Underwriter Resume Examples

Jul 18, 2024

|

12 min read

Crafting a standout underwriter resume: Tips to ensure you’re a ‘premium’ candidate in the insurance industry. Learn how to highlight your skills, experience, and qualifications effectively.

Rated by 348 people

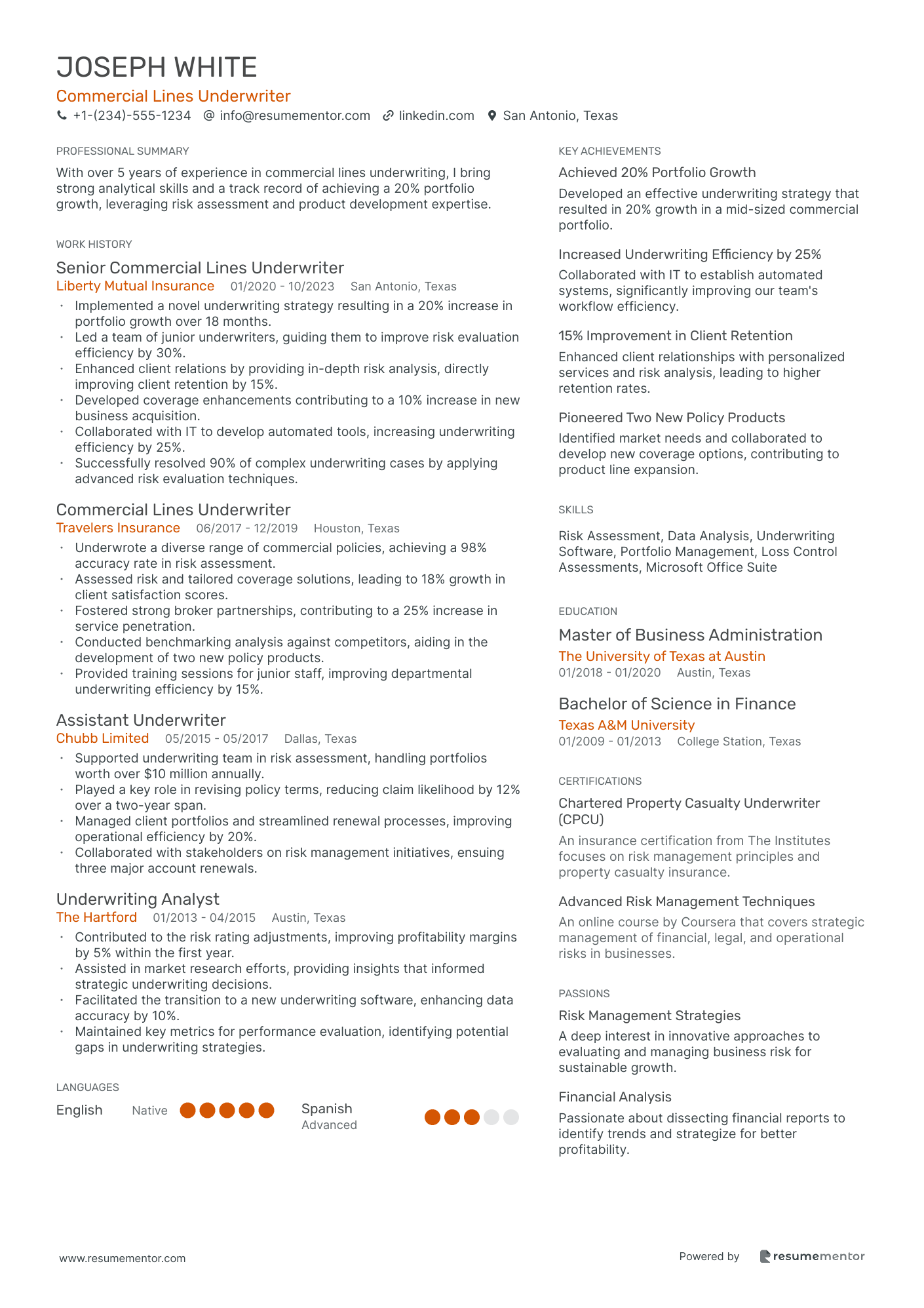

Commercial Lines Underwriter

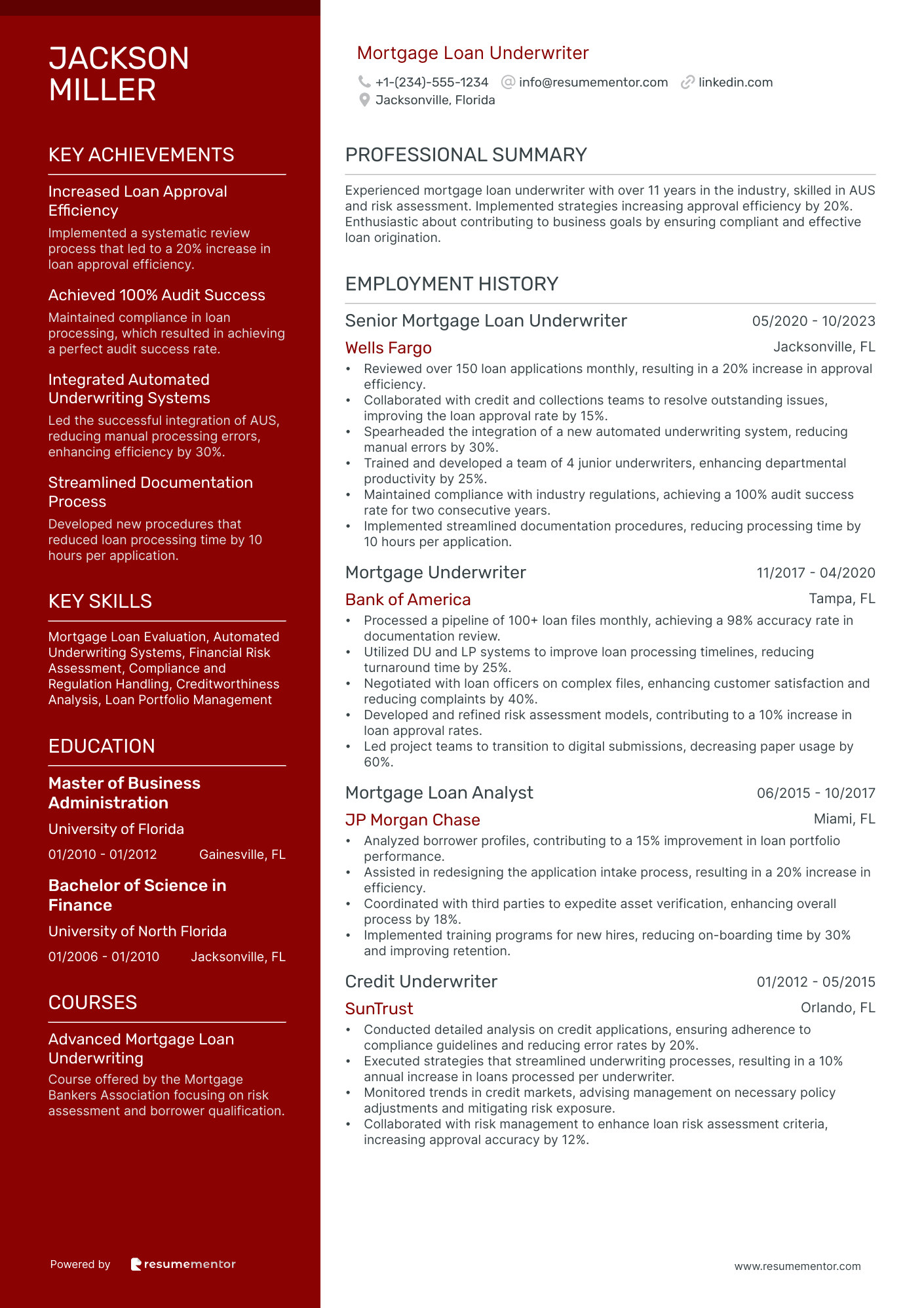

Mortgage Loan Underwriter

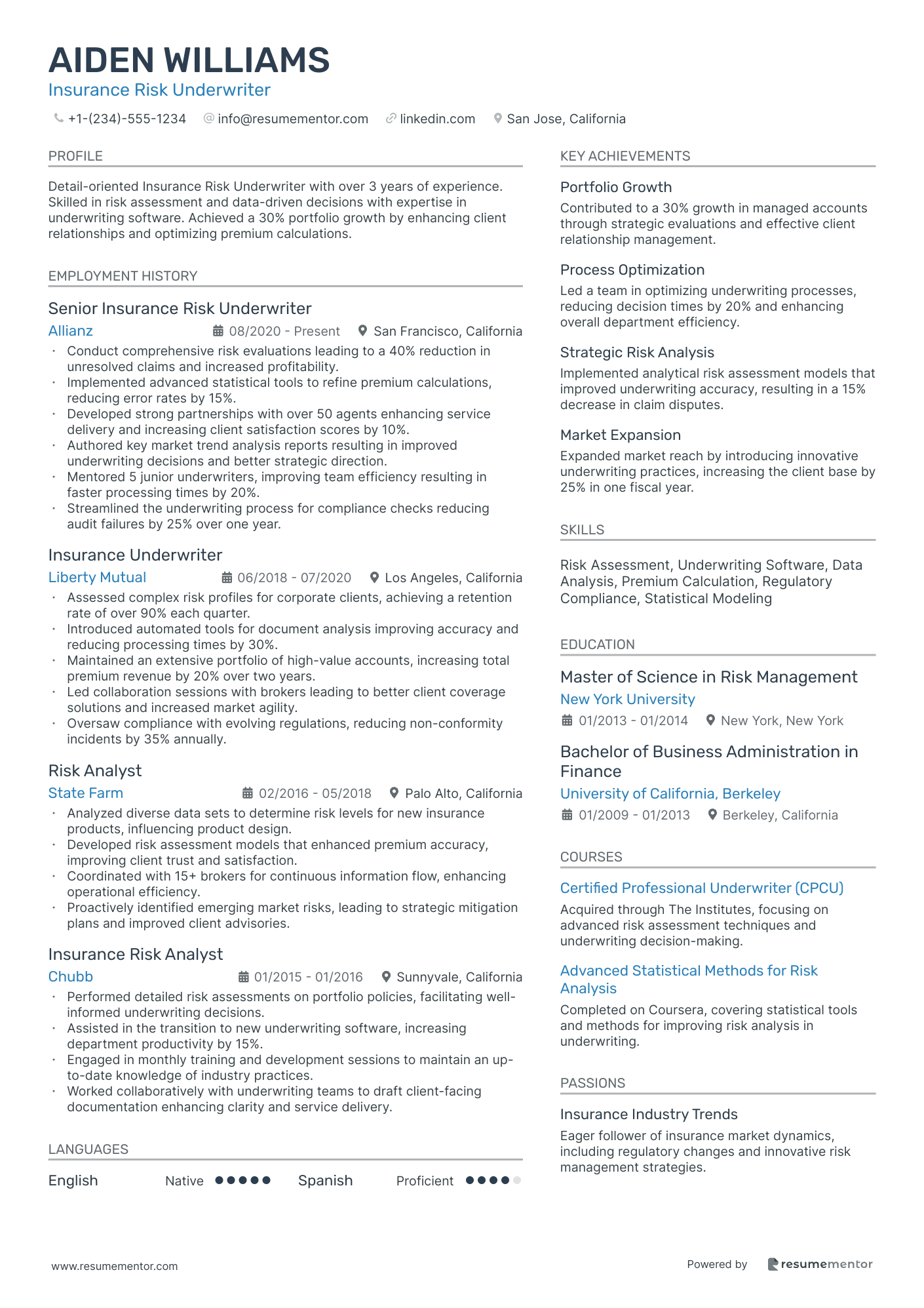

Insurance Risk Underwriter

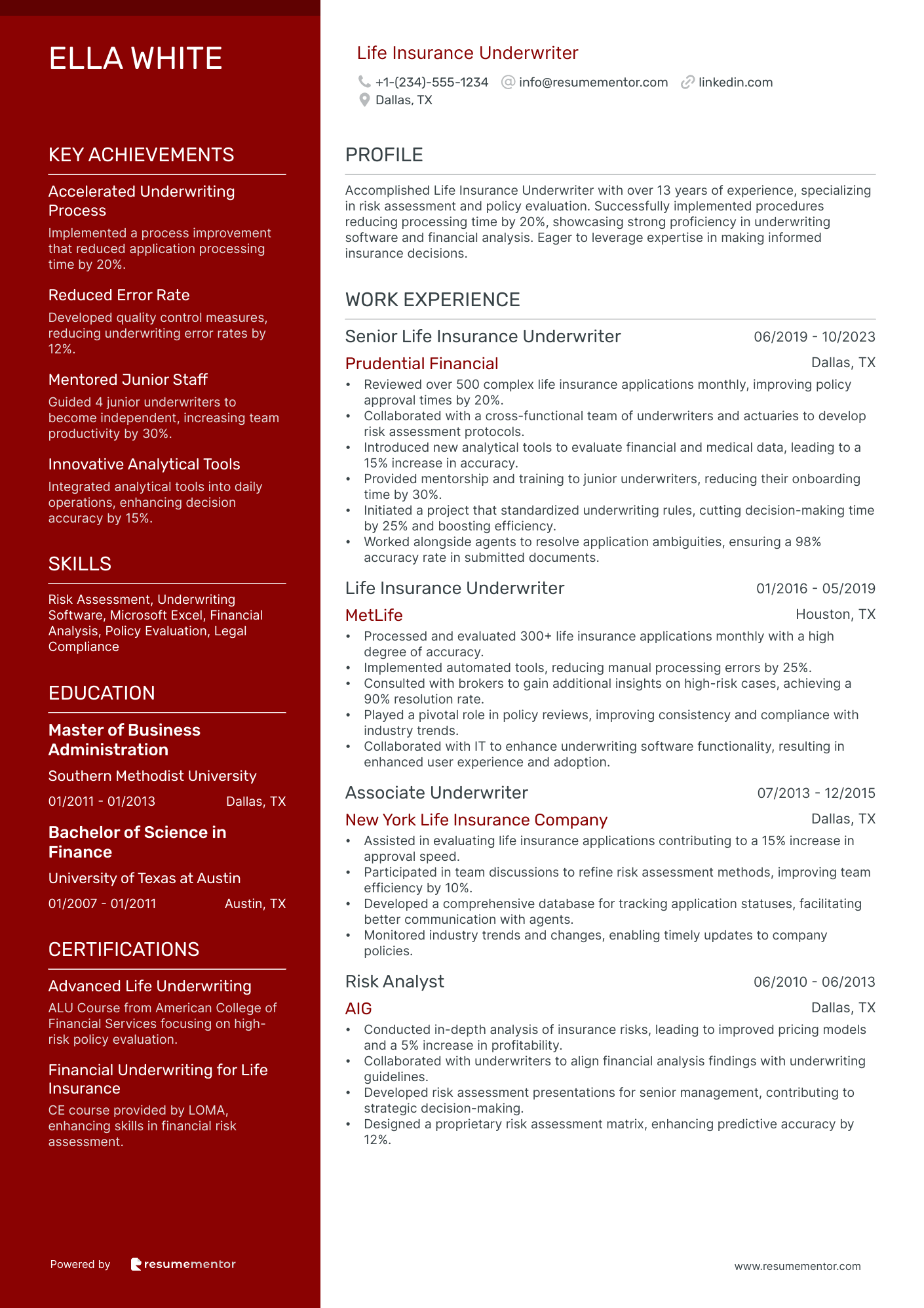

Life Insurance Underwriter

Senior Healthcare Underwriter

Financial Bonds Underwriter

Auto Insurance Underwriter

Property and Casualty Underwriter

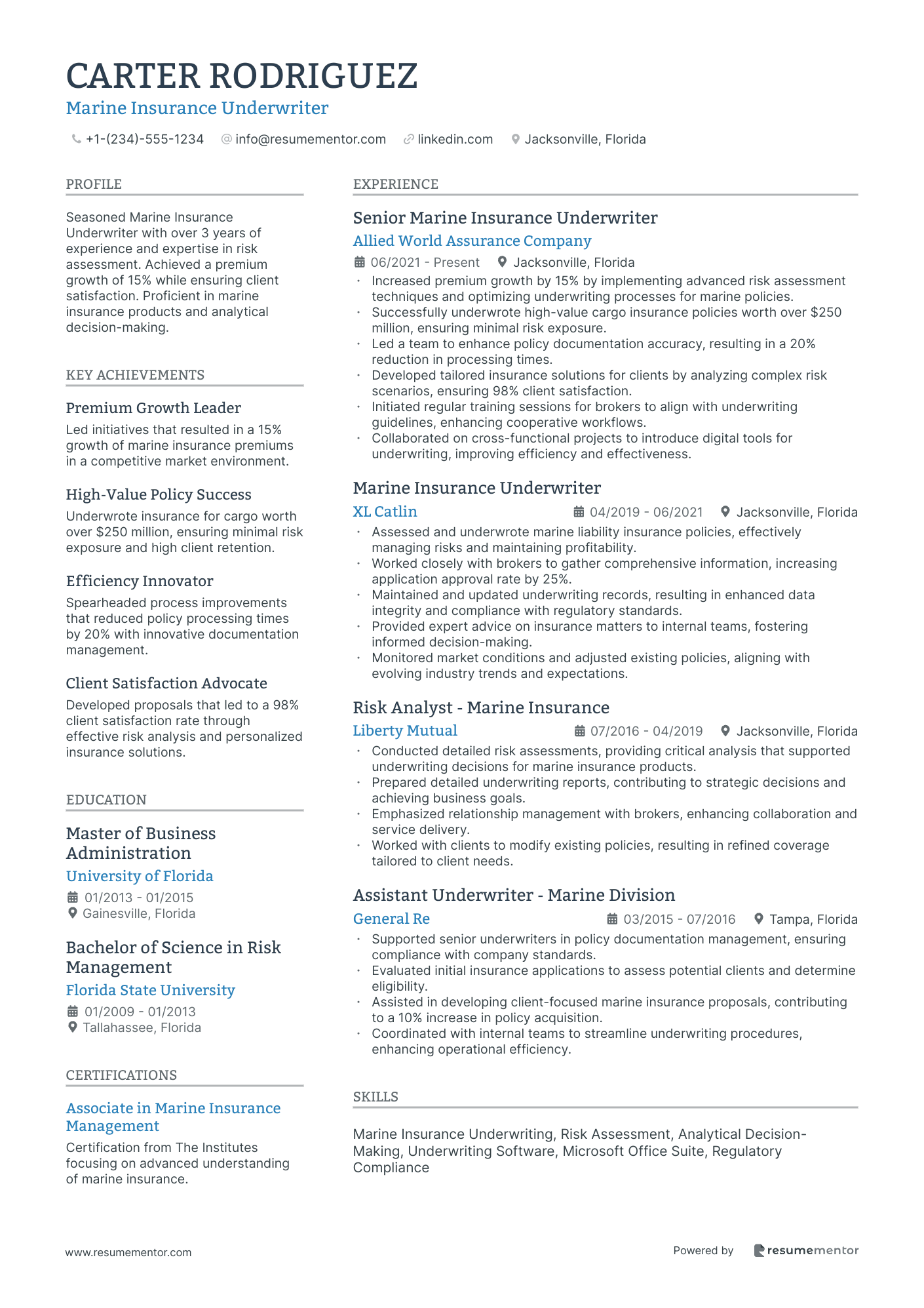

Marine Insurance Underwriter

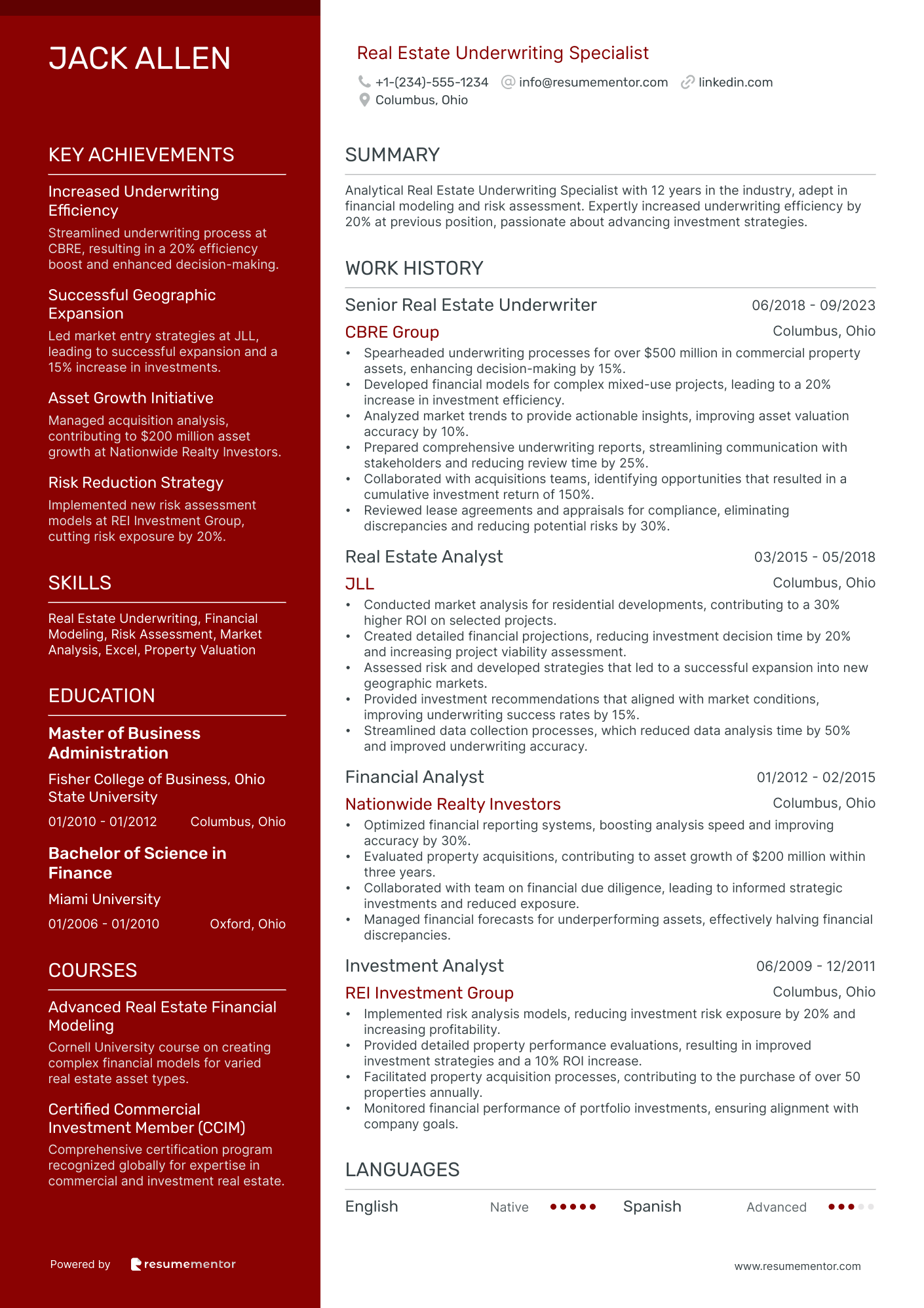

Real Estate Underwriting Specialist

Commercial Lines Underwriter resume sample

- •Implemented a novel underwriting strategy resulting in a 20% increase in portfolio growth over 18 months.

- •Led a team of junior underwriters, guiding them to improve risk evaluation efficiency by 30%.

- •Enhanced client relations by providing in-depth risk analysis, directly improving client retention by 15%.

- •Developed coverage enhancements contributing to a 10% increase in new business acquisition.

- •Collaborated with IT to develop automated tools, increasing underwriting efficiency by 25%.

- •Successfully resolved 90% of complex underwriting cases by applying advanced risk evaluation techniques.

- •Underwrote a diverse range of commercial policies, achieving a 98% accuracy rate in risk assessment.

- •Assessed risk and tailored coverage solutions, leading to 18% growth in client satisfaction scores.

- •Fostered strong broker partnerships, contributing to a 25% increase in service penetration.

- •Conducted benchmarking analysis against competitors, aiding in the development of two new policy products.

