Senior Financial Analyst Resume Examples

Mar 25, 2025

|

12 min read

Master the art of crafting a senior financial analyst resume with our guide—it's time to invest in your career's success and avoid making any cents-less mistakes. Transform your experience into a winning portfolio that opens doors.

Rated by 348 people

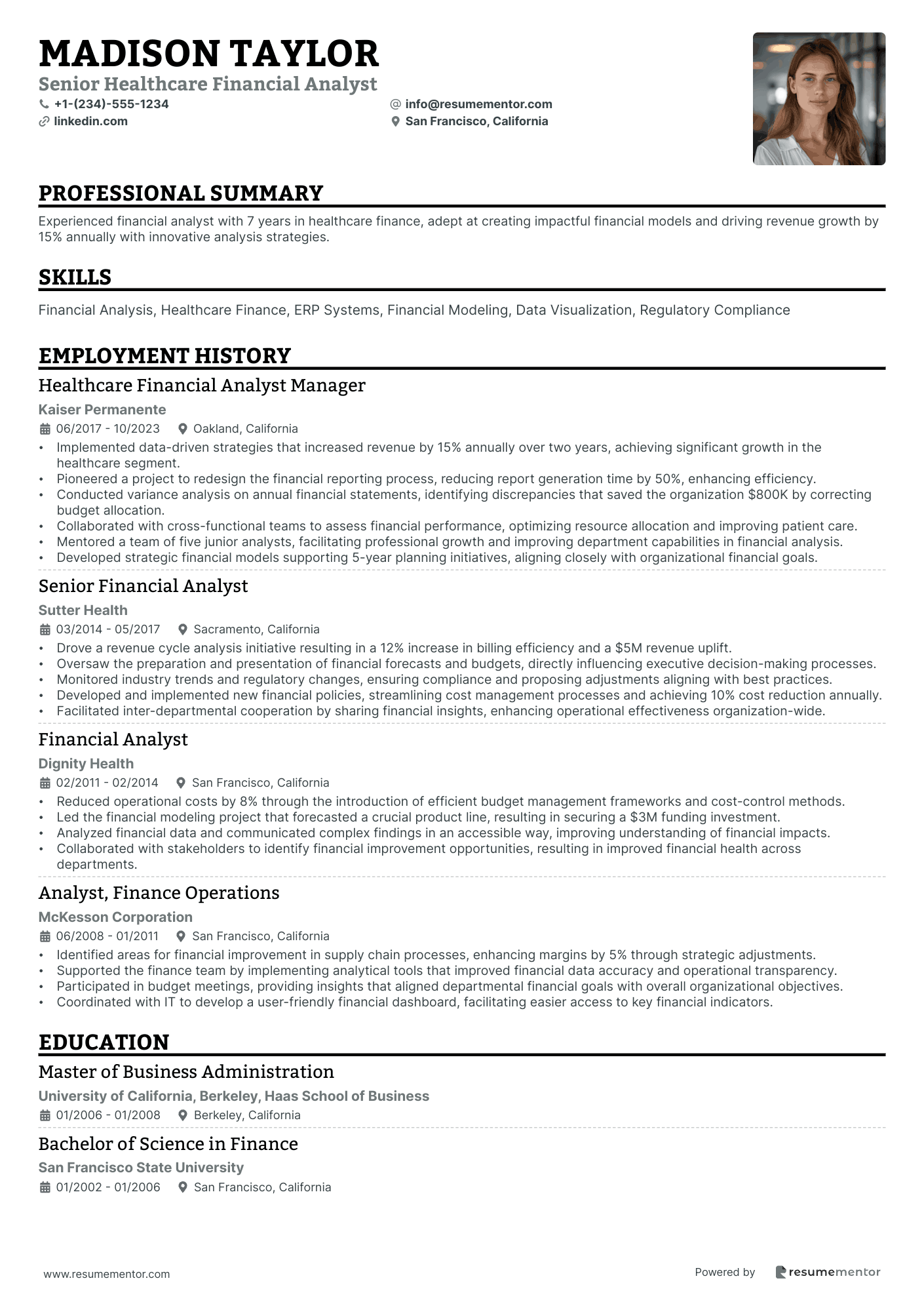

Senior Healthcare Financial Analyst

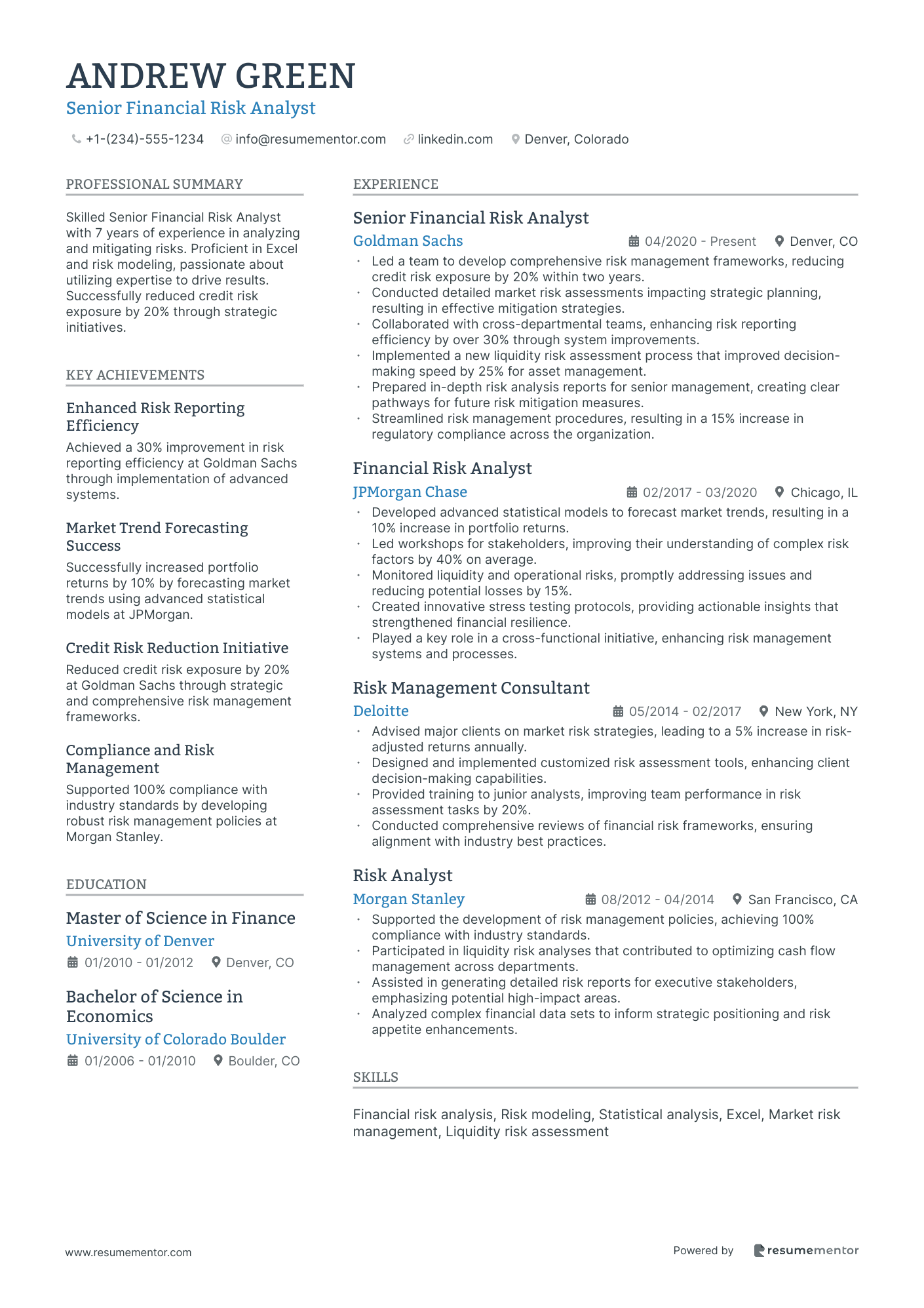

Senior Financial Risk Analyst

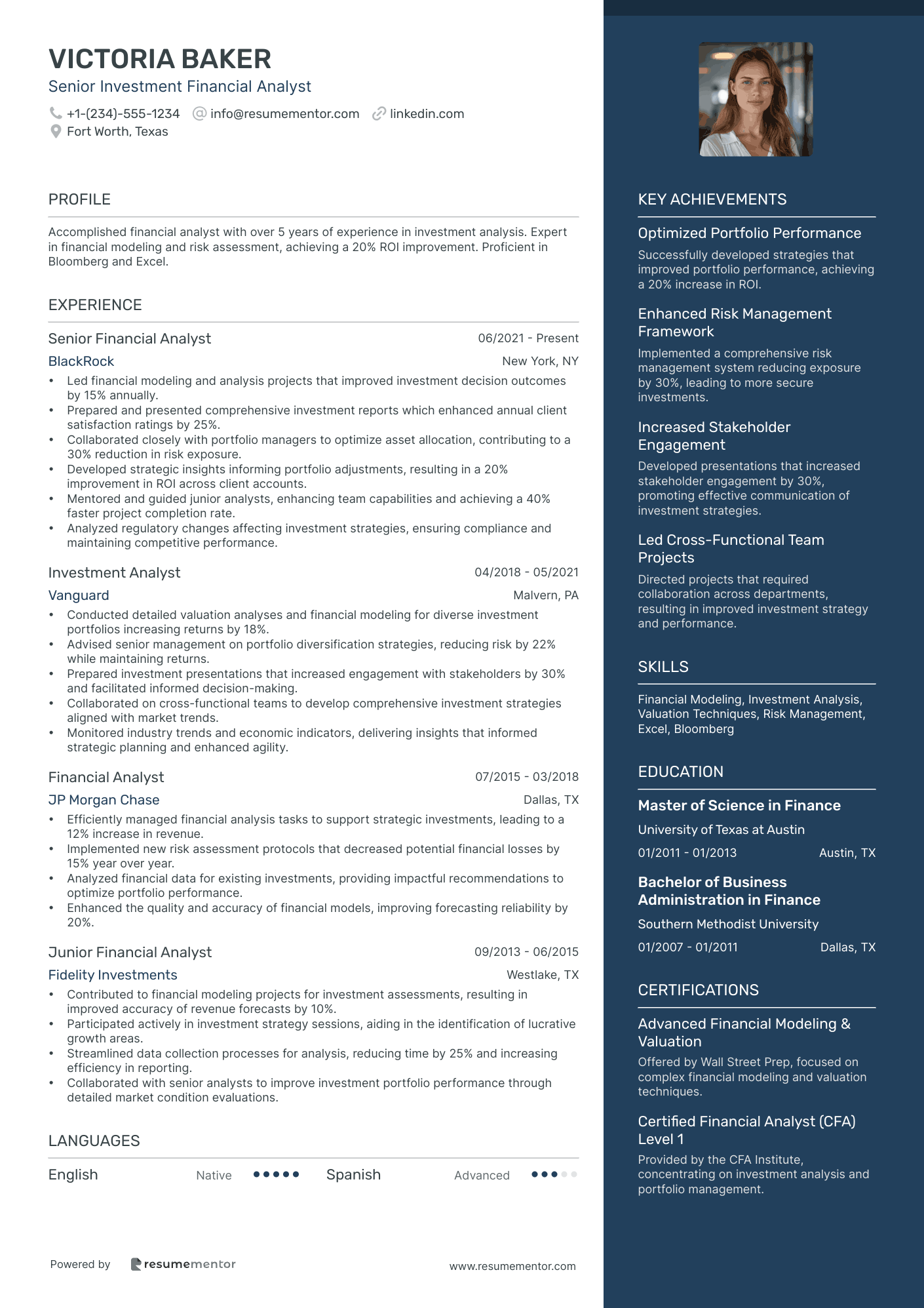

Senior Investment Financial Analyst

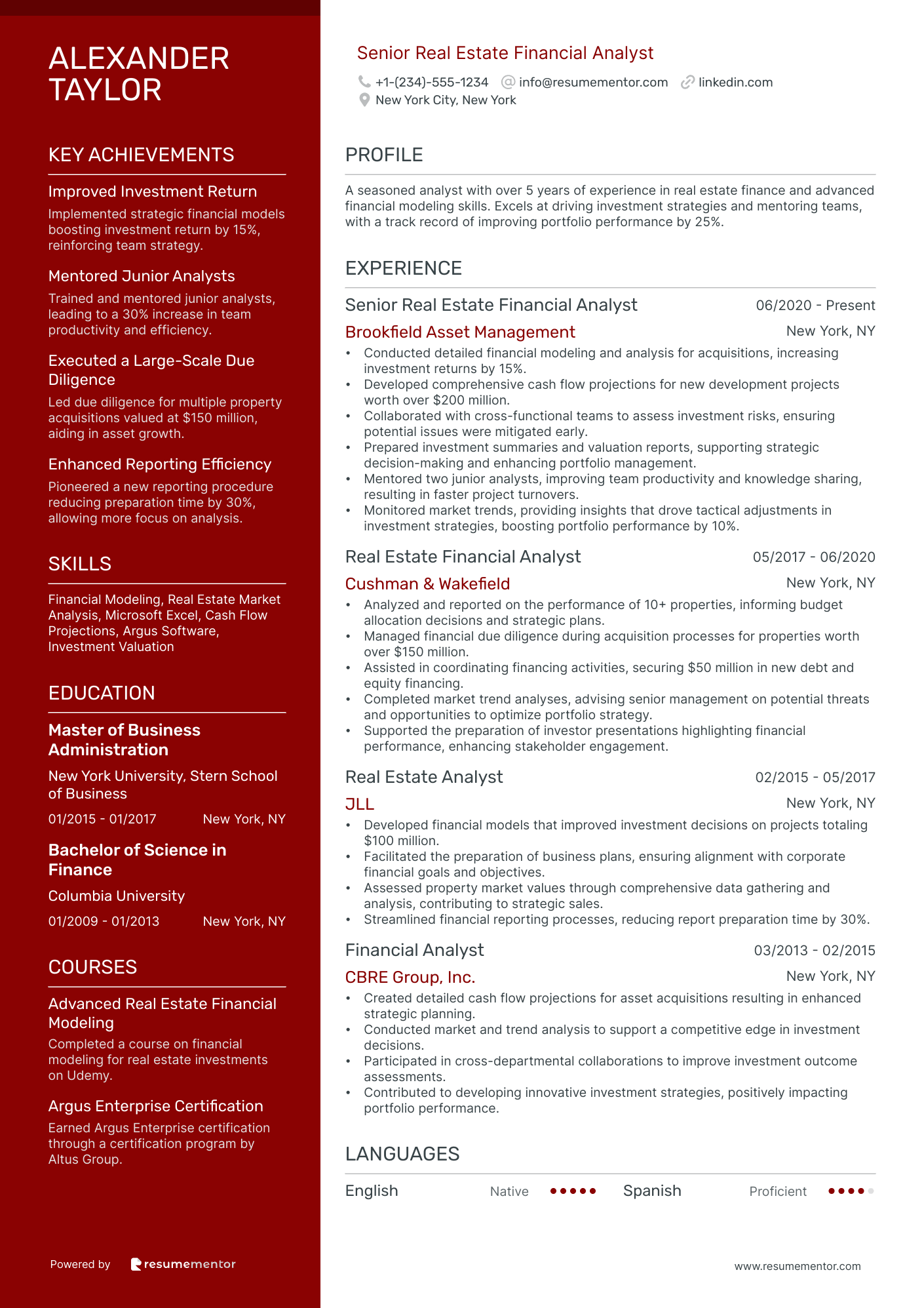

Senior Real Estate Financial Analyst

Senior Quantitative Financial Analyst

Senior Financial Planning and Analysis Analyst

Senior Mergers and Acquisitions Financial Analyst

Senior Retail Finance Analyst

Senior Corporate Finance Strategy Analyst

Senior Healthcare Financial Analyst resume sample

- •Implemented data-driven strategies that increased revenue by 15% annually over two years, achieving significant growth in the healthcare segment.

- •Pioneered a project to redesign the financial reporting process, reducing report generation time by 50%, enhancing efficiency.

- •Conducted variance analysis on annual financial statements, identifying discrepancies that saved the organization $800K by correcting budget allocation.

- •Collaborated with cross-functional teams to assess financial performance, optimizing resource allocation and improving patient care.

- •Mentored a team of five junior analysts, facilitating professional growth and improving department capabilities in financial analysis.

- •Developed strategic financial models supporting 5-year planning initiatives, aligning closely with organizational financial goals.

- •Drove a revenue cycle analysis initiative resulting in a 12% increase in billing efficiency and a $5M revenue uplift.

- •Oversaw the preparation and presentation of financial forecasts and budgets, directly influencing executive decision-making processes.

- •Monitored industry trends and regulatory changes, ensuring compliance and proposing adjustments aligning with best practices.

- •Developed and implemented new financial policies, streamlining cost management processes and achieving 10% cost reduction annually.

- •Facilitated inter-departmental cooperation by sharing financial insights, enhancing operational effectiveness organization-wide.

- •Reduced operational costs by 8% through the introduction of efficient budget management frameworks and cost-control methods.

- •Led the financial modeling project that forecasted a crucial product line, resulting in securing a $3M funding investment.

