Private Banking Resume Examples

Jul 18, 2024

|

12 min read

"Craft a winning private banking resume that earns interest: tips for highlighting your financial expertise, tailoring your experience, and showcasing your unique skills to stand out in the competitive banking industry."

Rated by 348 people

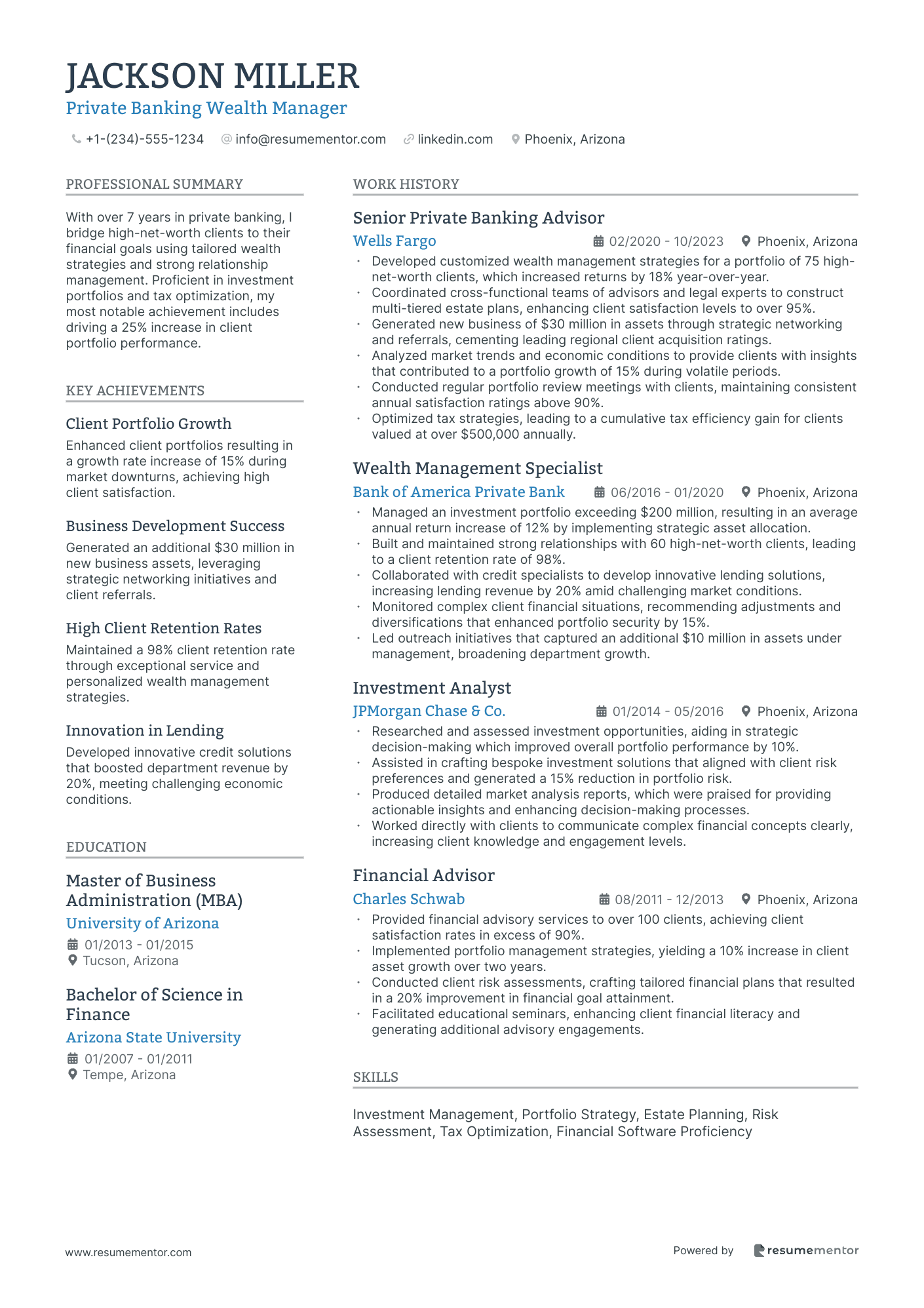

Private Banking Wealth Manager

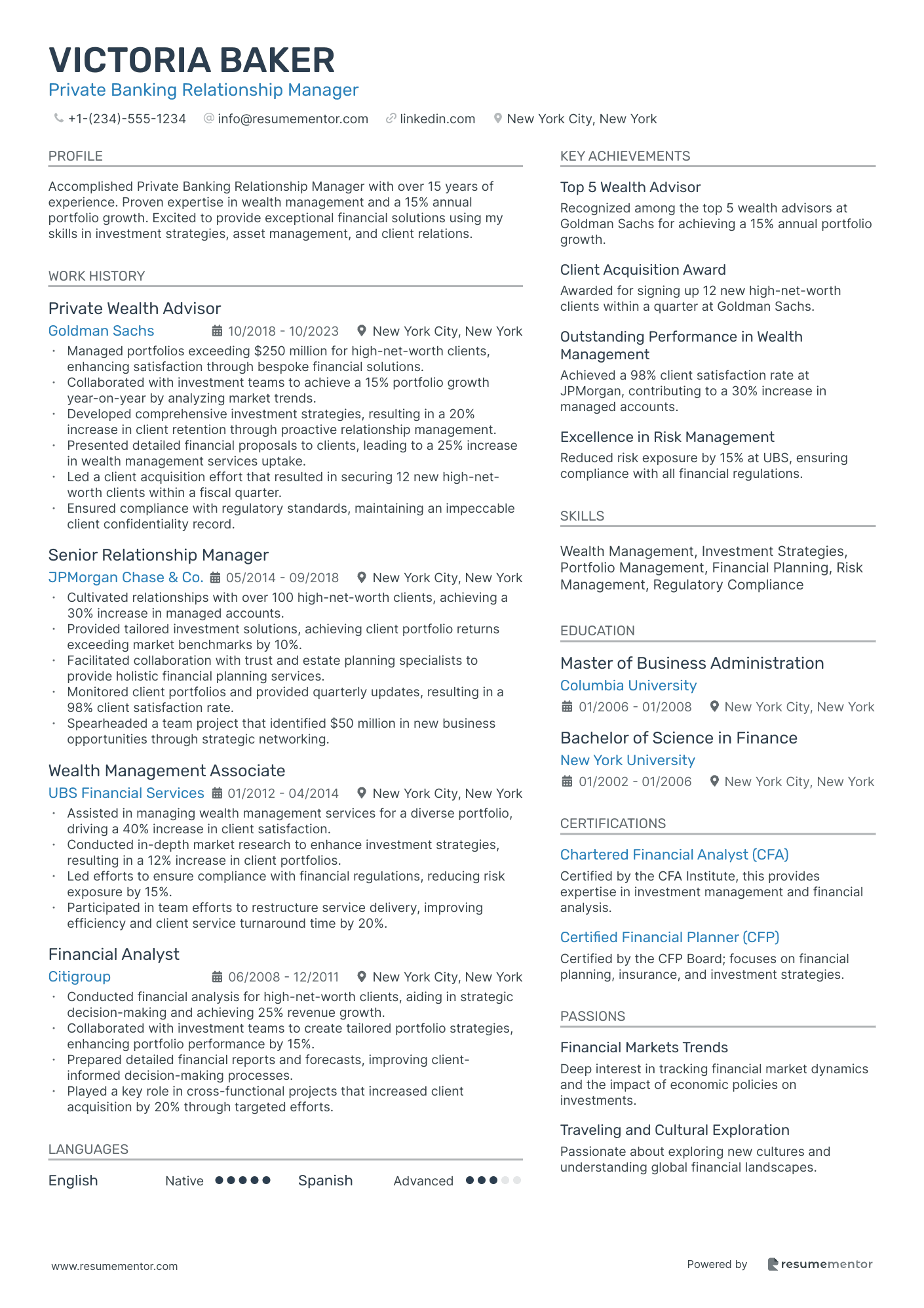

Private Banking Relationship Manager

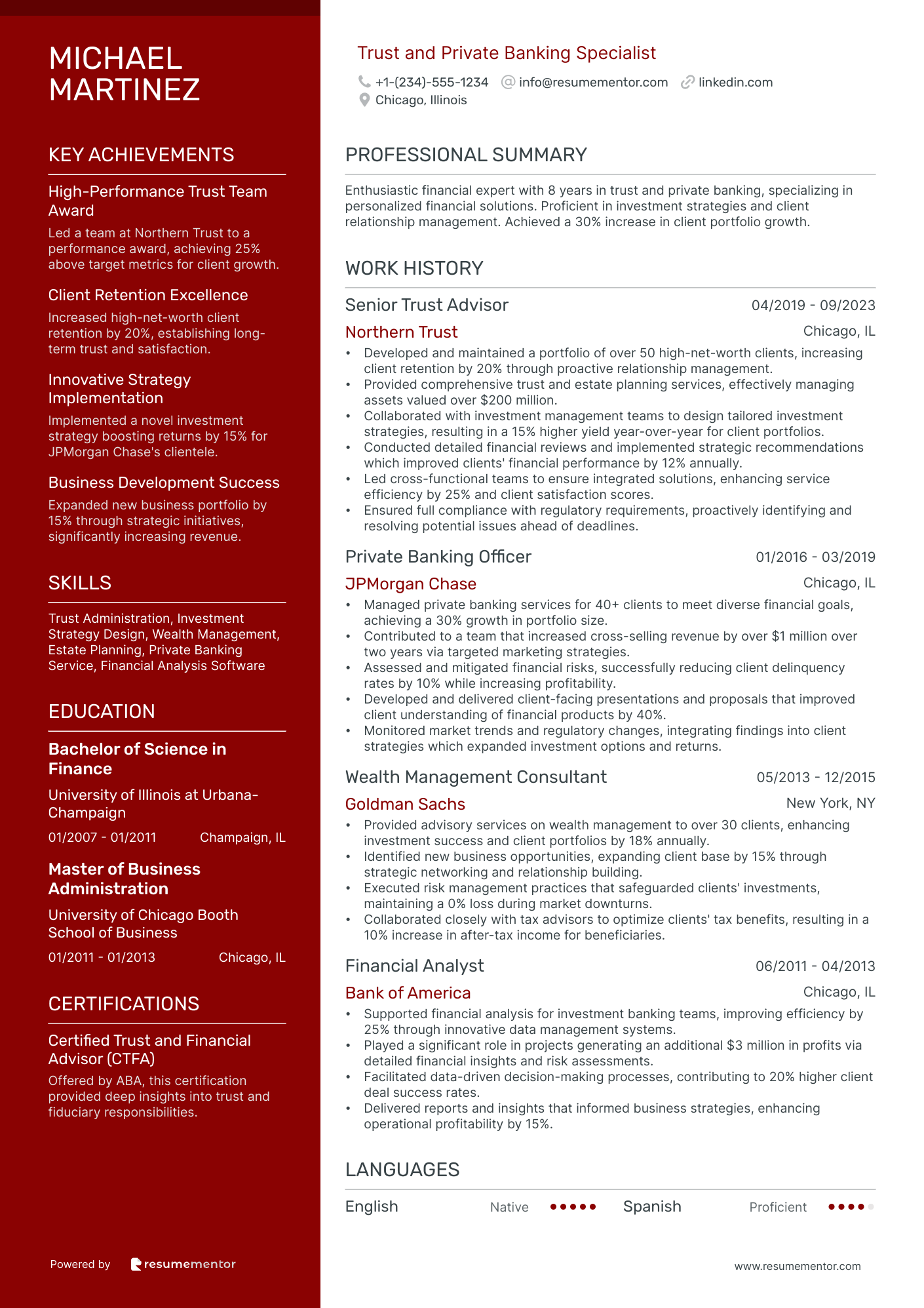

Trust and Private Banking Specialist

Private Banking Credit Analyst

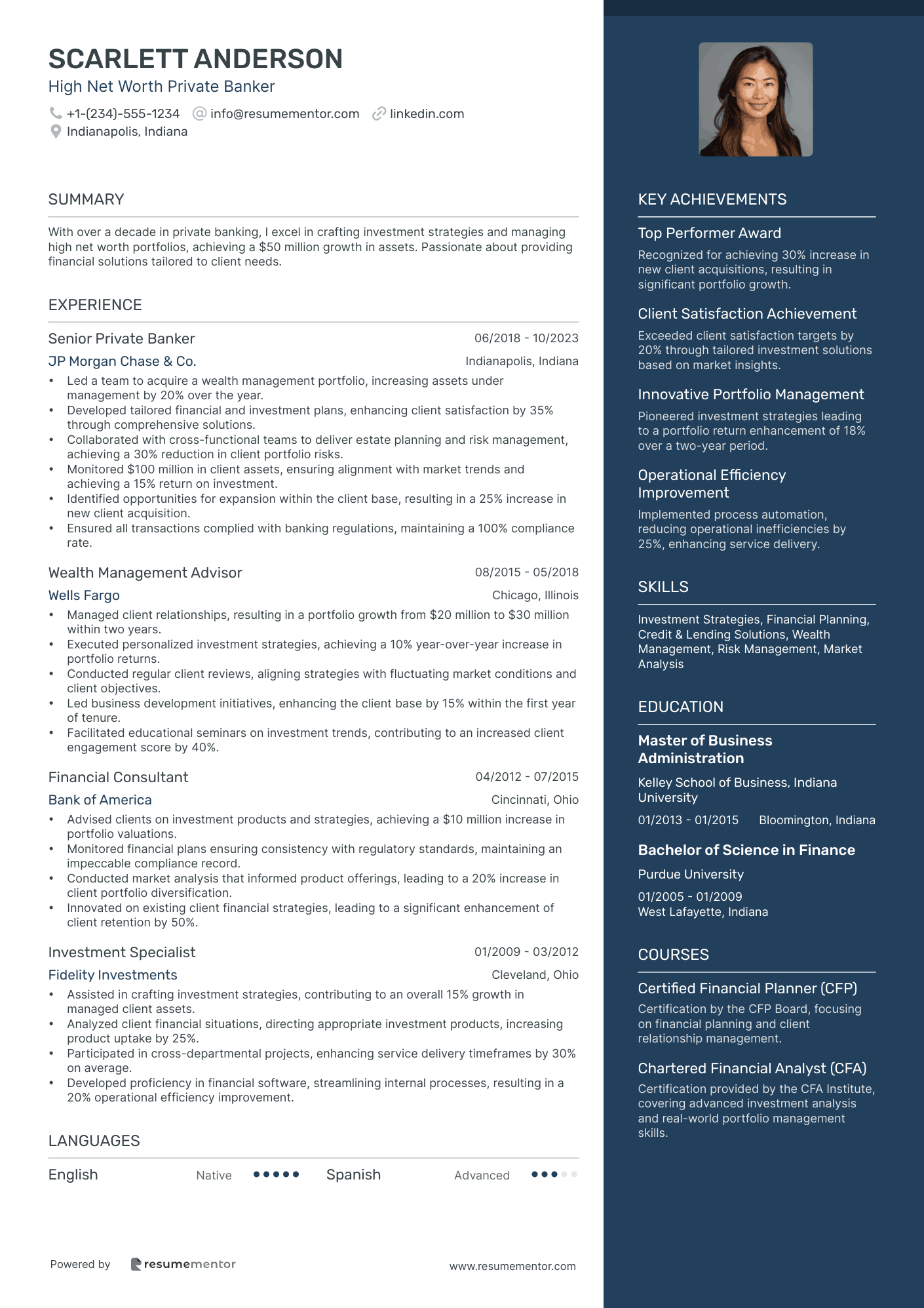

High Net Worth Private Banker

Private Banking Mortgage Advisor

Private Banking Risk Manager

Private Banking Operations Specialist

Private Banking Financial Planner

Private Banking Wealth Manager resume sample

- •Developed customized wealth management strategies for a portfolio of 75 high-net-worth clients, which increased returns by 18% year-over-year.

- •Coordinated cross-functional teams of advisors and legal experts to construct multi-tiered estate plans, enhancing client satisfaction levels to over 95%.

- •Generated new business of $30 million in assets through strategic networking and referrals, cementing leading regional client acquisition ratings.

- •Analyzed market trends and economic conditions to provide clients with insights that contributed to a portfolio growth of 15% during volatile periods.

- •Conducted regular portfolio review meetings with clients, maintaining consistent annual satisfaction ratings above 90%.

