Certified Financial Planner Resume Examples

Jul 18, 2024

|

12 min read

Planning for Success: Crafting Your Certified Financial Planner Resume to Stand Out

Rated by 348 people

Certified Retirement Planning Counselor

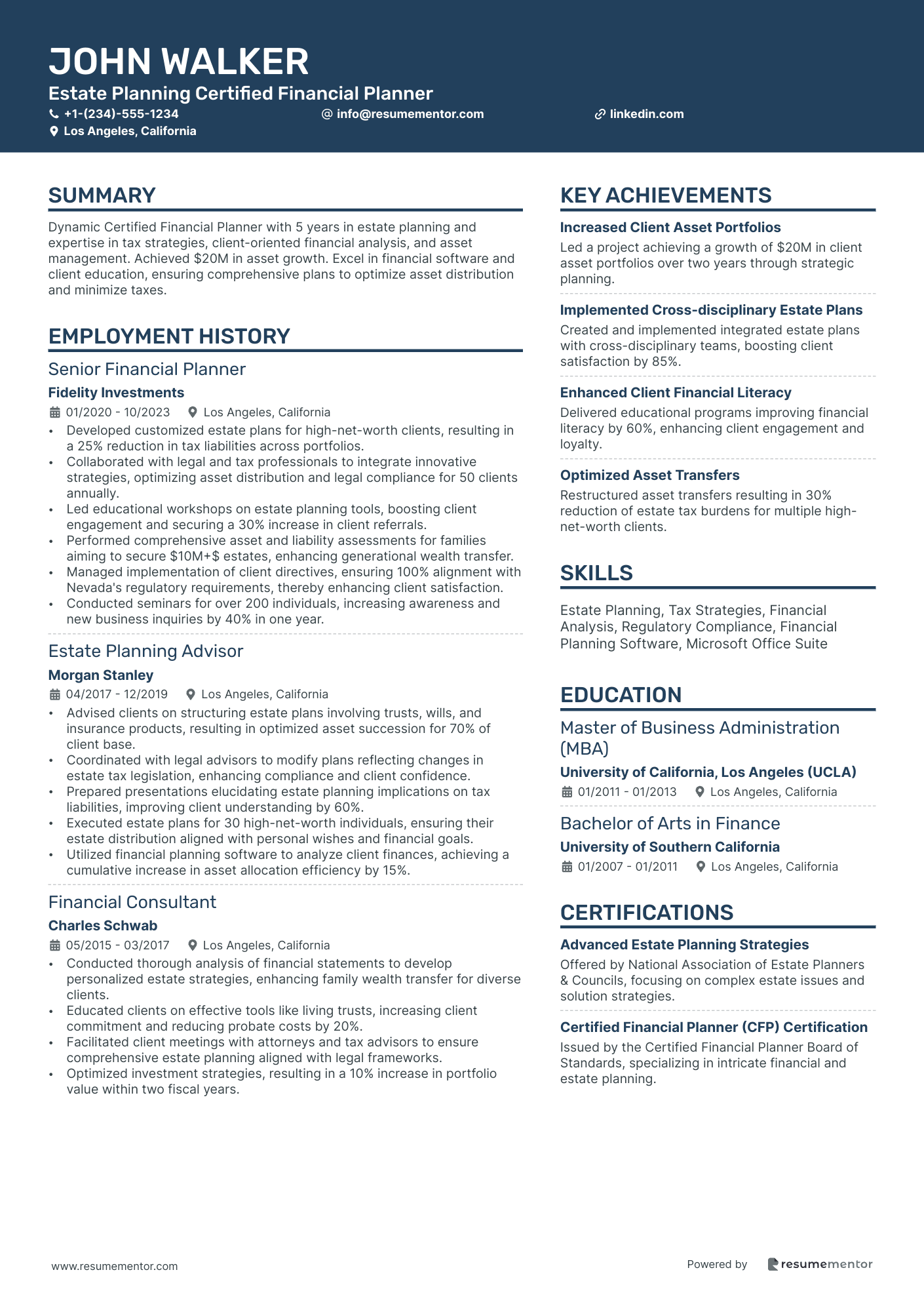

Estate Planning Certified Financial Planner

