Self Employed Accountant Resume Examples

Jul 18, 2024

|

12 min read

Balancing the books: Your step-by-step guide to writing a self-employed accountant resume that adds up. Learn how to showcase your skills, experience, and expertise to attract potential clients and employers.

Rated by 348 people

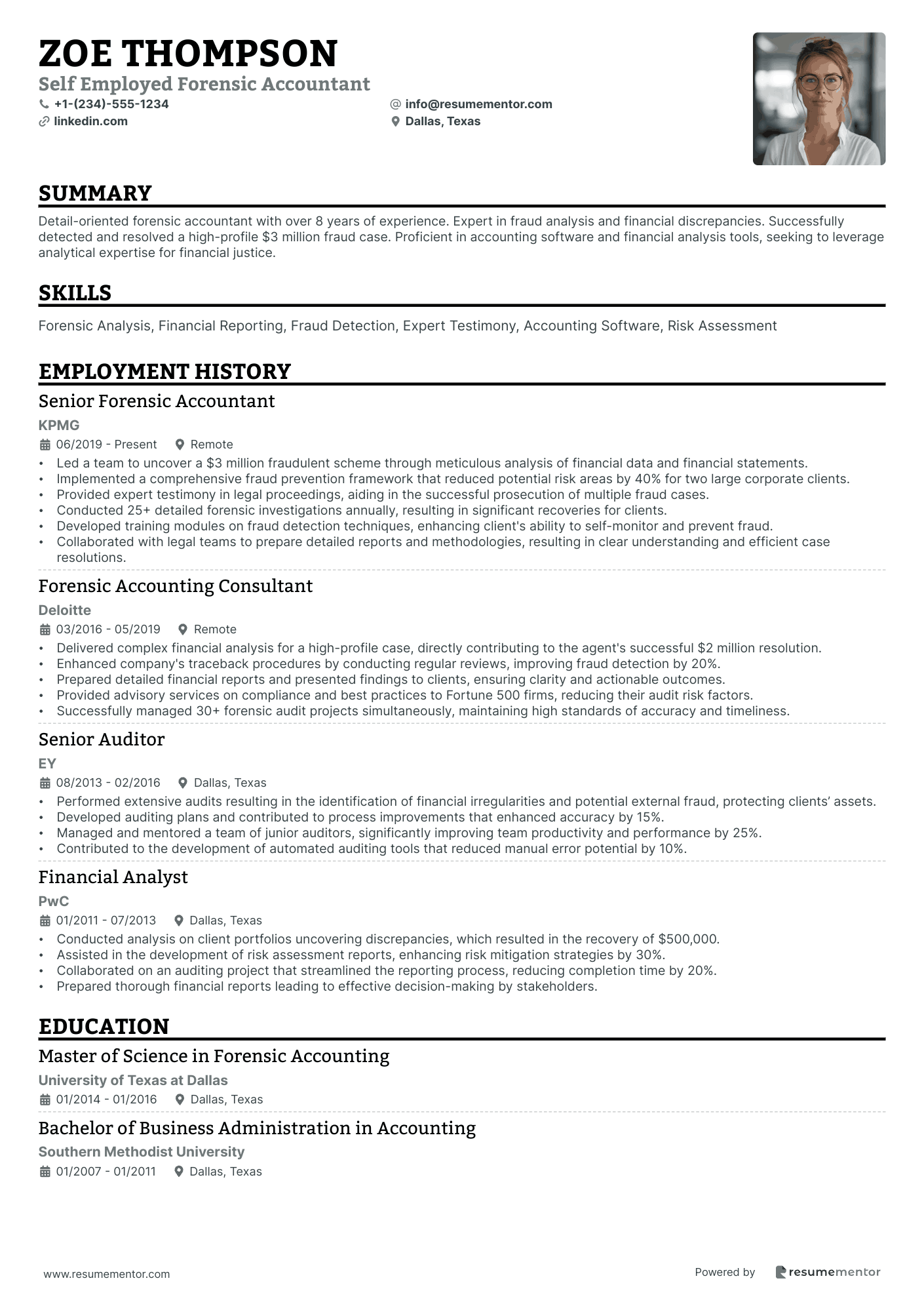

Self Employed Forensic Accountant

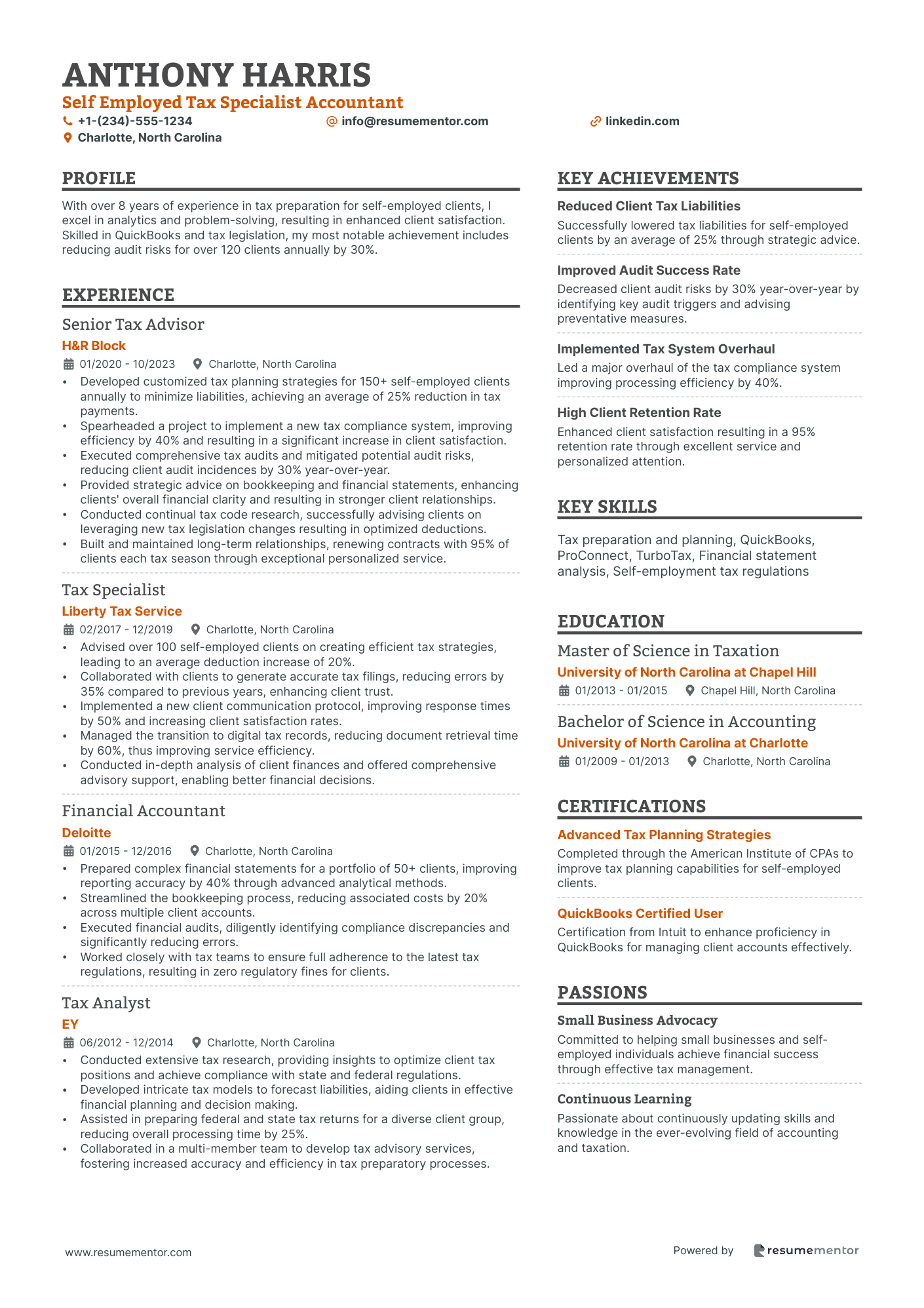

Self Employed Tax Specialist Accountant

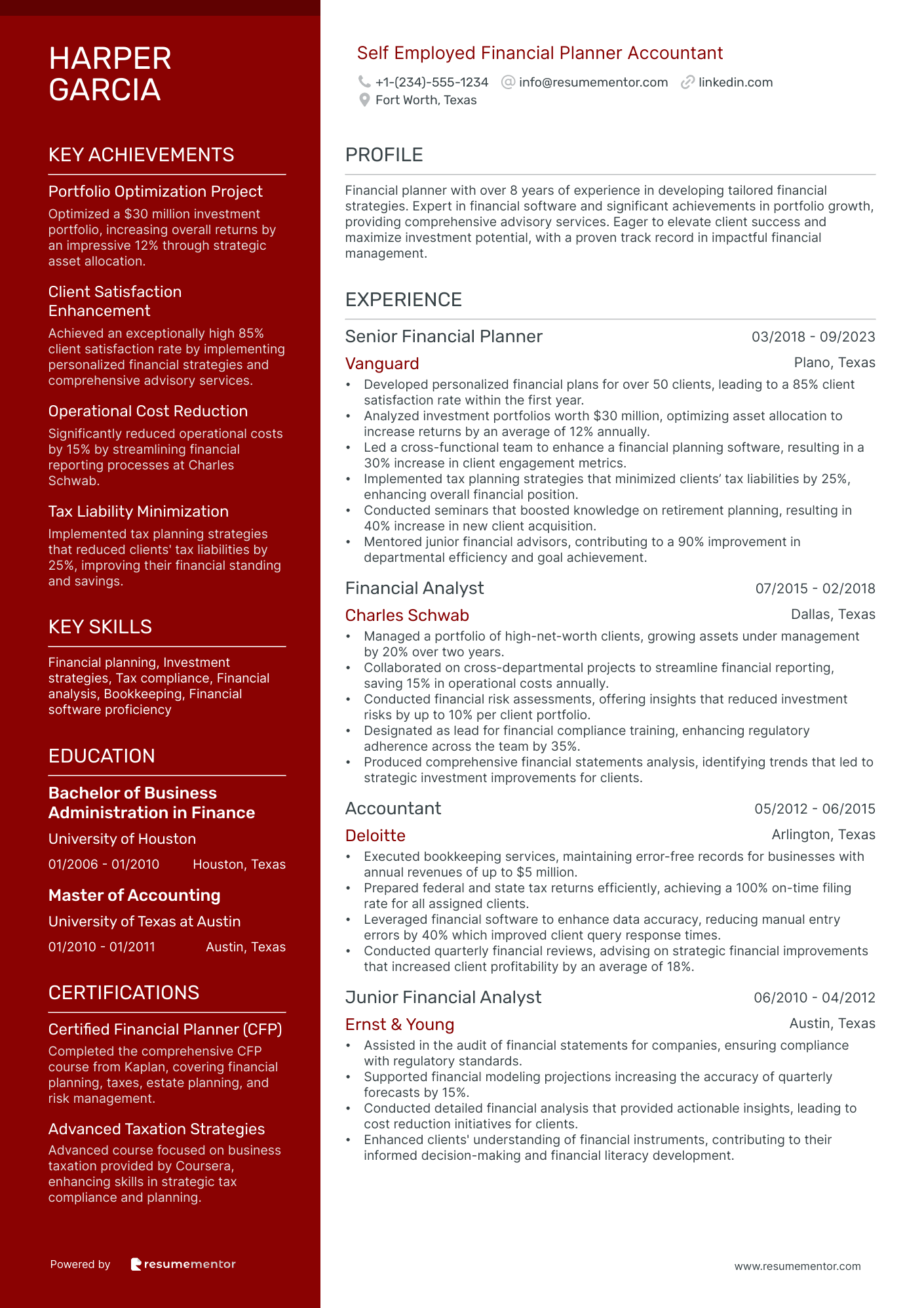

Self Employed Financial Planner Accountant

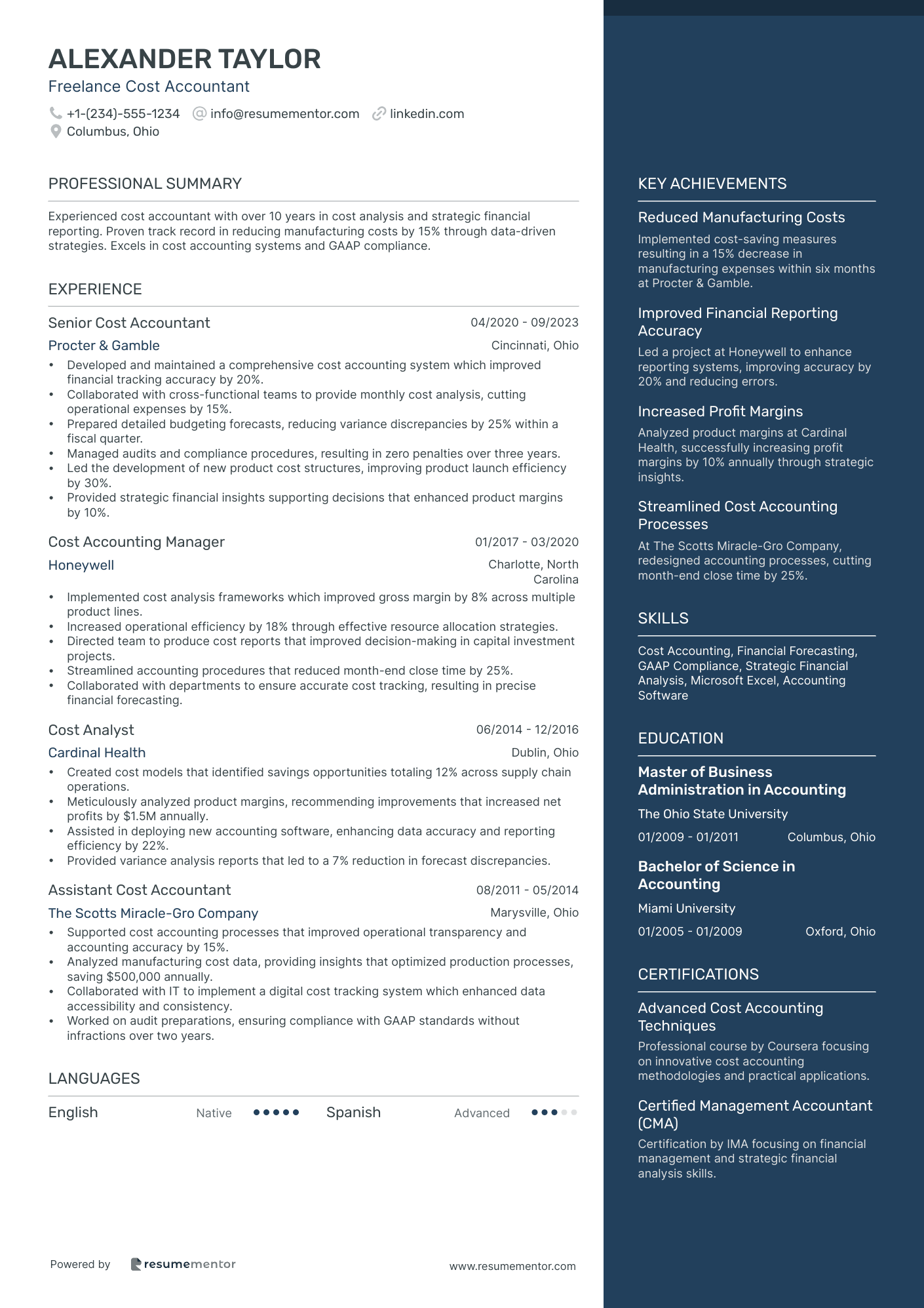

Freelance Cost Accountant

Independent Financial Analyst Accountant

Sole Proprietor Auditing Accountant

Freelance Management Accountant

Independent Project Accountant

Freelance Certified Public Accountant

Self Employed Environmental Accountant

Self Employed Forensic Accountant resume sample

- •Led a team to uncover a $3 million fraudulent scheme through meticulous analysis of financial data and financial statements.

- •Implemented a comprehensive fraud prevention framework that reduced potential risk areas by 40% for two large corporate clients.

- •Provided expert testimony in legal proceedings, aiding in the successful prosecution of multiple fraud cases.

- •Conducted 25+ detailed forensic investigations annually, resulting in significant recoveries for clients.

- •Developed training modules on fraud detection techniques, enhancing client's ability to self-monitor and prevent fraud.

- •Collaborated with legal teams to prepare detailed reports and methodologies, resulting in clear understanding and efficient case resolutions.

- •Delivered complex financial analysis for a high-profile case, directly contributing to the agent's successful $2 million resolution.

- •Enhanced company's traceback procedures by conducting regular reviews, improving fraud detection by 20%.

