VAT Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Craft a standout VAT accountant resume and ensure you’re not taxing the recruiter’s patience."

Rated by 348 people

VAT Compliance Accountant

VAT & Indirect Tax Accountant

VAT Reconciliation Accountant

International VAT Accountant

VAT Reporting Accountant

VAT Advisory Accountant

VAT and Corporate Tax Accountant

VAT Audit Specialist Accountant

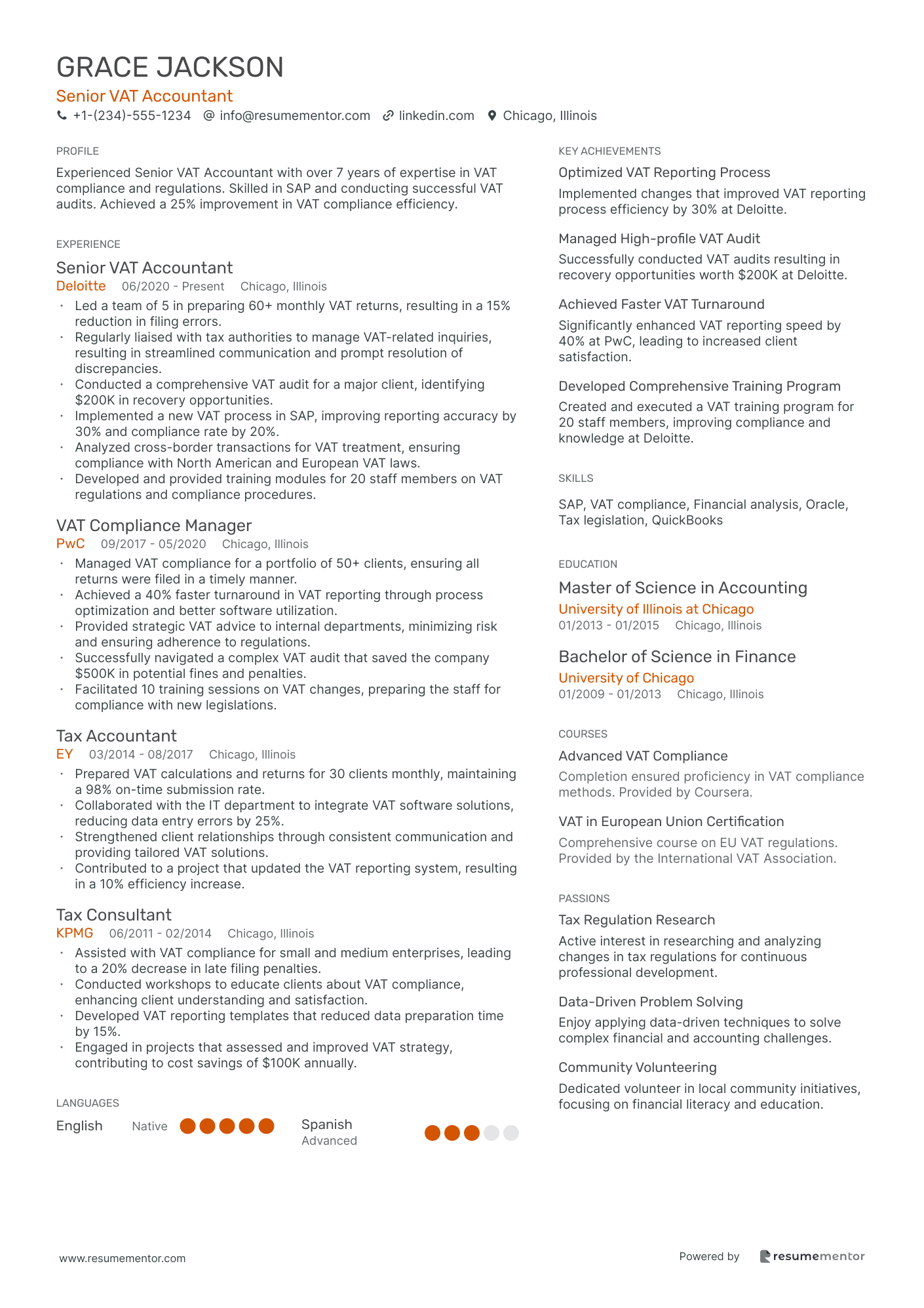

Senior VAT Accountant

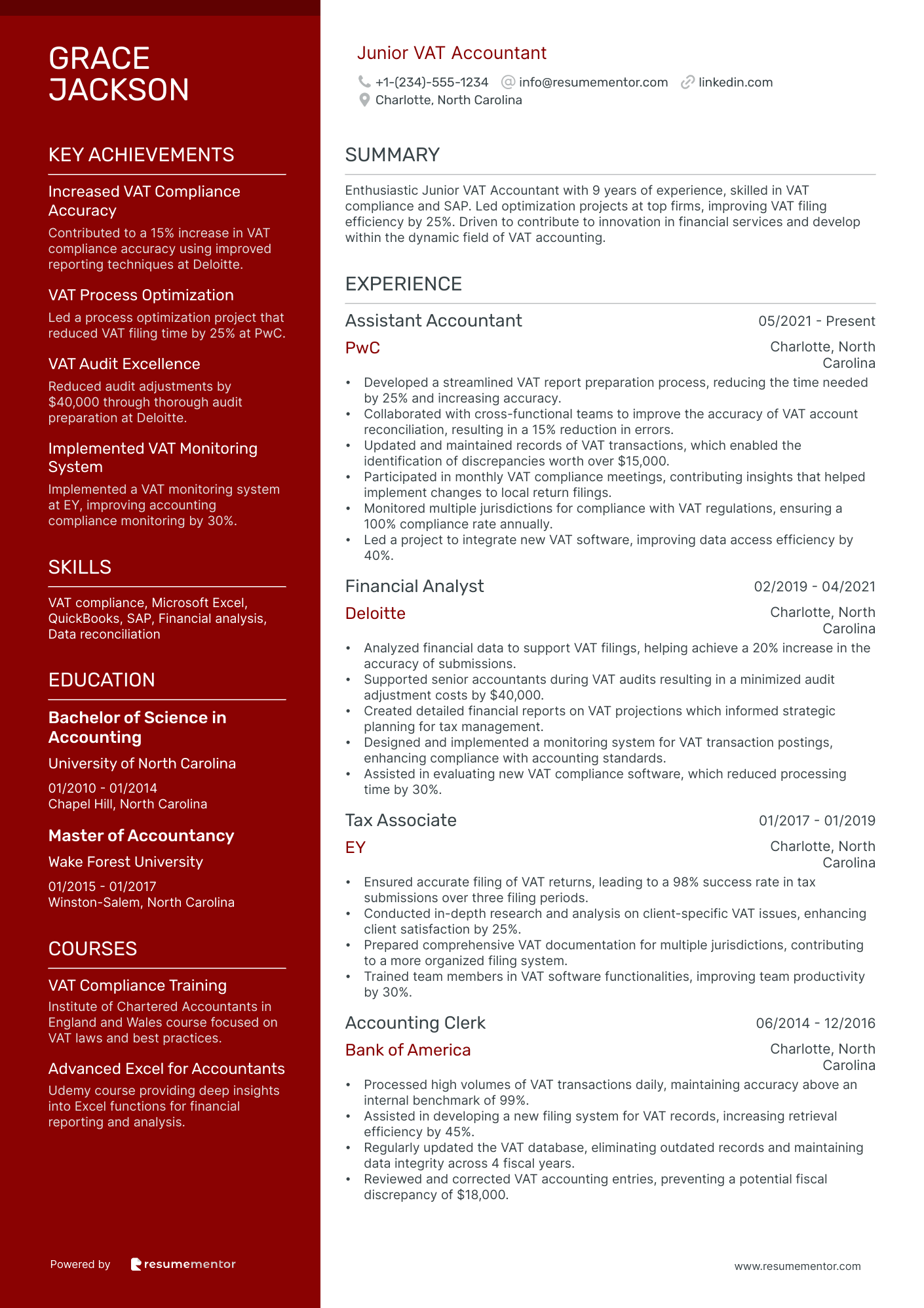

Junior VAT Accountant

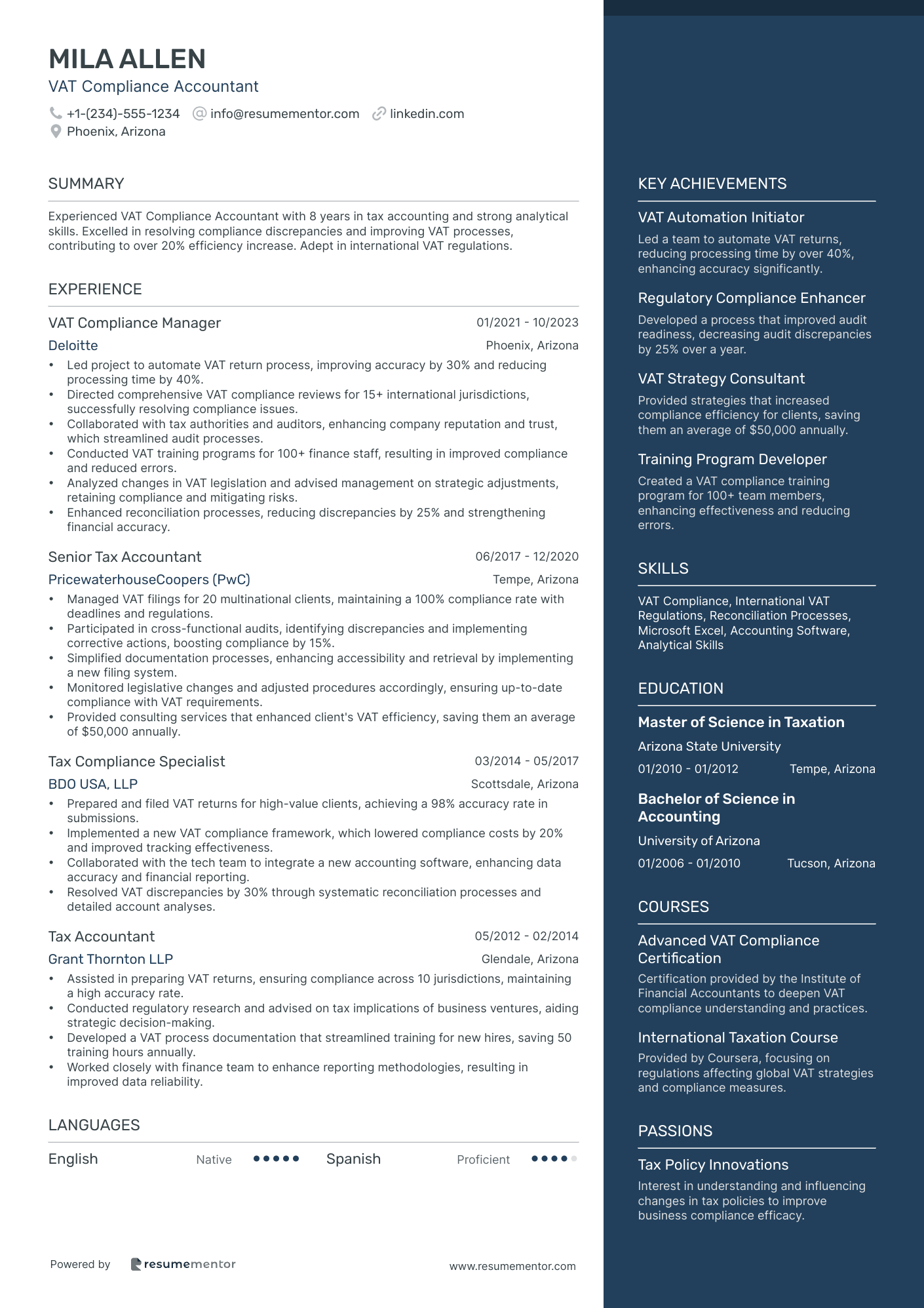

VAT Compliance Accountant resume sample

- •Led project to automate VAT return process, improving accuracy by 30% and reducing processing time by 40%.

- •Directed comprehensive VAT compliance reviews for 15+ international jurisdictions, successfully resolving compliance issues.

- •Collaborated with tax authorities and auditors, enhancing company reputation and trust, which streamlined audit processes.

- •Conducted VAT training programs for 100+ finance staff, resulting in improved compliance and reduced errors.

- •Analyzed changes in VAT legislation and advised management on strategic adjustments, retaining compliance and mitigating risks.

- •Enhanced reconciliation processes, reducing discrepancies by 25% and strengthening financial accuracy.

- •Managed VAT filings for 20 multinational clients, maintaining a 100% compliance rate with deadlines and regulations.

- •Participated in cross-functional audits, identifying discrepancies and implementing corrective actions, boosting compliance by 15%.

- •Simplified documentation processes, enhancing accessibility and retrieval by implementing a new filing system.

- •Monitored legislative changes and adjusted procedures accordingly, ensuring up-to-date compliance with VAT requirements.

- •Provided consulting services that enhanced client's VAT efficiency, saving them an average of $50,000 annually.

- •Prepared and filed VAT returns for high-value clients, achieving a 98% accuracy rate in submissions.