- •Provided training sessions for junior staff, improving departmental underwriting efficiency by 15%.

- •Supported underwriting team in risk assessment, handling portfolios worth over $10 million annually.

- •Played a key role in revising policy terms, reducing claim likelihood by 12% over a two-year span.

- •Managed client portfolios and streamlined renewal processes, improving operational efficiency by 20%.

- •Collaborated with stakeholders on risk management initiatives, ensuing three major account renewals.

- •Contributed to the risk rating adjustments, improving profitability margins by 5% within the first year.

- •Assisted in market research efforts, providing insights that informed strategic underwriting decisions.

- •Facilitated the transition to a new underwriting software, enhancing data accuracy by 10%.

- •Maintained key metrics for performance evaluation, identifying potential gaps in underwriting strategies.

Mortgage Loan Underwriter resume sample

- •Reviewed over 150 loan applications monthly, resulting in a 20% increase in approval efficiency.

- •Collaborated with credit and collections teams to resolve outstanding issues, improving the loan approval rate by 15%.

- •Spearheaded the integration of a new automated underwriting system, reducing manual errors by 30%.

- •Trained and developed a team of 4 junior underwriters, enhancing departmental productivity by 25%.

- •Maintained compliance with industry regulations, achieving a 100% audit success rate for two consecutive years.

- •Implemented streamlined documentation procedures, reducing processing time by 10 hours per application.

- •Processed a pipeline of 100+ loan files monthly, achieving a 98% accuracy rate in documentation review.

- •Utilized DU and LP systems to improve loan processing timelines, reducing turnaround time by 25%.

