Real Estate Investment Banking Resume Examples

Jul 18, 2024

|

12 min read

Building a standout real estate investment banking resume: Land your dream job by showcasing your unique skills and experience. Here's your ultimate guide to crafting a resume that will make recruiters take notice.

Rated by 348 people

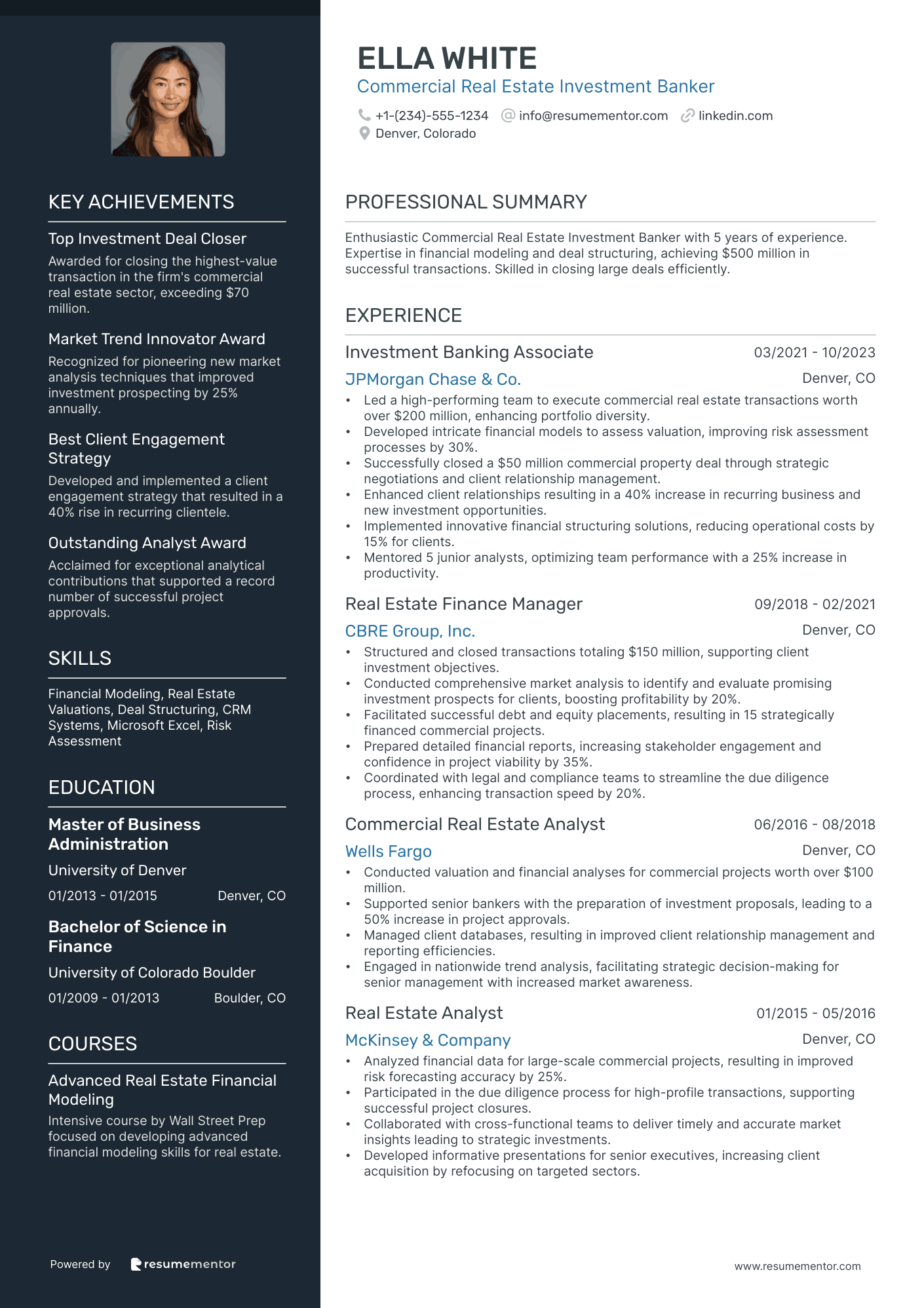

Commercial Real Estate Investment Banker

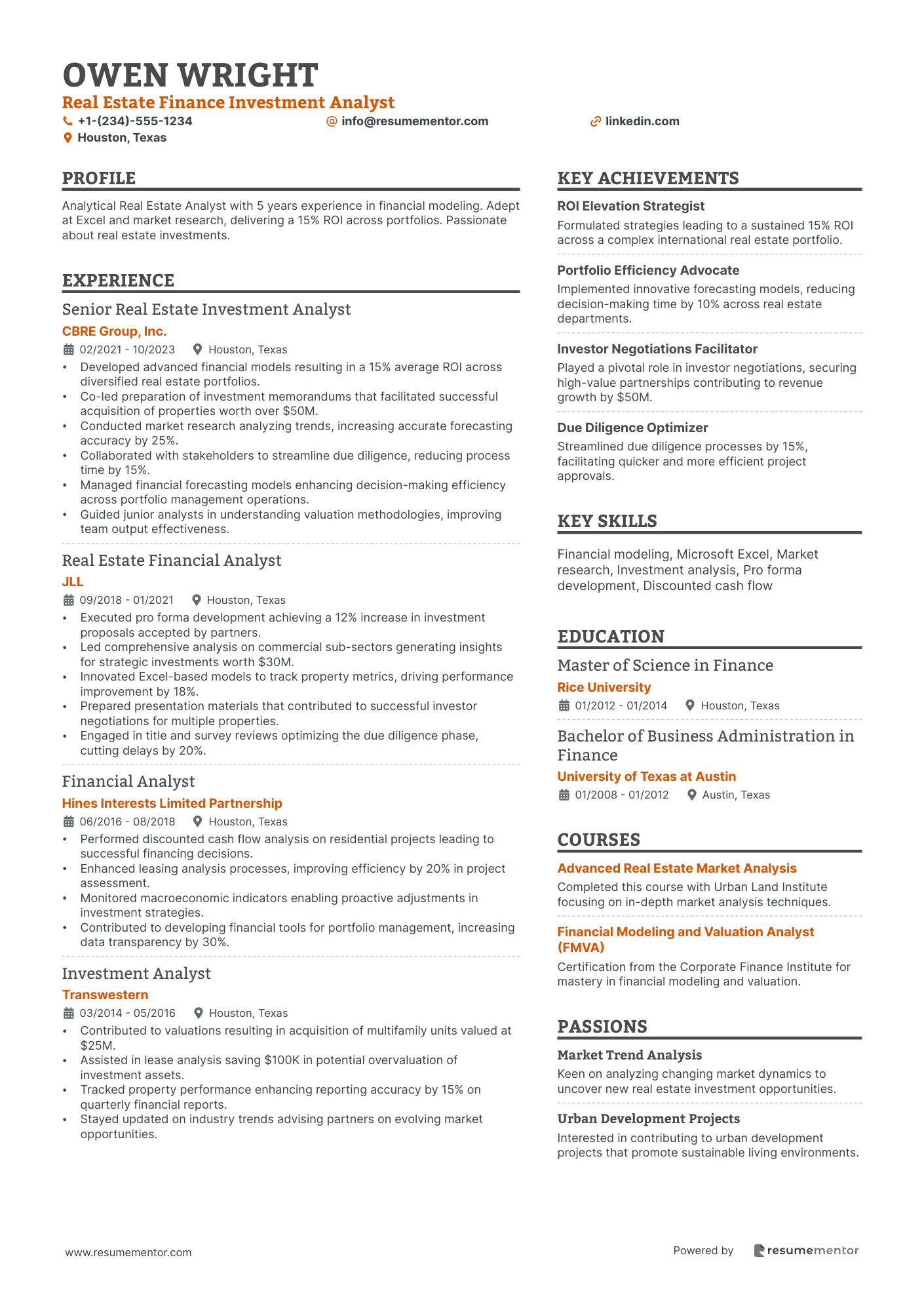

Real Estate Finance Investment Analyst

Residential Real Estate Investment Banker

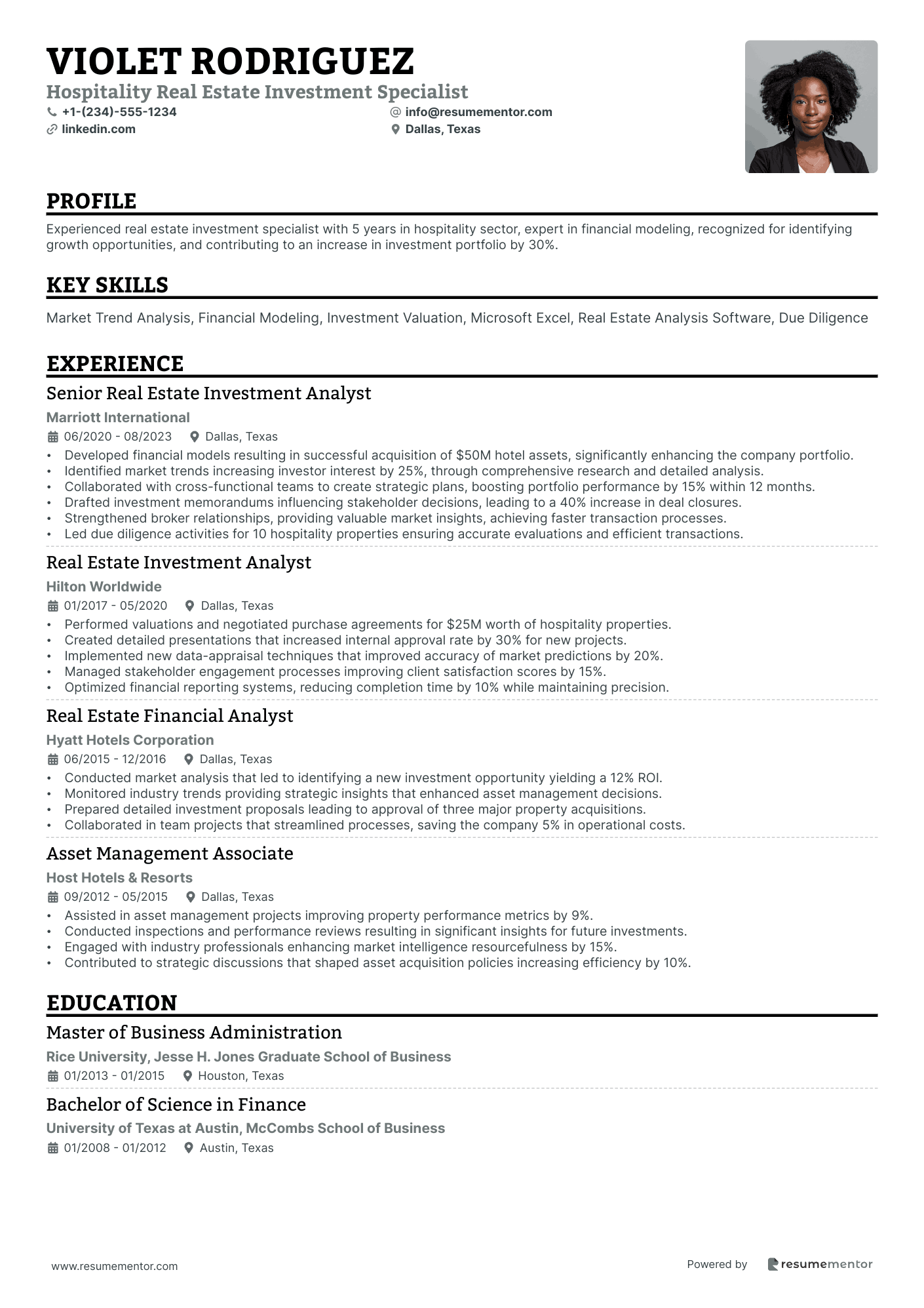

Hospitality Real Estate Investment Specialist

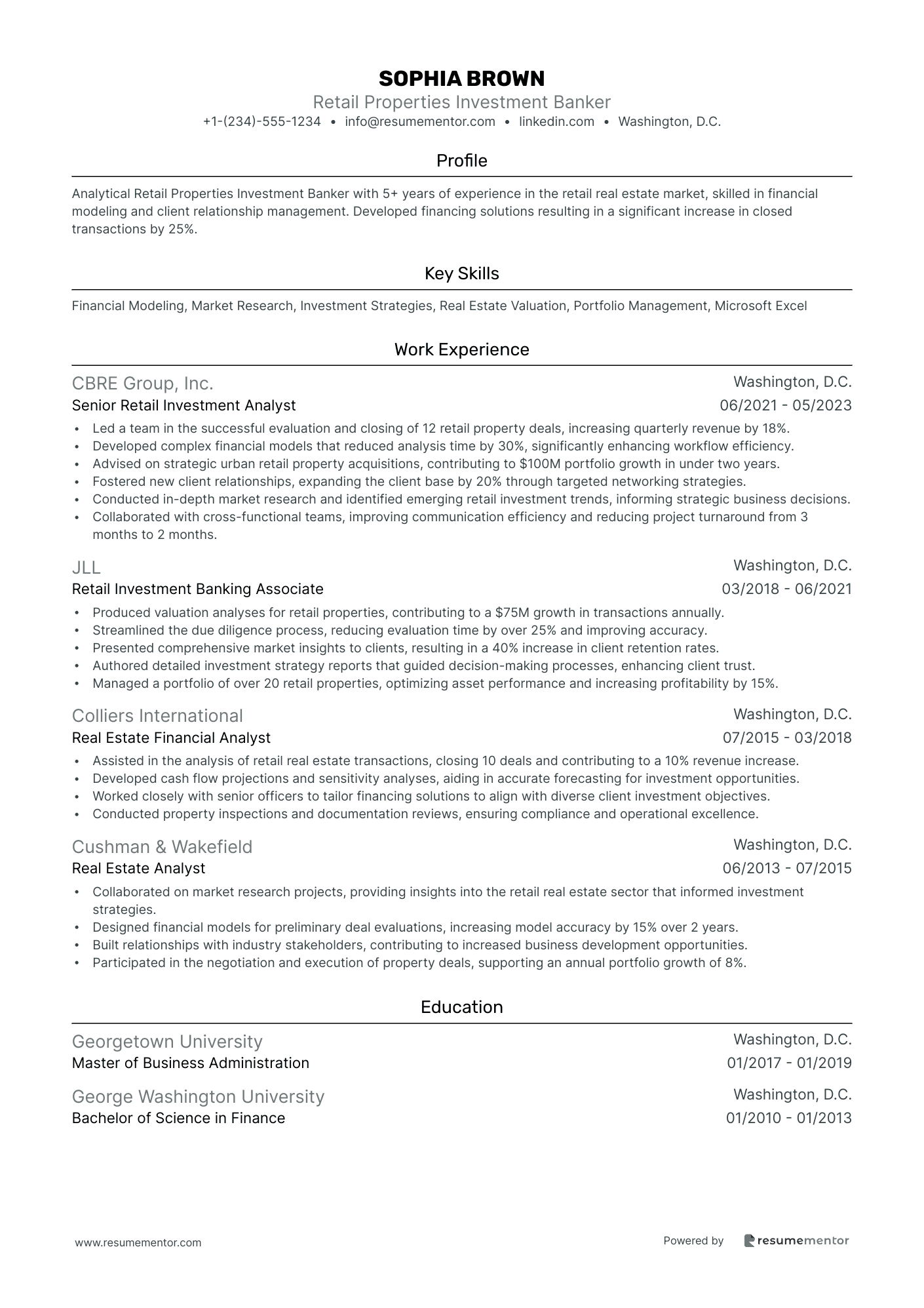