- •Prepared detailed financial reports and presented findings to clients, ensuring clarity and actionable outcomes.

- •Provided advisory services on compliance and best practices to Fortune 500 firms, reducing their audit risk factors.

- •Successfully managed 30+ forensic audit projects simultaneously, maintaining high standards of accuracy and timeliness.

- •Performed extensive audits resulting in the identification of financial irregularities and potential external fraud, protecting clients’ assets.

- •Developed auditing plans and contributed to process improvements that enhanced accuracy by 15%.

- •Managed and mentored a team of junior auditors, significantly improving team productivity and performance by 25%.

- •Contributed to the development of automated auditing tools that reduced manual error potential by 10%.

- •Conducted analysis on client portfolios uncovering discrepancies, which resulted in the recovery of $500,000.

- •Assisted in the development of risk assessment reports, enhancing risk mitigation strategies by 30%.

- •Collaborated on an auditing project that streamlined the reporting process, reducing completion time by 20%.

- •Prepared thorough financial reports leading to effective decision-making by stakeholders.

Self Employed Tax Specialist Accountant resume sample

- •Developed customized tax planning strategies for 150+ self-employed clients annually to minimize liabilities, achieving an average of 25% reduction in tax payments.

- •Spearheaded a project to implement a new tax compliance system, improving efficiency by 40% and resulting in a significant increase in client satisfaction.

- •Executed comprehensive tax audits and mitigated potential audit risks, reducing client audit incidences by 30% year-over-year.

- •Provided strategic advice on bookkeeping and financial statements, enhancing clients' overall financial clarity and resulting in stronger client relationships.

- •Conducted continual tax code research, successfully advising clients on leveraging new tax legislation changes resulting in optimized deductions.

- •Built and maintained long-term relationships, renewing contracts with 95% of clients each tax season through exceptional personalized service.

- •Advised over 100 self-employed clients on creating efficient tax strategies, leading to an average deduction increase of 20%.

- •Collaborated with clients to generate accurate tax filings, reducing errors by 35% compared to previous years, enhancing client trust.

- •Implemented a new client communication protocol, improving response times by 50% and increasing client satisfaction rates.

- •Managed the transition to digital tax records, reducing document retrieval time by 60%, thus improving service efficiency.

- •Conducted in-depth analysis of client finances and offered comprehensive advisory support, enabling better financial decisions.

- •Prepared complex financial statements for a portfolio of 50+ clients, improving reporting accuracy by 40% through advanced analytical methods.

- •Streamlined the bookkeeping process, reducing associated costs by 20% across multiple client accounts.

- •Executed financial audits, diligently identifying compliance discrepancies and significantly reducing errors.

- •Worked closely with tax teams to ensure full adherence to the latest tax regulations, resulting in zero regulatory fines for clients.

- •Conducted extensive tax research, providing insights to optimize client tax positions and achieve compliance with state and federal regulations.

- •Developed intricate tax models to forecast liabilities, aiding clients in effective financial planning and decision making.

- •Assisted in preparing federal and state tax returns for a diverse client group, reducing overall processing time by 25%.

- •Collaborated in a multi-member team to develop tax advisory services, fostering increased accuracy and efficiency in tax preparatory processes.

Self Employed Financial Planner Accountant resume sample

- •Developed personalized financial plans for over 50 clients, leading to a 85% client satisfaction rate within the first year.

- •Analyzed investment portfolios worth $30 million, optimizing asset allocation to increase returns by an average of 12% annually.

- •Led a cross-functional team to enhance a financial planning software, resulting in a 30% increase in client engagement metrics.

- •Implemented tax planning strategies that minimized clients’ tax liabilities by 25%, enhancing overall financial position.

- •Conducted seminars that boosted knowledge on retirement planning, resulting in 40% increase in new client acquisition.

- •Mentored junior financial advisors, contributing to a 90% improvement in departmental efficiency and goal achievement.

- •Managed a portfolio of high-net-worth clients, growing assets under management by 20% over two years.

- •Collaborated on cross-departmental projects to streamline financial reporting, saving 15% in operational costs annually.

- •Conducted financial risk assessments, offering insights that reduced investment risks by up to 10% per client portfolio.

- •Designated as lead for financial compliance training, enhancing regulatory adherence across the team by 35%.

- •Produced comprehensive financial statements analysis, identifying trends that led to strategic investment improvements for clients.

- •Executed bookkeeping services, maintaining error-free records for businesses with annual revenues of up to $5 million.

- •Prepared federal and state tax returns efficiently, achieving a 100% on-time filing rate for all assigned clients.

- •Leveraged financial software to enhance data accuracy, reducing manual entry errors by 40% which improved client query response times.

- •Conducted quarterly financial reviews, advising on strategic financial improvements that increased client profitability by an average of 18%.

- •Assisted in the audit of financial statements for companies, ensuring compliance with regulatory standards.

- •Supported financial modeling projections increasing the accuracy of quarterly forecasts by 15%.

- •Conducted detailed financial analysis that provided actionable insights, leading to cost reduction initiatives for clients.

- •Enhanced clients' understanding of financial instruments, contributing to their informed decision-making and financial literacy development.

Freelance Cost Accountant resume sample

- •Developed and maintained a comprehensive cost accounting system which improved financial tracking accuracy by 20%.

- •Collaborated with cross-functional teams to provide monthly cost analysis, cutting operational expenses by 15%.

- •Prepared detailed budgeting forecasts, reducing variance discrepancies by 25% within a fiscal quarter.

- •Managed audits and compliance procedures, resulting in zero penalties over three years.

- •Led the development of new product cost structures, improving product launch efficiency by 30%.

- •Provided strategic financial insights supporting decisions that enhanced product margins by 10%.

- •Implemented cost analysis frameworks which improved gross margin by 8% across multiple product lines.

- •Increased operational efficiency by 18% through effective resource allocation strategies.

- •Directed team to produce cost reports that improved decision-making in capital investment projects.

- •Streamlined accounting procedures that reduced month-end close time by 25%.

- •Collaborated with departments to ensure accurate cost tracking, resulting in precise financial forecasting.

- •Created cost models that identified savings opportunities totaling 12% across supply chain operations.

- •Meticulously analyzed product margins, recommending improvements that increased net profits by $1.5M annually.

- •Assisted in deploying new accounting software, enhancing data accuracy and reporting efficiency by 22%.

- •Provided variance analysis reports that led to a 7% reduction in forecast discrepancies.

- •Supported cost accounting processes that improved operational transparency and accounting accuracy by 15%.

- •Analyzed manufacturing cost data, providing insights that optimized production processes, saving $500,000 annually.

- •Collaborated with IT to implement a digital cost tracking system which enhanced data accessibility and consistency.

- •Worked on audit preparations, ensuring compliance with GAAP standards without infractions over two years.