- •Optimized tax strategies, leading to a cumulative tax efficiency gain for clients valued at over $500,000 annually.

- •Managed an investment portfolio exceeding $200 million, resulting in an average annual return increase of 12% by implementing strategic asset allocation.

- •Built and maintained strong relationships with 60 high-net-worth clients, leading to a client retention rate of 98%.

- •Collaborated with credit specialists to develop innovative lending solutions, increasing lending revenue by 20% amid challenging market conditions.

- •Monitored complex client financial situations, recommending adjustments and diversifications that enhanced portfolio security by 15%.

- •Led outreach initiatives that captured an additional $10 million in assets under management, broadening department growth.

- •Researched and assessed investment opportunities, aiding in strategic decision-making which improved overall portfolio performance by 10%.

- •Assisted in crafting bespoke investment solutions that aligned with client risk preferences and generated a 15% reduction in portfolio risk.

- •Produced detailed market analysis reports, which were praised for providing actionable insights and enhancing decision-making processes.

- •Worked directly with clients to communicate complex financial concepts clearly, increasing client knowledge and engagement levels.

- •Provided financial advisory services to over 100 clients, achieving client satisfaction rates in excess of 90%.

- •Implemented portfolio management strategies, yielding a 10% increase in client asset growth over two years.

- •Conducted client risk assessments, crafting tailored financial plans that resulted in a 20% improvement in financial goal attainment.

- •Facilitated educational seminars, enhancing client financial literacy and generating additional advisory engagements.

Private Banking Relationship Manager resume sample

- •Managed portfolios exceeding $250 million for high-net-worth clients, enhancing satisfaction through bespoke financial solutions.

- •Collaborated with investment teams to achieve a 15% portfolio growth year-on-year by analyzing market trends.

- •Developed comprehensive investment strategies, resulting in a 20% increase in client retention through proactive relationship management.

- •Presented detailed financial proposals to clients, leading to a 25% increase in wealth management services uptake.

- •Led a client acquisition effort that resulted in securing 12 new high-net-worth clients within a fiscal quarter.

- •Ensured compliance with regulatory standards, maintaining an impeccable client confidentiality record.

- •Cultivated relationships with over 100 high-net-worth clients, achieving a 30% increase in managed accounts.

- •Provided tailored investment solutions, achieving client portfolio returns exceeding market benchmarks by 10%.

- •Facilitated collaboration with trust and estate planning specialists to provide holistic financial planning services.

