Public Accountant Resume Examples

Jul 18, 2024

|

12 min read

Master your public accountant resume with this simple guide: balance your skills and experience to make your qualifications add up.

Rated by 348 people

Certified Public Accountant (CPA)

Government Public Accountant

Forensic Public Accountant

Environmental Public Accountant

Public Audit Specialist

Nonprofit Public Accountant

Public Tax Accounting Specialist

Public Accounting Consultant

Corporate Public Accountant

Public Financial Reporting Accountant

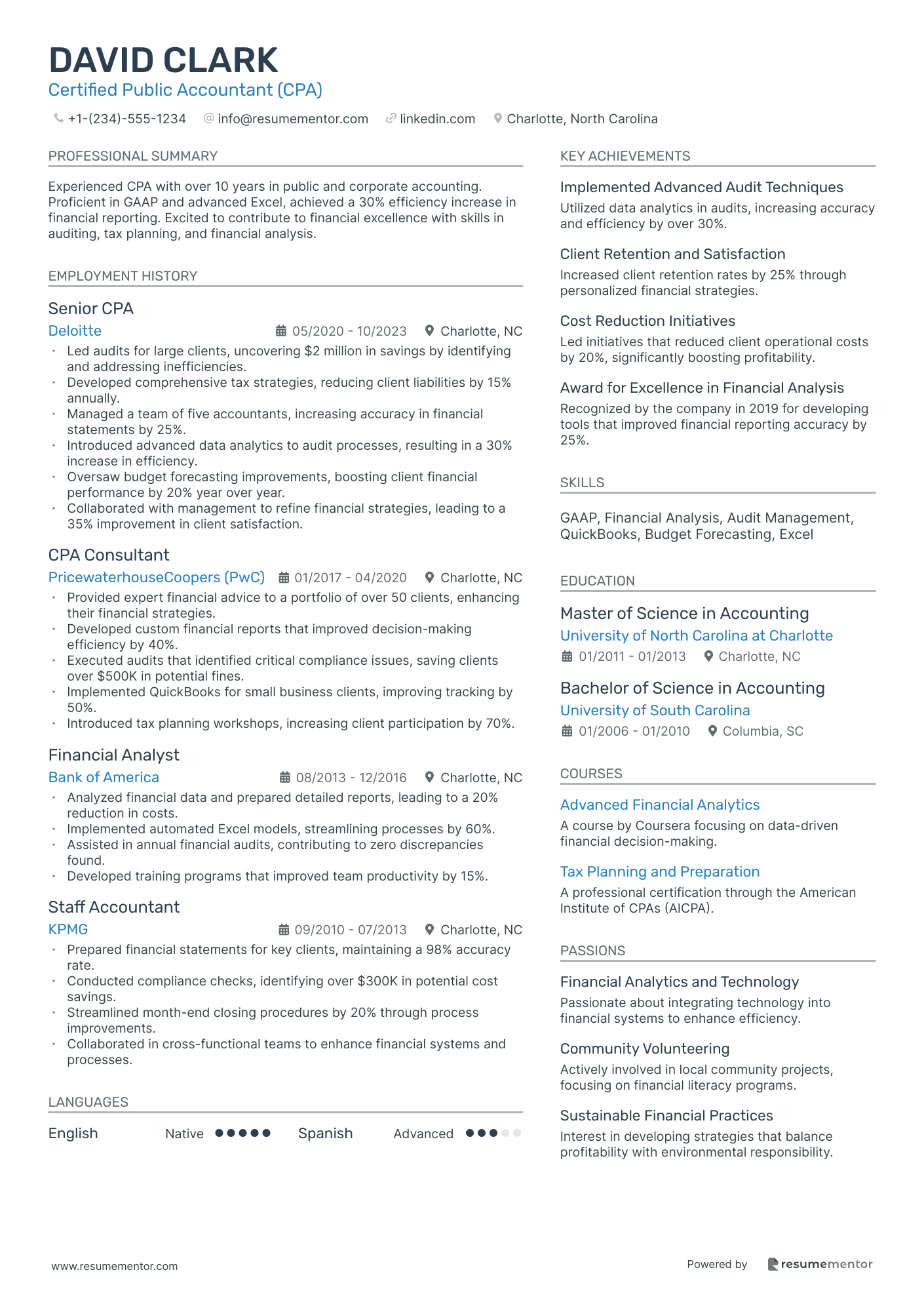

Certified Public Accountant (CPA) resume sample

- •Led audits for large clients, uncovering $2 million in savings by identifying and addressing inefficiencies.

- •Developed comprehensive tax strategies, reducing client liabilities by 15% annually.

- •Managed a team of five accountants, increasing accuracy in financial statements by 25%.

- •Introduced advanced data analytics to audit processes, resulting in a 30% increase in efficiency.

- •Oversaw budget forecasting improvements, boosting client financial performance by 20% year over year.

- •Collaborated with management to refine financial strategies, leading to a 35% improvement in client satisfaction.

- •Provided expert financial advice to a portfolio of over 50 clients, enhancing their financial strategies.

- •Developed custom financial reports that improved decision-making efficiency by 40%.

- •Executed audits that identified critical compliance issues, saving clients over $500K in potential fines.

- •Implemented QuickBooks for small business clients, improving tracking by 50%.

- •Introduced tax planning workshops, increasing client participation by 70%.

- •Analyzed financial data and prepared detailed reports, leading to a 20% reduction in costs.

- •Implemented automated Excel models, streamlining processes by 60%.

- •Assisted in annual financial audits, contributing to zero discrepancies found.

- •Developed training programs that improved team productivity by 15%.

- •Prepared financial statements for key clients, maintaining a 98% accuracy rate.

- •Conducted compliance checks, identifying over $300K in potential cost savings.

- •Streamlined month-end closing procedures by 20% through process improvements.

- •Collaborated in cross-functional teams to enhance financial systems and processes.