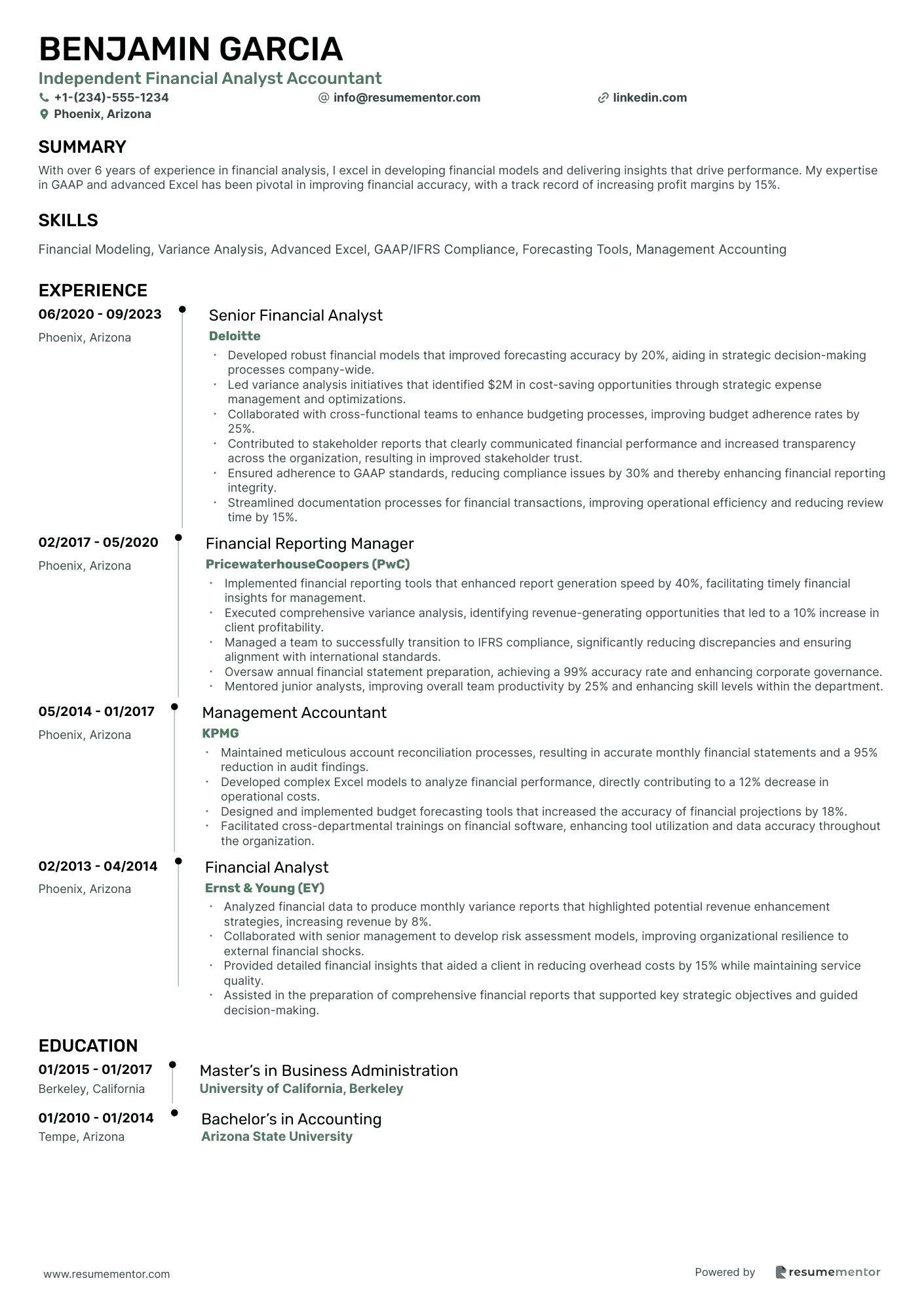

Independent Financial Analyst Accountant resume sample

- •Developed robust financial models that improved forecasting accuracy by 20%, aiding in strategic decision-making processes company-wide.

- •Led variance analysis initiatives that identified $2M in cost-saving opportunities through strategic expense management and optimizations.

- •Collaborated with cross-functional teams to enhance budgeting processes, improving budget adherence rates by 25%.

- •Contributed to stakeholder reports that clearly communicated financial performance and increased transparency across the organization, resulting in improved stakeholder trust.

- •Ensured adherence to GAAP standards, reducing compliance issues by 30% and thereby enhancing financial reporting integrity.

- •Streamlined documentation processes for financial transactions, improving operational efficiency and reducing review time by 15%.

- •Implemented financial reporting tools that enhanced report generation speed by 40%, facilitating timely financial insights for management.

- •Executed comprehensive variance analysis, identifying revenue-generating opportunities that led to a 10% increase in client profitability.

- •Managed a team to successfully transition to IFRS compliance, significantly reducing discrepancies and ensuring alignment with international standards.

- •Oversaw annual financial statement preparation, achieving a 99% accuracy rate and enhancing corporate governance.

- •Mentored junior analysts, improving overall team productivity by 25% and enhancing skill levels within the department.

- •Maintained meticulous account reconciliation processes, resulting in accurate monthly financial statements and a 95% reduction in audit findings.

- •Developed complex Excel models to analyze financial performance, directly contributing to a 12% decrease in operational costs.

- •Designed and implemented budget forecasting tools that increased the accuracy of financial projections by 18%.

- •Facilitated cross-departmental trainings on financial software, enhancing tool utilization and data accuracy throughout the organization.

- •Analyzed financial data to produce monthly variance reports that highlighted potential revenue enhancement strategies, increasing revenue by 8%.

- •Collaborated with senior management to develop risk assessment models, improving organizational resilience to external financial shocks.

- •Provided detailed financial insights that aided a client in reducing overhead costs by 15% while maintaining service quality.

- •Assisted in the preparation of comprehensive financial reports that supported key strategic objectives and guided decision-making.

Sole Proprietor Auditing Accountant resume sample

- •Led the audit of financial statements for over 50 sole proprietors ensuring compliance with GAAP standards, resulting in an audit success rate of 98%.

- •Analyzed financial discrepancies and collaborated with clients on improvement strategies, resulting in a 20% increase in financial accuracy.

- •Prepared and presented over 100 comprehensive audit reports that detailed findings, recommendations, and risks to stakeholders, ensuring informed financial decisions.

- •Worked with cross-functional teams to devise personalized audit strategies that increased client satisfaction scores by 15%.

- •Developed educational seminars for clients on financial best practices, improving client understanding by 30% and compliance rates by 25%.

- •Monitored changes in accounting regulations to provide timely updates that safeguarded clients from non-compliance penalties, reducing their risk by 40%.

- •Directed audit operations for a portfolio of 35 sole proprietors, maintaining a 100% on-time completion rate.

- •Enhanced audit processes that reduced auditing time by 25% while maintaining a thorough review process.

- •Provided expertise in financial analysis leading to opportunities for improvement, resulting in average client savings of 10%.

- •Implemented a new client relationship management system, boosting client retention rates by 30%.

- •Drafted and presented detailed audit findings to executive teams, improving executive understanding of financial trends by 40%.

- •Oversaw financial statements auditing for 60 sole proprietors each quarter, consistently exceeding accuracy benchmarks by 15%.

- •Cultivated strong client relationships through exceptional service, achieving a 95% client satisfaction rate.

- •Developed financial reporting improvements that increased reporting efficiency by 35%.

- •Coordinated with tax teams to ensure seamless integration and compliance, reducing audit revision rates by 20%.

- •Conducted audits for financial documents from sole proprietorships, achieving a 92% compliance rate with IRS regulations.

- •Led junior accounting teams in developing interim audit reports, reducing potential errors by 30%.

- •Advised clients on audit processes and potential financial risks, improving clarity on financial outcomes by 25%.

- •Implemented new accounting software solutions that improved reporting accuracy for clients by 25%.

Freelance Management Accountant resume sample

- •Led a team in enhancing monthly management accounts accuracy, improving timelines by 20% and increasing financial reliability.

- •Executed variance analyses and comprehensive commentaries that reduced forecasting errors by 30%, supporting strategic decisions.

- •Collaborated across departments to optimize budget performances, leading to a cumulative cost saving of $500,000 annually.

- •Implemented internal audit processes, reducing financial discrepancies by 15% within a fiscal year.

- •Spearheaded financial modeling projects, increasing forecasting accuracy, resulting in strategic savings of $1 million.

- •Developed ad-hoc financial reports for the executive team, enhancing strategic planning by evidencing current performance metrics.

- •Managed reconciliations and financial audits, achieving 95% accuracy in reported $50 million annual revenue.

- •Optimized financial data processes, shortening the monthly closing time by 3 days through efficiency tools.

- •Provided annual budget analyses that identified $200,000 in potential savings for reinvestment.

- •Facilitated cross-departmental review meetings, enhancing collaboration and resource allocation efforts.

- •Edited and verified accuracy of financial statements, aligning them with regulatory compliance standards consistently.

- •Developed detailed financial reports resulting in a 10% improvement in management’s visibility on operational costs.

- •Participated in budget preparatory meetings, contributing to a balanced budget with 98% adherence to original plan.

- •Created effective tracking of expenditures, leading to a 5% reduction in unnecessary spending.

- •Conducted compliance audits, ensuring all processes meet stringent internal and external auditing requirements.

- •Processed financial data entries with extreme accuracy, maintaining the integrity of financial audits and reports.

- •Collaborated with finance personnel to streamline accounting procedures, achieving a 12% reduction in data processing time.

- •Assisted in preparing comprehensive financial forecasts, aiding in timely strategic decision implementation.

- •Provided technical support for accounting software migrations, resulting in enhanced efficiency and reliability.

