Bank Sales Resume Examples

Jul 18, 2024

|

12 min read

Sell your skills: Craft a standout bank sales resume that secures your next big move. Learn to highlight your experience, woo hiring managers, and open the vault to new career opportunities.

Rated by 348 people

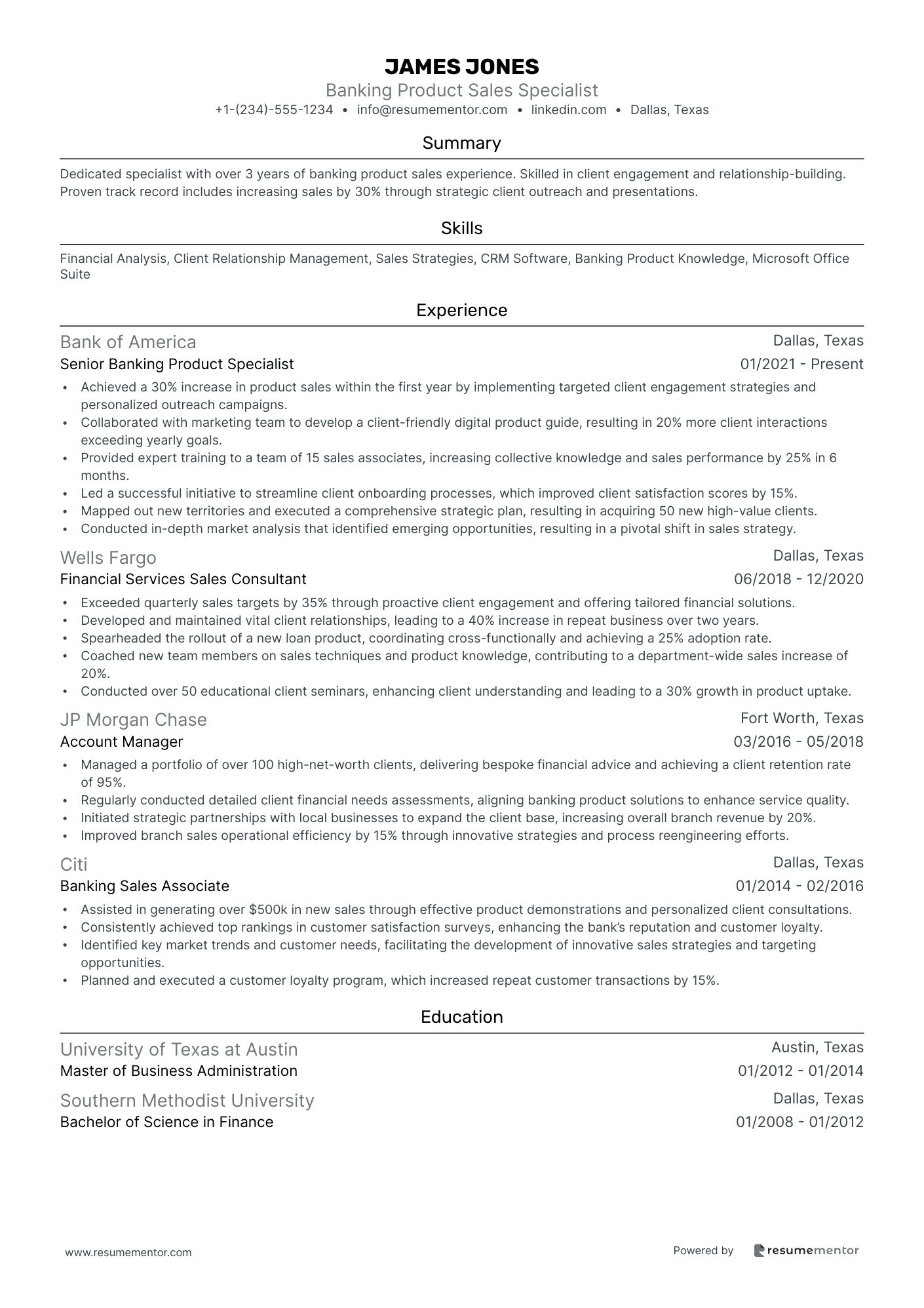