- •Implemented a new VAT compliance framework, which lowered compliance costs by 20% and improved tracking effectiveness.

- •Collaborated with the tech team to integrate a new accounting software, enhancing data accuracy and financial reporting.

- •Resolved VAT discrepancies by 30% through systematic reconciliation processes and detailed account analyses.

- •Assisted in preparing VAT returns, ensuring compliance across 10 jurisdictions, maintaining a high accuracy rate.

- •Conducted regulatory research and advised on tax implications of business ventures, aiding strategic decision-making.

- •Developed a VAT process documentation that streamlined training for new hires, saving 50 training hours annually.

- •Worked closely with finance team to enhance reporting methodologies, resulting in improved data reliability.

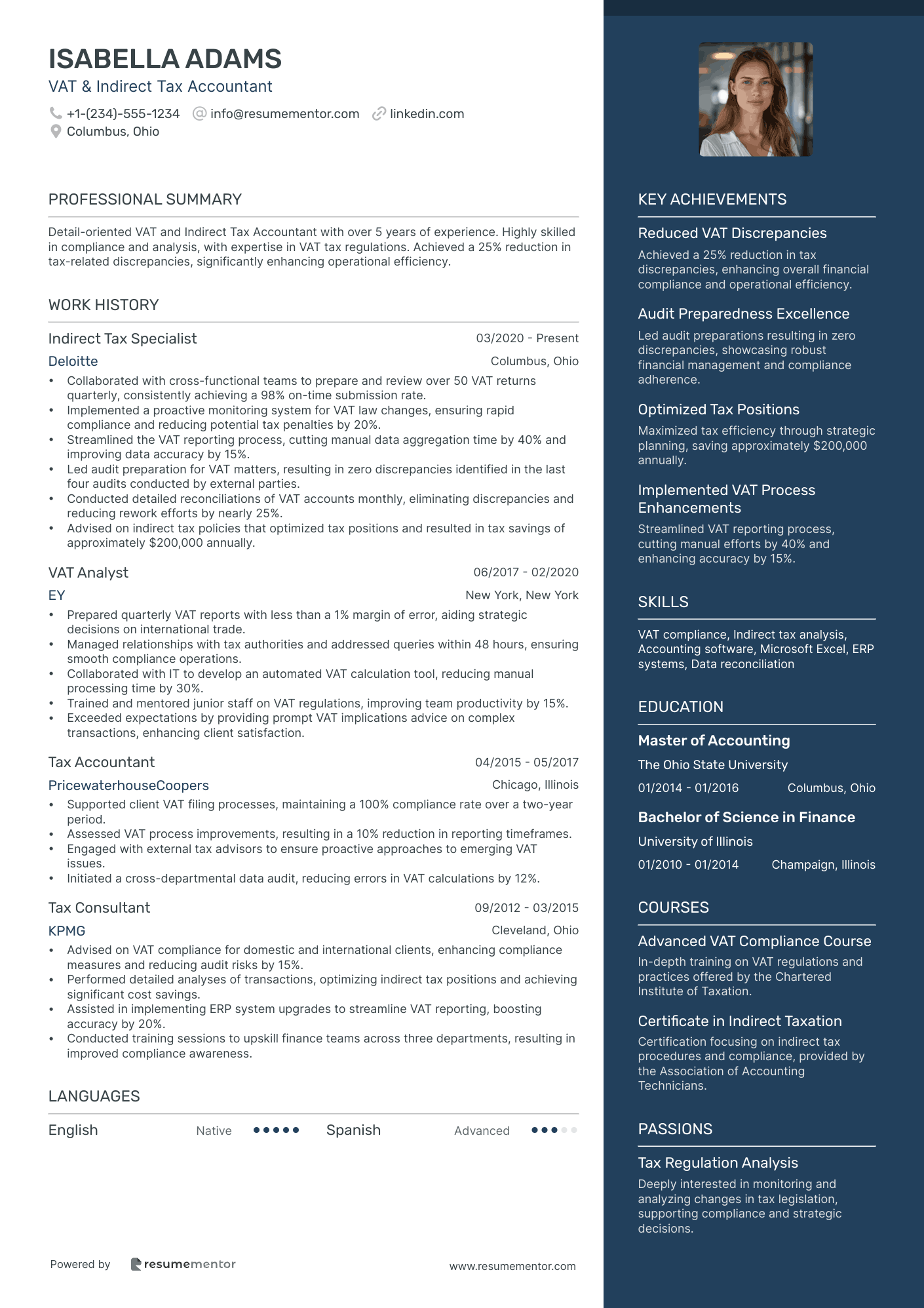

VAT & Indirect Tax Accountant resume sample

- •Collaborated with cross-functional teams to prepare and review over 50 VAT returns quarterly, consistently achieving a 98% on-time submission rate.

- •Implemented a proactive monitoring system for VAT law changes, ensuring rapid compliance and reducing potential tax penalties by 20%.

- •Streamlined the VAT reporting process, cutting manual data aggregation time by 40% and improving data accuracy by 15%.

- •Led audit preparation for VAT matters, resulting in zero discrepancies identified in the last four audits conducted by external parties.

- •Conducted detailed reconciliations of VAT accounts monthly, eliminating discrepancies and reducing rework efforts by nearly 25%.

- •Advised on indirect tax policies that optimized tax positions and resulted in tax savings of approximately $200,000 annually.

- •Prepared quarterly VAT reports with less than a 1% margin of error, aiding strategic decisions on international trade.

- •Managed relationships with tax authorities and addressed queries within 48 hours, ensuring smooth compliance operations.

- •Collaborated with IT to develop an automated VAT calculation tool, reducing manual processing time by 30%.

