Business Finance Analyst Resume Examples

Jul 18, 2024

|

12 min read

Master your business finance analyst resume: tips to stand out and get hired!

Rated by 348 people

International Business Finance Analyst

Financial Planning and Analysis Business Analyst

Business Operations and Finance Analyst

Business Performance Finance Analyst

Business Finance Compliance Analyst

Strategic Business Finance Analyst

Real Estate Business Finance Analyst

Business Finance Systems Analyst

Business Process Finance Analyst

Business Intelligence and Finance Analyst

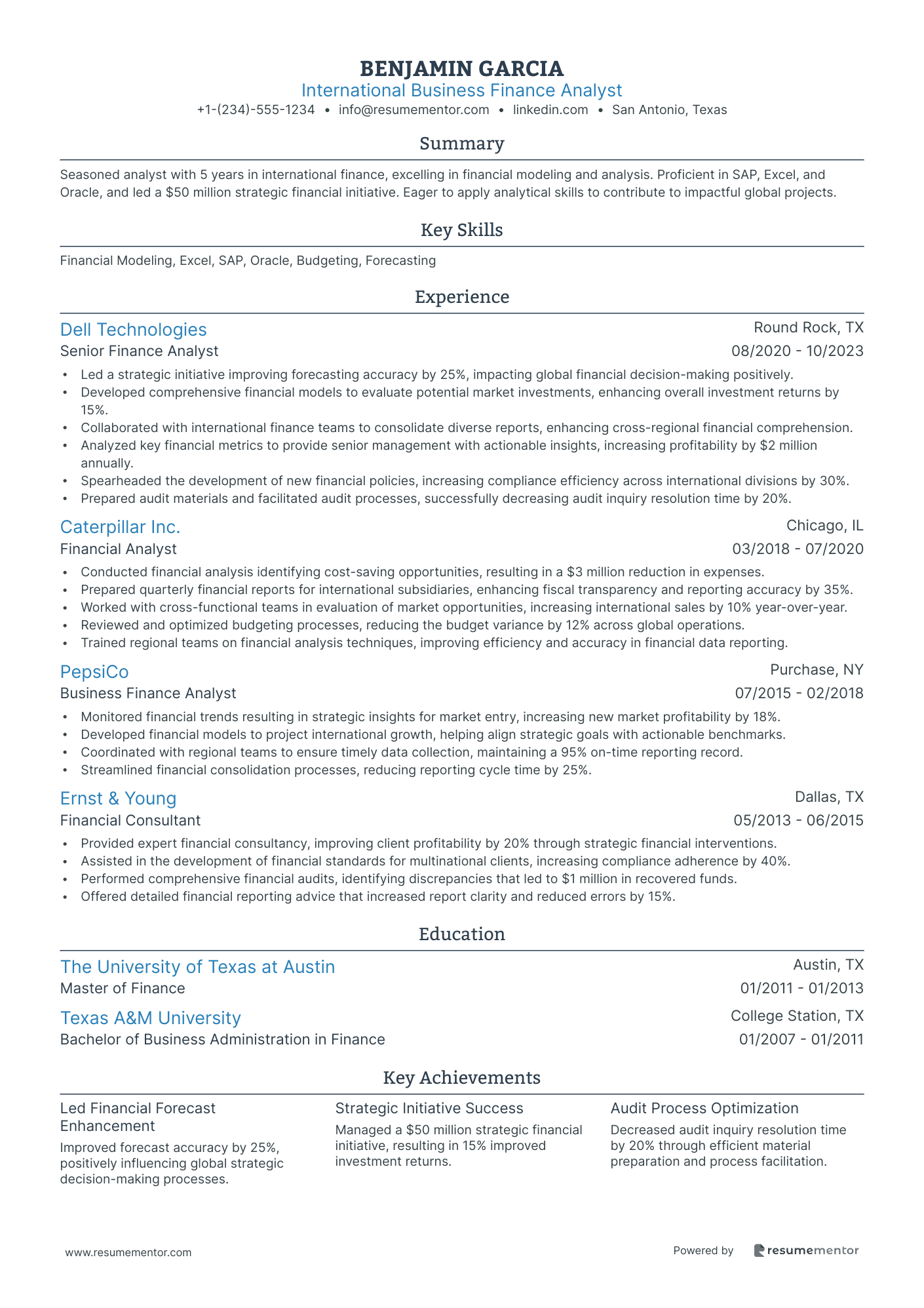

International Business Finance Analyst resume sample

When applying for this position, it’s essential to showcase any experience working with international markets or financial regulations. Highlight any language skills that could support global communication and collaboration. Having knowledge of foreign exchange and international tax laws will set you apart. Mention any relevant coursework or certifications, such as 'International Finance' or 'Cross-Cultural Management', emphasizing their direct relevance to the role. Use the 'skill-action-result' technique to illustrate how your analytical skills have led to better financial decisions or improved profitability for prior employers.

- •Led a strategic initiative improving forecasting accuracy by 25%, impacting global financial decision-making positively.

- •Developed comprehensive financial models to evaluate potential market investments, enhancing overall investment returns by 15%.

- •Collaborated with international finance teams to consolidate diverse reports, enhancing cross-regional financial comprehension.

- •Analyzed key financial metrics to provide senior management with actionable insights, increasing profitability by $2 million annually.

- •Spearheaded the development of new financial policies, increasing compliance efficiency across international divisions by 30%.

- •Prepared audit materials and facilitated audit processes, successfully decreasing audit inquiry resolution time by 20%.

- •Conducted financial analysis identifying cost-saving opportunities, resulting in a $3 million reduction in expenses.

- •Prepared quarterly financial reports for international subsidiaries, enhancing fiscal transparency and reporting accuracy by 35%.

- •Worked with cross-functional teams in evaluation of market opportunities, increasing international sales by 10% year-over-year.

- •Reviewed and optimized budgeting processes, reducing the budget variance by 12% across global operations.

- •Trained regional teams on financial analysis techniques, improving efficiency and accuracy in financial data reporting.

- •Monitored financial trends resulting in strategic insights for market entry, increasing new market profitability by 18%.

- •Developed financial models to project international growth, helping align strategic goals with actionable benchmarks.

- •Coordinated with regional teams to ensure timely data collection, maintaining a 95% on-time reporting record.

- •Streamlined financial consolidation processes, reducing reporting cycle time by 25%.

- •Provided expert financial consultancy, improving client profitability by 20% through strategic financial interventions.

- •Assisted in the development of financial standards for multinational clients, increasing compliance adherence by 40%.

- •Performed comprehensive financial audits, identifying discrepancies that led to $1 million in recovered funds.

- •Offered detailed financial reporting advice that increased report clarity and reduced errors by 15%.

Financial Planning and Analysis Business Analyst resume sample

When applying for this role, focus on your experience with budgeting, forecasting, and variance analysis. Highlight any analytical tools you’ve used, such as Excel or financial modeling software, to demonstrate your technical skills. It’s helpful to showcase projects where you improved financial performance or reduced costs. Be sure to mention your teamwork experience, particularly with cross-functional teams, as collaboration is key. Use metrics to illustrate your impact, such as percentage increases in efficiency or accuracy. These details will strengthen your application.

- •Led financial forecasting and budgeting for a $500M product line, improving forecast accuracy by 20% through advanced data analysis techniques.

- •Collaborated with cross-functional teams to re-evaluate cost structures, leading to an 18% reduction in operational expenses.

- •Developed and implemented a new financial model to assess market entry scenarios, which resulted in a strategic expansion into two new regions.

- •Streamlined the financial reporting process by integrating new software tools, reducing report preparation time by 25%.

- •Conducted detailed variance analysis monthly, uncovering insights that helped optimize financial performance by focusing on key growth drivers.

- •Prepared detailed presentations for senior executives, synthesizing complex data into actionable insights that influenced business strategy.

- •Orchestrated multi-year budget plans aligning with corporate growth targets, leading to a 15% improvement in department budget adherence.

- •Executed quantitative analysis on investment opportunities, facilitating capital allocation decisions worth over $200M.

- •Contributed to process improvements in financial operations, saving the finance team approximately 300 hours annually.

- •Implemented financial control measures that resulted in a 10% decrease in expenses quarter-over-quarter.

- •Provided in-depth ad-hoc analysis reports that guided key decision-makers in prioritizing strategic project initiatives.

- •Assisted in the preparation of annual and quarterly operating budgets, participating in the successful control of expenses by 7%.