Banking Product Sales Specialist

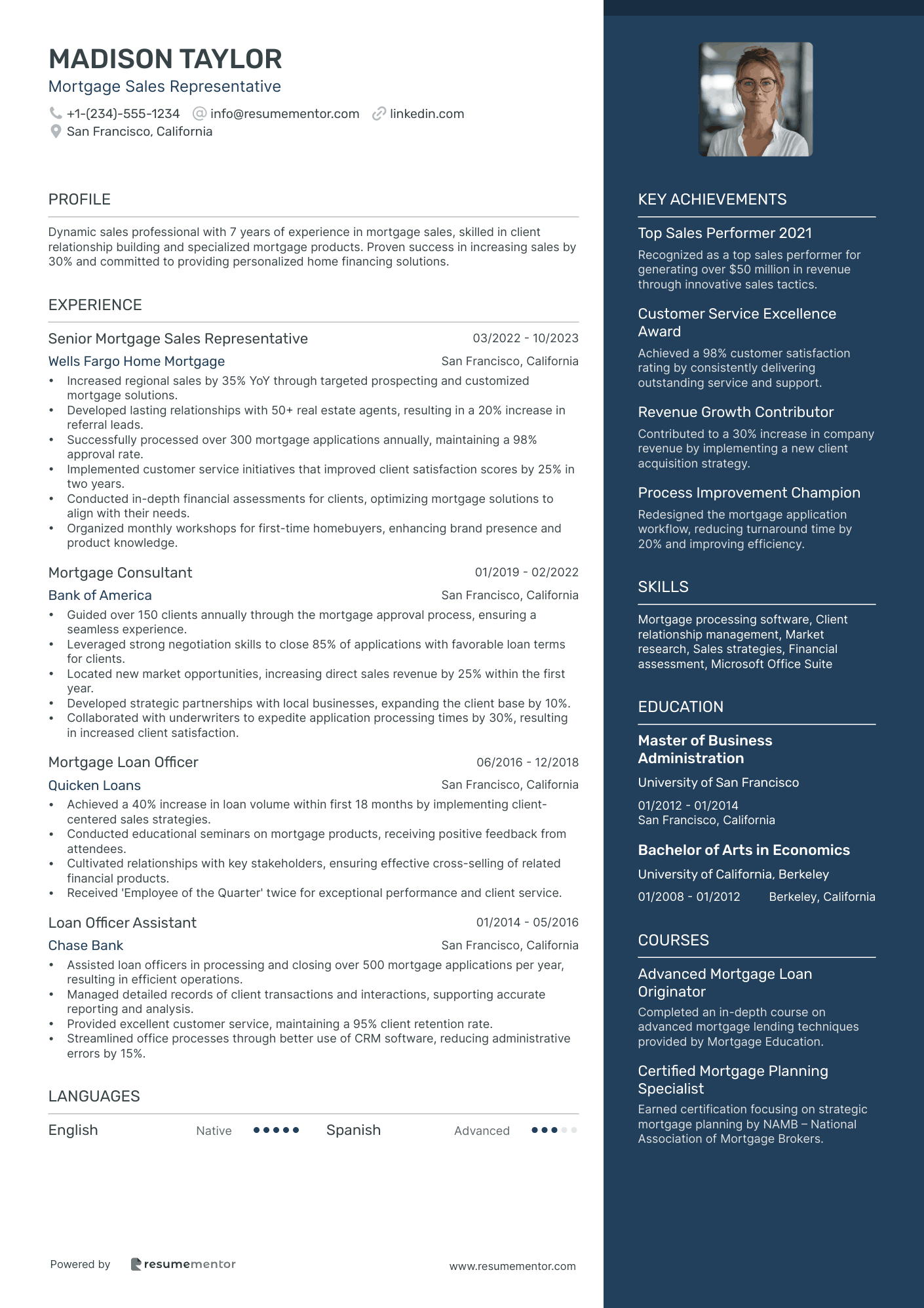

Mortgage Sales Representative

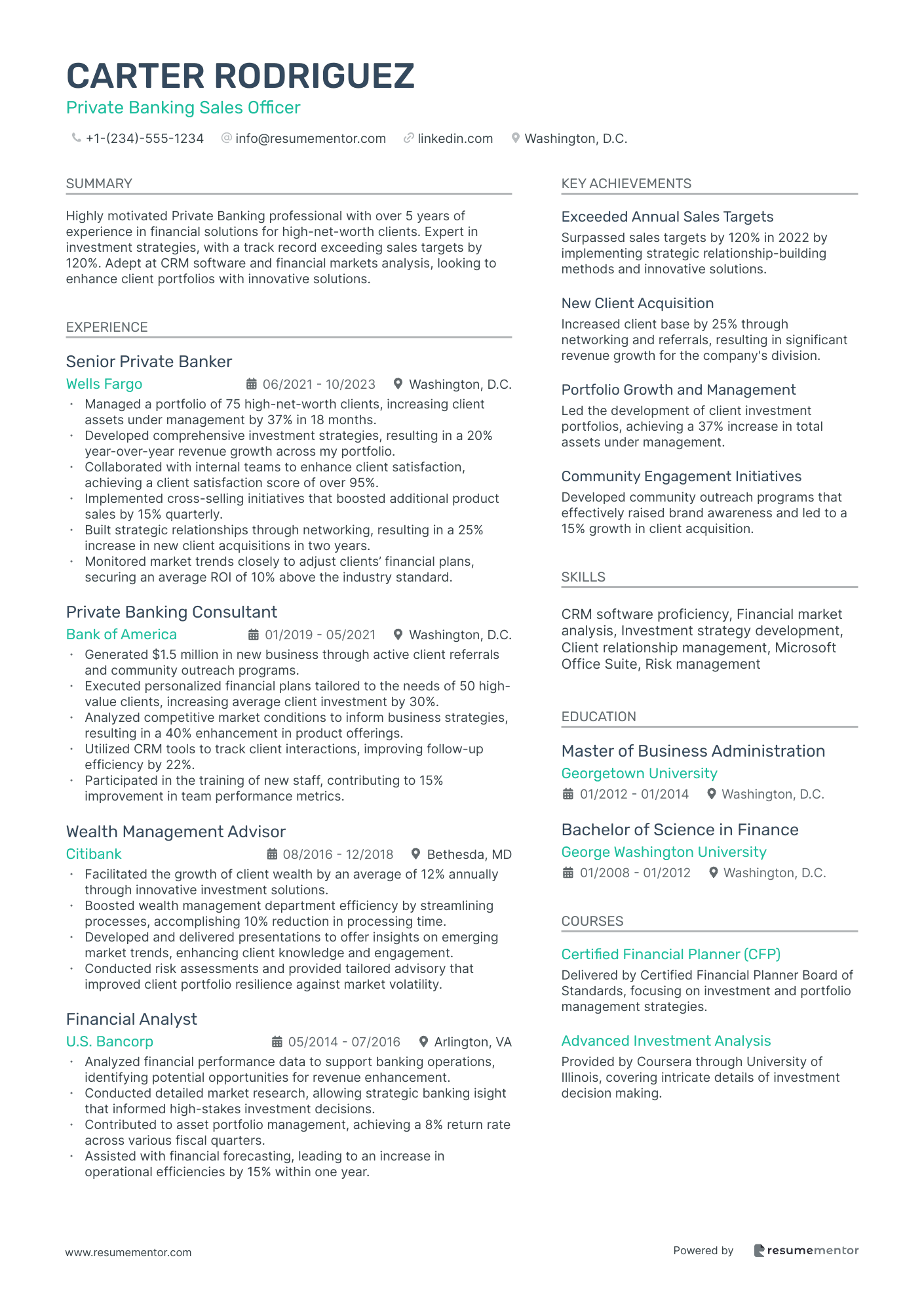

Private Banking Sales Officer

Consumer Banking Sales Specialist

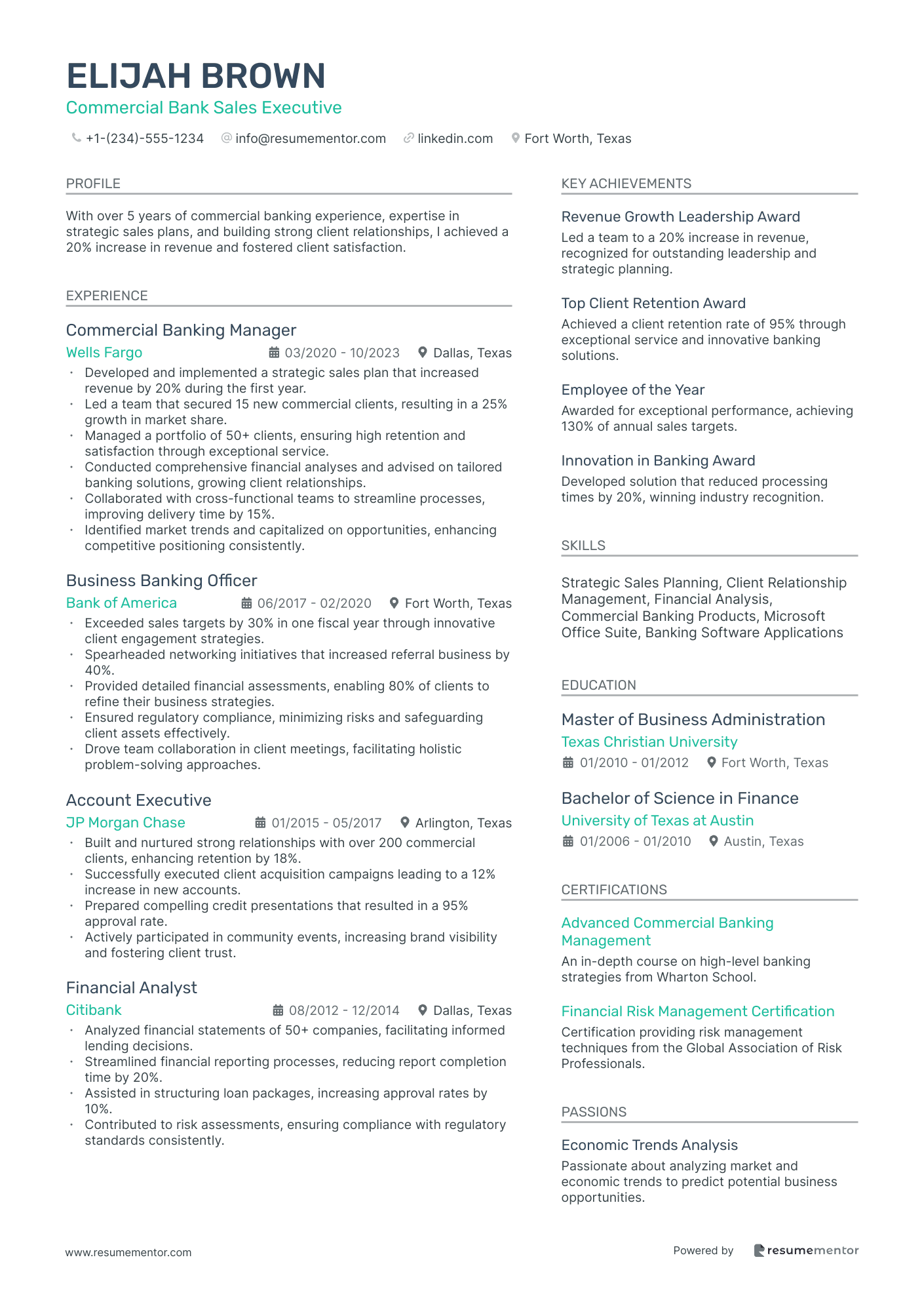

Commercial Bank Sales Executive