Retail Properties Investment Banker

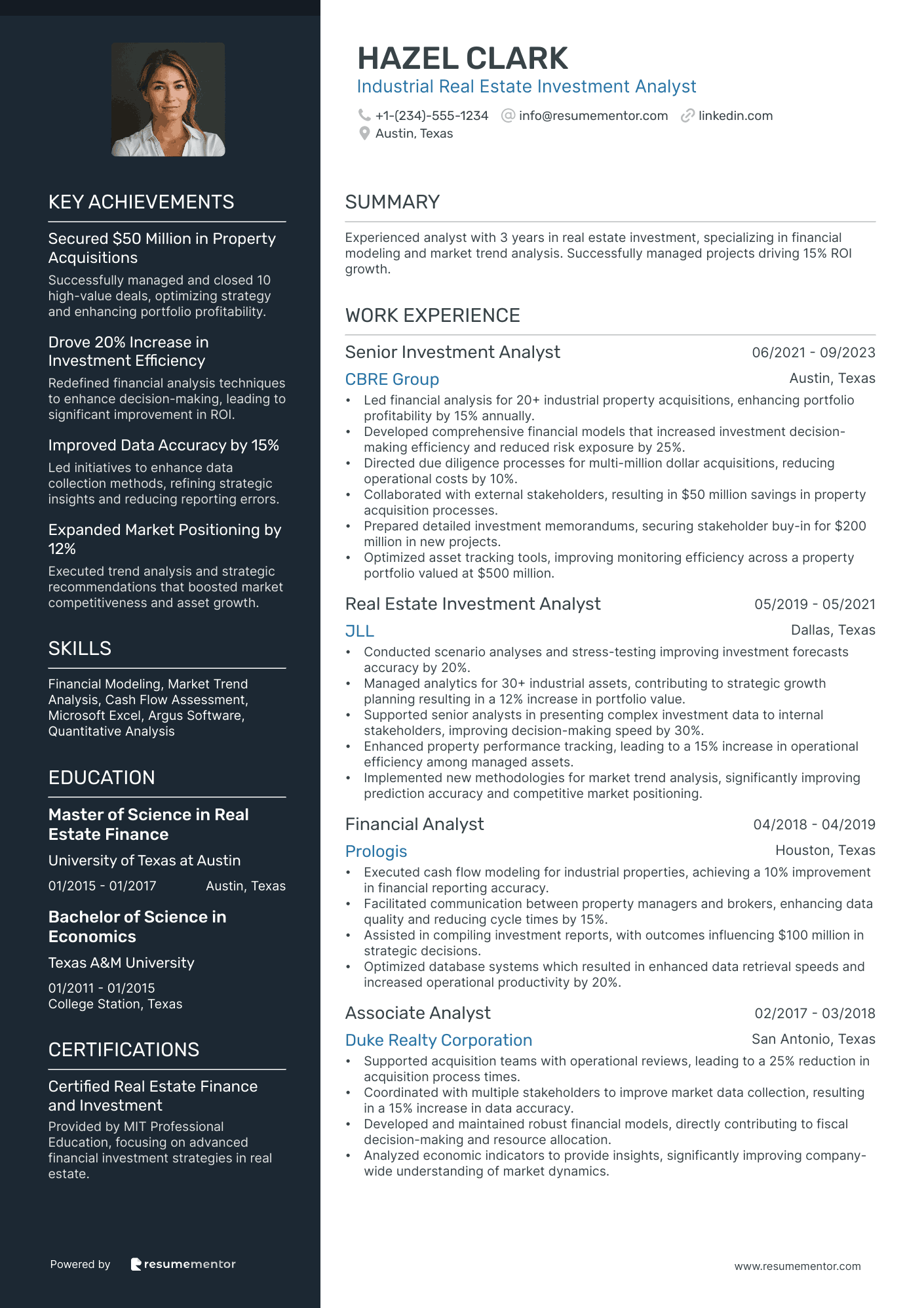

Industrial Real Estate Investment Analyst

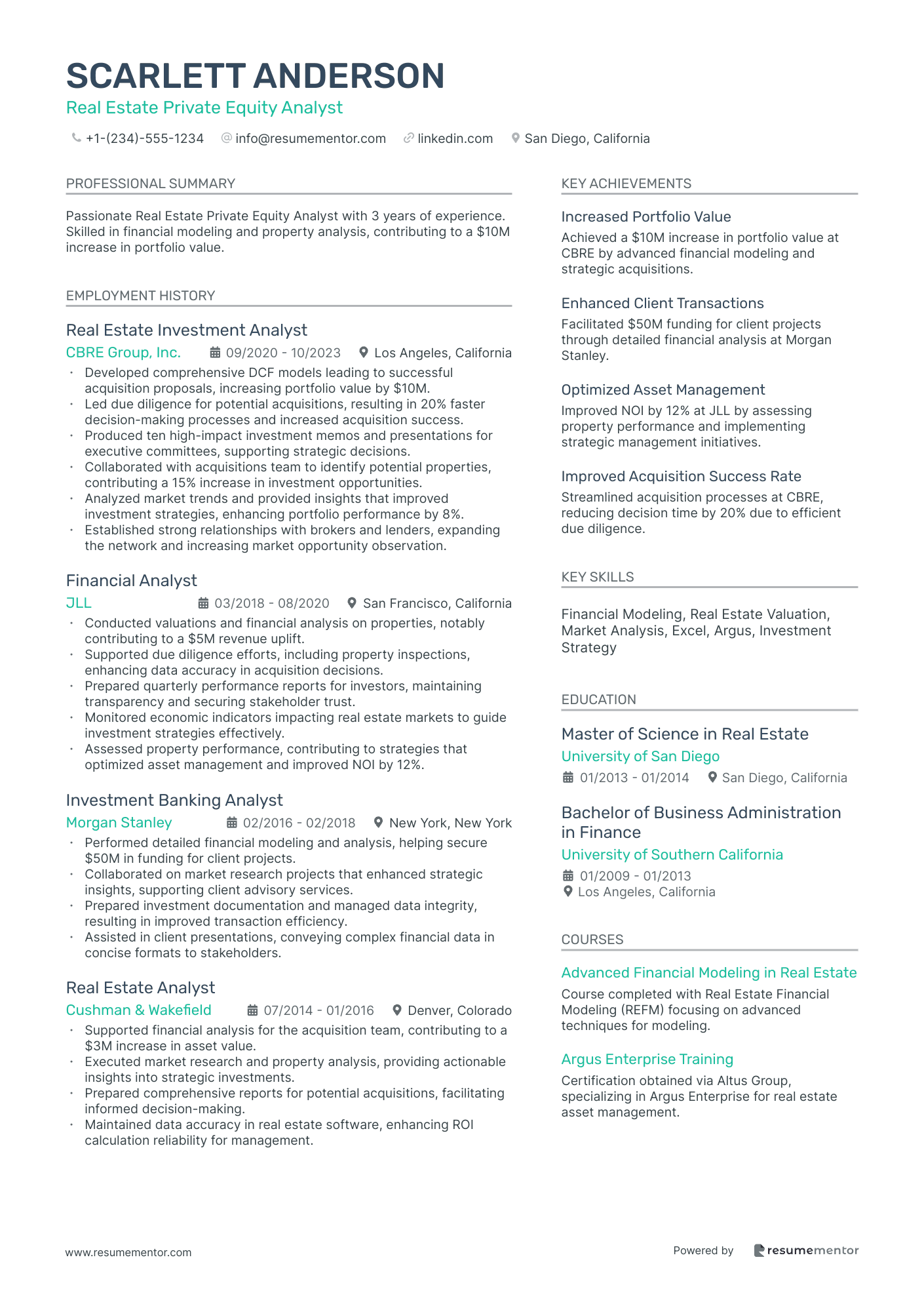

Real Estate Private Equity Analyst

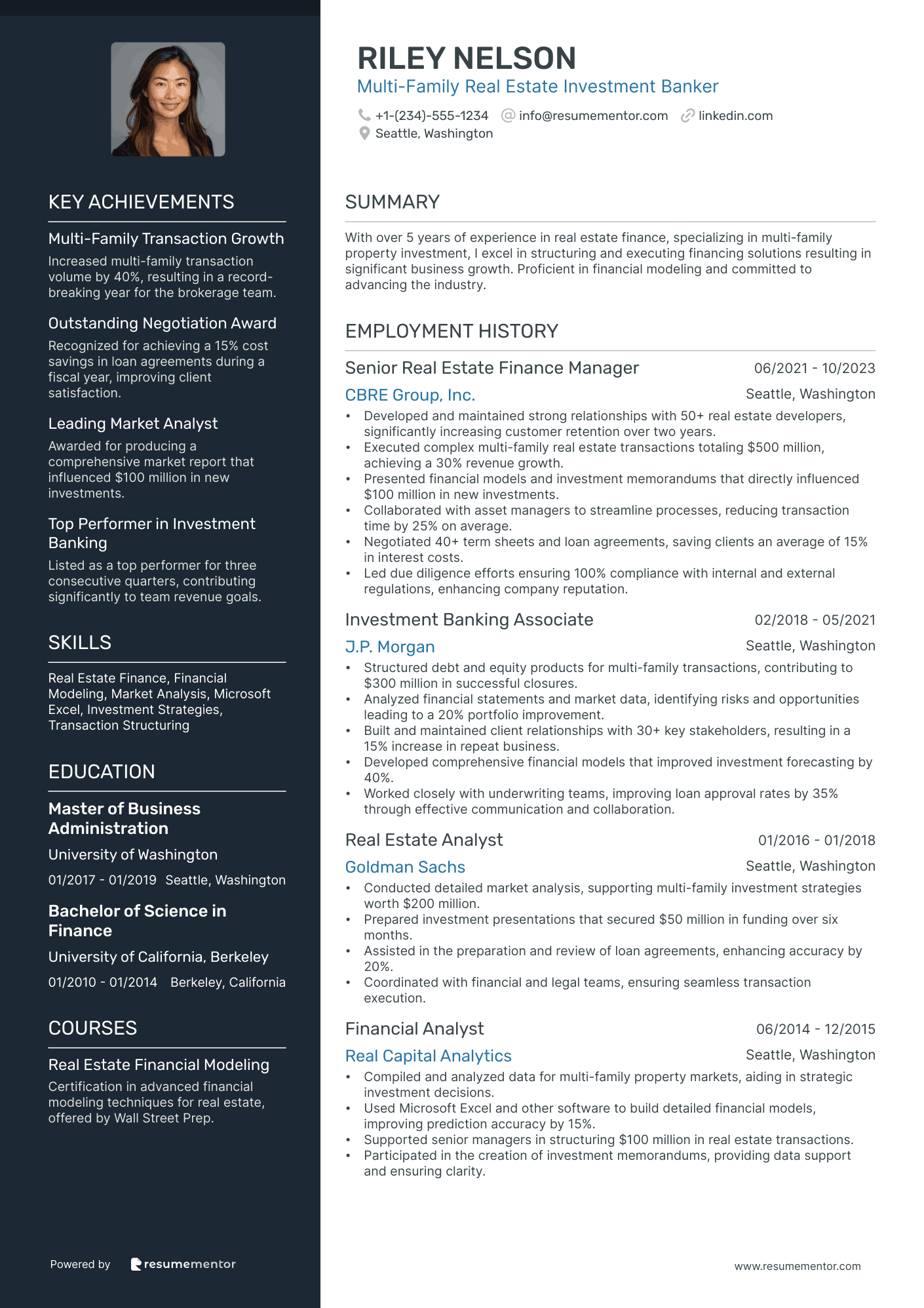

Multi-Family Real Estate Investment Banker

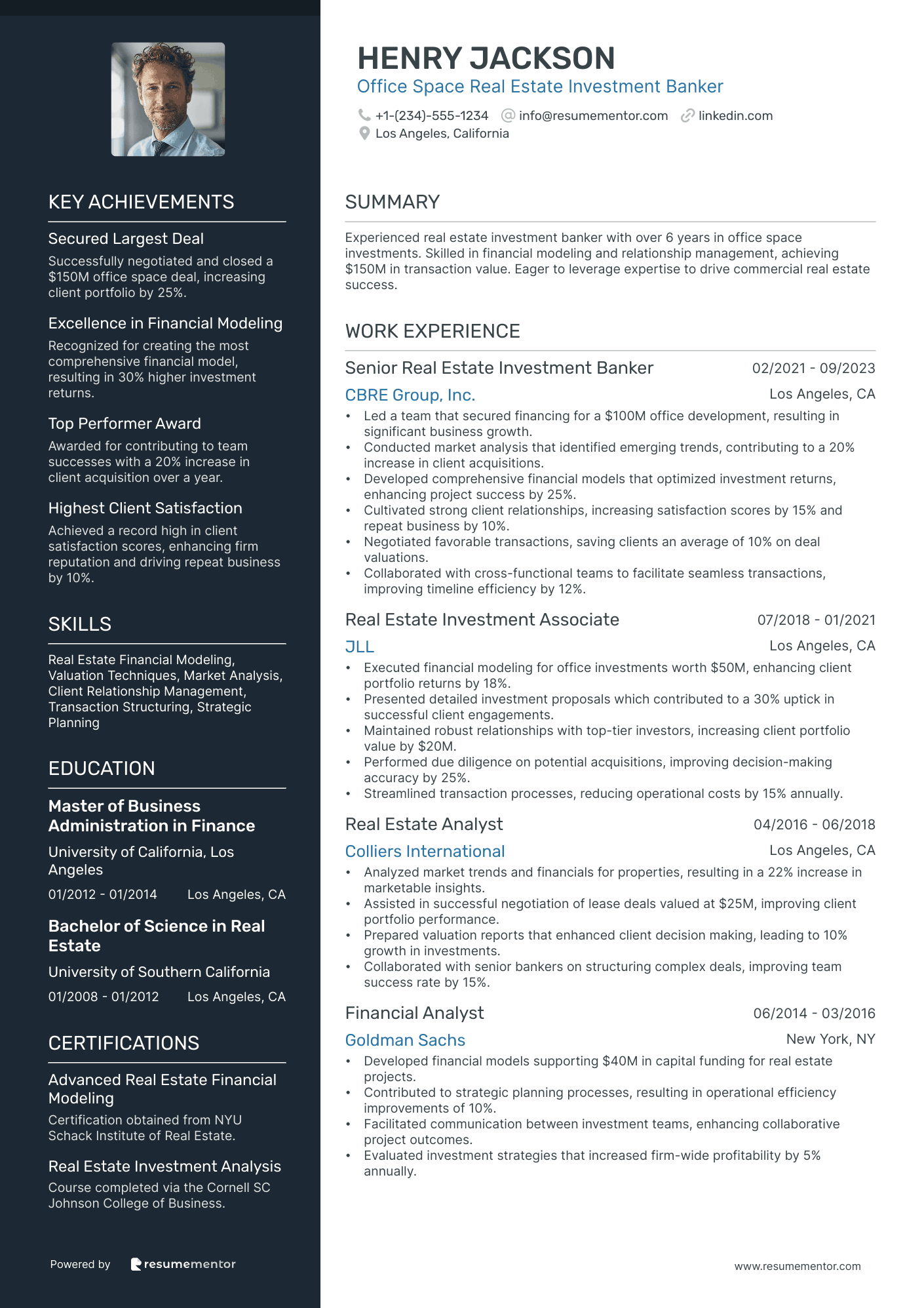

