Tax Lawyer Resume Examples

Jul 18, 2024

|

12 min read

"Crafting the perfect tax lawyer resume: tips to stand out and land your next role — because every detail counts when you're balancing the scales of justice."

Rated by 348 people

International Tax Lawyer

Estate Planning Tax Lawyer

Property Tax Legal Specialist

Tax Controversy Attorney

Transactional Tax Attorney

Mergers and Acquisitions Tax Lawyer

Cross Border Taxation Lawyer

State and Local Tax Attorney

Charitable Giving Tax Legal Specialist

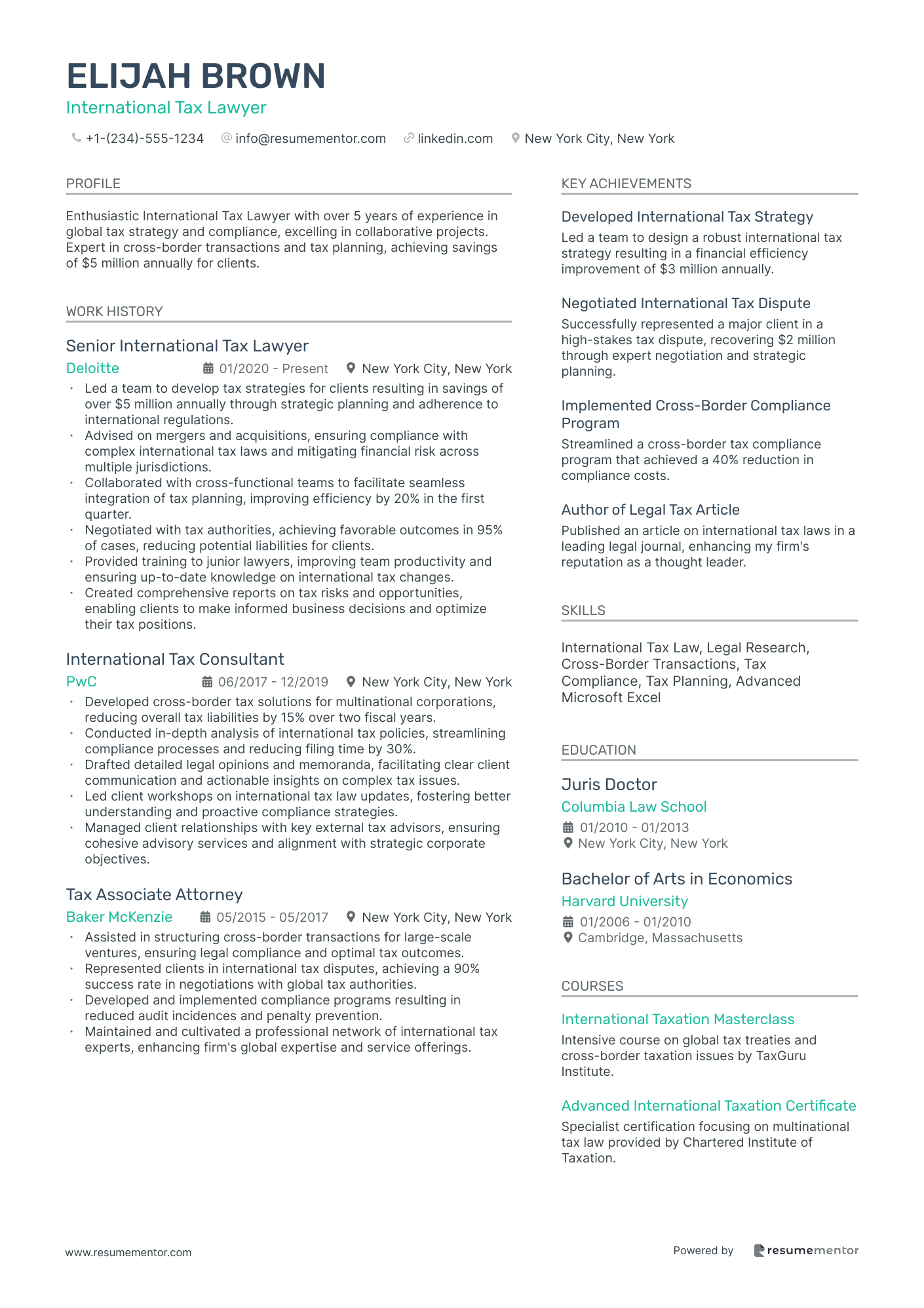

International Tax Lawyer resume sample

- •Led a team to develop tax strategies for clients resulting in savings of over $5 million annually through strategic planning and adherence to international regulations.

- •Advised on mergers and acquisitions, ensuring compliance with complex international tax laws and mitigating financial risk across multiple jurisdictions.

- •Collaborated with cross-functional teams to facilitate seamless integration of tax planning, improving efficiency by 20% in the first quarter.

- •Negotiated with tax authorities, achieving favorable outcomes in 95% of cases, reducing potential liabilities for clients.

- •Provided training to junior lawyers, improving team productivity and ensuring up-to-date knowledge on international tax changes.

- •Created comprehensive reports on tax risks and opportunities, enabling clients to make informed business decisions and optimize their tax positions.

- •Developed cross-border tax solutions for multinational corporations, reducing overall tax liabilities by 15% over two fiscal years.

- •Conducted in-depth analysis of international tax policies, streamlining compliance processes and reducing filing time by 30%.

- •Drafted detailed legal opinions and memoranda, facilitating clear client communication and actionable insights on complex tax issues.

- •Led client workshops on international tax law updates, fostering better understanding and proactive compliance strategies.

- •Managed client relationships with key external tax advisors, ensuring cohesive advisory services and alignment with strategic corporate objectives.

- •Assisted in structuring cross-border transactions for large-scale ventures, ensuring legal compliance and optimal tax outcomes.

- •Represented clients in international tax disputes, achieving a 90% success rate in negotiations with global tax authorities.

- •Developed and implemented compliance programs resulting in reduced audit incidences and penalty prevention.

- •Maintained and cultivated a professional network of international tax experts, enhancing firm's global expertise and service offerings.

- •Supported multinational corporations in identifying and leveraging tax opportunities, saving clients an average of 10% annually in taxes.

- •Conducted research on international tax jurisdictions, providing clients with strategic insights to optimize tax benefits.

- •Reviewed and scrutinized global operations, identifying tax risks and recommending mitigating strategies with a 95% client satisfaction rate.

- •Contributed to building client-focused global tax strategies that resulted in significant efficiencies and cost reductions.