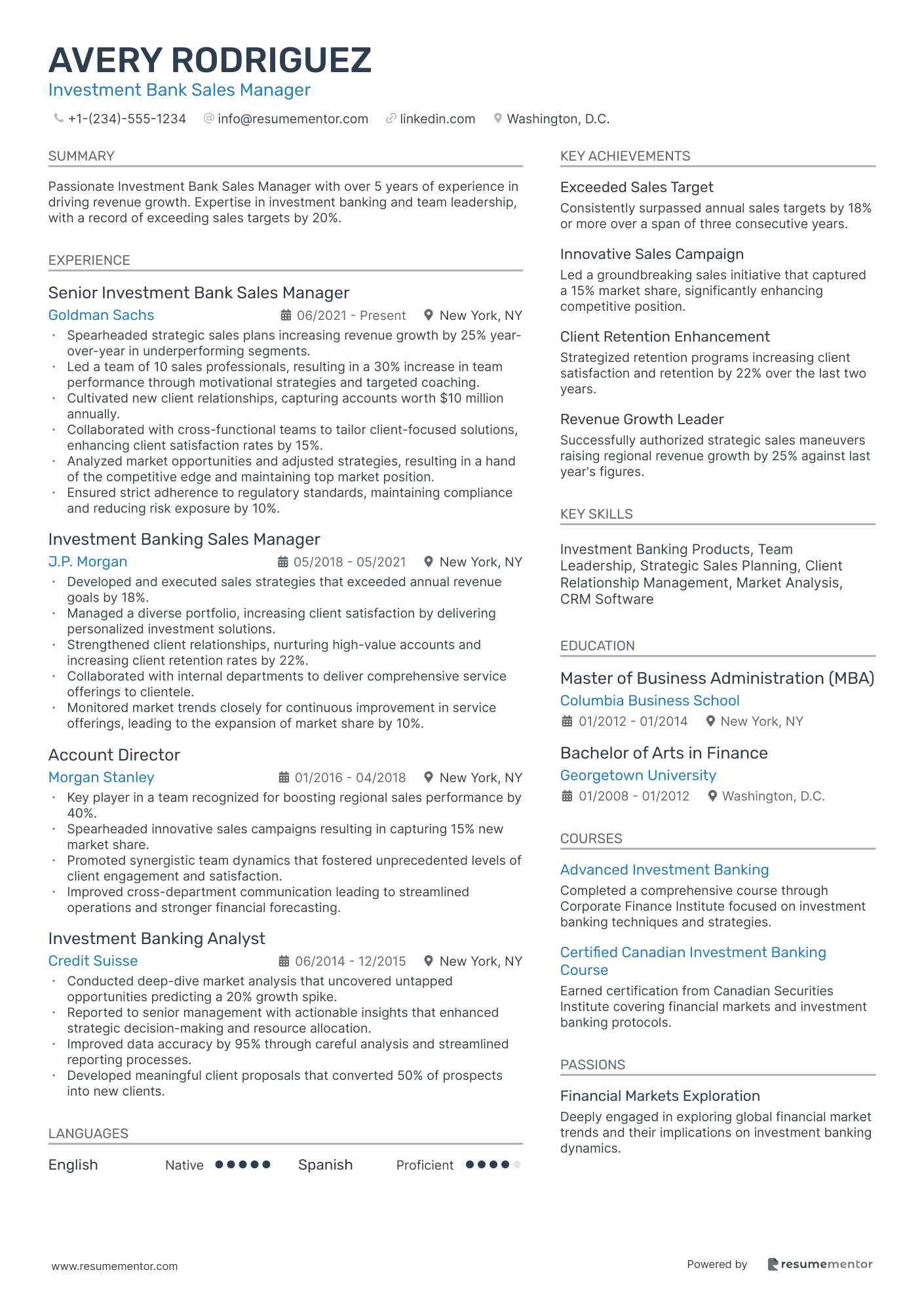

Investment Bank Sales Manager

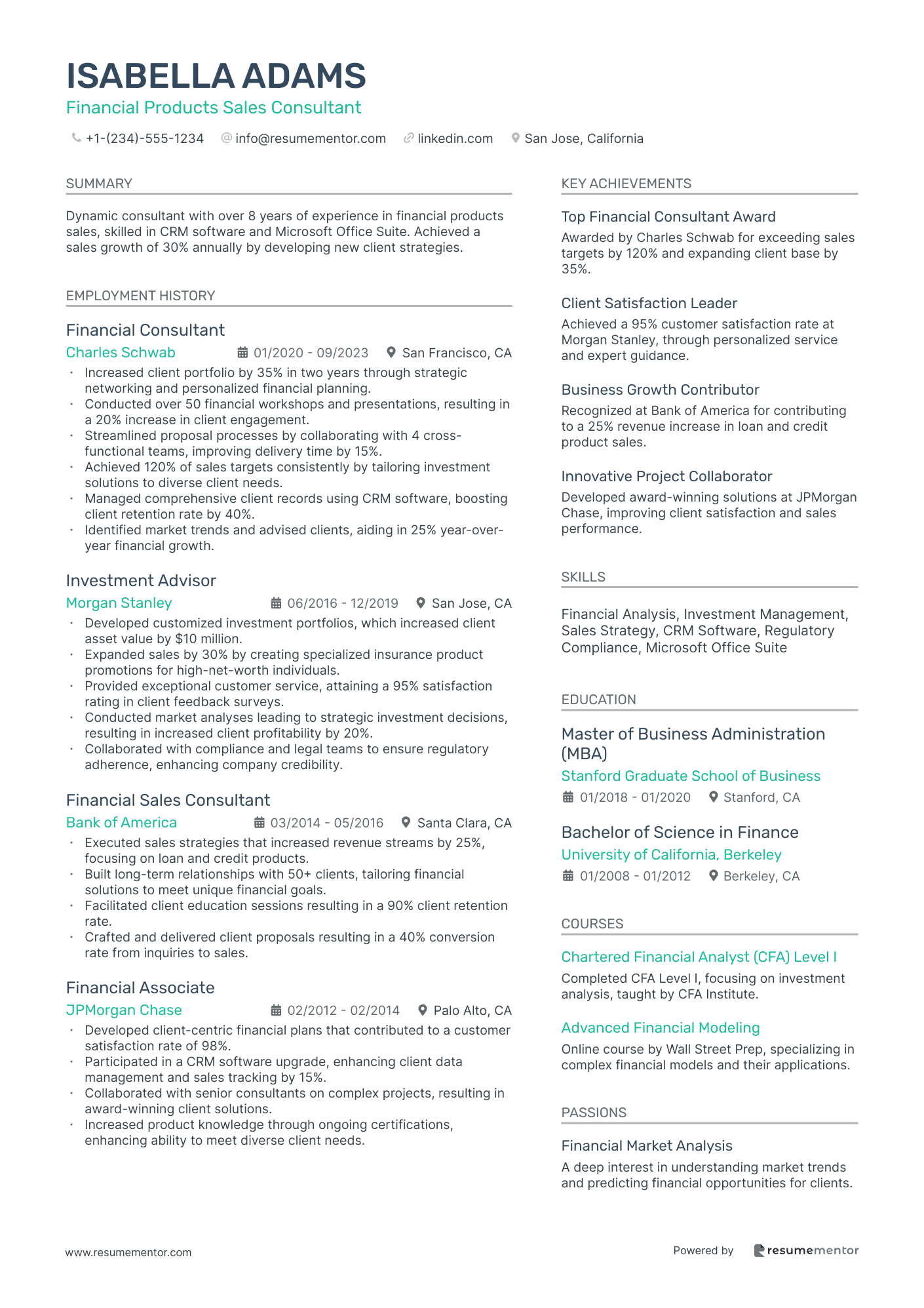

Financial Products Sales Consultant

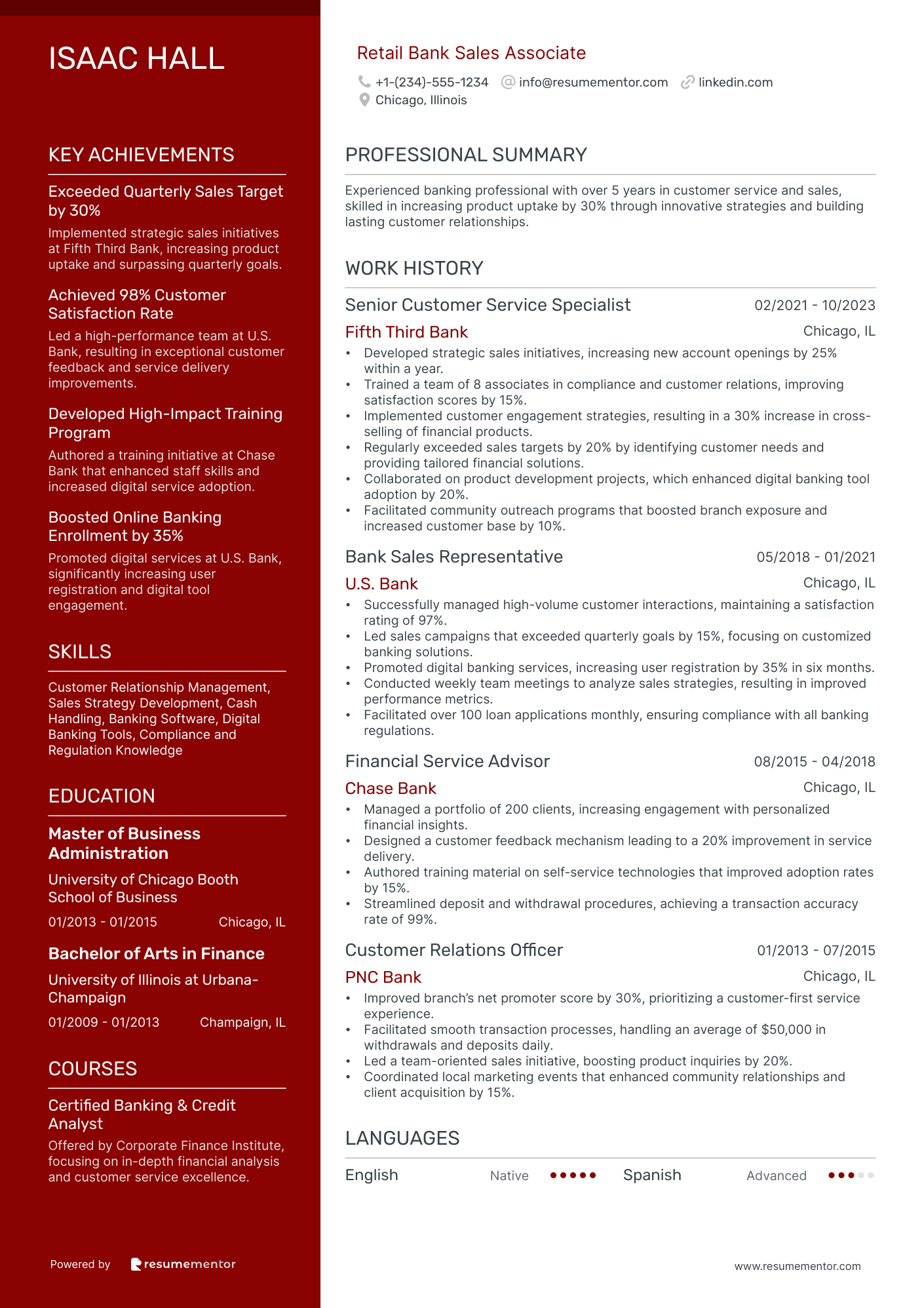

Retail Bank Sales Associate

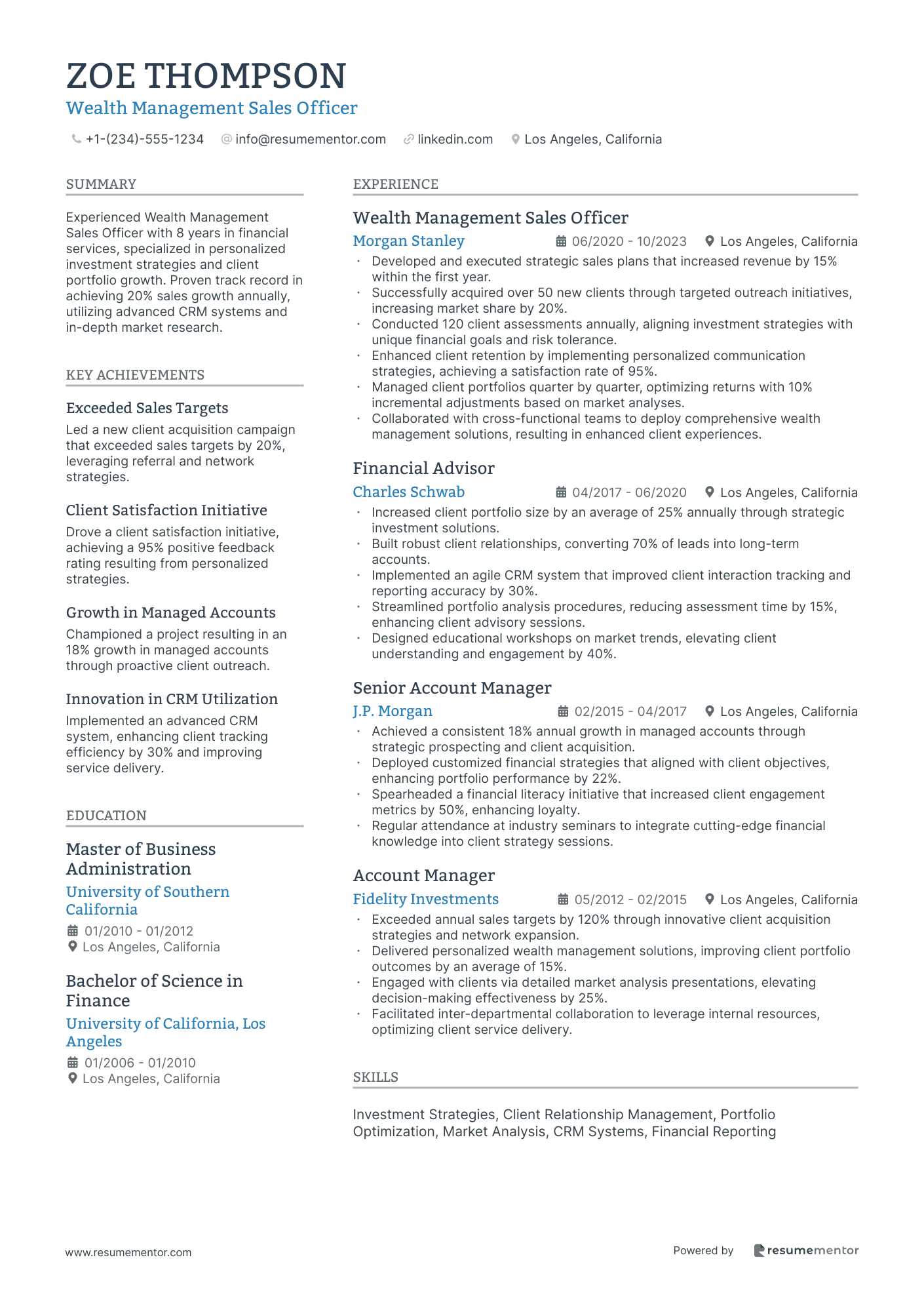

Wealth Management Sales Officer

