone Banking Specialist resume sample

- •Managed an average of 75 inbound and outbound calls per day, advising corporate clients on various banking services, resulting in a 20% increase in customer satisfaction scores.

- •Efficiently processed over 200 wire transfers and ACH payments monthly, ensuring adherence to compliance protocols and reducing errors by 15%.

- •Resolved complex inquiries by collaborating with cross-functional teams, maintaining a 95% first-call resolution rate.

- •Assisted clients with online banking troubleshooting, achieving an 80% technical issue resolution success rate.

- •Conducted training for junior team members on best practices, enhancing overall team productivity by 10%.

- •Maintained up-to-date knowledge of banking regulations, assisting clients with informed advice on loan products and investment opportunities.

- •Provided expert advice on financial products resulting in a 25% increase in corporate client engagement with available banking services.

- •Facilitated over 150 account management consultations monthly, ensuring efficient transaction requests and updates.

- •Implemented CRM system enhancements, contributing to a 15% reduction in client transaction processing time.

- •Led a project to streamline service documentation processes, reducing administrative errors by 20%.

- •Monitored industry trends to offer informed assistance, helping clients make smart financial decisions.

- •Handled a volume of over 200 corporate client calls weekly, addressing account inquiries and service requests.

- •Implemented a new client feedback protocol, increasing customer approval ratings by 10%.

- •Executed timely processing of wire transfers, enhancing daily operational efficiency by 25%.

- •Participated in a cross-functional team to resolve complex technical issues, successfully improving service uptime by 5%.

- •Assisted with over 100 daily banking transactions, ensuring compliance with security practices.

- •Successfully handled client inquiries leading to a 30% improvement in service delivery times.

- •Contributed insights to a customer service workshop, resulting in staff efficiency improving by 15%.

- •Engaged with clients during follow-up calls, achieving a 10% increase in satisfaction scores.

In the fast-paced world of phone banking, your resume acts as your calling card. Each day, you engage people with your exceptional communication skills, yet translating those skills onto paper can feel challenging. Highlighting your ability to efficiently manage calls and solve customer issues is crucial for landing the job you desire. This process can often feel like climbing a mountain without a map, yet it's essential.

As a phone banker, you wield technical expertise in systems and software, paired with strong communication and stellar customer service. Turning these strengths into a powerful resume is vital. Using a well-structured resume template can help you neatly organize your skills and achievements, simplifying the writing process. This makes utilizing resume templates a smart move on your path.

Keeping your resume clean and professional ensures your most valuable traits stand out to potential employers. Imagine your resume as a bridge that connects your on-the-job experiences to new opportunities. When crafted thoughtfully, it becomes more than just a document; it tells your professional story with clarity and conviction. Let’s dive into shaping your experiences and skills into a resume that sets you apart in the phone banking industry.

Key Takeaways

- Your phone banking resume should effectively showcase your customer service skills and financial transaction expertise, integrating your strengths in managing client calls and using banking software.

- A functional resume format is recommended to prioritize skills and achievements, especially if transitioning from another industry or having a diverse job history.

- Highlight both your technical proficiency in banking software and soft skills like communication and problem-solving, ensuring they are relevant to the phone banking industry.

- Include clear and concise sections for education and certifications, listing relevant qualifications with dates and institutions to enhance credibility.

- Consider adding extra sections for languages, hobbies, volunteer work, and relevant books to showcase a well-rounded personality and demonstrate additional talents valuable to employers.

What to focus on when writing your phone banking resume

Your phone banking resume needs to effectively integrate your strengths in customer service and financial transactions. This involves highlighting your expertise in managing client calls, making their banking experience as smooth as possible—your communication skills ensure questions are handled with professionalism and accuracy. Demonstrating strong abilities in maintaining financial records and using banking software ties directly into the core demands of the job.

