Trust Accountant Resume Examples

Jul 18, 2024

|

12 min read

Make your trust accountant resume shine: essential tips to gain trust in the finance world. Learn how to stand out with your skills, experience, and expertise. Use these strategies to build a resume that truly counts.

Rated by 348 people

Trust Fund Accountant

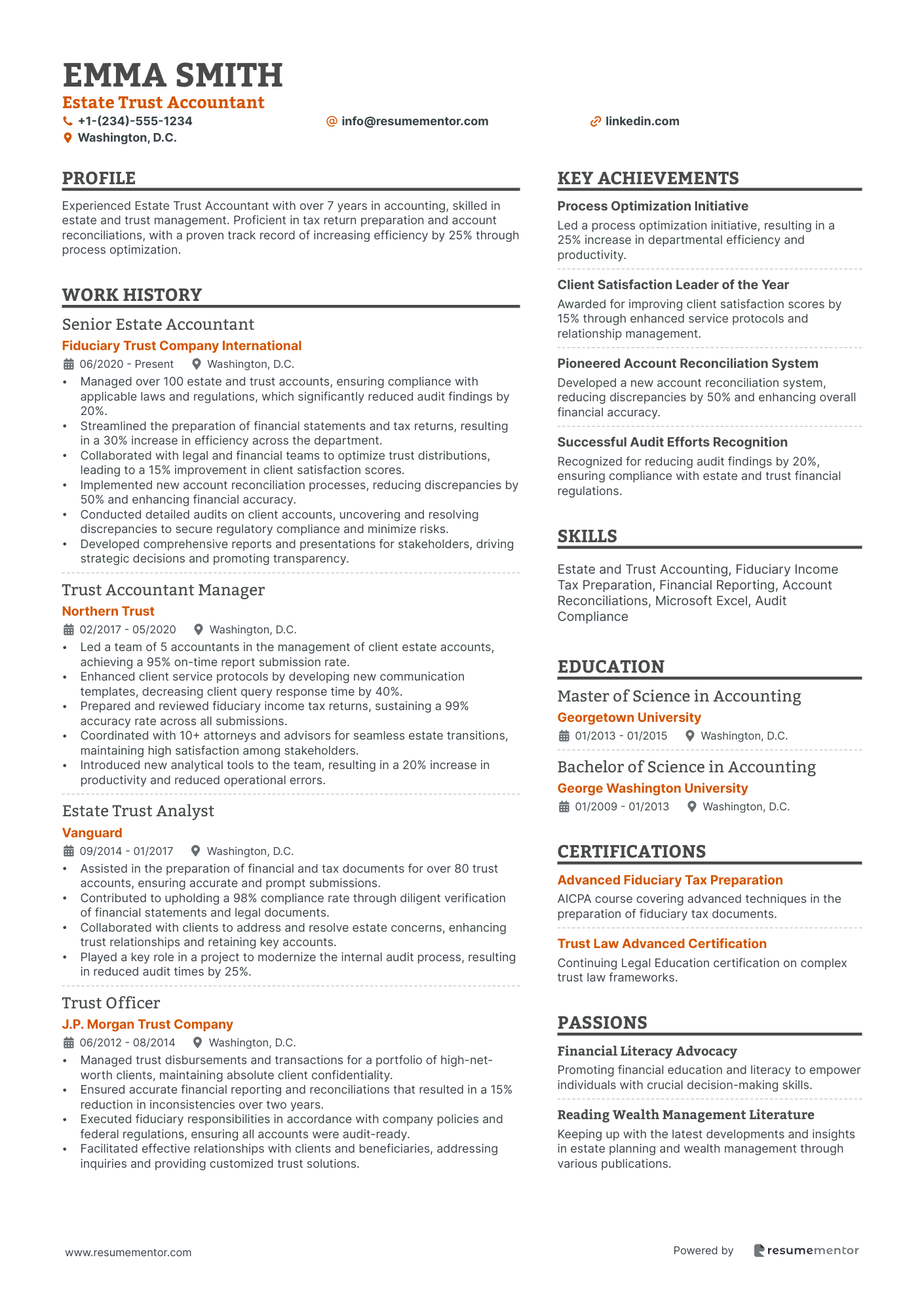

Estate Trust Accountant

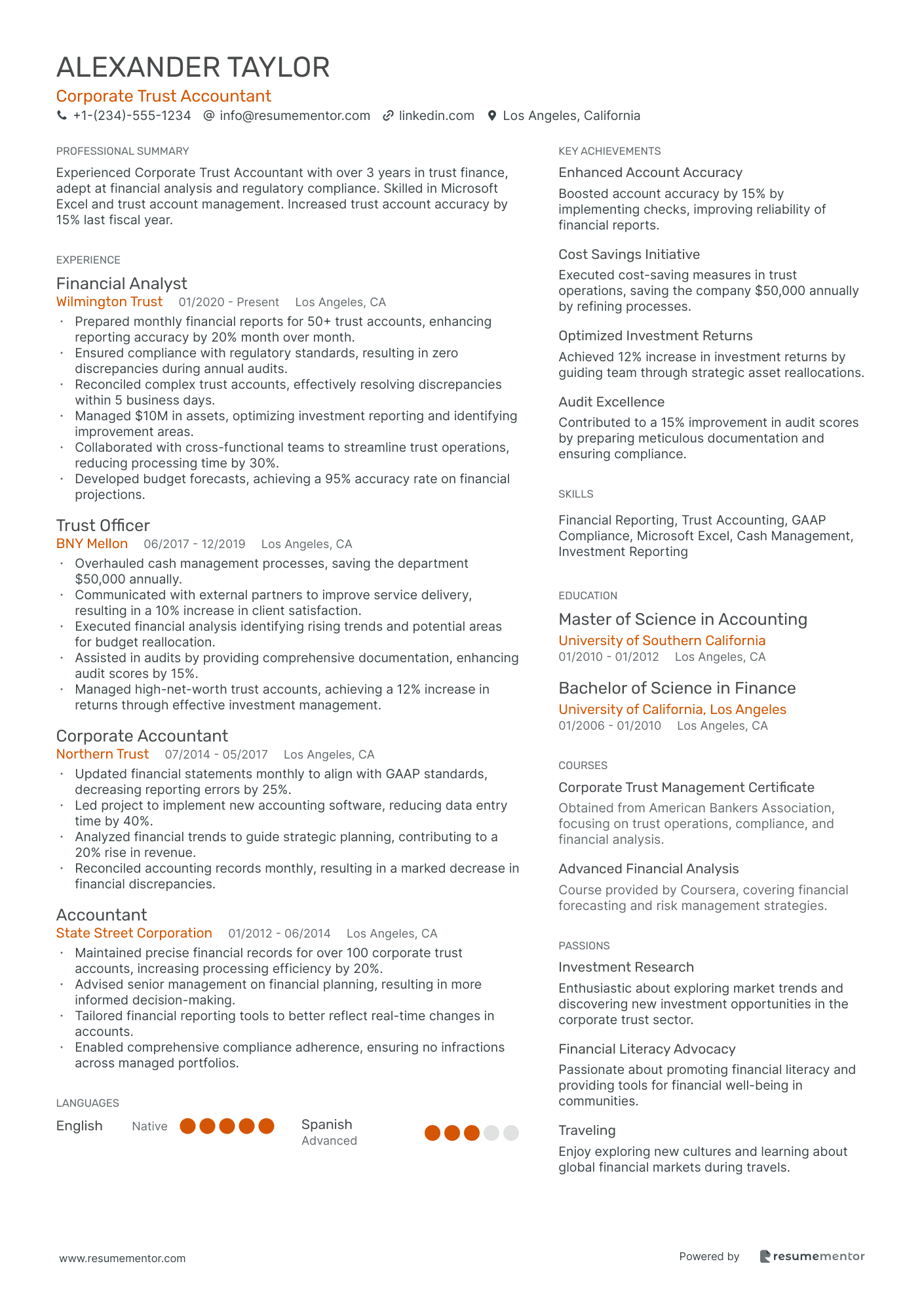

Corporate Trust Accountant

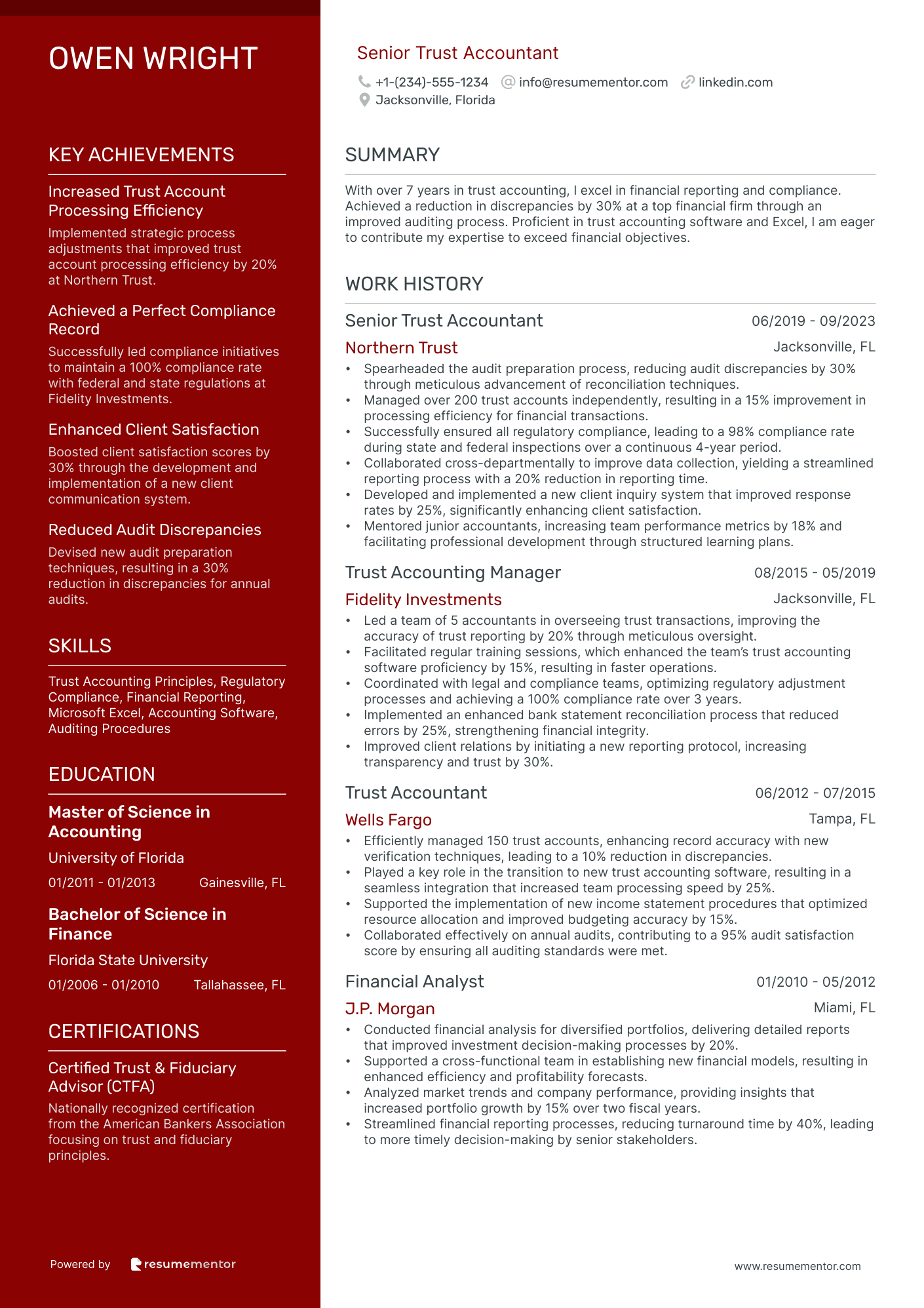

Senior Trust Accountant

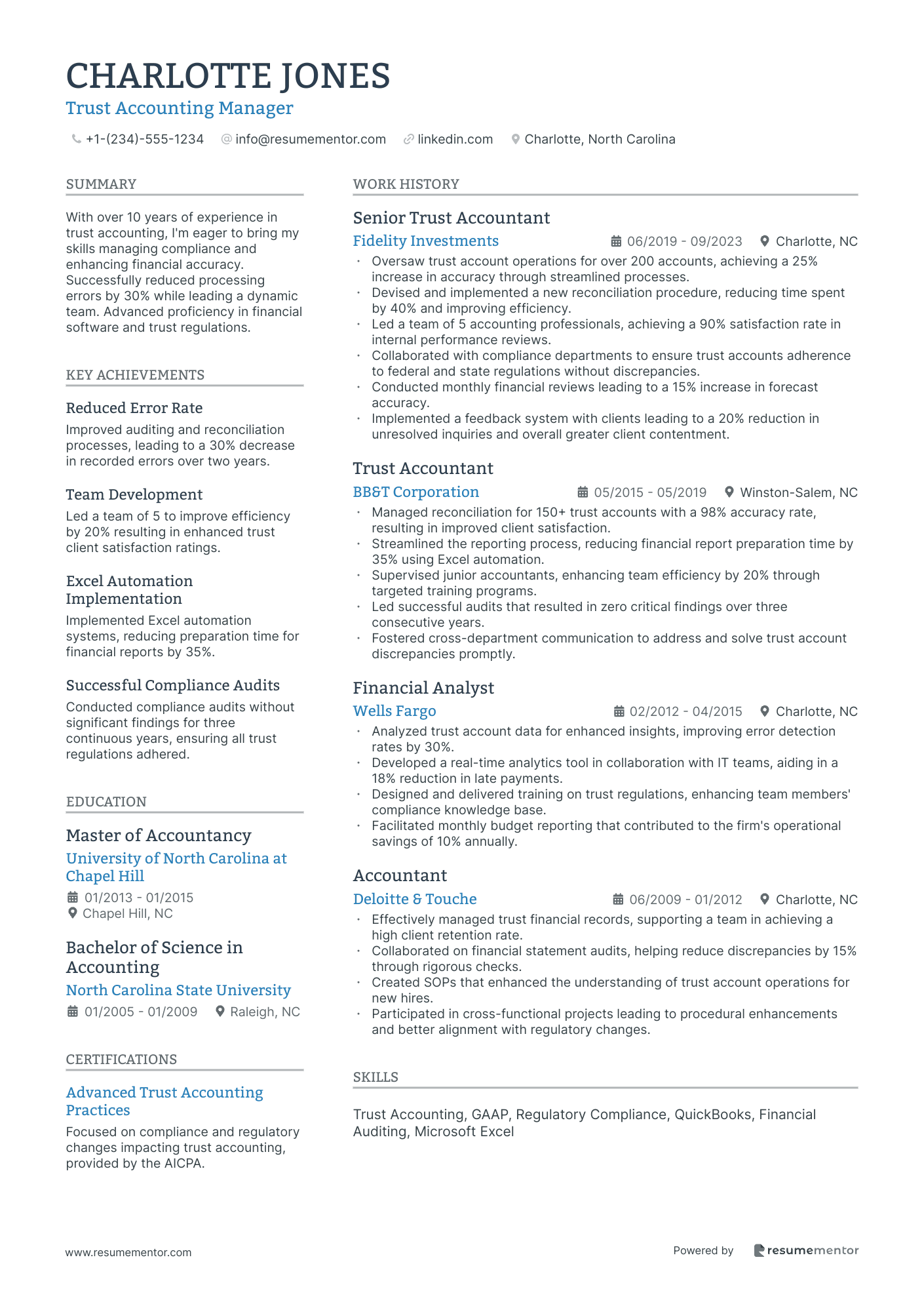

Trust Accounting Manager

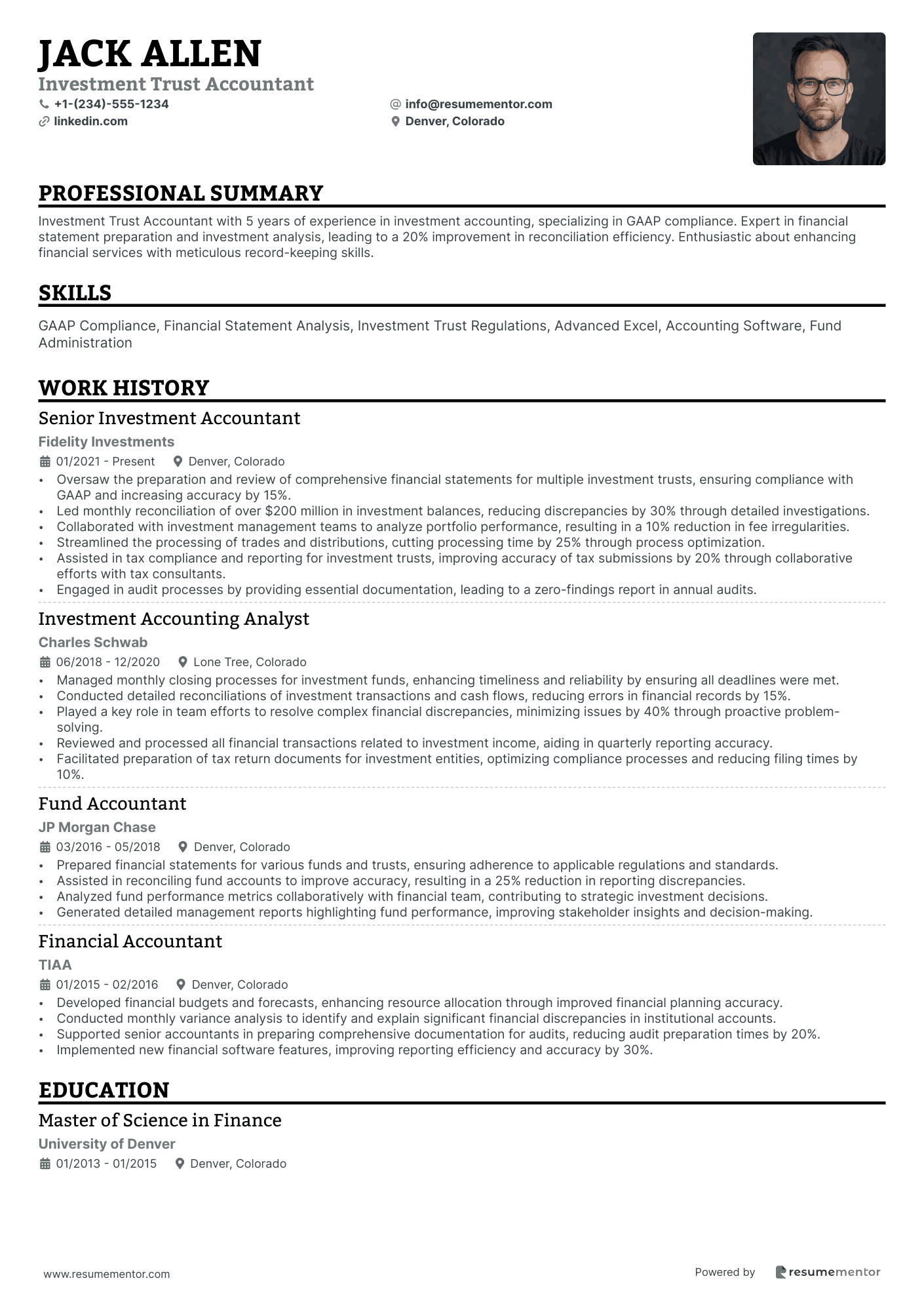

