Banking Customer Service Resume Examples

Jul 18, 2024

|

12 min read

Acing Your Banking Customer Service Resume: Tips to Make Your Skills 'Interest'-ing and Your Experience 'Deposit'-worthy

Rated by 348 people

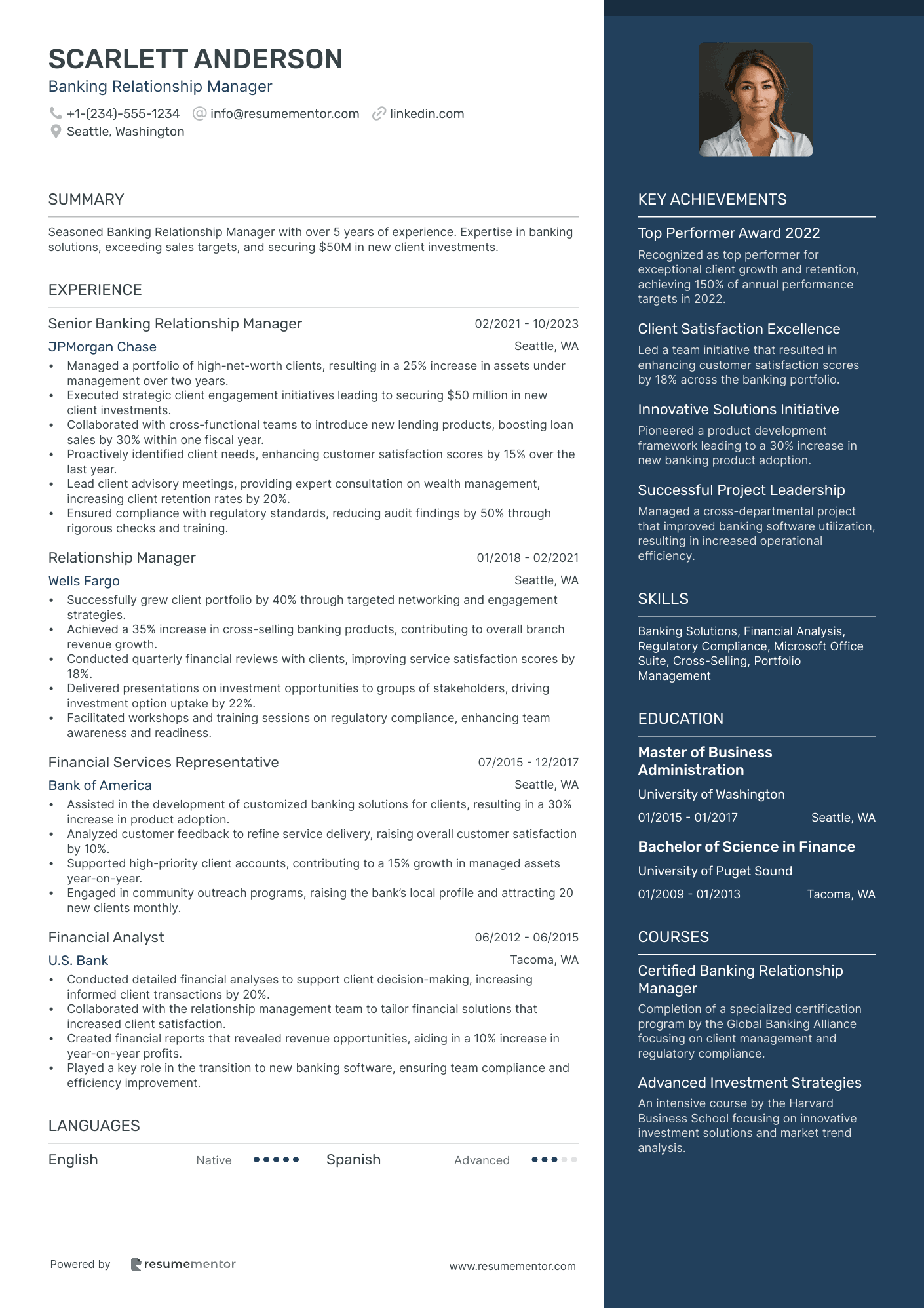

Banking Relationship Manager

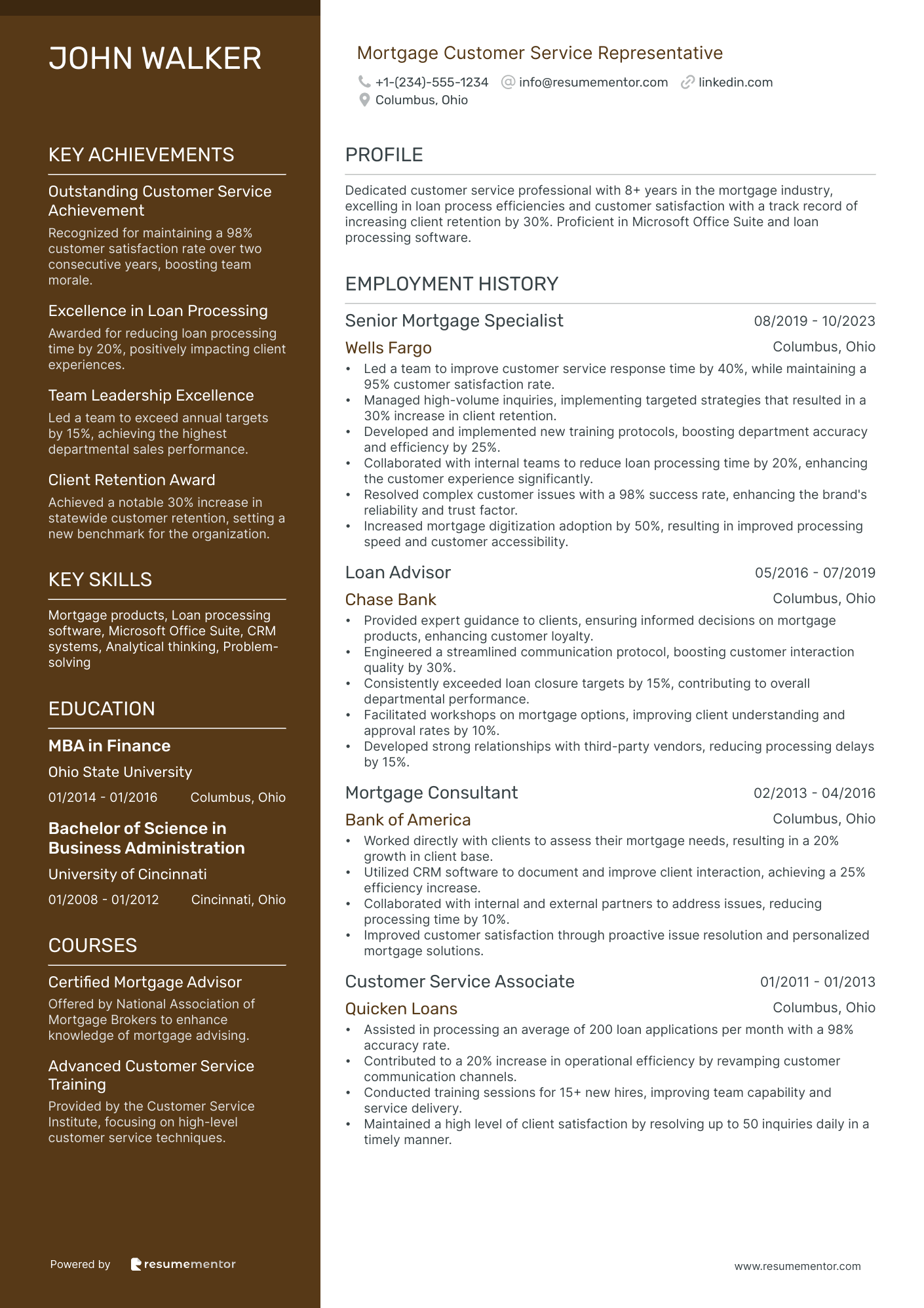

Mortgage Customer Service Representative

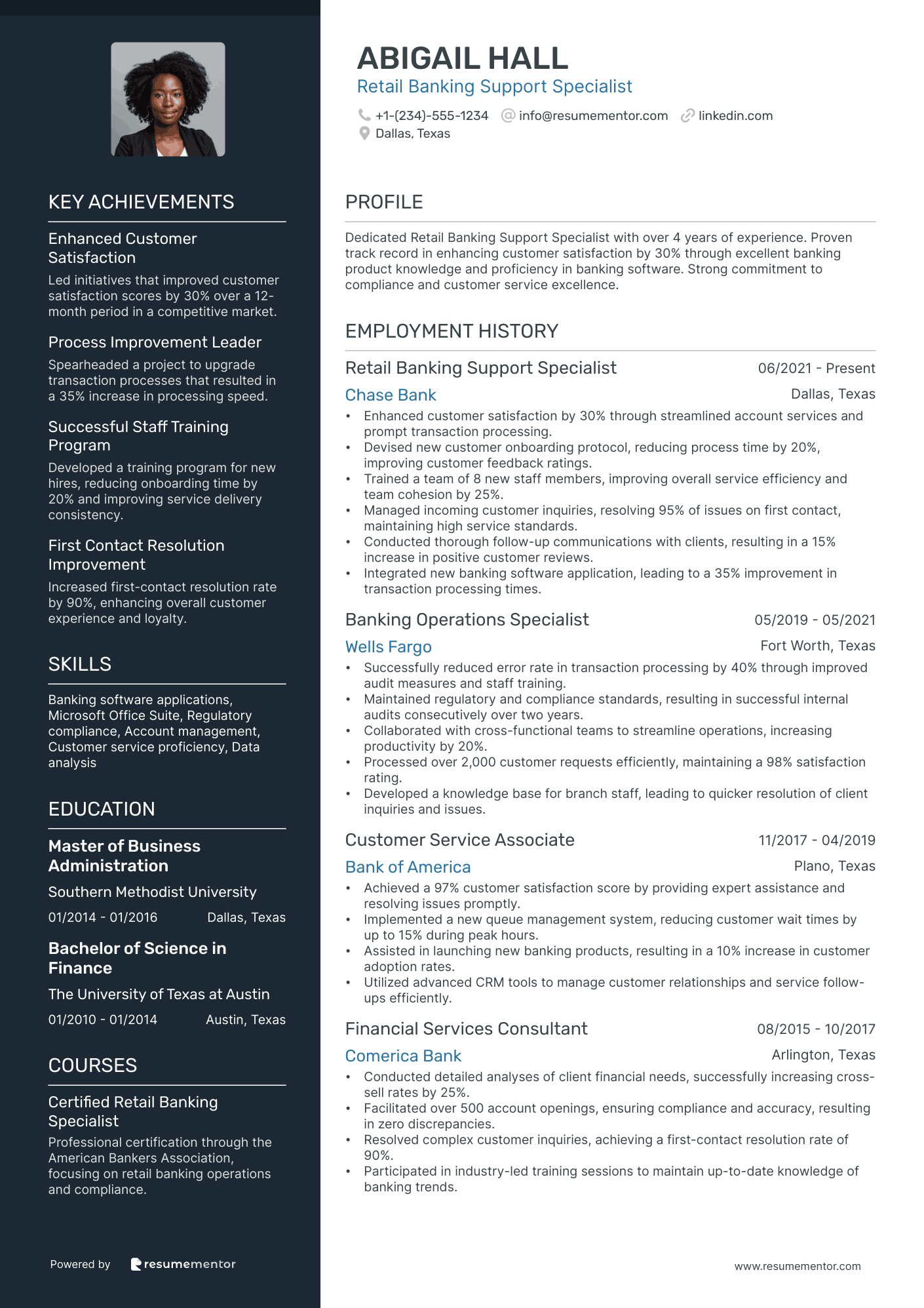

Retail Banking Support Specialist

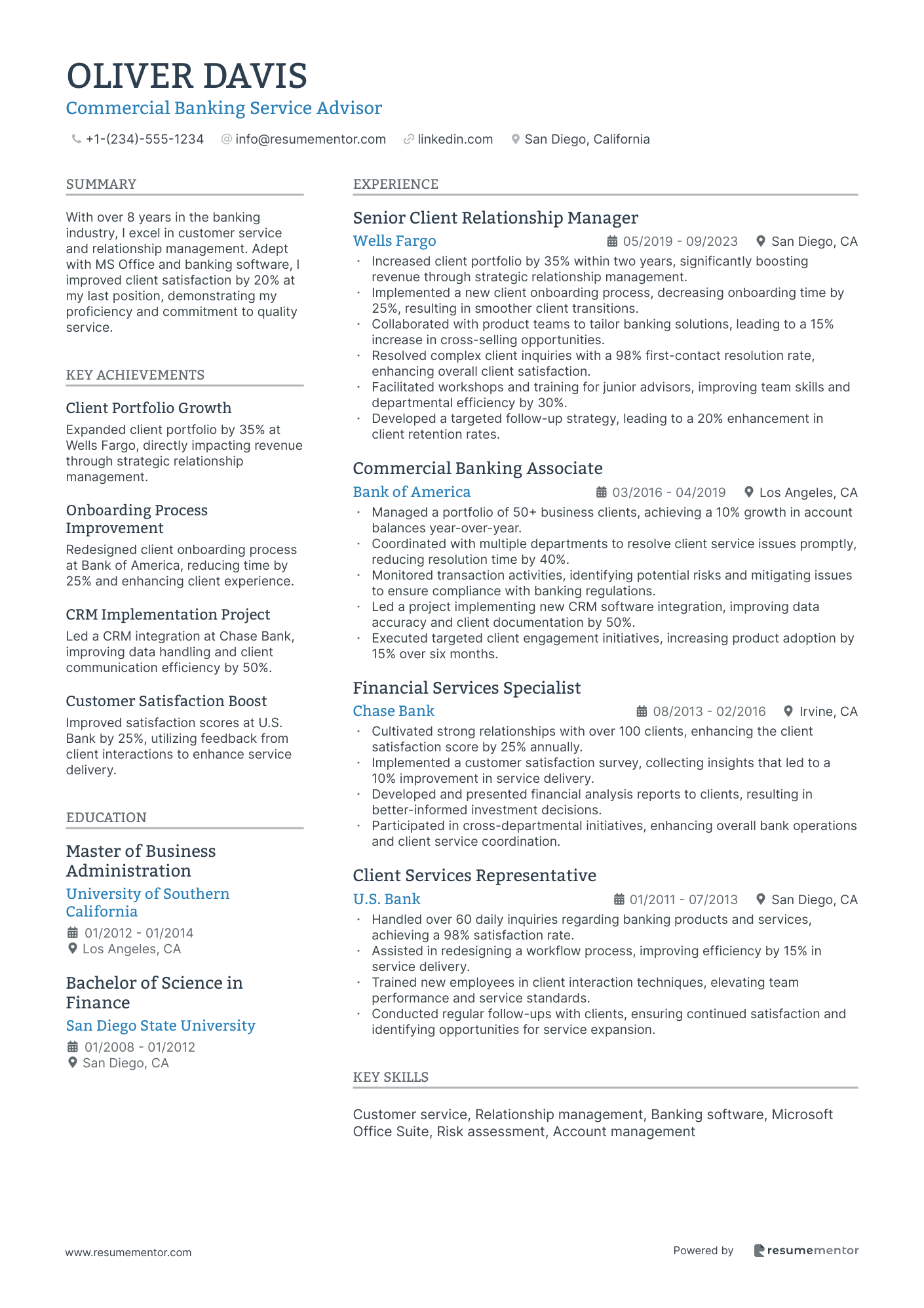

Commercial Banking Service Advisor

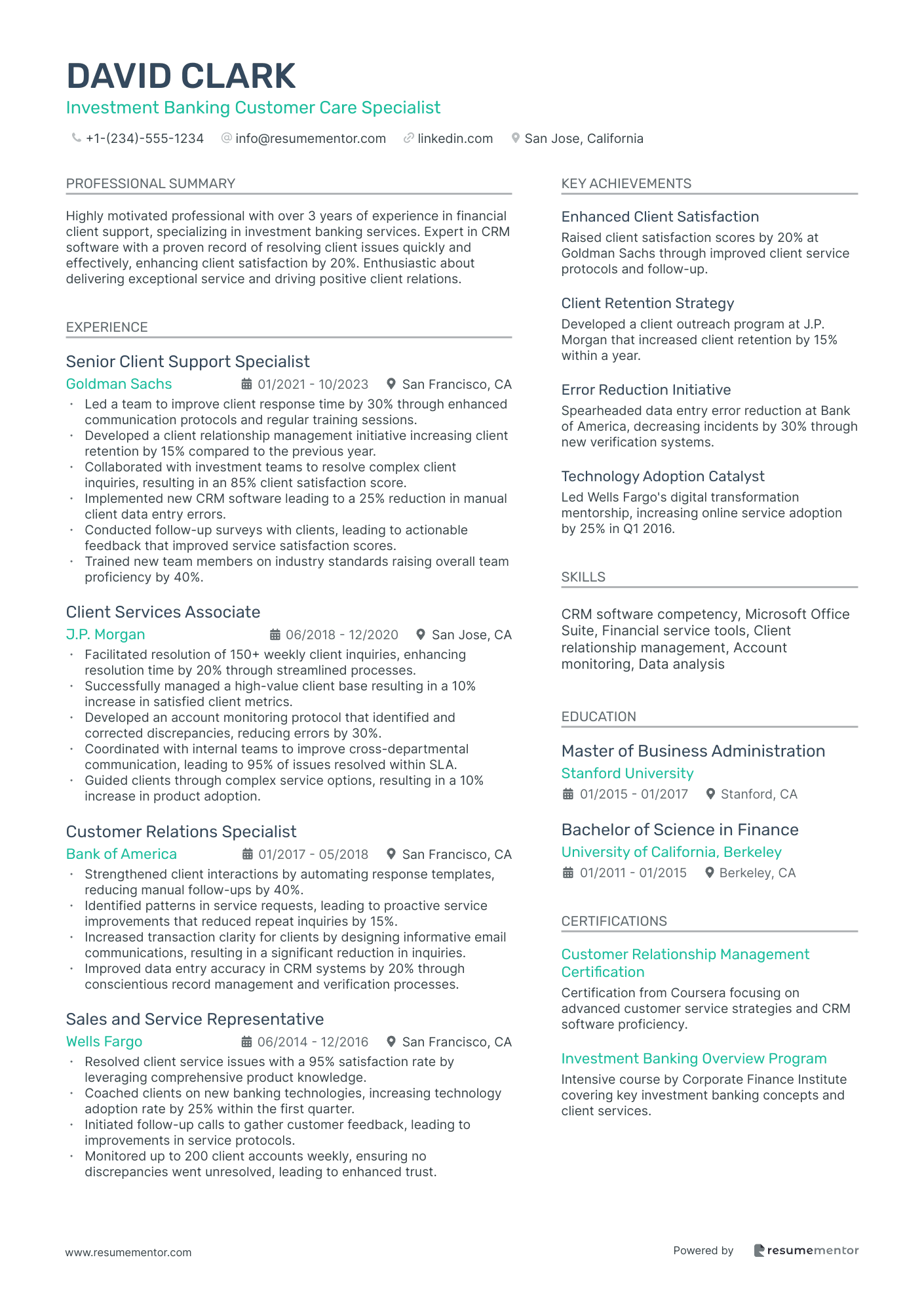

Investment Banking Customer Care Specialist

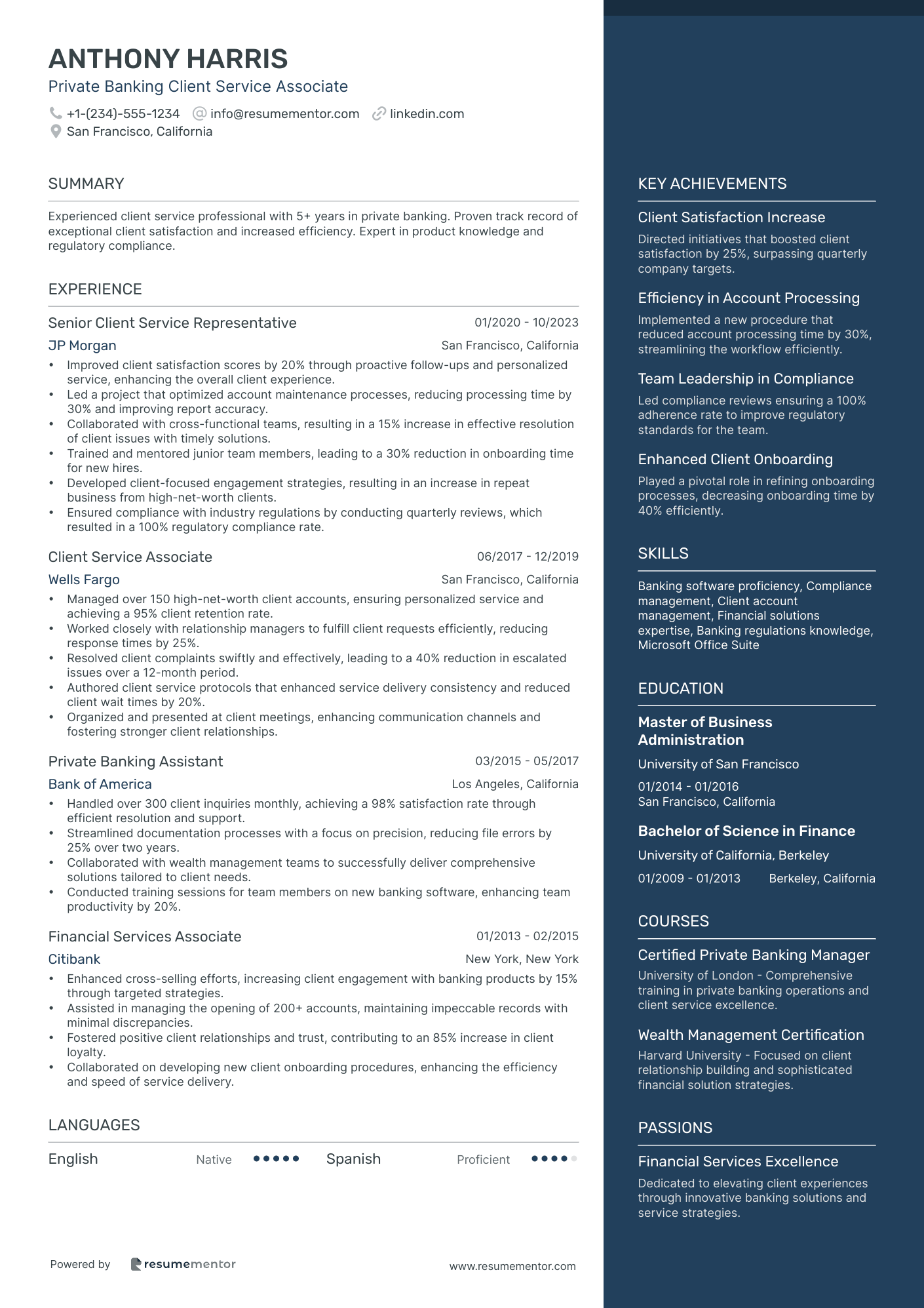

Private Banking Client Service Associate

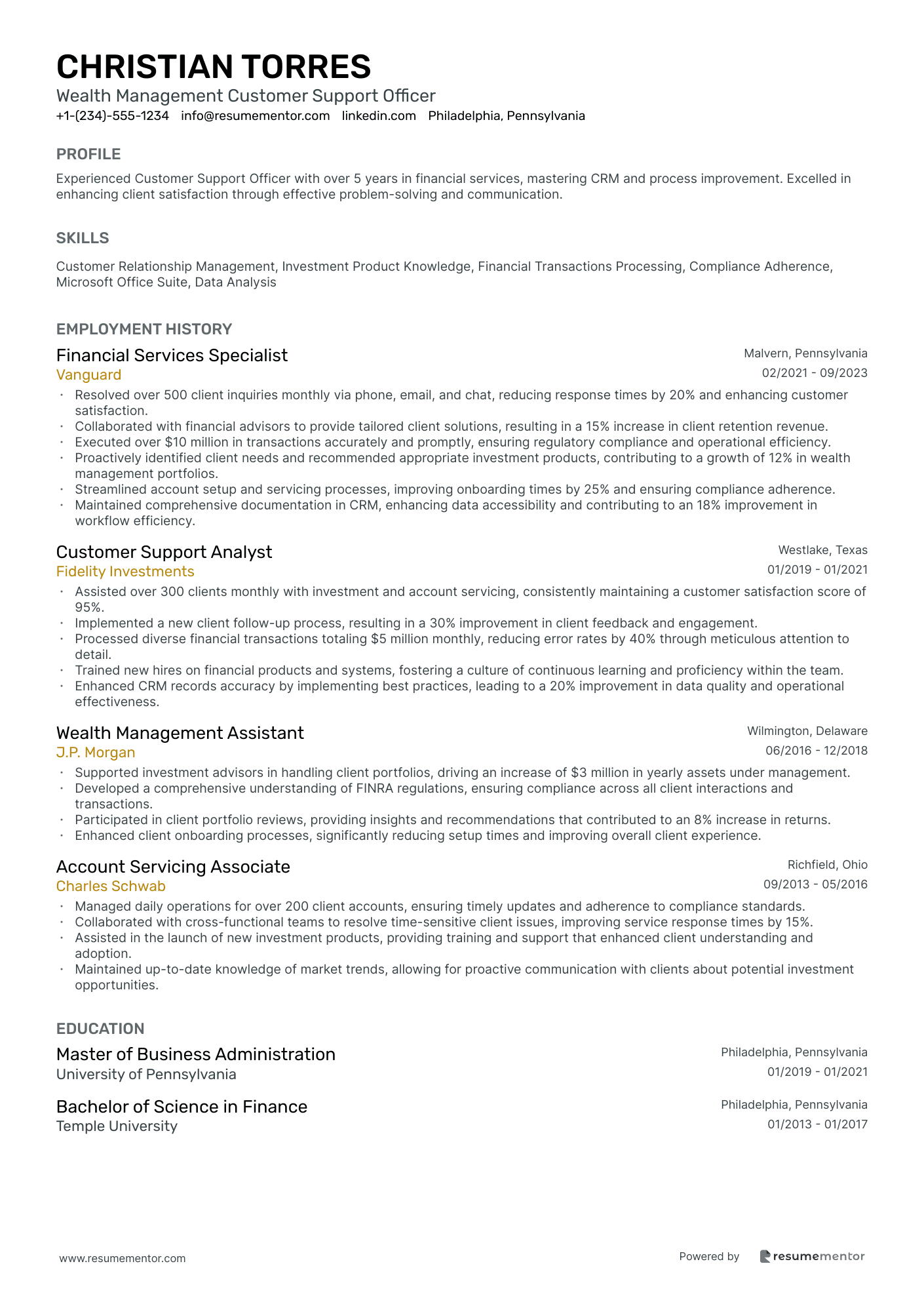

Wealth Management Customer Support Officer

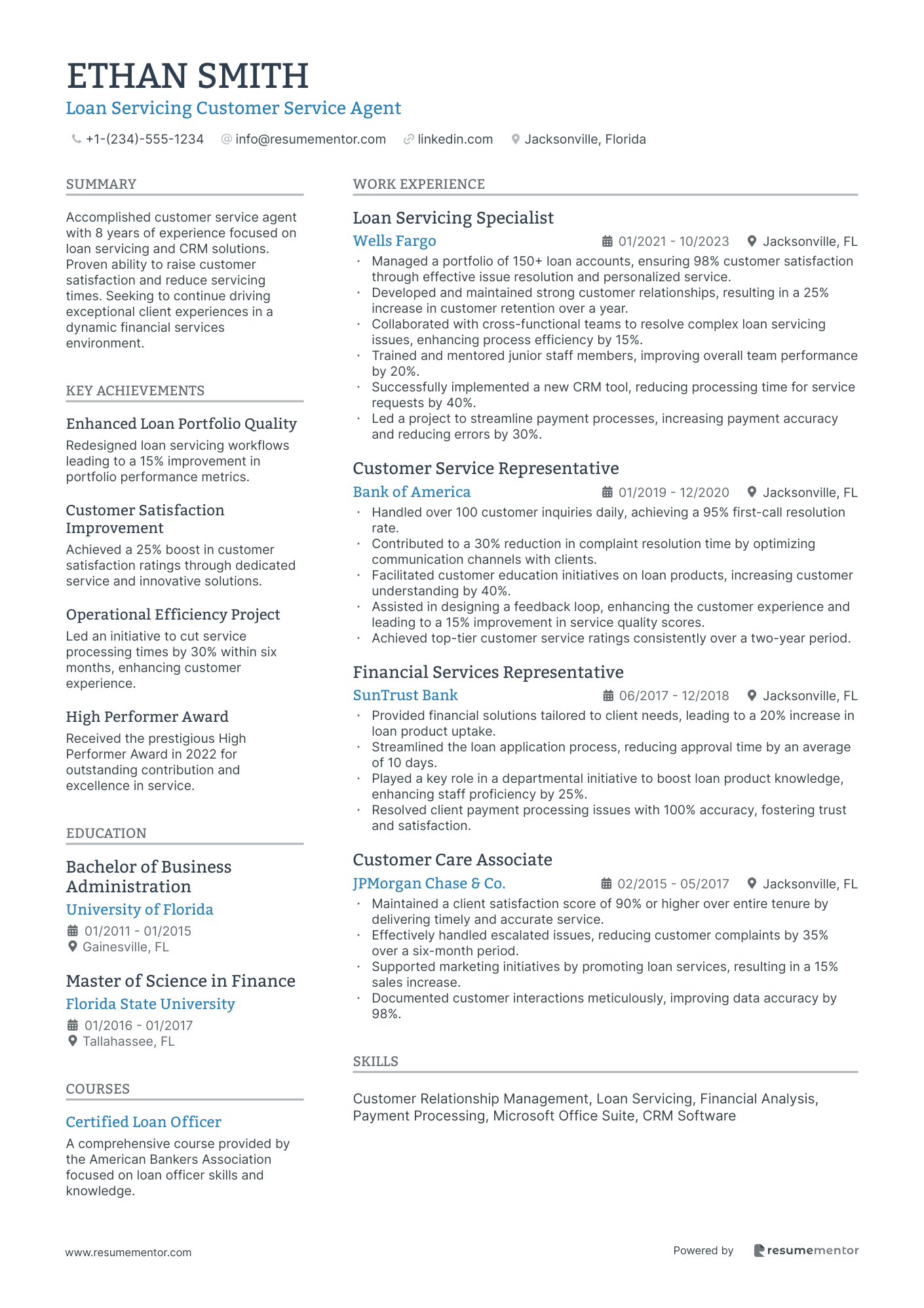

Loan Servicing Customer Service Agent

Foreign Exchange Banking Support Associate

Online Banking Customer Helpdesk Representative

Banking Relationship Manager resume sample

- •Managed a portfolio of high-net-worth clients, resulting in a 25% increase in assets under management over two years.

- •Executed strategic client engagement initiatives leading to securing $50 million in new client investments.

- •Collaborated with cross-functional teams to introduce new lending products, boosting loan sales by 30% within one fiscal year.

- •Proactively identified client needs, enhancing customer satisfaction scores by 15% over the last year.

- •Lead client advisory meetings, providing expert consultation on wealth management, increasing client retention rates by 20%.

- •Ensured compliance with regulatory standards, reducing audit findings by 50% through rigorous checks and training.

- •Successfully grew client portfolio by 40% through targeted networking and engagement strategies.

