Tax Attorney Resume Examples

Jul 18, 2024

|

12 min read

Master your tax attorney resume: Tips to claim your success in the legal field. Follow this guide to make your expertise stand out and avoid common pitfalls that could audit your chances of landing the job.

Rated by 348 people

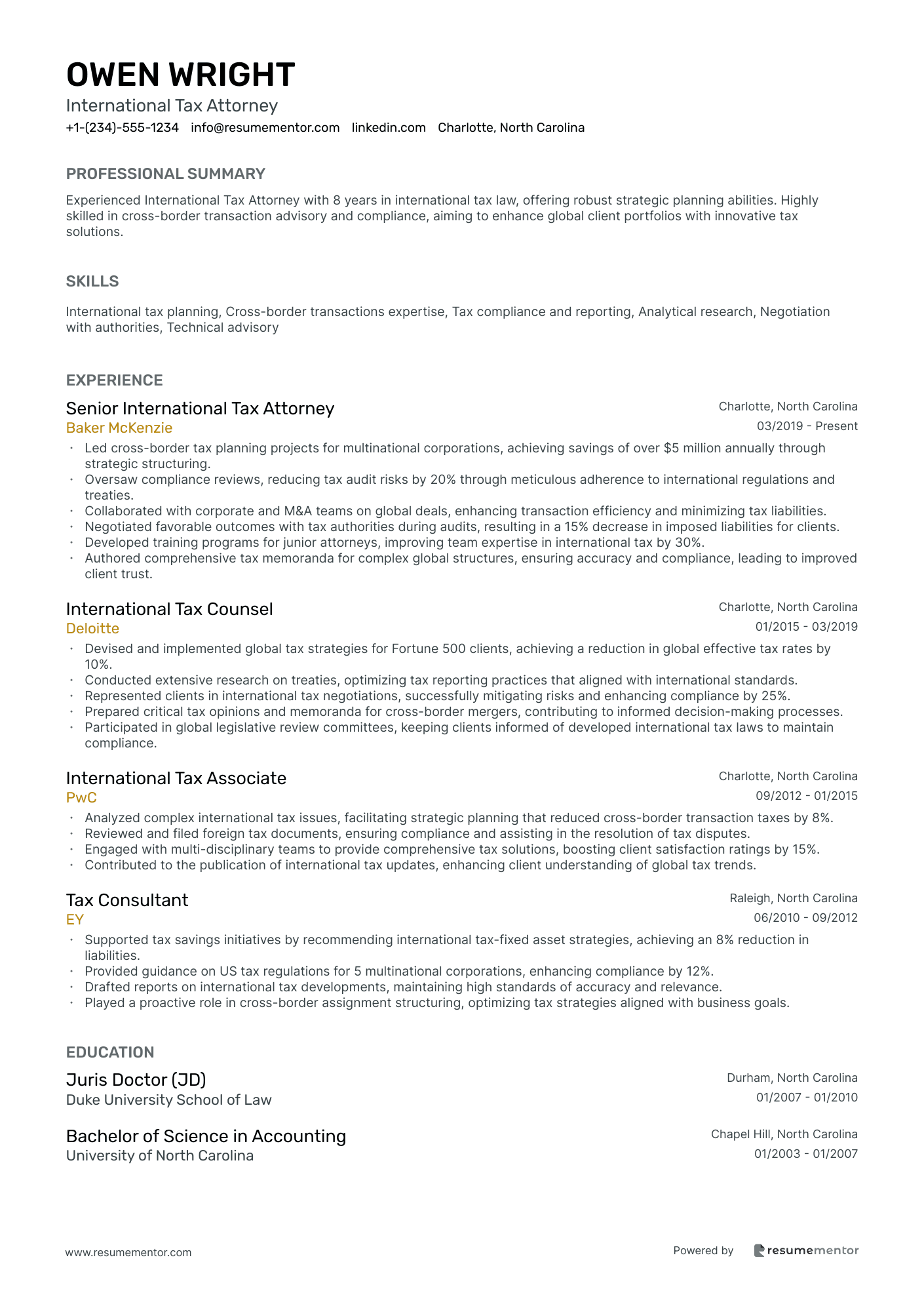

International Tax Attorney

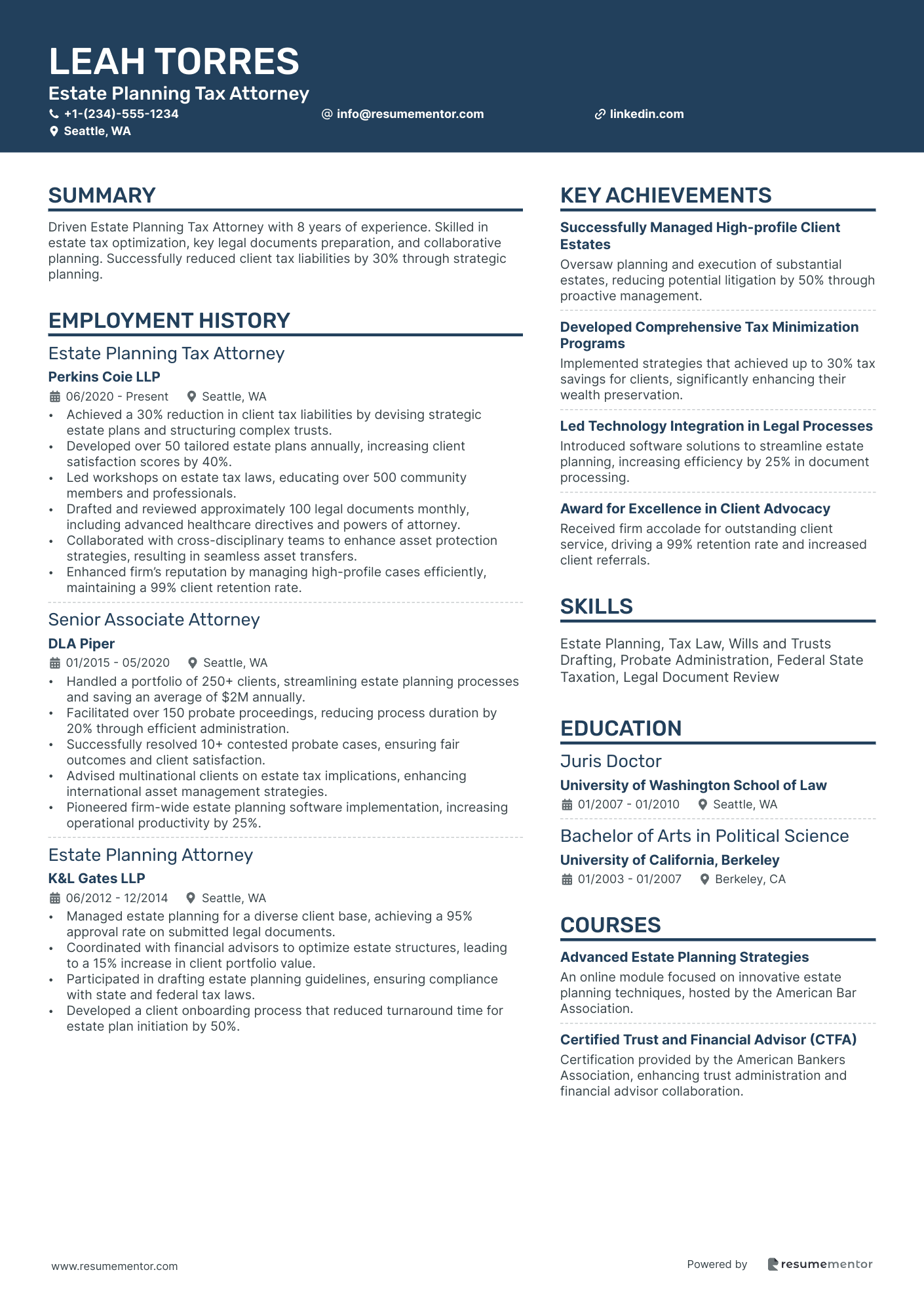

Estate Planning Tax Attorney