- •Monitored client portfolios and provided quarterly updates, resulting in a 98% client satisfaction rate.

- •Spearheaded a team project that identified $50 million in new business opportunities through strategic networking.

- •Assisted in managing wealth management services for a diverse portfolio, driving a 40% increase in client satisfaction.

- •Conducted in-depth market research to enhance investment strategies, resulting in a 12% increase in client portfolios.

- •Led efforts to ensure compliance with financial regulations, reducing risk exposure by 15%.

- •Participated in team efforts to restructure service delivery, improving efficiency and client service turnaround time by 20%.

- •Conducted financial analysis for high-net-worth clients, aiding in strategic decision-making and achieving 25% revenue growth.

- •Collaborated with investment teams to create tailored portfolio strategies, enhancing portfolio performance by 15%.

- •Prepared detailed financial reports and forecasts, improving client-informed decision-making processes.

- •Played a key role in cross-functional projects that increased client acquisition by 20% through targeted efforts.

Trust and Private Banking Specialist resume sample

- •Developed and maintained a portfolio of over 50 high-net-worth clients, increasing client retention by 20% through proactive relationship management.

- •Provided comprehensive trust and estate planning services, effectively managing assets valued over $200 million.

- •Collaborated with investment management teams to design tailored investment strategies, resulting in a 15% higher yield year-over-year for client portfolios.

- •Conducted detailed financial reviews and implemented strategic recommendations which improved clients' financial performance by 12% annually.

- •Led cross-functional teams to ensure integrated solutions, enhancing service efficiency by 25% and client satisfaction scores.

- •Ensured full compliance with regulatory requirements, proactively identifying and resolving potential issues ahead of deadlines.

- •Managed private banking services for 40+ clients to meet diverse financial goals, achieving a 30% growth in portfolio size.

- •Contributed to a team that increased cross-selling revenue by over $1 million over two years via targeted marketing strategies.

- •Assessed and mitigated financial risks, successfully reducing client delinquency rates by 10% while increasing profitability.

- •Developed and delivered client-facing presentations and proposals that improved client understanding of financial products by 40%.

- •Monitored market trends and regulatory changes, integrating findings into client strategies which expanded investment options and returns.

- •Provided advisory services on wealth management to over 30 clients, enhancing investment success and client portfolios by 18% annually.

- •Identified new business opportunities, expanding client base by 15% through strategic networking and relationship building.

- •Executed risk management practices that safeguarded clients' investments, maintaining a 0% loss during market downturns.

- •Collaborated closely with tax advisors to optimize clients' tax benefits, resulting in a 10% increase in after-tax income for beneficiaries.

- •Supported financial analysis for investment banking teams, improving efficiency by 25% through innovative data management systems.

- •Played a significant role in projects generating an additional $3 million in profits via detailed financial insights and risk assessments.

- •Facilitated data-driven decision-making processes, contributing to 20% higher client deal success rates.

- •Delivered reports and insights that informed business strategies, enhancing operational profitability by 15%.

Private Banking Credit Analyst resume sample

- •Managed a portfolio worth over $100M by conducting rigorous credit analyses and assessments, resulting in increased profitability by 15%.

- •Prepared detailed credit proposals for high-net-worth clients, leading to a 25% approval rate increase annually.

- •Collaborated with relationship managers to customize financial services for clients, enhancing customer satisfaction to a 95% score.

- •Led risk assessment tasks for various loans, minimizing potential losses by 20% through proactive measures.

- •Maintained up-to-date knowledge of market trends, advising clients on optimal financial solutions.

- •Developed automated reporting tools using Excel, improving reporting efficiency by 40%.

- •Evaluated creditworthiness of 200+ client applications, resulting in a 30% reduction in default rates.

- •Implemented a new credit scoring model using financial modeling tools, improving risk prediction accuracy by 10%.

- •Conducted regular portfolio reviews and identified $50M in potential risks, implementing measures to mitigate these.

- •Collaborated effectively with the underwriting team to streamline the loan approval process, reducing lead time by 15%.

- •Presented analysis in client meetings, effectively explaining complex financial scenarios and addressing inquiries.

- •Assisted in the management of high-net-worth client portfolios, enhancing asset growth by 12% within a year.

- •Conducted comprehensive financial analyses, supporting the approval of 150+ private banking services.

- •Monitored economic conditions to predict creditworthiness trends, leading to better risk assessments and decisions.

- •Facilitated communication between clients and financial advisors, strengthening relationships and increasing client retention by 20%.

- •Performed detailed financial analysis on volume data, providing insights that increased efficiency by 15%.

- •Created financial reports to support management in decision-making processes, enhancing strategic planning effectiveness.

- •Played a key role in developing credit policies, resulting in a 10% improvement in compliance rates.

- •Supported cross-functional teams in various financial projects, boosting project delivery times by 25%.

High Net Worth Private Banker resume sample

- •Led a team to acquire a wealth management portfolio, increasing assets under management by 20% over the year.

- •Developed tailored financial and investment plans, enhancing client satisfaction by 35% through comprehensive solutions.

- •Collaborated with cross-functional teams to deliver estate planning and risk management, achieving a 30% reduction in client portfolio risks.

- •Monitored $100 million in client assets, ensuring alignment with market trends and achieving a 15% return on investment.

- •Identified opportunities for expansion within the client base, resulting in a 25% increase in new client acquisition.

- •Ensured all transactions complied with banking regulations, maintaining a 100% compliance rate.

- •Managed client relationships, resulting in a portfolio growth from $20 million to $30 million within two years.

- •Executed personalized investment strategies, achieving a 10% year-over-year increase in portfolio returns.

- •Conducted regular client reviews, aligning strategies with fluctuating market conditions and client objectives.

- •Led business development initiatives, enhancing the client base by 15% within the first year of tenure.

- •Facilitated educational seminars on investment trends, contributing to an increased client engagement score by 40%.

- •Advised clients on investment products and strategies, achieving a $10 million increase in portfolio valuations.

- •Monitored financial plans ensuring consistency with regulatory standards, maintaining an impeccable compliance record.

- •Conducted market analysis that informed product offerings, leading to a 20% increase in client portfolio diversification.

- •Innovated on existing client financial strategies, leading to a significant enhancement of client retention by 50%.

- •Assisted in crafting investment strategies, contributing to an overall 15% growth in managed client assets.

- •Analyzed client financial situations, directing appropriate investment products, increasing product uptake by 25%.