- •Achieved a 35% increase in cross-selling banking products, contributing to overall branch revenue growth.

- •Conducted quarterly financial reviews with clients, improving service satisfaction scores by 18%.

- •Delivered presentations on investment opportunities to groups of stakeholders, driving investment option uptake by 22%.

- •Facilitated workshops and training sessions on regulatory compliance, enhancing team awareness and readiness.

- •Assisted in the development of customized banking solutions for clients, resulting in a 30% increase in product adoption.

- •Analyzed customer feedback to refine service delivery, raising overall customer satisfaction by 10%.

- •Supported high-priority client accounts, contributing to a 15% growth in managed assets year-on-year.

- •Engaged in community outreach programs, raising the bank’s local profile and attracting 20 new clients monthly.

- •Conducted detailed financial analyses to support client decision-making, increasing informed client transactions by 20%.

- •Collaborated with the relationship management team to tailor financial solutions that increased client satisfaction.

- •Created financial reports that revealed revenue opportunities, aiding in a 10% increase in year-on-year profits.

- •Played a key role in the transition to new banking software, ensuring team compliance and efficiency improvement.

Mortgage Customer Service Representative resume sample

- •Led a team to improve customer service response time by 40%, while maintaining a 95% customer satisfaction rate.

- •Managed high-volume inquiries, implementing targeted strategies that resulted in a 30% increase in client retention.

- •Developed and implemented new training protocols, boosting department accuracy and efficiency by 25%.

- •Collaborated with internal teams to reduce loan processing time by 20%, enhancing the customer experience significantly.