- •Collaborated with finance and operations teams to improve financial processes, decreasing month-end reporting times by 10%.

- •Developed and maintained financial models to evaluate profitability scenarios, enhancing decision-making capabilities for senior managers.

- •Facilitated financial performance presentations for internal stakeholders, aiding in the monthly assessments of business units.

- •Supported budget management efforts, which aligned department spends with strategic corporate initiatives.

- •Performed comprehensive analysis of financial data, contributing to a performance improvement that boosted efficiency by 5%.

- •Managed reporting tasks for multiple projects, ensuring data integrity and usability for financial review processes.

- •Engaged with cross-departmental teams to enhance understanding of key financial metrics, fostering a culture of informed decision-making.

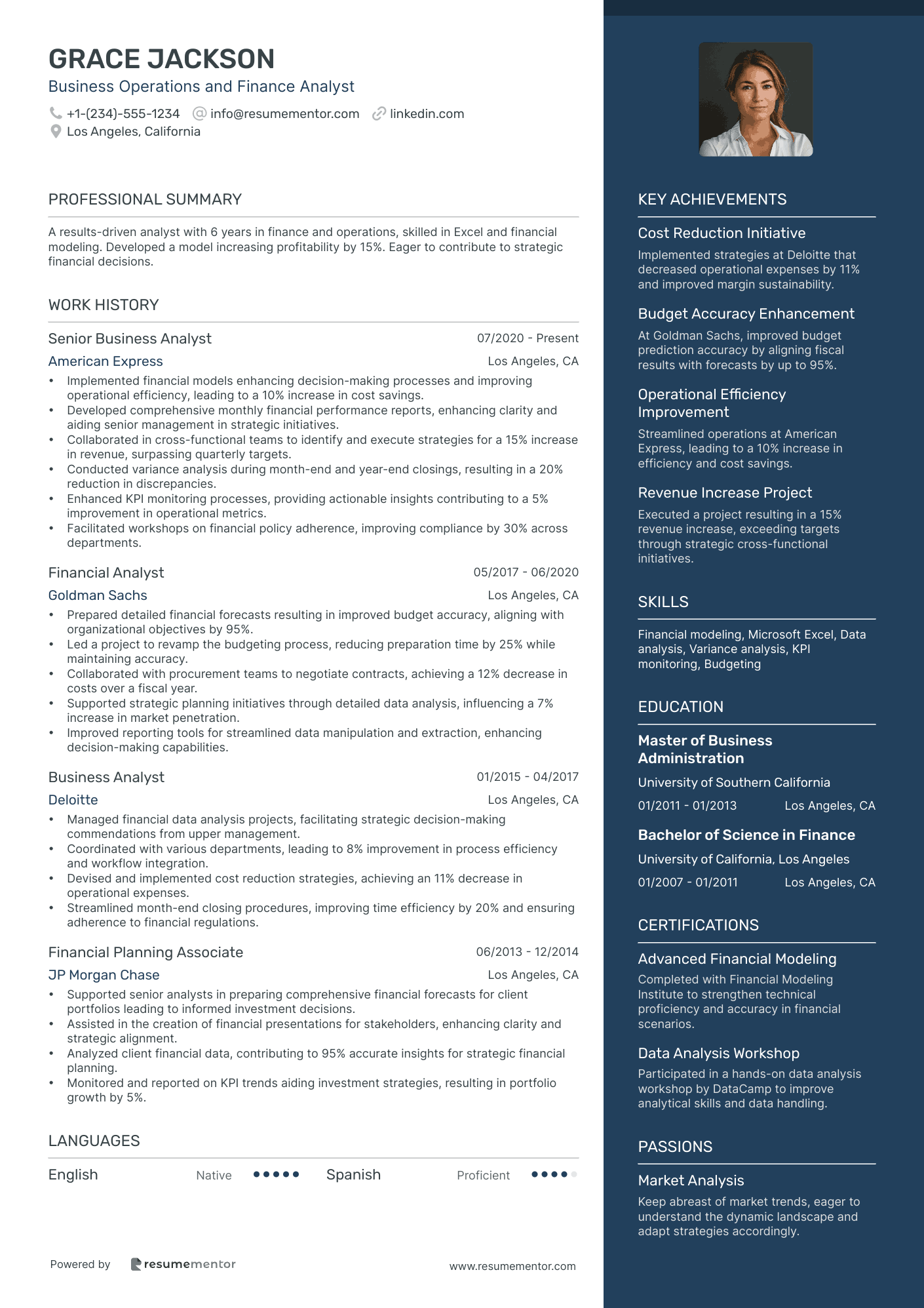

Business Operations and Finance Analyst resume sample

When applying for this role, emphasize your analytical skills and experience in process improvement. Highlight any relevant tools or software you have used, such as Microsoft Excel or SQL, to show your technical proficiency. If you've completed any relevant coursework or certifications, like 'Data Analysis' or 'Operations Management,' be sure to mention them. Use specific examples that demonstrate your ability to streamline operations or reduce costs, applying the 'skill-action-result' format to illustrate your impact on previous projects or teams.

- •Implemented financial models enhancing decision-making processes and improving operational efficiency, leading to a 10% increase in cost savings.

- •Developed comprehensive monthly financial performance reports, enhancing clarity and aiding senior management in strategic initiatives.

- •Collaborated in cross-functional teams to identify and execute strategies for a 15% increase in revenue, surpassing quarterly targets.

- •Conducted variance analysis during month-end and year-end closings, resulting in a 20% reduction in discrepancies.

- •Enhanced KPI monitoring processes, providing actionable insights contributing to a 5% improvement in operational metrics.

- •Facilitated workshops on financial policy adherence, improving compliance by 30% across departments.

- •Prepared detailed financial forecasts resulting in improved budget accuracy, aligning with organizational objectives by 95%.

- •Led a project to revamp the budgeting process, reducing preparation time by 25% while maintaining accuracy.

- •Collaborated with procurement teams to negotiate contracts, achieving a 12% decrease in costs over a fiscal year.

- •Supported strategic planning initiatives through detailed data analysis, influencing a 7% increase in market penetration.

- •Improved reporting tools for streamlined data manipulation and extraction, enhancing decision-making capabilities.

- •Managed financial data analysis projects, facilitating strategic decision-making commendations from upper management.

- •Coordinated with various departments, leading to 8% improvement in process efficiency and workflow integration.

- •Devised and implemented cost reduction strategies, achieving an 11% decrease in operational expenses.

- •Streamlined month-end closing procedures, improving time efficiency by 20% and ensuring adherence to financial regulations.

- •Supported senior analysts in preparing comprehensive financial forecasts for client portfolios leading to informed investment decisions.

- •Assisted in the creation of financial presentations for stakeholders, enhancing clarity and strategic alignment.

- •Analyzed client financial data, contributing to 95% accurate insights for strategic financial planning.

- •Monitored and reported on KPI trends aiding investment strategies, resulting in portfolio growth by 5%.

Business Performance Finance Analyst resume sample

When applying for this role, focus on your analytical skills and experience with financial modeling. Highlight any experience with performance metrics and KPIs, as they are crucial for assessing business health. Mention familiarity with tools like Excel, Tableau, or financial software. Certifications or coursework in financial analysis or data analysis should be included as evidence of your expertise. Use specific examples showing how you've identified trends that led to cost savings or revenue growth in past roles, using the 'skill-action-result' format to strengthen your narrative.

- •Led a team in developing financial models that improved profit margins by 15% within one fiscal year through data-driven insights.

- •Collaborated with cross-departmental teams to streamline budgeting processes, resulting in a 12% reduction in overhead costs.

- •Created comprehensive financial dashboards, improving reporting accuracy and reducing decision-making time by 25%.

- •Analyzed quarterly performance trends leading to strategic shifts increasing market share by 8% in core business units.

- •Assisted senior management in presenting financial findings that shaped long-term business strategy effectively.

- •Enhanced the financial forecasting models, improving accuracy by 18%, positively impacting executive decision-making.

- •Spearheaded a project to integrate KPI tracking systems which improved performance monitoring efficiency by 22%.

- •Conducted variance analysis to address discrepancies, ultimately saving the company $1.5 million annually.

- •Designed financial presentations for stakeholders, facilitating better understanding of quarterly financial results.

- •Developed reporting tools that supported performance improvement initiatives, leading to a 10% increase in productivity.

