Tally Accountant Resume Examples

Jul 18, 2024

|

12 min read

Balance your career success with our guide on how to write a tally accountant resume that adds up. Make your skills shine and land that dream job in accounting with ease.

Rated by 348 people

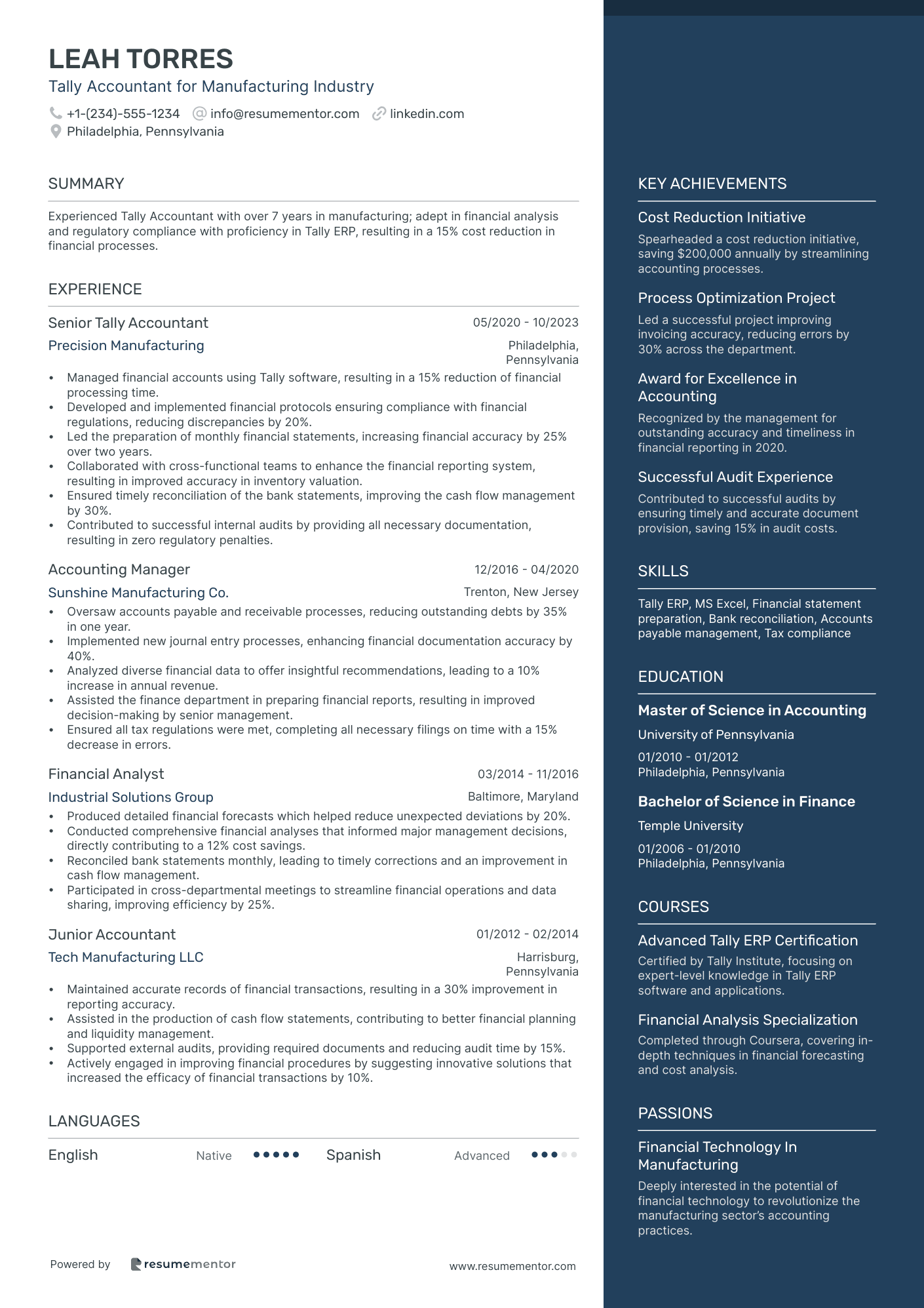

Tally Accountant for Manufacturing Industry

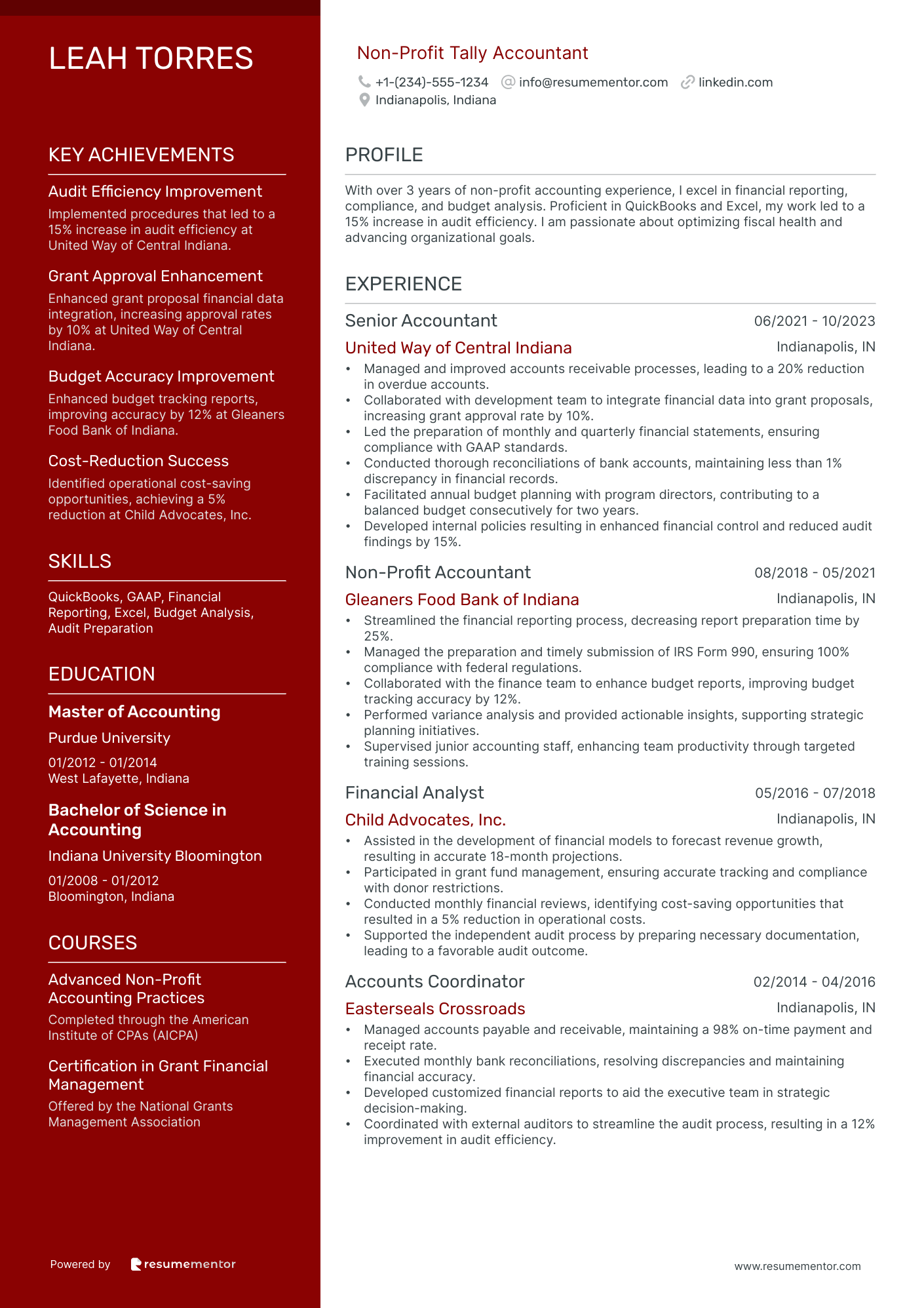

Non-Profit Tally Accountant

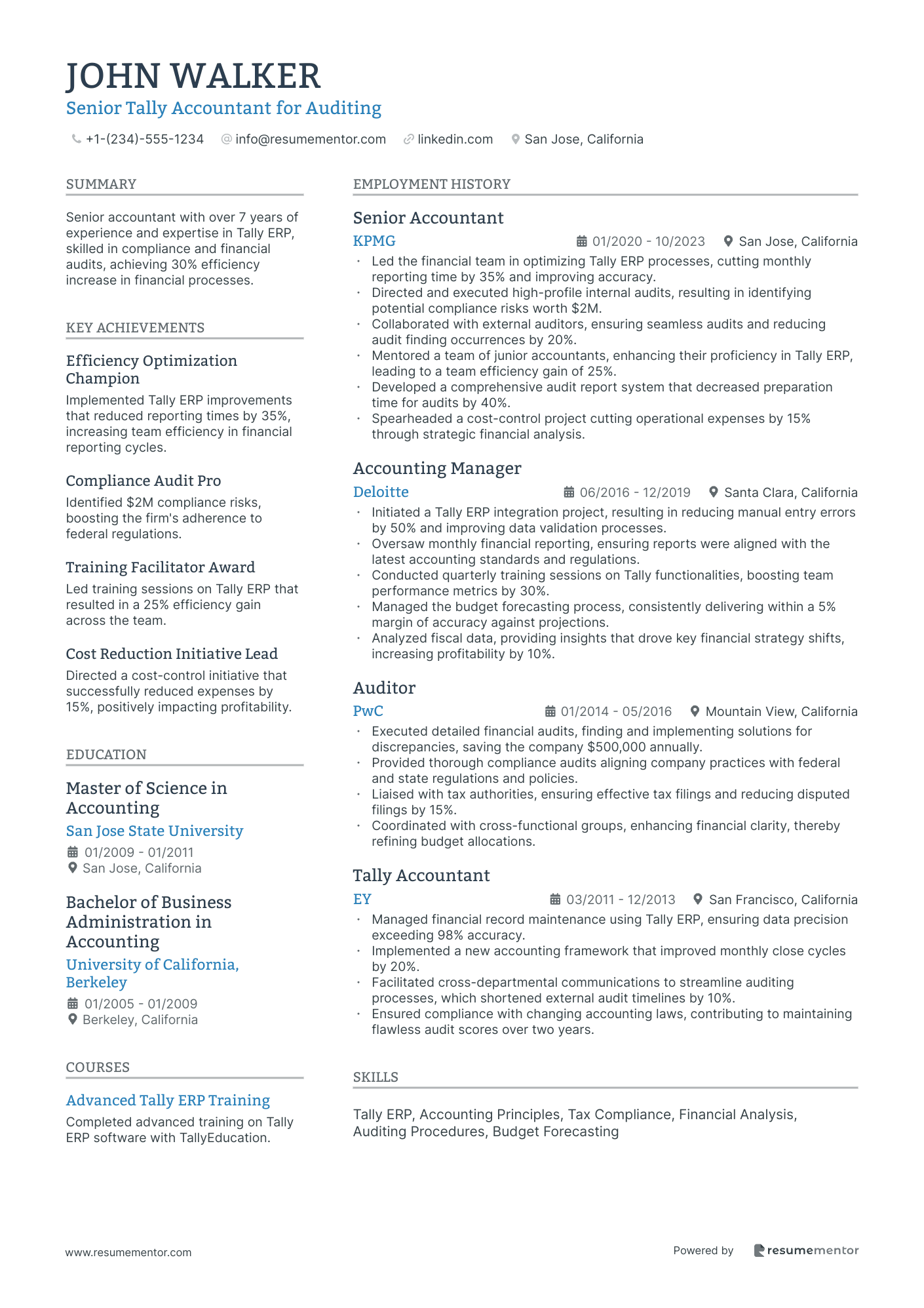

Senior Tally Accountant for Auditing

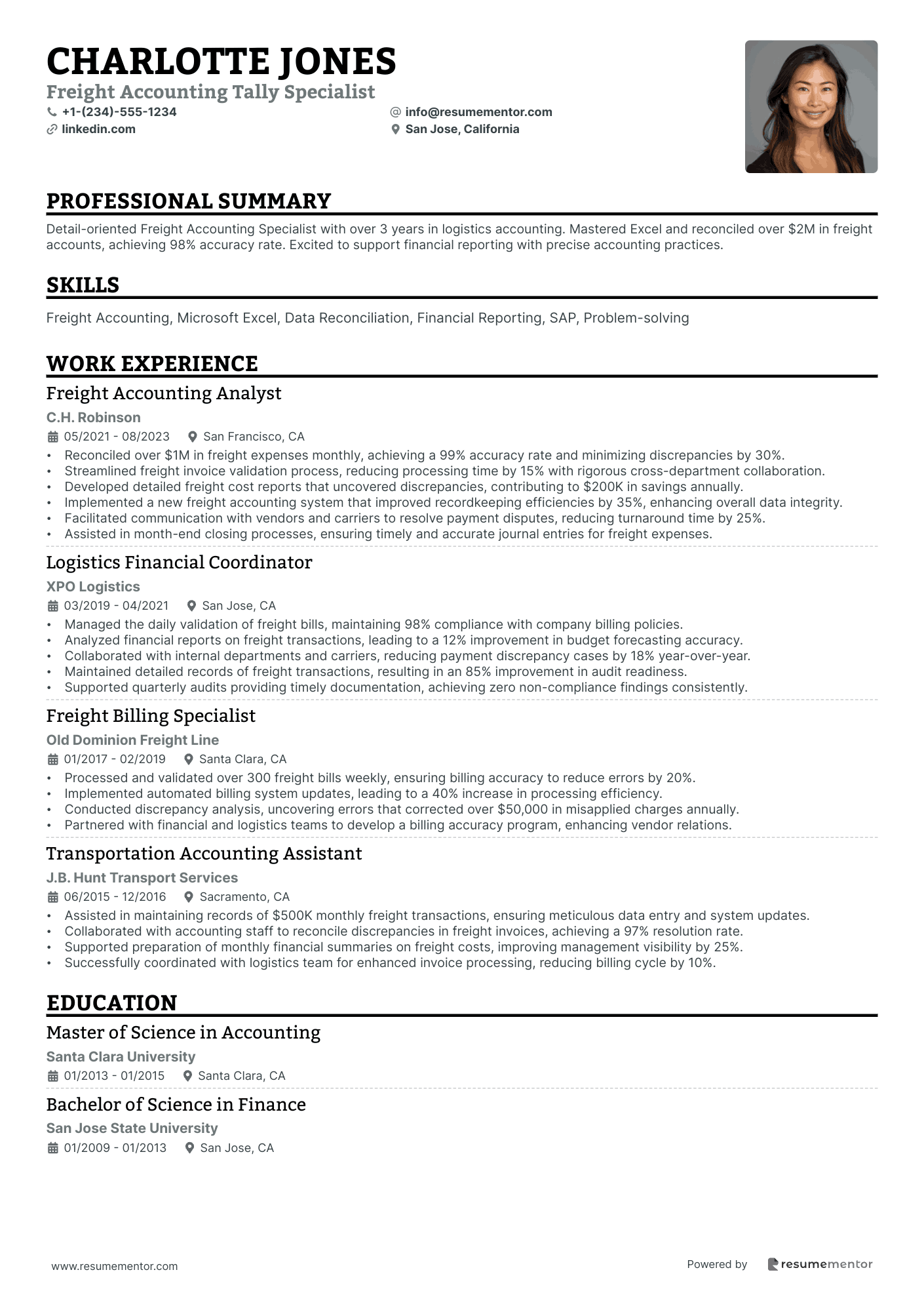

Freight Accounting Tally Specialist

Retail Business Tally Accountant

Tally Accountant with Tax Specialization

Financial Analysis Tally Accountant

Investment Tally Accounting Specialist

Public Sector Tally Accountant

Payroll Tally Accounting Specialist

Tally Accountant for Manufacturing Industry resume sample

When applying for a position in the manufacturing industry, it's important to highlight your knowledge of inventory management and cost accounting. Detail any experience with production budgeting or variance analysis, as these are critical for determining profitability. If you've completed courses in 'Cost Accounting' or 'Inventory Control', be sure to mention them, including their duration. Use quantifiable achievements to demonstrate your contributions, such as how your financial analyses led to a specific percentage increase in efficiency or cost reduction for your previous employers.

- •Managed financial accounts using Tally software, resulting in a 15% reduction of financial processing time.

- •Developed and implemented financial protocols ensuring compliance with financial regulations, reducing discrepancies by 20%.

- •Led the preparation of monthly financial statements, increasing financial accuracy by 25% over two years.

- •Collaborated with cross-functional teams to enhance the financial reporting system, resulting in improved accuracy in inventory valuation.

- •Ensured timely reconciliation of the bank statements, improving the cash flow management by 30%.

- •Contributed to successful internal audits by providing all necessary documentation, resulting in zero regulatory penalties.

- •Oversaw accounts payable and receivable processes, reducing outstanding debts by 35% in one year.

- •Implemented new journal entry processes, enhancing financial documentation accuracy by 40%.

- •Analyzed diverse financial data to offer insightful recommendations, leading to a 10% increase in annual revenue.

- •Assisted the finance department in preparing financial reports, resulting in improved decision-making by senior management.

- •Ensured all tax regulations were met, completing all necessary filings on time with a 15% decrease in errors.