Investment Trust Accountant

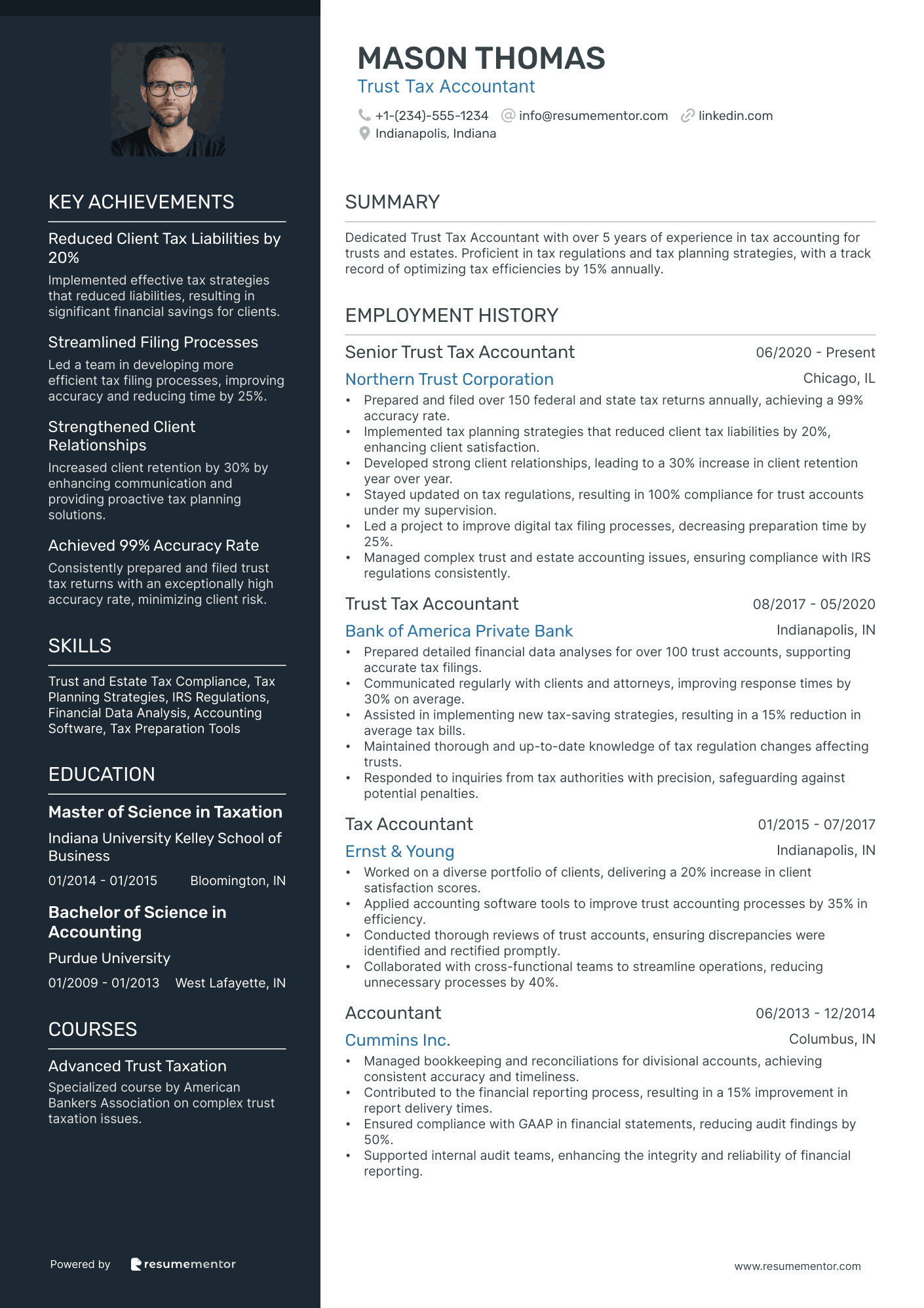

Trust Tax Accountant

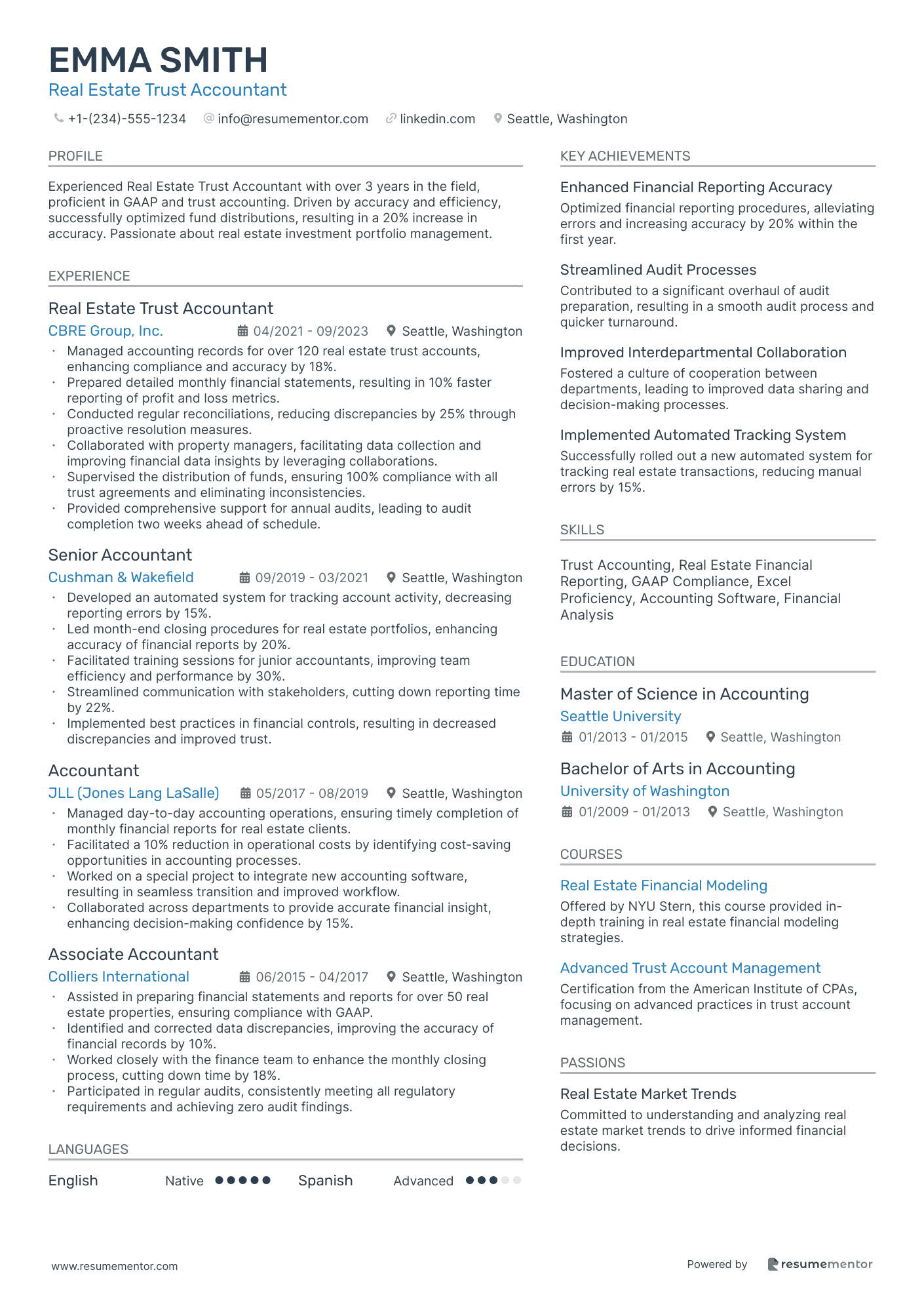

Real Estate Trust Accountant

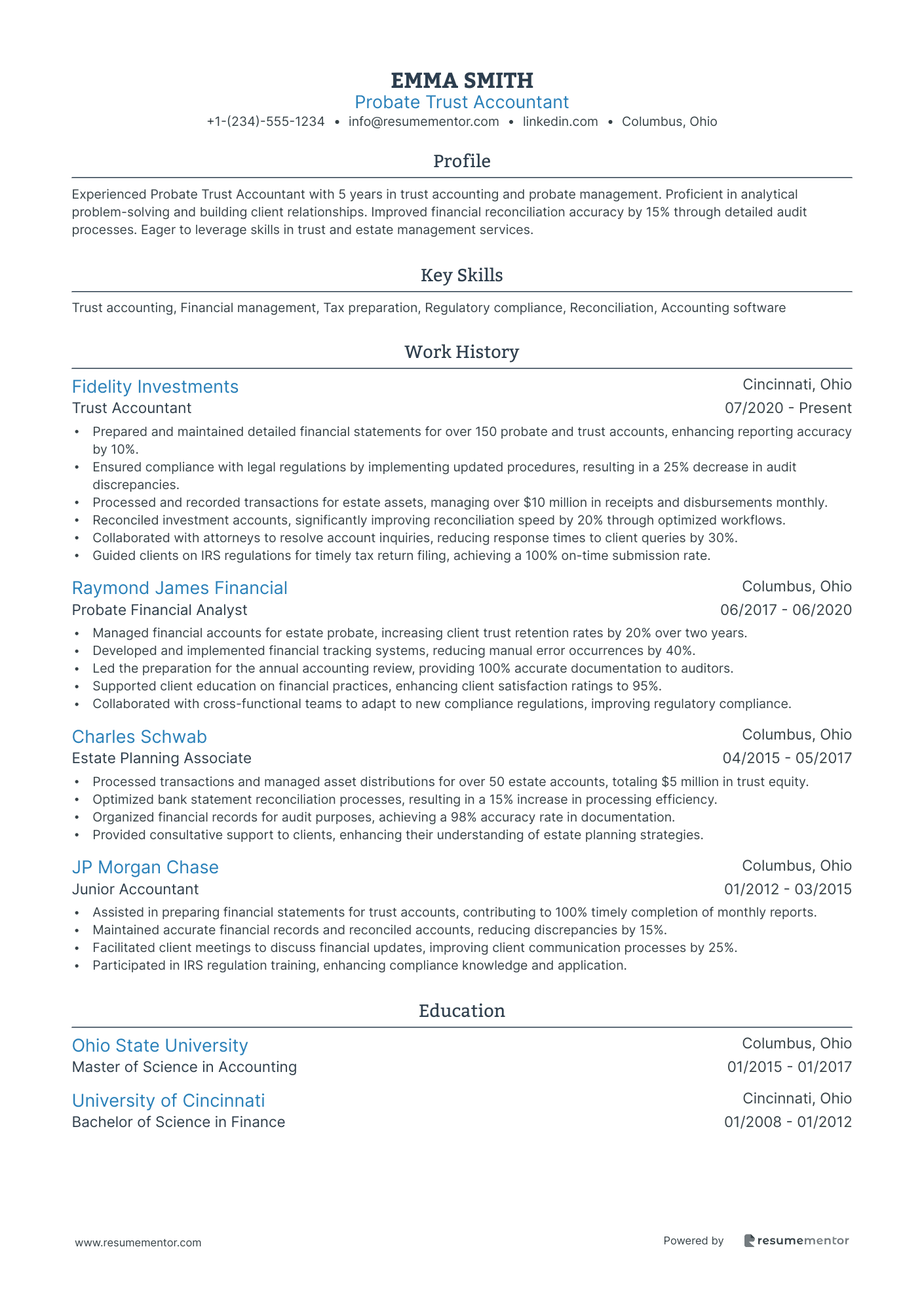

Probate Trust Accountant

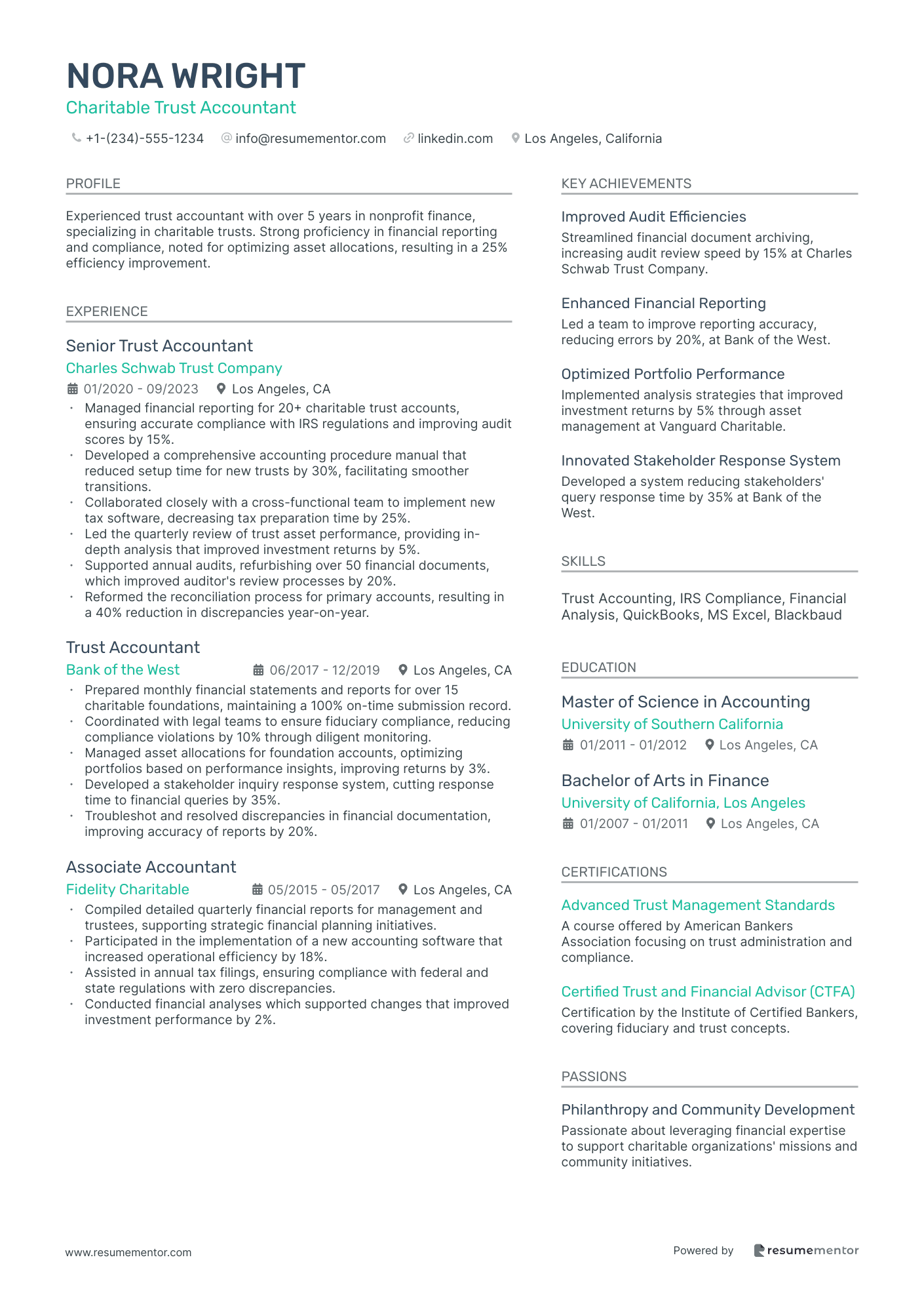

Charitable Trust Accountant

Trust Fund Accountant resume sample

- •Managed over 50 trust fund accounts, increasing reconciliation speed by 25% and accuracy by 15%.

- •Successfully collaborated with a team of attorneys and financial advisers on regulatory compliance issues.

- •Performed comprehensive audits resulting in a 30% reduction in account variances.