- •Led budgeting and forecasting activities, reducing errors by 30% and enhancing financial planning accuracy.

- •Implemented a new reporting system that reduced deliverable preparation time by 40%, improving team efficiency.

- •Collaborated on cross-functional projects to achieve revenue growth of 6% across multiple product lines.

- •Analyzed sales trends leading to strategic price adjustments that increased revenue by $3 million.

- •Supported financial closing processes ensuring 100% accuracy in reports and adherence to strict deadlines.

- •Conducted financial assessments that led to the optimization of supply chain operations, cutting costs by 5%.

- •Developed financial models facilitating improved tracking of key business metrics, enhancing management oversight.

- •Provided comprehensive financial data analysis resulting in effective cost management strategies being implemented.

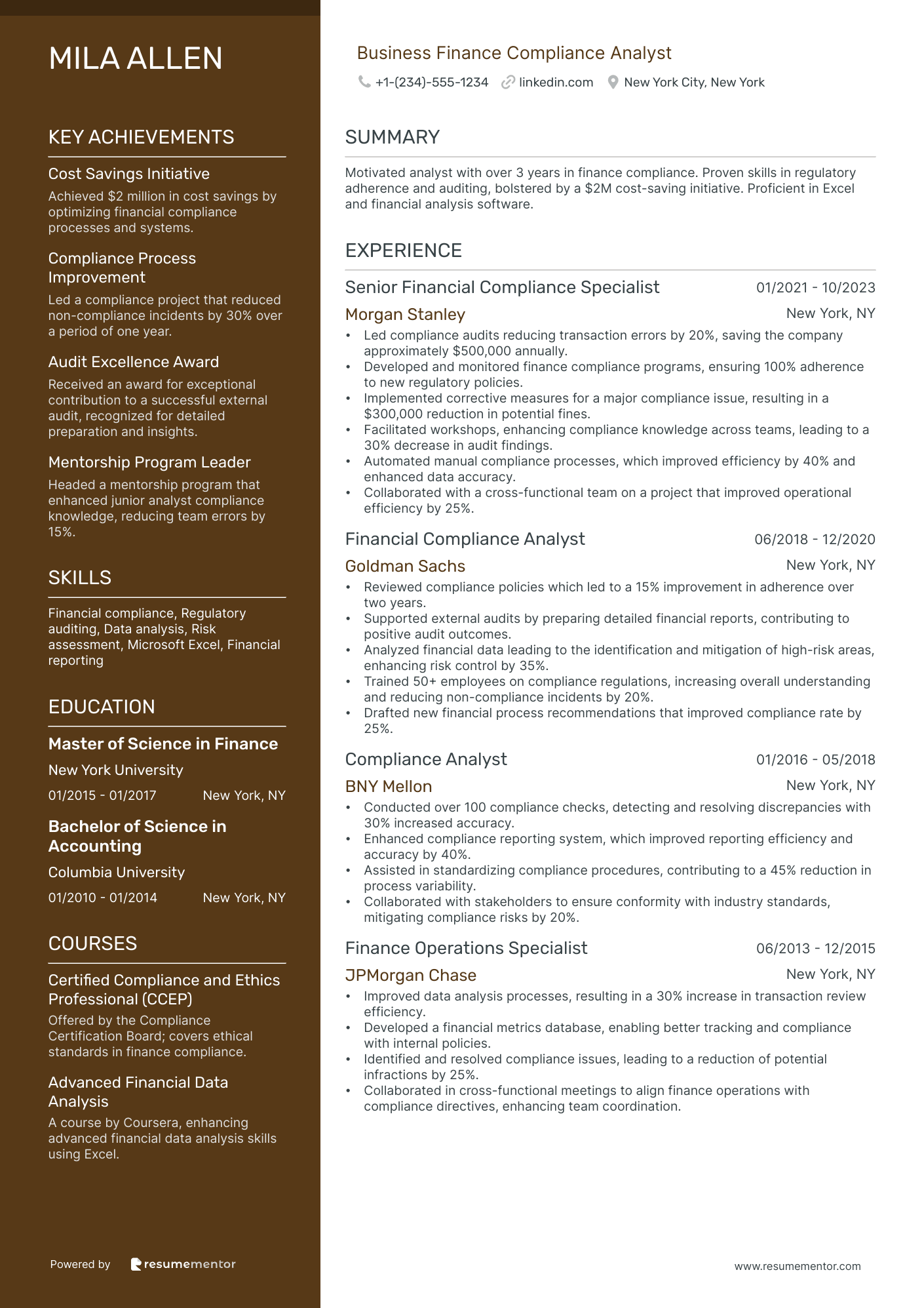

Business Finance Compliance Analyst resume sample

When applying for this role, showcase your experience with compliance regulations and risk management frameworks. Detail any past work in auditing or financial reporting, as these are critical components. Highlight your proficiency in data analysis and relevant software tools, such as Excel or compliance management systems. Include any certifications like 'Certified Compliance & Ethics Professional' to demonstrate dedication. Use specific examples to illustrate how your attention to detail has improved compliance efforts or reduced risk for your previous employers, following a 'skill-action-result' format.

- •Led compliance audits reducing transaction errors by 20%, saving the company approximately $500,000 annually.

- •Developed and monitored finance compliance programs, ensuring 100% adherence to new regulatory policies.

- •Implemented corrective measures for a major compliance issue, resulting in a $300,000 reduction in potential fines.

- •Facilitated workshops, enhancing compliance knowledge across teams, leading to a 30% decrease in audit findings.

- •Automated manual compliance processes, which improved efficiency by 40% and enhanced data accuracy.

- •Collaborated with a cross-functional team on a project that improved operational efficiency by 25%.

- •Reviewed compliance policies which led to a 15% improvement in adherence over two years.

- •Supported external audits by preparing detailed financial reports, contributing to positive audit outcomes.

- •Analyzed financial data leading to the identification and mitigation of high-risk areas, enhancing risk control by 35%.

- •Trained 50+ employees on compliance regulations, increasing overall understanding and reducing non-compliance incidents by 20%.

- •Drafted new financial process recommendations that improved compliance rate by 25%.

- •Conducted over 100 compliance checks, detecting and resolving discrepancies with 30% increased accuracy.

- •Enhanced compliance reporting system, which improved reporting efficiency and accuracy by 40%.

- •Assisted in standardizing compliance procedures, contributing to a 45% reduction in process variability.

- •Collaborated with stakeholders to ensure conformity with industry standards, mitigating compliance risks by 20%.

- •Improved data analysis processes, resulting in a 30% increase in transaction review efficiency.

- •Developed a financial metrics database, enabling better tracking and compliance with internal policies.

- •Identified and resolved compliance issues, leading to a reduction of potential infractions by 25%.

- •Collaborated in cross-functional meetings to align finance operations with compliance directives, enhancing team coordination.

Strategic Business Finance Analyst resume sample

When applying for this role, it’s important to showcase your analytical skills and experience with financial modeling. Highlight your proficiency in data analysis tools, like Excel or Tableau, and emphasize any work with budgeting or forecasting. Include successful projects where you influenced business strategy and financial outcomes, using the 'skill-action-result' framework. Mention relevant coursework in finance or strategic management to underline your understanding. Strong problem-solving skills and an ability to communicate complex financial concepts to non-financial stakeholders can greatly enhance your application.

- •Led financial analysis projects that increased company sales by 15% by driving strategic insights into market expansion.

- •Developed comprehensive financial models that optimized budget allocations, resulting in a 10% cost reduction.

- •Collaborated with cross-departmental leadership to re-evaluate business strategies, contributing to a 5% revenue growth.

- •Improved forecasting accuracy by 20% through implemented data-driven decisions and enhanced analytical techniques.

- •Implemented new reporting systems integrating SAP, which improved financial reporting speed and accuracy by 30%.

- •Presented actionable financial insights to executive leadership, influencing decisions leading to 8% profit enhancement.

- •Contributed to a 12% increase in quarterly revenue by refining financial models and executing data-driven insights.

- •Oversaw the budgeting process and ensured alignment with organizational objectives, improving budget adherence by 25%.

- •Streamlined month-end close processes, reducing reporting time by 40% with advanced Excel modeling.

- •Monitored KPIs and delivered strategic recommendations, aiding in the successful launch of two major initiatives.

- •Facilitated cross-functional strategy meetings, providing a financial perspective that led to enhanced project success rates.