- •Produced detailed financial forecasts which helped reduce unexpected deviations by 20%.

- •Conducted comprehensive financial analyses that informed major management decisions, directly contributing to a 12% cost savings.

- •Reconciled bank statements monthly, leading to timely corrections and an improvement in cash flow management.

- •Participated in cross-departmental meetings to streamline financial operations and data sharing, improving efficiency by 25%.

- •Maintained accurate records of financial transactions, resulting in a 30% improvement in reporting accuracy.

- •Assisted in the production of cash flow statements, contributing to better financial planning and liquidity management.

- •Supported external audits, providing required documents and reducing audit time by 15%.

- •Actively engaged in improving financial procedures by suggesting innovative solutions that increased the efficacy of financial transactions by 10%.

Non-Profit Tally Accountant resume sample

When applying for this role, it’s important to showcase your experience with budgeting and financial reporting in the non-profit sector. Highlight any experience with grant management and fund allocation. Strong analytical skills are essential, so include examples of how you’ve tracked expenses or improved financial processes. If you have certifications in non-profit financial management or relevant coursework, mention these to demonstrate your commitment. Use specific results to illustrate your impact, such as how your financial oversight helped secure additional funding or streamline operations.

- •Managed and improved accounts receivable processes, leading to a 20% reduction in overdue accounts.

- •Collaborated with development team to integrate financial data into grant proposals, increasing grant approval rate by 10%.

- •Led the preparation of monthly and quarterly financial statements, ensuring compliance with GAAP standards.

- •Conducted thorough reconciliations of bank accounts, maintaining less than 1% discrepancy in financial records.

- •Facilitated annual budget planning with program directors, contributing to a balanced budget consecutively for two years.

- •Developed internal policies resulting in enhanced financial control and reduced audit findings by 15%.

- •Streamlined the financial reporting process, decreasing report preparation time by 25%.

- •Managed the preparation and timely submission of IRS Form 990, ensuring 100% compliance with federal regulations.

- •Collaborated with the finance team to enhance budget reports, improving budget tracking accuracy by 12%.

- •Performed variance analysis and provided actionable insights, supporting strategic planning initiatives.

- •Supervised junior accounting staff, enhancing team productivity through targeted training sessions.

- •Assisted in the development of financial models to forecast revenue growth, resulting in accurate 18-month projections.

- •Participated in grant fund management, ensuring accurate tracking and compliance with donor restrictions.

- •Conducted monthly financial reviews, identifying cost-saving opportunities that resulted in a 5% reduction in operational costs.

- •Supported the independent audit process by preparing necessary documentation, leading to a favorable audit outcome.

- •Managed accounts payable and receivable, maintaining a 98% on-time payment and receipt rate.

- •Executed monthly bank reconciliations, resolving discrepancies and maintaining financial accuracy.

- •Developed customized financial reports to aid the executive team in strategic decision-making.

- •Coordinated with external auditors to streamline the audit process, resulting in a 12% improvement in audit efficiency.

Senior Tally Accountant for Auditing resume sample

When applying for this role, highlight your experience with financial auditing and compliance. Mention any specific accounting software you are proficient in, especially those relevant to auditing processes. Include certifications such as 'Certified Internal Auditor' or 'Certified Public Accountant' to demonstrate your commitment to the field. Use quantifiable achievements to illustrate how you've improved financial accuracy or increased audit efficiency. Structure your cover letter to reflect a 'skill-action-result' format, showing how your expertise can add value to the auditing team and enhance overall performance.

- •Led the financial team in optimizing Tally ERP processes, cutting monthly reporting time by 35% and improving accuracy.

- •Directed and executed high-profile internal audits, resulting in identifying potential compliance risks worth $2M.

- •Collaborated with external auditors, ensuring seamless audits and reducing audit finding occurrences by 20%.

- •Mentored a team of junior accountants, enhancing their proficiency in Tally ERP, leading to a team efficiency gain of 25%.

- •Developed a comprehensive audit report system that decreased preparation time for audits by 40%.

- •Spearheaded a cost-control project cutting operational expenses by 15% through strategic financial analysis.

- •Initiated a Tally ERP integration project, resulting in reducing manual entry errors by 50% and improving data validation processes.

- •Oversaw monthly financial reporting, ensuring reports were aligned with the latest accounting standards and regulations.

- •Conducted quarterly training sessions on Tally functionalities, boosting team performance metrics by 30%.

- •Managed the budget forecasting process, consistently delivering within a 5% margin of accuracy against projections.

- •Analyzed fiscal data, providing insights that drove key financial strategy shifts, increasing profitability by 10%.

- •Executed detailed financial audits, finding and implementing solutions for discrepancies, saving the company $500,000 annually.

- •Provided thorough compliance audits aligning company practices with federal and state regulations and policies.

- •Liaised with tax authorities, ensuring effective tax filings and reducing disputed filings by 15%.

- •Coordinated with cross-functional groups, enhancing financial clarity, thereby refining budget allocations.

- •Managed financial record maintenance using Tally ERP, ensuring data precision exceeding 98% accuracy.

- •Implemented a new accounting framework that improved monthly close cycles by 20%.

- •Facilitated cross-departmental communications to streamline auditing processes, which shortened external audit timelines by 10%.

- •Ensured compliance with changing accounting laws, contributing to maintaining flawless audit scores over two years.

Freight Accounting Tally Specialist resume sample

When applying for this role, it's essential to highlight your experience with logistics and transportation management. Showcase your familiarity with freight regulations and accounting principles. If you have completed certifications in 'Freight Accounting' or 'Logistics Management', make sure they are prominent in your application. Provide specific examples of how your organizational skills streamlined processes or minimized errors in previous positions. Use a 'skill-action-result' framework to demonstrate how your analytical abilities improved financial tracking and reporting. This clarity will strengthen your application.

- •Reconciled over $1M in freight expenses monthly, achieving a 99% accuracy rate and minimizing discrepancies by 30%.

- •Streamlined freight invoice validation process, reducing processing time by 15% with rigorous cross-department collaboration.

- •Developed detailed freight cost reports that uncovered discrepancies, contributing to $200K in savings annually.

- •Implemented a new freight accounting system that improved recordkeeping efficiencies by 35%, enhancing overall data integrity.

- •Facilitated communication with vendors and carriers to resolve payment disputes, reducing turnaround time by 25%.

- •Assisted in month-end closing processes, ensuring timely and accurate journal entries for freight expenses.

- •Managed the daily validation of freight bills, maintaining 98% compliance with company billing policies.

- •Analyzed financial reports on freight transactions, leading to a 12% improvement in budget forecasting accuracy.

- •Collaborated with internal departments and carriers, reducing payment discrepancy cases by 18% year-over-year.

- •Maintained detailed records of freight transactions, resulting in an 85% improvement in audit readiness.

- •Supported quarterly audits providing timely documentation, achieving zero non-compliance findings consistently.

- •Processed and validated over 300 freight bills weekly, ensuring billing accuracy to reduce errors by 20%.

- •Implemented automated billing system updates, leading to a 40% increase in processing efficiency.

- •Conducted discrepancy analysis, uncovering errors that corrected over $50,000 in misapplied charges annually.

- •Partnered with financial and logistics teams to develop a billing accuracy program, enhancing vendor relations.

- •Assisted in maintaining records of $500K monthly freight transactions, ensuring meticulous data entry and system updates.

- •Collaborated with accounting staff to reconcile discrepancies in freight invoices, achieving a 97% resolution rate.

- •Supported preparation of monthly financial summaries on freight costs, improving management visibility by 25%.

- •Successfully coordinated with logistics team for enhanced invoice processing, reducing billing cycle by 10%.