- •Negotiated with loan officers on complex files, enhancing customer satisfaction and reducing complaints by 40%.

- •Developed and refined risk assessment models, contributing to a 10% increase in loan approval rates.

- •Led project teams to transition to digital submissions, decreasing paper usage by 60%.

- •Analyzed borrower profiles, contributing to a 15% improvement in loan portfolio performance.

- •Assisted in redesigning the application intake process, resulting in a 20% increase in efficiency.

- •Coordinated with third parties to expedite asset verification, enhancing overall process by 18%.

- •Implemented training programs for new hires, reducing on-boarding time by 30% and improving retention.

- •Conducted detailed analysis on credit applications, ensuring adherence to compliance guidelines and reducing error rates by 20%.

- •Executed strategies that streamlined underwriting processes, resulting in a 10% annual increase in loans processed per underwriter.

- •Monitored trends in credit markets, advising management on necessary policy adjustments and mitigating risk exposure.

- •Collaborated with risk management to enhance loan risk assessment criteria, increasing approval accuracy by 12%.

Insurance Risk Underwriter resume sample

- •Conduct comprehensive risk evaluations leading to a 40% reduction in unresolved claims and increased profitability.

- •Implemented advanced statistical tools to refine premium calculations, reducing error rates by 15%.

- •Developed strong partnerships with over 50 agents enhancing service delivery and increasing client satisfaction scores by 10%.

- •Authored key market trend analysis reports resulting in improved underwriting decisions and better strategic direction.

- •Mentored 5 junior underwriters, improving team efficiency resulting in faster processing times by 20%.

