Special Finance Assistant Resume Examples

Jul 18, 2024

|

12 min read

Ace your job hunt with our guide on how to write a special finance assistant resume, and get ready to "account" for every opportunity. Learn key tips to highlight your skills and land your dream financial job.

Rated by 348 people

International Finance Support Specialist

Real Estate Financial Assistance Director

Healthcare Financial Associate

Education Finance Support Officer

Non-profit Finance Assistance Coordinator

Technology Investment Financial Assistant

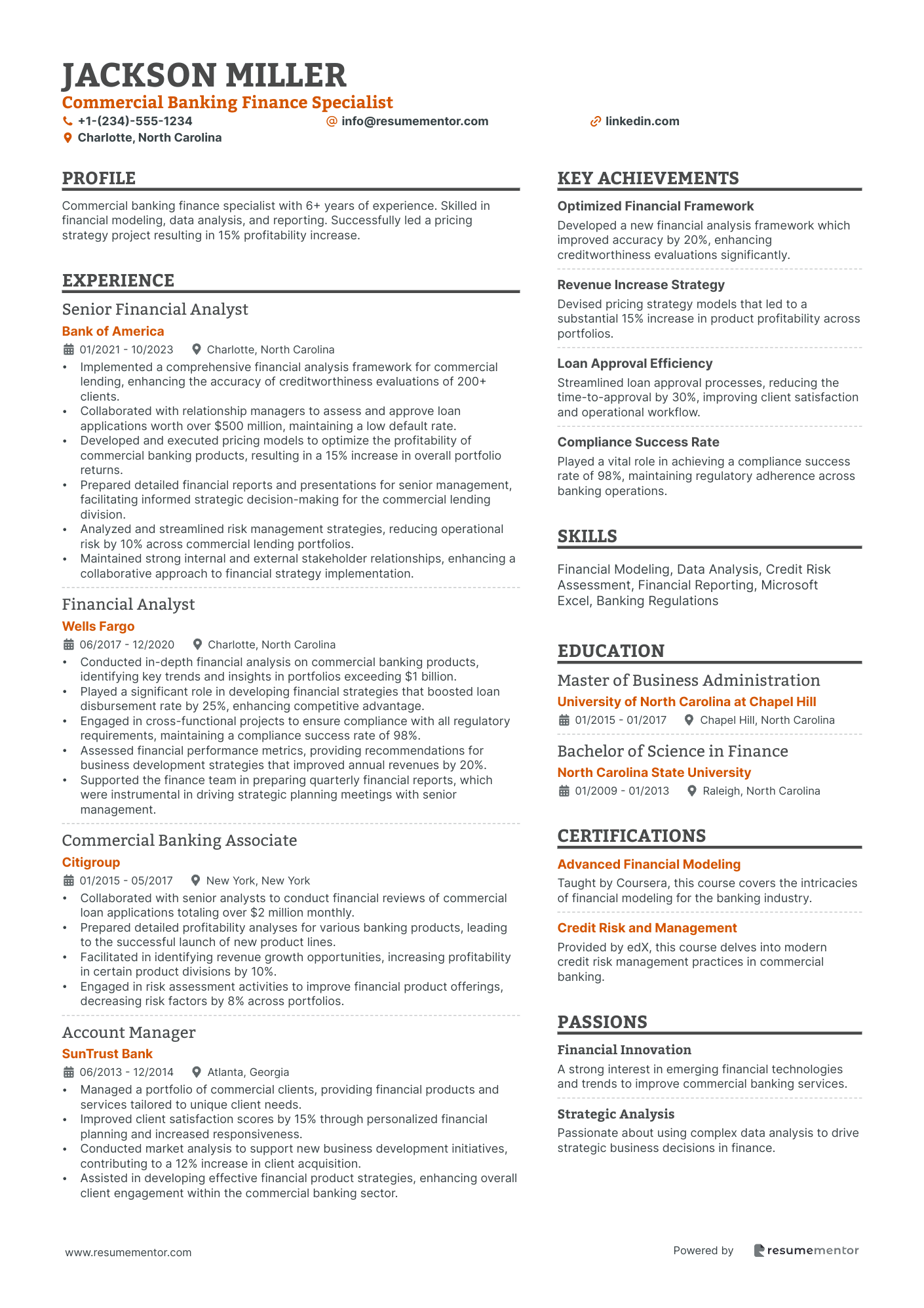

Commercial Banking Finance Specialist

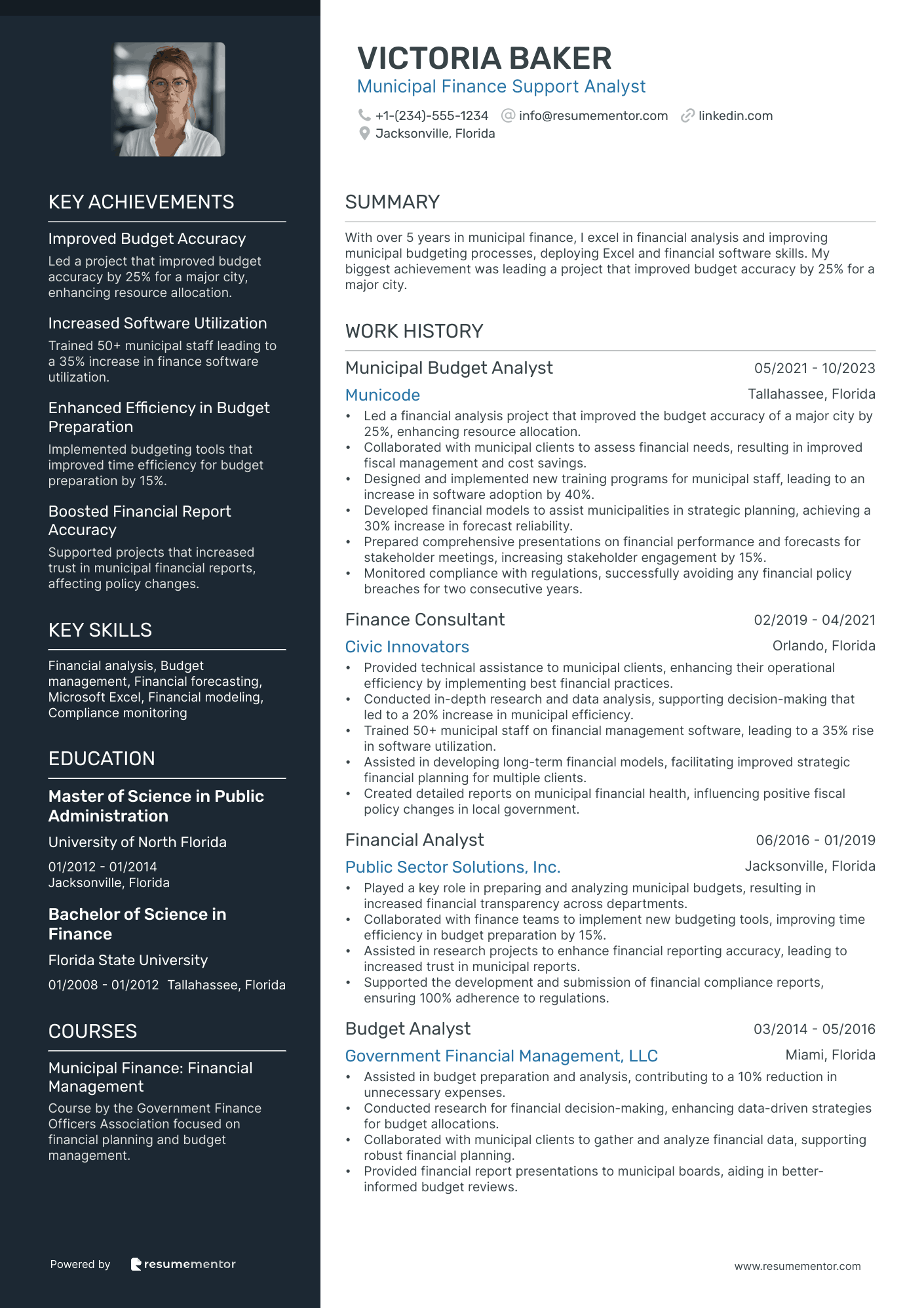

Municipal Finance Support Analyst

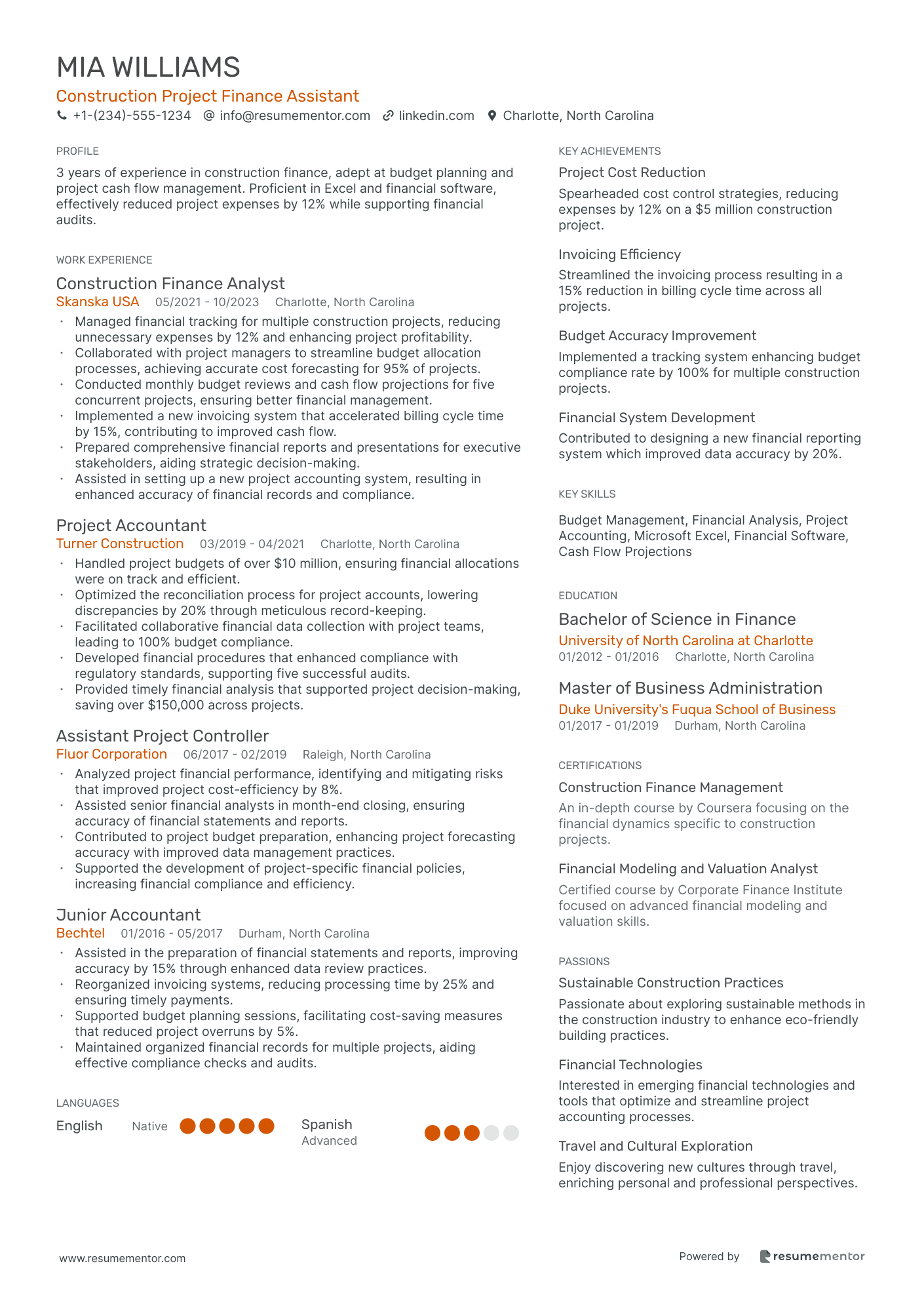

Construction Project Finance Assistant

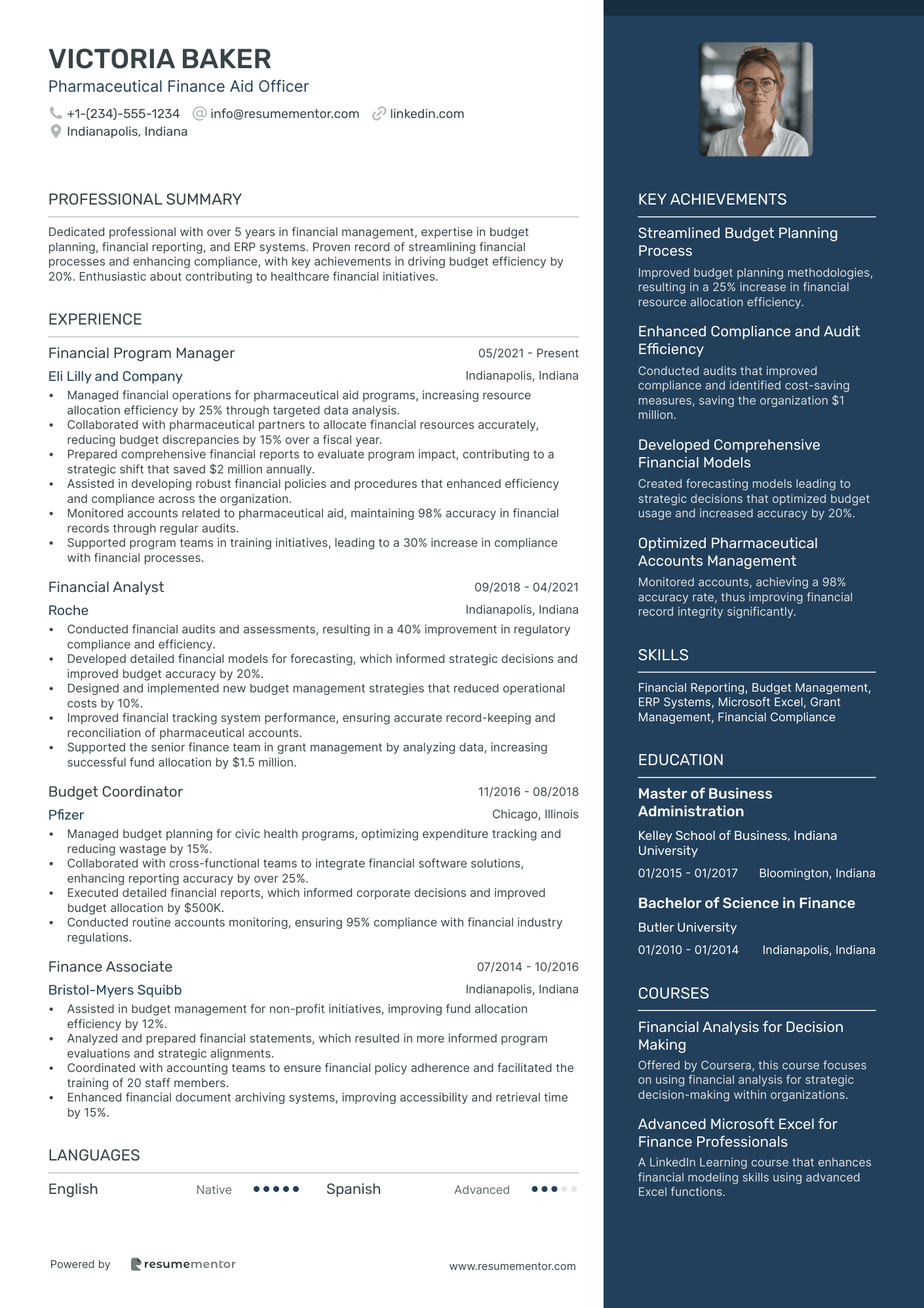

Pharmaceutical Finance Aid Officer

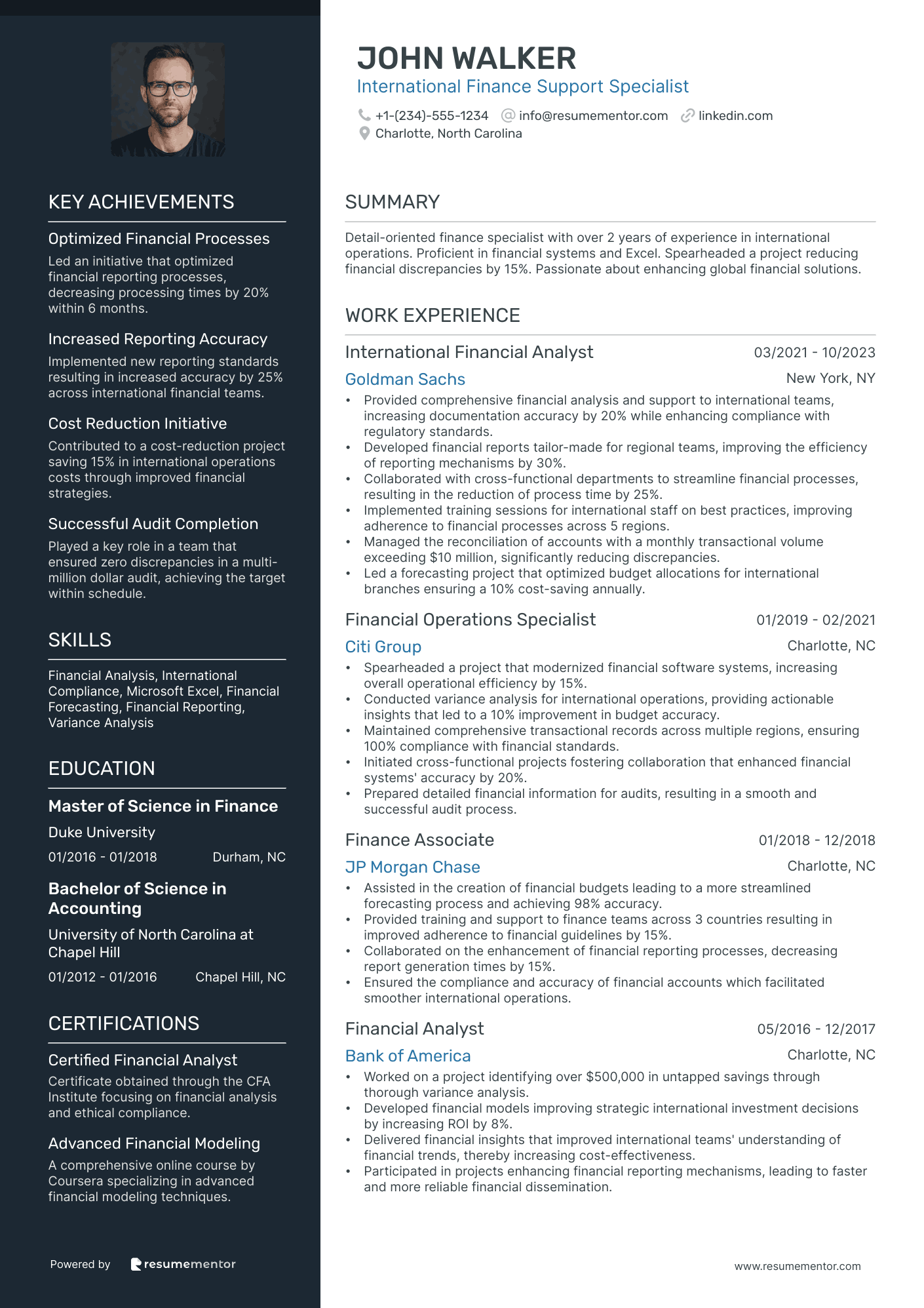

International Finance Support Specialist resume sample

- •Provided comprehensive financial analysis and support to international teams, increasing documentation accuracy by 20% while enhancing compliance with regulatory standards.

- •Developed financial reports tailor-made for regional teams, improving the efficiency of reporting mechanisms by 30%.

- •Collaborated with cross-functional departments to streamline financial processes, resulting in the reduction of process time by 25%.

- •Implemented training sessions for international staff on best practices, improving adherence to financial processes across 5 regions.

- •Managed the reconciliation of accounts with a monthly transactional volume exceeding $10 million, significantly reducing discrepancies.

- •Led a forecasting project that optimized budget allocations for international branches ensuring a 10% cost-saving annually.

- •Spearheaded a project that modernized financial software systems, increasing overall operational efficiency by 15%.

- •Conducted variance analysis for international operations, providing actionable insights that led to a 10% improvement in budget accuracy.

- •Maintained comprehensive transactional records across multiple regions, ensuring 100% compliance with financial standards.

- •Initiated cross-functional projects fostering collaboration that enhanced financial systems' accuracy by 20%.

- •Prepared detailed financial information for audits, resulting in a smooth and successful audit process.

- •Assisted in the creation of financial budgets leading to a more streamlined forecasting process and achieving 98% accuracy.

