QA Banking Resume Examples

Jul 18, 2024

|

12 min read

Master your QA banking resume with tips that help you "check" all the right boxes. Learn how to highlight your skills, experience, and key accomplishments to catch a recruiter's eye and secure your dream job.

Rated by 348 people

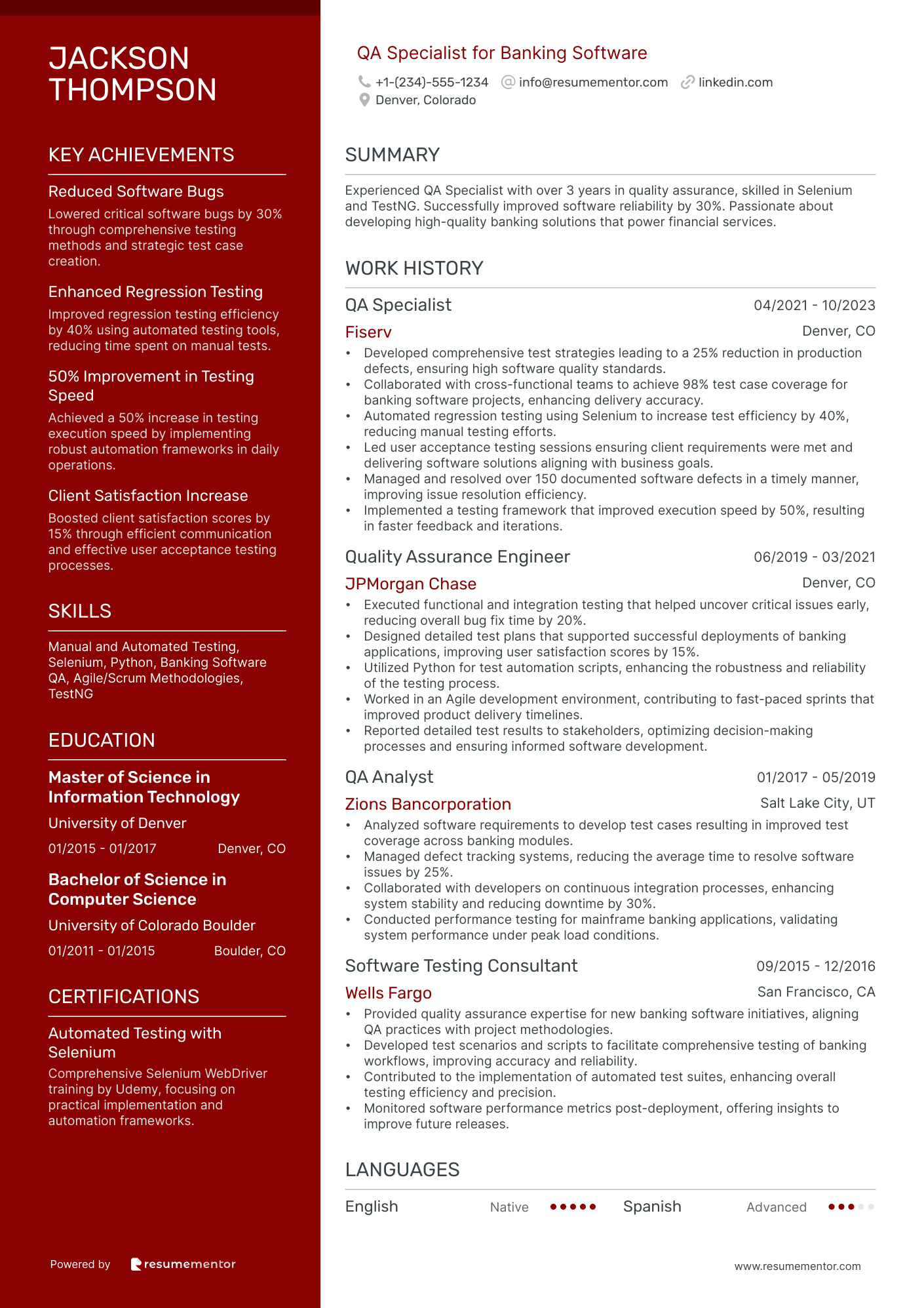

QA Specialist for Banking Software

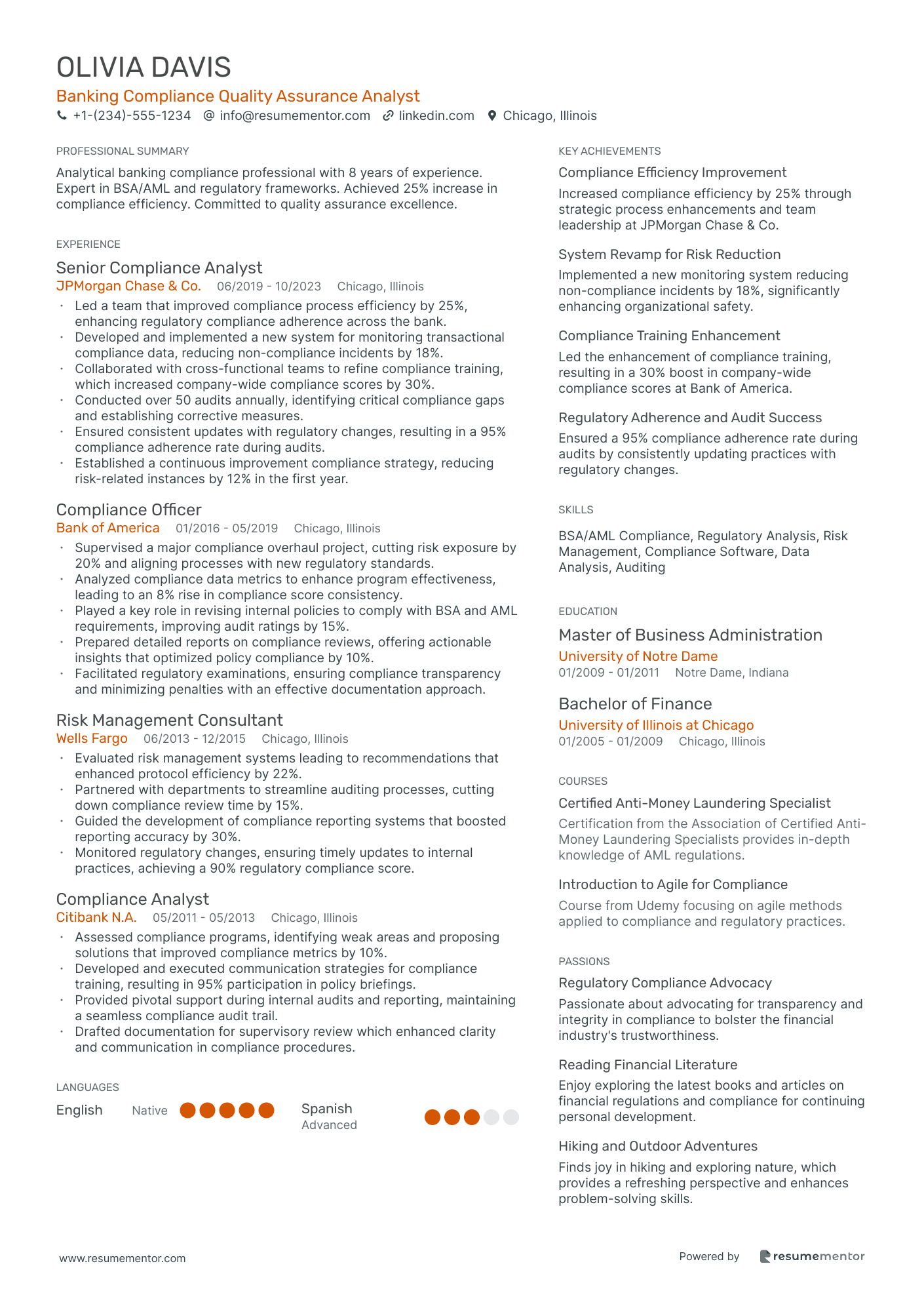

Banking Compliance Quality Assurance Analyst

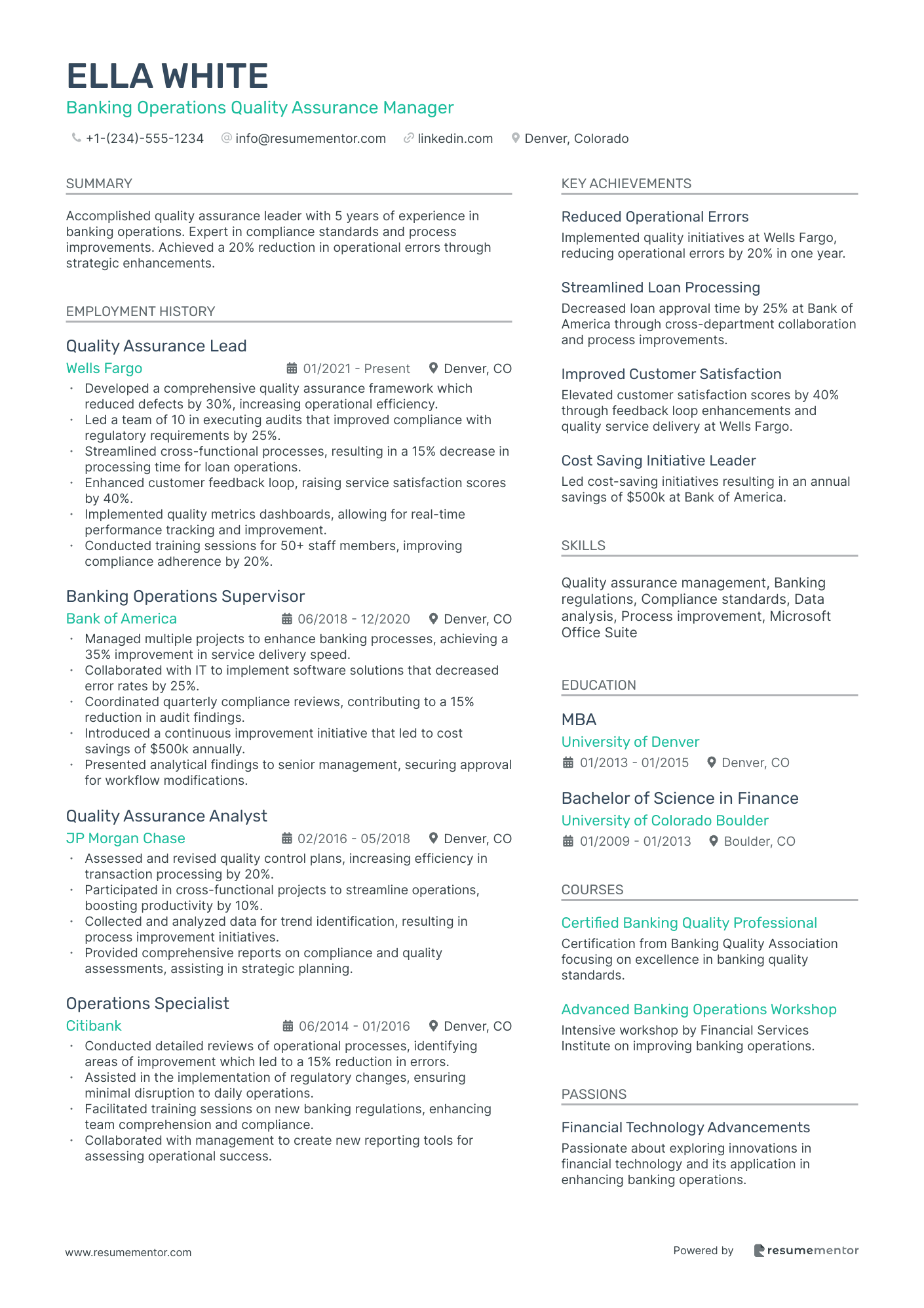

Banking Operations Quality Assurance Manager

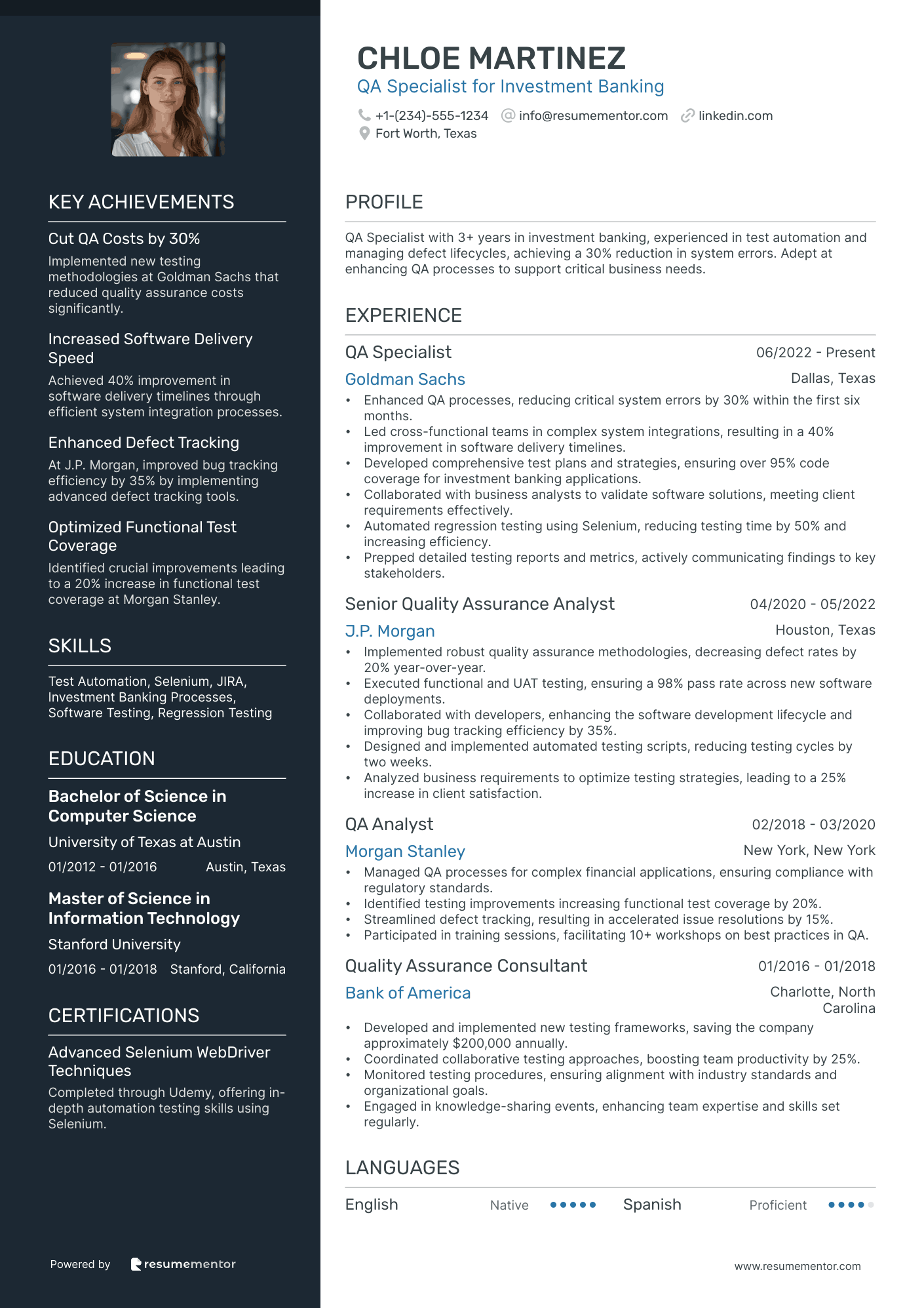

QA Specialist for Investment Banking

QA Tester for Mobile Banking Applications

Card Payment Quality Assurance Analyst

Quality Assurance Specialist for Financial Systems

Mortgage Banking Quality Assurance Analyst

Quality Assurance Engineer for Digital Banking

Regulatory Compliance QA Officer in Banking

QA Specialist for Banking Software resume sample

When applying for a QA Specialist position in banking software, it’s important to highlight your experience with software testing and quality assurance methodologies. Mention any familiarity with banking regulations or financial compliance standards, as these are crucial in this sector. Showcase relevant tools or technologies you have used, like automated testing frameworks or bug tracking software. Lastly, illustrate how your attention to detail and problem-solving skills led to improved software quality or reduced bug rates in previous projects, emphasizing the direct impact on customer satisfaction and business outcomes.

- •Developed comprehensive test strategies leading to a 25% reduction in production defects, ensuring high software quality standards.

- •Collaborated with cross-functional teams to achieve 98% test case coverage for banking software projects, enhancing delivery accuracy.

- •Automated regression testing using Selenium to increase test efficiency by 40%, reducing manual testing efforts.

- •Led user acceptance testing sessions ensuring client requirements were met and delivering software solutions aligning with business goals.

- •Managed and resolved over 150 documented software defects in a timely manner, improving issue resolution efficiency.

- •Implemented a testing framework that improved execution speed by 50%, resulting in faster feedback and iterations.

- •Executed functional and integration testing that helped uncover critical issues early, reducing overall bug fix time by 20%.

- •Designed detailed test plans that supported successful deployments of banking applications, improving user satisfaction scores by 15%.

- •Utilized Python for test automation scripts, enhancing the robustness and reliability of the testing process.

- •Worked in an Agile development environment, contributing to fast-paced sprints that improved product delivery timelines.

- •Reported detailed test results to stakeholders, optimizing decision-making processes and ensuring informed software development.

- •Analyzed software requirements to develop test cases resulting in improved test coverage across banking modules.

- •Managed defect tracking systems, reducing the average time to resolve software issues by 25%.