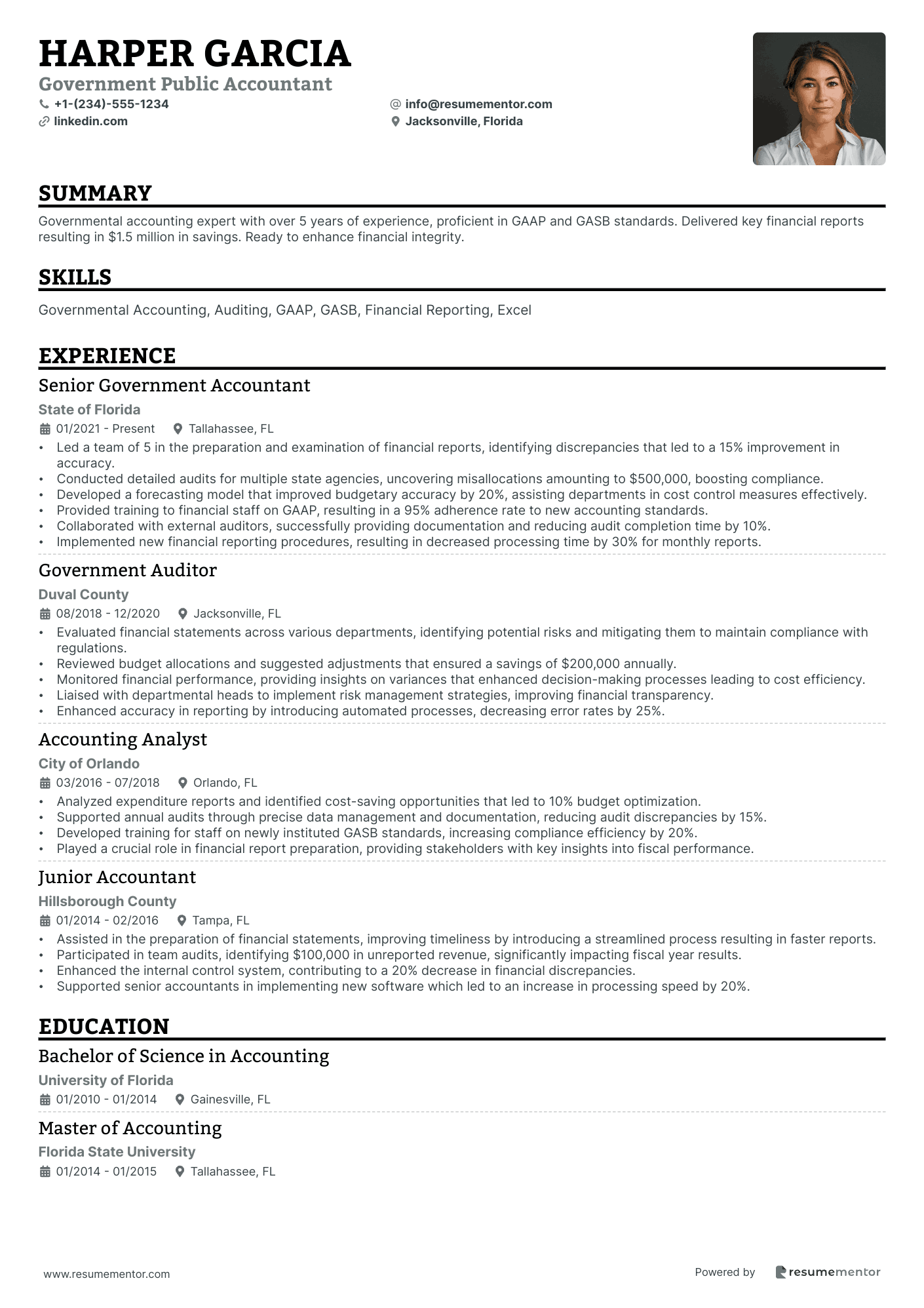

Government Public Accountant resume sample

- •Led a team of 5 in the preparation and examination of financial reports, identifying discrepancies that led to a 15% improvement in accuracy.

- •Conducted detailed audits for multiple state agencies, uncovering misallocations amounting to $500,000, boosting compliance.

- •Developed a forecasting model that improved budgetary accuracy by 20%, assisting departments in cost control measures effectively.

- •Provided training to financial staff on GAAP, resulting in a 95% adherence rate to new accounting standards.

- •Collaborated with external auditors, successfully providing documentation and reducing audit completion time by 10%.

- •Implemented new financial reporting procedures, resulting in decreased processing time by 30% for monthly reports.

- •Evaluated financial statements across various departments, identifying potential risks and mitigating them to maintain compliance with regulations.

- •Reviewed budget allocations and suggested adjustments that ensured a savings of $200,000 annually.

- •Monitored financial performance, providing insights on variances that enhanced decision-making processes leading to cost efficiency.

- •Liaised with departmental heads to implement risk management strategies, improving financial transparency.

- •Enhanced accuracy in reporting by introducing automated processes, decreasing error rates by 25%.

- •Analyzed expenditure reports and identified cost-saving opportunities that led to 10% budget optimization.

- •Supported annual audits through precise data management and documentation, reducing audit discrepancies by 15%.

- •Developed training for staff on newly instituted GASB standards, increasing compliance efficiency by 20%.

- •Played a crucial role in financial report preparation, providing stakeholders with key insights into fiscal performance.

- •Assisted in the preparation of financial statements, improving timeliness by introducing a streamlined process resulting in faster reports.

- •Participated in team audits, identifying $100,000 in unreported revenue, significantly impacting fiscal year results.

- •Enhanced the internal control system, contributing to a 20% decrease in financial discrepancies.

- •Supported senior accountants in implementing new software which led to an increase in processing speed by 20%.

Forensic Public Accountant resume sample

- •Led a comprehensive fraud investigation that resulted in recovering $1.5 million in misappropriated funds, enhancing client financial integrity.

- •Developed financial models to detect fraudulent activities, which increased fraud detection rates by 35% over a 12-month period.

- •Collaborated with legal teams, providing expert testimony in legal proceedings, directly contributing to successful case resolutions.

- •Trained and mentored junior staff to develop skills in forensic accounting and fraud prevention, increasing team efficiency by 25%.

- •Conducted risk assessments for high-profile clients, resulting in reduced financial discrepancies by 40% annually.

- •Prepared detailed forensic accounting reports, providing clear, actionable recommendations followed by clients to prevent further fraud.

- •Managed forensic audits for multinational corporations to uncover financial misconduct, leading to over $3 million in cost recoveries.

- •Developed strategies for client fraud risk assessments, reducing financial risk exposures by approximately 30% annually.

- •Successfully led engagements requiring cross-functional collaboration with legal and compliance teams to ensure comprehensive fraud investigations.

- •Implemented cutting-edge data analysis tools that improved identification of irregularities and reduced audit times by 20%.

- •Acted as a trusted advisor on financial integrity, fostering strong client relationships that resulted in a 90% client retention rate.

- •Conducted in-depth financial record analysis leading to the identification and resolution of $500,000 in fraudulent transactions.

- •Worked with clients to design and implement internal controls, significantly reducing fraud risk within organizations.

- •Facilitated workshops on fraud detection techniques, enhancing client capabilities to independently monitor financial operations.

- •Provided litigation support, preparing reports and testimony that contributed to a successful ruling in a major fraud case.

- •Assisted in audits for large clients, identifying discrepancies that helped recover approximately $200,000 in financial anomalies.

- •Developed skills in advanced data analysis tools, significantly improving audit accuracy and efficiency over three years.

- •Collaborated with audit teams to streamline procedures, reducing audit completion time by 15% while maintaining high-quality standards.

- •Played a crucial role in compliance assessments, ensuring clients adhered to stringent financial regulations to prevent legal issues.