- •Developed and analyzed business cases for potential investments worth over $200M, fostering informed decisions.

- •Reduced operational costs by 15% through the implementation of financial efficiency projects and thorough variance analysis.

- •Performed detailed financial forecasting, improving business planning accuracy and aiding in strategic growth decisions.

- •Collaborated with marketing and operations to support strategic initiatives that led to a 10% market share increase.

- •Assisted in creating detailed financial reports for executive board meetings, enhancing investment decision-making processes.

- •Provided ad-hoc financial analysis leading to cost-saving decisions, optimizing expenditure by $500K annually.

- •Supported strategic planning sessions with insightful data and financial models, improving organizational strategic alignment.

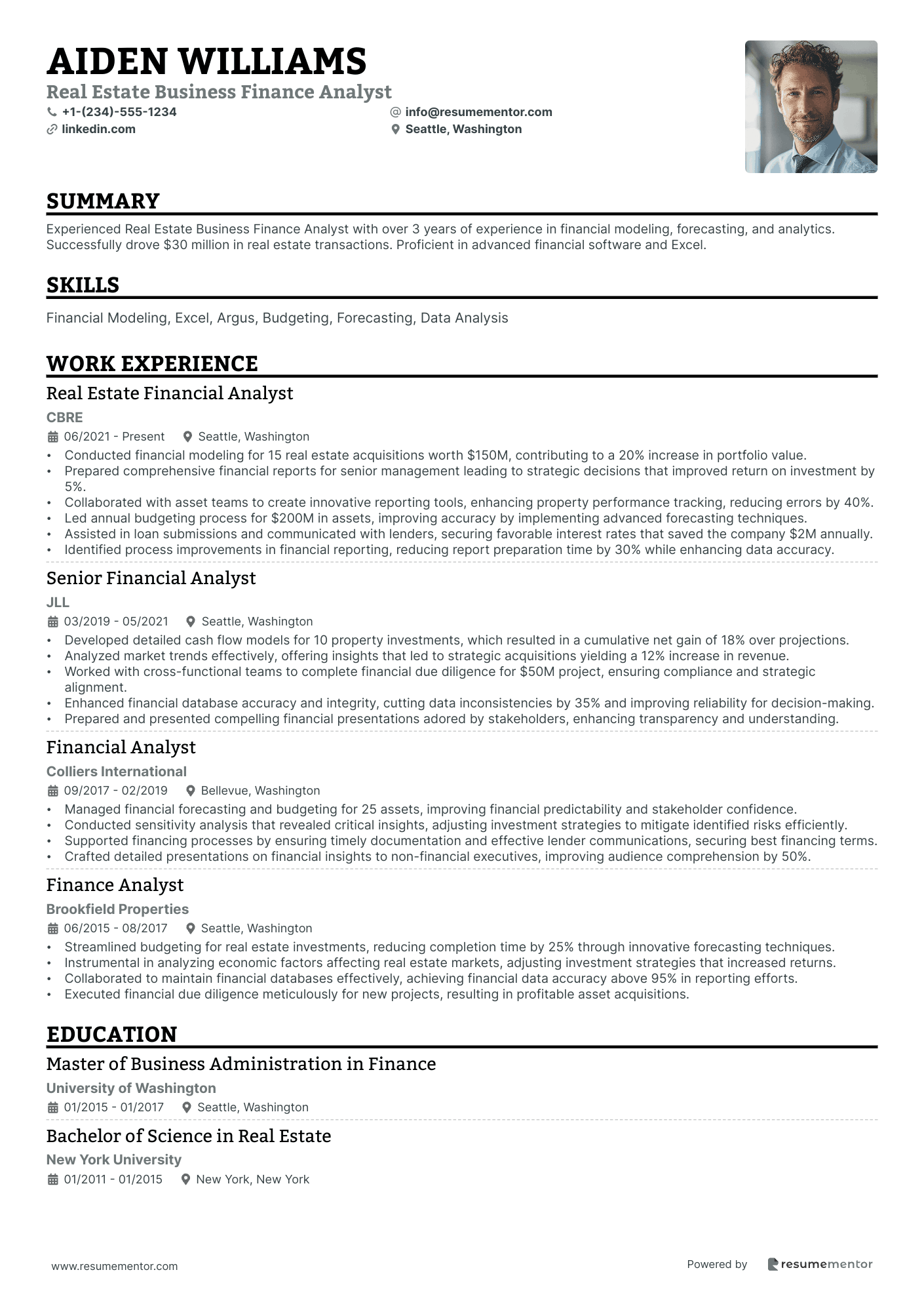

Real Estate Business Finance Analyst resume sample

When applying for this role, it's important to highlight any previous experience in real estate finance or property management. Analytical skills are essential, so mention any projects where you assessed property values or financial risks. If you have certifications like 'Real Estate Finance' or 'Investment Analysis', include them to show your commitment to the field. Use the 'skill-action-result' method to demonstrate how your financial analyses have optimized investment strategies or improved budgeting for real estate projects, making your cover letter impactful and results-oriented.

- •Conducted financial modeling for 15 real estate acquisitions worth $150M, contributing to a 20% increase in portfolio value.

- •Prepared comprehensive financial reports for senior management leading to strategic decisions that improved return on investment by 5%.

- •Collaborated with asset teams to create innovative reporting tools, enhancing property performance tracking, reducing errors by 40%.

- •Led annual budgeting process for $200M in assets, improving accuracy by implementing advanced forecasting techniques.

- •Assisted in loan submissions and communicated with lenders, securing favorable interest rates that saved the company $2M annually.

- •Identified process improvements in financial reporting, reducing report preparation time by 30% while enhancing data accuracy.

- •Developed detailed cash flow models for 10 property investments, which resulted in a cumulative net gain of 18% over projections.

- •Analyzed market trends effectively, offering insights that led to strategic acquisitions yielding a 12% increase in revenue.

- •Worked with cross-functional teams to complete financial due diligence for $50M project, ensuring compliance and strategic alignment.

- •Enhanced financial database accuracy and integrity, cutting data inconsistencies by 35% and improving reliability for decision-making.

- •Prepared and presented compelling financial presentations adored by stakeholders, enhancing transparency and understanding.

- •Managed financial forecasting and budgeting for 25 assets, improving financial predictability and stakeholder confidence.

- •Conducted sensitivity analysis that revealed critical insights, adjusting investment strategies to mitigate identified risks efficiently.

- •Supported financing processes by ensuring timely documentation and effective lender communications, securing best financing terms.

- •Crafted detailed presentations on financial insights to non-financial executives, improving audience comprehension by 50%.

- •Streamlined budgeting for real estate investments, reducing completion time by 25% through innovative forecasting techniques.

- •Instrumental in analyzing economic factors affecting real estate markets, adjusting investment strategies that increased returns.

- •Collaborated to maintain financial databases effectively, achieving financial data accuracy above 95% in reporting efforts.

- •Executed financial due diligence meticulously for new projects, resulting in profitable asset acquisitions.