- •Analyzed financial data and communicated complex findings in an accessible way, improving understanding of financial impacts.

- •Collaborated with stakeholders to identify financial improvement opportunities, resulting in improved financial health across departments.

- •Identified areas for financial improvement in supply chain processes, enhancing margins by 5% through strategic adjustments.

- •Supported the finance team by implementing analytical tools that improved financial data accuracy and operational transparency.

- •Participated in budget meetings, providing insights that aligned departmental financial goals with overall organizational objectives.

- •Coordinated with IT to develop a user-friendly financial dashboard, facilitating easier access to key financial indicators.

Senior Financial Risk Analyst resume sample

- •Led a team to develop comprehensive risk management frameworks, reducing credit risk exposure by 20% within two years.

- •Conducted detailed market risk assessments impacting strategic planning, resulting in effective mitigation strategies.

- •Collaborated with cross-departmental teams, enhancing risk reporting efficiency by over 30% through system improvements.

- •Implemented a new liquidity risk assessment process that improved decision-making speed by 25% for asset management.

- •Prepared in-depth risk analysis reports for senior management, creating clear pathways for future risk mitigation measures.

- •Streamlined risk management procedures, resulting in a 15% increase in regulatory compliance across the organization.

- •Developed advanced statistical models to forecast market trends, resulting in a 10% increase in portfolio returns.

- •Led workshops for stakeholders, improving their understanding of complex risk factors by 40% on average.

- •Monitored liquidity and operational risks, promptly addressing issues and reducing potential losses by 15%.

- •Created innovative stress testing protocols, providing actionable insights that strengthened financial resilience.

- •Played a key role in a cross-functional initiative, enhancing risk management systems and processes.

- •Advised major clients on market risk strategies, leading to a 5% increase in risk-adjusted returns annually.

- •Designed and implemented customized risk assessment tools, enhancing client decision-making capabilities.

- •Provided training to junior analysts, improving team performance in risk assessment tasks by 20%.

- •Conducted comprehensive reviews of financial risk frameworks, ensuring alignment with industry best practices.

- •Supported the development of risk management policies, achieving 100% compliance with industry standards.

- •Participated in liquidity risk analyses that contributed to optimizing cash flow management across departments.

- •Assisted in generating detailed risk reports for executive stakeholders, emphasizing potential high-impact areas.

- •Analyzed complex financial data sets to inform strategic positioning and risk appetite enhancements.

Senior Investment Financial Analyst resume sample

- •Led financial modeling and analysis projects that improved investment decision outcomes by 15% annually.

- •Prepared and presented comprehensive investment reports which enhanced annual client satisfaction ratings by 25%.

- •Collaborated closely with portfolio managers to optimize asset allocation, contributing to a 30% reduction in risk exposure.

- •Developed strategic insights informing portfolio adjustments, resulting in a 20% improvement in ROI across client accounts.

- •Mentored and guided junior analysts, enhancing team capabilities and achieving a 40% faster project completion rate.

- •Analyzed regulatory changes affecting investment strategies, ensuring compliance and maintaining competitive performance.

- •Conducted detailed valuation analyses and financial modeling for diverse investment portfolios increasing returns by 18%.

- •Advised senior management on portfolio diversification strategies, reducing risk by 22% while maintaining returns.

- •Prepared investment presentations that increased engagement with stakeholders by 30% and facilitated informed decision-making.

- •Collaborated on cross-functional teams to develop comprehensive investment strategies aligned with market trends.

- •Monitored industry trends and economic indicators, delivering insights that informed strategic planning and enhanced agility.

- •Efficiently managed financial analysis tasks to support strategic investments, leading to a 12% increase in revenue.

- •Implemented new risk assessment protocols that decreased potential financial losses by 15% year over year.

- •Analyzed financial data for existing investments, providing impactful recommendations to optimize portfolio performance.

- •Enhanced the quality and accuracy of financial models, improving forecasting reliability by 20%.

- •Contributed to financial modeling projects for investment assessments, resulting in improved accuracy of revenue forecasts by 10%.

- •Participated actively in investment strategy sessions, aiding in the identification of lucrative growth areas.

- •Streamlined data collection processes for analysis, reducing time by 25% and increasing efficiency in reporting.

- •Collaborated with senior analysts to improve investment portfolio performance through detailed market condition evaluations.

Senior Real Estate Financial Analyst resume sample

- •Conducted detailed financial modeling and analysis for acquisitions, increasing investment returns by 15%.

- •Developed comprehensive cash flow projections for new development projects worth over $200 million.

- •Collaborated with cross-functional teams to assess investment risks, ensuring potential issues were mitigated early.

- •Prepared investment summaries and valuation reports, supporting strategic decision-making and enhancing portfolio management.

- •Mentored two junior analysts, improving team productivity and knowledge sharing, resulting in faster project turnovers.

- •Monitored market trends, providing insights that drove tactical adjustments in investment strategies, boosting portfolio performance by 10%.

- •Analyzed and reported on the performance of 10+ properties, informing budget allocation decisions and strategic plans.

- •Managed financial due diligence during acquisition processes for properties worth over $150 million.

- •Assisted in coordinating financing activities, securing $50 million in new debt and equity financing.

- •Completed market trend analyses, advising senior management on potential threats and opportunities to optimize portfolio strategy.

- •Supported the preparation of investor presentations highlighting financial performance, enhancing stakeholder engagement.

- •Developed financial models that improved investment decisions on projects totaling $100 million.

- •Facilitated the preparation of business plans, ensuring alignment with corporate financial goals and objectives.

- •Assessed property market values through comprehensive data gathering and analysis, contributing to strategic sales.

- •Streamlined financial reporting processes, reducing report preparation time by 30%.

- •Created detailed cash flow projections for asset acquisitions resulting in enhanced strategic planning.

- •Conducted market and trend analysis to support a competitive edge in investment decisions.

- •Participated in cross-departmental collaborations to improve investment outcome assessments.

- •Contributed to developing innovative investment strategies, positively impacting portfolio performance.

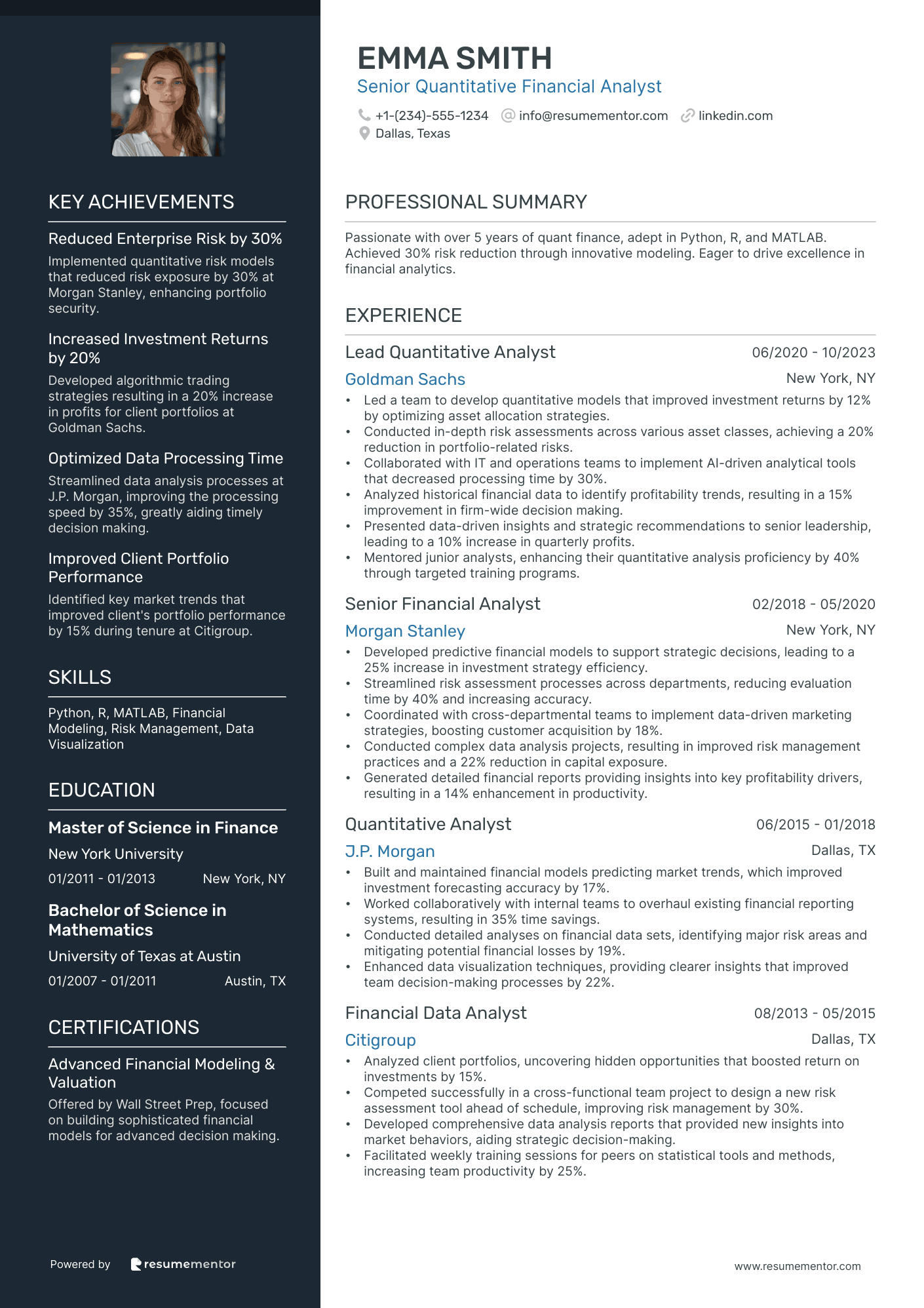

Senior Quantitative Financial Analyst resume sample

- •Led a team to develop quantitative models that improved investment returns by 12% by optimizing asset allocation strategies.