- •Streamlined the underwriting process for compliance checks reducing audit failures by 25% over one year.

- •Assessed complex risk profiles for corporate clients, achieving a retention rate of over 90% each quarter.

- •Introduced automated tools for document analysis improving accuracy and reducing processing times by 30%.

- •Maintained an extensive portfolio of high-value accounts, increasing total premium revenue by 20% over two years.

- •Led collaboration sessions with brokers leading to better client coverage solutions and increased market agility.

- •Oversaw compliance with evolving regulations, reducing non-conformity incidents by 35% annually.

- •Analyzed diverse data sets to determine risk levels for new insurance products, influencing product design.

- •Developed risk assessment models that enhanced premium accuracy, improving client trust and satisfaction.

- •Coordinated with 15+ brokers for continuous information flow, enhancing operational efficiency.

- •Proactively identified emerging market risks, leading to strategic mitigation plans and improved client advisories.

- •Performed detailed risk assessments on portfolio policies, facilitating well-informed underwriting decisions.

- •Assisted in the transition to new underwriting software, increasing department productivity by 15%.

- •Engaged in monthly training and development sessions to maintain an up-to-date knowledge of industry practices.

- •Worked collaboratively with underwriting teams to draft client-facing documentation enhancing clarity and service delivery.

Life Insurance Underwriter resume sample

- •Reviewed over 500 complex life insurance applications monthly, improving policy approval times by 20%.

- •Collaborated with a cross-functional team of underwriters and actuaries to develop risk assessment protocols.

- •Introduced new analytical tools to evaluate financial and medical data, leading to a 15% increase in accuracy.

- •Provided mentorship and training to junior underwriters, reducing their onboarding time by 30%.

- •Initiated a project that standardized underwriting rules, cutting decision-making time by 25% and boosting efficiency.

- •Worked alongside agents to resolve application ambiguities, ensuring a 98% accuracy rate in submitted documents.

- •Processed and evaluated 300+ life insurance applications monthly with a high degree of accuracy.

- •Implemented automated tools, reducing manual processing errors by 25%.

- •Consulted with brokers to gain additional insights on high-risk cases, achieving a 90% resolution rate.

- •Played a pivotal role in policy reviews, improving consistency and compliance with industry trends.

- •Collaborated with IT to enhance underwriting software functionality, resulting in enhanced user experience and adoption.

- •Assisted in evaluating life insurance applications contributing to a 15% increase in approval speed.

- •Participated in team discussions to refine risk assessment methods, improving team efficiency by 10%.

- •Developed a comprehensive database for tracking application statuses, facilitating better communication with agents.

- •Monitored industry trends and changes, enabling timely updates to company policies.

- •Conducted in-depth analysis of insurance risks, leading to improved pricing models and a 5% increase in profitability.

- •Collaborated with underwriters to align financial analysis findings with underwriting guidelines.

- •Developed risk assessment presentations for senior management, contributing to strategic decision-making.

- •Designed a proprietary risk assessment matrix, enhancing predictive accuracy by 12%.

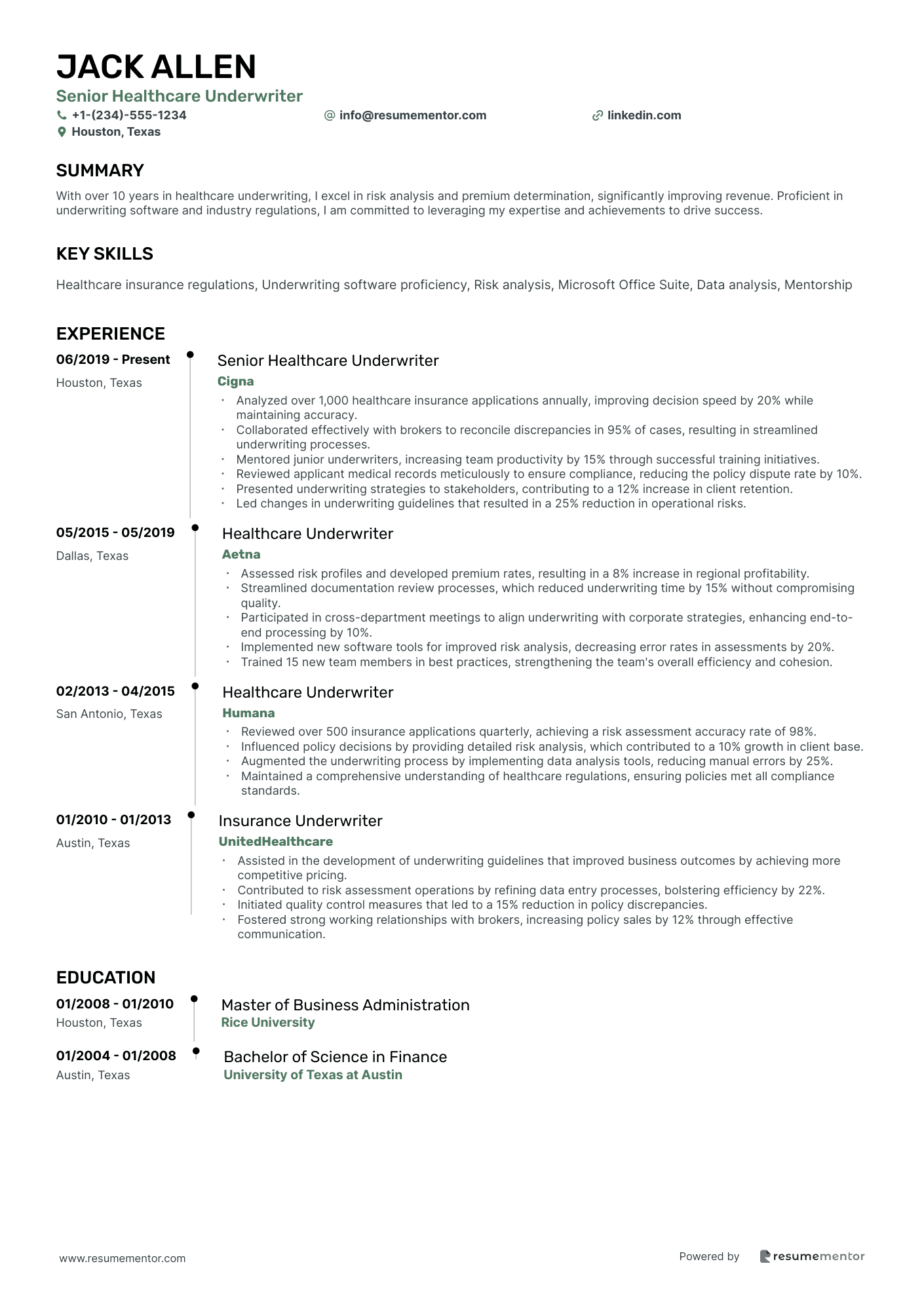

Senior Healthcare Underwriter resume sample

- •Analyzed over 1,000 healthcare insurance applications annually, improving decision speed by 20% while maintaining accuracy.

- •Collaborated effectively with brokers to reconcile discrepancies in 95% of cases, resulting in streamlined underwriting processes.

- •Mentored junior underwriters, increasing team productivity by 15% through successful training initiatives.

- •Reviewed applicant medical records meticulously to ensure compliance, reducing the policy dispute rate by 10%.

- •Presented underwriting strategies to stakeholders, contributing to a 12% increase in client retention.

- •Led changes in underwriting guidelines that resulted in a 25% reduction in operational risks.

- •Assessed risk profiles and developed premium rates, resulting in a 8% increase in regional profitability.

- •Streamlined documentation review processes, which reduced underwriting time by 15% without compromising quality.

- •Participated in cross-department meetings to align underwriting with corporate strategies, enhancing end-to-end processing by 10%.

- •Implemented new software tools for improved risk analysis, decreasing error rates in assessments by 20%.

- •Trained 15 new team members in best practices, strengthening the team's overall efficiency and cohesion.

- •Reviewed over 500 insurance applications quarterly, achieving a risk assessment accuracy rate of 98%.

- •Influenced policy decisions by providing detailed risk analysis, which contributed to a 10% growth in client base.

- •Augmented the underwriting process by implementing data analysis tools, reducing manual errors by 25%.

- •Maintained a comprehensive understanding of healthcare regulations, ensuring policies met all compliance standards.

- •Assisted in the development of underwriting guidelines that improved business outcomes by achieving more competitive pricing.

- •Contributed to risk assessment operations by refining data entry processes, bolstering efficiency by 22%.

- •Initiated quality control measures that led to a 15% reduction in policy discrepancies.

- •Fostered strong working relationships with brokers, increasing policy sales by 12% through effective communication.

