Treasury Accountant Resume Examples

Jul 18, 2024

|

12 min read

Craft a winning treasury accountant resume: tips and examples for showcasing your financial expertise and key achievements, ensuring your skills shine bright like a polished coin to potential employers.

Rated by 348 people

Corporate Treasury Accountant

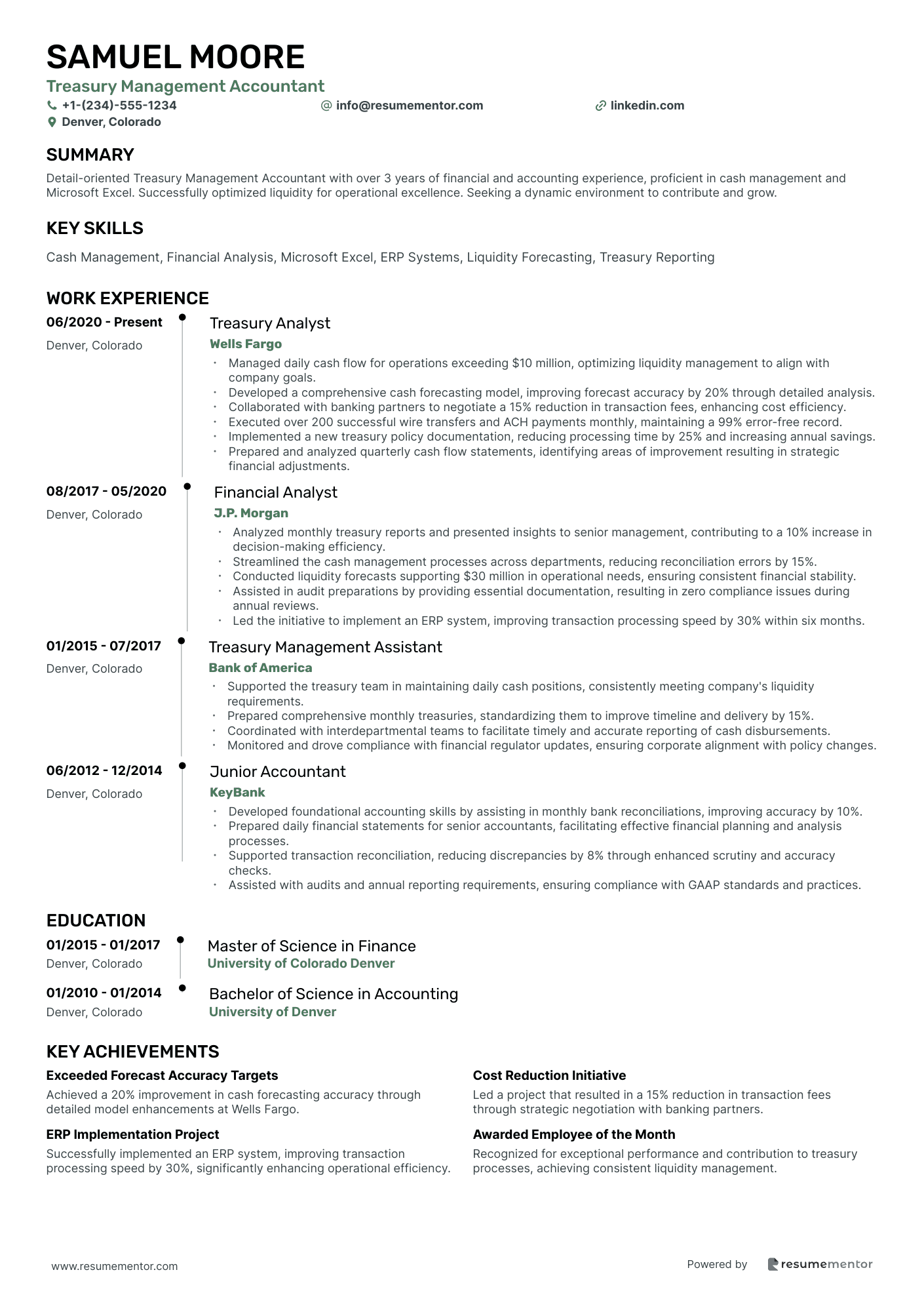

Treasury Management Accountant

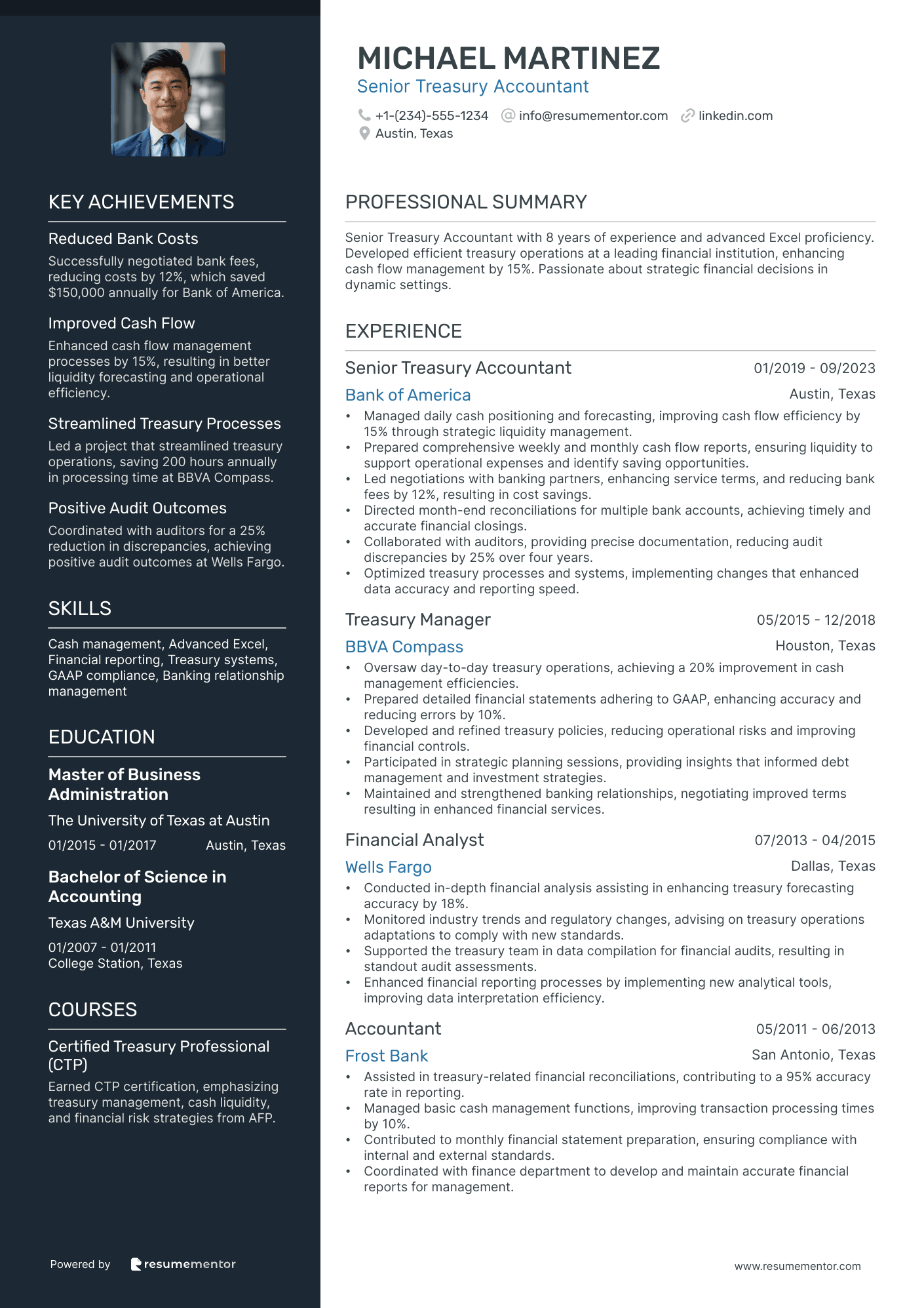

Senior Treasury Accountant