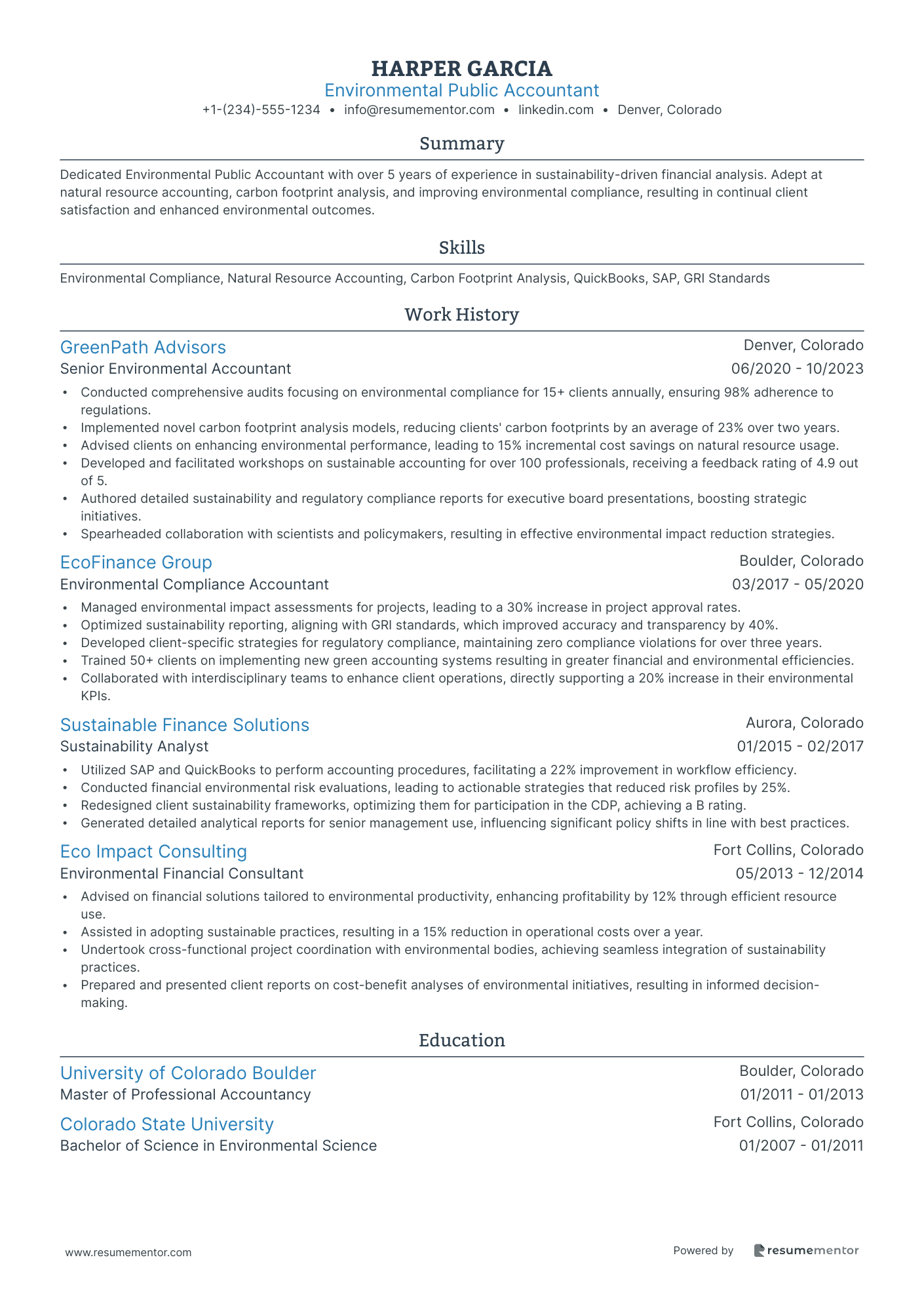

Environmental Public Accountant resume sample

- •Conducted comprehensive audits focusing on environmental compliance for 15+ clients annually, ensuring 98% adherence to regulations.

- •Implemented novel carbon footprint analysis models, reducing clients' carbon footprints by an average of 23% over two years.

- •Advised clients on enhancing environmental performance, leading to 15% incremental cost savings on natural resource usage.

- •Developed and facilitated workshops on sustainable accounting for over 100 professionals, receiving a feedback rating of 4.9 out of 5.

- •Authored detailed sustainability and regulatory compliance reports for executive board presentations, boosting strategic initiatives.

- •Spearheaded collaboration with scientists and policymakers, resulting in effective environmental impact reduction strategies.

- •Managed environmental impact assessments for projects, leading to a 30% increase in project approval rates.

- •Optimized sustainability reporting, aligning with GRI standards, which improved accuracy and transparency by 40%.

- •Developed client-specific strategies for regulatory compliance, maintaining zero compliance violations for over three years.

- •Trained 50+ clients on implementing new green accounting systems resulting in greater financial and environmental efficiencies.

- •Collaborated with interdisciplinary teams to enhance client operations, directly supporting a 20% increase in their environmental KPIs.

- •Utilized SAP and QuickBooks to perform accounting procedures, facilitating a 22% improvement in workflow efficiency.

- •Conducted financial environmental risk evaluations, leading to actionable strategies that reduced risk profiles by 25%.

- •Redesigned client sustainability frameworks, optimizing them for participation in the CDP, achieving a B rating.

- •Generated detailed analytical reports for senior management use, influencing significant policy shifts in line with best practices.

- •Advised on financial solutions tailored to environmental productivity, enhancing profitability by 12% through efficient resource use.

- •Assisted in adopting sustainable practices, resulting in a 15% reduction in operational costs over a year.

- •Undertook cross-functional project coordination with environmental bodies, achieving seamless integration of sustainability practices.

- •Prepared and presented client reports on cost-benefit analyses of environmental initiatives, resulting in informed decision-making.

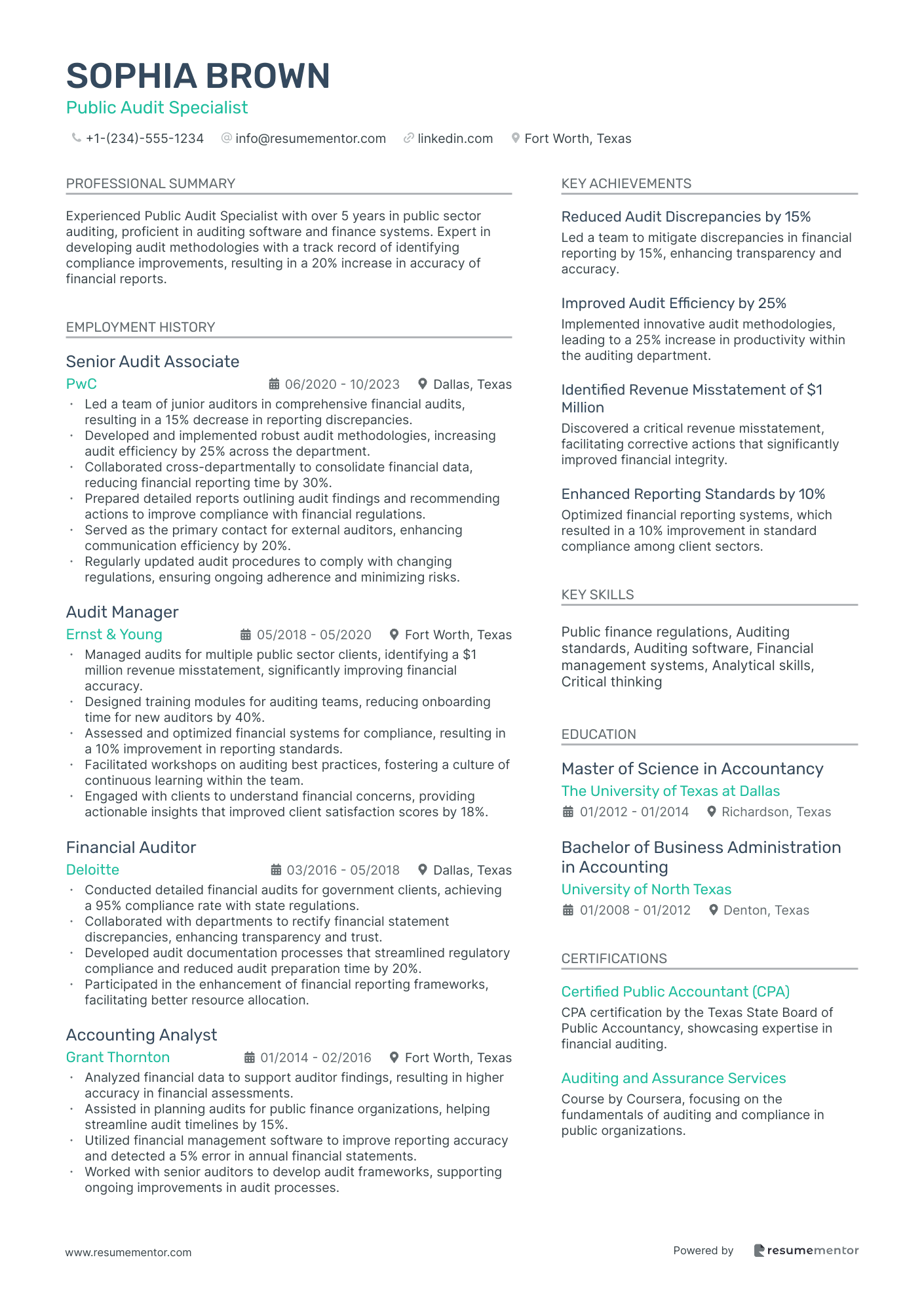

Public Audit Specialist resume sample

- •Led a team of junior auditors in comprehensive financial audits, resulting in a 15% decrease in reporting discrepancies.

- •Developed and implemented robust audit methodologies, increasing audit efficiency by 25% across the department.

- •Collaborated cross-departmentally to consolidate financial data, reducing financial reporting time by 30%.

- •Prepared detailed reports outlining audit findings and recommending actions to improve compliance with financial regulations.