- •Provided training and support to finance teams across 3 countries resulting in improved adherence to financial guidelines by 15%.

- •Collaborated on the enhancement of financial reporting processes, decreasing report generation times by 15%.

- •Ensured the compliance and accuracy of financial accounts which facilitated smoother international operations.

- •Worked on a project identifying over $500,000 in untapped savings through thorough variance analysis.

- •Developed financial models improving strategic international investment decisions by increasing ROI by 8%.

- •Delivered financial insights that improved international teams' understanding of financial trends, thereby increasing cost-effectiveness.

- •Participated in projects enhancing financial reporting mechanisms, leading to faster and more reliable financial dissemination.

Real Estate Financial Assistance Director resume sample

- •Developed programs that increased affordable housing funding 25% over three years by securing and optimizing diverse funding streams.

- •Led a team of 8 analysts to improve program efficiency, resulting in a 30% reduction in processing times for applications.

- •Collaborated with 5 state agencies, enhancing the company's funding capabilities by 40% through strategic alliances.

- •Implemented data-driven strategies that elevated client satisfaction scores by 35%, enhancing outreach and engagement.

- •Oversaw complex financial transactions worth over $15M, ensuring compliance and maximizing resource allocation.

- •Authored and presented comprehensive reports that guided executive decision-making and expanded grant programs.

- •Managed $10M annual grant budget used to support housing projects, successfully increasing project completion rates by 20%.

- •Collaborated with private and public partners, increasing funding efficiency by 15% through streamlined processes.

- •Led the initiative to implement a new financial modeling framework, resulting in more accurate project forecasts and analyses.

- •Provided technical guidance to 12 stakeholders, enhancing project delivery precision and aligning with strategic goals.

- •Conducted outreach and training, improving knowledge sharing practices with local housing developers by 50%.

- •Coordinated financial initiatives that directly increased available affordable housing units by 10% annually.

- •Developed strategic partnerships with 3 local organizations, enhancing the capacity and effectiveness of housing programs.

- •Monitored program compliance extensively, significantly reducing audit findings by 80% over a four-year period.

