Regional Finance Director Resume Examples

Jul 18, 2024

|

12 min read

Mastering your regional finance director resume: Showcasing your skills to be a money mastermind. Learn tips to highlight your expertise and experience effectively. Boost your chances and get ready to take control of your financial future!

Rated by 348 people

Regional Finance Director for Strategic Investments

Healthcare Sector Regional Finance Director

Regional Finance Director for Non-profit Organizations

Regional Budgeting and Forecasting Finance Director

Regional Finance Director- Mergers and Acquisitions

Regional Supply Chain Finance Director

Corporate Banking Regional Finance Director

Regional Finance Director for Capital Planning

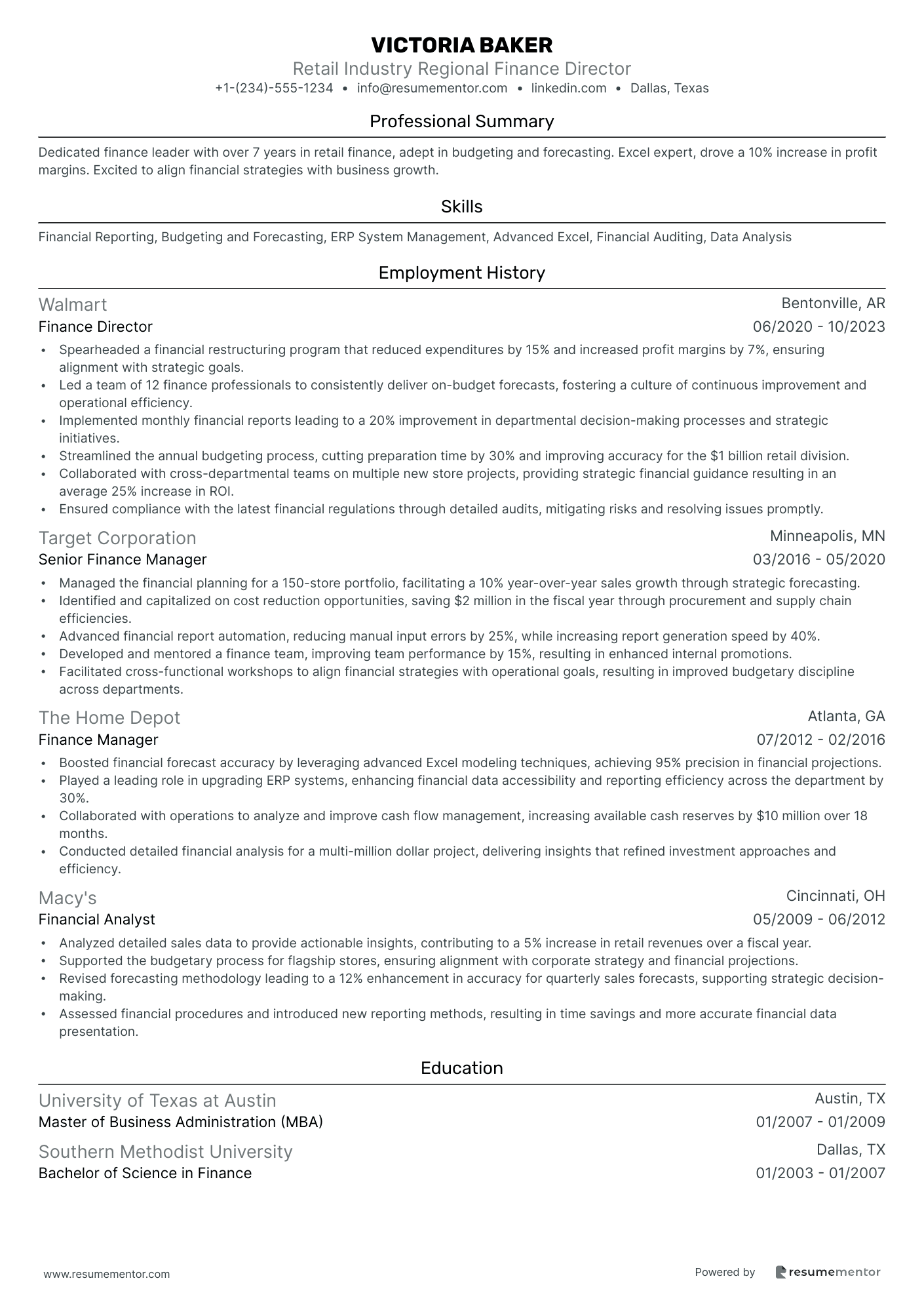

Retail Industry Regional Finance Director

Regional Finance Director for Risk Management

Regional Finance Director for Strategic Investments resume sample

When applying for this role, it’s important to underscore your expertise in financial analysis and investment strategies. Highlight any experience in managing portfolios or conducting risk assessments. Include any relevant certifications such as CFA or coursework in investment management. Use quantifiable achievements to demonstrate your impact, like increased ROI or enhanced financial forecasting accuracy. Additionally, showcase your ability to collaborate with cross-functional teams and your experience in presenting findings to stakeholders, as clear communication can drive strategic decision-making.

- •Led the financial planning for $200 million in strategic investments, improving profitability by 20% through detailed analysis and effective management.

- •Developed comprehensive financial models to evaluate project viability, influencing decision-making for 15 key initiatives.

- •Collaborated with senior leadership to identify investment opportunities, resulting in $50 million revenue growth over three years.

- •Managed a team of 8 finance professionals, implementing best practices that improved reporting efficiency by 30%.

- •Presented financial performance reports to stakeholders, providing insights that contributed to a 25% increase in project ROI.