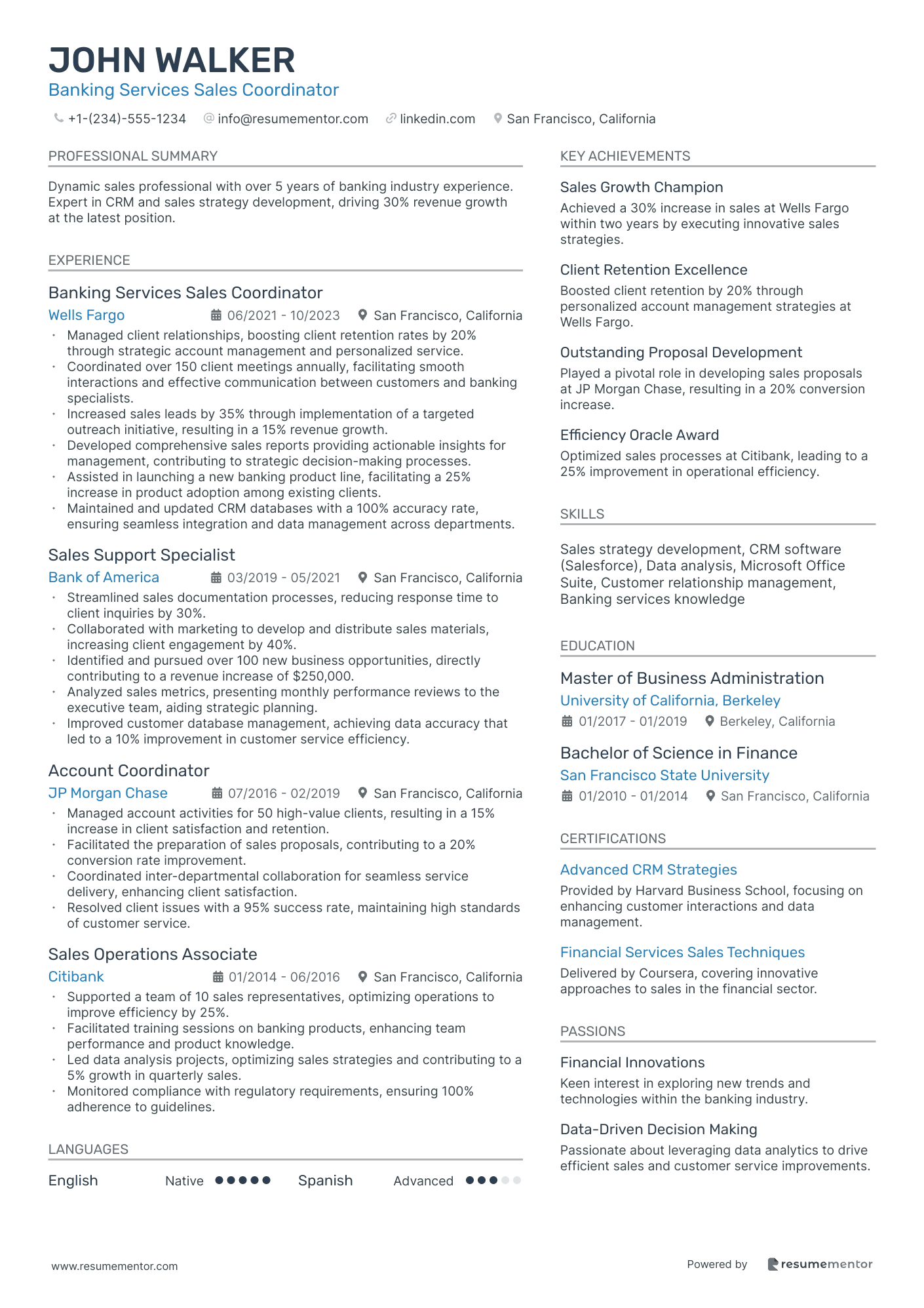

Banking Services Sales Coordinator

Banking Product Sales Specialist resume sample

- •Achieved a 30% increase in product sales within the first year by implementing targeted client engagement strategies and personalized outreach campaigns.