- •Trained and mentored junior staff on VAT regulations, improving team productivity by 15%.

- •Exceeded expectations by providing prompt VAT implications advice on complex transactions, enhancing client satisfaction.

- •Supported client VAT filing processes, maintaining a 100% compliance rate over a two-year period.

- •Assessed VAT process improvements, resulting in a 10% reduction in reporting timeframes.

- •Engaged with external tax advisors to ensure proactive approaches to emerging VAT issues.

- •Initiated a cross-departmental data audit, reducing errors in VAT calculations by 12%.

- •Advised on VAT compliance for domestic and international clients, enhancing compliance measures and reducing audit risks by 15%.

- •Performed detailed analyses of transactions, optimizing indirect tax positions and achieving significant cost savings.

- •Assisted in implementing ERP system upgrades to streamline VAT reporting, boosting accuracy by 20%.

- •Conducted training sessions to upskill finance teams across three departments, resulting in improved compliance awareness.

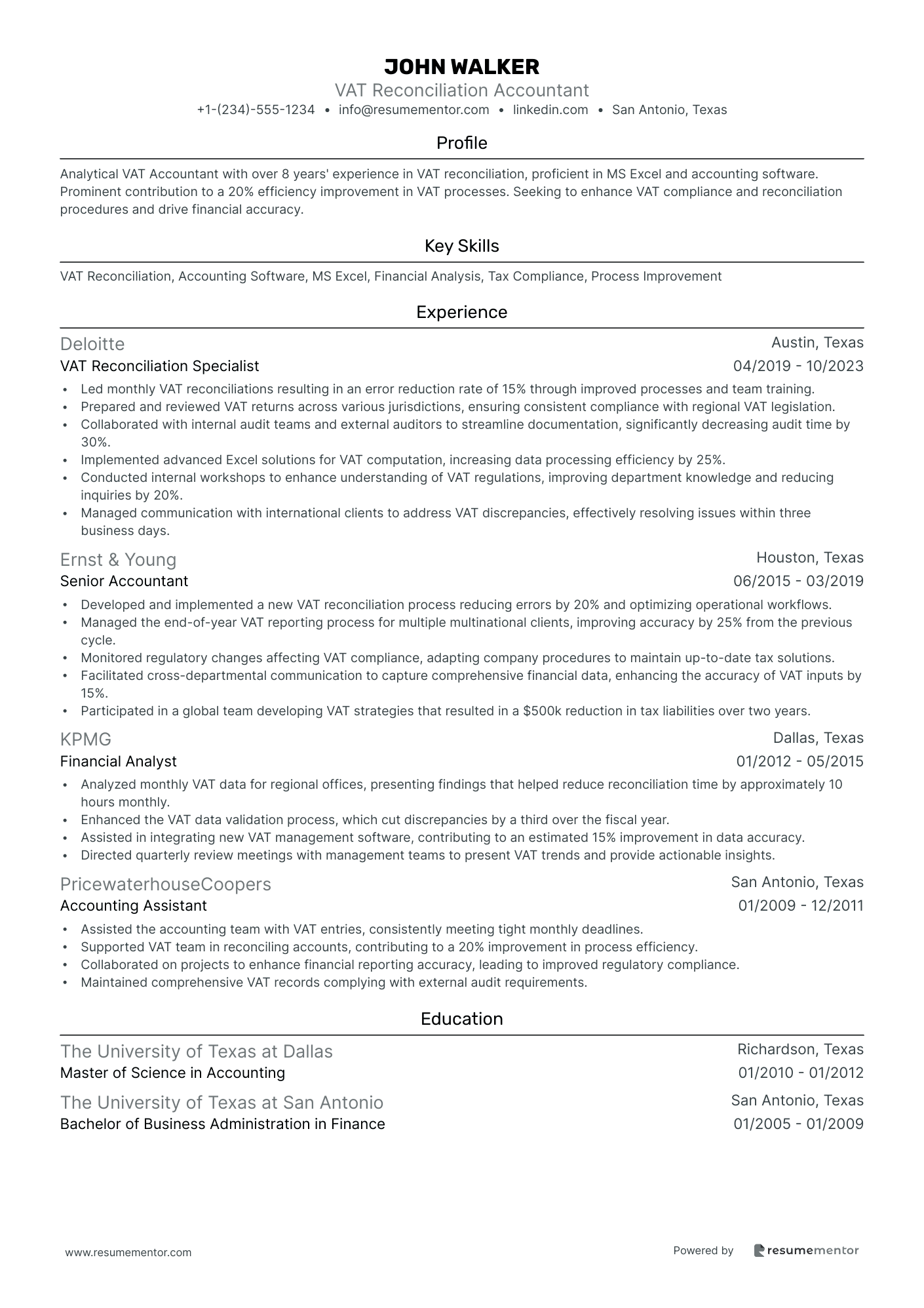

VAT Reconciliation Accountant resume sample

- •Led monthly VAT reconciliations resulting in an error reduction rate of 15% through improved processes and team training.

- •Prepared and reviewed VAT returns across various jurisdictions, ensuring consistent compliance with regional VAT legislation.

- •Collaborated with internal audit teams and external auditors to streamline documentation, significantly decreasing audit time by 30%.

- •Implemented advanced Excel solutions for VAT computation, increasing data processing efficiency by 25%.

- •Conducted internal workshops to enhance understanding of VAT regulations, improving department knowledge and reducing inquiries by 20%.

- •Managed communication with international clients to address VAT discrepancies, effectively resolving issues within three business days.

- •Developed and implemented a new VAT reconciliation process reducing errors by 20% and optimizing operational workflows.

- •Managed the end-of-year VAT reporting process for multiple multinational clients, improving accuracy by 25% from the previous cycle.

- •Monitored regulatory changes affecting VAT compliance, adapting company procedures to maintain up-to-date tax solutions.

- •Facilitated cross-departmental communication to capture comprehensive financial data, enhancing the accuracy of VAT inputs by 15%.

- •Participated in a global team developing VAT strategies that resulted in a $500k reduction in tax liabilities over two years.

- •Analyzed monthly VAT data for regional offices, presenting findings that helped reduce reconciliation time by approximately 10 hours monthly.

- •Enhanced the VAT data validation process, which cut discrepancies by a third over the fiscal year.

- •Assisted in integrating new VAT management software, contributing to an estimated 15% improvement in data accuracy.

- •Directed quarterly review meetings with management teams to present VAT trends and provide actionable insights.

- •Assisted the accounting team with VAT entries, consistently meeting tight monthly deadlines.

- •Supported VAT team in reconciling accounts, contributing to a 20% improvement in process efficiency.

- •Collaborated on projects to enhance financial reporting accuracy, leading to improved regulatory compliance.

- •Maintained comprehensive VAT records complying with external audit requirements.

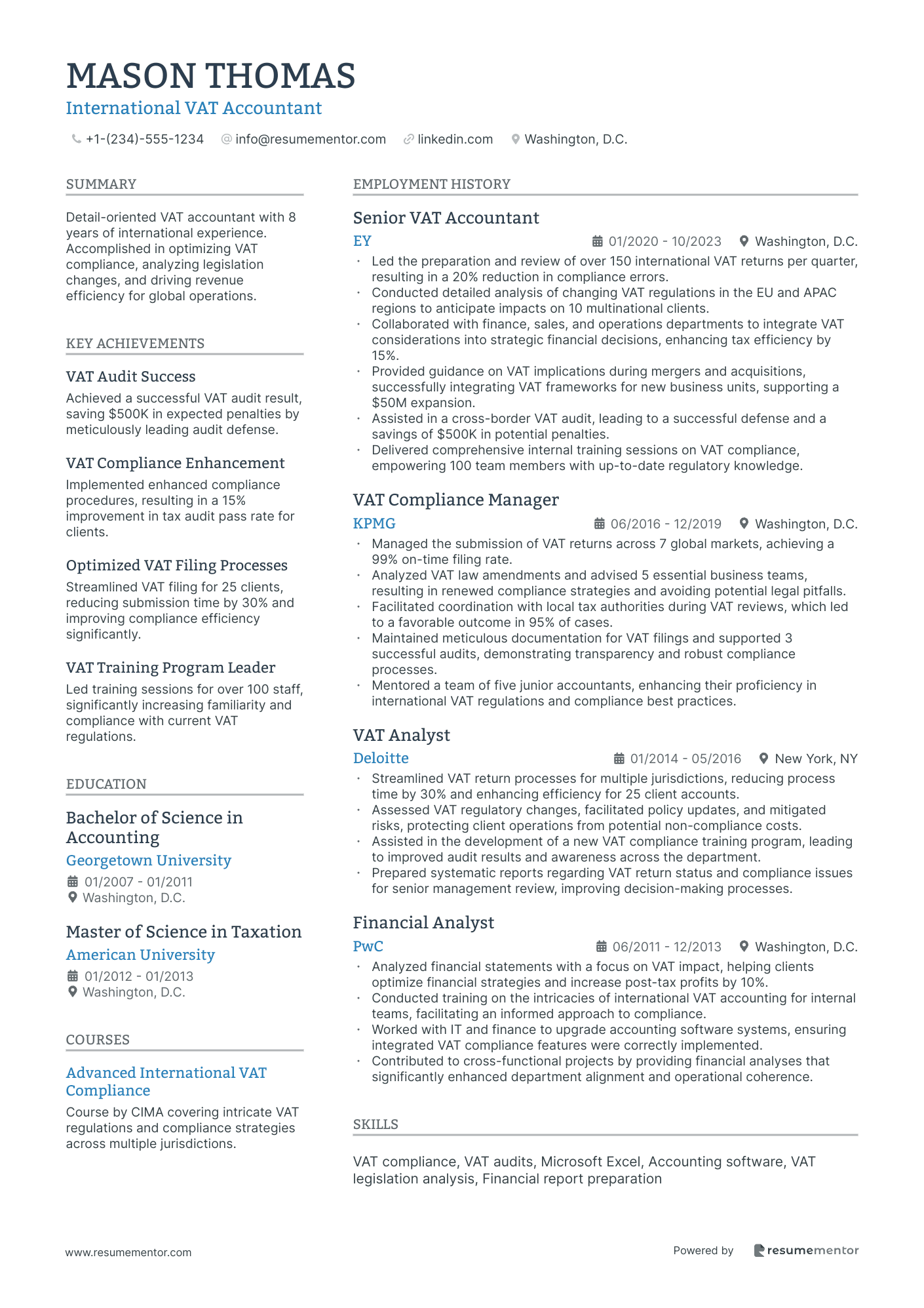

International VAT Accountant resume sample

- •Led the preparation and review of over 150 international VAT returns per quarter, resulting in a 20% reduction in compliance errors.