- •Ensured compliance with regulations and internal policies, resulting in zero audit issues for 4 consecutive years.

- •Provided strategic financial insights for a $150M product line, achieving a 10% cost reduction through efficient resource allocation.

- •Designed financial models for investment analysis, leading to a 15% improvement in investment returns.

- •Analyzed KPIs and advised on strategic adjustments, enhancing portfolio performance by 12% annually.

- •Conducted risk assessments on investment decisions, mitigating potential losses by $5 million through proactive strategy.

- •Facilitated cross-functional collaboration, aligning financial strategies with business operations leading to streamlined processes.

- •Analyzed financial data for strategic projects, enabling a 15% increase in overall investment efficiency.

- •Developed and optimized financial reporting tools, reducing reporting time by 40% across departments.

- •Supported senior leadership in assessing investment opportunities, resulting in a 25% increase in project approvals.

- •Prepared detailed financial analyses for strategic initiatives, informing critical business decisions.

- •Managed budget forecasting for $100M portfolio, improving budget accuracy by 18% through strategic planning.

- •Assisted in developing budget allocation strategies, resulting in a 10% cost saving in operational expenses.

- •Compiled and analyzed financial data, contributing to informed financial planning that increased investment potentials.

- •Collaborated with cross-functional teams to ensure alignment in budgetary planning, enhancing departmental cohesiveness.

Healthcare Sector Regional Finance Director resume sample

When applying for a role in this field, it’s essential to showcase any prior experience in financial management within the healthcare sector. Highlight your knowledge of healthcare regulations and compliance standards. Strong analytical skills are critical for assessing financial performance and budgeting effectively. If you have completed training in healthcare finance or obtained certifications such as Certified Healthcare Financial Professional (CHFP), be sure to mention these. Use the ‘skill-action-result’ framework to provide concrete examples of how your financial strategies have improved operational efficiency and contributed to overall organizational success.

- •Led a team of financial analysts to achieve a 10% reduction in operational costs through efficiency improvements.

- •Developed and executed budgeting processes for healthcare facilities, resulting in alignment with corporate objectives and a 5% increase in financial performance.

- •Collaborated with senior leadership to implement new financial policies that safeguarded assets and ensured regulatory compliance.

- •Established a comprehensive financial reporting dashboard, enhancing data transparency and enabling proactive financial management.

- •Implemented a financial forecasting model that reduced variance by 15% and provided actionable insights to stakeholders.

- •Managed risk assessment strategies which minimized financial discrepancies and optimized fiscal responsibility within the region.

- •Directed the development of strategic financial plans that improved forecast accuracy by 20%.

- •Led cross-departmental financial audits, ensuring compliance with healthcare regulations and enhancing trust with regulatory bodies.

- •Orchestrated initiatives to optimize reimbursement processes, resulting in a 15% increase in revenue cycle efficiency.

- •Played an integral role in finance technology solutions implementation, boosting operational efficiency by 30%.

- •Provided financial leadership on business unit projects, successfully advising on risk mitigation strategies that enhanced fiscal outcomes.

- •Analyzed large datasets to provide strategic insights into cost management and potential financial efficiencies across the organization.

- •Championed the establishment of new financial models, leading to a marked improvement in forecasting accuracy by 18%.

- •Coordinated with executive teams to present data-driven recommendations, improving financial decision-making processes.

- •Managed financial reporting projects that increased transparency and clarity among stakeholders and executives alike.

- •Facilitated training programs for junior analysts, increasing team analytical proficiency and collaboration.

- •Executed detailed financial analyses that increased cost-saving measures across departments by 12%.

- •Developed performance metrics to track hospital financial health, significantly improving data accuracy and reliability.

- •Supported financial reporting upgrades, contributing to better clarity and accessibility of financial data.

- •Collaborated with accounting teams to ensure appropriate financial controls and compliance were maintained.

Regional Finance Director for Non-profit Organizations resume sample

When applying for this position, it’s important to highlight any experience with budgeting and financial reporting specific to non-profits. Mention your familiarity with grant management and compliance, as these are essential in this sector. Demonstrating a commitment to mission-driven work is vital; share specific examples of how you've contributed to community impact. Additionally, if you've gained certifications in non-profit finance or participated in relevant training, be sure to include those. Use metrics where possible to illustrate your contributions to previous organizations, focusing on tangible results achieved.

- •Led the financial oversight of a $150M budget, implementing cost-saving measures and achieving a 10% reduction in operational costs.

- •Managed the preparation of annual budgets and forecasts, increasing accuracy by 20% through data-driven analyses and stakeholder collaboration.

- •Streamlined financial policies, resulting in a 15% improvement in audit outcomes and reducing compliance risks.

- •Coordinated complex audits across multiple entities, liaising with auditors to ensure adherence to regulatory requirements.

- •Enhanced financial staff training programs, improving team efficiency by 25% and advancing professional development.

- •Developed strategic financial presentations for board meetings, effectively communicating financial performance and securing $5M in donor funding.

- •Analyzed and monitored a $50M budget, identifying cost inefficiencies that led to a 7% reduction in expenditures.

- •Collaborated with program managers to align financial strategies with mission objectives, enhancing funding allocations by $3M.

- •Developed integrated financial models, boosting strategic decision-making capabilities by incorporating robust data analysis.

- •Implemented new financial software, increasing reporting accuracy by 30% and reducing data entry errors.

- •Facilitated financial planning workshops, enhancing financial literacy among 30+ program leaders and staff members.

- •Managed financial reports for 15 nationwide initiatives, improving report turnaround times by 20% through process innovation.

- •Conducted in-depth financial analysis, enabling strategic allocation changes that resulted in a 5% increase in program funding.