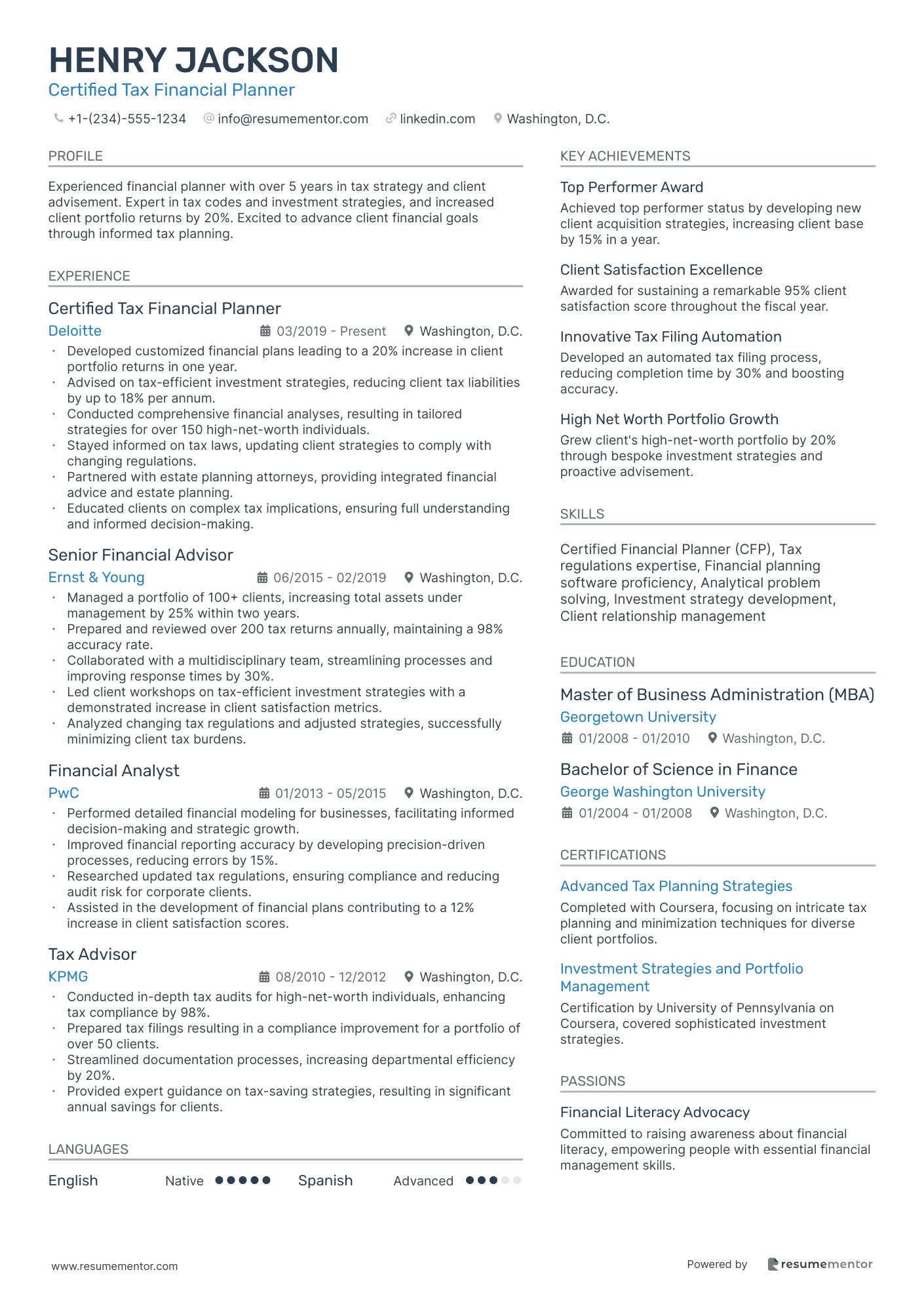

Certified Tax Financial Planner

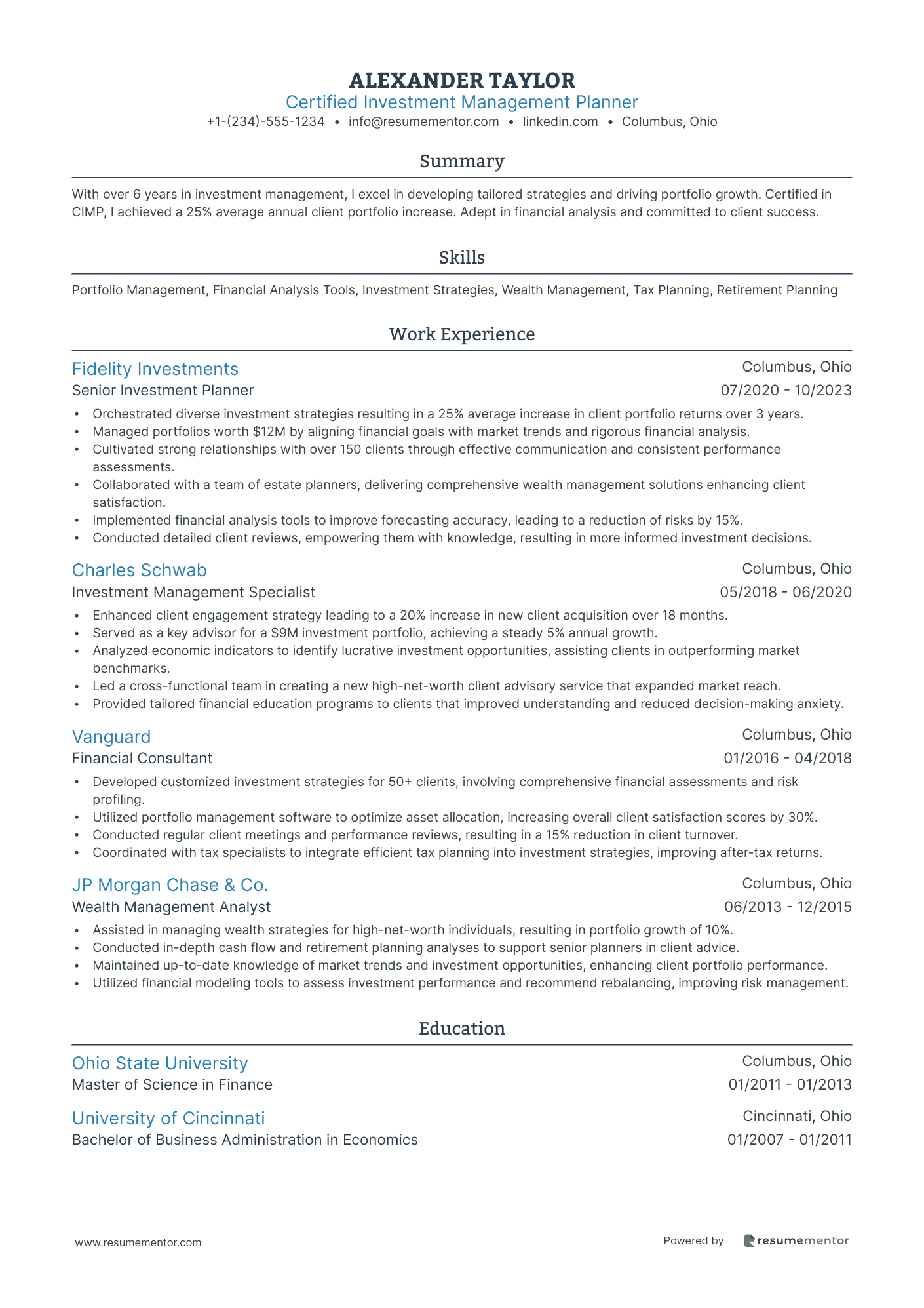

Certified Investment Management Planner

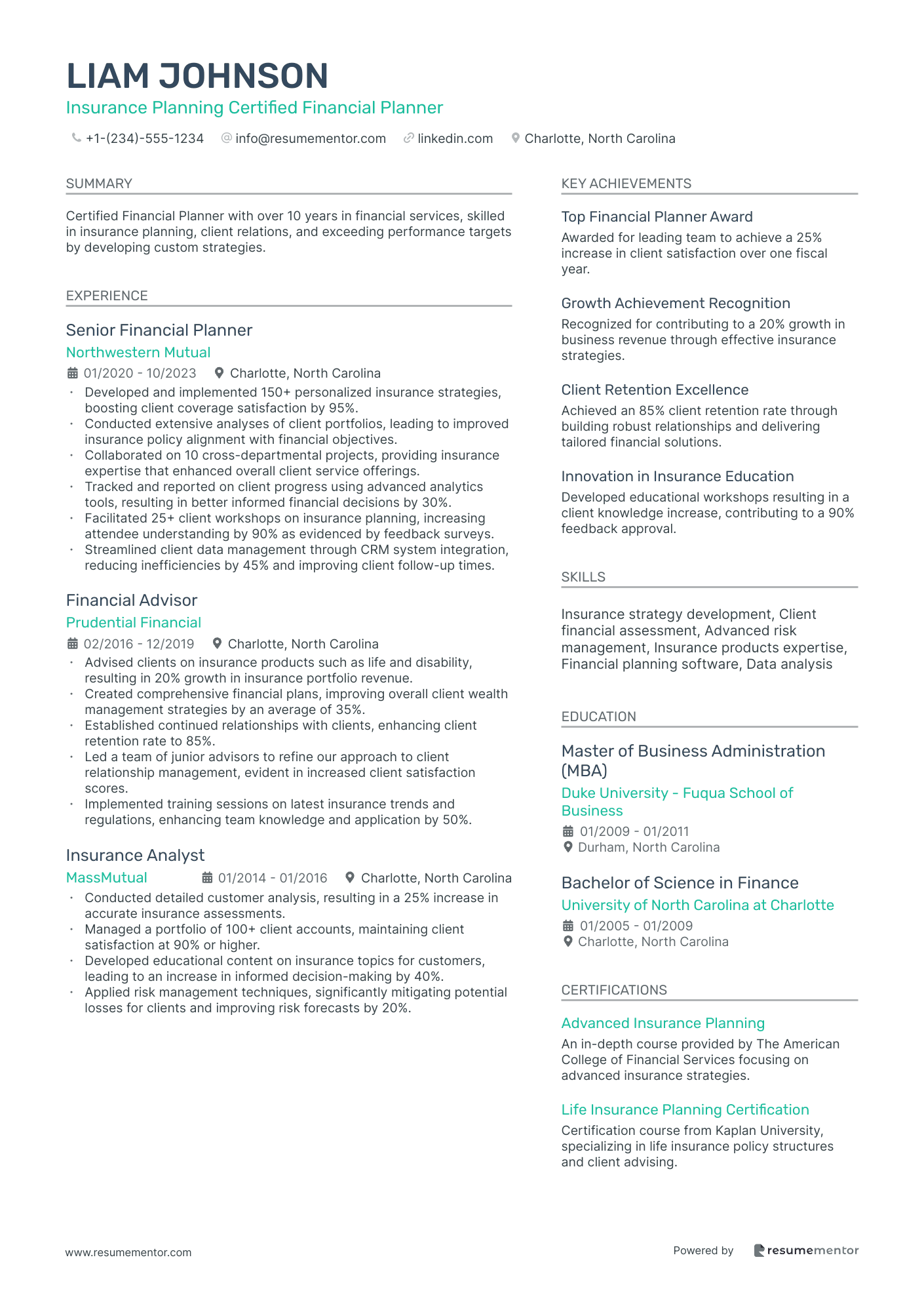

Insurance Planning Certified Financial Planner

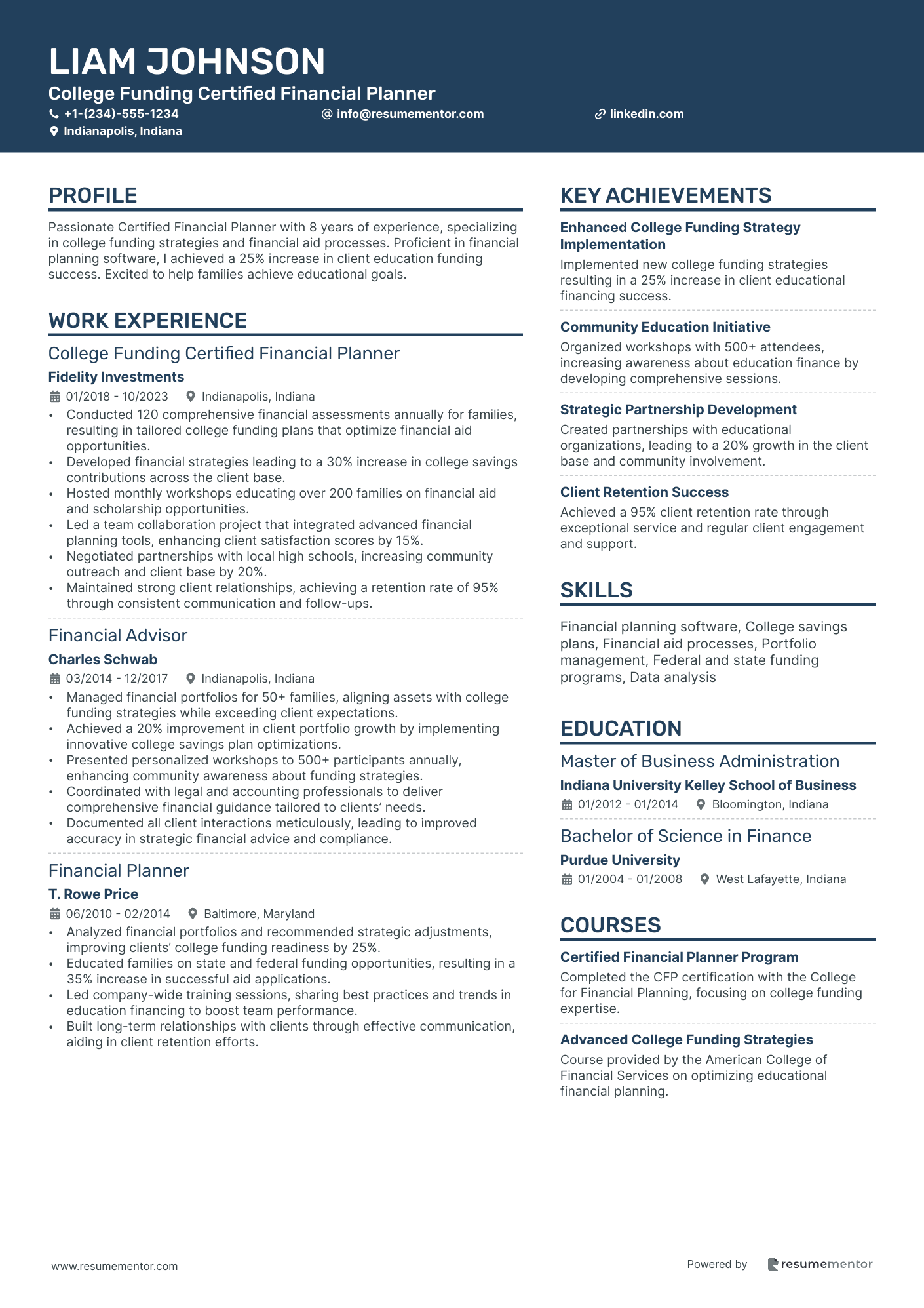

College Funding Certified Financial Planner