Treasury and Tax Accountant

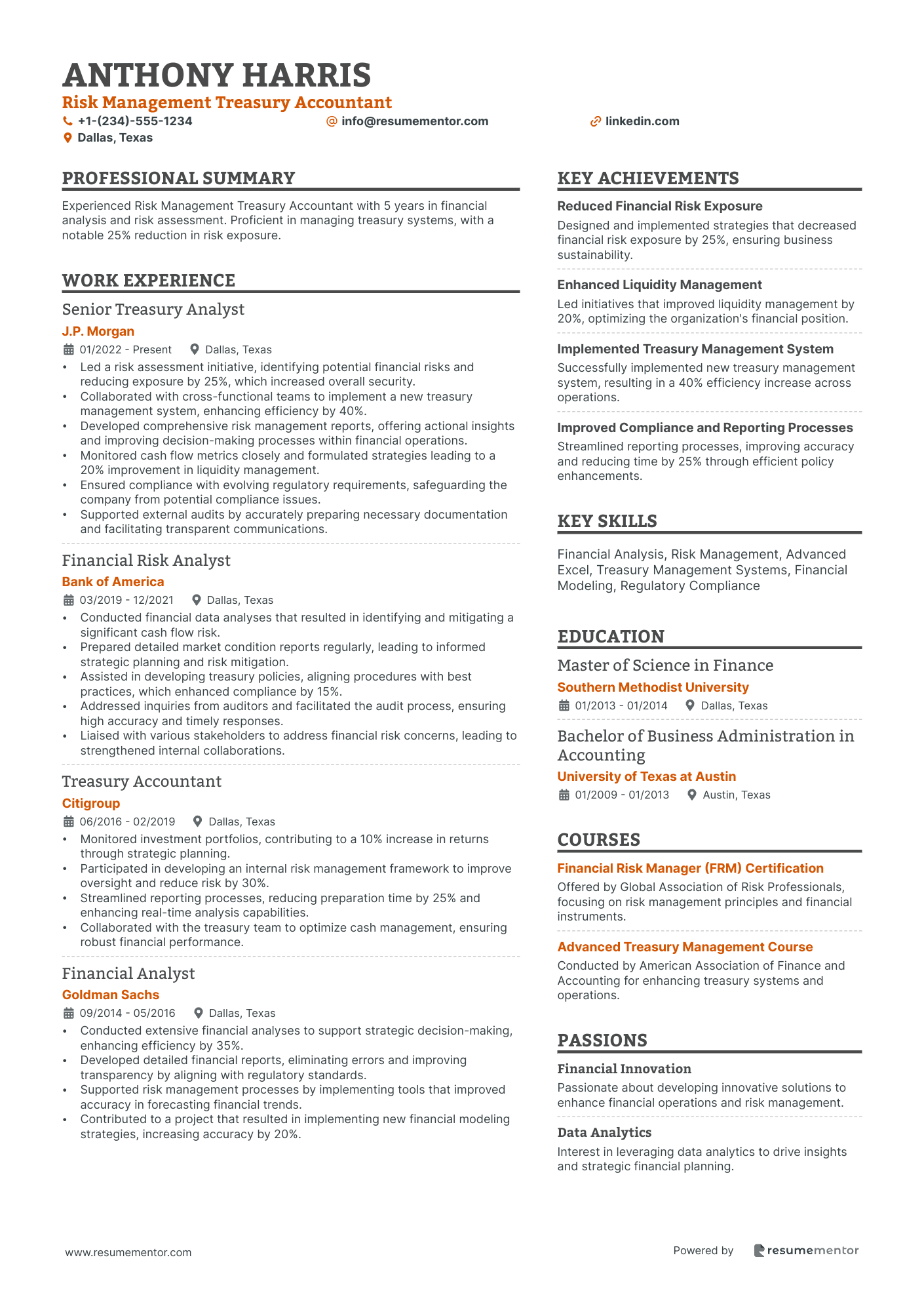

Risk Management Treasury Accountant

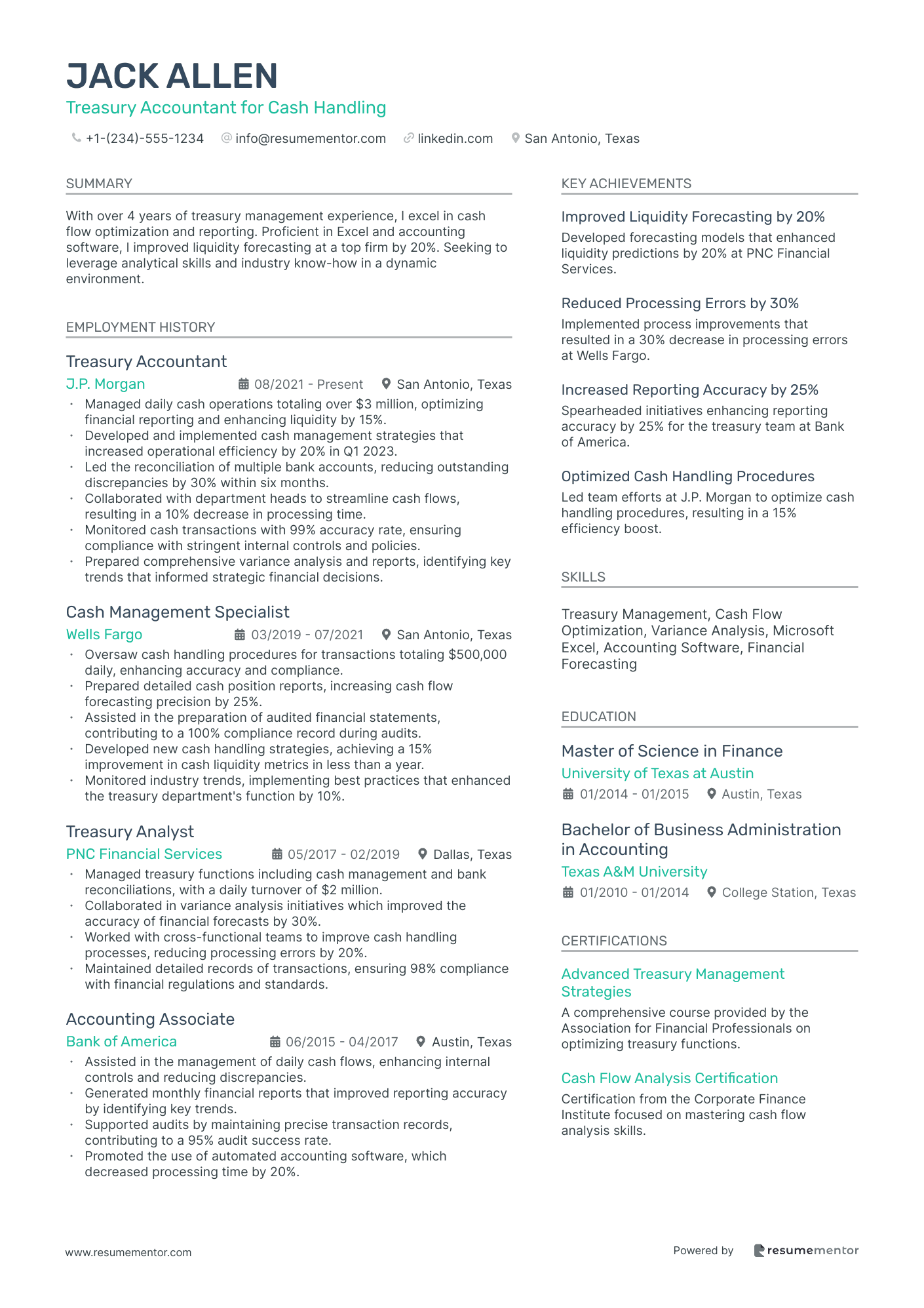

Treasury Accountant for Cash Handling

Investment Treasury Accountant

Foreign Exchange Treasury Accountant

Capital Markets Treasury Accountant

Public Sector Treasury Accountant

Corporate Treasury Accountant resume sample

- •Successfully implemented a cash forecasting model, improving accuracy by 30% and enhancing liquidity management.