- •Served as the primary contact for external auditors, enhancing communication efficiency by 20%.

- •Regularly updated audit procedures to comply with changing regulations, ensuring ongoing adherence and minimizing risks.

- •Managed audits for multiple public sector clients, identifying a $1 million revenue misstatement, significantly improving financial accuracy.

- •Designed training modules for auditing teams, reducing onboarding time for new auditors by 40%.

- •Assessed and optimized financial systems for compliance, resulting in a 10% improvement in reporting standards.

- •Facilitated workshops on auditing best practices, fostering a culture of continuous learning within the team.

- •Engaged with clients to understand financial concerns, providing actionable insights that improved client satisfaction scores by 18%.

- •Conducted detailed financial audits for government clients, achieving a 95% compliance rate with state regulations.

- •Collaborated with departments to rectify financial statement discrepancies, enhancing transparency and trust.

- •Developed audit documentation processes that streamlined regulatory compliance and reduced audit preparation time by 20%.

- •Participated in the enhancement of financial reporting frameworks, facilitating better resource allocation.

- •Analyzed financial data to support auditor findings, resulting in higher accuracy in financial assessments.

- •Assisted in planning audits for public finance organizations, helping streamline audit timelines by 15%.

- •Utilized financial management software to improve reporting accuracy and detected a 5% error in annual financial statements.

- •Worked with senior auditors to develop audit frameworks, supporting ongoing improvements in audit processes.

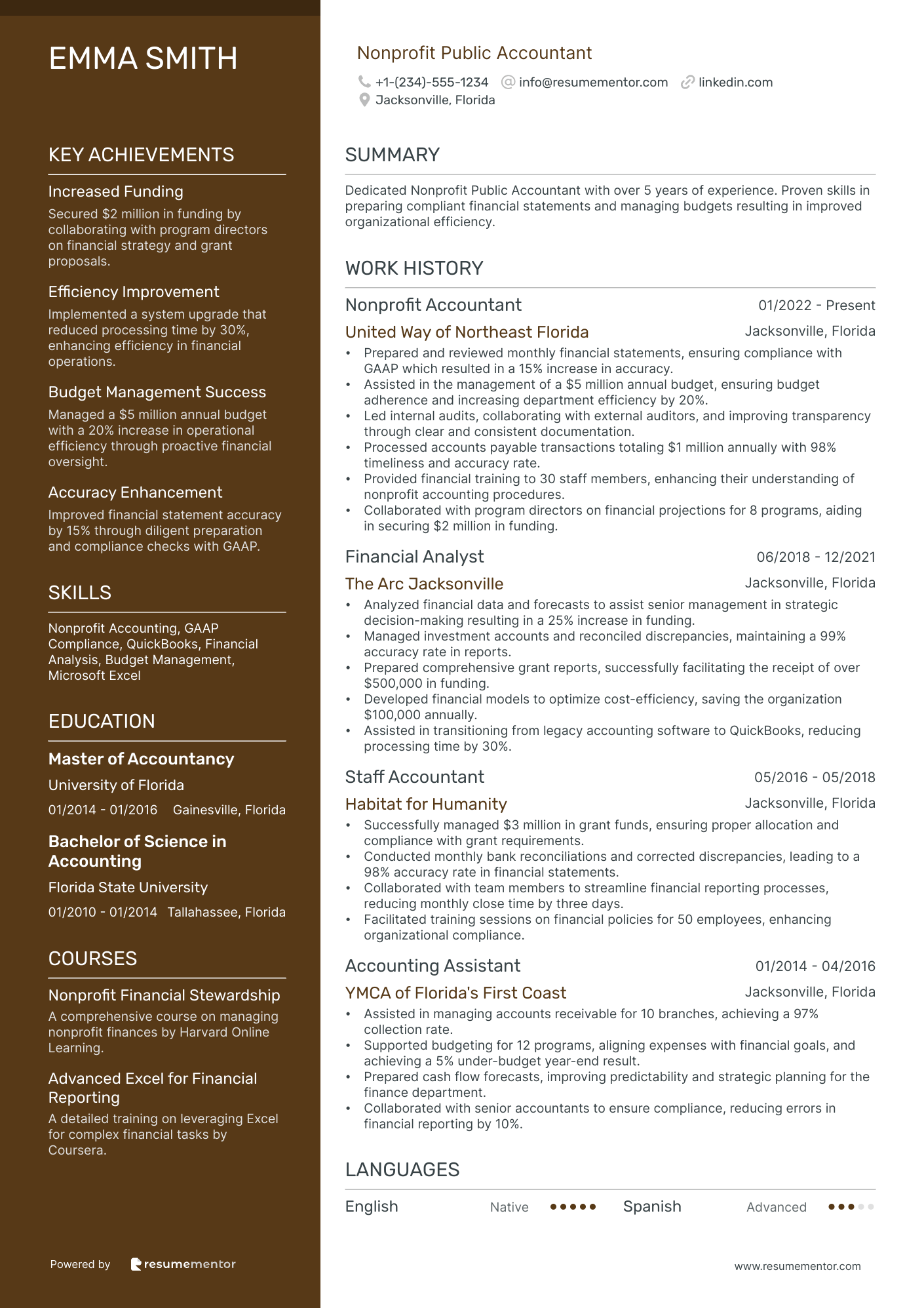

Nonprofit Public Accountant resume sample

- •Prepared and reviewed monthly financial statements, ensuring compliance with GAAP which resulted in a 15% increase in accuracy.

- •Assisted in the management of a $5 million annual budget, ensuring budget adherence and increasing department efficiency by 20%.

- •Led internal audits, collaborating with external auditors, and improving transparency through clear and consistent documentation.

- •Processed accounts payable transactions totaling $1 million annually with 98% timeliness and accuracy rate.

- •Provided financial training to 30 staff members, enhancing their understanding of nonprofit accounting procedures.

- •Collaborated with program directors on financial projections for 8 programs, aiding in securing $2 million in funding.

- •Analyzed financial data and forecasts to assist senior management in strategic decision-making resulting in a 25% increase in funding.

- •Managed investment accounts and reconciled discrepancies, maintaining a 99% accuracy rate in reports.

- •Prepared comprehensive grant reports, successfully facilitating the receipt of over $500,000 in funding.

- •Developed financial models to optimize cost-efficiency, saving the organization $100,000 annually.

- •Assisted in transitioning from legacy accounting software to QuickBooks, reducing processing time by 30%.

- •Successfully managed $3 million in grant funds, ensuring proper allocation and compliance with grant requirements.

- •Conducted monthly bank reconciliations and corrected discrepancies, leading to a 98% accuracy rate in financial statements.

- •Collaborated with team members to streamline financial reporting processes, reducing monthly close time by three days.

- •Facilitated training sessions on financial policies for 50 employees, enhancing organizational compliance.

- •Assisted in managing accounts receivable for 10 branches, achieving a 97% collection rate.

- •Supported budgeting for 12 programs, aligning expenses with financial goals, and achieving a 5% under-budget year-end result.

- •Prepared cash flow forecasts, improving predictability and strategic planning for the finance department.

- •Collaborated with senior accountants to ensure compliance, reducing errors in financial reporting by 10%.