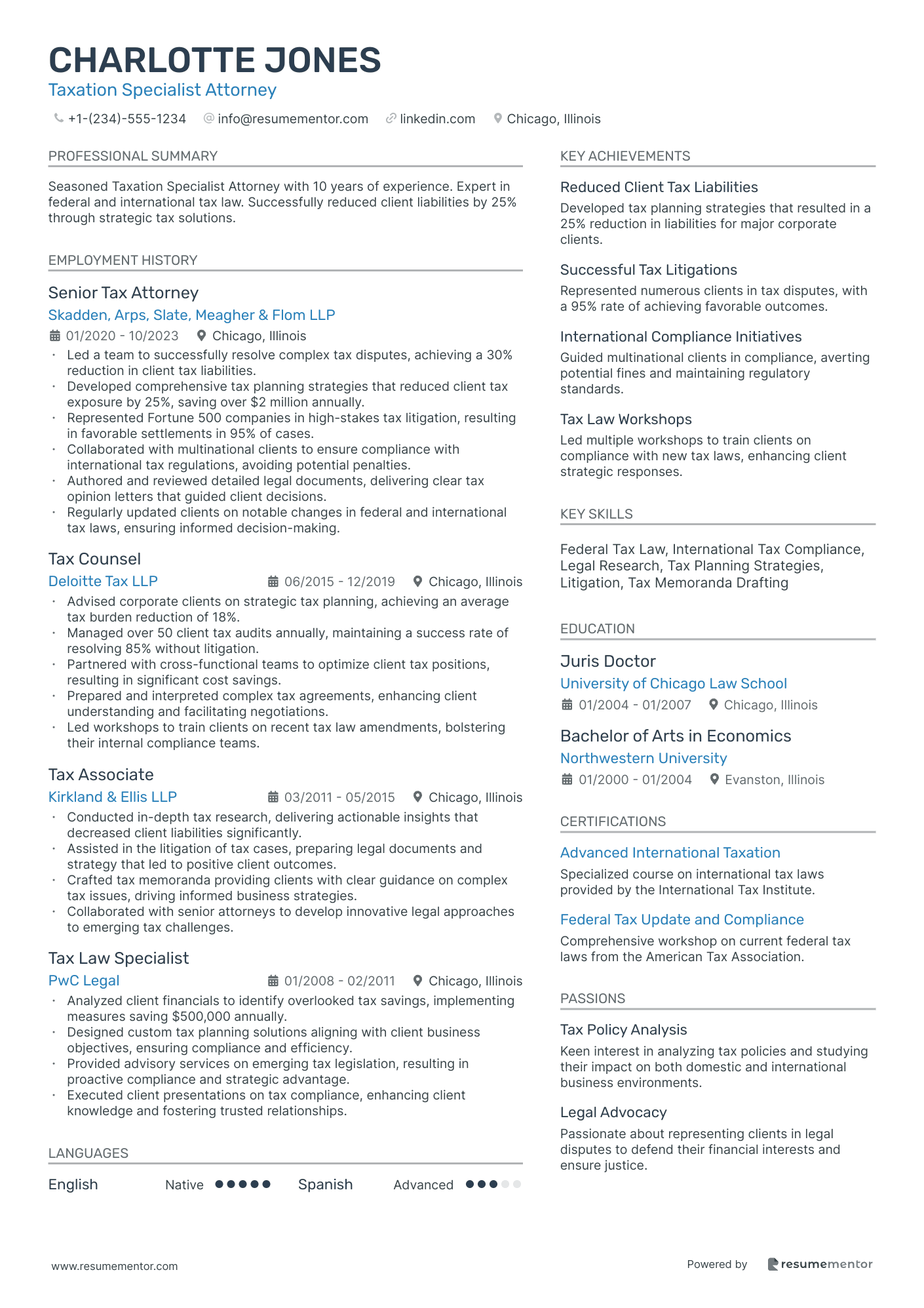

Taxation Specialist Attorney

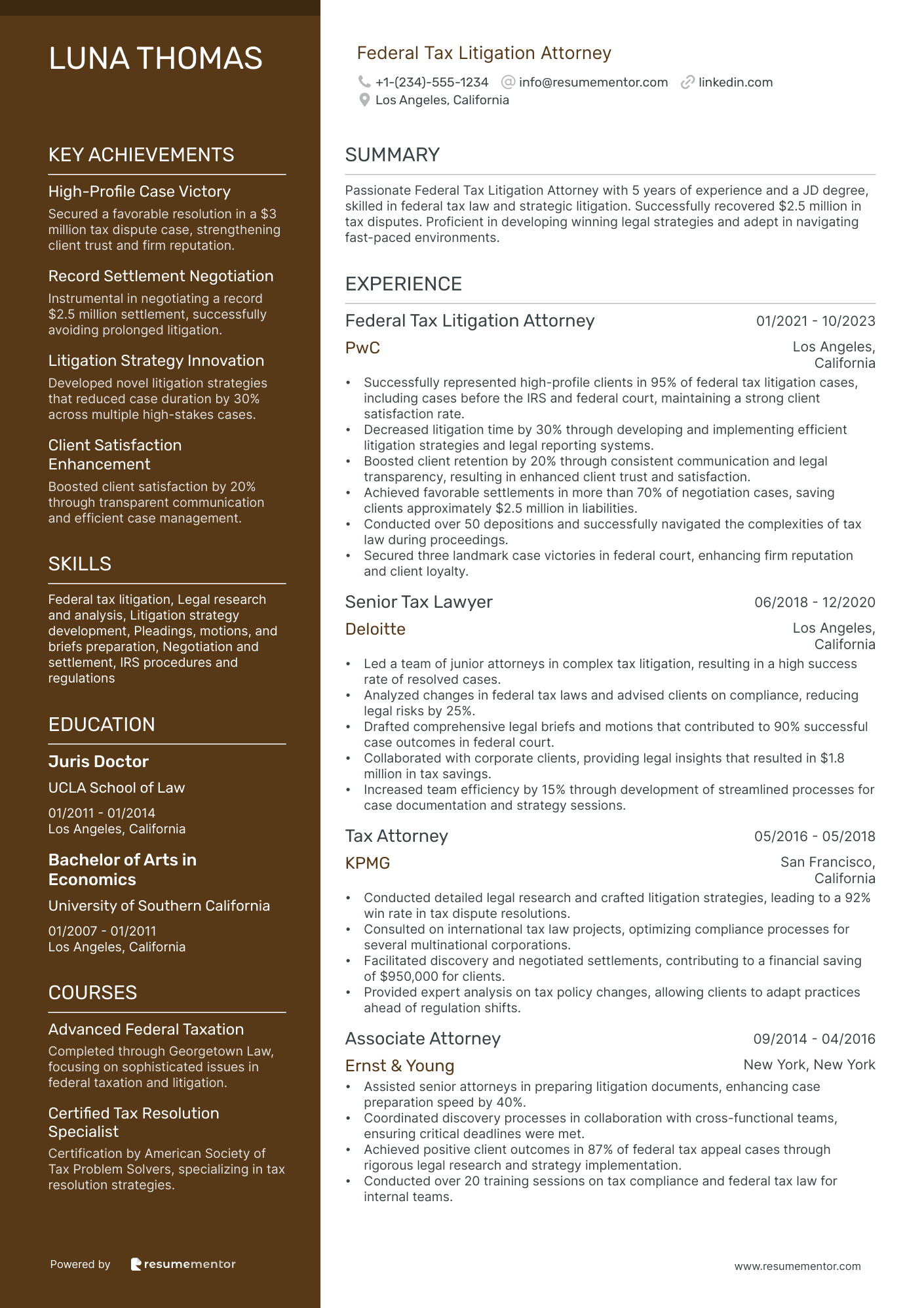

Federal Tax Litigation Attorney

Property Tax Attorney

Income Tax Attorney

Sales Tax Specialist Lawyer

Trust and Estate Tax Attorney

Tax Haven Advisor Attorney

International Tax Attorney resume sample

- •Led cross-border tax planning projects for multinational corporations, achieving savings of over $5 million annually through strategic structuring.