- •Participated in cross-departmental projects, enhancing service delivery timeframes by 30% on average.

- •Developed proficiency in financial software, streamlining internal processes, resulting in a 20% operational efficiency improvement.

Private Banking Mortgage Advisor resume sample

- •Increased high-net-worth client portfolio by 30% through strategic advisory services and tailored mortgage solutions.

- •Led cross-departmental collaboration with credit analysts and underwriters, improving mortgage application approval rates by 25%.

- •Conducted comprehensive financial assessments for clients, resulting in tailored mortgage plans that met their long-term objectives.

- •Streamlined mortgage application process, reducing completion time by 15% and ensuring timely documentation submission.

- •Organized networking events, increasing new client acquisition rate by 20% year-over-year.

- •Ensured 100% compliance with regulatory requirements, reducing instances of loan processing errors by 30%.

- •Advised on diverse mortgage products, increasing client satisfaction scores by 40% over four years.

- •Implemented client engagement strategies that boosted repeat business by 15% annually.

- •Developed and facilitated training for new team members, improving team efficiency by 20%.

- •Achieved a 95% success rate in mortgage approvals through diligent application reviews and client consultation.

- •Coordinated with legal teams to maintain compliance, resulting in zero discrepancies with federal regulations during audits.

- •Successfully managed over $100 million in annual mortgage volume while maintaining high client engagement levels.

- •Provided expert advisory on mortgage rate trends, helping clients in making informed decisions.

- •Increased mortgage application acceptance rates by 12% through improved documentation processes.

- •Maintained strong client relationships, resulting in a 95% client retention rate.

- •Conducted in-depth financial analyses that improved loan processing times by 10%.

- •Developed financial models that accurately predicted market trends by 85% accuracy rate.

- •Assisted in the development of a new client portfolio analysis tool, reducing analysis time by 20%.

- •Collaborated with senior analysts to refine mortgage advisory strategies.

Private Banking Risk Manager resume sample

- •Led a team to implement risk management frameworks, resulting in a 30% reduction in overall risk exposure.

- •Developed comprehensive risk assessments that identified key risk areas, directly contributing to strategic adjustments and process improvements.

- •Collaborated with compliance and audit teams, ensuring adherence to regulatory requirements and minimizing potential liabilities by 15%.

- •Initiated a project for automated risk monitoring systems, improving real-time analysis capabilities by 40%.

- •Streamlined risk reporting processes, decreasing report preparation time by 25% and increasing operational efficiency.

- •Conducted bi-annual training workshops for junior analysts, enhancing their understanding of risk management policies.

- •Consulted cross-functional teams on risk implications of new ventures, enhancing decision-making processes and reducing potential risks by 10%.

- •Created risk metrics and KPIs, enabling more accurate predictions and early risk identification, leading to a 20% improvement in risk mitigation.

- •Monitored market trends and regulatory updates to advise on risk management adjustments, ensuring proactive management and compliance.

- •Prepared detailed risk management reports for executive leadership, facilitating informed strategic planning.

- •Organized quarterly seminars on industry trends, increasing awareness and understanding of regulatory changes among staff by 30%.

- •Assisted in the design and implementation of risk management frameworks for the banking division, enhancing risk coverage by 25%.

- •Analyzed financial and operational data to identify high-risk scenarios, reducing risk probabilities significantly.

- •Liaised with external auditors to ensure comprehensive risk assessments, improving the audit satisfaction score by 15%.

- •Led a cross-departmental initiative to standardize risk assessment practices, which improved the organization's risk management index.

- •Supported risk management team in developing strategies for private banking operations, achieving a 10% increase in risk mitigation effectiveness.

- •Conducted analysis and presented findings on potential risks, contributing to strategic adjustments and policy updates.

- •Implemented risk communication protocols, which improved stakeholder engagement and understanding by 20%.

- •Collaborated with IT to integrate software solutions for enhanced risk monitoring, resulting in improved data accuracy.

Private Banking Operations Specialist resume sample

- •Spearheaded an initiative to enhance transaction processing speed, reducing client waiting times by 30%.

- •Collaborated with relationship managers to automate account documentation, resulting in improved accuracy and a 25% increase in efficiency.

- •Developed a comprehensive training program for new hires, boosting team performance scores by an average of 20%.

- •Managed weekly client review meetings, leading to a 15% increase in high-net-worth client retention.

- •Optimized the fund transfer protocol, achieving a 40% reduction in error rates across the division.

- •Led compliance audits, ensuring all transactions adhered to regulatory standards and pinpointing areas for improvement.

- •Facilitated a major overhaul of the account reconciliation process, enhancing accuracy by 20%.

- •Collaborated with IT to integrate new banking software, cutting down manual entry errors by 50%.

- •Responded to high-volume client inquiries, achieving a 20% increase in first call resolution rates.

- •Conducted quarterly training workshops on emerging financial regulations, keeping the team informed.

- •Played a pivotal role in cross-departmental projects, streamlining account maintenance operations and reducing turnaround times by 15%.

- •Managed daily fund transfers and deposits, ensuring compliance and reducing discrepancies by 12%.

- •Worked with cross-functional teams to resolve complex account documentation issues efficiently.

- •Implemented a new client inquiry tracking system, leading to a 30% improvement in response times.

- •Engaged in strategic planning sessions aimed at improving client service, enhancing overall satisfaction scores.

- •Executed daily banking transactions with utmost accuracy, contributing to a 95% compliance rate.

- •Streamlined account opening procedures, reducing time to complete by 20%.

- •Provided excellent client support, reflected by a 15% increase in customer satisfaction ratings.

- •Developed a monthly detailed transaction report system to ensure transparency and compliance.

Private Banking Financial Planner resume sample

- •Led a team managing high-net-worth client portfolios worth over $300 million, fostering a 30% growth in client retention and satisfaction.

- •Developed comprehensive financial plans and investment strategies that increased client portfolio values by an average of 15% year-over-year.

- •Collaborated with investment, trust, and insurance specialists to ensure delivery of comprehensive and tailored client solutions.

- •Continuously monitored economic trends and adopted market insights, leading to 10% enhanced client portfolio performance.

- •Presented complex financial proposals that resulted in a $50 million increase in firm assets under management.

- •Successfully navigated regulatory requirements ensuring 100% compliance and enhancing team adherence to internal policies.

- •Established and maintained strategic relationships with over 75 high-net-worth clients, aiding in $200 million asset growth.