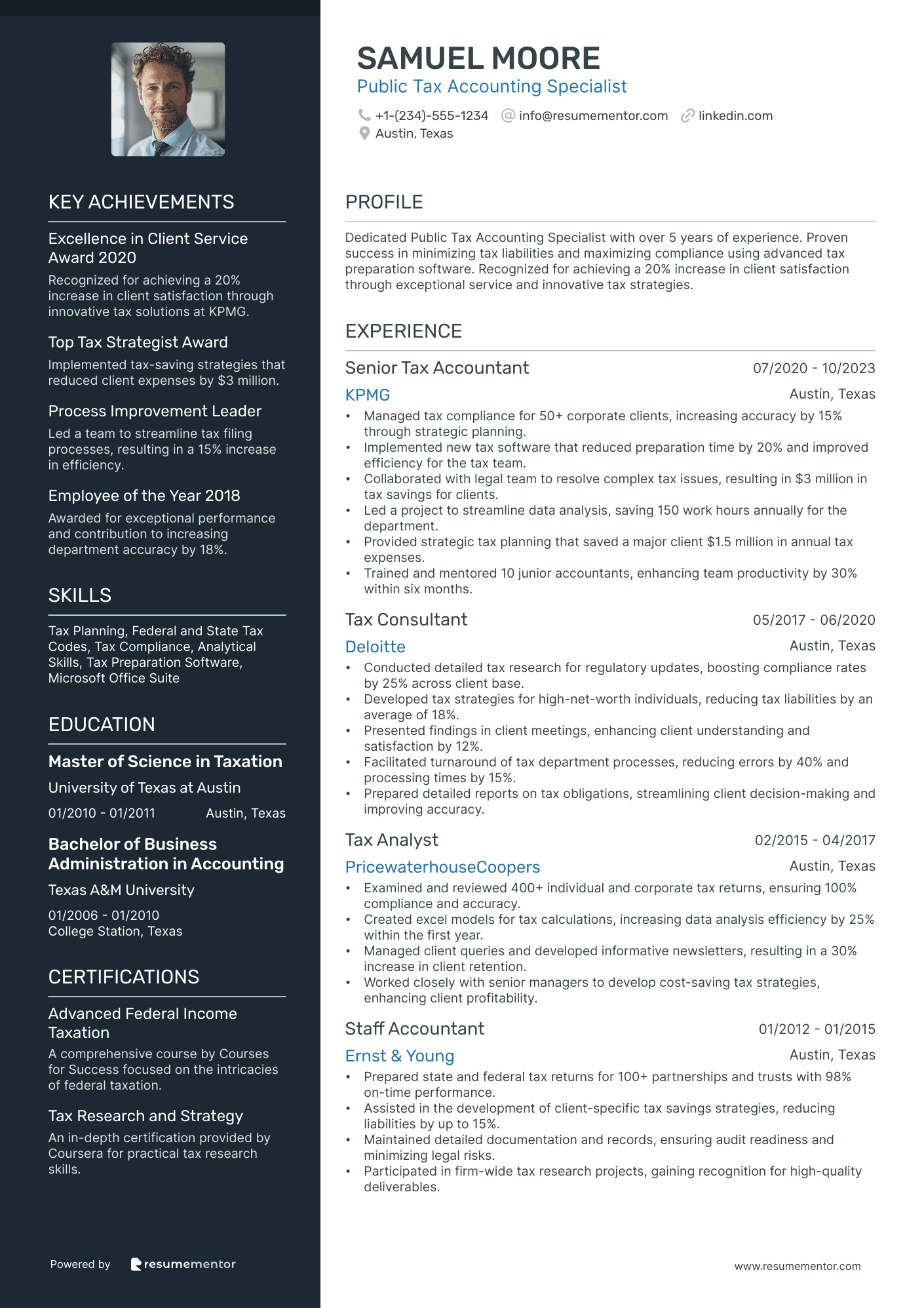

Public Tax Accounting Specialist resume sample

- •Managed tax compliance for 50+ corporate clients, increasing accuracy by 15% through strategic planning.

- •Implemented new tax software that reduced preparation time by 20% and improved efficiency for the tax team.

- •Collaborated with legal team to resolve complex tax issues, resulting in $3 million in tax savings for clients.

- •Led a project to streamline data analysis, saving 150 work hours annually for the department.

- •Provided strategic tax planning that saved a major client $1.5 million in annual tax expenses.

- •Trained and mentored 10 junior accountants, enhancing team productivity by 30% within six months.

- •Conducted detailed tax research for regulatory updates, boosting compliance rates by 25% across client base.

- •Developed tax strategies for high-net-worth individuals, reducing tax liabilities by an average of 18%.

- •Presented findings in client meetings, enhancing client understanding and satisfaction by 12%.

- •Facilitated turnaround of tax department processes, reducing errors by 40% and processing times by 15%.

- •Prepared detailed reports on tax obligations, streamlining client decision-making and improving accuracy.

- •Examined and reviewed 400+ individual and corporate tax returns, ensuring 100% compliance and accuracy.

- •Created excel models for tax calculations, increasing data analysis efficiency by 25% within the first year.

- •Managed client queries and developed informative newsletters, resulting in a 30% increase in client retention.

- •Worked closely with senior managers to develop cost-saving tax strategies, enhancing client profitability.

- •Prepared state and federal tax returns for 100+ partnerships and trusts with 98% on-time performance.

- •Assisted in the development of client-specific tax savings strategies, reducing liabilities by up to 15%.

- •Maintained detailed documentation and records, ensuring audit readiness and minimizing legal risks.

- •Participated in firm-wide tax research projects, gaining recognition for high-quality deliverables.

Public Accounting Consultant resume sample

- •Led comprehensive analysis projects resulting in a 20% increase in operational efficiency for major clients.

- •Developed detailed financial statements and reports, ensuring 100% compliance with federal and state regulations.

- •Improved tax planning strategies, resulting in a 15% reduction in tax liabilities for portfolio of clients.

- •Conducted workshops to train client accounting teams, increasing departmental productivity by 25%.

- •Collaborated on complex projects, enhancing quality of deliverables through innovative solutions and adherence to deadlines.

- •Provided strategic business advice, increasing client satisfaction scores by 30% year over year.

- •Executed financial audits to ensure compliance with GAAP, improving accuracy of reports across multiple industries.

- •Created customized financial models, increasing client revenue forecasting accuracy by 10%.

- •Developed and implemented new accounting policies, enhancing operational productivity by 18%.

- •Collaborated with diverse teams to address financial reporting complexities, improving deliverable timelines by 15%.

- •Presented findings at industry conferences, expanding firm’s client base by 5% annually.

- •Assessed financial operations, resulting in identification of cost-saving measures that reduced expenses by 12%.

- •Managed preparation and submission of tax documents, achieving a 100% on-time compliance rate.

- •Facilitated business development initiatives, contributing to a 10% growth in client acquisitions.

- •Provided expert consultation, enhancing client understanding of complex financial concepts significantly.

- •Assisted in preparing financial statements for small businesses, ensuring compliance with accounting standards.

- •Analyzed financial data to predict trends, helping improve client strategic planning by 10%.

- •Supported tax preparation processes, maintaining compliance with changing tax laws.

- •Contributed to the development of procedural documentation, simplifying client onboarding processes by 15%.

Corporate Public Accountant resume sample

- •Led the preparation and analysis of financial statements, ensuring completion ahead of schedule with a 99% accuracy rate.

- •Improved month-end and year-end closing processes, leading to a 20% reduction in errors.

- •Conducted in-depth variance analysis, identifying cost-saving opportunities that resulted in a $500,000 annual reduction.

- •Collaborated with cross-functional teams to develop budgeting solutions, enhancing forecast accuracy by 15%.

- •Ensured compliance with all regulatory requirements, reducing potential fines by 40%.

- •Spearheaded the implementation of new internal controls, safeguarding $2 million in assets.

- •Prepared detailed financial reports, enhancing transparency and resulted in a 10% increase in stakeholder trust.

- •Analyzed complex data sets and provided actionable insights, facilitating a 5% improvement in operational efficiency.

- •Developed a new financial reporting model, streamlining processes and reducing report preparation time by 25%.

- •Assisted in audit processes, resulting in a 35% faster completion time without compromising quality.

- •Coordinated with external auditors to improve audit outcomes, achieving a cleaner audit with zero findings.

- •Managed reconciliations and journal entries, ensuring a 98% accuracy rate in financial records.

- •Enhanced month-end closing procedures, leading to a 30% time reduction in closing cycles.

- •Implemented GAAP compliant procedures, improving compliance score by 15 points.

- •Collaborated on strategic initiatives, contributing to a 12% increase in company revenues year-over-year.