- •Tracked financial metrics and dashboards, facilitating informed discussions among senior leadership and enabling strategic pivots.

- •Contributed to the successful coordination of a $10M fundraising campaign, providing vital financial insights and strategy.

- •Assisted in controlling a $20M regional budget, increasing financial accuracy and integrity through rigorous data checks.

- •Implemented a new accounting system, reducing reconciliation errors by 40% and streamlining month-end processes.

- •Supported audit preparation and execution, resulting in no unfavorable findings during comprehensive financial reviews.

- •Fostered relationships with community partners, improving transparency and increasing shared funding initiatives by 25%.

Regional Budgeting and Forecasting Finance Director resume sample

When applying for this role, it’s important to showcase your experience with budgeting and financial forecasting. Highlight any analytical skills you possess and mention tools like Excel or financial modeling software you've mastered. Include specific examples of how your forecasting has informed strategic decisions in past roles. Discuss your ability to work cross-functionally, collaborating with various departments to align budgets with business objectives. Use a 'skill-action-result' structure to illustrate how your expertise has improved financial performance in previous organizations.

- •Led a team to drive regional budgeting processes, achieving 95% alignment with organizational strategies and objectives.

- •Implemented forecasting models that improved revenue projection accuracy by 25%, supporting strategic decision-making.

- •Collaborated across departments to ensure budget compliance, enhancing financial performance by analyzing metrics.

- •Delivered insightful reports on budget variances and forecasts, reducing discrepancies by 30% year over year.

- •Mentored regional finance teams, fostering improvements in accuracy and accountability for financial planning.

- •Spearheaded continuous improvements in methodologies, resulting in streamlined budgeting processes.

- •Developed comprehensive financial forecasting models, enhancing revenue forecasting accuracy by 20%.

- •Analyzed trends and delivered actionable insights that improved decision-making and increased profit margins by 15%.

- •Prepared detailed financial summaries, enabling stakeholders to adjust strategies effectively, meeting targets.

- •Coordinated the annual budgeting process, achieving consensus and reducing the cycle time by 10%.

- •Participated in strategic initiatives, aligning financial goals with corporate objectives for sustained growth.

- •Directed financial planning activities for multiple departments, improving budget adherence by 18%.

- •Collaborated with cross-functional teams to refine forecasting processes, resulting in a 22% accuracy increase.

- •Facilitated training for finance staff, enhancing analytical skills and promoting a culture of financial acumen.

- •Managed compliance with policies and regulations, ensuring accurate reporting and minimizing audit findings by 25%.

- •Supported the financial reporting process, providing accurate data for executive decision making, decreasing delays by 15%.

- •Analyzed expenses and implemented cost-saving measures, contributing to a 10% reduction in operational costs.

- •Collaborated in developing annual budgets, aligning departmental plans with corporate financial goals.

- •Assisted in strategic projects that streamlined financial workflows, enhancing overall efficiency.

Regional Finance Director- Mergers and Acquisitions resume sample

When applying for a role in Mergers and Acquisitions, it's essential to showcase any prior experience in financial analysis or deal structuring. Highlight skills in strategic planning and risk assessment. If you've completed courses like 'Corporate Finance' or 'Valuation Techniques', mention these to demonstrate your technical expertise. Provide specific instances where your involvement in transactions led to significant savings or revenue growth for your previous employers. Use a 'skill-action-result' format to illustrate your contributions and how they shaped successful outcomes in past deals.

- •Led and executed the financial strategy for $150 million in acquisitions, resulting in a 20% increase in market share.

- •Directed valuation and due diligence processes, reducing acquisition timeline by 15% while maintaining quality assessments.

- •Collaborated with cross-functional teams to ensure smooth integration post-acquisition; managed systems alignment and governance structures.

- •Delivered detailed financial modeling for all M&A activities, enhancing decision-making capabilities for senior leadership.

- •Engaged with investment banks and legal experts, increasing transaction efficiency and securing 5 successful acquisition deals.

- •Designed performance metrics, facilitating improved tracking and forecasting of financial outcomes for M&A initiatives.

- •Managed financial analysis and prepared presentations for executive board meetings to showcase acquisition opportunities.

- •Developed financial models and valuation metrics, contributing to a successful $75M merger with a key industry player.

- •Conducted comprehensive market research, enhancing strategic insights and leading to a 10% growth in acquisitive targets.

- •Acted as financial advisor during negotiations, ensuring favorable terms within M&A transactions and compliance with corporate goals.

- •Oversaw post-acquisition financial integration, achieving alignment in processes and financial practices across new entities.

- •Led financial analysis efforts that identified a $10 million cost-saving opportunity across regional operations.

- •Contributed to the development of financial projections, supporting strategic planning for potential M&A endeavors.

- •Collaborated with departments to streamline financial reporting, resulting in increased efficiency and data accuracy.

- •Assessed the competitive landscape and prepared analysis reports to guide M&A decision-making processes.

- •Provided strategic financial consultation for major M&A projects, significantly improving client acquisition strategies.

- •Engaged in detailed financial due diligence, offering client recommendations that led to profitable business expansions.

- •Evaluated corporate governance structures within M&A transactions to ensure compliance and operational efficiency.

- •Presented strategic growth opportunities to client executives, increasing understanding of M&A impacts on market positioning.

Regional Supply Chain Finance Director resume sample

When applying for this role, emphasize any experience in logistics or supply chain management. Highlight your analytical skills, especially in cost reduction and optimization. Mention relevant training or certifications such as 'Supply Chain Management' or 'Financial Analytics.' Provide examples where your data-driven decisions have led to improvements, following a 'skill-action-result' framework. Additionally, discussing your ability to collaborate with cross-functional teams can set you apart, showcasing how you’ve driven efficiencies and enhanced overall supply chain performance in previous positions.

