US Accountant Resume Examples

Jul 18, 2024

|

12 min read

Get the job done: follow our guide to crafting the perfect accountant resume that stands out and counts. Learn how to showcase your skills, experience, and achievements effectively.

Rated by 348 people

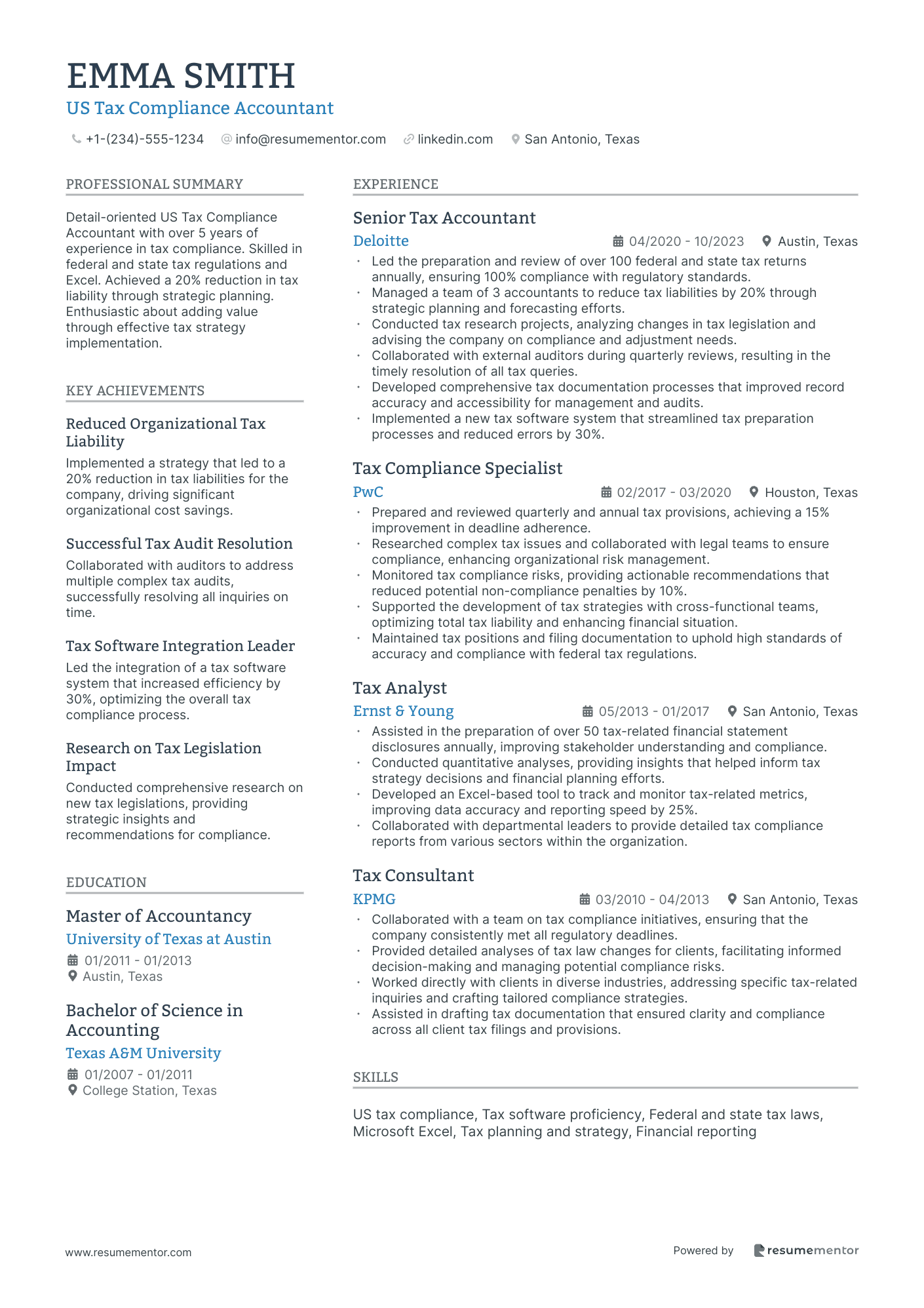

US Tax Compliance Accountant

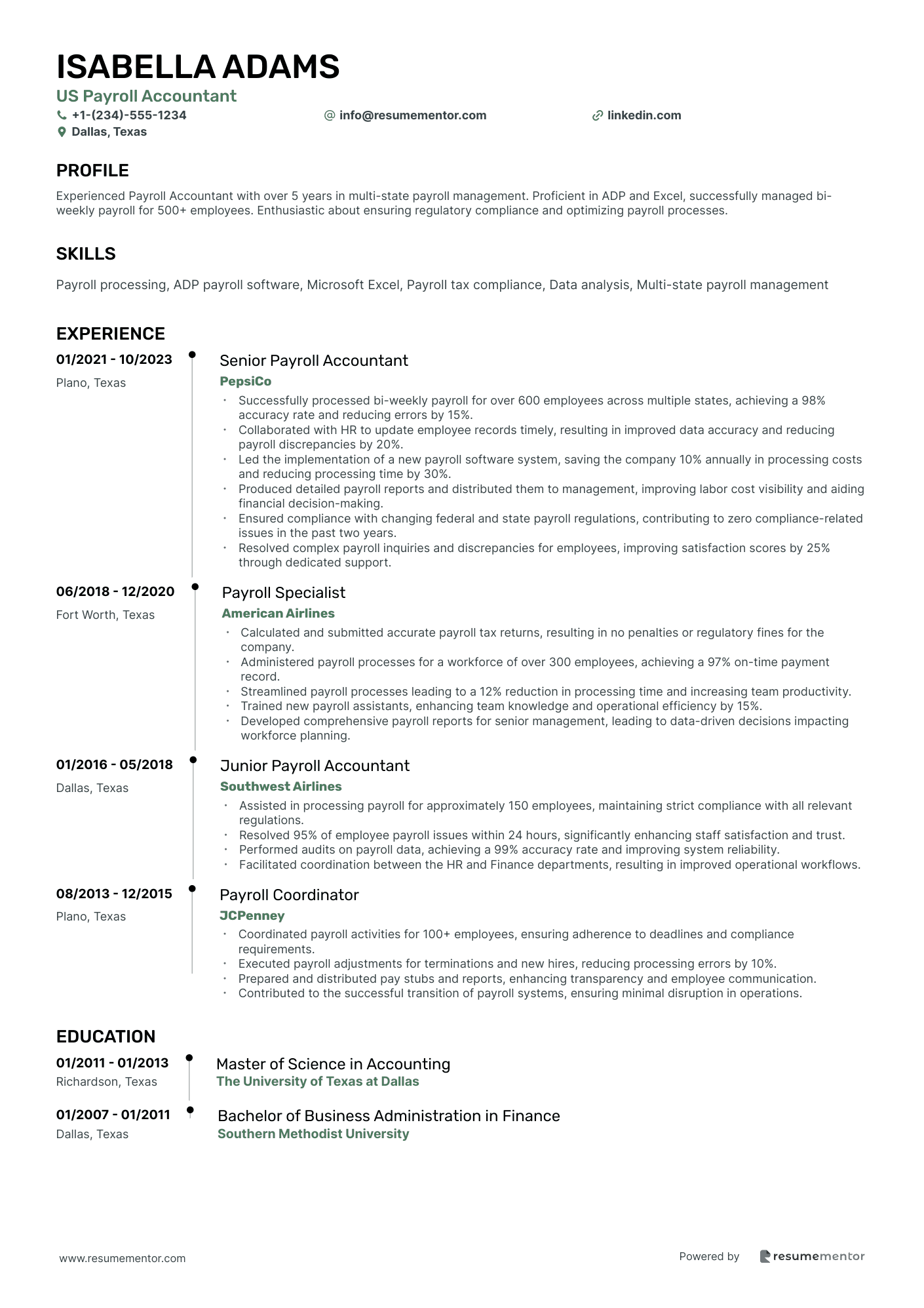

US Payroll Accountant

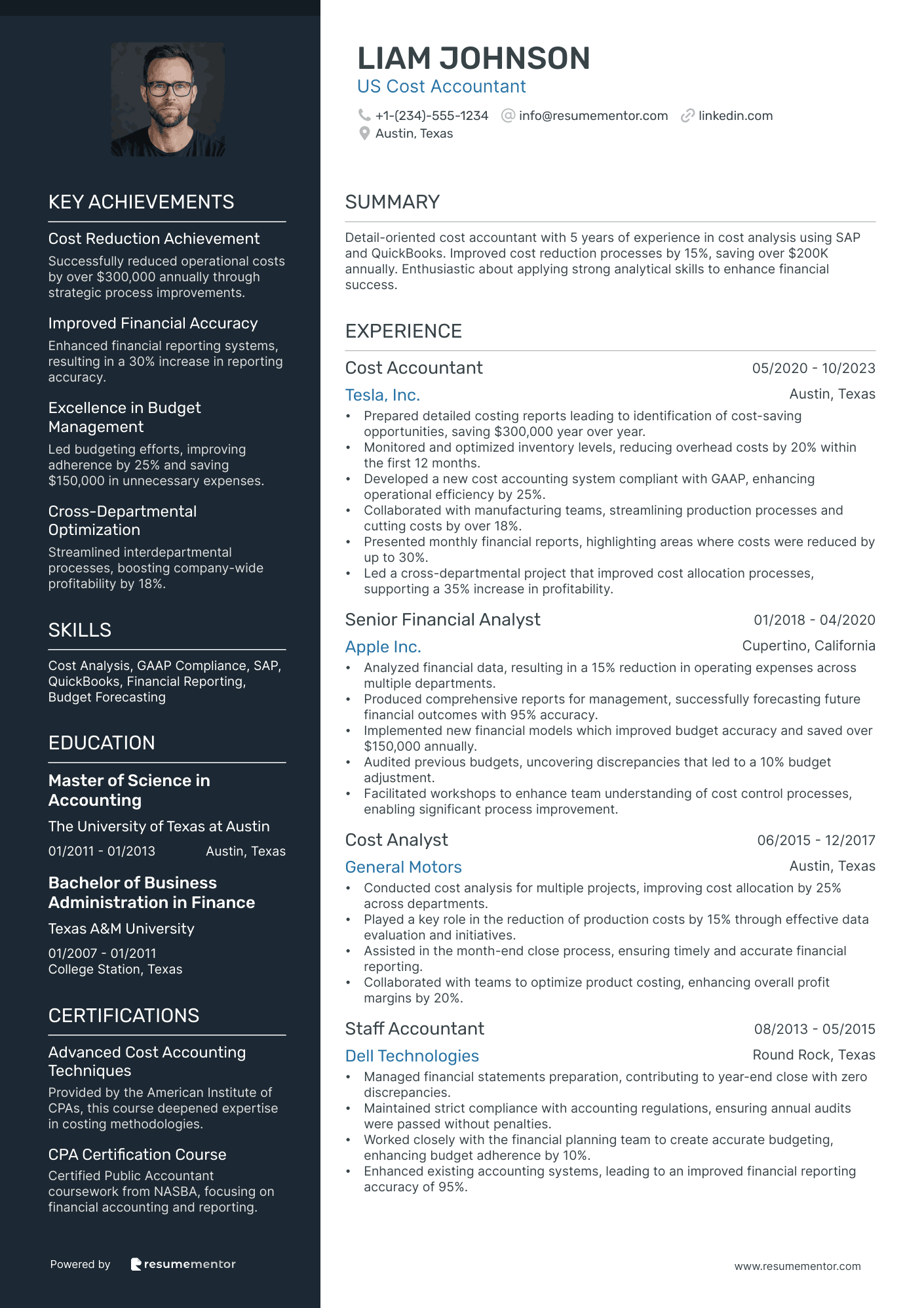

US Cost Accountant

US Forensic Accountant

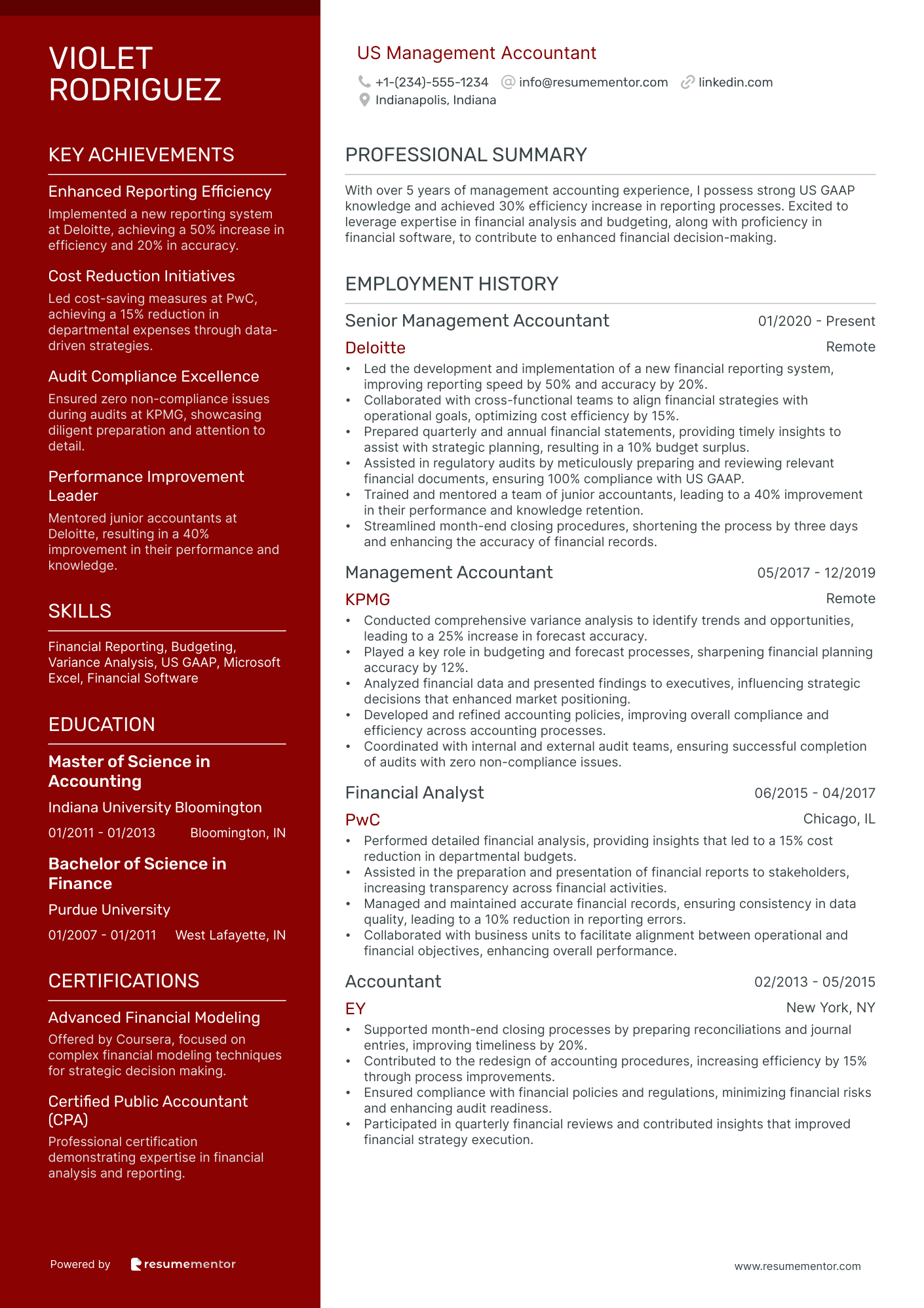

US Management Accountant