- •Provided financial advice on investment projects, improving capital allocation efficiency by 8%.

- •Assisted in the month-end close processes, resulting in an improved efficiency by 25% in report timelines.

- •Supported the preparation of budgets and forecasts, increasing forecast accuracy by 10%.

- •Participated in internal audit preparations, contributing to identifying and mitigating potential issues.

- •Maintained accounting software data integrity, sustaining a 0% data discrepancy rate.

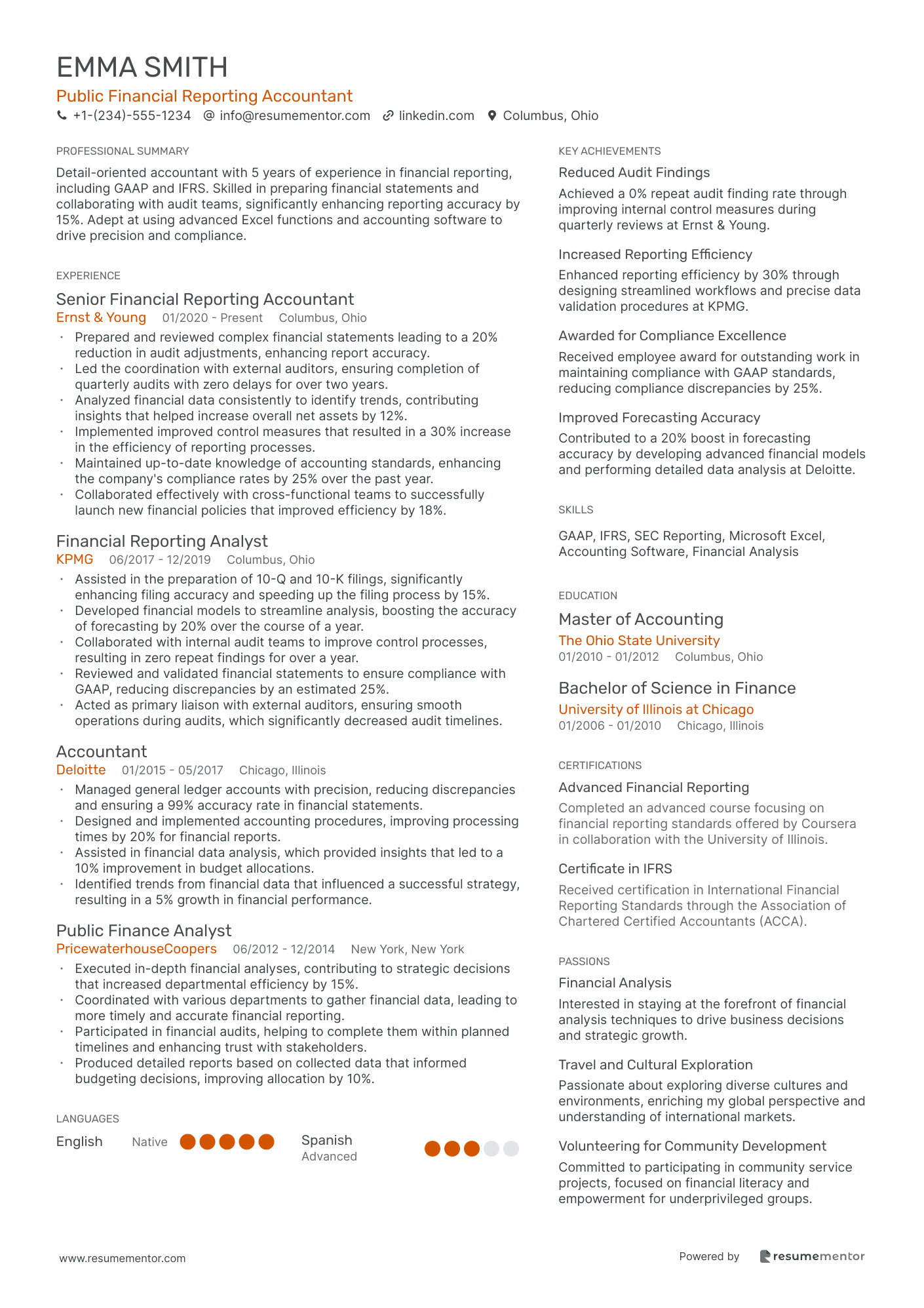

Public Financial Reporting Accountant resume sample

- •Prepared and reviewed complex financial statements leading to a 20% reduction in audit adjustments, enhancing report accuracy.

- •Led the coordination with external auditors, ensuring completion of quarterly audits with zero delays for over two years.

- •Analyzed financial data consistently to identify trends, contributing insights that helped increase overall net assets by 12%.

- •Implemented improved control measures that resulted in a 30% increase in the efficiency of reporting processes.

- •Maintained up-to-date knowledge of accounting standards, enhancing the company's compliance rates by 25% over the past year.

- •Collaborated effectively with cross-functional teams to successfully launch new financial policies that improved efficiency by 18%.

- •Assisted in the preparation of 10-Q and 10-K filings, significantly enhancing filing accuracy and speeding up the filing process by 15%.

- •Developed financial models to streamline analysis, boosting the accuracy of forecasting by 20% over the course of a year.

- •Collaborated with internal audit teams to improve control processes, resulting in zero repeat findings for over a year.

- •Reviewed and validated financial statements to ensure compliance with GAAP, reducing discrepancies by an estimated 25%.

- •Acted as primary liaison with external auditors, ensuring smooth operations during audits, which significantly decreased audit timelines.

- •Managed general ledger accounts with precision, reducing discrepancies and ensuring a 99% accuracy rate in financial statements.

- •Designed and implemented accounting procedures, improving processing times by 20% for financial reports.

- •Assisted in financial data analysis, which provided insights that led to a 10% improvement in budget allocations.

- •Identified trends from financial data that influenced a successful strategy, resulting in a 5% growth in financial performance.

- •Executed in-depth financial analyses, contributing to strategic decisions that increased departmental efficiency by 15%.

- •Coordinated with various departments to gather financial data, leading to more timely and accurate financial reporting.

- •Participated in financial audits, helping to complete them within planned timelines and enhancing trust with stakeholders.

- •Produced detailed reports based on collected data that informed budgeting decisions, improving allocation by 10%.

As a public accountant, your resume is like a financial statement—concise, clear, and meticulously detailed. You're adept at balancing numbers, preparing reports, and navigating complex regulations. Translating these skills onto a resume is crucial for standing out in your competitive field.

Crafting a resume tailored to public accounting requires extra attention. Within it, your expertise in audit management, tax compliance, and financial reporting needs to shine. Yet beyond that, your analytical prowess and attention to detail should also be evident, ensuring your resume doesn't become a mere list of numbers and jargon.

This is where starting with the right foundation can make all the difference. By using a resume template, you can effectively organize your skills and experience, crafting a document that is both logical and compelling.

Potential employers seek more than just qualifications; they want a clear picture of how you can contribute to their team. Whether managing complex audits or offering transparent financial advice, your resume should convey your value with purpose.

Ultimately, you're not just listing tasks; you're telling the story of your professional journey. This guide will help you present your skills and achievements clearly, ensuring your resume is as precise and impactful as the reports you prepare. Let’s dive in!

Key Takeaways

- Craft a resume that highlights your financial acumen, attention to detail, and ability to balance technical skills with communication strengths.

- Use a clear, structured format featuring contact information, a professional summary, work experience, education, certifications, and a skills section.

- Choose a chronological resume format to present a clear career progression and ensure that your resume is ATS-friendly.

- Emphasize quantifiable achievements in your experience section, using action-oriented language and specific examples to validate your skills.

- Include additional sections like language proficiency, hobbies, volunteer work, and continued learning to provide a holistic view of your professional qualifications.