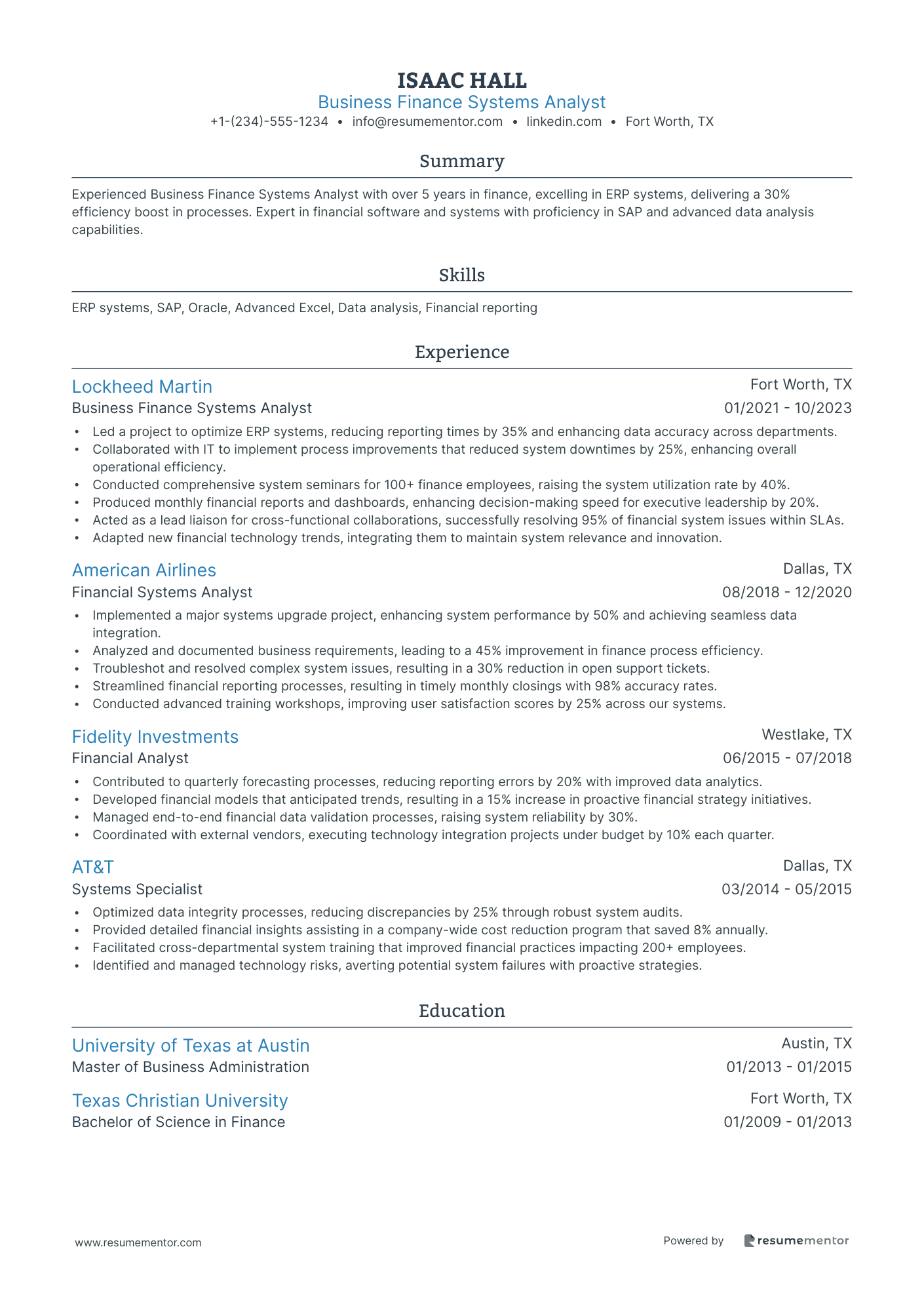

Business Finance Systems Analyst resume sample

When applying for a role in this field, it’s important to showcase any experience with financial systems or data analysis. Highlight technical skills such as proficiency in tools like SQL or SAP. Mention any relevant coursework or certifications, such as 'Financial Modeling' or 'Data Analytics'. Use concise examples demonstrating how your analytical skills optimized processes or saved costs in previous roles. Employ the 'skill-action-result' format to illustrate your contributions effectively, ensuring you connect your experience to the potential value you bring to the new organization.

- •Led a project to optimize ERP systems, reducing reporting times by 35% and enhancing data accuracy across departments.

- •Collaborated with IT to implement process improvements that reduced system downtimes by 25%, enhancing overall operational efficiency.

- •Conducted comprehensive system seminars for 100+ finance employees, raising the system utilization rate by 40%.

- •Produced monthly financial reports and dashboards, enhancing decision-making speed for executive leadership by 20%.

- •Acted as a lead liaison for cross-functional collaborations, successfully resolving 95% of financial system issues within SLAs.

- •Adapted new financial technology trends, integrating them to maintain system relevance and innovation.

- •Implemented a major systems upgrade project, enhancing system performance by 50% and achieving seamless data integration.

- •Analyzed and documented business requirements, leading to a 45% improvement in finance process efficiency.

- •Troubleshot and resolved complex system issues, resulting in a 30% reduction in open support tickets.

- •Streamlined financial reporting processes, resulting in timely monthly closings with 98% accuracy rates.

- •Conducted advanced training workshops, improving user satisfaction scores by 25% across our systems.

- •Contributed to quarterly forecasting processes, reducing reporting errors by 20% with improved data analytics.

- •Developed financial models that anticipated trends, resulting in a 15% increase in proactive financial strategy initiatives.

- •Managed end-to-end financial data validation processes, raising system reliability by 30%.

- •Coordinated with external vendors, executing technology integration projects under budget by 10% each quarter.

- •Optimized data integrity processes, reducing discrepancies by 25% through robust system audits.

- •Provided detailed financial insights assisting in a company-wide cost reduction program that saved 8% annually.

- •Facilitated cross-departmental system training that improved financial practices impacting 200+ employees.

- •Identified and managed technology risks, averting potential system failures with proactive strategies.

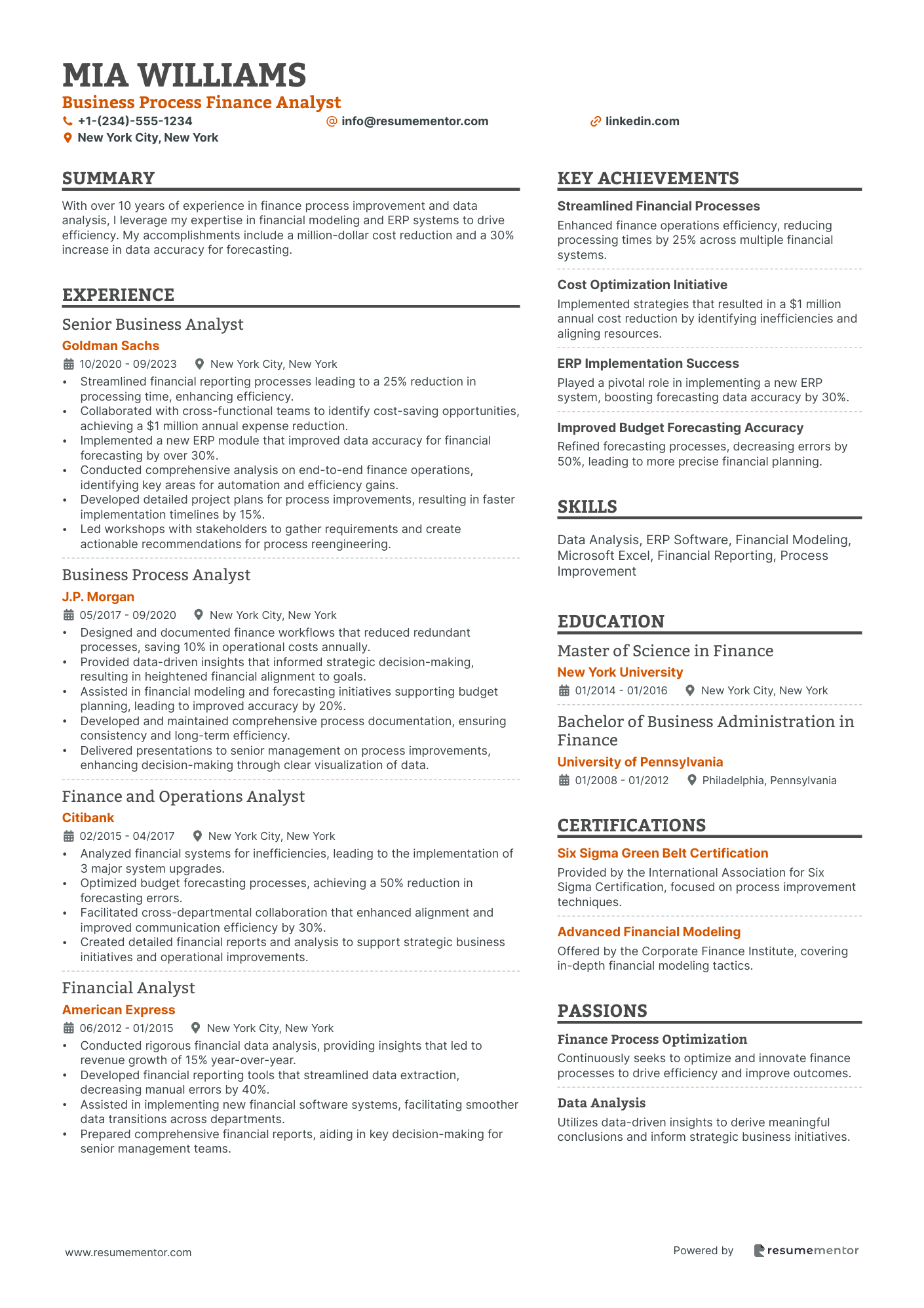

Business Process Finance Analyst resume sample

When applying for this role, it's essential to highlight any experience in process improvement or operational efficiency. Mention any experience with financial modeling or data analysis, as these are key skills. If you have relevant coursework, such as 'Operations Management' or 'Data Analysis Techniques', be sure to include these. Use specific examples that demonstrate how your contributions have streamlined processes or reduced costs. Follow the ‘skill-action-result’ method to showcase your successes and their impact on previous organizations.