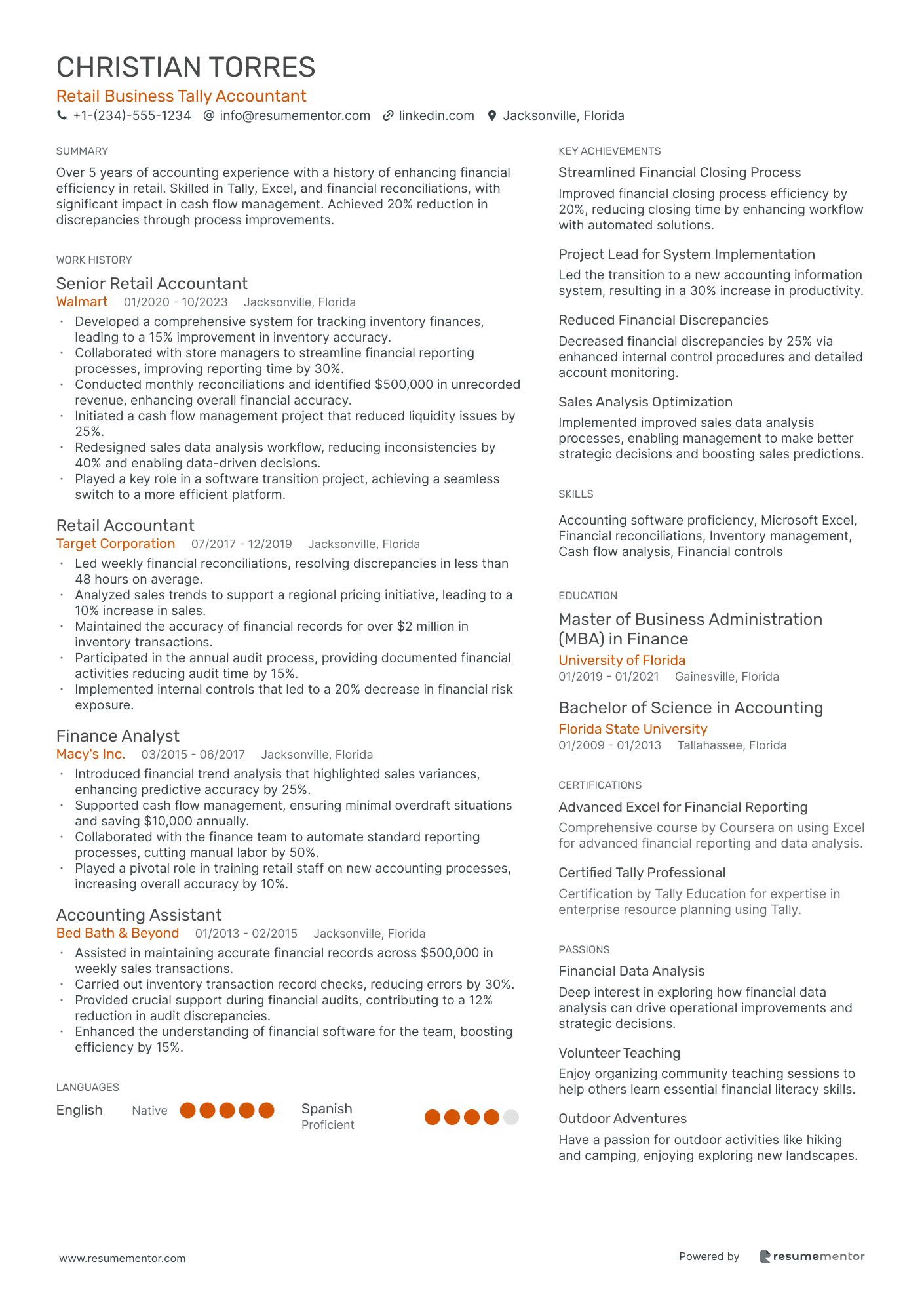

Retail Business Tally Accountant resume sample

When applying for this role, focus on your experience with inventory management and financial record-keeping. Highlight any familiarity with retail accounting software and mention sales performance metrics you've achieved. Include relevant training or certifications, such as 'Retail Management' or 'Accounting Principles'. Use examples that demonstrate how your attention to detail has minimized errors or streamlined processes in previous positions. Showcasing your ability to analyze financial data and make informed decisions is key to presenting yourself as a valuable asset to the team.

- •Developed a comprehensive system for tracking inventory finances, leading to a 15% improvement in inventory accuracy.

- •Collaborated with store managers to streamline financial reporting processes, improving reporting time by 30%.

- •Conducted monthly reconciliations and identified $500,000 in unrecorded revenue, enhancing overall financial accuracy.

- •Initiated a cash flow management project that reduced liquidity issues by 25%.

- •Redesigned sales data analysis workflow, reducing inconsistencies by 40% and enabling data-driven decisions.

- •Played a key role in a software transition project, achieving a seamless switch to a more efficient platform.

- •Led weekly financial reconciliations, resolving discrepancies in less than 48 hours on average.

- •Analyzed sales trends to support a regional pricing initiative, leading to a 10% increase in sales.

- •Maintained the accuracy of financial records for over $2 million in inventory transactions.

- •Participated in the annual audit process, providing documented financial activities reducing audit time by 15%.

- •Implemented internal controls that led to a 20% decrease in financial risk exposure.

- •Introduced financial trend analysis that highlighted sales variances, enhancing predictive accuracy by 25%.

- •Supported cash flow management, ensuring minimal overdraft situations and saving $10,000 annually.

- •Collaborated with the finance team to automate standard reporting processes, cutting manual labor by 50%.

- •Played a pivotal role in training retail staff on new accounting processes, increasing overall accuracy by 10%.

- •Assisted in maintaining accurate financial records across $500,000 in weekly sales transactions.

- •Carried out inventory transaction record checks, reducing errors by 30%.

- •Provided crucial support during financial audits, contributing to a 12% reduction in audit discrepancies.

- •Enhanced the understanding of financial software for the team, boosting efficiency by 15%.

Tally Accountant with Tax Specialization resume sample

When applying for a role in this field, it’s important to showcase your expertise in tax regulations and compliance. Highlight any previous experience in preparing tax returns or assisting clients with audits. Mention relevant certifications, like a CPA or tax courses, to demonstrate your qualifications. Provide examples of how you optimized tax processes or enhanced accuracy in filings. Use a 'skill-action-result' format to show the impact of your work, such as reduced penalties or improved refund timelines, to strengthen your application.

- •Implemented Tally ERP to streamline financial record-keeping, reducing error rates by 30% over a six-month period.

- •Lead a team in preparing and filing accurate GST and VAT returns, resulting in zero penalties from authorities.

- •Collaborated with cross-functional teams to gather and analyze financial data, cutting report preparation time by 25%.

- •Reviewed ongoing tax strategies resulting in a saving of 20% on annual tax liabilities.

- •Assisted in annual budget forecasting, improving the accuracy of financial projections by 15%.

- •Led the documentation preparation during the annual audit, expediting the process and reducing auditor inquiries by 40%.

- •Conducted detailed tax planning, achieving compliance and optimizing tax returns.

- •Managed resolution of tax-related queries, successfully avoiding potential fines and reducing compliance risk.

- •Oversaw the maintenance of financial records in Tally ERP, enhancing the accuracy of quarterly financial statements.

- •Prepared comprehensive financial reports, enabling data-driven decision-making across the finance department.

- •Facilitated in-depth training sessions on tax regulations, boosting the department's efficiency by 10%.

- •Developed and implemented tax-saving strategies, achieving substantial fiscal relief for the company.

- •Collaborated with external auditors to ensure tax compliance, effectively resolving any discrepancies.

- •Prepared and reviewed quarterly tax and VAT reports, maintaining compliance and avoiding penalties.

- •Optimized accounting procedures to enhance financial data accuracy by 15%, supporting strategic planning.

- •Assisted in tax compliance projects, contributing to a 98% accuracy rate in tax returns.

- •Monitored changes in tax legislation, updating company policies to align with best practices.

- •Generated detailed financial reports to facilitate effective budget management.

- •Conducted reconciliations and maintained up-to-date financial records using Tally ERP.