- •Resolved complex customer issues with a 98% success rate, enhancing the brand's reliability and trust factor.

- •Increased mortgage digitization adoption by 50%, resulting in improved processing speed and customer accessibility.

- •Provided expert guidance to clients, ensuring informed decisions on mortgage products, enhancing customer loyalty.

- •Engineered a streamlined communication protocol, boosting customer interaction quality by 30%.

- •Consistently exceeded loan closure targets by 15%, contributing to overall departmental performance.

- •Facilitated workshops on mortgage options, improving client understanding and approval rates by 10%.

- •Developed strong relationships with third-party vendors, reducing processing delays by 15%.

- •Worked directly with clients to assess their mortgage needs, resulting in a 20% growth in client base.

- •Utilized CRM software to document and improve client interaction, achieving a 25% efficiency increase.

- •Collaborated with internal and external partners to address issues, reducing processing time by 10%.

- •Improved customer satisfaction through proactive issue resolution and personalized mortgage solutions.

- •Assisted in processing an average of 200 loan applications per month with a 98% accuracy rate.

- •Contributed to a 20% increase in operational efficiency by revamping customer communication channels.

- •Conducted training sessions for 15+ new hires, improving team capability and service delivery.

- •Maintained a high level of client satisfaction by resolving up to 50 inquiries daily in a timely manner.

Retail Banking Support Specialist resume sample

- •Enhanced customer satisfaction by 30% through streamlined account services and prompt transaction processing.

- •Devised new customer onboarding protocol, reducing process time by 20%, improving customer feedback ratings.