- •Streamlined the preparation of tax documents, improving timeliness of submissions by 20%.

- •Led the training program for new staff, reducing onboarding time from 3 months to 2 months.

- •Implemented a new account management system, resulting in 15% more efficient fund distribution.

- •Analyzed trust fund data leading to a strategic pivot in fund allocations that improved client returns by 10%.

- •Orchestrated compliance projects that ensured adherence to evolving industry regulations, increasing client trust.

- •Negotiated discrepancies in complex financial data, achieving resolution with a 90% satisfaction rate from clients.

- •Conducted quarterly reviews with stakeholders, yielding a 20% increase in operational transparency.

- •Collaborated with technology teams to update accounting systems, resulting in a 15% reduction in processing time.

- •Enhanced accounting protocols leading to a 50% reduction in end-of-month closing times.

- •Monitored financial accounts that reduced errors in transactions by 10% through rigorous checks.

- •Managed client inquiries efficiently, maintaining a 95% satisfaction score in account handling.

- •Assisted with the preparation of financial statements that guided investment strategies effectively.

- •Handled the daily maintenance of financial records, consistently aligning with industry best practices.

- •Prepared detailed fund reports that improved investor insight into fund performance by 20%.

- •Resolved audit discrepancies, improving overall trust account accuracy significantly.

- •Monitored interest calculations and fund distributions, reducing turnaround times by 10%.

Estate Trust Accountant resume sample

- •Managed over 100 estate and trust accounts, ensuring compliance with applicable laws and regulations, which significantly reduced audit findings by 20%.

- •Streamlined the preparation of financial statements and tax returns, resulting in a 30% increase in efficiency across the department.

- •Collaborated with legal and financial teams to optimize trust distributions, leading to a 15% improvement in client satisfaction scores.

- •Implemented new account reconciliation processes, reducing discrepancies by 50% and enhancing financial accuracy.

- •Conducted detailed audits on client accounts, uncovering and resolving discrepancies to secure regulatory compliance and minimize risks.

- •Developed comprehensive reports and presentations for stakeholders, driving strategic decisions and promoting transparency.

- •Led a team of 5 accountants in the management of client estate accounts, achieving a 95% on-time report submission rate.

- •Enhanced client service protocols by developing new communication templates, decreasing client query response time by 40%.

- •Prepared and reviewed fiduciary income tax returns, sustaining a 99% accuracy rate across all submissions.

- •Coordinated with 10+ attorneys and advisors for seamless estate transitions, maintaining high satisfaction among stakeholders.

- •Introduced new analytical tools to the team, resulting in a 20% increase in productivity and reduced operational errors.

- •Assisted in the preparation of financial and tax documents for over 80 trust accounts, ensuring accurate and prompt submissions.

- •Contributed to upholding a 98% compliance rate through diligent verification of financial statements and legal documents.

- •Collaborated with clients to address and resolve estate concerns, enhancing trust relationships and retaining key accounts.

- •Played a key role in a project to modernize the internal audit process, resulting in reduced audit times by 25%.

- •Managed trust disbursements and transactions for a portfolio of high-net-worth clients, maintaining absolute client confidentiality.

- •Ensured accurate financial reporting and reconciliations that resulted in a 15% reduction in inconsistencies over two years.

- •Executed fiduciary responsibilities in accordance with company policies and federal regulations, ensuring all accounts were audit-ready.

- •Facilitated effective relationships with clients and beneficiaries, addressing inquiries and providing customized trust solutions.

Corporate Trust Accountant resume sample

- •Prepared monthly financial reports for 50+ trust accounts, enhancing reporting accuracy by 20% month over month.

- •Ensured compliance with regulatory standards, resulting in zero discrepancies during annual audits.

- •Reconciled complex trust accounts, effectively resolving discrepancies within 5 business days.

- •Managed $10M in assets, optimizing investment reporting and identifying improvement areas.

- •Collaborated with cross-functional teams to streamline trust operations, reducing processing time by 30%.

- •Developed budget forecasts, achieving a 95% accuracy rate on financial projections.

- •Overhauled cash management processes, saving the department $50,000 annually.

- •Communicated with external partners to improve service delivery, resulting in a 10% increase in client satisfaction.

- •Executed financial analysis identifying rising trends and potential areas for budget reallocation.

- •Assisted in audits by providing comprehensive documentation, enhancing audit scores by 15%.

- •Managed high-net-worth trust accounts, achieving a 12% increase in returns through effective investment management.

- •Updated financial statements monthly to align with GAAP standards, decreasing reporting errors by 25%.

- •Led project to implement new accounting software, reducing data entry time by 40%.

- •Analyzed financial trends to guide strategic planning, contributing to a 20% rise in revenue.

- •Reconciled accounting records monthly, resulting in a marked decrease in financial discrepancies.

- •Maintained precise financial records for over 100 corporate trust accounts, increasing processing efficiency by 20%.

- •Advised senior management on financial planning, resulting in more informed decision-making.

- •Tailored financial reporting tools to better reflect real-time changes in accounts.

- •Enabled comprehensive compliance adherence, ensuring no infractions across managed portfolios.

Senior Trust Accountant resume sample

- •Spearheaded the audit preparation process, reducing audit discrepancies by 30% through meticulous advancement of reconciliation techniques.

- •Managed over 200 trust accounts independently, resulting in a 15% improvement in processing efficiency for financial transactions.

- •Successfully ensured all regulatory compliance, leading to a 98% compliance rate during state and federal inspections over a continuous 4-year period.

- •Collaborated cross-departmentally to improve data collection, yielding a streamlined reporting process with a 20% reduction in reporting time.

- •Developed and implemented a new client inquiry system that improved response rates by 25%, significantly enhancing client satisfaction.

- •Mentored junior accountants, increasing team performance metrics by 18% and facilitating professional development through structured learning plans.

- •Led a team of 5 accountants in overseeing trust transactions, improving the accuracy of trust reporting by 20% through meticulous oversight.

- •Facilitated regular training sessions, which enhanced the team’s trust accounting software proficiency by 15%, resulting in faster operations.

- •Coordinated with legal and compliance teams, optimizing regulatory adjustment processes and achieving a 100% compliance rate over 3 years.

- •Implemented an enhanced bank statement reconciliation process that reduced errors by 25%, strengthening financial integrity.

- •Improved client relations by initiating a new reporting protocol, increasing transparency and trust by 30%.

- •Efficiently managed 150 trust accounts, enhancing record accuracy with new verification techniques, leading to a 10% reduction in discrepancies.

- •Played a key role in the transition to new trust accounting software, resulting in a seamless integration that increased team processing speed by 25%.

- •Supported the implementation of new income statement procedures that optimized resource allocation and improved budgeting accuracy by 15%.

- •Collaborated effectively on annual audits, contributing to a 95% audit satisfaction score by ensuring all auditing standards were met.

- •Conducted financial analysis for diversified portfolios, delivering detailed reports that improved investment decision-making processes by 20%.

- •Supported a cross-functional team in establishing new financial models, resulting in enhanced efficiency and profitability forecasts.

- •Analyzed market trends and company performance, providing insights that increased portfolio growth by 15% over two fiscal years.

- •Streamlined financial reporting processes, reducing turnaround time by 40%, leading to more timely decision-making by senior stakeholders.

Trust Accounting Manager resume sample

- •Oversaw trust account operations for over 200 accounts, achieving a 25% increase in accuracy through streamlined processes.

- •Devised and implemented a new reconciliation procedure, reducing time spent by 40% and improving efficiency.

- •Led a team of 5 accounting professionals, achieving a 90% satisfaction rate in internal performance reviews.

- •Collaborated with compliance departments to ensure trust accounts adherence to federal and state regulations without discrepancies.

- •Conducted monthly financial reviews leading to a 15% increase in forecast accuracy.

- •Implemented a feedback system with clients leading to a 20% reduction in unresolved inquiries and overall greater client contentment.

- •Managed reconciliation for 150+ trust accounts with a 98% accuracy rate, resulting in improved client satisfaction.

- •Streamlined the reporting process, reducing financial report preparation time by 35% using Excel automation.

- •Supervised junior accountants, enhancing team efficiency by 20% through targeted training programs.

- •Led successful audits that resulted in zero critical findings over three consecutive years.

- •Fostered cross-department communication to address and solve trust account discrepancies promptly.

- •Analyzed trust account data for enhanced insights, improving error detection rates by 30%.

- •Developed a real-time analytics tool in collaboration with IT teams, aiding in a 18% reduction in late payments.

- •Designed and delivered training on trust regulations, enhancing team members' compliance knowledge base.

- •Facilitated monthly budget reporting that contributed to the firm's operational savings of 10% annually.

- •Effectively managed trust financial records, supporting a team in achieving a high client retention rate.

- •Collaborated on financial statement audits, helping reduce discrepancies by 15% through rigorous checks.

