Supervisory Accountant Resume Examples

Jul 18, 2024

|

12 min read

Master the art of crafting a standout supervisory accountant resume: tally up your experience, skills, and accomplishments to become the "ledger-ndary" candidate every company wants.

Rated by 348 people

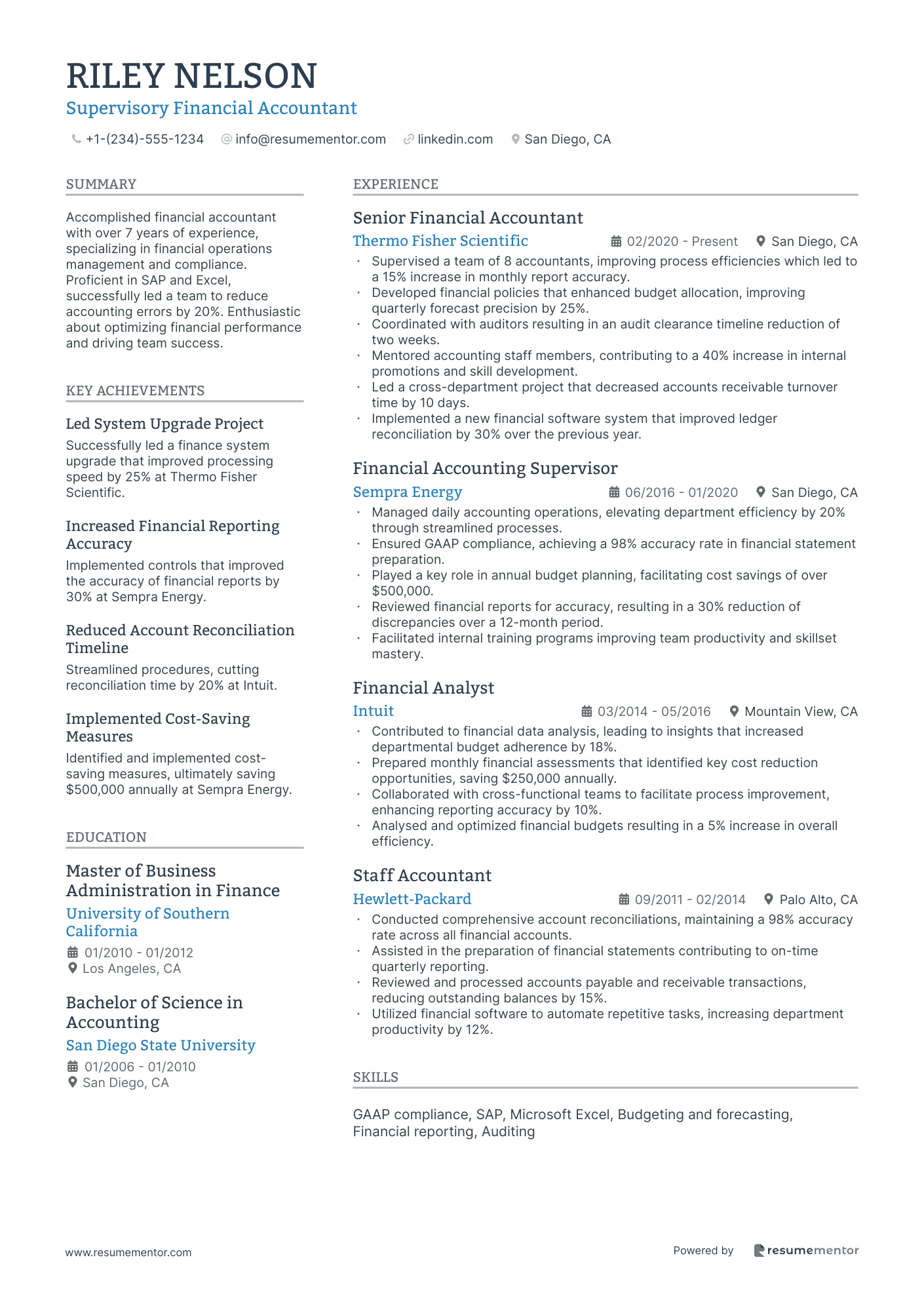

Supervisory Financial Accountant

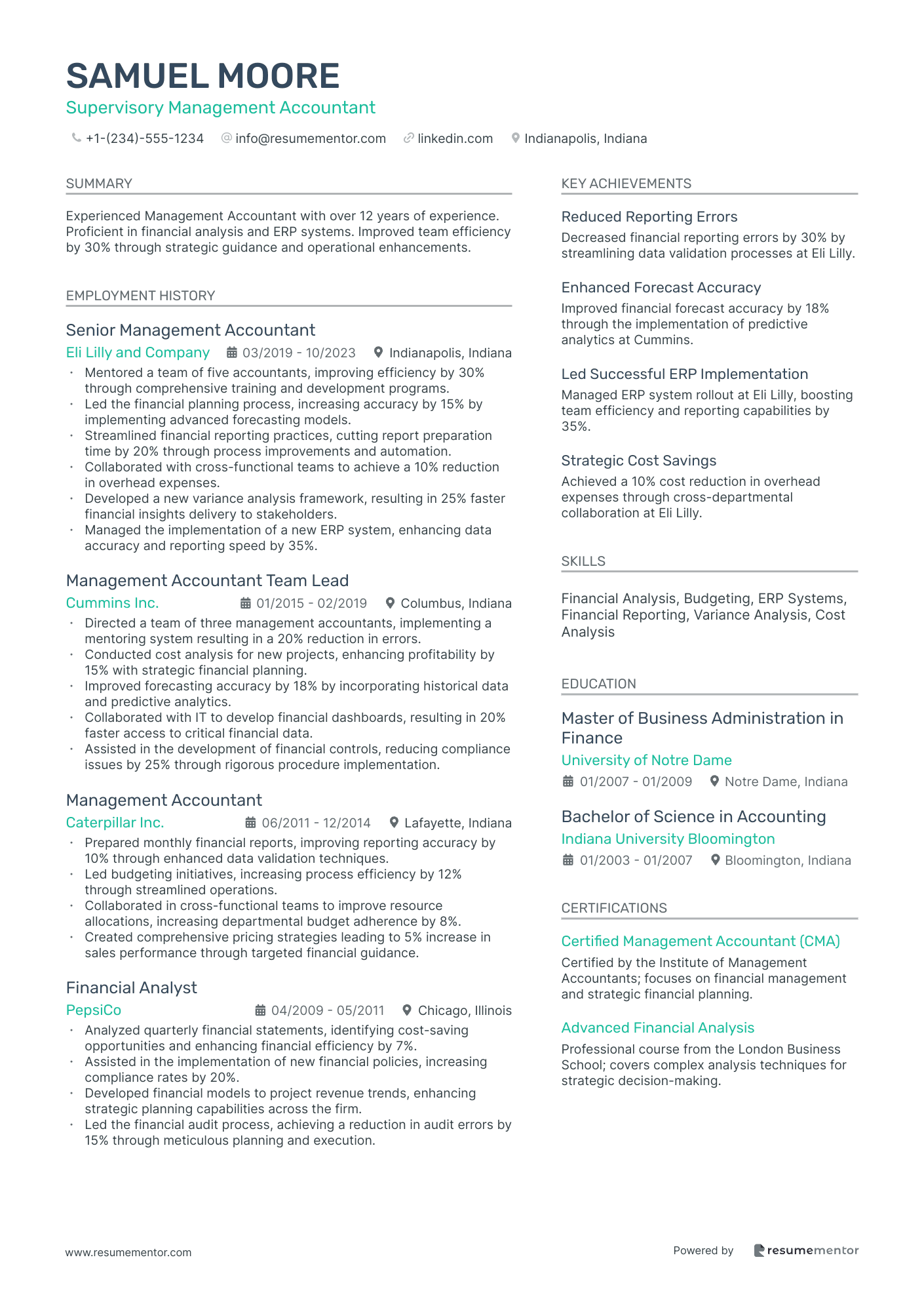

Supervisory Management Accountant

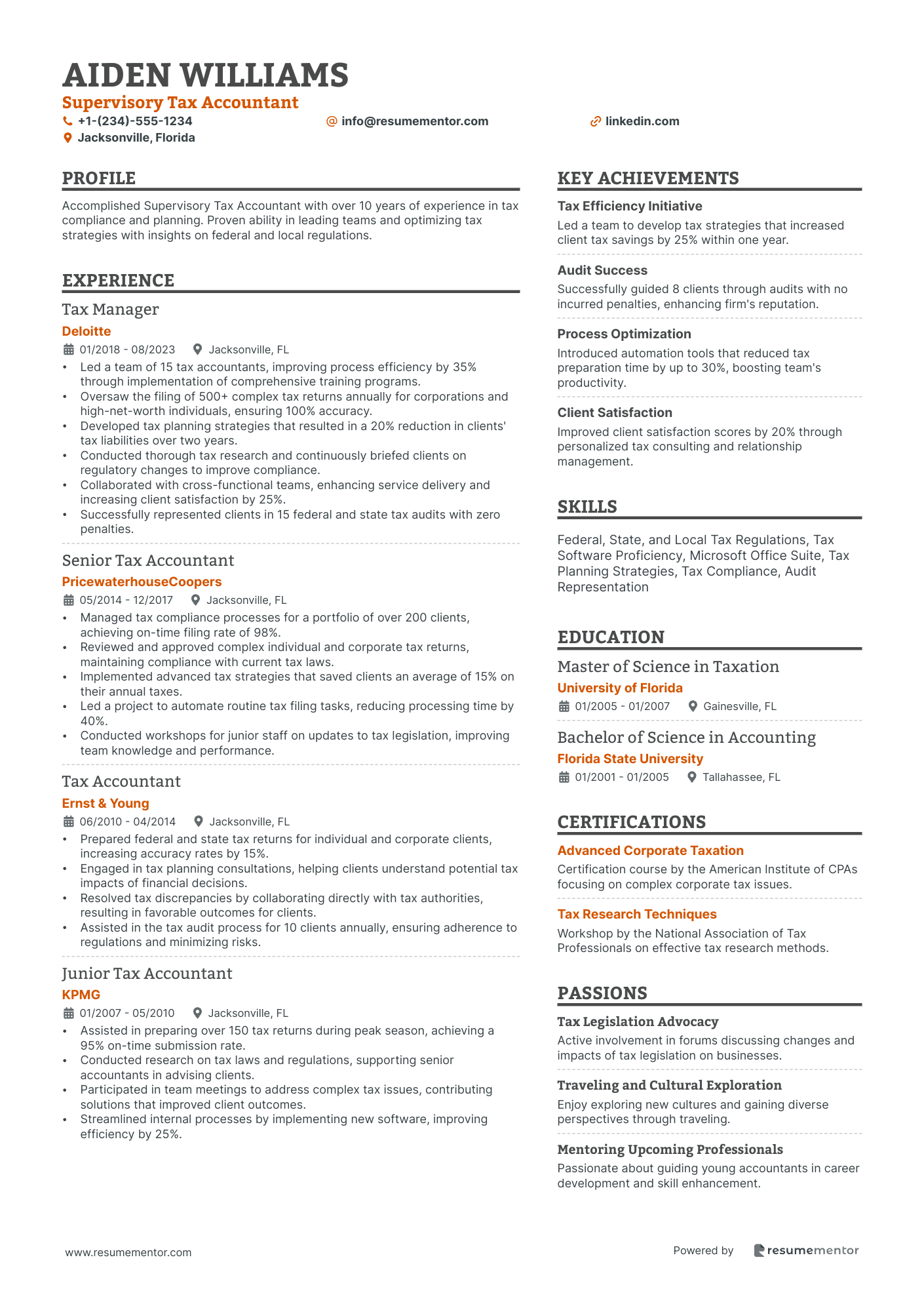

Supervisory Tax Accountant

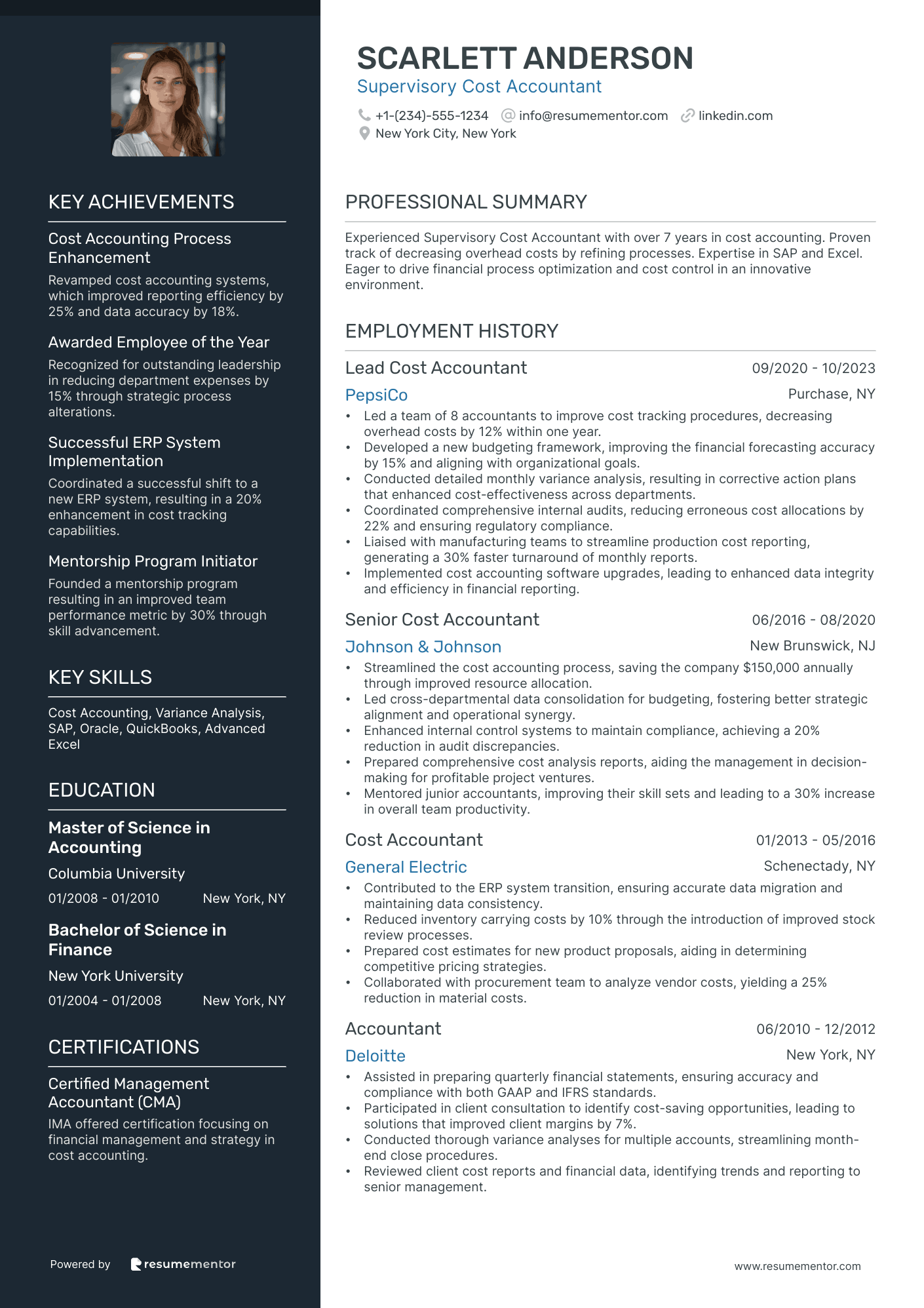

Supervisory Cost Accountant

Supervisory Forensic Accountant

Supervisory External Audit Accountant

Supervisory Accountant for Non-profit Organizations

Supervisory Internal Audit Accountant

Supervisory Revenue Accountant

Supervisory Payroll Accountant

Supervisory Financial Accountant resume sample

- •Supervised a team of 8 accountants, improving process efficiencies which led to a 15% increase in monthly report accuracy.

- •Developed financial policies that enhanced budget allocation, improving quarterly forecast precision by 25%.

- •Coordinated with auditors resulting in an audit clearance timeline reduction of two weeks.

- •Mentored accounting staff members, contributing to a 40% increase in internal promotions and skill development.

- •Led a cross-department project that decreased accounts receivable turnover time by 10 days.

- •Implemented a new financial software system that improved ledger reconciliation by 30% over the previous year.

- •Managed daily accounting operations, elevating department efficiency by 20% through streamlined processes.

- •Ensured GAAP compliance, achieving a 98% accuracy rate in financial statement preparation.

- •Played a key role in annual budget planning, facilitating cost savings of over $500,000.

- •Reviewed financial reports for accuracy, resulting in a 30% reduction of discrepancies over a 12-month period.