- •Executed detailed market analyses, identifying funding gaps and positioning programs for increased investment.

- •Assisted in the analysis of market trends, which contributed to a 10% increase in allocated project funds across the portfolio.

- •Supported the development of financial tools that improved forecasting accuracy, increasing alignment with market dynamics.

- •Contributed to the standardization of reporting processes, improving analytical outputs by 15% in quality and timeliness.

- •Involved in collaborative projects that strengthened team understanding of complex financial data and reporting methodologies.

Healthcare Financial Associate resume sample

- •Performed in-depth financial analysis for healthcare departments, improving budget accuracy by 15%.

- •Collaborated with cross-functional teams to refine financial strategies, resulting in a 10% reduction in costs.

- •Facilitated timely preparation of monthly financial statements and variance reports for senior management.

- •Oversaw a $20M annual budget, ensuring compliance and financial integrity, with a 98% accuracy rate.

- •Directed the accounts receivable process, resolving outstanding balances 30% faster than previous year.

- •Drove initiatives to enhance revenue cycle management, increasing departmental revenues by 5%.

- •Developed comprehensive financial reports supporting departmental budget planning across multiple units.

- •Identified cost-saving opportunities within operational budgets, achieving a 10% efficiency increase.

- •Orchestrated budget meetings with department heads to streamline budgetary processes organization-wide.

- •Monitored compliance with financial regulations, maintaining audit readiness with zero discrepancies.

- •Pioneered a financial forecasting model that increased predictive accuracy by 12% year-over-year.

- •Analyzed healthcare revenue cycle workflows, reducing claim denials by 25% through process improvements.

- •Led a team in implementing billing system optimizations, increasing transaction speed by 30%.

- •Developed training materials for team members, elevating knowledge in financial compliance and billing.

- •Generated monthly financial performance reports, facilitating data-driven decisions for department leaders.

- •Supported the general ledger accounting process, ensuring timely monthly closings and 98% accuracy.

- •Assisted in financial audits, providing comprehensive documentation and achieving positive reports.

- •Collaborated with accounts payable to expedite vendor payments, reducing processing time by 15%.