- •Led a team of 5 in designing financial models, achieving a 20% improvement in operational efficiency.

- •Implemented advanced forecasting techniques resulting in a 15% reduction in budget variance.

- •Partnered with sales and operations to drive a 25% increase in profitability through strategic financial planning.

- •Streamlined financial reporting processes, improving data accuracy by 30% across all reports.

- •Presented quarterly financial analysis to senior leadership, supporting a key strategic initiative.

- •Mentored finance team, enhancing skill-sets and increasing team productivity by 25%.

- •Developed and monitored KPIs, resulting in a 30% improvement in supply chain efficiency.

- •Collaborated on cross-functional teams implementing cost reduction strategies, saving $5M annually.

- •Conducted post-project financial reviews on 10 major projects, identifying areas for future improvements.

- •Redesigned budgeting process, reducing preparation time by 20%, and increasing forecasting accuracy.

- •Provided financial insight for procurement strategies, reducing overhead costs by 18% over two years.

- •Analyzed supply chain models, offering insights leading to 10% cost savings across multiple projects.

- •Assisted in the implementation of a new ERP system, enhancing data management capabilities by 40%.

- •Prepared detailed financial reports, influencing the strategic decision-making process for senior leadership.

- •Participated in developing financial planning tools, improving budgeting processes by 15%.

- •Supported operations finance team driving a 12% increase in cost efficiency across logistics operations.

- •Performed variance analysis, pinpointing savings opportunities, resulting in a $3M cost reduction.

- •Facilitated budgeting workshops, enhancing team forecasting skills, and improving budget accuracy by 10%.

- •Created detailed supply chain financial models, aligned with company strategic objectives.

Corporate Banking Regional Finance Director resume sample

When applying for this position, focus on your experience with credit risk assessment and financial analysis. Highlight your ability to develop and maintain client relationships, as this is essential for portfolio management. Include any certifications related to corporate finance or banking regulations to demonstrate your expertise. Use a 'skill-action-result' format to showcase examples where your decisions led to improved loan performance or increased client satisfaction. This will illustrate your impact on previous organizations and strengthen your application.

- •Managed financial planning processes contributing to a 15% increase in regional performance and efficiency.

- •Led a team to develop financial strategies that resulted in a 20% reduction in operational costs.

- •Prepared financial forecasts that informed executive decisions leading to a 25% increase in revenue growth.

- •Ensured compliance with financial regulations, maintaining a strong control environment and zero compliance issues.

- •Analyzed KPIs leading to a 10% improvement in regional operational efficiency.

- •Spearheaded financial reports that significantly enhanced stakeholder engagement and trust.

- •Developed and implemented cost-saving initiatives achieving 18% yearly budget reductions.

- •Collaborated with cross-functional teams to enhance reporting processes, resulting in a 30% increase in accuracy and timeliness.

- •Successfully identified and addressed financial inefficiencies leading to a $3 million cost saving annually.

- •Managed regional financial reporting, facilitating informed decision-making for senior management.

- •Enhanced team performance through effective mentorship, leading to a 40% increase in team productivity.

- •Conducted in-depth financial analysis, contributing insights leading to a 12% revenue increase.

- •Assisted in developing strategic plans that enhanced market competitiveness by 25%.

- •Improved reporting efficiency by 50% through process redesign and technology integration.

- •Supported financial implications of new product initiatives leading to a $5 million increase in revenue.

- •Managed company-wide budgets leading to a 10% increase in financial resource optimization.

- •Facilitated audits ensuring compliance and enhancing financial transparency with zero reportable issues.

- •Analyzed financial positions, identifying opportunities for investment resulting in a 15% ROI.

- •Collaborated with teams to streamline financial processes, resulting in $2 million returns.

Regional Finance Director for Capital Planning resume sample

When applying for this role, it's important to showcase your experience in financial forecasting and analysis. Highlight any involvement in capital budgeting processes or investment strategies. Include any relevant certifications, such as CFA or CIMA, to demonstrate your expertise. Emphasize your ability to collaborate with cross-functional teams and present financial models to stakeholders. Use specific examples to detail how your insights led to improved capital allocation or cost savings, following the 'skill-action-result' framework for clarity and impact on decision-making processes.

- •Led the capital allocation strategy that increased returns by 20%, achieving alignment with corporate goals and objectives.

- •Developed financial models to evaluate potential investments, leading to successful funding of projects worth over $500 million.

- •Presented quarterly financial performance and capital investment reports to the executive board, enhancing transparency and strategic decision-making.

- •Collaborated with cross-functional teams to execute a major capital project under budget and ahead of schedule, saving $2 million.

- •Enhanced mentorship programs in the finance department, resulting in a 15% increase in team productivity and engagement.

- •Implemented financial procedures that reduced capital expenditure overruns by 10%, fostering better budget adherence across projects.

- •Spearheaded comprehensive financial forecasts that informed capital projects, culminating in over $200 million in optimized investments.

- •Conducted risk assessments for potential projects, streamlining project approval times by 25% through improved process efficiency.

- •Prepared detailed quarterly investment reports for stakeholders, leading to improved transparency and stakeholder satisfaction.

- •Implemented budget monitoring systems, resulting in a 10% reduction in operational expenditures over two fiscal years.

- •Orchestrated cross-departmental meetings to ensure financial alignment, contributing to the successful completion of 15 capital projects.

- •Designed and implemented financial forecasting models, improving accuracy by 30% and assisting strategic decision-making.

- •Led project evaluations for large-scale investments, driving a 15% improvement in financial returns across the board.