- •Managed credit facilities and banking relationships, resulting in a 10% reduction in banking fees over a year.

- •Led treasury audits, ensuring compliance with company policies and reducing audit findings by 15%.

- •Collaborated with cross-functional teams to integrate treasury processes, increasing accuracy of financial reporting by 25%.

- •Analyzed foreign exchange risks and advised on hedging strategies, minimizing exposure and saving $100,000 annually.

- •Supported senior management with financial analyses that influenced policy decisions, contributing to a 5% increase in efficiency.

- •Developed a comprehensive cash flow report system, improving reporting time from 5 days to 2 days monthly.

- •Coordinated with banks for setting up new credit lines, enhancing company liquidity by 15% within the fiscal year.

- •Performed market trend analysis that informed treasury strategies, supporting a 7% improvement in investment returns.

- •Streamlined treasury operations through automation, reducing manual reconciliation time by 40%.

- •Assisted in compliance audits for treasury operations, successfully passing with zero findings on multiple occasions.

- •Conducted thorough analyses of cash transactions, improving the accuracy of bank account reconciliations by 18%.

- •Supported the preparation of investment performance reports, leading to actionable insights and improved returns.

- •Managed daily cash positioning tasks, ensuring optimal cash funding and utilization across all business units.

- •Worked closely with auditors to streamline external audit processes, reducing audit duration by 20%.

- •Maintained accurate financial records, achieving a 98% accuracy rate in monthly reconciliations across multiple accounts.

- •Prepared detailed cash flow statements, supporting effective treasury and investment strategies during a critical growth phase.

- •Aided in the implementation of treasury controls, resulting in increased operational efficiency and policy compliance.

- •Collaborated in cross-departmental projects to refine financial reporting processes, improving data accuracy by 10%.

Treasury Management Accountant resume sample

- •Managed daily cash flow for operations exceeding $10 million, optimizing liquidity management to align with company goals.

- •Developed a comprehensive cash forecasting model, improving forecast accuracy by 20% through detailed analysis.

- •Collaborated with banking partners to negotiate a 15% reduction in transaction fees, enhancing cost efficiency.

- •Executed over 200 successful wire transfers and ACH payments monthly, maintaining a 99% error-free record.

- •Implemented a new treasury policy documentation, reducing processing time by 25% and increasing annual savings.

- •Prepared and analyzed quarterly cash flow statements, identifying areas of improvement resulting in strategic financial adjustments.

- •Analyzed monthly treasury reports and presented insights to senior management, contributing to a 10% increase in decision-making efficiency.

- •Streamlined the cash management processes across departments, reducing reconciliation errors by 15%.

- •Conducted liquidity forecasts supporting $30 million in operational needs, ensuring consistent financial stability.

- •Assisted in audit preparations by providing essential documentation, resulting in zero compliance issues during annual reviews.

- •Led the initiative to implement an ERP system, improving transaction processing speed by 30% within six months.

- •Supported the treasury team in maintaining daily cash positions, consistently meeting company's liquidity requirements.

- •Prepared comprehensive monthly treasuries, standardizing them to improve timeline and delivery by 15%.

- •Coordinated with interdepartmental teams to facilitate timely and accurate reporting of cash disbursements.

- •Monitored and drove compliance with financial regulator updates, ensuring corporate alignment with policy changes.

- •Developed foundational accounting skills by assisting in monthly bank reconciliations, improving accuracy by 10%.

- •Prepared daily financial statements for senior accountants, facilitating effective financial planning and analysis processes.

- •Supported transaction reconciliation, reducing discrepancies by 8% through enhanced scrutiny and accuracy checks.

- •Assisted with audits and annual reporting requirements, ensuring compliance with GAAP standards and practices.

Senior Treasury Accountant resume sample

- •Managed daily cash positioning and forecasting, improving cash flow efficiency by 15% through strategic liquidity management.

- •Prepared comprehensive weekly and monthly cash flow reports, ensuring liquidity to support operational expenses and identify saving opportunities.

- •Led negotiations with banking partners, enhancing service terms, and reducing bank fees by 12%, resulting in cost savings.

- •Directed month-end reconciliations for multiple bank accounts, achieving timely and accurate financial closings.

- •Collaborated with auditors, providing precise documentation, reducing audit discrepancies by 25% over four years.

- •Optimized treasury processes and systems, implementing changes that enhanced data accuracy and reporting speed.

- •Oversaw day-to-day treasury operations, achieving a 20% improvement in cash management efficiencies.

- •Prepared detailed financial statements adhering to GAAP, enhancing accuracy and reducing errors by 10%.

- •Developed and refined treasury policies, reducing operational risks and improving financial controls.

- •Participated in strategic planning sessions, providing insights that informed debt management and investment strategies.

- •Maintained and strengthened banking relationships, negotiating improved terms resulting in enhanced financial services.

- •Conducted in-depth financial analysis assisting in enhancing treasury forecasting accuracy by 18%.

- •Monitored industry trends and regulatory changes, advising on treasury operations adaptations to comply with new standards.

- •Supported the treasury team in data compilation for financial audits, resulting in standout audit assessments.

- •Enhanced financial reporting processes by implementing new analytical tools, improving data interpretation efficiency.

- •Assisted in treasury-related financial reconciliations, contributing to a 95% accuracy rate in reporting.

- •Managed basic cash management functions, improving transaction processing times by 10%.

- •Contributed to monthly financial statement preparation, ensuring compliance with internal and external standards.

- •Coordinated with finance department to develop and maintain accurate financial reports for management.

Treasury and Tax Accountant resume sample

- •Managed daily cash positions and implemented strategies that improved cash flow management efficiency by 20%, greatly benefiting overall liquidity.

- •Led a team in preparing and reviewing complex federal and state tax returns, reducing filing errors by 30%.

- •Collaborated across departments to provide comprehensive tax planning solutions, resulting in an effective tax strategy and compliance.

- •Implemented a new cash management strategy that significantly reduced bank fees by $50k annually.

- •Coordinated and supported tax audits, providing precise documentation and explanations that resulted in clearances with no penalties.

- •Reviewed financial statements to analyze and explain variances, aiding in accurate financial reporting and strategic planning.

- •Conducted thorough cash position analyses, leading to a 15% improvement in liquidity management.

- •Assisted in the development of cash management strategies, enhancing the treasury’s operational efficiency.

- •Performed tax compliance review across federal, state, and local levels, contributing to adherence and minimizing filing mistakes.

- •Led tax research initiatives, providing crucial insights on regulatory changes impacting business operations.

- •Developed a process for monitoring and analyzing accounts payable and receivable, ensuring accuracy and reducing errors by 25%.

- •Reviewed and prepared tax returns, ensuring compliance with applicable federal and state regulations.

- •Contributed to research and analysis for tax planning, providing actionable recommendations for cost savings.

- •Supported audits by furnishing requisite documents, gaining positive audit outcomes with zero audit discrepancies.

- •Maintained meticulous records of all transactions related to treasury and tax, facilitating quick retrieval during audits.

- •Reviewed financial statements to identify and explain variances in tax liabilities, assisting in planning and strategy.

- •Maintained compliance by staying informed on changing tax laws and implementing necessary updates in tax policies.

Risk Management Treasury Accountant resume sample

- •Led a risk assessment initiative, identifying potential financial risks and reducing exposure by 25%, which increased overall security.

- •Collaborated with cross-functional teams to implement a new treasury management system, enhancing efficiency by 40%.