- •Facilitated internal training programs improving team productivity and skillset mastery.

- •Contributed to financial data analysis, leading to insights that increased departmental budget adherence by 18%.

- •Prepared monthly financial assessments that identified key cost reduction opportunities, saving $250,000 annually.

- •Collaborated with cross-functional teams to facilitate process improvement, enhancing reporting accuracy by 10%.

- •Analysed and optimized financial budgets resulting in a 5% increase in overall efficiency.

- •Conducted comprehensive account reconciliations, maintaining a 98% accuracy rate across all financial accounts.

- •Assisted in the preparation of financial statements contributing to on-time quarterly reporting.

- •Reviewed and processed accounts payable and receivable transactions, reducing outstanding balances by 15%.

- •Utilized financial software to automate repetitive tasks, increasing department productivity by 12%.

Supervisory Management Accountant resume sample

- •Mentored a team of five accountants, improving efficiency by 30% through comprehensive training and development programs.

- •Led the financial planning process, increasing accuracy by 15% by implementing advanced forecasting models.

- •Streamlined financial reporting practices, cutting report preparation time by 20% through process improvements and automation.

- •Collaborated with cross-functional teams to achieve a 10% reduction in overhead expenses.

- •Developed a new variance analysis framework, resulting in 25% faster financial insights delivery to stakeholders.

- •Managed the implementation of a new ERP system, enhancing data accuracy and reporting speed by 35%.

- •Directed a team of three management accountants, implementing a mentoring system resulting in a 20% reduction in errors.

- •Conducted cost analysis for new projects, enhancing profitability by 15% with strategic financial planning.