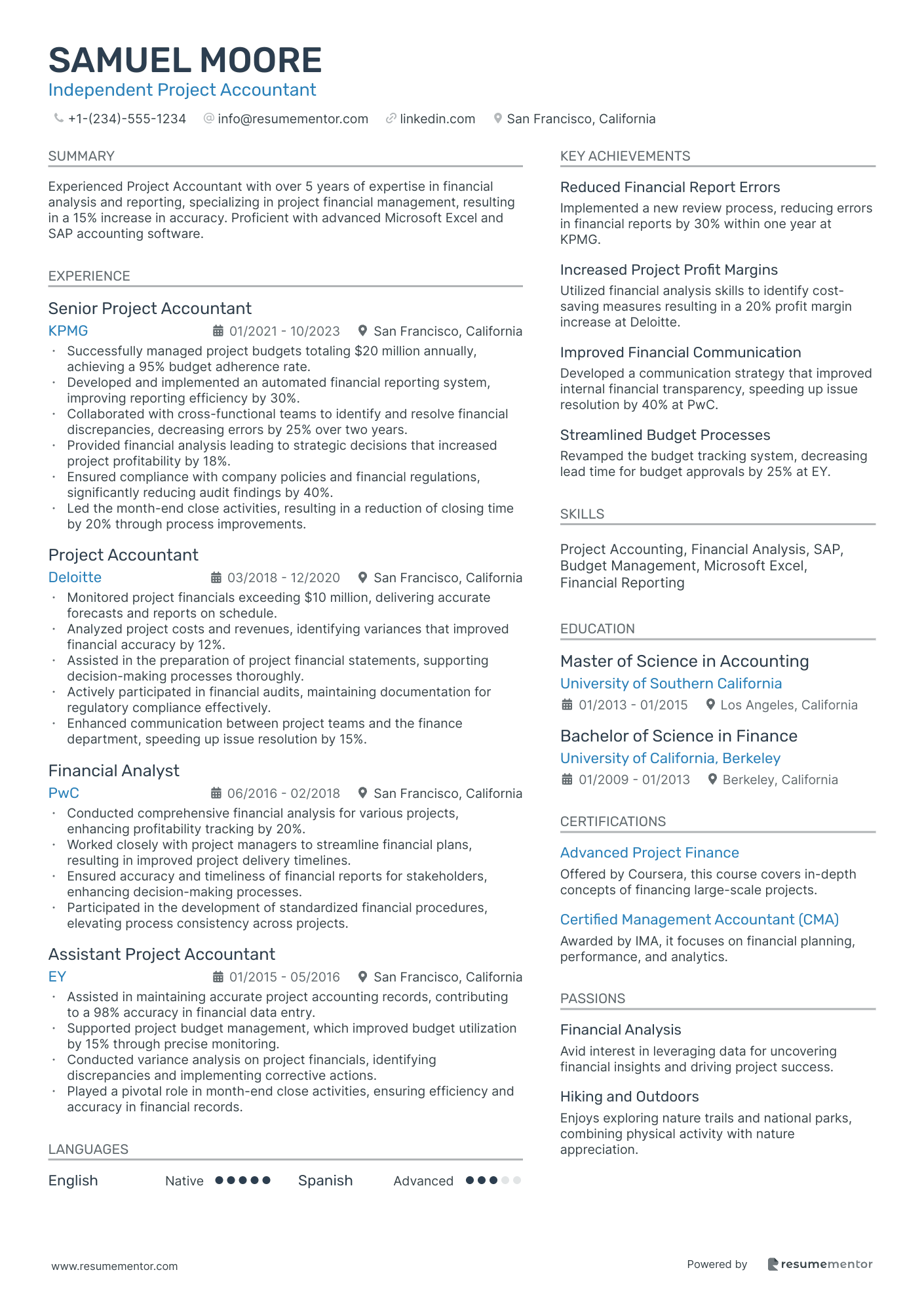

Independent Project Accountant resume sample

- •Successfully managed project budgets totaling $20 million annually, achieving a 95% budget adherence rate.

- •Developed and implemented an automated financial reporting system, improving reporting efficiency by 30%.

- •Collaborated with cross-functional teams to identify and resolve financial discrepancies, decreasing errors by 25% over two years.

- •Provided financial analysis leading to strategic decisions that increased project profitability by 18%.

- •Ensured compliance with company policies and financial regulations, significantly reducing audit findings by 40%.

- •Led the month-end close activities, resulting in a reduction of closing time by 20% through process improvements.

- •Monitored project financials exceeding $10 million, delivering accurate forecasts and reports on schedule.

- •Analyzed project costs and revenues, identifying variances that improved financial accuracy by 12%.

- •Assisted in the preparation of project financial statements, supporting decision-making processes thoroughly.

- •Actively participated in financial audits, maintaining documentation for regulatory compliance effectively.

- •Enhanced communication between project teams and the finance department, speeding up issue resolution by 15%.

- •Conducted comprehensive financial analysis for various projects, enhancing profitability tracking by 20%.

- •Worked closely with project managers to streamline financial plans, resulting in improved project delivery timelines.

- •Ensured accuracy and timeliness of financial reports for stakeholders, enhancing decision-making processes.

- •Participated in the development of standardized financial procedures, elevating process consistency across projects.

- •Assisted in maintaining accurate project accounting records, contributing to a 98% accuracy in financial data entry.

- •Supported project budget management, which improved budget utilization by 15% through precise monitoring.

- •Conducted variance analysis on project financials, identifying discrepancies and implementing corrective actions.

- •Played a pivotal role in month-end close activities, ensuring efficiency and accuracy in financial records.

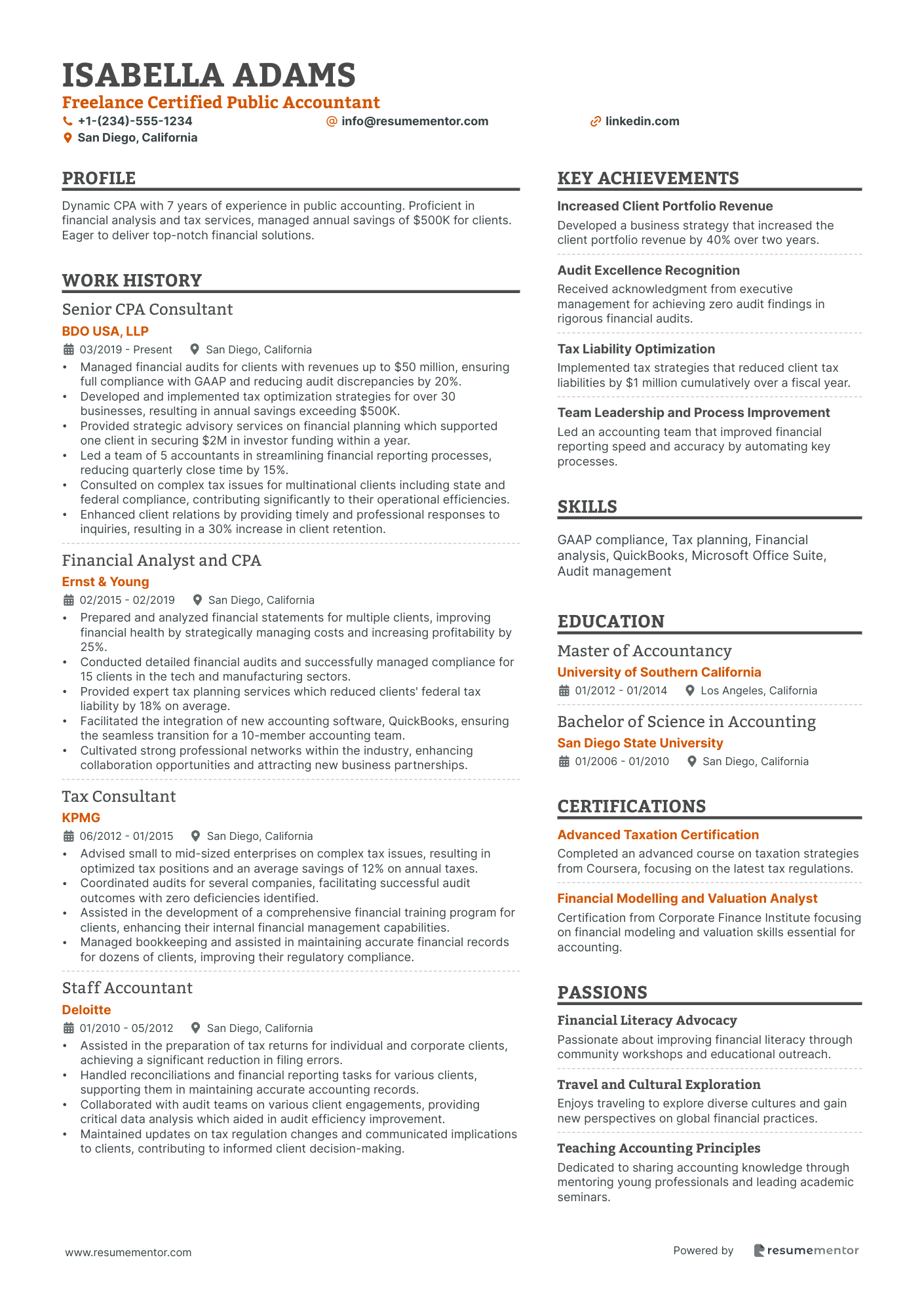

Freelance Certified Public Accountant resume sample

- •Managed financial audits for clients with revenues up to $50 million, ensuring full compliance with GAAP and reducing audit discrepancies by 20%.