How to structure your phone banking resume

- Contact Information—Make sure your contact details are clear and professional; your full name, phone number, and email should be easy to find at a glance. Including an up-to-date LinkedIn profile showcases a well-rounded professional image, allowing recruiters to easily access more information about your career achievements and endorsements.

- Professional Summary—Your summary should be a compelling snapshot of your career. Capture how your customer service skills and banking knowledge intersect, highlighting accomplishments in handling calls efficiently and resolving issues smoothly. A well-worded summary can instantly convey your value to potential employers and entice them to read further.

- Work Experience—Describing your past roles should not just be about listing duties. Emphasize specific achievements, such as reducing call durations or improving customer satisfaction scores. Demonstrate how you exceeded performance benchmarks or contributed to a team's success, making your experience memorable and impactful.

- Skills—Under skills, include technical abilities like proficiency in banking software and vital soft skills such as communication and problem-solving. These are crucial in banking roles, where you need to navigate complex issues while maintaining composure and professionalism. Highlighting these skills indicates you're well-equipped for the challenges of phone banking.

- Education—Your educational background provides foundational support for your qualifications. Mentioning your degrees, relevant coursework, or specific certifications brings attention to your preparedness and dedication to understanding financial systems and customer service principles.

- Achievements/Awards—Awards and recognitions add credibility to your resume by showing tangible proof of your work ethic and success. Whether it’s an award for outstanding service or a recognition for exceeding targets, these accolades underscore your commitment to excellence in the banking sector.

Moving forward, your resume format is crucial to ensure clarity and readability. Next, we'll delve into each section more deeply, providing further guidance on crafting a standout phone banking resume.

Which resume format to choose

Crafting a phone banking resume starts with choosing the right format to effectively highlight your unique skills and experiences. In this field, a functional resume works well because it prioritizes your capabilities and achievements. This is particularly beneficial if you’re transitioning from another industry or if your job history is diverse. By focusing on what you can do for the company, you immediately catch the eye of potential employers.

When it comes to modern fonts, selecting Raleway, Lato, or Montserrat can make a significant difference. These fonts are not just stylish but also easy to read, helping your resume stand out while maintaining professionalism. A well-chosen font ensures that your document remains attractive and accessible to hiring managers, making it easier for them to focus on your qualifications.

Saving your resume as a PDF is crucial because it locks in the formatting, ensuring it looks the same on any device the recruiter uses. This consistency is important as it presents you as detail-oriented and organized, traits highly valued in a phone banking role where precision is key.

Lastly, setting your margins to 1 inch on all sides keeps your resume looking neat and organized. This creates a clean visual structure, making it easier for employers to navigate through your information. A well-structured resume reflects a professional attitude, underscoring your fit for the highly structured environment of phone banking. Through these elements, you create a document that not only tells your story but does so in a way that resonates with the industry.

How to write a quantifiable resume experience section

Your experience section is crucial in a phone banking resume because it demonstrates your growth and readiness for the role. This part of your resume should clearly outline your achievements and the skills you've gained, providing potential employers with a snapshot of your value. Start by listing your most recent role and work backward, typically covering the last 10-15 years unless an earlier role is particularly relevant. Focus on titles that align with your desired career path, which helps create a consistent narrative.

Tailoring your resume to each job is vital. By aligning your experiences with the job description, you can highlight the most relevant skills and achievements. Strong action words like "achieved," "managed," and "improved" make your contributions stand out, while quantifying your successes—such as boosting customer satisfaction or reducing wait times—offers clear evidence of your impact. Check out this example that ties everything together seamlessly:

- •Boosted customer satisfaction scores by 20% through effective problem-solving and quick service.

- •Handled an average of 150 calls daily, resolving inquiries and issues with efficiency.

- •Trained 15 new representatives, cutting down onboarding time by 30%.

- •Introduced a feedback system, slashing customer wait times by 40%.