- •Improved financial reporting processes, reducing report preparation time by 20% and enhancing efficiency.

- •Collaborated on a cross-functional team to optimize funding allocation, contributing to a $10 million savings in project costs.

- •Conducted in-depth financial analyses on investment projects, leading to an increase in project ROI by 12%.

- •Streamlined capital expenditure tracking, reducing reporting errors by 15% and ensuring compliance with budgetary constraints.

- •Prepared and presented budget variance reports to management, enhancing strategic planning processes.

- •Worked with senior analysts to refine financial models, resulting in an improved 25% accuracy in forecasts.

Retail Industry Regional Finance Director resume sample

When applying for this role, it’s important to showcase your experience in managing budgets and financial forecasts specific to the retail sector. Emphasize your ability to analyze sales data to optimize inventory and pricing strategies. Highlight any partnerships with supply chain teams and how you’ve improved cost efficiencies or revenue growth. Incorporate relevant certifications in retail management or financial analysis. Use tangible examples that demonstrate how your financial insights have directly led to increased sales or reduced expenses, using a 'skill-action-result' format for clarity.

- •Spearheaded a financial restructuring program that reduced expenditures by 15% and increased profit margins by 7%, ensuring alignment with strategic goals.

- •Led a team of 12 finance professionals to consistently deliver on-budget forecasts, fostering a culture of continuous improvement and operational efficiency.

- •Implemented monthly financial reports leading to a 20% improvement in departmental decision-making processes and strategic initiatives.

- •Streamlined the annual budgeting process, cutting preparation time by 30% and improving accuracy for the $1 billion retail division.

- •Collaborated with cross-departmental teams on multiple new store projects, providing strategic financial guidance resulting in an average 25% increase in ROI.

- •Ensured compliance with the latest financial regulations through detailed audits, mitigating risks and resolving issues promptly.

- •Managed the financial planning for a 150-store portfolio, facilitating a 10% year-over-year sales growth through strategic forecasting.

- •Identified and capitalized on cost reduction opportunities, saving $2 million in the fiscal year through procurement and supply chain efficiencies.

- •Advanced financial report automation, reducing manual input errors by 25%, while increasing report generation speed by 40%.

- •Developed and mentored a finance team, improving team performance by 15%, resulting in enhanced internal promotions.

- •Facilitated cross-functional workshops to align financial strategies with operational goals, resulting in improved budgetary discipline across departments.

- •Boosted financial forecast accuracy by leveraging advanced Excel modeling techniques, achieving 95% precision in financial projections.

- •Played a leading role in upgrading ERP systems, enhancing financial data accessibility and reporting efficiency across the department by 30%.

- •Collaborated with operations to analyze and improve cash flow management, increasing available cash reserves by $10 million over 18 months.

- •Conducted detailed financial analysis for a multi-million dollar project, delivering insights that refined investment approaches and efficiency.

- •Analyzed detailed sales data to provide actionable insights, contributing to a 5% increase in retail revenues over a fiscal year.

- •Supported the budgetary process for flagship stores, ensuring alignment with corporate strategy and financial projections.

- •Revised forecasting methodology leading to a 12% enhancement in accuracy for quarterly sales forecasts, supporting strategic decision-making.

- •Assessed financial procedures and introduced new reporting methods, resulting in time savings and more accurate financial data presentation.

Regional Finance Director for Risk Management resume sample

When applying for a role in risk management, it's important to showcase your experience with assessing financial risks and developing mitigation strategies. Highlight your analytical skills and proficiency in using risk management software. If you have completed relevant training or certifications, like 'Risk Management Fundamentals' or 'Financial Analysis Techniques', include these to demonstrate your commitment. Provide specific examples where your risk assessment improved decision-making or reduced losses in previous positions, using a 'skill-action-result' format to illustrate your impact on the organization.

- •Developed a comprehensive risk management framework that reduced risk exposure by 25% within the first year.

- •Led a cross-functional team that identified cost-saving measures, resulting in an annual savings of over $10M.

- •Collaborated with leadership to implement budgeting strategies that improved forecast accuracy by 15%.

- •Established a new mentoring program, increasing team engagement metrics by 18%.

- •Enhanced compliance reporting, reducing audit issues by 40% and gaining positive feedback from external auditors.

- •Implemented a strategic financial analysis tool that identified potential risks in the regional market.

- •Directed the risk assessment process that mitigated potential losses in a volatile market environment.

- •Facilitated inter-departmental projects that improved overall operational efficiency by 20%.

- •Presented comprehensive financial risk reports to senior management, leading to strategic policy adjustments.

- •Drove a major digital transformation project, streamlining financial processes and cutting manual errors by 30%.

- •Initiated a training program on financial risk management principles, enhancing team's analytical skills by 25%.

- •Analyzed financial data that pinpointed risk factors, contributing to a 15% increase in profit margins.

- •Developed key performance indicators that improved financial reporting accuracy by 20%.

- •Prepared monthly financial reports used in executive strategy sessions, shaping regional business objectives.

- •Optimized financial planning processes, resulting in higher predictive accuracy and decision-making capabilities.

- •Conducted in-depth market analysis, driving data-driven decisions and improving investment portfolio returns by 10%.

- •Implemented a risk reporting system that streamlined compliance with regulatory requirements, increasing audit efficiency.

- •Collaborated in the creation of financial models that enhanced strategic planning and risk assessments.

- •Assessed market risk factors, providing significant insights that helped avoid potential financial setbacks.

As a regional finance director, crafting your resume is like mapping out a financial landscape, requiring precision, skill, and strategy. With your extensive expertise, distilling it onto a single page can feel overwhelming. Deciding which finance knowledge to highlight and how to frame your strategic successes is often a challenge.