- •Collaborated with developers on continuous integration processes, enhancing system stability and reducing downtime by 30%.

- •Conducted performance testing for mainframe banking applications, validating system performance under peak load conditions.

- •Provided quality assurance expertise for new banking software initiatives, aligning QA practices with project methodologies.

- •Developed test scenarios and scripts to facilitate comprehensive testing of banking workflows, improving accuracy and reliability.

- •Contributed to the implementation of automated test suites, enhancing overall testing efficiency and precision.

- •Monitored software performance metrics post-deployment, offering insights to improve future releases.

Banking Compliance Quality Assurance Analyst resume sample

When applying for this role, it’s important to showcase your understanding of regulatory frameworks like AML and KYC. Highlight any previous experience in auditing or compliance processes. If you've completed relevant training or certifications, such as 'Certified Compliance and Ethics Professional', mention these to demonstrate your commitment. Use specific examples of how your analytical skills have identified compliance issues or streamlined processes, following a 'challenge-action-result' format. Emphasize your attention to detail and how it has protected previous employers from potential risks.

- •Led a team that improved compliance process efficiency by 25%, enhancing regulatory compliance adherence across the bank.

- •Developed and implemented a new system for monitoring transactional compliance data, reducing non-compliance incidents by 18%.

- •Collaborated with cross-functional teams to refine compliance training, which increased company-wide compliance scores by 30%.

- •Conducted over 50 audits annually, identifying critical compliance gaps and establishing corrective measures.

- •Ensured consistent updates with regulatory changes, resulting in a 95% compliance adherence rate during audits.

- •Established a continuous improvement compliance strategy, reducing risk-related instances by 12% in the first year.

- •Supervised a major compliance overhaul project, cutting risk exposure by 20% and aligning processes with new regulatory standards.

- •Analyzed compliance data metrics to enhance program effectiveness, leading to an 8% rise in compliance score consistency.

- •Played a key role in revising internal policies to comply with BSA and AML requirements, improving audit ratings by 15%.

- •Prepared detailed reports on compliance reviews, offering actionable insights that optimized policy compliance by 10%.

- •Facilitated regulatory examinations, ensuring compliance transparency and minimizing penalties with an effective documentation approach.

- •Evaluated risk management systems leading to recommendations that enhanced protocol efficiency by 22%.

- •Partnered with departments to streamline auditing processes, cutting down compliance review time by 15%.

- •Guided the development of compliance reporting systems that boosted reporting accuracy by 30%.

- •Monitored regulatory changes, ensuring timely updates to internal practices, achieving a 90% regulatory compliance score.

- •Assessed compliance programs, identifying weak areas and proposing solutions that improved compliance metrics by 10%.

- •Developed and executed communication strategies for compliance training, resulting in 95% participation in policy briefings.

- •Provided pivotal support during internal audits and reporting, maintaining a seamless compliance audit trail.

- •Drafted documentation for supervisory review which enhanced clarity and communication in compliance procedures.

Banking Operations Quality Assurance Manager resume sample

When applying for this position, it's important to showcase your experience in process improvement and operational efficiency. Highlight any familiarity with compliance regulations and how you've ensured adherence in previous roles. If you've led teams or trained staff, emphasize these leadership experiences. Mention specific projects where you identified quality issues and implemented solutions that improved performance metrics. Use quantitative results to demonstrate impact, such as reducing errors by a certain percentage or increasing customer satisfaction scores. Clear examples of these contributions will strengthen your application.

- •Developed a comprehensive quality assurance framework which reduced defects by 30%, increasing operational efficiency.

- •Led a team of 10 in executing audits that improved compliance with regulatory requirements by 25%.

- •Streamlined cross-functional processes, resulting in a 15% decrease in processing time for loan operations.

- •Enhanced customer feedback loop, raising service satisfaction scores by 40%.

- •Implemented quality metrics dashboards, allowing for real-time performance tracking and improvement.

- •Conducted training sessions for 50+ staff members, improving compliance adherence by 20%.

- •Managed multiple projects to enhance banking processes, achieving a 35% improvement in service delivery speed.

- •Collaborated with IT to implement software solutions that decreased error rates by 25%.

- •Coordinated quarterly compliance reviews, contributing to a 15% reduction in audit findings.

- •Introduced a continuous improvement initiative that led to cost savings of $500k annually.

- •Presented analytical findings to senior management, securing approval for workflow modifications.

- •Assessed and revised quality control plans, increasing efficiency in transaction processing by 20%.

- •Participated in cross-functional projects to streamline operations, boosting productivity by 10%.

- •Collected and analyzed data for trend identification, resulting in process improvement initiatives.

- •Provided comprehensive reports on compliance and quality assessments, assisting in strategic planning.

- •Conducted detailed reviews of operational processes, identifying areas of improvement which led to a 15% reduction in errors.

- •Assisted in the implementation of regulatory changes, ensuring minimal disruption to daily operations.

- •Facilitated training sessions on new banking regulations, enhancing team comprehension and compliance.

- •Collaborated with management to create new reporting tools for assessing operational success.

QA Specialist for Investment Banking resume sample

Highlight your technical skills in financial software and data analysis to strengthen your application. Mention any experience with regulatory compliance and risk management, as these are critical in the banking sector. If you've completed any certifications such as 'Financial Analysis' or 'Investment Strategies', make sure to include them. Provide concrete examples of how your analytical skills have led to better outcomes or streamlined processes in past roles, using a 'skill-action-result' format to clearly demonstrate your impact.

- •Enhanced QA processes, reducing critical system errors by 30% within the first six months.

- •Led cross-functional teams in complex system integrations, resulting in a 40% improvement in software delivery timelines.

- •Developed comprehensive test plans and strategies, ensuring over 95% code coverage for investment banking applications.

- •Collaborated with business analysts to validate software solutions, meeting client requirements effectively.

- •Automated regression testing using Selenium, reducing testing time by 50% and increasing efficiency.

- •Prepped detailed testing reports and metrics, actively communicating findings to key stakeholders.

- •Implemented robust quality assurance methodologies, decreasing defect rates by 20% year-over-year.

- •Executed functional and UAT testing, ensuring a 98% pass rate across new software deployments.

- •Collaborated with developers, enhancing the software development lifecycle and improving bug tracking efficiency by 35%.

- •Designed and implemented automated testing scripts, reducing testing cycles by two weeks.

- •Analyzed business requirements to optimize testing strategies, leading to a 25% increase in client satisfaction.

- •Managed QA processes for complex financial applications, ensuring compliance with regulatory standards.

- •Identified testing improvements increasing functional test coverage by 20%.

- •Streamlined defect tracking, resulting in accelerated issue resolutions by 15%.

- •Participated in training sessions, facilitating 10+ workshops on best practices in QA.

- •Developed and implemented new testing frameworks, saving the company approximately $200,000 annually.

- •Coordinated collaborative testing approaches, boosting team productivity by 25%.

- •Monitored testing procedures, ensuring alignment with industry standards and organizational goals.

- •Engaged in knowledge-sharing events, enhancing team expertise and skills set regularly.