- •Implemented financial policies that enhanced department compliance with regulatory standards.

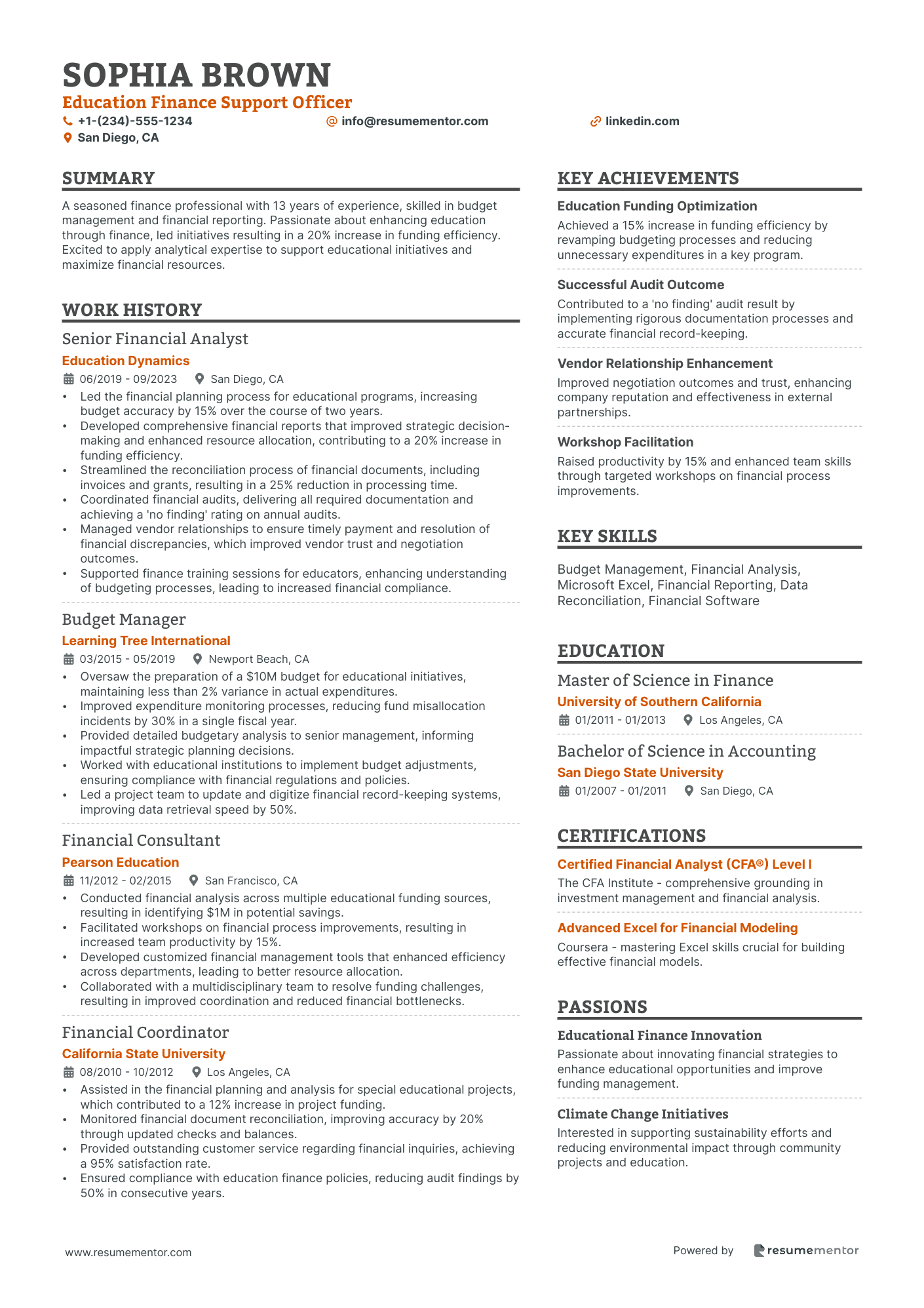

Education Finance Support Officer resume sample

- •Led the financial planning process for educational programs, increasing budget accuracy by 15% over the course of two years.

- •Developed comprehensive financial reports that improved strategic decision-making and enhanced resource allocation, contributing to a 20% increase in funding efficiency.

- •Streamlined the reconciliation process of financial documents, including invoices and grants, resulting in a 25% reduction in processing time.

- •Coordinated financial audits, delivering all required documentation and achieving a 'no finding' rating on annual audits.

- •Managed vendor relationships to ensure timely payment and resolution of financial discrepancies, which improved vendor trust and negotiation outcomes.

- •Supported finance training sessions for educators, enhancing understanding of budgeting processes, leading to increased financial compliance.

- •Oversaw the preparation of a $10M budget for educational initiatives, maintaining less than 2% variance in actual expenditures.

- •Improved expenditure monitoring processes, reducing fund misallocation incidents by 30% in a single fiscal year.

- •Provided detailed budgetary analysis to senior management, informing impactful strategic planning decisions.

- •Worked with educational institutions to implement budget adjustments, ensuring compliance with financial regulations and policies.

- •Led a project team to update and digitize financial record-keeping systems, improving data retrieval speed by 50%.

- •Conducted financial analysis across multiple educational funding sources, resulting in identifying $1M in potential savings.

- •Facilitated workshops on financial process improvements, resulting in increased team productivity by 15%.

- •Developed customized financial management tools that enhanced efficiency across departments, leading to better resource allocation.

- •Collaborated with a multidisciplinary team to resolve funding challenges, resulting in improved coordination and reduced financial bottlenecks.

- •Assisted in the financial planning and analysis for special educational projects, which contributed to a 12% increase in project funding.

- •Monitored financial document reconciliation, improving accuracy by 20% through updated checks and balances.

- •Provided outstanding customer service regarding financial inquiries, achieving a 95% satisfaction rate.

- •Ensured compliance with education finance policies, reducing audit findings by 50% in consecutive years.