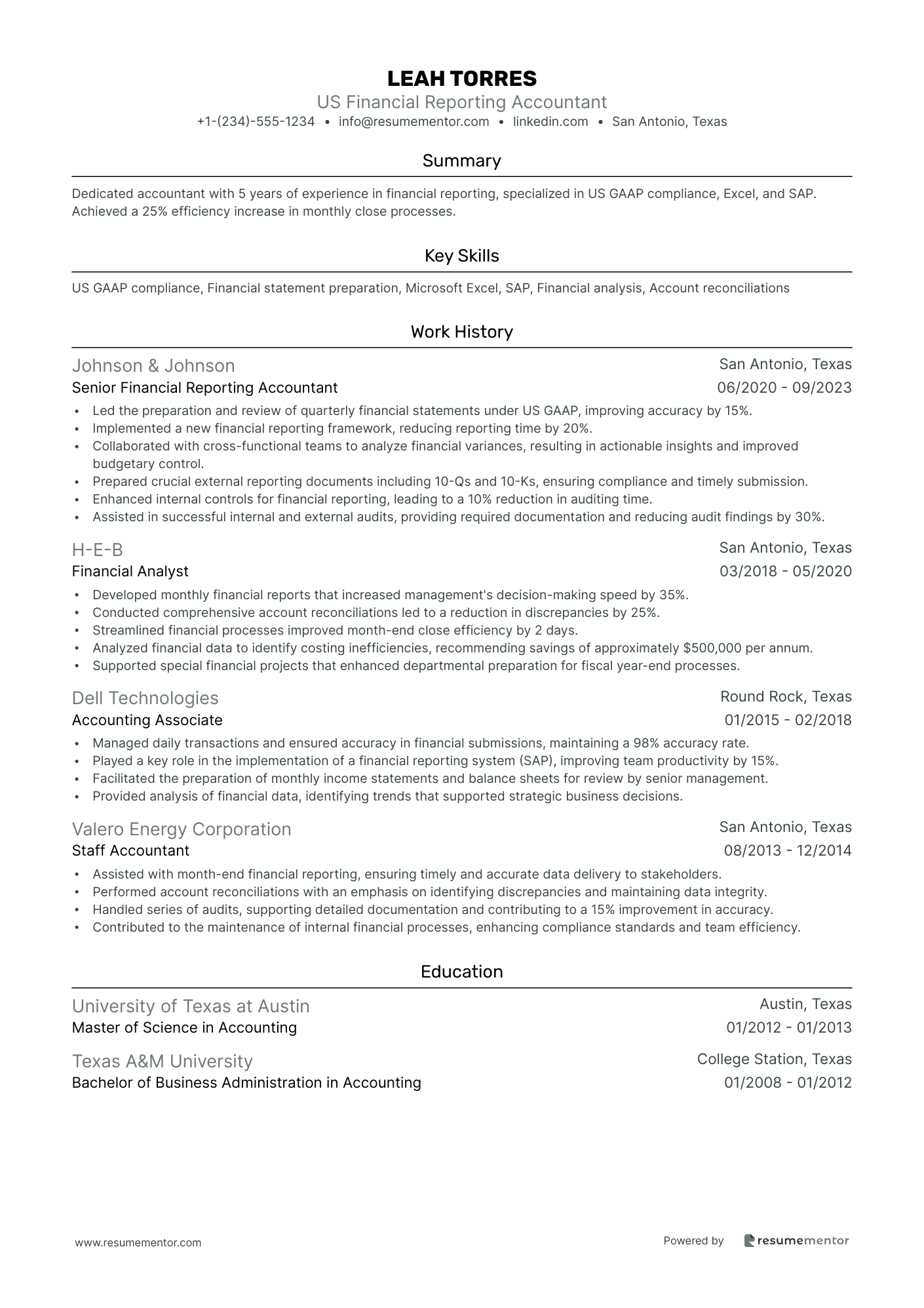

US Financial Reporting Accountant

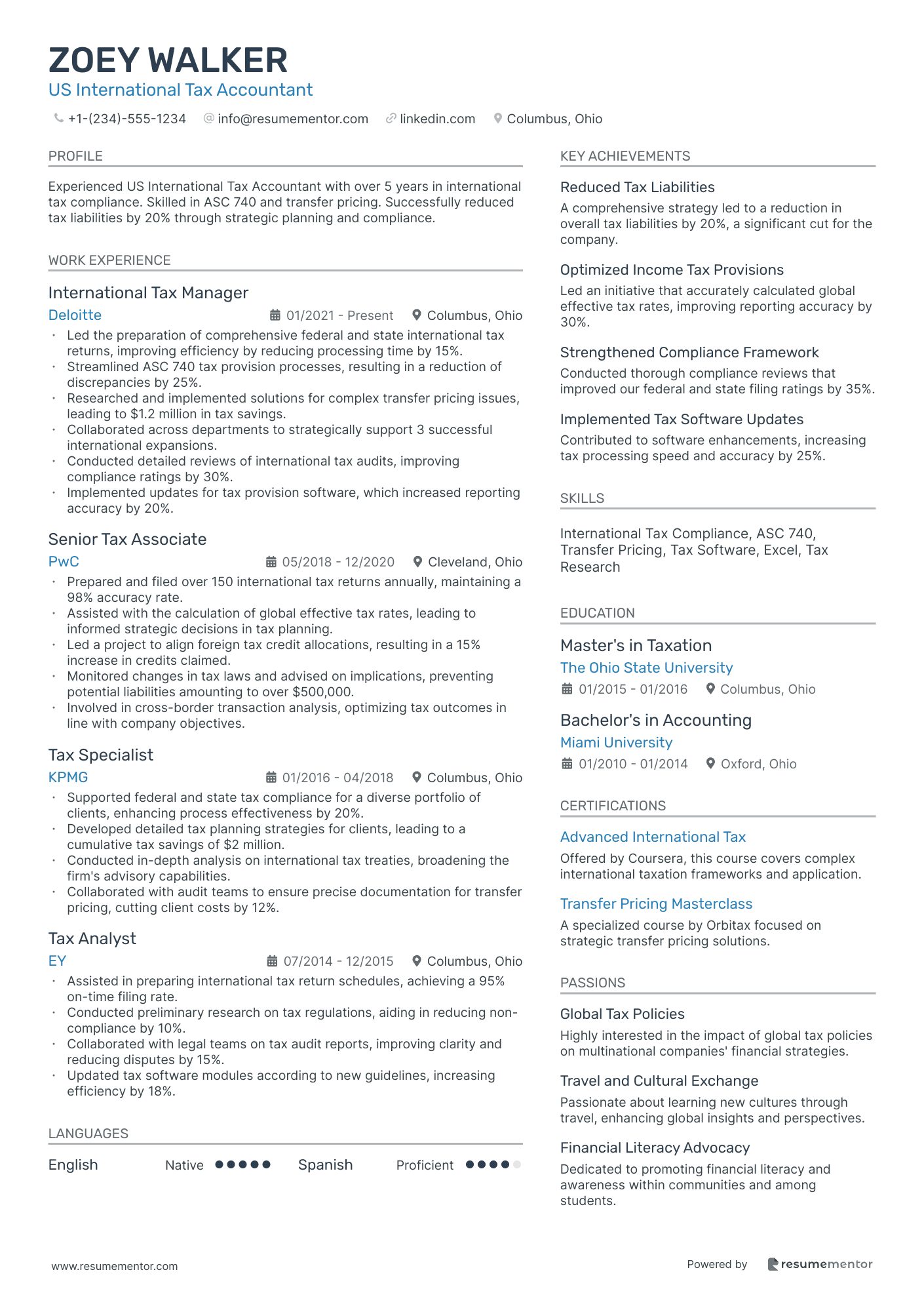

US International Tax Accountant

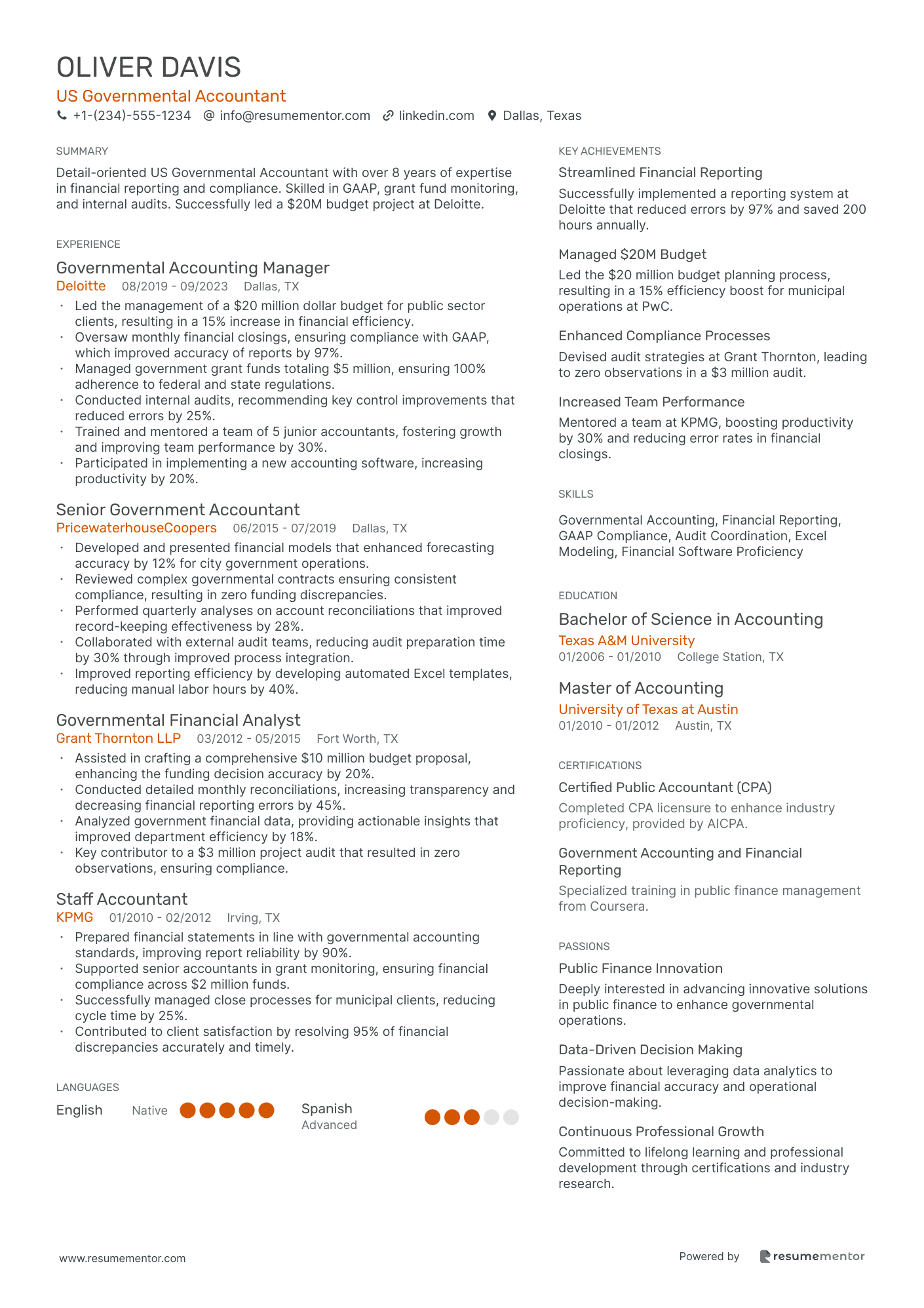

US Governmental Accountant

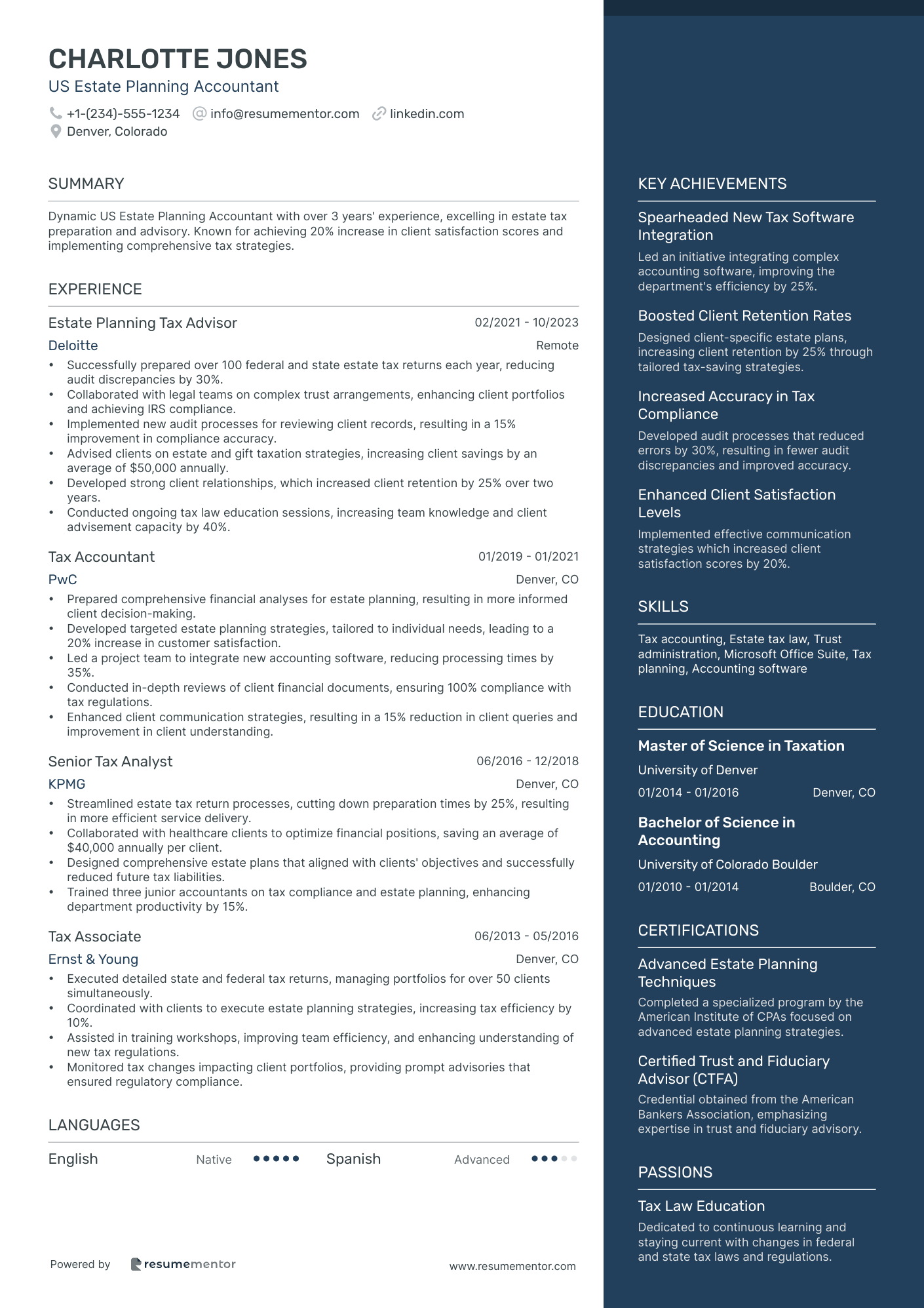