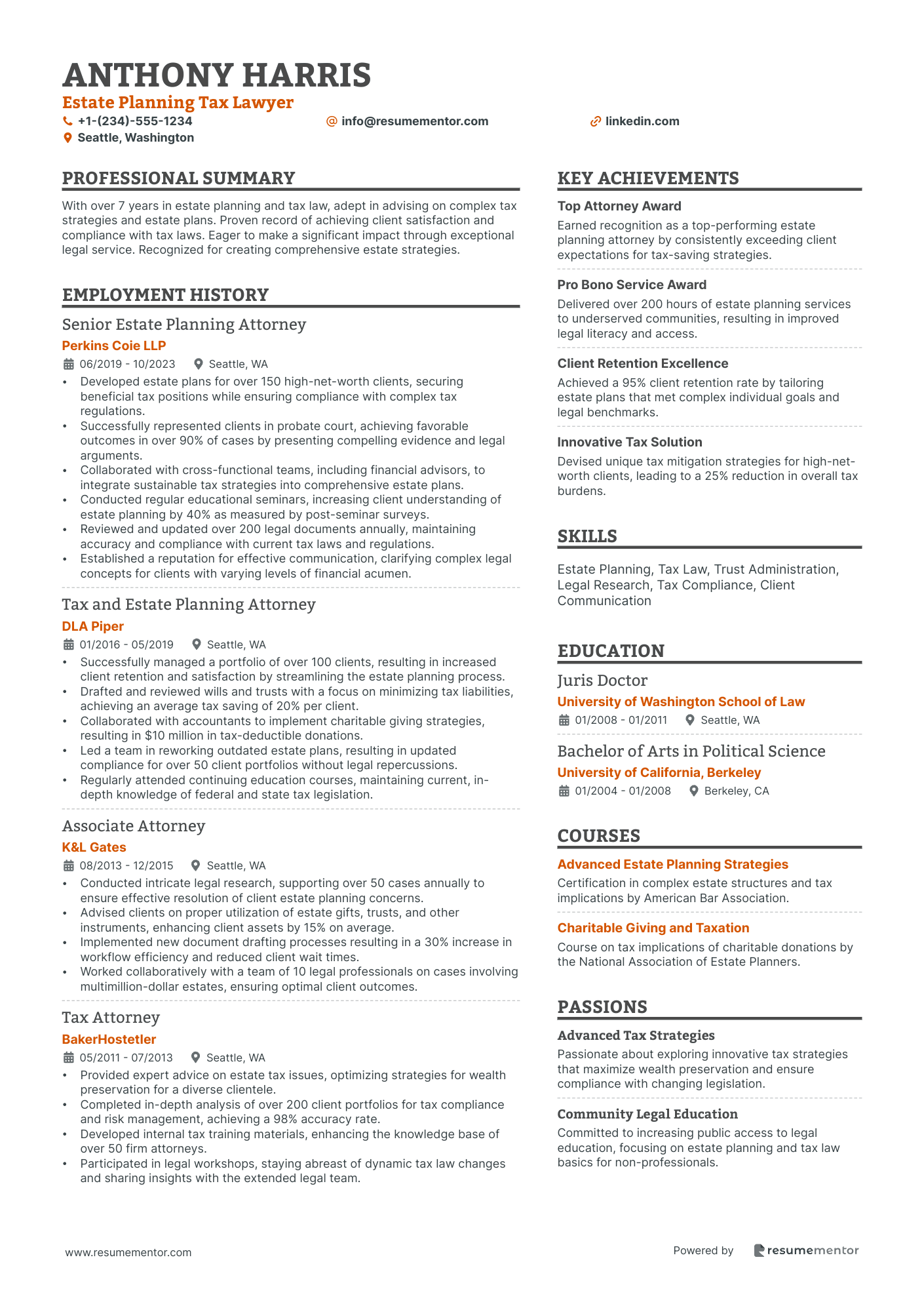

Estate Planning Tax Lawyer resume sample

- •Developed estate plans for over 150 high-net-worth clients, securing beneficial tax positions while ensuring compliance with complex tax regulations.

- •Successfully represented clients in probate court, achieving favorable outcomes in over 90% of cases by presenting compelling evidence and legal arguments.

- •Collaborated with cross-functional teams, including financial advisors, to integrate sustainable tax strategies into comprehensive estate plans.

- •Conducted regular educational seminars, increasing client understanding of estate planning by 40% as measured by post-seminar surveys.

- •Reviewed and updated over 200 legal documents annually, maintaining accuracy and compliance with current tax laws and regulations.

- •Established a reputation for effective communication, clarifying complex legal concepts for clients with varying levels of financial acumen.

- •Successfully managed a portfolio of over 100 clients, resulting in increased client retention and satisfaction by streamlining the estate planning process.

- •Drafted and reviewed wills and trusts with a focus on minimizing tax liabilities, achieving an average tax saving of 20% per client.

- •Collaborated with accountants to implement charitable giving strategies, resulting in $10 million in tax-deductible donations.

- •Led a team in reworking outdated estate plans, resulting in updated compliance for over 50 client portfolios without legal repercussions.

- •Regularly attended continuing education courses, maintaining current, in-depth knowledge of federal and state tax legislation.

- •Conducted intricate legal research, supporting over 50 cases annually to ensure effective resolution of client estate planning concerns.

- •Advised clients on proper utilization of estate gifts, trusts, and other instruments, enhancing client assets by 15% on average.

- •Implemented new document drafting processes resulting in a 30% increase in workflow efficiency and reduced client wait times.

- •Worked collaboratively with a team of 10 legal professionals on cases involving multimillion-dollar estates, ensuring optimal client outcomes.

- •Provided expert advice on estate tax issues, optimizing strategies for wealth preservation for a diverse clientele.

- •Completed in-depth analysis of over 200 client portfolios for tax compliance and risk management, achieving a 98% accuracy rate.

- •Developed internal tax training materials, enhancing the knowledge base of over 50 firm attorneys.

- •Participated in legal workshops, staying abreast of dynamic tax law changes and sharing insights with the extended legal team.

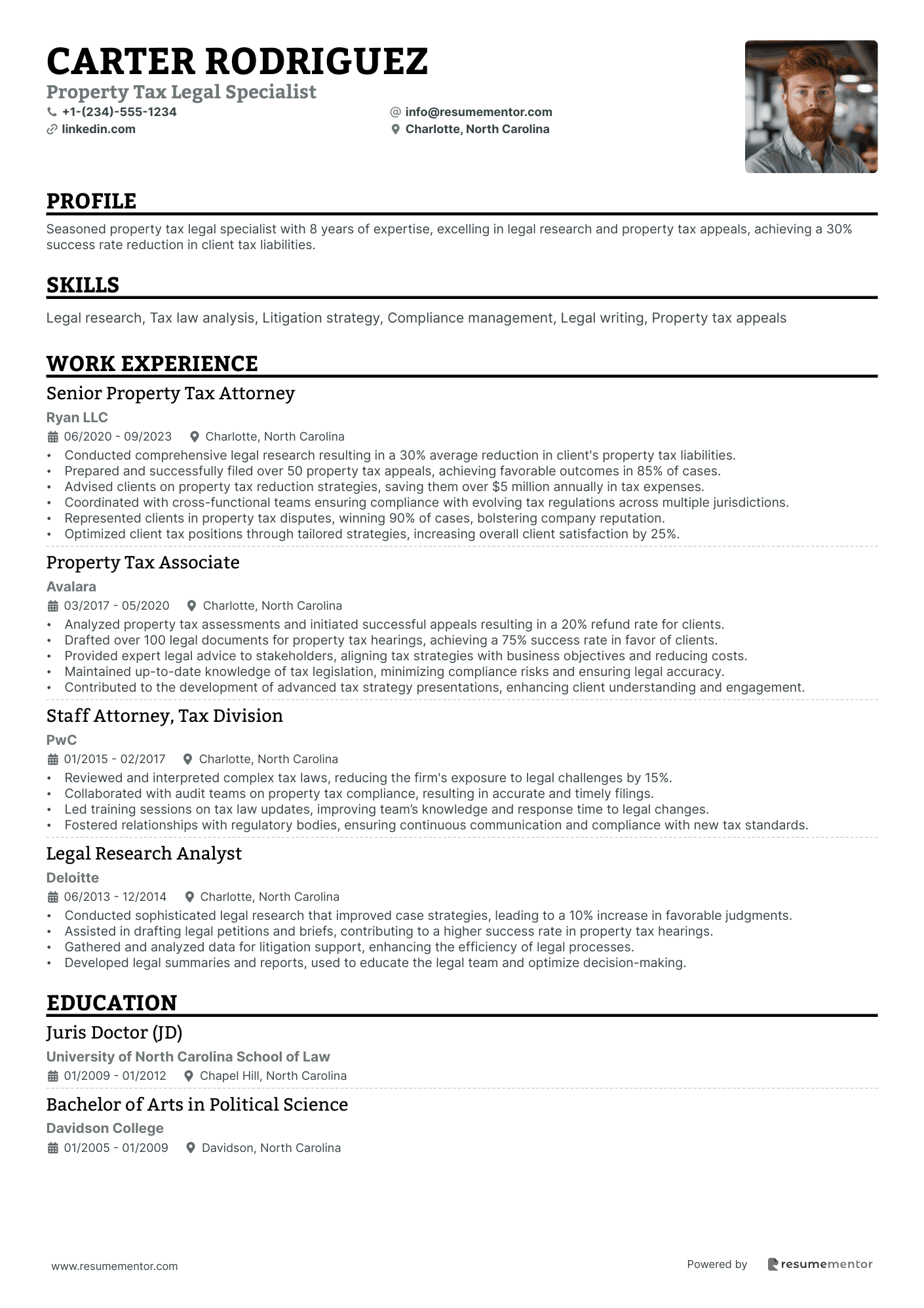

Property Tax Legal Specialist resume sample

- •Conducted comprehensive legal research resulting in a 30% average reduction in client's property tax liabilities.

- •Prepared and successfully filed over 50 property tax appeals, achieving favorable outcomes in 85% of cases.

- •Advised clients on property tax reduction strategies, saving them over $5 million annually in tax expenses.

- •Coordinated with cross-functional teams ensuring compliance with evolving tax regulations across multiple jurisdictions.

- •Represented clients in property tax disputes, winning 90% of cases, bolstering company reputation.

- •Optimized client tax positions through tailored strategies, increasing overall client satisfaction by 25%.

- •Analyzed property tax assessments and initiated successful appeals resulting in a 20% refund rate for clients.

- •Drafted over 100 legal documents for property tax hearings, achieving a 75% success rate in favor of clients.

- •Provided expert legal advice to stakeholders, aligning tax strategies with business objectives and reducing costs.

- •Maintained up-to-date knowledge of tax legislation, minimizing compliance risks and ensuring legal accuracy.

- •Contributed to the development of advanced tax strategy presentations, enhancing client understanding and engagement.

- •Reviewed and interpreted complex tax laws, reducing the firm's exposure to legal challenges by 15%.

- •Collaborated with audit teams on property tax compliance, resulting in accurate and timely filings.