- •Conducted in-depth risk assessments across various asset classes, achieving a 20% reduction in portfolio-related risks.

- •Collaborated with IT and operations teams to implement AI-driven analytical tools that decreased processing time by 30%.

- •Analyzed historical financial data to identify profitability trends, resulting in a 15% improvement in firm-wide decision making.

- •Presented data-driven insights and strategic recommendations to senior leadership, leading to a 10% increase in quarterly profits.

- •Mentored junior analysts, enhancing their quantitative analysis proficiency by 40% through targeted training programs.

- •Developed predictive financial models to support strategic decisions, leading to a 25% increase in investment strategy efficiency.

- •Streamlined risk assessment processes across departments, reducing evaluation time by 40% and increasing accuracy.

- •Coordinated with cross-departmental teams to implement data-driven marketing strategies, boosting customer acquisition by 18%.

- •Conducted complex data analysis projects, resulting in improved risk management practices and a 22% reduction in capital exposure.

- •Generated detailed financial reports providing insights into key profitability drivers, resulting in a 14% enhancement in productivity.

- •Built and maintained financial models predicting market trends, which improved investment forecasting accuracy by 17%.

- •Worked collaboratively with internal teams to overhaul existing financial reporting systems, resulting in 35% time savings.

- •Conducted detailed analyses on financial data sets, identifying major risk areas and mitigating potential financial losses by 19%.

- •Enhanced data visualization techniques, providing clearer insights that improved team decision-making processes by 22%.

- •Analyzed client portfolios, uncovering hidden opportunities that boosted return on investments by 15%.

- •Competed successfully in a cross-functional team project to design a new risk assessment tool ahead of schedule, improving risk management by 30%.

- •Developed comprehensive data analysis reports that provided new insights into market behaviors, aiding strategic decision-making.

- •Facilitated weekly training sessions for peers on statistical tools and methods, increasing team productivity by 25%.

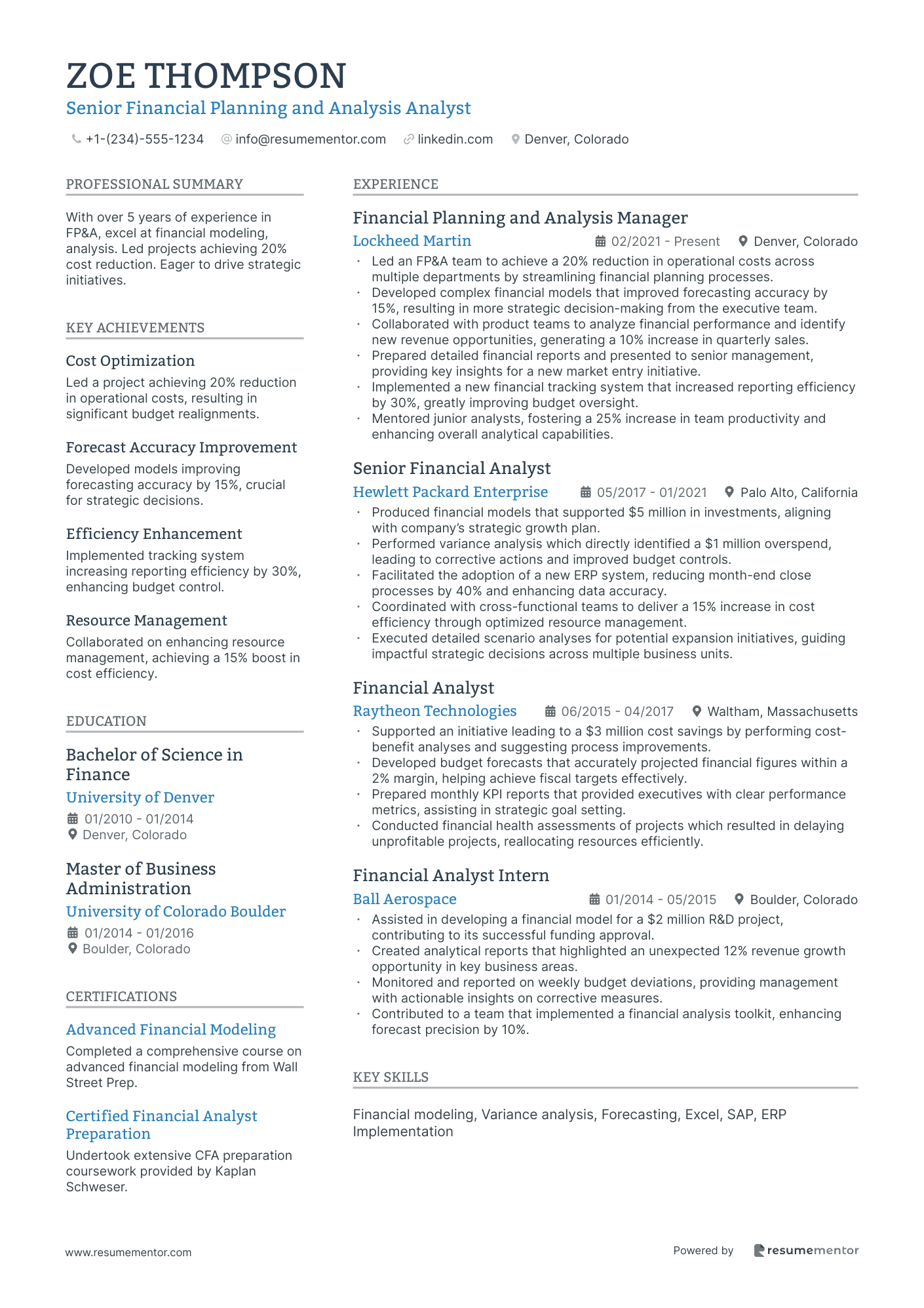

Senior Financial Planning and Analysis Analyst resume sample

- •Led an FP&A team to achieve a 20% reduction in operational costs across multiple departments by streamlining financial planning processes.

- •Developed complex financial models that improved forecasting accuracy by 15%, resulting in more strategic decision-making from the executive team.

- •Collaborated with product teams to analyze financial performance and identify new revenue opportunities, generating a 10% increase in quarterly sales.

- •Prepared detailed financial reports and presented to senior management, providing key insights for a new market entry initiative.

- •Implemented a new financial tracking system that increased reporting efficiency by 30%, greatly improving budget oversight.

- •Mentored junior analysts, fostering a 25% increase in team productivity and enhancing overall analytical capabilities.

- •Produced financial models that supported $5 million in investments, aligning with company’s strategic growth plan.

- •Performed variance analysis which directly identified a $1 million overspend, leading to corrective actions and improved budget controls.

- •Facilitated the adoption of a new ERP system, reducing month-end close processes by 40% and enhancing data accuracy.

- •Coordinated with cross-functional teams to deliver a 15% increase in cost efficiency through optimized resource management.

- •Executed detailed scenario analyses for potential expansion initiatives, guiding impactful strategic decisions across multiple business units.

- •Supported an initiative leading to a $3 million cost savings by performing cost-benefit analyses and suggesting process improvements.

- •Developed budget forecasts that accurately projected financial figures within a 2% margin, helping achieve fiscal targets effectively.

- •Prepared monthly KPI reports that provided executives with clear performance metrics, assisting in strategic goal setting.

- •Conducted financial health assessments of projects which resulted in delaying unprofitable projects, reallocating resources efficiently.

- •Assisted in developing a financial model for a $2 million R&D project, contributing to its successful funding approval.