- •Achieved a 20% increase in client referrals through effective investment management and superior client service delivery.

- •Conducted in-depth financial assessments that informed tailored investment plans, significantly optimizing tax strategies.

- •Facilitated client workshops on estate planning, resulting in a 40% rise in client understanding and engagement.

- •Identified key investment opportunities by analyzing market conditions, leading to a 12% boost in client portfolio returns.

- •Guided 50+ clients in financial planning, resulting in $80 million asset portfolio growth within two years.

- •Implemented personalized risk management solutions, decreasing portfolio risk by 15% and increasing client investments.

- •Managed client portfolios, adjusting strategies based on market shifts, maintaining a 98% client retention rate.

- •Enhanced team collaboration leading to streamlined processes and increased effectiveness in client servicing by 25%.

- •Supported development of investment strategies resulting in a 10% increase in client investment returns.

- •Assisted in drafting detailed investment proposals for high-net-worth clients, significantly boosting client acquisition rates.

- •Participated in client meetings to discuss financial strategies, increasing client engagement by 15%.

- •Updated financial planning software systems, improving operational efficiency and reducing client response time by 20%.

Navigating the private banking world is like steering a finely-tuned ship through financial seas, where every detail counts. As a private banker, your resume isn't just a document; it's your compass, guiding you toward your next career opportunity. Yet, when it comes to balancing your financial expertise with the art of building client relations, writing this key document can feel overwhelming.

This challenge comes from the need to seamlessly highlight your skills—from wealth management to client engagement—without making it feel like climbing a steep hill. In a sector that demands precision, effectively showcasing your analytical skills without getting lost in financial jargon is an art in itself. Coupled with the fierce competition in the financial world, standing out becomes not just important but essential.

Here's where a resume template can become your guiding star. It offers the structure you need, ensuring every vital detail is captured while allowing your personal and professional story to shine through. With a variety of resume templates at your fingertips, transforming the daunting task of resume writing into a smooth journey is within reach.

In this guide, you'll discover how to convey your value effectively, turning your career accomplishments into a compelling narrative. Each section of your resume, from your objectives to achievements, will reflect the drive and dedication required in private banking. Let’s dive in and craft a resume that becomes a true representation of your professional voyage.

Key Takeaways

- Your private banking resume should highlight financial expertise and client relationship skills while emphasizing analytical and communication strengths.

- Use a clear and professional format like reverse-chronological to showcase recent accomplishments, ensuring consistent branding with modern fonts and well-spaced margins.

- In the experience section, focus on quantifiable achievements and align them with the skills and requirements of the job to demonstrate impact clearly.

- The resume summary should capture your skills and experience concisely, setting the tone for the rest of your application.

- Include sections beyond work experience, like certifications, language skills, and volunteer work, to provide a fuller picture of your abilities and character.

What to focus on when writing your private banking resume

A private banking resume should effectively convey your financial expertise and strong client relationship skills to the recruiter. You need to clearly highlight your abilities to manage wealth successfully while understanding complex financial products, all while building trust with clients. This requires showcasing your strong analytical and communication skills as well, which are vital in this field.

How to structure your private banking resume

- Contact Information — Start with your full name, phone number, and professional email address at the top. Contact details are crucial since they provide the first step for recruiters to reach out. Use a professional email rather than a personal one to set the right tone. Make sure that all information is current and easy to read, ensuring you are accessible to both recruiters and applicant tracking systems (ATS).

- Professional Summary — Move into a concise paragraph that encapsulates your private banking experience. This summary should be a snapshot that captures your career achievements and aspirations in the field. By emphasizing your skills in wealth management and client relations, you present yourself as a strong candidate from the outset. Words like "portfolio management" and "investment strategies" help clarify your area of expertise, providing a context for the accomplishments listed in your work history.

- Work Experience — Follow up with a list of your relevant positions in reverse chronological order. Here, your objective is to demonstrate how your past roles have prepared you for the position you are applying for. Detail specific achievements and responsibilities that showcase your proficiency in financial advisory, risk assessment, and asset allocation. Align your experience with the skills highlighted in your professional summary to provide a cohesive narrative.

- Education — Then, detail your educational background, particularly if your degrees are in finance or economics. Education is foundational to your credibility, especially in a field as specialized as private banking. Mention any prestigious certifications like CFA or CFP, as these underscore your commitment to continuous growth and capability in the financial sector.

- Skills — Next, highlight your specific skills, such as financial analysis, client engagement, and investment management. Ensure they align with the job description and demonstrate depth in your knowledge. Using language specific to the industry helps emphasize your expertise and positions you as a strong candidate for the role.

- Technical Proficiency — Finally, list any financial software or tools you are proficient in, such as Bloomberg Terminal or Excel, which play a critical role in private banking. These tools are essential for executing complex financial transactions and analyses, strengthening your candidacy by showcasing your ability to handle technical demands of the job.

Optional sections like "Professional Affiliations" or "Volunteer Experience" can further enrich your resume by demonstrating your leadership and dedication to community involvement. Transitioning to the next focus—resume format, we will cover each section more in-depth, ensuring you have the tools you need to craft an effective resume.

Which resume format to choose

Creating a private banking resume starts with choosing a clear and professional format that highlights your strengths. The reverse-chronological format is most effective in this industry, as it showcases your most recent accomplishments first. This helps potential employers quickly grasp your career trajectory and relevant experience, crucial in the fast-paced world of finance.

Selecting the right font can subtly impact how your resume is perceived. Opt for modern and clean choices like Lato, Montserrat, or Raleway, which lend a touch of freshness while maintaining a professional appearance. These fonts set your resume apart, avoiding the standard look of Arial and Times New Roman, and can indirectly reflect your attention to contemporary trends.

Ensuring consistency and professionalism throughout your document is also critical. Saving your resume as a PDF guarantees that your formatting and structure remain intact across all devices. This creates a reliable experience for employers and signals your organizational skills, a valuable asset in private banking.

Finally, pay attention to details by setting one-inch margins around your document. This not only enhances readability but also provides a balanced and professional look. These margins create a pleasing amount of white space, which helps emphasize the content itself. A well-structured resume reflects your meticulousness and attention to detail, both indispensable qualities in private banking.