- •Led training sessions on tax law updates, improving team’s knowledge and response time to legal changes.

- •Fostered relationships with regulatory bodies, ensuring continuous communication and compliance with new tax standards.

- •Conducted sophisticated legal research that improved case strategies, leading to a 10% increase in favorable judgments.

- •Assisted in drafting legal petitions and briefs, contributing to a higher success rate in property tax hearings.

- •Gathered and analyzed data for litigation support, enhancing the efficiency of legal processes.

- •Developed legal summaries and reports, used to educate the legal team and optimize decision-making.

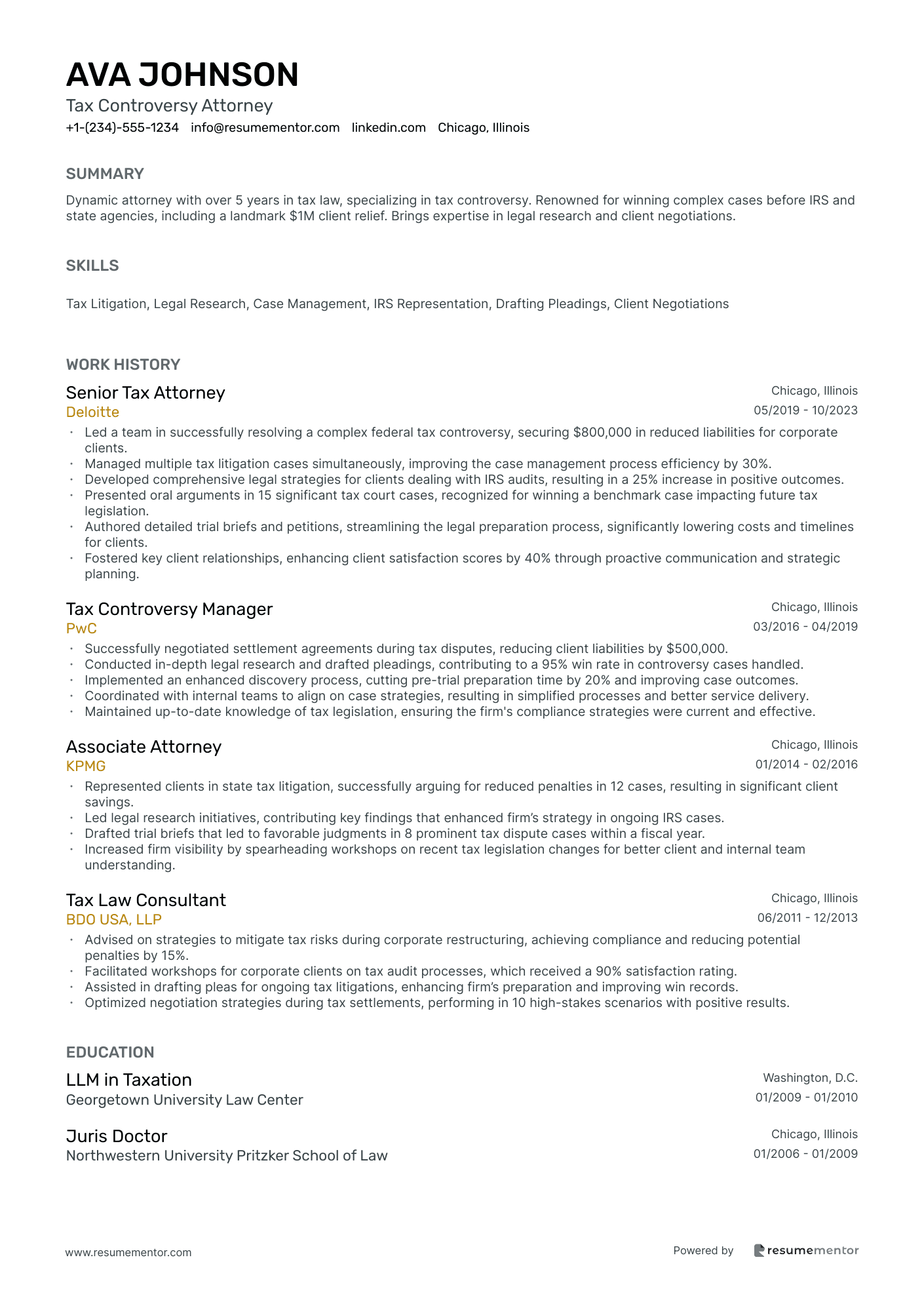

Tax Controversy Attorney resume sample

- •Led a team in successfully resolving a complex federal tax controversy, securing $800,000 in reduced liabilities for corporate clients.

- •Managed multiple tax litigation cases simultaneously, improving the case management process efficiency by 30%.

- •Developed comprehensive legal strategies for clients dealing with IRS audits, resulting in a 25% increase in positive outcomes.

- •Presented oral arguments in 15 significant tax court cases, recognized for winning a benchmark case impacting future tax legislation.

- •Authored detailed trial briefs and petitions, streamlining the legal preparation process, significantly lowering costs and timelines for clients.

- •Fostered key client relationships, enhancing client satisfaction scores by 40% through proactive communication and strategic planning.

- •Successfully negotiated settlement agreements during tax disputes, reducing client liabilities by $500,000.

- •Conducted in-depth legal research and drafted pleadings, contributing to a 95% win rate in controversy cases handled.

- •Implemented an enhanced discovery process, cutting pre-trial preparation time by 20% and improving case outcomes.

- •Coordinated with internal teams to align on case strategies, resulting in simplified processes and better service delivery.

- •Maintained up-to-date knowledge of tax legislation, ensuring the firm's compliance strategies were current and effective.

- •Represented clients in state tax litigation, successfully arguing for reduced penalties in 12 cases, resulting in significant client savings.

- •Led legal research initiatives, contributing key findings that enhanced firm’s strategy in ongoing IRS cases.

- •Drafted trial briefs that led to favorable judgments in 8 prominent tax dispute cases within a fiscal year.

- •Increased firm visibility by spearheading workshops on recent tax legislation changes for better client and internal team understanding.

- •Advised on strategies to mitigate tax risks during corporate restructuring, achieving compliance and reducing potential penalties by 15%.

- •Facilitated workshops for corporate clients on tax audit processes, which received a 90% satisfaction rating.

- •Assisted in drafting pleas for ongoing tax litigations, enhancing firm’s preparation and improving win records.

- •Optimized negotiation strategies during tax settlements, performing in 10 high-stakes scenarios with positive results.

