Retail Banking Resume Examples

Jul 18, 2024

|

12 min read

"Craft your perfect retail banking resume: a step-by-step guide. Learn expert tips to land your dream banking role and make your skills account for more."

Rated by 348 people

Retail Banking Operations Manager

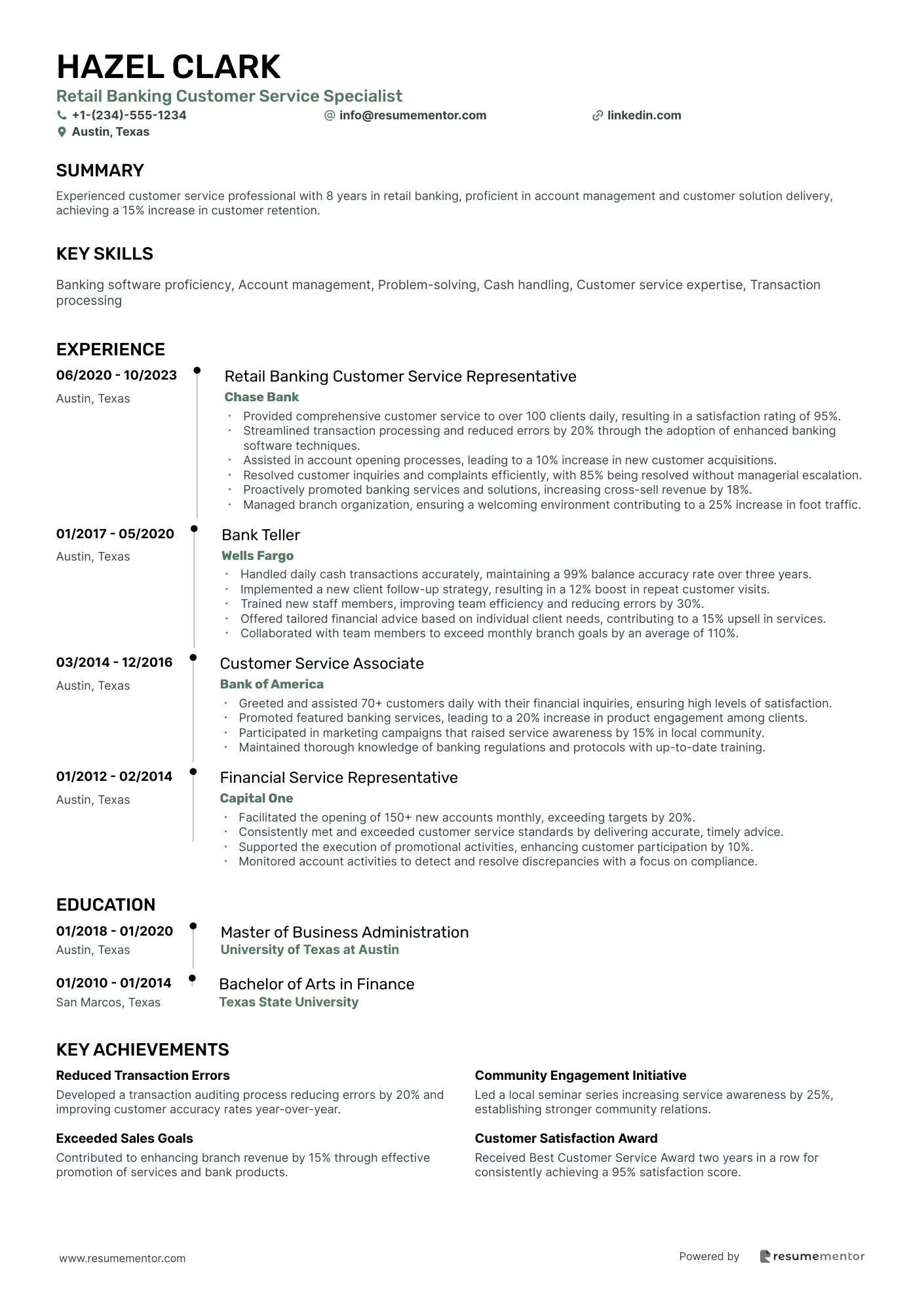

Retail Banking Customer Service Specialist

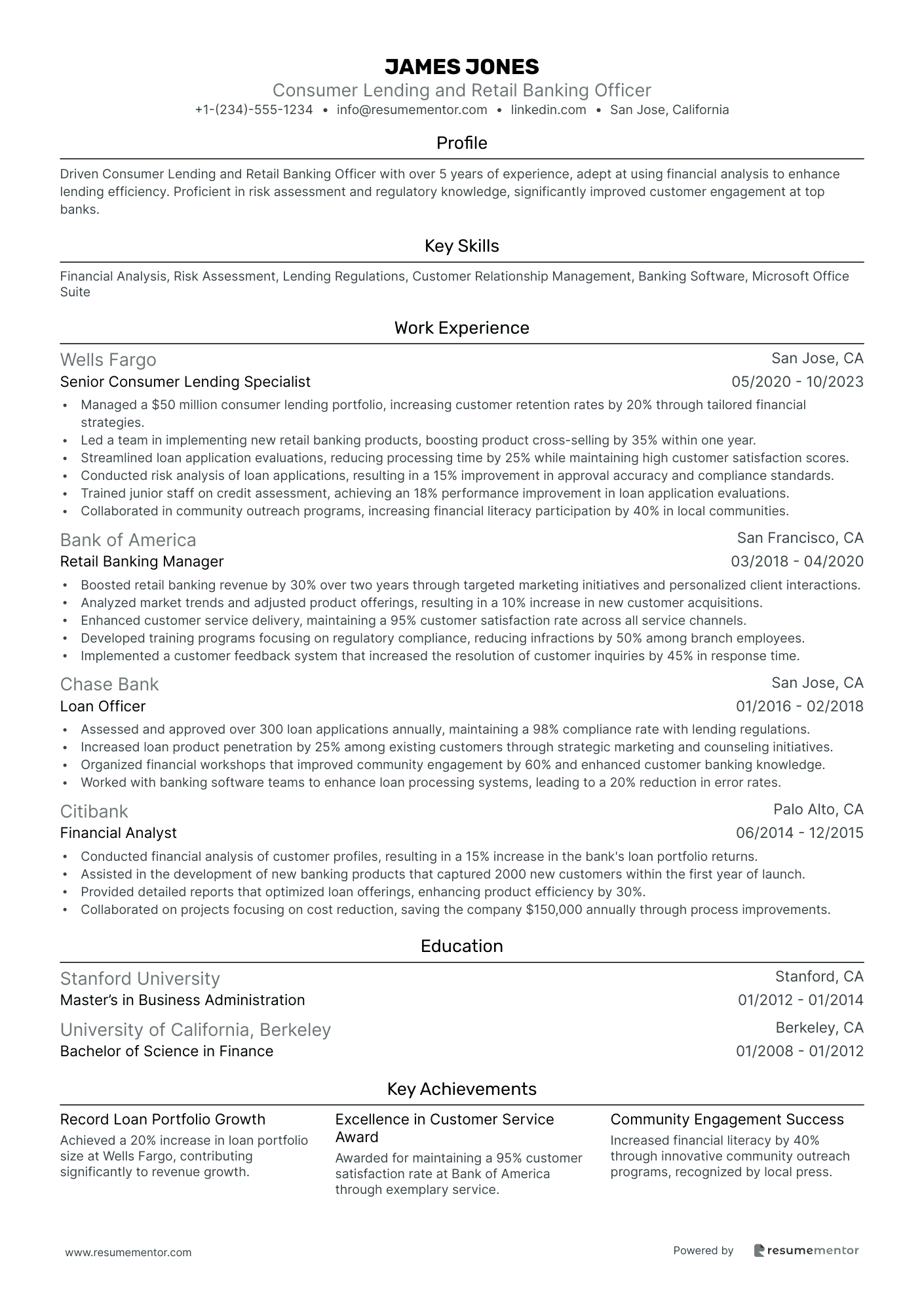

Consumer Lending and Retail Banking Officer

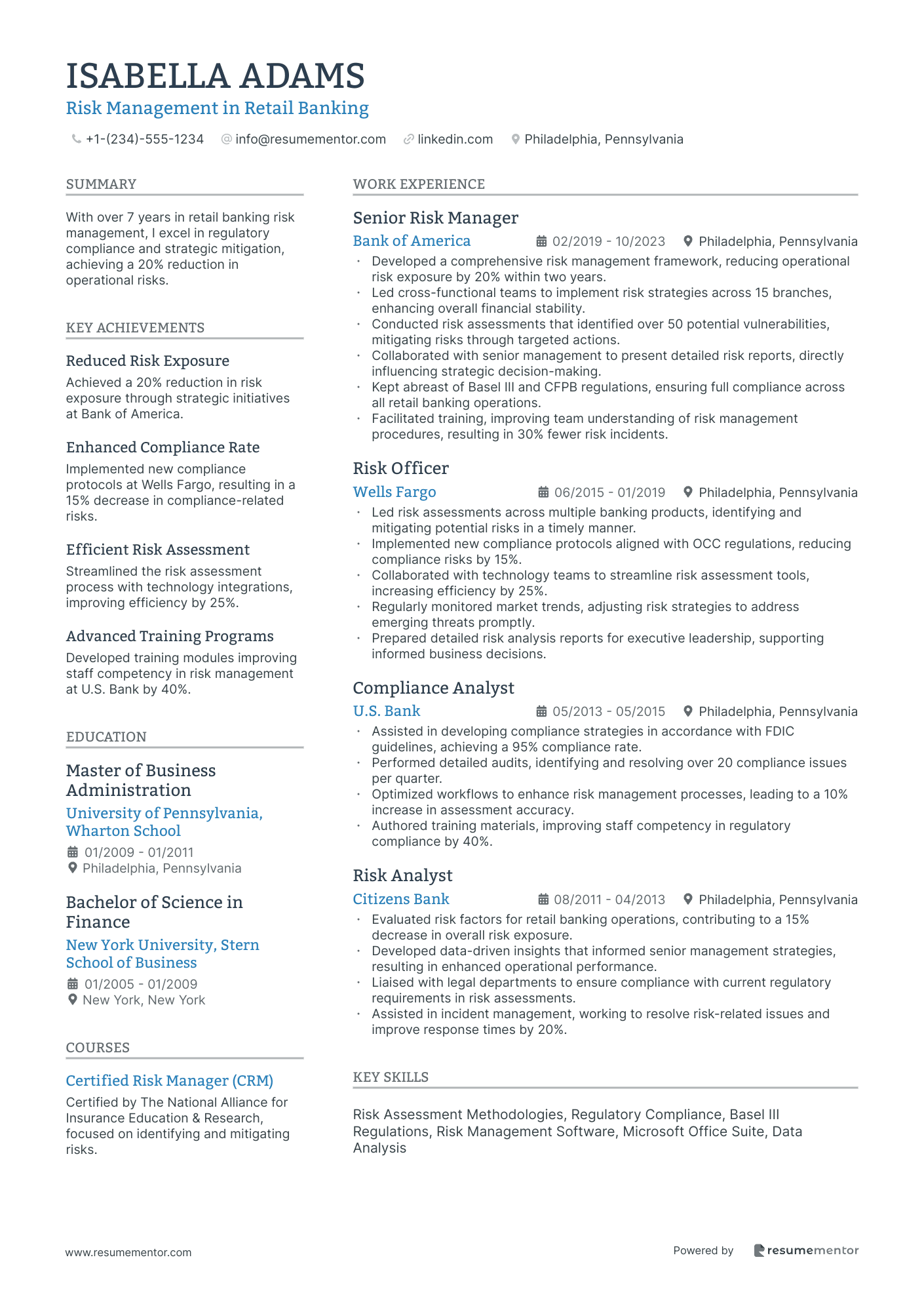

Risk Management in Retail Banking

Retail Banking Compliance Officer

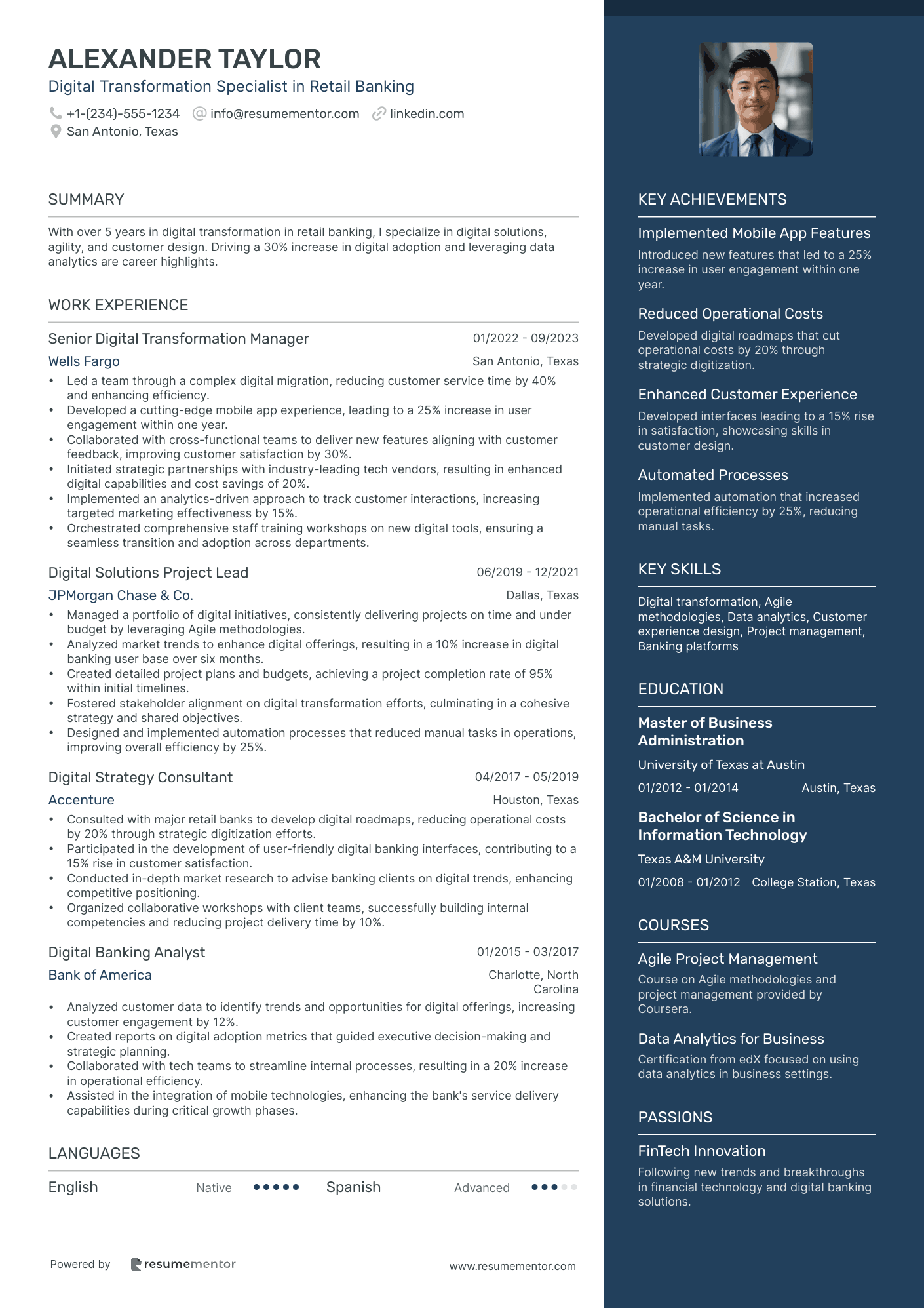

Digital Transformation Specialist in Retail Banking

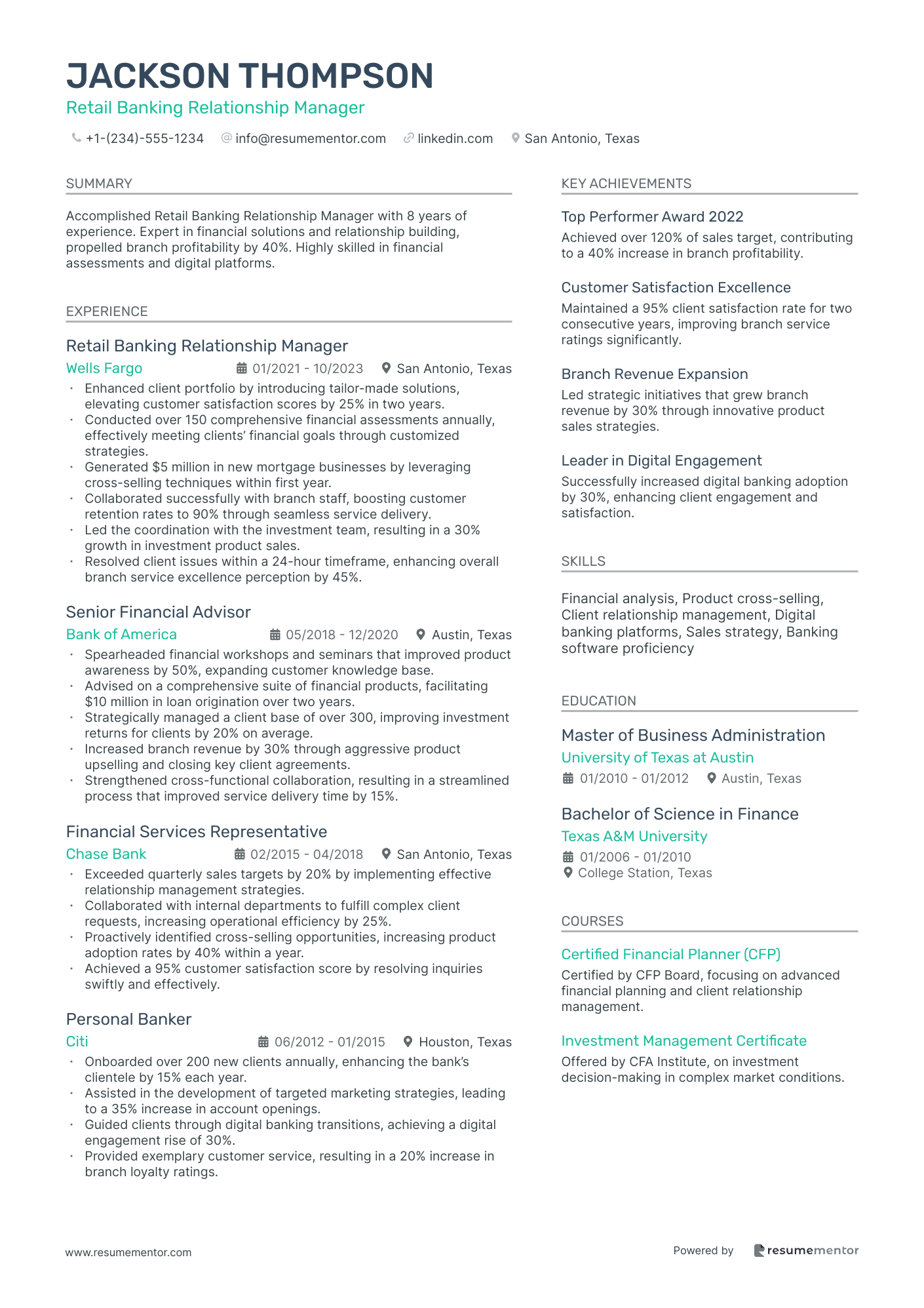

Retail Banking Relationship Manager

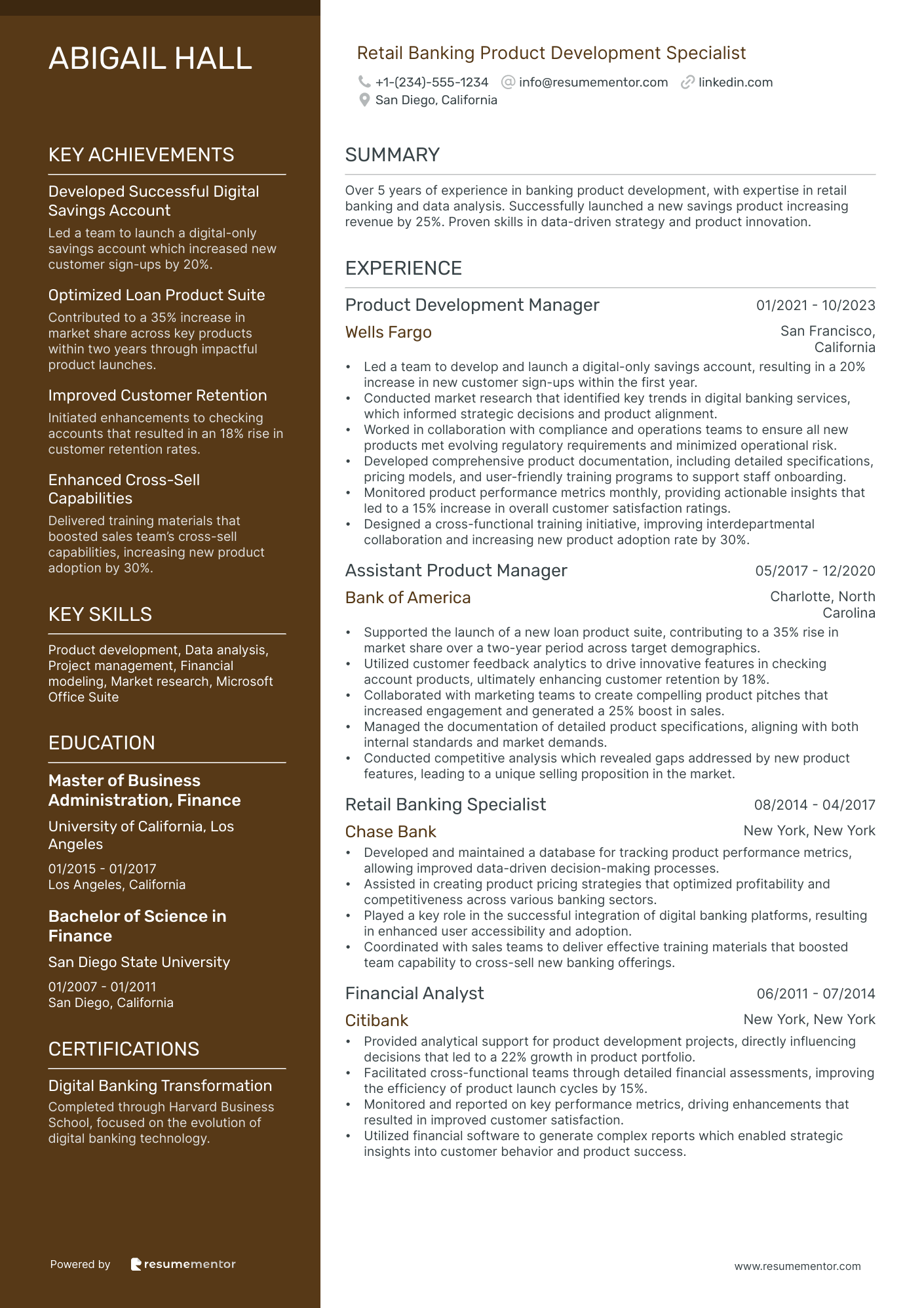

Retail Banking Product Development Specialist