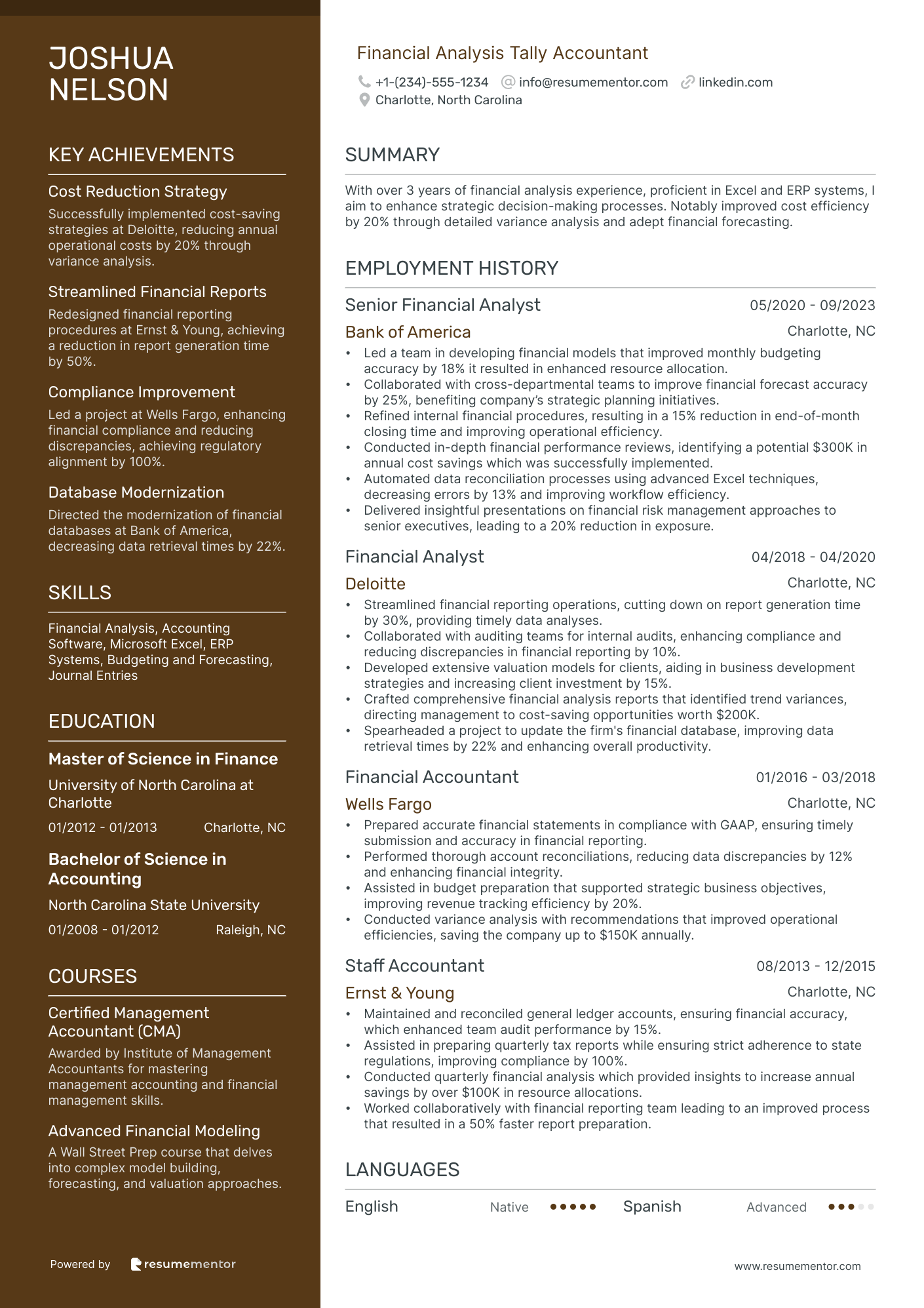

Financial Analysis Tally Accountant resume sample

When applying for this position, it's essential to highlight your analytical skills and attention to detail. Showcase any experience with financial modeling or data analysis tools like Excel or Tally. If you've completed relevant courses such as 'Financial Analysis' or 'Data Interpretation', be sure to mention these. Include quantifiable achievements, using a 'challenge-action-result' framework to demonstrate how your contributions improved financial processes or reporting. Tailoring your cover letter to reflect your problem-solving abilities and data-driven decisions will enhance your application’s impact.

- •Led a team in developing financial models that improved monthly budgeting accuracy by 18% it resulted in enhanced resource allocation.

- •Collaborated with cross-departmental teams to improve financial forecast accuracy by 25%, benefiting company’s strategic planning initiatives.

- •Refined internal financial procedures, resulting in a 15% reduction in end-of-month closing time and improving operational efficiency.

- •Conducted in-depth financial performance reviews, identifying a potential $300K in annual cost savings which was successfully implemented.

- •Automated data reconciliation processes using advanced Excel techniques, decreasing errors by 13% and improving workflow efficiency.

- •Delivered insightful presentations on financial risk management approaches to senior executives, leading to a 20% reduction in exposure.

- •Streamlined financial reporting operations, cutting down on report generation time by 30%, providing timely data analyses.

- •Collaborated with auditing teams for internal audits, enhancing compliance and reducing discrepancies in financial reporting by 10%.

- •Developed extensive valuation models for clients, aiding in business development strategies and increasing client investment by 15%.

- •Crafted comprehensive financial analysis reports that identified trend variances, directing management to cost-saving opportunities worth $200K.

- •Spearheaded a project to update the firm's financial database, improving data retrieval times by 22% and enhancing overall productivity.

- •Prepared accurate financial statements in compliance with GAAP, ensuring timely submission and accuracy in financial reporting.

- •Performed thorough account reconciliations, reducing data discrepancies by 12% and enhancing financial integrity.

- •Assisted in budget preparation that supported strategic business objectives, improving revenue tracking efficiency by 20%.

- •Conducted variance analysis with recommendations that improved operational efficiencies, saving the company up to $150K annually.

- •Maintained and reconciled general ledger accounts, ensuring financial accuracy, which enhanced team audit performance by 15%.

- •Assisted in preparing quarterly tax reports while ensuring strict adherence to state regulations, improving compliance by 100%.

- •Conducted quarterly financial analysis which provided insights to increase annual savings by over $100K in resource allocations.

- •Worked collaboratively with financial reporting team leading to an improved process that resulted in a 50% faster report preparation.

Investment Tally Accounting Specialist resume sample

When applying for this role, emphasize any experience with financial analysis and reporting. Highlighting proficiency in accounting software, such as Tally or other ERP systems, is vital. Showcase your ability to manage investment portfolios or assist in financial forecasting. Mention any relevant certifications like 'Financial Analysis' or 'Investment Management.' Use a concrete example to illustrate how your analytical skills improved financial outcomes in previous positions, focusing on the 'skill-action-result' method to demonstrate your impact on organizational success.

- •Managed a portfolio of over $200 million, ensuring quarterly reports were delivered with 98% accuracy and compliance.

- •Led a project to streamline account reconciliation processes, reducing processing time by 30%.

- •Collaborated with portfolio managers to provide enhanced analytics, improving client satisfaction scores by 15%.

- •Implemented new accounting software system, reducing discrepancies in cash flow accounts by 20%.

- •Coordinated audit preparation activities, resulting in a successful audit with zero critical findings.

- •Developed financial reporting for senior management, increasing transparency of investment returns.

- •Analyzed investment data for discrepancies, resulting in a 25% increase in report accuracy.

- •Maintained ledgers and records for investment portfolios worth $150 million, ensuring compliance with internal controls.

- •Facilitated the implementation of new accounting procedures, cutting reconciliation time by 25%.

- •Provided support during external audits, leading to swift audit completions with positive feedback.

- •Reviewed monthly and quarterly financial statements, ensuring alignment with regulatory standards.

- •Prepared detailed financial analysis reports, leading to more informed strategic investment decisions.

- •Monitored cash flows related to $100 million of investment activities, enhancing cash management by 15%.

- •Collaborated with IT to enhance the accuracy of financial reports using SAP software.

- •Developed training sessions for new team members, increasing team productivity by 20%.

- •Managed reconciliation of complex financial transactions, increasing accuracy of financial statements by 18%.

- •Provided crucial support to portfolio managers during the fiscal year-end process.

- •Participated in the development of new accounting policies, resulting in more streamlined operations.

- •Implemented systematic reviews of investment ledger which led to 20% fewer discrepancies.