- •Created analytical reports that highlighted an unexpected 12% revenue growth opportunity in key business areas.

- •Monitored and reported on weekly budget deviations, providing management with actionable insights on corrective measures.

- •Contributed to a team that implemented a financial analysis toolkit, enhancing forecast precision by 10%.

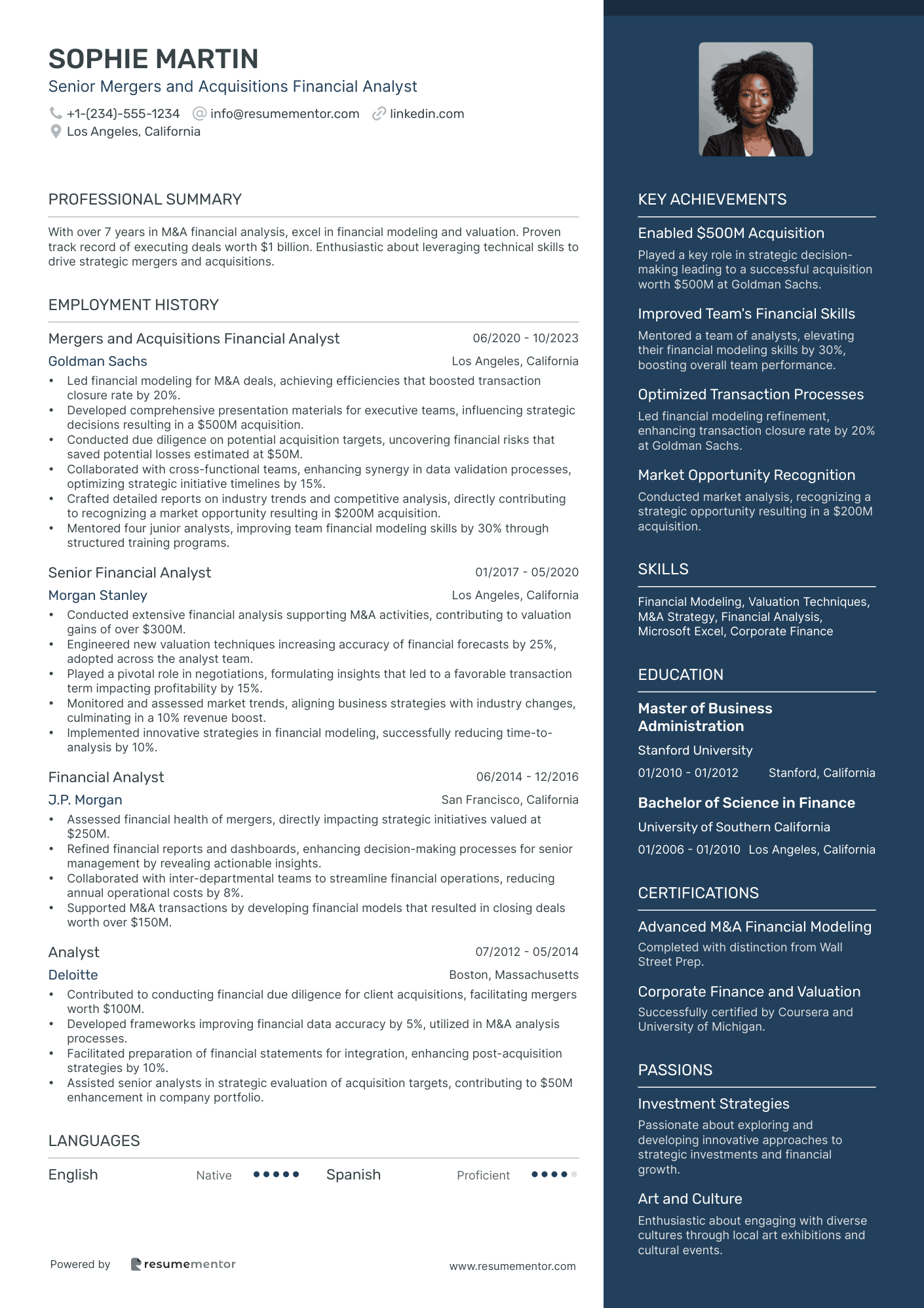

Senior Mergers and Acquisitions Financial Analyst resume sample

- •Led financial modeling for M&A deals, achieving efficiencies that boosted transaction closure rate by 20%.

- •Developed comprehensive presentation materials for executive teams, influencing strategic decisions resulting in a $500M acquisition.

- •Conducted due diligence on potential acquisition targets, uncovering financial risks that saved potential losses estimated at $50M.

- •Collaborated with cross-functional teams, enhancing synergy in data validation processes, optimizing strategic initiative timelines by 15%.

- •Crafted detailed reports on industry trends and competitive analysis, directly contributing to recognizing a market opportunity resulting in $200M acquisition.

- •Mentored four junior analysts, improving team financial modeling skills by 30% through structured training programs.

- •Conducted extensive financial analysis supporting M&A activities, contributing to valuation gains of over $300M.

- •Engineered new valuation techniques increasing accuracy of financial forecasts by 25%, adopted across the analyst team.

- •Played a pivotal role in negotiations, formulating insights that led to a favorable transaction term impacting profitability by 15%.

- •Monitored and assessed market trends, aligning business strategies with industry changes, culminating in a 10% revenue boost.

- •Implemented innovative strategies in financial modeling, successfully reducing time-to-analysis by 10%.

- •Assessed financial health of mergers, directly impacting strategic initiatives valued at $250M.

- •Refined financial reports and dashboards, enhancing decision-making processes for senior management by revealing actionable insights.

- •Collaborated with inter-departmental teams to streamline financial operations, reducing annual operational costs by 8%.

- •Supported M&A transactions by developing financial models that resulted in closing deals worth over $150M.

- •Contributed to conducting financial due diligence for client acquisitions, facilitating mergers worth $100M.

- •Developed frameworks improving financial data accuracy by 5%, utilized in M&A analysis processes.

- •Facilitated preparation of financial statements for integration, enhancing post-acquisition strategies by 10%.

- •Assisted senior analysts in strategic evaluation of acquisition targets, contributing to $50M enhancement in company portfolio.