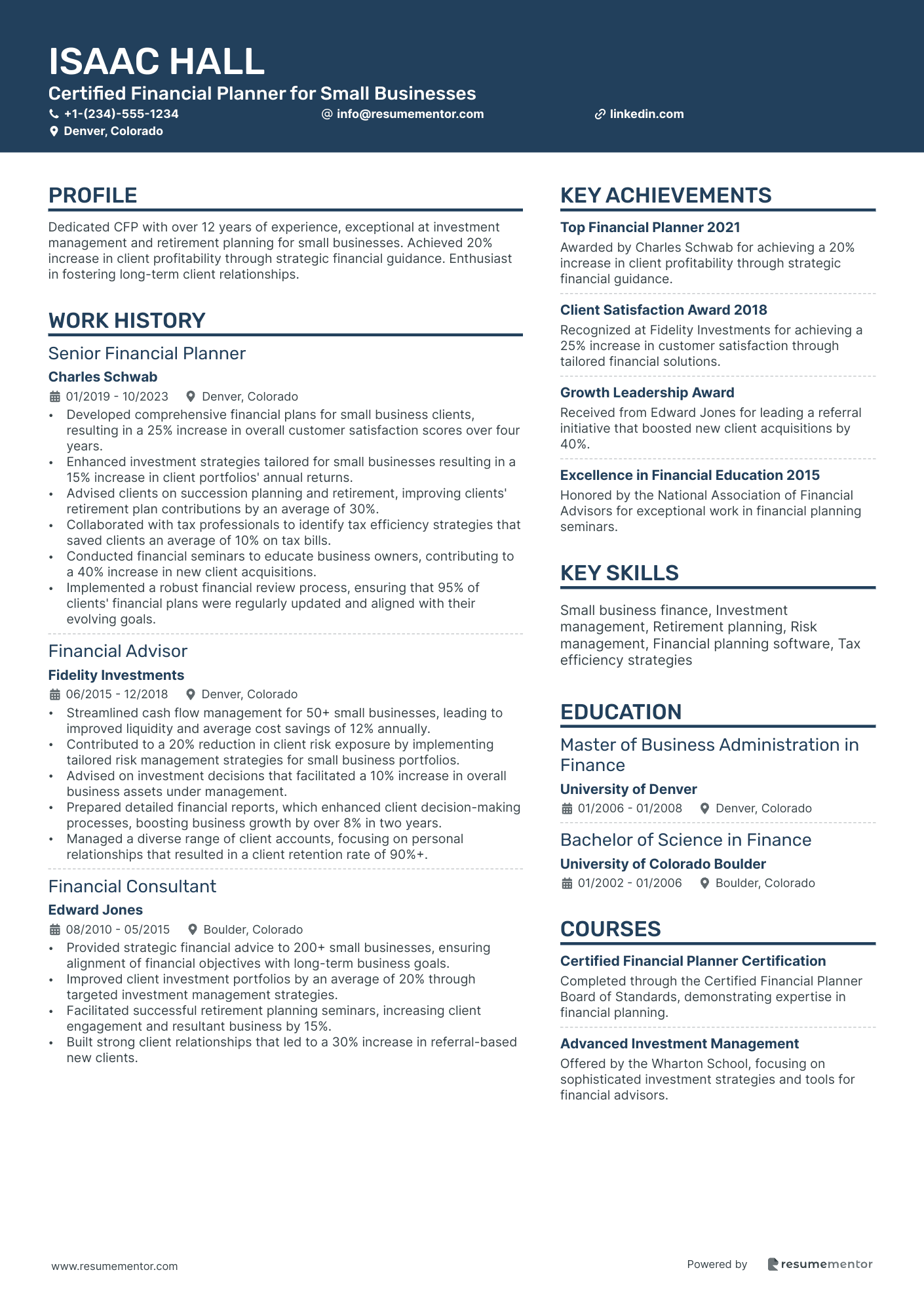

Certified Financial Planner for Small Businesses

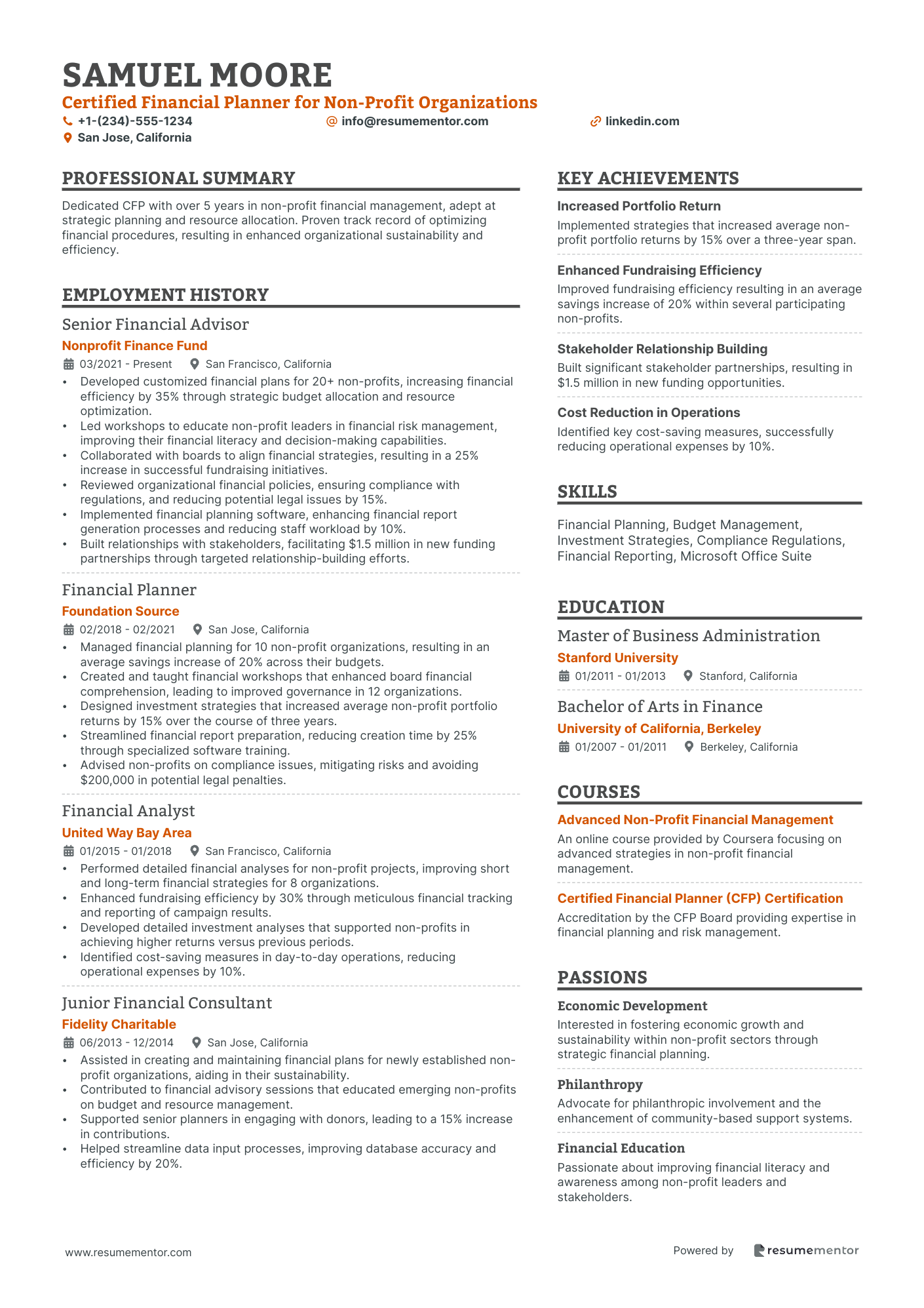

Certified Financial Planner for Non-Profit Organizations

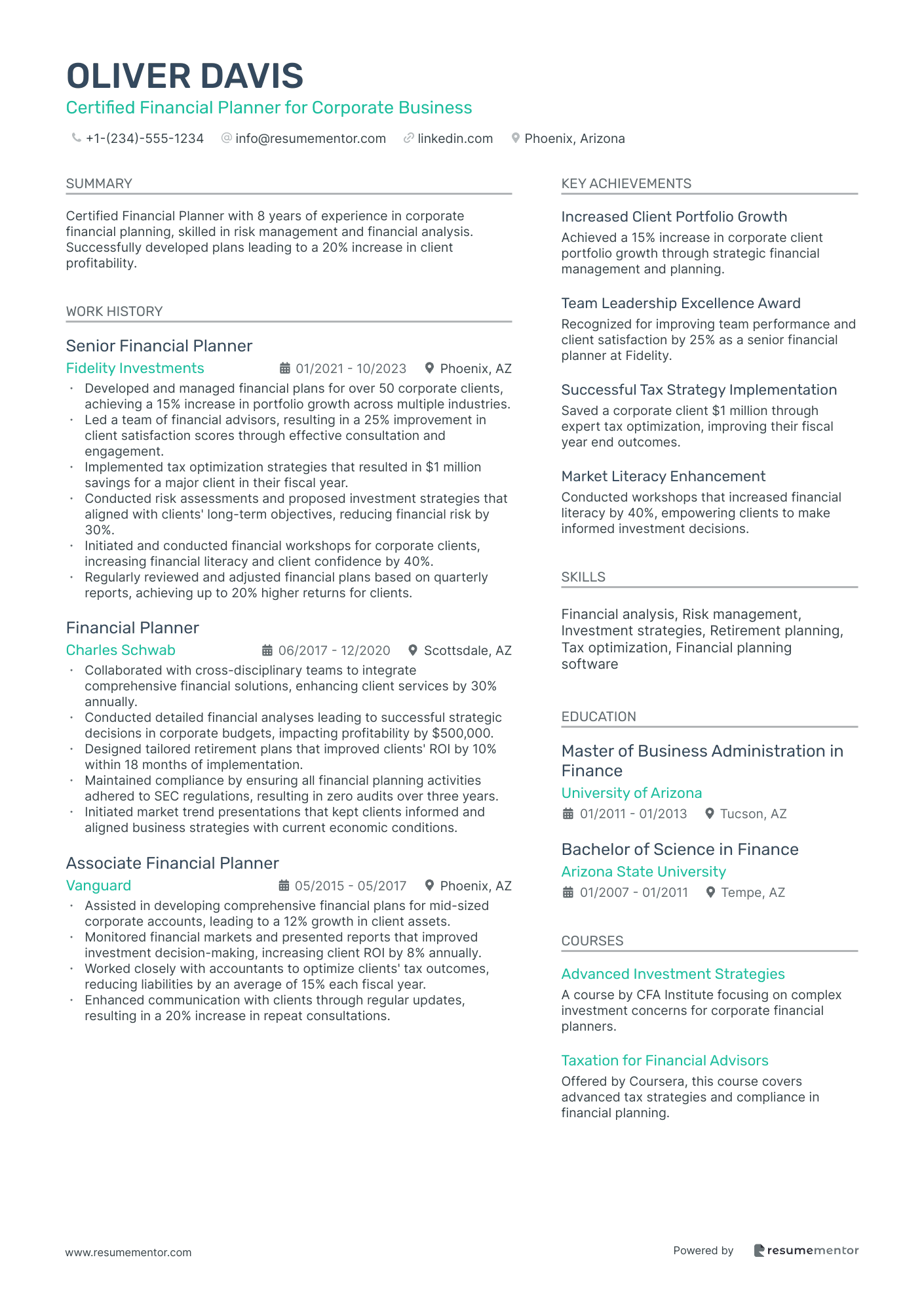

Certified Financial Planner for Corporate Business