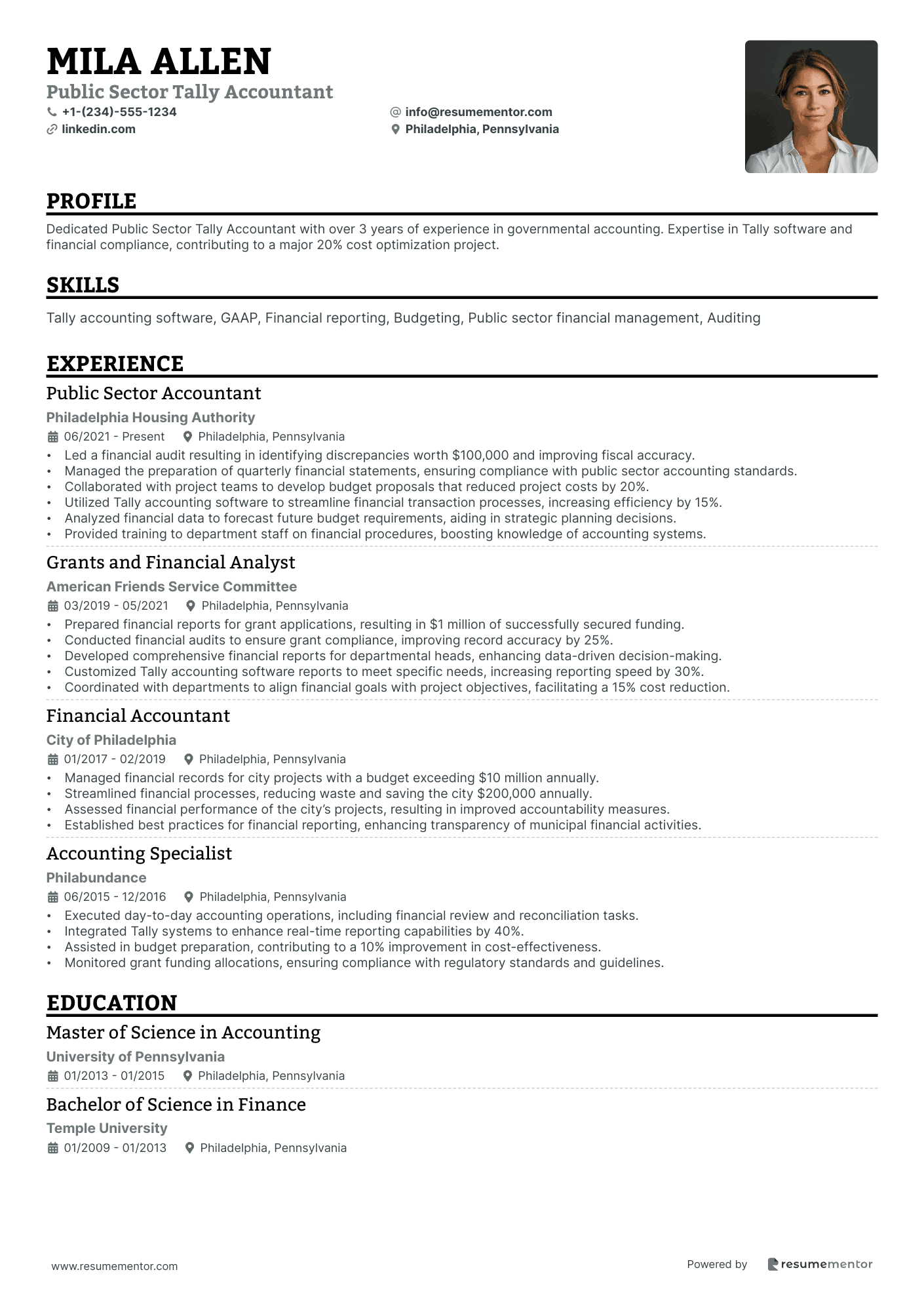

Public Sector Tally Accountant resume sample

When applying for this position, highlight any experience working with government contracts or public sector finance. Detail your familiarity with compliance regulations specific to public accounting. Mention any relevant training or certifications, especially in areas like public sector accounting standards. Provide concrete examples of how you’ve contributed to budget management or financial reporting in past roles. Use metrics to demonstrate impact, such as cost savings achieved or improved reporting accuracy. Tailor your cover letter to show commitment to transparency and accountability in public financial management.

- •Led a financial audit resulting in identifying discrepancies worth $100,000 and improving fiscal accuracy.

- •Managed the preparation of quarterly financial statements, ensuring compliance with public sector accounting standards.

- •Collaborated with project teams to develop budget proposals that reduced project costs by 20%.

- •Utilized Tally accounting software to streamline financial transaction processes, increasing efficiency by 15%.

- •Analyzed financial data to forecast future budget requirements, aiding in strategic planning decisions.

- •Provided training to department staff on financial procedures, boosting knowledge of accounting systems.

- •Prepared financial reports for grant applications, resulting in $1 million of successfully secured funding.

- •Conducted financial audits to ensure grant compliance, improving record accuracy by 25%.

- •Developed comprehensive financial reports for departmental heads, enhancing data-driven decision-making.

- •Customized Tally accounting software reports to meet specific needs, increasing reporting speed by 30%.

- •Coordinated with departments to align financial goals with project objectives, facilitating a 15% cost reduction.

- •Managed financial records for city projects with a budget exceeding $10 million annually.

- •Streamlined financial processes, reducing waste and saving the city $200,000 annually.

- •Assessed financial performance of the city’s projects, resulting in improved accountability measures.

- •Established best practices for financial reporting, enhancing transparency of municipal financial activities.

- •Executed day-to-day accounting operations, including financial review and reconciliation tasks.

- •Integrated Tally systems to enhance real-time reporting capabilities by 40%.

- •Assisted in budget preparation, contributing to a 10% improvement in cost-effectiveness.

- •Monitored grant funding allocations, ensuring compliance with regulatory standards and guidelines.

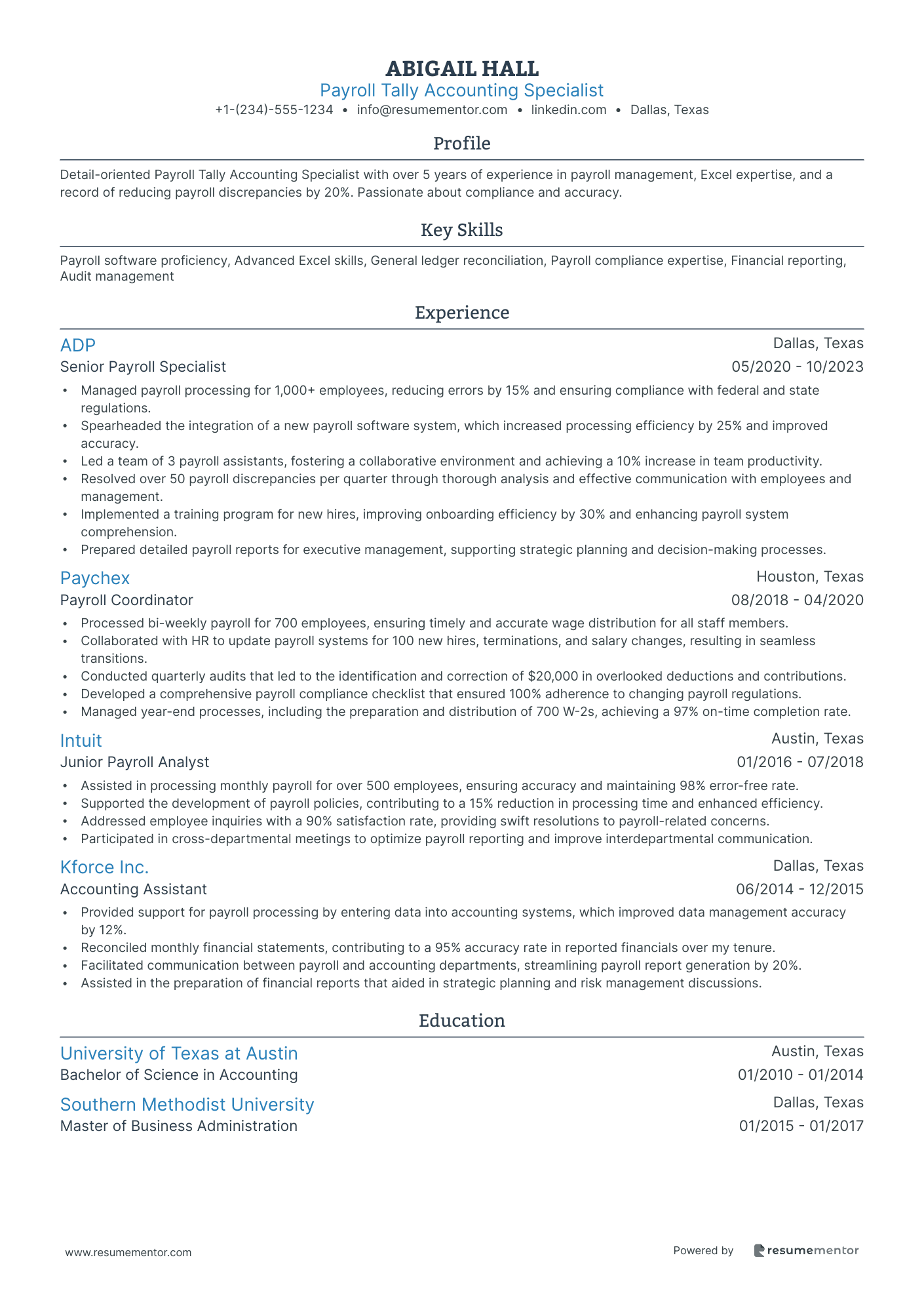

Payroll Tally Accounting Specialist resume sample

When applying for this role, it's essential to showcase your experience with payroll software and any previous roles involving payroll processing. Highlight your attention to detail and ability to meet deadlines, as accuracy is critical in this field. If you have certifications like 'Certified Payroll Professional' or completed any specialized training, make sure to include those. Provide specific examples demonstrating how you've improved payroll efficiency or corrected discrepancies, using a 'skill-action-result' approach to illustrate the impact on your team's performance.

- •Managed payroll processing for 1,000+ employees, reducing errors by 15% and ensuring compliance with federal and state regulations.

- •Spearheaded the integration of a new payroll software system, which increased processing efficiency by 25% and improved accuracy.

- •Led a team of 3 payroll assistants, fostering a collaborative environment and achieving a 10% increase in team productivity.

- •Resolved over 50 payroll discrepancies per quarter through thorough analysis and effective communication with employees and management.