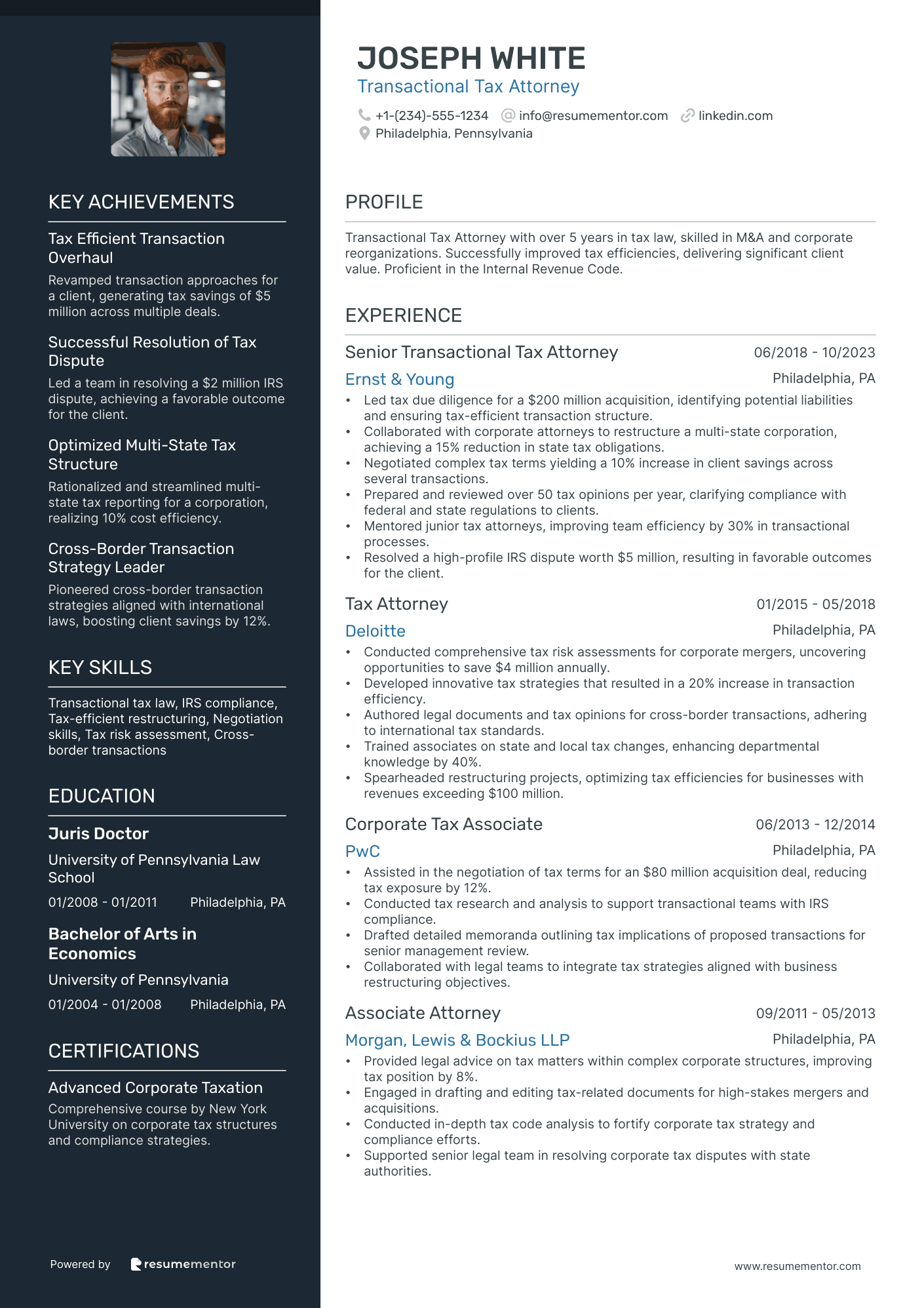

Transactional Tax Attorney resume sample

- •Led tax due diligence for a $200 million acquisition, identifying potential liabilities and ensuring tax-efficient transaction structure.

- •Collaborated with corporate attorneys to restructure a multi-state corporation, achieving a 15% reduction in state tax obligations.

- •Negotiated complex tax terms yielding a 10% increase in client savings across several transactions.

- •Prepared and reviewed over 50 tax opinions per year, clarifying compliance with federal and state regulations to clients.

- •Mentored junior tax attorneys, improving team efficiency by 30% in transactional processes.

- •Resolved a high-profile IRS dispute worth $5 million, resulting in favorable outcomes for the client.

- •Conducted comprehensive tax risk assessments for corporate mergers, uncovering opportunities to save $4 million annually.

- •Developed innovative tax strategies that resulted in a 20% increase in transaction efficiency.

- •Authored legal documents and tax opinions for cross-border transactions, adhering to international tax standards.

- •Trained associates on state and local tax changes, enhancing departmental knowledge by 40%.

- •Spearheaded restructuring projects, optimizing tax efficiencies for businesses with revenues exceeding $100 million.

- •Assisted in the negotiation of tax terms for an $80 million acquisition deal, reducing tax exposure by 12%.

- •Conducted tax research and analysis to support transactional teams with IRS compliance.

- •Drafted detailed memoranda outlining tax implications of proposed transactions for senior management review.

- •Collaborated with legal teams to integrate tax strategies aligned with business restructuring objectives.

- •Provided legal advice on tax matters within complex corporate structures, improving tax position by 8%.

- •Engaged in drafting and editing tax-related documents for high-stakes mergers and acquisitions.

- •Conducted in-depth tax code analysis to fortify corporate tax strategy and compliance efforts.

- •Supported senior legal team in resolving corporate tax disputes with state authorities.

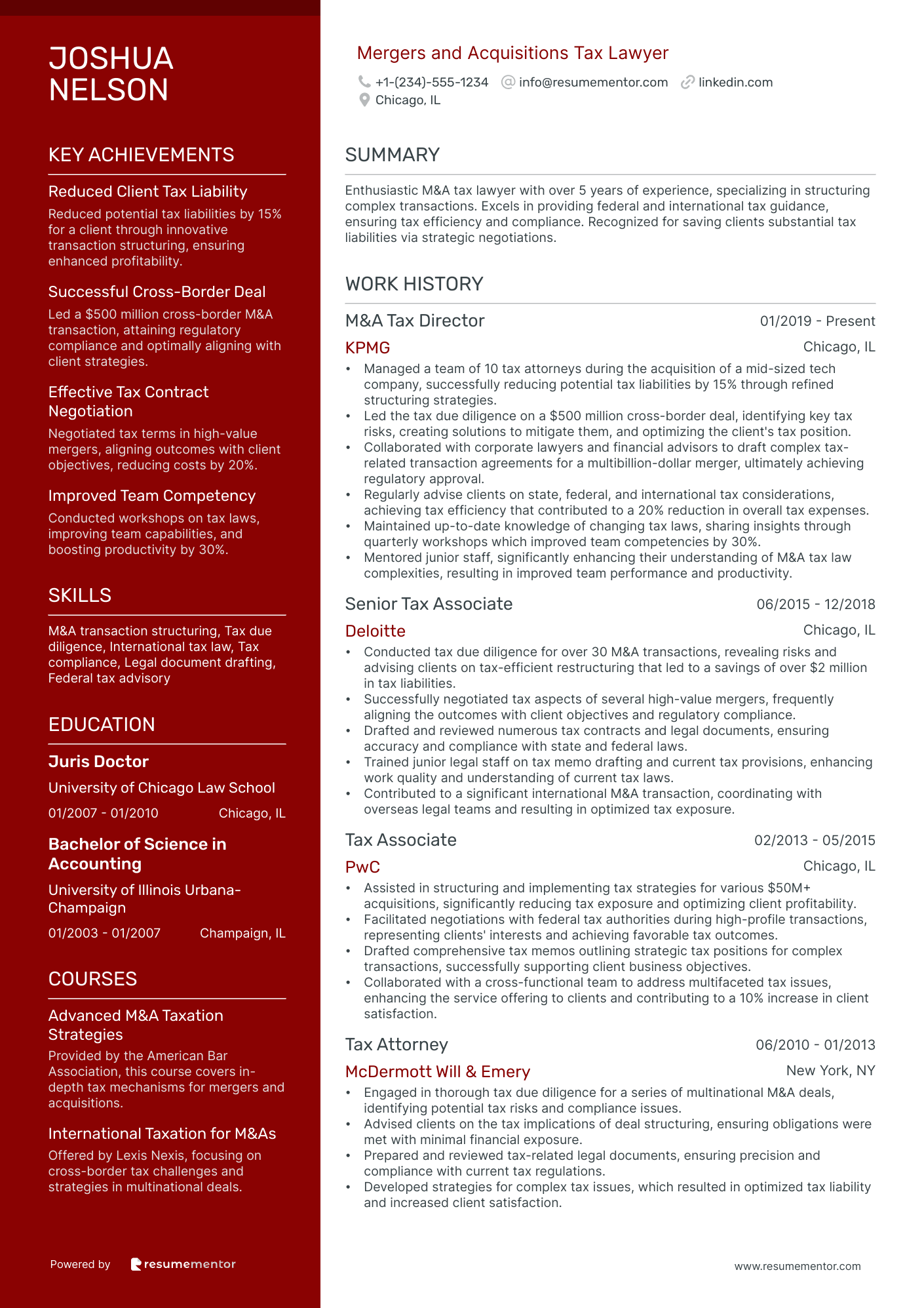

Mergers and Acquisitions Tax Lawyer resume sample

- •Managed a team of 10 tax attorneys during the acquisition of a mid-sized tech company, successfully reducing potential tax liabilities by 15% through refined structuring strategies.

- •Led the tax due diligence on a $500 million cross-border deal, identifying key tax risks, creating solutions to mitigate them, and optimizing the client's tax position.

- •Collaborated with corporate lawyers and financial advisors to draft complex tax-related transaction agreements for a multibillion-dollar merger, ultimately achieving regulatory approval.

- •Regularly advise clients on state, federal, and international tax considerations, achieving tax efficiency that contributed to a 20% reduction in overall tax expenses.

- •Maintained up-to-date knowledge of changing tax laws, sharing insights through quarterly workshops which improved team competencies by 30%.

- •Mentored junior staff, significantly enhancing their understanding of M&A tax law complexities, resulting in improved team performance and productivity.

- •Conducted tax due diligence for over 30 M&A transactions, revealing risks and advising clients on tax-efficient restructuring that led to a savings of over $2 million in tax liabilities.

- •Successfully negotiated tax aspects of several high-value mergers, frequently aligning the outcomes with client objectives and regulatory compliance.

- •Drafted and reviewed numerous tax contracts and legal documents, ensuring accuracy and compliance with state and federal laws.

- •Trained junior legal staff on tax memo drafting and current tax provisions, enhancing work quality and understanding of current tax laws.

- •Contributed to a significant international M&A transaction, coordinating with overseas legal teams and resulting in optimized tax exposure.

- •Assisted in structuring and implementing tax strategies for various $50M+ acquisitions, significantly reducing tax exposure and optimizing client profitability.

- •Facilitated negotiations with federal tax authorities during high-profile transactions, representing clients' interests and achieving favorable tax outcomes.