- •Created SOPs that enhanced the understanding of trust account operations for new hires.

- •Participated in cross-functional projects leading to procedural enhancements and better alignment with regulatory changes.

Investment Trust Accountant resume sample

- •Oversaw the preparation and review of comprehensive financial statements for multiple investment trusts, ensuring compliance with GAAP and increasing accuracy by 15%.

- •Led monthly reconciliation of over $200 million in investment balances, reducing discrepancies by 30% through detailed investigations.

- •Collaborated with investment management teams to analyze portfolio performance, resulting in a 10% reduction in fee irregularities.

- •Streamlined the processing of trades and distributions, cutting processing time by 25% through process optimization.

- •Assisted in tax compliance and reporting for investment trusts, improving accuracy of tax submissions by 20% through collaborative efforts with tax consultants.

- •Engaged in audit processes by providing essential documentation, leading to a zero-findings report in annual audits.

- •Managed monthly closing processes for investment funds, enhancing timeliness and reliability by ensuring all deadlines were met.

- •Conducted detailed reconciliations of investment transactions and cash flows, reducing errors in financial records by 15%.

- •Played a key role in team efforts to resolve complex financial discrepancies, minimizing issues by 40% through proactive problem-solving.

- •Reviewed and processed all financial transactions related to investment income, aiding in quarterly reporting accuracy.

- •Facilitated preparation of tax return documents for investment entities, optimizing compliance processes and reducing filing times by 10%.

- •Prepared financial statements for various funds and trusts, ensuring adherence to applicable regulations and standards.

- •Assisted in reconciling fund accounts to improve accuracy, resulting in a 25% reduction in reporting discrepancies.

- •Analyzed fund performance metrics collaboratively with financial team, contributing to strategic investment decisions.

- •Generated detailed management reports highlighting fund performance, improving stakeholder insights and decision-making.

- •Developed financial budgets and forecasts, enhancing resource allocation through improved financial planning accuracy.

- •Conducted monthly variance analysis to identify and explain significant financial discrepancies in institutional accounts.

- •Supported senior accountants in preparing comprehensive documentation for audits, reducing audit preparation times by 20%.

- •Implemented new financial software features, improving reporting efficiency and accuracy by 30%.

Trust Tax Accountant resume sample

- •Prepared and filed over 150 federal and state tax returns annually, achieving a 99% accuracy rate.

- •Implemented tax planning strategies that reduced client tax liabilities by 20%, enhancing client satisfaction.

- •Developed strong client relationships, leading to a 30% increase in client retention year over year.

- •Stayed updated on tax regulations, resulting in 100% compliance for trust accounts under my supervision.

- •Led a project to improve digital tax filing processes, decreasing preparation time by 25%.

- •Managed complex trust and estate accounting issues, ensuring compliance with IRS regulations consistently.

- •Prepared detailed financial data analyses for over 100 trust accounts, supporting accurate tax filings.

- •Communicated regularly with clients and attorneys, improving response times by 30% on average.

- •Assisted in implementing new tax-saving strategies, resulting in a 15% reduction in average tax bills.

- •Maintained thorough and up-to-date knowledge of tax regulation changes affecting trusts.

- •Responded to inquiries from tax authorities with precision, safeguarding against potential penalties.

- •Worked on a diverse portfolio of clients, delivering a 20% increase in client satisfaction scores.

- •Applied accounting software tools to improve trust accounting processes by 35% in efficiency.

- •Conducted thorough reviews of trust accounts, ensuring discrepancies were identified and rectified promptly.

- •Collaborated with cross-functional teams to streamline operations, reducing unnecessary processes by 40%.

- •Managed bookkeeping and reconciliations for divisional accounts, achieving consistent accuracy and timeliness.

- •Contributed to the financial reporting process, resulting in a 15% improvement in report delivery times.

- •Ensured compliance with GAAP in financial statements, reducing audit findings by 50%.

- •Supported internal audit teams, enhancing the integrity and reliability of financial reporting.

Real Estate Trust Accountant resume sample

- •Managed accounting records for over 120 real estate trust accounts, enhancing compliance and accuracy by 18%.

- •Prepared detailed monthly financial statements, resulting in 10% faster reporting of profit and loss metrics.

- •Conducted regular reconciliations, reducing discrepancies by 25% through proactive resolution measures.

- •Collaborated with property managers, facilitating data collection and improving financial data insights by leveraging collaborations.

- •Supervised the distribution of funds, ensuring 100% compliance with all trust agreements and eliminating inconsistencies.

- •Provided comprehensive support for annual audits, leading to audit completion two weeks ahead of schedule.

- •Developed an automated system for tracking account activity, decreasing reporting errors by 15%.

- •Led month-end closing procedures for real estate portfolios, enhancing accuracy of financial reports by 20%.

- •Facilitated training sessions for junior accountants, improving team efficiency and performance by 30%.

- •Streamlined communication with stakeholders, cutting down reporting time by 22%.

- •Implemented best practices in financial controls, resulting in decreased discrepancies and improved trust.

- •Managed day-to-day accounting operations, ensuring timely completion of monthly financial reports for real estate clients.

- •Facilitated a 10% reduction in operational costs by identifying cost-saving opportunities in accounting processes.

- •Worked on a special project to integrate new accounting software, resulting in seamless transition and improved workflow.

- •Collaborated across departments to provide accurate financial insight, enhancing decision-making confidence by 15%.

- •Assisted in preparing financial statements and reports for over 50 real estate properties, ensuring compliance with GAAP.

- •Identified and corrected data discrepancies, improving the accuracy of financial records by 10%.

- •Worked closely with the finance team to enhance the monthly closing process, cutting down time by 18%.

- •Participated in regular audits, consistently meeting all regulatory requirements and achieving zero audit findings.

Probate Trust Accountant resume sample

- •Prepared and maintained detailed financial statements for over 150 probate and trust accounts, enhancing reporting accuracy by 10%.

- •Ensured compliance with legal regulations by implementing updated procedures, resulting in a 25% decrease in audit discrepancies.

- •Processed and recorded transactions for estate assets, managing over $10 million in receipts and disbursements monthly.

- •Reconciled investment accounts, significantly improving reconciliation speed by 20% through optimized workflows.

- •Collaborated with attorneys to resolve account inquiries, reducing response times to client queries by 30%.

- •Guided clients on IRS regulations for timely tax return filing, achieving a 100% on-time submission rate.

- •Managed financial accounts for estate probate, increasing client trust retention rates by 20% over two years.

- •Developed and implemented financial tracking systems, reducing manual error occurrences by 40%.

- •Led the preparation for the annual accounting review, providing 100% accurate documentation to auditors.

- •Supported client education on financial practices, enhancing client satisfaction ratings to 95%.

- •Collaborated with cross-functional teams to adapt to new compliance regulations, improving regulatory compliance.

- •Processed transactions and managed asset distributions for over 50 estate accounts, totaling $5 million in trust equity.

- •Optimized bank statement reconciliation processes, resulting in a 15% increase in processing efficiency.

- •Organized financial records for audit purposes, achieving a 98% accuracy rate in documentation.

- •Provided consultative support to clients, enhancing their understanding of estate planning strategies.

- •Assisted in preparing financial statements for trust accounts, contributing to 100% timely completion of monthly reports.

- •Maintained accurate financial records and reconciled accounts, reducing discrepancies by 15%.

- •Facilitated client meetings to discuss financial updates, improving client communication processes by 25%.

- •Participated in IRS regulation training, enhancing compliance knowledge and application.

Charitable Trust Accountant resume sample

- •Managed financial reporting for 20+ charitable trust accounts, ensuring accurate compliance with IRS regulations and improving audit scores by 15%.

- •Developed a comprehensive accounting procedure manual that reduced setup time for new trusts by 30%, facilitating smoother transitions.

- •Collaborated closely with a cross-functional team to implement new tax software, decreasing tax preparation time by 25%.

- •Led the quarterly review of trust asset performance, providing in-depth analysis that improved investment returns by 5%.

- •Supported annual audits, refurbishing over 50 financial documents, which improved auditor's review processes by 20%.

- •Reformed the reconciliation process for primary accounts, resulting in a 40% reduction in discrepancies year-on-year.

- •Prepared monthly financial statements and reports for over 15 charitable foundations, maintaining a 100% on-time submission record.

- •Coordinated with legal teams to ensure fiduciary compliance, reducing compliance violations by 10% through diligent monitoring.

- •Managed asset allocations for foundation accounts, optimizing portfolios based on performance insights, improving returns by 3%.

- •Developed a stakeholder inquiry response system, cutting response time to financial queries by 35%.

- •Troubleshot and resolved discrepancies in financial documentation, improving accuracy of reports by 20%.

- •Compiled detailed quarterly financial reports for management and trustees, supporting strategic financial planning initiatives.

- •Participated in the implementation of a new accounting software that increased operational efficiency by 18%.