- •Improved forecasting accuracy by 18% by incorporating historical data and predictive analytics.

- •Collaborated with IT to develop financial dashboards, resulting in 20% faster access to critical financial data.

- •Assisted in the development of financial controls, reducing compliance issues by 25% through rigorous procedure implementation.

- •Prepared monthly financial reports, improving reporting accuracy by 10% through enhanced data validation techniques.

- •Led budgeting initiatives, increasing process efficiency by 12% through streamlined operations.

- •Collaborated in cross-functional teams to improve resource allocations, increasing departmental budget adherence by 8%.

- •Created comprehensive pricing strategies leading to 5% increase in sales performance through targeted financial guidance.

- •Analyzed quarterly financial statements, identifying cost-saving opportunities and enhancing financial efficiency by 7%.

- •Assisted in the implementation of new financial policies, increasing compliance rates by 20%.

- •Developed financial models to project revenue trends, enhancing strategic planning capabilities across the firm.

- •Led the financial audit process, achieving a reduction in audit errors by 15% through meticulous planning and execution.

Supervisory Tax Accountant resume sample

- •Led a team of 15 tax accountants, improving process efficiency by 35% through implementation of comprehensive training programs.

- •Oversaw the filing of 500+ complex tax returns annually for corporations and high-net-worth individuals, ensuring 100% accuracy.

- •Developed tax planning strategies that resulted in a 20% reduction in clients' tax liabilities over two years.

- •Conducted thorough tax research and continuously briefed clients on regulatory changes to improve compliance.

- •Collaborated with cross-functional teams, enhancing service delivery and increasing client satisfaction by 25%.

- •Successfully represented clients in 15 federal and state tax audits with zero penalties.

- •Managed tax compliance processes for a portfolio of over 200 clients, achieving on-time filing rate of 98%.

- •Reviewed and approved complex individual and corporate tax returns, maintaining compliance with current tax laws.

- •Implemented advanced tax strategies that saved clients an average of 15% on their annual taxes.

- •Led a project to automate routine tax filing tasks, reducing processing time by 40%.

- •Conducted workshops for junior staff on updates to tax legislation, improving team knowledge and performance.

- •Prepared federal and state tax returns for individual and corporate clients, increasing accuracy rates by 15%.

- •Engaged in tax planning consultations, helping clients understand potential tax impacts of financial decisions.

- •Resolved tax discrepancies by collaborating directly with tax authorities, resulting in favorable outcomes for clients.

- •Assisted in the tax audit process for 10 clients annually, ensuring adherence to regulations and minimizing risks.

- •Assisted in preparing over 150 tax returns during peak season, achieving a 95% on-time submission rate.

- •Conducted research on tax laws and regulations, supporting senior accountants in advising clients.

- •Participated in team meetings to address complex tax issues, contributing solutions that improved client outcomes.

- •Streamlined internal processes by implementing new software, improving efficiency by 25%.

Supervisory Cost Accountant resume sample

- •Led a team of 8 accountants to improve cost tracking procedures, decreasing overhead costs by 12% within one year.

- •Developed a new budgeting framework, improving the financial forecasting accuracy by 15% and aligning with organizational goals.

- •Conducted detailed monthly variance analysis, resulting in corrective action plans that enhanced cost-effectiveness across departments.

- •Coordinated comprehensive internal audits, reducing erroneous cost allocations by 22% and ensuring regulatory compliance.

- •Liaised with manufacturing teams to streamline production cost reporting, generating a 30% faster turnaround of monthly reports.

- •Implemented cost accounting software upgrades, leading to enhanced data integrity and efficiency in financial reporting.

- •Streamlined the cost accounting process, saving the company $150,000 annually through improved resource allocation.

- •Led cross-departmental data consolidation for budgeting, fostering better strategic alignment and operational synergy.

- •Enhanced internal control systems to maintain compliance, achieving a 20% reduction in audit discrepancies.

- •Prepared comprehensive cost analysis reports, aiding the management in decision-making for profitable project ventures.

- •Mentored junior accountants, improving their skill sets and leading to a 30% increase in overall team productivity.

- •Contributed to the ERP system transition, ensuring accurate data migration and maintaining data consistency.

- •Reduced inventory carrying costs by 10% through the introduction of improved stock review processes.

- •Prepared cost estimates for new product proposals, aiding in determining competitive pricing strategies.

- •Collaborated with procurement team to analyze vendor costs, yielding a 25% reduction in material costs.

- •Assisted in preparing quarterly financial statements, ensuring accuracy and compliance with both GAAP and IFRS standards.

- •Participated in client consultation to identify cost-saving opportunities, leading to solutions that improved client margins by 7%.

- •Conducted thorough variance analyses for multiple accounts, streamlining month-end close procedures.

- •Reviewed client cost reports and financial data, identifying trends and reporting to senior management.

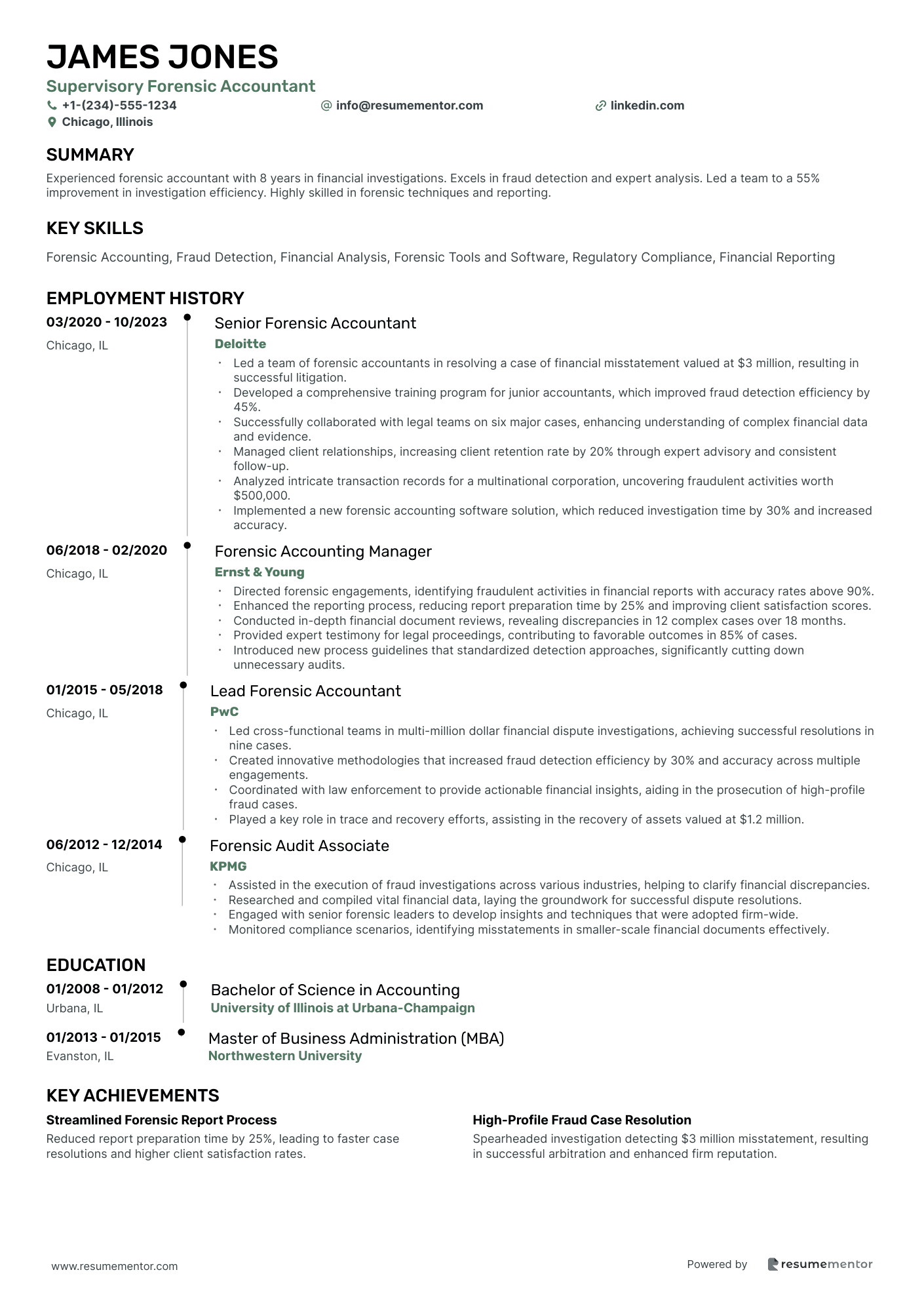

Supervisory Forensic Accountant resume sample

- •Led a team of forensic accountants in resolving a case of financial misstatement valued at $3 million, resulting in successful litigation.

- •Developed a comprehensive training program for junior accountants, which improved fraud detection efficiency by 45%.

- •Successfully collaborated with legal teams on six major cases, enhancing understanding of complex financial data and evidence.

- •Managed client relationships, increasing client retention rate by 20% through expert advisory and consistent follow-up.

- •Analyzed intricate transaction records for a multinational corporation, uncovering fraudulent activities worth $500,000.

- •Implemented a new forensic accounting software solution, which reduced investigation time by 30% and increased accuracy.

