Beginner Accountant Resume Examples

Jul 18, 2024

|

12 min read

Balancing your career goals with a strong beginner accountant resume: Tips on highlighting your skills, education, and experience to make your CV add up and stand out.

Rated by 348 people

Entry-Level Tax Accountant

Trainee Financial Accountant

Beginner Accounts Payable Accountant

Entry-Level Accounts Receivable Accountant

Trainee Auditing Accountant

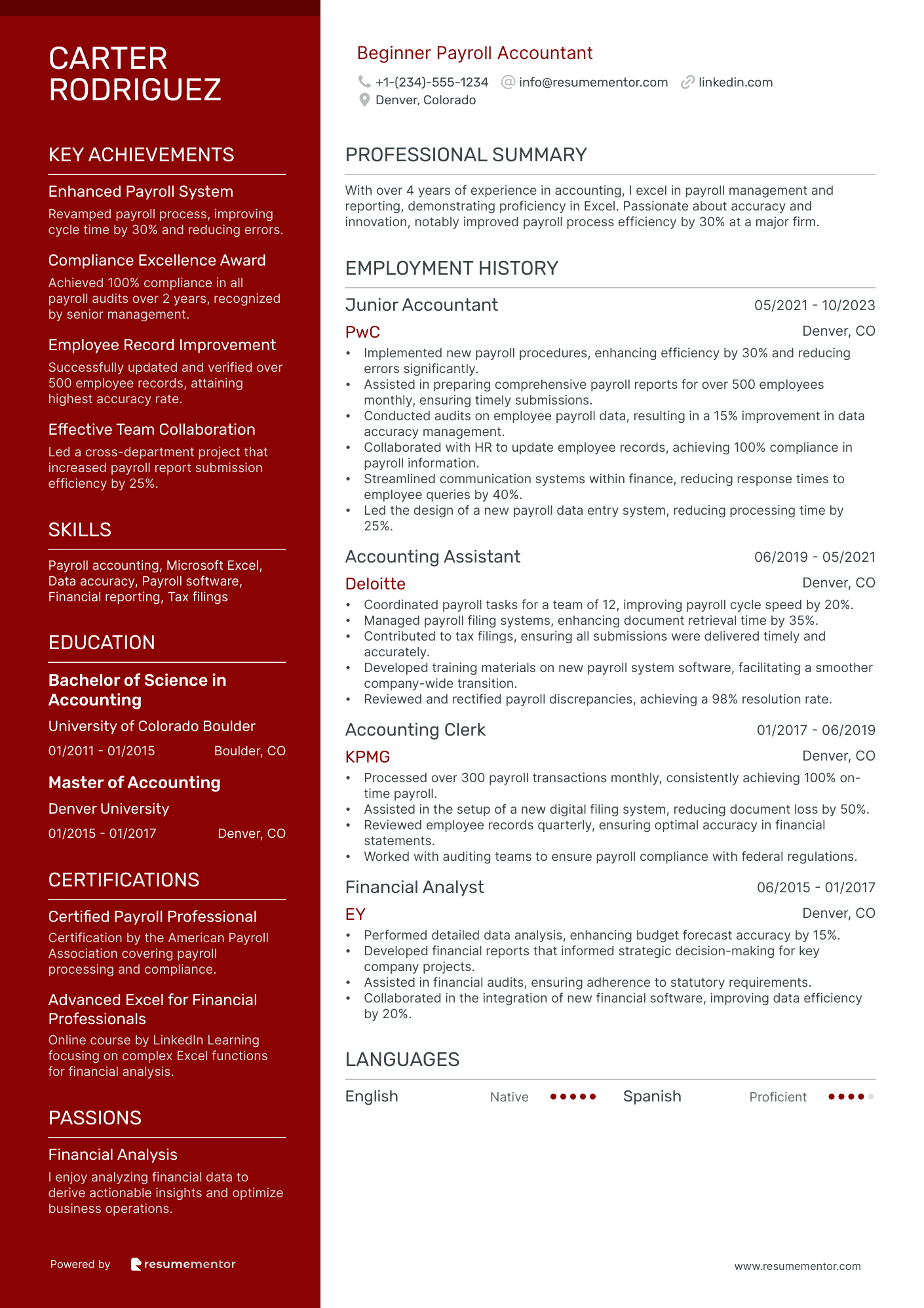

Beginner Payroll Accountant

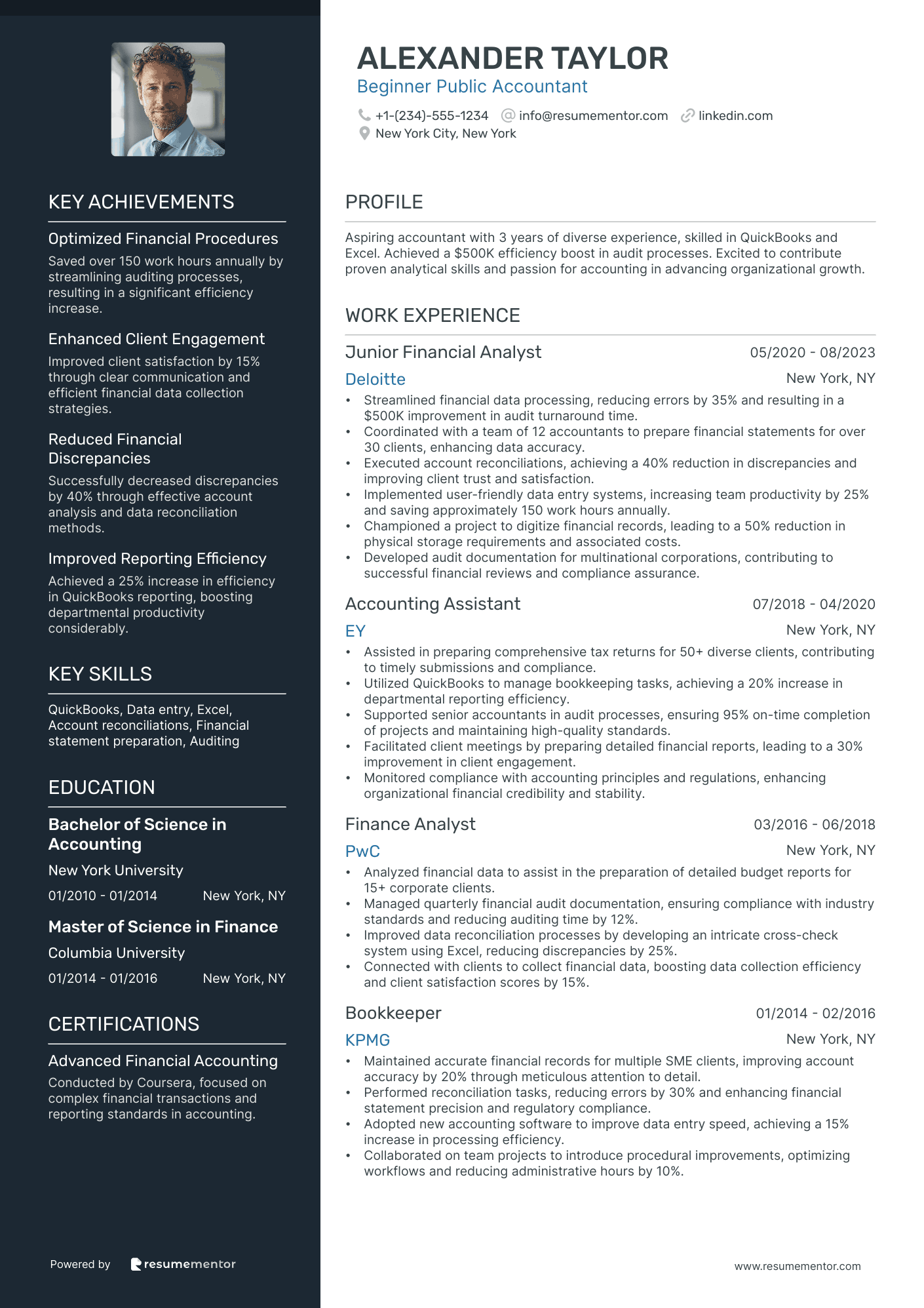

Beginner Public Accountant

Entry-Level Tax Accountant resume sample

- •Prepared over 100 federal and state income tax returns annually for various clients, improving accuracy by 15%.

- •Collaborated with a team of six to develop and implement new tax strategies, reducing client tax liabilities by 10%.

- •Researched complex tax regulations in multiple jurisdictions, facilitating client tax compliance and saving $25,000 in potential penalties.

- •Led a client service initiative, improving client satisfaction scores by 25% and enhancing retention rates by 15%.

- •Utilized advanced Excel functions to streamline data analysis, resulting in a 30% increase in team processing speed.

- •Mentored three junior staff members in tax preparation processes, strengthening the team's overall capability and output.

- •Assisted in preparing over 150 individual and corporate tax returns, leading to a 98% accuracy rate.

- •Supported tax planning projects that increased client tax refund claims by 20% within the fiscal year.

- •Analyzed revisions in tax law, resulting in updated compliance checklists and saved clients $30,000 in tax liabilities.

- •Facilitated quarterly tax compliance workshops, resulting in a 40% improvement in internal process alignment.

- •Compiled comprehensive audit trails for client records, enhancing integrity and efficiency of audit processes by 25%.

- •Conducted detailed tax research, supporting the development of solutions for complex client queries.

- •Provided well-organized financial documentation, facilitating preparation for external audits and increasing timeliness by 20%.