- •Collaborated with marketing team to develop a client-friendly digital product guide, resulting in 20% more client interactions exceeding yearly goals.

- •Provided expert training to a team of 15 sales associates, increasing collective knowledge and sales performance by 25% in 6 months.

- •Led a successful initiative to streamline client onboarding processes, which improved client satisfaction scores by 15%.

- •Mapped out new territories and executed a comprehensive strategic plan, resulting in acquiring 50 new high-value clients.

- •Conducted in-depth market analysis that identified emerging opportunities, resulting in a pivotal shift in sales strategy.

- •Exceeded quarterly sales targets by 35% through proactive client engagement and offering tailored financial solutions.

- •Developed and maintained vital client relationships, leading to a 40% increase in repeat business over two years.

- •Spearheaded the rollout of a new loan product, coordinating cross-functionally and achieving a 25% adoption rate.

- •Coached new team members on sales techniques and product knowledge, contributing to a department-wide sales increase of 20%.

- •Conducted over 50 educational client seminars, enhancing client understanding and leading to a 30% growth in product uptake.

- •Managed a portfolio of over 100 high-net-worth clients, delivering bespoke financial advice and achieving a client retention rate of 95%.

- •Regularly conducted detailed client financial needs assessments, aligning banking product solutions to enhance service quality.

- •Initiated strategic partnerships with local businesses to expand the client base, increasing overall branch revenue by 20%.

- •Improved branch sales operational efficiency by 15% through innovative strategies and process reengineering efforts.

- •Assisted in generating over $500k in new sales through effective product demonstrations and personalized client consultations.

- •Consistently achieved top rankings in customer satisfaction surveys, enhancing the bank’s reputation and customer loyalty.

- •Identified key market trends and customer needs, facilitating the development of innovative sales strategies and targeting opportunities.

- •Planned and executed a customer loyalty program, which increased repeat customer transactions by 15%.

Mortgage Sales Representative resume sample

- •Increased regional sales by 35% YoY through targeted prospecting and customized mortgage solutions.

- •Developed lasting relationships with 50+ real estate agents, resulting in a 20% increase in referral leads.

- •Successfully processed over 300 mortgage applications annually, maintaining a 98% approval rate.

- •Implemented customer service initiatives that improved client satisfaction scores by 25% in two years.

- •Conducted in-depth financial assessments for clients, optimizing mortgage solutions to align with their needs.

- •Organized monthly workshops for first-time homebuyers, enhancing brand presence and product knowledge.

- •Guided over 150 clients annually through the mortgage approval process, ensuring a seamless experience.

- •Leveraged strong negotiation skills to close 85% of applications with favorable loan terms for clients.

- •Located new market opportunities, increasing direct sales revenue by 25% within the first year.

- •Developed strategic partnerships with local businesses, expanding the client base by 10%.

- •Collaborated with underwriters to expedite application processing times by 30%, resulting in increased client satisfaction.

- •Achieved a 40% increase in loan volume within first 18 months by implementing client-centered sales strategies.

- •Conducted educational seminars on mortgage products, receiving positive feedback from attendees.

- •Cultivated relationships with key stakeholders, ensuring effective cross-selling of related financial products.

- •Received 'Employee of the Quarter' twice for exceptional performance and client service.

- •Assisted loan officers in processing and closing over 500 mortgage applications per year, resulting in efficient operations.

- •Managed detailed records of client transactions and interactions, supporting accurate reporting and analysis.

- •Provided excellent customer service, maintaining a 95% client retention rate.

- •Streamlined office processes through better use of CRM software, reducing administrative errors by 15%.

Private Banking Sales Officer resume sample

- •Managed a portfolio of 75 high-net-worth clients, increasing client assets under management by 37% in 18 months.

- •Developed comprehensive investment strategies, resulting in a 20% year-over-year revenue growth across my portfolio.

- •Collaborated with internal teams to enhance client satisfaction, achieving a client satisfaction score of over 95%.

- •Implemented cross-selling initiatives that boosted additional product sales by 15% quarterly.

- •Built strategic relationships through networking, resulting in a 25% increase in new client acquisitions in two years.

- •Monitored market trends closely to adjust clients’ financial plans, securing an average ROI of 10% above the industry standard.

- •Generated $1.5 million in new business through active client referrals and community outreach programs.

- •Executed personalized financial plans tailored to the needs of 50 high-value clients, increasing average client investment by 30%.

- •Analyzed competitive market conditions to inform business strategies, resulting in a 40% enhancement in product offerings.

- •Utilized CRM tools to track client interactions, improving follow-up efficiency by 22%.

- •Participated in the training of new staff, contributing to 15% improvement in team performance metrics.

- •Facilitated the growth of client wealth by an average of 12% annually through innovative investment solutions.

- •Boosted wealth management department efficiency by streamlining processes, accomplishing 10% reduction in processing time.

- •Developed and delivered presentations to offer insights on emerging market trends, enhancing client knowledge and engagement.

- •Conducted risk assessments and provided tailored advisory that improved client portfolio resilience against market volatility.

- •Analyzed financial performance data to support banking operations, identifying potential opportunities for revenue enhancement.

- •Conducted detailed market research, allowing strategic banking isight that informed high-stakes investment decisions.

- •Contributed to asset portfolio management, achieving a 8% return rate across various fiscal quarters.

- •Assisted with financial forecasting, leading to an increase in operational efficiencies by 15% within one year.

Consumer Banking Sales Specialist resume sample

- •Increased the branch's annual consumer banking product sales by 30% through effective cross-selling strategies and personalized customer service.

- •Spearheaded a new client onboarding process that improved customer satisfaction scores by 15%, resulting in higher retention rates.

- •Developed a comprehensive sales training program for new hires, leading to a 20% drop in the average time taken to achieve initial sales targets.

- •Conducted workshops on banking regulations, enhancing team knowledge and reducing compliance errors by 10%.

- •Led community outreach initiatives, effectively presenting banking solutions that drove a 25% rise in new account openings.

- •Utilized CRM tools extensively to document customer interactions and track sales activities, enhancing team coordination and sales forecasts.

- •Successfully achieved 120% of annual sales targets by tailoring financial products to customer needs and improving their satisfaction.

- •Resolved customer inquiries efficiently and professionally, resulting in a quarterly increase in customer approval ratings by 12%.

- •Collaborated with team members to streamline processes and achieve branch-wide sales goals, with a 15% increase in productivity.

- •Maintained comprehensive knowledge of banking products and compliance policies, ensuring accurate information was provided to all clients.

- •Initiated partnership with local businesses for joint promotions, resulting in a 50% increase in new leads and customer engagement.

- •Consistently achieved monthly sales goals, increasing personal loan sales by 20% through personalized service and follow-ups.

- •Conducted financial needs assessments for clients, uncovering opportunities and improving the bank's product uptake by 25%.

- •Implemented relationship-building strategies that resulted in customer referrals rising by 15%, boosting branch foot traffic.

- •Regularly updated CRM with client information and opportunities, enhancing team’s ability to forecast and strategize effectively.

- •Developed strong interpersonal relationships with customers, significantly improving their satisfaction and loyalty to the bank.

- •Exceeded sales targets by 10% through active promotion of customized banking solutions and regular client reviews.

- •Played a key role in a project to improve transaction processing times, which reduced client wait times by 20%.

- •Prepared detailed sales reports for management, aiding in strategic planning and operational improvements.

Commercial Bank Sales Executive resume sample

- •Developed and implemented a strategic sales plan that increased revenue by 20% during the first year.

- •Led a team that secured 15 new commercial clients, resulting in a 25% growth in market share.

- •Managed a portfolio of 50+ clients, ensuring high retention and satisfaction through exceptional service.

- •Conducted comprehensive financial analyses and advised on tailored banking solutions, growing client relationships.

- •Collaborated with cross-functional teams to streamline processes, improving delivery time by 15%.

- •Identified market trends and capitalized on opportunities, enhancing competitive positioning consistently.

- •Exceeded sales targets by 30% in one fiscal year through innovative client engagement strategies.

- •Spearheaded networking initiatives that increased referral business by 40%.

- •Provided detailed financial assessments, enabling 80% of clients to refine their business strategies.

- •Ensured regulatory compliance, minimizing risks and safeguarding client assets effectively.

