General Ledger Accountant Resume Examples

Jul 18, 2024

|

12 min read

Ace your accountant resume with these tips: a definitive guide to standing out and balancing your skills – master the ledger column pun for extra wit.

Rated by 348 people

General Ledger Analyst

Corporate General Ledger Accountant

Project Accounting Specialist

Financial Systems Accountant

Senior General Ledger Accountant

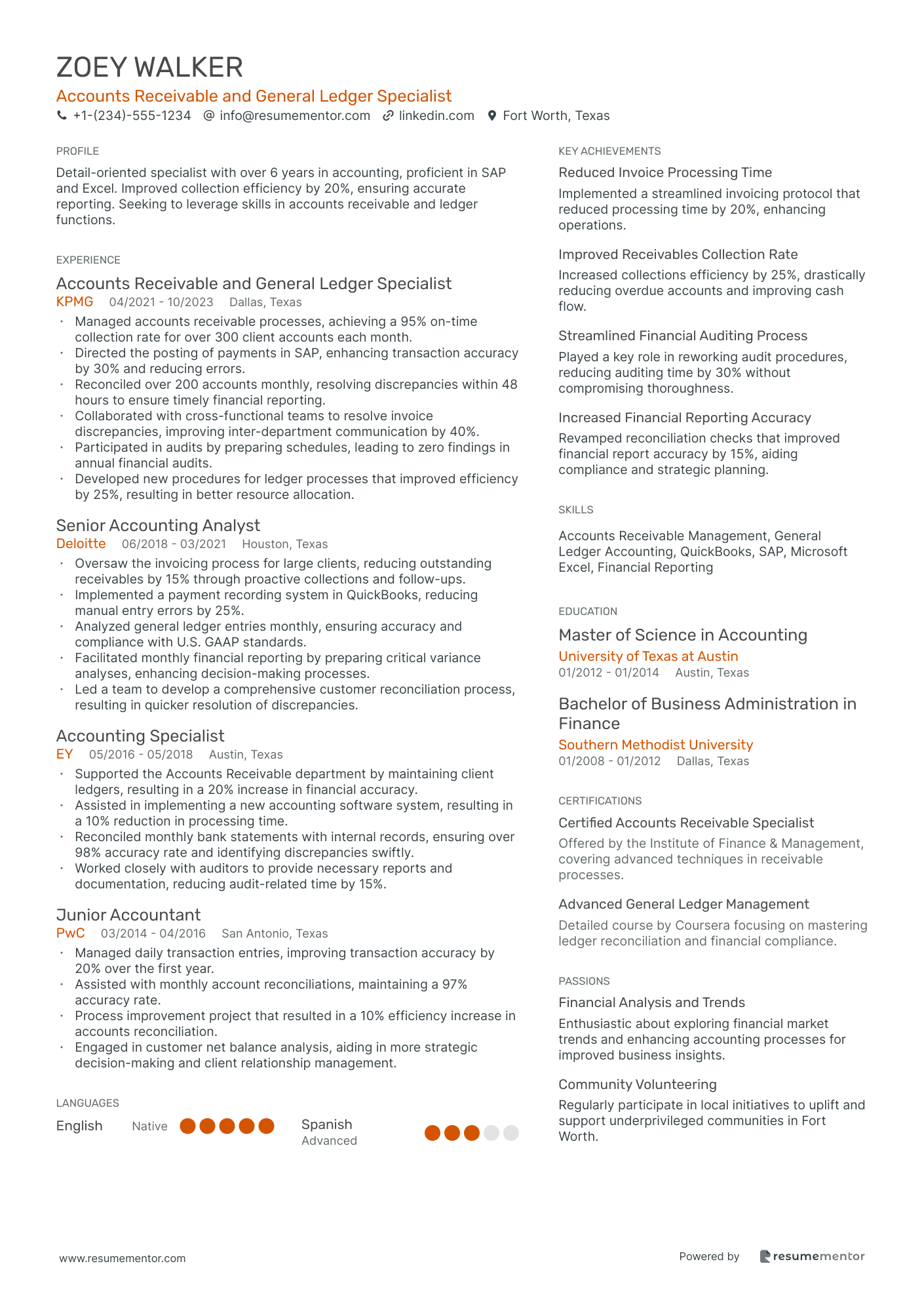

Accounts Receivable and General Ledger Specialist

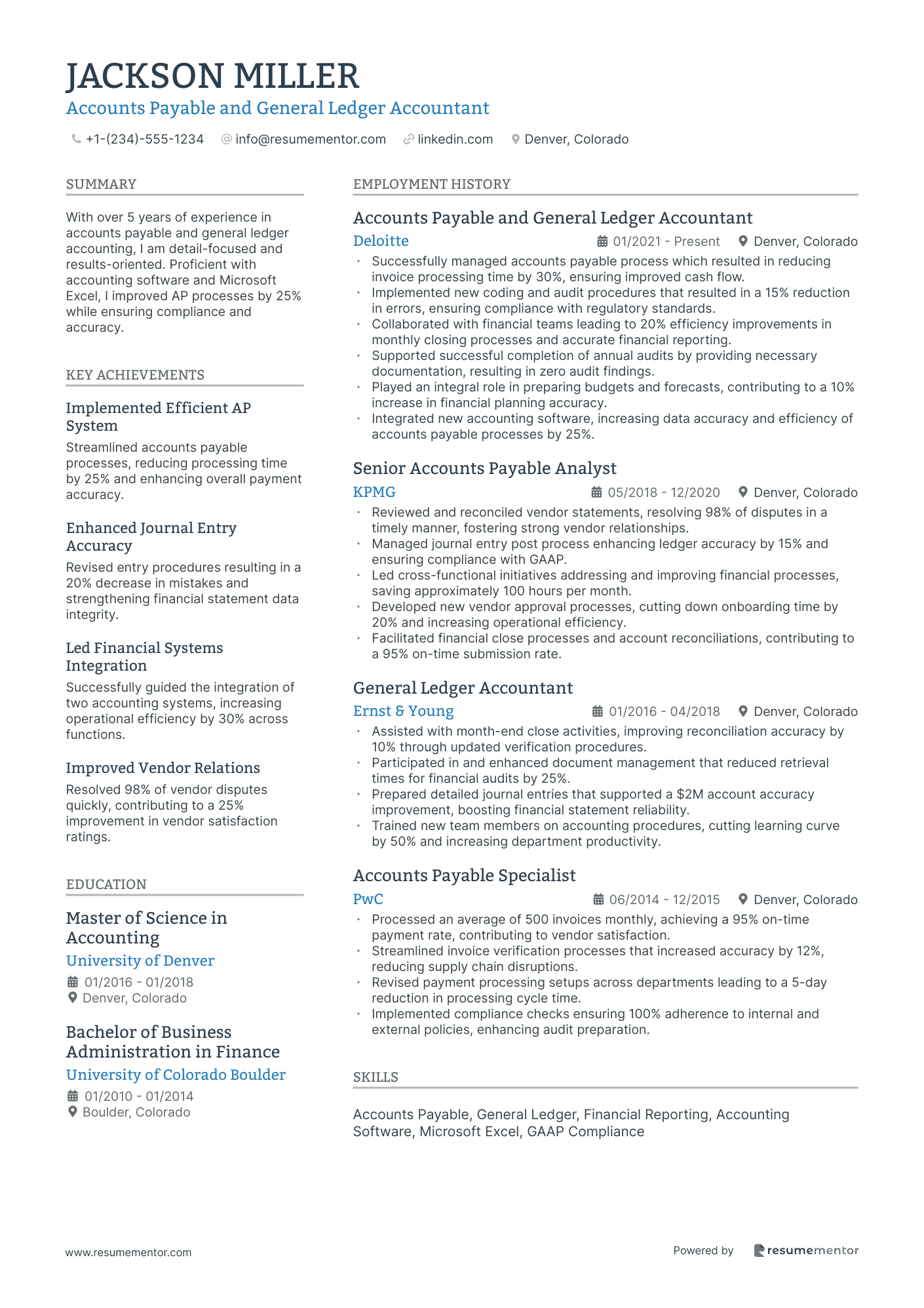

Accounts Payable and General Ledger Accountant

Auditing and General Ledger Accountant

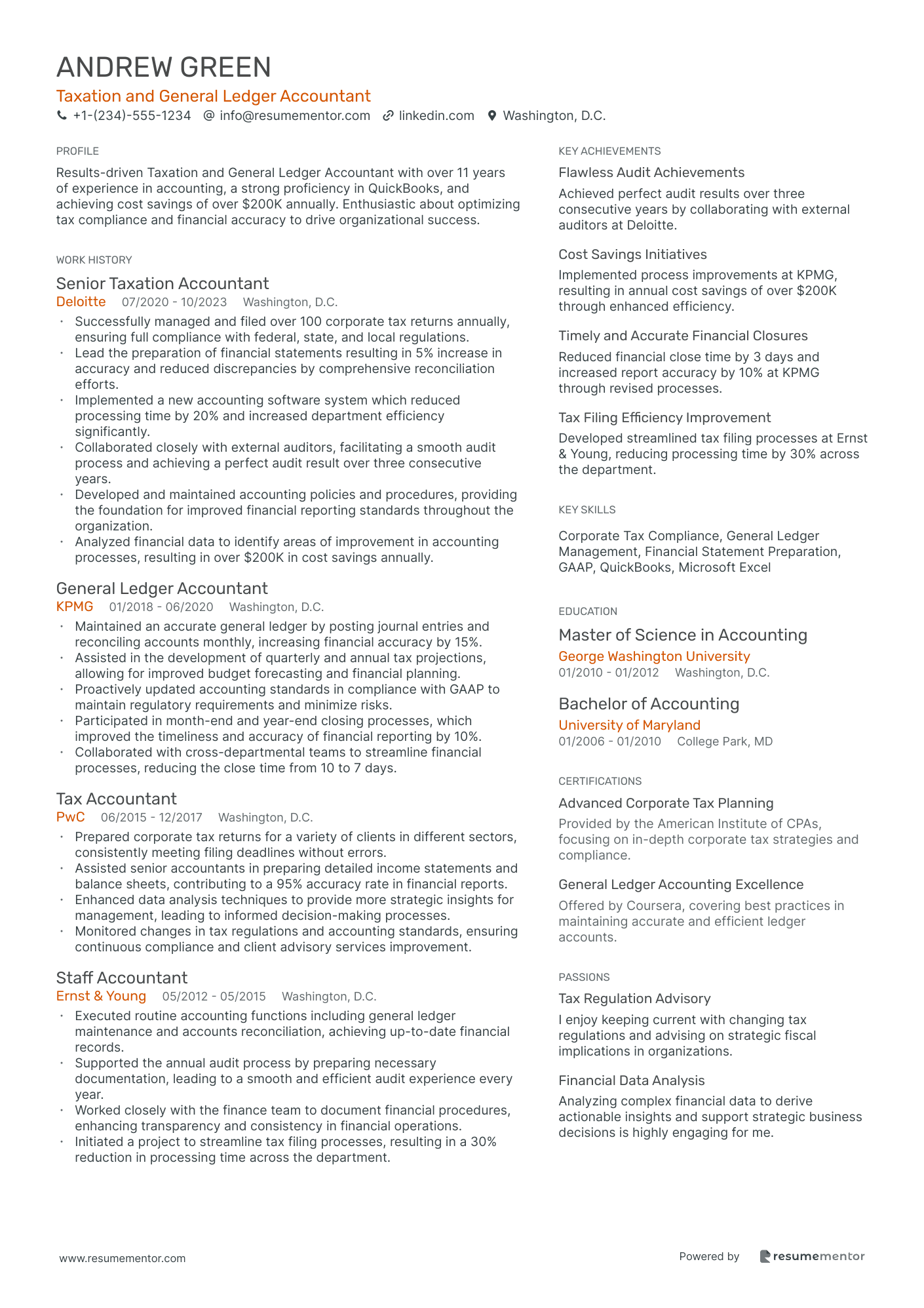

Taxation and General Ledger Accountant