Office Space Real Estate Investment Banker

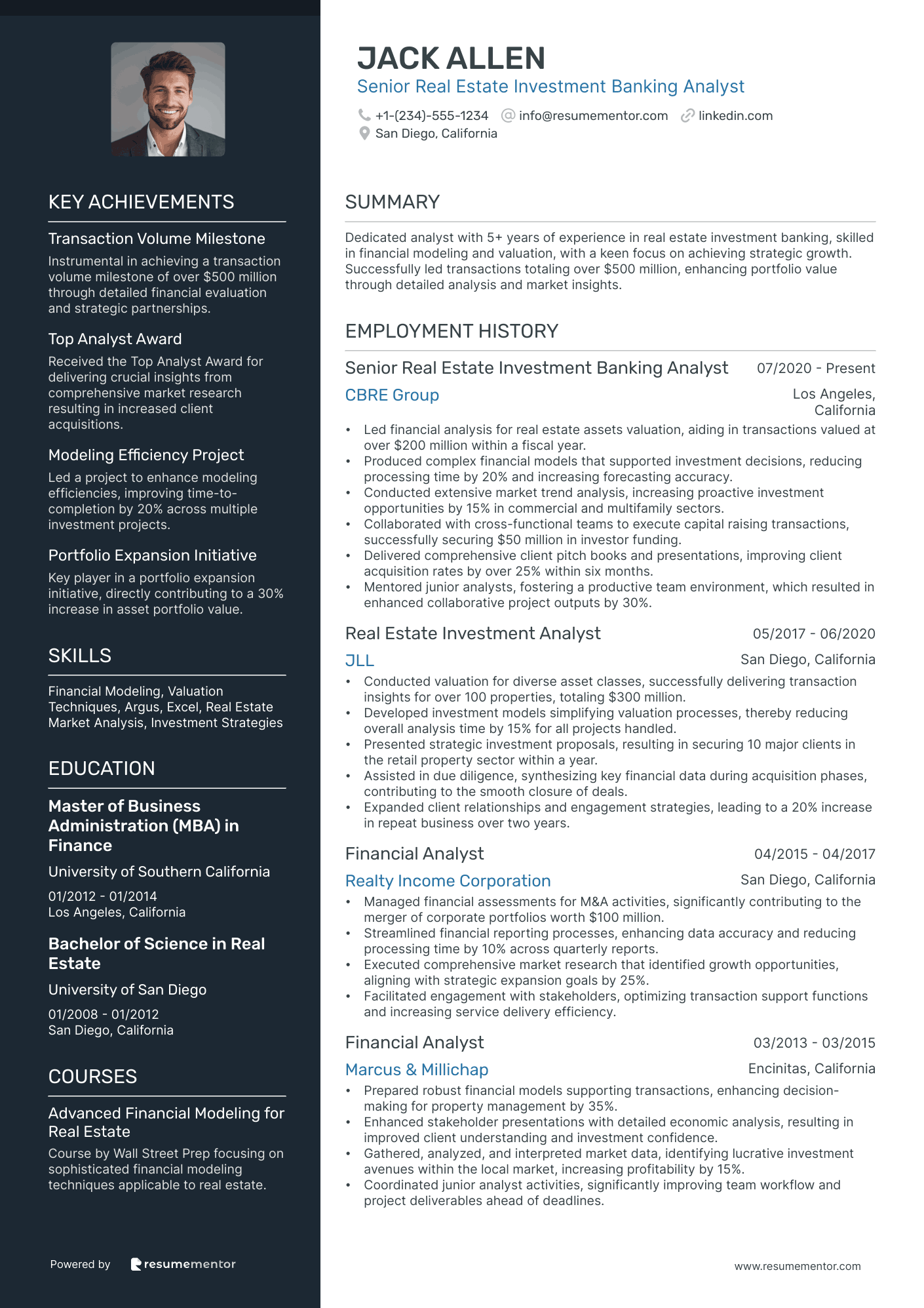

Senior Real Estate Investment Banking Analyst

Commercial Real Estate Investment Banker resume sample

- •Led a high-performing team to execute commercial real estate transactions worth over $200 million, enhancing portfolio diversity.