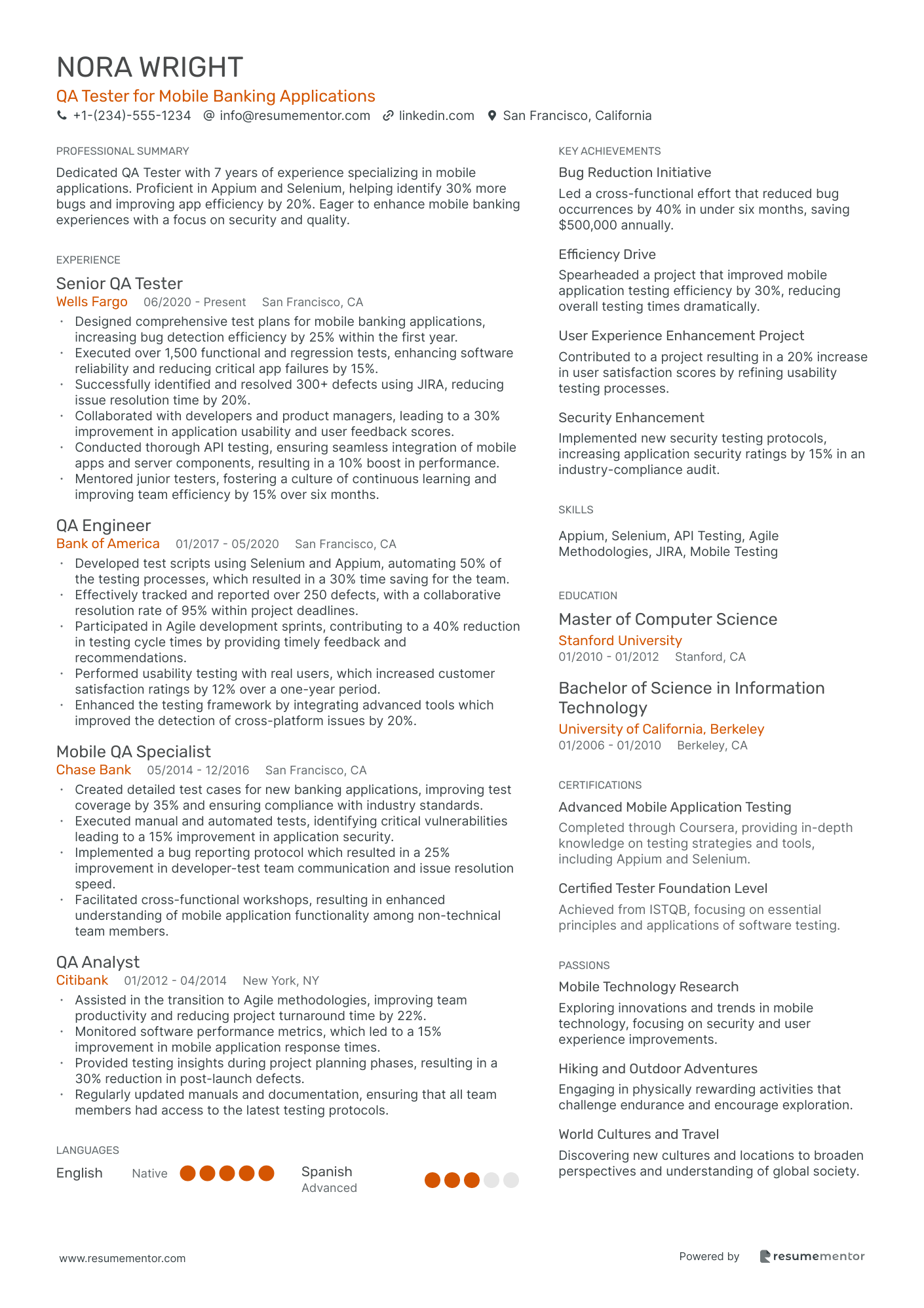

QA Tester for Mobile Banking Applications resume sample

When applying for this role, it's essential to highlight any experience with mobile application testing or quality assurance. Discuss your familiarity with testing tools such as Appium or Selenium, which can improve test efficiency. Mention your understanding of mobile banking regulations and security standards, as these are critical in this field. Use specific examples that showcase your ability to identify bugs and improve user experience, following a 'skill-action-result' format to illustrate the impact of your contributions on previous projects.

- •Designed comprehensive test plans for mobile banking applications, increasing bug detection efficiency by 25% within the first year.

- •Executed over 1,500 functional and regression tests, enhancing software reliability and reducing critical app failures by 15%.

- •Successfully identified and resolved 300+ defects using JIRA, reducing issue resolution time by 20%.

- •Collaborated with developers and product managers, leading to a 30% improvement in application usability and user feedback scores.

- •Conducted thorough API testing, ensuring seamless integration of mobile apps and server components, resulting in a 10% boost in performance.

- •Mentored junior testers, fostering a culture of continuous learning and improving team efficiency by 15% over six months.

- •Developed test scripts using Selenium and Appium, automating 50% of the testing processes, which resulted in a 30% time saving for the team.

- •Effectively tracked and reported over 250 defects, with a collaborative resolution rate of 95% within project deadlines.

- •Participated in Agile development sprints, contributing to a 40% reduction in testing cycle times by providing timely feedback and recommendations.

- •Performed usability testing with real users, which increased customer satisfaction ratings by 12% over a one-year period.

- •Enhanced the testing framework by integrating advanced tools which improved the detection of cross-platform issues by 20%.

- •Created detailed test cases for new banking applications, improving test coverage by 35% and ensuring compliance with industry standards.

- •Executed manual and automated tests, identifying critical vulnerabilities leading to a 15% improvement in application security.

- •Implemented a bug reporting protocol which resulted in a 25% improvement in developer-test team communication and issue resolution speed.

- •Facilitated cross-functional workshops, resulting in enhanced understanding of mobile application functionality among non-technical team members.

- •Assisted in the transition to Agile methodologies, improving team productivity and reducing project turnaround time by 22%.

- •Monitored software performance metrics, which led to a 15% improvement in mobile application response times.

- •Provided testing insights during project planning phases, resulting in a 30% reduction in post-launch defects.

- •Regularly updated manuals and documentation, ensuring that all team members had access to the latest testing protocols.

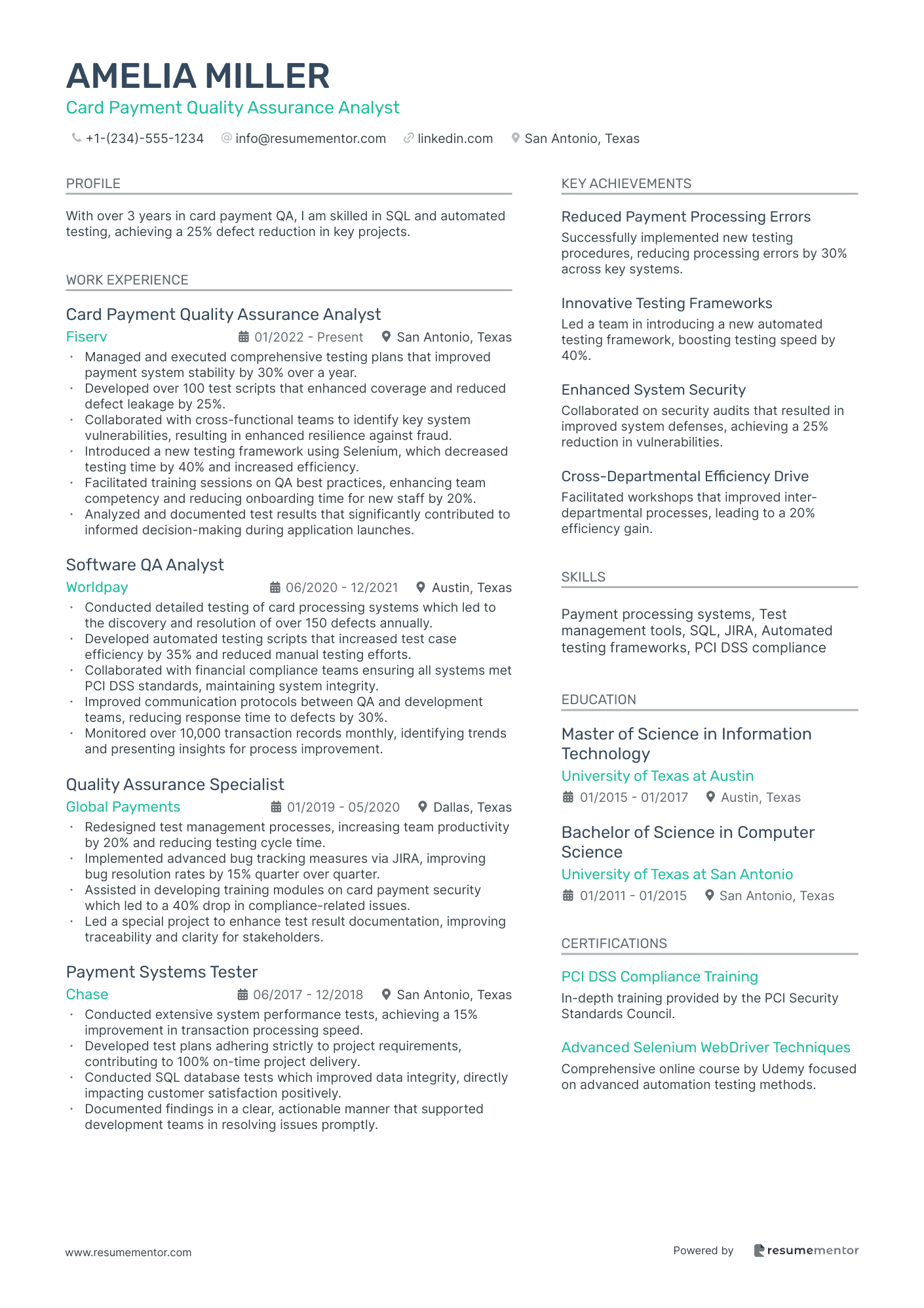

Card Payment Quality Assurance Analyst resume sample

When applying for this position, it's important to showcase any experience in payment processing or financial systems. Highlight your attention to detail and analytical skills, as these are critical for identifying discrepancies. If you possess relevant certifications, such as 'Certified Quality Auditor' or 'Payment Card Industry Data Security Standard (PCI DSS)', be sure to include them. Use specific examples to demonstrate how you've improved processes or reduced errors, following a 'challenge-action-outcome' framework. Your ability to work collaboratively will also set you apart from other candidates.

- •Managed and executed comprehensive testing plans that improved payment system stability by 30% over a year.

- •Developed over 100 test scripts that enhanced coverage and reduced defect leakage by 25%.