- •Oversaw compliance reviews, reducing tax audit risks by 20% through meticulous adherence to international regulations and treaties.

- •Collaborated with corporate and M&A teams on global deals, enhancing transaction efficiency and minimizing tax liabilities.

- •Negotiated favorable outcomes with tax authorities during audits, resulting in a 15% decrease in imposed liabilities for clients.

- •Developed training programs for junior attorneys, improving team expertise in international tax by 30%.

- •Authored comprehensive tax memoranda for complex global structures, ensuring accuracy and compliance, leading to improved client trust.

- •Devised and implemented global tax strategies for Fortune 500 clients, achieving a reduction in global effective tax rates by 10%.

- •Conducted extensive research on treaties, optimizing tax reporting practices that aligned with international standards.

- •Represented clients in international tax negotiations, successfully mitigating risks and enhancing compliance by 25%.

- •Prepared critical tax opinions and memoranda for cross-border mergers, contributing to informed decision-making processes.

- •Participated in global legislative review committees, keeping clients informed of developed international tax laws to maintain compliance.

- •Analyzed complex international tax issues, facilitating strategic planning that reduced cross-border transaction taxes by 8%.

- •Reviewed and filed foreign tax documents, ensuring compliance and assisting in the resolution of tax disputes.

- •Engaged with multi-disciplinary teams to provide comprehensive tax solutions, boosting client satisfaction ratings by 15%.

- •Contributed to the publication of international tax updates, enhancing client understanding of global tax trends.

- •Supported tax savings initiatives by recommending international tax-fixed asset strategies, achieving an 8% reduction in liabilities.

- •Provided guidance on US tax regulations for 5 multinational corporations, enhancing compliance by 12%.

- •Drafted reports on international tax developments, maintaining high standards of accuracy and relevance.

- •Played a proactive role in cross-border assignment structuring, optimizing tax strategies aligned with business goals.

Estate Planning Tax Attorney resume sample

- •Achieved a 30% reduction in client tax liabilities by devising strategic estate plans and structuring complex trusts.

- •Developed over 50 tailored estate plans annually, increasing client satisfaction scores by 40%.

- •Led workshops on estate tax laws, educating over 500 community members and professionals.

- •Drafted and reviewed approximately 100 legal documents monthly, including advanced healthcare directives and powers of attorney.

- •Collaborated with cross-disciplinary teams to enhance asset protection strategies, resulting in seamless asset transfers.

- •Enhanced firm’s reputation by managing high-profile cases efficiently, maintaining a 99% client retention rate.

- •Handled a portfolio of 250+ clients, streamlining estate planning processes and saving an average of $2M annually.

- •Facilitated over 150 probate proceedings, reducing process duration by 20% through efficient administration.

- •Successfully resolved 10+ contested probate cases, ensuring fair outcomes and client satisfaction.

- •Advised multinational clients on estate tax implications, enhancing international asset management strategies.

- •Pioneered firm-wide estate planning software implementation, increasing operational productivity by 25%.

- •Managed estate planning for a diverse client base, achieving a 95% approval rate on submitted legal documents.

- •Coordinated with financial advisors to optimize estate structures, leading to a 15% increase in client portfolio value.

- •Participated in drafting estate planning guidelines, ensuring compliance with state and federal tax laws.

- •Developed a client onboarding process that reduced turnaround time for estate plan initiation by 50%.

- •Researched tax law modifications, providing timely updates and insightful advice to improve client planning strategies.

- •Assisted in creating educational materials for estate planning seminars, increasing client acquisition by 30%.

- •Streamlined document standardization across the firm, enhancing efficiency in legal document preparation.

- •Engaged closely with clients to customize estate plans, focusing on minimizing tax liabilities effectively.

Taxation Specialist Attorney resume sample

- •Led a team to successfully resolve complex tax disputes, achieving a 30% reduction in client tax liabilities.

- •Developed comprehensive tax planning strategies that reduced client tax exposure by 25%, saving over $2 million annually.

- •Represented Fortune 500 companies in high-stakes tax litigation, resulting in favorable settlements in 95% of cases.

- •Collaborated with multinational clients to ensure compliance with international tax regulations, avoiding potential penalties.

- •Authored and reviewed detailed legal documents, delivering clear tax opinion letters that guided client decisions.

- •Regularly updated clients on notable changes in federal and international tax laws, ensuring informed decision-making.

- •Advised corporate clients on strategic tax planning, achieving an average tax burden reduction of 18%.

- •Managed over 50 client tax audits annually, maintaining a success rate of resolving 85% without litigation.

- •Partnered with cross-functional teams to optimize client tax positions, resulting in significant cost savings.

- •Prepared and interpreted complex tax agreements, enhancing client understanding and facilitating negotiations.

- •Led workshops to train clients on recent tax law amendments, bolstering their internal compliance teams.

- •Conducted in-depth tax research, delivering actionable insights that decreased client liabilities significantly.

- •Assisted in the litigation of tax cases, preparing legal documents and strategy that led to positive client outcomes.

- •Crafted tax memoranda providing clients with clear guidance on complex tax issues, driving informed business strategies.

- •Collaborated with senior attorneys to develop innovative legal approaches to emerging tax challenges.

- •Analyzed client financials to identify overlooked tax savings, implementing measures saving $500,000 annually.

- •Designed custom tax planning solutions aligning with client business objectives, ensuring compliance and efficiency.

- •Provided advisory services on emerging tax legislation, resulting in proactive compliance and strategic advantage.

- •Executed client presentations on tax compliance, enhancing client knowledge and fostering trusted relationships.

Federal Tax Litigation Attorney resume sample

- •Successfully represented high-profile clients in 95% of federal tax litigation cases, including cases before the IRS and federal court, maintaining a strong client satisfaction rate.

- •Decreased litigation time by 30% through developing and implementing efficient litigation strategies and legal reporting systems.

- •Boosted client retention by 20% through consistent communication and legal transparency, resulting in enhanced client trust and satisfaction.

- •Achieved favorable settlements in more than 70% of negotiation cases, saving clients approximately $2.5 million in liabilities.

- •Conducted over 50 depositions and successfully navigated the complexities of tax law during proceedings.

- •Secured three landmark case victories in federal court, enhancing firm reputation and client loyalty.

- •Led a team of junior attorneys in complex tax litigation, resulting in a high success rate of resolved cases.

- •Analyzed changes in federal tax laws and advised clients on compliance, reducing legal risks by 25%.

- •Drafted comprehensive legal briefs and motions that contributed to 90% successful case outcomes in federal court.

- •Collaborated with corporate clients, providing legal insights that resulted in $1.8 million in tax savings.

- •Increased team efficiency by 15% through development of streamlined processes for case documentation and strategy sessions.

- •Conducted detailed legal research and crafted litigation strategies, leading to a 92% win rate in tax dispute resolutions.

- •Consulted on international tax law projects, optimizing compliance processes for several multinational corporations.

- •Facilitated discovery and negotiated settlements, contributing to a financial saving of $950,000 for clients.