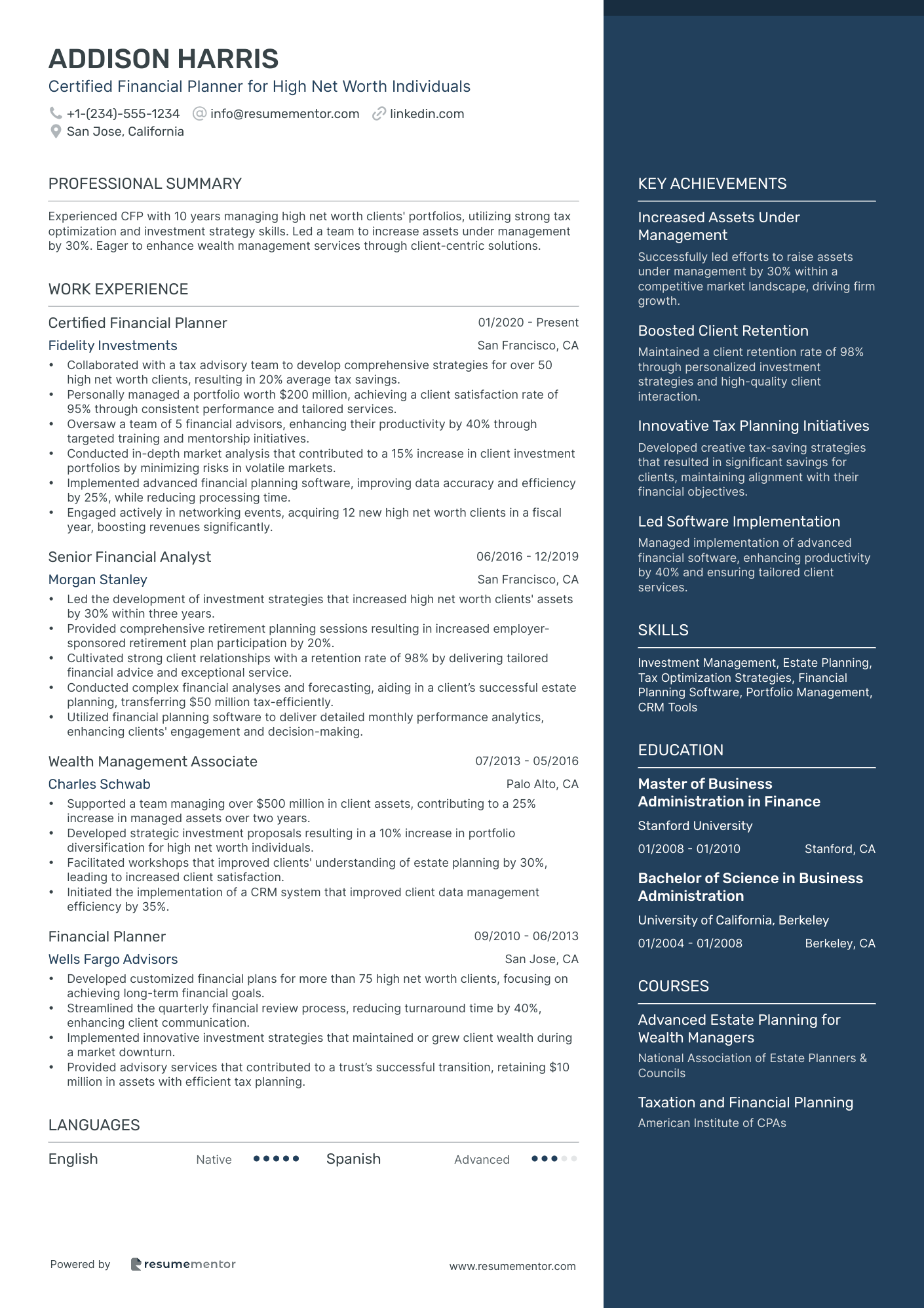

Certified Financial Planner for High Net Worth Individuals

Certified Retirement Planning Counselor resume sample

- •Conducted over 150 personalized retirement planning consultations annually to assess clients’ financial goals, increasing client satisfaction by 20% over two years.