Your resume serves as your professional portfolio, making that crucial introduction to potential employers. To stand out among many, it needs to capture attention quickly. That's where a well-structured resume template becomes crucial. Using a well-designed template ensures you capture all necessary elements without missing a beat.

Finding the right format and focusing on the content that truly reflects your abilities can be tricky. A one-size-fits-all resume often falls short of conveying your unique experiences. Tailoring your resume to showcase your journey and achievements in a way that aligns with your audience is vital.

This guide will show you how to translate your accomplishments and financial expertise into a compelling story. You'll find practical advice on selecting the best format, avoiding common pitfalls, and elevating your resume to professional standards. As you aim for new roles or growth in your current position, mastering resume writing is a crucial step in your career journey.

Key Takeaways

- Crafting a well-structured resume is essential to quickly capture the attention of potential employers and showcase your abilities and achievements effectively.

- Using a chronological format and modern fonts enhances readability, professionalism, and allows your career progression to stand out clearly.

- Tailor your resume by spotlighting quantifiable achievements and utilizing action verbs to demonstrate your leadership and strategic impact.

- Including a focused resume summary and skills section strengthens your candidacy by communicating your leadership, financial expertise, and relevant soft and hard skills.

- Enhancing your resume with additional sections like certifications, languages, and volunteer activities adds depth and portrays a well-rounded professional profile.

What to focus on when writing your regional finance director resume

As a regional finance director, your resume needs to convey leadership and strategic financial management skills to the recruiter. It should highlight your ability to drive financial performance across multiple locations, demonstrating expertise in budgeting, forecasting, and overseeing financial operations with precision. Show how your proficiency in regulatory compliance and risk management complements your ability to work closely with stakeholders.

How to structure your regional finance director resume

- Contact Information — It's vital to ensure clarity and accessibility, as the first thing a recruiter will see is how to reach you. Include your full name, phone number, email, and LinkedIn profile prominently. This basic information sets the stage for the rest of your resume by ensuring you are easily reachable.

- Professional Summary — Provide a powerful opening statement that captures your years of experience and key achievements. Your summary should reflect your personal brand, emphasizing your approach to financial leadership, along with an overview of your skills in financial planning and analysis tailored to regional markets.

- Work Experience — Detail your past roles in reverse chronological order, concentrating on those experiences that showcase your regional oversight skills. This section should highlight achievements like improved financial efficiency and cost reductions, using metrics to quantify your impact and demonstrate your value to potential employers.

- Education — List any degrees relevant to your role, such as finance or business degrees, and certifications like CPA or CFA that bolster your financial credibility. This signals your commitment to maintaining a high standard of professional development in the field.

- Skills — Emphasize critical abilities such as strategic financial planning, regulatory compliance, and proficiency with financial software like SAP or Oracle. These skills are essential for a regional finance director, reflecting your technical aptitude and readiness to handle complex financial operations.

- Achievements — Spotlight significant accomplishments, particularly those with measurable outcomes like increased profit margins or successful financial consolidations. Including these will provide evidence of your ability to deliver results and drive success.

- To round out your resume, consider including sections like "Professional Affiliations" or "Community Involvement." Highlight your commitment to the industry and community leadership, which offers a glimpse into your professional network and dedication to finance beyond the workplace. Now that we have an overview of how to structure your resume, let's delve deeper into each section below to ensure you convey the right message and impact.

Which resume format to choose

Your resume format is essential in presenting your career trajectory as a regional finance director. A chronological format is particularly effective in this field because it emphasizes your career progression, allowing potential employers to clearly see how your roles and contributions have evolved over time. This format is especially valuable in finance, where experience and advancement are key indicators of your expertise and reliability.

The choice of font subtly impacts the professionalism and readability of your resume. Opt for modern fonts like Lato, Montserrat, or Raleway, which bring a fresh and polished look. These fonts maintain a professional appearance that can highlight your attention to detail, a crucial quality in financial roles. Keeping your text between 10 and 12 points ensures that your resume is easy to read while also appearing concise and well-prepared.

Opting for a PDF format for your resume is critical because it locks in the formatting exactly as intended. In finance, precision matters, and sending your resume as a PDF guarantees that your document will look the same on any device or platform. This consistency reflects the meticulousness expected in a finance director's role.

Margins are another important consideration when crafting your resume. A standard 1-inch margin on all sides provides a clean frame for your content, ensuring that it doesn't appear cluttered on the page. This balance of space mirrors the organized and structured approach you bring to financial management, helping to strengthen the overall impression you wish to convey. By fine-tuning each of these elements, you craft a resume that effectively represents your professional narrative and stature in the finance industry.

How to write a quantifiable resume experience section

The resume experience section is a key tool for a regional finance director, marking your significant career milestones and financial leadership. By centering on measurable achievements, you demonstrate your ability to drive results and add value. Start with the most recent roles first, showing a clear, upward career trajectory within the financial sector. Limit your history to the last decade or so to focus on relevant accomplishments. Choose job titles that highlight your finance expertise and align these experiences with the job ad’s requirements. This approach ensures you present a tailored resume that resonates with what prospective employers seek. Incorporating action verbs like "led," "increased," "implemented," and "optimized" adds clarity to your impact.

Here's a polished example for a regional finance director:

- •Increased regional revenue by 20% over three years by implementing cost-saving initiatives and optimizing financial processes.

- •Led a team of 15 finance professionals, enhancing productivity and collaboration, resulting in a 25% reduction in reporting time.

- •Implemented a new financial forecasting model that improved accuracy by 30%, supporting better strategic decision-making.