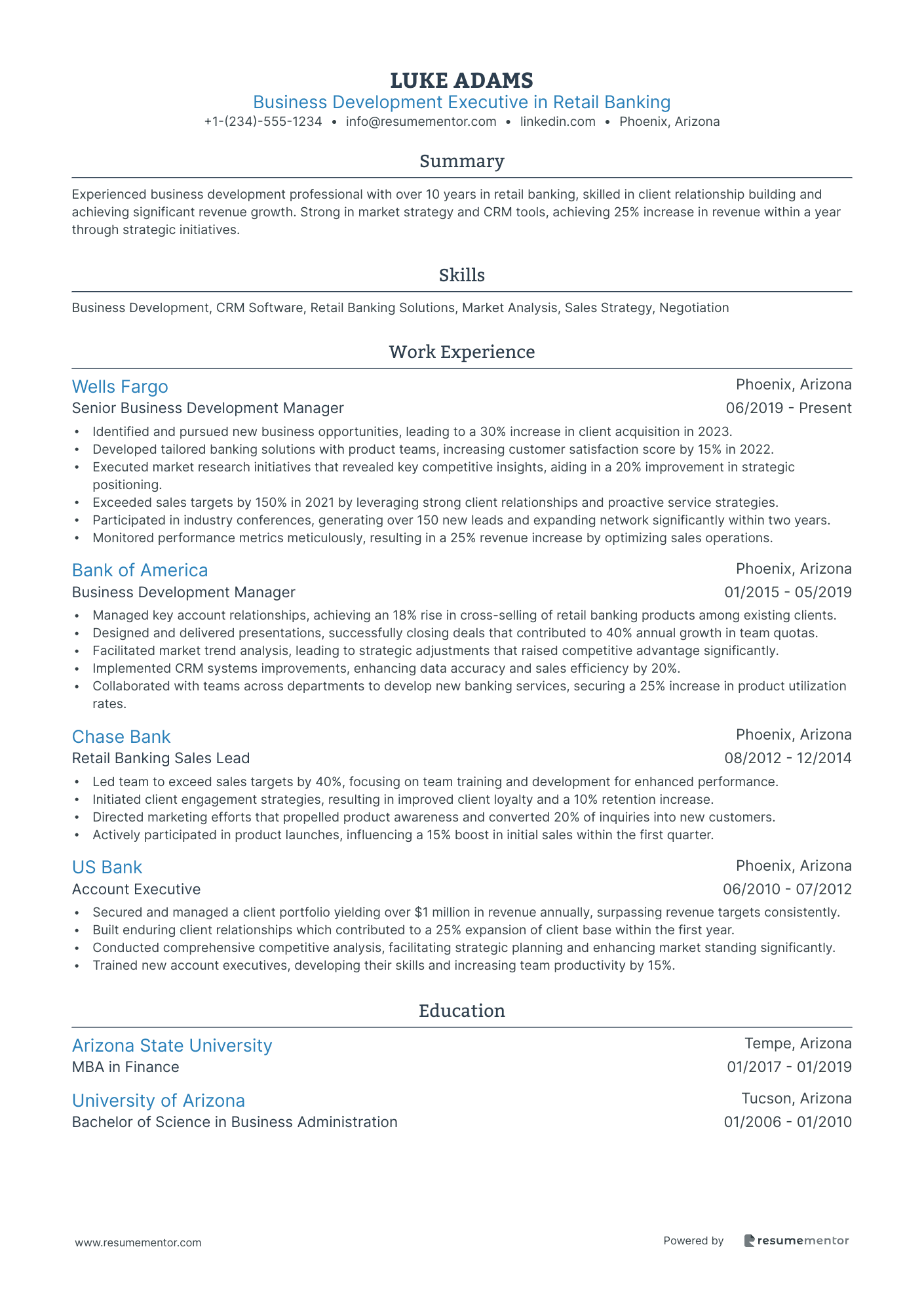

Business Development Executive in Retail Banking

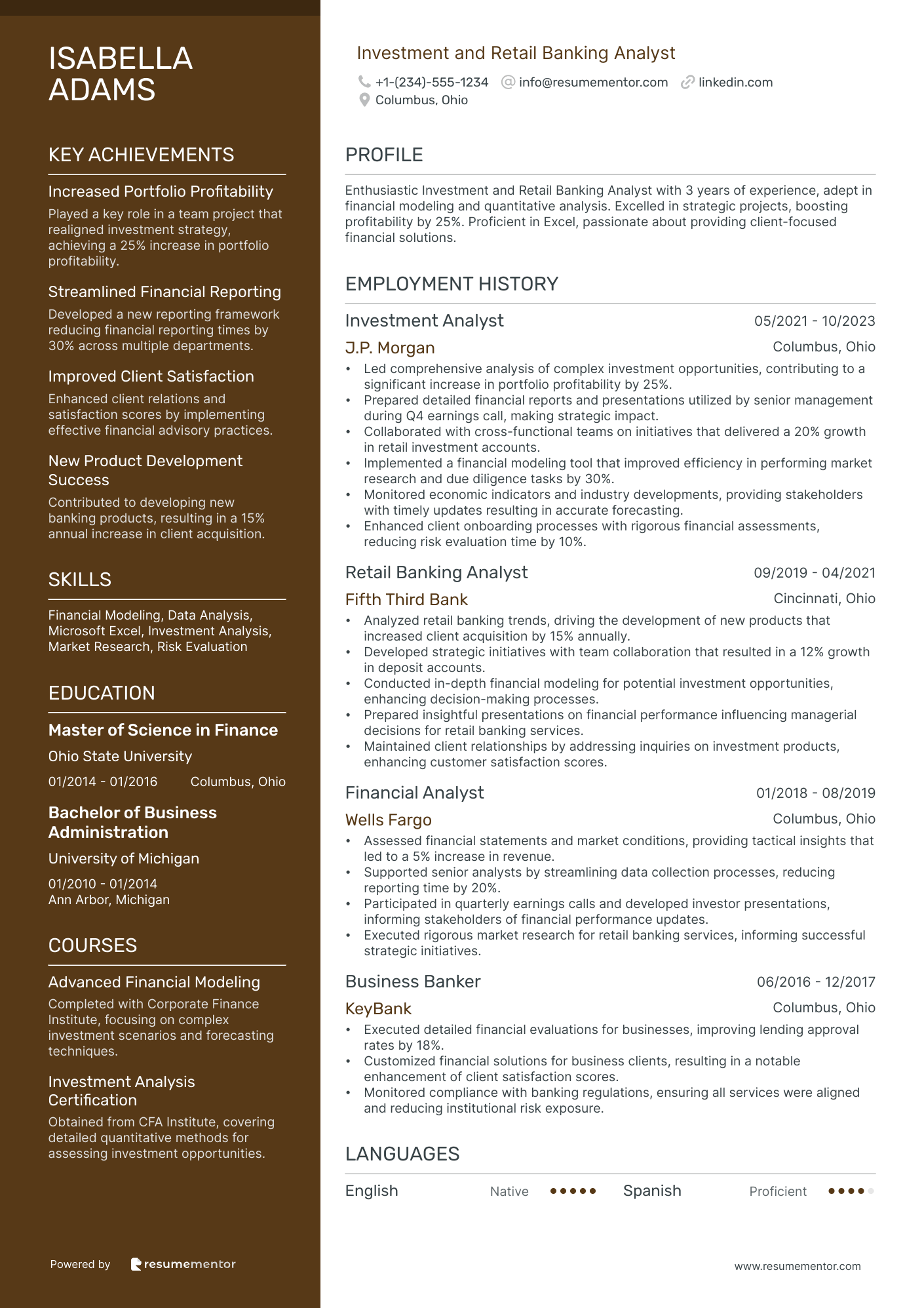

Investment and Retail Banking Analyst

Retail Banking Operations Manager resume sample

- •Directed a team of 30 banking professionals, achieving a 25% increase in branch efficiency through streamlined processes.

- •Implemented a new compliance training program that improved regulatory adherence scores by 15% over six months.

- •Led cross-departmental projects improving transaction processing speed by 20%, resulting in enhanced customer satisfaction.

- •Resolved 98% of escalated customer issues within 48 hours, leading to a 10% increase in overall customer satisfaction.

- •Developed and instituted performance metrics, reducing operational costs by 20% annually while maintaining service quality.