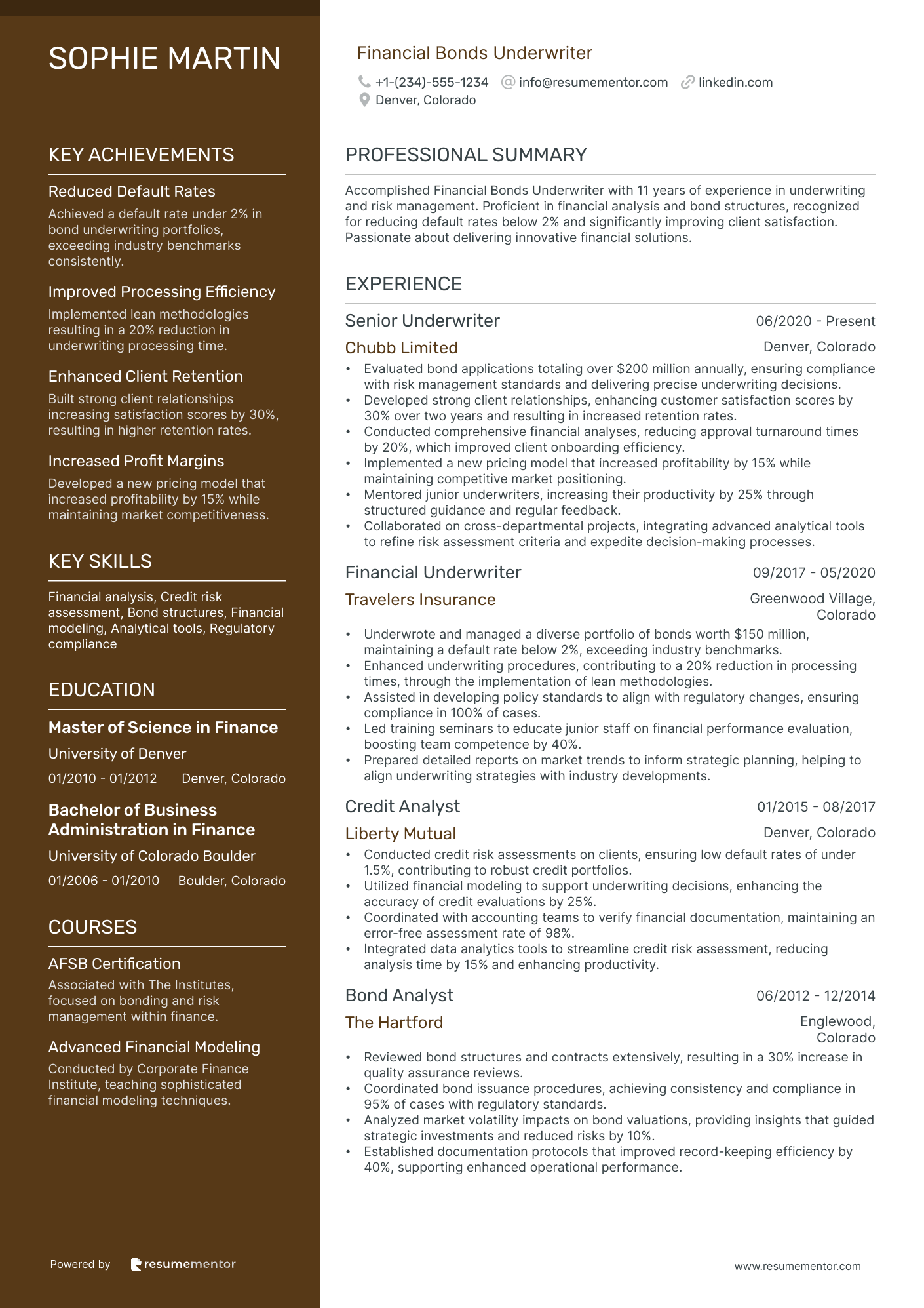

Financial Bonds Underwriter resume sample

- •Evaluated bond applications totaling over $200 million annually, ensuring compliance with risk management standards and delivering precise underwriting decisions.

- •Developed strong client relationships, enhancing customer satisfaction scores by 30% over two years and resulting in increased retention rates.

- •Conducted comprehensive financial analyses, reducing approval turnaround times by 20%, which improved client onboarding efficiency.

- •Implemented a new pricing model that increased profitability by 15% while maintaining competitive market positioning.

- •Mentored junior underwriters, increasing their productivity by 25% through structured guidance and regular feedback.

- •Collaborated on cross-departmental projects, integrating advanced analytical tools to refine risk assessment criteria and expedite decision-making processes.

- •Underwrote and managed a diverse portfolio of bonds worth $150 million, maintaining a default rate below 2%, exceeding industry benchmarks.

- •Enhanced underwriting procedures, contributing to a 20% reduction in processing times, through the implementation of lean methodologies.

- •Assisted in developing policy standards to align with regulatory changes, ensuring compliance in 100% of cases.

- •Led training seminars to educate junior staff on financial performance evaluation, boosting team competence by 40%.

- •Prepared detailed reports on market trends to inform strategic planning, helping to align underwriting strategies with industry developments.

- •Conducted credit risk assessments on clients, ensuring low default rates of under 1.5%, contributing to robust credit portfolios.

- •Utilized financial modeling to support underwriting decisions, enhancing the accuracy of credit evaluations by 25%.

- •Coordinated with accounting teams to verify financial documentation, maintaining an error-free assessment rate of 98%.

- •Integrated data analytics tools to streamline credit risk assessment, reducing analysis time by 15% and enhancing productivity.

- •Reviewed bond structures and contracts extensively, resulting in a 30% increase in quality assurance reviews.

- •Coordinated bond issuance procedures, achieving consistency and compliance in 95% of cases with regulatory standards.

- •Analyzed market volatility impacts on bond valuations, providing insights that guided strategic investments and reduced risks by 10%.

- •Established documentation protocols that improved record-keeping efficiency by 40%, supporting enhanced operational performance.

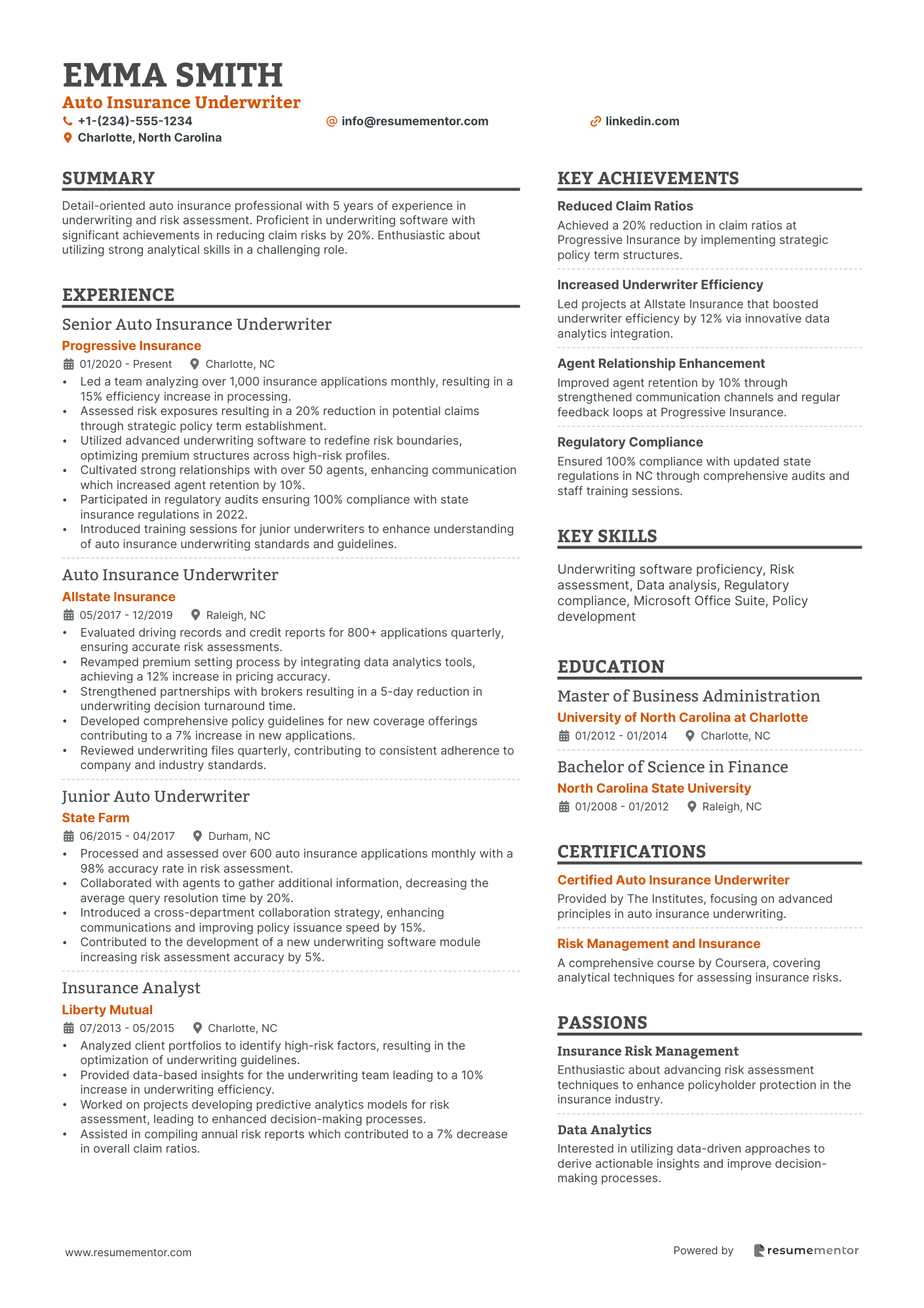

Auto Insurance Underwriter resume sample

- •Led a team analyzing over 1,000 insurance applications monthly, resulting in a 15% efficiency increase in processing.