- •Conducted detailed analysis of changing VAT regulations in the EU and APAC regions to anticipate impacts on 10 multinational clients.

- •Collaborated with finance, sales, and operations departments to integrate VAT considerations into strategic financial decisions, enhancing tax efficiency by 15%.

- •Provided guidance on VAT implications during mergers and acquisitions, successfully integrating VAT frameworks for new business units, supporting a $50M expansion.

- •Assisted in a cross-border VAT audit, leading to a successful defense and a savings of $500K in potential penalties.

- •Delivered comprehensive internal training sessions on VAT compliance, empowering 100 team members with up-to-date regulatory knowledge.

- •Managed the submission of VAT returns across 7 global markets, achieving a 99% on-time filing rate.

- •Analyzed VAT law amendments and advised 5 essential business teams, resulting in renewed compliance strategies and avoiding potential legal pitfalls.

- •Facilitated coordination with local tax authorities during VAT reviews, which led to a favorable outcome in 95% of cases.

- •Maintained meticulous documentation for VAT filings and supported 3 successful audits, demonstrating transparency and robust compliance processes.

- •Mentored a team of five junior accountants, enhancing their proficiency in international VAT regulations and compliance best practices.

- •Streamlined VAT return processes for multiple jurisdictions, reducing process time by 30% and enhancing efficiency for 25 client accounts.

- •Assessed VAT regulatory changes, facilitated policy updates, and mitigated risks, protecting client operations from potential non-compliance costs.

- •Assisted in the development of a new VAT compliance training program, leading to improved audit results and awareness across the department.

- •Prepared systematic reports regarding VAT return status and compliance issues for senior management review, improving decision-making processes.

- •Analyzed financial statements with a focus on VAT impact, helping clients optimize financial strategies and increase post-tax profits by 10%.

- •Conducted training on the intricacies of international VAT accounting for internal teams, facilitating an informed approach to compliance.

- •Worked with IT and finance to upgrade accounting software systems, ensuring integrated VAT compliance features were correctly implemented.

- •Contributed to cross-functional projects by providing financial analyses that significantly enhanced department alignment and operational coherence.

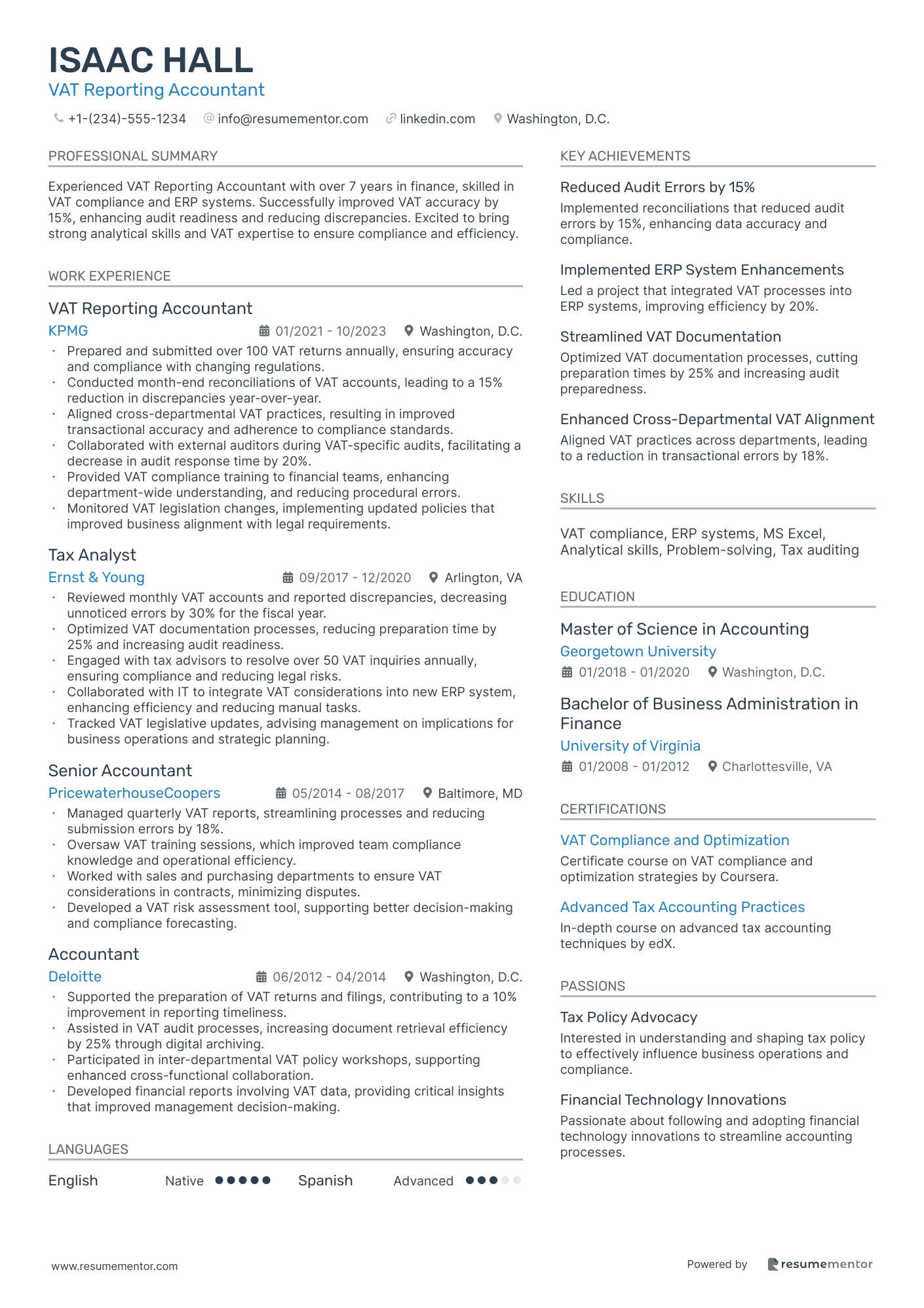

VAT Reporting Accountant resume sample

- •Prepared and submitted over 100 VAT returns annually, ensuring accuracy and compliance with changing regulations.

- •Conducted month-end reconciliations of VAT accounts, leading to a 15% reduction in discrepancies year-over-year.

- •Aligned cross-departmental VAT practices, resulting in improved transactional accuracy and adherence to compliance standards.

- •Collaborated with external auditors during VAT-specific audits, facilitating a decrease in audit response time by 20%.

- •Provided VAT compliance training to financial teams, enhancing department-wide understanding, and reducing procedural errors.

- •Monitored VAT legislation changes, implementing updated policies that improved business alignment with legal requirements.

- •Reviewed monthly VAT accounts and reported discrepancies, decreasing unnoticed errors by 30% for the fiscal year.

- •Optimized VAT documentation processes, reducing preparation time by 25% and increasing audit readiness.

- •Engaged with tax advisors to resolve over 50 VAT inquiries annually, ensuring compliance and reducing legal risks.

- •Collaborated with IT to integrate VAT considerations into new ERP system, enhancing efficiency and reducing manual tasks.

- •Tracked VAT legislative updates, advising management on implications for business operations and strategic planning.

- •Managed quarterly VAT reports, streamlining processes and reducing submission errors by 18%.

- •Oversaw VAT training sessions, which improved team compliance knowledge and operational efficiency.

- •Worked with sales and purchasing departments to ensure VAT considerations in contracts, minimizing disputes.

- •Developed a VAT risk assessment tool, supporting better decision-making and compliance forecasting.

- •Supported the preparation of VAT returns and filings, contributing to a 10% improvement in reporting timeliness.

- •Assisted in VAT audit processes, increasing document retrieval efficiency by 25% through digital archiving.

- •Participated in inter-departmental VAT policy workshops, supporting enhanced cross-functional collaboration.

- •Developed financial reports involving VAT data, providing critical insights that improved management decision-making.