- •Collaborated across departments to integrate IT solutions, boosting productivity and reducing manual errors by 30%.

- •Assisted in managing daily retail operations, achieving a 15% increase in throughput across 15 branches.

- •Facilitated compliance updates, decreasing audit findings by 10% through proactive issue resolutions.

- •Enhanced service delivery by introducing workflow optimizations, increasing transaction accuracy by 12%.

- •Led a team of 15, fostering a culture that resulted in a 20% decrease in employee turnover.

- •Contributed to strategic planning sessions, aligning operational goals with business objectives.

- •Managed all aspects of branch operations, increasing customer acquisition rates by 18% over two years.

- •Ensured compliance with banking regulations, leading to zero major findings during annual audits.

- •Implemented customer service protocols, boosting the Net Promoter Score by 15 points in one year.

- •Developed a training module for new hires, reducing onboarding time by 25%.

- •Executed daily banking operations, contributing to a 5% reduction in branch operational errors.

- •Delivered high-quality customer service, earning recognition as top associate three quarters in a row.

- •Conducted regulatory compliance checks, reducing non-compliance incidents by 7%.

- •Participated in a pilot workflow improvement project, resulting in an 8% efficiency gain.

Retail Banking Customer Service Specialist resume sample

- •Provided comprehensive customer service to over 100 clients daily, resulting in a satisfaction rating of 95%.