- •Developed tailored retirement plans for clients, including advanced income strategies, asset allocation, and risk assessment methodologies.

- •Collaborated with a multi-disciplinary team of financial advisors and accountants, enhancing service offerings by integrating tax-efficiency elements into client plans.

- •Led a series of 10 educational workshops and seminars on retirement planning, significantly increasing local engagement and financial literacy in the community.

- •Maintained accurate and confidential client records, ensuring 100% compliance with financial regulations and contributing to audit readiness.

- •Provided ongoing support to clients, resulting in a 30% increase in client retention and loyalty through adaptive retirement strategies.

- •Advised a portfolio of 120 clients, achieving an average annual investment return increase of 5% through strategic asset management.

- •Educated clients on 401(k), IRA, and other retirement accounts to maximize their retirement portfolios, achieving a 95% client satisfaction rate.

- •Streamlined consultation processes by implementing new financial software tools, reducing appointment durations by 15% while improving quality.

- •Conducted market analysis and adapted investment strategies accordingly, resulting in a 40% improvement in client portfolio performance during volatile periods.

- •Initiated collaborative projects with investment analysts to identify emerging market trends, enhancing strategic decision-making.

- •Developed customized retirement plans for over 100 clients, achieving a 30% improvement in financial goal attainment for clients.

- •Partnered with client relations teams to elevate service delivery and address unique client needs leading to increased satisfaction.

- •Conducted detailed reviews of investment portfolio performance, advising strategic adjustments for optimized results across diverse market conditions.

- •Enhanced retirement plan education by disseminating clear, actionable insights on tax implications and benefits, engaging clients in proactive planning.

- •Analyzed market trends and client portfolios daily, identifying opportunities for higher returns which led to a 22% increase in portfolio valuation.

- •Collaborated with clients to tailor financial strategies ensuring alignment with both short-term needs and long-term retirement objectives.

- •Provided in-depth workshops on investment education, resulting in a 33% increase in client financial literacy test scores.

- •Effectively communicated complex financial concepts in understandable terms, improving client understanding and trust across a diverse clientele.

Estate Planning Certified Financial Planner resume sample

- •Developed customized estate plans for high-net-worth clients, resulting in a 25% reduction in tax liabilities across portfolios.

- •Collaborated with legal and tax professionals to integrate innovative strategies, optimizing asset distribution and legal compliance for 50 clients annually.

- •Led educational workshops on estate planning tools, boosting client engagement and securing a 30% increase in client referrals.

- •Performed comprehensive asset and liability assessments for families aiming to secure $10M+$ estates, enhancing generational wealth transfer.

- •Managed implementation of client directives, ensuring 100% alignment with Nevada's regulatory requirements, thereby enhancing client satisfaction.

- •Conducted seminars for over 200 individuals, increasing awareness and new business inquiries by 40% in one year.

- •Advised clients on structuring estate plans involving trusts, wills, and insurance products, resulting in optimized asset succession for 70% of client base.

- •Coordinated with legal advisors to modify plans reflecting changes in estate tax legislation, enhancing compliance and client confidence.

- •Prepared presentations elucidating estate planning implications on tax liabilities, improving client understanding by 60%.

- •Executed estate plans for 30 high-net-worth individuals, ensuring their estate distribution aligned with personal wishes and financial goals.

- •Utilized financial planning software to analyze client finances, achieving a cumulative increase in asset allocation efficiency by 15%.

- •Conducted thorough analysis of financial statements to develop personalized estate strategies, enhancing family wealth transfer for diverse clients.

- •Educated clients on effective tools like living trusts, increasing client commitment and reducing probate costs by 20%.

- •Facilitated client meetings with attorneys and tax advisors to ensure comprehensive estate planning aligned with legal frameworks.

- •Optimized investment strategies, resulting in a 10% increase in portfolio value within two fiscal years.

- •Analyzed client portfolios to streamline asset management and estate strategies, enhancing financial outcomes by reducing liabilities.

- •Collaborated with financial planning team to create presentations, improving client retention and engagement by 35%.

- •Executed tax-efficient investment plans tailored to client estate goals, resulting in a 15% improvement in client satisfaction.

- •Monitored market trends to advise estate planning strategies, ensuring up-to-date client advisory services.

Certified Tax Financial Planner resume sample

- •Developed customized financial plans leading to a 20% increase in client portfolio returns in one year.

- •Advised on tax-efficient investment strategies, reducing client tax liabilities by up to 18% per annum.

- •Conducted comprehensive financial analyses, resulting in tailored strategies for over 150 high-net-worth individuals.

- •Stayed informed on tax laws, updating client strategies to comply with changing regulations.

- •Partnered with estate planning attorneys, providing integrated financial advice and estate planning.

- •Educated clients on complex tax implications, ensuring full understanding and informed decision-making.

- •Managed a portfolio of 100+ clients, increasing total assets under management by 25% within two years.

- •Prepared and reviewed over 200 tax returns annually, maintaining a 98% accuracy rate.

- •Collaborated with a multidisciplinary team, streamlining processes and improving response times by 30%.

- •Led client workshops on tax-efficient investment strategies with a demonstrated increase in client satisfaction metrics.

- •Analyzed changing tax regulations and adjusted strategies, successfully minimizing client tax burdens.

- •Performed detailed financial modeling for businesses, facilitating informed decision-making and strategic growth.

- •Improved financial reporting accuracy by developing precision-driven processes, reducing errors by 15%.

- •Researched updated tax regulations, ensuring compliance and reducing audit risk for corporate clients.

- •Assisted in the development of financial plans contributing to a 12% increase in client satisfaction scores.

- •Conducted in-depth tax audits for high-net-worth individuals, enhancing tax compliance by 98%.

- •Prepared tax filings resulting in a compliance improvement for a portfolio of over 50 clients.

- •Streamlined documentation processes, increasing departmental efficiency by 20%.

- •Provided expert guidance on tax-saving strategies, resulting in significant annual savings for clients.

Certified Investment Management Planner resume sample

- •Orchestrated diverse investment strategies resulting in a 25% average increase in client portfolio returns over 3 years.

- •Managed portfolios worth $12M by aligning financial goals with market trends and rigorous financial analysis.

- •Cultivated strong relationships with over 150 clients through effective communication and consistent performance assessments.

- •Collaborated with a team of estate planners, delivering comprehensive wealth management solutions enhancing client satisfaction.

- •Implemented financial analysis tools to improve forecasting accuracy, leading to a reduction of risks by 15%.

- •Conducted detailed client reviews, empowering them with knowledge, resulting in more informed investment decisions.

- •Enhanced client engagement strategy leading to a 20% increase in new client acquisition over 18 months.

- •Served as a key advisor for a $9M investment portfolio, achieving a steady 5% annual growth.

- •Analyzed economic indicators to identify lucrative investment opportunities, assisting clients in outperforming market benchmarks.

- •Led a cross-functional team in creating a new high-net-worth client advisory service that expanded market reach.

- •Provided tailored financial education programs to clients that improved understanding and reduced decision-making anxiety.

- •Developed customized investment strategies for 50+ clients, involving comprehensive financial assessments and risk profiling.

- •Utilized portfolio management software to optimize asset allocation, increasing overall client satisfaction scores by 30%.

- •Conducted regular client meetings and performance reviews, resulting in a 15% reduction in client turnover.

- •Coordinated with tax specialists to integrate efficient tax planning into investment strategies, improving after-tax returns.

- •Assisted in managing wealth strategies for high-net-worth individuals, resulting in portfolio growth of 10%.