US Estate Planning Accountant

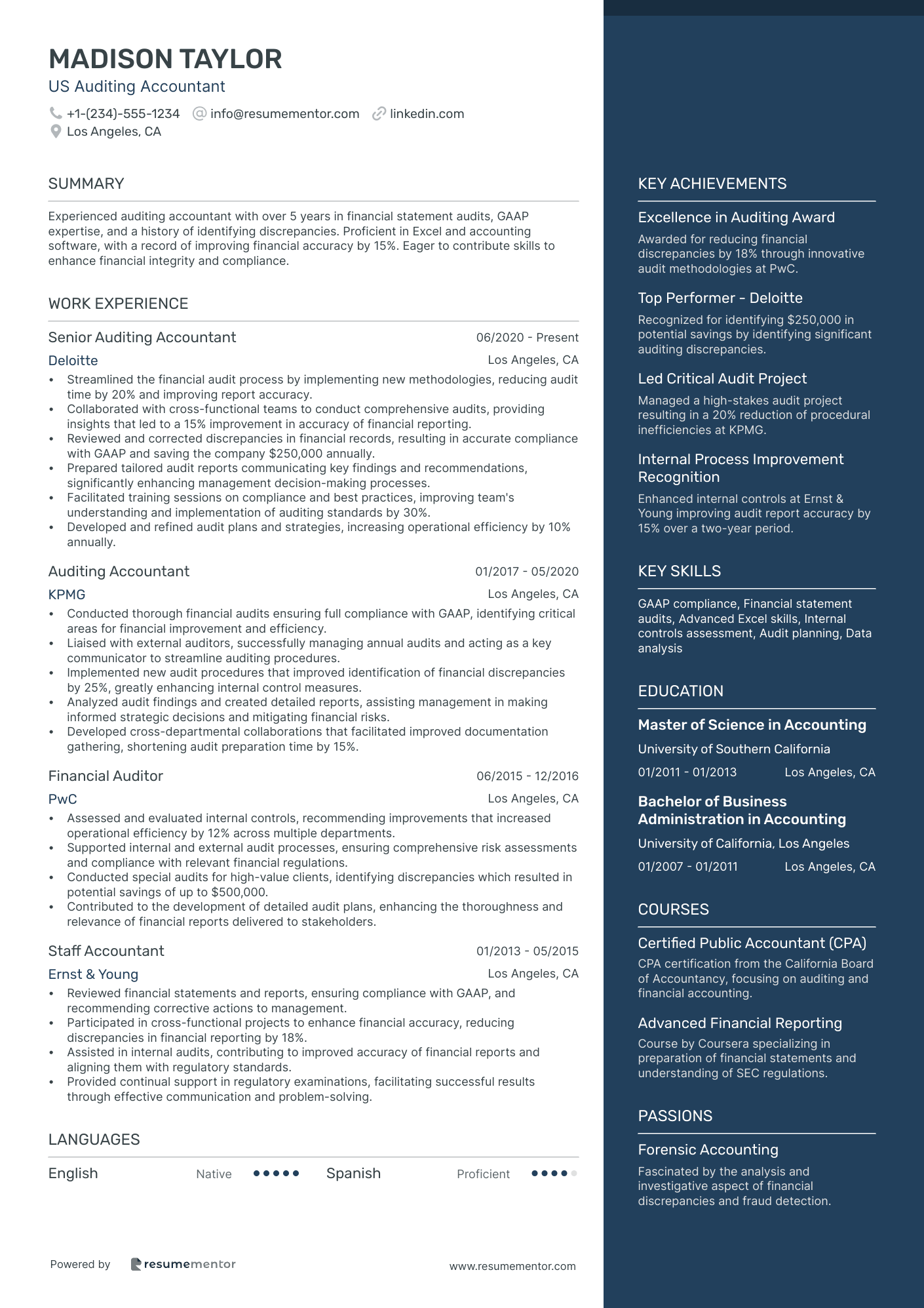

US Auditing Accountant

US Tax Compliance Accountant resume sample

- •Led the preparation and review of over 100 federal and state tax returns annually, ensuring 100% compliance with regulatory standards.