- •Managed client communication, ensuring a streamlined information exchange and fostering long-term professional relationships.

- •Participated in software implementation projects, which modernized tax preparation operations, reducing preparation time by 15%.

- •Supported senior accountants in organizing and maintaining comprehensive financial documentation for over 50 clients.

- •Assisted in the preparation of estimated tax payments contributing to a 95% on-time submission rate.

- •Utilized Microsoft Excel to track changes in financial data, enhancing reporting efficiencies by 30%.

- •Maintained clear communication with financial teams, ensuring accurate record-keeping and compliance with deadlines.

Trainee Financial Accountant resume sample

- •Led the monthly reconciliation process, ensuring 98% accuracy, and resolving discrepancies in financial statements promptly.

- •Developed a comprehensive budget plan, resulting in a 15% reduction in operational expenses within a year.

- •Collaborated closely with auditors, providing critical documentation for annual audits, contributing to a 100% compliance rating.

- •Implemented a new financial software system, which improved report generation speed by 25%.

- •Contributed to special projects focused on improving cash flow management, boosting liquidity position by 20%.

- •Enhanced the process of VAT return preparations, resulting in faster submission times by 30%.

- •Assisted in preparation and analysis of financial statements, contributing to timely reporting by reducing delays by 20%.

- •Supported monthly account reconciliation, achieving an accuracy increase from 92% to 98%.

- •Participated in budget analysis, identifying and advising on cost-saving measures that reduced department expenses by 10%.

- •Maintained the general ledger, ensuring precise and up-to-date transactions with zero errors detected in audits.

- •Facilitated the transition to digital documentation, enhancing accessibility and efficiency for the finance team by 40%.

- •Supported financial statement preparation, ensuring compliance with accounting standards, enhancing accuracy to 95%.

- •Contributed to the development of monthly financial forecasts, providing key insights and increasing forecast accuracy by 15%.

- •Assisted with accounts payable by optimizing the invoice process, which reduced processing time from 10 to 5 days.

- •Participated in governmental audits by organizing necessary documents promptly, contributing to a timely audit completion.

- •Assisted in financial statement analysis, increasing report precision by 20% through detailed verification practices.

- •Collaborated with the finance team to implement process improvements, resulting in decreased errors in financial reports.

- •Supported tax filing processes, ensuring timely VAT submissions by improving internal scheduling systems.

- •Provided insights for quarterly budget reviews, which helped identify potential overspending and optimize budget allocations.

Beginner Accounts Payable Accountant resume sample

- •Reduced vendor payment processing time by 20% through process streamlining and improved workflow management.

- •Managed and reconciled over 500 monthly invoices, ensuring accuracy and timely processing to maintain strong vendor relationships.

- •Collaborated with cross-functional teams to integrate a new accounting software, enhancing departmental efficiency and resulting in a 15% decrease in processing errors.

- •Developed a comprehensive training module for new hires, which accelerated their onboarding process by 30%.

- •Implemented enhanced data verification procedures, reducing fraudulent transactions by 25% within the first quarter of implementation.

- •Led a project to automate payment request approvals, achieving a 40% reduction in manual oversight requirements.

- •Processed and audited 800+ expense reports monthly, maintaining policy compliance and accuracy.

- •Aided in the monthly reconciliation of AP accounts, contributing to the reduction of discrepancies by 15%.

- •Supported the implementation of an ERP system which improved data accuracy and processing speed by 20%.

- •Facilitated monthly financial reviews with the management team, providing insights that helped cut operation costs by 10%.

- •Streamlined invoice matching process, decreasing unprocessed invoices by 18% within the initial six months.

- •Increased billing efficiency by 25% through redesigning data entry processes.

- •Supported monthly close activities, where I ensured 100% compliance with GAAP standards.

- •Resolved discrepancies in invoicing, resulting in the recovery of $50,000 in outstanding balances.

- •Synthesized financial data from varied sources, enhancing the monthly report depth and accuracy by 30%.

- •Assisted in the preparation of financial statements and reports, focusing on accuracy and timeliness.

- •Managed vendor databases, ensuring up-to-date contact information and improving communication efficiency by 15%.

- •Supported the finance team in monthly and quarterly audits, contributing to an error reduction of 20%.

- •Developed a standardized procedure for record keeping, improving document retrieval times by 50%.

Entry-Level Accounts Receivable Accountant resume sample

- •Implemented a new invoicing system that reduced late payment occurrences by 20% within the first quarter.

- •Coordinated with the sales department to streamline billing processes, improving efficiency by 15%.

- •Analyzed monthly financial statements for discrepancies, resulting in a 10% decrease in accounting errors.

- •Maintained customer ledgers, ensuring accurate records, and initiated reconciliation processes quarterly.

- •Managed a portfolio of over 200 client accounts, enhancing customer relations and reducing unpaid invoices.