- •Developed comprehensive risk management reports, offering actional insights and improving decision-making processes within financial operations.

- •Monitored cash flow metrics closely and formulated strategies leading to a 20% improvement in liquidity management.

- •Ensured compliance with evolving regulatory requirements, safeguarding the company from potential compliance issues.

- •Supported external audits by accurately preparing necessary documentation and facilitating transparent communications.

- •Conducted financial data analyses that resulted in identifying and mitigating a significant cash flow risk.

- •Prepared detailed market condition reports regularly, leading to informed strategic planning and risk mitigation.

- •Assisted in developing treasury policies, aligning procedures with best practices, which enhanced compliance by 15%.

- •Addressed inquiries from auditors and facilitated the audit process, ensuring high accuracy and timely responses.

- •Liaised with various stakeholders to address financial risk concerns, leading to strengthened internal collaborations.

- •Monitored investment portfolios, contributing to a 10% increase in returns through strategic planning.

- •Participated in developing an internal risk management framework to improve oversight and reduce risk by 30%.

- •Streamlined reporting processes, reducing preparation time by 25% and enhancing real-time analysis capabilities.

- •Collaborated with the treasury team to optimize cash management, ensuring robust financial performance.

- •Conducted extensive financial analyses to support strategic decision-making, enhancing efficiency by 35%.

- •Developed detailed financial reports, eliminating errors and improving transparency by aligning with regulatory standards.

- •Supported risk management processes by implementing tools that improved accuracy in forecasting financial trends.

- •Contributed to a project that resulted in implementing new financial modeling strategies, increasing accuracy by 20%.

Treasury Accountant for Cash Handling resume sample

- •Managed daily cash operations totaling over $3 million, optimizing financial reporting and enhancing liquidity by 15%.

- •Developed and implemented cash management strategies that increased operational efficiency by 20% in Q1 2023.

- •Led the reconciliation of multiple bank accounts, reducing outstanding discrepancies by 30% within six months.

- •Collaborated with department heads to streamline cash flows, resulting in a 10% decrease in processing time.

- •Monitored cash transactions with 99% accuracy rate, ensuring compliance with stringent internal controls and policies.

- •Prepared comprehensive variance analysis and reports, identifying key trends that informed strategic financial decisions.

- •Oversaw cash handling procedures for transactions totaling $500,000 daily, enhancing accuracy and compliance.

- •Prepared detailed cash position reports, increasing cash flow forecasting precision by 25%.

- •Assisted in the preparation of audited financial statements, contributing to a 100% compliance record during audits.

- •Developed new cash handling strategies, achieving a 15% improvement in cash liquidity metrics in less than a year.

- •Monitored industry trends, implementing best practices that enhanced the treasury department's function by 10%.

- •Managed treasury functions including cash management and bank reconciliations, with a daily turnover of $2 million.

- •Collaborated in variance analysis initiatives which improved the accuracy of financial forecasts by 30%.

- •Worked with cross-functional teams to improve cash handling processes, reducing processing errors by 20%.

- •Maintained detailed records of transactions, ensuring 98% compliance with financial regulations and standards.

- •Assisted in the management of daily cash flows, enhancing internal controls and reducing discrepancies.

- •Generated monthly financial reports that improved reporting accuracy by identifying key trends.

- •Supported audits by maintaining precise transaction records, contributing to a 95% audit success rate.

- •Promoted the use of automated accounting software, which decreased processing time by 20%.

Investment Treasury Accountant resume sample

- •Led the reconciliation and reporting of investment portfolios totaling $1 billion, achieving a 98% accuracy rate.

- •Implemented process improvements that reduced month-end closing time by 15%, enhancing productivity.

- •Prepared detailed financial analysis on portfolio performance, resulting in strategic insights for capital allocation.

- •Ensured GAAP compliance in all reporting activities, reducing audit findings by 25% in one year.

- •Collaborated cross-functionally to implement new accounting software, streamlining treasury operations.

- •Trained a team of 5 accountants, elevating their knowledge in investment reporting procedures.

- •Managed daily treasury functions, processing transactions worth $500 million to ensure optimal liquidity.

- •Developed cash flow forecasting models leading to improved capital reserve management by 10%.

- •Assisted in the development and documentation of treasury policies, resulting in increased operational efficiency.

- •Conducted comprehensive variance analyses, providing actionable insights for senior management.

- •Supported external audits by preparing detailed documentation, achieving zero audit adjustments for two consecutive cycles.

- •Prepared and reviewed journal entries for investment transactions, maintaining a 99% accuracy rate.

- •Led the preparation of quarterly and annual financial statements and reports under stringent deadlines.

- •Implemented an automated reconciliation process, reducing manual errors and improving efficiency by 20%.

- •Coordinated with internal and external auditors, resulting in favorable audit outcomes.

- •Provided training on investment accounting best practices, contributing to enhanced team performance.

- •Assisted in the monthly closing activities, contributing to timely completion of financial reports.

- •Analyzed investment portfolios, delivering reports that improved risk assessment processes.

- •Recorded cash management transactions, aiding in accurate cash flow forecasting.

- •Supported senior accountants in the preparation of financial schedules and analysis.