This section stands out by connecting your work directly to the key aspects of the phone banking role, making your impact clear. Quantifying achievements, like raising customer satisfaction by 20%, underscores your effectiveness. Each bullet point begins with a compelling action verb and highlights measurable success. By tailoring your experience to match the job, you ensure that potential employers see how you can bring similar value to their team, transforming your work history into a cohesive and compelling story of achievement.

Skills-Focused resume experience section

A skills-focused phone banking resume experience section should effectively showcase your achievements and the skills you bring to the role. Begin with your job title and workplace before clearly stating the dates of employment. Use bullet points to outline your major responsibilities and accomplishments, ensuring that each one illustrates how you applied your skills to make a positive impact. As you create these points, maintain a focus on how you contributed to team success and helped achieve company goals.

It's important to emphasize your communication, customer service, and problem-solving abilities. Describe how you managed high volumes of calls while keeping customer satisfaction high. Highlight how your expertise aided in improving team efficiency, perhaps through training new staff members to enhance their customer interactions. Use strong action verbs to draw readers in and vividly describe your contributions and achievements.

Phone Banking Specialist

Sunny Bank Corp

June 2020 - Present

- Handled over 100 customer inquiries per day, maintaining a satisfaction rating of 95%

- Trained and mentored a team of 10 new employees, improving team's output by 20%

- Resolved complex banking issues efficiently, decreasing customer wait times by 15%

- Implemented and monitored feedback systems, boosting service quality by focusing on customer needs

Achievement-Focused resume experience section

An achievement-focused phone banking resume experience section should emphasize the positive impact you've made rather than just listing tasks. Highlight specific results you've accomplished, such as boosting customer satisfaction or enhancing call efficiency, to show your effectiveness in the role. Use numbers and percentages to quantify your contributions, making them clear and measurable. Describe any innovative approaches you've employed to resolve customer issues or improve workflows, demonstrating your problem-solving skills. To make your resume even more compelling, align your accomplishments with the job you're applying for, ensuring that your skills and results resonate with the company’s goals.

Start each bullet point with action verbs like “improved,” “optimized,” or “enhanced” to convey initiative and drive. Highlight collaborative efforts, showcasing how you work well with others to streamline service processes, which presents you as a team player with leadership qualities. By illustrating how you can add value to a company, your resume will truly stand out in a competitive job market.

Phone Banking Specialist

First Bank Corp

January 2020 - Present

- Increased customer satisfaction scores by 20% through effective communication and personalized service.

- Reduced average call handling time by 15%, enhancing overall efficiency and productivity.

- Trained and mentored 10 new team members, fostering a supportive and knowledgeable work environment.

- Developed a new feedback mechanism, leading to a 25% improvement in service quality.

Leadership-Focused resume experience section

A leadership-focused phone banking resume experience section should begin by highlighting your role in steering teams or projects to success. Start with how you've inspired your team and put systems in place that boosted performance. For instance, describe any training programs you developed that resulted in higher customer satisfaction or boosted efficiency. Sharing measurable results from your leadership efforts can clearly demonstrate your impact.

Entries should seamlessly link your responsibilities and achievements, using powerful verbs and quantified results to showcase your value. Tie your leadership abilities directly to the larger objectives of the team or organization. Demonstrating this connection not only conveys what you accomplished but also why it was significant, giving potential employers a compelling reason to view you as a strong candidate.

Phone Banking Team Leader

Friendly Bank Corporation

June 2019 - May 2021

- Led a team of 15 phone banking representatives, resulting in a 20% increase in customer satisfaction ratings.

- Developed a training program that improved call efficiency by 30%, significantly streamlining the customer support process.

- Implemented a monitoring system that reduced response time by 40%, boosting team productivity and client retention.

- Coordinated weekly meetings to enhance communication and commitment to team goals, leading to an overall sales growth of 15%.