- •Implemented a training program for new hires, improving onboarding efficiency by 30% and enhancing payroll system comprehension.

- •Prepared detailed payroll reports for executive management, supporting strategic planning and decision-making processes.

- •Processed bi-weekly payroll for 700 employees, ensuring timely and accurate wage distribution for all staff members.

- •Collaborated with HR to update payroll systems for 100 new hires, terminations, and salary changes, resulting in seamless transitions.

- •Conducted quarterly audits that led to the identification and correction of $20,000 in overlooked deductions and contributions.

- •Developed a comprehensive payroll compliance checklist that ensured 100% adherence to changing payroll regulations.

- •Managed year-end processes, including the preparation and distribution of 700 W-2s, achieving a 97% on-time completion rate.

- •Assisted in processing monthly payroll for over 500 employees, ensuring accuracy and maintaining 98% error-free rate.

- •Supported the development of payroll policies, contributing to a 15% reduction in processing time and enhanced efficiency.

- •Addressed employee inquiries with a 90% satisfaction rate, providing swift resolutions to payroll-related concerns.

- •Participated in cross-departmental meetings to optimize payroll reporting and improve interdepartmental communication.

- •Provided support for payroll processing by entering data into accounting systems, which improved data management accuracy by 12%.

- •Reconciled monthly financial statements, contributing to a 95% accuracy rate in reported financials over my tenure.

- •Facilitated communication between payroll and accounting departments, streamlining payroll report generation by 20%.

- •Assisted in the preparation of financial reports that aided in strategic planning and risk management discussions.

Writing a resume for a tally accountant can often feel like balancing books without a calculator. You need precision and detail, but it can be tough to know what to include and what to leave out. As a tally accountant, you might excel at managing finances, but presenting your skills on paper can be a different ball game. The job market is competitive, and a resume that doesn't stand out might cost you opportunities. Many tally accountants struggle with how to highlight their specific skills and experiences effectively. This guide will help you craft a resume that showcases your strengths and gets you noticed by employers.

Choosing the right resume template is crucial for tally accountants. The right format will help you organize your information clearly and professionally. It ensures that all your key skills and experiences are presented in a way that catches the employer's eye.

With more than 700 resume examples available, you can find the perfect template to start your resume today!

Key Takeaways

- Choosing the right resume template is essential to organize skills and experiences clearly and professionally, making your resume stand out to employers.

- A reverse-chronological format highlighting recent achievements, coupled with modern fonts and PDF formatting, ensures a professional look and ATS compatibility.

- Effective resumes should focus on specific contributions and quantifiable results, using strong action words to demonstrate impacts and achievements clearly.

- Key sections to include are Contact Information, Professional Summary, Work Experience, Skills, Education, and Certifications, with optional sections like Professional Affiliations and Languages.

- Highlighting relevant certifications, industry-specific skills, and experiences, as well as using tailored keywords throughout your resume, enhances visibility and appeal to recruiters and ATS systems.

What to focus on when writing your tally accountant resume

To capture a recruiter's attention, your tally accountant resume should clearly showcase your skills, experiences, and accomplishments in accounting and finance. Highlight your proficiency in Tally software, accuracy in financial reporting, and ability to manage accounting tasks efficiently. Your resume should communicate your expertise in tax compliance, account reconciliation, and financial analysis.

To boost its impact, consider including:

- Specific contributions to cost reductions or financial process improvements.

- Examples of successfully leading audits or financial reviews.

- Metrics on how you improved financial accuracy and reporting speed.

- Relevant certifications or specialized training in accounting software.

Must have information on your tally accountant resume

Creating a standout resume for a tally accountant involves including key sections tailored to the role. Your resume should have the following essential sections:

- Contact Information

- Professional Summary

- Work Experience

- Skills

- Education

- Certifications

You might also consider adding sections such as Professional Affiliations and Languages to set yourself apart from the competition. Ensure each section is clearly labeled and well-organized to pass through Applicant Tracking Systems (ATS) effectively.

Which resume format to choose

For a tally accountant resume, the best format is the reverse-chronological format because it highlights your most recent experience and achievements. Modern fonts like Rubik and Montserrat are more engaging alternatives to Arial and Times New Roman. PDFs are the best filetype to preserve your formatting and ensure it looks professional when opened. Keep your margins at one inch on all sides for a clean look. Use clear section headings to ensure your resume is easily read by Applicant Tracking Systems (ATS). Essential resume sections for a tally accountant include:

- Contact Information

- Summary

- Professional Experience

- Education

- Skills

- Certifications

- Technical Competencies

Resume Mentor's free resume builder handles all of this for you, making it easy to create a professional resume.

How to write a quantifiable resume experience section

Crafting the experience section of your resume as a tally accountant requires attention to detail and a focus on achievements. Start your resume with your most recent job and then work backwards. Only include jobs relevant to the position you're applying for, typically within the last 10 to 15 years. It’s important to tailor your resume for each job application by highlighting the most relevant experiences and achievements that match the job description.

To make your resume stand out, use action words that demonstrate your contributions and impacts. Words like "achieved," "improved," "designed," "implemented," and "managed" show your active role in past positions. Avoid using generic phrases that don't provide specific information. Instead, focus on quantifiable results such as "increased efficiency by 15%" or "reduced costs by 10%."

Below are two examples to help illustrate these points:

- •Handled company accounting tasks

- •Worked with vendors

- •Maintained ledgers and journal entries

This example is ineffective because it lacks specific achievements, relies on vague language, and doesn’t demonstrate the actual impact. For instance, “Handled company accounting tasks” is too generic and doesn't provide insight into your skills or accomplishments.

Now, let's see an improved version:

- •Improved invoice processing efficiency by 20% through streamlined procedures

- •Reduced errors in financial reporting by 15% by implementing a new review system

- •Managed accounts payable and receivable, ensuring timely payments and collections

This example is effective because it provides detailed achievements and figures. Phrases like "Improved invoice processing efficiency by 20%" and "Reduced errors in financial reporting by 15%" show your specific contributions. This makes it clear to potential employers how you've made a positive impact in your previous roles.

Tailor your resume by focusing on your key accomplishments and using strong action words. This approach will make your resume more engaging and effective in catching the eye of hiring managers.

Tally accountant resume experience examples

Are you ready to count your successes? Exploring your achievements in a clear and interesting way can make sure your resume stands out like a diamond in a spreadsheet! Read on for various ways to highlight your expertise as a Tally Accountant.

Achievement-focused

Highlight your biggest wins and how they made a difference at your workplace.

Senior Tally Accountant

ABC Corp.

June 2018 - Present

- Implemented a new accounting system that reduced closing times by 50%

- Achieved a 98% accuracy rate in financial reporting

- Awarded 'Employee of the Year' twice for outstanding performance

Skills-focused

Focus on the specific skills that you bring to the table and how they benefit the company.

Tally Accountant

XYZ Enterprises

March 2015 - May 2018

- Expert in Tally ERP 9 and QuickBooks

- Proficient in tax preparation and financial audits

- Strong analytical and problem-solving abilities

Responsibility-focused

Showcase the key responsibilities you handled, emphasizing how important they were for your team or company.

Accounting Manager

LMN Solutions

January 2013 - February 2015

- Supervised a team of 5 junior accountants

- Ensured compliance with all regulatory requirements

- Managed the complete financial cycle from bookkeeping to reporting

Project-focused

Detail the crucial projects you took part in or led, and explain their positive outcomes.

Project Accountant

Financial Tech Inc.

August 2011 - December 2012

- Led a project to revamp the invoicing system, reducing errors by 30%

- Implemented a budget forecasting tool that improved financial planning

- Coordinated a successful company-wide transition to a new accounting software

Result-focused

Emphasize the results of your work, whether in terms of dollars saved, time reduced, or quality improved.

Financial Analyst

Money Matters Co.

February 2009 - July 2011

- Increased profitability by 15% through detailed financial analysis

- Reduced accounts receivable days outstanding by 10%

- Enhanced the accuracy of financial forecasts by 20%

Industry-Specific Focus

Demonstrate your knowledge and experience in the specific industry you’ve worked in.

Retail Accountant

ShopSmart Ltd.

March 2007 - January 2009

- Specialized in retail accounting, dealing with multiple store locations

- Managed inventory accounting and cost control processes

- Developed financial reports tailored to the retail sector

Problem-Solving focused

Explain how you solved significant problems and turned challenges into opportunities.

Accounting Associate

Fiscal Solutions

July 2005 - February 2007

- Identified and resolved discrepancies in financial records, improving accuracy by 25%

- Streamlined the payroll process, cutting down errors by 15%

- Addressed compliance issues that avoided penalties for the company

Innovation-focused

Show how your innovative ideas contributed to the success of your team or company.