- •Streamlined transaction processing and reduced errors by 20% through the adoption of enhanced banking software techniques.

- •Assisted in account opening processes, leading to a 10% increase in new customer acquisitions.

- •Resolved customer inquiries and complaints efficiently, with 85% being resolved without managerial escalation.

- •Proactively promoted banking services and solutions, increasing cross-sell revenue by 18%.

- •Managed branch organization, ensuring a welcoming environment contributing to a 25% increase in foot traffic.

- •Handled daily cash transactions accurately, maintaining a 99% balance accuracy rate over three years.

- •Implemented a new client follow-up strategy, resulting in a 12% boost in repeat customer visits.

- •Trained new staff members, improving team efficiency and reducing errors by 30%.

- •Offered tailored financial advice based on individual client needs, contributing to a 15% upsell in services.

- •Collaborated with team members to exceed monthly branch goals by an average of 110%.

- •Greeted and assisted 70+ customers daily with their financial inquiries, ensuring high levels of satisfaction.

- •Promoted featured banking services, leading to a 20% increase in product engagement among clients.

- •Participated in marketing campaigns that raised service awareness by 15% in local community.

- •Maintained thorough knowledge of banking regulations and protocols with up-to-date training.

- •Facilitated the opening of 150+ new accounts monthly, exceeding targets by 20%.

- •Consistently met and exceeded customer service standards by delivering accurate, timely advice.

- •Supported the execution of promotional activities, enhancing customer participation by 10%.

- •Monitored account activities to detect and resolve discrepancies with a focus on compliance.

Consumer Lending and Retail Banking Officer resume sample

- •Managed a $50 million consumer lending portfolio, increasing customer retention rates by 20% through tailored financial strategies.

- •Led a team in implementing new retail banking products, boosting product cross-selling by 35% within one year.

- •Streamlined loan application evaluations, reducing processing time by 25% while maintaining high customer satisfaction scores.

- •Conducted risk analysis of loan applications, resulting in a 15% improvement in approval accuracy and compliance standards.

- •Trained junior staff on credit assessment, achieving an 18% performance improvement in loan application evaluations.

- •Collaborated in community outreach programs, increasing financial literacy participation by 40% in local communities.

- •Boosted retail banking revenue by 30% over two years through targeted marketing initiatives and personalized client interactions.

- •Analyzed market trends and adjusted product offerings, resulting in a 10% increase in new customer acquisitions.

- •Enhanced customer service delivery, maintaining a 95% customer satisfaction rate across all service channels.

- •Developed training programs focusing on regulatory compliance, reducing infractions by 50% among branch employees.

- •Implemented a customer feedback system that increased the resolution of customer inquiries by 45% in response time.

- •Assessed and approved over 300 loan applications annually, maintaining a 98% compliance rate with lending regulations.

- •Increased loan product penetration by 25% among existing customers through strategic marketing and counseling initiatives.

- •Organized financial workshops that improved community engagement by 60% and enhanced customer banking knowledge.

- •Worked with banking software teams to enhance loan processing systems, leading to a 20% reduction in error rates.

- •Conducted financial analysis of customer profiles, resulting in a 15% increase in the bank's loan portfolio returns.

- •Assisted in the development of new banking products that captured 2000 new customers within the first year of launch.

- •Provided detailed reports that optimized loan offerings, enhancing product efficiency by 30%.

- •Collaborated on projects focusing on cost reduction, saving the company $150,000 annually through process improvements.

Risk Management in Retail Banking resume sample

- •Developed a comprehensive risk management framework, reducing operational risk exposure by 20% within two years.

- •Led cross-functional teams to implement risk strategies across 15 branches, enhancing overall financial stability.

- •Conducted risk assessments that identified over 50 potential vulnerabilities, mitigating risks through targeted actions.

- •Collaborated with senior management to present detailed risk reports, directly influencing strategic decision-making.

- •Kept abreast of Basel III and CFPB regulations, ensuring full compliance across all retail banking operations.

- •Facilitated training, improving team understanding of risk management procedures, resulting in 30% fewer risk incidents.

- •Led risk assessments across multiple banking products, identifying and mitigating potential risks in a timely manner.

- •Implemented new compliance protocols aligned with OCC regulations, reducing compliance risks by 15%.

- •Collaborated with technology teams to streamline risk assessment tools, increasing efficiency by 25%.

- •Regularly monitored market trends, adjusting risk strategies to address emerging threats promptly.

- •Prepared detailed risk analysis reports for executive leadership, supporting informed business decisions.

- •Assisted in developing compliance strategies in accordance with FDIC guidelines, achieving a 95% compliance rate.

- •Performed detailed audits, identifying and resolving over 20 compliance issues per quarter.

- •Optimized workflows to enhance risk management processes, leading to a 10% increase in assessment accuracy.

- •Authored training materials, improving staff competency in regulatory compliance by 40%.

- •Evaluated risk factors for retail banking operations, contributing to a 15% decrease in overall risk exposure.

- •Developed data-driven insights that informed senior management strategies, resulting in enhanced operational performance.

- •Liaised with legal departments to ensure compliance with current regulatory requirements in risk assessments.

- •Assisted in incident management, working to resolve risk-related issues and improve response times by 20%.

Retail Banking Compliance Officer resume sample

- •Led comprehensive compliance audits across retail divisions, reducing audit findings by 25% and improving regulatory adherence.

- •Developed new compliance training initiatives for over 200 banking staff, enhancing regulatory understanding and reducing compliance incidents by 15%.

- •Implemented effective compliance monitoring systems, increasing compliance issue resolution efficiency by 30% within the team.

- •Managed cross-departmental compliance collaborations, significantly decreasing compliance issue resolution time by 40%.

- •Prepared and presented compliance risk assessments to senior management, leading to informed decision-making and enhanced policy updates.

- •Stayed abreast of evolving banking regulations, ensuring proactive compliance policy adjustments and fostering a compliance-focused culture.

- •Spearheaded the development and maintenance of compliance policies, resulting in a 20% increase in regulatory requirement adherence.

- •Conducted extensive compliance audits, identifying critical improvement areas and facilitating a 30% enhancement in operational procedures.

- •Provided training sessions on new compliance regulations for over 150 retail banking employees, improving compliance knowledge organization-wide.

- •Collaborated with risk management to address compliance findings effectively, achieving a 25% reduction in unresolved compliance issues.

- •Authored comprehensive compliance reports for regulatory bodies and senior management, supporting transparent communication and proactive policy changes.

- •Revamped risk assessment methodologies, leading to more accurate compliance tracking and a 40% decrease in regulation breaches.

- •Advised departments on compliance matters, significantly reducing potential violations and enhancing internal policy understanding.

- •Enabled seamless regulatory updates by implementing efficient tracking systems, maintaining high compliance standards.

- •Played a key role in compliance policy revisions, resulting in a 30% increase in adherence to banking regulations.

- •Assisted in the development of compliance audit programs, leading to improved regulatory compliance and process efficiency.

- •Coordinated compliance trainings for retail personnel, achieving a 35% decrease in employee-reported compliance issues.

- •Streamlined communication processes for policy updates, enhancing understanding and implementation among retail banking staff.

- •Conducted detailed compliance data analyses, resulting in a 20% improvement in identifying and resolving compliance anomalies.

Digital Transformation Specialist in Retail Banking resume sample

- •Led a team through a complex digital migration, reducing customer service time by 40% and enhancing efficiency.

- •Developed a cutting-edge mobile app experience, leading to a 25% increase in user engagement within one year.

- •Collaborated with cross-functional teams to deliver new features aligning with customer feedback, improving customer satisfaction by 30%.

- •Initiated strategic partnerships with industry-leading tech vendors, resulting in enhanced digital capabilities and cost savings of 20%.

- •Implemented an analytics-driven approach to track customer interactions, increasing targeted marketing effectiveness by 15%.

- •Orchestrated comprehensive staff training workshops on new digital tools, ensuring a seamless transition and adoption across departments.

- •Managed a portfolio of digital initiatives, consistently delivering projects on time and under budget by leveraging Agile methodologies.

- •Analyzed market trends to enhance digital offerings, resulting in a 10% increase in digital banking user base over six months.

- •Created detailed project plans and budgets, achieving a project completion rate of 95% within initial timelines.

- •Fostered stakeholder alignment on digital transformation efforts, culminating in a cohesive strategy and shared objectives.