- •Collaborated with cross-functional teams to identify key system vulnerabilities, resulting in enhanced resilience against fraud.

- •Introduced a new testing framework using Selenium, which decreased testing time by 40% and increased efficiency.

- •Facilitated training sessions on QA best practices, enhancing team competency and reducing onboarding time for new staff by 20%.

- •Analyzed and documented test results that significantly contributed to informed decision-making during application launches.

- •Conducted detailed testing of card processing systems which led to the discovery and resolution of over 150 defects annually.

- •Developed automated testing scripts that increased test case efficiency by 35% and reduced manual testing efforts.

- •Collaborated with financial compliance teams ensuring all systems met PCI DSS standards, maintaining system integrity.

- •Improved communication protocols between QA and development teams, reducing response time to defects by 30%.

- •Monitored over 10,000 transaction records monthly, identifying trends and presenting insights for process improvement.

- •Redesigned test management processes, increasing team productivity by 20% and reducing testing cycle time.

- •Implemented advanced bug tracking measures via JIRA, improving bug resolution rates by 15% quarter over quarter.

- •Assisted in developing training modules on card payment security which led to a 40% drop in compliance-related issues.

- •Led a special project to enhance test result documentation, improving traceability and clarity for stakeholders.

- •Conducted extensive system performance tests, achieving a 15% improvement in transaction processing speed.

- •Developed test plans adhering strictly to project requirements, contributing to 100% on-time project delivery.

- •Conducted SQL database tests which improved data integrity, directly impacting customer satisfaction positively.

- •Documented findings in a clear, actionable manner that supported development teams in resolving issues promptly.

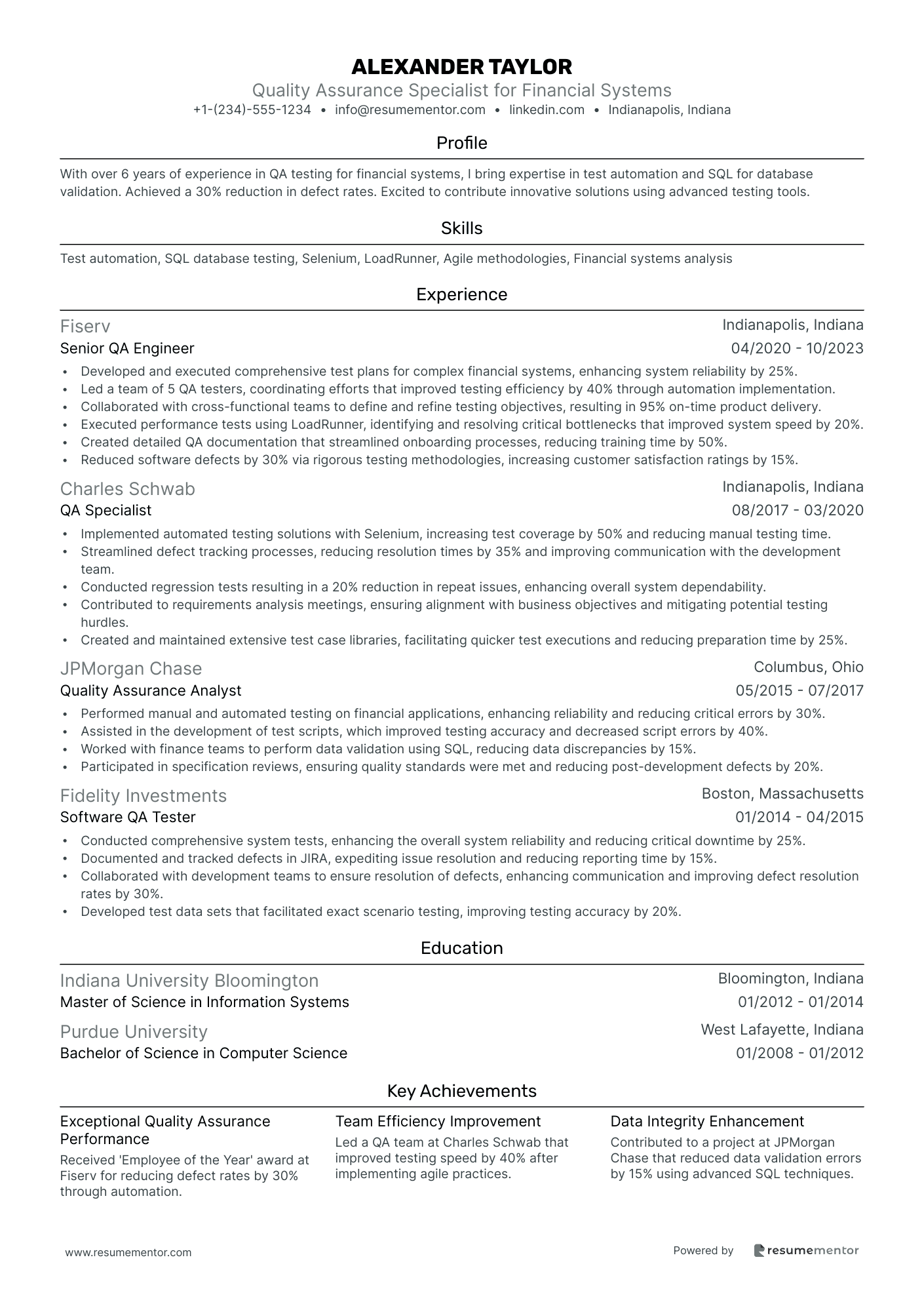

Quality Assurance Specialist for Financial Systems resume sample

When applying for this role, it's essential to showcase experience with financial software and testing methodologies. Highlight any relevant technical skills, such as familiarity with SQL or scripting languages. Mention certifications like 'Certified Software Tester' to demonstrate your commitment to the field. Include specific examples of how your testing ensured software quality and compliance with financial regulations. Use the 'skill-action-result' format to illustrate how your contributions prevented costly errors or improved system reliability, making your application stand out to hiring managers.

- •Developed and executed comprehensive test plans for complex financial systems, enhancing system reliability by 25%.

- •Led a team of 5 QA testers, coordinating efforts that improved testing efficiency by 40% through automation implementation.

- •Collaborated with cross-functional teams to define and refine testing objectives, resulting in 95% on-time product delivery.

- •Executed performance tests using LoadRunner, identifying and resolving critical bottlenecks that improved system speed by 20%.

- •Created detailed QA documentation that streamlined onboarding processes, reducing training time by 50%.

- •Reduced software defects by 30% via rigorous testing methodologies, increasing customer satisfaction ratings by 15%.

- •Implemented automated testing solutions with Selenium, increasing test coverage by 50% and reducing manual testing time.

- •Streamlined defect tracking processes, reducing resolution times by 35% and improving communication with the development team.

- •Conducted regression tests resulting in a 20% reduction in repeat issues, enhancing overall system dependability.

- •Contributed to requirements analysis meetings, ensuring alignment with business objectives and mitigating potential testing hurdles.

- •Created and maintained extensive test case libraries, facilitating quicker test executions and reducing preparation time by 25%.

- •Performed manual and automated testing on financial applications, enhancing reliability and reducing critical errors by 30%.

- •Assisted in the development of test scripts, which improved testing accuracy and decreased script errors by 40%.

- •Worked with finance teams to perform data validation using SQL, reducing data discrepancies by 15%.

- •Participated in specification reviews, ensuring quality standards were met and reducing post-development defects by 20%.

- •Conducted comprehensive system tests, enhancing the overall system reliability and reducing critical downtime by 25%.

- •Documented and tracked defects in JIRA, expediting issue resolution and reducing reporting time by 15%.

- •Collaborated with development teams to ensure resolution of defects, enhancing communication and improving defect resolution rates by 30%.

- •Developed test data sets that facilitated exact scenario testing, improving testing accuracy by 20%.