- •Streamlined financial reporting processes leading to a 25% reduction in processing time, enhancing efficiency.

- •Collaborated with cross-functional teams to identify cost-saving opportunities, achieving a $1 million annual expense reduction.

- •Implemented a new ERP module that improved data accuracy for financial forecasting by over 30%.

- •Conducted comprehensive analysis on end-to-end finance operations, identifying key areas for automation and efficiency gains.

- •Developed detailed project plans for process improvements, resulting in faster implementation timelines by 15%.

- •Led workshops with stakeholders to gather requirements and create actionable recommendations for process reengineering.

- •Designed and documented finance workflows that reduced redundant processes, saving 10% in operational costs annually.

- •Provided data-driven insights that informed strategic decision-making, resulting in heightened financial alignment to goals.

- •Assisted in financial modeling and forecasting initiatives supporting budget planning, leading to improved accuracy by 20%.

- •Developed and maintained comprehensive process documentation, ensuring consistency and long-term efficiency.

- •Delivered presentations to senior management on process improvements, enhancing decision-making through clear visualization of data.

- •Analyzed financial systems for inefficiencies, leading to the implementation of 3 major system upgrades.

- •Optimized budget forecasting processes, achieving a 50% reduction in forecasting errors.

- •Facilitated cross-departmental collaboration that enhanced alignment and improved communication efficiency by 30%.

- •Created detailed financial reports and analysis to support strategic business initiatives and operational improvements.

- •Conducted rigorous financial data analysis, providing insights that led to revenue growth of 15% year-over-year.

- •Developed financial reporting tools that streamlined data extraction, decreasing manual errors by 40%.

- •Assisted in implementing new financial software systems, facilitating smoother data transitions across departments.

- •Prepared comprehensive financial reports, aiding in key decision-making for senior management teams.

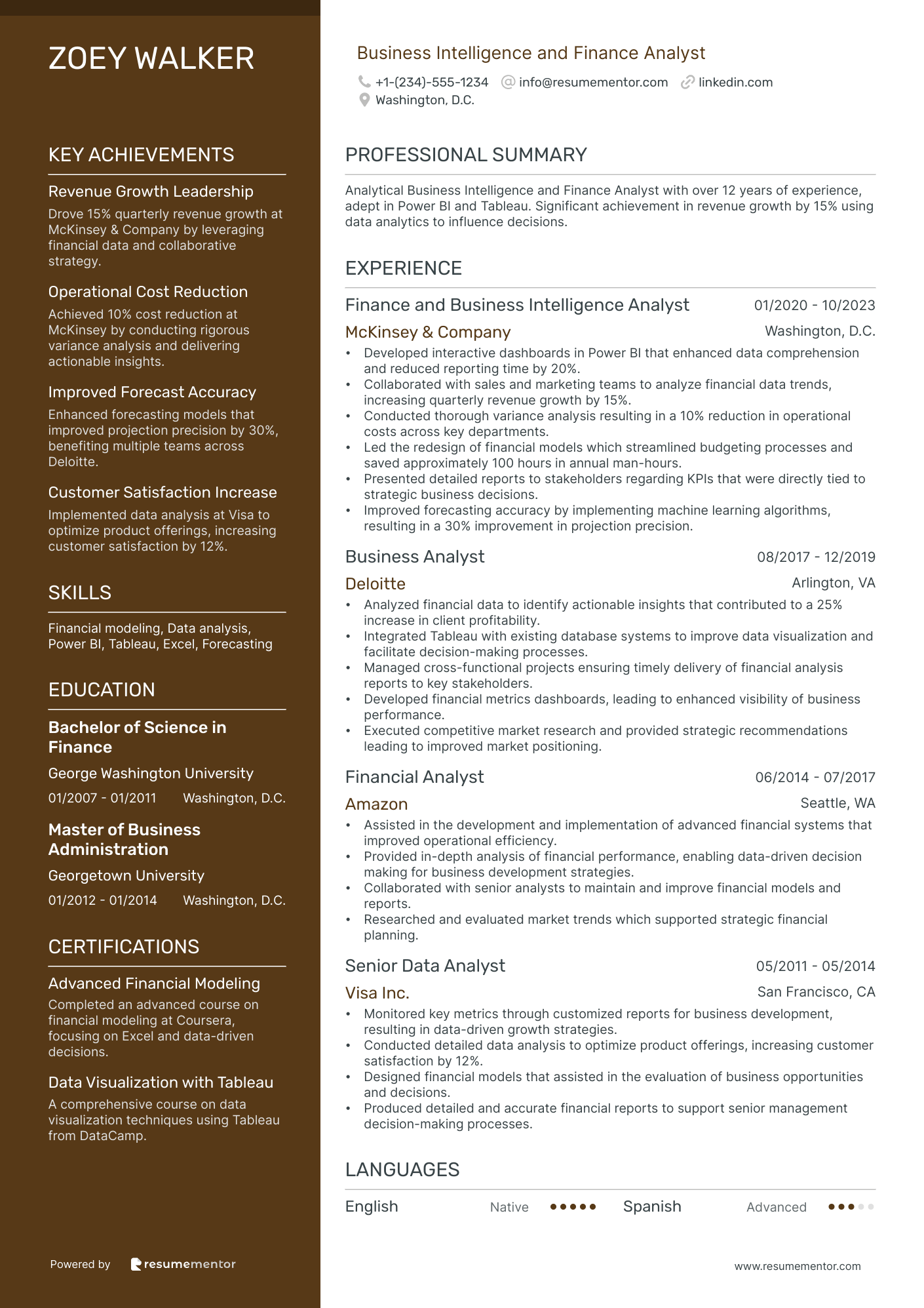

Business Intelligence and Finance Analyst resume sample

When applying for this role, highlight your experience with data visualization tools like Tableau or Power BI. Emphasize your ability to analyze data trends and translate them into actionable insights. Mention any relevant coursework or certifications in data analytics or financial modeling, detailing their duration for added strength. Include specific instances where your analytical skills led to improved operational efficiency or cost savings, using the 'skill-action-result' framework to make your achievements clear and impactful.

- •Developed interactive dashboards in Power BI that enhanced data comprehension and reduced reporting time by 20%.

- •Collaborated with sales and marketing teams to analyze financial data trends, increasing quarterly revenue growth by 15%.

- •Conducted thorough variance analysis resulting in a 10% reduction in operational costs across key departments.

- •Led the redesign of financial models which streamlined budgeting processes and saved approximately 100 hours in annual man-hours.

- •Presented detailed reports to stakeholders regarding KPIs that were directly tied to strategic business decisions.

- •Improved forecasting accuracy by implementing machine learning algorithms, resulting in a 30% improvement in projection precision.

- •Analyzed financial data to identify actionable insights that contributed to a 25% increase in client profitability.

- •Integrated Tableau with existing database systems to improve data visualization and facilitate decision-making processes.

- •Managed cross-functional projects ensuring timely delivery of financial analysis reports to key stakeholders.

- •Developed financial metrics dashboards, leading to enhanced visibility of business performance.

- •Executed competitive market research and provided strategic recommendations leading to improved market positioning.

- •Assisted in the development and implementation of advanced financial systems that improved operational efficiency.

- •Provided in-depth analysis of financial performance, enabling data-driven decision making for business development strategies.

- •Collaborated with senior analysts to maintain and improve financial models and reports.

- •Researched and evaluated market trends which supported strategic financial planning.

- •Monitored key metrics through customized reports for business development, resulting in data-driven growth strategies.

- •Conducted detailed data analysis to optimize product offerings, increasing customer satisfaction by 12%.

- •Designed financial models that assisted in the evaluation of business opportunities and decisions.

- •Produced detailed and accurate financial reports to support senior management decision-making processes.

As a business finance analyst, your resume is your blueprint for success. In the competitive world of finance, capturing your analytical insights and financial expertise can feel like navigating a spreadsheet without the right formula. This is why highlighting your skills in financial analysis, data interpretation, and strategic decision-making is crucial. But where do you start?