- •Assessed risk exposures resulting in a 20% reduction in potential claims through strategic policy term establishment.

- •Utilized advanced underwriting software to redefine risk boundaries, optimizing premium structures across high-risk profiles.

- •Cultivated strong relationships with over 50 agents, enhancing communication which increased agent retention by 10%.

- •Participated in regulatory audits ensuring 100% compliance with state insurance regulations in 2022.

- •Introduced training sessions for junior underwriters to enhance understanding of auto insurance underwriting standards and guidelines.

- •Evaluated driving records and credit reports for 800+ applications quarterly, ensuring accurate risk assessments.

- •Revamped premium setting process by integrating data analytics tools, achieving a 12% increase in pricing accuracy.

- •Strengthened partnerships with brokers resulting in a 5-day reduction in underwriting decision turnaround time.

- •Developed comprehensive policy guidelines for new coverage offerings contributing to a 7% increase in new applications.

- •Reviewed underwriting files quarterly, contributing to consistent adherence to company and industry standards.

- •Processed and assessed over 600 auto insurance applications monthly with a 98% accuracy rate in risk assessment.

- •Collaborated with agents to gather additional information, decreasing the average query resolution time by 20%.

- •Introduced a cross-department collaboration strategy, enhancing communications and improving policy issuance speed by 15%.

- •Contributed to the development of a new underwriting software module increasing risk assessment accuracy by 5%.

- •Analyzed client portfolios to identify high-risk factors, resulting in the optimization of underwriting guidelines.

- •Provided data-based insights for the underwriting team leading to a 10% increase in underwriting efficiency.

- •Worked on projects developing predictive analytics models for risk assessment, leading to enhanced decision-making processes.

- •Assisted in compiling annual risk reports which contributed to a 7% decrease in overall claim ratios.

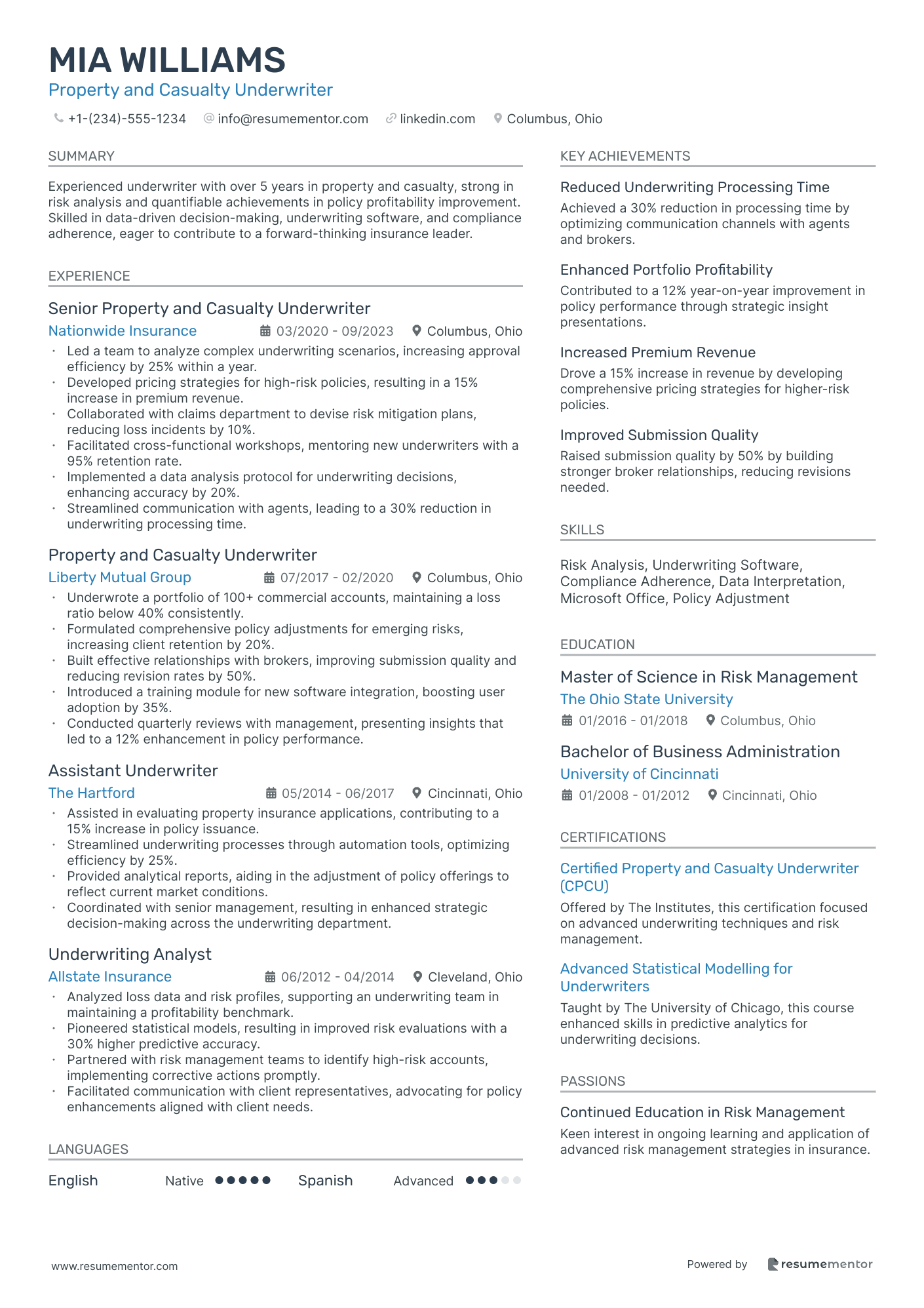

Property and Casualty Underwriter resume sample

- •Led a team to analyze complex underwriting scenarios, increasing approval efficiency by 25% within a year.

- •Developed pricing strategies for high-risk policies, resulting in a 15% increase in premium revenue.

- •Collaborated with claims department to devise risk mitigation plans, reducing loss incidents by 10%.

- •Facilitated cross-functional workshops, mentoring new underwriters with a 95% retention rate.

- •Implemented a data analysis protocol for underwriting decisions, enhancing accuracy by 20%.

- •Streamlined communication with agents, leading to a 30% reduction in underwriting processing time.

- •Underwrote a portfolio of 100+ commercial accounts, maintaining a loss ratio below 40% consistently.

- •Formulated comprehensive policy adjustments for emerging risks, increasing client retention by 20%.

- •Built effective relationships with brokers, improving submission quality and reducing revision rates by 50%.

- •Introduced a training module for new software integration, boosting user adoption by 35%.

- •Conducted quarterly reviews with management, presenting insights that led to a 12% enhancement in policy performance.

- •Assisted in evaluating property insurance applications, contributing to a 15% increase in policy issuance.

- •Streamlined underwriting processes through automation tools, optimizing efficiency by 25%.

- •Provided analytical reports, aiding in the adjustment of policy offerings to reflect current market conditions.

- •Coordinated with senior management, resulting in enhanced strategic decision-making across the underwriting department.

- •Analyzed loss data and risk profiles, supporting an underwriting team in maintaining a profitability benchmark.

- •Pioneered statistical models, resulting in improved risk evaluations with a 30% higher predictive accuracy.

- •Partnered with risk management teams to identify high-risk accounts, implementing corrective actions promptly.

- •Facilitated communication with client representatives, advocating for policy enhancements aligned with client needs.

Marine Insurance Underwriter resume sample

- •Increased premium growth by 15% by implementing advanced risk assessment techniques and optimizing underwriting processes for marine policies.

- •Successfully underwrote high-value cargo insurance policies worth over $250 million, ensuring minimal risk exposure.

- •Led a team to enhance policy documentation accuracy, resulting in a 20% reduction in processing times.

- •Developed tailored insurance solutions for clients by analyzing complex risk scenarios, ensuring 98% client satisfaction.

- •Initiated regular training sessions for brokers to align with underwriting guidelines, enhancing cooperative workflows.

- •Collaborated on cross-functional projects to introduce digital tools for underwriting, improving efficiency and effectiveness.

- •Assessed and underwrote marine liability insurance policies, effectively managing risks and maintaining profitability.

- •Worked closely with brokers to gather comprehensive information, increasing application approval rate by 25%.

- •Maintained and updated underwriting records, resulting in enhanced data integrity and compliance with regulatory standards.

- •Provided expert advice on insurance matters to internal teams, fostering informed decision-making.

- •Monitored market conditions and adjusted existing policies, aligning with evolving industry trends and expectations.

- •Conducted detailed risk assessments, providing critical analysis that supported underwriting decisions for marine insurance products.

- •Prepared detailed underwriting reports, contributing to strategic decisions and achieving business goals.

- •Emphasized relationship management with brokers, enhancing collaboration and service delivery.

- •Worked with clients to modify existing policies, resulting in refined coverage tailored to client needs.

- •Supported senior underwriters in policy documentation management, ensuring compliance with company standards.

- •Evaluated initial insurance applications to assess potential clients and determine eligibility.

- •Assisted in developing client-focused marine insurance proposals, contributing to a 10% increase in policy acquisition.