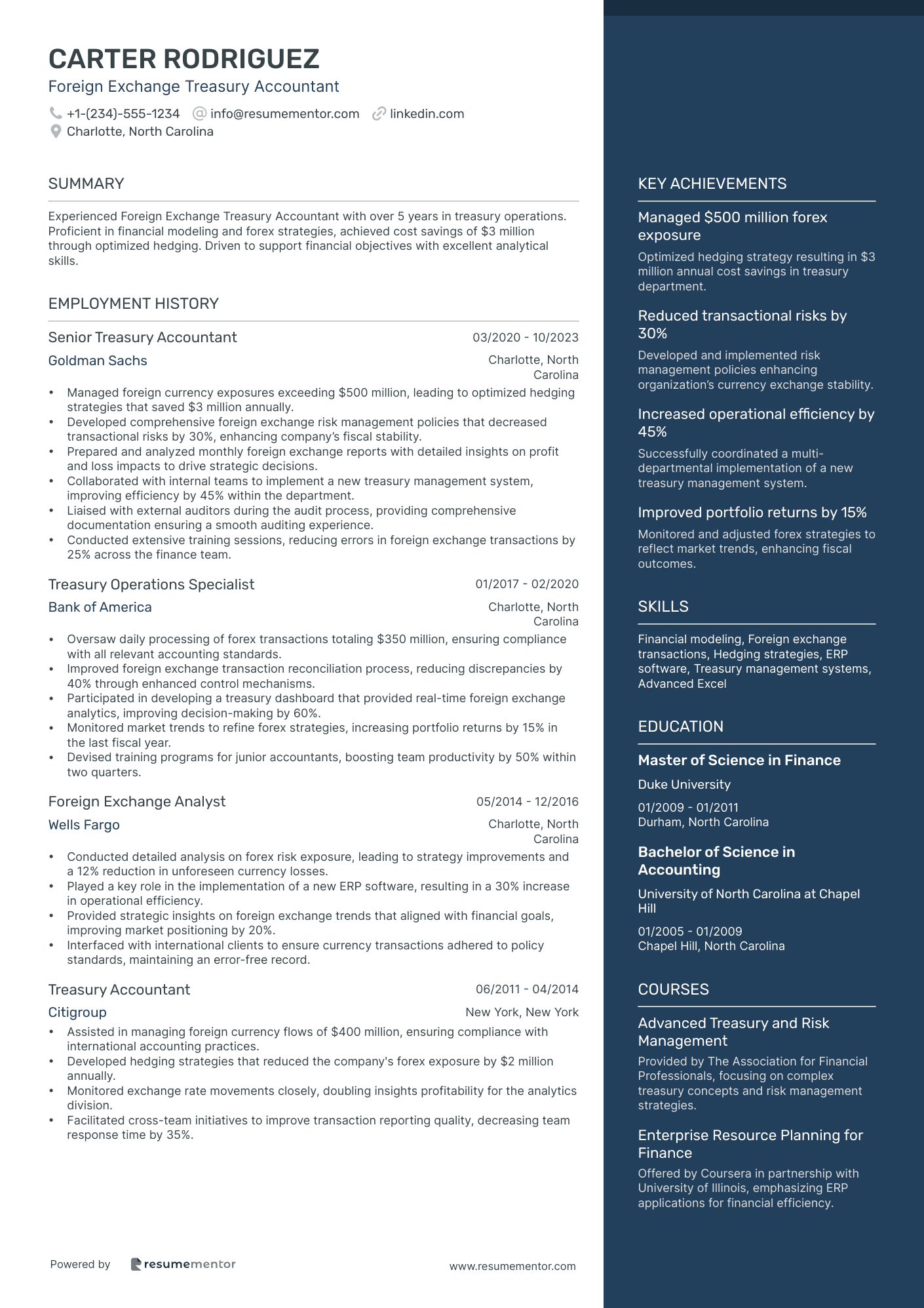

Foreign Exchange Treasury Accountant resume sample

- •Managed foreign currency exposures exceeding $500 million, leading to optimized hedging strategies that saved $3 million annually.

- •Developed comprehensive foreign exchange risk management policies that decreased transactional risks by 30%, enhancing company’s fiscal stability.

- •Prepared and analyzed monthly foreign exchange reports with detailed insights on profit and loss impacts to drive strategic decisions.

- •Collaborated with internal teams to implement a new treasury management system, improving efficiency by 45% within the department.

- •Liaised with external auditors during the audit process, providing comprehensive documentation ensuring a smooth auditing experience.

- •Conducted extensive training sessions, reducing errors in foreign exchange transactions by 25% across the finance team.

- •Oversaw daily processing of forex transactions totaling $350 million, ensuring compliance with all relevant accounting standards.

- •Improved foreign exchange transaction reconciliation process, reducing discrepancies by 40% through enhanced control mechanisms.

- •Participated in developing a treasury dashboard that provided real-time foreign exchange analytics, improving decision-making by 60%.

- •Monitored market trends to refine forex strategies, increasing portfolio returns by 15% in the last fiscal year.

- •Devised training programs for junior accountants, boosting team productivity by 50% within two quarters.

- •Conducted detailed analysis on forex risk exposure, leading to strategy improvements and a 12% reduction in unforeseen currency losses.

- •Played a key role in the implementation of a new ERP software, resulting in a 30% increase in operational efficiency.

- •Provided strategic insights on foreign exchange trends that aligned with financial goals, improving market positioning by 20%.

- •Interfaced with international clients to ensure currency transactions adhered to policy standards, maintaining an error-free record.

- •Assisted in managing foreign currency flows of $400 million, ensuring compliance with international accounting practices.

- •Developed hedging strategies that reduced the company's forex exposure by $2 million annually.

- •Monitored exchange rate movements closely, doubling insights profitability for the analytics division.

- •Facilitated cross-team initiatives to improve transaction reporting quality, decreasing team response time by 35%.

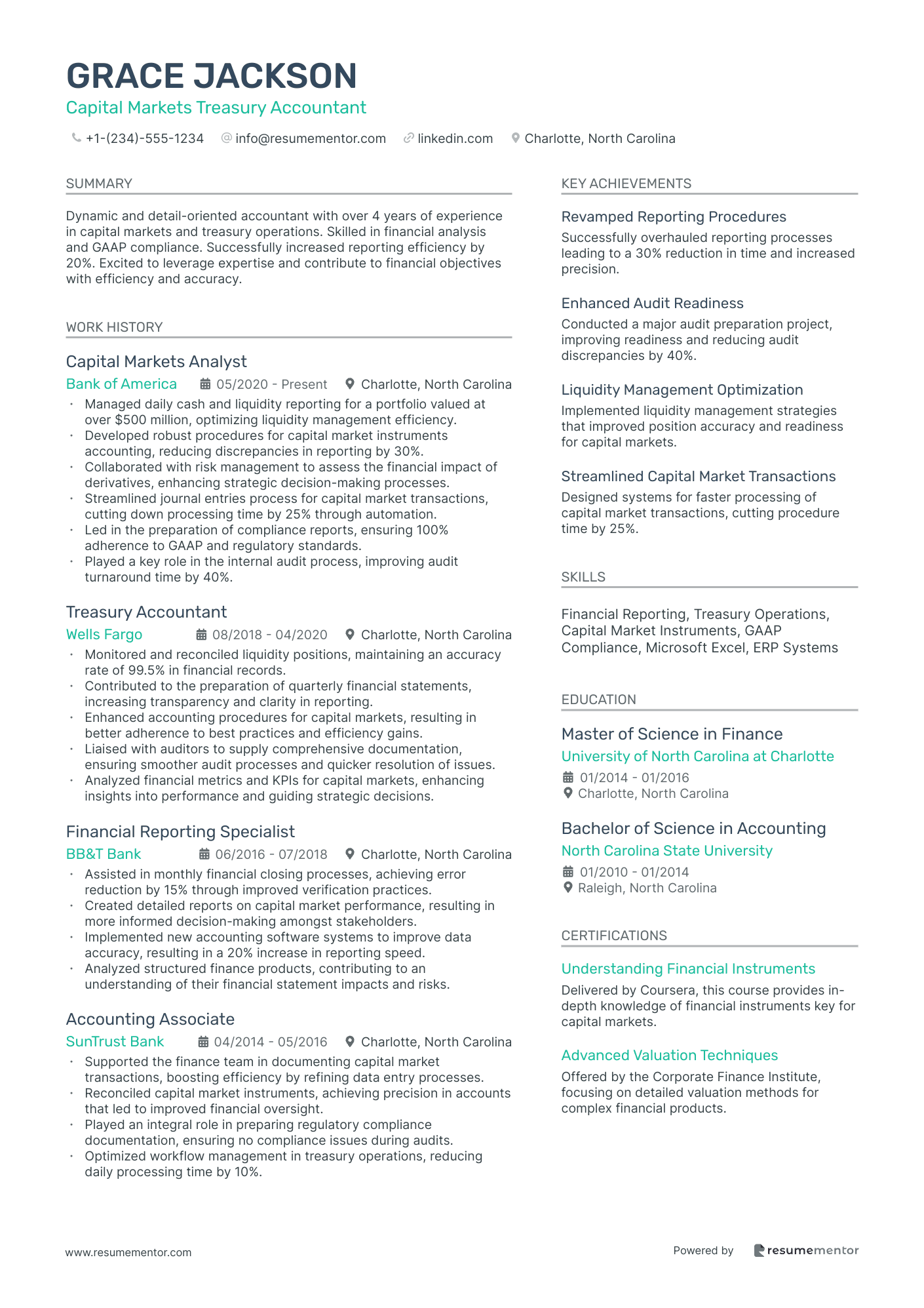

Capital Markets Treasury Accountant resume sample

- •Managed daily cash and liquidity reporting for a portfolio valued at over $500 million, optimizing liquidity management efficiency.

- •Developed robust procedures for capital market instruments accounting, reducing discrepancies in reporting by 30%.

- •Collaborated with risk management to assess the financial impact of derivatives, enhancing strategic decision-making processes.

- •Streamlined journal entries process for capital market transactions, cutting down processing time by 25% through automation.

- •Led in the preparation of compliance reports, ensuring 100% adherence to GAAP and regulatory standards.

- •Played a key role in the internal audit process, improving audit turnaround time by 40%.

- •Monitored and reconciled liquidity positions, maintaining an accuracy rate of 99.5% in financial records.

- •Contributed to the preparation of quarterly financial statements, increasing transparency and clarity in reporting.

- •Enhanced accounting procedures for capital markets, resulting in better adherence to best practices and efficiency gains.