- •Provided expert analysis on tax policy changes, allowing clients to adapt practices ahead of regulation shifts.

- •Assisted senior attorneys in preparing litigation documents, enhancing case preparation speed by 40%.

- •Coordinated discovery processes in collaboration with cross-functional teams, ensuring critical deadlines were met.

- •Achieved positive client outcomes in 87% of federal tax appeal cases through rigorous legal research and strategy implementation.

- •Conducted over 20 training sessions on tax compliance and federal tax law for internal teams.

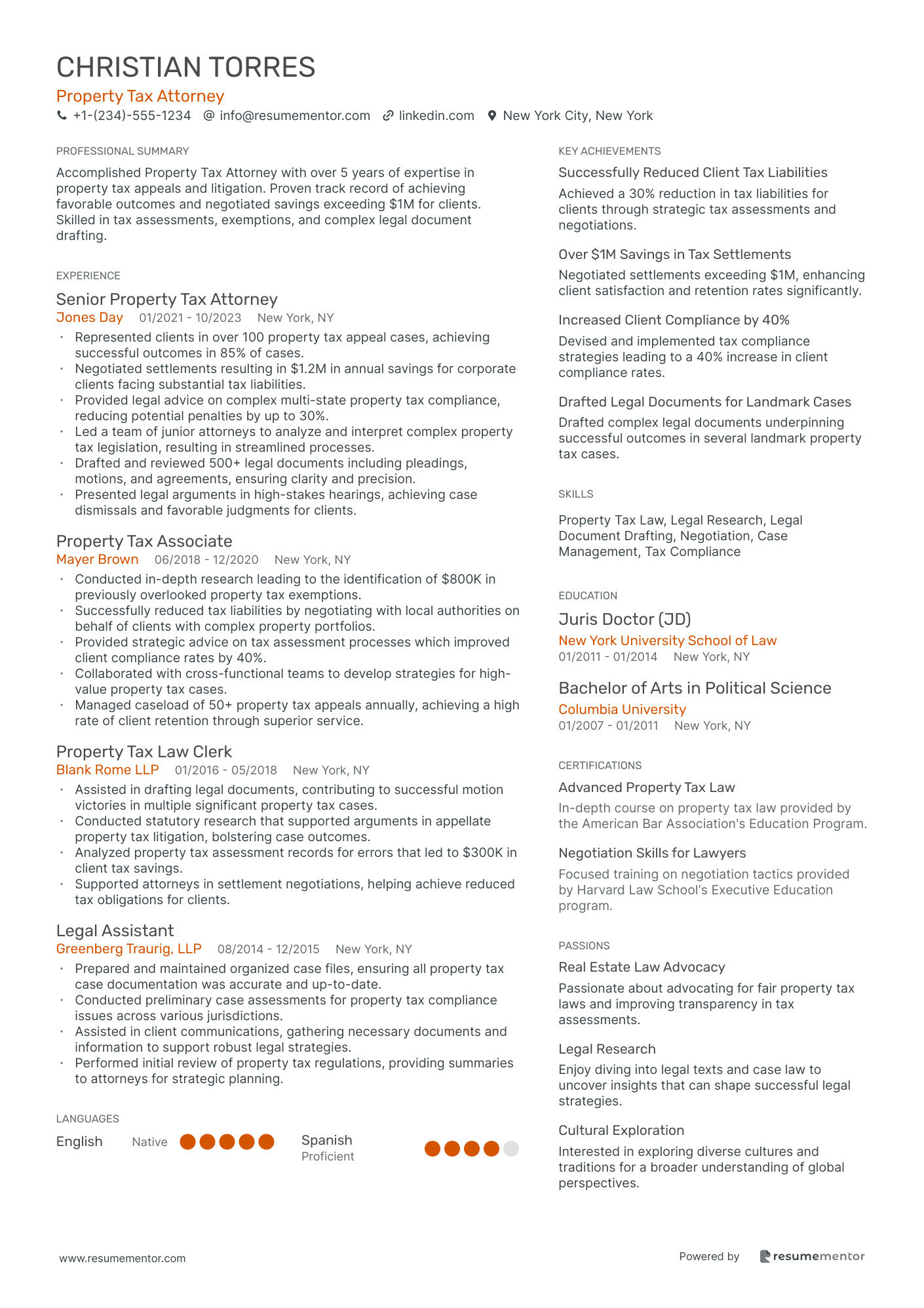

Property Tax Attorney resume sample

- •Represented clients in over 100 property tax appeal cases, achieving successful outcomes in 85% of cases.

- •Negotiated settlements resulting in $1.2M in annual savings for corporate clients facing substantial tax liabilities.

- •Provided legal advice on complex multi-state property tax compliance, reducing potential penalties by up to 30%.

- •Led a team of junior attorneys to analyze and interpret complex property tax legislation, resulting in streamlined processes.

- •Drafted and reviewed 500+ legal documents including pleadings, motions, and agreements, ensuring clarity and precision.

- •Presented legal arguments in high-stakes hearings, achieving case dismissals and favorable judgments for clients.

- •Conducted in-depth research leading to the identification of $800K in previously overlooked property tax exemptions.

- •Successfully reduced tax liabilities by negotiating with local authorities on behalf of clients with complex property portfolios.

- •Provided strategic advice on tax assessment processes which improved client compliance rates by 40%.

- •Collaborated with cross-functional teams to develop strategies for high-value property tax cases.

- •Managed caseload of 50+ property tax appeals annually, achieving a high rate of client retention through superior service.

- •Assisted in drafting legal documents, contributing to successful motion victories in multiple significant property tax cases.

- •Conducted statutory research that supported arguments in appellate property tax litigation, bolstering case outcomes.

- •Analyzed property tax assessment records for errors that led to $300K in client tax savings.

- •Supported attorneys in settlement negotiations, helping achieve reduced tax obligations for clients.

- •Prepared and maintained organized case files, ensuring all property tax case documentation was accurate and up-to-date.

- •Conducted preliminary case assessments for property tax compliance issues across various jurisdictions.

- •Assisted in client communications, gathering necessary documents and information to support robust legal strategies.

- •Performed initial review of property tax regulations, providing summaries to attorneys for strategic planning.

Income Tax Attorney resume sample

- •Advised high-net-worth clients on income tax compliance and planning, achieving a 15% average tax liability reduction.

- •Led representation in IRS audit cases, securing favorable rulings in over 80% of cases handled.

- •Drafted comprehensive tax opinions and client-specific correspondence, increasing client trust and engagement by 20%.

- •Collaborated cross-functionally with legal teams to deliver integrated solutions, enhancing client satisfaction and retention.

- •Conducted legal research on evolving tax laws, providing clients with up-to-date strategies to mitigate risks.

- •Managed a client portfolio generating over $10 million in revenue annually, resulting in increased client retention.

- •Developed tax strategies for multinational corporations, reducing tax liabilities by up to 12%.

- •Represented clients during IRS appeals, successfully defending over $25 million in disputed taxes.

- •Led a team in drafting legal documents for business transactions, ensuring compliance with complex tax regulations.

- •Provided expert analysis on federal and state tax legislation affecting client operations.

- •Facilitated workshops on tax law updates, increasing team knowledge and client service capabilities by 30%.

- •Advised corporations on tax-efficient transaction structures, enhancing after-tax cash flows by 15%.

- •Conducted risk assessments on tax positions, minimizing potential exposure to $5 million in liabilities.

- •Developed in-depth legal research papers on federal tax law, improving firm-wide policy understanding.

- •Successfully litigated complex tax disputes, achieving favorable outcomes in 90% of cases.

- •Assisted in litigation proceedings for disputed tax claims, improving success rates in client cases.