- •Managed a team of 3 accountants to reduce tax liabilities by 20% through strategic planning and forecasting efforts.

- •Conducted tax research projects, analyzing changes in tax legislation and advising the company on compliance and adjustment needs.

- •Collaborated with external auditors during quarterly reviews, resulting in the timely resolution of all tax queries.

- •Developed comprehensive tax documentation processes that improved record accuracy and accessibility for management and audits.

- •Implemented a new tax software system that streamlined tax preparation processes and reduced errors by 30%.

- •Prepared and reviewed quarterly and annual tax provisions, achieving a 15% improvement in deadline adherence.

- •Researched complex tax issues and collaborated with legal teams to ensure compliance, enhancing organizational risk management.

- •Monitored tax compliance risks, providing actionable recommendations that reduced potential non-compliance penalties by 10%.

- •Supported the development of tax strategies with cross-functional teams, optimizing total tax liability and enhancing financial situation.

- •Maintained tax positions and filing documentation to uphold high standards of accuracy and compliance with federal tax regulations.

- •Assisted in the preparation of over 50 tax-related financial statement disclosures annually, improving stakeholder understanding and compliance.

- •Conducted quantitative analyses, providing insights that helped inform tax strategy decisions and financial planning efforts.

- •Developed an Excel-based tool to track and monitor tax-related metrics, improving data accuracy and reporting speed by 25%.

- •Collaborated with departmental leaders to provide detailed tax compliance reports from various sectors within the organization.

- •Collaborated with a team on tax compliance initiatives, ensuring that the company consistently met all regulatory deadlines.

- •Provided detailed analyses of tax law changes for clients, facilitating informed decision-making and managing potential compliance risks.

- •Worked directly with clients in diverse industries, addressing specific tax-related inquiries and crafting tailored compliance strategies.

- •Assisted in drafting tax documentation that ensured clarity and compliance across all client tax filings and provisions.

US Payroll Accountant resume sample

- •Successfully processed bi-weekly payroll for over 600 employees across multiple states, achieving a 98% accuracy rate and reducing errors by 15%.

- •Collaborated with HR to update employee records timely, resulting in improved data accuracy and reducing payroll discrepancies by 20%.

- •Led the implementation of a new payroll software system, saving the company 10% annually in processing costs and reducing processing time by 30%.

- •Produced detailed payroll reports and distributed them to management, improving labor cost visibility and aiding financial decision-making.

- •Ensured compliance with changing federal and state payroll regulations, contributing to zero compliance-related issues in the past two years.

- •Resolved complex payroll inquiries and discrepancies for employees, improving satisfaction scores by 25% through dedicated support.

- •Calculated and submitted accurate payroll tax returns, resulting in no penalties or regulatory fines for the company.

- •Administered payroll processes for a workforce of over 300 employees, achieving a 97% on-time payment record.

- •Streamlined payroll processes leading to a 12% reduction in processing time and increasing team productivity.

- •Trained new payroll assistants, enhancing team knowledge and operational efficiency by 15%.

- •Developed comprehensive payroll reports for senior management, leading to data-driven decisions impacting workforce planning.

- •Assisted in processing payroll for approximately 150 employees, maintaining strict compliance with all relevant regulations.

- •Resolved 95% of employee payroll issues within 24 hours, significantly enhancing staff satisfaction and trust.

- •Performed audits on payroll data, achieving a 99% accuracy rate and improving system reliability.

- •Facilitated coordination between the HR and Finance departments, resulting in improved operational workflows.

- •Coordinated payroll activities for 100+ employees, ensuring adherence to deadlines and compliance requirements.

- •Executed payroll adjustments for terminations and new hires, reducing processing errors by 10%.

- •Prepared and distributed pay stubs and reports, enhancing transparency and employee communication.

- •Contributed to the successful transition of payroll systems, ensuring minimal disruption in operations.

US Cost Accountant resume sample

- •Prepared detailed costing reports leading to identification of cost-saving opportunities, saving $300,000 year over year.

- •Monitored and optimized inventory levels, reducing overhead costs by 20% within the first 12 months.

- •Developed a new cost accounting system compliant with GAAP, enhancing operational efficiency by 25%.

- •Collaborated with manufacturing teams, streamlining production processes and cutting costs by over 18%.

- •Presented monthly financial reports, highlighting areas where costs were reduced by up to 30%.

- •Led a cross-departmental project that improved cost allocation processes, supporting a 35% increase in profitability.

- •Analyzed financial data, resulting in a 15% reduction in operating expenses across multiple departments.

- •Produced comprehensive reports for management, successfully forecasting future financial outcomes with 95% accuracy.

- •Implemented new financial models which improved budget accuracy and saved over $150,000 annually.

- •Audited previous budgets, uncovering discrepancies that led to a 10% budget adjustment.

- •Facilitated workshops to enhance team understanding of cost control processes, enabling significant process improvement.

- •Conducted cost analysis for multiple projects, improving cost allocation by 25% across departments.

- •Played a key role in the reduction of production costs by 15% through effective data evaluation and initiatives.

- •Assisted in the month-end close process, ensuring timely and accurate financial reporting.

- •Collaborated with teams to optimize product costing, enhancing overall profit margins by 20%.

- •Managed financial statements preparation, contributing to year-end close with zero discrepancies.

- •Maintained strict compliance with accounting regulations, ensuring annual audits were passed without penalties.

- •Worked closely with the financial planning team to create accurate budgeting, enhancing budget adherence by 10%.

- •Enhanced existing accounting systems, leading to an improved financial reporting accuracy of 95%.

US Forensic Accountant resume sample

- •Led forensic investigations identifying fraud that led to recovery of $500K in client assets.

- •Developed risk management strategies reducing financial discrepancies by 30% in one year.

- •Collaborated with legal teams to support litigation, resulting in successful resolution of financial disputes.

- •Testified in legal proceedings as an expert witness, clearly defending methodologies to support findings.

- •Conducted comprehensive analyses of financial records, identifying over $1M in financial mismanagement.

- •Prepared detailed reports for senior management, contributing to improved compliance and accuracy.

- •Identified complex financial discrepancies through meticulous forensic analyses, aiding in fraud prevention strategies.

- •Assisted in developing internal controls that reduced fraudulent activities by 25%.

- •Worked with regulatory authorities to support investigations, enhancing compliance measures significantly.

- •Conducted risk assessments that improved financial accuracy across multiple client divisions.

- •Presented findings to diverse stakeholders, improving transparency and understanding of financial risks.

- •Analyzed financial statements and tax returns for compliance, increasing accuracy by 40%.

- •Conducted extensive forensic audits uncovering $250K in fraud across various portfolios.

- •Developed training programs on fraud prevention attended by 200+ employees, enhancing risk awareness.

- •Collaborated with law enforcement on fraud cases, improving investigation efficiency by 15%.

- •Performed regular audits resulting in improved compliance with financial regulations by 20%.

- •Assisted in implementing new accounting practices which enhanced reporting accuracy by 35%.

- •Provided analytical support solving financial discrepancies for diverse clients in the region.

- •Evaluated internal control systems, contributing to more secure financial processing procedures.

US Management Accountant resume sample

- •Led the development and implementation of a new financial reporting system, improving reporting speed by 50% and accuracy by 20%.

- •Collaborated with cross-functional teams to align financial strategies with operational goals, optimizing cost efficiency by 15%.

- •Prepared quarterly and annual financial statements, providing timely insights to assist with strategic planning, resulting in a 10% budget surplus.

- •Assisted in regulatory audits by meticulously preparing and reviewing relevant financial documents, ensuring 100% compliance with US GAAP.

- •Trained and mentored a team of junior accountants, leading to a 40% improvement in their performance and knowledge retention.

- •Streamlined month-end closing procedures, shortening the process by three days and enhancing the accuracy of financial records.

- •Conducted comprehensive variance analysis to identify trends and opportunities, leading to a 25% increase in forecast accuracy.

- •Played a key role in budgeting and forecast processes, sharpening financial planning accuracy by 12%.

- •Analyzed financial data and presented findings to executives, influencing strategic decisions that enhanced market positioning.

- •Developed and refined accounting policies, improving overall compliance and efficiency across accounting processes.

- •Coordinated with internal and external audit teams, ensuring successful completion of audits with zero non-compliance issues.

- •Performed detailed financial analysis, providing insights that led to a 15% cost reduction in departmental budgets.