- •Trained a team of 8 new staff members, improving overall service efficiency and team cohesion by 25%.

- •Managed incoming customer inquiries, resolving 95% of issues on first contact, maintaining high service standards.

- •Conducted thorough follow-up communications with clients, resulting in a 15% increase in positive customer reviews.

- •Integrated new banking software application, leading to a 35% improvement in transaction processing times.

- •Successfully reduced error rate in transaction processing by 40% through improved audit measures and staff training.

- •Maintained regulatory and compliance standards, resulting in successful internal audits consecutively over two years.

- •Collaborated with cross-functional teams to streamline operations, increasing productivity by 20%.

- •Processed over 2,000 customer requests efficiently, maintaining a 98% satisfaction rating.

- •Developed a knowledge base for branch staff, leading to quicker resolution of client inquiries and issues.

- •Achieved a 97% customer satisfaction score by providing expert assistance and resolving issues promptly.

- •Implemented a new queue management system, reducing customer wait times by up to 15% during peak hours.

- •Assisted in launching new banking products, resulting in a 10% increase in customer adoption rates.

- •Utilized advanced CRM tools to manage customer relationships and service follow-ups efficiently.

- •Conducted detailed analyses of client financial needs, successfully increasing cross-sell rates by 25%.

- •Facilitated over 500 account openings, ensuring compliance and accuracy, resulting in zero discrepancies.

- •Resolved complex customer inquiries, achieving a first-contact resolution rate of 90%.

- •Participated in industry-led training sessions to maintain up-to-date knowledge of banking trends.