- •Developed intricate financial models to assess valuation, improving risk assessment processes by 30%.

- •Successfully closed a $50 million commercial property deal through strategic negotiations and client relationship management.

- •Enhanced client relationships resulting in a 40% increase in recurring business and new investment opportunities.

- •Implemented innovative financial structuring solutions, reducing operational costs by 15% for clients.

- •Mentored 5 junior analysts, optimizing team performance with a 25% increase in productivity.

- •Structured and closed transactions totaling $150 million, supporting client investment objectives.

- •Conducted comprehensive market analysis to identify and evaluate promising investment prospects for clients, boosting profitability by 20%.

- •Facilitated successful debt and equity placements, resulting in 15 strategically financed commercial projects.

- •Prepared detailed financial reports, increasing stakeholder engagement and confidence in project viability by 35%.

- •Coordinated with legal and compliance teams to streamline the due diligence process, enhancing transaction speed by 20%.

- •Conducted valuation and financial analyses for commercial projects worth over $100 million.

- •Supported senior bankers with the preparation of investment proposals, leading to a 50% increase in project approvals.

- •Managed client databases, resulting in improved client relationship management and reporting efficiencies.

- •Engaged in nationwide trend analysis, facilitating strategic decision-making for senior management with increased market awareness.

- •Analyzed financial data for large-scale commercial projects, resulting in improved risk forecasting accuracy by 25%.

- •Participated in the due diligence process for high-profile transactions, supporting successful project closures.

- •Collaborated with cross-functional teams to deliver timely and accurate market insights leading to strategic investments.

- •Developed informative presentations for senior executives, increasing client acquisition by refocusing on targeted sectors.

Real Estate Finance Investment Analyst resume sample

- •Developed advanced financial models resulting in a 15% average ROI across diversified real estate portfolios.

- •Co-led preparation of investment memorandums that facilitated successful acquisition of properties worth over $50M.

- •Conducted market research analyzing trends, increasing accurate forecasting accuracy by 25%.

- •Collaborated with stakeholders to streamline due diligence, reducing process time by 15%.

- •Managed financial forecasting models enhancing decision-making efficiency across portfolio management operations.

- •Guided junior analysts in understanding valuation methodologies, improving team output effectiveness.

- •Executed pro forma development achieving a 12% increase in investment proposals accepted by partners.

- •Led comprehensive analysis on commercial sub-sectors generating insights for strategic investments worth $30M.

- •Innovated Excel-based models to track property metrics, driving performance improvement by 18%.

- •Prepared presentation materials that contributed to successful investor negotiations for multiple properties.

- •Engaged in title and survey reviews optimizing the due diligence phase, cutting delays by 20%.

- •Performed discounted cash flow analysis on residential projects leading to successful financing decisions.

- •Enhanced leasing analysis processes, improving efficiency by 20% in project assessment.

- •Monitored macroeconomic indicators enabling proactive adjustments in investment strategies.

- •Contributed to developing financial tools for portfolio management, increasing data transparency by 30%.

- •Contributed to valuations resulting in acquisition of multifamily units valued at $25M.

- •Assisted in lease analysis saving $100K in potential overvaluation of investment assets.

- •Tracked property performance enhancing reporting accuracy by 15% on quarterly financial reports.

- •Stayed updated on industry trends advising partners on evolving market opportunities.

Residential Real Estate Investment Banker resume sample

- •Spearheaded over $500 million in residential real estate transactions, achieving a 95% client satisfaction rate.

- •Developed relationships with premier developers, resulting in a portfolio growth of 30% year-over-year.

- •Created comprehensive financial models for construction projects, enhancing client decision-making processes.

- •Managed cross-functional teams to deliver tailored financing solutions, increasing efficiency by 40%.

- •Presented strategic insights and trends at industry conferences, expanding our market presence by 20%.

- •Negotiated multi-million dollar acquisition loans, leading to a 15% increase in departmental revenues.

- •Successfully closed transactions valued at $250 million, enhancing client ROI by 12% on average.

- •Conducted in-depth market analysis, offering clients actionable insights leading to informed investment decisions.

- •Collaborated with underwriting teams to secure financing approvals, reducing processing time by 25%.

- •Advised clients on refinancing strategies, resulting in a 10% reduction in their borrowing costs.

- •Fostered partnerships with real estate organizations, broadening clientele by 15% within one year.

- •Implemented innovative financial solutions, boosting deal closure rates by 20% annually.

- •Analyzed residential property portfolios and provided insights that led to an average 8% increase in value.

- •Authored detailed presentations that attracted new clients, increasing account onboarding by 25%.

- •Instrumental in a $100 million project finance initiative, contributing to a significant market share gain.

- •Conducted thorough market research, aiding in the identification of lucrative investment opportunities.

- •Assisted in the structuring of financing packages that optimized client capital expenditure by 18%.

- •Coordinated with credit analysts to ensure deal compliance, reducing risk exposure by 15%.

- •Created financial reports and models that streamlined client presentations and proposals.

Hospitality Real Estate Investment Specialist resume sample

- •Developed financial models resulting in successful acquisition of $50M hotel assets, significantly enhancing the company portfolio.

- •Identified market trends increasing investor interest by 25%, through comprehensive research and detailed analysis.

- •Collaborated with cross-functional teams to create strategic plans, boosting portfolio performance by 15% within 12 months.

- •Drafted investment memorandums influencing stakeholder decisions, leading to a 40% increase in deal closures.

- •Strengthened broker relationships, providing valuable market insights, achieving faster transaction processes.

- •Led due diligence activities for 10 hospitality properties ensuring accurate evaluations and efficient transactions.

- •Performed valuations and negotiated purchase agreements for $25M worth of hospitality properties.

- •Created detailed presentations that increased internal approval rate by 30% for new projects.

- •Implemented new data-appraisal techniques that improved accuracy of market predictions by 20%.

- •Managed stakeholder engagement processes improving client satisfaction scores by 15%.

- •Optimized financial reporting systems, reducing completion time by 10% while maintaining precision.

- •Conducted market analysis that led to identifying a new investment opportunity yielding a 12% ROI.

- •Monitored industry trends providing strategic insights that enhanced asset management decisions.

- •Prepared detailed investment proposals leading to approval of three major property acquisitions.

- •Collaborated in team projects that streamlined processes, saving the company 5% in operational costs.

- •Assisted in asset management projects improving property performance metrics by 9%.

- •Conducted inspections and performance reviews resulting in significant insights for future investments.

- •Engaged with industry professionals enhancing market intelligence resourcefulness by 15%.

- •Contributed to strategic discussions that shaped asset acquisition policies increasing efficiency by 10%.

Retail Properties Investment Banker resume sample

- •Led a team in the successful evaluation and closing of 12 retail property deals, increasing quarterly revenue by 18%.

- •Developed complex financial models that reduced analysis time by 30%, significantly enhancing workflow efficiency.

- •Advised on strategic urban retail property acquisitions, contributing to $100M portfolio growth in under two years.

- •Fostered new client relationships, expanding the client base by 20% through targeted networking strategies.

- •Conducted in-depth market research and identified emerging retail investment trends, informing strategic business decisions.

- •Collaborated with cross-functional teams, improving communication efficiency and reducing project turnaround from 3 months to 2 months.

- •Produced valuation analyses for retail properties, contributing to a $75M growth in transactions annually.

- •Streamlined the due diligence process, reducing evaluation time by over 25% and improving accuracy.

- •Presented comprehensive market insights to clients, resulting in a 40% increase in client retention rates.

- •Authored detailed investment strategy reports that guided decision-making processes, enhancing client trust.

- •Managed a portfolio of over 20 retail properties, optimizing asset performance and increasing profitability by 15%.

- •Assisted in the analysis of retail real estate transactions, closing 10 deals and contributing to a 10% revenue increase.

- •Developed cash flow projections and sensitivity analyses, aiding in accurate forecasting for investment opportunities.

- •Worked closely with senior officers to tailor financing solutions to align with diverse client investment objectives.

- •Conducted property inspections and documentation reviews, ensuring compliance and operational excellence.

- •Collaborated on market research projects, providing insights into the retail real estate sector that informed investment strategies.

- •Designed financial models for preliminary deal evaluations, increasing model accuracy by 15% over 2 years.

- •Built relationships with industry stakeholders, contributing to increased business development opportunities.

- •Participated in the negotiation and execution of property deals, supporting an annual portfolio growth of 8%.

Industrial Real Estate Investment Analyst resume sample

- •Led financial analysis for 20+ industrial property acquisitions, enhancing portfolio profitability by 15% annually.