- •Led the accounts receivable month-end closing process, delivering reports with 95% accuracy on time.

- •Revised billing procedures, cutting average billing cycle time by 25%, resulting in improved cash flow.

- •Addressed and resolved customer billing inquiries, achieving a 90% customer satisfaction rating.

- •Collaborated with the IT team to automate invoice generation, reducing manual errors by 30%.

- •Trained and supervised a team of two junior clerks, improving team performance by 20%.

- •Conducted weekly review meetings with sales, accounting, and customer service teams to sync accounting data.

- •Supported the finance team in budget preparation, which led to optimized resource allocation and cost savings of 5%.

- •Prepared detailed financial reports for senior management, contributing to data-driven decision making.

- •Led variance analysis and identified key factors impacting revenue growth, influencing strategic planning.

- •Worked on cross-functional projects with the operations team to standardize accounting practices company-wide.

- •Assisted in the preparation of audit reports, reducing overall audit time by 15% for clients.

- •Evaluated internal controls and identified areas of improvement, enhancing efficiency and compliance.

- •Contributed to the audit planning process, achieving successful validation of financial statements for key clients.

- •Participated in full audit cycles, from planning to completion, ensuring thorough and accurate audits.

Trainee Auditing Accountant resume sample

- •Led a team project to streamline financial reporting processes, cutting completion time by 25% and improving accuracy.

- •Analyzed financial data leading to a 30% error reduction in quarterly budget reporting, resulting in enhanced client trust.

- •Managed audit support tasks and reconciliations, achieving compliance with regulatory standards across three fiscal years.

- •Collaborated with managerial teams, providing insights that improved decision-making processes for major financial strategies.

- •Utilized advanced Excel skills to automate reports, increasing efficiency by 40% and reducing manual labor for the team.

- •Assisted in developing training programs for junior analysts, enhancing team knowledge and improving organizational competency.

- •Conducted in-depth evaluations of financial statements, identifying errors that significantly reduced discrepancies by 15%.

- •Established audit workflows and organized data effectively, which increased document retrieval efficiency by 30%.

- •Participated in client meetings to discuss audit findings, building strong professional relationships and enhancing client satisfaction.

- •Supported the audit team in implementing a new auditing tool, resulting in a 20% increase in overall audit efficiency.

- •Participated in internal audits that uncovered several process inefficiencies, facilitating corrective actions and preventing future discrepancies.

- •Assisted in preparing comprehensive financial reports that increased transparency and accuracy for stakeholders by 20%.

- •Optimized data entry processes, reducing entry errors by 25% and enhancing overall database reliability.

- •Supported financial audits by compiling necessary documentation, adhering to deadlines, and maintaining compliance standards.

- •Tracked budget variances across departments, identifying cost-saving measures that led to a 10% reduction in operational expenses.

- •Managed daily accounting transactions, ensuring accuracy and compliance that improved monthly reconciliation efficiency by 30%.

- •Assisted in financial recordkeeping and data management, enhancing accessibility and reducing retrieval time by 40%.

- •Provided excellent customer service to clients, resolving issues in account discrepancies promptly and effectively.

- •Initiated an inventory control system that reduced losses by 15%, improving overall financial reporting control.

Beginner Payroll Accountant resume sample

- •Implemented new payroll procedures, enhancing efficiency by 30% and reducing errors significantly.

- •Assisted in preparing comprehensive payroll reports for over 500 employees monthly, ensuring timely submissions.

- •Conducted audits on employee payroll data, resulting in a 15% improvement in data accuracy management.

- •Collaborated with HR to update employee records, achieving 100% compliance in payroll information.

- •Streamlined communication systems within finance, reducing response times to employee queries by 40%.

- •Led the design of a new payroll data entry system, reducing processing time by 25%.

- •Coordinated payroll tasks for a team of 12, improving payroll cycle speed by 20%.

- •Managed payroll filing systems, enhancing document retrieval time by 35%.

- •Contributed to tax filings, ensuring all submissions were delivered timely and accurately.

- •Developed training materials on new payroll system software, facilitating a smoother company-wide transition.

- •Reviewed and rectified payroll discrepancies, achieving a 98% resolution rate.

- •Processed over 300 payroll transactions monthly, consistently achieving 100% on-time payroll.

- •Assisted in the setup of a new digital filing system, reducing document loss by 50%.

- •Reviewed employee records quarterly, ensuring optimal accuracy in financial statements.

- •Worked with auditing teams to ensure payroll compliance with federal regulations.

- •Performed detailed data analysis, enhancing budget forecast accuracy by 15%.

- •Developed financial reports that informed strategic decision-making for key company projects.

- •Assisted in financial audits, ensuring adherence to statutory requirements.

- •Collaborated in the integration of new financial software, improving data efficiency by 20%.

Beginner Public Accountant resume sample

- •Streamlined financial data processing, reducing errors by 35% and resulting in a $500K improvement in audit turnaround time.