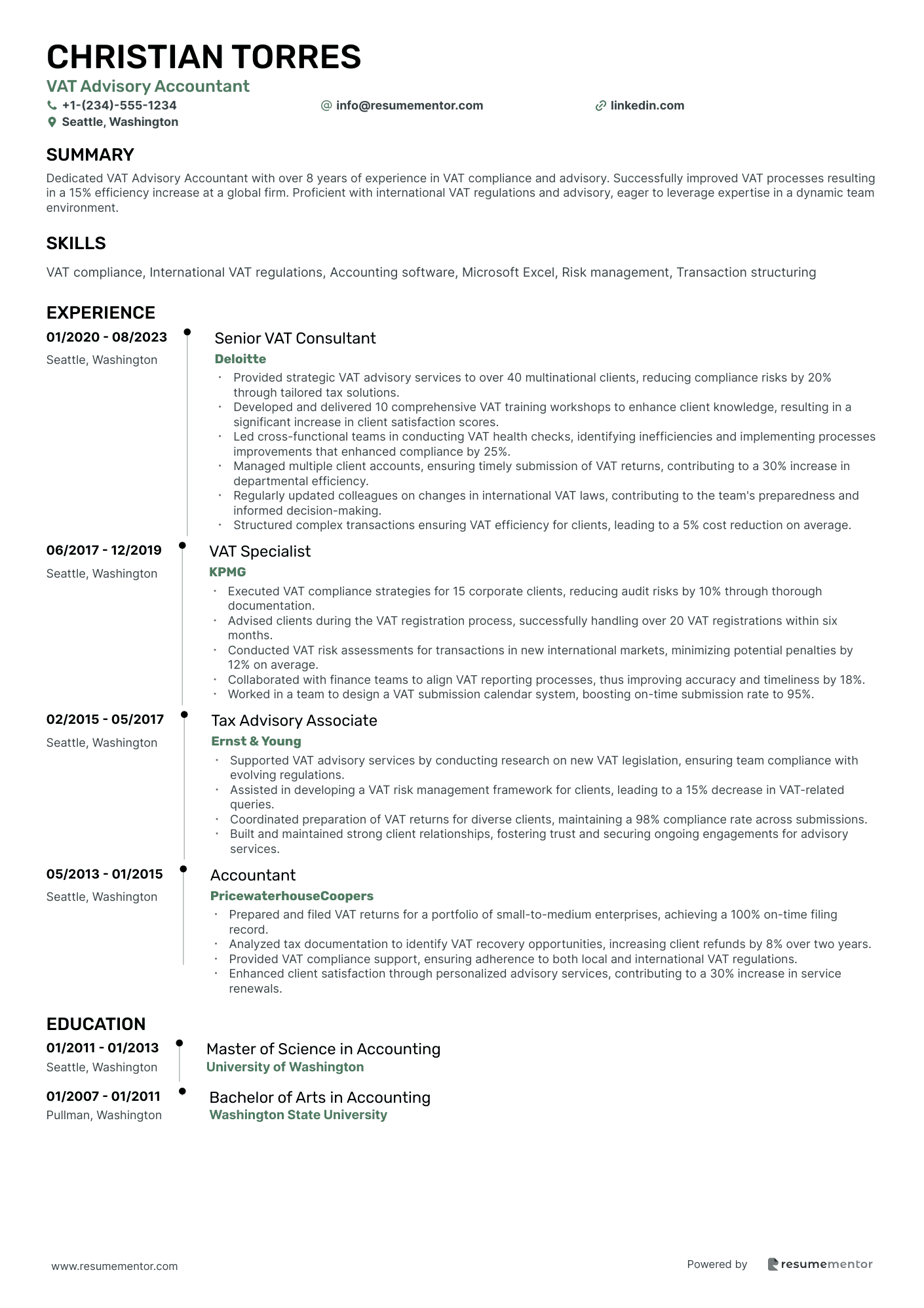

VAT Advisory Accountant resume sample

- •Provided strategic VAT advisory services to over 40 multinational clients, reducing compliance risks by 20% through tailored tax solutions.

- •Developed and delivered 10 comprehensive VAT training workshops to enhance client knowledge, resulting in a significant increase in client satisfaction scores.

- •Led cross-functional teams in conducting VAT health checks, identifying inefficiencies and implementing processes improvements that enhanced compliance by 25%.

- •Managed multiple client accounts, ensuring timely submission of VAT returns, contributing to a 30% increase in departmental efficiency.

- •Regularly updated colleagues on changes in international VAT laws, contributing to the team's preparedness and informed decision-making.

- •Structured complex transactions ensuring VAT efficiency for clients, leading to a 5% cost reduction on average.

- •Executed VAT compliance strategies for 15 corporate clients, reducing audit risks by 10% through thorough documentation.

- •Advised clients during the VAT registration process, successfully handling over 20 VAT registrations within six months.

- •Conducted VAT risk assessments for transactions in new international markets, minimizing potential penalties by 12% on average.

- •Collaborated with finance teams to align VAT reporting processes, thus improving accuracy and timeliness by 18%.

- •Worked in a team to design a VAT submission calendar system, boosting on-time submission rate to 95%.

- •Supported VAT advisory services by conducting research on new VAT legislation, ensuring team compliance with evolving regulations.

- •Assisted in developing a VAT risk management framework for clients, leading to a 15% decrease in VAT-related queries.

- •Coordinated preparation of VAT returns for diverse clients, maintaining a 98% compliance rate across submissions.

- •Built and maintained strong client relationships, fostering trust and securing ongoing engagements for advisory services.

- •Prepared and filed VAT returns for a portfolio of small-to-medium enterprises, achieving a 100% on-time filing record.

- •Analyzed tax documentation to identify VAT recovery opportunities, increasing client refunds by 8% over two years.

- •Provided VAT compliance support, ensuring adherence to both local and international VAT regulations.

- •Enhanced client satisfaction through personalized advisory services, contributing to a 30% increase in service renewals.

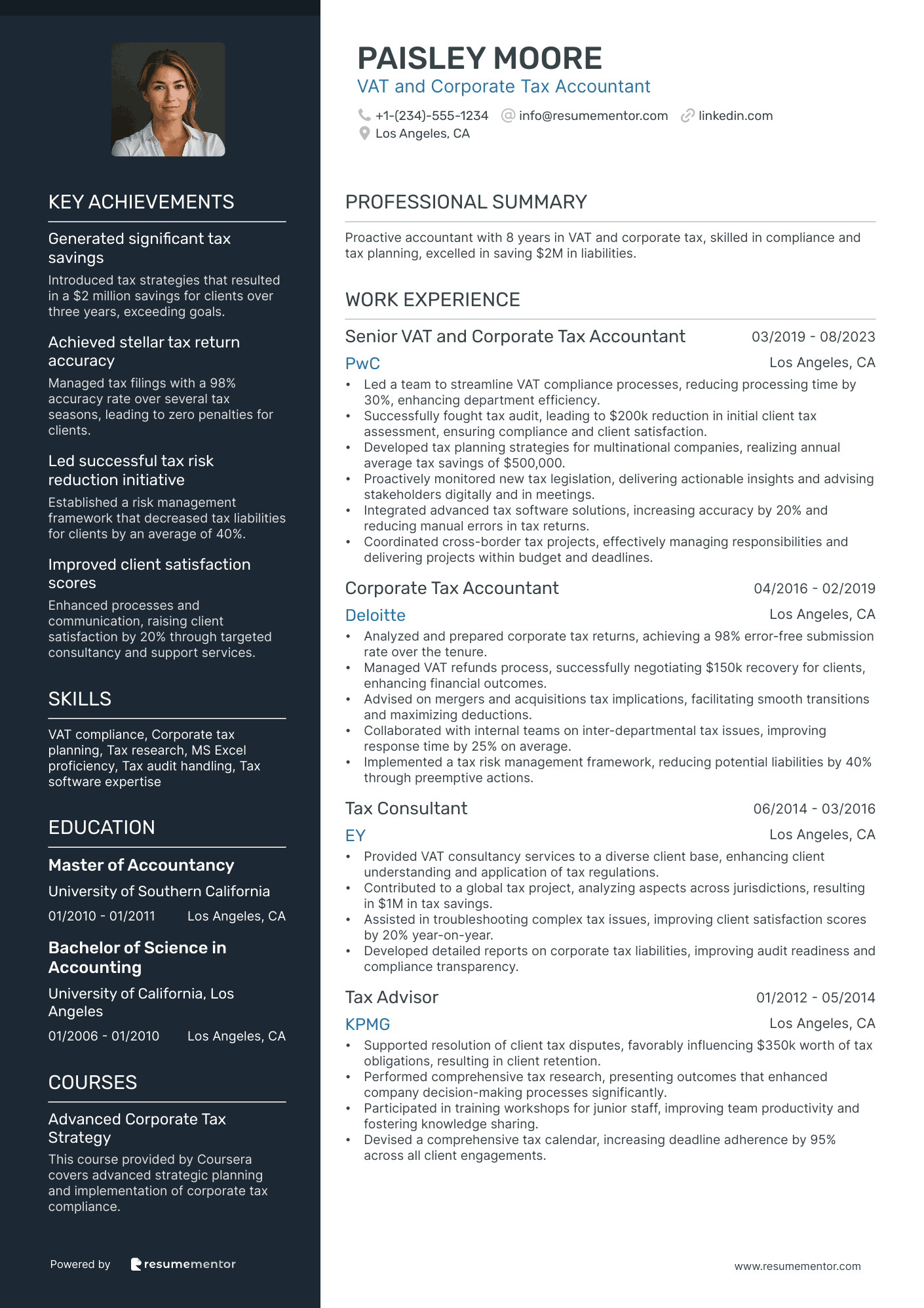

VAT and Corporate Tax Accountant resume sample

- •Led a team to streamline VAT compliance processes, reducing processing time by 30%, enhancing department efficiency.