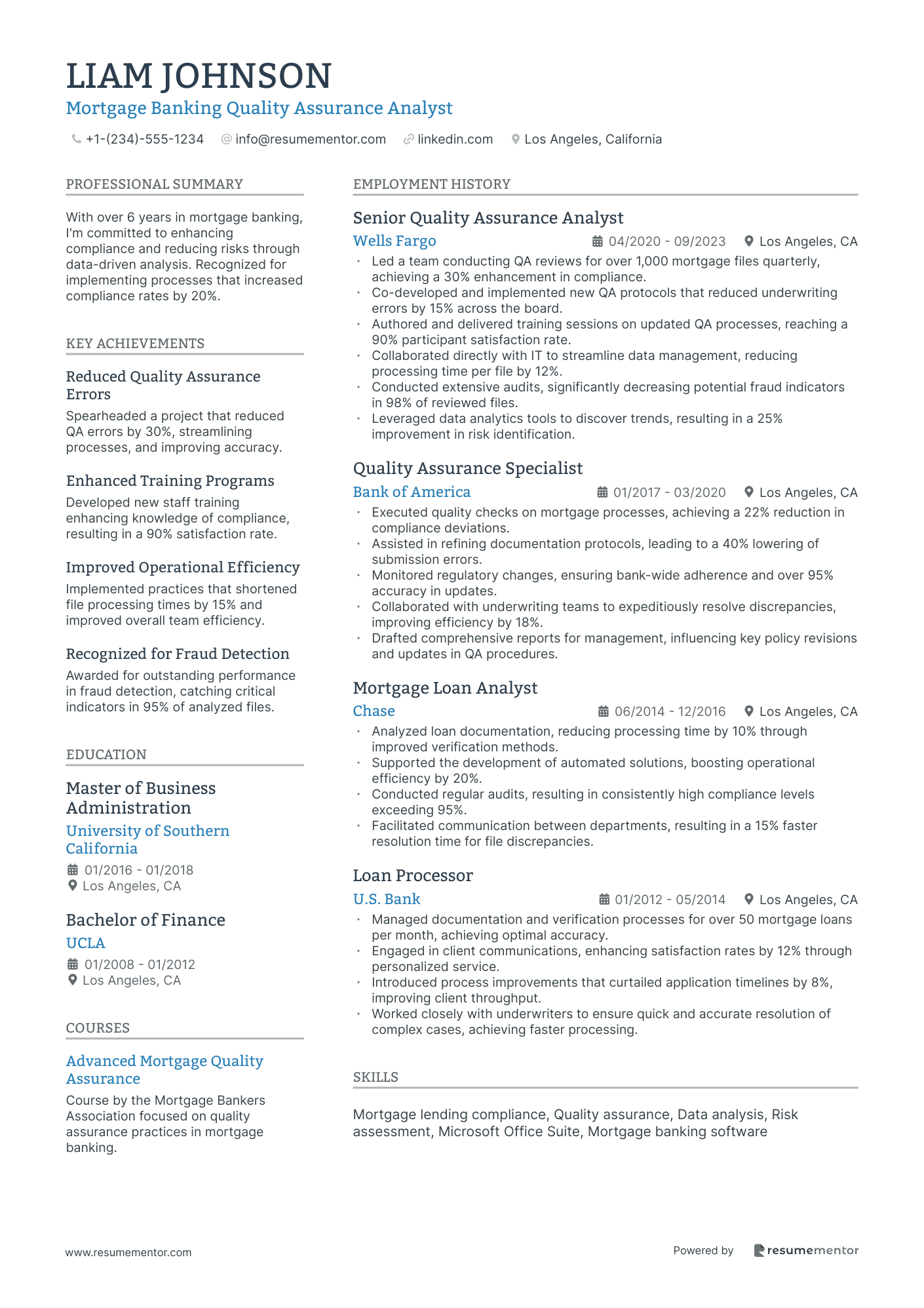

Mortgage Banking Quality Assurance Analyst resume sample

When applying for this role, it’s important to highlight any experience in mortgage processing or underwriting. Showcase strong analytical skills and attention to detail, as these are essential for quality assurance tasks. If you have completed any relevant courses or certifications, such as 'Mortgage Loan Originator Licensing,' be sure to mention them with specific dates. Include examples of how you have successfully identified issues or improved processes in prior positions. Use a 'skill-action-result' approach to demonstrate your impact effectively.

- •Led a team conducting QA reviews for over 1,000 mortgage files quarterly, achieving a 30% enhancement in compliance.

- •Co-developed and implemented new QA protocols that reduced underwriting errors by 15% across the board.

- •Authored and delivered training sessions on updated QA processes, reaching a 90% participant satisfaction rate.

- •Collaborated directly with IT to streamline data management, reducing processing time per file by 12%.

- •Conducted extensive audits, significantly decreasing potential fraud indicators in 98% of reviewed files.

- •Leveraged data analytics tools to discover trends, resulting in a 25% improvement in risk identification.

- •Executed quality checks on mortgage processes, achieving a 22% reduction in compliance deviations.

- •Assisted in refining documentation protocols, leading to a 40% lowering of submission errors.

- •Monitored regulatory changes, ensuring bank-wide adherence and over 95% accuracy in updates.

- •Collaborated with underwriting teams to expeditiously resolve discrepancies, improving efficiency by 18%.

- •Drafted comprehensive reports for management, influencing key policy revisions and updates in QA procedures.

- •Analyzed loan documentation, reducing processing time by 10% through improved verification methods.

- •Supported the development of automated solutions, boosting operational efficiency by 20%.

- •Conducted regular audits, resulting in consistently high compliance levels exceeding 95%.

- •Facilitated communication between departments, resulting in a 15% faster resolution time for file discrepancies.

- •Managed documentation and verification processes for over 50 mortgage loans per month, achieving optimal accuracy.

- •Engaged in client communications, enhancing satisfaction rates by 12% through personalized service.

- •Introduced process improvements that curtailed application timelines by 8%, improving client throughput.

- •Worked closely with underwriters to ensure quick and accurate resolution of complex cases, achieving faster processing.

Quality Assurance Engineer for Digital Banking resume sample

When applying for this role, emphasize any experience with automated testing tools like Selenium or JMeter. Highlight your knowledge of software development life cycles (SDLC) and Agile methodologies. Mention any certifications in quality assurance or software testing. Provide examples of how your testing strategies improved the software quality or reduced bugs in past projects. Use the 'skill-action-result' framework to show how your contributions led to a smoother workflow or enhanced user experience, which are critical in digital banking environments.

- •Collaborated with development teams to improve test coverage by 35%, enhancing overall software robustness.

- •Developed comprehensive test plans and scripts, resulting in a 25% reduction in customer-reported issues.

- •Enhanced automated testing frameworks using Selenium, leading to a 40% decrease in testing time.

- •Participated in design and code reviews, identifying potential quality issues and ensuring product excellence.

- •Streamlined defect documentation and tracking processes, reducing resolution times by 20%.

- •Conducted regression testing on key digital banking features, maintaining a 98% functionality success rate.

- •Automated end-to-end testing for mobile banking applications, boosting test efficiency by 30%.

- •Collaborated with cross-functional teams to implement agile methodologies, enhancing project delivery.

- •Utilized JUnit and Selenium to execute over 500 automated test cases, improving product reliability.

- •Identified and reported over 200 defects, contributing to a 15% increase in customer satisfaction.

- •Managed regression testing efforts for application updates, ensuring zero critical failures post-release.

- •Designed and executed test cases for banking software, improving quality benchmarks by 10%.

- •Achieved a 20% reduction in critical incidents by proactively identifying product defects.

- •Used Postman for API testing, ensuring data integrity and functionality across multiple platforms.

- •Streamlined communication with stakeholders, resulting in increased transparency in quality metrics.

- •Participated in quality assurance processes, achieving a 95% success rate on release testing.

- •Improved test design methodologies, contributing to ongoing enhancements in testing accuracy.

- •Assisted in maintaining automated testing scripts, supporting the QA team's efficiency.

Regulatory Compliance QA Officer in Banking resume sample

When crafting your cover letter, highlight your understanding of regulatory frameworks and any experience with compliance audits. Showcase proficiency in risk assessment and mitigation strategies. It's important to mention relevant certifications like 'Certified Regulatory Compliance Manager' or similar credentials. Use specific examples that illustrate how your actions corrected compliance issues and improved processes. Follow a 'skill-action-result' format to demonstrate how your work led to enhanced compliance and reduced risks for previous employers, showcasing your impact on operational integrity and overall performance.

- •Developed and maintained compliance monitoring programs, enhancing adherence to regulations by 30% within one year.

- •Led a team to conduct in-depth audits, uncovering risks and halving compliance violations across the organization.

- •Collaborated across departments to create a unified compliance strategy, streamlining operations and improving efficiency by 20%.

- •Provided comprehensive reports to management and regulators, resulting in improved regulatory relations and fewer inquiries.

- •Analyzed data trends, recommend improvements, and implemented best practices, leading to a 25% decrease in audit discrepancies.

- •Responded efficiently to regulatory inquiries and managed documentation for examinations, ensuring timely and accurate submissions.

- •Conducted comprehensive assessments on compliance protocols, identifying gaps that were subsequently reduced by 40%.

- •Implemented corrective action plans, addressing identified issues, resulting in increased compliance efficiency and reduced penalties.

- •Led internal compliance training initiatives, enhancing team knowledge and reducing errors by 15%.

- •Advised management on compliance strategies, fostering proactive issue resolution and stronger policy adherence.

- •Monitored changing regulations, ensuring that company policies remained compliant and adaptive to new requirements.

- •Assessed and improved compliance systems, leading to a 20% increase in reporting accuracy.

- •Collaborated closely with legal departments, ensuring synchronization between regulatory and internal policies.

- •Assisted in training sessions, disseminating compliance knowledge, and reducing the department's regulatory inquiries by half.

- •Facilitated effective communication on compliance updates, promoting rapid adjustment and adaptability within the team.

- •Analyzed risk data and trends, recommending proactive strategies to minimize banking operational risks by 15%.