Commercial Banking Service Advisor resume sample

- •Increased client portfolio by 35% within two years, significantly boosting revenue through strategic relationship management.

- •Implemented a new client onboarding process, decreasing onboarding time by 25%, resulting in smoother client transitions.

- •Collaborated with product teams to tailor banking solutions, leading to a 15% increase in cross-selling opportunities.

- •Resolved complex client inquiries with a 98% first-contact resolution rate, enhancing overall client satisfaction.

- •Facilitated workshops and training for junior advisors, improving team skills and departmental efficiency by 30%.

- •Developed a targeted follow-up strategy, leading to a 20% enhancement in client retention rates.

- •Managed a portfolio of 50+ business clients, achieving a 10% growth in account balances year-over-year.

- •Coordinated with multiple departments to resolve client service issues promptly, reducing resolution time by 40%.

- •Monitored transaction activities, identifying potential risks and mitigating issues to ensure compliance with banking regulations.

- •Led a project implementing new CRM software integration, improving data accuracy and client documentation by 50%.

- •Executed targeted client engagement initiatives, increasing product adoption by 15% over six months.

- •Cultivated strong relationships with over 100 clients, enhancing the client satisfaction score by 25% annually.

- •Implemented a customer satisfaction survey, collecting insights that led to a 10% improvement in service delivery.

- •Developed and presented financial analysis reports to clients, resulting in better-informed investment decisions.

- •Participated in cross-departmental initiatives, enhancing overall bank operations and client service coordination.

- •Handled over 60 daily inquiries regarding banking products and services, achieving a 98% satisfaction rate.

- •Assisted in redesigning a workflow process, improving efficiency by 15% in service delivery.

- •Trained new employees in client interaction techniques, elevating team performance and service standards.

- •Conducted regular follow-ups with clients, ensuring continued satisfaction and identifying opportunities for service expansion.

Investment Banking Customer Care Specialist resume sample

- •Led a team to improve client response time by 30% through enhanced communication protocols and regular training sessions.

- •Developed a client relationship management initiative increasing client retention by 15% compared to the previous year.

- •Collaborated with investment teams to resolve complex client inquiries, resulting in an 85% client satisfaction score.

- •Implemented new CRM software leading to a 25% reduction in manual client data entry errors.

- •Conducted follow-up surveys with clients, leading to actionable feedback that improved service satisfaction scores.

- •Trained new team members on industry standards raising overall team proficiency by 40%.

- •Facilitated resolution of 150+ weekly client inquiries, enhancing resolution time by 20% through streamlined processes.

- •Successfully managed a high-value client base resulting in a 10% increase in satisfied client metrics.

- •Developed an account monitoring protocol that identified and corrected discrepancies, reducing errors by 30%.

- •Coordinated with internal teams to improve cross-departmental communication, leading to 95% of issues resolved within SLA.

- •Guided clients through complex service options, resulting in a 10% increase in product adoption.

- •Strengthened client interactions by automating response templates, reducing manual follow-ups by 40%.

- •Identified patterns in service requests, leading to proactive service improvements that reduced repeat inquiries by 15%.

- •Increased transaction clarity for clients by designing informative email communications, resulting in a significant reduction in inquiries.

- •Improved data entry accuracy in CRM systems by 20% through conscientious record management and verification processes.

- •Resolved client service issues with a 95% satisfaction rate by leveraging comprehensive product knowledge.

- •Coached clients on new banking technologies, increasing technology adoption rate by 25% within the first quarter.

- •Initiated follow-up calls to gather customer feedback, leading to improvements in service protocols.

- •Monitored up to 200 client accounts weekly, ensuring no discrepancies went unresolved, leading to enhanced trust.

Private Banking Client Service Associate resume sample

- •Improved client satisfaction scores by 20% through proactive follow-ups and personalized service, enhancing the overall client experience.

- •Led a project that optimized account maintenance processes, reducing processing time by 30% and improving report accuracy.

- •Collaborated with cross-functional teams, resulting in a 15% increase in effective resolution of client issues with timely solutions.

- •Trained and mentored junior team members, leading to a 30% reduction in onboarding time for new hires.

- •Developed client-focused engagement strategies, resulting in an increase in repeat business from high-net-worth clients.

- •Ensured compliance with industry regulations by conducting quarterly reviews, which resulted in a 100% regulatory compliance rate.

- •Managed over 150 high-net-worth client accounts, ensuring personalized service and achieving a 95% client retention rate.

- •Worked closely with relationship managers to fulfill client requests efficiently, reducing response times by 25%.

- •Resolved client complaints swiftly and effectively, leading to a 40% reduction in escalated issues over a 12-month period.

- •Authored client service protocols that enhanced service delivery consistency and reduced client wait times by 20%.

- •Organized and presented at client meetings, enhancing communication channels and fostering stronger client relationships.

- •Handled over 300 client inquiries monthly, achieving a 98% satisfaction rate through efficient resolution and support.

- •Streamlined documentation processes with a focus on precision, reducing file errors by 25% over two years.

- •Collaborated with wealth management teams to successfully deliver comprehensive solutions tailored to client needs.

- •Conducted training sessions for team members on new banking software, enhancing team productivity by 20%.

- •Enhanced cross-selling efforts, increasing client engagement with banking products by 15% through targeted strategies.

- •Assisted in managing the opening of 200+ accounts, maintaining impeccable records with minimal discrepancies.

- •Fostered positive client relationships and trust, contributing to an 85% increase in client loyalty.

- •Collaborated on developing new client onboarding procedures, enhancing the efficiency and speed of service delivery.

Wealth Management Customer Support Officer resume sample

- •Resolved over 500 client inquiries monthly via phone, email, and chat, reducing response times by 20% and enhancing customer satisfaction.

- •Collaborated with financial advisors to provide tailored client solutions, resulting in a 15% increase in client retention revenue.

- •Executed over $10 million in transactions accurately and promptly, ensuring regulatory compliance and operational efficiency.

- •Proactively identified client needs and recommended appropriate investment products, contributing to a growth of 12% in wealth management portfolios.

- •Streamlined account setup and servicing processes, improving onboarding times by 25% and ensuring compliance adherence.

- •Maintained comprehensive documentation in CRM, enhancing data accessibility and contributing to an 18% improvement in workflow efficiency.

- •Assisted over 300 clients monthly with investment and account servicing, consistently maintaining a customer satisfaction score of 95%.

- •Implemented a new client follow-up process, resulting in a 30% improvement in client feedback and engagement.

- •Processed diverse financial transactions totaling $5 million monthly, reducing error rates by 40% through meticulous attention to detail.

- •Trained new hires on financial products and systems, fostering a culture of continuous learning and proficiency within the team.

- •Enhanced CRM records accuracy by implementing best practices, leading to a 20% improvement in data quality and operational effectiveness.

- •Supported investment advisors in handling client portfolios, driving an increase of $3 million in yearly assets under management.

- •Developed a comprehensive understanding of FINRA regulations, ensuring compliance across all client interactions and transactions.

- •Participated in client portfolio reviews, providing insights and recommendations that contributed to an 8% increase in returns.

- •Enhanced client onboarding processes, significantly reducing setup times and improving overall client experience.

- •Managed daily operations for over 200 client accounts, ensuring timely updates and adherence to compliance standards.

- •Collaborated with cross-functional teams to resolve time-sensitive client issues, improving service response times by 15%.

- •Assisted in the launch of new investment products, providing training and support that enhanced client understanding and adoption.

- •Maintained up-to-date knowledge of market trends, allowing for proactive communication with clients about potential investment opportunities.

Loan Servicing Customer Service Agent resume sample

- •Managed a portfolio of 150+ loan accounts, ensuring 98% customer satisfaction through effective issue resolution and personalized service.

- •Developed and maintained strong customer relationships, resulting in a 25% increase in customer retention over a year.

- •Collaborated with cross-functional teams to resolve complex loan servicing issues, enhancing process efficiency by 15%.

- •Trained and mentored junior staff members, improving overall team performance by 20%.

- •Successfully implemented a new CRM tool, reducing processing time for service requests by 40%.

- •Led a project to streamline payment processes, increasing payment accuracy and reducing errors by 30%.

- •Handled over 100 customer inquiries daily, achieving a 95% first-call resolution rate.

- •Contributed to a 30% reduction in complaint resolution time by optimizing communication channels with clients.

- •Facilitated customer education initiatives on loan products, increasing customer understanding by 40%.

- •Assisted in designing a feedback loop, enhancing the customer experience and leading to a 15% improvement in service quality scores.

- •Achieved top-tier customer service ratings consistently over a two-year period.

- •Provided financial solutions tailored to client needs, leading to a 20% increase in loan product uptake.

- •Streamlined the loan application process, reducing approval time by an average of 10 days.

- •Played a key role in a departmental initiative to boost loan product knowledge, enhancing staff proficiency by 25%.

- •Resolved client payment processing issues with 100% accuracy, fostering trust and satisfaction.

- •Maintained a client satisfaction score of 90% or higher over entire tenure by delivering timely and accurate service.

- •Effectively handled escalated issues, reducing customer complaints by 35% over a six-month period.