- •Developed comprehensive financial models that increased investment decision-making efficiency and reduced risk exposure by 25%.

- •Directed due diligence processes for multi-million dollar acquisitions, reducing operational costs by 10%.

- •Collaborated with external stakeholders, resulting in $50 million savings in property acquisition processes.

- •Prepared detailed investment memorandums, securing stakeholder buy-in for $200 million in new projects.

- •Optimized asset tracking tools, improving monitoring efficiency across a property portfolio valued at $500 million.

- •Conducted scenario analyses and stress-testing improving investment forecasts accuracy by 20%.

- •Managed analytics for 30+ industrial assets, contributing to strategic growth planning resulting in a 12% increase in portfolio value.

- •Supported senior analysts in presenting complex investment data to internal stakeholders, improving decision-making speed by 30%.

- •Enhanced property performance tracking, leading to a 15% increase in operational efficiency among managed assets.

- •Implemented new methodologies for market trend analysis, significantly improving prediction accuracy and competitive market positioning.

- •Executed cash flow modeling for industrial properties, achieving a 10% improvement in financial reporting accuracy.

- •Facilitated communication between property managers and brokers, enhancing data quality and reducing cycle times by 15%.

- •Assisted in compiling investment reports, with outcomes influencing $100 million in strategic decisions.

- •Optimized database systems which resulted in enhanced data retrieval speeds and increased operational productivity by 20%.

- •Supported acquisition teams with operational reviews, leading to a 25% reduction in acquisition process times.

- •Coordinated with multiple stakeholders to improve market data collection, resulting in a 15% increase in data accuracy.

- •Developed and maintained robust financial models, directly contributing to fiscal decision-making and resource allocation.

- •Analyzed economic indicators to provide insights, significantly improving company-wide understanding of market dynamics.

Real Estate Private Equity Analyst resume sample

- •Developed comprehensive DCF models leading to successful acquisition proposals, increasing portfolio value by $10M.

- •Led due diligence for potential acquisitions, resulting in 20% faster decision-making processes and increased acquisition success.

- •Produced ten high-impact investment memos and presentations for executive committees, supporting strategic decisions.

- •Collaborated with acquisitions team to identify potential properties, contributing a 15% increase in investment opportunities.

- •Analyzed market trends and provided insights that improved investment strategies, enhancing portfolio performance by 8%.

- •Established strong relationships with brokers and lenders, expanding the network and increasing market opportunity observation.

- •Conducted valuations and financial analysis on properties, notably contributing to a $5M revenue uplift.

- •Supported due diligence efforts, including property inspections, enhancing data accuracy in acquisition decisions.

- •Prepared quarterly performance reports for investors, maintaining transparency and securing stakeholder trust.

- •Monitored economic indicators impacting real estate markets to guide investment strategies effectively.

- •Assessed property performance, contributing to strategies that optimized asset management and improved NOI by 12%.

- •Performed detailed financial modeling and analysis, helping secure $50M in funding for client projects.

- •Collaborated on market research projects that enhanced strategic insights, supporting client advisory services.

- •Prepared investment documentation and managed data integrity, resulting in improved transaction efficiency.

- •Assisted in client presentations, conveying complex financial data in concise formats to stakeholders.

- •Supported financial analysis for the acquisition team, contributing to a $3M increase in asset value.

- •Executed market research and property analysis, providing actionable insights into strategic investments.

- •Prepared comprehensive reports for potential acquisitions, facilitating informed decision-making.

- •Maintained data accuracy in real estate software, enhancing ROI calculation reliability for management.

Multi-Family Real Estate Investment Banker resume sample

- •Developed and maintained strong relationships with 50+ real estate developers, significantly increasing customer retention over two years.

- •Executed complex multi-family real estate transactions totaling $500 million, achieving a 30% revenue growth.

- •Presented financial models and investment memorandums that directly influenced $100 million in new investments.

- •Collaborated with asset managers to streamline processes, reducing transaction time by 25% on average.

- •Negotiated 40+ term sheets and loan agreements, saving clients an average of 15% in interest costs.

- •Led due diligence efforts ensuring 100% compliance with internal and external regulations, enhancing company reputation.

- •Structured debt and equity products for multi-family transactions, contributing to $300 million in successful closures.

- •Analyzed financial statements and market data, identifying risks and opportunities leading to a 20% portfolio improvement.

- •Built and maintained client relationships with 30+ key stakeholders, resulting in a 15% increase in repeat business.

- •Developed comprehensive financial models that improved investment forecasting by 40%.

- •Worked closely with underwriting teams, improving loan approval rates by 35% through effective communication and collaboration.

- •Conducted detailed market analysis, supporting multi-family investment strategies worth $200 million.

- •Prepared investment presentations that secured $50 million in funding over six months.

- •Assisted in the preparation and review of loan agreements, enhancing accuracy by 20%.

- •Coordinated with financial and legal teams, ensuring seamless transaction execution.

- •Compiled and analyzed data for multi-family property markets, aiding in strategic investment decisions.

- •Used Microsoft Excel and other software to build detailed financial models, improving prediction accuracy by 15%.

- •Supported senior managers in structuring $100 million in real estate transactions.

- •Participated in the creation of investment memorandums, providing data support and ensuring clarity.

Office Space Real Estate Investment Banker resume sample

- •Led a team that secured financing for a $100M office development, resulting in significant business growth.

- •Conducted market analysis that identified emerging trends, contributing to a 20% increase in client acquisitions.

- •Developed comprehensive financial models that optimized investment returns, enhancing project success by 25%.

- •Cultivated strong client relationships, increasing satisfaction scores by 15% and repeat business by 10%.

- •Negotiated favorable transactions, saving clients an average of 10% on deal valuations.

- •Collaborated with cross-functional teams to facilitate seamless transactions, improving timeline efficiency by 12%.

- •Executed financial modeling for office investments worth $50M, enhancing client portfolio returns by 18%.

- •Presented detailed investment proposals which contributed to a 30% uptick in successful client engagements.

- •Maintained robust relationships with top-tier investors, increasing client portfolio value by $20M.

- •Performed due diligence on potential acquisitions, improving decision-making accuracy by 25%.

- •Streamlined transaction processes, reducing operational costs by 15% annually.

- •Analyzed market trends and financials for properties, resulting in a 22% increase in marketable insights.

- •Assisted in successful negotiation of lease deals valued at $25M, improving client portfolio performance.

- •Prepared valuation reports that enhanced client decision making, leading to 10% growth in investments.

- •Collaborated with senior bankers on structuring complex deals, improving team success rate by 15%.

- •Developed financial models supporting $40M in capital funding for real estate projects.

- •Contributed to strategic planning processes, resulting in operational efficiency improvements of 10%.

- •Facilitated communication between investment teams, enhancing collaborative project outcomes.

- •Evaluated investment strategies that increased firm-wide profitability by 5% annually.

Senior Real Estate Investment Banking Analyst resume sample

- •Led financial analysis for real estate assets valuation, aiding in transactions valued at over $200 million within a fiscal year.

- •Produced complex financial models that supported investment decisions, reducing processing time by 20% and increasing forecasting accuracy.

- •Conducted extensive market trend analysis, increasing proactive investment opportunities by 15% in commercial and multifamily sectors.

- •Collaborated with cross-functional teams to execute capital raising transactions, successfully securing $50 million in investor funding.

- •Delivered comprehensive client pitch books and presentations, improving client acquisition rates by over 25% within six months.

- •Mentored junior analysts, fostering a productive team environment, which resulted in enhanced collaborative project outputs by 30%.

- •Conducted valuation for diverse asset classes, successfully delivering transaction insights for over 100 properties, totaling $300 million.

- •Developed investment models simplifying valuation processes, thereby reducing overall analysis time by 15% for all projects handled.

- •Presented strategic investment proposals, resulting in securing 10 major clients in the retail property sector within a year.

- •Assisted in due diligence, synthesizing key financial data during acquisition phases, contributing to the smooth closure of deals.

- •Expanded client relationships and engagement strategies, leading to a 20% increase in repeat business over two years.

- •Managed financial assessments for M&A activities, significantly contributing to the merger of corporate portfolios worth $100 million.

- •Streamlined financial reporting processes, enhancing data accuracy and reducing processing time by 10% across quarterly reports.

- •Executed comprehensive market research that identified growth opportunities, aligning with strategic expansion goals by 25%.

- •Facilitated engagement with stakeholders, optimizing transaction support functions and increasing service delivery efficiency.

- •Prepared robust financial models supporting transactions, enhancing decision-making for property management by 35%.

- •Enhanced stakeholder presentations with detailed economic analysis, resulting in improved client understanding and investment confidence.

- •Gathered, analyzed, and interpreted market data, identifying lucrative investment avenues within the local market, increasing profitability by 15%.

- •Coordinated junior analyst activities, significantly improving team workflow and project deliverables ahead of deadlines.