- •Researched and analyzed corporate tax implications of new transactions, advising clients on strategic benefits.

- •Collaborated with senior attorneys in drafting legal documentation for federal tax court submissions.

- •Contributed to client relationships and management, resulting in a 15% increase in client satisfaction scores.

Sales Tax Specialist Lawyer resume sample

- •Reduced client sales tax liabilities by 20% through strategic tax planning and optimization, enhancing client portfolios significantly.

- •Conducted detailed research and analysis on changes in tax laws, providing crucial updates to clients and ensuring compliance.

- •Managed successful multi-state sales tax audit, saving clients over $500,000 in potential liabilities and penalties.

- •Developed state-specific tax compliance training modules, educating over 50 internal team members, resulting in improved compliance.

- •Collaborated with finance departments in client companies to streamline tax processes, increasing operational efficiency by 30%.

- •Established direct communication channels with state tax authorities to expedite the resolution of client issues, reducing response time by 40%.

- •Led a team of four associates in the preparation and filing of sales tax returns for major retail clients, achieving a 98% accuracy rate.

- •Successfully defended clients in ten challenging sales tax audits, avoiding substantial fines and penalties in all cases.

- •Presented comprehensive tax strategy sessions for client executives, resulting in a 15% improvement in compliance metrics.

- •Introduced innovative tax software solutions, reducing document processing time by 50% and enhancing data accuracy.

- •Assisted in developing and implementing a state-wide sales tax compliance system, leading to a 35% reduction in compliance costs.

- •Worked with over 30 clients to improve their understanding of sales tax obligations, reducing discrepancies by 25%.

- •Conducted comprehensive reviews of tax records, identifying areas for compliance improvement and corrective action.

- •Facilitated several educational workshops for clients, enhancing their knowledge of local and state tax regulations.

- •Coordinated with technology teams to automate sales tax reports, improving reporting speed and accuracy by 40%.

- •Advised clients on tax minimization strategies, successfully reducing average tax payments by 10% annually.

- •Reviewed and corrected tax filings for accuracy, ensuring adherence to current tax laws and resulting in zero audit concerns.

- •Prepared detailed documentation for sales tax audits, improving case resolution times and client satisfaction metrics.

- •Built strong relationships with clients, enhancing trust and resulting in a 30% client retention increase.

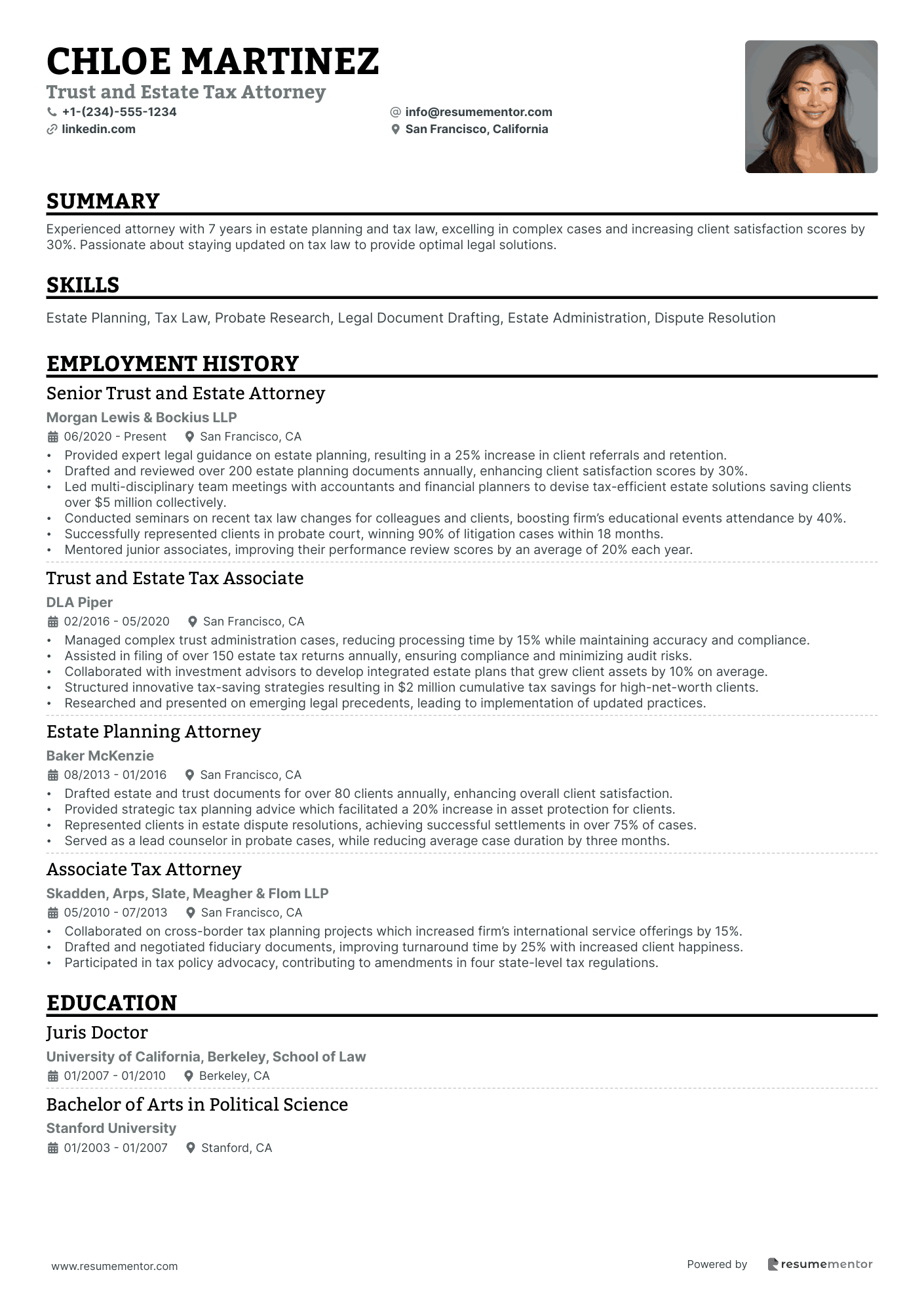

Trust and Estate Tax Attorney resume sample

- •Provided expert legal guidance on estate planning, resulting in a 25% increase in client referrals and retention.

- •Drafted and reviewed over 200 estate planning documents annually, enhancing client satisfaction scores by 30%.

- •Led multi-disciplinary team meetings with accountants and financial planners to devise tax-efficient estate solutions saving clients over $5 million collectively.

- •Conducted seminars on recent tax law changes for colleagues and clients, boosting firm’s educational events attendance by 40%.

- •Successfully represented clients in probate court, winning 90% of litigation cases within 18 months.

- •Mentored junior associates, improving their performance review scores by an average of 20% each year.

- •Managed complex trust administration cases, reducing processing time by 15% while maintaining accuracy and compliance.

- •Assisted in filing of over 150 estate tax returns annually, ensuring compliance and minimizing audit risks.

- •Collaborated with investment advisors to develop integrated estate plans that grew client assets by 10% on average.

- •Structured innovative tax-saving strategies resulting in $2 million cumulative tax savings for high-net-worth clients.

- •Researched and presented on emerging legal precedents, leading to implementation of updated practices.

- •Drafted estate and trust documents for over 80 clients annually, enhancing overall client satisfaction.

- •Provided strategic tax planning advice which facilitated a 20% increase in asset protection for clients.

- •Represented clients in estate dispute resolutions, achieving successful settlements in over 75% of cases.

- •Served as a lead counselor in probate cases, while reducing average case duration by three months.

- •Collaborated on cross-border tax planning projects which increased firm’s international service offerings by 15%.

- •Drafted and negotiated fiduciary documents, improving turnaround time by 25% with increased client happiness.