- •Supported marketing initiatives by promoting loan services, resulting in a 15% sales increase.

- •Documented customer interactions meticulously, improving data accuracy by 98%.

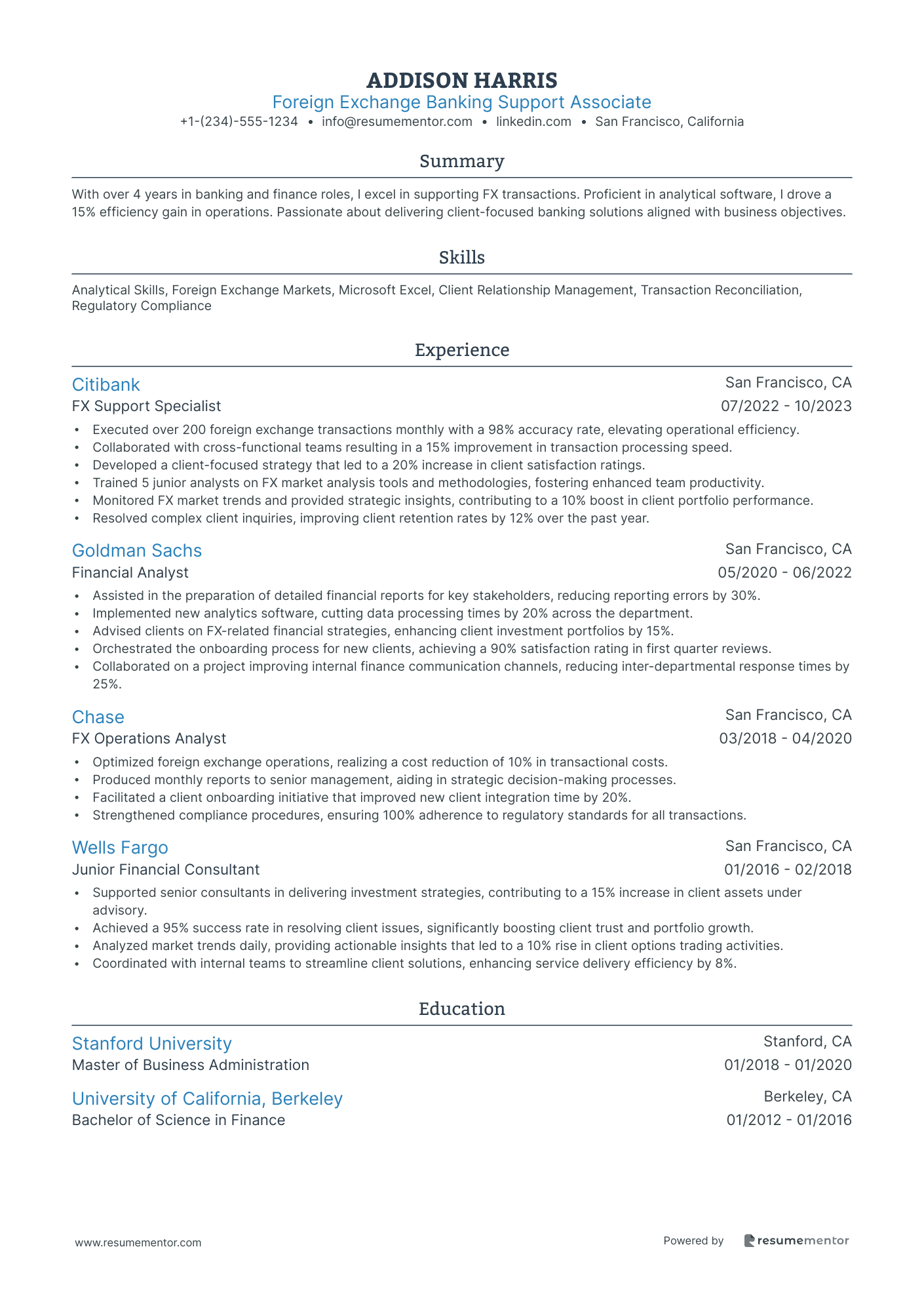

Foreign Exchange Banking Support Associate resume sample

- •Executed over 200 foreign exchange transactions monthly with a 98% accuracy rate, elevating operational efficiency.

- •Collaborated with cross-functional teams resulting in a 15% improvement in transaction processing speed.

- •Developed a client-focused strategy that led to a 20% increase in client satisfaction ratings.

- •Trained 5 junior analysts on FX market analysis tools and methodologies, fostering enhanced team productivity.

- •Monitored FX market trends and provided strategic insights, contributing to a 10% boost in client portfolio performance.

- •Resolved complex client inquiries, improving client retention rates by 12% over the past year.

- •Assisted in the preparation of detailed financial reports for key stakeholders, reducing reporting errors by 30%.

- •Implemented new analytics software, cutting data processing times by 20% across the department.

- •Advised clients on FX-related financial strategies, enhancing client investment portfolios by 15%.

- •Orchestrated the onboarding process for new clients, achieving a 90% satisfaction rating in first quarter reviews.

- •Collaborated on a project improving internal finance communication channels, reducing inter-departmental response times by 25%.

- •Optimized foreign exchange operations, realizing a cost reduction of 10% in transactional costs.

- •Produced monthly reports to senior management, aiding in strategic decision-making processes.

- •Facilitated a client onboarding initiative that improved new client integration time by 20%.

- •Strengthened compliance procedures, ensuring 100% adherence to regulatory standards for all transactions.

- •Supported senior consultants in delivering investment strategies, contributing to a 15% increase in client assets under advisory.

- •Achieved a 95% success rate in resolving client issues, significantly boosting client trust and portfolio growth.

- •Analyzed market trends daily, providing actionable insights that led to a 10% rise in client options trading activities.

- •Coordinated with internal teams to streamline client solutions, enhancing service delivery efficiency by 8%.

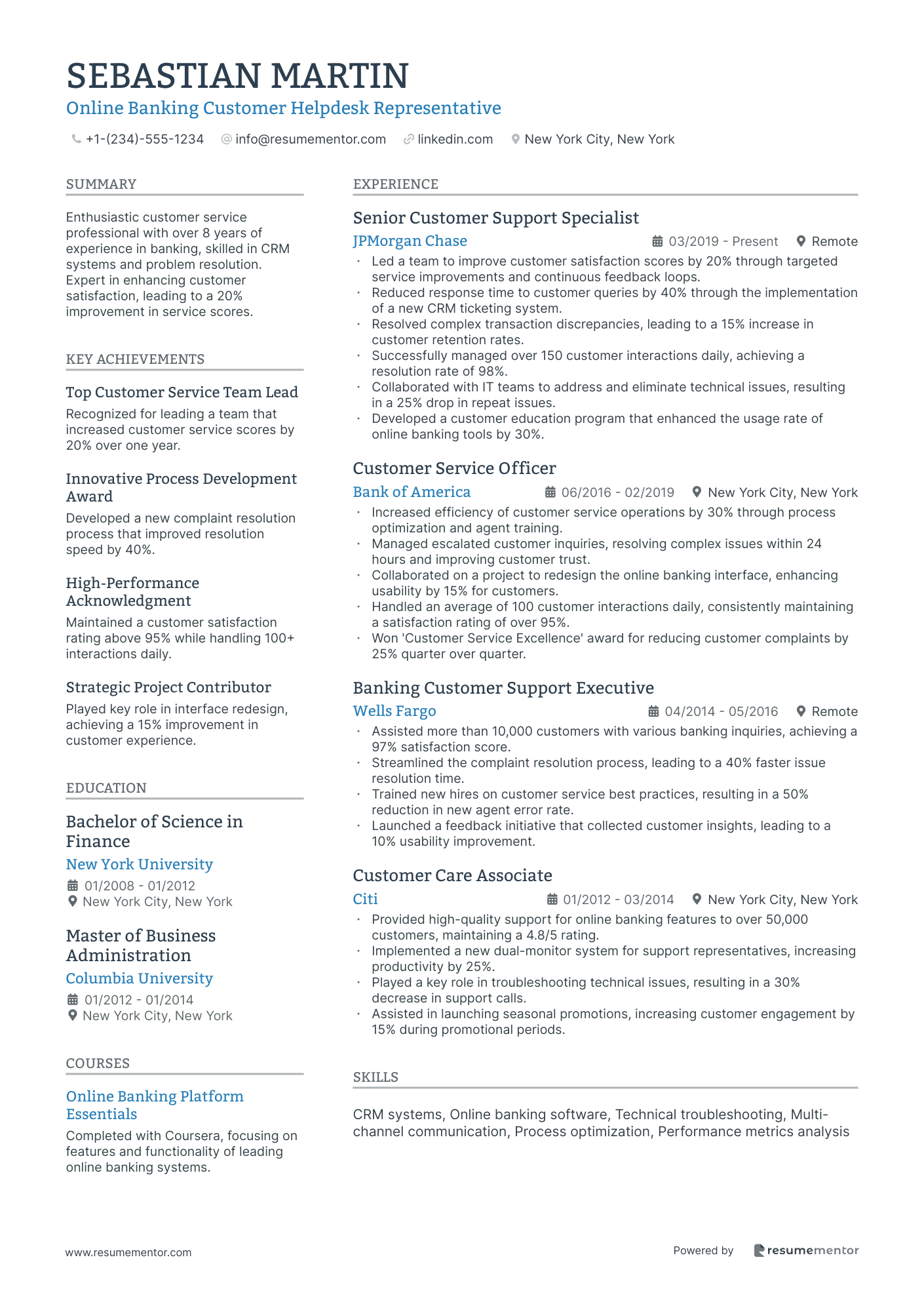

Online Banking Customer Helpdesk Representative resume sample

- •Led a team to improve customer satisfaction scores by 20% through targeted service improvements and continuous feedback loops.