- •Coordinated with internal teams to streamline underwriting procedures, enhancing operational efficiency.

Real Estate Underwriting Specialist resume sample

- •Spearheaded underwriting processes for over $500 million in commercial property assets, enhancing decision-making by 15%.

- •Developed financial models for complex mixed-use projects, leading to a 20% increase in investment efficiency.

- •Analyzed market trends to provide actionable insights, improving asset valuation accuracy by 10%.

- •Prepared comprehensive underwriting reports, streamlining communication with stakeholders and reducing review time by 25%.

- •Collaborated with acquisitions teams, identifying opportunities that resulted in a cumulative investment return of 150%.

- •Reviewed lease agreements and appraisals for compliance, eliminating discrepancies and reducing potential risks by 30%.

- •Conducted market analysis for residential developments, contributing to a 30% higher ROI on selected projects.

- •Created detailed financial projections, reducing investment decision time by 20% and increasing project viability assessment.

- •Assessed risk and developed strategies that led to a successful expansion into new geographic markets.

- •Provided investment recommendations that aligned with market conditions, improving underwriting success rates by 15%.

- •Streamlined data collection processes, which reduced data analysis time by 50% and improved underwriting accuracy.

- •Optimized financial reporting systems, boosting analysis speed and improving accuracy by 30%.

- •Evaluated property acquisitions, contributing to asset growth of $200 million within three years.

- •Collaborated with team on financial due diligence, leading to informed strategic investments and reduced exposure.

- •Managed financial forecasts for underperforming assets, effectively halving financial discrepancies.

- •Implemented risk analysis models, reducing investment risk exposure by 20% and increasing profitability.

- •Provided detailed property performance evaluations, resulting in improved investment strategies and a 10% ROI increase.

- •Facilitated property acquisition processes, contributing to the purchase of over 50 properties annually.

- •Monitored financial performance of portfolio investments, ensuring alignment with company goals.

As an underwriter, you are like a gatekeeper, balancing risk and reward with precision. This skill requires a sharp eye for detail and a head for numbers, yet translating these abilities into a compelling resume can often feel as complex as the policies you handle. In today’s competitive job market, your technical expertise might easily be overlooked without a standout resume.

Effectively communicating your skills and experience is key to catching a hiring manager’s attention. It's important to clearly highlight your strengths in risk assessment and financial analysis. Here, a resume template can be your ally, offering a framework that presents your skills and experiences clearly and professionally.

A good template guides the organization of your resume, presenting information in a clean and logical layout that mirrors the professionalism you bring to your work. This not only streamlines the process of resume writing but also ensures you make a powerful impression. With a well-structured resume, you can rise above the competition and showcase your unique qualifications.

Approach your resume with the same precision and thought you apply to underwriting, and you’ll truly stand out in your job search. Think of it as your personal risk assessment — make sure it effectively reflects the depth and breadth of your abilities and expertise.

Key Takeaways

- Emphasizing specialized skills and experiences is crucial for an underwriter resume to stand out in a competitive job market.

- A well-structured template can aid in organizing a resume, ensuring a professional presentation that clearly highlights key competencies.

- Showcasing risk assessment and financial analysis skills, along with certifications, can effectively demonstrate one's qualifications and expertise.

- Including sections like Professional Affiliations or Awards can further highlight a commitment to growth and exceptional achievements.

- Tailoring the resume with relevant hard and soft skills and aligning experiences with the job description boosts applicant visibility and relevance.

What to focus on when writing your underwriter resume

An underwriter resume should convey your analytical skills and attention to detail, which are crucial for evaluating risk. These skills highlight your capacity to make informed decisions under pressure and manage complex financial data. Demonstrating your experience with underwriting processes and familiarity with industry regulations is essential to catching the recruiter's attention. Your ability to communicate your expertise will set the foundation for a compelling resume.

Resume Format—Selecting the right format is crucial to communicate your professional journey effectively. A clear and organized structure not only catches the eye but also ensures your key experiences are easily understood by recruiters and Applicant Tracking Systems (ATS). As we dive deeper into each section, from contact information to certifications, remember that a logical flow will make your resume shine.

How to structure your underwriter resume

- Contact Information: Clearly present your name, phone number, email, and LinkedIn profile to ensure easy communication.

- Professional Summary: Create a powerful statement that ties together your underwriting experience and key skills, focusing on your ability to analyze risk and financial data effectively.

- Skills: List critical underwriting skills, including risk assessment and financial analysis, as well as your proficiency with industry software like Excel and specialized platforms.

- Work Experience: Show your career achievements with detailed bullet points that illustrate your capability in managing high-value portfolios and improving decision-making processes.

- Education: Connect your educational background to your professional goals by listing degrees in finance or related fields, and include any certifications that enhance your qualifications.

- Certifications: Reinforce your expertise by mentioning certifications such as Chartered Property Casualty Underwriter (CPCU) or Associate in Commercial Underwriting (AU), further proving your dedication to the field.

To add more depth, consider optional sections like “Professional Affiliations” or “Awards and Recognition” to highlight your exceptional achievements and commitment to professional growth.

Which resume format to choose

When writing an underwriter resume, the format plays a crucial role in effectively showcasing your experience. A chronological format works best, as it systematically presents your career history, making it easy for potential employers to see your progression and expertise in underwriting.

Choosing the right font adds a modern touch to your resume. Opt for Rubik, Lato, or Montserrat, which offer a clean and professional appearance. These fonts ensure that your resume is not only stylish but also easy to read, helping your qualifications stand out.

Saving your resume as a PDF is a critical step. PDFs preserve your formatting across all devices, ensuring that your resume looks the same on any screen. This consistency reflects your attention to detail and professionalism, important traits for an underwriter.

Finally, keep your margins at one inch on all sides. This provides a clean, organized layout that enhances readability and ensures nothing important gets cut off when printed. By paying attention to these details, your underwriter resume will effectively communicate your skills and experience to hiring managers, positioning you as a strong candidate in the competitive job market.

How to write a quantifiable resume experience section

In the experience section of your underwriter resume, it's essential to highlight your skills in analyzing risks and making informed decisions. Start with your most recent job and list your experiences in reverse chronological order to show your career progression. This section should clearly reflect your achievements and growth in the underwriting field, ideally including roles from the past 10-15 years to maintain relevance. When listing job titles, choose those that align closely with the position you're targeting. Tailor your resume to the job ad by matching your skills and successes to the listed qualifications and responsibilities, ensuring every point is relevant. Use dynamic action words like "assessed," "evaluated," "optimized," and "led" to effectively communicate your impact.

- •Boosted portfolio profitability by 20% through smart risk evaluations and selecting the right customers.

- •Cut claim payouts by 15% by using advanced predictive analytics.

- •Streamlined underwriting processes, reducing processing time by 30% for faster outcomes.

- •Guided junior underwriters, resulting in a 25% improvement in overall team performance.

This enhanced experience section stands out by integrating your quantifiable achievements into a cohesive narrative of impact. Increasing profitability and reducing claim payouts demonstrate your effective risk management skills, illustrating how you can directly contribute to a company's financial success. Streamlining processes not only improves efficiency but also highlights your ability to lead change for better results. By guiding junior underwriters, you showcase leadership and a commitment to team growth, which complements your individual contributions. Connecting these achievements in a way that reflects what the employer values makes your resume both compelling and relevant.

Training and Development Focused resume experience section

A training and development-focused underwriter resume experience section should effectively highlight your practical experience and contributions to enhancing team capabilities. Start by reflecting on your main responsibilities and achievements in previous roles, particularly how you’ve helped others grow in their understanding and skills. Emphasize how you’ve contributed to creating and delivering training programs that have supported and improved the proficiency of fellow underwriters. Describe your ability to develop comprehensive training materials, facilitate engaging workshops, or mentor colleagues, connecting each point to specific instances where your actions led to measurable improvements in performance or skills.

Use concrete examples with measurable outcomes to illustrate your impact, maintaining a narrative that flows smoothly with dynamic action verbs. Keep the language clear and accessible, ensuring readers can easily follow the positive changes your work has inspired. Throughout, demonstrate your deep understanding of underwriting processes and how your training endeavors have optimized them. Here's an example of how this could look:

Senior Underwriter

Global Insurance Solutions

January 2020 - Present

- Developed and implemented a comprehensive training program that increased underwriting accuracy by 15%.

- Conducted workshops and developed training materials for new underwriter hires, reducing ramp-up time by 20%.

- Mentored a team of 10 junior underwriters, resulting in a 25% improvement in their processing times.

- Partnered with senior leadership to align training strategies with business goals, enhancing overall department efficiency.

Industry-Specific Focus resume experience section

A resume experience section for an underwriter-focused position should effectively communicate your specialized skills and noteworthy successes in the field. Start by stating your role and employment dates clearly, making it easy for readers to grasp your professional background. Highlight your expertise in areas like risk assessment, policy evaluation, and data-driven decision-making. To illustrate your impact, share specific accomplishments that demonstrate how you've reduced costs or increased profitability, using numbers to emphasize these achievements.

Moving beyond your individual skills, emphasize your understanding of industry standards and regulatory requirements, showing how you stay aligned with best practices. Discuss your experience collaborating with other teams or leading projects to showcase your ability to work effectively with others and lead when necessary. Overall, each bullet point should weave together your achievements and skills, painting a picture of you as a strong candidate who consistently adds value and upholds high standards within the underwriting team.