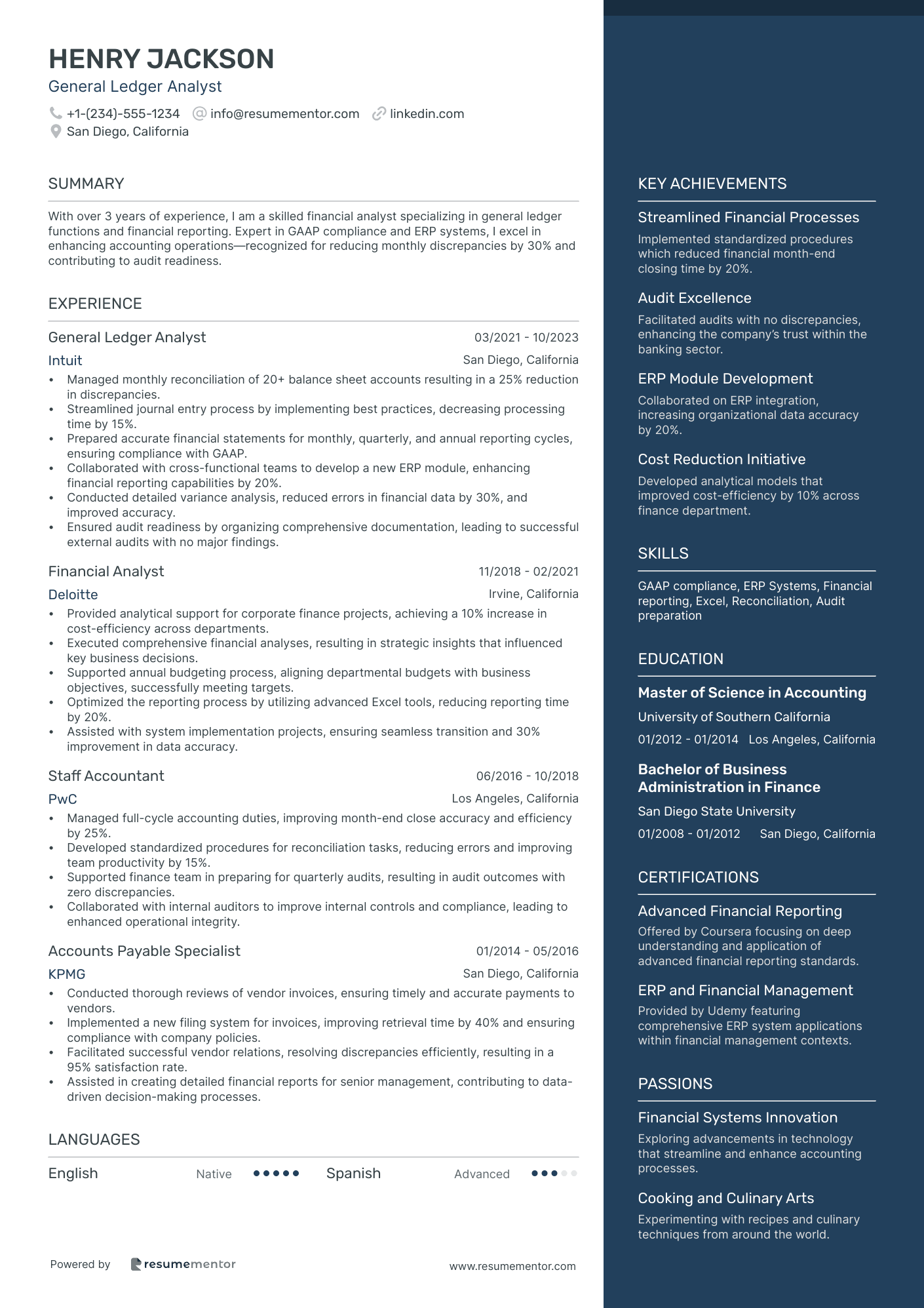

General Ledger Analyst resume sample

When applying for this position, it’s essential to showcase your analytical skills and attention to detail. Highlight any experience with financial reporting and data analysis. Mention any relevant coursework or certifications such as 'Accounting Information Systems' or 'Advanced Excel', noting the duration. Demonstrate how your analytical skills have led to improved accuracy in financial statements or operational efficiency. Use a 'skill-action-result' format to illustrate your contributions, showing how they positively impacted previous employers and added value to their financial processes.