- •Conducted in-depth cash flow and retirement planning analyses to support senior planners in client advice.

- •Maintained up-to-date knowledge of market trends and investment opportunities, enhancing client portfolio performance.

- •Utilized financial modeling tools to assess investment performance and recommend rebalancing, improving risk management.

Insurance Planning Certified Financial Planner resume sample

- •Developed and implemented 150+ personalized insurance strategies, boosting client coverage satisfaction by 95%.

- •Conducted extensive analyses of client portfolios, leading to improved insurance policy alignment with financial objectives.

- •Collaborated on 10 cross-departmental projects, providing insurance expertise that enhanced overall client service offerings.

- •Tracked and reported on client progress using advanced analytics tools, resulting in better informed financial decisions by 30%.

- •Facilitated 25+ client workshops on insurance planning, increasing attendee understanding by 90% as evidenced by feedback surveys.

- •Streamlined client data management through CRM system integration, reducing inefficiencies by 45% and improving client follow-up times.

- •Advised clients on insurance products such as life and disability, resulting in 20% growth in insurance portfolio revenue.

- •Created comprehensive financial plans, improving overall client wealth management strategies by an average of 35%.

- •Established continued relationships with clients, enhancing client retention rate to 85%.

- •Led a team of junior advisors to refine our approach to client relationship management, evident in increased client satisfaction scores.

- •Implemented training sessions on latest insurance trends and regulations, enhancing team knowledge and application by 50%.

- •Conducted detailed customer analysis, resulting in a 25% increase in accurate insurance assessments.

- •Managed a portfolio of 100+ client accounts, maintaining client satisfaction at 90% or higher.

- •Developed educational content on insurance topics for customers, leading to an increase in informed decision-making by 40%.

- •Applied risk management techniques, significantly mitigating potential losses for clients and improving risk forecasts by 20%.

- •Assisted in devising investment strategies that yielded a 15% increase in portfolio performance annually.

- •Conducted insurance and investment plan reviews, improving alignment with client goals in 70% of cases.

- •Coordinated with senior planners to ensure comprehensive client coverage and satisfactory service outcomes.

- •Supported new client acquisition efforts, contributing to a client base growth of 50% over two years.

College Funding Certified Financial Planner resume sample

- •Conducted 120 comprehensive financial assessments annually for families, resulting in tailored college funding plans that optimize financial aid opportunities.

- •Developed financial strategies leading to a 30% increase in college savings contributions across the client base.

- •Hosted monthly workshops educating over 200 families on financial aid and scholarship opportunities.

- •Led a team collaboration project that integrated advanced financial planning tools, enhancing client satisfaction scores by 15%.

- •Negotiated partnerships with local high schools, increasing community outreach and client base by 20%.

- •Maintained strong client relationships, achieving a retention rate of 95% through consistent communication and follow-ups.

- •Managed financial portfolios for 50+ families, aligning assets with college funding strategies while exceeding client expectations.

- •Achieved a 20% improvement in client portfolio growth by implementing innovative college savings plan optimizations.

- •Presented personalized workshops to 500+ participants annually, enhancing community awareness about funding strategies.

- •Coordinated with legal and accounting professionals to deliver comprehensive financial guidance tailored to clients’ needs.

- •Documented all client interactions meticulously, leading to improved accuracy in strategic financial advice and compliance.

- •Analyzed financial portfolios and recommended strategic adjustments, improving clients’ college funding readiness by 25%.

- •Educated families on state and federal funding opportunities, resulting in a 35% increase in successful aid applications.

- •Led company-wide training sessions, sharing best practices and trends in education financing to boost team performance.

- •Built long-term relationships with clients through effective communication, aiding in client retention efforts.

- •Supported senior planners with analysis and preparation of financial plans, enhancing team productivity by 18%.

- •Researched and compiled data on college funding trends, providing valuable insights for client presentations.

- •Assisted with client meetings, sharpening interpersonal skills and contributing to 10% increase in client retention.

- •Streamlined financial assessment processes for efficiency, reducing preparation time by 12%.

Certified Financial Planner for Small Businesses resume sample

- •Developed comprehensive financial plans for small business clients, resulting in a 25% increase in overall customer satisfaction scores over four years.

- •Enhanced investment strategies tailored for small businesses resulting in a 15% increase in client portfolios' annual returns.

- •Advised clients on succession planning and retirement, improving clients' retirement plan contributions by an average of 30%.

- •Collaborated with tax professionals to identify tax efficiency strategies that saved clients an average of 10% on tax bills.

- •Conducted financial seminars to educate business owners, contributing to a 40% increase in new client acquisitions.

- •Implemented a robust financial review process, ensuring that 95% of clients' financial plans were regularly updated and aligned with their evolving goals.

- •Streamlined cash flow management for 50+ small businesses, leading to improved liquidity and average cost savings of 12% annually.

- •Contributed to a 20% reduction in client risk exposure by implementing tailored risk management strategies for small business portfolios.

- •Advised on investment decisions that facilitated a 10% increase in overall business assets under management.

- •Prepared detailed financial reports, which enhanced client decision-making processes, boosting business growth by over 8% in two years.

- •Managed a diverse range of client accounts, focusing on personal relationships that resulted in a client retention rate of 90%+.

- •Provided strategic financial advice to 200+ small businesses, ensuring alignment of financial objectives with long-term business goals.

- •Improved client investment portfolios by an average of 20% through targeted investment management strategies.

- •Facilitated successful retirement planning seminars, increasing client engagement and resultant business by 15%.

- •Built strong client relationships that led to a 30% increase in referral-based new clients.

- •Assisted in the development of long-term financial plans, resulting in an 18% improvement in client accounts' financial performance.

- •Conducted comprehensive financial analysis that contributed to more informed client financial decisions.

- •Managed a broad range of client accounts, ensuring efficient handling of financial needs and timely delivery of services.

- •Partnered with senior financial planners to enhance the service offerings, resulting in a 25% growth in client base.

Certified Financial Planner for Corporate Business resume sample

- •Developed and managed financial plans for over 50 corporate clients, achieving a 15% increase in portfolio growth across multiple industries.

- •Led a team of financial advisors, resulting in a 25% improvement in client satisfaction scores through effective consultation and engagement.

- •Implemented tax optimization strategies that resulted in $1 million savings for a major client in their fiscal year.

- •Conducted risk assessments and proposed investment strategies that aligned with clients' long-term objectives, reducing financial risk by 30%.

- •Initiated and conducted financial workshops for corporate clients, increasing financial literacy and client confidence by 40%.

- •Regularly reviewed and adjusted financial plans based on quarterly reports, achieving up to 20% higher returns for clients.

- •Collaborated with cross-disciplinary teams to integrate comprehensive financial solutions, enhancing client services by 30% annually.

- •Conducted detailed financial analyses leading to successful strategic decisions in corporate budgets, impacting profitability by $500,000.

- •Designed tailored retirement plans that improved clients' ROI by 10% within 18 months of implementation.

- •Maintained compliance by ensuring all financial planning activities adhered to SEC regulations, resulting in zero audits over three years.

- •Initiated market trend presentations that kept clients informed and aligned business strategies with current economic conditions.

- •Assisted in developing comprehensive financial plans for mid-sized corporate accounts, leading to a 12% growth in client assets.

- •Monitored financial markets and presented reports that improved investment decision-making, increasing client ROI by 8% annually.

- •Worked closely with accountants to optimize clients' tax outcomes, reducing liabilities by an average of 15% each fiscal year.

- •Enhanced communication with clients through regular updates, resulting in a 20% increase in repeat consultations.

- •Provided detailed investment analysis and supporting data to senior planners, contributing to a 5% portfolio growth on average.

- •Streamlined data management processes, cutting report preparation time by 30%, increasing efficiency in client service delivery.

- •Assisted in market research which helped in identifying emerging market opportunities, resulting in high-value investments for clients.

- •Supported senior planners during client meetings by preparing detailed financial statements and projections, improving client engagement.

Certified Financial Planner for High Net Worth Individuals resume sample

- •Collaborated with a tax advisory team to develop comprehensive strategies for over 50 high net worth clients, resulting in 20% average tax savings.

- •Personally managed a portfolio worth $200 million, achieving a client satisfaction rate of 95% through consistent performance and tailored services.

- •Oversaw a team of 5 financial advisors, enhancing their productivity by 40% through targeted training and mentorship initiatives.

- •Conducted in-depth market analysis that contributed to a 15% increase in client investment portfolios by minimizing risks in volatile markets.

- •Implemented advanced financial planning software, improving data accuracy and efficiency by 25%, while reducing processing time.