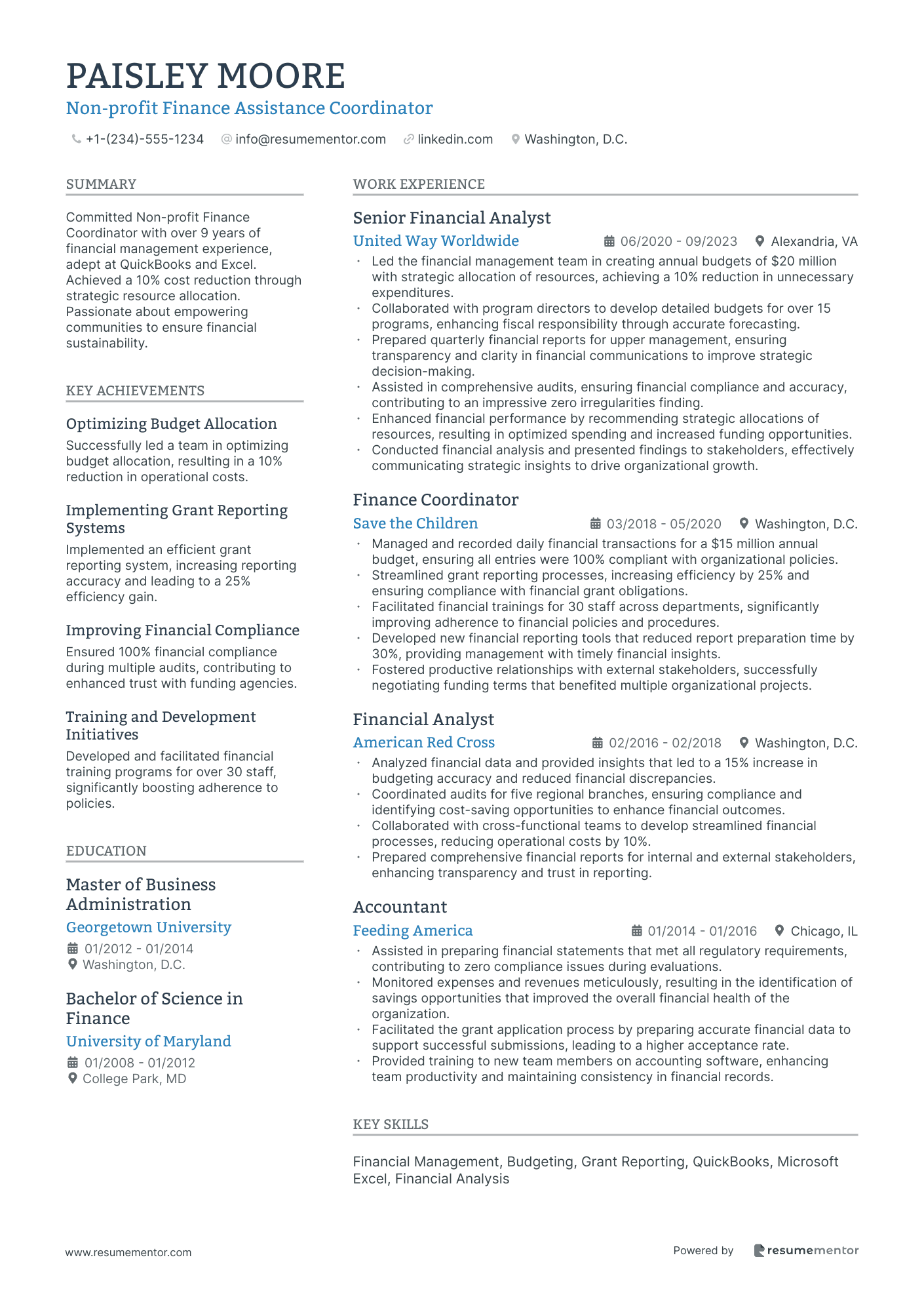

Non-profit Finance Assistance Coordinator resume sample

- •Led the financial management team in creating annual budgets of $20 million with strategic allocation of resources, achieving a 10% reduction in unnecessary expenditures.

- •Collaborated with program directors to develop detailed budgets for over 15 programs, enhancing fiscal responsibility through accurate forecasting.

- •Prepared quarterly financial reports for upper management, ensuring transparency and clarity in financial communications to improve strategic decision-making.

- •Assisted in comprehensive audits, ensuring financial compliance and accuracy, contributing to an impressive zero irregularities finding.

- •Enhanced financial performance by recommending strategic allocations of resources, resulting in optimized spending and increased funding opportunities.

- •Conducted financial analysis and presented findings to stakeholders, effectively communicating strategic insights to drive organizational growth.

- •Managed and recorded daily financial transactions for a $15 million annual budget, ensuring all entries were 100% compliant with organizational policies.

- •Streamlined grant reporting processes, increasing efficiency by 25% and ensuring compliance with financial grant obligations.

- •Facilitated financial trainings for 30 staff across departments, significantly improving adherence to financial policies and procedures.

- •Developed new financial reporting tools that reduced report preparation time by 30%, providing management with timely financial insights.

- •Fostered productive relationships with external stakeholders, successfully negotiating funding terms that benefited multiple organizational projects.

- •Analyzed financial data and provided insights that led to a 15% increase in budgeting accuracy and reduced financial discrepancies.

- •Coordinated audits for five regional branches, ensuring compliance and identifying cost-saving opportunities to enhance financial outcomes.

- •Collaborated with cross-functional teams to develop streamlined financial processes, reducing operational costs by 10%.

- •Prepared comprehensive financial reports for internal and external stakeholders, enhancing transparency and trust in reporting.

- •Assisted in preparing financial statements that met all regulatory requirements, contributing to zero compliance issues during evaluations.

- •Monitored expenses and revenues meticulously, resulting in the identification of savings opportunities that improved the overall financial health of the organization.

- •Facilitated the grant application process by preparing accurate financial data to support successful submissions, leading to a higher acceptance rate.

- •Provided training to new team members on accounting software, enhancing team productivity and maintaining consistency in financial records.

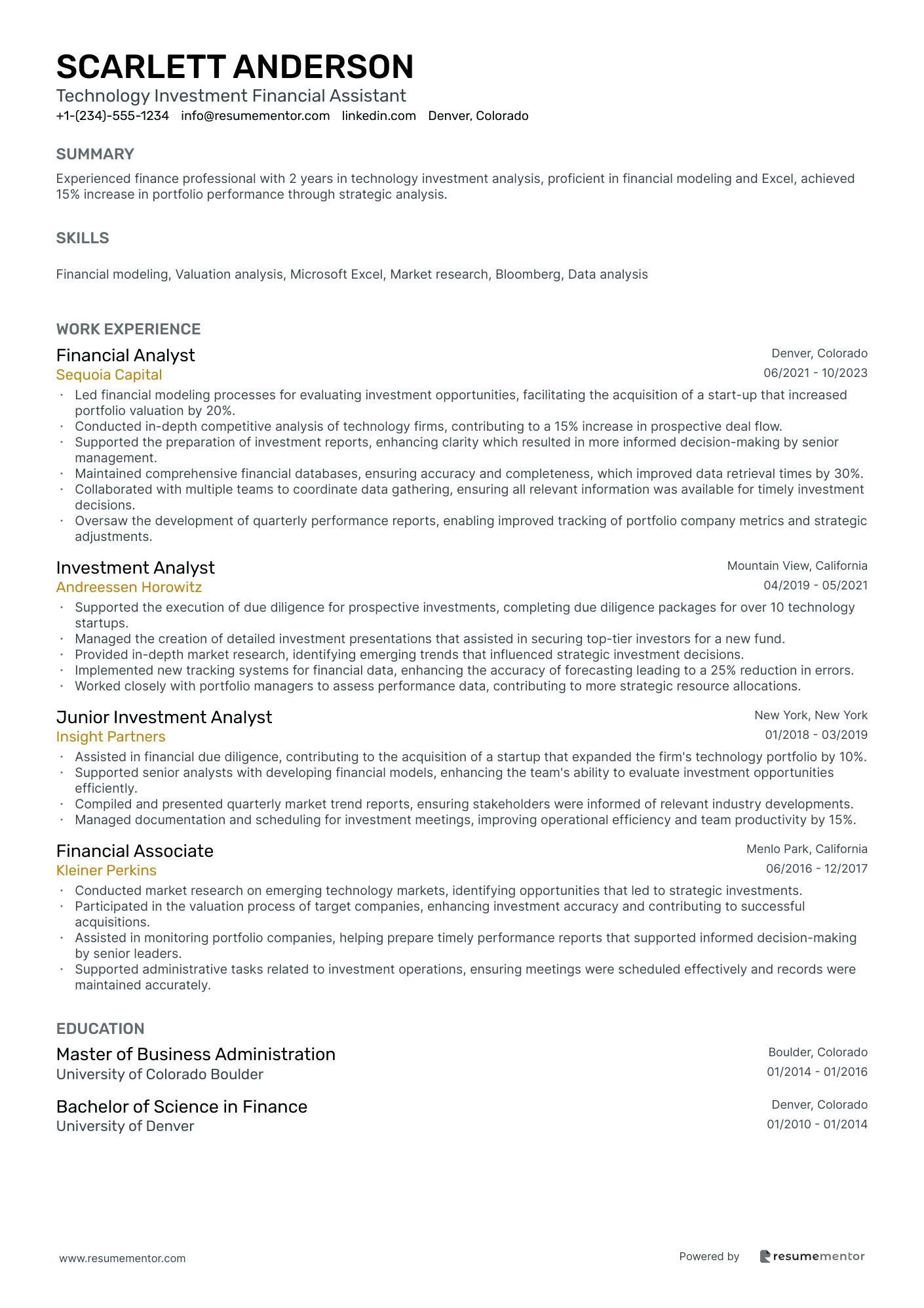

Technology Investment Financial Assistant resume sample

- •Led financial modeling processes for evaluating investment opportunities, facilitating the acquisition of a start-up that increased portfolio valuation by 20%.

- •Conducted in-depth competitive analysis of technology firms, contributing to a 15% increase in prospective deal flow.

- •Supported the preparation of investment reports, enhancing clarity which resulted in more informed decision-making by senior management.

- •Maintained comprehensive financial databases, ensuring accuracy and completeness, which improved data retrieval times by 30%.

- •Collaborated with multiple teams to coordinate data gathering, ensuring all relevant information was available for timely investment decisions.

- •Oversaw the development of quarterly performance reports, enabling improved tracking of portfolio company metrics and strategic adjustments.

- •Supported the execution of due diligence for prospective investments, completing due diligence packages for over 10 technology startups.

- •Managed the creation of detailed investment presentations that assisted in securing top-tier investors for a new fund.

- •Provided in-depth market research, identifying emerging trends that influenced strategic investment decisions.

- •Implemented new tracking systems for financial data, enhancing the accuracy of forecasting leading to a 25% reduction in errors.