What to focus on when writing your public accountant resume

How to write a public accountant resume involves capturing your financial acumen and commitment to accuracy. Each section of your resume should reflect this expertise and provide a comprehensive picture of your capabilities. Begin by emphasizing your qualification to manage financial reports effectively and ensure compliance through auditing processes. Highlight your ability to communicate clearly with clients and demonstrate unwavering attention to detail throughout.

How to structure your public accountant resume

- Contact Information: This is a crucial starting point on your resume—it should be straightforward and professional. Ensure your full name, a professional email address, and a contact number are easily visible. Including a LinkedIn profile link can provide recruiters with a more detailed view of your professional background and network, adding credibility to your application.

- Professional Summary: This section should succinctly encapsulate your career highlights and key competencies—it’s your initial chance to leave a strong impression. Tailor it to reflect your core strengths, such as mastery of GAAP, proficiency in tax preparation, and effectiveness in audits. Demonstrating an ability to drive financial accuracy positions you as a valuable asset in the accounting industry.

- Work Experience: In this section, detail specific roles and responsibilities to convey your professional journey. Focus on quantifiable achievements that show your ability to boost financial accuracy and efficiency, such as overseeing successful audits or implementing process improvements. By showcasing your contributions to past employers, you pave the way for future success.

- Education: Highlight your academic background by listing your accounting degree(s) and relevant coursework. This section not only validates your expertise but also shows your commitment to keeping abreast of industry developments. Any additional achievements or honors can further bolster your profile.

- Certifications and Licenses: Having recognized certifications, such as a CPA, is critical in public accounting and can set you apart from other candidates. Including these credentials emphasizes your dedication to the field and your readiness to handle complex accounting tasks.

- Technical Skills: The ability to adeptly use accounting software like QuickBooks or SAP is a key component of success in public accounting. This section should clearly outline these competencies and demonstrate your fluency with specialized financial analysis tools, which are crucial for modern accounting challenges.

Each of these sections plays a pivotal role in structuring your public accountant resume. Together, they form a comprehensive picture of your professional qualifications and readiness for the role. Up next, we'll dive deeper into these sections and explore how to format them effectively for an ATS-friendly resume.

Which resume format to choose

As a public accountant, selecting the right resume format is crucial for making a strong impression, and the chronological format often works best. This format highlights your work history in a clear and organized manner, offering potential employers a straightforward view of your career path and achievements. It allows you to clearly showcase your progression in roles, showcasing your commitment and reliability—key traits for accountants.

When it comes to choosing the right font, look for one that is modern yet professional. Fonts like Rubik, Montserrat, or Lato provide a sleek appearance that enhances readability without overwhelming the page. These fonts strike the right balance between style and substance, keeping your resume visually appealing while maintaining focus on the content.

Maintaining a polished presentation is essential, so always save and send your resume as a PDF. This file type guarantees that your carefully chosen format and fonts remain intact across various devices and platforms. As a public accountant, attention to detail is part of your skill set, and a well-presented PDF resume reflects that precision.

Setting your document with one-inch margins on all sides ensures a tidy and well-organized layout, which makes your resume easy to read. Adequate white space helps emphasize the key details without clutter, aiding the reader in processing the information efficiently. This organization mirrors the careful detail-oriented nature that is required in accounting.

By harmonizing these elements—format, font, file type, and margins—you present a resume that effectively communicates your expertise and dedication in the field of public accounting.

How to write a quantifiable resume experience section

The experience section in your public accountant resume is key to highlighting your abilities and accomplishments effectively. Start by focusing on quantifiable successes that align with the job you're eyeing. Arrange your experiences in reverse chronological order, ensuring the latest roles come first. Typically, your work history should cover the last 10 to 15 years unless you have older experiences that are particularly relevant. Use clear job titles that reflect your career growth, making it easy for employers to see your progression. Tailor your resume to match the job ad by using similar action-oriented language, which helps emphasize your achievements. Verbs like "managed," "analyzed," "developed," and "improved" can make your accomplishments pop and resonate with employers.

Here's an effective example of a public accountant's experience section:

- •Managed over 30 client portfolios, driving a 15% annual revenue increase.

- •Developed a new financial reporting system, cutting reporting time by 20%.

- •Led a team to complete external audits, achieving a 10% cost reduction.

- •Conducted comprehensive tax analysis, saving clients an average of $50K each year.

This experience section flows smoothly by connecting each component to the key responsibilities of a public accountant. Tailoring the content to highlight your skills ensures each achievement is directly tied to what employers need. Using action verbs like "managed," "developed," and "led" provides a natural transition into your accomplishments, quickly showcasing your ability to lead and innovate. Each bullet point weaves into the narrative of success by detailing quantifiable outcomes such as increasing revenue and saving costs, offering a cohesive and compelling snapshot of your contributions. By including specific figures and percentages, your achievements gain credibility and align seamlessly with employer expectations, making your resume both engaging and relevant.

Project-Focused resume experience section

A project-focused public accountant resume experience section should clearly showcase your achievements and highlight your expertise. Start by identifying the specific project or type of work you want to feature, such as auditing or risk assessment. Then, create a cohesive narrative that demonstrates your problem-solving skills and financial acumen, using action verbs to describe your contributions and the impact you've made. Tailor the details to reflect what a potential employer would find valuable, with an emphasis on leadership and teamwork skills.

When crafting the bullet points, focus on the tasks you performed and the results you achieved. Highlight accomplishments that had a quantifiable impact on the client or organization, keeping each point concise but informative. Demonstrate your grasp of accounting principles and project management, ensuring that every element aligns with what a prospective employer expects. Use language that highlights your strengths and results, creating a seamless flow that ties your experiences together.

Senior Public Accountant

XYZ Financial Solutions

June 2020 - Present

- Led a team of 5 in auditing the financial statements of a major client, reducing discrepancies by 30%.

- Implemented new spreadsheet tracking techniques that boosted productivity by 15%.

- Collaborated with cross-functional teams to develop a comprehensive risk assessment methodology.

- Streamlined the reporting process, improving delivery times for audit reports by 20%.

Problem-Solving Focused resume experience section

A problem-solving-focused public accountant resume experience section should clearly showcase your ability to analyze financial data and implement effective solutions. Start each entry by listing your employment dates, followed by your job title and the company's name. Use bullet points to weave a narrative that describes the challenges you tackled, the actions you took, and the outcomes you achieved. This approach helps demonstrate how you've played a crucial role in driving organizational improvement. By incorporating specific metrics, you provide employers with a clear understanding of your impact.

In your bullet points, illustrate your capacity to resolve financial challenges and enhance processes. Highlight specific instances, such as identifying accounting errors, developing tax-saving strategies, and improving process efficiency. By maintaining clarity and conciseness, and ensuring each point covers a unique skill, you paint a comprehensive picture of your ability to handle diverse accounting challenges effectively.

Senior Public Accountant

XYZ Accounting Firm

June 2018 - September 2022

- Identified and corrected a $30,000 accounting error, ensuring accurate financial reporting and informed decision-making.

- Devised strategies that reduced tax liabilities by 15%, showcasing creative and strategic financial planning.

- Enhanced payroll efficiency by streamlining processes, cutting processing time by 40% and minimizing errors.

- Collaborated effectively with teams to develop a budgeting system, significantly improving cost forecasting accuracy by 25%.

Achievement-Focused resume experience section

A public accountant-focused resume experience section should highlight your most significant accomplishments and responsibilities, demonstrating your impact in previous roles. Begin by listing the job title, workplace, and dates of employment clearly. As you craft the bullet points, make sure to emphasize achievements using numbers or percentages, providing a vivid picture of your contributions. This comprehensive approach ensures that your skills and dedication come across effectively.

Move beyond listing duties by focusing on the results you achieved. Use strong action verbs to provide depth to your accomplishments. Instead of simply stating involvement in "financial reporting," illustrate how you "cut monthly reporting errors by 15% with improved processes." By emphasizing how you saved money, increased efficiency, or enhanced client satisfaction, you create a compelling narrative that distinguishes you from other candidates.