- •Managed monthly reconciliation of 20+ balance sheet accounts resulting in a 25% reduction in discrepancies.

- •Streamlined journal entry process by implementing best practices, decreasing processing time by 15%.

- •Prepared accurate financial statements for monthly, quarterly, and annual reporting cycles, ensuring compliance with GAAP.

- •Collaborated with cross-functional teams to develop a new ERP module, enhancing financial reporting capabilities by 20%.

- •Conducted detailed variance analysis, reduced errors in financial data by 30%, and improved accuracy.

- •Ensured audit readiness by organizing comprehensive documentation, leading to successful external audits with no major findings.

- •Provided analytical support for corporate finance projects, achieving a 10% increase in cost-efficiency across departments.

- •Executed comprehensive financial analyses, resulting in strategic insights that influenced key business decisions.

- •Supported annual budgeting process, aligning departmental budgets with business objectives, successfully meeting targets.

- •Optimized the reporting process by utilizing advanced Excel tools, reducing reporting time by 20%.

- •Assisted with system implementation projects, ensuring seamless transition and 30% improvement in data accuracy.

- •Managed full-cycle accounting duties, improving month-end close accuracy and efficiency by 25%.

- •Developed standardized procedures for reconciliation tasks, reducing errors and improving team productivity by 15%.

- •Supported finance team in preparing for quarterly audits, resulting in audit outcomes with zero discrepancies.

- •Collaborated with internal auditors to improve internal controls and compliance, leading to enhanced operational integrity.

- •Conducted thorough reviews of vendor invoices, ensuring timely and accurate payments to vendors.

- •Implemented a new filing system for invoices, improving retrieval time by 40% and ensuring compliance with company policies.

- •Facilitated successful vendor relations, resolving discrepancies efficiently, resulting in a 95% satisfaction rate.

- •Assisted in creating detailed financial reports for senior management, contributing to data-driven decision-making processes.

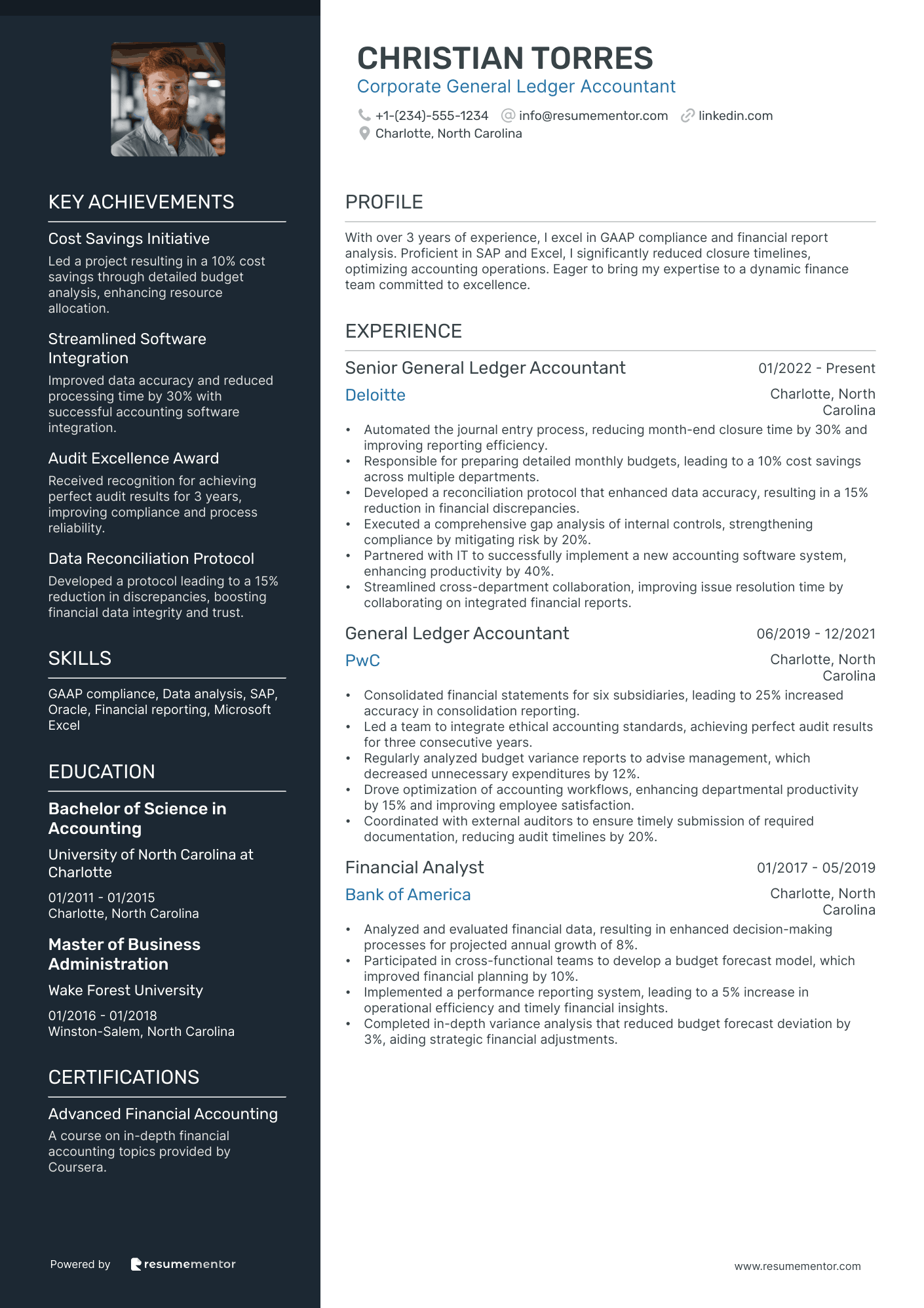

Corporate General Ledger Accountant resume sample

Emphasize your proficiency in accounting software such as SAP or Oracle. Mention your experience with month-end close processes and financial reporting, highlighting any improvements you’ve made in efficiency or accuracy. If you have experience in compliance and auditing, be sure to include that. Discuss how your analytical skills have helped identify discrepancies and contributed to financial integrity. Use specific examples to illustrate how your contributions led to a clearer financial picture for your previous employers, focusing on the results achieved.

- •Automated the journal entry process, reducing month-end closure time by 30% and improving reporting efficiency.

- •Responsible for preparing detailed monthly budgets, leading to a 10% cost savings across multiple departments.

- •Developed a reconciliation protocol that enhanced data accuracy, resulting in a 15% reduction in financial discrepancies.

- •Executed a comprehensive gap analysis of internal controls, strengthening compliance by mitigating risk by 20%.

- •Partnered with IT to successfully implement a new accounting software system, enhancing productivity by 40%.

- •Streamlined cross-department collaboration, improving issue resolution time by collaborating on integrated financial reports.

- •Consolidated financial statements for six subsidiaries, leading to 25% increased accuracy in consolidation reporting.

- •Led a team to integrate ethical accounting standards, achieving perfect audit results for three consecutive years.

- •Regularly analyzed budget variance reports to advise management, which decreased unnecessary expenditures by 12%.

- •Drove optimization of accounting workflows, enhancing departmental productivity by 15% and improving employee satisfaction.

- •Coordinated with external auditors to ensure timely submission of required documentation, reducing audit timelines by 20%.

- •Analyzed and evaluated financial data, resulting in enhanced decision-making processes for projected annual growth of 8%.

- •Participated in cross-functional teams to develop a budget forecast model, which improved financial planning by 10%.

- •Implemented a performance reporting system, leading to a 5% increase in operational efficiency and timely financial insights.

- •Completed in-depth variance analysis that reduced budget forecast deviation by 3%, aiding strategic financial adjustments.

- •Processed and monitored over 300 journal entries monthly, maintaining a 98% accuracy rate in data entry.

- •Assisted in the preparation of detailed financial reports, supporting management in achieving a 15% budget accuracy improvement.

- •Resolved discrepancies through efficient collaboration across departments, improving resolution time by 25%.

- •Provided support during external audits, enhancing audit process efficiency and meeting all compliance requirements.