- •Coordinated with a team of 12 accountants to prepare financial statements for over 30 clients, enhancing data accuracy.

- •Executed account reconciliations, achieving a 40% reduction in discrepancies and improving client trust and satisfaction.

- •Implemented user-friendly data entry systems, increasing team productivity by 25% and saving approximately 150 work hours annually.

- •Championed a project to digitize financial records, leading to a 50% reduction in physical storage requirements and associated costs.

- •Developed audit documentation for multinational corporations, contributing to successful financial reviews and compliance assurance.

- •Assisted in preparing comprehensive tax returns for 50+ diverse clients, contributing to timely submissions and compliance.

- •Utilized QuickBooks to manage bookkeeping tasks, achieving a 20% increase in departmental reporting efficiency.

- •Supported senior accountants in audit processes, ensuring 95% on-time completion of projects and maintaining high-quality standards.

- •Facilitated client meetings by preparing detailed financial reports, leading to a 30% improvement in client engagement.

- •Monitored compliance with accounting principles and regulations, enhancing organizational financial credibility and stability.

- •Analyzed financial data to assist in the preparation of detailed budget reports for 15+ corporate clients.

- •Managed quarterly financial audit documentation, ensuring compliance with industry standards and reducing auditing time by 12%.

- •Improved data reconciliation processes by developing an intricate cross-check system using Excel, reducing discrepancies by 25%.

- •Connected with clients to collect financial data, boosting data collection efficiency and client satisfaction scores by 15%.

- •Maintained accurate financial records for multiple SME clients, improving account accuracy by 20% through meticulous attention to detail.

- •Performed reconciliation tasks, reducing errors by 30% and enhancing financial statement precision and regulatory compliance.

- •Adopted new accounting software to improve data entry speed, achieving a 15% increase in processing efficiency.

- •Collaborated on team projects to introduce procedural improvements, optimizing workflows and reducing administrative hours by 10%.

Stepping into the accounting world can feel like navigating a complex maze, with your resume serving as a crucial map. As a beginner accountant, this document is your introduction, guiding employers through both your skills and your potential. Conveying your strengths, especially your attention to detail, can be challenging at this stage, but it’s vital since precision is a key compass in accounting.

Organizing your experiences and skills in a way that captures attention is often difficult. You may wonder how to build a structured resume or which details to emphasize. To tackle this, a resume template can be immensely helpful. It provides a clean, professional format that ensures your resume is appealing and easy to follow.

When you highlight your educational background and relevant coursework, you leverage your foundational knowledge. This forms the backbone of your technical grasp of financial accounting principles. Bringing attention to any internships, projects, or part-time roles further showcases your commitment and readiness for the accounting field.

Your resume is typically your first chance to make a lasting impression. Strive to make it as polished and precise as a well-organized ledger. With a focused and compelling resume, you set the foundation for securing a promising role in accounting.

Key Takeaways

- The resume is a crucial map to guide employers through your skills, particularly attention to detail, which is vital in accounting.

- Using a professional resume template can aid in organizing experiences and skills to capture an employer's attention.

- Highlighting educational background, relevant coursework, internships, and projects demonstrates foundational knowledge in accounting.

- A polished and precise resume, akin to a well-organized ledger, leaves a lasting impression on potential employers.

- Maintaining a chronological layout, using modern fonts, and saving the resume in PDF format helps present a clear and consistent professional image.

What to focus on when writing your beginner accountant resume

A beginner accountant resume should convey your foundational skills in accounting, showing your eagerness to learn and contribute to a team. It should highlight your attention to detail and your understanding of basic accounting principles, which are crucial to success in this field. Clearly outlining your education and any practical experience from internships or entry-level roles will give recruiters a clearer picture of your capabilities.

How to structure your beginner accountant resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile—these details should be prominently displayed to ensure recruiters can contact you easily. Make sure your email is professional and your LinkedIn profile is updated to reflect your resume, as consistency builds trust and credibility.

- Objective Statement: Follow with a concise statement that reflects your career goals in accounting—this section should capture your enthusiasm for the field and succinctly present how your skills align with the job you’re applying for. Tailor this statement to each specific job to show that you’ve considered how you can contribute uniquely to that role.

- Education: Next, list your degree, major, and the institution you graduated from—ensure this section highlights achievements like a high GPA or relevant courses, such as Financial Accounting and Managerial Accounting, which demonstrate your preparedness for the job. Including any honors or relevant projects can further underscore your dedication and academic prowess.

- Skills: Complement your education by highlighting specific accounting skills—detail proficiency in tools like QuickBooks, Excel, or SAP, as these are essential in most accounting roles. Soft skills, such as analytical ability and problem-solving, should also be included, as they reflect your capacity to handle complex financial data effectively.