- •Liaised with auditors to supply comprehensive documentation, ensuring smoother audit processes and quicker resolution of issues.

- •Analyzed financial metrics and KPIs for capital markets, enhancing insights into performance and guiding strategic decisions.

- •Assisted in monthly financial closing processes, achieving error reduction by 15% through improved verification practices.

- •Created detailed reports on capital market performance, resulting in more informed decision-making amongst stakeholders.

- •Implemented new accounting software systems to improve data accuracy, resulting in a 20% increase in reporting speed.

- •Analyzed structured finance products, contributing to an understanding of their financial statement impacts and risks.

- •Supported the finance team in documenting capital market transactions, boosting efficiency by refining data entry processes.

- •Reconciled capital market instruments, achieving precision in accounts that led to improved financial oversight.

- •Played an integral role in preparing regulatory compliance documentation, ensuring no compliance issues during audits.

- •Optimized workflow management in treasury operations, reducing daily processing time by 10%.

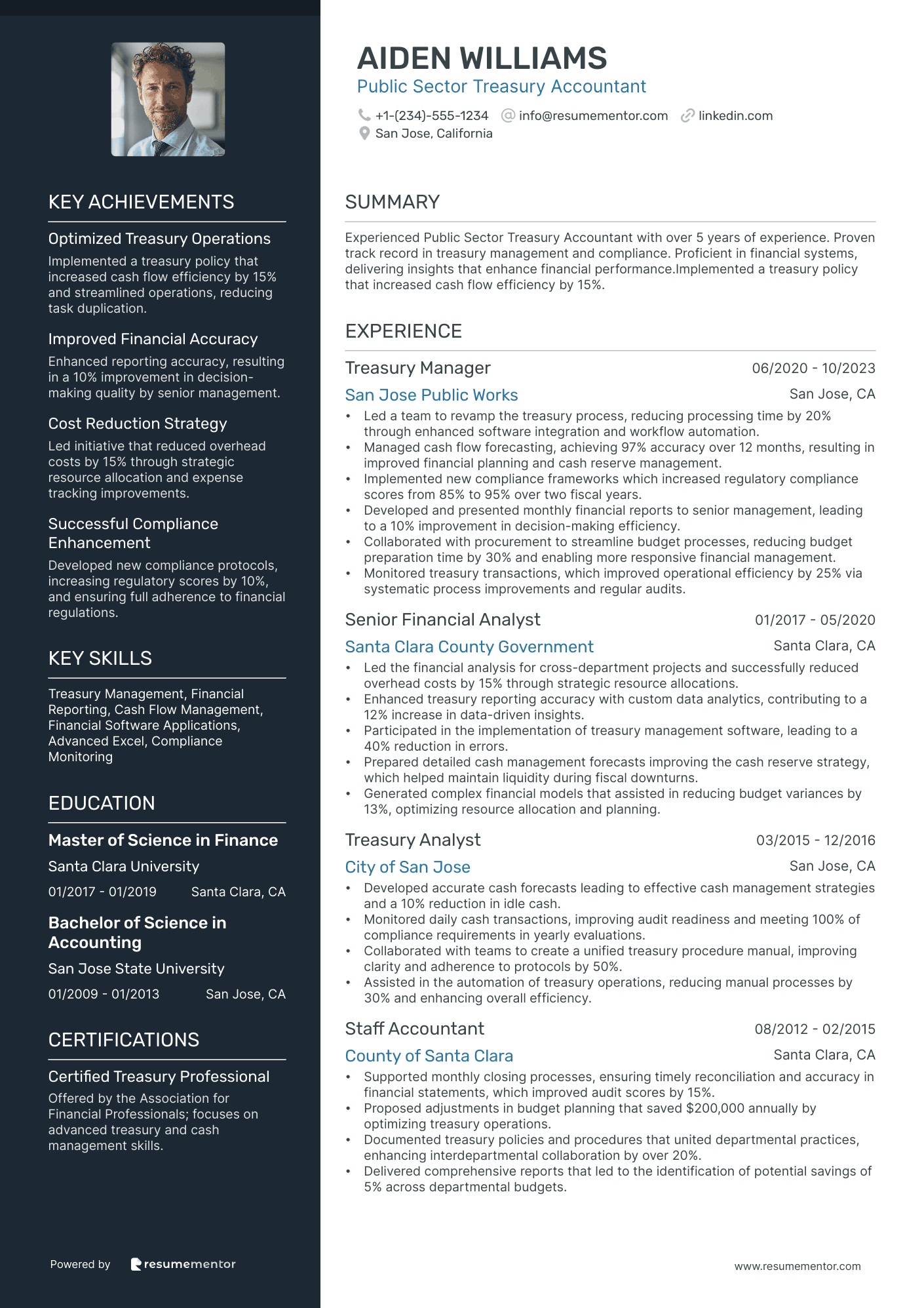

Public Sector Treasury Accountant resume sample

- •Led a team to revamp the treasury process, reducing processing time by 20% through enhanced software integration and workflow automation.

- •Managed cash flow forecasting, achieving 97% accuracy over 12 months, resulting in improved financial planning and cash reserve management.

- •Implemented new compliance frameworks which increased regulatory compliance scores from 85% to 95% over two fiscal years.

- •Developed and presented monthly financial reports to senior management, leading to a 10% improvement in decision-making efficiency.

- •Collaborated with procurement to streamline budget processes, reducing budget preparation time by 30% and enabling more responsive financial management.

- •Monitored treasury transactions, which improved operational efficiency by 25% via systematic process improvements and regular audits.

- •Led the financial analysis for cross-department projects and successfully reduced overhead costs by 15% through strategic resource allocations.

- •Enhanced treasury reporting accuracy with custom data analytics, contributing to a 12% increase in data-driven insights.

- •Participated in the implementation of treasury management software, leading to a 40% reduction in errors.

- •Prepared detailed cash management forecasts improving the cash reserve strategy, which helped maintain liquidity during fiscal downturns.

- •Generated complex financial models that assisted in reducing budget variances by 13%, optimizing resource allocation and planning.

- •Developed accurate cash forecasts leading to effective cash management strategies and a 10% reduction in idle cash.

- •Monitored daily cash transactions, improving audit readiness and meeting 100% of compliance requirements in yearly evaluations.

- •Collaborated with teams to create a unified treasury procedure manual, improving clarity and adherence to protocols by 50%.

- •Assisted in the automation of treasury operations, reducing manual processes by 30% and enhancing overall efficiency.

- •Supported monthly closing processes, ensuring timely reconciliation and accuracy in financial statements, which improved audit scores by 15%.

- •Proposed adjustments in budget planning that saved $200,000 annually by optimizing treasury operations.

- •Documented treasury policies and procedures that united departmental practices, enhancing interdepartmental collaboration by over 20%.

- •Delivered comprehensive reports that led to the identification of potential savings of 5% across departmental budgets.

Crafting the perfect treasury accountant resume can feel like navigating a complex financial statement. Your ability to manage and analyze finances is the lifeblood of your potential employer's operations, and putting that into words is key.

However, turning your expertise into an eye-catching document is challenging. Your skills in ensuring liquidity, managing risks, and optimizing cash flow need to shine through, even if employers skim through resumes quickly.

Here’s where a resume template becomes invaluable. These templates offer a clear, professional layout, providing the structure you need to emphasize your skills and achievements effectively. Explore these resume templates to get a head start.

As a treasury accountant, your expertise safeguards a company’s financial health. Capturing your skills clearly and effectively opens the door to new opportunities. Make sure your resume reflects both your financial acumen and strategic insight. Presenting your accomplishments in an organized manner ensures that your resume stands out. With the right approach, turn your resume into a powerful testament to your capabilities.

Key Takeaways

- Emphasize your skills in budgeting, compliance, and financial analysis to highlight your abilities as a treasury accountant.

- Using a resume template with a professional layout can effectively showcase your skills and achievements to potential employers.