- •Assisted in annual tax filings, ensuring compliance with federal and state regulations with zero discrepancies.

- •Conducted financial analyses which supported changes that improved investment performance by 2%.

- •Maintained and reconciled accounts for multiple charitable funds, achieving a 99% accuracy rate.

- •Contributed to the formulation of new accounting policies, resulting in increased procedural efficiency by 10%.

- •Collaborated in the preparation of donor reports, reducing report generation time by 25%.

- •Assisted with internal audits, refining financial processes, which led to reducing errors by 15%.

Crafting a resume as a trust accountant is like building a bridge to your next opportunity. While your financial expertise is vital, translating these skills onto paper requires a thoughtful approach. This becomes even more crucial when your skills are specialized, and you need to stand out in a competitive job market.

Getting the right balance between your technical skills and hands-on experience is essential to engage potential employers. This balance shows that you’re not just qualified but the perfect fit for the role. To help with this, using a resume template can streamline your process by effectively organizing your information.

A well-structured template ensures your qualifications are front and center, allowing you to concentrate on telling your story. This also helps you avoid common pitfalls like employment gaps or vague job descriptions. Your resume represents more than just a list of past jobs; it’s a snapshot of your professional journey.

When structured correctly, your resume communicates not just where you've been, but where you’re headed. Your unique strengths as a trust accountant deserve to be highlighted, making your resume a powerful tool in securing your next great role.

Key Takeaways

- Crafting a resume for a trust accountant involves balancing technical skills with relevant experience to engage potential employers effectively.

- An organized resume template is crucial in showcasing qualifications prominently while avoiding pitfalls like employment gaps.

- A well-structured resume communicates not just past experiences but future ambitions, highlighting unique strengths in trust accounting.

- Attention to elements like contact information, professional summary, and skillset ensures a comprehensive presentation of one's capabilities and value.

- Incorporating sections such as certifications, volunteer experience, and personal interests adds depth to the application, making candidates more appealing to employers.

What to focus on when writing your trust accountant resume

Your trust accountant resume should effectively convey your expertise in managing finances and responsibilities related to trusts. As you emphasize your skills, ensure you highlight your attention to detail and strong analytical abilities, which are essential in this field. Let's explore how to write each section of a trust accountant resume.

How to structure your trust accountant resume

- Contact Information — Begin by ensuring your contact details are presented clearly at the top. This includes your full name, phone number, email address, and LinkedIn profile. Having this information easily accessible helps recruiters reach you swiftly, an essential first step in the hiring process.

- Professional Summary — Craft a concise paragraph that summarizes your experience and expertise in trust accounting. This section should highlight your proficiency in fiduciary duties and compliance with regulatory standards, tailoring your summary to reflect the specific needs of trust accounting.

- Work Experience — This section brings your professional background to life by detailing prior roles and achievements in trust accounting. Focus on accomplishments that demonstrate your capability, such as successful audits, effective fund management, and improvements in account accuracy. Each point should offer insight into your problem-solving skills and ability to handle complex financial scenarios.

- Education — List your academic credentials related to accounting or finance, ensuring to include the institutions you attended, their locations, and your graduation dates. Adding any relevant certifications like CPA or CFA can further strengthen your qualifications and showcase your commitment to professional development.

- Skills — Highlight key skills that align with trust accounting responsibilities, such as proficiency in tax software, understanding of trust protocols, and financial analysis acumen. These skills should reinforce your work experience and demonstrate your readiness for the nuanced demands of the role.

- Certifications and Professional Memberships — Illustrate your dedication to the field by listing any additional certifications and memberships in organizations like the American Institute of CPAs. This section underscores your ongoing professional growth and commitment to staying updated in trust accounting.

To round out your resume, consider including optional sections such as "Volunteer Experience" or "Projects." These can provide a more holistic view of your abilities by showcasing trust-related initiatives you've led or participated in. Below, we will cover each section more in-depth to ensure your resume format effectively highlights your qualifications as a trust accountant.

Which resume format to choose

As a trust accountant, choosing the right resume format can significantly impact how your expertise is perceived by potential employers. The reverse chronological format serves as a reliable choice by focusing on your most recent positions first. This allows you to effectively communicate your career progression and the depth of your experience with financial records, a crucial aspect in the accounting field.

While structuring your resume, the choice of font might seem minor, but it contributes to the overall impression you make. Fonts like Lato, Montserrat, and Raleway offer a modern, clean look that aligns with a professional style. These fonts ensure readability while also bringing a contemporary touch to your resume, setting you apart from more traditionally formatted documents.

The format is just one piece of the puzzle. Saving your resume as a PDF is crucial to maintaining the design and structure you've carefully crafted. PDFs safeguard your format from unwanted shifts that can occur if your document is opened in various word processors, ensuring consistency across devices and platforms.

Finally, consider the overall layout presented by your margins. One-inch margins provide an organized framework for your content, balancing text with whitespace. This design choice ensures that your resume remains visually appealing and easy to navigate, which can make a significant difference in capturing a hiring manager’s attention. Together, these elements work cohesively to create a professional and polished trust accountant resume.

How to write a quantifiable resume experience section

The experience section of your trust accountant resume is essential for making a strong impression in the accounting field. This section highlights your quantifiable achievements, showcasing your ability to manage trust accounts while demonstrating your attention to detail. By structuring it in reverse chronological order and starting with your most recent position, you present a clear progression of your career. It's typically best to cover the past 10-15 years, focusing only on roles relevant to trust accounting. Tailoring your resume to the job ad is crucial; including keywords from the job description helps communicate how your experience aligns with the position's needs. Action words like "managed," "led," "improved," and "implemented" vividly highlight what you've accomplished.

Here’s a well-crafted example of a trust accountant experience section:

- •Led a team that improved accuracy of financial statements by 30% through enhanced audit procedures.

- •Managed over 250 trust accounts, ensuring compliance with company policies and regulatory requirements.

- •Implemented a new software system, reducing report preparation time by 20%.

- •Trained and mentored junior accountants, resulting in a 40% increase in team productivity.

This experience section excels because it creates a compelling narrative of your professional strengths. Each bullet point connects your skills with real impacts on the organization, like enhancing financial accuracy and boosting productivity. With strong action words and measurable results, your skills and accomplishments naturally capture attention. By aligning all these aspects with what potential employers are looking for, you position yourself as an ideal candidate who meets their specific needs in trust accounting.

Efficiency-Focused resume experience section

An efficiency-focused trust accountant resume experience section should showcase how you’ve made key improvements in processes, cost savings, and accuracy. By zooming in on your specific contributions, you can highlight your role in driving positive change. Use action verbs to convey a sense of achievement, and whenever possible, back up your claims with numbers or percentages to clearly outline your impact. Aim to craft each bullet point as part of a bigger story that ties back to the overall theme of efficiency.

Keeping language simple and direct ensures your achievements are both clear and compelling. Maintaining a consistent style across bullet points helps create a smooth reading flow. Here’s how this could look in practice:

Trust Accountant

ABC Financial Services

June 2018 - Present

- Streamlined the monthly reconciliation process, cutting completion time by 20%, thereby freeing up resources for other tasks.

- Enhanced report accuracy by 30% through implementing automation tools, which led to more reliable financial overviews.

- Collaborated with IT to integrate new software, boosting data management efficiency by 25% and improving response time for inquiries.

- Led a team to revise protocols, resulting in annual savings of $50,000 and setting a standard for operational excellence.

Training and Development Focused resume experience section

A training and development-focused trust accountant resume experience section should effectively highlight your contributions to enhancing team skills and improving processes. Begin by emphasizing projects or roles where you actively trained others, developed new programs, or optimized existing procedures. It's important to demonstrate how these initiatives have driven growth for both the team and the organization. Use clear, action-oriented language to underscore your role in fostering a nurturing learning environment.

In describing your experience, incorporate specific examples or numbers to effectively showcase your achievements and clarify your responsibilities. Tailor each bullet point to illustrate how your training initiatives have enhanced operational efficiency or team capacity. This approach helps recruiters appreciate your potential value in building a productive team, emphasizing your capability to nurture a skilled workforce.

Trust Accountant

XYZ Financial Services

Jan 2020 - Present

- Led the development and implementation of a training program that improved team productivity by 20%.

- Designed and facilitated workshops that enhanced team skills and increased efficiency.

- Collaborated with management to identify learning objectives and tailored programs to meet goals.

- Mentored junior accountants, resulting in faster onboarding and team integration.

Responsibility-Focused resume experience section

A responsibility-focused trust accountant resume experience section should clearly demonstrate your ability to manage financial trusts while ensuring compliance with necessary laws and regulations. Start by showcasing how your precision and dedication in handling financial tasks have a direct impact on the accuracy and timeliness of reporting. Provide specific examples that highlight how you've contributed to improving accounting processes or played a key role in enhancing financial decision-making. For instance, showcasing experience in preparing financial statements, handling tax reporting, or executing audits can underscore your area of expertise. Ensure your descriptions are straightforward, reinforcing your strong grasp of essential financial principles and how they benefit your employers.