The task of crafting a standout resume can be daunting, especially with the need to focus on finance-specific skills. Many analysts find it challenging to communicate these strengths concisely. Using a resume template can be your guiding light here, structuring your experience in a way that resonates with potential employers. Check out various resume templates to find one that aligns with your story.

Beyond listing your career journey, your resume should clearly articulate your ability to transform data into actionable insights. It must showcase your skills in communicating complex information to diverse stakeholders. Highlighting tasks like creating financial models and conducting risk assessments will make you stand out.

By maintaining clarity and precision, you ensure that employers recognize your potential to drive business success. Each word should contribute to painting a clear picture of how you can add value. With a strong foundation, you are one step closer to landing your dream role.

Key Takeaways

- To effectively write a business finance analyst resume, emphasize analytical skills and financial expertise to communicate your ability to enhance a business's financial health.

- Utilizing a reverse-chronological format highlights the most recent achievements and facilitates tracking of career progression, while fonts like Rubik and Lato ensure clarity and professionalism.

- Quantifiable achievements in the experience section using action words establish a results-driven narrative that showcases your skill in analyzing financial performance.

- Incorporate both hard and soft skills to demonstrate technical proficiency in financial matters and the ability to work effectively with others, fulfilling the role's collaborative and analytical demands.

- A well-crafted education section underscores your academic achievements and relevant coursework, ensuring alignment with job requirements and presenting you as a qualified candidate.

What to focus on when writing your business finance analyst resume

A business finance analyst resume should effectively communicate your analytical skills and financial expertise to the recruiter—this is the foundation of capturing their interest. Your resume needs to seamlessly show how your ability to interpret financial data can contribute to strategic decisions, giving a clear and comprehensive picture of your role in enhancing a business's financial health. Highlighting your competencies in financial modeling and delivering actionable insights reassures employers of the value you bring. The structure of your resume should prioritize clarity and relevance to support this messaging effectively—below we'll explore each essential section in more depth.

How to structure your business finance analyst resume

- Contact Information — Make sure this section provides all necessary details for easy communication. Your name should stand out, and your professional email, phone number, and LinkedIn profile must be up-to-date. Easily accessible contact information ensures the recruiter can reach out effortlessly.

- Professional Summary — This is not just an introduction but a brief encapsulation of your career. Focus on your experience with financial data analysis and insights you've offered that have driven business success. This section sets the tone for the rest of your resume, highlighting your impact and aligning your strengths with the job requirements.

- Work Experience — List previous roles by detailing job titles, companies, and dates. Emphasize achievements by using quantifiable outcomes like improved profit margins or cost savings. This paints a picture of your professional journey and the tangible impact you've made in past positions, illustrating your value-add to teams.

- Education — Mention your degree, major, school name, and graduation date. Highlight relevant coursework or honors that complement your financial expertise. Educational background demonstrates foundational knowledge, and relevant coursework can underscore your specific skills in finance.

- Skills — List industry-relevant skills such as financial modeling, proficiency in advanced Excel, data analysis, and familiarity with ERP software like SAP or Oracle. These skills reflect your technical abilities and preparedness to handle the analytical demands of the role.

- Certifications — If you have certifications like CFA, CPA, or others, include these to boost your professional credibility and underscore your commitment to the field. Such credentials can differentiate you from candidates without formal certifications.

Understanding how to structure your resume is crucial, as it ensures the recruiter can easily navigate through your expertise. In the sections below, we’ll cover each element more in-depth, which can provide further insights into crafting a comprehensive business finance analyst resume.

Which resume format to choose

Crafting a standout resume as a business finance analyst requires a focus on clarity and organization. Start by using a reverse-chronological format; this approach highlights your most recent roles and achievements, making it easy for employers to track your career progression and understand your expertise. When it comes to fonts, the right choice can subtly enhance the professionalism of your resume. Consider using modern fonts like Rubik, Lato, or Montserrat. These fonts are not only visually appealing but also easy to read, which is essential in conveying detailed financial information clearly.

Saving your resume as a PDF is a must. This file type safeguards your formatting, ensuring it looks the same on every device—a critical factor when your resume is being reviewed by both human resources staff and automated systems. Margins should be set to one inch on all sides. This standard margin size provides ample white space, making your content more accessible and less overwhelming to read.

By focusing on these elements, your resume will effectively present your qualifications in a way that reflects the precision and attention to detail inherent in the finance industry. Each aspect, from format to font choice, plays a role in making your resume a clear representation of both your skills and professionalism.

How to write a quantifiable resume experience section

The experience section of your business finance analyst resume plays a vital role in showcasing your impact and expertise. It should highlight your past roles, quantifiable achievements, and the skills that contributed to those successes. Begin with your most recent position and work backward, covering the last 10-15 years of relevant experience. Choose job titles that emphasize your financial analysis skills while tailoring your resume to the job ad by integrating relevant keywords. Strong action words like "analyzed," "optimized," and "enhanced" create a dynamic narrative. Use bullet points for clarity, ensuring each point conveys a specific accomplishment effectively.

Here's an example for a business finance analyst:

- •Boosted company profitability by 15% over two years through detailed financial analysis and strategic recommendations.

- •Implemented a new budget tracking system, cutting overhead costs by 10% annually.

- •Streamlined financial reporting processes, trimming reporting time by 25% and enhancing accuracy.

- •Led cross-functional teams to develop business strategies that increased market share by 20%.

This experience section excels by weaving relevant and structured information seamlessly. By detailing achievements like "boosted company profitability by 15%," you provide tangible evidence of your expertise and impact. Connecting action-oriented language with specific numbers illustrates a results-driven narrative. This example emphasizes your skill in analyzing and optimizing financial performance, aligning with what employers seek in a business finance analyst. Each concise bullet point adds weight to your story, showcasing critical thinking and leadership—essential for success in the finance industry.

Skills-Focused resume experience section

A skills-focused business finance analyst resume experience section should effectively emphasize your strengths and accomplishments by beginning with your job title, company name, and employment dates. This foundation allows you to highlight essential skills, such as financial modeling, forecasting, and data analysis, which distinguish you as a strong candidate. To communicate your contributions clearly, use bullet points that outline how you applied these skills to achieve meaningful results, incorporating numbers to provide solid evidence of your impact.

Maintaining simplicity and clarity in your language is crucial to avoiding confusion, so steer clear of any jargon. Focus on the training, tools, and techniques that enabled you to make a significant difference in your role. Each bullet should cover a unique achievement or responsibility, seamlessly demonstrating your adaptability and problem-solving abilities. By tailoring these points to the position you're applying for, you ensure that the skills you highlight are both relevant and impressive.

Business Finance Analyst

XYZ Corporation

Jan 2020 - Jun 2023

- Led a team to boost financial reporting accuracy by 20% using advanced Excel functions and Power BI.

- Saved $250,000 annually for the company by spotting spending discrepancies and recommending cost-saving measures.

- Streamlined the budgeting process, cutting preparation time by 30%.

- Worked with cross-functional teams to provide data-driven investment recommendations, leading to a 15% revenue growth.

Technology-Focused resume experience section

A technology-focused business finance analyst resume experience section should clearly show how your technical skills improve financial performance and inform better decision-making. Begin by stating your role and the company you worked for, along with your employment dates. Highlight the specific technological tools you've mastered—like SQL, advanced Excel, or financial modeling software—and explain how you applied these tools to meet specific challenges or goals within the organization.

Focus on creating engaging bullet points that weave together your role and your accomplishments cohesively. Use strong action words and measurable results to highlight your contributions, such as cutting costs, boosting reporting accuracy, or delivering insights that led to smart business decisions. Keep your descriptions both concise and descriptive, providing context to illustrate how your technological expertise benefited the company. By doing so, you make it clear to employers that you're not just tech-savvy, but you also apply your technological skills thoughtfully and effectively in a finance setting.

Business Finance Analyst

Tech Solutions Inc.

June 2018 - May 2022

- Designed and implemented an Excel-based forecasting model that improved budget accuracy by 20%.

- Utilized SQL to automate complex financial reporting processes, reducing report preparation time by 30%.

- Collaborated with IT to integrate new financial software, resulting in a 15% increase in department efficiency.

- Conducted data-driven analysis to support strategic initiatives, leading to a 10% increase in profit margins.