- •Designed and implemented automation processes that reduced manual tasks in operations, improving overall efficiency by 25%.

- •Consulted with major retail banks to develop digital roadmaps, reducing operational costs by 20% through strategic digitization efforts.

- •Participated in the development of user-friendly digital banking interfaces, contributing to a 15% rise in customer satisfaction.

- •Conducted in-depth market research to advise banking clients on digital trends, enhancing competitive positioning.

- •Organized collaborative workshops with client teams, successfully building internal competencies and reducing project delivery time by 10%.

- •Analyzed customer data to identify trends and opportunities for digital offerings, increasing customer engagement by 12%.

- •Created reports on digital adoption metrics that guided executive decision-making and strategic planning.

- •Collaborated with tech teams to streamline internal processes, resulting in a 20% increase in operational efficiency.

- •Assisted in the integration of mobile technologies, enhancing the bank's service delivery capabilities during critical growth phases.

Retail Banking Relationship Manager resume sample

- •Enhanced client portfolio by introducing tailor-made solutions, elevating customer satisfaction scores by 25% in two years.

- •Conducted over 150 comprehensive financial assessments annually, effectively meeting clients’ financial goals through customized strategies.

- •Generated $5 million in new mortgage businesses by leveraging cross-selling techniques within first year.

- •Collaborated successfully with branch staff, boosting customer retention rates to 90% through seamless service delivery.

- •Led the coordination with the investment team, resulting in a 30% growth in investment product sales.

- •Resolved client issues within a 24-hour timeframe, enhancing overall branch service excellence perception by 45%.

- •Spearheaded financial workshops and seminars that improved product awareness by 50%, expanding customer knowledge base.

- •Advised on a comprehensive suite of financial products, facilitating $10 million in loan origination over two years.

- •Strategically managed a client base of over 300, improving investment returns for clients by 20% on average.

- •Increased branch revenue by 30% through aggressive product upselling and closing key client agreements.

- •Strengthened cross-functional collaboration, resulting in a streamlined process that improved service delivery time by 15%.

- •Exceeded quarterly sales targets by 20% by implementing effective relationship management strategies.

- •Collaborated with internal departments to fulfill complex client requests, increasing operational efficiency by 25%.

- •Proactively identified cross-selling opportunities, increasing product adoption rates by 40% within a year.

- •Achieved a 95% customer satisfaction score by resolving inquiries swiftly and effectively.

- •Onboarded over 200 new clients annually, enhancing the bank’s clientele by 15% each year.

- •Assisted in the development of targeted marketing strategies, leading to a 35% increase in account openings.

- •Guided clients through digital banking transitions, achieving a digital engagement rise of 30%.

- •Provided exemplary customer service, resulting in a 20% increase in branch loyalty ratings.

Retail Banking Product Development Specialist resume sample

- •Led a team to develop and launch a digital-only savings account, resulting in a 20% increase in new customer sign-ups within the first year.

- •Conducted market research that identified key trends in digital banking services, which informed strategic decisions and product alignment.

- •Worked in collaboration with compliance and operations teams to ensure all new products met evolving regulatory requirements and minimized operational risk.

- •Developed comprehensive product documentation, including detailed specifications, pricing models, and user-friendly training programs to support staff onboarding.

- •Monitored product performance metrics monthly, providing actionable insights that led to a 15% increase in overall customer satisfaction ratings.

- •Designed a cross-functional training initiative, improving interdepartmental collaboration and increasing new product adoption rate by 30%.

- •Supported the launch of a new loan product suite, contributing to a 35% rise in market share over a two-year period across target demographics.

- •Utilized customer feedback analytics to drive innovative features in checking account products, ultimately enhancing customer retention by 18%.

- •Collaborated with marketing teams to create compelling product pitches that increased engagement and generated a 25% boost in sales.

- •Managed the documentation of detailed product specifications, aligning with both internal standards and market demands.

- •Conducted competitive analysis which revealed gaps addressed by new product features, leading to a unique selling proposition in the market.

- •Developed and maintained a database for tracking product performance metrics, allowing improved data-driven decision-making processes.

- •Assisted in creating product pricing strategies that optimized profitability and competitiveness across various banking sectors.

- •Played a key role in the successful integration of digital banking platforms, resulting in enhanced user accessibility and adoption.

- •Coordinated with sales teams to deliver effective training materials that boosted team capability to cross-sell new banking offerings.

- •Provided analytical support for product development projects, directly influencing decisions that led to a 22% growth in product portfolio.

- •Facilitated cross-functional teams through detailed financial assessments, improving the efficiency of product launch cycles by 15%.

- •Monitored and reported on key performance metrics, driving enhancements that resulted in improved customer satisfaction.

- •Utilized financial software to generate complex reports which enabled strategic insights into customer behavior and product success.

Business Development Executive in Retail Banking resume sample

- •Identified and pursued new business opportunities, leading to a 30% increase in client acquisition in 2023.

- •Developed tailored banking solutions with product teams, increasing customer satisfaction score by 15% in 2022.

- •Executed market research initiatives that revealed key competitive insights, aiding in a 20% improvement in strategic positioning.

- •Exceeded sales targets by 150% in 2021 by leveraging strong client relationships and proactive service strategies.

- •Participated in industry conferences, generating over 150 new leads and expanding network significantly within two years.

- •Monitored performance metrics meticulously, resulting in a 25% revenue increase by optimizing sales operations.

- •Managed key account relationships, achieving an 18% rise in cross-selling of retail banking products among existing clients.

- •Designed and delivered presentations, successfully closing deals that contributed to 40% annual growth in team quotas.

- •Facilitated market trend analysis, leading to strategic adjustments that raised competitive advantage significantly.

- •Implemented CRM systems improvements, enhancing data accuracy and sales efficiency by 20%.

- •Collaborated with teams across departments to develop new banking services, securing a 25% increase in product utilization rates.

- •Led team to exceed sales targets by 40%, focusing on team training and development for enhanced performance.

- •Initiated client engagement strategies, resulting in improved client loyalty and a 10% retention increase.

- •Directed marketing efforts that propelled product awareness and converted 20% of inquiries into new customers.

- •Actively participated in product launches, influencing a 15% boost in initial sales within the first quarter.

- •Secured and managed a client portfolio yielding over $1 million in revenue annually, surpassing revenue targets consistently.

- •Built enduring client relationships which contributed to a 25% expansion of client base within the first year.

- •Conducted comprehensive competitive analysis, facilitating strategic planning and enhancing market standing significantly.

- •Trained new account executives, developing their skills and increasing team productivity by 15%.

Investment and Retail Banking Analyst resume sample

- •Led comprehensive analysis of complex investment opportunities, contributing to a significant increase in portfolio profitability by 25%.

- •Prepared detailed financial reports and presentations utilized by senior management during Q4 earnings call, making strategic impact.

- •Collaborated with cross-functional teams on initiatives that delivered a 20% growth in retail investment accounts.

- •Implemented a financial modeling tool that improved efficiency in performing market research and due diligence tasks by 30%.

- •Monitored economic indicators and industry developments, providing stakeholders with timely updates resulting in accurate forecasting.

- •Enhanced client onboarding processes with rigorous financial assessments, reducing risk evaluation time by 10%.

- •Analyzed retail banking trends, driving the development of new products that increased client acquisition by 15% annually.

- •Developed strategic initiatives with team collaboration that resulted in a 12% growth in deposit accounts.

- •Conducted in-depth financial modeling for potential investment opportunities, enhancing decision-making processes.

- •Prepared insightful presentations on financial performance influencing managerial decisions for retail banking services.

- •Maintained client relationships by addressing inquiries on investment products, enhancing customer satisfaction scores.

- •Assessed financial statements and market conditions, providing tactical insights that led to a 5% increase in revenue.

- •Supported senior analysts by streamlining data collection processes, reducing reporting time by 20%.

- •Participated in quarterly earnings calls and developed investor presentations, informing stakeholders of financial performance updates.

- •Executed rigorous market research for retail banking services, informing successful strategic initiatives.

- •Executed detailed financial evaluations for businesses, improving lending approval rates by 18%.

- •Customized financial solutions for business clients, resulting in a notable enhancement of client satisfaction scores.

- •Monitored compliance with banking regulations, ensuring all services were aligned and reducing institutional risk exposure.