- •Assisted in the preparation and presentation of financial reports to stakeholders, increasing transparency across financial activities.

- •Managed and maintained accurate financial records, ensuring consistency in data quality, leading to a 10% reduction in reporting errors.

- •Collaborated with business units to facilitate alignment between operational and financial objectives, enhancing overall performance.

- •Supported month-end closing processes by preparing reconciliations and journal entries, improving timeliness by 20%.

- •Contributed to the redesign of accounting procedures, increasing efficiency by 15% through process improvements.

- •Ensured compliance with financial policies and regulations, minimizing financial risks and enhancing audit readiness.

- •Participated in quarterly financial reviews and contributed insights that improved financial strategy execution.

US Financial Reporting Accountant resume sample

- •Led the preparation and review of quarterly financial statements under US GAAP, improving accuracy by 15%.

- •Implemented a new financial reporting framework, reducing reporting time by 20%.

- •Collaborated with cross-functional teams to analyze financial variances, resulting in actionable insights and improved budgetary control.

- •Prepared crucial external reporting documents including 10-Qs and 10-Ks, ensuring compliance and timely submission.

- •Enhanced internal controls for financial reporting, leading to a 10% reduction in auditing time.

- •Assisted in successful internal and external audits, providing required documentation and reducing audit findings by 30%.

- •Developed monthly financial reports that increased management's decision-making speed by 35%.

- •Conducted comprehensive account reconciliations led to a reduction in discrepancies by 25%.

- •Streamlined financial processes improved month-end close efficiency by 2 days.

- •Analyzed financial data to identify costing inefficiencies, recommending savings of approximately $500,000 per annum.

- •Supported special financial projects that enhanced departmental preparation for fiscal year-end processes.

- •Managed daily transactions and ensured accuracy in financial submissions, maintaining a 98% accuracy rate.

- •Played a key role in the implementation of a financial reporting system (SAP), improving team productivity by 15%.

- •Facilitated the preparation of monthly income statements and balance sheets for review by senior management.

- •Provided analysis of financial data, identifying trends that supported strategic business decisions.

- •Assisted with month-end financial reporting, ensuring timely and accurate data delivery to stakeholders.

- •Performed account reconciliations with an emphasis on identifying discrepancies and maintaining data integrity.

- •Handled series of audits, supporting detailed documentation and contributing to a 15% improvement in accuracy.

- •Contributed to the maintenance of internal financial processes, enhancing compliance standards and team efficiency.

US International Tax Accountant resume sample

- •Led the preparation of comprehensive federal and state international tax returns, improving efficiency by reducing processing time by 15%.

- •Streamlined ASC 740 tax provision processes, resulting in a reduction of discrepancies by 25%.

- •Researched and implemented solutions for complex transfer pricing issues, leading to $1.2 million in tax savings.

- •Collaborated across departments to strategically support 3 successful international expansions.

- •Conducted detailed reviews of international tax audits, improving compliance ratings by 30%.

- •Implemented updates for tax provision software, which increased reporting accuracy by 20%.

- •Prepared and filed over 150 international tax returns annually, maintaining a 98% accuracy rate.

- •Assisted with the calculation of global effective tax rates, leading to informed strategic decisions in tax planning.

- •Led a project to align foreign tax credit allocations, resulting in a 15% increase in credits claimed.

- •Monitored changes in tax laws and advised on implications, preventing potential liabilities amounting to over $500,000.

- •Involved in cross-border transaction analysis, optimizing tax outcomes in line with company objectives.

- •Supported federal and state tax compliance for a diverse portfolio of clients, enhancing process effectiveness by 20%.

- •Developed detailed tax planning strategies for clients, leading to a cumulative tax savings of $2 million.

- •Conducted in-depth analysis on international tax treaties, broadening the firm's advisory capabilities.

- •Collaborated with audit teams to ensure precise documentation for transfer pricing, cutting client costs by 12%.

- •Assisted in preparing international tax return schedules, achieving a 95% on-time filing rate.

- •Conducted preliminary research on tax regulations, aiding in reducing non-compliance by 10%.

- •Collaborated with legal teams on tax audit reports, improving clarity and reducing disputes by 15%.

- •Updated tax software modules according to new guidelines, increasing efficiency by 18%.

US Governmental Accountant resume sample

- •Led the management of a $20 million dollar budget for public sector clients, resulting in a 15% increase in financial efficiency.

- •Oversaw monthly financial closings, ensuring compliance with GAAP, which improved accuracy of reports by 97%.

- •Managed government grant funds totaling $5 million, ensuring 100% adherence to federal and state regulations.

- •Conducted internal audits, recommending key control improvements that reduced errors by 25%.

- •Trained and mentored a team of 5 junior accountants, fostering growth and improving team performance by 30%.

- •Participated in implementing a new accounting software, increasing productivity by 20%.

- •Developed and presented financial models that enhanced forecasting accuracy by 12% for city government operations.

- •Reviewed complex governmental contracts ensuring consistent compliance, resulting in zero funding discrepancies.

- •Performed quarterly analyses on account reconciliations that improved record-keeping effectiveness by 28%.

- •Collaborated with external audit teams, reducing audit preparation time by 30% through improved process integration.

- •Improved reporting efficiency by developing automated Excel templates, reducing manual labor hours by 40%.

- •Assisted in crafting a comprehensive $10 million budget proposal, enhancing the funding decision accuracy by 20%.

- •Conducted detailed monthly reconciliations, increasing transparency and decreasing financial reporting errors by 45%.

- •Analyzed government financial data, providing actionable insights that improved department efficiency by 18%.

- •Key contributor to a $3 million project audit that resulted in zero observations, ensuring compliance.

- •Prepared financial statements in line with governmental accounting standards, improving report reliability by 90%.

- •Supported senior accountants in grant monitoring, ensuring financial compliance across $2 million funds.

- •Successfully managed close processes for municipal clients, reducing cycle time by 25%.

- •Contributed to client satisfaction by resolving 95% of financial discrepancies accurately and timely.

US Estate Planning Accountant resume sample

- •Successfully prepared over 100 federal and state estate tax returns each year, reducing audit discrepancies by 30%.

- •Collaborated with legal teams on complex trust arrangements, enhancing client portfolios and achieving IRS compliance.

- •Implemented new audit processes for reviewing client records, resulting in a 15% improvement in compliance accuracy.

- •Advised clients on estate and gift taxation strategies, increasing client savings by an average of $50,000 annually.

- •Developed strong client relationships, which increased client retention by 25% over two years.

- •Conducted ongoing tax law education sessions, increasing team knowledge and client advisement capacity by 40%.

- •Prepared comprehensive financial analyses for estate planning, resulting in more informed client decision-making.

- •Developed targeted estate planning strategies, tailored to individual needs, leading to a 20% increase in customer satisfaction.

- •Led a project team to integrate new accounting software, reducing processing times by 35%.

- •Conducted in-depth reviews of client financial documents, ensuring 100% compliance with tax regulations.

- •Enhanced client communication strategies, resulting in a 15% reduction in client queries and improvement in client understanding.

- •Streamlined estate tax return processes, cutting down preparation times by 25%, resulting in more efficient service delivery.

- •Collaborated with healthcare clients to optimize financial positions, saving an average of $40,000 annually per client.

- •Designed comprehensive estate plans that aligned with clients' objectives and successfully reduced future tax liabilities.

- •Trained three junior accountants on tax compliance and estate planning, enhancing department productivity by 15%.

- •Executed detailed state and federal tax returns, managing portfolios for over 50 clients simultaneously.

- •Coordinated with clients to execute estate planning strategies, increasing tax efficiency by 10%.

- •Assisted in training workshops, improving team efficiency, and enhancing understanding of new tax regulations.

- •Monitored tax changes impacting client portfolios, providing prompt advisories that ensured regulatory compliance.

US Auditing Accountant resume sample

- •Streamlined the financial audit process by implementing new methodologies, reducing audit time by 20% and improving report accuracy.

- •Collaborated with cross-functional teams to conduct comprehensive audits, providing insights that led to a 15% improvement in accuracy of financial reporting.

- •Reviewed and corrected discrepancies in financial records, resulting in accurate compliance with GAAP and saving the company $250,000 annually.

- •Prepared tailored audit reports communicating key findings and recommendations, significantly enhancing management decision-making processes.

- •Facilitated training sessions on compliance and best practices, improving team's understanding and implementation of auditing standards by 30%.

- •Developed and refined audit plans and strategies, increasing operational efficiency by 10% annually.

- •Conducted thorough financial audits ensuring full compliance with GAAP, identifying critical areas for financial improvement and efficiency.

- •Liaised with external auditors, successfully managing annual audits and acting as a key communicator to streamline auditing procedures.