Venturing into real estate investment banking is like constructing a high-rise, and your resume is the blueprint. You need to seamlessly balance your financial acumen, market insights, and analytical prowess while ensuring your achievements stand tall on paper. This task can feel daunting when every word in your resume must carry weight in a highly competitive field.

Your resume is your key to unlocking interview opportunities, making it crucial to communicate your expertise effectively. The challenge lies in presenting complex skills and multifaceted experiences in a concise manner. In such a competitive arena, your resume needs to capture attention instantly, much like a striking building on the skyline.

A resume template can provide the structure you need to craft your professional narrative. It's akin to establishing a solid foundation before you start building. A well-structured template ensures your key details are prominently highlighted and correctly formatted. To start building your resume framework, consider exploring these resume templates.

Your aim is to create a vivid impression with clarity and precision. Transforming your resume from a static document into a dynamic career story can open doors to new opportunities. Approach this process like constructing your own skyscraper, ensuring every piece contributes to a structure that stands out.

Key Takeaways

- Your real estate investment banking resume should highlight your financial expertise and real estate acumen, effectively communicating complex skills in a concise manner to capture attention instantly.

- Utilize a well-structured resume template that emphasizes key details and supports a dynamic career story, creating a standout impression with clarity and precision.

- Employ a reverse-chronological format, modern fonts, PDF format for consistency, and proper margins to enhance readability and professionalism.

- Include quantifiable achievements within your experience section to clearly demonstrate your impact, using strong action words to emphasize accomplishments and align with job ads.

- Effectively use hard and soft skills to align with job descriptions, ensuring your resume highlights strengths and qualifications like financial modeling, negotiation skills, and decision-making.

What to focus on when writing your real estate investment banking resume

Your real estate investment banking resume should seamlessly communicate both your financial expertise and real estate acumen—everything from complex transaction management to adeptness in valuation should be clear.

How to structure your real estate investment banking resume

- Contact Information: This section serves as the gateway for potential employers to reach out. It's crucial to include your full name, professional email address, phone number, and a LinkedIn profile. Make sure your LinkedIn profile is up-to-date and reflects the same professional tone and accomplishments as your resume. Ensuring your contact details are clear and accessible reinforces your professional image and readiness for communication.

- Professional Summary: This brief introduction is your chance to make a strong first impression. It should encapsulate your career highlights and expertise in real estate investment banking. Shine a light on the unique experiences or skills that set you apart, and let your enthusiasm for the industry come through. Crafting this summary with clear insights into your career trajectory and achievements will entice recruiters to dive deeper into your resume, facilitating the transition to your experience section.

- Experience: In this section, detail your work history, focusing on roles within real estate investment banking. Specifically, highlight your accomplishments in deal structuring, financial analysis, and portfolio management. Providing concrete examples and quantifiable outcomes can help illustrate the impact you've made in past roles. This section should paint a picture of your career progression and how your experiences have prepared you for new opportunities, setting the stage for the education section.

- Education: Highlight your academic background by listing relevant degrees and certifications you've obtained. If you have a strong GPA, include it to further validate your academic achievements. Emphasize education that directly supports your real estate investment banking skills. Discussing relevant coursework or projects can bridge your academic learnings with real-world applications and segue into your skills section.

- Skills: Outline key skills that reinforce your expertise in real estate investment banking. Include technical skills like financial modeling and market analysis, as well as industry-specific software worth mentioning, such as Excel or ARGUS. Highlighting these skills will demonstrate your ability to handle quantitative and analytical tasks effectively, pointing to your readiness for the demands of the role. The importance of certification toward your hiring potential leads naturally to your certifications section.

- Certifications: Here, include achievements like the CFA designation, Series 79, or real estate licenses. These certifications serve as endorsements of your expertise and dedication to the industry. By confirming your specialized knowledge and competence, this section complements the skills you've listed and reinforces your commitment to professional growth. As we delve deeper into each section below, you'll see how they collectively build a compelling resume.

Which resume format to choose

Pursuing a career in real estate investment banking? Start your resume with a reverse-chronological format. This structure highlights your professional journey, allowing recruiters to easily assess your growth and accomplishments in the industry.

When it comes to font choice, consider modern options like Raleway, Montserrat, or Lato. These fonts not only give your resume a fresh and clean appearance but also enhance readability, which is crucial when you're trying to make a strong impression.

Saving your resume as a PDF is essential. This ensures that your carefully crafted format remains consistent no matter what device or software the recruiter uses, preserving the professional image you're aiming for.

Setting your margins to about 1 inch on all sides gives your resume a tidy and ordered look. Adequate white space around the text makes it more inviting and easier for recruiters to read through your credentials without feeling overwhelmed.

By focusing on these elements, your real estate investment banking resume will not only look professional but will also effectively communicate your skills and experience to potential employers.

How to write a quantifiable resume experience section

Creating a standout real estate investment banking resume experience section means highlighting your impactful achievements. This part of the resume should clearly demonstrate the value you've brought to past employers through quantifiable results. By doing this, you effectively show your career journey, skills, and successes in a compelling way. Start by listing your jobs with the most recent one first, working backward over the last 10-15 years unless an older role is particularly relevant. Make sure to include job titles that align with the position you're targeting. Tailoring your resume to the job ad is crucial, so integrate keywords and phrases directly from it. Utilizing strong action words such as "negotiated," "secured," or "increased" will further emphasize your accomplishments.

Tailored example:

- •Negotiated and closed $500M in real estate transactions across multiple property sectors, exceeding annual targets by 20%.

- •Developed comprehensive financial models that reduced project risk by 15%, enhancing investor confidence and capital inflow.

- •Secured strategic funding partnerships that increased the firm's investment portfolio by 30% within two years.

- •Mentored a team of 10 analysts, resulting in a 25% improvement in project efficiency and successful deal closures.

This experience section is effective because it focuses on quantifiable achievements, illustrating a track record of delivering results. By presenting specific numbers, you demonstrate the scope of your impact, from transaction volume to enhanced project efficiency. This approach captures attention by connecting past roles with outcomes that are significant to potential employers. With a structured format, this section allows for easy navigation, helping hiring managers quickly access key details. By tailoring your experience to align with job ads, you underscore your understanding of the role and industry, boosting your chances of finding the right fit. The targeted strategy paired with powerful action words highlights your expertise as a real estate investment banking professional, creating a cohesive and compelling narrative.

Training and Development Focused resume experience section

A training and development-focused real estate investment banking resume experience section should clearly demonstrate your skills and contributions. Begin by listing the title of your role, the workplace, and the dates you worked there. Follow this with a brief description of your responsibilities and achievements, emphasizing how you’ve contributed to the development and training of others. Use active language to highlight your successes, making them stand out and underscoring the value you added to your previous positions.

To ensure readability, structure your accomplishments into bullet points that seamlessly connect your training initiatives to the broader company goals. Each bullet point should highlight how you led or contributed to these initiatives, showcasing your strategy development and positive impact on the team or company. Reflecting on your unique experiences shows how you contributed to the growth of your previous employers. This approach helps your resume convey a cohesive story of your qualifications, while demonstrating your capability to foster development and growth in an organization.

Training & Development Specialist

ABC Real Estate Investment Bank

Jan 2019 - Mar 2023

- Led a cross-functional team to create effective training programs for new hires, which cut onboarding time by 30%.

- Introduced innovative digital tools that enhanced employee skills and boosted participation rates by 25%.

- Collaborated with senior management to identify training needs, crafting workshops that raised employee satisfaction scores by 20%.

- Partnered with industry experts to host monthly training seminars, facilitating knowledge-sharing and expanding networking opportunities for staff.

Collaboration-Focused resume experience section

A collaboration-focused real estate investment banking resume experience section should showcase how effectively you work with others to achieve shared objectives. Use engaging language to detail your role in team projects, your leadership in joint ventures, and how you collaborate to solve problems. Highlight how your interpersonal skills have transformed projects, mergers, or acquisitions into successes. Identify experiences where teamwork was crucial and describe them succinctly with clear, action-driven language.

When crafting your bullet points, emphasize the tangible outcomes of your collaboration. Illustrate the partnerships you've built, the negotiations you've guided, and the group strategies you've developed. Incorporating metrics can further demonstrate your achievements and their overall impact. This approach will not only display your ability to work harmoniously with others but also underline a proven track record of thriving in collaborative environments that yield significant results.

Senior Investment Banking Analyst

ABC Real Estate Investment Co.

June 2018 - Present

- Led a group of five analysts in acquiring a $50 million office property, showcasing the power of joint effort.

- Worked alongside various teams to improve the due diligence process, reducing the timeline by 20%.

- Engaged stakeholders effectively, securing an extra $10 million in funding for ongoing projects.

- Cultivated strong partnerships, resulting in two new strategic alliances each year.