Technology-Focused resume experience section

A technology-focused phone banking resume experience section should clearly demonstrate how your technical skills and expertise enhance phone banking operations. Begin by stating your job title, workplace, and the dates you were employed. Connect your bullet points to emphasize your practical experience with phone banking systems and your ability to resolve technical challenges effectively. Highlight achievements that reflect your contributions, such as streamlining processes or integrating innovative technologies to improve outcomes like call efficiency and customer satisfaction.

Use language that is simple and avoids unnecessary jargon, focusing instead on how your technical skills support customer service solutions. Show your ability to adapt quickly to new technologies and face challenges head-on. Tailor this section carefully to align with the specific job you're applying for, ensuring that your skills and experiences fit seamlessly with what the employer desires.

Technical Support Specialist

ABC Bank

June 2020 - Present

- Resolved over 200 technical issues per month, reducing customer complaints by 30%.

- Implemented a new phone banking software that decreased call processing time by 20%.

- Trained a team of 15 on the use of updated technology for improved service delivery.

- Developed an automated troubleshooting guide that increased first-call resolution rates by 25%.

Write your phone banking resume summary section

A customer-focused phone banking resume summary should effectively showcase your experience and skills to grab attention quickly. Begin by being concise, ideally using three to five sentences to summarize your background. For instance:

Such a summary is powerful because it clearly outlines your qualifications relevant to the role. It seamlessly highlights your strengths in managing phone banking tasks. Descriptive words like "results-driven" and "skilled" convey confidence and proficiency. Including achievements like hitting sales targets not only adds detail but also backs up your claims. When describing yourself, use straightforward and positive language to make an impact. Cut out any vague statements and zero in on specific skills you possess. Ensure your summary aligns with the job’s key requirements and tailor it for each application. Understanding the difference between resume sections is vital. A summary provides a snapshot of your expertise, whereas a resume objective outlines your career goals, fitting those new to the field. A resume profile merges these elements, highlighting both skills and aspirations. Meanwhile, a summary of qualifications lists achievements concisely. Opt for a summary if experienced, or an objective if entering the field. Crafting an engaging resume summary sets a positive tone for your entire resume, helping you stand out and connect with potential employers.

Listing your phone banking skills on your resume

A skills-focused phone banking resume should effectively highlight your qualifications by showcasing your strengths and competencies. This section can stand alone or be seamlessly integrated into other parts of your resume, such as experience and summary sections, to provide a comprehensive view of your fit for the role. Strengths and soft skills revolve around interpersonal abilities, creativity, and communication, while hard skills encompass the concrete abilities you've mastered, like technical proficiency or data analysis.

Integrating these skills and strengths as resume keywords is crucial, as it connects your capabilities with the job description. This strategic alignment enhances the likelihood that your resume will capture the attention of hiring managers and surpass applicant tracking systems. Highlighting relevant skills specific to phone banking is essential for elevating your resume.

Example of a standalone skills section for a phone banking resume:

This example succeeds by listing eight relevant skills clearly and concisely, highlighting core competencies crucial for a phone banking role. Each skill serves as a keyword, aligning with the job description and increasing the chances of standing out in applicant tracking systems. The structured format ensures that your skills are easy to scan, allowing recruiters to quickly recognize your qualifications.

Best hard skills to feature on your phone banking resume

In phone banking, hard skills should clearly demonstrate your ability to perform specific tasks. These skills highlight your effectiveness in managing technical and procedural duties.

Hard Skills

- Data entry accuracy

- Call center technology proficiency

- Financial transactions processing

- CRM software expertise

- Account management

- Regulatory compliance knowledge

- Basic IT troubleshooting

- Cross-selling techniques

- Performance metrics analysis

- Multiline phone systems

- Credit card processing

- Fraud detection

- Call recording systems

- Customer data protection

- Online banking navigation

Best soft skills to feature on your phone banking resume

Soft skills in phone banking should underline your capacity to connect with customers and collaborate in a team. They reflect how you handle interpersonal situations and adapt to dynamic environments.