Project Accounting Specialist resume sample

When applying for this role, focus on any experience in project management or accounting. Highlighting proficiency with financial software such as Excel or project management tools can set you apart. Include any relevant coursework or certifications like 'Construction Accounting' or 'Project Management Basics' to demonstrate your expertise. Provide specific examples of how your financial analysis skills helped streamline project budgets or improved reporting accuracy. Use the 'skill-action-result' framework to showcase your contributions to past projects, emphasizing how they positively impacted overall project delivery.

- •Prepared and analyzed project budgets resulting in a 10% increase in overall project cost efficiency through streamlined forecasting methodologies.

- •Successfully monitored project expenses, identifying and rectifying overspend issues, leading to a cost reduction of 12%.

- •Spearheaded the review and approval of project invoices, ensuring accuracy, which improved billing turnaround time by 20%.

- •Assisted in creating detailed financial documentation for projects, contributing to achieving financial reporting accuracy levels above 95%.

- •Collaborated with cross-functional teams to enhance financial data analysis capabilities, which supported informed decision-making within project management.

- •Provided comprehensive guidance to project managers, enhancing their understanding of financial procedures by presenting monthly training sessions.

- •Developed detailed financial reports enhancing the accuracy of project financial statements by more than 8% over the fiscal year.

- •Led financial audits for key projects, maintaining compliance with internal and external regulations, improving financial integrity by 15%.

- •Enhanced document verification process through integration of a new accounting software, reducing approval errors by 25%.

- •Coordinated month-end and year-end close processes, improving reconciliation efficiency by 30%.

- •Trained junior staff members in financial accounting principles, significantly reducing team errors and increasing efficiency.

- •Managed project budgeting activities, maintaining budget adherence at 98% accuracy throughout the project lifecycle.

- •Reviewed and consolidated financial reports, which enhanced executive decision-making by providing clear financial insights.

- •Streamlined forecasting processes, resulting in a time savings of over 20% on future project planning.

- •Collaborated closely with project teams to gather financial data, significantly boosting the precision of project financial projections.

- •Supported accurate financial report preparation, which led to a 7% increase in data integrity for client accounts.

- •Assisted in project financial reviews, helping identify cost-saving opportunities that improved overall project margin by 5%.

- •Facilitated financial documentation processes that supported enhanced compliance with accounting standards across various projects.

- •Analyzed budget variances and provided insightful explanations that fostered improved budget forecasting capabilities.

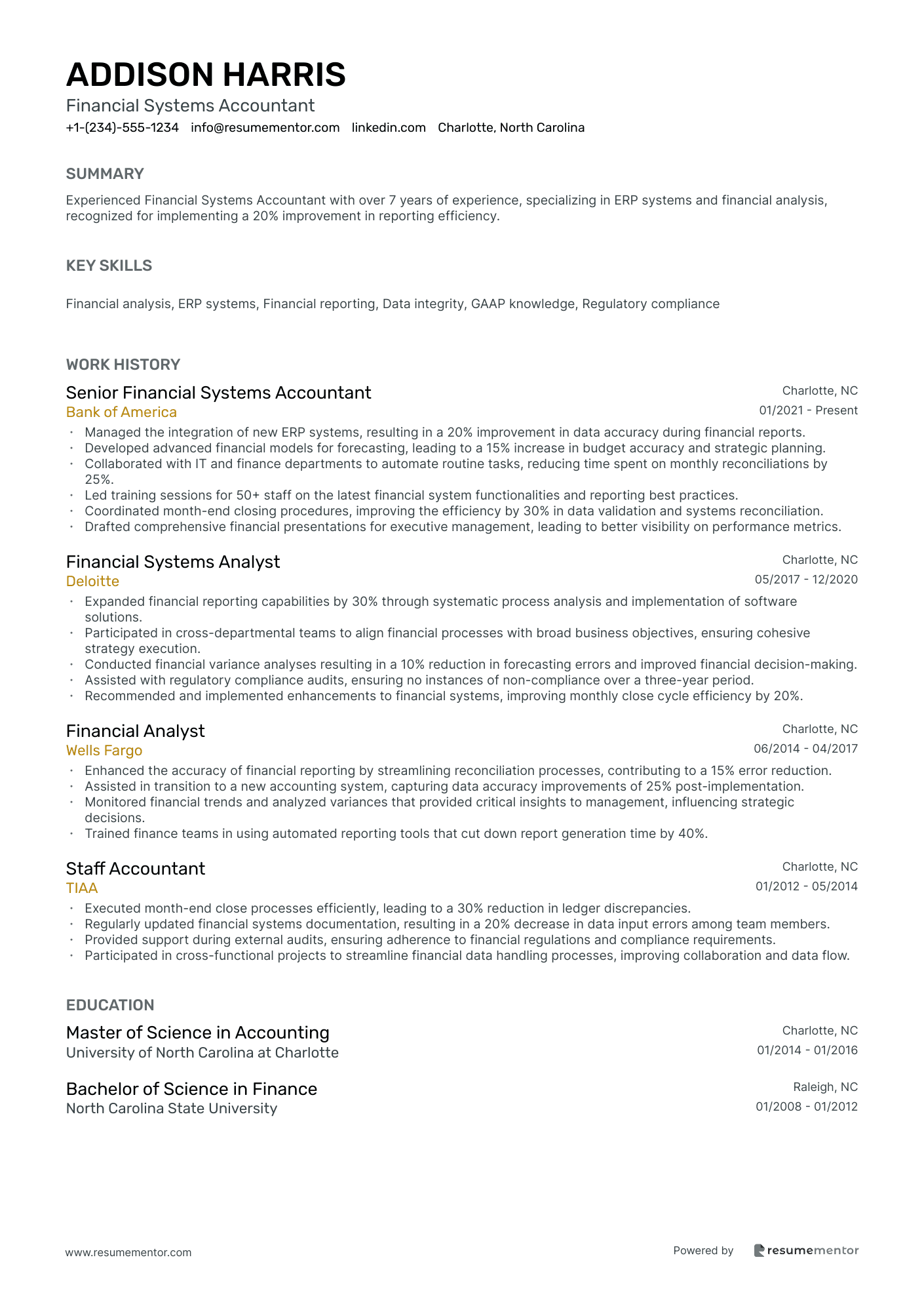

Financial Systems Accountant resume sample

When applying for this position, emphasize any experience with financial software and systems. Highlight skills in data analysis, reporting, and support, as they are key. Mention relevant coursework or certifications like 'Accounting Information Systems' or 'Financial Software Applications' to show expertise. Include examples of how you have streamlined processes or improved reporting accuracy in previous roles, using a 'skill-action-result' framework. Demonstrating your ability to adapt and enhance financial systems will strengthen your application and showcase your value to potential employers.

- •Managed the integration of new ERP systems, resulting in a 20% improvement in data accuracy during financial reports.

- •Developed advanced financial models for forecasting, leading to a 15% increase in budget accuracy and strategic planning.

- •Collaborated with IT and finance departments to automate routine tasks, reducing time spent on monthly reconciliations by 25%.

- •Led training sessions for 50+ staff on the latest financial system functionalities and reporting best practices.

- •Coordinated month-end closing procedures, improving the efficiency by 30% in data validation and systems reconciliation.

- •Drafted comprehensive financial presentations for executive management, leading to better visibility on performance metrics.

- •Expanded financial reporting capabilities by 30% through systematic process analysis and implementation of software solutions.

- •Participated in cross-departmental teams to align financial processes with broad business objectives, ensuring cohesive strategy execution.

- •Conducted financial variance analyses resulting in a 10% reduction in forecasting errors and improved financial decision-making.

- •Assisted with regulatory compliance audits, ensuring no instances of non-compliance over a three-year period.

- •Recommended and implemented enhancements to financial systems, improving monthly close cycle efficiency by 20%.

- •Enhanced the accuracy of financial reporting by streamlining reconciliation processes, contributing to a 15% error reduction.

- •Assisted in transition to a new accounting system, capturing data accuracy improvements of 25% post-implementation.

- •Monitored financial trends and analyzed variances that provided critical insights to management, influencing strategic decisions.

- •Trained finance teams in using automated reporting tools that cut down report generation time by 40%.

- •Executed month-end close processes efficiently, leading to a 30% reduction in ledger discrepancies.

- •Regularly updated financial systems documentation, resulting in a 20% decrease in data input errors among team members.

- •Provided support during external audits, ensuring adherence to financial regulations and compliance requirements.