- •Directed forensic engagements, identifying fraudulent activities in financial reports with accuracy rates above 90%.

- •Enhanced the reporting process, reducing report preparation time by 25% and improving client satisfaction scores.

- •Conducted in-depth financial document reviews, revealing discrepancies in 12 complex cases over 18 months.

- •Provided expert testimony for legal proceedings, contributing to favorable outcomes in 85% of cases.

- •Introduced new process guidelines that standardized detection approaches, significantly cutting down unnecessary audits.

- •Led cross-functional teams in multi-million dollar financial dispute investigations, achieving successful resolutions in nine cases.

- •Created innovative methodologies that increased fraud detection efficiency by 30% and accuracy across multiple engagements.

- •Coordinated with law enforcement to provide actionable financial insights, aiding in the prosecution of high-profile fraud cases.

- •Played a key role in trace and recovery efforts, assisting in the recovery of assets valued at $1.2 million.

- •Assisted in the execution of fraud investigations across various industries, helping to clarify financial discrepancies.

- •Researched and compiled vital financial data, laying the groundwork for successful dispute resolutions.

- •Engaged with senior forensic leaders to develop insights and techniques that were adopted firm-wide.

- •Monitored compliance scenarios, identifying misstatements in smaller-scale financial documents effectively.

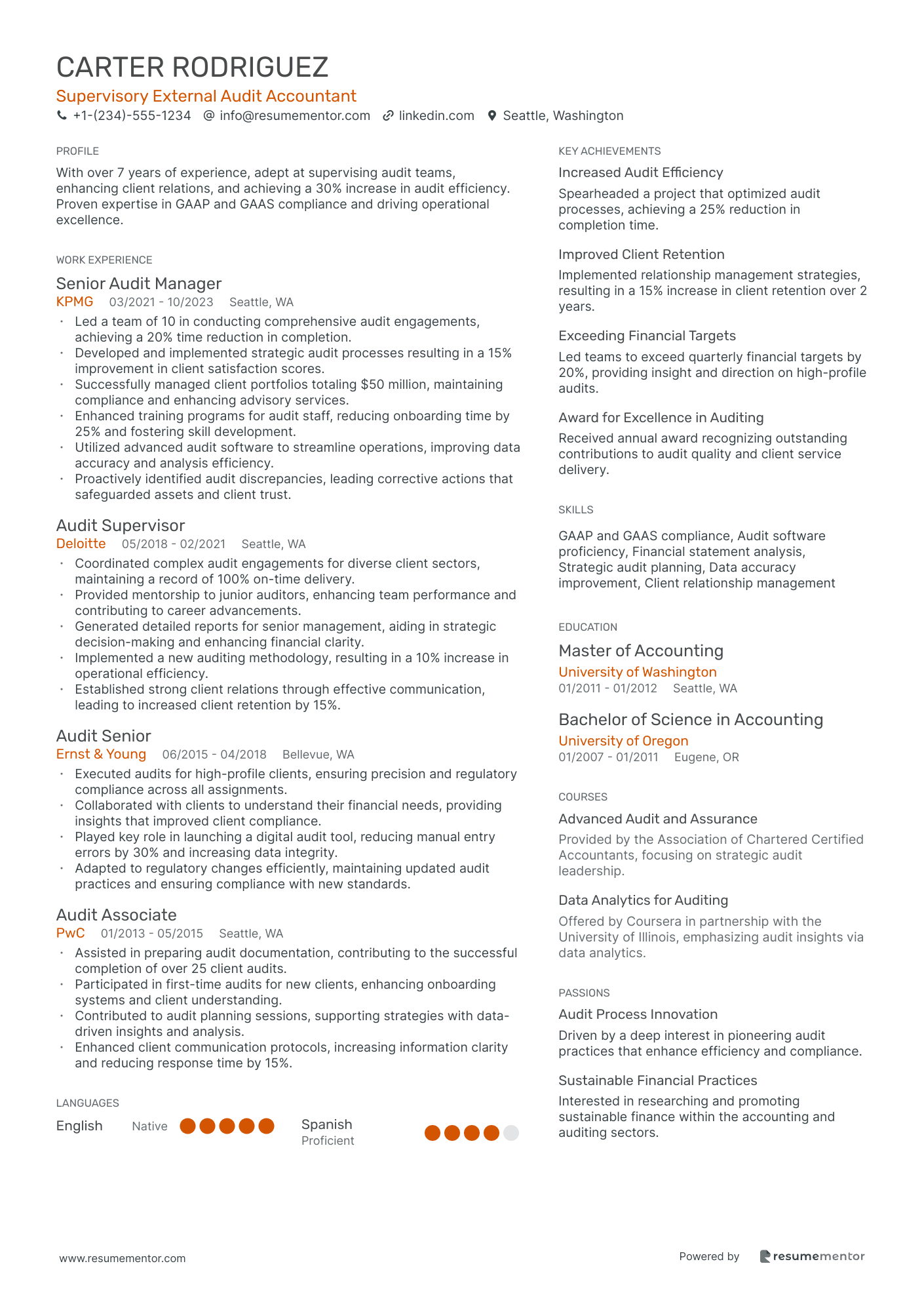

Supervisory External Audit Accountant resume sample

- •Led a team of 10 in conducting comprehensive audit engagements, achieving a 20% time reduction in completion.

- •Developed and implemented strategic audit processes resulting in a 15% improvement in client satisfaction scores.

- •Successfully managed client portfolios totaling $50 million, maintaining compliance and enhancing advisory services.

- •Enhanced training programs for audit staff, reducing onboarding time by 25% and fostering skill development.

- •Utilized advanced audit software to streamline operations, improving data accuracy and analysis efficiency.

- •Proactively identified audit discrepancies, leading corrective actions that safeguarded assets and client trust.

- •Coordinated complex audit engagements for diverse client sectors, maintaining a record of 100% on-time delivery.

- •Provided mentorship to junior auditors, enhancing team performance and contributing to career advancements.

- •Generated detailed reports for senior management, aiding in strategic decision-making and enhancing financial clarity.

- •Implemented a new auditing methodology, resulting in a 10% increase in operational efficiency.

- •Established strong client relations through effective communication, leading to increased client retention by 15%.

- •Executed audits for high-profile clients, ensuring precision and regulatory compliance across all assignments.

- •Collaborated with clients to understand their financial needs, providing insights that improved client compliance.

- •Played key role in launching a digital audit tool, reducing manual entry errors by 30% and increasing data integrity.

- •Adapted to regulatory changes efficiently, maintaining updated audit practices and ensuring compliance with new standards.

- •Assisted in preparing audit documentation, contributing to the successful completion of over 25 client audits.

- •Participated in first-time audits for new clients, enhancing onboarding systems and client understanding.

- •Contributed to audit planning sessions, supporting strategies with data-driven insights and analysis.

- •Enhanced client communication protocols, increasing information clarity and reducing response time by 15%.