- •Reduced response time to customer queries by 40% through the implementation of a new CRM ticketing system.

- •Resolved complex transaction discrepancies, leading to a 15% increase in customer retention rates.

- •Successfully managed over 150 customer interactions daily, achieving a resolution rate of 98%.

- •Collaborated with IT teams to address and eliminate technical issues, resulting in a 25% drop in repeat issues.

- •Developed a customer education program that enhanced the usage rate of online banking tools by 30%.

- •Increased efficiency of customer service operations by 30% through process optimization and agent training.

- •Managed escalated customer inquiries, resolving complex issues within 24 hours and improving customer trust.

- •Collaborated on a project to redesign the online banking interface, enhancing usability by 15% for customers.

- •Handled an average of 100 customer interactions daily, consistently maintaining a satisfaction rating of over 95%.

- •Won 'Customer Service Excellence' award for reducing customer complaints by 25% quarter over quarter.

- •Assisted more than 10,000 customers with various banking inquiries, achieving a 97% satisfaction score.

- •Streamlined the complaint resolution process, leading to a 40% faster issue resolution time.

- •Trained new hires on customer service best practices, resulting in a 50% reduction in new agent error rate.

- •Launched a feedback initiative that collected customer insights, leading to a 10% usability improvement.

- •Provided high-quality support for online banking features to over 50,000 customers, maintaining a 4.8/5 rating.

- •Implemented a new dual-monitor system for support representatives, increasing productivity by 25%.

- •Played a key role in troubleshooting technical issues, resulting in a 30% decrease in support calls.

- •Assisted in launching seasonal promotions, increasing customer engagement by 15% during promotional periods.

Crafting an exceptional banking customer service resume is like navigating a lively financial district; you want your unique skills and experience to shine amid all the noise. Many people struggle with showcasing their abilities in financial communication and problem-solving, which are crucial in this field. Your resume should effectively communicate your talents in handling financial inquiries and delivering top-notch service to make you stand out.

The importance of clarity and organization in your resume cannot be overstated, and a resume template is the perfect guide for achieving this. Think of it as a detailed building plan that helps you structure your information logically and attractively. By exploring a variety of resume templates, you can find one that aligns with your personal style, ensuring that your strengths are highlighted effectively.

Choosing the right format with the help of a template allows your skills to shine through without overwhelming the reader. It showcases your expertise in using banking software and your knack for resolving customer issues efficiently, making your case as a valuable team member.

In a competitive job market, an effective resume can be the key to catching the eye of hiring managers. By presenting your abilities strategically, you clearly communicate the value you bring to the role. Follow this guide to craft a resume that opens doors to exciting opportunities in banking customer service.

Key Takeaways

- Your banking customer service resume should articulate your capabilities in financial transactions, customer inquiries, and comprehension of banking products effectively.

- An organized resume template enables clarity, facilitating a logical and appealing introduction of your skills and experience.

- A reverse-chronological format, a modern font choice, and saving your resume as a PDF enhances professionalism and readability.

- Your experience section should leverage action words and quantifiable achievements to highlight your customer service impact.

- A well-constructed skills section focusing on both hard and soft skills becomes a crucial tool for aligning with industry expectations.

What to focus on when writing your banking customer service resume

A banking customer service resume should clearly convey your ability to handle financial transactions, effectively address customer inquiries, and demonstrate a solid understanding of banking products. This shows your capacity to deliver excellent service and efficiently solve problems, appealing to recruiters seeking team players who enhance customer satisfaction and contribute positively to the organization's goals.

How to structure your banking customer service resume

- Contact Information: Provide your full name, phone number, email address, and LinkedIn profile, if available—ensuring that your contact details are accurate is crucial for potential employers to connect with you easily. It's important to maintain updated and professional contact information as this forms the first impression.

- Professional Summary: This is your chance to highlight your banking customer service experience—focusing on problem-solving and communication skills that set you apart. Aim for a compelling summary that captures your professional ethos and showcases your main strengths in the field, catching the recruiter's attention right away.

- Work Experience: Detailing relevant job titles, companies, and dates, along with achievements like boosting customer satisfaction scores, helps illustrate your impact in previous roles. Emphasize responsibilities that demonstrate your expertise in customer interactions and your ability to multitask efficiently within dynamic banking environments.

- Skills: Including keywords like "cash handling," "financial transactions," and "customer relationship management" ensures your resume aligns with industry expectations—this section should reflect both your core competencies and specialized skills, painting a broad picture of your qualifications.

- Education: Listing relevant degrees, institutions, and dates, along with finance and customer service-related courses, underscores your foundational knowledge. Highlight any academic achievements that relate directly to banking or customer service, reinforcing your preparedness for the role.

- Certifications: Showcasing certifications like "Certified Customer Service Professional" or "Bank Teller" adds credibility and highlights your commitment to the field—these credentials can provide a competitive edge and demonstrate your proactive engagement with ongoing professional development.

Now that we've covered the key sections, let's delve deeper into how to format your resume effectively, ensuring each component is crafted to make the strongest impact possible.

Which resume format to choose

Crafting an effective banking customer service resume starts with selecting the right format that shows your experience clearly and professionally. A reverse-chronological format is particularly useful as it emphasizes your most recent roles and responsibilities, making it easier for potential employers to understand your career progression and current skill set.

When it comes to font choice, opt for modern styles like Rubik, Raleway, or Lato. These fonts give your resume a contemporary feel, making your information easy to read while still looking professional. Your choice of font subtly influences the first impression you make on hiring managers, so sticking to these clean options can enhance your resume's appeal.

Saving your document as a PDF is crucial. This file type preserves your layout and fonts across different devices and software, ensuring your resume appears exactly as you designed it when a potential employer opens it. This consistency is key in maintaining a professional appearance.

Finally, consider the layout design by maintaining one-inch margins on all sides. This creates a balanced look, providing enough white space to guide the reader's eye comfortably through your achievements and skills. A well-organized presentation can set your resume apart in a competitive banking industry, helping you make a strong impression from the start.

How to write a quantifiable resume experience section

Your experience section is a vital part of a banking customer service resume, bringing together your skills, achievements, and distinctive qualities. Focus on past roles where you effectively addressed customer issues, streamlined processes, and contributed to team success. List your jobs in reverse chronological order, starting with the most recent. Include roles from the last 10 to 15 years unless an older job is highly relevant to the position you seek. Tailoring each bullet point to align with the job you're applying for is essential, as it highlights the skills and achievements that a prospective employer values. Using action words like “achieved,” “implemented,” “resolved,” and “enhanced” clearly demonstrates your impact.

Here’s an example of a strong experience section for banking customer service:

- •Improved customer satisfaction ratings by 25% through implementation of efficient service strategies.

- •Trained and mentored a team of 10 representatives, leading to a 15% increase in team performance metrics.

- •Resolved 150+ customer issues weekly, reducing resolution time by 20% through proactive problem-solving.

- •Enhanced cross-department collaboration which resulted in a 30% reduction in processing errors.

This experience section shines because it connects your skills directly to what potential employers are seeking. Each bullet point offers a concrete and quantifiable achievement that paints a clear picture of your impact. Demonstrating improvements in customer satisfaction and team mentoring shows off your leadership and problem-solving expertise. Specific results, like a 25% boost in satisfaction ratings and a 20% faster resolution time, provide tangible proof of your effectiveness. The chronological structure underscores your career progression and commitment, while the use of strong action words ties everything together, making it easy for the reader to see your value in a banking customer service role.

Industry-Specific Focus resume experience section

A banking-focused customer service resume experience section should clearly highlight your skills and achievements relevant to delivering excellent customer service in the banking industry. Begin by listing your job titles, workplaces, and the dates of your employment to set the foundation for your experience. Then, use bullet points to illustrate your accomplishments, emphasizing action verbs and specific contributions. This approach showcases your proficiency in banking and your ability to provide outstanding customer service seamlessly.

When crafting your bullet points, integrate essential skills like communication, problem-solving, and your expertise in banking products to create a cohesive narrative. Explain how you've applied these skills to enhance customer experiences or achieve targets, and include measurable outcomes to underscore your effectiveness. This not only demonstrates your capability to meet customer needs but also highlights the positive impact of your work. Keep your sentences clear and interconnected, ensuring that each point naturally leads to the next.

Customer Service Specialist

Bank of America

June 2019 - Present

- Managed over 150 customer inquiries daily through phone and email, boosting customer satisfaction to 95%.

- Trained new team members on service protocols, which increased team efficiency by 20%.

- Created a feedback program that led to a 30% rise in positive customer reviews, enhancing overall customer experience.