- •Developed and implemented tax optimization strategies for over 30 businesses, resulting in annual savings exceeding $500K.

- •Provided strategic advisory services on financial planning which supported one client in securing $2M in investor funding within a year.

- •Led a team of 5 accountants in streamlining financial reporting processes, reducing quarterly close time by 15%.

- •Consulted on complex tax issues for multinational clients including state and federal compliance, contributing significantly to their operational efficiencies.

- •Enhanced client relations by providing timely and professional responses to inquiries, resulting in a 30% increase in client retention.

- •Prepared and analyzed financial statements for multiple clients, improving financial health by strategically managing costs and increasing profitability by 25%.

- •Conducted detailed financial audits and successfully managed compliance for 15 clients in the tech and manufacturing sectors.

- •Provided expert tax planning services which reduced clients' federal tax liability by 18% on average.

- •Facilitated the integration of new accounting software, QuickBooks, ensuring the seamless transition for a 10-member accounting team.

- •Cultivated strong professional networks within the industry, enhancing collaboration opportunities and attracting new business partnerships.

- •Advised small to mid-sized enterprises on complex tax issues, resulting in optimized tax positions and an average savings of 12% on annual taxes.

- •Coordinated audits for several companies, facilitating successful audit outcomes with zero deficiencies identified.

- •Assisted in the development of a comprehensive financial training program for clients, enhancing their internal financial management capabilities.

- •Managed bookkeeping and assisted in maintaining accurate financial records for dozens of clients, improving their regulatory compliance.

- •Assisted in the preparation of tax returns for individual and corporate clients, achieving a significant reduction in filing errors.

- •Handled reconciliations and financial reporting tasks for various clients, supporting them in maintaining accurate accounting records.

- •Collaborated with audit teams on various client engagements, providing critical data analysis which aided in audit efficiency improvement.

- •Maintained updates on tax regulation changes and communicated implications to clients, contributing to informed client decision-making.

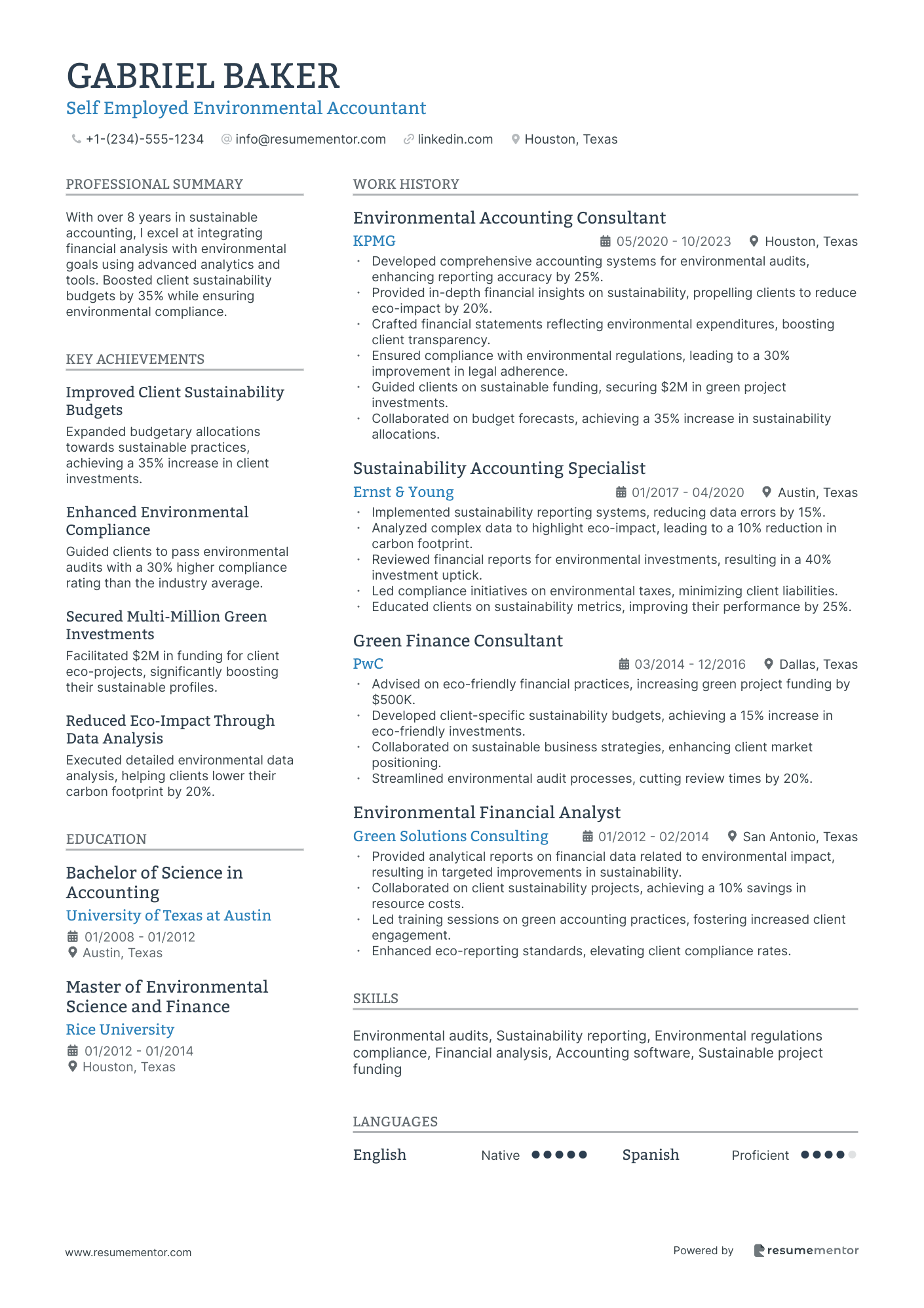

Self Employed Environmental Accountant resume sample

- •Developed comprehensive accounting systems for environmental audits, enhancing reporting accuracy by 25%.

- •Provided in-depth financial insights on sustainability, propelling clients to reduce eco-impact by 20%.

- •Crafted financial statements reflecting environmental expenditures, boosting client transparency.

- •Ensured compliance with environmental regulations, leading to a 30% improvement in legal adherence.

- •Guided clients on sustainable funding, securing $2M in green project investments.

- •Collaborated on budget forecasts, achieving a 35% increase in sustainability allocations.

- •Implemented sustainability reporting systems, reducing data errors by 15%.

- •Analyzed complex data to highlight eco-impact, leading to a 10% reduction in carbon footprint.

- •Reviewed financial reports for environmental investments, resulting in a 40% investment uptick.

- •Led compliance initiatives on environmental taxes, minimizing client liabilities.

- •Educated clients on sustainability metrics, improving their performance by 25%.

- •Advised on eco-friendly financial practices, increasing green project funding by $500K.

- •Developed client-specific sustainability budgets, achieving a 15% increase in eco-friendly investments.

- •Collaborated on sustainable business strategies, enhancing client market positioning.

- •Streamlined environmental audit processes, cutting review times by 20%.

- •Provided analytical reports on financial data related to environmental impact, resulting in targeted improvements in sustainability.

- •Collaborated on client sustainability projects, achieving a 10% savings in resource costs.

- •Led training sessions on green accounting practices, fostering increased client engagement.

- •Enhanced eco-reporting standards, elevating client compliance rates.

As a self-employed accountant, writing a resume might feel like steering a ship through uncharted waters. In today's competitive job market, standing out is vital, and your resume is your opportunity to highlight both your financial expertise and problem-solving skills. It's important to transform your entrepreneurial journey into a narrative that resonates with potential employers.