As a retail banker, your resume acts like a financial portfolio, showcasing your skills and experience to potential employers. Yet, amidst fierce competition, highlighting your unique talents can feel daunting. Drawing attention to your leadership skills, customer service expertise, and financial knowledge becomes essential.

Guiding clients through complex choices is second nature to you, and creating a compelling resume demands that same careful attention. With the daily juggling of numbers and customer interactions, articulating these strengths on paper can seem overwhelming. That's why a structured approach, like using a resume template, brings clarity and ensures you highlight what employers value most.

Your resume should reflect your technical proficiency with financial products and your strong communication and problem-solving skills. Illustrating these abilities with real examples of enhancing customer satisfaction or navigating challenges can set you apart. Your understanding of financial regulations is another asset that can elevate your resume.

Furthermore, the presentation of your resume is crucial. Like a well-organized bank statement, a clean and professional design enhances readability. Tailoring your resume for each job application demonstrates the dedication you apply to understanding and fulfilling clients' unique needs.

Crafting your resume with a strong foundation not only communicates your value effectively but also opens doors to new opportunities in your career.

Key Takeaways

- A well-structured retail banking resume highlights leadership, customer service expertise, and financial knowledge using clear language and organized sections.

- Prioritize illustrating financial proficiency and communication skills with real examples, like improving customer satisfaction or overcoming banking challenges.

- Using a clean and professional resume design improves readability and tailoring each application underscores your dedication to client needs.

- Choosing a chronological format and saving in PDF ensures your resume presents a polished and stable professional image on any device.

- Incorporate both hard skills like financial analysis and soft skills like customer service to align with job descriptions and capture employer attention.

What to focus on when writing your retail banking resume

Your retail banking resume should quickly communicate your financial expertise and strong customer service skills to the recruiter—think about what sets you apart and how your experiences have crafted your professional identity. Highlight how you can enhance banking experiences, drive profitability, and ensure compliance with regulations. Use clear language and structured sections, making it easy for ATS systems to scan your qualifications.

How to structure your retail banking resume

- Contact Information: Ensure your full name, phone number, email address, and LinkedIn profile are both current and professional—this is the simplest way for employers to reach you and sets an immediate first impression. An email address that uses your full name adds professionalism, while a well-curated LinkedIn profile shows your commitment to keeping your professional online presence updated.

- Professional Summary: Offer a brief, compelling glimpse into your career—capture your unique strengths and tailor this section to the job you are applying for. Focus on your experience within financial services and customer relations, highlighting any specific specialties, such as loan processing or wealth management, that set you apart. Avoid generic statements and shine a light on achievements that mirror the job posting.

- Experience: Outline past roles in retail banking in a way that highlights your achievements—illustrate how you successfully managed banking operations or tackled challenges to achieve company goals. Provide concrete examples like sales growth, improvements in customer satisfaction, or successful risk management efforts. Use bullet points for clarity and impact, making it easy to see your successes at a glance.

- Education: List relevant degrees and certifications like a Bachelor’s in Finance or a Certified Financial Planner designation—these academic achievements underpin your practical skills and commitment to the industry. Include the institutions and graduation dates to give context to your academic background, showing your foundational knowledge in finance-related subjects.

- Skills: Highlight important skills that showcase your strengths—consider what the job requires most, from customer service excellence to proficiency in banking software. Mention your expertise in financial products and awareness of compliance requirements, illustrating a well-rounded professional profile. If you have language skills, these can be a valuable asset in a diverse marketplace, so be sure to include them.

- Achievements: Share tangible examples of your contributions—whether it's leading teams to exceed sales targets or implementing cost-saving measures, these achievements need to be relevant and impressive. If you've received awards for outstanding service, mention them to underscore your dedication, building credibility and showcasing your capacity for excellence.

To round out your resume, consider adding optional sections like volunteer work or professional affiliations. These can give additional depth and highlight a broader skill set if they relate to banking, such as volunteering for financial literacy programs. Below, we'll delve into each section more in-depth and discuss how best to format your retail banking resume in a way that stands out.

Which resume format to choose

Crafting a retail banking resume involves focusing on crucial details that reflect your professionalism. Choosing a chronological format is key, as it effectively highlights your career growth and relevant banking experience, both essential in demonstrating stability and expertise to potential employers. To keep your resume looking modern and professional, select fonts like Rubic, Lato, or Montserrat. These fonts offer a clean and contemporary appearance that makes your information easy to read, projecting a polished image. Saving your document as a PDF is crucial; it ensures that your precise formatting is preserved so your resume looks the same on every device potential employers might use. Maintaining one-inch margins around your document provides a balanced and organized layout, helping your content stand out without appearing cluttered. Together, these elements work harmoniously to showcase your attention to detail and commitment to presenting yourself as a capable banking professional.

How to write a quantifiable resume experience section

The experience section of your retail banking resume plays a crucial role in showcasing your skills and banking journey. It focuses not just on your duties, but on the impact and achievements you've had throughout your career. You should start with your most recent job and include relevant roles from the last 10 to 15 years. This approach helps paint a clear picture of your career progression. Use strong action verbs like "increased," "developed," or "achieved" to highlight your successes. By aligning your accomplishments with the job description, you demonstrate how your past roles have prepared you for the new position and show potential employers the value you can bring.

- •Boosted customer retention by 25% in two years by delivering personalized solutions.

- •Increased loan applications by 40% through targeted marketing strategies.

- •Achieved a 20% growth in new accounts by implementing a client referral program.

- •Ensured 100% compliance with banking regulations, reducing audit findings by 30%.

This experience section stands out because it seamlessly connects your achievements with the value you bring to potential employers. Each bullet point highlights significant accomplishments, providing insight into how you positively impacted your previous organization. The use of strong action verbs ties your successes together, illustrating your drive and effectiveness. By tailoring the section to the job description, you emphasize relevant achievements that directly align with the needs of the position, ensuring a cohesive and compelling narrative that captures the attention of hiring managers.

Innovation-Focused resume experience section

A retail banking innovation-focused resume experience section should effectively highlight your role in leading transformative initiatives. Begin by specifying the dates and nature of your role, using a title that underscores your focus on innovation. Clearly detail your contributions by providing straightforward examples of how you drove change and the impact of your actions. Include quantifiable results whenever possible to give a clear picture of your successes.

It's important to tie these achievements to the skills and technologies you employed. Mention digital tools, software, or methods that were pivotal in your efforts. In your bullet points, connect how you identified opportunities for innovation with the strategies you used and the positive outcomes achieved. Avoid complex jargon and focus on creating a clear and impactful narrative. The aim is to produce an experience section that is coherent and memorable, underlining your capability to lead and manage innovation effectively in retail banking.

Solutions Architect

ABC Retail Bank

Jan 2020 - Dec 2022

- Developed and launched a customer-focused mobile app, boosting digital engagement by 30% and creating a seamless user experience.

- Led a team to streamline loan processing, significantly reducing approval time by 25%, which directly improved customer satisfaction.

- Implemented AI-driven chatbots, enhancing response times and contributing to a 15% reduction in customer service costs.

- Championed a cross-departmental cybersecurity initiative that resulted in a 40% reduction in breaches, strengthening trust and security.

Problem-Solving Focused resume experience section

A problem-solving-focused retail banking resume experience section should highlight your adeptness at tackling challenges and showcasing results. Start by identifying instances in which you encountered specific issues and successfully implemented solutions. Use strong action verbs to convey your role and illustrate the impact of your actions. Highlight measurable results and improvements from your efforts, showcasing the tangible benefits you can bring to an organization.

As you craft this section, consider using the STAR (Situation, Task, Action, Result) method to structure your achievements coherently. Describe the context of the problem, outline your responsibilities, detail the actions you took, and share the positive results achieved. This approach helps demonstrate your teamwork abilities and how you effectively leverage technology or innovative methods to resolve issues. Keep your descriptions clear and concise, ensuring each entry contributes to your overall candidacy. Here's a structured example of how this experience section might look:

Retail Banking Specialist

FinancePlus Bank

June 2020 - Present

- Led a team to redesign customer feedback mechanisms, increasing satisfaction scores by 20%.

- Implemented a streamlined process for handling inquiries which reduced response time by 50%.

- Developed a training module on problem-solving for new hires, improving employee onboarding experience.

- Collaborated with IT to automate data analysis, enhancing decision-making efficiency.