- •Participated in cross-functional projects to streamline financial data handling processes, improving collaboration and data flow.

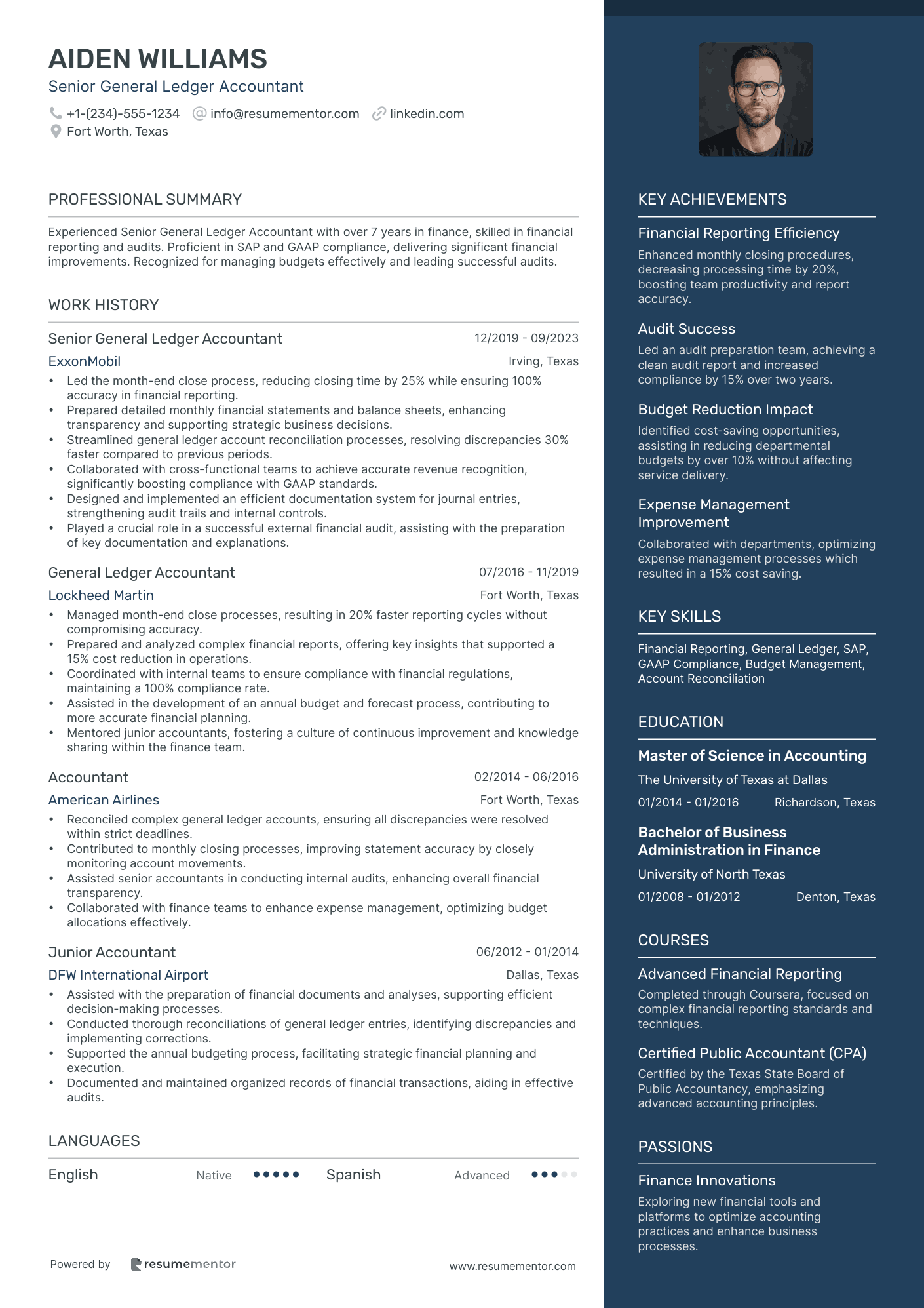

Senior General Ledger Accountant resume sample

When applying for a Senior General Ledger Accountant position, showcase your expertise in managing month-end close processes and regulatory compliance. Highlight any experience with financial software or ERP systems, as proficiency in tools like SAP or Oracle can set you apart. Mention any leadership roles, as mentoring junior staff can demonstrate your ability to elevate team performance. Use quantifiable achievements, such as reducing reporting errors by a certain percentage, to illustrate your impact. Tailoring your cover letter to include these elements will strengthen your application.

- •Led the month-end close process, reducing closing time by 25% while ensuring 100% accuracy in financial reporting.

- •Prepared detailed monthly financial statements and balance sheets, enhancing transparency and supporting strategic business decisions.

- •Streamlined general ledger account reconciliation processes, resolving discrepancies 30% faster compared to previous periods.

- •Collaborated with cross-functional teams to achieve accurate revenue recognition, significantly boosting compliance with GAAP standards.

- •Designed and implemented an efficient documentation system for journal entries, strengthening audit trails and internal controls.

- •Played a crucial role in a successful external financial audit, assisting with the preparation of key documentation and explanations.

- •Managed month-end close processes, resulting in 20% faster reporting cycles without compromising accuracy.

- •Prepared and analyzed complex financial reports, offering key insights that supported a 15% cost reduction in operations.

- •Coordinated with internal teams to ensure compliance with financial regulations, maintaining a 100% compliance rate.

- •Assisted in the development of an annual budget and forecast process, contributing to more accurate financial planning.

- •Mentored junior accountants, fostering a culture of continuous improvement and knowledge sharing within the finance team.

- •Reconciled complex general ledger accounts, ensuring all discrepancies were resolved within strict deadlines.

- •Contributed to monthly closing processes, improving statement accuracy by closely monitoring account movements.

- •Assisted senior accountants in conducting internal audits, enhancing overall financial transparency.

- •Collaborated with finance teams to enhance expense management, optimizing budget allocations effectively.

- •Assisted with the preparation of financial documents and analyses, supporting efficient decision-making processes.

- •Conducted thorough reconciliations of general ledger entries, identifying discrepancies and implementing corrections.

- •Supported the annual budgeting process, facilitating strategic financial planning and execution.

- •Documented and maintained organized records of financial transactions, aiding in effective audits.

Accounts Receivable and General Ledger Specialist resume sample

When applying for this role, emphasize your experience with invoicing and payment processing. Detail your proficiency in accounting software, as this is essential for accuracy and efficiency. Highlight any training in financial regulations or best practices that you have completed. Include examples of how your attention to detail has minimized errors or improved cash flow for previous employers. Use the 'skill-action-result' approach to showcase your contributions, such as streamlining processes that led to faster collections and enhanced financial reporting.

- •Managed accounts receivable processes, achieving a 95% on-time collection rate for over 300 client accounts each month.

- •Directed the posting of payments in SAP, enhancing transaction accuracy by 30% and reducing errors.

- •Reconciled over 200 accounts monthly, resolving discrepancies within 48 hours to ensure timely financial reporting.

- •Collaborated with cross-functional teams to resolve invoice discrepancies, improving inter-department communication by 40%.

- •Participated in audits by preparing schedules, leading to zero findings in annual financial audits.

- •Developed new procedures for ledger processes that improved efficiency by 25%, resulting in better resource allocation.

- •Oversaw the invoicing process for large clients, reducing outstanding receivables by 15% through proactive collections and follow-ups.

- •Implemented a payment recording system in QuickBooks, reducing manual entry errors by 25%.

- •Analyzed general ledger entries monthly, ensuring accuracy and compliance with U.S. GAAP standards.

- •Facilitated monthly financial reporting by preparing critical variance analyses, enhancing decision-making processes.

- •Led a team to develop a comprehensive customer reconciliation process, resulting in quicker resolution of discrepancies.

- •Supported the Accounts Receivable department by maintaining client ledgers, resulting in a 20% increase in financial accuracy.

- •Assisted in implementing a new accounting software system, resulting in a 10% reduction in processing time.

- •Reconciled monthly bank statements with internal records, ensuring over 98% accuracy rate and identifying discrepancies swiftly.

- •Worked closely with auditors to provide necessary reports and documentation, reducing audit-related time by 15%.

- •Managed daily transaction entries, improving transaction accuracy by 20% over the first year.