- •Successfully fought tax audit, leading to $200k reduction in initial client tax assessment, ensuring compliance and client satisfaction.

- •Developed tax planning strategies for multinational companies, realizing annual average tax savings of $500,000.

- •Proactively monitored new tax legislation, delivering actionable insights and advising stakeholders digitally and in meetings.

- •Integrated advanced tax software solutions, increasing accuracy by 20% and reducing manual errors in tax returns.

- •Coordinated cross-border tax projects, effectively managing responsibilities and delivering projects within budget and deadlines.

- •Analyzed and prepared corporate tax returns, achieving a 98% error-free submission rate over the tenure.

- •Managed VAT refunds process, successfully negotiating $150k recovery for clients, enhancing financial outcomes.

- •Advised on mergers and acquisitions tax implications, facilitating smooth transitions and maximizing deductions.

- •Collaborated with internal teams on inter-departmental tax issues, improving response time by 25% on average.

- •Implemented a tax risk management framework, reducing potential liabilities by 40% through preemptive actions.

- •Provided VAT consultancy services to a diverse client base, enhancing client understanding and application of tax regulations.

- •Contributed to a global tax project, analyzing aspects across jurisdictions, resulting in $1M in tax savings.

- •Assisted in troubleshooting complex tax issues, improving client satisfaction scores by 20% year-on-year.

- •Developed detailed reports on corporate tax liabilities, improving audit readiness and compliance transparency.

- •Supported resolution of client tax disputes, favorably influencing $350k worth of tax obligations, resulting in client retention.

- •Performed comprehensive tax research, presenting outcomes that enhanced company decision-making processes significantly.

- •Participated in training workshops for junior staff, improving team productivity and fostering knowledge sharing.

- •Devised a comprehensive tax calendar, increasing deadline adherence by 95% across all client engagements.

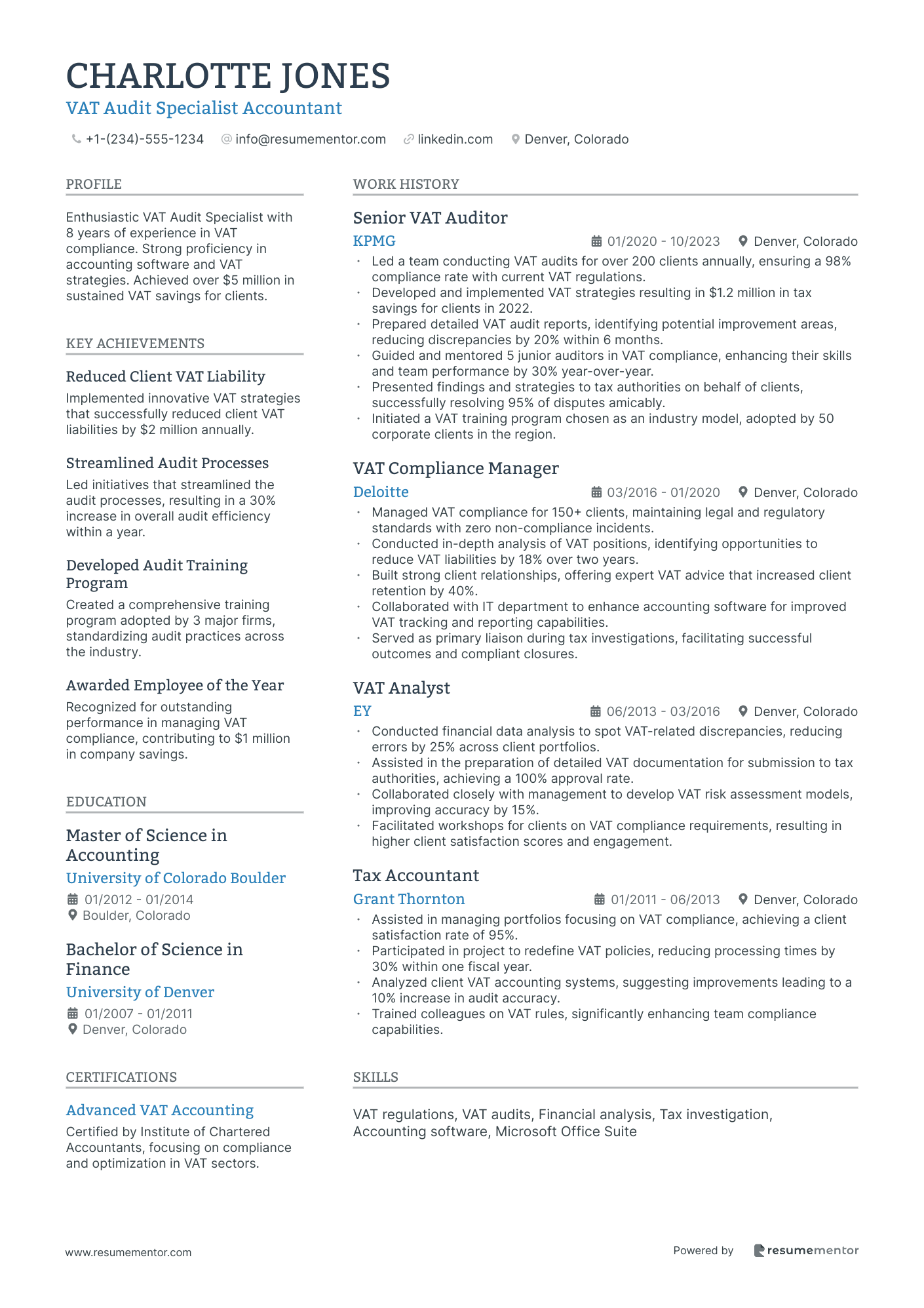

VAT Audit Specialist Accountant resume sample

- •Led a team conducting VAT audits for over 200 clients annually, ensuring a 98% compliance rate with current VAT regulations.

- •Developed and implemented VAT strategies resulting in $1.2 million in tax savings for clients in 2022.

- •Prepared detailed VAT audit reports, identifying potential improvement areas, reducing discrepancies by 20% within 6 months.

- •Guided and mentored 5 junior auditors in VAT compliance, enhancing their skills and team performance by 30% year-over-year.

- •Presented findings and strategies to tax authorities on behalf of clients, successfully resolving 95% of disputes amicably.

- •Initiated a VAT training program chosen as an industry model, adopted by 50 corporate clients in the region.

- •Managed VAT compliance for 150+ clients, maintaining legal and regulatory standards with zero non-compliance incidents.

- •Conducted in-depth analysis of VAT positions, identifying opportunities to reduce VAT liabilities by 18% over two years.

- •Built strong client relationships, offering expert VAT advice that increased client retention by 40%.

- •Collaborated with IT department to enhance accounting software for improved VAT tracking and reporting capabilities.

- •Served as primary liaison during tax investigations, facilitating successful outcomes and compliant closures.

- •Conducted financial data analysis to spot VAT-related discrepancies, reducing errors by 25% across client portfolios.

- •Assisted in the preparation of detailed VAT documentation for submission to tax authorities, achieving a 100% approval rate.

- •Collaborated closely with management to develop VAT risk assessment models, improving accuracy by 15%.

- •Facilitated workshops for clients on VAT compliance requirements, resulting in higher client satisfaction scores and engagement.

- •Assisted in managing portfolios focusing on VAT compliance, achieving a client satisfaction rate of 95%.

- •Participated in project to redefine VAT policies, reducing processing times by 30% within one fiscal year.

- •Analyzed client VAT accounting systems, suggesting improvements leading to a 10% increase in audit accuracy.

- •Trained colleagues on VAT rules, significantly enhancing team compliance capabilities.

Senior VAT Accountant resume sample

- •Led a team of 5 in preparing 60+ monthly VAT returns, resulting in a 15% reduction in filing errors.

- •Regularly liaised with tax authorities to manage VAT-related inquiries, resulting in streamlined communication and prompt resolution of discrepancies.

- •Conducted a comprehensive VAT audit for a major client, identifying $200K in recovery opportunities.

- •Implemented a new VAT process in SAP, improving reporting accuracy by 30% and compliance rate by 20%.

- •Analyzed cross-border transactions for VAT treatment, ensuring compliance with North American and European VAT laws.

- •Developed and provided training modules for 20 staff members on VAT regulations and compliance procedures.

- •Managed VAT compliance for a portfolio of 50+ clients, ensuring all returns were filed in a timely manner.

- •Achieved a 40% faster turnaround in VAT reporting through process optimization and better software utilization.

- •Provided strategic VAT advice to internal departments, minimizing risk and ensuring adherence to regulations.

- •Successfully navigated a complex VAT audit that saved the company $500K in potential fines and penalties.

- •Facilitated 10 training sessions on VAT changes, preparing the staff for compliance with new legislations.

- •Prepared VAT calculations and returns for 30 clients monthly, maintaining a 98% on-time submission rate.

- •Collaborated with the IT department to integrate VAT software solutions, reducing data entry errors by 25%.

- •Strengthened client relationships through consistent communication and providing tailored VAT solutions.

- •Contributed to a project that updated the VAT reporting system, resulting in a 10% efficiency increase.

- •Assisted with VAT compliance for small and medium enterprises, leading to a 20% decrease in late filing penalties.