- Collaborated with the sales team to cross-sell financial products, driving a 10% increase in revenue and strengthening customer relationships.

Leadership-Focused resume experience section

A banking customer service leadership-focused resume experience section should highlight your leadership abilities and the positive changes you've driven in past roles. Emphasize how you led, managed, and inspired your team to reach higher levels of customer satisfaction. Discuss specific improvements you've championed, such as decreasing customer complaints or enhancing service efficiency, to showcase your effectiveness as a leader.

Clearly outline your accomplishments with bullet points, using strong action verbs to convey your initiative and impact. Incorporate numbers and percentages whenever possible to paint a vivid picture of your success. Tailor your experience to align with the specific job you're applying for, focusing on the most relevant skills and outcomes. This strategic presentation of your leadership achievements will help you stand out by demonstrating how your actions led to improved service and business results.

Customer Service Team Leader

Bank XYZ

January 2018 - Present

- Led a team of 15 representatives, boosting overall customer satisfaction by 20%.

- Implemented training programs that reduced customer wait times by 30%.

- Coached team members to achieve personal development goals, resulting in a 50% increase in internal promotions.

- Monitored and resolved escalated issues, minimizing complaint resolutions by 35%.

Skills-Focused resume experience section

A skills-focused banking customer service resume experience section should highlight the specific abilities that make you an ideal candidate for the role. Begin by reflecting on moments when your skills led to significant improvements or solutions, especially in handling customer inquiries or communication with diverse clientele. With these examples in mind, create clear statements that illustrate your contributions and achievements in a way that is easy to understand. Use data, such as numbers or percentages, to give a concrete sense of your impact and success.

Each bullet point should connect to a key skill like resolving customer issues, managing accounts, or mentoring new employees, demonstrating how these abilities translate into tangible workplace benefits. By tailoring your language to underline the positive changes your skills brought about, you help employers see your potential value. Conclude with outcomes or achievements to reinforce how your past roles prepared you to add value to future workplaces.

Customer Service Associate

Sunshine Bank

June 2020 - Present

- Resolved over 200 customer inquiries weekly, boosting satisfaction ratings by 15%.

- Managed account setups and maintenance for 150+ clients monthly, ensuring accuracy and security.

- Trained and mentored 5 new hires, enhancing team performance and service quality.

- Introduced a feedback system that improved service efficiency by 10%.

Efficiency-Focused resume experience section

A banking customer service efficiency-focused resume experience section should showcase how you've made processes smoother, minimized wait times, and enhanced customer interactions. Focus on highlighting the impact rather than simply listing tasks, using strong action words like "streamlined," "transformed," or "accelerated" to emphasize your achievements. To make your claims more convincing, include measurable results, such as reducing processing times or improving customer satisfaction scores. Reflect on the obstacles you faced, the actions you took to address them, and the successful outcomes you achieved.

Organizing each job entry with dates, your job title, and the organization helps frame your contributions clearly. Begin each bullet point with an action verb and maintain a focus on results, which strengthens the narrative of your ability to enhance efficiency in banking processes and customer service. Here's an example to guide you:

Customer Service Specialist

Bank XYZ

June 2020 - September 2023

- Streamlined the customer complaint process, reducing resolution time by 40%.

- Implemented new training programs that led to a 30% improvement in customer satisfaction scores.

- Developed a new database system that improved information retrieval time by 50%.

- Collaborated with IT to automate routine tasks, saving 20 staff hours per week.

Write your banking customer service resume summary section

A banking-focused customer service resume experience section should immediately grab attention by highlighting your skills and achievements. It's essential to provide a snapshot of your expertise if you have experience in this field. Start by reflecting on your strengths and craft two to three sentences that effectively convey what makes you stand out. Here's a sample summary:

This concise summary highlights your dedication to client satisfaction and your ability to handle responsibilities effectively. Your choice of words should be clear and directly related to the job you're targeting. If you're at the start of your career, you might opt for a resume objective instead, outlining your aspirations and goals. A resume profile combines these elements, providing context to your experience. On the other hand, a summary of qualifications is more of a direct list of your attributes. These sections cater to different career stages and purposes, so selecting the right one will illuminate your unique skills and align with your career path.

Listing your banking customer service skills on your resume

A banking customer service-focused resume experience section should seamlessly integrate your skills and strengths to demonstrate your value. Skills can be a standalone feature or woven into your summary and experience areas, highlighting your ability to connect with and support customers. While soft skills illustrate your interpersonal abilities, hard skills are the specific, teachable capabilities learned through training or education.

When chosen wisely, these skills and strengths become vital resume keywords, increasing your chances of passing through job filters. They directly align your qualifications with the core requirements of the industry.

For example, here is a skills section for a banking customer service resume in JSON format:

This section is effective because it is straightforward and focuses on essential customer service competencies. Each keyword is tailored to meet industry requirements, ensuring clarity and impact without extra fluff.

Best hard skills to feature on your banking customer service resume

For a banking customer service role, hard skills should reflect your ability to proficiently manage job-specific tasks. They demonstrate your technical expertise and capacity to navigate banking operations smoothly.

Hard Skills

- Cash Handling

- Data Entry

- Account Management

- Banking Software Proficiency

- Financial Transactions

- Cross-Selling

- Loan Processing

- Regulatory Compliance

- Currency Exchange

- Financial Analysis

- Report Generation

- Risk Assessment

- Check Processing

- Ledger Balancing

- Fraud Detection

Best soft skills to feature on your banking customer service resume

Soft skills are just as essential to a banking customer service role, as they highlight your ability to build strong customer relationships. These skills underscore how well you collaborate with others and address customer needs effectively.

Soft Skills

- Communication

- Problem Solving

- Empathy

- Active Listening

- Patience

- Adaptability

- Conflict Resolution

- Attention to Detail

- Time Management

- Teamwork

- Multitasking

- Decision Making

- Emotional Intelligence

- Customer Focus

- Negotiation

How to include your education on your resume

An education section is an important part of your resume because it highlights your academic background and qualifications. Tailoring this section to the job you are applying for is crucial. When applying for a banking customer service position, focus on relevant education and omit unrelated details.

When listing a degree, include the degree type, your field of study, and the name of the institution. If you graduated with honors, such as cum laude, include it to enhance your credentials. For example, write "Bachelor of Business Administration, Cum Laude" if applicable. Indicating your GPA can also be beneficial if it's strong. Represent it in the form "GPA: 3.8/4.0."

Here is an example that is not ideal:

This example is less relevant for a banking role since it highlights an art degree.

Here is a more relevant example:

This is a strong example for a banking customer service position. It shows a relevant degree in finance from a well-known university and includes an impressive GPA, which emphasizes a solid academic foundation. Highlighting pertinent education creates a focused and compelling application.

How to include banking customer service certificates on your resume

Including a certificates section in your banking customer service resume is essential. List the name of each certificate clearly. Include the date you received each certificate. Add the issuing organization for authenticity. Certificates can also be included in the header to catch immediate attention. For example, you can write "Certified Banking Specialist, 2025 (ABA)" alongside your name and contact info.

The example above is strong because it includes certificates directly related to banking customer service. It mentions the dates, confirming the applicant's recent competence in the field. It also includes the names of well-known issuers, which adds credibility. This shows potential employers that you have the specific skills and recognition needed for the job.

Extra sections to include in your banking customer service resume

Creating a professional and engaging resume is crucial for standing out in the banking customer service industry. Including sections like languages, hobbies and interests, volunteer work, and books can make your resume more attractive to potential employers.

- Language section — List any languages you speak fluently to showcase your communication skills and cultural adaptability. Highlighting bilingual or multilingual abilities can make you a more valuable asset in a diverse customer service environment.

- Hobbies and interests section — Include hobbies that reflect teamwork, leadership, or analytical skills to show you are well-rounded. This section can provide a glimpse into your personality and how you might fit into the company culture.

- Volunteer work section — Mention any volunteer work to demonstrate your commitment to community and altruistic values. Volunteering can highlight your soft skills like empathy, communication, and problem-solving, which are essential in customer service roles.

- Books section — List books that you have read related to banking, finance, or customer service to show your industry knowledge. This can also indicate that you are proactive about self-improvement and staying updated in your field.

Including these sections in your resume can add depth and dimension to your application, making you stand out as a well-rounded and driven candidate.

In Conclusion

In conclusion, crafting a strong banking customer service resume takes careful attention to detail and a strategic approach. Your resume is not just a list of past jobs; it's a tool to showcase your unique skills and achievements in the banking industry. By focusing on clear organization and presentation, you can effectively convey your abilities to potential employers. Use a structured format to highlight your most recent roles and accomplishments, ensuring that your skills stand out. Incorporating both hard and soft skills gives a balanced view of your capabilities, emphasizing your technical competence and interpersonal strengths. Tailor each section to align with the job you are targeting, making sure that both your education and any certifications directly relate to the position. Including extra sections, such as volunteer work or specific books read, can add personal depth, illustrating your commitment to professional growth and community involvement. Remember, your resume is often the first impression you make, so make it count by being both comprehensive and concise. By implementing these strategies, you position yourself to attract attention in the competitive banking customer service field and open doors to exciting career opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.