- •Drafted comprehensive tax memos outlining strategic tax positions for complex transactions, successfully supporting client business objectives.

- •Collaborated with a cross-functional team to address multifaceted tax issues, enhancing the service offering to clients and contributing to a 10% increase in client satisfaction.

- •Engaged in thorough tax due diligence for a series of multinational M&A deals, identifying potential tax risks and compliance issues.

- •Advised clients on the tax implications of deal structuring, ensuring obligations were met with minimal financial exposure.

- •Prepared and reviewed tax-related legal documents, ensuring precision and compliance with current tax regulations.

- •Developed strategies for complex tax issues, which resulted in optimized tax liability and increased client satisfaction.

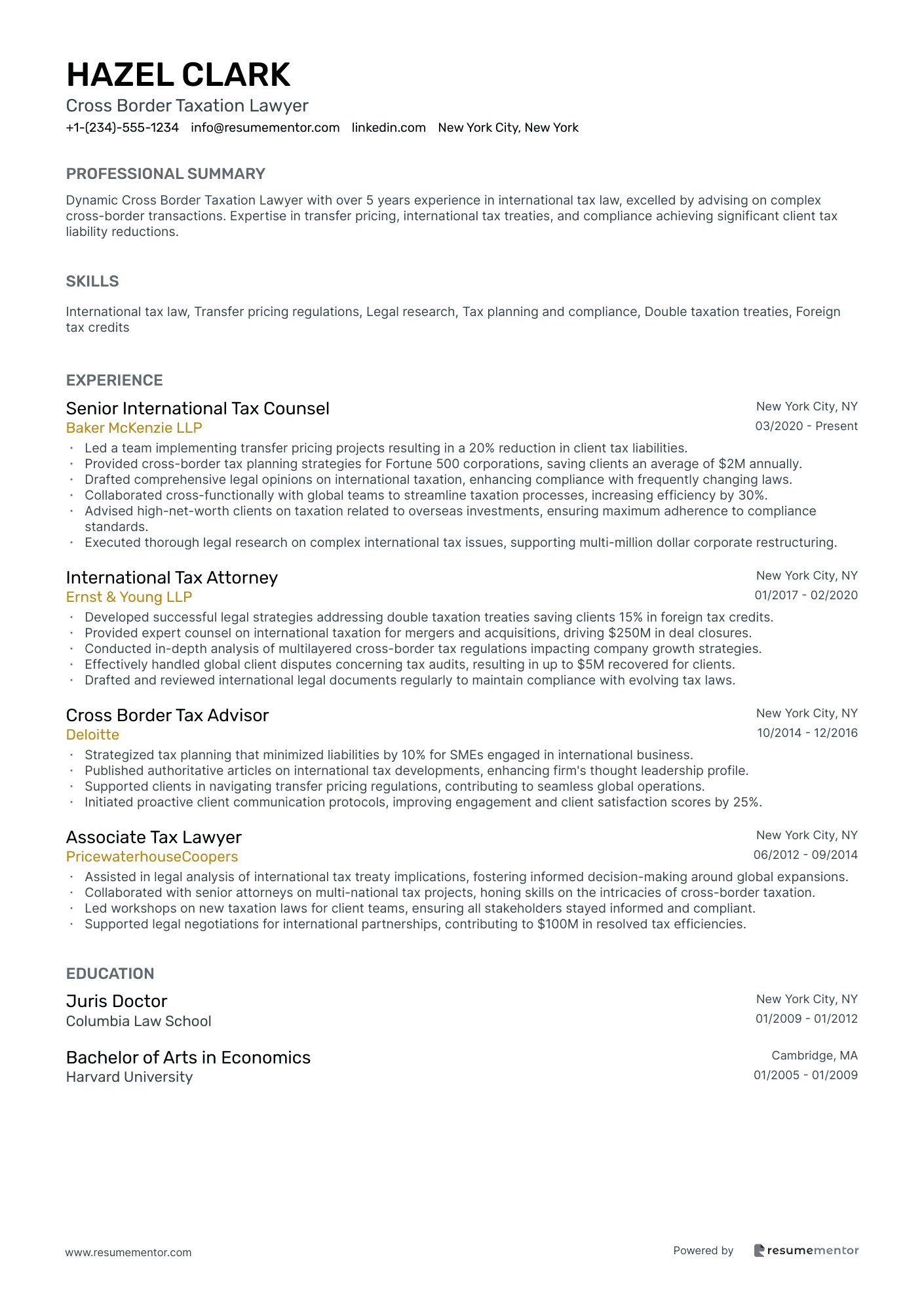

Cross Border Taxation Lawyer resume sample

- •Led a team implementing transfer pricing projects resulting in a 20% reduction in client tax liabilities.

- •Provided cross-border tax planning strategies for Fortune 500 corporations, saving clients an average of $2M annually.

- •Drafted comprehensive legal opinions on international taxation, enhancing compliance with frequently changing laws.

- •Collaborated cross-functionally with global teams to streamline taxation processes, increasing efficiency by 30%.

- •Advised high-net-worth clients on taxation related to overseas investments, ensuring maximum adherence to compliance standards.

- •Executed thorough legal research on complex international tax issues, supporting multi-million dollar corporate restructuring.

- •Developed successful legal strategies addressing double taxation treaties saving clients 15% in foreign tax credits.

- •Provided expert counsel on international taxation for mergers and acquisitions, driving $250M in deal closures.

- •Conducted in-depth analysis of multilayered cross-border tax regulations impacting company growth strategies.

- •Effectively handled global client disputes concerning tax audits, resulting in up to $5M recovered for clients.

- •Drafted and reviewed international legal documents regularly to maintain compliance with evolving tax laws.

- •Strategized tax planning that minimized liabilities by 10% for SMEs engaged in international business.

- •Published authoritative articles on international tax developments, enhancing firm's thought leadership profile.

- •Supported clients in navigating transfer pricing regulations, contributing to seamless global operations.

- •Initiated proactive client communication protocols, improving engagement and client satisfaction scores by 25%.

- •Assisted in legal analysis of international tax treaty implications, fostering informed decision-making around global expansions.

- •Collaborated with senior attorneys on multi-national tax projects, honing skills on the intricacies of cross-border taxation.

- •Led workshops on new taxation laws for client teams, ensuring all stakeholders stayed informed and compliant.

- •Supported legal negotiations for international partnerships, contributing to $100M in resolved tax efficiencies.