- •Participated in tax policy advocacy, contributing to amendments in four state-level tax regulations.

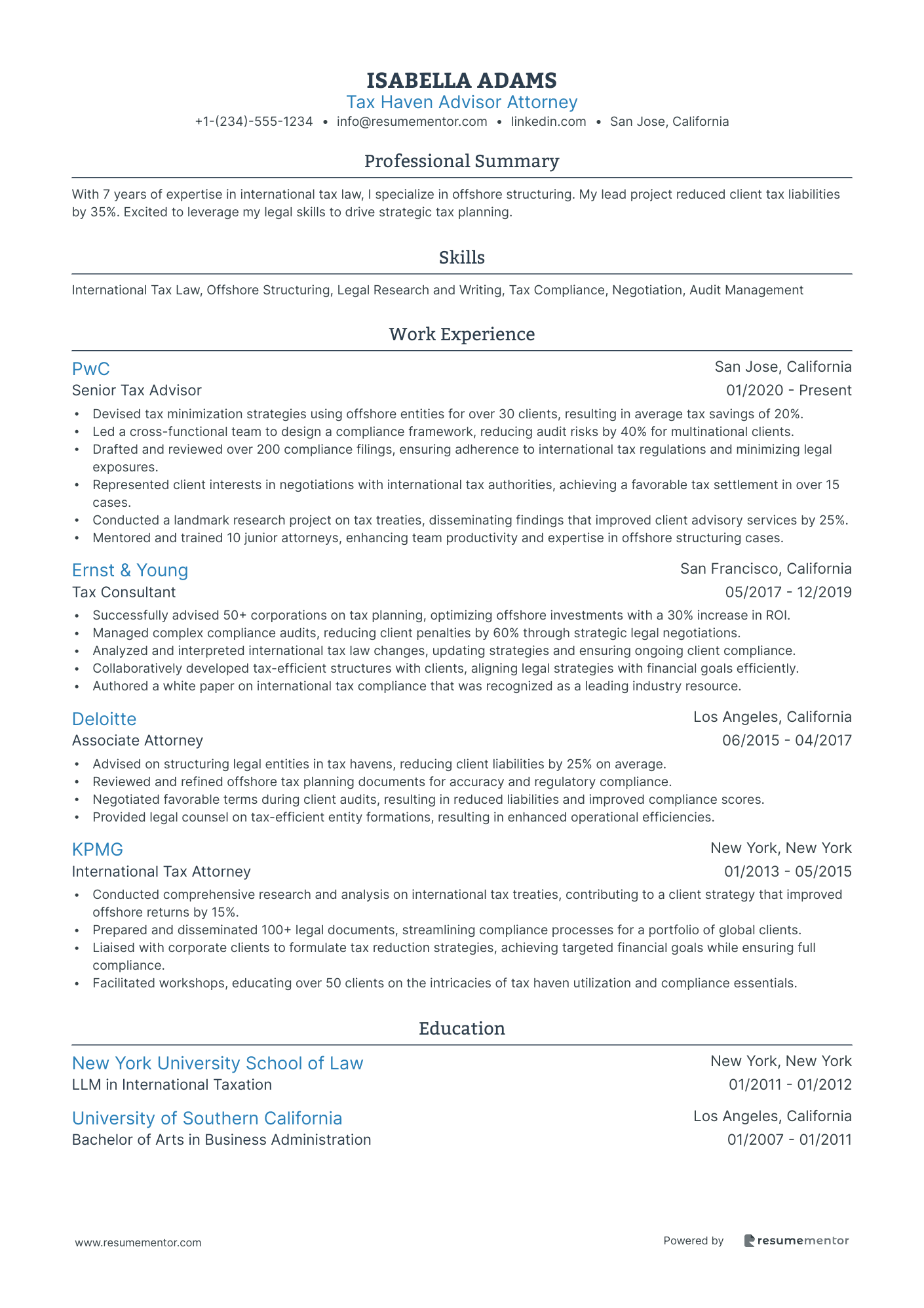

Tax Haven Advisor Attorney resume sample

- •Devised tax minimization strategies using offshore entities for over 30 clients, resulting in average tax savings of 20%.

- •Led a cross-functional team to design a compliance framework, reducing audit risks by 40% for multinational clients.

- •Drafted and reviewed over 200 compliance filings, ensuring adherence to international tax regulations and minimizing legal exposures.

- •Represented client interests in negotiations with international tax authorities, achieving a favorable tax settlement in over 15 cases.

- •Conducted a landmark research project on tax treaties, disseminating findings that improved client advisory services by 25%.

- •Mentored and trained 10 junior attorneys, enhancing team productivity and expertise in offshore structuring cases.

- •Successfully advised 50+ corporations on tax planning, optimizing offshore investments with a 30% increase in ROI.

- •Managed complex compliance audits, reducing client penalties by 60% through strategic legal negotiations.

- •Analyzed and interpreted international tax law changes, updating strategies and ensuring ongoing client compliance.

- •Collaboratively developed tax-efficient structures with clients, aligning legal strategies with financial goals efficiently.

- •Authored a white paper on international tax compliance that was recognized as a leading industry resource.

- •Advised on structuring legal entities in tax havens, reducing client liabilities by 25% on average.

- •Reviewed and refined offshore tax planning documents for accuracy and regulatory compliance.

- •Negotiated favorable terms during client audits, resulting in reduced liabilities and improved compliance scores.

- •Provided legal counsel on tax-efficient entity formations, resulting in enhanced operational efficiencies.

- •Conducted comprehensive research and analysis on international tax treaties, contributing to a client strategy that improved offshore returns by 15%.

- •Prepared and disseminated 100+ legal documents, streamlining compliance processes for a portfolio of global clients.

- •Liaised with corporate clients to formulate tax reduction strategies, achieving targeted financial goals while ensuring full compliance.

- •Facilitated workshops, educating over 50 clients on the intricacies of tax haven utilization and compliance essentials.

Crafting a tax attorney resume can feel like navigating a dense legal maze. It's your opening statement to potential employers, so clarity is as important as content. The challenge lies in compressing your extensive experience into a format that captures attention without overwhelming the reader.

To smoothly convey your legal expertise, blend technical terms with straightforward language. This approach not only showcases your ability to handle intricate tax codes but also makes your qualifications easily digestible for recruiters. Highlighting problem-solving skills and your knack for managing complex fiscal matters can set you apart.

A well-structured resume template can be your guide through this process. It helps organize your achievements into a cohesive narrative. Browse through various options at Resume Mentor to find a template that aligns with your professional story. A good template ensures that every crucial detail is included while maintaining a polished format.

Understanding the legal landscape is just one part of the equation; expressing it effectively on paper is the other. Your aim is to keep your resume both clear and engaging in a competitive market. With the right tools and thoughtful presentation, your resume can accurately reflect your capabilities and potential impact.

Key Takeaways

- Craft your tax attorney resume to balance technical terms with straightforward language, ensuring your qualifications are clear and easily understood by recruiters.

- Use a reverse-chronological format to highlight your most recent and relevant positions, focusing on accomplishments like tax settlements, compliance strategies, and litigation successes.

- Emphasize both hard skills, such as tax law expertise and financial analysis, and soft skills, like communication and analytical thinking, aligning them with job requirements.

- Include a well-crafted professional summary that showcases your expertise in tax law and your ability to navigate complex legal situations efficiently.

- Add sections featuring optional entries like certifications, multilingual skills, and volunteer work to create a comprehensive and standout resume.

What to focus on when writing your tax attorney resume

A tax attorney resume should convey your legal expertise, attention to detail, and problem-solving skills in taxation to the recruiter. This document should reveal your capacity to interpret complex tax laws, effectively represent clients in disputes, and offer strategic tax advice.