- •Drove team collaboration in client meetings, facilitating holistic problem-solving approaches.

- •Built and nurtured strong relationships with over 200 commercial clients, enhancing retention by 18%.

- •Successfully executed client acquisition campaigns leading to a 12% increase in new accounts.

- •Prepared compelling credit presentations that resulted in a 95% approval rate.

- •Actively participated in community events, increasing brand visibility and fostering client trust.

- •Analyzed financial statements of 50+ companies, facilitating informed lending decisions.

- •Streamlined financial reporting processes, reducing report completion time by 20%.

- •Assisted in structuring loan packages, increasing approval rates by 10%.

- •Contributed to risk assessments, ensuring compliance with regulatory standards consistently.

Investment Bank Sales Manager resume sample

- •Spearheaded strategic sales plans increasing revenue growth by 25% year-over-year in underperforming segments.

- •Led a team of 10 sales professionals, resulting in a 30% increase in team performance through motivational strategies and targeted coaching.

- •Cultivated new client relationships, capturing accounts worth $10 million annually.

- •Collaborated with cross-functional teams to tailor client-focused solutions, enhancing client satisfaction rates by 15%.

- •Analyzed market opportunities and adjusted strategies, resulting in a hand of the competitive edge and maintaining top market position.

- •Ensured strict adherence to regulatory standards, maintaining compliance and reducing risk exposure by 10%.

- •Developed and executed sales strategies that exceeded annual revenue goals by 18%.

- •Managed a diverse portfolio, increasing client satisfaction by delivering personalized investment solutions.

- •Strengthened client relationships, nurturing high-value accounts and increasing client retention rates by 22%.

- •Collaborated with internal departments to deliver comprehensive service offerings to clientele.

- •Monitored market trends closely for continuous improvement in service offerings, leading to the expansion of market share by 10%.

- •Key player in a team recognized for boosting regional sales performance by 40%.

- •Spearheaded innovative sales campaigns resulting in capturing 15% new market share.

- •Promoted synergistic team dynamics that fostered unprecedented levels of client engagement and satisfaction.

- •Improved cross-department communication leading to streamlined operations and stronger financial forecasting.

- •Conducted deep-dive market analysis that uncovered untapped opportunities predicting a 20% growth spike.

- •Reported to senior management with actionable insights that enhanced strategic decision-making and resource allocation.

- •Improved data accuracy by 95% through careful analysis and streamlined reporting processes.

- •Developed meaningful client proposals that converted 50% of prospects into new clients.

Financial Products Sales Consultant resume sample

- •Increased client portfolio by 35% in two years through strategic networking and personalized financial planning.

- •Conducted over 50 financial workshops and presentations, resulting in a 20% increase in client engagement.

- •Streamlined proposal processes by collaborating with 4 cross-functional teams, improving delivery time by 15%.

- •Achieved 120% of sales targets consistently by tailoring investment solutions to diverse client needs.

- •Managed comprehensive client records using CRM software, boosting client retention rate by 40%.

- •Identified market trends and advised clients, aiding in 25% year-over-year financial growth.

- •Developed customized investment portfolios, which increased client asset value by $10 million.

- •Expanded sales by 30% by creating specialized insurance product promotions for high-net-worth individuals.

- •Provided exceptional customer service, attaining a 95% satisfaction rating in client feedback surveys.

- •Conducted market analyses leading to strategic investment decisions, resulting in increased client profitability by 20%.

- •Collaborated with compliance and legal teams to ensure regulatory adherence, enhancing company credibility.

- •Executed sales strategies that increased revenue streams by 25%, focusing on loan and credit products.

- •Built long-term relationships with 50+ clients, tailoring financial solutions to meet unique financial goals.

- •Facilitated client education sessions resulting in a 90% client retention rate.

- •Crafted and delivered client proposals resulting in a 40% conversion rate from inquiries to sales.

- •Developed client-centric financial plans that contributed to a customer satisfaction rate of 98%.

- •Participated in a CRM software upgrade, enhancing client data management and sales tracking by 15%.

- •Collaborated with senior consultants on complex projects, resulting in award-winning client solutions.

- •Increased product knowledge through ongoing certifications, enhancing ability to meet diverse client needs.

Retail Bank Sales Associate resume sample

- •Developed strategic sales initiatives, increasing new account openings by 25% within a year.

- •Trained a team of 8 associates in compliance and customer relations, improving satisfaction scores by 15%.

- •Implemented customer engagement strategies, resulting in a 30% increase in cross-selling of financial products.

- •Regularly exceeded sales targets by 20% by identifying customer needs and providing tailored financial solutions.

- •Collaborated on product development projects, which enhanced digital banking tool adoption by 20%.

- •Facilitated community outreach programs that boosted branch exposure and increased customer base by 10%.

- •Successfully managed high-volume customer interactions, maintaining a satisfaction rating of 97%.

- •Led sales campaigns that exceeded quarterly goals by 15%, focusing on customized banking solutions.

- •Promoted digital banking services, increasing user registration by 35% in six months.

- •Conducted weekly team meetings to analyze sales strategies, resulting in improved performance metrics.

- •Facilitated over 100 loan applications monthly, ensuring compliance with all banking regulations.

- •Managed a portfolio of 200 clients, increasing engagement with personalized financial insights.

- •Designed a customer feedback mechanism leading to a 20% improvement in service delivery.

- •Authored training material on self-service technologies that improved adoption rates by 15%.

- •Streamlined deposit and withdrawal procedures, achieving a transaction accuracy rate of 99%.

- •Improved branch’s net promoter score by 30%, prioritizing a customer-first service experience.

- •Facilitated smooth transaction processes, handling an average of $50,000 in withdrawals and deposits daily.

- •Led a team-oriented sales initiative, boosting product inquiries by 20%.

- •Coordinated local marketing events that enhanced community relationships and client acquisition by 15%.

Wealth Management Sales Officer resume sample

- •Developed and executed strategic sales plans that increased revenue by 15% within the first year.

- •Successfully acquired over 50 new clients through targeted outreach initiatives, increasing market share by 20%.

- •Conducted 120 client assessments annually, aligning investment strategies with unique financial goals and risk tolerance.

- •Enhanced client retention by implementing personalized communication strategies, achieving a satisfaction rate of 95%.

- •Managed client portfolios quarter by quarter, optimizing returns with 10% incremental adjustments based on market analyses.

- •Collaborated with cross-functional teams to deploy comprehensive wealth management solutions, resulting in enhanced client experiences.

- •Increased client portfolio size by an average of 25% annually through strategic investment solutions.

- •Built robust client relationships, converting 70% of leads into long-term accounts.

- •Implemented an agile CRM system that improved client interaction tracking and reporting accuracy by 30%.

- •Streamlined portfolio analysis procedures, reducing assessment time by 15%, enhancing client advisory sessions.

- •Designed educational workshops on market trends, elevating client understanding and engagement by 40%.

- •Achieved a consistent 18% annual growth in managed accounts through strategic prospecting and client acquisition.

- •Deployed customized financial strategies that aligned with client objectives, enhancing portfolio performance by 22%.

- •Spearheaded a financial literacy initiative that increased client engagement metrics by 50%, enhancing loyalty.

- •Regular attendance at industry seminars to integrate cutting-edge financial knowledge into client strategy sessions.

- •Exceeded annual sales targets by 120% through innovative client acquisition strategies and network expansion.

- •Delivered personalized wealth management solutions, improving client portfolio outcomes by an average of 15%.

- •Engaged with clients via detailed market analysis presentations, elevating decision-making effectiveness by 25%.

- •Facilitated inter-departmental collaboration to leverage internal resources, optimizing client service delivery.

Banking Services Sales Coordinator resume sample

- •Managed client relationships, boosting client retention rates by 20% through strategic account management and personalized service.

- •Coordinated over 150 client meetings annually, facilitating smooth interactions and effective communication between customers and banking specialists.

- •Increased sales leads by 35% through implementation of a targeted outreach initiative, resulting in a 15% revenue growth.

- •Developed comprehensive sales reports providing actionable insights for management, contributing to strategic decision-making processes.

- •Assisted in launching a new banking product line, facilitating a 25% increase in product adoption among existing clients.

- •Maintained and updated CRM databases with a 100% accuracy rate, ensuring seamless integration and data management across departments.

- •Streamlined sales documentation processes, reducing response time to client inquiries by 30%.

- •Collaborated with marketing to develop and distribute sales materials, increasing client engagement by 40%.

- •Identified and pursued over 100 new business opportunities, directly contributing to a revenue increase of $250,000.

- •Analyzed sales metrics, presenting monthly performance reviews to the executive team, aiding strategic planning.

- •Improved customer database management, achieving data accuracy that led to a 10% improvement in customer service efficiency.