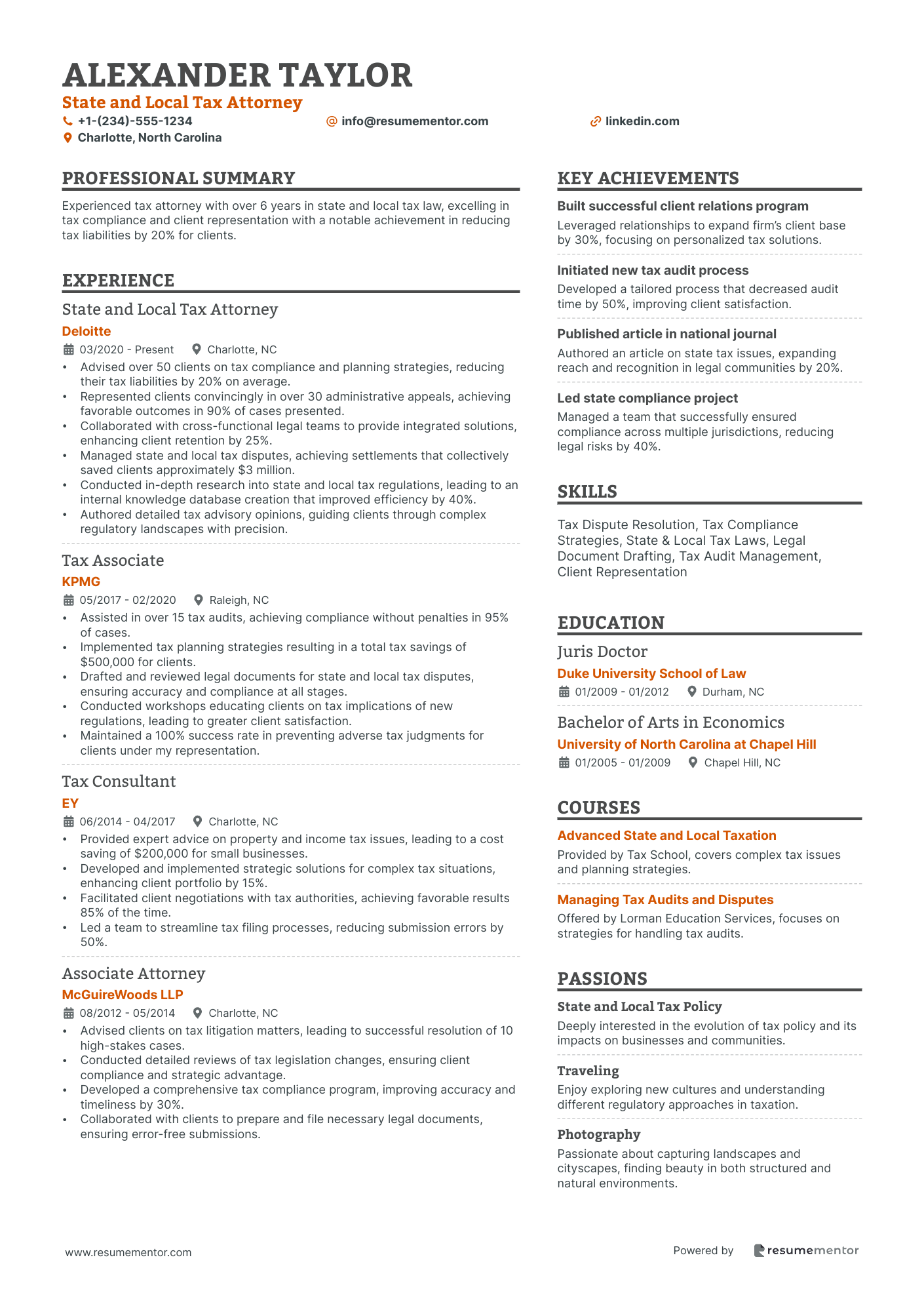

State and Local Tax Attorney resume sample

- •Advised over 50 clients on tax compliance and planning strategies, reducing their tax liabilities by 20% on average.

- •Represented clients convincingly in over 30 administrative appeals, achieving favorable outcomes in 90% of cases presented.

- •Collaborated with cross-functional legal teams to provide integrated solutions, enhancing client retention by 25%.

- •Managed state and local tax disputes, achieving settlements that collectively saved clients approximately $3 million.

- •Conducted in-depth research into state and local tax regulations, leading to an internal knowledge database creation that improved efficiency by 40%.

- •Authored detailed tax advisory opinions, guiding clients through complex regulatory landscapes with precision.

- •Assisted in over 15 tax audits, achieving compliance without penalties in 95% of cases.

- •Implemented tax planning strategies resulting in a total tax savings of $500,000 for clients.

- •Drafted and reviewed legal documents for state and local tax disputes, ensuring accuracy and compliance at all stages.

- •Conducted workshops educating clients on tax implications of new regulations, leading to greater client satisfaction.

- •Maintained a 100% success rate in preventing adverse tax judgments for clients under my representation.

- •Provided expert advice on property and income tax issues, leading to a cost saving of $200,000 for small businesses.

- •Developed and implemented strategic solutions for complex tax situations, enhancing client portfolio by 15%.

- •Facilitated client negotiations with tax authorities, achieving favorable results 85% of the time.

- •Led a team to streamline tax filing processes, reducing submission errors by 50%.

- •Advised clients on tax litigation matters, leading to successful resolution of 10 high-stakes cases.

- •Conducted detailed reviews of tax legislation changes, ensuring client compliance and strategic advantage.

- •Developed a comprehensive tax compliance program, improving accuracy and timeliness by 30%.

- •Collaborated with clients to prepare and file necessary legal documents, ensuring error-free submissions.

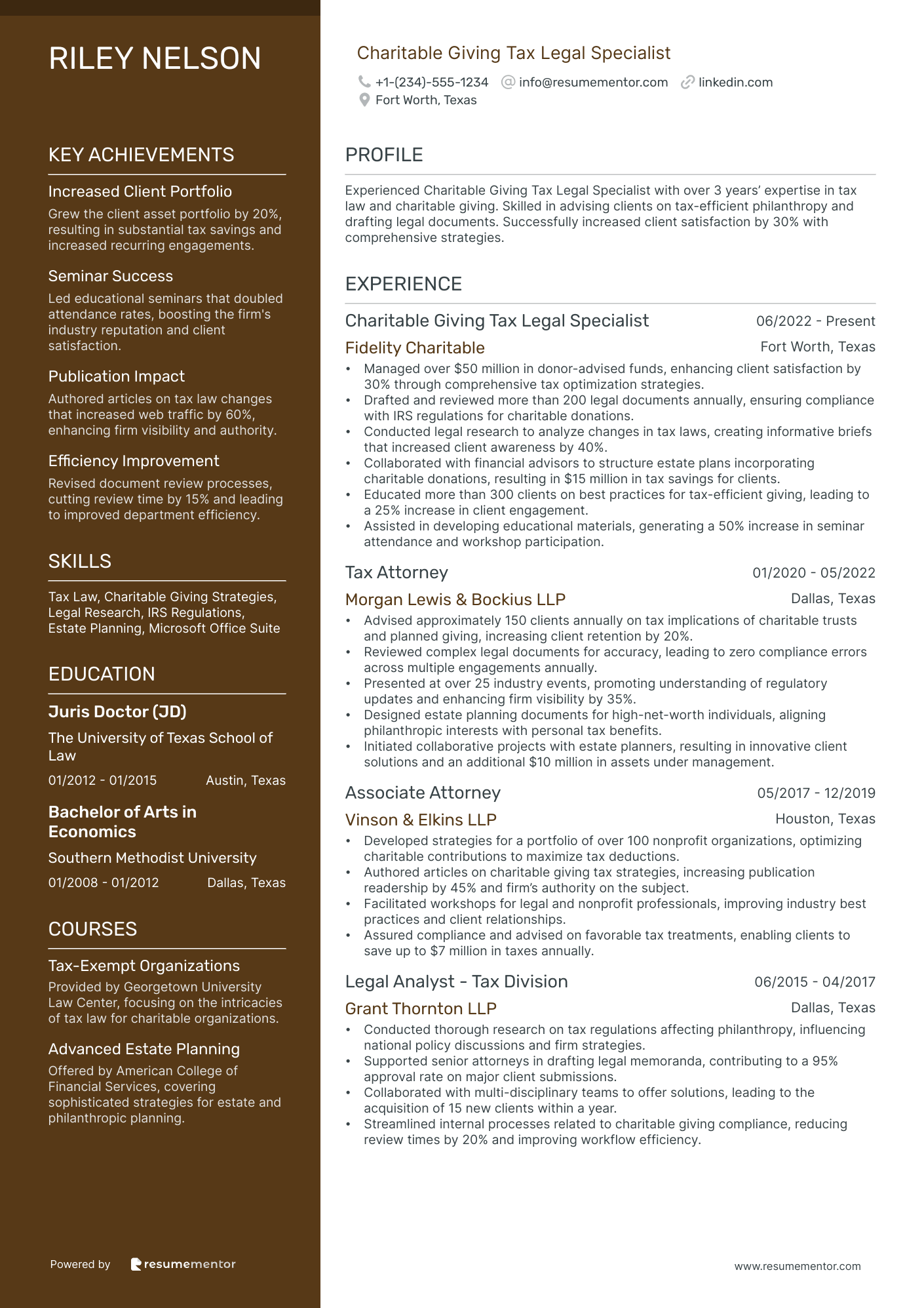

Charitable Giving Tax Legal Specialist resume sample

- •Managed over $50 million in donor-advised funds, enhancing client satisfaction by 30% through comprehensive tax optimization strategies.

- •Drafted and reviewed more than 200 legal documents annually, ensuring compliance with IRS regulations for charitable donations.

- •Conducted legal research to analyze changes in tax laws, creating informative briefs that increased client awareness by 40%.

- •Collaborated with financial advisors to structure estate plans incorporating charitable donations, resulting in $15 million in tax savings for clients.

- •Educated more than 300 clients on best practices for tax-efficient giving, leading to a 25% increase in client engagement.

- •Assisted in developing educational materials, generating a 50% increase in seminar attendance and workshop participation.

- •Advised approximately 150 clients annually on tax implications of charitable trusts and planned giving, increasing client retention by 20%.

- •Reviewed complex legal documents for accuracy, leading to zero compliance errors across multiple engagements annually.

- •Presented at over 25 industry events, promoting understanding of regulatory updates and enhancing firm visibility by 35%.

- •Designed estate planning documents for high-net-worth individuals, aligning philanthropic interests with personal tax benefits.

- •Initiated collaborative projects with estate planners, resulting in innovative client solutions and an additional $10 million in assets under management.

- •Developed strategies for a portfolio of over 100 nonprofit organizations, optimizing charitable contributions to maximize tax deductions.

- •Authored articles on charitable giving tax strategies, increasing publication readership by 45% and firm’s authority on the subject.

- •Facilitated workshops for legal and nonprofit professionals, improving industry best practices and client relationships.

- •Assured compliance and advised on favorable tax treatments, enabling clients to save up to $7 million in taxes annually.

- •Conducted thorough research on tax regulations affecting philanthropy, influencing national policy discussions and firm strategies.