- •Managed a $50 million budget, ensuring compliance and alignment with organizational goals, while reducing expenses by 10%.

This experience section stands out by intertwining quantifiable results with your leadership story, creating a narrative of impact and efficiency. Each point builds on the last, painting a picture of a forward-thinking finance leader who uses data-driven strategies to achieve organizational goals. Tailoring these achievements to the role further highlights your fit as a strategic leader, ready to propel financial growth and efficiency.

Innovation-Focused resume experience section

An innovation-focused regional finance director resume experience section should clearly demonstrate your ability to drive change and enhance financial practices creatively. Begin by highlighting your achievements and set the stage for how your innovative efforts have impacted financial strategy. Use examples that show your skill in implementing solutions that boost efficiency and drive productivity. Highlight your role in introducing technology, optimizing processes, and managing projects with a fresh perspective.

Arrange your experiences in reverse chronological order, leading with your most recent role. Opt for straightforward language to describe your responsibilities and accomplishments, making sure to emphasize the innovative outcomes. Tailor your bullet points to reflect strategic leadership and measurable results that showcase your capability to innovate in financial contexts. This approach demonstrates how your innovative mindset has fueled company growth and success.

Regional Finance Director

XYZ Corporation

June 2019 - Present

- Led a financial transformation initiative that increased cost efficiency by 20% through advanced analytics and AI-driven forecasting.

- Implemented a modern budgeting system, reducing annual preparation time by 30% while enhancing accuracy.

- Fostered cross-department collaboration to develop new financial models, boosting revenue streams by 15% within one year.

- Launched a digital training program for finance staff, improving productivity by 25% and promoting a culture of continuous learning.

Efficiency-Focused resume experience section

A resume experience section for a regional finance director with an efficiency focus should showcase your knack for optimizing financial operations and achieving measurable cost savings. It's important to start by highlighting times when you've managed budgets or improved financial processes, leading to more streamlined outcomes. Using direct language, back your achievements with numbers or percentages to provide concrete evidence of your impact.

Next, weave different examples of how you've spearheaded efficiency into your bullet points. This could involve how you streamlined financial reporting systems, developed effective budgeting strategies, or introduced new financial technologies. Each bullet should reflect a specific accomplishment that demonstrates your ability to manage resources effectively and meet financial objectives. Ultimately, your goal is to convey to potential employers how your experience in driving efficiency can benefit their organization.

Regional Finance Director

XYZ Corporation

June 2018 - Present

- Reduced monthly financial closing time by 30% through process optimization and automation.

- Implemented a new budgeting tool that improved forecasting accuracy by 20% across all departments.

- Led a cross-functional team to cut operating costs by 15% year-over-year without sacrificing service quality.

- Devised and executed a streamlined compliance protocol that resulted in zero audit findings for two consecutive years.

Problem-Solving Focused resume experience section

A problem-solving-focused Regional Finance Director resume experience section should clearly highlight your ability to drive significant improvements and tackle complex challenges. Start by emphasizing accomplishments that demonstrate your knack for enhancing financial performance and achieving tangible results. Use strong action verbs in each bullet point to reflect your proactive approach and successful outcomes, ensuring that your content aligns with how your skills contributed to the company's objectives and growth.

Focus on being concise yet informative, describing the problems you faced and the strategic solutions you implemented. Incorporating metrics will strengthen your narrative and illustrate the extent of your impact. This way, you seamlessly exhibit your analytical skills and leadership within finance operations, making your experience section compelling and cohesive.

Regional Finance Director

ABC Financial Services

2018 - 2023

- Implemented a cost reduction strategy that lowered operational expenses by 15% annually.

- Led a cross-regional team to streamline financial reporting processes, cutting the turnaround time by 30%.

- Developed risk management plans that minimized financial exposure by 20%.

- Revamped budget forecasting methods to improve accuracy with advanced data analytics tools.

Training and Development Focused resume experience section

A training and development-focused Regional Finance Director resume experience section should highlight your impact on team growth and performance. Start by emphasizing the training programs you’ve created and the skills your team has developed under your guidance, showcasing clear improvements. Share examples of how you have designed and led successful training sessions, focusing on their goals and the positive outcomes achieved. By illustrating how your initiatives have enhanced both team and business performance, you demonstrate your unique blend of financial expertise and leadership skills.

To ensure clarity, use direct bullet points to capture your achievements. Each point should reflect a particular facet of your training and development efforts that led to improvements. Highlight achievements such as boosting team productivity, enhancing financial skills, integrating new tools, or supporting strategic growth through innovative training. Make sure to underline the measurable impacts and transformations that emerged from your leadership, weaving a cohesive narrative of your contributions.

Regional Finance Director

- Led weekly workshops to enhance finance team skills, improving report accuracy by 20%.

- Created a mentorship program that boosted employee retention by 15%.

- Introduced financial modeling software, cutting budget forecast time by 30%.

- Designed training for better cross-department collaboration, increasing teamwork scores by 25%.

Write your regional finance director resume summary section

A finance-focused regional finance director resume summary should offer a quick and compelling glimpse into your professional journey. This part of your resume is where you showcase leadership in finance, strategic planning, and regional financial oversight. An example might look like this:

This summary works because it clearly ties your experience, skills, and achievements together, painting a vivid picture of your capabilities. When describing yourself, focus on mentioning the key skills and achievements that represent the essence of your career. Words should be chosen to precisely reflect who you are professionally, avoiding vague phrases that could dilute your impact.

Grasping the difference between various resume sections can ensure you use the right one. A resume summary is ideal for seasoned professionals, providing a snapshot of career accomplishments and skills. In contrast, a resume objective, which focuses on your career goals, suits newcomers or those switching fields. A resume profile serves as a broader take, blending skills and aspirations, while a summary of qualifications specifically lists relevant skills, achievements, and experiences.