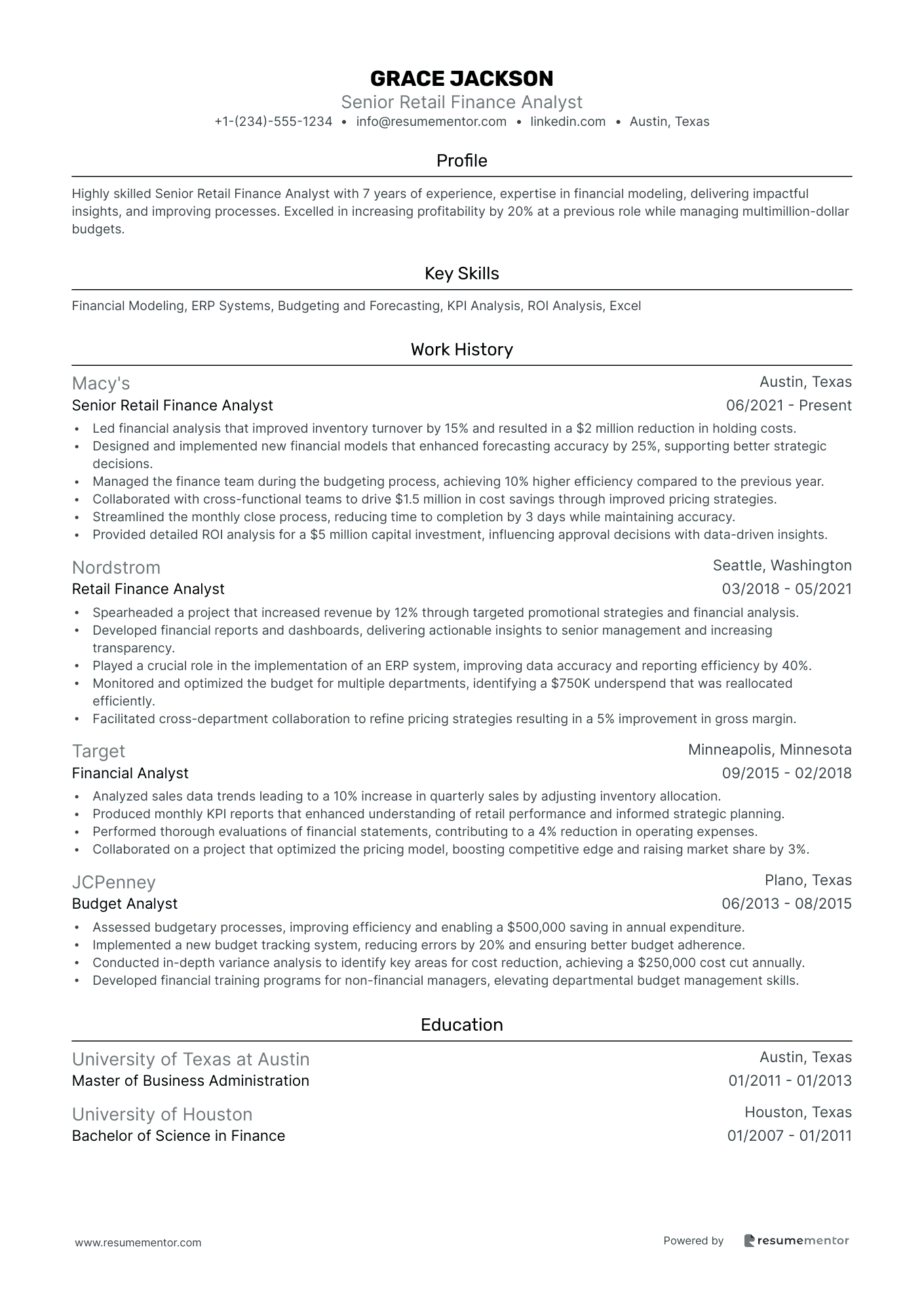

Senior Retail Finance Analyst resume sample

- •Led financial analysis that improved inventory turnover by 15% and resulted in a $2 million reduction in holding costs.

- •Designed and implemented new financial models that enhanced forecasting accuracy by 25%, supporting better strategic decisions.

- •Managed the finance team during the budgeting process, achieving 10% higher efficiency compared to the previous year.

- •Collaborated with cross-functional teams to drive $1.5 million in cost savings through improved pricing strategies.

- •Streamlined the monthly close process, reducing time to completion by 3 days while maintaining accuracy.

- •Provided detailed ROI analysis for a $5 million capital investment, influencing approval decisions with data-driven insights.

- •Spearheaded a project that increased revenue by 12% through targeted promotional strategies and financial analysis.

- •Developed financial reports and dashboards, delivering actionable insights to senior management and increasing transparency.

- •Played a crucial role in the implementation of an ERP system, improving data accuracy and reporting efficiency by 40%.

- •Monitored and optimized the budget for multiple departments, identifying a $750K underspend that was reallocated efficiently.

- •Facilitated cross-department collaboration to refine pricing strategies resulting in a 5% improvement in gross margin.

- •Analyzed sales data trends leading to a 10% increase in quarterly sales by adjusting inventory allocation.

- •Produced monthly KPI reports that enhanced understanding of retail performance and informed strategic planning.

- •Performed thorough evaluations of financial statements, contributing to a 4% reduction in operating expenses.

- •Collaborated on a project that optimized the pricing model, boosting competitive edge and raising market share by 3%.

- •Assessed budgetary processes, improving efficiency and enabling a $500,000 saving in annual expenditure.

- •Implemented a new budget tracking system, reducing errors by 20% and ensuring better budget adherence.

- •Conducted in-depth variance analysis to identify key areas for cost reduction, achieving a $250,000 cost cut annually.

- •Developed financial training programs for non-financial managers, elevating departmental budget management skills.

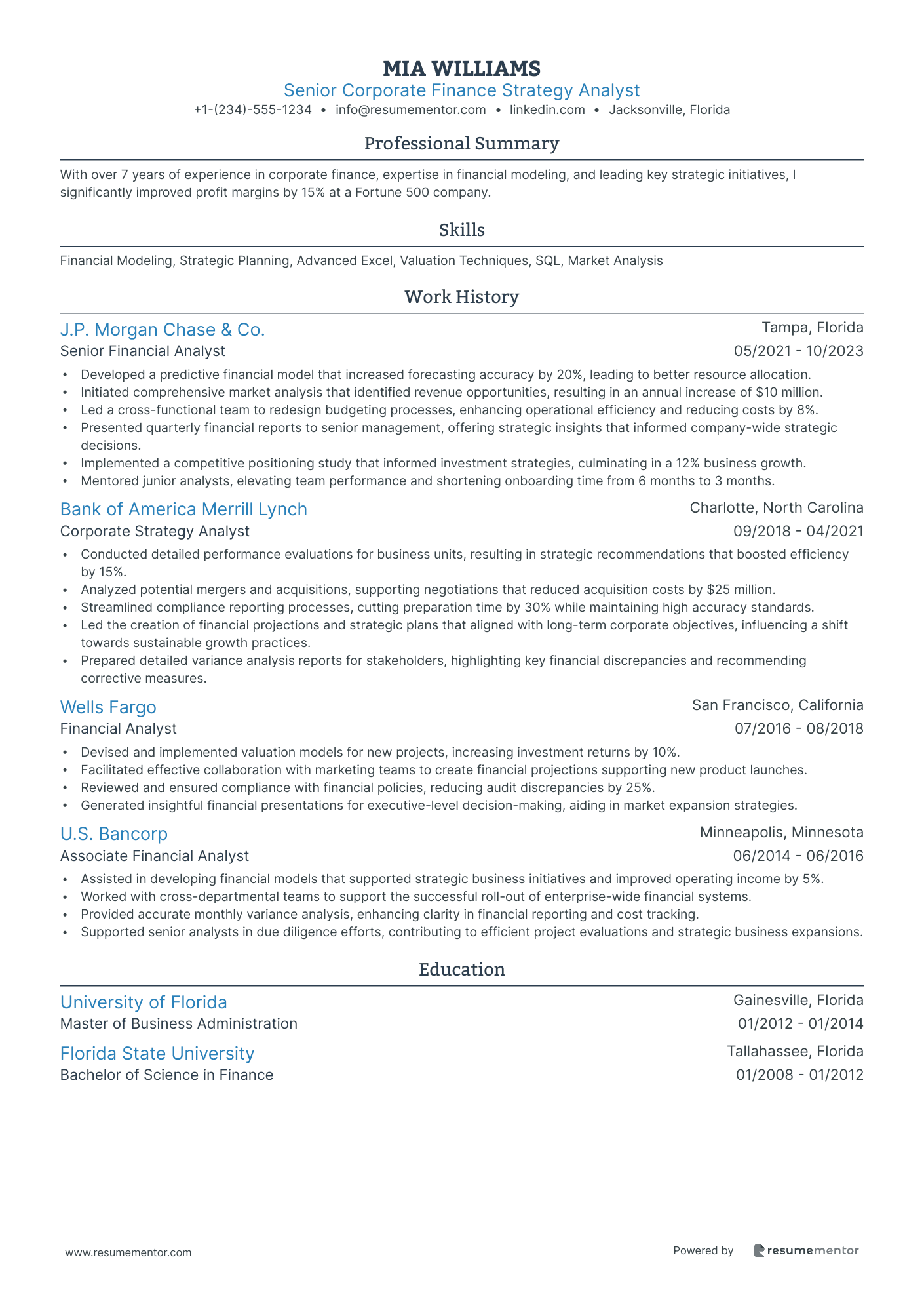

Senior Corporate Finance Strategy Analyst resume sample

- •Developed a predictive financial model that increased forecasting accuracy by 20%, leading to better resource allocation.

- •Initiated comprehensive market analysis that identified revenue opportunities, resulting in an annual increase of $10 million.

- •Led a cross-functional team to redesign budgeting processes, enhancing operational efficiency and reducing costs by 8%.

- •Presented quarterly financial reports to senior management, offering strategic insights that informed company-wide strategic decisions.

- •Implemented a competitive positioning study that informed investment strategies, culminating in a 12% business growth.

- •Mentored junior analysts, elevating team performance and shortening onboarding time from 6 months to 3 months.

- •Conducted detailed performance evaluations for business units, resulting in strategic recommendations that boosted efficiency by 15%.

- •Analyzed potential mergers and acquisitions, supporting negotiations that reduced acquisition costs by $25 million.

- •Streamlined compliance reporting processes, cutting preparation time by 30% while maintaining high accuracy standards.

- •Led the creation of financial projections and strategic plans that aligned with long-term corporate objectives, influencing a shift towards sustainable growth practices.

- •Prepared detailed variance analysis reports for stakeholders, highlighting key financial discrepancies and recommending corrective measures.

- •Devised and implemented valuation models for new projects, increasing investment returns by 10%.

- •Facilitated effective collaboration with marketing teams to create financial projections supporting new product launches.

- •Reviewed and ensured compliance with financial policies, reducing audit discrepancies by 25%.

- •Generated insightful financial presentations for executive-level decision-making, aiding in market expansion strategies.

- •Assisted in developing financial models that supported strategic business initiatives and improved operating income by 5%.

- •Worked with cross-departmental teams to support the successful roll-out of enterprise-wide financial systems.