- Experience: Any internships, part-time jobs, or volunteer work should follow here—describe activities where you applied accounting concepts, like reconciling accounts or assisting with audits, showing actionable examples of your skills. Highlighting real-world experience, even if limited, gives you a competitive edge by demonstrating that you can practically apply your learning.

- Certifications: Lastly, add any relevant certifications, like CPA-related coursework or workshops on financial reporting—these serve as proof of your growing expertise and commitment to continuous learning in the accounting field. Certifications can make you stand out as someone who is proactive about their professional development.

Consider adding optional sections like awards, extracurricular activities, or volunteer roles that relate to accounting or demonstrate leadership and organizational skills—these can further enhance your profile. Below, we'll cover each section more in-depth to ensure your resume format effectively showcases your strengths and readiness for an accounting role.

Which resume format to choose

Crafting a resume as a beginner accountant involves attention to several key elements to ensure a strong first impression. Starting with the format, a chronological layout is particularly effective in the accounting field. It arranges your academic achievements and any related experience in a clear timeline, making it easy for employers to quickly understand your background and professional trajectory. This format underscores your commitment to learning and growth, which is vital in the accounting industry.

The choice of font plays an equally important role in shaping your resume's presentation. Opting for modern fonts like Raleway, Lato, or Montserrat ensures that your document looks updated yet remains professional. These fonts are clean and straightforward, which reinforces the precision and clarity valued in accounting without overwhelming the reader with too many stylistic choices.

To preserve the integrity of your carefully designed resume, saving it as a PDF is essential. This file type locks in your formatting, ensuring that no matter what software or device a recruiter uses, your resume appears exactly as you intended. This consistency is crucial in preventing any misinterpretation of your information, especially in a detail-oriented field like accounting.

Lastly, maintaining one-inch margins on all sides of your resume provides the necessary white space that enhances readability. This aspect of layout design helps ensure that your information doesn't feel cramped, making it easier for potential employers to navigate your credentials and experiences efficiently. Together, these well-considered elements create a resume that not only communicates your potential effectively but also reflects the meticulous approach that is a hallmark of the accounting profession.

How to write a quantifiable resume experience section

Crafting a standout resume experience section is essential for a beginner accountant, as this part highlights your work history and achievements, making it clear to employers how your skills match their needs. Start by listing jobs in reverse chronological order, with recent positions at the top, emphasizing relevant experiences that align closely with the job description you’re targeting. Typically, focus on the past 10 years unless your key experience is more recent, ensuring that job titles are clear and descriptive.

Tailoring this section involves aligning your previous duties and accomplishments with the specific requirements in the job ad, transforming your resume into a targeted story of your career. Use active, dynamic verbs like "achieved," "managed," "developed," or "improved" to clearly convey your contributions, aiming for each bullet point to reflect a quantifiable achievement. This approach allows potential employers to easily understand the tangible impact you've made at past jobs.

- •Processed over 200 accounts receivable transactions monthly, reducing overdue accounts by 15%.

- •Aided in preparing monthly financial statements, which increased reporting efficiency by 10%.

- •Developed an Excel tracking system that improved invoice processing time by 20%.

- •Collaborated with a cross-functional team to implement a new budgeting tool, enhancing budget accuracy by 25%.

This section effectively connects your achievements through specific, quantifiable outcomes that highlight your impact. By ensuring each bullet ties back to a clear result, employers can easily see the value you’ve added in your previous roles. Aligning your achievements with the job's requirements strengthens your candidacy and paints a cohesive picture of your capabilities. The use of active language adds vitality to your resume, emphasizing your proactive approach and ability to deliver valuable results, both of which are highly sought after in the accounting field.

Problem-Solving Focused resume experience section

A problem-solving-focused accountant resume experience section should highlight your analytical skills and attention to detail by showcasing instances where you made a tangible impact. Draw from your experiences in internships, part-time jobs, or volunteer work where you navigated accounting challenges. Clearly outline the issues you dealt with and emphasize the proactive steps you took along with the outcomes they generated. Even if your professional history is brief, demonstrate your problem-solving abilities with specific examples and measurable results.

Begin by selecting roles where problem-solving was essential. Use impactful action verbs in your bullet points to demonstrate your involvement and contributions. Whether you refined a budgeting process, supported a financial audit, or optimized invoicing, make sure to emphasize your role. Keep your statements concise yet informative, ensuring they convey your resourcefulness and precision. Linking these experiences together will not only highlight your skills but also your dedication to tackling the real-world challenges in accounting.

Accounting Intern

XYZ Financial Services

June 2022 - August 2022

- Identified and reconciled a $5,000 discrepancy in expense reports, ensuring accurate financial records.

- Streamlined the data entry process, reducing errors by 15% and increasing team efficiency.

- Assisted in preparing quarterly financial statements, contributing to an error-free reporting cycle.