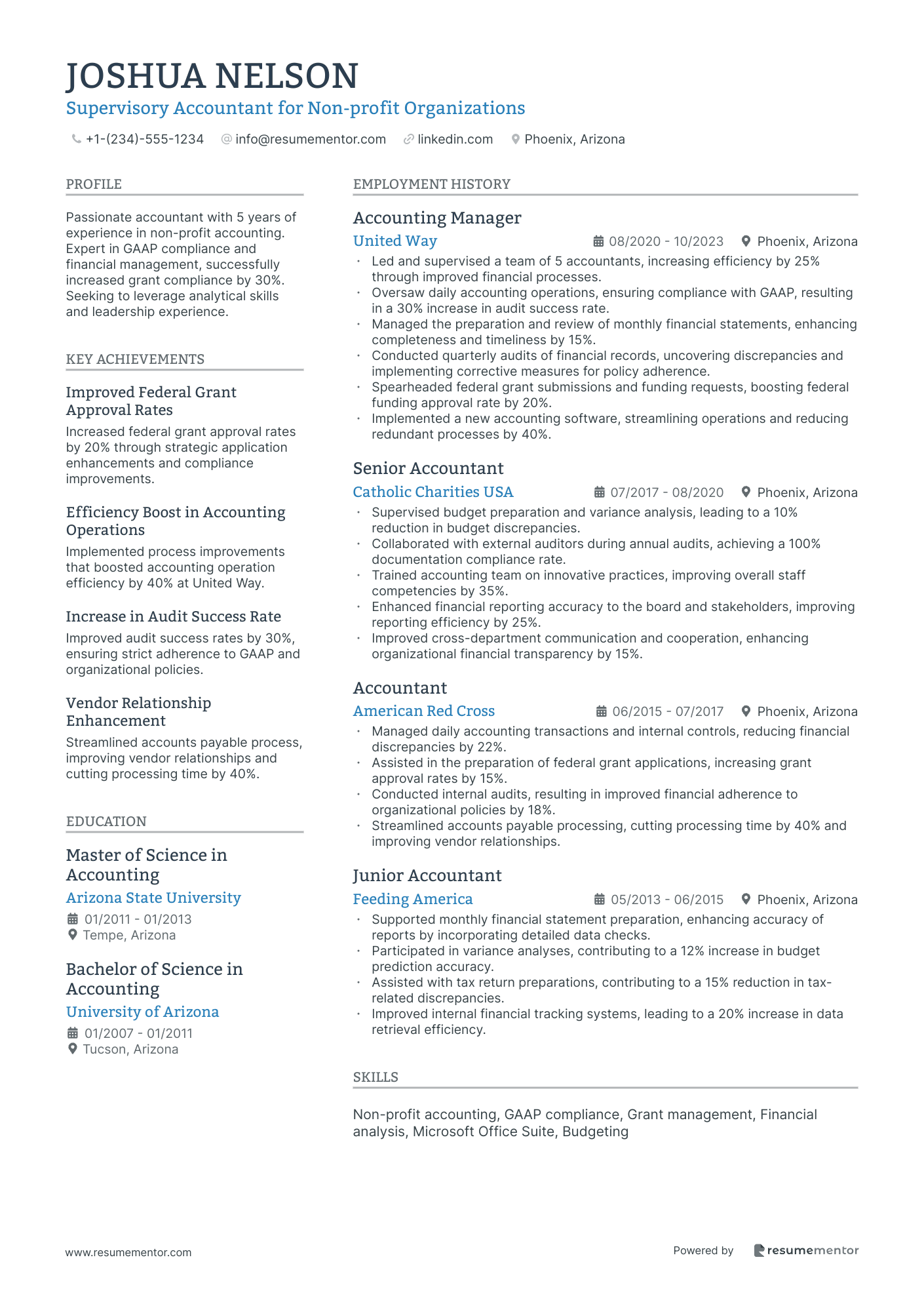

Supervisory Accountant for Non-profit Organizations resume sample

- •Led and supervised a team of 5 accountants, increasing efficiency by 25% through improved financial processes.

- •Oversaw daily accounting operations, ensuring compliance with GAAP, resulting in a 30% increase in audit success rate.

- •Managed the preparation and review of monthly financial statements, enhancing completeness and timeliness by 15%.

- •Conducted quarterly audits of financial records, uncovering discrepancies and implementing corrective measures for policy adherence.

- •Spearheaded federal grant submissions and funding requests, boosting federal funding approval rate by 20%.

- •Implemented a new accounting software, streamlining operations and reducing redundant processes by 40%.

- •Supervised budget preparation and variance analysis, leading to a 10% reduction in budget discrepancies.

- •Collaborated with external auditors during annual audits, achieving a 100% documentation compliance rate.

- •Trained accounting team on innovative practices, improving overall staff competencies by 35%.

- •Enhanced financial reporting accuracy to the board and stakeholders, improving reporting efficiency by 25%.

- •Improved cross-department communication and cooperation, enhancing organizational financial transparency by 15%.

- •Managed daily accounting transactions and internal controls, reducing financial discrepancies by 22%.

- •Assisted in the preparation of federal grant applications, increasing grant approval rates by 15%.

- •Conducted internal audits, resulting in improved financial adherence to organizational policies by 18%.

- •Streamlined accounts payable processing, cutting processing time by 40% and improving vendor relationships.

- •Supported monthly financial statement preparation, enhancing accuracy of reports by incorporating detailed data checks.

- •Participated in variance analyses, contributing to a 12% increase in budget prediction accuracy.

- •Assisted with tax return preparations, contributing to a 15% reduction in tax-related discrepancies.

- •Improved internal financial tracking systems, leading to a 20% increase in data retrieval efficiency.

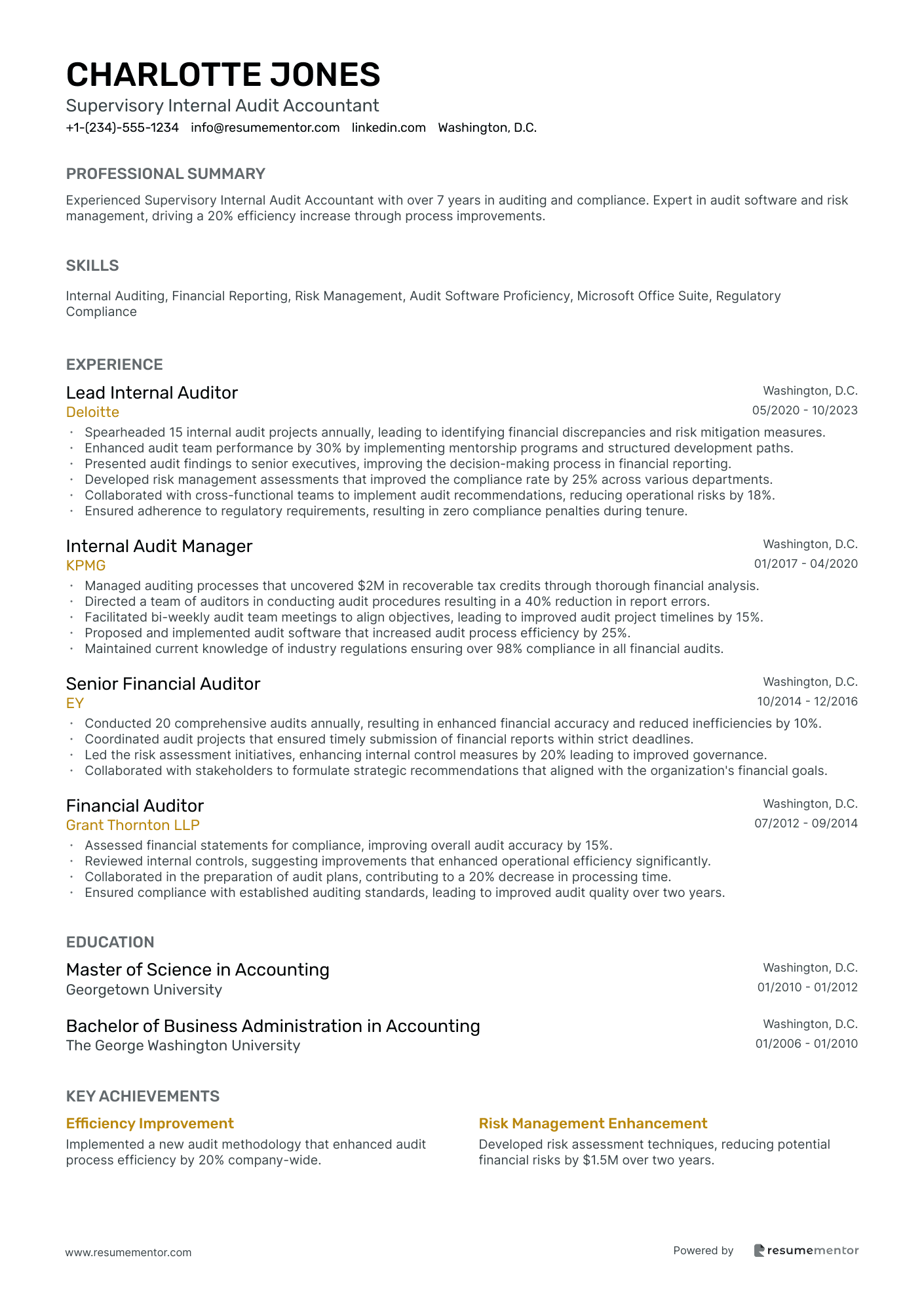

Supervisory Internal Audit Accountant resume sample

- •Spearheaded 15 internal audit projects annually, leading to identifying financial discrepancies and risk mitigation measures.

- •Enhanced audit team performance by 30% by implementing mentorship programs and structured development paths.

- •Presented audit findings to senior executives, improving the decision-making process in financial reporting.

- •Developed risk management assessments that improved the compliance rate by 25% across various departments.

- •Collaborated with cross-functional teams to implement audit recommendations, reducing operational risks by 18%.

- •Ensured adherence to regulatory requirements, resulting in zero compliance penalties during tenure.

- •Managed auditing processes that uncovered $2M in recoverable tax credits through thorough financial analysis.

- •Directed a team of auditors in conducting audit procedures resulting in a 40% reduction in report errors.

- •Facilitated bi-weekly audit team meetings to align objectives, leading to improved audit project timelines by 15%.

- •Proposed and implemented audit software that increased audit process efficiency by 25%.

- •Maintained current knowledge of industry regulations ensuring over 98% compliance in all financial audits.

- •Conducted 20 comprehensive audits annually, resulting in enhanced financial accuracy and reduced inefficiencies by 10%.

- •Coordinated audit projects that ensured timely submission of financial reports within strict deadlines.

- •Led the risk assessment initiatives, enhancing internal control measures by 20% leading to improved governance.

- •Collaborated with stakeholders to formulate strategic recommendations that aligned with the organization's financial goals.

- •Assessed financial statements for compliance, improving overall audit accuracy by 15%.

- •Reviewed internal controls, suggesting improvements that enhanced operational efficiency significantly.

- •Collaborated in the preparation of audit plans, contributing to a 20% decrease in processing time.

- •Ensured compliance with established auditing standards, leading to improved audit quality over two years.