- •Supported ongoing risk assessments, bolstering the organization's overall risk mitigation strategies.

- •Facilitated risk training sessions to staff, contributing to improved awareness and reduced internal incidents by 20%.

- •Developed risk management documentation, clarifying procedures and enhancing team compliance with industry standards.

As a QA professional in banking, you serve as the guardian of quality, ensuring that all systems operate smoothly and efficiently. Your resume acts as your calling card in this competitive field, showcasing your ability to maintain precision and reliability. Crafting a resume that truly represents your wide-ranging skills can feel like piecing together a complex puzzle, where every element needs to align to catch a recruiter's attention.

You may find it challenging to communicate your unique contributions effectively. The intricate nature of QA banking roles demands that you present your technical expertise in areas like test automation and risk management clearly and engagingly. This is where the use of a resume template can become invaluable, offering a structured framework that showcases your skills seamlessly.

A well-crafted template ensures you cover essential sections like education, experience, and certifications without hassle. By utilizing resume templates, you can focus on highlighting your achievements specifically while letting the layout take care of itself. This approach allows your resume to resonate with employers who value precision and technical proficiency.

Keep the focus on how you contribute as a vital team member, emphasizing the value you bring. With the right structure in place, you can present a strong, unified front and move closer to securing your next role. Dive in with confidence, allowing your resume to reflect the quality assurance expertise you embody.

Key Takeaways

- A QA banking resume should demonstrate technical expertise and precision in areas like test automation and risk management, using a structured template to enhance presentation.

- Resume structure is crucial, encompassing elements like contact information, professional summary, work experience, and education, all tailored to highlight relevant achievements.

- Utilizing a reverse-chronological format and modern fonts, maintaining a clean, consistent appearance is vital, with a PDF format ensuring layout integrity.

- Quantifiable achievements in the experience section, detailed technical, and soft skills are essential for illustrating proficiency in the competitive QA banking field.

- Including a targeted education section, certification acknowledgment, and optional personalized sections like languages or volunteer work can provide a comprehensive view of qualifications.

What to focus on when writing your QA banking resume

A QA banking resume should clearly show your strong analytical skills and attention to detail, especially in banking systems. Demonstrating your ability to ensure the quality and accuracy of financial services and products is essential. Highlighting your experience with testing methods, automation tools, and regulatory compliance will make you stand out to recruiters.

How to structure your QA banking resume

- Contact Information: Start with your full name, phone number, professional email, and LinkedIn profile to make sure you can be easily reached—think of this as the gateway to your professional persona. Ensure these details are up-to-date so recruiters can reach you without hassle. This section should be easy to find and immediately readable for maximum impact.

- Professional Summary: Craft a brief statement that captures your QA experience in the banking industry, mentioning key achievements or certifications that set you apart—this is your chance to make a strong first impression. It should encapsulate who you are professionally and what unique skills you bring to the table. Think of it as your elevator pitch condensed into a few impactful sentences.

- Work Experience: Next, list your relevant roles and describe your responsibilities. Focus particularly on QA tasks within banking, noting any improvements in testing processes or compliance you ensured—make sure to quantify achievements where possible. Using action verbs can illustrate your contributions dynamically, emphasizing how you’ve added value to past roles.

- Technical Skills: Then, detail your skills, such as familiarity with banking software, proficiency in testing tools like Selenium or QTP, and understanding of regulatory standards like SOX or Dodd-Frank—these specifics can set your resume apart from more generalized ones. Tailor your skills to match what’s in demand in the banking QA field, showing potential employers that you possess the exact skills they’re looking for.

- Education: Follow with your academic background, highlighting degrees in finance or computer science to show your foundational knowledge—education can serve as a solid base that bolsters your practical experience. Highlight any coursework relevant to QA and banking to further support your qualifications as a candidate.

- Certifications: If you have them, include certifications like ISTQB or specific banking QA credentials to demonstrate your expertise—these certifications underscore your dedication to the field. They show your commitment to staying current with industry standards and best practices, which can be a significant plus in the eyes of a recruiter.

Each section above offers a more in-depth view of what to include in your resume, ensuring it's detailed and aligned with the industry standards we'll cover in the following sections.

Which resume format to choose

When crafting a qa banking resume, focusing on key details like format and fonts is crucial for making a strong impression. Start with a reverse-chronological format, which is ideal for the banking sector because your latest experiences and skills are spotlighted, reflecting your current capabilities. In a field driven by accuracy and detail, having your most relevant experience visible first can significantly impact hiring decisions.

Choosing the right font can subtly influence how your resume is perceived. Opt for modern fonts such as Lato, Montserrat, or Raleway. These fonts provide a clean and polished look without overwhelming the reader, keeping your content the star of the show. The style and readability of these fonts align well with the professionalism expected in banking, ensuring your resume looks both fresh and competent.

Always save your resume as a PDF before sending it out. PDFs maintain your layout and formatting, unlike other file types that might skew your presentation when opened on different systems. This consistency is important, as it reflects the precision and attention to detail required in qa banking roles.

Finally, set your margins to one inch on all sides. This creates a balanced and neat appearance, allowing for adequate white space which improves readability. In a competitive field like banking, where clarity and organization are key, these elements come together to deliver a resume that is not only visually appealing but also effective in communicating your qualifications.

How to write a quantifiable resume experience section

When crafting your QA banking experience section, focus on highlighting measurable achievements that track your career progression and showcase your contributions. Start with your most recent job to provide potential employers a clear picture of your professional growth over the last 10-15 years. This continuous storyline will help emphasize the skills you've applied and the results you've achieved. By using job titles that illustrate your advancement within the QA field, coupled with tailored content that matches the job ad's keywords and skills, you create a cohesive narrative. Strong action verbs like "improved," "implemented," and "reduced" further strengthen this connection, showing the impact you've consistently had.

Here’s an example of an effective QA banking resume experience section in JSON format:

- •Implemented a new test automation framework that reduced regression testing time by 40%.

- •Collaborated with cross-functional teams to enhance application stability, resulting in a 30% decrease in customer complaints.

- •Developed and optimized QA processes that improved defect detection rates by 25% in the first year.

- •Mentored junior QA analysts, contributing to a skill upgrade across the team that led to a 15% increase in test coverage.

By using action-oriented language and quantifiable results, your experience section seamlessly ties together your roles and achievements. This example stands out by weaving specific achievements into a cohesive narrative of your impact in QA processes, reflecting your ability to drive improvements and achieve success in the banking industry. Illustrating your contributions in this manner shows potential employers the value you consistently bring, aligning your past efforts with the skills they seek. The metrics reinforce this narrative by providing concrete evidence of your success, helping employers understand the full extent of your contributions.

Efficiency-Focused resume experience section

A QA banking efficiency-focused resume experience section should start by highlighting roles where you've significantly driven improvements or cost reductions. Dive into your key contributions and the impactful results you delivered. Using strong action verbs will help convey how you streamlined processes for enhanced efficiency. Make your achievements stand out by quantifying them; numbers and percentages can provide a clear snapshot of the difference you made.

Maintaining clarity and directness is crucial. Avoid jargon that could muddy the reader's understanding. Instead, opt for terms that are well-known within the banking and QA sectors. If you employed specific technologies or methods to boost efficiency, make sure to include them. This approach not only showcases your practical skills but also underlines your commitment to improving workflows continuously.

QA Analyst

June 2020 - Present

- Redesigned the QA testing process, cutting review time by 20%, which sped up project completion.

- Introduced a tracking system that reduced error rates by 15% thanks to real-time monitoring.

- Teamed up with cross-functional groups to develop straightforward processes, boosting team productivity by 10%.

- Put automation tools in place that saved 200 work hours each year, enhancing resource use.

Problem-Solving Focused resume experience section

A QA Banking Problem-Solving focused resume experience section should aim to highlight your accomplishments in detecting and resolving issues effectively. Start by illustrating how you maintained smooth and secure banking systems, emphasizing any improvements or efficiencies you've achieved along the way. Make sure to clearly detail your role, connecting it with specific skills you used to tackle problems, and mention any tools or methods that played a part in your success. By doing so, you establish a strong narrative that underscores your ability to ensure system reliability.

When presenting the bullet points, focus on how you identified challenges, the decisive actions you took, and the positive outcomes of your efforts. This part is key to showing measurable achievements, like reductions in error rates or enhanced system performance, which lend credibility to your expertise. Seamlessly weave these examples to tell a cohesive story about your contribution to maintaining high-quality banking systems, reinforcing your value to future employers.

QA Analyst

Global Bank Solutions

Jan 2020 - Dec 2022

- Reduced system errors by 30% by implementing automated testing procedures

- Collaborated with cross-functional teams to resolve complex system issues swiftly

- Enhanced user satisfaction by ensuring a seamless online banking experience

- Led a project to integrate new software tools, increasing process efficiency by 20%

Technology-Focused resume experience section

A QA banking technology-focused resume experience section should effectively showcase your skills and achievements in quality assurance within the banking sector. Start by highlighting your role and responsibilities, emphasizing what you accomplished in banking technology. Adding specific metrics, like efficiency improvements or cost savings, strengthens your narrative. Use clear language to demonstrate your understanding of the banking technology landscape, and describe your involvement in developing or testing key software applications or systems.