- •Managed account activities for 50 high-value clients, resulting in a 15% increase in client satisfaction and retention.

- •Facilitated the preparation of sales proposals, contributing to a 20% conversion rate improvement.

- •Coordinated inter-departmental collaboration for seamless service delivery, enhancing client satisfaction.

- •Resolved client issues with a 95% success rate, maintaining high standards of customer service.

- •Supported a team of 10 sales representatives, optimizing operations to improve efficiency by 25%.

- •Facilitated training sessions on banking products, enhancing team performance and product knowledge.

- •Led data analysis projects, optimizing sales strategies and contributing to a 5% growth in quarterly sales.

- •Monitored compliance with regulatory requirements, ensuring 100% adherence to guidelines.

As a bank sales professional, creating a resume isn't just about listing your job history—it's like building a financial portfolio that shows off your strengths. Effectively communicating your skills and achievements can make all the difference in standing out in a crowded job market. You may find it daunting to present your accomplishments clearly, but your resume is your first impression with potential employers.

Highlighting your ability to exceed sales targets, your expertise with financial products, and your relationship-building skills is key. How you structure your resume can significantly impact its effectiveness. Simplifying this process with a resume template can help organize your information in an engaging way.

In this guide, you'll learn how to create a resume that showcases your sales expertise alongside your technical know-how in the banking industry. You’ll gain insights into aligning your achievements with employer expectations, helping you stand out as the ideal candidate. By the end, you'll be ready to present a resume that truly markets your unique strengths in the field.

Key Takeaways

- A successful teacher resume should be tailored with a professional summary that captures core competencies and highlights career achievements, setting the stage for the rest of the document.

- Include a detailed experience section with specific examples of past successes, focusing on positions that demonstrate growth or contributed significantly to educational improvement.

- Supplement the experience with a skills section that articulates strong teaching abilities, classroom management, and subject matter expertise, aligning with job expectations.

- Education should be listed with relevant degrees and certifications, indicating preparedness for teaching roles and commitment to ongoing professional development.

- Consider adding notable achievements, such as contributions to student success or curriculum development, to offer concrete evidence of past impacts in educational settings.

What to focus on when writing your bank sales resume

Your bank sales resume should clearly demonstrate your ability to boost revenue while building strong client relationships. This involves emphasizing your talent for selling financial products and consistently achieving your targets.

How to structure your bank sales resume

- Contact Information: Start with your full name, phone number, email, and city/state—making it easy for recruiters is crucial, as it ensures they can quickly reach out for interviews or further discussions. Ensuring your contact details are straightforward and up-to-date reflects professionalism and attention to detail, traits valued in banking roles.

- Professional Summary: Follow up with a concise summary that underscores your expertise in bank sales—distilling your career achievements and core competencies into a few impactful sentences. This statement sets the tone for the rest of your resume, offering a snapshot of your ability to meet and exceed sales targets while fostering positive client relationships.

- Experience: Next, detail your relevant work history with a focus on sales roles—this section should include specific examples of your success in driving sales and client acquisition. Highlighting positions where you advanced in responsibility or where your contributions led to significant revenue growth can make your candidacy more compelling to recruiters.

- Skills: Complement your experience with a list of essential banking sales skills—be explicit about your strengths in customer relationship management, product knowledge, negotiation, and communication. Mentioning your proficiency with tools like CRM systems showcases your technical capability, indicating that you can effectively leverage technology to drive sales performance.

- Education: Your educational background, including degrees and relevant certifications, should reflect your foundational knowledge—courses or training in finance or sales that align with bank sales demonstrate your commitment to professional development and your preparedness for the complexities of the role.

- Achievements: Conclude with a section on notable achievements—focus on quantifiable successes, such as increasing sales percentages or improving client satisfaction scores, providing concrete evidence of your impact within previous roles. These achievements not only validate your skills but offer a forecast of the potential contributions you can make in a new position.

Transitioning into the resume format, it is important to structure these sections in a way that aligns with modern recruitment processes. Below, we’ll delve into each section more in-depth, ensuring your resume is both comprehensive and tailored to stand out in the competitive field of bank sales.

Which resume format to choose

Creating a standout bank sales resume starts with selecting the right format, which is crucial in presenting your professional journey effectively. In this industry, a reverse-chronological format is ideal because it highlights your most recent roles and achievements first, showing your career growth and making an immediate impact on hiring managers.

Once you've set the format, your choice of font can subtly influence the overall impression of your resume. Opt for modern yet professional fonts like Lato, Montserrat, or Raleway. These fonts offer a contemporary and clean look, enhancing readability and conveying a sense of current style that aligns well with a dynamic field like bank sales without overwhelming the reader.

Saving your resume as a PDF is a critical step to ensure consistency in how it is viewed by potential employers. This file format preserves the structure and design, keeping your information intact and making sure it appears polished and professional on any device.

Finally, maintaining one-inch margins all around your resume gives it a balanced, neat, and organized look. This approach ensures that there's enough white space, making your content easy to read and helping to focus attention on your key achievements and skills.

Considering these elements collectively will enable you to craft a resume that effectively showcases your qualifications and leaves a lasting impression in the competitive bank sales field.

How to write a quantifiable resume experience section

A powerful bank sales resume experience section helps you stand out to hiring managers by highlighting your achievements and impact. In this section, make your skills and successes relevant to the job you want. Structure it by listing jobs in reverse chronological order, starting with the most recent. This approach lets employers see your career path clearly. Aim to go back about 10-15 years, unless an older role holds significant relevance. Including job titles that match the role you're applying for further solidifies your fit for the position. Tailor your resume to each job ad by aligning your experiences with the specific requirements listed. Incorporate strong action verbs like "boosted," "secured," "developed," and "implemented" to convey your accomplishments effectively.

For a bank sales role, emphasize increases in sales and customer satisfaction by mentioning quantifiable results, like percentage increases or specific dollar figures. This paints a vivid picture of your capabilities. Here’s how a strong example comes together:

- •Increased quarterly sales by 45% with strategic client engagement and product upsell.

- •Developed and executed a client acquisition strategy that grew the customer base by 25% in one year.

- •Secured $1.2M in new deposits by building strong customer relationships and offering personalized financial solutions.

- •Implemented a training program that enhanced team productivity by 30%, boosting sales performance.

This experience section stands out by weaving clear achievements and quantifiable results throughout. Incorporating specific numbers and percentages to demonstrate success makes it easy for hiring managers to recognize the impact. The tailored language directly links your experiences to bank sales responsibilities, creating a coherent narrative. Using action verbs energizes the text, illustrating your initiative and results-oriented approach. This resume example aligns seamlessly with the essential skills for bank sales roles, emphasizing growth in sales and client relationships.

Achievement-Focused resume experience section

A sales-focused bank sales resume experience section should highlight the tangible outcomes and measurable impact you've achieved in your role. Begin by outlining your main responsibilities and clearly demonstrate how your efforts helped achieve key objectives. Incorporating concrete numbers and percentages will showcase your success, whether in terms of sales growth or improved customer relations. This precision not only emphasizes your achievements but also draws a clear connection between your efforts and results.

The structure should feature your job title and the company, followed by bullet points detailing your key accomplishments. Use strong action verbs to start each bullet point, ensuring that your outcomes align with broader bank goals. This method effectively communicates your immediate value to potential employers, making you an impressive candidate for the position.

Sales Specialist

XYZ Bank

June 2020 - August 2023

- Boosted quarterly sales by 25% through strategic outreach and personalized banking solutions.

- Secured a 95% customer satisfaction score by delivering outstanding service and resolving issues quickly.

- Grew client base by 30% in 18 months by launching local marketing efforts and building community partnerships.

- Optimized account opening processes, cutting down required time by 20% and enhancing customer experience.

Skills-Focused resume experience section

A bank sales-focused resume experience section should clearly demonstrate your ability to achieve sales goals and excel in providing exceptional customer service. Begin by stating your job title and the duration of your role at the company. With bullet points, illustrate specific examples where your sales skills and customer service expertise made a difference. Each point should highlight how you contributed to the bank’s success, whether through building strong client relationships or successfully rolling out new banking products, emphasizing outcomes like higher sales or enhanced customer satisfaction to reveal your impact.

Use action-oriented language in each bullet point to describe your responsibilities and achievements, employing strong verbs for clarity. Whenever possible, include numbers to provide concrete proof of your success. If you led any special projects or initiatives, explain how these efforts improved sales and customer experiences. Tailor your bullet points to demonstrate your knowledge of banking products and how you applied this knowledge to meet customer needs effectively. Maintain the reader's interest by crafting a clear, concise narrative that ties directly to your banking sales skills.

Senior Sales Associate

First National Bank

January 2020 - Present

- Increased monthly sales targets by 15% through strategic upselling and cross-selling techniques.