It's important that your experience section weaves together achievements and responsibilities in a manner that highlights your understanding of trust accounting. Using direct and active language can make your key accomplishments stand out, helping potential employers immediately see how your skills and insights can contribute to their organization. Avoid overly technical language but ensure the content reflects the depth of your financial acumen by focusing on clear, impactful descriptions.

Trust Accountant

Acme Financial Services

August 2018 - May 2023

- Managed over 50 trust accounts, ensuring accurate and timely financial reporting.

- Led a system overhaul that improved reporting efficiency by 30% within the first year.

- Collaborated with legal teams to ensure all trust decisions complied with current laws, reducing compliance errors to zero.

- Prepared detailed financial reports for stakeholders, enhancing transparency and decision-making.

Collaboration-Focused resume experience section

A collaboration-focused trust accountant resume experience section should emphasize your ability to work well with others and achieve collective goals. Begin by illustrating how you've thrived in team settings and contributed to joint projects that led to significant company benefits. Highlight specific scenarios where you coordinated with different teams and used action verbs like "partnered" and "facilitated" to demonstrate your proactive role in these efforts.

Each bullet point should clearly show how your collaboration improved team outcomes or streamlined processes. Include any measurable results, such as increased accuracy or efficiency, to underscore your impact. Use simple and direct language to highlight your skills in building relationships and working smoothly with colleagues across departments.

Trust Accountant

Reliable Finance Solutions

January 2020 - Present

- Coordinated efforts between the accounting and IT teams to integrate new financial software, reducing data entry errors by 30%.

- Partnered with auditors and compliance officers to successfully complete a key audit, ensuring alignment with regulatory standards.

- Facilitated monthly cross-departmental meetings to enhance understanding of financial objectives, improving team performance and results.

- Worked with the operations team to streamline financial reporting processes, cutting report preparation time by 15%.

Write your trust accountant resume summary section

A trust accountant-focused resume experience section should instantly capture the attention of hiring managers. Highlighting your professional achievements and skills directly relevant to the job is key. Here's an example of a summary that showcases what sets a seasoned trust accountant apart:

This concise yet powerful summary clearly demonstrates extensive experience and measurable success. It highlights key skills like compliance and collaboration, crucial for a trust accountant role. To strengthen your summary, describe yourself with words that convey confidence, expertise, and a results-driven mindset.

Language like "proven track record" and "skilled at" not only communicates what you do but also how effectively you do it. Understanding the distinctions between resume sections helps tailor your application. While a summary offers a quick career overview, an objective states your career goals, making it suitable for beginners. A profile blends background and goals, while a summary of qualifications lists top skills and accomplishments. Tailor these sections to your experience level to ensure your resume resonates with employers. Whether you're crafting a summary or an objective, focus on clarity and relevancy for the best impact.

Listing your trust accountant skills on your resume

A skills-focused trust accountant resume should effectively highlight both your technical abilities and personal attributes. When crafting your skills section, consider presenting it as a standalone piece or incorporating it into other areas, like your experience and summary. This strategy allows you to effectively communicate your strengths across your entire resume. Strengths and soft skills, such as teamwork and adaptability, are personal attributes that showcase how you handle various situations. In contrast, hard skills are specific competencies gained through training and experience, like accounting software proficiency or financial reporting expertise.

Your skills and strengths essentially serve as the keywords of your resume. Strategically placing them throughout your document helps align your resume with the job description and increases the chance of catching employers’ eyes, especially with automated systems in play. Taking the time to choose the right skills and naturally weaving them into your resume can truly elevate its visibility.

Here's what a standalone skills section might include:

This example is effective because it highlights skills directly related to trust accounting, underscoring your proficiency in essential areas. Each skill listed is connected to the typical responsibilities you'll face, evidencing the technical knowledge required for the role.

Best hard skills to feature on your trust accountant resume

Highlighting hard skills is vital; they demonstrate specialized knowledge and show that you can manage technical tasks like scrutinizing financial documents or navigating regulatory complexities. The most valuable hard skills include:

Hard Skills

- Tax Compliance

- Financial Reporting

- Trust Administration

- GAAP Knowledge

- Fund Accounting

- Budget Analysis

- Risk Management

- Spreadsheet Tools (Excel)

- Financial Statement Preparation

- Regulatory Knowledge

- Auditing Practices

- Asset Management

- Financial Planning

- Investment Strategies

- Data Analysis

Best soft skills to feature on your trust accountant resume

Equally important are soft skills, which speak to how you interact with others and adjust to different environments. Showcasing these skills reveals your potential to excel in collaborative and complex situations. Top soft skills to consider are:

Soft Skills

- Communication

- Attention to Detail

- Critical Thinking

- Problem-Solving

- Adaptability

- Organization

- Teamwork

- Decision-Making

- Ethical Judgment

- Stress Management

- Creativity

- Interpersonal Skills

- Leadership

- Negotiation

- Time Management

How to include your education on your resume

The education section is an essential part of a trust accountant's resume as it showcases your qualifications and background relevant to the job. Tailoring your education section to the specific role is crucial, meaning you should only include degrees or coursework pertinent to trust accounting. Consider omitting irrelevant qualifications that don't add value to your application. If your GPA is 3.5 or higher, it's advisable to include it to highlight your academic success. You might also want to mention honors such as cum laude, which demonstrates your academic excellence. When listing your degree, include details such as the type of degree, the institution, and your graduation date.

- •Graduated cum laude

The second example is an outstanding trust accountant resume education section because it highlights a relevant degree in accounting, which aligns perfectly with the trust accountant role. It also includes a strong GPA of 3.7, emphasizing academic achievement. Mentioning "cum laude" demonstrates an extra level of dedication and excellence in the field of study. This example effectively communicates the candidate’s commitment and capability in accounting, which is crucial for the trust accountant position. Including such relevant details helps make your application stand out to potential employers.

How to include trust accountant certificates on your resume

Including a certificates section in your trust accountant resume is crucial as it showcases your additional expertise and commitment to your profession. Certificates can be featured in their own section or even in the header of your resume. In the header, you could include certificates like this: "Jane Doe, CPA, CFTA."

List the name of the certificate. Include the date you received the certificate. Add the issuing organization for each certificate. Ensure the certificates are relevant to the trust accountant role. Keep the presentation clean and straightforward for easy reading.

This example is good because it lists three certificates relevant to trust accounting, showing your diverse skills. It provides the full title of each certificate and the well-known institution that issued it. This helps potential employers quickly verify your qualifications and see your dedication to the field. The presentation is neat and easy to understand, ensuring your achievements stand out.

Extra sections to include in your trust accountant resume

When crafting a resume for a trust accountant, showcasing additional skills and interests can set you apart from other candidates. Adding sections that highlight your languages, hobbies, volunteer work, and reading can make your application more dynamic and engaging. This approach provides a complete view of your abilities and passions.

- Language section — Include any languages you speak fluently, such as Spanish or Mandarin, which can show your ability to work with diverse clients. This also indicates your adaptability and communication skills in a global market.

- Hobbies and interests section — Mention interests like chess or playing a musical instrument, which can highlight your analytical thinking and discipline. Sharing personal interests can make you more memorable to hiring managers.

- Volunteer work section — Include experiences such as helping at a local nonprofit or mentoring students, to demonstrate your community involvement and leadership skills. Volunteer work often reveals your ability to work well in teams and manage projects.

- Books section — List books related to finance or personal development that you have read recently, such as "The Intelligent Investor" by Benjamin Graham, to show your ongoing commitment to self-improvement. This can give employers insight into your professional knowledge and motivation to stay current in your field.

By integrating these sections into your resume, you can provide a fuller picture of who you are both professionally and personally. This approach not only showcases your qualifications as a trust accountant but also your character and interests, adding depth to your application.

In Conclusion

In conclusion, creating a standout resume as a trust accountant requires careful consideration of how you present your skills, experiences, and personal attributes. Your resume acts as a bridge to new career opportunities, so it's crucial to balance your technical abilities with your unique professional narrative. Using a well-structured resume template can highlight your qualifications and help you strategically align your skills with the needs of potential employers. Make sure to emphasize quantifiable achievements in trust management that showcase your expertise in ensuring accuracy and compliance. Select a resume format that best reflects your experience and choose a clean, professional font to maintain readability. Further enhance your resume by highlighting relevant certifications, key skills, and involvement in training or collaboration efforts. Remember to include an education section that underscores your academic background in accounting or finance, complemented by any accolades or honors. Extra sections like volunteer work or personal interests can enrich your resume, offering a glimpse into your broader skill set and passions. Finally, your resume is more than a document; it's a reflection of your professional journey and readiness to take on new challenges. By meticulously crafting each section, you ensure your resume makes a compelling case for your candidacy as a trust accountant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.