Senior Public Accountant

Bright Financial Solutions

March 2019 - Present

- Reduced monthly financial reporting errors by 15% by introducing a thorough triple-check system.

- Boosted team productivity by 20% after implementing a new accounting software.

- Secured $500,000 in tax savings for clients through the identification and use of underutilized tax credits.

- Streamlined audit preparation processes, cutting preparation time by 30% and lifting client satisfaction scores.

Training and Development Focused resume experience section

A Training and Development-focused public accountant resume experience section should start by showcasing your successes in nurturing skills and fostering professional growth. Emphasizing your ability to train others, lead initiatives, and optimize processes will highlight your role in enhancing team capabilities. Demonstrating your accomplishments through specific examples proves your ability to contribute to the development of others. Including metrics or numbers will help illustrate the tangible impact you have made.

Organizing your achievements using bullet points ensures clarity and brevity while focusing on distinct responsibilities related to training and development. By using simple language and starting each point with action verbs like "led," "developed," or "implemented," you create a clear picture of your capabilities. Tailoring the content to emphasize experiences and skills directly tied to public accounting will make your resume stand out.

Senior Public Accountant

XYZ Accounting Firm

January 2020 - Present

- Led a team of 5 in designing a training program that improved audit efficiency by 20%.

- Developed interactive workshops to enhance team understanding of new accounting software.

- Implemented a mentorship program that increased staff retention by 15% over two years.

- Created training materials that simplified complex concepts for easier employee comprehension.

Write your public accountant resume summary section

A public accountant-focused resume summary should effectively highlight your unique skills and achievements. Begin by stating your years of experience, the specialized skills you offer, and any relevant certifications you hold. This section serves as a snapshot that quickly conveys why you are an exceptional candidate. Your goal is to show how your expertise can meet the company's needs. Consider this example:

This example blends your experience, skills, and certifications into a compelling narrative using strong action words that project confidence and capability. Such a summary grabs attention by quickly showcasing your top qualifications. Differentiating between resume sections is also essential—while a summary spotlights qualifications, a resume objective centers on career aspirations, typically suiting those new to the field. A resume profile offers a more rounded view, including personality traits alongside skills and experiences. Meanwhile, a summary of qualifications features specific achievements in bullet points, ideal for highlighting expertise. Understanding these formats allows you to tailor your resume effectively to your career goals, ensuring it resonates with potential employers.

Listing your public accountant skills on your resume

A skills-focused public accountant resume should clearly highlight your strengths across both soft and hard skills. Your skills can stand alone or seamlessly integrate into your experience and summary sections, creating a cohesive narrative. When we mention strengths, we often mean soft skills like communication and teamwork, which complement your technical abilities. In contrast, hard skills are specific, measurable abilities such as financial analysis or expertise in accounting software.

These skills do more than fill out your resume—they act as essential keywords that make your qualifications easily discoverable by potential employers. Thoughtfully selected keywords ensure that your resume stands out to both automated systems and hiring managers, enhancing your chances of landing an interview.

For example, a standalone skills section for public accountants might look like this:

This section is effective because it concisely highlights capabilities essential to public accounting. Each skill is crucial, indicating that you can manage both routine and complex tasks. The use of specific skills as keywords ensures your resume is both comprehensive and easy to navigate, making it more attractive to recruiters looking for particular competencies.

Best hard skills to feature on your public accountant resume

Hard skills are the practical, measurable abilities that demonstrate your technical expertise in accounting. They prove you can handle the detailed aspects of accounting, from analysis to compliance. These skills communicate your reliability in accuracy and adherence to standards. Consider including these hard skills:

Hard Skills

- Financial Analysis

- Auditing Procedures

- Tax Preparation

- Budget Management

- Proficiency in QuickBooks

- General Ledger Accounting

- Account Reconciliation

- Spreadsheet Software Expertise (e.g., Excel)

- Financial Reporting

- Regulatory Compliance Knowledge

- Cost Accounting

- Data Analysis

- Variance Analysis

- Risk Management

- Financial Modeling

Best soft skills to feature on your public accountant resume

Soft skills are equally important, illustrating your ability to collaborate and manage various situations effectively. They show your aptitude for teamwork, problem-solving, and adaptability. Featuring the right soft skills can communicate your strengths as a well-rounded professional. Consider these soft skills:

Soft Skills

- Attention to Detail

- Strong Communication

- Problem Solving

- Time Management

- Adaptability

- Critical Thinking

- Teamwork

- Client Relationship Management

- Leadership

- Negotiation

- Organizational Skills

- Decision-Making

- Multitasking

- Initiative

- Stress Management

How to include your education on your resume

The education section of your resume is more than just a list of degrees; it's a critical part that showcases your qualifications as a public accountant. Tailoring it to the job you're applying for is essential. If you have any credentials that do not relate to accounting, leave them out. When listing your degree, start with your highest education level. Include your GPA only if it's impressive or required, and note if you graduated with honors like cum laude. Use a clear and structured format to ensure that hiring managers see the relevance of your education quickly.

Including a GPA can be beneficial, particularly if it's above 3.5. Mention honors such as cum laude right after your degree title to highlight your achievements. Let’s look at some examples:

The second example is effective because it lists a relevant degree, making your fit for a public accountant role obvious. The GPA of 3.8 and cum laude distinction highlight your academic excellence. This structured approach helps potential employers quickly understand your training and qualifications.

How to include public accountant certificates on your resume

The certificates section is a crucial part of your public accountant resume. Keeping it well-organized helps demonstrate your professional development and expertise.

Start by listing the name of each certification you hold. Include the date you obtained the certification and add the issuing organization for each. You can position this section prominently within your resume or include it in the header for immediate visibility. For example, you could display "Certified Public Accountant (CPA)" in the header to quickly catch the employer's eye.

This example is excellent because it includes certifications relevant to the field of accounting, such as CPA, CFA, and CMA. Each certification is clearly labeled with its issuing organization, making it easy for employers to verify your qualifications. This approach effectively highlights your expertise and dedication to continuing education in your profession.

Extra sections to include in your public accountant resume

When crafting a stellar public accountant resume, including various sections can paint a vivid picture of your skills and personality. These additional sections go beyond standard information and offer insights into your versatility and unique interests.

- Language section — Demonstrate your ability to work in diverse environments by listing additional languages you speak fluently. This can offer an edge in roles requiring bilingual or multilingual communication.

- Hobbies and interests section — Add a personal touch to your resume, showcasing what you are passionate about outside of work. This gives potential employers a well-rounded view of your personality and can help in team settings.

- Volunteer work section — Highlight your community engagement and willingness to contribute beyond professional duties. Volunteer experience often reflects strong leadership and collaboration skills, valuable in a public accountant role.

- Books section — Show your commitment to continuous learning by listing any relevant accounting or business books you’ve read. This indicates that you are proactive in keeping up with industry trends and practices.

Incorporating these sections can make your resume more appealing and set you apart from other candidates. They offer potential employers a glimpse into your broader capabilities and interests, which is essential for a holistic view of your candidacy.

In Conclusion

In conclusion, crafting a public accountant resume is both an art and a science, requiring strategic organization and an emphasis on relevant skills and accomplishments. By tailoring your resume to highlight key qualifications like audit management, tax compliance, and attention to detail, you create an impactful narrative that engages potential employers. Structuring your resume with clear sections on contact information, work experience, education, technical skills, and certifications increases the clarity and professionalism of your application. Selecting a chronological format and using a modern, professional font ensures your document is easy to read and visually appealing. Remember to include quantifiable achievements in your experience section, painting a vivid picture of your career successes. As you emphasize both your hard and soft skills, you show a balanced portrait of your abilities and personal attributes. Consider adding extra sections like languages, volunteer work, or hobbies to provide a holistic view of your capabilities and interests. Such additions can set you apart and present you as a well-rounded candidate. Whether you're a seasoned accountant or new to the field, your well-crafted resume is key to opening doors and securing interviews. Keep refining and updating your resume to adapt to emerging trends and new opportunities in public accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.