Industry-Specific Focus resume experience section

A business finance analyst-focused resume experience section should showcase your ability to drive strategic decisions within a specific industry. Start by highlighting roles where you leveraged data analysis to deliver insights that informed key business strategies. Focus on how your expertise in forecasting, budgeting, and risk assessment led to positive results, and include metrics to quantify your impact. This helps potential employers understand the tangible benefits you bring.

Organize your achievements with bullet points that clearly convey your contributions. Incorporate specific details, such as percentages or dollar amounts, to demonstrate your role in enhancing cost savings or boosting revenue. This approach provides a clear picture of your capabilities, making it easy for employers to envision the contributions you will make. Ensure the language flows smoothly to maintain the reader's interest and convey your accomplishments effectively.

Business Finance Analyst

Acme Corp

June 2018 - August 2022

- Introduced efficiency measures that cut overhead costs by 15% through detailed analysis of quarterly financial reports.

- Collaborated with the procurement department to develop a new budgeting model, resulting in $200,000 annual savings.

- Conducted industry-specific risk assessments, reducing financial exposure across various projects.

- Streamlined financial reporting processes, decreasing report preparation time by 20%.

Growth-Focused resume experience section

A growth-focused business finance analyst resume experience section should clearly highlight how your skills have propelled business success. Emphasize your knack for leveraging data to drive impactful decisions and quantifiable improvements. Begin with action words to narrate your responsibilities and their outcomes, using numbers to elevate your accomplishments. This approach allows potential employers to immediately grasp the value you bring.

Tailor each entry to match the job you’re targeting to strengthen your application. Start with your job title, the company name, and your tenure. Follow this with bullet points that capture your main achievements, focusing on actions that enhanced processes, reduced costs, or increased revenue. By illustrating how you identified opportunities and turned insights into results, your experience section will stand out convincingly.

Business Finance Analyst

Tech Innovators Inc.

Jan 2020 - Present

- Led data analysis initiatives identifying cost-saving opportunities, achieving a 15% reduction in yearly expenses.

- Implemented reporting systems improving financial forecast accuracy by 20%.

- Streamlined budgeting processes with cross-functional collaboration, enhancing operational efficiency.

- Developed dashboards for real-time insights, increasing decision-making speed by 25%.

Write your business finance analyst resume summary section

A results-focused Business Finance Analyst resume should clearly showcase your skills and experience to make you stand out to potential employers. Whether you're seasoned in your field or just starting your career, a well-crafted summary can be essential. Highlighting your key achievements and the value you bring is crucial. For instance, you might consider writing:

This example highlights your experience, top skills, and significant achievements, providing recruiters with a clear picture of your fit for the role. If you’re less experienced and crafting a resume objective, focus on what you aim to achieve and how you plan to benefit the employer. A strong objective could be:

[here was the JSON object 2]

This objective shows your career goals and eagerness to learn, aligning with employer expectations for new talent. Understanding the differences between a summary and related sections is also helpful. A resume summary focuses on your experience and skills, illustrating why you're ideal for the position. A resume objective, on the other hand, highlights your aspirations and intended contributions. A resume profile blends aspects of both, touching on key accomplishments briefly. Meanwhile, a summary of qualifications bullet-lists specific achievements or skills. Each section targets different goals based on your experience and career path.

Listing your business finance analyst skills on your resume

A skills-focused business finance analyst resume should clearly showcase the qualifications that make you stand out. You can choose to list your skills in a dedicated section or weave them into other parts of your resume, like your experience or summary. Highlighting your strengths often underscores your soft skills, such as communication and teamwork, which are crucial in a collaborative setting. In contrast, hard skills are the specific abilities or knowledge you gain through education and training that are necessary for the technical aspects of the role.

These skills and strengths act as keywords that recruiters look for in databases, making them essential for boosting the visibility and appeal of your resume. Based on this approach, here's an example of how you can format a standalone skills section on your resume:

Having a clear and concise skills section like this makes your technical abilities easy to identify and highlights the expertise relevant to the role. Now let's delve into the specific hard and soft skills that a business finance analyst should showcase.

Best hard skills to feature on your business finance analyst resume

Your resume should highlight hard skills that demonstrate your technical proficiency and expertise in financial matters. These should include:

Hard Skills

- Financial modeling

- Data analysis

- SQL

- Microsoft Excel

- Budgeting

- Forecasting

- Risk assessment

- Financial reporting

- Business intelligence tools

- Cost analysis

- Accounting

- Variance analysis

- Financial planning

- Statistical analysis

- ERP systems knowledge

Best soft skills to feature on your business finance analyst resume

Complement your hard skills by showcasing soft skills that illustrate your ability to work effectively with others and manage tasks proficiently. These may include:

Soft Skills

- Communication

- Problem-solving

- Critical thinking

- Attention to detail

- Adaptability

- Teamwork

- Time management

- Conflict resolution

- Decision-making

- Leadership

- Interpersonal skills

- Creativity

- Organization

- Initiative

- Analytical thinking

How to include your education on your resume

The education section of your business finance analyst resume is crucial. It highlights your academic achievements and sets you apart from other candidates. Tailor this section to match the job you're aiming for by including only relevant education. If certain degrees or courses do not relate to the role, omit them. When you include your GPA, make sure it adds value. If it is above 3.5, it’s generally a good idea to list it. Cum laude honors should be included as they demonstrate academic excellence. Clearly state the degree earned, as well as the name and location of the institution.

A wrong example may look cluttered or include irrelevant information:

A strong example succinctly presents relevant education:

The second example is effective due to its precision and relevance. It includes the degree that matches the job, the notable university, and an impressive GPA. There's no unnecessary detail, which makes it easy for recruiters to focus on what matters. With clarity and relevance, this section helps present you as a qualified candidate.

How to include business finance analyst certificates on your resume

Including a certificates section in your business finance analyst resume is essential. It shows your specialized skills and dedication to your profession. Follow these steps to ensure this section stands out.

First, list the name of each certificate you've earned. Include the date of completion to show when you obtained each credential. Add the issuing organization so employers know the credibility of your certificates. If space allows, you can feature important certificates in your resume header for immediate visibility.

For instance, an example of including a certificate in the header would be as follows:

Here’s an example of a strong standalone certificates section:

[here was the JSON object 2]

This example is effective because it clearly lists relevant and respected credentials. Each certificate is provided with its full title and issuing organization. This helps demonstrate your expertise and commitment to professional development in business finance analysis.

Extra sections to include in your business finance analyst resume

When crafting a resume as a business finance analyst, it's crucial to highlight not only your professional skills but also your personal attributes and experiences that make you a well-rounded candidate. Including multiple sections beyond your work experience can greatly enhance your resume.

- Language section — Demonstrate your communication flexibility by listing languages you are fluent in; this can open doors to international roles or companies with diverse teams.

- Hobbies and interests section — Show your personality and potential cultural fit by adding hobbies that align with the team’s values or the corporate culture.

- Volunteer work section — Illustrate your commitment to the community and altruistic values by showcasing volunteer work; this can indicate strong moral character and leadership skills.

- Books section — Highlight your drive for continuous learning by listing influential books you've read related to finance, leadership, or business strategy.

Including these sections can make your resume stand out and present you as a multi-dimensional candidate, enhancing your overall appeal to potential employers.

In Conclusion

In conclusion, crafting a business finance analyst resume is a strategic endeavor that requires precision and a clear presentation of your skills and experiences. By focusing on a format that highlights your most relevant and recent achievements, you can create a compelling narrative that showcases your value to potential employers. Start by selecting the right resume format, such as the reverse-chronological approach, to ensure that your career progression and expertise are apparent. Paying attention to detail in formatting, like margin sizes and font choices, can enhance the readability and professionalism of your document.

Moreover, clearly presenting your quantifiable achievements in the experience section, whether through numbers or strong action verbs, can significantly increase the impact of your resume. Remember, showcasing your financial acumen involves not only listing your technical skills but also demonstrating how these skills translate into successful business outcomes. Incorporating sections on education and certifications provides further evidence of your qualifications, assuring employers of your commitment to the field.

Including additional sections such as language proficiency, volunteer work, or hobbies can round out your resume by adding personal elements that illustrate your adaptability and cultural fit. These sections might seem minor, but they contribute to the complete picture of you as a candidate. By combining structured content with strategic insights into your professional attributes, your resume becomes not just a document but a reflection of your potential to drive success in the financial sector.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.