- Collaborated with team members to improve auditing techniques, enhancing the department's accuracy and reliability.

Achievement-Focused resume experience section

A beginner accountant-focused resume experience section should aim to clearly showcase your skills and accomplishments. Begin by emphasizing specific achievements and, whenever possible, quantify these accomplishments to show tangible value. Highlight experiences where you improved processes, saved time, or boosted accuracy, demonstrating how you applied your accounting skills in various settings. This approach will draw attention to your ability to contribute effectively, even if your experience is limited.

Clearly describe your role and its impact on the team, using simple language to convey your contributions. Incorporate mentions of any accounting software or tools you've mastered, reflecting your technical proficiency. Start each accomplishment with an active verb to effectively communicate the positive outcomes driven by your initiative and problem-solving skills. This cohesive narrative will help potential employers understand the value you can bring to their team.

Accounting Intern

ABC Corp

June 2020 - August 2021

- Prepared monthly financial statements, reducing errors by 15% with careful attention to detail.

- Worked with a team of 5 to streamline the billing process, decreasing processing time by 20%.

- Used Excel to track accounts receivable, improving collection times by 10%.

- Supported annual audits and identified discrepancies, aiding in a smoother audit process.

Efficiency-Focused resume experience section

An efficiency-focused junior accountant resume experience section should clearly demonstrate how you've enhanced processes and increased productivity. Start by using direct, straightforward language to describe your key responsibilities and achievements, with a focus on examples where you've optimized efficiency, streamlined tasks, or conserved resources. Incorporate specific metrics or percentages to effectively showcase tangible improvements. This approach will emphasize your contributions and highlight how you've made processes smoother and more effective.

Each bullet point should focus on a distinct skill or accomplishment and use strong action verbs to illustrate your role in driving efficiency. For instance, rather than stating "improved report timeliness," detail how you "reduced report turnaround time by 20% through the implementation of automated data entry." This not only conveys what you accomplished but also demonstrates the positive impact on the company. Including numbers provides concrete proof of your achievements, making them more compelling. Keep your tone confident and factual throughout to maintain a professional and impressive resume.

Junior Accountant

ABC Financial Services

June 2021 - August 2023

- Automated monthly financial reports, cutting preparation time by 25%.

- Streamlined data entry processes, reducing errors by 30% and saving 10 hours each week.

- Introduced a filing system that sped up document retrieval by 40%.

- Collaborated with IT to upgrade accounting software, boosting department efficiency.

Skills-Focused resume experience section

A skills-focused resume experience section for a beginner accountant should emphasize your skills and achievements, helping you stand out to potential employers. Begin by identifying your key accounting skills, such as proficiency with accounting software, attention to detail, and financial analysis capabilities. Use these skills as a foundation to describe your past experiences, even if they weren't in direct accounting roles. This not only demonstrates how you applied these skills but also highlights the results you achieved.

Incorporate specific, quantifiable bullet points, using action verbs to convey a proactive, results-oriented approach. Although you may be a beginner, focus on accomplishments that showcase your initiative and problem-solving abilities. If you lack direct accounting experience, highlight transferable skills like project management or teamwork from other roles. This method of presentation helps employers see your potential to excel in an accounting position.

Finance Volunteer

Local Community Center

June 2021 - August 2021

- Handled daily reconciliations of donations, ensuring accuracy.

- Utilized Excel to track and report on budget expenses, aiding transparency.

- Assisted with monthly financial reports, providing input on discrepancies.

- Collaborated with a team to organize financial data for the annual report.

Write your beginner accountant resume summary section

A beginner-focused accountant resume summary should serve as a compelling introduction that hooks a hiring manager’s attention. Think of your summary as a quick personal pitch that highlights your strengths and potential. For example:

This example effectively combines key skills like analytical abilities and software expertise, which are crucial for accounting roles. Mentioning educational achievements adds credibility, while internship experience demonstrates hands-on knowledge. Expressing a desire to join a specific company highlights your ambition and shows how well you fit the role.

Selecting the right words to describe yourself is crucial. Words like "motivated," "dedicated," and "passionate" give employers a sense of your enthusiasm and readiness for the job. Strive to keep it concise and impactful, painting a quick yet powerful image of your professional identity.

Understanding different resume components can further refine your writing. A resume summary succinctly covers your experience and skills. If you're new to a field, a resume objective, which focuses on your career goals, can be more fitting. A resume profile blends elements of a summary and an objective, while a summary of qualifications highlights key accomplishments, ideal for experienced professionals.

Tailoring your resume content to the job you’re after demonstrates focus and commitment. By using specific examples and clear language, your entry-level accountant resume can truly stand out.

Listing your beginner accountant skills on your resume

A skills-focused beginner accountant resume section should make your abilities shine. It’s vital to present your skills effectively, both as a standalone section and woven into your experience or summary. Showcasing strengths and soft skills tells employers about your character and how well you can collaborate. In contrast, hard skills highlight specific proficiencies like using accounting software or analyzing financial data.