- •Engaged actively in networking events, acquiring 12 new high net worth clients in a fiscal year, boosting revenues significantly.

- •Led the development of investment strategies that increased high net worth clients' assets by 30% within three years.

- •Provided comprehensive retirement planning sessions resulting in increased employer-sponsored retirement plan participation by 20%.

- •Cultivated strong client relationships with a retention rate of 98% by delivering tailored financial advice and exceptional service.

- •Conducted complex financial analyses and forecasting, aiding in a client’s successful estate planning, transferring $50 million tax-efficiently.

- •Utilized financial planning software to deliver detailed monthly performance analytics, enhancing clients' engagement and decision-making.

- •Supported a team managing over $500 million in client assets, contributing to a 25% increase in managed assets over two years.

- •Developed strategic investment proposals resulting in a 10% increase in portfolio diversification for high net worth individuals.

- •Facilitated workshops that improved clients' understanding of estate planning by 30%, leading to increased client satisfaction.

- •Initiated the implementation of a CRM system that improved client data management efficiency by 35%.

- •Developed customized financial plans for more than 75 high net worth clients, focusing on achieving long-term financial goals.

- •Streamlined the quarterly financial review process, reducing turnaround time by 40%, enhancing client communication.

- •Implemented innovative investment strategies that maintained or grew client wealth during a market downturn.

- •Provided advisory services that contributed to a trust’s successful transition, retaining $10 million in assets with efficient tax planning.

In the fast-paced world of finance, crafting a compelling resume is crucial for a certified financial planner. While your skill in managing portfolios is undeniable, translating those skills into a format that captures attention can feel like navigating uncharted waters. Each element of your resume should flow seamlessly to form a cohesive story of your professional journey.

This challenge of standing out, even with considerable expertise, underscores the importance of a well-crafted resume. It's your gateway in the competitive job market, spotlighting your experience and highlighting your unique problem-solving abilities.

Here’s where a resume template comes into play as a valuable tool. A structured template ensures your resume is presented in a professional, easy-to-read format, giving your skills the spotlight they deserve. While not designed specifically for financial planners, such templates provide a foundation for a polished and cohesive presentation.

Think of your resume as the first glimpse employers have of your financial prowess. It needs to reflect both your technical expertise in finance and the distinctive value you bring. As you embark on crafting your resume, aim for clarity and precision to leave a lasting impression that resonates with potential employers.

Key Takeaways

- Crafting a compelling resume is essential for certified financial planners to stand out in a competitive job market by highlighting experience and unique problem-solving abilities.

- Utilizing a structured resume template can aid in creating a polished and cohesive presentation that showcases financial expertise.

- It's crucial for the resume to highlight technical finance skills, certifications, and a clear career progression, ideally presented in a chronological format to illustrate growth.

- The experience section should focus on quantifiable achievements and relevant skills, using action verbs to demonstrate impact in financial planning roles.

- Extending the resume with sections on certifications, education, skills, and additional attributes like language skills or volunteer work can further enhance its appeal.

What to focus on when writing your certified financial planner resume

A certified financial planner resume should effectively highlight your expertise in assisting clients with achieving their financial goals. Your resume needs to emphasize skills like investment strategies, retirement planning, and tax optimization, clearly illustrating how you bring value to the role. This ensures that recruiters immediately recognize your qualifications and potential impact in the financial planning field.

How to structure your certified financial planner resume

- Contact Information — Your contact details are the first thing a recruiter will look at, so they must be clear and professional. Provide your full name, an up-to-date phone number, a professional email address, and a link to your LinkedIn profile. Ensuring easy access to your contact information allows potential employers to reach out quickly if they find your qualifications appealing.

- Professional Summary — This section is crucial as it sets the tone for the rest of your resume. It should succinctly encapsulate your financial planning experience and emphasize your expertise in areas like investment management and retirement planning. This snapshot of your professional identity should intrigue recruiters, encouraging them to read further.

- Certifications and Licenses — Certifications like CFP® (Certified Financial Planner) and licenses such as Series 7 and Series 66 are significant in establishing your credentials. They signal your commitment to professional excellence and reassure employers of your up-to-date expertise in financial planning standards and practices.

- Experience — Your work history should focus on financial planning roles where you can highlight your achievements with quantifiable results. Using action verbs to describe how you've enhanced client portfolios or improved business outcomes demonstrates your effectiveness and success in the industry.

- Education — Even with experience, your educational background is a key component that supports your knowledge base. Listing your degree in finance or economics, alongside the institution and graduation year, underscores your dedication to building a strong foundation in financial planning principles.

- Skills — Highlighting skills like tax planning, risk management, asset allocation, and client relationship management helps define your specific abilities. These skills are essential to showcasing your capacity to add value to a potential employer's team.

Now that we've outlined the key components, let's delve deeper into the ideal resume format for a certified financial planner, ensuring each section stands out effectively.

Which resume format to choose

Crafting a resume as a certified financial planner involves structuring your document in a way that highlights your professional journey and expertise. A chronological format is ideal because it clearly illustrates your career development, allowing employers to easily see your growth and achievements in the financial sector. Choosing the right font can enhance the overall appeal of your resume. Modern options like Lato, Raleway, or Montserrat offer a clean and professional aesthetic that aligns well with the precision and clarity valued in financial planning.

Saving your resume as a PDF is crucial to ensure your document maintains its formatting across all platforms and devices, preserving the professional layout you've worked hard to create. It's also important to consider the overall readability of your resume. Using one-inch margins adds ample white space, making your document look organized and easy to read. Focusing on concise language that effectively highlights your skills and key accomplishments will help your qualifications stand out, making a strong impression on potential employers seeking a certified financial planner.

How to write a quantifiable resume experience section

A strong experience section on a certified financial planner resume is essential for catching an employer's attention. Start by highlighting relevant accomplishments and skills in financial planning, organizing your work history from the most recent backward. Focus on the last 10-15 years, prioritizing roles that align with the job you're targeting. Use action verbs like "developed," "implemented," and "advised" to convey leadership and impact. Tailor your resume to the job ad by aligning your experiences with its requirements, and be sure to quantify your achievements to reflect measurable results. Consider this example:

- •Increased clients' investment portfolio returns by an average of 15% annually through strategic portfolio management.

- •Developed personalized financial plans that resulted in a 90% client retention rate over five years.

- •Implemented tax-saving strategies that saved clients an average of $20,000 annually.

- •Advised on retirement planning, resulting in an increase in clients' retirement savings by 25% on average.

This experience section makes a strong impression because it seamlessly connects your achievements to the certified financial planner role. Each bullet point clearly quantifies success, using measurable outcomes to build a coherent success narrative. By incorporating numbers and percentages, you create a vivid picture of the value you bring to potential employers. This focused approach ensures your resume aligns with specific job ads, emphasizing relevant skills and experiences. The well-organized structure guides hiring managers, making your career progression easy to follow. Demonstrating measurable outcomes highlights not only your expertise in financial planning but also your capacity to excel, making you a standout candidate.

Technology-Focused resume experience section

A Technology-Focused Certified Financial Planner resume experience section should spotlight your expertise in leveraging financial technologies to enhance client services. Begin by detailing the tech tools and software you have mastered, such as financial planning programs and data analytics. Explain how these have been integral in addressing client needs and boosting the efficiency of your processes, creating a cohesive narrative of technology-driven success.

Highlight specific accomplishments that demonstrate your tech-savvy approach and the value you've brought through innovation. Discuss the measurable impacts of your work, such as improved client outcomes through the adoption of advanced technologies. By emphasizing your ability to stay ahead of tech trends and integrate them effectively, you show potential employers that you are committed to both innovation and exceptional client service, seamlessly integrating these facets into your role.

Senior Financial Advisor

Innovative Financial Solutions

January 2020 - Present

- Implemented a financial planning software that improved client data analysis efficiency by 30%.

- Utilized data analytics tools to forecast market trends, enhancing client portfolio growth by 15% yearly.

- Integrated a client relationship management system, resulting in a 40% increase in client retention.

- Led the transition to a cloud-based financial solution, ensuring compliance and improving accessibility for clients.

Achievement-Focused resume experience section

A certified financial planner's achievement-focused resume experience section should clearly showcase the value you've added in each role. Begin with strong action verbs and emphasize specific accomplishments that demonstrate your impact. When possible, use numbers and metrics to highlight your success in reaching company goals. This approach not only illustrates your capability but also shows how you've addressed challenges, exceeded targets, and added value in previous roles.