Achievement-Focused resume experience section

A retail banking-focused resume experience section should effectively highlight your achievements in a cohesive and engaging manner. Begin each experience with a succinct heading that captures the essence of your role. Using bullet points, detail your accomplishments in a straightforward and accessible way, ensuring that each point builds upon the previous one for a smooth reading experience. Incorporate measurable details to clearly demonstrate the impact you've made.

Concentrate on how you've driven improvements in operations, increased sales, or enhanced customer satisfaction. Discuss any initiatives you led or customer service excellence that delivered positive outcomes, illustrating your strategic thinking and problem-solving abilities. By weaving these elements together, you showcase not just your qualifications but also the tangible benefits you brought to each role, painting a vivid picture of your professional contributions.

Relationship Manager

Community Bank Inc.

June 2020 - August 2022

- Increased account openings by 30% through targeted cross-selling efforts.

- Improved customer onboarding process, cutting down wait times by 15%.

- Earned a 95% customer satisfaction score with personalized banking services.

- Led a team of five to consistently exceed quarterly sales targets by 20%.

Industry-Specific Focus resume experience section

A retail banking-focused resume experience section should spotlight your successes rather than simply listing your duties. Begin by identifying the skills and experiences that align with the role you're targeting; these will form the backbone of your narrative. Tailor the section to emphasize concrete results, like major boosts in customer satisfaction or sales achievements. Using action verbs, vividly describe your responsibilities and accomplishments to highlight your ability to meet customer needs, manage financial products, and nurture strong client relationships. Recognition, such as awards, can add another layer of credibility to your profile.

To make your narrative more compelling, include specific numbers that showcase your achievements, like measurable increases in sales or improvements in customer retention rates. Discuss challenges you faced and how you overcame them to illustrate your problem-solving capabilities. These details not only make your resume more engaging but also underscore the value you bring to potential employers. By focusing on tangible outcomes and employing clear, descriptive language, your resume will stand out to hiring managers looking for proven success in the retail banking industry.

Retail Banking Supervisor

First National Bank

January 2017 - March 2022

- Boosted customer satisfaction by 25% through improved service delivery and personalized banking solutions.

- Led a team of 15 tellers to achieve a 20% increase in monthly sales of savings and loan products.

- Implemented a new training program for customer service reps, cutting complaint resolution time by 35%.

- Awarded Employee of the Year in 2020 for outstanding performance in customer relations and sales.

Write your retail banking resume summary section

A retail-banking-focused resume should make a strong first impression with a clear and engaging summary. This section should capture your key skills and experiences, offering a snapshot of your professional life that immediately grabs attention. Here's a powerful example of a compelling retail banking resume summary:

.

This example is effective because it quickly highlights relevant experience and skills, establishing credibility with specifics like "over 8 years." Mentioning areas such as "financial analysis" and "risk management" makes it directly relatable to the job. When describing yourself, use strong, confident words like "dedicated" and "proven" to paint a picture of reliability and expertise. The resume summary differs from other sections, such as the objective, profile, or qualifications list.

Where a summary emphasizes your experience and skills, a resume objective is more about your career goals and often suits those new to the field. A resume profile offers a broader but still concise overview of your career, while a summary of qualifications lists key skills and achievements in bullet form. Each of these sections serves a distinct purpose, but a well-written summary is your best choice for showcasing experience and making an immediate impact.

Listing your retail banking skills on your resume

A retail banking-focused resume should thoughtfully incorporate your skills and strengths to paint a clear picture of your capabilities. You can showcase these as a standalone section or weave them into other areas like your experience and summary. Highlighting strengths and soft skills reveals who you are and how you work with others, while hard skills demonstrate specific, teachable abilities, like technical knowledge and practical tasks, essential in retail banking.

These skills not only showcase your qualifications but also act as keywords, matching the terms employers look for in job descriptions. By using industry-specific terminology, you increase your chances of capturing the attention of hiring managers and landing interviews.

Here is an example of a standalone skills section that clearly illustrates relevant abilities vital to retail banking:

This section is effective because it lists crucial abilities that align with typical responsibilities in the retail banking sector, demonstrating a blend of technical expertise and industry-preferred competencies.

Best hard skills to feature on your retail banking resume

Incorporating hard skills into your resume communicates your technical abilities and industry acumen. These skills underline your capacity to handle banking tasks efficiently and adhere to standards.

Hard Skills

- Financial Analysis

- Data Analysis

- Risk Management

- Budgeting

- Loan Processing

- Credit Analysis

- Regulatory Compliance

- Fraud Detection

- Accounting

- Operations Management

- Customer Relationship Management (CRM) Software

- Financial Reporting

- Investment Knowledge

- Sales Target Achievement

- Digital Banking Tools

Best soft skills to feature on your retail banking resume

Highlighting soft skills on your resume underscores your ability to effectively interact with clients and collaborate within a team. These skills reflect your talent in managing customer relations and maintaining composure under stress.

Soft Skills

- Customer Service

- Communication

- Problem-Solving

- Teamwork

- Attention to Detail

- Time Management

- Adaptability

- Multitasking

- Empathy

- Conflict Resolution

- Patience

- Leadership

- Interpersonal Skills

- Stress Management

- Negotiation

How to include your education on your resume

The education section is a crucial part of your retail banking resume. It showcases your academic background and offers proof of skills relevant to the position. Tailoring this section to the job you're applying for ensures that you present only the most relevant information. Irrelevant education should be left out to avoid distractions. If your GPA is impressive, include it on the resume. If you graduated cum laude, mention it to highlight your academic accomplishment. When listing a degree, specify the type of degree (e.g., Bachelor of Science) and the major.

Here is an example of an incorrect education section:

Here is an example of a well-crafted education section:

The second example is effective because it presents a degree closely aligned with the retail banking field, making it relevant to potential employers. A high GPA enhances the candidate's credibility, while the cum laude distinction underscores academic excellence. Highlighting relevant achievements assures hiring managers that you're serious and committed. Focused information paints a clear picture of your qualifications and makes you a competitive candidate.

How to include retail banking certificates on your resume

Including a certificates section in your retail banking resume is crucial. Certificates highlight your expertise and commitment to the industry. You can also include certificates in the header for instant visibility.

List the name of the certificate, include the date you earned it, add the issuing organization, and highlight its relevance to retail banking. Be concise but specific about each certificate's importance. Only include certificates that add value to your application for a retail banking position.

This example is effective because it lists relevant certificates such as the Certified Retail Banker (CRB) from the American Bankers Association, which showcases specialized knowledge in retail banking. The Financial Modeling and Valuation Analyst (FMVA) indicates strong analytical skills, and the Anti-Money Laundering (AML) Certificate demonstrates a focus on compliance. Each certificate is clearly named with the issuer, verifying its credibility and enhancing your resume's impact.

Extra sections to include in your retail banking resume

In retail banking, the ability to connect with customers and manage their financial needs is crucial. Crafting a well-rounded resume can significantly boost your chances of landing your dream job in this industry.

Language section—Add a language section to show your ability to serve diverse customers. Demonstrate your fluency in multiple languages, which will be an asset in a customer-centric role.

Hobbies and interests section—Include a hobbies and interests section to showcase your personality. Highlight interests that demonstrate relevant skills, like attention to detail or customer service orientation.

Volunteer work section—Include volunteer work to show your commitment to community service. Show how these experiences have enhanced your leadership, communication, or organizational skills.

Books section—Mention books that have inspired you or advanced your professional growth. Highlighting industry-relevant books can show your commitment to staying informed and enhancing your expertise.

In Conclusion

In conclusion, crafting a retail banking resume requires a careful balance of showcasing your skills, experiences, and achievements. Your resume is not just a document—it’s your personal brand that speaks for you even before a conversation begins. Highlighting your customer service abilities and financial expertise can set you apart in a competitive field. Tailor each application to match the job's requirements and demonstrate your commitment to understanding client needs. Using a structured template helps ensure that your resume is both easy to read and comprehend. It's important to feature quantifiable achievements to effectively convey your value to potential employers. Including your educational qualifications and certificates demonstrates your dedication to the industry and adds credibility. Additionally, incorporating extra sections like language abilities or relevant volunteer work can offer a more rounded view of who you are and what you bring. Remember, the goal is to make a compelling case for why you are the right choice for the position. With a well-crafted resume, you can open doors to exciting opportunities and progress in your retail banking career effectively.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.