Skills-Focused resume experience section

A skills-focused real estate investment banking resume experience section should emphasize your key roles and achievements in areas such as financial modeling, investment analysis, and deal structuring. Start by highlighting specific projects that showcase your direct involvement, and use quantitative results to demonstrate the impact of your work. Keep your descriptions clear and concise, using bullet points to make your accomplishments easy for potential employers to grasp. Each bullet should reflect a different skill or notable achievement, forming a comprehensive picture of your expertise.

Illustrate how your efforts contributed to the success of your team or organization by describing both your actions and the outcomes. Incorporate numbers or percentages to quantify your contributions wherever possible, underscoring your ability to achieve measurable results. This approach not only highlights your past achievements but also aligns them with the qualities employers seek in potential candidates. By effectively conveying your contributions and the skills you've developed, you present a compelling narrative of your career progress.

Real Estate Investment Banking Analyst

XYZ Capital

Jan 2020 - Present

- Created financial models that increased investment returns by 20%.

- Led due diligence for acquisitions exceeding $50 million.

- Developed strategic proposals securing $100 million in capital funding.

- Worked with senior advisors to enhance portfolio holdings for better risk management.

Project-Focused resume experience section

A project-focused senior analyst resume experience section should effectively convey your collective impact on major real estate investment initiatives. Begin by highlighting significant projects in which your contributions played a key role in achieving success. Use bullet points to break down your accomplishments, providing clear context that showcases your influence within each project's broader scope. Keep the language straightforward to ensure easy comprehension.

Link your achievements with quantifiable data like numbers, percentages, or dollar amounts to make it easier for potential employers to understand the tangible results you've driven. Focus on critical skills relevant to the industry, such as property valuation, financial modeling, and deal structuring, to emphasize your expertise. Strong action verbs will further enhance the narrative, showcasing your proactive role and the successful outcomes you facilitated.

Senior Analyst

ABC Investment Banking Firm

2020 - 2023

- Led a team of analysts in a $30 million due diligence project for a major acquisition, enhancing valuation accuracy by 15%.

- Created detailed financial models that supported investment strategies, which resulted in a 20% increase in returns.

- Facilitated stakeholder negotiations to streamline processes, reducing costs by 10% during a property redevelopment effort.

- Built and maintained client relationships, successfully securing $50 million in ongoing portfolio management contracts.

Write your real estate investment banking resume summary section

A real estate investment banking resume should effectively highlight your strengths and value through its summary section. This part of your resume should showcase the skills and achievements relevant to the job, providing a clear snapshot of your qualifications. If you're an experienced professional, reflect on your accomplishments and expertise to demonstrate what you offer. Here's an insightful example:

This example is effective because it’s concise and informative. By including years of experience and highlighting important skills like deal structuring and financial modeling, it reflects what’s crucial in the field. Achievements such as revenue growth and solid client relationships show tangible results, which is appealing to employers.

If you're new to the field or changing careers, focusing on a resume objective is more suitable. It tells your career goals and the value you aspire to bring. Consider this sample:

[here was the JSON object 2]

This objective communicates enthusiasm and direction. By highlighting educational achievements and internship experience, it addresses what’s important for entry-level roles.

Understanding the differences between a summary and an objective is key. A summary emphasizes experience and accomplishments, ideal for seasoned professionals. Meanwhile, an objective is tailored for entry-level positions, concentrating on goals and potential contributions. A resume profile blends both elements, summarizing your background and ambitions effectively. Lastly, a summary of qualifications lists your key skills and achievements, clearly stating what sets you apart. Tailoring this section according to your career stage ensures your resume resonates with potential employers.

Listing your real estate investment banking skills on your resume

A real estate investment banking resume should emphasize your skills effectively to make a strong impression. Start by deciding whether your skills will stand alone or weave into sections like experience or summary. Showcasing your strengths and soft skills tells employers what makes you stand out. Hard skills, learned through experience and training, are equally essential. Together, these skills function as powerful resume keywords, capturing attention in digital searches and appealing to hiring managers. Choosing these keywords carefully aligns you better with job descriptions.

Here's how a skills section might look for real estate investment banking:

This skills section effectively highlights critical capabilities with clarity and focus. Including these specific skills addresses what real estate investment banking positions typically require, ensuring your resume reaches those seeking particular qualifications.

Best hard skills to feature on your real estate investment banking resume

In this profession, hard skills demonstrate your expertise and task-handling abilities. Employers want someone who can manage intricate financial challenges and portfolios adeptly.

Hard Skills

- Financial Modeling

- Market Analysis

- Valuation Techniques

- Risk Assessment

- MS Excel Proficiency

- Portfolio Management

- Contract Law

- Real Estate Financing

- Statistical Analysis

- Data Interpretation

- Due Diligence

- Cost Estimation

- Capital Markets Knowledge

- Compliance Regulations

- Strategic Planning

Best soft skills to feature on your real estate investment banking resume

These skills reveal your interpersonal abilities and personal strengths. Employers are on the lookout for candidates with exceptional decision-making capabilities and communication skills.

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Decision-Making

- Negotiation Skills

- Time Management

- Team Collaboration

- Adaptability

- Leadership

- Communication

- Relationship Building

- Stress Management

- Creativity

- Strategic Thinking

- Integrity

How to include your education on your resume

The education section of a resume is an important component that offers potential employers an insight into your academic background and qualifications. Tailoring your education section to the job you're applying for is crucial, emphasizing only those credentials that align with the role. Listing a degree clearly involves providing the name of the degree, along with the institution and the dates of attendance. If you have a strong GPA, including it can be beneficial, but make sure it aligns with industry standards. Honors such as cum laude should be mentioned, as these distinctions highlight academic excellence.

Here is what not to do:

This example misses the mark due to its lack of relevance to investment banking and the lack of specificity in detailing location, achievements, or additional qualifications.

A more effective example would be:

- •Graduated summa cum laude

- •Relevant coursework: Investment Analysis, Real Estate Finance

This second example works well because it clearly relates to real estate investment banking with a relevant degree and coursework, includes a strong GPA, and highlights honors that demonstrate competence. Including the institution's location adds to its credibility, while specific courses underline relevant skills.

How to include real estate investment banking certificates on your resume

Including a certificates section in your real estate investment banking resume is crucial. Certificates can highlight your skills and credibility in the field.

List the name of the certificate to clearly indicate what you have achieved. Include the date of completion to show how recent and relevant the certification is. Add the issuing organization to verify the legitimacy of the certificate.

You can also spotlight certificates in the header of your resume. For example, "John Doe, CFA, Real Estate Investment Banker". This instantly communicates your qualifications to potential employers.

A good standalone certificates section should be clear and relevant to the job. Here's an example:

This example works well because it includes highly relevant certificates for real estate investment banking. The CFA designation is widely recognized, showcasing strong analytical skills. The REFM certification emphasizes specific expertise in real estate financial modeling. Both certificates add value and credibility to your resume.

Extra sections to include in your real estate investment banking resume

Creating a resume for real estate investment banking involves showcasing a unique blend of financial acumen, analytical skills, and industry knowledge. In addition, it’s essential to highlight personal qualities and experiences that set you apart and round out your professional profile.

Language section — List your proficiency in multiple languages to demonstrate your global outlook. Knowing additional languages can help in international real estate transactions and client relationships.

Hobbies and interests section — Include hobbies and interests that display your well-rounded personality and stress management. Activities like golf or sailing can also illustrate your ability to network and build relationships.

Volunteer work section — Highlight volunteer experiences to show your community involvement and leadership. Participating in projects like Habitat for Humanity can reflect your understanding of real estate from a different perspective.

Books section — Mention books you’ve read relevant to finance or real estate to indicate your commitment to ongoing learning. Reading titles like "Rich Dad Poor Dad" can show your dedication to financial literacy and investment knowledge.

In Conclusion

In conclusion, crafting a compelling real estate investment banking resume is a strategic process that bridges your career journey with future opportunities. Your resume should serve as a bold reflection of your expertise and achievements, like a towering skyscraper on a city's skyline. Each section of your resume, from professional summary and experience to skills and certifications, needs to be thoughtfully constructed to communicate your value effectively. The integration of quantifiable results, tailored experiences, and relevant training underscores your readiness for new challenges in the field.

Remember, the structure and design of your resume are as important as the content. Using modern fonts, consistent formatting, and saving your resume as a PDF ensure clarity and professionalism. Including extra sections like language proficiencies or volunteer work can further enhance your profile by highlighting your diverse capabilities and interests.

Ultimately, the goal is to capture the attention of hiring managers by showcasing your unique qualifications in real estate investment banking. A well-structured resume not only reflects your past achievements but also positions you as a compelling candidate for future opportunities. By emphasizing your skills, dedication, and industry-specific knowledge, you build a resume that not only opens doors but sets you apart in a competitive landscape.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.