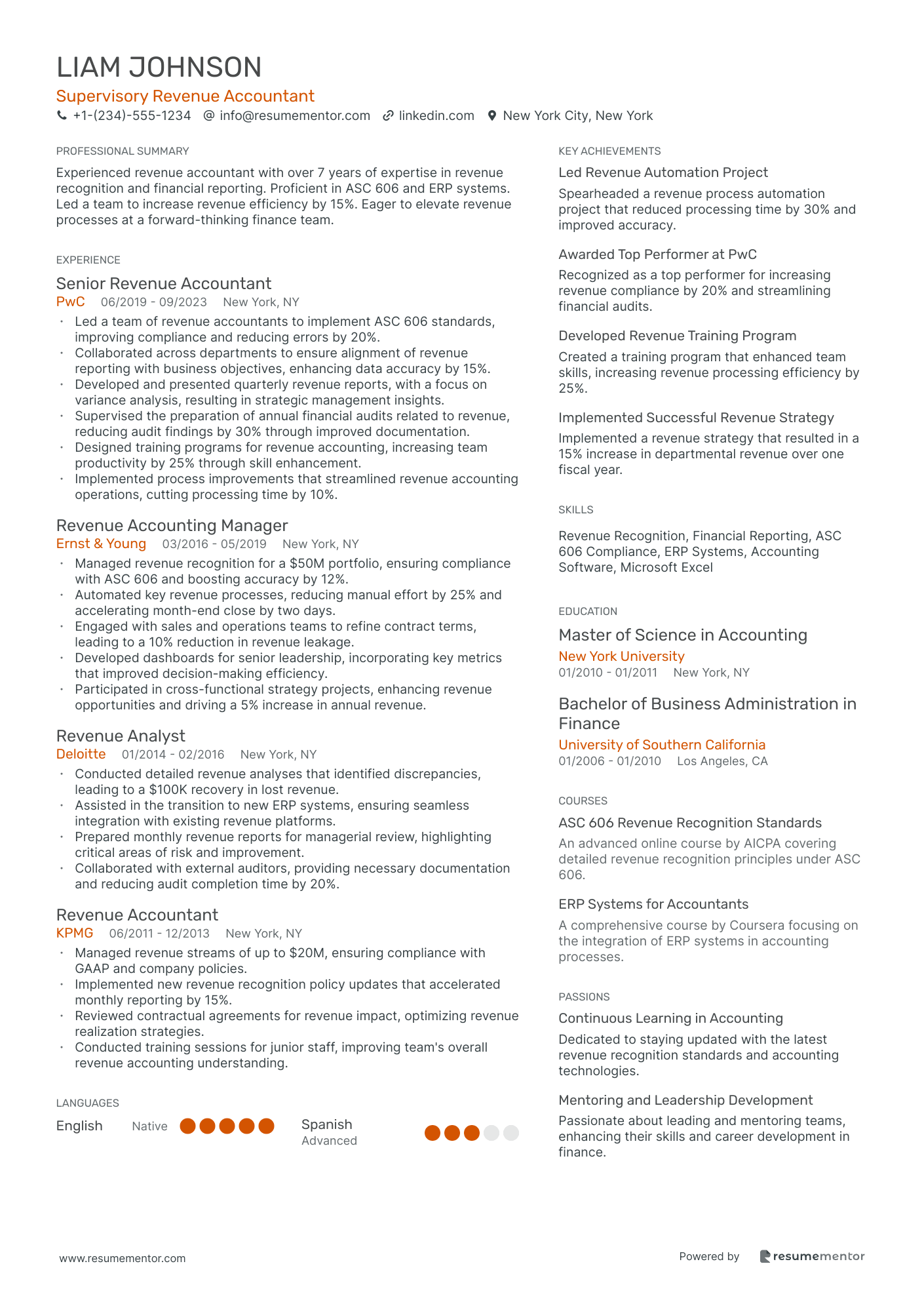

Supervisory Revenue Accountant resume sample

- •Led a team of revenue accountants to implement ASC 606 standards, improving compliance and reducing errors by 20%.

- •Collaborated across departments to ensure alignment of revenue reporting with business objectives, enhancing data accuracy by 15%.

- •Developed and presented quarterly revenue reports, with a focus on variance analysis, resulting in strategic management insights.

- •Supervised the preparation of annual financial audits related to revenue, reducing audit findings by 30% through improved documentation.

- •Designed training programs for revenue accounting, increasing team productivity by 25% through skill enhancement.

- •Implemented process improvements that streamlined revenue accounting operations, cutting processing time by 10%.

- •Managed revenue recognition for a $50M portfolio, ensuring compliance with ASC 606 and boosting accuracy by 12%.

- •Automated key revenue processes, reducing manual effort by 25% and accelerating month-end close by two days.

- •Engaged with sales and operations teams to refine contract terms, leading to a 10% reduction in revenue leakage.

- •Developed dashboards for senior leadership, incorporating key metrics that improved decision-making efficiency.

- •Participated in cross-functional strategy projects, enhancing revenue opportunities and driving a 5% increase in annual revenue.

- •Conducted detailed revenue analyses that identified discrepancies, leading to a $100K recovery in lost revenue.

- •Assisted in the transition to new ERP systems, ensuring seamless integration with existing revenue platforms.

- •Prepared monthly revenue reports for managerial review, highlighting critical areas of risk and improvement.

- •Collaborated with external auditors, providing necessary documentation and reducing audit completion time by 20%.

- •Managed revenue streams of up to $20M, ensuring compliance with GAAP and company policies.

- •Implemented new revenue recognition policy updates that accelerated monthly reporting by 15%.

- •Reviewed contractual agreements for revenue impact, optimizing revenue realization strategies.

- •Conducted training sessions for junior staff, improving team's overall revenue accounting understanding.

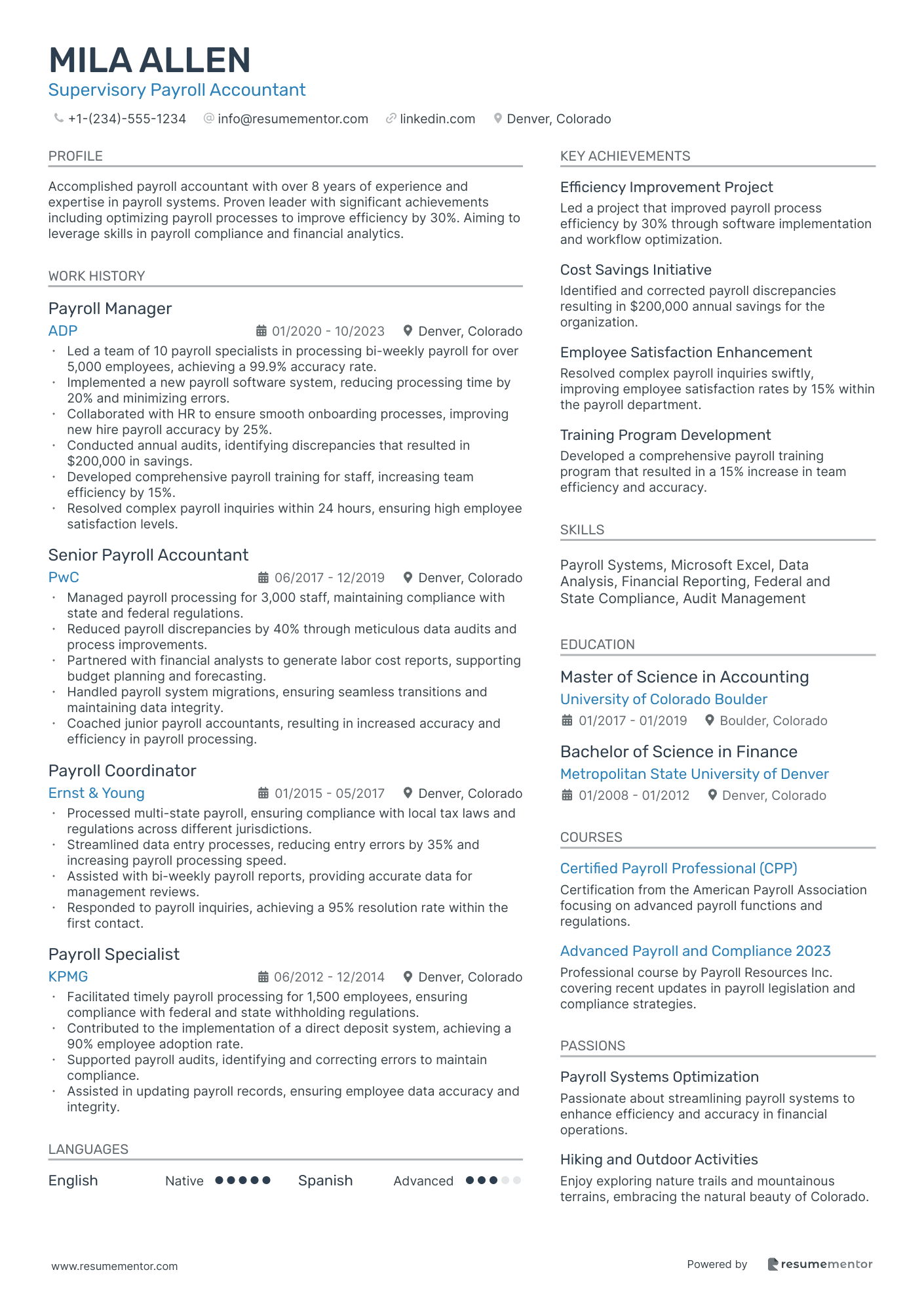

Supervisory Payroll Accountant resume sample

- •Led a team of 10 payroll specialists in processing bi-weekly payroll for over 5,000 employees, achieving a 99.9% accuracy rate.