- •Worked closely with portfolio managers to assess performance data, contributing to more strategic resource allocations.

- •Assisted in financial due diligence, contributing to the acquisition of a startup that expanded the firm's technology portfolio by 10%.

- •Supported senior analysts with developing financial models, enhancing the team's ability to evaluate investment opportunities efficiently.

- •Compiled and presented quarterly market trend reports, ensuring stakeholders were informed of relevant industry developments.

- •Managed documentation and scheduling for investment meetings, improving operational efficiency and team productivity by 15%.

- •Conducted market research on emerging technology markets, identifying opportunities that led to strategic investments.

- •Participated in the valuation process of target companies, enhancing investment accuracy and contributing to successful acquisitions.

- •Assisted in monitoring portfolio companies, helping prepare timely performance reports that supported informed decision-making by senior leaders.

- •Supported administrative tasks related to investment operations, ensuring meetings were scheduled effectively and records were maintained accurately.

Commercial Banking Finance Specialist resume sample

- •Implemented a comprehensive financial analysis framework for commercial lending, enhancing the accuracy of creditworthiness evaluations of 200+ clients.

- •Collaborated with relationship managers to assess and approve loan applications worth over $500 million, maintaining a low default rate.

- •Developed and executed pricing models to optimize the profitability of commercial banking products, resulting in a 15% increase in overall portfolio returns.

- •Prepared detailed financial reports and presentations for senior management, facilitating informed strategic decision-making for the commercial lending division.

- •Analyzed and streamlined risk management strategies, reducing operational risk by 10% across commercial lending portfolios.

- •Maintained strong internal and external stakeholder relationships, enhancing a collaborative approach to financial strategy implementation.

- •Conducted in-depth financial analysis on commercial banking products, identifying key trends and insights in portfolios exceeding $1 billion.

- •Played a significant role in developing financial strategies that boosted loan disbursement rate by 25%, enhancing competitive advantage.

- •Engaged in cross-functional projects to ensure compliance with all regulatory requirements, maintaining a compliance success rate of 98%.

- •Assessed financial performance metrics, providing recommendations for business development strategies that improved annual revenues by 20%.

- •Supported the finance team in preparing quarterly financial reports, which were instrumental in driving strategic planning meetings with senior management.

- •Collaborated with senior analysts to conduct financial reviews of commercial loan applications totaling over $2 million monthly.

- •Prepared detailed profitability analyses for various banking products, leading to the successful launch of new product lines.

- •Facilitated in identifying revenue growth opportunities, increasing profitability in certain product divisions by 10%.

- •Engaged in risk assessment activities to improve financial product offerings, decreasing risk factors by 8% across portfolios.

- •Managed a portfolio of commercial clients, providing financial products and services tailored to unique client needs.

- •Improved client satisfaction scores by 15% through personalized financial planning and increased responsiveness.

- •Conducted market analysis to support new business development initiatives, contributing to a 12% increase in client acquisition.

- •Assisted in developing effective financial product strategies, enhancing overall client engagement within the commercial banking sector.

Municipal Finance Support Analyst resume sample

- •Led a financial analysis project that improved the budget accuracy of a major city by 25%, enhancing resource allocation.

- •Collaborated with municipal clients to assess financial needs, resulting in improved fiscal management and cost savings.

- •Designed and implemented new training programs for municipal staff, leading to an increase in software adoption by 40%.

- •Developed financial models to assist municipalities in strategic planning, achieving a 30% increase in forecast reliability.

- •Prepared comprehensive presentations on financial performance and forecasts for stakeholder meetings, increasing stakeholder engagement by 15%.

- •Monitored compliance with regulations, successfully avoiding any financial policy breaches for two consecutive years.

- •Provided technical assistance to municipal clients, enhancing their operational efficiency by implementing best financial practices.

- •Conducted in-depth research and data analysis, supporting decision-making that led to a 20% increase in municipal efficiency.

- •Trained 50+ municipal staff on financial management software, leading to a 35% rise in software utilization.

- •Assisted in developing long-term financial models, facilitating improved strategic financial planning for multiple clients.

- •Created detailed reports on municipal financial health, influencing positive fiscal policy changes in local government.

- •Played a key role in preparing and analyzing municipal budgets, resulting in increased financial transparency across departments.

- •Collaborated with finance teams to implement new budgeting tools, improving time efficiency in budget preparation by 15%.

- •Assisted in research projects to enhance financial reporting accuracy, leading to increased trust in municipal reports.

- •Supported the development and submission of financial compliance reports, ensuring 100% adherence to regulations.

- •Assisted in budget preparation and analysis, contributing to a 10% reduction in unnecessary expenses.

- •Conducted research for financial decision-making, enhancing data-driven strategies for budget allocations.

- •Collaborated with municipal clients to gather and analyze financial data, supporting robust financial planning.

- •Provided financial report presentations to municipal boards, aiding in better-informed budget reviews.

Construction Project Finance Assistant resume sample

- •Managed financial tracking for multiple construction projects, reducing unnecessary expenses by 12% and enhancing project profitability.

- •Collaborated with project managers to streamline budget allocation processes, achieving accurate cost forecasting for 95% of projects.

- •Conducted monthly budget reviews and cash flow projections for five concurrent projects, ensuring better financial management.

- •Implemented a new invoicing system that accelerated billing cycle time by 15%, contributing to improved cash flow.

- •Prepared comprehensive financial reports and presentations for executive stakeholders, aiding strategic decision-making.

- •Assisted in setting up a new project accounting system, resulting in enhanced accuracy of financial records and compliance.

- •Handled project budgets of over $10 million, ensuring financial allocations were on track and efficient.

- •Optimized the reconciliation process for project accounts, lowering discrepancies by 20% through meticulous record-keeping.

- •Facilitated collaborative financial data collection with project teams, leading to 100% budget compliance.

- •Developed financial procedures that enhanced compliance with regulatory standards, supporting five successful audits.

- •Provided timely financial analysis that supported project decision-making, saving over $150,000 across projects.

- •Analyzed project financial performance, identifying and mitigating risks that improved project cost-efficiency by 8%.

- •Assisted senior financial analysts in month-end closing, ensuring accuracy of financial statements and reports.

- •Contributed to project budget preparation, enhancing project forecasting accuracy with improved data management practices.

- •Supported the development of project-specific financial policies, increasing financial compliance and efficiency.

- •Assisted in the preparation of financial statements and reports, improving accuracy by 15% through enhanced data review practices.

- •Reorganized invoicing systems, reducing processing time by 25% and ensuring timely payments.

- •Supported budget planning sessions, facilitating cost-saving measures that reduced project overruns by 5%.

- •Maintained organized financial records for multiple projects, aiding effective compliance checks and audits.

Pharmaceutical Finance Aid Officer resume sample

- •Managed financial operations for pharmaceutical aid programs, increasing resource allocation efficiency by 25% through targeted data analysis.

- •Collaborated with pharmaceutical partners to allocate financial resources accurately, reducing budget discrepancies by 15% over a fiscal year.

- •Prepared comprehensive financial reports to evaluate program impact, contributing to a strategic shift that saved $2 million annually.

- •Assisted in developing robust financial policies and procedures that enhanced efficiency and compliance across the organization.

- •Monitored accounts related to pharmaceutical aid, maintaining 98% accuracy in financial records through regular audits.

- •Supported program teams in training initiatives, leading to a 30% increase in compliance with financial processes.

- •Conducted financial audits and assessments, resulting in a 40% improvement in regulatory compliance and efficiency.

- •Developed detailed financial models for forecasting, which informed strategic decisions and improved budget accuracy by 20%.

- •Designed and implemented new budget management strategies that reduced operational costs by 10%.

- •Improved financial tracking system performance, ensuring accurate record-keeping and reconciliation of pharmaceutical accounts.

- •Supported the senior finance team in grant management by analyzing data, increasing successful fund allocation by $1.5 million.

- •Managed budget planning for civic health programs, optimizing expenditure tracking and reducing wastage by 15%.

- •Collaborated with cross-functional teams to integrate financial software solutions, enhancing reporting accuracy by over 25%.

- •Executed detailed financial reports, which informed corporate decisions and improved budget allocation by $500K.

- •Conducted routine accounts monitoring, ensuring 95% compliance with financial industry regulations.

- •Assisted in budget management for non-profit initiatives, improving fund allocation efficiency by 12%.

- •Analyzed and prepared financial statements, which resulted in more informed program evaluations and strategic alignments.