Soft Skills

- Active listening

- Empathy

- Communication skills

- Patience

- Flexibility

- Teamwork

- Detail orientation

- Conflict resolution

- Critical thinking

- Positive attitude

- Time management

- Stress management

- Customer focus

- Rapport building

- Problem sensitivity

How to include your education on your resume

The education section of your resume is a critical part to include when applying for a phone banking position. Tailoring it to the job means you should only include relevant education that highlights your abilities for this role. Leaving out unrelated degrees can help keep your resume focused and effective. When listing your degree, always include the full name of the degree, the institution's name, and the location. If you graduated with honors such as cum laude, include this to emphasize your academic achievements. Displaying your GPA can be beneficial—especially if it was impressive. Format it clearly, like "GPA: 3.6/4.0," if you choose to share it.

Below are examples to guide you:

In contrast:

- •Graduated cum laude

The second example stands out because it directly relates to phone banking with a finance degree. It demonstrates a high GPA that reflects the candidate's knowledge and dedication. The inclusion of cum laude further highlights excellence and commitment to learning, which can be very attractive to employers in phone banking. This section is concise yet informative, making it a powerful tool in the candidate’s application.

How to include phone banking certificates on your resume

Including a certificates section in your phone banking resume is important. Start by listing the name of the certificate, such as "Certified Financial Services Security Professional." Include the date you received it, for example, "April 2021." Add the issuing organization, such as "Financial Services Institute." Certificates can also be included in the header. For example: "John Doe, Certified Financial Services Security Professional (Financial Services Institute)."

Here is an example of a good certificates section:

This example is effective because it clearly lists each certification relevant to phone banking. The dates and issuing organizations are also included, providing credibility. Each certification is specific to the financial services industry, showing relevant expertise. This format makes it easy for hiring managers to see your qualifications at a glance.

Extra sections to include in your phone banking resume

Building a strong resume for a phone banking position involves highlighting relevant experience and skills, but adding unique sections like languages, hobbies, interests, volunteer work, and books can set you apart. These sections can showcase your well-rounded personality and additional talents that can be valuable to an employer. Below are suggestions on how to include and benefit from these sections on your phone banking resume.

Language section — List any foreign languages you speak fluently. Show multilingual abilities that can help you communicate with a diverse range of clients.

Hobbies and interests section — Include hobbies that demonstrate skills like communication, problem-solving, or teamwork. Show how personal activities align with the skills needed for phone banking roles.

Volunteer work section — Highlight volunteer activities that show a commitment to the community or skills relevant to phone banking. Demonstrate your willingness to go above and beyond, showcasing your ability to handle customer service tasks.

Books section — Mention books you've read that are relevant to customer service, communication, or personal development. Show your dedication to improving skills applicable to a phone banking career.

In Conclusion

In conclusion, shaping a standout phone banking resume requires strategic focus on your strengths and achievements. Your resume is more than just a document; it's a gateway to new opportunities. Clearly organized contact information ensures recruiters can reach you easily, while a compelling professional summary captures their interest from the start. Detailing your work experience with quantifiable achievements not only illustrates your competencies but also sets you apart from other candidates. Aligning your skills with job requirements through a carefully crafted skills section enhances your appeal to potential employers.

Consider each section of your resume an opportunity to communicate key aspects of your professional journey. Your education and certifications demonstrate your commitment to the field, while additional sections like languages and volunteer work offer a glimpse into your well-rounded character. Remember, consistency in formatting strengthens your resume's readability and impact; using a modern font and saving your document as a PDF ensures it looks polished on any device.

By focusing on an achievement-driven narrative, you showcase not just what you've done, but also how it has made a difference. Each part of your resume should connect to your desired role, painting a comprehensive picture of a qualified phone banking professional ready to contribute to a new team. With emphasis on both your technical and soft skills, you are creating a persuasive case for why you are the ideal candidate. Let your resume be the bridge that connects you to future success in the phone banking industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.