- •Implemented a new payroll software system, reducing processing time by 20% and minimizing errors.

- •Collaborated with HR to ensure smooth onboarding processes, improving new hire payroll accuracy by 25%.

- •Conducted annual audits, identifying discrepancies that resulted in $200,000 in savings.

- •Developed comprehensive payroll training for staff, increasing team efficiency by 15%.

- •Resolved complex payroll inquiries within 24 hours, ensuring high employee satisfaction levels.

- •Managed payroll processing for 3,000 staff, maintaining compliance with state and federal regulations.

- •Reduced payroll discrepancies by 40% through meticulous data audits and process improvements.

- •Partnered with financial analysts to generate labor cost reports, supporting budget planning and forecasting.

- •Handled payroll system migrations, ensuring seamless transitions and maintaining data integrity.

- •Coached junior payroll accountants, resulting in increased accuracy and efficiency in payroll processing.

- •Processed multi-state payroll, ensuring compliance with local tax laws and regulations across different jurisdictions.

- •Streamlined data entry processes, reducing entry errors by 35% and increasing payroll processing speed.

- •Assisted with bi-weekly payroll reports, providing accurate data for management reviews.

- •Responded to payroll inquiries, achieving a 95% resolution rate within the first contact.

- •Facilitated timely payroll processing for 1,500 employees, ensuring compliance with federal and state withholding regulations.

- •Contributed to the implementation of a direct deposit system, achieving a 90% employee adoption rate.

- •Supported payroll audits, identifying and correcting errors to maintain compliance.

- •Assisted in updating payroll records, ensuring employee data accuracy and integrity.

In the world of finance, as a supervisory accountant, you’re like the captain steering a ship through intricate financial waters. Your blend of accounting skills and leadership qualities prepares you to guide teams to success smoothly. Yet, when it comes to writing your resume, even seasoned professionals can face challenges in how best to present themselves. Crafting a resume that balances your financial expertise with your leadership abilities is key. It’s easy to get lost in technical details and overlook the importance of highlighting your management skills.

Finding the right structure can make this process much easier. A resume template provides a framework to effectively organize your thoughts, allowing you to focus on what truly matters. These templates help you streamline your content, ensuring that your key career achievements stand out without unnecessary clutter.

Creating a standout resume involves more than just listing qualifications; it’s about illustrating your impact on financial operations. Understanding what recruiters look for in a supervisory accountant enables you to tailor your resume to those expectations. An eye-catching layout also plays a crucial role in capturing and holding a reader's attention.

Navigating the job market successfully means continuously refining how you present your multifaceted talents. This involves showcasing your technical expertise alongside your ability to lead teams and manage financial strategies effectively. Together, let’s create a resume that boosts your career prospects and helps you land your next role.

Key Takeaways

- Crafting a teacher resume involves effectively balancing your teaching credentials with management skills to ensure your expertise and leadership are prominent.

- Utilizing a resume template helps organize content, streamline achievements, and emphasize key qualifications without unnecessary clutter.

- Tailoring your resume to align with employment goals and industry expectations is crucial for showcasing the impact made on educational settings.

- The resume's format should highlight both technical knowledge and teaching leadership skills to leave a strong impression on potential employers.

- Including quantifiable achievements and using action verbs enhances the resume's readability and demonstrates competence and initiative.

What to focus on when writing your supervisory accountant resume

A supervisory accountant resume should clearly convey your financial expertise, leadership skills, and attention to detail—capturing your ability to manage accounting operations and lead a team. Your experience with budgeting, financial reporting, and ensuring compliance needs to be highlighted. A well-structured resume that is both ATS-friendly and engaging for readers is crucial.

How to structure your supervisory accountant resume

- Contact Information: Your contact details should be easy to locate at the top of your resume. Include your name, phone number, professional email, and LinkedIn profile. This information should stand out to ensure recruiters can easily reach you.

- Professional Summary: The summary is your elevator pitch. Introduce your background in supervisory accounting, focusing on your key strengths such as team leadership and financial analysis. This sets the tone for the rest of your resume by aligning your skills with the job requirements.

- Work Experience: Use bullet points to clearly outline your previous roles in accounting, detailing your responsibilities and accomplishments. Highlight how you improved financial processes, reduced costs, or led successful audits. This section illustrates your ability to apply your skills in real-world scenarios.

- Education: List your academic background, including degrees, certifications, and any relevant coursework. Mentioning credentials like a CPA certification strengthens your qualifications and links to the skills you possess.

- Skills: Include a section for your core competencies such as financial reporting, data analysis, and software proficiency in tools like QuickBooks and SAP. This section is essential to underscore your technical expertise and how it applies to accounting operations.

- Certifications: Highlight any certifications related to finance, particularly those that demonstrate leadership or specific accounting skills, such as advanced Excel certification or a Chartered Accountant credential. This shows your commitment to professional growth.

As we delve into each section more in-depth, we'll focus on structuring your resume effectively to capture all your qualifications and achievements.

Which resume format to choose

For your supervisory accountant resume, using a chronological format is highly effective. This format not only underscores your progressive career journey but also highlights your extensive experience in managing accounting operations, essential for this role. When it comes to font choice, modern options like Rubic, Lato, and Montserrat lend your resume a clean and polished look. These fonts convey professionalism while allowing your skills and achievements to shine through without distraction.

Save and send your resume as a PDF to ensure your meticulous formatting is preserved across all platforms and devices. This step is crucial because consistent presentation underscores your attention to detail, a vital trait for a supervisory accountant.

Setting your margins to 1 inch on all sides creates ample white space, helping guide the reader's eye smoothly through the document. This balance between text and space not only makes your resume easy to read but also reflects the organizational skills expected in your field. Collectively, these elements craft a resume that exudes professionalism and efficiently communicates your qualifications.

How to write a quantifiable resume experience section

Creating a standout supervisory accountant experience section is crucial for capturing attention, as it highlights your achievements and capabilities while aligning your skills with the job requirements. Focus on using strong action words and ensure your achievements are measurable to make an impact. Organize your experiences with the most recent first, so your latest accomplishments are immediately visible. Typically, you'll include work from the last 10-15 years and select job titles relevant to the position you're targeting. Tailoring your resume to the job ad involves using similar language and highlighting key requirements, ensuring your presentation is directly aligned with employer expectations. By choosing action words like "led," "managed," "developed," and "implemented," you effectively convey your authority and competence in the field.

- •Reduced the month-end close process by 30% by implementing automated reconciliation procedures.

- •Supervised a team of 10 accountants, boosting productivity by 15% in the first year.

- •Developed a budgeting system that increased the accuracy of financial forecasts by 25%.

- •Led a project that enhanced internal controls, cutting audit findings by 40%.

Your experience section shines because it strategically highlights your leadership and results, using strong action verbs to demonstrate your initiative. Quantifiable achievements offer clear evidence of your ability to deliver meaningful results, seamlessly linking past contributions to future potential. By tailoring the language to industry standards and focusing on specific achievements, you signal to employers that you understand and can meet their needs. This concise storytelling effectively captures your career trajectory, emphasizing not only leadership but also the productivity that drives success. This clarity helps hiring managers quickly appreciate the value you bring to their organization.

Achievement-Focused resume experience section

A supervisory accountant-focused resume experience section should highlight the impact you've made in your previous roles, showcasing your contributions to operational success. Begin by emphasizing specific achievements that demonstrate your proficiency in managing financial tasks and leading teams. Use concrete numbers and examples to effectively illustrate your accomplishments. Each bullet point should start with an action verb, clearly communicating the results of your efforts and keeping the information relevant and concise.

By tailoring each entry to match the qualifications employers seek in a supervisory accountant, your resume can stand out. Highlight leadership experiences like guiding a team or implementing strategic initiatives, which show your ability to solve problems and improve processes. By showcasing how you've achieved cost reductions or enhanced efficiency, you illustrate your proactive approach and ability to deliver tangible results.

Supervisory Accountant

Finance Solutions Inc.

June 2018 - Present

- Led a team of 10 accountants, improving monthly financial reporting speed by 30%

- Initiated cost-reduction strategies that resulted in $200,000 annual savings

- Developed a new budgeting system that increased forecasting accuracy by 15%

- Coached and mentored junior accountants, leading to a 20% improvement in team productivity

Efficiency-Focused resume experience section

An efficiency-focused supervisory accountant resume experience section should highlight your ability to enhance financial operations through process improvements and cost reductions. Reflect on specific instances where you introduced tools or methods that streamlined workflows. Ensure these claims are backed by numbers, like percentage reductions in processing time or cost savings. It's also important to emphasize initiatives where you led a team, illustrating your leadership skills and impact.

Your goal is to present yourself as a resourceful problem-solver who adds value through efficient financial practices. Use strong action verbs like "enhanced," "managed," and "optimized" to convey your contributions confidently. Connect your achievements to the broader goals of the companies you've worked for, showing that your strategies align with their overall objectives. This approach provides clear evidence for potential employers of how you can improve their financial departments.

Supervisory Accountant

ABC Financial Group

2020 - Present

- Reduced the monthly closing process time by 30% with a new streamlined reporting system, aligning with company goals for faster reporting.