- Choose a reverse-chronological format and modern fonts like Lato or Raleway to ensure clarity and professionalism in your resume.

- Include a concise professional summary and detail your work experience with quantifiable achievements that demonstrate your impact.

- List relevant certifications, like the Certified Treasury Professional (CTP), to validate your qualifications for the role.

What to focus on when writing your treasury accountant resume

Your treasury accountant resume should clearly reflect your strong grasp of financial management and expertise in handling cash flow and investments. Emphasizing your skills in budgeting, compliance, and financial analysis can effectively highlight your abilities. Recruiters will be looking for your experience in overseeing treasury operations, making your ability to assess financial risks crucial.

How to structure your treasury accountant resume

- Contact Information — Make sure to include your name, phone number, email, and LinkedIn profile so recruiters can easily connect with you. Keep this information updated and professional to leave a solid first impression.

- Professional Summary — Provide a brief overview of your experience in treasury management, highlighting your key achievements to capture interest. This section should be not just informative but also engaging, encouraging recruiters to read further into your resume.

- Work Experience — Detail your roles in cash management, risk evaluation, and financial reporting to demonstrate your comprehensive industry knowledge. Focus on achievements where you've made a significant impact, as this sets you apart from others.

- Skills — Display your expertise in areas such as cash flow forecasting, financial modeling, and familiarity with treasury software like TMS or SAP, which are highly valued. Tailor your skills to what seems most relevant to the job description to catch the recruiter's eye.

- Education — Include degrees in finance or accounting, along with certifications like the Certified Treasury Professional (CTP) to underscore your qualifications. Highlight any honors or relevant coursework that aligns with the job's requirements.

- Technical Proficiency — List your experience with treasury management software and industry-specific tools to show your capability in modern financial environments. Demonstrating these proficiencies can show employers you are ready to hit the ground running.

With these foundation points set, we will delve into each section more in-depth to prepare a standout resume tailored specifically for a treasury accountant role.

Which resume format to choose

As a treasury accountant, creating a clear and organized resume is crucial to making a great impression. Using a reverse-chronological format is ideal, as this layout emphasizes your most recent experience first. This makes it easy for finance employers to quickly assess your current skills and achievements, which is essential in a field where precision and recent experience can make all the difference.

The choice of font can subtly influence the way your resume is perceived. Opt for modern and professional fonts like Lato, Montserrat, or Raleway. These fonts offer a clean look that enhances readability without sacrificing professionalism. They provide an edge over the more commonly used Arial or Times New Roman, helping your resume stand out in a stack of applications.

Consistency in presentation is also a key factor in how your resume is received. Always save your resume as a PDF. This file type is universally accessible and preserves your carefully formatted document exactly as intended, ensuring finance employers see your resume in the best possible light.

In terms of format, maintaining one-inch margins on all sides is a simple yet effective choice. This spacing creates ample white space, which not only makes your resume look clean and organized but also makes it easier to read. A clutter-free layout can communicate your ability to handle financial data with clarity and precision.

By focusing on these essential elements—a clean format, modern fonts, consistent presentation, and attention to detail—you’ll craft a resume that makes a significant impact in the treasury accounting field. Each component works together to highlight your qualifications in a way that resonates with potential employers, showcasing both your skills and your professionalism.

How to write a quantifiable resume experience section

To craft a compelling treasury accountant experience section, emphasize your distinct contributions in past roles by starting with your most recent job first, as this adheres to reverse chronological order. Focus on the last 10-15 years, spotlighting positions that align closely with treasury accounting. Tailor your entries to the specific job description by mirroring its keywords and highlighting pertinent skills and successes, using clear action words like "optimized," "implemented," or "reconciled." Including numbers that show your impact helps convey the value you've added in previous roles. This approach underscores why you're the right candidate for the new position by clearly linking past achievements to potential future successes.

- •Implemented a new cash management system, cutting processing time by 30% and boosting financial report accuracy.

- •Optimized investment strategies that upped portfolio returns by 15% over three years.

- •Reconciled financial statement discrepancies, improving audit findings by 20%.

- •Led a team of five in daily treasury tasks, raising productivity by 25%.

This treasury accountant experience section stands out by seamlessly integrating quantifiable achievements that reflect real impact in prior roles. By aligning recent work with the treasury accountant field, it demonstrates a clear progression of skills, ensuring a strong connection between your past and future potential. Every bullet point is backed by specific metrics, like time savings and productivity increases, which makes your successes both believable and impressive. Tailoring the section to common treasury accounting tasks while using the language of job postings ensures it remains relevant. Meanwhile, vivid action verbs make your contributions compelling, capturing attention and illustrating the significance of your role. This well-structured and targeted approach creates a cohesive narrative that resonates with hiring managers, enhancing your job search efforts.

Achievement-Focused resume experience section

A treasury accountant-focused resume experience section should effectively highlight your achievements, showing the real difference your work made. Begin by showcasing specific accomplishments rather than merely listing duties. Reflect on times when you've had a significant impact, using numbers wherever possible to demonstrate the scale of your contributions. This approach helps potential employers quickly grasp the value you brought to previous roles by focusing on actions that led to cost savings, process improvements, risk management, or enhanced financial insights.

Each bullet point should start with an action verb that clearly describes your achievements, making your contributions strong and impactful. Avoid vague claims by providing concrete examples and results, ensuring that anyone reading your resume can appreciate your skills and the benefits you delivered. Tailor these statements to the job you're aiming for, emphasizing the aspects of your experience that align closely with the new role.

Treasury Accountant

XYZ Financial Services

January 2020 - Present

- Implemented a new cash management system, cutting down bank fees by 15% annually.

- Streamlined the month-end reporting process, reducing time spent by 25%.

- Worked with cross-functional teams to create a strong risk management framework.

- Optimized investment strategies, boosting annual portfolio returns by 8%.

Customer-Focused resume experience section

A client-focused treasury accountant resume experience section should highlight your skill in handling financial tasks while nurturing client relationships. Begin by showcasing specific instances where you engaged with clients or collaborated with teams to enhance financial reporting or analysis. Illustrate how you employed financial tools or software to streamline processes, always ensuring client needs remain a priority. This approach can lead to valuable outcomes, such as increased client retention or improved operational efficiency, demonstrating the impact of your work.

It's important to convey problem-solving abilities by sharing examples of resolving financial discrepancies or enhancing processes, which contribute to a better client experience. Quantify your achievements when possible to clearly demonstrate the scope of your contributions. Keep each bullet point focused, directly linking your treasury accounting skills with exceptional customer service.

Senior Treasury Accountant

Financial Solutions Corp

Jan 2020 - Present

- Improved client reporting accuracy through automated processes, cutting delivery time by 20%.

- Worked closely with teams to address complex treasury issues, boosting client satisfaction rates by 15%.

- Built strong professional relationships with key clients, which led to a 30% rise in account renewals.

- Conducted training sessions on client-focused strategies, enhancing team efficiency and client feedback scores.

Growth-Focused resume experience section

A growth-focused treasury accountant resume experience section should highlight achievements that have significantly impacted the company. Start by showcasing improvements you made, such as reducing costs or boosting efficiency through enhanced financial reporting. Connect your actions to the tangible benefits they brought, and use active verbs to illustrate your role in these successes. Focus on how each contribution demonstrates your adaptability and growth potential, emphasizing skills like analysis, risk management, and strategic planning.

The goal is to provide a cohesive picture of your professional journey, centered on growth and impact. This narrative helps potential employers understand how you can drive positive change and tackle financial challenges in their organization. By sharing specific successes from your past, you enable them to foresee the value you could bring to their team.

Treasury Accountant

XYZ Corporation

June 2020 - Present

- Implemented a new treasury management system that reduced processing time by 30%, streamlining operations.

- Developed a forecasting model that improved cash flow accuracy by 20%, leading to smarter investment decisions.

- Led a team to identify and mitigate risk factors, saving the company $500,000 each year by enhancing risk management strategies.