Aim to keep your descriptions clear and concise, highlighting your expertise in areas like building client relationships, growing investments strategically, and reducing risks. Rather than listing duties, focus on illustrating your growth and meaningful contributions in each position. Tailor your experience to align with the job you’re pursuing, and ensure it underscores how your past achievements support your career goals.

Certified Financial Planner

ABC Wealth Management

June 2018 - Present

- Helped over 200 clients reach financial goals, boosting client portfolio growth by 25% each year.

- Created tailored financial plans that lowered client investment risks by 30%.

- Mentored a team of 5 junior planners, increasing team efficiency by 40%.

- Implemented strategies that added $1.5 million in revenue for the fiscal year.

Result-Focused resume experience section

A result-focused certified financial planner resume experience section should effectively highlight your responsibilities and achievements to showcase your tangible impact. Begin by listing your job title, the company name, and your employment duration. In the bullet points, focus on quantifiable accomplishments and specific examples, illustrating how you made a positive contribution to your previous roles. Ensure each point connects your actions to the outcomes, using numbers or percentages to enhance clarity and impact.

To make your bullet points compelling, use straightforward language and strong action verbs, illustrating your effectiveness as a financial planner. Highlighting your skills in financial analysis, investment strategies, and managing client relationships is crucial. Instead of vague statements, zero in on real contributions that elevate your professional standing. This approach not only underscores your unique value but also paints a clear picture of your track record in driving results.

Certified Financial Planner

ABC Wealth Management

Jan 2015 - Dec 2020

- Boosted client portfolio growth by 20% annually through smart investment planning.

- Lowered client financial risks by creating personalized insurance and tax strategies.

- Streamlined financial reports, saving over 50 hours a year in admin time.

- Increased client numbers by 30% with effective networking and referrals.

Skills-Focused resume experience section

A skills-focused certified financial planner resume experience section should showcase your expertise and accomplishments in financial planning, highlighting the abilities that set you apart. It's important to concentrate on achievements that demonstrate your skill in managing clients’ financial portfolios, offering insightful advice, and planning for their future growth. Providing quantifiable accomplishments, like the percentage increase in a client's investment portfolio or the number of clients managed, will make your achievements stand out. By crafting concise and powerful bullet points, you can effectively present the skills and successes relevant to each role you've held.

Begin by listing the dates of your employment, job title, and organization. Describe your skills and achievements for each role using dynamic action words that convey initiative and proactive decision-making. This approach will illustrate your strong capability in building client relationships and working with various financial products. The structure ensures employers can quickly identify the strengths you bring to the table and your proven track record in financial planning.

Certified Financial Planner

Finance Solutions Inc.

June 2018 - September 2023

- Increased clients’ investment portfolios by an average of 40% annually with strategic planning and personalized advice.

- Created comprehensive financial plans tailored to each client, boosting the client satisfaction rate to 95%.

- Managed a diverse client portfolio of over 100, ensuring growth and stability.

- Led financial literacy seminars, enhancing client understanding and trust in our services.

Write your certified financial planner resume summary section

A results-focused certified financial planner resume summary should efficiently highlight your experience, skills, and unique qualities in just a few sentences. Your goal is to quickly grab a hiring manager's attention by showcasing your most relevant qualifications. Consider incorporating elements like this into your summary:

The effectiveness of this summary lies in its ability to convey a strong narrative, linking your experience to tangible results and specific skills. Phrases like "proven track record" demonstrate measurable success, while mentioning "portfolio diversification" focuses on your technical expertise. When adding numbers or specific achievements, you create an even more compelling story. This summary also emphasizes your ability to communicate and provide clear, valuable advice, a vital skill in financial planning.

Understanding the distinction between a summary and other sections like a resume objective or profile is crucial. A resume objective is more suitable if you have less experience. For instance, you might express a desire to apply your academic knowledge in a practical setting. A summary profile offers a more narrative style that can weave in your accomplishments. In contrast, a summary of qualifications typically lists your key skills, appealing to those seeking specific attributes. By crafting a summary that effectively showcases your skills and experience, your resume is more likely to leave a lasting impression.

Listing your certified financial planner skills on your resume

A skills-focused certified financial planner resume should highlight your unique abilities effectively. Your skills section can stand alone or be integrated into your experience and summary areas seamlessly. Showcasing your strengths and soft skills demonstrates that you're not just skillful but also a proactive team player. Hard skills, such as financial analysis and tax planning, are crucial because they quantify your technical expertise.

These skills and strengths serve as key resume keywords, crucial for drawing attention from employers. They ensure your resume stands out, both to hiring algorithms and to recruiters personally searching for top candidates.

Here's an example of how to structure your skills section in JSON format:

This example is impactful because it lists relevant skills that align with the role, making it easy for recruiters to identify your qualifications quickly.

Best hard skills to feature on your certified financial planner resume

Emphasizing hard skills is critical as a certified financial planner because they highlight your ability to manage financial tasks with expertise. Your technical skills communicate your competence and readiness to handle the job effectively. Here are some key hard skills:

Hard Skills

- Financial Analysis

- Investment Strategies

- Tax Planning

- Portfolio Management

- Risk Assessment

- Retirement Planning

- Real Estate Planning

- Estate Planning

- Budget Development

- Asset Allocation

- Financial Modeling

- Cash Flow Analysis

- Wealth Management

- Debt Management

- Financial Software Proficiency

Best soft skills to feature on your certified financial planner resume

While hard skills are crucial, soft skills are essential to show how you interact with clients and teams. They reveal your potential to thrive in diverse settings and build strong relationships. Here are some valuable soft skills to highlight:

Soft Skills

- Communication

- Analytical Thinking

- Problem Solving

- Attention to Detail

- Time Management

- Client Service

- Decision Making

- Empathy

- Adaptability

- Negotiation

- Teamwork

- Leadership

- Emotional Intelligence

- Listening Skills

- Networking Skills

How to include your education on your resume

The education section is a crucial part of your resume, especially if you're applying for a role as a certified financial planner. It shows your qualifications and educational background. Tailor this section to the specific job, excluding any irrelevant details. When listing your GPA, include it if it is impressive (generally above 3.5) and was obtained recently. If you graduated with honors such as cum laude, list it alongside your degree. Make sure to clearly state your degree, the institution, and the dates attended.

Here's an example that needs improvement:

This example lacks relevance and does not highlight relevant accomplishments. Here is an effective example:

This second example is strong because it aligns with the financial planning role you are aiming for. Listing cum laude demonstrates your academic success, and including a high GPA further exhibits your competence in the field. The focus on finance, rather than an unrelated subject, makes your application more compelling.

How to include certified financial planner certificates on your resume

Including a certificates section in your certified financial planner resume is crucial. Start by listing the name of the certificate. Include the date you received it. Add the issuing organization. This information shows your qualifications and builds trust. If you want to highlight your certificates, you can also include them in the header of your resume. For example:

Jane Doe, CFP® Certified Financial Planner | CFA Charterholder | MBA

Having a standalone certificates section helps organize these key credentials. Here's a good example:

json

This section is effective because it clearly lists relevant certificates. Each item includes the title and issuer, validating your expertise. Such a layout makes it easy for employers to see your qualifications at a glance.

Extra sections to include in your certified financial planner resume

Crafting a standout resume as a certified financial planner can significantly boost your career prospects. Highlighting key sections on your resume can showcase your diverse skill set and make you a more attractive candidate to potential employers.

Language section — Demonstrate multilingual skills to appeal to a wider client base and global financial markets.

Hobbies and interests section — Show your well-rounded personality and stress-management techniques by mentioning relevant personal activities.

Volunteer work section — Highlight your social responsibility and ability to manage finances altruistically.

Books section — Display your commitment to continuous education and staying updated with financial trends by listing influential books you have read.

Including these sections can make your resume more comprehensive and engaging. Employers appreciate candidates who bring diverse experiences and knowledge to the table.

In Conclusion

In conclusion, creating an effective resume is vital for a certified financial planner striving to stand out in the competitive finance industry. By focusing on clarity and structure, your resume can effectively showcase your qualifications and unique expertise. Utilizing a structured template ensures your resume is presented clearly, helping hiring managers appreciate your skills. Each resume section should be tailored to highlight your achievements and contributions in finance, emphasizing both hard skills like financial analysis and soft skills such as communication. A chronological format shows your career growth succinctly, while quantifiable accomplishments prove your success. Including relevant certifications and education strengthens your resume, illustrating your dedication to professional excellence. Extra sections on language skills or volunteer work can further enhance your resume, showcasing your well-rounded abilities. By crafting a resume that reflects both your technical prowess and personal attributes, you position yourself as a compelling candidate ready to take on new challenges in the field of financial planning.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.