Senior Underwriter

ABC Financial Group

January 2020 - Present

- Analyzed financial statements leading to a 15% decrease in loan default rates.

- Evaluated and approved loan applications worth up to $5 million.

- Collaborated with risk management to refine credit policies, improving efficiency by 20%.

- Mentored junior underwriters, enhancing their decision-making skills and reducing processing times.

Innovation-Focused resume experience section

An innovation-focused underwriter resume experience section should effectively showcase your problem-solving abilities and creative skills. Start by clearly detailing projects that highlight your contributions in unique ways, emphasizing how you introduced innovative solutions. Be sure to use specific examples and quantify your achievements to give a concrete sense of your impact, which adds credibility and context. Additionally, mentioning any awards or recognitions can further validate your creative approaches.

In crafting this section, aim for clarity and specificity about your roles and job titles to paint a full picture of your responsibilities. Explain how your innovative ideas led to positive outcomes, such as improved efficiency or more streamlined processes. Utilize bullet points for an easy-to-read format, highlighting the most impressive aspects of your work to quickly capture the attention of potential employers. This approach demonstrates your ability to bring innovation to the underwriting field.

Senior Underwriter

Prime Insurance Co.

January 2020 - Present

- Led a team to develop a predictive model using AI, increasing underwriting accuracy by 20%.

- Implemented a streamlined process reducing policy issuance time from 3 weeks to 5 days.

- Pioneered a collaborative platform with cross-functional teams, enhancing communication and efficiency.

- Recognized for innovative risk assessment methods, earning the 'Innovator of the Year' award.

Achievement-Focused resume experience section

An achievement-focused underwriter resume experience section should demonstrate your specific successes by highlighting concrete outcomes rather than listing duties. Begin by identifying the key contributions you've made in your roles, ensuring that each achievement is both measurable and impactful. Focus on areas like reducing risk or streamlining processes, as these are valuable to potential employers. Using action verbs and numbers will effectively convey your impact. For instance, detailing how you managed a portfolio should include its size and any improvements you implemented. Your experience should reflect your skills in analyzing risk, making informed decisions, and driving positive results.

To present your experience effectively, keep the format consistent and easy to read. Use bullet points to highlight your achievements, starting each with a strong action verb and ensuring each showcases a different skill or impact. Balancing technical skills with abilities in communication and teamwork will present you as a well-rounded professional. Align your experiences with the values and needs of the hiring company, tailoring them to the job description to make your application stand out.

Senior Underwriter

XYZ Insurance Co.

June 2019 - Present

- Reduced risk exposure by 15% with a new risk assessment protocol, leading to cost savings.

- Developed a new training program for hires, boosting underwriting efficiency by 20%.

- Managed a $50 million portfolio, elevating client satisfaction scores to an all-time high.

- Streamlined the claims adjustment process with the claims department, cutting processing time by 30%.

Write your underwriter resume summary section

A results-focused underwriter resume summary should capture your key strengths, experience, and distinct qualities that set you apart. Here’s an effective way to shape this section:

This example strings together your expertise, achievements, and the tangible impact you've made. It paints a picture of not just what you do, but how well you do it. When describing yourself, focus on qualities that make you unique and valuable. Use active language to highlight your strengths and the contributions you can make to a potential employer.

Connecting your professional story helps bring coherence to your resume. For instance, understanding the type of resume section that best suits your experience can enhance your presentation. A summary is ideal for experienced professionals, providing a quick career snapshot. If you're starting out, a resume objective centers more on your goals. Meanwhile, a profile can offer a broader view with less focus on numbers, and a summary of qualifications lists your skills in specific terms, common in technical fields.

Choosing the right format and crafting a compelling narrative can help you stand out. Your summary isn’t only about showing qualifications; it’s about outlining why you’re the perfect fit for the role. This thoughtful approach leaves a lasting impression on employers.

Listing your underwriter skills on your resume

A skill-focused underwriter resume should effectively highlight your abilities and strengths. Your skills can stand alone in a dedicated section or be woven into your summary and experience areas. By emphasizing strengths through soft skills, you demonstrate adaptability and interpersonal abilities. Meanwhile, hard skills represent the technical expertise required to perform specific job tasks. Using these skills and strengths as keywords makes your resume align better with job descriptions, boosting your visibility.

Consider this straightforward standalone skills section:

This section is concise, focusing on underwriting skills that employers seek. This focus ensures that your resume provides a clear picture of your capabilities.

Best hard skills to feature on your underwriter resume

Achieving an effective underwriter resume involves highlighting your ability to assess risks, analyze financial documents, and make informed decisions. These skills showcase your technical competence and judgment.

Hard Skills

- Risk Assessment

- Financial Analysis

- Data Interpretation

- Regulatory Compliance

- Market Research

- Credit Analysis

- Policy Evaluation

- Actuarial Science

- Statistical Modeling

- Loan Underwriting

- Claim Processing

- Fraud Detection

- Underwriting Software Proficiency

- Legal Knowledge

- Contract Review

Best soft skills to feature on your underwriter resume

Complementing your hard skills with soft skills enhances your ability to communicate and navigate complex situations. These skills show your proficiency in collaboration and task management.

A well-rounded resume showcases both hard and soft skills, proving you're ready for any challenge.

Soft Skills

- Communication

- Attention to Detail

- Decision Making

- Problem-Solving

- Team Collaboration

- Time Management

- Adaptability

- Negotiation

- Customer Service

- Emotional Intelligence

- Critical Thinking

- Conflict Resolution

- Leadership

- Multi-tasking

- Stress Management

How to include your education on your resume

The education section is a critical component of an underwriter's resume. Tailoring this section to match the job you're applying for is key. Avoid listing irrelevant education; focus on degrees and coursework that support your underwriting skills. When noting your GPA, include it only if it's impressive, typically 3.5 or above. If you graduated with honors, such as cum laude, this is a strong point to display. List your degree accurately, specifying the level of the degree and the field of study. Here are examples highlighting the do's and don'ts.

The second example is particularly effective because it focuses on relevant qualifications, specifically highlighting a degree in finance, which is closely tied to underwriting. It also includes an impressive GPA and a cum laude distinction, both of which underscore the candidate's academic prowess in a way that aligns with the needs of the role.

How to include underwriter certificates on your resume

The certificates section is an important part of your underwriter resume. Including relevant certifications can make your application stand out and show that you have the qualifications. You can even add certificates in the header to ensure they are easily seen.

Start by listing the name of the certificate. Include the date you received it to show how recent your skills are. Add the issuing organization to show credibility. For example, in the header, you could put: "Certified Insurance Underwriter (2022) - The Institutes".

A good standalone certificates section would look like this:

This example is good because it lists relevant certifications that align with an underwriter's job. The certificates are issued by reputable organizations, adding credibility to your qualifications. Including the date shows your credentials are up to date, which is crucial in the insurance field. Having these certificates can make you a more attractive candidate to potential employers.

Extra sections to include in your underwriter resume

Creating a compelling resume as an underwriter involves emphasizing specialized skills, experiences, and qualities that make you stand out. Including various sections in your resume can paint a more comprehensive picture for potential employers. Here's how to integrate different elements effectively and what benefits they offer:

Language section — Demonstrate your proficiency in multiple languages to show versatility and the ability to work with diverse clients or markets. Highlighting languages can give you an edge in international or multicultural firms.

Hobbies and interests section — Illustrate your well-rounded personality and stress management skills. Sharing interests can create a personal connection with the hiring manager and show that you're engaged in self-care outside of work.

Volunteer work section — Showcase your commitment to community and leadership qualities. Including volunteer experience highlights your ability to manage responsibilities and work in team settings, essential traits for an underwriter.

Books section — Show your commitment to continuous learning and staying updated with industry trends. Mentioning relevant books helps underline your dedication to personal and professional growth and can spark meaningful conversations during interviews.

These sections add depth to your resume, making you appear as a holistic candidate. Potential employers can gain insights into both your hard and soft skills, enhancing your appeal for the role.

In Conclusion

In conclusion, crafting a standout resume as an underwriter requires precision and thoughtful presentation, similar to the careful assessments you make in your profession. Your resume is an opportunity to showcase more than technical skills; it's about painting a picture of your professional story. Starting with a clear, chronological layout, your experience section should highlight not only what you have done but specifically how you have impacted your previous employers.

Including quantifiable achievements underscores your value and helps potential employers understand the direct benefits of your abilities. The choice of a modern, readable font reflects your attention to detail and professionalism, with PDFs ensuring that your resume maintains its format across any device. Furthermore, a strong summary at the beginning of your resume offers a snapshot of your experience and skills, immediately capturing the interest of hiring managers.

Moreover, integrating sections like certifications, education, and additional achievements enhances your resume's depth. It allows you to present yourself comprehensively, connecting your personality with your professional capabilities. Highlighting soft skills, such as communication and teamwork, beside technical proficiencies, gives a balanced view of who you are as a candidate. By thoughtfully curating each section, you not only affirm your readiness for new challenges but also clearly align your qualifications with the role you're aiming for. Ultimately, your resume becomes a reflection of your career path and potential, leaving a lasting impression on prospective employers.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.