Translating your varied experiences into a cohesive story can be tricky, especially when you have to quantify achievements and clarify the different roles you’ve embraced. This is where a well-structured resume can be your guiding star. Using a well-designed resume template helps keep your experiences organized, making your strengths more apparent. Consider checking out these resume templates to get started.

With a template in hand, you can seamlessly lay out your skills, such as financial strategy and tax expertise, in a clear and compelling manner. While showcasing your technical know-how is crucial, presenting it effectively is equally important. Striking a balance between demonstrating your capabilities and making your story relatable to potential employers is key. This guide is here to help you weave a resume that captures your entrepreneurial spirit and highlights the unique value you bring as a self-employed accountant.

Key Takeaways

- The article emphasizes transforming varied professional experiences into a cohesive story in the resume of a self-employed accountant, highlighting achievements rather than just roles and responsibilities.

- Key resume components include a prominent contact information section, a compelling professional summary focusing on accounting specialties, and a detailed experience section with quantifiable outcomes.

- Advanced accounting skills, certifications, and educational background should be clearly presented to underscore professionalism and expertise in the field.

- Inclusion of soft skills such as communication, problem-solving, and adaptability is essential to demonstrate a capability to manage diverse responsibilities effectively.

- Formatting tips suggest using a chronological order, modern fonts, saving resumes as PDFs, and maintaining one-inch margins for a professional and organized appearance.

What to focus on when writing your self employed accountant resume

A self employed accountant resume should clearly convey your ability to independently handle complex financial tasks. It should help potential clients recognize your effectiveness in meeting their financial needs with expert precision. Demonstrating skills in analysis and keen attention to detail, your resume should effectively highlight your strengths.

How to structure your self employed accountant resume

- Contact Information—Ensure your contact details are prominent and up-to-date. Include your full name as it appears on professional accounts, a reliable phone number, a professional email address, and a LinkedIn profile. This makes it straightforward for recruiters to reach you and explore your professional network.

- Professional Summary—Craft a compelling overview that combines your years of experience with your accounting specialties. Focus on particular niches you’ve excelled in, such as tax planning or regulatory compliance consulting. Highlight achievements, like successful financial audits or substantial savings generated for clients, to grab immediate attention.

- Experience—Detail your professional journey by emphasizing the depth and breadth of your client consultations. Highlight specific projects, describing the scope of services like financial reporting, auditing, or bookkeeping. Include concrete outcomes, demonstrating your direct contributions to client success and satisfaction.

- Skills—Emphasize advanced accounting skills that set you apart. Highlight your proficiency in tax codes, financial analysis, and software like QuickBooks or Excel. Provide context that shows how these skills have been applied effectively in real-world scenarios, underlining your capability to handle diverse accounting challenges.

- Education—Show the foundation of your knowledge by listing your degree in accounting or finance. If you have advanced certifications such as a CPA or CMA, make sure to include these credentials, as they underscore your commitment to maintaining high professional standards.

- Achievements—Strengthen your resume with notable achievements that demonstrate your impact, such as increasing client revenue or streamlining financial processes. Providing quantifiable metrics for these successes can make them even more compelling to potential clients or employers.

By following this structure, you can create a resume that clearly articulates your value as a self employed accountant. Below, we'll cover each section in more depth to ensure your resume stands out.

Which resume format to choose

Creating an effective resume as a self-employed accountant starts with selecting the right format. The chronological format is ideal because it allows you to present your work history in a clear timeline. This approach helps potential clients and employers easily track your professional growth and understand your depth of experience in managing finances and accounting tasks.

Selecting the right font adds a modern and professional touch to your resume. Consider using Rubik, Lato, or Montserrat. These fonts are not only stylish but also optimize readability, ensuring that your skills and achievements are easily understood. The visual appeal of these modern fonts can set your resume apart from those using more traditional types like Arial or Times New Roman.

When it's time to save your resume, always choose PDF format. This ensures that your formatting stays consistent and appears professional, no matter what device is used to view it. PDFs protect your document's layout, which is crucial for maintaining the integrity of your work, especially when graphics or specific alignments are involved.

Attention to detail is vital, and that includes your resume's margins. Maintain one-inch margins on all sides to create a tidy and uncluttered appearance. This spacing helps to emphasize your content, making it easy for readers to focus on the significant parts of your experience and skills without distractions.

In essence, when writing your resume as a self-employed accountant, focus on a chronological format to highlight your career path, choose modern fonts to enhance readability, save as a PDF for consistent presentation, and use one-inch margins for a clean, professional look.

How to write a quantifiable resume experience section

The experience section of your resume is vital for illustrating your achievements and expertise as a self employed accountant. Highlight your successes with tangible outcomes that show the financial value you provide to clients. Starting with your most recent roles, present your history in reverse chronological order to help employers easily see your latest experience and skills. Limit your timeline to the past 10-15 years, focusing on roles that showcase your strength. Titles like "Self Employed Accountant" or "Independent Accounting Consultant" clearly convey your role. Tailor your resume by incorporating key terms and skills from the job ad, emphasizing experiences that directly relate to the position. Strong action words such as "reduced," "implemented," "optimized," and "audited" effectively convey your achievements and initiative.

Here’s an example for a self employed accountant:

- •Reduced client tax liability by 20% through strategic tax planning and deductions.

- •Implemented a streamlined accounting system, increasing operational efficiency by 30%.

- •Optimized client financial reports, leading to a cost savings of $50,000 annually.

- •Audited and corrected discrepancies in financial records, resulting in improved accuracy by 25%.

This experience section distinguishes itself by focusing on quantifiable achievements that demonstrate your critical skills. By using action-oriented language, like "reduced" and "implemented," you convey the meaningful impact of your contributions. Providing specific figures, such as a 20% tax liability reduction and $50,000 in annual savings, offers clear evidence of your effectiveness. When you tailor your resume to align with the job description, you enhance your relevance as a candidate. The clear structure and straightforward titles, combined with detailed location information, create a cohesive and professional appearance that makes it easy for hiring managers to recognize your value.

Skills-Focused resume experience section

A skills-focused self-employed accountant resume experience section should emphasize your expertise and adaptability. Start by highlighting the key skills and achievements that match the job you’re aiming for, focusing on the accounting techniques you know best, such as financial analysis, tax preparation, or budgeting. Use numbers to give weight to these achievements, showing how you've made a positive impact on your clients. Clearly illustrating these contributions can convey the value you bring.

In this section, emphasize your ability to juggle diverse responsibilities, a crucial trait for any self-employed professional. Include bullet points demonstrating how you manage these tasks efficiently, mentioning industries or client types you've worked with to highlight your versatility. Focus on achievements with tangible, positive outcomes, and use active language for engagement. This approach not only showcases your skills but also paints a complete picture of your professional capabilities. Here’s an example of how that might look in JSON format:

Self-Employed Accountant

January 2016 - Present

- Developed customized financial strategies for over 50 small businesses, leading to a 15% average increase in profitability.

- Streamlined accounting processes using advanced software, cutting clients' administrative costs by 20%.

- Conducted audits and provided tax filing services, ensuring 100% compliance with all regulatory requirements.

- Designed and implemented financial education workshops, helping clients better understand and manage their finances.

Growth-Focused resume experience section

A growth-focused self-employed accountant resume experience section should clearly demonstrate how your work has driven success for your clients. Begin by listing your job titles, like "Independent Accountant" or "Financial Consultant," which set the stage for the impact you've made. Follow with bullet points that concisely highlight specific achievements. Focusing on how you’ve added value gives potential clients or employers a quick understanding of your contributions.

Use numbers wherever possible to quantify your accomplishments, offering concrete proof of your effectiveness that others can easily grasp. Choose action verbs to describe your responsibilities, putting the spotlight on outcomes rather than daily tasks. This approach helps potential employers visualize how you can play a crucial role in growing their business. Be sure to emphasize the skills most relevant to the kinds of opportunities you are pursuing, painting a clear picture of your capabilities.

Self-Employed Accountant

January 2020 - Present

- Boosted client revenue by 25% through strategic financial planning and cost management.

- Cut tax liabilities by 15% by implementing customized strategies and optimizing deductions.

- Enhanced cash flow forecasting accuracy by 30% to improve decision-making.

- Assisted in business expansion that led to a 20% increase in annual profits.

Problem-Solving Focused resume experience section

A problem-solving focused resume experience section should highlight your ability to tackle financial challenges effectively. Start by listing your projects or jobs with clear and concise details, using active language and quantifiable outcomes to demonstrate your impact. It's important to showcase your skills in managing complex financial situations, adapting to changes, and enhancing the efficiency of financial operations. For each role, detail specific instances where your problem-solving skills made a tangible difference, such as resolving issues or achieving client goals. This approach ensures you communicate your capabilities effectively to potential clients or employers.