- Led a team that successfully automated data entry, which boosted accuracy and saved over 150 hours annually, contributing to improved team productivity.

- Conducted training sessions that enhanced the team's software skills, leading to a 20% reduction in errors, and supporting a culture of continuous improvement.

- Implemented cost-control measures that decreased office supply expenses by 15% annually, reinforcing the company's commitment to reducing operational costs.

Responsibility-Focused resume experience section

A responsibility-focused supervisory accountant resume experience section should clearly present how you manage accounting tasks while leading a team effectively. Your job experiences should highlight your leadership skills and your ability to enhance financial processes. Clearly detail your responsibilities, such as preparing budgets, overseeing financial reporting, and ensuring compliance with regulations to show a cohesive picture of your role. To make your impact tangible, use numbers and results to demonstrate how your efforts have positively influenced the company by reducing costs or streamlining procedures.

Organize the experience section with concise bullet points that reflect your key duties and achievements, linked by a common goal of organizational success. Begin each bullet with a strong action verb to convey determination and accomplishment, seamlessly tying your day-to-day responsibilities with the outcomes you have achieved. By weaving a narrative through these points, you illustrate how you’ve driven improved results for your company through leadership and teamwork. Tailor each entry to showcase the unique contributions you’ve made, ensuring the reader sees a cohesive story of your professional journey.

Supervisory Accountant

ABC Financial Solutions

June 2019 - Present

- Led a team of 5 accountants, boosting efficiency by 20% through streamlined processes.

- Developed and implemented budget plans that cut overall expenses by 10% for the fiscal year.

- Oversaw monthly financial reporting, ensuring 100% accuracy for senior management reviews.

- Maintained compliance with financial regulations, achieving zero audit findings over three years.

Leadership-Focused resume experience section

A leadership-focused supervisory accountant resume experience section should emphasize your ability to guide and inspire teams while making a measurable impact on the organization. By starting with your leadership qualities and achievements, you demonstrate how effectively you guide your team to success. Tailor your job descriptions to illustrate the ways you've driven team and organizational achievements, such as enhancing processes, saving costs, or improving financial reporting.

In each role, offer specific examples of projects or initiatives where you took charge. Clearly structure this information with bullet points, showing your actions and the results. Whenever possible, quantify your impact, highlighting improvements in efficiency or financial accuracy. Your aim is to connect your skills and leadership qualities, proving to hiring managers that you're not only proficient in accounting but also a capable leader.

Supervisory Accountant

Acme Corporation

January 2020 - Present

- Led a team of five accountants, improving financial reporting accuracy by 15%.

- Implemented a new budgeting process that reduced overhead costs by 10%.

- Coached and developed junior staff, leading to two team members earning promotions.

- Streamlined the month-end close process, cutting completion time by 20%.

Write your supervisory accountant resume summary section

A supervisory accountant-focused resume summary should highlight your extensive experience, unique skills, and notable achievements in a cohesive manner. Emphasizing relevant certifications or significant projects you’ve led can effectively showcase your expertise. Clear and specific language about your accomplishments and strengths is crucial for making your summary shine. Consider this example:

This example weaves together your skills and achievements to present a compelling narrative about your capabilities. For newcomers to the field, a resume objective might be more fitting. It zeroes in on your career goals and what you aspire to accomplish, providing a glimpse into your professional intentions. While a summary focuses on past accomplishments, an objective emphasizes future goals, making it ideal for less experienced candidates aiming to impress with their ambition.

Meanwhile, a resume profile, which offers a broader overview by including personal attributes and skills, helps paint a fuller picture of you as a professional. In contrast, a summary of qualifications presents a bullet-point list of your core achievements and skills, which is particularly effective for those with varied experience. By understanding the nuances of each section type, you can tailor your resume to suit your career stage and experience, ensuring it captures attention while clearly communicating your value.

Listing your supervisory accountant skills on your resume

A skills-focused supervisory accountant resume should clearly highlight your qualifications from the start. You can choose to create a separate skills section or integrate it into your summary and experience areas. This strategy allows you to effectively spotlight your capabilities. Your strengths often include soft skills like leadership and communication, which complement the hard skills required for the role. Hard skills refer to the technical abilities you've developed through training or experience, such as financial analysis or budgeting. Including a blend of these skills and strengths acts as keywords, making your resume more searchable to attract potential employers.

Here's a sample skills section for this role:

This section is clearly laid out and focused on the key competencies needed for a supervisory accountant. By including both technical and leadership skills, it provides a holistic view of your professional abilities.

Best hard skills to feature on your supervisory accountant resume

Your hard skills should reflect your expertise in financial management and analysis. These competencies illustrate your ability to perform detailed accounting tasks with precision. Highlight skills that show your technical proficiency and effectiveness in managing accounting responsibilities.

Hard Skills

- Financial Analysis

- Budgeting

- Regulatory Compliance

- Tax Preparation

- Cost Accounting

- Project Management

- Microsoft Excel

- Forecasting

- Financial Reporting

- Auditing

- Internal Controls

- Accounts Payable/Receivable

- QuickBooks

- Payroll Management

- General Ledger Reconciliation

Best soft skills to feature on your supervisory accountant resume

Your soft skills should highlight your ability to lead and communicate effectively. These qualities demonstrate your proficiency in working collaboratively and adapting within a dynamic environment. Focus on skills that emphasize your leadership and problem-solving strengths.

Soft Skills

- Leadership

- Communication

- Problem-solving

- Team Collaboration

- Attention to Detail

- Decision Making

- Time Management

- Adaptability

- Organization

- Conflict Resolution

- Critical Thinking

- Empathy

- Stress Management

- Negotiation

- Creativity

How to include your education on your resume

The education section is a crucial part of your resume, especially for a supervisory accountant role. It showcases your academic background and sets the foundation for your qualifications. Make sure to tailor this section to the job you are applying for. Include relevant degrees and omit any unrelated education. When listing your degree, be clear and concise. For example, instead of writing "Bachelor of Science," specify "Bachelor of Science in Accounting."

If you graduated with honors, such as cum laude, include this distinction as it highlights your academic achievements. To showcase your GPA, insert it if it's impressive, usually 3.5 or higher. For transparency, use the format "GPA: 3.7/4.0."

Here's an unclear example of an education section:

And here's a strong example for a supervisory accountant position:

- •Graduated Cum Laude

The second example is strong because it specifies a relevant degree for an accounting role and includes the GPA as well as the "Cum Laude" honor. This clearly shows your academic qualifications, emphasizes your achievement, and highlights your relevance to the position.

How to include supervisory accountant certificates on your resume

Including a certificates section on your resume is a crucial step for a supervisory accountant. List the name of the certificate, ensuring it's relevant to accounting or finance. Include the date you obtained the certification to give employers a timeline of your credentials. Add the issuing organization to add credibility and context to your qualifications. Certificates can also be placed in the header for easy visibility.

For example, you might include this in your header:

Jane Smith, CPA, CIA, CMA Supervisory Accountant

A strong standalone certificates section would look something like this:

This example is effective because it shows relevant certifications that demonstrate advanced skills. Each certification is clearly listed with the associated issuing body, adding authority to your skills. Employers can quickly see your qualifications, making you a strong candidate for a supervisory role in accounting.

Extra sections to include in your supervisory accountant resume

Creating a resume for a supervisory accountant position can feel overwhelming, but including diverse sections may give you an edge. These sections showcase not only your expertise but also your personal traits and broader skills.

Language section — Highlight any additional languages you speak fluently. This can demonstrate your global communication capabilities and increase your value in multi-national firms.

Hobbies and interests section — Share activities that reflect soft skills like leadership or analytical thinking. This gives recruiters a glimpse into your personality and how you might fit into the team culture.

Volunteer work section — Detail any volunteer experience, especially in finance-related roles. This exhibits your community commitment and expands on your hands-on abilities.

Books section — List up to three finance or leadership books you've read. This signals that you are actively seeking knowledge and staying updated in your field.

Including these sections enriches your resume, highlighting your well-rounded profile. They can make your application stand out and show that you bring more than just professional skills to the table.

In Conclusion

In conclusion, building a strong supervisory accountant resume is about showcasing both your accounting prowess and your ability to lead a team effectively. By using a clear structure and a chronological format, you can highlight your career progression and accomplishments in managing finances. Including quantifiable results within your experience section offers concrete evidence of your impact on previous organizations, making your resume compelling and persuasive to potential employers. Don't forget to emphasize both hard skills, such as financial analysis and regulatory compliance, and soft skills like leadership and communication for a balanced profile.

A well-crafted summary section can capture your years of experience and key achievements, setting the tone for the rest of your resume. When detailing your educational background, remember to specify relevant degrees and any honors, as they underscore your qualifications and dedication. Certificates related to accounting are also critical in establishing your credibility and expertise in the field.

Additionally, consider adding sections like languages, hobbies, or volunteer work to give a fuller picture of who you are beyond your professional skills. These elements can help you stand out in a competitive job market by highlighting your unique attributes and interests.

Finally, remember to tailor your resume to each job application by incorporating industry-specific terms and focusing on the qualifications that match the job description. With attention to detail and careful presentation, your resume can effectively communicate your value and readiness for the next challenging role as a supervisory accountant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.