- •Assisted with monthly account reconciliations, maintaining a 97% accuracy rate.

- •Process improvement project that resulted in a 10% efficiency increase in accounts reconciliation.

- •Engaged in customer net balance analysis, aiding in more strategic decision-making and client relationship management.

Accounts Payable and General Ledger Accountant resume sample

When applying for this role, it's essential to showcase any prior experience you have in managing invoices and processing payments. Highlight your attention to detail and analytical skills, as they are critical for ensuring accuracy and compliance. If you have familiarity with accounting software or financial reporting, make sure to include this. Use specific examples that demonstrate how you've streamlined processes or reduced errors, focusing on the positive outcomes. Lastly, emphasize your ability to collaborate with vendors and internal teams to maintain strong relationships.

- •Successfully managed accounts payable process which resulted in reducing invoice processing time by 30%, ensuring improved cash flow.

- •Implemented new coding and audit procedures that resulted in a 15% reduction in errors, ensuring compliance with regulatory standards.

- •Collaborated with financial teams leading to 20% efficiency improvements in monthly closing processes and accurate financial reporting.

- •Supported successful completion of annual audits by providing necessary documentation, resulting in zero audit findings.

- •Played an integral role in preparing budgets and forecasts, contributing to a 10% increase in financial planning accuracy.

- •Integrated new accounting software, increasing data accuracy and efficiency of accounts payable processes by 25%.

- •Reviewed and reconciled vendor statements, resolving 98% of disputes in a timely manner, fostering strong vendor relationships.

- •Managed journal entry post process enhancing ledger accuracy by 15% and ensuring compliance with GAAP.

- •Led cross-functional initiatives addressing and improving financial processes, saving approximately 100 hours per month.

- •Developed new vendor approval processes, cutting down onboarding time by 20% and increasing operational efficiency.

- •Facilitated financial close processes and account reconciliations, contributing to a 95% on-time submission rate.

- •Assisted with month-end close activities, improving reconciliation accuracy by 10% through updated verification procedures.

- •Participated in and enhanced document management that reduced retrieval times for financial audits by 25%.

- •Prepared detailed journal entries that supported a $2M account accuracy improvement, boosting financial statement reliability.

- •Trained new team members on accounting procedures, cutting learning curve by 50% and increasing department productivity.

- •Processed an average of 500 invoices monthly, achieving a 95% on-time payment rate, contributing to vendor satisfaction.

- •Streamlined invoice verification processes that increased accuracy by 12%, reducing supply chain disruptions.

- •Revised payment processing setups across departments leading to a 5-day reduction in processing cycle time.

- •Implemented compliance checks ensuring 100% adherence to internal and external policies, enhancing audit preparation.

Auditing and General Ledger Accountant resume sample

When applying for this role, it's essential to showcase any prior experience with financial audits or reconciliations. Highlight your analytical skills and attention to detail, as these are critical. If you've completed courses in 'Auditing Standards' or 'Financial Reporting', be sure to include them. Provide specific examples of how you identified discrepancies or improved reporting accuracy in previous positions, using a 'skill-action-result' framework. Additionally, mention any relevant software proficiency, such as in accounting software or data analysis tools, that can streamline financial processes.

- •Led annual general ledger audits, correcting discrepancies and improving record accuracy by 25%.

- •Spearheaded implementation of new accounting software, enhancing data accuracy and reducing reconciliation time by 40%.

- •Coordinated with cross-functional teams for accurate reporting, resulting in a 15% reduction in compliance issues.

- •Developed detailed variance analyses to support budgeting processes, leading to a 10% increase in forecasting accuracy.

- •Managed monthly financial statement preparation, ensuring full compliance with GAAP standards.

- •Implemented internal control improvements, saving $300k annually.

- •Conducted monthly account reconciliations with 98% accuracy, improving data reliability across departments.

- •Designed a risk assessment framework, leading to enhanced internal control functions and 20% fewer audit findings.

- •Collaborated with IT to automate financial processes, reducing manual labor and cutting process time by 30%.

- •Prepared multi-department financial analysis reports, supporting key strategic decisions with clear data insights.

- •Trained junior accountants in financial reporting standards, improving team performance by 15% within six months.

- •Analyzed financial statements against market trends, providing recommendations that increased investment returns by 12%.

- •Developed detailed financial models for forecasting, contributing to a 15% improvement in decision-making accuracy.

- •Assisted in external audits, successfully reducing compliance-related penalties by 10%.

- •Collaborated with finance teams to standardize reporting procedures, leading to a 25% reduction in errors.

- •Conducted detailed account reconciliations, maintaining a 99% accuracy rate across all financial records.

- •Supported teams during internal audits, significantly aiding in a 20% enhancement of financial control processes.

- •Assisted in preparing financial reports, ensuring all documents met strict regulatory standards with zero errors.

- •Optimized accounting procedures, leading to improved efficiency and reduced departmental processing time by 15%.

Taxation and General Ledger Accountant resume sample

When applying for this position, it’s essential to highlight your knowledge of tax regulations and compliance. Emphasize your experience with tax preparation and filing for both individuals and businesses. If you have completed courses or received certifications related to taxation, include them to showcase your expertise. Mention any specific software you are proficient in, like QuickBooks or TaxCalc, and provide instances where your analytical skills led to cost savings or compliance improvements for previous employers, focusing on a 'skill-action-result' framework.

- •Successfully managed and filed over 100 corporate tax returns annually, ensuring full compliance with federal, state, and local regulations.

- •Lead the preparation of financial statements resulting in 5% increase in accuracy and reduced discrepancies by comprehensive reconciliation efforts.

- •Implemented a new accounting software system which reduced processing time by 20% and increased department efficiency significantly.

- •Collaborated closely with external auditors, facilitating a smooth audit process and achieving a perfect audit result over three consecutive years.

- •Developed and maintained accounting policies and procedures, providing the foundation for improved financial reporting standards throughout the organization.

- •Analyzed financial data to identify areas of improvement in accounting processes, resulting in over $200K in cost savings annually.

- •Maintained an accurate general ledger by posting journal entries and reconciling accounts monthly, increasing financial accuracy by 15%.

- •Assisted in the development of quarterly and annual tax projections, allowing for improved budget forecasting and financial planning.

- •Proactively updated accounting standards in compliance with GAAP to maintain regulatory requirements and minimize risks.

- •Participated in month-end and year-end closing processes, which improved the timeliness and accuracy of financial reporting by 10%.

- •Collaborated with cross-departmental teams to streamline financial processes, reducing the close time from 10 to 7 days.

- •Prepared corporate tax returns for a variety of clients in different sectors, consistently meeting filing deadlines without errors.

- •Assisted senior accountants in preparing detailed income statements and balance sheets, contributing to a 95% accuracy rate in financial reports.

- •Enhanced data analysis techniques to provide more strategic insights for management, leading to informed decision-making processes.

- •Monitored changes in tax regulations and accounting standards, ensuring continuous compliance and client advisory services improvement.

- •Executed routine accounting functions including general ledger maintenance and accounts reconciliation, achieving up-to-date financial records.

- •Supported the annual audit process by preparing necessary documentation, leading to a smooth and efficient audit experience every year.

- •Worked closely with the finance team to document financial procedures, enhancing transparency and consistency in financial operations.

- •Initiated a project to streamline tax filing processes, resulting in a 30% reduction in processing time across the department.

Crafting a resume as a general ledger accountant is akin to balancing an intricate financial sheet, where each detail is crucial. You need to ensure your accounting expertise shines clearly to capture the attention of potential employers. This requires blending your technical skills and proficiency in managing complex financial tasks into a cohesive narrative.

To make your resume truly stand out, focus on highlighting your precision and attention to detail in handling financial records. Though this might seem overwhelming, leveraging a resume template can make the task far more manageable. Templates provide a structured way to present your information, simplifying the process and helping you showcase the value you bring to prospective employers.

For structure and guidance, consider exploring various resume templates. These templates can free you from formatting concerns, allowing you to concentrate on crafting a compelling content. An organized resume not only illustrates your accounting acumen but also your ability to thrive in the fast-paced financial world.