- •Supported senior attorneys in drafting legal memoranda, contributing to a 95% approval rate on major client submissions.

- •Collaborated with multi-disciplinary teams to offer solutions, leading to the acquisition of 15 new clients within a year.

- •Streamlined internal processes related to charitable giving compliance, reducing review times by 20% and improving workflow efficiency.

As a tax lawyer, creating the perfect resume is like navigating a complex tax code. You know how essential precision and expertise are, but turning those into a compelling resume requires a different approach. This guide will help you effectively highlight your specialized skills.

Employers look for resumes that clearly share achievements in tax law, yet balancing legal language with readability is often challenging. A thoughtfully designed resume highlights your story and skills in a way that stands out. Using a resume template can streamline this process, organizing your accomplishments so nothing essential gets overlooked.

Your resume must demonstrate your capability to tackle complex legal issues efficiently. An ordinary format won't suffice to convey your unique value. With the right template, you can emphasize content over layout, ensuring all key elements are presented effectively. Explore these resume templates to find one that aligns with your style and needs.

Think of your resume as a case brief aimed at an employer, arguing convincingly for why you're the ideal choice. By using the right tools and approach, your resume can become your strongest piece of evidence. Together, let's unlock the secrets to transforming your tax law resume into a compelling argument.

Key Takeaways

- A well-crafted tax lawyer resume should showcase your specialized skills, achievements, and the capability to handle complex tax issues effectively.

- Using a resume format like reverse-chronological can allow employers to quickly see your career progression and relevant work experiences.

- Your experience section should focus on quantifiable achievements using action verbs, highlighting your impact and leadership skills in tax law.

- Including certifications, technical proficiencies, and both soft and hard skills relevant to tax law will strengthen your resume's appeal.

- Adding extra sections like language proficiency, hobbies, volunteer work, and books read can enrich your resume and demonstrate a well-rounded skill set.

What to focus on when writing your tax lawyer resume

A well-crafted tax lawyer resume—an essential tool in your job application arsenal—should clearly communicate your strengths and expertise in tax law. To convey your ability to handle complex tax matters, start with a concise professional summary. This section captures your legal acumen by highlighting your years of experience and key proficiencies like tax strategy and negotiation, which lay the groundwork for the rest of your resume.

How to structure your tax lawyer resume

- Your work experience section dives deeper—illustrating your role-specific skills by detailing your previous positions. Include job titles, companies, and responsibilities, but focus on your achievements that demonstrate your success, like effective tax liability reductions for clients, which speak to your practical impact in real-world scenarios.

- In the education section, list your law degree along with specialized courses or certifications related to tax law. Share the educational institution and your graduation year, underscoring the academic foundation that supports your expertise in tax law.

- Your licenses and certifications section builds on this foundation—validating your qualifications with your state bar membership and relevant certifications like a CPA or LL.M. in Taxation, which underscore your dedication and authority in the tax law domain.

- The skills section should draw connections between your past roles and your abilities. Highlight core competencies such as IRS tax codes knowledge, tax litigation experience, and negotiation skills, weaving these into a narrative that supports your candidacy and previous work history.

- Conclude with your technical proficiencies, where you list the tax software and research databases you're familiar with, such as LexisNexis or Bloomberg Tax, as these tools are integral to effective tax law practice.

This section lays the groundwork for optional areas like professional affiliations or publications, enriching your resume further. Below, we’ll cover each section more in-depth, ensuring you know how to best compile an impactful resume tailored to a tax lawyer role.

Which resume format to choose

Creating an impressive tax lawyer resume starts with selecting the reverse-chronological format, which is perfect for emphasizing your legal expertise and career progression. This format ensures that employers immediately see your most recent and relevant work experiences. When it comes to font selection, choosing a modern option like Raleway, Lato, or Montserrat can subtly convey professionalism while maintaining readability. These fonts provide a fresh take on traditional styles, helping your resume stand out without losing its formal appeal, which is crucial in legal professions. Always save your resume as a PDF to ensure that your carefully chosen design and formatting remain intact across different platforms and devices, presenting a consistent professional image. Additionally, use 1-inch margins on all sides of the document. This not only enhances readability by avoiding a cluttered look but also leaves room for notes by potential interviewers, who may bring a printed copy to your meeting. By thoughtfully integrating these key elements, your resume will effectively communicate your skills and experiences, helping you make a strong impression in the competitive field of tax law.

How to write a quantifiable resume experience section

A tax lawyer resume experience section should highlight your expertise and effectiveness in the field. By focusing on roles that demonstrate your skill in handling complex legal issues, you create a narrative that positions you as an expert. Organizing this section in reverse chronological order allows you to spotlight your most recent and relevant experiences, giving employers a clear view of your career progression. Limiting your entries to the last 10-15 years keeps the content current and relevant. Using recognizable job titles, like Associate, Senior Tax Lawyer, or Partner, helps align your experience level with industry standards. Tailoring each entry by matching the keywords and skills from the job description ensures that your resume speaks directly to what employers are seeking. This alignment is crucial for making your resume stand out. Employing action words like "managed," "optimized," and "conducted" communicates your impact and initiative effectively.

- •Saved clients over $15 million in potential tax liabilities through strategic audits and negotiations.

- •Led a team of 5 junior associates, boosting case resolution efficiency by 30%.

- •Implemented a compliance program that cut audit findings by 25% annually.

- •Authored and published five articles in leading tax law journals, enhancing firm reputation and client trust.

This experience section stands out because it seamlessly combines impact and leadership in tax law. Each bullet point flows naturally into the next, collectively portraying a narrative of significant achievements. By focusing on quantifiable successes, the section illustrates your contributions in a clear and compelling way. It's tailored for a senior role, with entries reflecting the strategic and leadership skills expected at advanced levels. The action words capture your proactive approach, emphasizing cost savings, team leadership, compliance enhancements, and professional development. Together, these elements build a cohesive story of success and ability, aligning perfectly with employer expectations.

Project-Focused resume experience section

A project-focused tax lawyer resume experience section should highlight your ability to manage and contribute to significant projects, showcasing your influence and skills. Start by identifying your most impactful achievements within these projects, providing concrete outcomes or metrics to illustrate your success. Use active and direct language when describing your role and contributions, ensuring each bullet point ties clearly to your skills and experience in tax law. This approach not only demonstrates your capabilities but also helps hiring managers quickly see the value you can bring.

Begin each entry with your job title and the company name, using bullet points to break down your duties into clear and concise achievements. Focus on project-related accomplishments, and be sure to incorporate numbers to underscore your success. Each bullet point should highlight different aspects of your role, showing your proficiency in handling various complex tax law situations. By maintaining this detailed and structured format, your resume will stand out, effectively portraying your expertise in managing significant tax projects to potential employers.

Senior Tax Attorney

XYZ Law Firm

June 2020 - Present

- Led a team of five on a high-profile tax restructuring project, resulting in a 25% reduction in corporate tax liabilities.

- Coordinated cross-departmental meetings to streamline the tax documentation process, improving efficiency by 30%.

- Developed a comprehensive tax strategy for client mergers, saving an estimated $1.5 million in potential penalties.

- Collaborated with financial departments to implement new tax software, reducing report preparation time by 40%.

Achievement-Focused resume experience section

A tax-focused resume experience section for a lawyer should clearly highlight your achievements and the positive outcomes you’ve created for clients. Start by focusing on accomplishments that demonstrate the value you've added, such as reducing client costs or successfully navigating complex legal cases. Use strong action verbs, and be specific with numbers to showcase the scope of your impact. Tailor each point to align with the skills the job requires, emphasizing your strengths in leadership, problem-solving, and tax law expertise.

Ensuring your entries are clear and engaging helps them stand out to anyone, even those unfamiliar with tax law. By highlighting results like the intricacies of cases managed or savings generated, you make your accomplishments shine. Avoid jargon for smooth readability, and ensure each sentence flows naturally into the next, making the narrative easy to follow and your contributions unmistakably clear.

Senior Tax Lawyer

Global Tax Solutions Inc.

January 2018 - March 2023

- Implemented tax planning strategies that cut overhead costs by 15% for a multinational company.

- Led a team of 5 to prepare and win a complex tax case, saving the client $2 million in liabilities.

- Developed tax compliance processes that secured a 100% audit pass rate over 3 straight years.

- Advised on mergers and acquisitions, offering tax-saving insights that led to successful deals.

Industry-Specific Focus resume experience section

A tax-focused tax lawyer resume experience section should clearly showcase your specialized skills and achievements in the field. Begin by identifying the specific areas of tax law where you excel and center your experience around these specialties. Use straightforward language to describe your contributions, placing emphasis on what you've accomplished and the skills you've developed. Each position you list should include specific examples of your work, with quantifiable success metrics that speak to your effectiveness. Significant cases or projects that highlight your expertise can further demonstrate your ability to deliver impactful results.