When you incorporate skills and strengths, they become powerful keywords that attract hiring managers and help your resume navigate automated screening systems. As a beginner accountant, emphasizing your skills can demonstrate your enthusiasm and readiness for accounting tasks.

Here's an example of how a standalone skills section might look:

This skills section clearly outlines essential accounting skills, succinctly showing employers your potential contributions.

Best hard skills to feature on your beginner accountant resume

Your hard skills should express preparedness for core accounting tasks, signaling your competence and value. Including sought-after hard skills ensures you’re aligned with what employers look for:

Hard Skills

- Financial Reporting

- Excel Proficiency

- Data Analysis

- Bookkeeping

- QuickBooks

- Tax Preparation

- Accounts Payable/Receivable

- General Ledger Accounting

- Financial Statement Analysis

- Auditing

- Account Reconciliation

- Payroll Processing

- Budgeting

- Financial Forecasting

- Cost Accounting

Best soft skills to feature on your beginner accountant resume

Your resume should also feature soft skills that illustrate your approach to workplace dynamics and challenges. These skills highlight your people skills and reliability as a team member:

Soft Skills

- Attention to Detail

- Time Management

- Problem-Solving

- Communication

- Adaptability

- Teamwork

- Critical Thinking

- Organization

- Strong Work Ethic

- Multitasking

- Initiative

- Analytical Thinking

- Interpersonal Skills

- Dependability

- Emotional Intelligence

How to include your education on your resume

The education section is a vital part of your beginner accountant resume. It shows your academic background and should be tailored to the job you're applying for. Irrelevant education should be left out to keep the content focused. When listing your degree, include the full title and the institution's name. Your GPA can be listed if it's above 3.0, and be specific about whether it was on a 4.0 scale.

Cum laude honors can also enhance your resume by noting it alongside your degree. Here is the wrong example of an education section:

Here is the right example of an education section:

The second example is strong because it offers a GPA and cum laude honor, which impress potential employers. It includes a relevant degree in Accounting, aligning perfectly with the job you're applying for. The focused and concise presentation makes it easy for hiring managers to understand your qualifications.

How to include beginner accountant certificates on your resume

Adding a certificates section to your beginner accountant resume is crucial. Certificates show your qualifications and commitment to the field. Place this section prominently, even in the header, to catch the employer's eye quickly. Start by listing the name of each certificate. Include the date you received it. Add the issuing organization for credibility. Arrange them in reverse chronological order to highlight the most recent achievements first.

For example:

This example is good because it lists relevant certificates that make you more appealing for accounting roles. The CPA and CMA certificates are industry-recognized and indicate a solid foundation in accounting principles. Showing the issuing bodies, like the American Institute of CPAs and the Institute of Management Accountants, adds authenticity. Placing this section at the top will ensure it's noticed.

Extra sections to include in your beginner accountant resume

Starting out as a beginner accountant can be a daunting challenge, but with the right resume, you can make a solid first impression. Highlighting your skills, experiences, and interests effectively on your resume can set you apart from the competition.

- Language section — List any languages you speak besides English. This can show potential employers your ability to work with diverse clients.

- Hobbies and interests section — Mention hobbies that demonstrate skills relevant to accounting, such as problem-solving or attention to detail. Including these can give employers insight into your personal qualities.

- Volunteer work section — Showcase any unpaid work that involved financial tasks or management. This can highlight your dedication and experience outside formal employment.

- Books section — Reference accounting books you've read to show your ongoing learning and interest in accounting. This can illustrate your commitment to expanding your knowledge.

Each of these sections can add unique value to your beginner accountant resume, helping you create a more rounded and compelling profile for potential employers.

In Conclusion

In conclusion, crafting a strong resume is essential for your journey as a beginner accountant. By organizing your resume effectively and highlighting key skills and experiences, you can successfully stand out to potential employers. A well-structured resume serves as your personal introduction, showcasing your attention to detail, eagerness to learn, and commitment to the accounting field. Utilizing a professional resume template can provide a clean format, making it easier for recruiters to navigate your strengths and qualifications. Remember to tailor your objective statement to each job, aligning your goals with the role you’re applying for. Highlighting your educational background and any practical experiences, such as internships or volunteer work, demonstrates your readiness to tackle real-world accounting challenges. Including both hard and soft skills is crucial, as it showcases your ability to handle complex financial data and collaborate within a team. Don’t forget to incorporate any relevant certifications, as these signify your dedication to professional growth. Consider adding extra sections like language skills or hobbies, which provide additional insights into your personality and capabilities. Keep your resume concise and focused, ensuring all information enhances your candidacy. By doing so, you create not just a document but a compelling story of your budding career in accounting, inviting employers to picture you as a valuable part of their team.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.