- •Provided accurate monthly variance analysis, enhancing clarity in financial reporting and cost tracking.

- •Supported senior analysts in due diligence efforts, contributing to efficient project evaluations and strategic business expansions.

As a senior financial analyst, navigating the job market can feel like steering a complex ship through turbulent waters. With analytical acumen and strategic thinking at your core, translating these strengths into a compelling resume can be daunting. While you're adept at deciphering economic data and financial projections, converting them into a document that makes an impact is another skill altogether.

If your current resume doesn’t capture the depth of your technical expertise, or you're frustrated by outdated formats, consider a new approach. This is where a well-structured resume template becomes invaluable. A polished resume template helps in presenting your skills and achievements clearly, keeping you focused on what matters most.

In the crowded job market, making your resume stand out is essential. Recruiters and hiring managers are inundated with countless applications, so it’s important your resume captures attention quickly. A good template not only saves time but ensures your resume highlights your expertise in financial analysis and ability to drive business success.

Our guide aims to help you create a resume that effectively communicates your value to potential employers. Whether you are seeking a new role or exploring fresh opportunities, we'll support you in crafting a resume that appeals to the right audience. Let’s begin transforming your expertise into a resume with precision and professionalism.

Key Takeaways

- A well-structured resume with a polished template can effectively highlight your technical expertise and achievements, essential in standing out in a competitive job market.

- For a senior financial analyst resume, focus on sections like contact information, a professional summary, core competencies, professional experience, education and certifications, and technical skills.

- Choose a reverse chronological format to highlight work history and achievements, and ensure readability with modern fonts, a PDF format, and appropriate margins.

- In the experience section, highlight quantifiable achievements using action verbs, and consider including additional sections like languages, volunteer work, and hobbies.

- Feature important certifications like CFA and CPA prominently, and make sure to include relevant soft and hard skills such as financial modeling and problem-solving to enhance your resume’s appeal.

What to focus on when writing your senior financial analyst resume

Your resume as a senior financial analyst should clearly communicate your expertise in turning data into strategic decisions—By effectively highlighting your abilities and experience, you can create a compelling document that stands out to recruiters.

How to structure your senior financial analyst resume

- Contact Information: Begin with your full name, phone number, and email address. Including a LinkedIn profile tailored to showcase your financial career can add an extra layer of professionalism. It's important to ensure this information is updated so potential employers can easily contact you.

- Professional Summary: This section is your initial introduction, allowing you to make a strong first impression. Emphasize your skills in financial analysis, strategic planning, and decision-making. Mention how many years you've been working in the field, alongside significant achievements that show your impact.

- Core Competencies: Listing your core competencies helps highlight key skills such as financial modeling, trend analysis, and data interpretation. This shows your ability to manage complex budgeting and forecasting challenges effectively, positioning you as a knowledgeable candidate.

- Professional Experience: Highlight your work history with detailed descriptions of your responsibilities and accomplishments. Use action verbs and quantify your achievements where possible to demonstrate the tangible value you have contributed in previous positions.

- Education and Certifications: Showcase your academic background by focusing on degrees related to finance. Adding any relevant certifications like CFA or CPA can further establish your expertise and commitment to the field.

- Technical Skills: Outline your proficiency in tools and software essential for financial analysis, like Excel, SAP, or Oracle. Explaining your experience with financial modeling or data visualization software reinforces your technical capabilities.

To refine your resume and ensure each section is impactful, consider structuring it to maximize readability and flow. Each of the listed sections can be explored further to create a robust and tailored application.

Which resume format to choose

Crafting your resume as a senior financial analyst means selecting a format that highlights your expertise effectively. The reverse chronological format is particularly suitable because it naturally underscores your work history and significant achievements. This approach meets the expectations of employers who want to understand your career progression and depth of experience in the finance industry.

Enhancing the appearance of your resume involves choosing the right fonts. Opt for modern fonts like Raleway, Lato, or Montserrat, which can add a touch of contemporary style and professionalism, helping your resume stand out without overshadowing the content. These fonts maintain readability while offering a fresh alternative to more traditional choices.

It's crucial to save your resume as a PDF. This format preserves your layout and formatting, ensuring it remains consistent and looks professional no matter what device your potential employer uses to view it. This small step helps avoid any misalignments or errors that could arise from other file types.

Paying attention to margins is also essential. Setting them to one inch on all sides keeps the layout clean and organized, ensuring that your text is easily readable. This balance of whitespace and content is important in making sure your resume looks polished and professional.

By focusing on these key elements, your resume will be well-structured, visually appealing, and tailored to capture the attention of finance industry employers.

How to write a quantifiable resume experience section

A strong resume experience section for a senior financial analyst effectively highlights your quantifiable achievements, making you a standout candidate. Start with your most recent role and list your positions in reverse-chronological order, including job titles, companies, locations, and dates. Limit your history to about 10-15 years, focusing on the most relevant jobs. Tailoring your resume is crucial—align your skills and experiences with those highlighted in the job description. Choose action words like "analyzed," "developed," and "optimized" to emphasize your contributions and impact.

- •Increased company revenue by 15% through detailed financial forecasts.

- •Streamlined budgeting, reducing costs by 10% each year.

- •Led the adoption of a new analytics tool, boosting reporting efficiency by 25%.

- •Created a financial model that improved decision-making across teams.

This experience section truly sets you apart by presenting your achievements in a coherent and impactful manner. Each bullet point not only demonstrates your role as a senior financial analyst but also highlights how you made a significant difference within the organization. The action words and metrics—like "increased," "streamlined," and "led"—work together to showcase your proactive approach and effective problem-solving skills. By tying your accomplishments to measurable outcomes, this section naturally aligns with what hiring managers are seeking, making your proficiency and suitability clear.

Project-Focused resume experience section

A project-focused senior financial analyst resume experience section should highlight your ability to deliver impactful results through strategic project involvement. Begin by selecting projects that best demonstrate your expertise and the positive influence you had on your company. Clearly describe your role in each project, focusing on concrete and measurable achievements that showcase your contribution. Use bullet points to present your responsibilities and results, emphasizing how your actions led to improved financial outcomes, streamlined processes, or supported strategic objectives.

Ensure each bullet point starts with a dynamic action verb and incorporates specific metrics or numbers to illustrate the significance of your contributions. This approach not only highlights your leadership and analytical skills but also demonstrates the tangible value you bring to an organization. Keeping your language straightforward helps maintain clarity and reader engagement. Tailor each project description to the job you're applying for, using relevant keywords that speak to the employer’s needs and priorities, solidifying your position as an excellent candidate for the role.

Senior Financial Analyst

Tech Innovations Inc.

March 2020 - Present

- Led a $500K cost reduction project, optimizing the budget and cutting waste by 15%.

- Developed a forecasting model that improved accuracy by 20%, which supported better decision-making.

- Collaborated with teams to implement a new financial planning system, boosting efficiency by 25%.

- Presented financial insights to senior management, helping influence strategic initiatives.

Skills-Focused resume experience section

A skills-focused resume experience section for a Senior Financial Analyst should clearly demonstrate how your expertise directly contributed to the success of your previous roles. Your objective is to portray yourself as a results-oriented professional who uses data analysis, trend forecasting, and strategic planning to guide businesses toward smarter financial decisions. Begin by identifying your key financial skills and seamlessly integrate them into your job descriptions, ensuring each one highlights your specific contributions and achievements.

Convey how your skills produced significant results and shaped the trajectory of the organizations you worked for. Highlight not only what you did but also the tangible benefits that resulted from your efforts, underlining your role in your team or company's achievements. Use strong action verbs like "developed," "managed," or "implemented" at the start of each bullet point to convey expertise effectively. This approach offers recruiters clear, quantifiable evidence of your capabilities and makes your resume stand out by consistently showcasing your value.

Senior Financial Analyst

TechSolutions Inc.

January 2018 - March 2023

- Developed comprehensive financial models to support business planning and forecasted revenues, resulting in a 15% increase in growth annually.

- Implemented cost-cutting strategies by analyzing historical financial data, reducing company expenses by 10%.

- Collaborated with cross-functional teams to streamline the budgeting process, boosting efficiency by 20%.

- Provided key insights from financial data that drove the company's significant expansion in market share.

Achievement-Focused resume experience section

A senior financial analyst resume experience section should highlight how you drive financial success through impactful actions. Emphasize your role in enhancing financial performance via strategic planning and decision-making. Use strong action verbs and quantifiable results to clearly communicate your achievements. Each bullet should seamlessly connect with the next, illustrating how you create growth and implement effective change within the company. Keeping the language clear and simple ensures that potential employers can easily grasp your potential contribution.