- Streamlined bank reconciliation processes, cutting errors by 40% and significantly boosting productivity.

Collaboration-Focused resume experience section

A Collaboration-Focused treasury accountant resume experience section should highlight how well you work with others to achieve financial goals. Begin by pointing out specific instances where you teamed up with colleagues or different departments. By sharing clear examples of your involvement, you demonstrate how your teamwork has enhanced financial procedures and improved reporting accuracy. Use action-oriented words like "coordinated," "partnered," and "facilitated" to clearly communicate your role and the positive impact you have made. Emphasize achievements that resulted from these collaborations, such as improved financial performance or more streamlined processes.

Each bullet point should clearly capture your contributions and their significance, focusing on how you integrated your efforts within a team to produce positive outcomes. Use straightforward language and avoid overly technical jargon to ensure your resume is easy to read and understand. Delivering detailed yet concise bullet points will quickly illustrate your ability to collaborate effectively and the substantial value you offer to any organization.

Treasury Accountant

Healthy Finance Solutions

June 2019 - Present

- Coordinated with finance team to implement a new accounting software, reducing data errors by 30%

- Partnered with procurement department to streamline expense reporting, improving efficiency by 15%

- Facilitated monthly cross-departmental meetings to align financial goals, enhancing communication and understanding

- Created a collaborative budgeting process that increased compliance with financial forecasts by 20%

Write your treasury accountant resume summary section

A treasury-focused accountant resume summary should immediately grab attention and highlight your key qualifications. Start by emphasizing your experience in treasury management, showcasing your strengths in areas like financial analysis, cash flow optimization, and risk management. Keeping your summary concise and rich with relevant details helps convey your potential value to employers.

For those with substantial experience, ensure your resume summary highlights your achievements. Consider this example:

This summary presents a clear picture of your expertise and the positive impact you've had in previous roles. Using powerful action verbs like "seasoned" and "proven" reinforces your professional image. It’s crucial to string together your skills and contributions, portraying a strong narrative of your capabilities.

Understanding the distinction between different resume sections is also important. While a resume summary focuses on your experience and achievements, a resume objective might outline your career goals and is suitable for entry-level candidates or career changers. A resume profile offers a broader view of your career, while a summary of qualifications lists your skills in bullet points. Each option serves a different purpose, and selecting the right one helps portray your strengths effectively. A carefully crafted summary sets the stage for the rest of your resume, guiding the reader through your professional journey.

Listing your treasury accountant skills on your resume

A skills-focused treasury accountant resume should effectively highlight your technical abilities and personal strengths. Start by deciding whether to create a dedicated skills section or incorporate these skills within your experience or summary sections. Highlighting strengths and soft skills demonstrates your communication, problem-solving, and teamwork abilities, which are crucial for a collaborative work environment. On the other hand, hard skills showcase your technical expertise, such as financial analysis and proficiency with financial software, which are essential for the role.

These skills and strengths serve as vital keywords in your resume. They help potential employers quickly assess your suitability for the role, particularly when automated systems filter applications. By incorporating the right keywords that align with the job description, you increase your chances of standing out and securing an interview.

Here's a streamlined example of a dedicated skills section in JSON format:

This section is effective because it provides a concise yet comprehensive list of competencies crucial for a treasury accountant. The listed skills are not only relevant but also aligned with what recruiters typically search for, thereby increasing your chances during initial screenings.

Best hard skills to feature on your treasury accountant resume

For a treasury accountant, focusing on hard skills is key. These skills communicate your ability to manage financial tasks and perform thorough analysis. Highlight skills such as:

Hard Skills

- Cash Flow Management

- Financial Reporting

- Budget Planning

- Reconciliation

- Risk Management

- Investment Management

- Treasury Operations

- Data Analysis

- Foreign Exchange Management

- Regulatory Compliance

- Financial Modeling

- Accounting Software Proficiency

- Fixed Income Analysis

- Strategic Financial Planning

- Capital Markets Expertise

Best soft skills to feature on your treasury accountant resume

Soft skills in a treasury accountant role emphasize your capacity to manage relationships and solve problems effectively. They demonstrate your capability to work well in teams and adjust to changing environments. Consider including these essential soft skills:

Soft Skills

- Communication

- Problem-Solving

- Attention to Detail

- Analytical Thinking

- Team Collaboration

- Time Management

- Adaptability

- Leadership

- Initiative

- Decision-Making

- Negotiation

- Conflict Resolution

- Creativity

- Emotional Intelligence

- Critical Thinking

How to include your education on your resume

An education section is a crucial part of your resume, especially for positions like a treasury accountant. It highlights your academic background and demonstrates your qualifications for the job. Tailor this section to the job you're targeting by including only relevant education. If a degree or certification isn't related to the role, it should be omitted.

Adding your GPA can enhance your resume, especially if it's impressive. Include it only if it's 3.0 or higher. If you graduated with honors, such as cum laude, include this accolade to showcase your academic achievements. When listing a degree, ensure you write the full title, clearly stating your major and the school you attended.

Here is a poor example of an education section:

Now, here is the stellar example for a treasury accountant:

- •Graduated magna cum laude

This second example aligns perfectly with the treasury accountant role. The degree is relevant and specific to finance. Including a high GPA of 3.8 enhances credibility, and the magna cum laude distinction highlights exceptional academic performance. This tailored approach makes it clear that you have the educational background needed for the treasury accountant position, presenting you as a strong candidate.

How to include treasury accountant certificates on your resume

Including a certificates section in your treasury accountant resume is vital. Certifications showcase your qualifications and dedication to your profession. You may opt to feature this section prominently in the header of your resume.

List the name of the certificate to catch the recruiter's eye. Include the date you earned the certification to show its relevance. Add the issuing organization to validate the credential's authenticity. Display the certifications in a clear, concise manner for easy readability.

Here’s a solid example:

This example is effective because it lists relevant certifications for a treasury accountant role. It also shows credible institutions that issued them. This helps reinforce your expertise and qualifications to potential employers.

Extra sections to include in your treasury accountant resume

Landing a job as a treasury accountant is both challenging and rewarding. It's essential to present a well-rounded resume that highlights your skills and experiences while also showcasing personal attributes that make you a unique candidate.

- Language section — Identify your proficiency in various languages to highlight your ability to communicate in global finance. This can open opportunities for roles that require multilingual capabilities.

- Hobbies and interests section — Showcase your personal interests to paint a fuller picture of who you are. This helps potential employers see you as a well-rounded individual beyond just your professional qualifications.

- Volunteer work section — Highlight your volunteer activities to show your commitment to giving back to the community. This demonstrates strong leadership and teamwork skills that are valuable in any job.

- Books section — List any books you’ve read that contribute to your professional growth. This can show your ongoing commitment to learning and staying current in your field.

Putting these sections in your resume can help set you apart from other candidates. They not only show your qualifications but also provide insights into your character. These tailored additions make your resume compelling and comprehensive.

In Conclusion

In conclusion, creating a treasury accountant resume that stands out involves a strategic blend of well-organized content and professional presentation. Your resume serves as a reflection of both your financial skills and your personal attributes, showcasing your potential to future employers. By emphasizing your experience in financial management, risk assessment, and cash flow optimization, you effectively demonstrate your ability to contribute to the financial health of an organization. Utilizing a clear format, modern fonts, and concise wording makes your resume accessible and appealing, aiding recruiters in quickly identifying your qualifications. Including metrics and achievements in your experience section provides concrete evidence of your past successes and potential future contributions. Your educational background and certifications further establish your credibility and readiness for the role, while extra sections such as language proficiency and volunteer work add depth to your profile. Ultimately, with careful attention to detail and a focus on relevant skills, you can craft a resume that not only highlights your expertise but also positions you as a valuable asset to any treasury team. This strategic approach ensures your resume resonates with employers, leading to more meaningful opportunities in your career as a treasury accountant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.