- •Coordinated with accounting teams to ensure financial policy adherence and facilitated the training of 20 staff members.

- •Enhanced financial document archiving systems, improving accessibility and retrieval time by 15%.

Creating an impactful special finance assistant resume is key to standing out in a competitive job market. Your role as a special finance assistant, with its focus on numbers and financial expertise, makes you the linchpin of any financial department. Yet, turning this multifaceted skill set into a compelling resume can feel overwhelming. Successfully capturing the essence of your responsibilities requires careful attention to detail.

Your resume should bring out your ability to manage complex financial tasks, along with your strengths in communication and organization. However, highlighting these technical financial skills effectively can be tricky, leaving you unsure of the right details and structure to use.

Here’s where a strong resume template becomes invaluable. By starting with a resume template, you lay down a solid foundation, ensuring you include all the necessary sections while concentrating on tailoring content to showcase your strengths.

Picture your resume as your personal elevator pitch to potential employers. With a reliable template and your financial acumen, you can clearly communicate not just your past achievements but also what you uniquely offer. Allow your resume to narrate the story of your professional journey, capturing the depth and breadth of your expertise as a special finance assistant.

Key Takeaways

- Creating an impactful special finance assistant resume involves showcasing financial expertise, organizational skills, and communication abilities.

- Using a structured resume template ensures you include all necessary sections and tailor content effectively to highlight your strengths.

- Your resume should serve as a personal elevator pitch, clearly communicating your professional journey and unique offerings to potential employers.

- Selecting the right resume format and font is critical for emphasizing career progression and ensuring easy readability.

- Incorporating additional sections like certifications, volunteer work, and interests can enhance your resume by highlighting diverse skills and a commitment to continual learning.

What to focus on when writing your special finance assistant resume

Your special finance assistant resume should clearly reflect your financial expertise and analytical skills—it's important to illustrate your ability to support financial operations effectively. This conveys your value within the finance sector. Key sections to include in your resume are designed to enhance these elements and should flow logically from one to the next.

How to structure your special finance assistant resume

- Contact information is foundational—it should start with your full name, phone number, a professional email address, and a LinkedIn profile. This basic but crucial section ensures recruiters can easily connect with you and move forward in the hiring process.

- The professional summary comes next, providing a snapshot of your expertise—this brief statement should highlight your core financial skills, such as attention to detail and budgeting experience, setting the tone for your proficiency in finance roles. It's an immediate introduction to your capabilities and draws the recruiter in to learn more.

- Skills expand on your professional abilities—listing out financial skills like proficiency in spreadsheet software, budget management, and financial reporting is essential. Including soft skills such as problem-solving and communication helps to round out your profile, making it look well-balanced and comprehensive.

- Work experience builds directly on your skills section—detail your relevant job roles, focusing on experiences in finance departments. Highlighting responsibilities such as account reconciliation, transaction processing, and assisting in financial audits demonstrates your practical application of the skills mentioned earlier and underscores your readiness.

- Education connects your background to your practical experience—list your degree(s) and any finance-related coursework or certifications, like a Bachelor's in Finance or relevant certifications such as CFA or CPA, showcasing your credentials and commitment to the field. These elements are essential for establishing your academic foundation in finance.

- Technical skills complement both your education and work experience—mention your proficiency with financial systems and tools such as SAP, QuickBooks, or Excel, which are crucial in demonstrating your technical capabilities within the finance sector.

Additionally, consider optional sections like certifications or volunteer experience to add more depth—these highlight your dedication to continued learning and community involvement. Before we delve deeper into each section, let’s first talk about the overall resume format that best suits a special finance assistant position.

Which resume format to choose

Creating your special finance assistant resume effectively starts with choosing the right format. A chronological format works well as it emphasizes your career progression and highlights your relevant experience and skills with clarity. This approach helps potential employers quickly see your expertise in financial tasks and projects.

Choosing the right font is also important to ensure your resume is easy to read and looks professional. Consider using modern fonts like Raleway, Montserrat, or Lato, which give your resume a polished and contemporary feel. These fonts are clean and straightforward, ensuring that your focus remains on the content rather than distracting styles.

Once your resume content is laid out, saving it as a PDF is essential. This file type preserves the formatting, ensuring it looks the same across all devices and operating systems. Recruiters will appreciate that your document is easy to open and view without layout issues, reflecting your attention to detail.

Finally, set one-inch margins on all sides to give your resume a clean, structured appearance. This spacing frames your content neatly, making it easier for employers to navigate. By paying attention to these elements, you ensure that your resume effectively showcases your potential as a special finance assistant.

How to write a quantifiable resume experience section

A strong resume experience section is your ticket to landing a special finance assistant role. In this part of your resume, highlight your key achievements and contributions to give employers a clear picture of your abilities. Start by listing your job title, company name, location, and the dates you worked there. Use bullet points to make your accomplishments stand out, ensuring they are both quantifiable and relevant to the job. This section paints a picture of your career path, showcasing the skills and accomplishments that make you a strong candidate.

Organize your experience in reverse chronological order, highlighting your most recent role first. Focus on the past 10 to 15 years, emphasizing aspects of your career that are most relevant to the job you're applying for. Tailor your resume by aligning your past responsibilities with the job ad’s requirements, demonstrating that you meet the employer’s needs. Use dynamic action words like "increased," "managed," and "developed" to make your achievements more compelling.

Here's a well-crafted example of the experience section for a special finance assistant:

- •Reduced processing errors by 30% through implementing quality audits and automated checks.

- •Managed financial records for over 200 client accounts, ensuring compliance and accuracy.

- •Assisted in the development of new financial planning strategies that increased client satisfaction by 15%.

- •Streamlined monthly reconciliation process, reducing time spent by 25% while enhancing report accuracy.

Notice how this experience section connects each aspect seamlessly. It begins by clearly outlining your role, providing context, and then moves into detailed achievements that reflect your impact. The use of strong action words paired with quantifiable results demonstrates the value you brought to your previous employer. By aligning these achievements with skills sought in the job ad, you present yourself as an ideal candidate who is both capable and ready to step into the role.

Collaboration-Focused resume experience section

A collaboration-focused finance assistant resume experience section should emphasize teamwork and effective communication. Start by describing how you contributed to team projects, ensuring smooth cooperation with colleagues and supporting various groups within the organization. Use powerful action words like "enhanced," "collaborated," or "coordinated" to make your contributions stand out. Ensure your bullet points are specific and showcase how your role made team tasks easier and led to better outcomes.

By detailing specific instances where your collaborative efforts fueled success, you provide a clear picture of your capabilities. For each position, include your title, company, dates, and, if necessary, a short job description. Keep bullet points concise, focusing on achievements and contributions rather than basic duties. Ultimately, aim to demonstrate not just what you did, but the positive impact your actions had on the team and organization.

Finance Assistant

XYZ Corporation

January 2020 - Present

- Collaborated with team members to design a new budget tracking system, improving accuracy by 30%.

- Worked with the sales department to align financial forecasts with sales projections, ensuring resource optimization.

- Coordinated with diverse departments to streamline invoicing processes, reducing processing time by 25%.

- Assisted in organizing and leading weekly cross-functional meetings to foster open communication and problem-solving.

Problem-Solving Focused resume experience section

A Problem-Solving Focused Finance Assistant resume experience section should highlight your ability to tackle financial challenges and implement effective solutions. Begin by listing your job title, the company you worked for, and the dates of your employment. Share specific experiences that demonstrate your problem-solving skills and emphasize how you addressed real issues in the finance field. Whether through process improvements, leveraging financial software to reduce errors, or thorough data analysis for cost savings, use action-focused language and provide measurable results to underscore your achievements.

Each bullet point should seamlessly illustrate a problem you faced, the actions you took, and the successful outcomes of those actions. Tailor each point to clearly show how you overcame specific financial obstacles. Be precise about your contributions, such as implementing systems that cut processing times or analyzing data that led to substantial savings. This section aims to convey to potential employers that you consistently and effectively address financial challenges, showcasing a reliable track record of delivering impactful solutions.

Finance Assistant

Bright Financial Solutions

June 2020 - August 2023

- Improved the monthly reconciliation process by integrating new accounting software, reducing errors by 30%.

- Analyzed expenditure reports to identify cost-saving opportunities, resulting in a 15% reduction in overhead costs.

- Developed and implemented a training program for junior staff, decreasing processing time by 20% and increasing overall efficiency.

- Streamlined the financial reporting process, reducing the report preparation time from five days to two days.