Junior Accountant

TechFinance Inc.

May 2003 - June 2005

- Introduced a digital filing system that cut paperwork by 40%

- Proposed a new inventory tracking method that improved efficiency

- Developed a custom budgeting tool for better financial planning

Leadership-focused

Highlight your leadership abilities and how you've managed teams or initiatives successfully.

Accounting Team Lead

Ledger Experts

January 2001 - April 2003

- Led a team of eight accountants to achieve departmental goals

- Mentored junior staff, resulting in a 20% improvement in performance

- Coordinated quarterly audits ensuring compliance

Customer-focused

Showcase how you contributed to customer satisfaction and client relationships.

Client Accountant

ClientFirst Solutions

September 1999 - December 2000

- Managed accounts for over 50 clients with a 98% satisfaction rate

- Built strong client relationships by providing excellent financial advice

- Customized financial reports to meet client needs accurately

Growth-focused

Focus on how you contributed to the growth of your company or department.

Finance Assistant

GrowthPartners Pty.

June 1997 - August 1999

- Assisted in increasing department efficiency by 30% through streamlined processes

- Supported strategies that led to a 10% growth in revenue

- Helped expand the client base by enhancing financial services

Efficiency-focused

Showcase how you made processes more efficient and saved resources for your company.

Bookkeeper

Efficiency Experts Inc.

March 1995 - May 1997

- Reduced the time taken for month-end closing by 40%

- Improved the efficiency of daily financial operations

- Cut down the financial reporting errors through accurate bookkeeping practices

Technology-focused

Demonstrate your proficiency with technology and how you've used it to benefit your workplace.

Tech Accountant

TechSavvy Accounting

January 1993 - February 1995

- Successfully migrated financial data to a new ERP system

- Implemented accounting software that improved reporting process

- Trained staff on new technological tools for enhanced productivity

Collaboration-focused

Show how you worked effectively with others to achieve common goals.

Account Coordinator

TeamFinance Ltd.

September 1990 - December 1992

- Collaborated with multiple departments for financial planning

- Coordinated with vendors and clients to resolve billing issues

- Worked in team settings to meet tight deadlines during audits

Training and Development focused

Highlight your role in training and developing other team members.

Training Specialist

TrainRight Financials

June 1988 - August 1990

- Conducted training sessions on new accounting systems

- Developed materials for staff training and development

- Mentored new hires to accelerate their onboarding process

Write your tally accountant resume summary section

Writing a winning resume summary can set you apart as a tally accountant. This section is your chance to make a stunning first impression by summarizing your key achievements and skills. You should aim to be clear and concise while showcasing what makes you perfect for the job.

An effective resume summary can give recruiters a snapshot of who you are and what you bring. Describing yourself well involves showcasing specific skills, experience, and traits. Avoid generic statements like "hard-working" or "detail-oriented." Instead, boost your summary by including measurable achievements and key skills relevant to the tally accountant role.

A summary is not the same as a resume objective, profile, or summary of qualifications. A resume objective focuses on your career goals and what you want to achieve. A resume profile is a brief snapshot of your achievements and skills. A summary of qualifications is a bullet-point list of your key accomplishments and abilities.

Here's an example of a poorly written resume summary:

This example lacks specific details and measurable achievements. It uses general traits like "dedicated" and "detail-oriented," which are too vague. The sentence structure is repetitive and doesn't showcase any unique skills or experiences.

Now, let’s look at a stronger example:

This example is much better. It is specific and speaks directly to the candidate's experience and skills. It mentions proficiency with Tally ERP 9 and Excel, and includes a measurable achievement. The summary clearly communicates the candidate's value, making it compelling to potential employers.

Listing your tally accountant skills on your resume

When writing the skills section of your tally accountant resume, you can create a standalone section to clearly showcase your abilities. Alternatively, you can incorporate your skills into other sections, such as your experience or summary. This helps to show how you’ve applied these skills in real-world scenarios.

Your strengths and soft skills include traits like attention to detail, problem-solving, and communication skills. Hard skills are specific, teachable abilities or knowledge sets that you have, like proficiency in Tally ERP, financial analysis, or tax preparation.

Skills and strengths are more than just abilities—they are keywords that resume scanners look for. Including them in various sections of your resume can help ensure that both human reviewers and automated systems take notice of your qualifications. Use keywords naturally and relevantly to describe how you excel in your role.

The provided example of a standalone skills section is effective because it lists very specific skills relevant to a tally accountant. Each skill is targeted and clear, which helps in portraying you as an ideal candidate for the job. The skills are varied but all within the domain of tally accounting, ensuring that your expertise is properly highlighted.

Best hard skills to feature on your tally accountant resume

Hard skills for a tally accountant should communicate your technical proficiency and capabilities in handling financial tasks. These skills are essential for employers to see that you can perform the job effectively.

Hard Skills

- Tally ERP

- Financial Reporting

- Tax Compliance

- Reconciliation

- Data Analysis

- Payroll Processing

- Budget Management

- Microsoft Excel

- Accounts Payable/Receivable

- Audit Preparation

- GST/VAT Filing

- Inventory Management

- Financial Forecasting

- Cost Accounting

- ERP Implementation

Best soft skills to feature on your tally accountant resume

Soft skills for a tally accountant should communicate your ability to interact well with others, solve problems, and manage tasks efficiently. These skills show that you can fit well within a team and handle work-related challenges effectively.

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Time Management

- Communication

- Team Collaboration

- Adaptability

- Confidentiality

- Customer Service

- Organizational Skills

- Leadership

- Multitasking

- Ethics

- Critical Thinking

- Negotiation

How to include your education on your resume

The education section on your tally accountant resume is vital. It informs potential employers about your academic background and accomplishments. Tailoring this section to the job you're applying for is crucial. Exclude any irrelevant education that doesn't support your candidacy. When listing a degree, include your GPA if it's above 3.0, and always mention honors like cum laude. Display your degree accurately with the issuing institution and dates of attendance.

This example is bad because it includes an irrelevant degree for a tally accountant job. The GPA is barely mentioned and not highlighted properly. There's no notable achievement or specific detail relevant to the job.

This example is excellent because it focuses on accounting, relevant to the tally accountant position. The GPA of 3.7 is prominently featured, indicating strong academic performance. The degree is detailed accurately, and the dates confirm a timely graduation.

How to include tally accountant certificates on your resume

Including a certificates section in your Tally accountant resume is crucial for showcasing your qualifications and skills. Use actionable steps to structure this section effectively. List the name of each certification clearly. Include the date you received the certificate. Add the issuing organization to give it credibility. Pose the information in a concise manner to ensure readability.

Certificates can also be featured in the header for quick visibility. For example: "John Doe, Certified Tally Accountant, Microsoft Certified: Data Analyst."

A well-crafted certificates section demonstrates your commitment to professional growth and expertise. Here's an example:

This example is effective because it is clear and relevant. Each certificate listed enhances your credibility as a Tally accountant. The details are specific and immediately highlight your qualifications to potential employers.

Extra sections to include in your tally accountant resume

In today’s job market, crafting a compelling resume is essential for standing out. For a Tally accountant, an effective resume isn't just about listing qualifications; it can also showcase your diverse skills and interests. Including extra sections like language proficiency, hobbies, volunteer work, and books can provide a more comprehensive picture of who you are.

Language section — Showcasing your language skills can attract employers who value communication in multiple languages. This added competence can enhance your job prospects in multinational companies.

Hobbies and interests section — Highlighting your hobbies and interests can make your resume more relatable and showcase your well-rounded personality. It's a method to connect with your potential employers on a personal level.

Volunteer work section — Including volunteer work demonstrates your commitment to social causes and teamwork skills. Employers often value candidates who show initiative outside of their professional responsibilities.

Books section — Mentioning the books you read can offer insights into your intellectual curiosity and areas of interest. This can spark conversations and can reflect positively on your self-improvement efforts.

Pair your tally accountant resume with a cover letter

A cover letter is a document that accompanies your resume in a job application. Its purpose is to introduce yourself, highlight your relevant skills, and explain why you are a good fit for the position. A well-crafted cover letter can help an applicant stand out by showcasing their personality and enthusiasm, which might not be evident from a resume alone.

For a tally accountant, your cover letter should focus on your proficiency with accounting software, attention to detail, and ability to manage financial records accurately. Highlight your relevant experience, such as working with financial reports, managing budgets, and ensuring compliance with accounting standards. Mention any certifications or courses you have completed that are relevant to accounting, and demonstrate your problem-solving skills and reliability.

Make your cover letter today using Resume Mentor's cover letter builder. It's easy to use and helps protect your content and formatting with PDF exporting.

Gabriel Baker

San Jose, California

+1-(234)-555-1234

help@resumementor.com

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.