How to write a quantifiable resume experience section

A strong private banking resume experience section should emphasize quantifiable achievements, clearly illustrating your impact in previous roles. Structuring it in reverse chronological order allows your most recent and relevant experiences to shine at the top. This arrangement not only demonstrates your expertise and success but also portrays you as a capable candidate. When deciding how far back to go, focus on the positions from the last 10–15 years that are most relevant. Choose job titles that reflect growth or specialization in private banking, which will catch the eye of hiring managers. Tailoring your resume to the job description is essential; ensure your experience aligns with the specific skills and requirements mentioned. Using action words like "achieved," "developed," and "optimized" helps convey your accomplishments in a compelling way.

- •Increased client portfolio values by an average of 20% annually by advising on low-risk, high-return investment strategies.

- •Achieved a client satisfaction score of 95% by developing tailored financial plans and maintaining regular communication.

- •Secured $50 million in new investments through strategic client acquisition and relationship-building efforts each year.

- •Optimized financial solutions for over 150 clients, resulting in a 30% increase in referral business.

The experience section above works well because it seamlessly highlights quantifiable achievements, providing hard evidence of your success in private banking. Each bullet point is directly tied to your impact on clients and the business, such as significant portfolio growth and high client satisfaction. This cohesive approach not only underscores your skills but also emphasizes your dedication to personalized service, a vital aspect of private banking. By including precise numbers and percentages, your contributions become clear and compelling, making it easy for potential employers to appreciate the value you brought to previous roles. The section’s structure adheres to industry standards, enhancing its effectiveness by focusing on a results-driven narrative that resonates with recruiters, which ultimately positions you as a standout candidate.

Customer-Focused resume experience section

A private banking-focused resume experience section should emphasize how you expertly anticipate and meet the needs of high-net-worth clients. Begin by highlighting key responsibilities and achievements that demonstrate your expertise in personalized banking. Use strong action verbs to detail your role in advising clients, managing financial portfolios, and fostering long-term relationships. This approach showcases how your customized service has enhanced client satisfaction and retention.

Strive for a seamless blend of technical skills and personal interaction. Include examples of your success in guiding clients through complex financial decisions or crafting bespoke solutions. Make sure to quantify achievements, such as the percentage increase in assets under management or the number of affluent clients added to the portfolio. This effectively portrays you as a knowledgeable and personable professional deeply committed to client success.

Senior Private Banking Advisor

XYZ Private Bank

June 2018 - Present

- Managed a portfolio of over 100 high-net-worth clients, resulting in a 30% increase in assets under management.

- Developed and implemented tailored financial plans, leading to a 20% boost in client satisfaction and retention.

- Collaborated with a team to expand the bank's client base, acquiring 25 new affluent clients through personalized outreach.

- Provided expert advice on investment strategies, contributing to an average annual portfolio growth of 15%.

Problem-Solving Focused resume experience section

A problem-solving-focused private banker resume experience section should emphasize your ability to deal with client challenges and devise effective solutions. Start by highlighting key moments where you effectively tackled issues or enhanced processes. Use active language to show the real impact of your actions, explaining the problems you encountered and how you resolved them, along with the positive outcomes achieved. If teamwork played a role, be sure to mention it along with any recognition you received for these efforts.

Short yet informative descriptions will provide potential employers with a clear understanding of your skills and contributions. Include quantifiable achievements, such as improvements in client satisfaction or reductions in processing times, to add depth to your claims. This section of your resume should clearly convey your resourcefulness and the tangible results you can deliver in the banking industry. Choose words that express confidence and highlight your competence in problem-solving tasks.

Private Banker

Global Bank Corp

January 2020 - March 2023

- Resolved client inquiries with a new communication process, cutting response time by 30%.

- Worked with a team to enhance client portfolio reviews, boosting satisfaction scores by 25%.

- Led a project to automate tasks, reducing costs by 20% and increasing efficiency.

- Trained junior bankers in problem-solving, improving team performance and client engagement.

Industry-Specific Focus resume experience section

A private banking-focused resume experience section should highlight your skills and accomplishments in nurturing relationships with high-net-worth clients. Begin by detailing your roles in wealth management and financial strategy, using specific examples that showcase your success in enhancing client satisfaction, managing substantial portfolios, and crafting successful financial plans. By incorporating industry-specific language, you can effectively demonstrate your deep understanding of the private banking sector.

In your bullet points, clearly link your achievements with measurable impacts. Highlight how you used innovative strategies to grow client portfolios or improve retention rates through personalized service. Emphasize your collaborative efforts with investment and credit departments to deliver comprehensive financial services. Finally, illustrate your ability to streamline processes, such as client onboarding, to enhance efficiency and client experience, ensuring all aspects of your experience tie together seamlessly.

Vice President of Private Banking

Elite Financial Solutions

March 2018 - Present

- Managed a portfolio of high-net-worth clients, achieving a 20% increase in assets under management over 2 years.

- Developed personalized financial plans for over 50 clients, leading to improved client satisfaction and retention rates.

- Worked closely with investment and credit departments to provide clients comprehensive financial services.

- Streamlined the client onboarding process, improving efficiency and reducing onboarding time by 30%.

Achievement-Focused resume experience section

A private banking achievement-focused resume experience section should effectively highlight the tangible impact you've made in your role. Begin by showcasing specific accomplishments that led to significant results, such as attracting new clients or increasing assets under management. Use strong action verbs like "led" or "transformed" to convey your proactive approach, while incorporating quantifiable metrics such as percentages or dollar figures to illustrate your success clearly. This strategy not only captures attention but also seamlessly demonstrates your skills and contributions in a compelling way.

To ensure a smooth narrative flow, balance detail with clarity while connecting each achievement coherently. Highlight varied aspects of your skill set, from client relations to strategic growth and leadership, ensuring each bullet point both stands alone and complements the overall story of your career success. By using straightforward language to unpack complex accomplishments, you make it easy for your audience to grasp your capabilities. Tailoring your content in this way reflects the precision and effectiveness that are highly valued in the world of private banking.

Senior Private Banking Manager

XYZ Private Bank

2019-2023

- Managed portfolios worth $50 million, achieving an average client return of 8% annually.

- Led a client acquisition campaign that grew new business by 25% over two years.

- Transformed investment strategies, boosting asset growth by 15% despite market fluctuations.

- Guided a team of financial analysts to streamline reporting, cutting errors by 30%.