- Developed and maintained strong relationships with over 100 clients, resulting in a 20% increase in customer retention.

- Trained and mentored new sales associates, improving overall department productivity by 25%.

- Successfully launched a new financial product in the local market, achieving 50% more sales than projected within the first quarter.

Training and Development Focused resume experience section

A bank sales training and development-focused resume experience section should clearly showcase how you've contributed to team growth and sales improvement. Start by detailing your employment period, job title, and the name of the company. Use strong, active language to connect your responsibilities with tangible achievements, underscoring your expertise in developing and executing training programs within the bank sales environment.

In the bullet points, seamlessly transition by detailing how you drove positive outcomes, such as boosting productivity or enhancing customer satisfaction. Highlight your role in creating impactful training materials or leading engaging workshops. These elements work together to give potential employers a cohesive and compelling view of your skills in training and development, ensuring your experience stands out.

Sales Training and Development Coordinator

ABC Bank

June 2018 - Present

- Developed and implemented training programs that increased sales team productivity by 25%.

- Led a team of trainers to deliver workshops that improved customer service satisfaction scores by 15%.

- Collaborated with cross-functional teams to design e-learning modules that reached over 3,000 employees.

- Monitored and evaluated training program effectiveness through feedback and performance metrics.

Customer-Focused resume experience section

A bank sales-focused resume experience section should clearly convey your ability to enhance customer satisfaction while driving sales. Begin by stating your job title, the workplace, and the dates you were employed to set the stage. Use bullet points to seamlessly illustrate how you improved processes, achieved impressive sales, and met customer needs effectively. Focus on highlighting your unique contributions and results rather than using generic language.

Each bullet point should provide a measurable and impactful achievement. For instance, mention any sales targets you surpassed, notable improvements in customer satisfaction, or the innovative strategies you brought to the table. By using dynamic action verbs, you can vividly showcase your influence while keeping the details honest. This cohesive narrative will help potential employers envision the meaningful contributions you could make to their team.

Sales Associate

Bank of Tomorrow

June 2021 - Present

- Boosted sales by 25% with personalized banking solutions that aligned with individual customer needs.

- Increased customer satisfaction scores by 15% through exceptional service and prompt problem resolution.

- Led a team to roll out a new digital tool, reducing customer wait times by 30% and enhancing the customer experience.

- Trained colleagues to enhance their customer interaction skills, resulting in improved overall team performance and satisfaction.

Write your bank sales resume summary section

A bank-focused sales resume summary should clearly emphasize your top strengths in sales and banking experience. It needs to catch the hiring manager’s attention right from the start. For instance, your summary should highlight specific achievements and your experience in a compelling way.

This example works well because it uses numbers to demonstrate success, instantly appealing to employers looking for tangible results. To describe yourself effectively, focus on what makes you unique by mentioning achievements like boosting sales or improving customer satisfaction. It's helpful to use action words such as “achieved,” “improved,” or “led” to convey your active contribution to past successes.

Understanding the distinction between a resume summary, an objective, and a profile is essential. A resume summary provides a snapshot of your career highlights and key accomplishments, making a strong first impression. In contrast, a resume objective focuses more on what you aim to achieve with the company, which is ideal for those starting out or switching careers. A resume profile blends your experience with your career goals, offering a comprehensive view. Meanwhile, a summary of qualifications lists skills specifically relevant to the position. Crafting a summary that is concise, specific, and engaging is crucial for grabbing an employer's attention quickly.

Listing your bank sales skills on your resume

A bank-focused sales resume should effectively present your skills, as they are crucial in showcasing your potential value to employers. Whether highlighted as a standalone section or integrated into your experience and summary, your skills can make a significant impact. Strengths often manifest through soft skills like communication and teamwork, which are essential for building client relationships. On the other hand, hard skills represent the specific abilities required for the job, such as financial analysis and proficiency in sales software.

Incorporating skills and strengths as resume keywords can enhance your chances of getting noticed, especially when applicant tracking systems are involved. These keywords help align your experience with the job’s demands, ensuring your application stands out. Consider this clearly structured skills section for a bank sales resume, shown in JSON format:

This section is effective due to its simple language and its focus on bank sales skills, allowing you to present your qualifications in a compelling manner.

Best hard skills to feature on your bank sales resume

Hard skills in bank sales demonstrate your technical expertise and ability to perform specific tasks. They illustrate your competence in areas crucial for success in banking sales roles.

Hard Skills

- Financial Analysis

- Risk Assessment

- Sales Strategy Development

- Customer Relationship Management (CRM)

- Data Analysis

- Product Knowledge

- Loans and Mortgages Understanding

- Negotiation

- Cross-selling

- Account Management

- Business Development

- Excel Proficiency

- Regulatory Compliance

- Sales Forecasting

- Market Research

Best soft skills to feature on your bank sales resume

Soft skills in bank sales highlight your interpersonal skills and how you interact with others. They show your effectiveness in communication, collaboration, and leadership, making you a vital team player.

Soft Skills

- Communication

- Customer Service

- Problem-solving

- Time Management

- Adaptability

- Conflict Resolution

- Attention to Detail

- Emotional Intelligence

- Teamwork

- Leadership

- Relationship Building

- Critical Thinking

- Initiative

- Empathy

- Stress Management

How to include your education on your resume

The education section of a resume is a crucial component that highlights your academic background. When tailoring your education section for a bank sales position, ensure that the details you include are relevant. Avoid listing any education that doesn't directly relate to your career goals in banking or sales. To include your GPA, mention it only if it's impressive (typically 3.5 or above) and the hiring company requests it. If you've graduated with honors, such as cum laude, be sure to add it next to your degree title. List your degree clearly by stating your major, followed by the degree type (e.g., Bachelor of Science in Finance).

Here is an incorrect example of an education section:

Now consider a correct example suitable for a bank sales role:

- •Graduated magna cum laude

The second example is ideal for a bank sales position because it lists a relevant degree in finance, a commendable GPA, and includes honors, demonstrating academic excellence. This information aligns with the skills and knowledge expected in the banking sector. Including academic achievements like magna cum laude can catch a hiring manager's eye and set you apart from other candidates.

How to include bank sales certificates on your resume

Including a certificates section in your bank sales resume is crucial. Certifications validate your skills and show your commitment to professional growth. List the name of the certificate to ensure clarity. Include the date to highlight the recency of your qualifications. Add the issuing organization to reinforce the credibility of your credential.

For higher visibility, certificates can also be included in the resume header. For example: "Certified Financial Planner (CFP), Financial Planning Standards Board - April 2021."

An effective standalone certificates section should look something like this:

This example is effective because it lists certifications relevant to bank sales, such as CFP, Series 7, and ChFC. It shows the issuing organizations, which add trust. The section is clear, concise, and easy to read, making it straightforward for recruiters.

Extra sections to include in your bank sales resume

Crafting a compelling bank sales resume involves highlighting not only your professional skills and experience, but also various personal attributes that make you a well-rounded candidate. Including sections on languages, hobbies and interests, volunteer work, and books can provide a fuller picture of who you are to potential employers.

- Language section — Highlight your proficiency in multiple languages to demonstrate your ability to communicate with diverse clients, enhancing customer service potential.

- Hobbies and interests section — Showcase your personal interests to illustrate qualities like teamwork, leadership, or creativity, which can be valuable assets in a sales role.

- Volunteer work section — Mention any volunteer experiences to reflect your community involvement and strong work ethic, both of which are critical for a customer-focused position.

- Books section — List relevant books you have read to show your dedication to continuous learning and professional development, which can inspire confidence in your ability to stay informed about industry trends.

Incorporating these sections into your resume enriches it, making you stand out as a well-rounded candidate who brings more to the table than just technical skills. Remember, the goal is to paint a picture of a dynamic individual who is equipped to thrive in the competitive world of bank sales.

In Conclusion

In conclusion, crafting a strong bank sales resume is essential for standing out in the competitive job market. It requires more than just listing past jobs; it's about strategically highlighting your achievements and skills. Your resume should clearly illustrate your success in meeting sales targets, your ability to build and maintain client relationships, and your proficiency with financial products. By focusing on these areas, you effectively communicate your value to potential employers. Choosing a clean, modern format and using quantifiable data to showcase your results can significantly enhance your resume's impact. Including relevant certifications, education, and any additional personal sections that highlight your unique qualities enriches the narrative of your professional journey. Remember, your resume is your first impression, so it should reflect not only your competencies but also your readiness to contribute meaningfully to a new team. By following the guidelines in this article, you'll be equipped to create a resume that captures attention and sets you apart as an ideal candidate in bank sales. Taking the time to tailor your resume to each position and focusing on your strengths will increase your chances of advancing in your career.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.