- •Conducted workshops to educate clients about VAT compliance, enhancing client understanding and satisfaction.

- •Developed VAT reporting templates that reduced data preparation time by 15%.

- •Engaged in projects that assessed and improved VAT strategy, contributing to cost savings of $100K annually.

Junior VAT Accountant resume sample

- •Developed a streamlined VAT report preparation process, reducing the time needed by 25% and increasing accuracy.

- •Collaborated with cross-functional teams to improve the accuracy of VAT account reconciliation, resulting in a 15% reduction in errors.

- •Updated and maintained records of VAT transactions, which enabled the identification of discrepancies worth over $15,000.

- •Participated in monthly VAT compliance meetings, contributing insights that helped implement changes to local return filings.

- •Monitored multiple jurisdictions for compliance with VAT regulations, ensuring a 100% compliance rate annually.

- •Led a project to integrate new VAT software, improving data access efficiency by 40%.

- •Analyzed financial data to support VAT filings, helping achieve a 20% increase in the accuracy of submissions.

- •Supported senior accountants during VAT audits resulting in a minimized audit adjustment costs by $40,000.

- •Created detailed financial reports on VAT projections which informed strategic planning for tax management.

- •Designed and implemented a monitoring system for VAT transaction postings, enhancing compliance with accounting standards.

- •Assisted in evaluating new VAT compliance software, which reduced processing time by 30%.

- •Ensured accurate filing of VAT returns, leading to a 98% success rate in tax submissions over three filing periods.

- •Conducted in-depth research and analysis on client-specific VAT issues, enhancing client satisfaction by 25%.

- •Prepared comprehensive VAT documentation for multiple jurisdictions, contributing to a more organized filing system.

- •Trained team members in VAT software functionalities, improving team productivity by 30%.

- •Processed high volumes of VAT transactions daily, maintaining accuracy above an internal benchmark of 99%.

- •Assisted in developing a new filing system for VAT records, increasing retrieval efficiency by 45%.

- •Regularly updated the VAT database, eliminating outdated records and maintaining data integrity across 4 fiscal years.

- •Reviewed and corrected VAT accounting entries, preventing a potential fiscal discrepancy of $18,000.

Crafting a resume as a VAT accountant can feel like navigating a maze of tax regulations. While your job demands precision and a deep understanding of VAT laws, translating these skills onto paper can be challenging. It’s essential to express your knack for detail, analytical skills, and thorough knowledge in a way that resonates.

Your resume should do more than list jobs; it should vividly spotlight your success in tax audits, compliance advisories, and financial assessments. Many people struggle with presenting their expertise clearly, but that's where using a well-structured resume template can make a difference. By utilizing the right resume templates, you can effectively highlight your achievements without getting bogged down by layout concerns.

Employers want to see evidence of your ability to handle VAT challenges with ease. Therefore, your resume should seamlessly blend your expertise with your problem-solving capabilities. Keeping it clear and concise is key—it's about showing depth while ensuring your resume stands out in a competitive field.

Key Takeaways

- Creating a strong VAT accountant resume requires highlighting your expertise in tax compliance, audits, and financial assessments, while presenting these in a clear and concise manner.

- A chronological resume format effectively showcases your career growth and relevant experiences in managing VAT-related responsibilities.

- Inclusion of specific and measurable achievements in your experience section, using action-oriented language, is crucial to demonstrate your impact and contributions.

- Highlighting both hard skills, like tax software proficiency and financial reporting, as well as soft skills like communication and analytical thinking, strengthens your profile.

- Adding certifications and relevant education details, such as degrees in accounting, further validates your qualifications and commitment to the field.

What to focus on when writing your VAT accountant resume

Your VAT accountant resume should clearly convey your expertise in managing value-added tax, ensuring compliance, and handling reporting tasks seamlessly. As you outline your skills and experiences, demonstrate how you've effectively tackled complex tax issues by articulating your ability to manage audits and optimize tax processes smoothly.

How to structure your VAT accountant resume

- Contact Information: Start with your name, phone number, email address, and LinkedIn profile—make sure all details are accurate to present a professional image that gives recruiters immediate access to reach you. A consistent format and professional email address help make a positive first impression.

- Professional Summary: Follow with a brief overview of your VAT accounting experience—highlight key achievements and any relevant certifications or licenses. This section is crucial for grabbing the recruiter's attention right away, offering a snapshot of what you bring to the table, and setting the stage for the detailed sections that follow.

- Experience: List your VAT accounting roles in reverse chronological order, focusing on responsibilities like VAT analysis and audit preparation. Detail specific achievements such as reducing tax liabilities or enhancing compliance accuracy—these accomplishments reinforce your capability and impact, showing the recruiter how you have contributed to previous employers' success.

- Education: Detail your degrees in accounting or finance, then highlight any additional studies or coursework related to taxation. This underscores your educational background and demonstrates a solid foundation that supports your VAT expertise.

- Skills: Emphasize abilities like VAT regulation compliance, proficiency with tax software, audit management, and financial reporting—ensure these reflect your specific strengths and align with your professional narrative. Tailor these skills to the job description to show you're a perfect fit for the role.

- Certifications: Wrap up with relevant certifications like CPA or CMA, including any specific to VAT or tax expertise—these accreditations underline your professional standards and commitment to staying current in the field.

Now that you've got an overview of what each section should communicate, we’ll cover each in more depth to help format your resume effectively and boost its impact.

Which resume format to choose

As a VAT accountant, the way you present your resume can significantly impact how potential employers perceive your expertise. The chronological format is particularly effective for this role because it underscores your extensive experience and career growth in a structured manner. By listing your positions in order, you allow employers to easily trace your professional journey, showcasing your reliability and competence in managing VAT-related responsibilities over time.

When it comes to font selection, a modern and professional typeface can subtly enhance your resume's appearance without distracting from the content. Choosing fonts like Lato, Montserrat, or Raleway offers a clean and appealing look that supports readability and keeps the focus on your accomplishments and skills rather than the styling. This minimalistic approach aligns with the precision and clarity valued in accounting roles.

Saving your resume as a PDF is crucial for ensuring that the format stays consistent regardless of where it’s viewed. This reliability projects a sense of professionalism crucial in tax-related fields, where accuracy and attention to detail are paramount. A PDF also protects your resume from unintentional edits or format shifts that could compromise the presentation of your meticulous work history.

Consistent one-inch margins provide a polished frame for your resume, giving each section room to breathe. This balance of text and white space not only makes your resume more visually appealing but also aligns with the methodical nature of accounting. It allows the key experiences and credentials to stand out, making it easier for hiring managers to digest the critical information.

Together, these elements contribute to a well-constructed resume that effectively communicates your skills, experience, and professionalism as a VAT accountant, setting the stage for a successful job application.

How to write a quantifiable resume experience section

A standout VAT accountant experience section emphasizes your real achievements and the outcomes you've delivered. Rather than listing duties, it showcases how you've made a tangible impact and highlights your specialized expertise. To create a clear narrative, organize your experience in reverse chronological order, starting with your most recent position. Cover approximately the last 10-15 years of your career unless earlier experience directly aligns with the role you're pursuing. When tailoring your resume, incorporate relevant keywords and skills to seamlessly align with the job description and employer expectations. Strong action verbs like "optimized," "implemented," "managed," and "analyzed" help to vividly convey your significant contributions.

Here's an example of a strong VAT accountant experience entry:

- •Implemented VAT process efficiencies, reducing reporting time by 30% within one year.

- •Managed VAT audits and successfully reduced potential penalties by $500,000 through strategic compliance initiatives.

- •Led a team to optimize the VAT recovery process, increasing recoveries by 20% annually.

- •Provided VAT advisory to cross-functional teams, resulting in tax savings of over $1 million.

This VAT accountant experience section stands out by weaving together specific, measurable achievements that demonstrate your contributions in a cohesive manner. By highlighting skills in saving money, leading teams, and optimizing processes, you paint a picture of yourself as a valuable asset to any employer. Each bullet flows into the next, building a narrative of continued success and improvement. Tailoring your resume to reflect the job description while providing concrete results ensures that you effectively communicate your value to potential employers.

Achievement-Focused resume experience section

An achievement-focused VAT accountant resume experience section should clearly demonstrate your skills in tax compliance and financial analysis while weaving in your strengths in teamwork and leadership. Start by identifying accomplishments that not only highlight your ability to streamline processes but also improve efficiency and ensure compliance with tax regulations. Use dynamic, action-oriented language to present your responsibilities, ensuring that you emphasize quantifiable successes that underline your impact. Showcasing your project management skills and leadership capacity is also important, as it underscores your ability to deliver accurate results under pressure.

Keep your descriptions concise and directly related to your experience, creating a seamless narrative of career progress and achievements. This approach will help potential employers understand the skills and value you bring to their organization. Here's how to structure this information effectively:

VAT Accountant

XYZ Tax Solutions

June 2019 - Present

- Enhanced VAT return process efficiency, cutting processing time by 20% through improved methods.

- Led a team to fix filing discrepancies, achieving a 100% compliance rate with tax authorities.

- Created training sessions for accounting staff, increasing their understanding of VAT regulations by 30%.

- Upgraded internal reporting systems, making financial data more accurate and clearer for management.

Innovation-Focused resume experience section

An Innovation-Focused VAT accountant resume experience section should emphasize your capacity to transform financial systems and drive improvements. Focus on instances where you have introduced innovative procedures, embraced new technology, or developed tools to enhance efficiency and accuracy. Your ability to collaborate with different departments to bring about these advancements is also crucial.