Focus on the specific achievements you've facilitated rather than merely listing tasks. Explain how you enhanced processes, led pivotal projects, and played a significant role in major financial successes. Each point should build upon the previous one, demonstrating a cohesive story of your accomplishments with tangible evidence. This method allows employers to see your value clearly and understand the positive influence you could bring to their team.

Senior Financial Analyst

ABC Financial Services

June 2020 - Present

- Boosted annual revenue by 25% through strategic planning and detailed data analysis, setting the stage for sustainable growth.

- Created a financial forecasting model that improved budget accuracy by 15%, providing clearer financial insights.

- Led a cross-functional team to streamline financial reporting, cutting delivery time by 50% and enhancing efficiency.

- Achieved $500,000 in annual cost savings by optimizing processes and negotiating better vendor contracts, significantly reducing expenses.

Responsibility-Focused resume experience section

A Responsibility-Focused senior financial analyst resume experience section should highlight your core responsibilities and achievements in a cohesive manner. Begin each bullet with an action verb to make your contributions stand out and flow smoothly. Describe your responsibilities by illustrating how they had a direct impact on the company, such as through improved financial forecasting or precise budget management. To effectively communicate your achievements, keep the information clear and include numbers or percentages when applicable.

Convey how your skills and experiences made a real difference in the workplace by mentioning the specific financial analysis tools or methods you utilized, thereby showcasing your expertise. This section should not only detail what you accomplished in your previous roles but also emphasize the benefits you brought to the company. Ensure each point is valuable by illustrating how you've solved problems or created opportunities within the financial landscape.

Senior Financial Analyst

XYZ Corporation

June 2018 - September 2023

- Led a team to develop accurate financial forecasts, improving forecasting accuracy by 15%.

- Designed financial models to evaluate strategic opportunities, increasing company revenue by 20%.

- Managed a $100M budget, ensuring financial compliance and reducing expenses by 10%.

- Collaborated with cross-functional teams to optimize financial processes, enhancing efficiency by 25%.

Write your senior financial analyst resume summary section

A finance-focused senior financial analyst resume experience section should immediately highlight your ability to deliver value through your expertise and past achievements. For an effective summary, focus on accomplishments and skills like financial modeling, budget forecasting, and strategic risk management, which are crucial in demonstrating your impact and adaptability. This approach will quickly convey your professional value to potential employers. For instance, a compelling summary might read:

This summary effectively integrates your experience, skills, and specific achievements, emphasizing your ability to drive business growth—a key focus for employers. Unlike a resume objective, which outlines what you want to achieve, a resume summary provides a concise snapshot of your accomplishments and unique capabilities. While a resume profile offers more detailed information, the summary of qualifications uses bullet points for clarity. Tailoring your summary to reflect your career stage and distinct strengths ensures it is both concise and engaging, capturing the essence of your professional journey in a few powerful sentences.

Listing your senior financial analyst skills on your resume

A finance-focused senior financial analyst resume should strategically highlight your skills throughout. You have the flexibility to create a dedicated skills section or seamlessly integrate these skills into your experience and summary. It’s important to feature your strengths and soft skills prominently, but don’t overlook hard skills either. Hard skills are the specific abilities you've acquired through education and practical experience, such as financial modeling or data analysis, that are crucial for this role.

These skills, along with your strengths, serve as important keywords in your resume. They are what employers look for, helping your application stand out. By showcasing these attributes effectively, you demonstrate your value and areas of expertise, making your resume more appealing to potential employers.

To illustrate, here's a concise and impactful example of a standalone skills section:

This example is effective because it is clear and direct. Presenting your relevant skills in this straightforward way ensures that your resume is easy to read and understand quickly.

Best hard skills to feature on your senior financial analyst resume

Your hard skills as a senior financial analyst should clearly demonstrate your technical and practical expertise in finance. These skills need to convey your ability to manage complex data, prepare detailed reports, and make informed decisions. Here’s a list of in-demand skills to consider:

Hard Skills

- Financial Modeling

- Data Analysis

- Budgeting

- Forecasting

- Risk Management

- Excel Proficiency

- Financial Reporting

- Variance Analysis

- SQL and Database Management

- Strategic Financial Planning

- Investment Analysis

- Cost-Benefit Analysis

- Auditing and Compliance

- ERP Systems Knowledge

- Economic Analysis

Best soft skills to feature on your senior financial analyst resume

Soft skills are equally important and should be part of your resume. They reflect how you interact with others and handle tasks. For a senior financial analyst, emphasize skills such as problem-solving, coherent communication, and leadership. Here are 15 essential soft skills to include:

Soft Skills

- Strong Communication

- Problem-Solving

- Analytical Thinking

- Leadership

- Time Management

- Team Collaboration

- Attention to Detail

- Adaptability

- Critical Thinking

- Decision-Making

- Negotiation

- Interpersonal Skills

- Motivational Ability

- Conflict Resolution

- Reliability

How to include your education on your resume

Writing the education section of your senior financial analyst resume is a key part of presenting yourself to potential employers. It provides proof of your academic background and shows relevant education that supports the job you're applying for. Avoid mentioning any education or coursework that's not directly related to financial analysis. Include your GPA if it's impressive, typically 3.5 or higher, and always specify it precisely by listing both the GPA and its maximum possible value, like 3.7/4.0. Noting any honors, such as cum laude, can further showcase your achievements. When listing your degree, include the full title, institution, and the years you attended. With this in mind, here’s an example of a poorly constructed education section:

- •Studied various cooking techniques and food safety practices.

Now, here's a strong, suitable example that fits a senior financial analyst position:

In this example, the focus is on directly relevant degrees such as an MBA in Finance and a Bachelor’s in Economics. Both include notable academic achievements like a high GPA and an honors distinction. These elements clearly demonstrate why you are qualified for the senior financial analyst role. Additionally, there's a clear display of educational progression and dedication to the field, making it an outstanding section.

How to include senior financial analyst certificates on your resume

Including a certificates section in your resume is crucial, especially for a senior financial analyst position, as it highlights your specialized knowledge and commitment to the field. List the name of each certification to ensure clarity and relevance. Include the date you received the certification to show when you completed the credential. Add the issuing organization to provide authenticity and recognition from a reputable source.

You can also incorporate certifications into your resume header for a streamlined look. For instance, writing "Jane Doe, CFA, CPA" can immediately showcase your qualifications to potential employers. Certificates such as CFA (Chartered Financial Analyst) and CPA (Certified Public Accountant) carry significant weight in the financial industry. This section not only validates your skills but enhances your professional credibility.

Here's an example of a well-structured certificates section in JSON format:

This example is strong because it includes highly relevant certifications for a senior financial analyst, with both the title and the respected issuing body clearly stated. This approach not only demonstrates expertise but also strengths that are crucial for advanced financial roles.

Extra sections to include on your senior financial analyst resume

Craft a resume that highlights your expertise and sets you apart as a senior financial analyst. Strong resumes capture a professional's skills while also offering a glimpse into their personality and interests, providing a fuller picture of their fit for a role.

Language section — Showcase your ability to communicate in multiple languages, which can open opportunities in global companies or with clients who speak different languages.

Hobbies and interests section — Highlight personal interests that demonstrate analytical thinking or dedication, which can reflect positively on your work performance and interactions with colleagues.

Volunteer work section — Include volunteer experiences that exhibit leadership and community involvement, emphasizing transferable skills such as project management and teamwork.

Books section — Display books related to finance or professional development you’ve read to show continued learning and a commitment to staying updated in your field.

Each section helps build a comprehensive understanding of who you are, both as a professional and as an individual. The aim is to create a resume that not only lists qualifications but also narrates a story of your professional journey and aspirations. These sections add depth beyond technical skills and provide insights into your values and how you might contribute to a team or company culture.

In Conclusion

In conclusion, creating a polished resume is essential for a senior financial analyst navigating the job market. As someone with advanced skills in financial modeling, budgeting, and strategic planning, translating your expertise into a well-structured resume can significantly enhance your job prospects. By focusing on a reverse chronological format, you can easily highlight your major achievements and career progression, while choosing modern fonts and maintaining clean margins will ensure a professional appearance. Including quantifiable achievements in your experience section is key, as it clearly communicates the tangible impacts of your work. Highlighting both hard skills and relevant soft skills on your resume presents you as a well-rounded candidate capable of making informed financial decisions. Furthermore, listing your education and certifications, like the CFA or CPA, confirms your commitment and credibility in the field. Finally, don't overlook the power of extra sections like language proficiency, volunteer experiences, and personal interests, which can offer additional insights into your personality and potential cultural fit with potential employers. By meticulously crafting each part of your resume, you ensure that it not only captures attention but also profoundly conveys your professional story. Taking these steps will position you as a compelling candidate and help you make a strong impression in the competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.