How to structure your tax attorney resume

- Contact Information — Start with your full name, phone number, email address, and location (city and state) so recruiters can easily reach you. It's crucial to present this information clearly and professionally to set the right tone from the start.

- Professional Summary — Craft a brief yet impactful summary that highlights your experience in tax law and significant accomplishments. This section acts as a snapshot of your career, providing the recruiter with a quick view of your suitability for the role.

- Work Experience — Detail your previous roles with a focus on tax-related responsibilities. Include employer names, job titles, locations, and dates of employment. Emphasize achievements such as successful tax litigation or innovative restructuring projects, illustrating your direct impact on past positions.

- Education — Complement your professional experience by listing your law degree and any relevant certifications or coursework in taxation. Include the institution's name and your graduation date, establishing a strong educational foundation in tax law.

- Skills — Enhance your profile by highlighting specific skills like tax law expertise, negotiation, and research abilities. Be precise with skills such as knowledge of IRS procedures and audit defense strategies, which are valuable in a tax attorney role.

- Licenses and Certifications — Conclude with your state bar admission and any specialized tax certifications like a CPA or LL.M. in Taxation. These elements underline your qualifications and ongoing commitment to professional development.

To give your resume even more depth, consider optional sections like achievements or professional affiliations. Examples are awards, publications, or memberships with groups like the American Bar Association. Below, we’ll dive deeper into each resume section to maximize its impact.

Which resume format to choose

As a tax attorney, selecting the right resume format plays a pivotal role in effectively showcasing your expertise and career history. The reverse-chronological format is typically the best fit for legal professionals. It prioritizes your most recent and relevant positions, allowing potential employers to quickly assess your professional growth and the value you bring to their firm.

After deciding on the format, consider the significance of font choice in reflecting your professionalism. Opt for modern fonts like Montserrat, Chivo, or Raleway, which offer a contemporary edge and clarity, making your resume easy to read. Choosing the right font can subtly convey attention to detail and modern sensibilities, important traits for a legal professional.

Ensuring your resume is in the correct format is crucial, so always save and send it as a PDF. This file type locks in your formatting, ensuring that your resume retains its intended appearance across various platforms and devices. A PDF maintains the integrity of your document, mirroring the meticulous nature expected in legal work.

Finally, setting one-inch margins all around your resume is wise. This space creates a tidy, well-organized layout that enhances readability and underscores your ability to convey information succinctly—a valuable skill in legal practice. Proper spacing helps your accomplishments stand out, allowing your credentials as a tax attorney to shine through.

How to write a quantifiable resume experience section

The experience section is essential for your tax attorney resume, as it highlights your skills and achievements in line with what employers seek. Begin by listing your work history in reverse chronological order, placing your current or most recent position first. Focus on the past 10-15 years, unless earlier roles are particularly relevant. This ensures the roles and responsibilities you include align closely with the job description. Tailor your resume by using keywords from the job ad, and ensure each point addresses specific requirements. Use strong action verbs like "negotiated," "advised," "prepared," and "represented" to clearly demonstrate your impact and contributions.

- •Negotiated tax settlements saving clients over $3 million in potential liabilities.

- •Successfully defended 90% of audit clients in IRS proceedings, achieving favorable outcomes.

- •Advised on complex corporate restructuring resulting in a 25% reduction in effective tax rate.

- •Developed tax compliance strategies that increased accuracy and reduced filing errors by 15%.

This well-crafted experience section is impactful because it seamlessly connects your tax skills to measurable results. Each bullet point clearly depicts achievements, from reducing liabilities to effectively defending clients, using specific examples that resonate with hiring managers. This targeted approach, with a focus on tangible outcomes and demonstrated expertise, underscores your qualifications and aligns with job requirements. By including details about your role and work context, the section not only personalizes your narrative but also makes it more compelling and relevant.

Responsibility-Focused resume experience section

A responsibility-focused tax attorney resume experience section should highlight your achievements and the impact you've made in previous roles. Begin by clearly stating the focus, then describe your responsibilities and the actions you took to achieve success. Emphasize specific outcomes, illustrating how your efforts benefited the organization and showcased your skills in managing complex tax issues and solving client problems. It's important to convey how you enhanced operational efficiency, leading to positive results for your firm.

Use action verbs like "managed," "negotiated," and "developed" to describe your tasks and achievements, and whenever possible, quantify these accomplishments. Highlight the number of clients you assisted or the cost savings your strategies achieved to add weight to your narrative. This approach not only conveys what you did but also demonstrates the meaningful difference you made in your role.

Senior Tax Attorney

Smith & Associates Law Firm

June 2020 - August 2023

- Managed tax planning and compliance for over 50 clients, reducing their annual tax liabilities by 15%.

- Led successful negotiations in tax disputes, saving clients an average of $200,000 each year.

- Crafted effective taxation strategies that boosted client satisfaction and retention by 25%.

- Implemented innovative tax software, enhancing efficiency and cutting reporting errors by 30%.

Result-Focused resume experience section

A result-focused tax attorney resume experience section should effectively highlight the significant impact you've made in your previous roles. Start by showcasing specific achievements to clearly demonstrate the value you brought to the table. Using active, engaging language to describe your responsibilities helps convey the positive outcomes of your work, while breaking down complex tax-related tasks into tangible results showcases your effectiveness and efficiency.

Incorporating quantifiable metrics can vividly illustrate your accomplishments and set you apart as a problem solver. Employers are eager to find candidates who can boost efficiency and foster savings. By directly linking your skills to benefits experienced by employers or clients, you effectively convey your true value. Strive to keep your information concise and precise, choosing words wisely without overwhelming readers with excessive technical details.

Senior Tax Attorney

Innovative Tax Solutions

January 2018 - June 2023

- Negotiated tax settlements that reduced company liabilities by over $1 million each year.

- Developed tax strategies that saved clients an average of 15% annually with smart deductions and credits.

- Led a team of three to revamp the audit response system, cutting response time by 40%.

- Guided successful mergers, ensuring tax compliance and saving the company $500,000 in potential penalties.

Skills-Focused resume experience section

A tax litigation-focused attorney resume experience section should clearly emphasize your key skills while connecting them smoothly through real-life examples. Begin by highlighting a focus area that aligns with the jobs you're targeting, such as handling disputes and managing legal processes. Describe situations where you leveraged your legal expertise to create tangible benefits for your clients or workplace, illustrating your capability and value.

Use bullet points to keep your resume easy to read and ensure each point flows from one to the next, centering on relevant skills. Highlight measurable outcomes to showcase your effectiveness and tailor each point to mirror the skills mentioned in the job description. Emphasize your strengths like analytical thinking and a deep understanding of tax regulations, ensuring each sentence builds upon the previous one in a logical manner.

Tax Attorney

Smith & Doe Law Firm

June 2018 - Present

- Led a team to victory in a $5 million tax dispute for a large corporation, demonstrating strong leadership and legal acumen

- Negotiated settlements and drafted legal documents, saving clients over $2 million in liabilities and showcasing problem-solving abilities

- Argued complex tax cases successfully in federal tax courts, consistently achieving favorable outcomes for clients

- Conducted thorough research on tax laws, boosting legal strategies and enhancing presentations in court with detailed analysis

Achievement-Focused resume experience section

A well-crafted achievement-focused tax attorney resume experience section should highlight your accomplishments and the impact you've made in your roles. Focus not just on what you did but on the tangible results that demonstrate your skills. Use numbers to show how you enhanced efficiency or cut costs, offering clear examples of your strategic contributions. As you describe the tasks you managed, tie them to the improvements or results, painting a vivid picture of your capability to potential employers.