Think of your resume as more than just a list of past jobs—it's your professional story. When crafted with care, it reveals the contributions you can make to any organization. Keeping it clear and concise ensures that your skills, experience, and achievements are easily noticed and valued. Your journey to success begins with a strong presentation of your abilities, and with the right tools, you can make a lasting impact.

Key Takeaways

- Crafting a general ledger accountant resume requires highlighting your accounting expertise, attention to detail, and ability to manage financial records effectively.

- Use a structured resume template to create a cohesive document that emphasizes your technical skills and experience while keeping it clear and concise.

- Draw attention to key accomplishments and experiences using action verbs and quantifiable results to demonstrate your impact in previous roles.

- Choose a resume format that aligns with your work history and career goals, employing modern fonts and saving your document as a PDF for consistency.

- Include relevant certifications, educational background, and a skills section that showcases both hard and soft skills critical for a general ledger accountant.

What to focus on when writing your general ledger accountant resume

Your general ledger accountant resume should effectively convey your financial expertise and understanding of accounting principles to capture a recruiter's attention. This document should highlight not just your ability to maintain precise financial records, but also your commitment to compliance with relevant regulations. Your strong analytical skills and attention to detail are essential elements that deserve emphasis throughout.

How to structure your general ledger accountant resume

- Contact Information: Start with your full name, phone number, and professional email address—ensuring these details are easy to find reinforces your availability and professionalism. Adding your LinkedIn profile here can provide recruiters with a broader view of your career and networking status.

- Professional Summary: Follow with a concise overview of your experience, focusing on your financial analysis skills and proficiency in accounting software. This summary should convey your career goals and your dedication to contributing effectively to any organization. It sets the stage for your specific experiences and strengths in the field.

- Work Experience: Dive into your relevant roles by showcasing responsibilities such as financial reporting, account reconciliations, and month-end closings—these demonstrate your operational expertise. Emphasizing accomplishments, like improving financial processes, can illustrate your impact and capability for driving efficiency within teams.

- Education: Building on this, include your degree in accounting or finance to establish your foundational knowledge. Highlight any certifications like CPA or CMA that underscore your expertise in accounting standards and boost your credibility for roles that prioritize rigorous financial accuracy.

- Skills: Complement your experience and education by listing skills specifically related to accounting, such as your proficiency with ERP systems like SAP or Oracle, as well as advanced Excel abilities. These demonstrate both your technical capabilities and your readiness to handle the financial systems used by top organizations.

- Achievements/Awards: Round off your résumé by noting any recognitions or accomplishments, such as successful projects that showcase your problem-solving abilities and dedication to quality work. These achievements help recruiters envision how you can use your skills to enhance processes and reduce errors within their organization.

As you prepare your resume, understanding the preferred resume format is essential—below, we'll cover each section more in-depth to ensure your resume stands out in the competitive field of general ledger accounting.

Which resume format to choose

Creating a resume for a general ledger accountant involves careful consideration of several key elements to effectively highlight your professional skills. Choosing the right format is crucial. A chronological format is often the best choice if you have a steady work history because it highlights your career progression and experience in financial roles. However, if you're transitioning into a new career path or have gaps in your employment, a functional format that emphasizes your accounting skills may be more effective.

When it comes to style, the font you select can subtly impact how your resume is received. Opt for modern fonts like Lato, Montserrat, or Raleway to give your resume a clean and professional appearance. These fonts are not only visually appealing but also enhance readability—crucial when your resume must effectively communicate complex financial expertise to potential employers.

Once your resume is polished, save it as a PDF to maintain your formatting. PDFs ensure your resume appears consistent on all devices, preserving the professional layout you’ve worked hard to create. This consistency is vital when submitting applications digitally, as it guarantees your resume looks the same whether viewed on a computer, tablet, or smartphone.

Attention to margins also plays a significant role in the presentation of your resume. Keeping margins around one inch on all sides provides a clean, organized look. This not only offers ample white space for readability but also presents the content in a way that feels both inviting and professional, allowing your achievements and skills to shine without distraction.

Incorporating the right format, fonts, and file type into your resume is essential for creating a cohesive and professional document. This tailored approach ensures your resume stands out and effectively conveys your qualifications and expertise in the field of accounting.

How to write a quantifiable resume experience section

The experience section of your general ledger accountant resume is essential for showcasing your ability to manage financial records effectively. By highlighting specific duties and accomplishments, you can clearly demonstrate the positive impact you've had on an organization’s financial health. Begin with your most recent positions, working backwards, and aim to cover the past 10 to 15 years if possible. To make your resume more appealing, align your expertise with the job ad requirements by using strong action verbs like “streamlined,” “implemented,” “optimized,” and “reconciled.” These verbs help convey your achievements as quantifiable results, which can demonstrate your value to potential employers.

- •Streamlined the month-end closing process, cutting time by 25% while boosting financial accuracy.

- •Implemented a new reconciliation system enhancing accuracy by 30%, strengthening internal controls.

- •Optimized financial reporting methods to align with GAAP, achieving a 20% reduction in errors.

- •Led a team of 5 accountants in automating workflows, increasing efficiency by 40%.

This experience section excels in highlighting your contributions to improving financial processes. Quantifiable achievements in each bullet point offer concrete examples of your impact. Using vibrant action verbs like “streamlined” and “implemented” ensures that your accomplishments come across as dynamic and proactive. By arranging your experience in reverse chronological order, your most significant and relevant accomplishments catch the reader’s attention right away. Customizing your resume with specific tasks and keywords from the job ad makes your skills appear directly aligned with what the company needs, positioning you as an ideal candidate.

Technology-Focused resume experience section

A technology-focused general ledger accountant resume experience section should effectively showcase how you blend accounting expertise with technological know-how. Begin by listing your previous roles, with an emphasis on responsibilities where you used accounting software and data systems to their full potential. It's important to highlight instances where you’ve improved processes or introduced new financial solutions through technology, providing concrete examples of your impact. Using action verbs and quantifying your outcomes can help make these achievements more compelling and tangible.

In your bullet points, delve into the practical application of technology in your day-to-day accounting duties. Mention specific software you’re adept at and any distinctive projects you've managed or supported to demonstrate your technical skills. This clarity and specificity make your resume both readable and engaging. Ensure your content speaks directly to the job you’re applying for by highlighting the most relevant skills and accomplishments, thereby showing potential employers the unique value you can bring to their team.

Senior Accountant

TechFin Solutions

2018-2021

- Implemented a new accounting software that reduced data entry errors by 30%.

- Developed automated financial reporting tools, saving the team 20 hours per month.

- Led a team in a systems integration project that streamlined processes and improved productivity.

- Provided training to staff on the new software platform, enhancing overall team proficiency.

Achievement-Focused resume experience section

A results-focused general ledger accountant resume experience section should highlight your achievements rather than simply listing tasks. Start by recalling instances where you made significant improvements, boosted accuracy, or achieved financial savings. Use numbers to illustrate your impact, such as the percentage by which you reduced errors or cut costs, as they convincingly convey your contributions. Highlight any unique skills that enabled you to address challenges or meet objectives effectively.

Ensure your bullet points are clear and impactful, emphasizing actions and results. Opt for strong, active verbs like "optimized," "spearheaded," or "reduced" to showcase your proactive approach. Illustrate the scope of your contributions by specifying details—how much, how many, how long. This method keeps your achievements concise yet comprehensive, enabling hiring managers to quickly grasp the depth of your expertise without getting lost in the particulars.

Senior General Ledger Accountant

XYZ Corp

June 2019 - Present

- Led a team to reduce monthly closing process time by 30% through streamlined procedures.

- Implemented an automated reconciliation system, resulting in a 25% reduction in human error.

- Coordinated with multiple departments to ensure accurate and timely financial reporting.

- Contributed to a 15% increase in accuracy by revising general ledger account mapping.

Customer-Focused resume experience section

A customer-focused general ledger accountant resume experience section should emphasize your ability to manage financial tasks with precision while putting customer needs first. It's important to showcase your skill in maintaining ledger accounts with accuracy, ensuring clients receive accurate and timely financial data. This experience section should reflect not only your technical skills and attention to detail but also your dedication to providing excellent service. Your ability to communicate clearly with clients and colleagues plays a crucial role, as it highlights your interpersonal skills in a finance-driven environment.