Write your private banking resume summary section

A private banking-focused resume summary section should capture the essence of your skills, experience, and aspirations in a few compelling sentences. This part of your resume is crucial as it sets the tone for your application. For those with significant experience, your summary might read:

By highlighting key achievements and skills, this summary presents a powerful case to potential employers, linking your past successes to their needs. If you're just starting in the field, a resume objective might suit you better, saying:

[here was the JSON object 2]

This objective effectively outlines your goals and enthusiasm, which is crucial for making a strong first impression. Understanding the difference between a summary and an objective is vital; the former highlights your accomplishments and is best for experienced professionals, while the latter focuses on your aspirations, making it ideal for newcomers. A resume profile, similar to a summary, often includes personal traits, offering more depth. Meanwhile, a summary of qualifications is a bulleted list of skills and achievements, providing a quick snapshot of your capabilities. By tailoring these sections to your experience and career goals, you enhance your resume's impact and increase your chances of landing the job.

Listing your private banking skills on your resume

A private banking-focused resume should effectively highlight your skills, whether in a standalone section or integrated into your experience and summary. Begin by emphasizing your strengths and soft skills, like communication and empathy, which complement technical skills. These hard skills—like financial analysis and portfolio management—are specific, teachable abilities that you can showcase to demonstrate your expertise. Incorporating both your skills and strengths as resume keywords ensures that your resume will catch the attention of recruiters and Applicant Tracking Systems (ATS) alike.

To create a compelling skills section, make sure it reflects key abilities relevant to private banking. Here's a sample standalone skills section in JSON format:

This skills section is impactful because it lists essential skills in private banking, presenting your expertise clearly and concisely. Each skill is carefully selected to reflect the capabilities that employers prioritize, underscoring your qualifications.

Best hard skills to feature on your private banking resume

Hard skills in private banking demonstrate your technical expertise and ability to handle financial responsibilities. Employers look for these crucial skills:

Hard Skills

- Financial Analysis

- Portfolio Management

- Risk Assessment

- Customer Relationship Management (CRM)

- Investment Strategies

- Regulatory Compliance

- Tax Planning

- Data Analysis

- Wealth Management

- Retirement Planning

- Asset Allocation

- Financial Modeling

- Cost-Benefit Analysis

- Credit Analysis

- Performance Metrics Analysis

Best soft skills to feature on your private banking resume

In addition to technical skills, soft skills are important for success in private banking, as they illustrate your ability to connect with clients and collaborate within a team. Highlighting these skills indicates you are both technically adept and personable:

Including these skills on your resume creates a well-rounded view of your technical proficiency and interpersonal abilities.

Soft Skills

- Communication

- Empathy

- Problem-solving

- Time management

- Adaptability

- Negotiation

- Attention to detail

- Teamwork

- Interpersonal skills

- Conflict resolution

- Customer service

- Leadership

- Decision-making

- Emotional intelligence

- Active listening

How to include your education on your resume

An education section is an essential part of your private banking resume, giving potential employers insight into your academic background. The education section should be tailored specifically to the private banking role you're applying for, meaning you should include only relevant education that enhances your candidacy. For instance, listing a degree in finance or economics is beneficial, whereas unrelated courses might not add value.

When including your GPA on your resume, only do so if it's above a 3.5 and you are a recent graduate. Format it as "GPA: 3.8/4.0" for clarity. If you graduated with honors, such as cum laude, list it next to your degree. For example, "Bachelor of Arts in Finance, cum laude."

It's crucial to list your degree accurately. Specify the type of degree and its relevance, such as "Bachelor of Science in Accounting" or "Master of Business Administration." Below are examples of how to structure your education section:

- •Participated in multiple extracurricular clubs.

The second example stands out because it highlights a relevant degree in finance, shows a high GPA, and includes an honors designation, all of which are impressive for a private banking role. This specific and well-organized information suggests that you have the necessary background and commitment to excel in the financial industry.

How to include private banking certificates on your resume

Including a certificates section on your private banking resume is crucial. It shows your commitment to continuous learning and can set you apart from other candidates. To create this section, start by listing the name of the certificate. Include the date you received it to show how current it is. Add the issuing organization to highlight the certificate's credibility. Certificates can also be added to the header for quick visibility.

Here's a good example of placing them in a standalone section:

This example is strong because it includes highly relevant certifications for a career in private banking. Each certificate is from a respected institution, adding credibility. The dates are omitted here, but you should include them to show how recent your qualifications are.

Extra sections to include in your private banking resume

Applying for a position in private banking requires you to showcase a diverse range of skills and experiences. Including sections beyond work experience can provide a fuller picture of your abilities and character.

Language section — Highlight language proficiencies to show your ability to communicate with diverse clients and international teams. Exhibit fluency or proficiency in languages like Spanish, Mandarin, or French to set yourself apart.

Hobbies and interests section — Demonstrate well-roundedness and personal interests to make your resume more memorable. Indicate activities like golfing, chess, or investing, which align well with client preferences in private banking.

Volunteer work section — Show community engagement by listing volunteer work with local charities or financial literacy programs. Illustrate commitment to social responsibility and leadership outside of your immediate career.

Books section — Share your habit of reading industry-relevant literature to underscore your continuous learning. Include titles like "The Wealth of Nations" by Adam Smith or "Principles" by Ray Dalio to indicate depth of knowledge.

In Conclusion

In conclusion, crafting an exceptional private banking resume requires a blend of thoughtfully selected structure, powerful content, and attention to detail. Your resume should serve as a clear reflection of your financial expertise, relational skills, and professional journey, effectively communicating your value to prospective employers. By incorporating elements such as a professional summary, targeted skill sets, and relevant work experiences, you set a strong foundation to capture attention in this competitive field.

Additionally, choosing the right format and maintaining consistency across sections will display your organizational skills, which are highly valued in private banking. Utilize specific, quantifiable achievements to add depth to your resume, making your contributions both memorable and verifiable. Including a well-structured education section and showcasing any pertinent certifications further bolsters your resume's impact and credibility.

Moreover, don't overlook the opportunity to include extra sections that add dimension to your professional persona. Highlighting language skills, volunteer work, or personal interests can present you as a multifaceted candidate, appealing to the diverse and dynamic nature of private banking roles. A keen understanding of the key technical and soft skills pertinent to private banking ensures you present a well-rounded profile.

Ultimately, a meticulously crafted resume should not only open doors but also reflect the precision, expertise, and client-focused mentality that are essential assets in the world of private banking. With careful thought and a strategic approach, your resume can indeed be the compass that guides you toward a successful career path.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.