Each of these sections serves its own function, so the choice depends on your career stage. For an established professional like a regional finance director, a resume summary is often your best bet, as it lays the groundwork for a memorable first impression.

Listing your regional finance director skills on your resume

A skills-focused regional finance director resume should integrate your expertise and abilities in a seamless and compelling way. You can choose to make the skills section stand alone or weave it into areas like your experience and summary. Highlighting your strengths and soft skills is essential as it demonstrates your ability to collaborate and handle challenges. Alongside this, your hard skills—such as financial analysis and budgeting—are the technical abilities that define your expertise. These skills collectively serve as important keywords, capturing the attention of hiring managers and applicant tracking systems to enhance your chances of landing an interview.

Example of a standalone skills section:

This skills section is effective because it lists key abilities relevant to a finance director, focusing on what adds value to the role. With each skill being specific, it's crucial for managing regional finance operations successfully.

Best hard skills to feature on your regional finance director resume

In a regional finance director role, hard skills are vital as they showcase your proficiency in financial management. These skills must communicate your capability to handle complex operations efficiently. Here's a list of crucial hard skills:

Hard Skills

- Financial Analysis

- Budget Management

- Risk Management

- Accounting Principles

- Forecasting Techniques

- Profit and Loss Management

- Regulatory Compliance

- Strategic Planning

- Auditing

- Cost Analysis

- Financial Reporting

- Precision in Data Analysis

- Mergers and Acquisitions

- Investment Analysis

- Tax Planning

Best soft skills to feature on your regional finance director resume

Soft skills in a regional finance director role reveal how effectively you work with others and tackle challenges. These abilities are essential for leading teams and fostering effective communication. Consider these top soft skills for your resume:

Soft Skills

- Leadership

- Problem Solving

- Communication

- Negotiation

- Adaptability

- Time Management

- Team Collaboration

- Decision-Making

- Critical Thinking

- Conflict Resolution

- Attention to Detail

- Emotional Intelligence

- Stress Management

- Motivation

- Creative Thinking

How to include your education on your resume

The education section on your resume is crucial as it showcases your academic background, which is often the foundation for your expertise. Tailor this section toward the regional finance director position by including relevant education and omitting any irrelevant qualifications. Only feature details that highlight your competence for the job. If your GPA is high, typically above 3.5, you should include it on your resume to demonstrate your academic success. Listing any academic honors such as cum laude will also enhance your credentials. Present your degrees clearly; mention the degree type, the institution, and if applicable, the dates attended.

Here's an example of how not to format your education section:

Now, let's look at an effective education section for a regional finance director:

This example stands out because it highlights an MBA in Finance from a prestigious institution, a key qualification for a finance director role. The GPA is included because it reflects strong academic performance. Such relevant and focused information convincingly positions you as an accomplished professional ready for the regional finance director role.

How to include regional finance director certificates on your resume

Including a certificates section on your resume is crucial for a role like a regional finance director. Certificates show that you have the specialized knowledge and skills needed for the job. You can also add certificates in the header to make them stand out.

List the name of the certificate. Include the date you received it. Add the issuing organization. Make sure each entry is clear and easy to understand. Put the most relevant certificates at the top.

Here's a good example:

This example is effective because it lists certificates relevant to a finance role. Each certificate includes the title and the issuing body, proving credibility. The format makes it easy for employers to see your qualifications at a glance. This approach strengthens your resume by showcasing your expertise and dedication.

Extra sections to include in your regional finance director resume

In today's competitive job market, crafting a standout resume is essential, especially for high-level positions like a regional finance director. This role often requires a blend of financial expertise, managerial skills, and the ability to communicate effectively. Adding extra sections can make your resume more attractive and well-rounded.

- Language section — List any additional languages you speak fluently or conversationally to highlight your global communication skills. Swahili, Spanish, and Mandarin can open doors to diverse teams and broaden your market reach.

- Hobbies and interests section — Include hobbies like chess or marathon running to show strategic thinking and endurance. These activities reflect qualities that can benefit long-term projects and high-pressure situations.

- Volunteer work section — Detail your involvement in community service, such as volunteering at a local food bank or mentoring youth in financial literacy. This emphasizes your commitment to social responsibility, showing that you bring ethical values to your role.

- Books section — Mention influential books you've read related to finance or leadership, like "The Intelligent Investor" by Benjamin Graham or "Good to Great" by Jim Collins. This demonstrates your continuous learning and dedication to professional growth.

Carefully chosen sections can provide valuable insights into your personality and skills. They can set you apart from other candidates while showcasing varied competencies and interests.

In Conclusion

In conclusion, crafting an effective resume as a regional finance director becomes a strategic exercise in showcasing your leadership and financial expertise. A well-structured resume should not only detail your professional journey but should also echo your readiness to tackle new challenges in complex financial landscapes. It's essential to lean on quantifiable achievements that narrate a compelling story of impact and efficiency, tailored specifically to your career objectives. Be sure to accentuate both hard and soft skills, illustrating your technical proficiency alongside your ability to lead and inspire teams. Remember, the design and format you choose play a pivotal role in conveying your attention to detail and professional demeanor. Moreover, complementing your core sections with well-chosen extras like certifications, language skills, and personal interests can paint a fuller picture of your capabilities, setting you apart from the competition. By following these guidelines, you will not only impress potential employers but also underscore your suitability for strategic roles in finance management. As you prepare for future opportunities, a crafted resume becomes your passport to career advancement, reflecting not just past successes but also your potential to drive financial strategy in today's dynamic business environment.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.