Begin by listing your most relevant or recent positions, demonstrating how each role contributed to client satisfaction through effective ledger management. Outline key accomplishments in your bullet points, focusing on improvements in financial systems, swift resolution of discrepancies, or process implementations that boosted client satisfaction. Use metrics and quantifiable outcomes to underline the impact you made. This approach helps connect your accounting proficiency with tangible results that prioritize the customer experience.

General Ledger Accountant

ABC Financial Services

June 2020 - Present

- Managed and reconciled ledger accounts, ensuring 99% accuracy for client financial data.

- Collaborated with cross-functional teams to streamline financial reporting, resulting in a 20% increase in process efficiency.

- Improved customer satisfaction through regular communication and prompt resolution of discrepancies.

- Implemented a new invoicing system that reduced processing time by 30%, enhancing client experience.

Skills-Focused resume experience section

A skills-focused general ledger accountant resume experience section should clearly highlight your key competencies and achievements that showcase your expertise in managing financial records. Begin by identifying essential skills such as financial analysis, reporting, and compliance, and integrate these into each job description with specific examples where you effectively applied them. Short, active sentences will keep your points clear and engaging, ensuring that your skills stand out.

By including quantifiable outcomes, you provide concrete evidence of your contributions. Explain your role in improving processes, boosting efficiency, or cutting costs, and support your claims with data whenever possible. This cohesive approach helps employers appreciate not just what you accomplished, but the significant impact you had on the organization’s success. In the end, your experience section should clearly reflect your competence and achievements, showcasing how your skills make a tangible difference.

General Ledger Accountant

TechCorp Financial

June 2018 - Present

- Managed monthly close process and reconciled 12 bank accounts to ensure accuracy in financial reporting.

- Implemented a new software solution that reduced monthly reporting time by 20%.

- Collaborated with external auditors during quarterly and annual audits to achieve zero audit adjustments.

- Developed and maintained documentation of accounting procedures to improve team performance and compliance.

Write your general ledger accountant resume summary section

A performance-focused general ledger accountant resume summary should quickly capture your expertise and noteworthy achievements. If you're experienced in this field, your summary should reflect your skills and successes concisely. Consider this example:

This summary does a great job of highlighting your credentials because it links specific experiences with skills that employers value. By showcasing quantifiable impacts, like a 20% increase in efficiency, it demonstrates your ability to deliver results. You should reflect on your own achievements to create a similar impact with your summary and customize it for each job you apply to.

If you're new to the field or switching careers, though, consider using a resume objective instead. This focuses on your career goals and how they align with the company's values. A resume profile can provide a broader overview of skills and experience, while a summary of qualifications lists particular skills and successes without narrative. For an experienced general ledger accountant, a focused summary highlights your depth of expertise and preparedness for the role.

Listing your general ledger accountant skills on your resume

A skills-focused general ledger accountant resume should emphasize both your technical and interpersonal abilities. When crafting this section, consider presenting your skills as a standalone list, making it easy for employers to immediately grasp your qualifications. You can also incorporate these skills into your experience and summary sections for a more integrated approach. Highlighting strengths and soft skills is essential, as they demonstrate your interpersonal abilities and unique traits. These are complemented by hard skills, which are specific, learned abilities such as tax preparation or proficiency with accounting software.

Think of your skills and strengths as keywords that employers search for. Using relevant terms effectively can help your resume stand out and pass through applicant tracking systems. Here's an example of a well-structured standalone skills section for a general ledger accountant:

This example effectively lists relevant skills that employers look for, keeping everything clear and straight to the point. Each skill is directly tied to accounting responsibilities, showcasing your expertise in a concise manner.

Best hard skills to feature on your general ledger accountant resume

Your resume should clearly highlight hard skills—these technical competencies demonstrate your ability to manage critical accounting tasks. Make sure to feature skills like:

Hard Skills

- Account Reconciliation

- Financial Reporting

- General Ledger Management

- GAAP Knowledge (Generally Accepted Accounting Principles)

- Tax Preparation

- ERP Systems (Enterprise Resource Planning)

- Budgeting

- Auditing

- Compliance Regulations

- Cost Analysis

- Spreadsheet Software Proficiency (Excel)

- Payroll Processing

- Financial Forecasting

- Risk Management

- Financial Planning

Best soft skills to feature on your general ledger accountant resume

In addition to technical skills, showcasing your soft skills is vital. These traits reflect how you manage relationships and interactions at work. As a general ledger accountant, you should emphasize soft skills that show teamwork and a sense of responsibility:

Soft Skills

- Attention to Detail

- Problem Solving

- Communication Skills

- Time Management

- Analytical Thinking

- Team Collaboration

- Adaptability

- Ethical Judgment

- Critical Thinking

- Organization

- Stress Management

- Creativity

- Resourcefulness

- Emotional Intelligence

- Presentation Skills

How to include your education on your resume

An education section is an essential part of your resume, especially for roles like a general ledger accountant. This section highlights your academic background and shows your dedication and expertise in the field. Tailor this section to the specific job, and don’t include irrelevant education that adds no value. When listing your degree, state the full name, your school’s name, and the year you graduated. If your GPA is impressive, include it in your resume. You can also mention honors like "cum laude" to emphasize your academic achievements. Here are examples to guide you:

- •Focused on painting and sculpture

The second example stands out because it is directly relevant to the role of a general ledger accountant. This candidate has a strong GPA of 3.95, which reflects a high level of academic excellence. Mentioning "Summa Cum Laude" further enhances credibility, highlighting both skill and dedication. This tailored information will resonate well with potential employers, reinforcing your qualification for the role.

How to include general ledger accountant certificates on your resume

Including a certificates section is an important part of your resume as a general ledger accountant. To create this section, list the name of each certificate clearly. Include the date you obtained the certificate. Add the issuing organization to give it credibility. If you prefer, you can also feature your certificates in the header of your resume for higher visibility. For example, "Certified Public Accountant (CPA) - AICPA" can be listed right under your name and contact information.

Here is a good example of a standalone certificates section:

This example is good because it includes highly relevant certificates for a general ledger accountant. Each certificate is clearly named, dated, and linked to a respected issuing organization. The certifications are essential for this role, adding value and credibility to your resume. Such a section assures employers of your qualifications and dedication to the industry. Make sure your certificates are up-to-date and recognized in your field.

Extra sections to include in your general ledger accountant resume

Crafting a compelling resume for a general ledger accountant involves not just showcasing your technical skills, but also highlighting diverse elements like language proficiency, hobbies, volunteer work, and reading interests. These sections give potential employers a well-rounded view of who you are beyond just your professional capabilities.

- Language section — Add this to demonstrate bilingual or multilingual abilities, which can be valuable in multinational companies.

- Hobbies and interests section — Include this to show your well-rounded personality and any skills that might relate indirectly to your job.

- Volunteer work section — Present your volunteer efforts to highlight your community engagement and transferable skills such as leadership or teamwork.

- Books section — Mentioning relevant books you’ve read to signal your ongoing education and interest in accounting or related fields.

Incorporating these sections helps paint a fuller picture of your capabilities and interests, increasing your chances of standing out.

In Conclusion

In conclusion, creating a resume that effectively showcases your skills as a general ledger accountant involves careful planning and attention to detail. Your resume should not just list your qualifications but also tell your professional story in a way that captures your ability to manage complex financial tasks. Using a structured template can help you organize your information clearly, making it easier for recruiters to see the value you bring to their organization. Focus on using strong action verbs and highlighting quantifiable achievements to show your impact in previous roles. Remember, the choice of format and style can influence how your resume is perceived, so opt for a clean design with modern fonts and save the document as a PDF to maintain consistency across devices.

Including comprehensive sections on your skills, education, and certifications is vital to demonstrate your qualifications. Show both your hard and soft skills, underscoring your technical expertise along with interpersonal abilities. Remember, every detail matters, including formatting choices like margins and font size. Craft a concise summary or objective to open your resume, clearly communicating your experience and goals. This will set the stage for the detailed examples of your achievements and skills that follow. The addition of extra sections, such as language skills or volunteer work, can provide a more rounded profile of your capabilities. Whether you're showcasing technological prowess or emphasizing customer satisfaction, tailor each section to align with the needs of potential employers. By thoughtfully compiling your resume, you'll position yourself as a strong candidate ready to contribute to the financial success of any organization.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.