Start by clearly defining your role and achievements in an engaging manner, using active verbs to highlight your involvement. Use specific examples of your accomplishments and back them with measurable results to convey your impact. This cohesive approach not only demonstrates your strategic contribution but also showcases your continuous growth, making a compelling case for future employers.

VAT Accountant

FinanceCorp Solutions

2018 - 2022

- Created an automated VAT calculation system that decreased errors by 30%, saving 10 hours of manual work weekly.

- Led a team across departments to streamline VAT submission processes, boosting efficiency by 25%.

- Designed a training module on new VAT regulations, enhancing team compliance knowledge throughout the department.

- Worked with developers to build a real-time VAT dashboard, providing immediate data insights and improving decision-making.

Skills-Focused resume experience section

A skills-focused VAT accountant resume experience section should clearly highlight the abilities and achievements that qualify you for the role. Start by identifying the essential skills, such as tax compliance, financial analysis, and reporting, and then tie these skills to your real-world achievements to showcase their relevance. Begin each bullet point with an action verb to make your tasks and accomplishments clear and easy to understand.

Each bullet point should reflect a crucial skill for a VAT accountant, with a focus on results and impact. For example, if you implemented a new software system that improved reporting efficiency, be sure to detail the specific improvements and outcomes. This method allows potential employers to easily grasp how your skills effectively translate into tangible benefits.

VAT Accountant

Accurate Tax Solutions

June 2020 – Present

- Streamlined VAT reporting process, reducing filing errors by 20% through new software implementation.

- Conducted detailed financial analyses that supported successful audits, saving the company from penalties.

- Developed training materials and workshops for junior accountants, improving team efficiency by 15%.

- Collaborated with cross-functional teams to ensure compliance with latest tax regulations and laws.

Collaboration-Focused resume experience section

A collaboration-focused VAT accountant resume experience section should effectively highlight your ability to work well with others and your strong communication skills. Begin by sharing experiences where you played a key role in projects requiring teamwork across departments or with external partners, and describe how your contributions made an impact. Your efforts in improving processes or tackling challenges should be clearly outlined, emphasizing how you facilitated better team efficiency or enhanced customer satisfaction.

Craft your descriptions to showcase your skill in effectively connecting and communicating with colleagues and partners. Use clear, active language to illustrate how you contributed to successful outcomes. When you describe process improvements or the solutions you implemented for VAT-related issues, specify the actions you took and highlight your collaborative efforts. Focus on tangible results that demonstrate the value of your teamwork and how it benefited your company or clients.

VAT Accountant

Global Finance Corp

June 2020 - Present

- Worked with finance and operations teams to streamline VAT reporting, reducing errors by 15%.

- Led cross-functional meetings to align VAT compliance strategies with departmental goals, improving efficiency.

- Collaborated with external auditors to ensure accurate and timely submission of VAT returns.

- Supported team training sessions to improve knowledge of VAT regulations, enhancing team performance.

Write your VAT accountant resume summary section

A VAT-focused accountant resume summary should emphasize your skills and experience in tax regulation and compliance. As a VAT accountant, presenting this expertise effectively is crucial. Your summary should not only showcase your qualifications but also the unique value you can bring to a company. Consider this example:

This summary flows naturally, as it introduces you as a seasoned professional with a specific focus on VAT accounting. By mentioning your years of experience, you quickly establish credibility. Highlighting a significant achievement, such as recovering $500K in VAT refunds, demonstrates your tangible impact on financial outcomes. Describing your analytical skills and attention to detail paints a clear picture of the personal qualities essential for this role.

When writing about yourself, ensure your language is concise and focused, using active words to underline your skills and successes. A resume summary differs from other resume elements because it provides a snapshot of your professional journey, ideal for those with substantial experience. In contrast, a resume objective highlights career goals and suits those just starting their careers. A resume profile offers a more detailed narrative, combining skills, goals, and experiences. Finally, a summary of qualifications lists your key competencies, benefiting those switching career paths. Understanding these distinctions helps you choose the best format for your resume, ensuring it grabs the potential employer’s attention.

Listing your VAT accountant skills on your resume

A skills-focused VAT accountant resume should effectively highlight both your technical abilities and personal strengths. Choosing to create a dedicated skills section or integrate these skills into your experience and summary parts can make a significant impact. Highlighting strengths and soft skills, such as attention to detail or strong communication, complements your technical prowess. Hard skills like proficiency in tax software or mastering VAT regulations represent teachable abilities essential for the role.

Integrating skills and strengths across your resume serves as powerful keywords. These keywords improve your chances of getting noticed by applicant tracking systems, boosting your likelihood of securing an interview.

Here's how you can structure a skills section:

In this skills section, each listed ability is vital for a VAT accountant, such as "VAT Compliance" and "Tax Planning," which align with industry needs. Skills like "Excel Proficiency" and "SAP Experience" show your capability with key tools, highlighting your readiness for job challenges.

Best hard skills to feature on your VAT accountant resume

Hard skills for a VAT accountant demonstrate your technical expertise. These abilities suggest you can manage complex financial tasks effectively. It's essential to feature skills such as:

Hard Skills

- VAT Compliance

- Tax Planning

- Financial Reporting

- Data Analysis

- Excel Proficiency

- SAP Experience

- IFRS Knowledge

- Tax Audit

- Regulatory Understanding

- Budget Management

- Accounting Software Proficiency

- Financial Forecasting

- Statutory Returns Filing

- Cost Analysis

- Reconciliation Skills

Best soft skills to feature on your VAT accountant resume

Soft skills highlight how you interact with others and adapt to team environments. As a VAT accountant, these skills show your ability to collaborate and communicate effectively. Consider emphasizing:

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Time Management

- Communication Skills

- Team Collaboration

- Adaptability

- Integrity

- Client Relations

- Organizational Skills

- Critical Thinking

- Initiative

- Decision Making

- Stress Management

- Negotiation Skills

How to include your education on your resume

An education section is an important part of your resume and can make a significant difference in landing an interview. Tailor this section for the VAT accountant position by including only relevant educational information. If you have an outstanding GPA, consider including it to highlight your academic achievements. When your school's grading system includes honor distinctions like cum laude, it is impressive to add this to your degree information. Clearly list the degree you obtained, along with the institution and the dates you attended. Avoid including irrelevant coursework or degrees that don't relate to accounting or finance. When preparing your education section, simple and direct formatting will highlight your qualifications effectively.

Here is a wrong example:

- •Participated in History Club.

- •Volunteered for local historical society.

And here's a correct example:

The second example works well because it directly aligns with a VAT accountant position. It includes a degree in accounting, which is relevant, and the academic honors and solid GPA underscore strong academic performance. This concise presentation helps potential employers quickly understand your qualifications without extraneous details.

How to include VAT accountant certificates on your resume

Including a certificates section in your VAT accountant resume is crucial. It shows employers your specialized skills and qualifications. You can also feature your certificates in the header to immediately capture attention.

List the name of the certificate clearly. Include the date it was issued to show current and updated qualifications. Add the issuing organization to give your certificate credibility. Use a simple format to ensure readability.

An example of a standalone certificates section looks like this:

This example is effective because it lists certificates highly relevant to the role of a VAT accountant. The credentials are from reputable organizations, adding weight to your qualifications. Each entry is clear and concise, making it easy for employers to see your certifications. This approach ensures your resume stands out and showcases your expertise.

Extra sections to include in your VAT accountant resume

A compelling resume helps you stand out in the competitive field of VAT accounting. Tailoring each section of your resume to showcase specific skills and experiences can significantly enhance your application. Focus on clear, concise details that highlight what makes you an ideal candidate.

Language section—List any languages you speak fluently to communicate better with international clients. Show your ability to adapt to global business environments.

Hobbies and interests section—Mention your hobbies to show you have well-rounded attributes and relieve job stress effectively. Keep it brief to maintain professionalism.

Volunteer work section—Include volunteer work to demonstrate community involvement and show you possess teamwork skills. Highlight experiences related to finance or accounting for added relevance.

Books section—Share books you’ve read related to VAT accounting or finance to display your dedication to continual learning. Pick titles that reflect current industry trends.

In Conclusion

In conclusion, crafting a successful VAT accountant resume requires a careful balance of detailed content and clear structure. Each section of your resume should reflect your expertise in VAT accounting while highlighting your unique achievements and skills. It is important to present your experience in a way that is both comprehensive and concise, ensuring that potential employers can quickly grasp your competence in managing complex tax issues. Using a structured template can help you organize your information efficiently, allowing each section to shine without overwhelming potential employers with unnecessary details.

Remember to emphasize your technical proficiencies, such as VAT compliance and financial reporting, alongside your soft skills, like analytical thinking and communication. This combination creates a full picture of you as not only a competent VAT accountant but also a valuable team member who can adapt and lead. Including relevant certifications provides further evidence of your expertise and dedication to staying current in the field.

Your education and additional sections, such as volunteer work or language skills, can further distinguish you from other candidates. Tailor these to reflect your strengths and show how they align with the demands of a VAT accountant role. Remember, the goal is to make your resume not just a list of past positions, but a compelling story of your professional journey and the unique value you offer.

Ultimately, a resume that blends your achievements with your personal capabilities presents you as a well-rounded candidate ready to tackle any VAT challenges. With these strategies, you are well-equipped to create a standout resume, positioning you for success in landing your desired role.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.