Project-Focused resume experience section

A project-focused finance assistant resume experience section should clearly showcase the projects where you made significant contributions. Start by highlighting your ability to handle financial data, assist with budgets, and support smart financial decisions. Use action words and incorporate numbers or specific outcomes to make your achievements stand out and resonate with potential employers. This approach helps to frame the real impact of your work.

Organize this information into concise bullet points that emphasize your strengths in the finance industry. Keep the language straightforward to ensure anyone can understand your contributions. Focus on your experience with financial tools and any unique skills that drove project success. The goal is to seamlessly demonstrate your expertise and reliability, proving that you are a valuable asset to any team. Here's a JSON-format example for guidance:

Finance Assistant

XYZ Corp

June 2020 - Present

- Improved budget accuracy by 15% through detailed financial reporting and analysis.

- Coordinated with cross-functional teams to streamline processes, saving the company $50,000 annually.

- Assisted in developing financial models for new projects, enhancing forecasting accuracy.

- Managed complex datasets using Excel and financial software, reducing data processing time by 20%.

Training and Development Focused resume experience section

A Training and Development-focused Special Finance Assistant resume experience section should clearly convey how your efforts have impacted your workplace. Start by listing your job titles, places of employment, and the dates associated with each role. Use bullet points to effectively highlight your key responsibilities and accomplishments, putting a spotlight on moments where you led or played a significant part in training programs, coached colleagues, or facilitated skill development. Be sure to mention specific financial tools or techniques that you taught.

Incorporate action verbs like "implemented," "conducted," and "developed" to emphasize your contributions and achievements. Customize this section to reflect the types of training you delivered, whether through hands-on coaching, workshops, or online learning platforms. This helps to illustrate your adaptability and effectiveness in different settings. Highlight your collaboration with team members to ensure that training programs met organizational needs. Whenever possible, include measurable outcomes to demonstrate the positive changes initiated by your training efforts.

Special Finance Assistant

January 2020 - Present

- Implemented a new financial software training program that reduced data entry errors by 30%.

- Conducted over 50 training sessions for cross-functional teams, leading to a 25% increase in process efficiency.

- Developed interactive online modules focusing on financial analysis, enhancing employee engagement by 40%.

- Collaborated with finance leaders to tailor training materials, ensuring alignment with organizational goals.

Write your special finance assistant resume summary section

A finance-focused special finance assistant resume summary should capture attention by highlighting your top skills and achievements. With relevant experience, a summary is your most effective tool. It offers a snapshot of your professional background in a concise format, ensuring hiring managers quickly see your value. For instance:

Connecting your skills and achievements, this summary demonstrates your expertise and what you bring to a company. Using action words effectively, it illustrates the responsibilities and successes you've managed. Alternatively, if you're new to the workforce or undergoing a career shift, a resume objective might be more fitting. This outlines your career goals and their alignment with the company's needs. Similarly, a resume profile is brief yet informative, summarizing experience and skills efficiently. A summary of qualifications gives a bullet-pointed list of key abilities. Whatever format you choose, ensure it matches your background and experience level. Tailor your approach to the specific job, utilizing language and keywords from the job posting to highlight suitability. Keeping the summary simple and engaging ensures it makes an immediate impact, drawing employers in from the start.

Listing your special finance assistant skills on your resume

A skills-focused special finance assistant resume should effectively showcase your abilities to stand out to employers. When writing the skills section, you can choose to have a dedicated area or seamlessly weave it into sections like your experience and summary. Highlighting your strengths and soft skills demonstrates how you interact with others and your ability to work as part of a team. On the other hand, hard skills represent the specific, teachable abilities you bring to the job.

Including skills and strengths as keywords on your resume can significantly impact your visibility to employers and help it pass through applicant tracking systems. The right keywords ensure your resume captures the attention it deserves.

Here’s an example of a standalone skills section:

This example is effective because it integrates both hard and soft skills, ensuring all vital competencies needed for a special finance assistant role are visible. The combination shows a balance of technical abilities and interpersonal strengths, providing a comprehensive overview.

Best hard skills to feature on your special finance assistant resume

Focusing on essential hard skills is crucial for handling financial tasks efficiently. These skills demonstrate accuracy, analytical expertise, and proficiency in financial software and practices. Highlight these in-demand hard skills:

Hard Skills

- Financial reporting

- Budget management

- Accounting principles

- Tax preparation

- Financial modeling

- Data analysis

- Ledger reconciliation

- Risk assessment

- Regulatory compliance

- Cost analysis

- Auditing procedures

- Spreadsheet proficiency

- Software familiarity (e.g., QuickBooks, SAP)

- Invoice processing

- Financial forecasting

Best soft skills to feature on your special finance assistant resume

Soft skills illustrate how you work with others and contribute to a positive work environment. As a special finance assistant, these skills showcase reliability, problem-solving, and collaboration. Consider these important soft skills:

Soft Skills

- Attention to detail

- Time management

- Multitasking

- Team collaboration

- Adaptability

- Communication abilities

- Problem-solving

- Confidentiality sensitivity

- Customer service

- Organizational skills

- Initiative

- Conflict resolution

- Patience

- Strong work ethic

- Interpersonal skills

How to include your education on your resume

An education section is a crucial part of your resume, showcasing your academic achievements and qualifications. It should be tailored to the job you're applying for, focusing on relevant education while excluding unrelated details. Including your GPA can highlight your academic performance, especially if it's impressive. Specify your GPA on a 4.0 scale, such as "GPA: 3.8/4.0," to give context. If you graduated with honors, indicate this by adding terms like "cum laude" next to your degree. When listing degrees, ensure clarity by stating the degree, institution, and date of graduation.

Here's a wrong example of an education section:

And here's a right example of a strong education section:

The second example shines because it highlights a relevant degree for a finance assistant position from a respected institution, along with an excellent GPA. It also showcases academic honors, which can impress potential employers with your dedication and intelligence. This approach ensures that the education section supports your overall candidacy and aligns with the job requirements.

How to include special finance assistant certificates on your resume

To include a certificates section in your special finance assistant resume, start by listing the name of each certificate. Include the date when you earned it. Add the issuing organization for each certificate. Certificates can also be highlighted in the header for quick recognition. For example: "Certified Financial Planner (CFP), 2022, Financial Planning Standards Board."

Here is a strong example of a standalone certificates section:

This example is good because it includes relevant certifications for a finance assistant. Both certificates are well-known and respected in the finance industry. The section is clear and concise, making it easy for hiring managers to spot your qualifications. Including the issuer adds credibility to your expertise. This shows you have the required knowledge and skills for the job.

Extra sections to include in your special finance assistant resume

Crafting a compelling resume as a special finance assistant involves not only highlighting your professional experience but also showcasing your diverse skill set and interests. Including additional sections like languages, hobbies and interests, volunteer work, and books can make your application stand out.

- Language section — Highlight any additional languages you speak to demonstrate your ability to communicate with diverse clients.

- Hobbies and interests section — Include this section to show you are a well-rounded individual, which can make you more memorable to hiring managers.

- Volunteer work section — Showcase any volunteer work to illustrate your commitment to your community and enhance your team-focused skills.

- Books section — List any finance-related books you’ve read to display your ongoing interest in the field and your dedication to continual learning.

By including these sections, you can effectively present yourself as a versatile and engaged individual, adding depth to your resume. This well-rounded approach can substantially improve your chances of landing the job by highlighting qualities that traditional resumes often overlook.

In Conclusion

In conclusion, crafting an exceptional special finance assistant resume requires careful consideration and a strategic approach. Your resume acts as your professional story, summarizing not only your technical skills and achievements but also giving potential employers insight into your personality and how you work with others. By showcasing your expertise in financial analysis, data management, and budgeting, you underline your technical proficiency. Additionally, highlighting soft skills like communication, teamwork, and problem-solving further sets you apart in today’s competitive job market. Remember, using a reliable template can provide a structured foundation that ensures you present a coherent and compelling narrative. Tailor each section, from your professional summary to your work experience, to reflect the specific requirements and values of the job you are applying for. Comprehensive education and certification sections add depth, while additional elements such as volunteer work and languages enrich your profile and emphasize your well-rounded character. Ultimately, a well-crafted resume not only informs but also engages, presenting you as a committed and valuable potential team member ready to contribute effectively to any financial department. With attention to detail and a focus on clarity, your resume can become a powerful tool for advancing your career as a special finance assistant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.