When reflecting on your projects, consider a situation where you addressed a client's financial discrepancies. Illustrate how you analyzed the financial data, identified the root cause, and implemented a strategic solution, such as simplifying their tax filing process or upgrading their financial tracking system. Make sure to clarify your role and the results, such as saving time or reducing errors. By emphasizing these experiences, you’re not just listing tasks but showcasing your value and expertise as a problem-solving accountant.

Accountant

January 2021 - Present

- Resolved a client's financial discrepancies by conducting a thorough audit and implementing new accounting software, reducing errors by 35%.

- Developed a streamlined tax filing process for a small business, saving them over 40 hours yearly in preparation time.

- Identified cost-saving opportunities in a client's budget, improving their cash flow by 10% within three months.

- Enhanced financial transparency for clients by creating comprehensive reporting templates, enabling better strategic planning.

Achievement-Focused resume experience section

An achievement-focused resume experience section for a self-employed accountant should effectively highlight the impact you've had through your expertise. Start by pinpointing major accomplishments and emphasize them with specific metrics and data to showcase your contributions. This approach not only demonstrates how your skills have solved problems or improved processes but also paints a clear picture of your value as a financial expert.

When detailing your experience, strive for descriptions that are both clear and engaging. Use strong action verbs and make sure each statement flows smoothly, as if you are guiding someone through your achievements who may not be familiar with accounting. By focusing on solutions and results like cost savings, business growth, or streamlined processes, you emphasize your ability to drive meaningful improvements for clients.

Self-Employed Accountant

June 2018 - Present

- Enhanced client financial statements with detailed analytics, leading to a 15% reduction in reporting errors.

- Managed tax planning for over 20 small businesses, achieving an average annual tax savings of 10% for clients.

- Created a streamlined bookkeeping system that cut monthly processing time by 30% for clients.

- Advised a client on a financial strategy overhaul that increased their profits by 25% within a year.

Write your self employed accountant resume summary section

A results-focused resume summary for a self-employed accountant should immediately capture what makes you unique. This section needs to give a clear, concise overview of your skills, experience, and the value you offer. Using straightforward language, you can highlight your main strengths and accomplishments to make a strong impression. For instance:

This summary effectively brings attention to your extensive experience and the skills that set you apart. By mentioning your proficiency in QuickBooks and highlighting a significant achievement, such as reducing client expenses, you add considerable value. While a resume objective might state your career aspirations, a summary zeroes in on your past achievements and skills. This approach is particularly advantageous for experienced candidates, as it underlines your established expertise.

While a resume profile is similar to a summary, it may include personal traits, whereas a summary of qualifications lists key competencies. Opting for a summary when you have a robust work history allows you to make your skills shine. Use factual, measurable results to describe yourself, as this not only captures attention but also builds your credibility.

Listing your self employed accountant skills on your resume

A skills-focused self-employed accountant resume should clearly highlight the capabilities that set you apart. Your skills can either form their own section or interlace seamlessly with your experience and summary. Your strengths, encompassing a blend of hard and soft skills, are crucial to making an impact. Hard skills refer to the specific technical knowledge, like accounting software proficiency and financial analysis capabilities, that you've acquired through training or practice.

When you incorporate your skills and strengths strategically, they act as vital keywords in your resume. These keywords not only highlight your specialized expertise but also help elevate your resume in digital searches. Thus, presenting a well-organized and clear skills section lets potential clients quickly recognize your qualifications.

Take, for instance, a standalone skills section in JSON format:

This skills section is efficient as it lists essential accounting skills directly. Skills like "Financial Analysis," "Tax Preparation," and "QuickBooks" are indispensable for those who are self-employed accountants. This clear presentation, free from unnecessary words, allows potential clients to easily grasp your competencies.

Best hard skills to feature on your self-employed accountant resume

Your resume should prominently feature hard skills that underscore your ability to handle financial tasks and master accounting tools. Here are vital hard skills to include:

Hard Skills

- Financial Analysis

- Tax Preparation

- Bookkeeping

- QuickBooks

- Excel Proficiency

- Budgeting

- Payroll Management

- Regulatory Compliance

- Financial Reporting

- Cost Accounting

- Cash Flow Management

- Auditing

- Business Strategy

- Investment Planning

- Risk Management

Best soft skills to feature on your self-employed accountant resume

Equally essential are soft skills, as they convey your capability to manage interactions and responsibilities effectively. Highlighting these skills will give insight into your interpersonal abilities:

Soft Skills

- Communication

- Attention to Detail

- Problem-Solving

- Time Management

- Adaptability

- Self-Motivation

- Critical Thinking

- Team Collaboration

- Decision-Making

- Patience

- Leadership

- Client Management

- Negotiation

- Initiative

- Stress Management

How to include your education on your resume

The education section of a resume is crucial, even for a self-employed accountant. This section should be tailored to the job you're applying for, showcasing relevant education that underscores your skills. Including irrelevant education distracts from your qualifications. When listing your degree, write the full title and focus on aspects that align with accounting. If you graduated with honors, like cum laude, include this distinction as it highlights your academic excellence. GPAs are optional but can be listed if above a 3.5; use a format like "GPA: 3.7/4.0" to keep it clear.

Here's an ineffective example:

Now, here's an effective example:

This second example is strong because it highlights a relevant degree, includes a notable GPA, and leaves out unnecessary information. The institution's name is credible, boosting your professional image. It’s clearly structured, making it easy for any potential client to read and understand your qualifications.

How to include self employed accountant certificates on your resume

Including a Certificates section is crucial for your self-employed accountant resume. List the name of each certificate, making sure it aligns with the requirements of the jobs you're targeting. Include the date you received each certificate to show your ongoing commitment to professional development. Add the issuing organization to give your credentials more credibility.

For a clean look, you can also include certificates in the header of your resume. For example:

Here is a well-structured example of a Certificates section: [here was the JSON object 2]

This example is effective because it clearly lists relevant certificates for an accountant. Each certificate is relevant and recognized in the industry, establishing your credentials. The dates and issuing organizations are included, adding credibility and detail. Such a section not only validates your skills but can also make your resume stand out to potential clients or employers. Nodes effectively keep your Certifications section organized and easy to read. Each certificate's relevance to accounting enhances your professional profile.

Extra sections to include in your self employed accountant resume

When you're preparing a resume for your self-employed accounting career, it’s essential to showcase a range of skills and experiences. Beyond your technical accounting abilities, additional resume sections can significantly boost your profile, making you more appealing to potential clients or employers.

Language section — Include languages to demonstrate your ability to communicate with a diverse clientele. Highlighting fluency in multiple languages can give you an edge over others who only speak one language.

Hobbies and interests section — Add this section to show you are a well-rounded individual with various interests. This can help create a personal connection and make you more relatable to potential clients.

Volunteer work section — Share your volunteer work to illustrate your commitment to the community and your willingness to go the extra mile. Volunteering also showcases your ability to manage your time and skills effectively outside of paid work.

Books section — List relevant books to emphasize continuous learning and passion for your field. Mentioning industry-related books can show your dedication to staying current with accounting trends and practices.

Using these sections correctly can set you apart in the competitive field of self-employed accounting. They provide a fuller picture of who you are, beyond your professional qualifications. This can help you connect better with clients, demonstrating qualities like versatility, continuous learning, and community involvement.

In Conclusion

In conclusion, crafting a resume as a self-employed accountant requires a strategic approach that emphasizes both your diverse skillset and entrepreneurial achievements. By clearly defining your professional journey through tailored sections like experience, skills, and certifications, you offer potential clients a comprehensive view of your capabilities. Highlighting quantifiable outcomes and specific expertise allows you to stand out in a crowded market. Keep in mind the importance of formatting; using modern fonts and maintaining clean margins enhances readability and presentation. The choice of a PDF format ensures that all elements of your resume remain intact across devices. Additionally, including sections like language proficiency or volunteer work can add depth to your profile, showcasing your well-roundedness and dedication to continuous growth. Remember, your resume is more than a list of jobs—it's a narrative of your professional life that should leave a lasting impression. With careful organization and attention to detail, your resume will effectively communicate the value you offer as a self-employed accountant. This comprehensive approach ensures that you not only meet industry standards but also appeal to potential clients looking for reliability and results.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.