Connecting your individual achievements to the broader context, illustrate how your work has benefited your clients or workplace. Employers look for tangible evidence of how you've applied your skills to achieve results, not just a rundown of your duties. By showcasing outcomes that demonstrate your adeptness at navigating complex tax regulations, representing clients successfully, or improving company tax processes, you enhance your resume's appeal. A consistent client-centered or results-driven narrative can truly elevate your experience section, setting you apart.

Tax Lawyer

Smith & Associates LLP

2015 - 2020

- Helped multiple large corporations reduce tax liabilities by an average of 15%, showcasing an in-depth understanding of tax regulations.

- Led a team in auditing company financials, identifying and correcting issues that saved $500,000 in penalties, demonstrating problem-solving skills.

- Created effective tax strategies for mergers and acquisitions to ensure smooth transitions, highlighting strategic planning abilities.

- Advised on international tax regulations, ensuring compliance and reducing risk in overseas markets, underscoring expertise in global tax issues.

Efficiency-Focused resume experience section

An efficiency-focused tax lawyer's resume experience section should highlight how you've improved processes, enhanced workflows, and achieved noteworthy results. Start by detailing the specific roles you've undertaken, clearly connecting them to measurable outcomes to illustrate your impact. It's important to highlight activities that showcase how your efforts led to streamlined operations, whether benefiting your organization or clients. Quantifying your achievements with figures, such as percentage improvements, time saved, or financial gains, provides tangible evidence of your contributions and helps employers easily grasp your true accomplishments.

To effectively convey efficiency, use concise language and action-oriented verbs. Emphasize the initiatives you've led, and explain how these initiatives allowed you to optimize tasks, perhaps through innovative strategies or new technology adoption. By highlighting your ability to tackle complex tax situations with organization and efficiency, you'll demonstrate your critical thinking skills. This will underscore your capacity to add value by reducing redundancies and boosting productivity, making your experience section compelling and impactful.

Senior Tax Lawyer

Smith & Associates Legal Firm

June 2018 - Present

- Reduced client audit preparation time by 30% through the development of a standardized document checklist.

- Streamlined tax filing processes leading to a 20% increase in team productivity using automated software solutions.

- Facilitated cross-departmental training sessions to enhance compliance knowledge, reducing error rates by 15%.

- Implemented a feedback system that increased client satisfaction scores by 25%.

Write your tax lawyer resume summary section

A tax-focused lawyer resume summary should clearly spotlight your expertise and achievements, setting you apart from other candidates. Use straightforward language to emphasize your legal skills and years of experience. For a tax lawyer, highlight your expertise in handling intricate tax issues and providing sound legal advice. Here's how you might structure it in JSON format:

When describing yourself in a resume summary, aim to connect your strengths and achievements in a cohesive narrative. Using an active voice and quantifying your results can add impact. This example works well because it combines specific experiences with measurable results, offering a vivid picture of your capabilities. It’s more effective than a resume objective, which might only express your interest in a field without detailing your successes. If you have considerable experience, a summary lets you highlight your consistent track record. By contrast, a resume profile gives a broader career overview, while a summary of qualifications lists skills for quick scanning. Each section has its place, but knowing how to convey your value in a summary can make all the difference in setting you apart from other applicants.

Listing your tax lawyer skills on your resume

A tax lawyer-focused resume should emphasize your skills and expertise effectively. Your skills section is crucial for showcasing what you offer and can either stand alone or be integrated into your experience and summary sections. Emphasizing strengths and soft skills, like communication and problem-solving, gives you an edge over others. Meanwhile, hard skills such as expertise in tax law and legal research show what you've learned and can measure. Both skills and strengths can serve as powerful resume keywords, making your application more likely to catch an employer's eye and pass through screening systems.

When crafting your skills section, use keywords relevant to tax law to ensure your resume stands out and communicates your understanding of vital industry competencies. Here’s a sample of a standalone skills section formatted as a JSON snippet for a tax lawyer:

This example effectively lists key skills related to a tax lawyer's duties, conveying your expertise concisely. Each skill is relevant and showcases your ability both broadly and deeply.

Best hard skills to feature on your tax lawyer resume

Highlighting hard skills is essential for a tax lawyer. These specialized abilities reflect your capacity to handle tasks requiring specific knowledge and training, showing employers you can manage the challenges you’ll face.

Hard Skills

- Tax Law Expertise

- Legal Research

- Regulatory Compliance

- Financial Analysis

- Contract Drafting

- Tax Planning

- Audit Representation

- Business Law Knowledge

- Litigation Skills

- Case Management

- Estate Planning

- Investment Compliance

- International Taxation

- Risk Assessment

- Corporate Tax Structures

Best soft skills to feature on your tax lawyer resume

Integrating soft skills into your resume enhances how you present yourself as a tax lawyer. These personal traits, such as effective collaboration and leadership, communicate your ability to work seamlessly with clients, colleagues, and other legal professionals, highlighting your contribution to team success.

Soft Skills

- Communication

- Problem Solving

- Negotiation

- Critical Thinking

- Attention to Detail

- Time Management

- Ethical Judgment

- Client Service

- Stress Management

- Adaptability

- Team Collaboration

- Leadership

- Conflict Resolution

- Multitasking

- Decision Making

How to include your education on your resume

An education section is an important part of a tax lawyer's resume as it highlights your academic credentials and qualifications. Tailoring it to the specific job you're applying for is key. If you have degrees or courses that are not relevant to tax law, omit them to keep the focus sharp. When including your GPA, only add it if it is impressive (generally 3.5 or higher). State it as "GPA: 3.8/4.0" if your school used a 4.0 scale. If you graduated with honors, like cum laude, make sure to include this right after your degree, such as "J.D., cum laude."

Here is an example where the education section is poorly done, listing unrelated details:

- •Focused on civil engineering fundamentals.

Contrast that with a strong example for a tax lawyer:

The second example shows only relevant education, highlighting a law degree from a prestigious institution. The inclusion of honors and a strong GPA demonstrates academic excellence, essential in a competitive field like tax law. This focused education section presents you as a well-qualified candidate for a tax lawyer role, ensuring that your resume stands out to employers looking for specific legal expertise.

How to include tax lawyer certificates on your resume

Including a certificates section is an important part of your tax lawyer resume. You should highlight your qualifications and show that you're staying current with legal practices. List the name of the certification, include the date it was obtained, and add the issuing organization. You can also incorporate certificates in the header.

For example, for your resume header:

John Doe, Tax Lawyer

Certified Public Accountant (CPA), Certified Tax Specialist (CTS)

When working on a standalone certificates section, you should list certifications relevant to tax law. Use bullet points for clarity. This approach ensures the employer sees your qualifications easily.

Here’s a JSON example of a certificates section:

This example is effective because it lists relevant certifications that demonstrate technical knowledge in tax law. Both qualifications are respected in the field and indicate a strong foundational expertise. This will impress potential employers and position you as a well-prepared candidate.

Extra sections to include in your tax lawyer resume

Navigating the complex world of tax law demands a high level of precision, analytical skills, and a strong understanding of ever-evolving regulations. As you craft your resume, ensuring that you highlight each aspect of your expertise and experience is pivotal.

Language section — Demonstrate your proficiency in multiple languages to stand out in international cases and appeal to diverse clients. Speaking languages such as Spanish or Mandarin can be particularly valuable in multinational tax matters.

Hobbies and interests section — Highlight hobbies like chess or puzzles to showcase your strategic and analytical thinking. They can subtly indicate your problem-solving skills and ability to think ahead, useful traits for a tax lawyer.

Volunteer work section — Include your volunteer work with legal aid societies or non-profits to demonstrate your commitment to community service. This can reflect your dedication to making a difference, important for building rapport with clients.

Books section — List influential books you’ve read on tax law or financial regulations to show your continuous learning and deep knowledge of the field. Mentioning titles such as "The Tax Code and You" can affirm your grasp of complex subjects.

In Conclusion

In conclusion, presenting a meticulously crafted resume is paramount for any aspiring tax lawyer aiming to secure their next role. By effectively communicating your expertise in tax law through a concise and targeted resume, you are more likely to catch the attention of potential employers. Focusing on key sections such as professional summaries, education, certifications, and skills underscores your qualifications and experience. Tailoring each part of your resume to emphasize your legal prowess, particularly in handling intricate tax issues, sets you apart in this competitive field. Consider formats that best highlight your career progression, like reverse-chronological order, to ensure clarity and impact. Your choice of layout, like using refined fonts and professional margins, further enhances this professional image. Ultimately, a resume that vividly illustrates your achievements and capabilities can serve as a potent tool in advocating for your candidacy to employers. Remember, every element on your resume should collectively narrate your professional journey, reinforcing your potential as a top candidate for any tax law position. This thoughtful approach ensures that your resume not only attracts attention but also lays the groundwork for securing the interviews you seek.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.