- •Implemented new audit procedures that improved identification of financial discrepancies by 25%, greatly enhancing internal control measures.

- •Analyzed audit findings and created detailed reports, assisting management in making informed strategic decisions and mitigating financial risks.

- •Developed cross-departmental collaborations that facilitated improved documentation gathering, shortening audit preparation time by 15%.

- •Assessed and evaluated internal controls, recommending improvements that increased operational efficiency by 12% across multiple departments.

- •Supported internal and external audit processes, ensuring comprehensive risk assessments and compliance with relevant financial regulations.

- •Conducted special audits for high-value clients, identifying discrepancies which resulted in potential savings of up to $500,000.

- •Contributed to the development of detailed audit plans, enhancing the thoroughness and relevance of financial reports delivered to stakeholders.

- •Reviewed financial statements and reports, ensuring compliance with GAAP, and recommending corrective actions to management.

- •Participated in cross-functional projects to enhance financial accuracy, reducing discrepancies in financial reporting by 18%.

- •Assisted in internal audits, contributing to improved accuracy of financial reports and aligning them with regulatory standards.

- •Provided continual support in regulatory examinations, facilitating successful results through effective communication and problem-solving.

Crafting an outstanding accountant resume is essential for landing your dream job. As an accountant, you expertly manage numbers and financial puzzles, but translating that expertise into a compelling resume can feel as intricate as navigating the tax code. To succeed, your resume needs to reflect your technical skills and your ability to offer strategic insights.

Understanding what hiring managers want can be confusing. You might struggle with highlighting your achievements in a way that effectively showcases your strengths while aligning with the job requirements. This is why a resume template becomes a valuable tool, offering clear structure and clean formatting to ensure your skills and successes stand out.

With countless resumes competing for attention, yours has to make an immediate impact. Clear organization and concise language are crucial, but using specific language about your role and achievements can set you apart. Consider your resume as an accounting ledger, where the balance of numbers and narrative tells your professional story.

Every part of your resume matters in weaving together this narrative. From the summary to your skills and work history, each section should contribute to a comprehensive picture of you as a well-rounded accountant. By leveraging your analytical mindset, you can ensure your resume captures interest not just at first glance but encourages a deeper look. This guide will lead you through each step, helping your resume reflect your unique skills and experiences in the world of accounting.

Key Takeaways

- An accountant resume should highlight technical skills and showcase strategic insights through a clear, structured format.

- Including detailed, quantifiable achievements in the experience section effectively demonstrates your skills and capabilities.

- Utilizing a chronological format, professional fonts, and PDF format ensures clarity and consistency in presentation.

- A summary section can highlight key qualifications and skills, while keywords in your skills section enhance appeal to employers.

- Incorporating education, certifications, and extra sections like languages or volunteer work can enrich your resume's personal depth.

What to focus on when writing your US accountant resume

Your US accountant resume should effectively convey your financial expertise and dependability to the recruiter—showcasing how you excel in managing financial records, ensuring compliance, and contributing to a company's financial health.

How to structure your US accountant resume

- Contact Information—It's crucial to list your full name, phone number, email address, and LinkedIn profile clearly. This ensures that recruiters can easily reach you and connect with your professional network.

- Professional Summary—Offer a concise snapshot of your accounting experience, highlighting key achievements and skills to demonstrate your suitability for the role. Mention specific accounting software like QuickBooks or SAP and your focus in areas such as tax accounting or auditing, ensuring alignment with the job's needs.

- Work Experience—Connect past roles to your responsibilities and achievements, using active verbs to illustrate your impact. Quantify achievements with examples like cost reduction or process improvements to effectively showcase your contributions to past employers.

- Education—Include your degree in accounting or finance, providing the institution's name, graduation year, and mentioning any honors to underline your foundational knowledge and academic excellence within the field.

- Certifications and Licenses—Bolster your qualifications by including credentials such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) that underline your professional standing and dedication to ongoing development.

- Technical Skills—Outline your proficiency with accounting software, Excel, and data analysis tools. Mention your familiarity with GAAP or other important financial regulations to emphasize your comprehensive skill set and readiness to tackle complex tasks.

To add depth to your resume, consider adding sections like Volunteer Experience, Languages, or Professional Affiliations, with examples such as the American Institute of CPAs—these sections can add a personal touch and showcase additional strengths. Now, let's delve deeper into the ideal format for these sections and explore each one more thoroughly below.

Which resume format to choose

For crafting a US accountant resume, choosing the right format is crucial to effectively highlighting your professional journey. A chronological format is often the best choice because it clearly showcases your work history, emphasizing your career progress and stability—key attributes in the accounting field.

When it comes to picking the right font, opt for modern, streamlined options like Raleway, Lato, or Montserrat. These fonts are professional and enhance readability without distracting from the details of your experience or skills. Their clean lines complement the precise nature of accounting work.

Saving your resume as a PDF is important. This format protects your carefully arranged layout, ensuring consistency in appearance regardless of where or how it's viewed. The last thing you want is a misaligned document when trying to make a great impression.

Maintaining 1-inch margins all around your resume provides a balanced, neat presentation. This spacing allows room for well-organized sections and plenty of white space, which helps the reader focus on your key qualifications without feeling overwhelmed by text. These details together form a polished resume that effectively presents your expertise in accounting.

How to write a quantifiable resume experience section

For a US accountant resume, the experience section plays a vital role in showcasing your skills and achievements. By focusing on quantifiable successes and accounting-related responsibilities, you effectively demonstrate your value. Organizing this section in reverse chronological order allows employers to quickly access your most recent roles, making it easier for them to assess your current capabilities. Tailoring your experience to align with the job ad ensures that you highlight the skills and achievements most relevant to the employer's needs. Using strong action words like "managed," "optimized," and "analyzed" communicates your impact and expertise. Limiting your work history to the last 10-15 years helps maintain relevance and showcases your career progression in accounting.

Here's a refined US accountant resume example:

- •Managed a team of 5 accountants, boosting department efficiency by 20%.

- •Streamlined financial reporting, cutting closing time by 30%.

- •Implemented a new budgeting system, saving $150,000 annually.

- •Analyzed trends to provide insights, driving a 15% revenue increase.

In this enhanced experience section, the flow of information connects smoothly. Each sentence builds on the previous one, seamlessly linking topics while maintaining focus on demonstrating your impact. The structured format ensures readability, and by aligning your accomplishments with the employer's requirements, you make a compelling case for your candidacy. This approach highlights your career growth, appealing to employers looking for stable and progressive professionals. Quantifiable achievements add substance and depth, illustrating your ability to enhance processes and contribute positively to the company's success.

Responsibility-Focused resume experience section

A responsibility-focused accountant resume experience section should effectively highlight your achievements in a cohesive manner. Begin with your most recent job to show potential employers your current expertise, explicitly stating the employment dates to provide a clear career timeline. Focus on illustrating your major responsibilities and the impact you made, emphasizing specific outcomes with concrete numbers or percentages. This level of detail transforms your experiences into tangible achievements that prospective employers can easily grasp.

Each job entry should be structured with the job title, workplace, and, if necessary, a short company description. Use bullet points to clearly outline your main achievements and tasks, employing strong action verbs and measurable metrics to create a vivid picture of your contributions. This approach not only highlights what you've accomplished but also provides a sense of your potential to excel in future roles. By weaving these elements together, your experience section will seamlessly convey both your past successes and your capability for future impact.

Senior Accountant

ABC Corporation

Jan 2020 - Present

- Prepared monthly financial statements for senior manager reviews, ensuring 98% accuracy.

- Managed accounts payable and receivable, cutting outstanding payments by 15% in six months.

- Conducted budget analysis that led to a 10% reduction in operational costs.

- Teamed up with auditors to streamline processes, boosting efficiency by 20%.

Training and Development Focused resume experience section

A training and development-focused accountant resume experience section should clearly demonstrate how you've enhanced learning experiences and improved team performance. Begin by showcasing your role in creating manuals or leading training sessions to present your instructional prowess. Dive into how you developed new training materials or refined the existing ones, ensuring they were effective and clear. Use bullet points to capture these achievements concisely, highlighting the tangible improvements your efforts brought to performance or efficiency.

To convey your involvement, start each bullet point with an action verb. Tailor your descriptions to emphasize the specific skills needed in an accounting training context. For instance, if you introduced training on new accounting software or overhauled existing programs, detail the impact. Including metrics, like the number of people trained or percentage improvements, will make your contributions more compelling and evident.

Accountant

ABC Financial Group

June 2020 - Present

- Designed and implemented a comprehensive training module for new accounting software, boosting staff proficiency by 30%.

- Led quarterly workshops to enhance knowledge of financial regulations, increasing team compliance success by 25%.

- Created instructional materials for different accounting expertise levels, receiving a 90% positive feedback score from participants.