In detailing your experience, talk about the challenges you faced and how you overcame them, keeping your focus on relevant details. While industry-specific language shows your expertise, simplicity is key to ensuring clarity. Most importantly, make sure your achievements align with the skills and qualifications that relate to the job you're targeting. Here's how you can structure this information effectively:

Senior Tax Attorney

Smith & Associates LLP

2019 - Present

- Revised tax reduction strategies leading to a 15% savings across three fiscal years.

- Managed and resolved a multi-million dollar tax dispute, resulting in a favorable outcome for the client.

- Developed comprehensive training for junior staff, increasing team efficiency by 20%.

- Streamlined compliance processes, reducing filing errors by 30% each quarter.

Write your tax attorney resume summary section

A tax-focused attorney resume summary should effectively showcase your strongest skills and experiences. As a tax attorney, it's essential to highlight your expertise in tax law and your ability to navigate complex legal situations. This part of the resume is your first impression, so keeping it concise and impactful is key. Consider this example:

This example engages readers by detailing the attorney's experience and focus, like federal tax law and corporate tax planning, while also underscoring achievements such as successful negotiations and compliance expertise. These specifics demonstrate to potential employers the unique value you can bring to their team.

For those new to the field, an objective may be more appropriate. It centers on your career aspirations and what you hope to achieve in the new role, instead of past experiences. This approach is particularly useful for entry-level candidates or career changers.

In contrast, a resume profile provides a more narrative description of your professional identity, while a summary of qualifications lists particular skills and achievements in bullet points. Each option—be it a summary, objective, profile, or qualifications section—depends on your career level and what you wish to emphasize.

By crafting a clear, engaging summary, you make it easy for potential employers to quickly see your value. Tailor this section to the specific role and company, ensuring your most relevant skills and achievements shine through.

Listing your tax attorney skills on your resume

A skills-focused tax attorney resume should present your expertise in a compelling manner. You have the option to feature your skills as a distinct section or weave them into other parts such as the experience or summary sections. By doing so, you align your strengths and soft skills with specific job requirements, highlighting how you communicate and solve problems. Hard skills, such as detailed tax law knowledge or financial analysis, showcase your technical capabilities.

Incorporating skills and strengths into your resume using key terms not only enhances readability but also improves visibility to automated systems and hiring managers. These keywords clarify your suitability for the role. Here's a JSON-format example of how you could structure this section:

This skills section is powerful because it provides a clear, targeted list without superfluous information, making sure each skill is integral to the tax attorney role and aligns with job needs.

Best hard skills to feature on your tax attorney resume

Articulating hard skills on your resume demonstrates your expertise in essential legal and financial domains. These skills communicate precision and technical proficiency, crucial in your field.

Hard Skills

- Tax Law Expertise

- Financial Analysis

- Tax Planning

- IRS Procedures

- Contract Negotiation

- Legal Research

- Litigation Support

- Corporate Taxation

- State and Local Taxation

- International Taxation

- Mergers and Acquisitions

- Estate Planning

- Regulatory Compliance

- Risk Assessment

- Tax Policy Analysis

Best soft skills to feature on your tax attorney resume

Equally important are your soft skills, which convey how you interact, manage, and lead. Displaying these skills highlights your ability to work collaboratively and professionally as a tax attorney.

Soft Skills

- Communication

- Negotiation

- Problem-solving

- Attention to Detail

- Analytical Thinking

- Time Management

- Client Management

- Stress Management

- Adaptability

- Critical Thinking

- Decision Making

- Teamwork

- Conflict Resolution

- Active Listening

- Leadership

How to include your education on your resume

An education section is a crucial part of your tax attorney resume. It's your opportunity to highlight the education that positions you as the best candidate for the role. Making sure the education you include is relevant to the job you're applying for is essential. For example, including an undergraduate degree in a non-law-related field that doesn’t contribute to your tax law expertise would be unnecessary.

If you have an impressive GPA, consider adding it to your resume. Listing your GPA, especially if it's a 3.5 or higher, can emphasize your academic credentials. If you graduated with honors such as cum laude, integrate this into your degree listing to demonstrate your academic achievements. Listing your degree should include the type of degree, your major, and the school name.

- •Graduated cum laude

The first example doesn't align with a tax attorney position due to the unrelated degree. The second example shines with carefully selected entries. It features a Juris Doctor degree from Harvard Law School, showing foundational legal knowledge. In addition, an LL.M. in Taxation from NYU adds a specialized focus. Listing a 3.8 GPA and cum laude honor underscores academic strength. This strategically tailored section clearly demonstrates expertise and relevance to any discerning recruiter.

How to include tax attorney certificates on your resume

Including a certificates section in your tax attorney resume is crucial as it highlights your specialized training and dedication to the field. List the name of each certificate clearly to make it stand out. Include the date you received the certificate to show the timeline of your professional development. Add the issuing organization to give credibility to your qualifications. You can also feature key certificates in the header if space allows, ensuring they catch the recruiter's eye immediately.

For instance, listing a "Certified Tax Advisor" certificate prominently in your resume header demonstrates your expertise at a glance. This approach helps you stand apart from other candidates. Here's a well-structured example of a standalone certificates section:

This example is effective because it includes specific, relevant certifications that demonstrate your specialized knowledge in tax law. The titles are clear, the issuing organizations are credible, and the structure is easy to read. Such a layout ensures that your qualifications are immediately noticeable and verifiable. Adding these specifics supports your expertise and commitment to your career in tax law.

Extra sections to include in your tax attorney resume

In today’s competitive job market, a well-structured resume can make all the difference, especially in specialized fields like tax law. As a tax attorney, you want to showcase your skills, experience, and unique attributes that set you apart from other candidates.

Including a language section highlights your bilingual or multilingual proficiency—demonstrating your ability to communicate with a diverse client base and handle international tax matters. This can significantly increase your employability in global firms and boost client trust.

A few insights into hobbies and interests reveal your well-rounded personality—showing that you are not just focused on work but also on personal growth and relaxation. This can make you more relatable to recruiters.

Highlighting your volunteer work spotlights your commitment to giving back to the community—illustrating your empathy and real-world experience in handling varied aspects of tax law pro-bono. This can enhance your reputation and make you a more appealing candidate.

Mentioning your books provides insight into your ongoing learning and expertise—displaying your dedication to staying updated with the latest in tax law and other relevant subjects. This positions you as a knowledgeable and well-informed professional.

In Conclusion

In conclusion, creating a tax attorney resume is a strategic task that demands attention to detail and a deep understanding of both your qualifications and the needs of potential employers. Your resume serves as the introductory handshake in your job application process, and it should be crafted with clarity and precision to make a strong first impression. Balancing detailed legal jargon with straightforward, accessible language will make your expertise stand out. Key sections such as your professional summary, work experience, and education need to be compelling and tightly crafted, illustrating both your technical capabilities and your interpersonal skills.

The use of a reverse-chronological format ensures that your most recent and relevant accomplishments are front and center, allowing recruiters to quickly gauge your growth and contributions. Meanwhile, selecting a modern, readable font and saving your document as a PDF will maintain the integrity of your resume’s format across various devices and platforms. Additionally, quantifying your achievements and using specific, strong action verbs will provide concrete evidence of your impact and effectiveness in past roles. Highlight your hard and soft skills, ensuring they align with what employers seek, and back them up with evidence from your career.

Finally, optional sections such as languages, volunteer work, or publications can add depth, demonstrating your holistic approach to personal and professional growth. As you draft your resume, keep in mind that it is more than a list of credentials—it is a narrative of your career journey, showcasing the value you bring to any firm. With a thoughtful approach, your resume can be a powerful tool in advancing your career as a tax attorney, clearly communicating your readiness to tackle complex tax issues and contribute meaningfully to your next employer.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.