As you list your experiences, use active verbs and detailed examples to illustrate your initiative and problem-solving abilities. Highlight positions where you've driven innovation and explain how these efforts contributed to the organization’s success. This approach not only emphasizes your commitment to quality but also showcases your ability to leverage technology for improving banking processes, resulting in a compelling and cohesive story.

Senior QA Engineer

FinTech Innovations

January 2020 - Present

- Led a team of QA engineers to develop automated testing tools, cutting testing time by 40% and speeding up software release cycles.

- Collaborated with cross-functional teams to resolve software issues in banking applications, which significantly boosted user experience scores by 25%.

- Created and implemented a risk-based testing framework, leading to a notable 30% reduction in post-release defects.

- Performed in-depth audits of compliance testing processes to ensure strict adherence to the latest banking regulations.

Achievement-Focused resume experience section

A QA-focused resume experience section should emphasize how your contributions positively impacted your team and organization. Begin by identifying the key skills and accomplishments that resonate with the requirements of the job you're pursuing. Using strong action verbs, vividly describe your responsibilities and the resulting impact. To make your value tangible, highlight outcomes and quantify achievements wherever possible, ensuring clarity and conciseness without overwhelming the reader.

Connecting your experience to tangible results strengthens your narrative, as framing your responsibilities around achieved outcomes paints a clearer picture of your potential. Explain how your efforts directly supported the organization's goals and efficiency. Customize your descriptions to closely align with the job's expected qualifications, showing how your past successes directly translate to the new role. This requires a keen understanding of the job's demands and confidently showcasing why your experiences and achievements make you a perfect fit.

QA Engineer

Tech Bank Corporation

January 2020 - Present

- Implemented a new testing protocol that reduced software bugs by 30%.

- Led a team of five testers in streamlining the QA process, improving efficiency by 40%.

- Developed automated test scripts that decreased testing time by 25%.

- Collaborated with developers to resolve critical issues, ensuring quality releases ahead of deadlines.

Write your QA banking resume summary section

A QA-focused banking resume summary should clearly highlight your expertise, unique skills, and relevant experience. Your summary is your chance to showcase your technical abilities and problem-solving skills within the banking industry. For instance, key areas might include experience with SQL, test automation, and risk assessment. Here’s an example of how such a summary might look in JSON format:

This summary is effective because it connects experience and skills directly to what potential employers are looking for. By highlighting your proven track record and attention to detail, you quickly convey why you’re the ideal candidate for a QA banking role. A concise and targeted summary also sets the stage for a strong first impression.

Understanding the nuances between a resume summary and objective is essential for crafting the right message. While a summary emphasizes your professional strengths and contributions, a resume objective focuses on your career goals and what you aim to achieve. Both serve different purposes yet work together to present a compelling narrative. A summary of qualifications lists achievements in a straightforward manner, while a resume profile combines elements of a summary and objective for a more detailed snapshot. Grasping these differences allows you to tailor your resume to effectively match the needs of any role you pursue.

Listing your QA banking skills on your resume

A skills-focused QA banking resume should clearly showcase your strengths and abilities to make a strong first impression. You have the option to list your skills in a standalone section to highlight your core competencies or integrate them into other areas like your experience and summary, showing how you've applied these skills in real-world situations. When discussing your strengths, remember that hard skills are the technical abilities or knowledge you've gained through training or formal education.

Incorporating skills and strengths into your resume serves as keywords that can help your application get noticed by recruiters and applicant tracking systems. These keywords should effectively communicate your capabilities and suitability for the QA banking role.

Here's an example of a standalone skills section in JSON format:

This skills section effectively presents key abilities, making it easy for hiring managers to quickly understand your expertise. Including technical skills like "Software Testing" and "Test Automation" highlights your proficiency with QA tools, while "Regulatory Compliance" demonstrates your knowledge of industry standards.

Best hard skills to feature on your QA banking resume

For a QA banking role, your hard skills should showcase technical expertise and your ability to perform specific tasks. These skills are critical for communicating your proficiency in managing banking software, adhering to regulatory requirements, and executing QA processes.

Hard Skills

- Software Testing

- Test Automation

- Quality Assurance

- Data Analysis

- SQL

- Risk Management

- Regression Testing

- Agile Methodologies

- Technical Documentation

- Bug Tracking

- Performance Testing

- Banking Software

- Manual Testing

- UAT (User Acceptance Testing)

- Regulatory Compliance

Best soft skills to feature on your QA banking resume

In QA banking, possessing essential soft skills is key for effective collaboration, problem-solving, and maintaining professional relationships. These skills should emphasize your capability in communication, adaptability, and leadership, all of which are necessary for team success.

Soft Skills

- Communication

- Problem-Solving

- Attention to Detail

- Adaptability

- Leadership

- Critical Thinking

- Teamwork

- Time Management

- Initiative

- Empathy

- Analytical Skills

- Conflict Resolution

- Patience

- Decision Making

- Creativity

How to include your education on your resume

The education section of a resume is crucial, especially for roles in the banking sector like QA positions. This part of your resume shows your academic background and proves you have the knowledge needed for the job. Your education should be tailored to fit the position you're applying to. Only include the education that is directly relevant to the banking industry. If you have a high GPA, you can list it to highlight your academic excellence. For a 3.5 GPA or above, it is generally acceptable to include it on your resume. Additionally, if you graduated with honors such as cum laude, this can also be a notable addition. When listing your degree, be sure to include the name of the degree, the institution, and the year of graduation.

Here is an incorrect example:

- •Member of the Drama Club

Here is a correct and outstanding example:

- •Graduated summa cum laude

The second example excels because it aligns perfectly with a QA banking role. It includes a finance-oriented degree from a reputable institution, coupled with a high GPA that signals strong academic performance. Mentioning graduating summa cum laude further enhances credibility, indicating a high level of dedication and mastery in the field.

How to include QA banking certificates on your resume

Adding a certificates section to your QA banking resume is vital. It shows your qualifications and expertise. To do this effectively, list the name of the certificate, include the date of issuance, and add the issuing organization.

Certificates can also be included in the header for quick visibility. For example: "Certified ISTQB® Tester by ISTQB®, 2022." Keeping it brief in the header ensures hiring managers spot it right away.

A good example of a standalone certificates section may look like this:

This example is strong because it includes certifications directly related to QA and banking. It shows your commitment to both quality assurance and the banking industry. Using well-recognized organizations adds credibility. Listing several relevant certificates demonstrates a broad skill set, enhancing your appeal to potential employers.

Extra sections to include in your QA banking resume

Navigating the competitive landscape of the banking industry requires a resume that not only highlights your technical abilities but also showcases your unique qualities. In the context of QA banking, it's essential to go beyond listing your hard skills; personalized sections can set you apart.

- language section — Highlight speaking more than one language. This can show your ability to work with diverse clients and teams.

- hobbies and interests section — Offer a glimpse into your personality and work-life balance. This can show potential fit within a company's culture.

- volunteer work section — Demonstrate a commitment to community and teamwork. This can also highlight skills applicable to QA, such as attention to detail or teamwork.

- books section — Share relevant reading material. This can showcase your passion for staying updated in the field of banking and quality assurance.

Filling these sections with genuine and thought-out content enhances your resume's impact, making you a stronger candidate for that banking QA position. So take the time to reflect on what makes you unique and let that shine through.

In Conclusion

In conclusion, creating a standout QA banking resume requires a thoughtful approach that highlights your unique blend of technical skills, problem-solving abilities, and a strong understanding of banking processes. By leveraging templates, you can structure your content to ensure clarity and coherence, highlighting aspects like your experience, certifications, and educational background effectively. Emphasizing quantifiable achievements throughout your experience section allows potential employers to see the impact you've made in past roles, showcasing your ability to drive results and improvements effectively.

Selecting the right resume format and maintaining consistency across your document ensures a polished presentation that aligns with industry expectations, enhancing readability and comprehension. Including both hard and soft skills in your resume reinforces your ability to contribute both technically and interpersonally, making you a well-rounded candidate. Your educational background and any additional certifications can serve as strong validators of your expertise and commitment to the field, particularly when aligned with job requirements. Furthermore, the inclusion of extra sections—like language skills, hobbies, and volunteer work—presents a more holistic view of who you are, painting a picture of how you might fit into an organization's culture.

Altogether, these elements work cohesively to create a robust resume that not only speaks to your qualifications and readiness for the role but also paints you as an individual with integrity, adaptability, and a passion for quality assurance in banking. By taking the time to carefully craft each section, you position yourself as a prime candidate, ready to exceed expectations in a competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.