- Worked with the IT department to integrate e-learning tools, enhancing remote training capabilities by 40%.

Skills-Focused resume experience section

A skills-focused accountant resume experience section should emphasize the abilities and achievements related to the job you're targeting. Start by selecting a relevant focus, like financial reporting or budget forecasting, and use this as your heading to anchor the content. To effectively demonstrate your impact, describe your accomplishments using action verbs and quantifiable results. Highlight your skills in analyzing complex financial data, crafting strategic plans, and utilizing financial software to align with job requirements.

Incorporate specific examples that showcase your skills in action to make your experience more relatable. By highlighting significant projects or responsibilities, you provide a deeper insight into your capabilities and show your ability to adapt to team and independent work settings. This approach not only highlights how well-qualified you are but also directly connects your experiences with what employers are seeking.

Senior Accountant

XYZ Financial Services

June 2020 - Present

- Developed annual financial plans and forecasts, improving budget accuracy by 15%.

- Analyzed monthly revenue reports, spotting trends and suggesting cost reductions.

- Worked with department heads to create balanced spend plans, optimizing expenditures.

- Used accounting software to streamline reconciliation processes, cutting errors by 30%.

Growth-Focused resume experience section

A growth-focused accountant resume experience section should clearly highlight how you have effectively contributed to a company’s financial expansion and efficiency. Concentrate on accomplishments that deliver tangible results, demonstrating your role in enhancing the company's financial success. Emphasize your involvement in key areas such as strategic financial planning, cost reduction, and revenue enhancement to show the meaningful impact of your work on the organization’s bottom line.

Integrate strong action verbs and provide detailed examples, while keeping the format clear and concise. Reflect on the unique value you added in each position and the specific benefits your efforts delivered to the company. Tailoring your experiences to highlight not only your achievements but also your proactive approach to growth will ensure your resume stands out effectively.

Senior Accountant

ABC Corp

2018 - 2022

- Led a team to implement a new budgeting system that reduced overhead costs by 15%.

- Developed a financial forecast model that improved accuracy by 20%, aiding investment decisions.

- Collaborated with the marketing team to analyze product profitability, resulting in a 10% increase in net margins.

- Streamlined monthly closing procedures, reducing completion time by 30%.

Write your US accountant resume summary section

A U.S. accountant-focused resume summary should clearly highlight your qualifications and capture an employer's interest. If you have extensive experience, using a summary is your best option. It provides a brief overview of your most impressive achievements and skills, making it ideal for experienced professionals. Consider this example:

This example excels because it not only highlights key areas of expertise but also showcases specific, impactful achievements. Words like "implemented" and "reduced" convey action and results, which are crucial in any summary. Connecting your skills with tangible outcomes makes your case more compelling.

When you describe yourself, focusing on qualities relevant to the job can strengthen your appeal. Choosing words like "analytical," "efficient," and "proactive" can catch an employer's eye, provided they accurately reflect your experiences. Authenticity ensures your descriptions resonate better.

It's also important to understand the differences between resume components when tailoring your application. A resume objective targets your future goals, ideal if you're new to the field or shifting careers. In contrast, a summary showcases your proven skills and experiences, perfect for seasoned professionals. Meanwhile, a profile is similar but less detailed, and a summary of qualifications offers a quick-scan bullet list. Choosing the right component depends largely on your career stage and how clearly you can convey your achievements and aims.

Listing your US accountant skills on your resume

A skills-focused US accountant resume should present your abilities in a way that clearly demonstrates your expertise and readiness for the job. Consider whether to showcase your skills as a separate section or weave them into your experience and summary. Highlight your strengths and soft skills, like communication and teamwork, to show your interpersonal abilities. Meanwhile, hard skills represent concrete capabilities you've mastered, such as proficiency in accounting software and financial analysis.

These skills and strengths are crucial resume keywords. They play a critical role in capturing the interest of hiring managers and tracking systems, thus enhancing your appeal as a candidate. Using these keywords strategically can set you apart in the job market.

Here's an example of a standalone skills section for a US accountant resume:

This skills section effectively highlights relevant abilities that employers are looking for, without unnecessary detail. Each skill directly aligns with key responsibilities in an accounting role.

Best hard skills to feature on your us accountant resume

Hard skills are the technical abilities that define your role as a US accountant. They signify your capacity to execute specific tasks required in accounting.

Hard Skills

- Proficiency in GAAP (Generally Accepted Accounting Principles)

- Financial statement preparation

- Tax compliance and planning

- Budgeting and forecasting

- Account reconciliation

- Payroll processing

- Auditing skills

- Financial analysis and reporting

- Proficiency in accounting software like QuickBooks or SAP

- Advanced knowledge of Excel (including pivot tables and VLOOKUP)

- Accounts payable and receivable management

- Internal controls and financial management

- Cost accounting

- Risk assessment and management

- Knowledge of federal and state tax codes

Best soft skills to feature on your us accountant resume

Soft skills offer insight into how you navigate workplace interactions and challenges, enhancing your technical abilities as an accountant.

Soft Skills

- Attention to detail

- Strong communication skills

- Problem-solving abilities

- Time management

- Critical thinking

- Organization

- Adaptability

- Teamwork and collaboration

- Professionalism

- Ethical judgment

- Decision making

- Customer service orientation

- Stress management

- Leadership qualities

- Initiative and proactivity

How to include your education on your resume

The education section of your resume is important, especially for an accountant role, as it showcases your academic background and qualifications. It's essential to tailor this section to the job you're applying for by including only relevant education. An unrelated educational background could clutter your resume. When listing your degree, begin with the degree title, followed by the institution's name, location, and your graduation date. Including your GPA is optional, but if it's strong (typically above 3.5) and recent, you might consider adding it for emphasis. If you graduated with honors such as cum laude, state this clearly as it highlights your academic achievement.

Here's a look at what to include and what to avoid:

Now, for a great example:

- •Graduated cum laude

This second example is ideal for an accountant position. It highlights a relevant degree and includes a competitive GPA and honors, which demonstrate your commitment and excellence. Noting that you graduated cum laude adds stature to your academic background. This information aligns well with the requirements and expectations an employer seeks when hiring for an accounting role.

How to include US accountant certificates on your resume

Including a certificates section in your US accountant resume is vital. List the name of the certificate first. Include the date you obtained it. Add the issuing organization next to it. This section showcases your qualifications and relevant expertise.

You can also include certificates in the header of your resume for immediate visibility. For example, "John Doe, CPA, CFE" highlights your credentials right after your name. It is a quick way to catch the employer's eye.

Here is a good example of a standalone certificates section:

This example is effective because it lists certificates that are highly relevant to accounting roles. It also provides the names of notable issuing organizations, adding credibility. This format is both clear and professional, making it easy for employers to understand your qualifications at a glance.

Extra sections to include in your US accountant resume

You’ve crafted an impressive resume showcasing your accounting expertise, but there’s more to you than just numbers. Including sections like languages, hobbies, volunteer work, and books can add depth to your profile and make you stand out as a well-rounded individual.

- Language section — Highlight any languages you speak fluently or are proficient in, as this can enhance your ability to work with diverse clients and colleagues.

- Hobbies and interests section — Share your hobbies and interests to give potential employers a glimpse into your personality and how you might fit into their company culture.

- Volunteer work section — Emphasize any volunteer experiences to demonstrate your commitment to community service and your ability to manage time effectively.

- Books section — List books you’ve read or are currently reading that relate to your profession or personal growth, showcasing your dedication to continual learning.

Using these sections effectively can create a richer picture of you, making your resume memorable and appealing. They not only display your skills and interests outside of financial statements but also build connections on a more personal level.

In Conclusion

In conclusion, crafting an impressive accountant resume requires a balance between demonstrating your technical expertise and conveying your unique personal attributes. A well-structured resume highlights not only your mastery of complex financial regulations and software but also your strategic contributions to organizational growth. Using a chronological format ensures clarity and emphasizes your career progression, while modern fonts and strategic PDF formatting maintain a polished appearance.

Integrating quantifiable achievements throughout your experience section demonstrates your tangible impact on previous employers, which is vital in illustrating your value to potential future employers. Highlighting hard skills such as proficiency in GAAP, tax preparation, and financial reporting aligns your profile with key industry demands. Simultaneously, showcasing soft skills like critical thinking and teamwork illustrates your readiness to contribute positively to a collaborative work environment.

Additionally, including certificates like CPA or CMA prominently on your resume adds credibility and highlights your commitment to professional development. Beyond professional achievements, adding sections on languages, volunteer work, or hobbies enriches your resume, providing a multifaceted view of your capabilities and interests. By weaving all these elements together, your resume becomes a powerful narrative of your professional journey, effectively setting you apart in the competitive accounting field.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.