CPA Tax Accountant Resume Examples

Jul 18, 2024

|

12 min read

Crafting a CPA tax accountant resume: your express route to financial success with numbers and narratives

Rated by 348 people

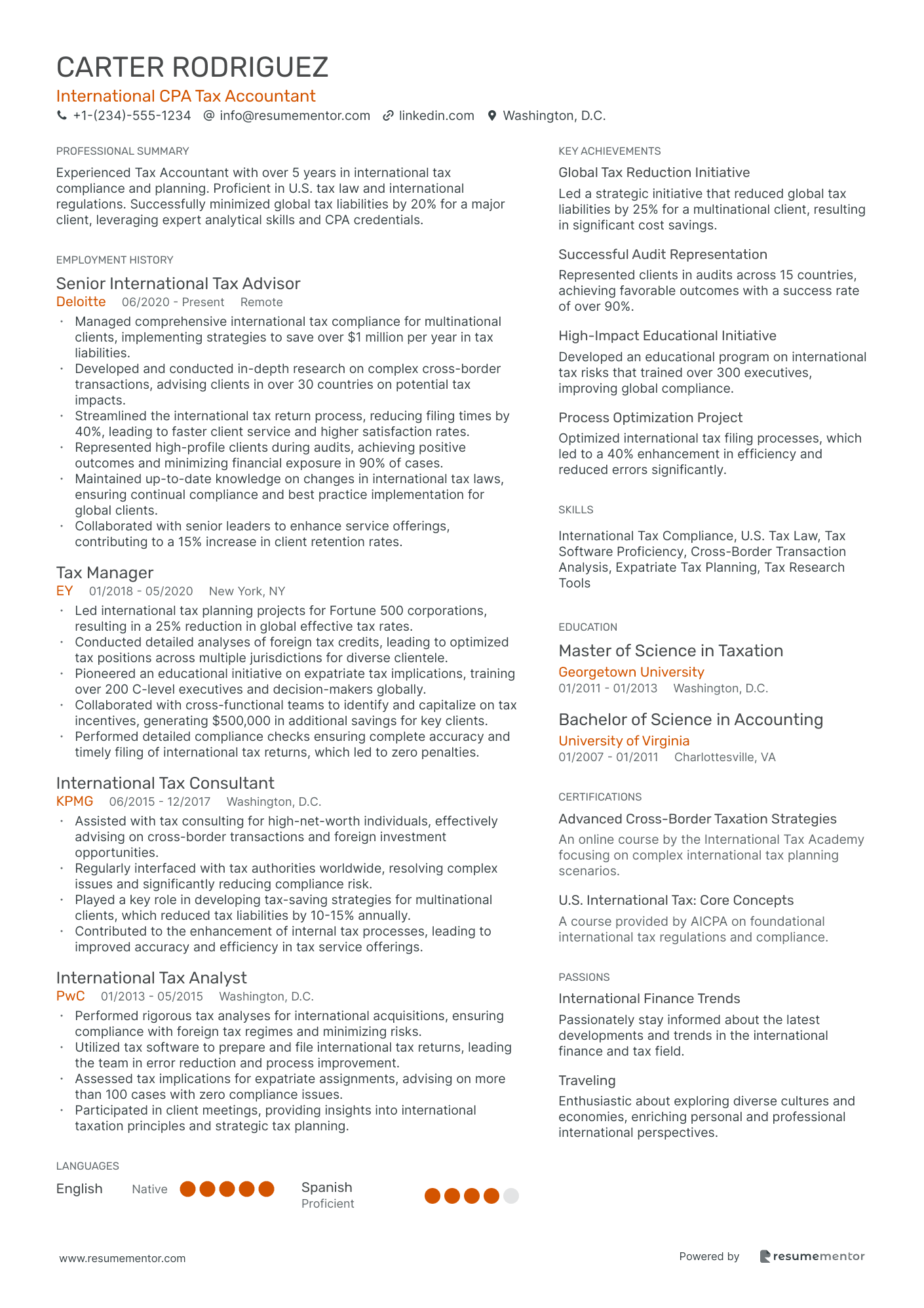

International CPA Tax Accountant

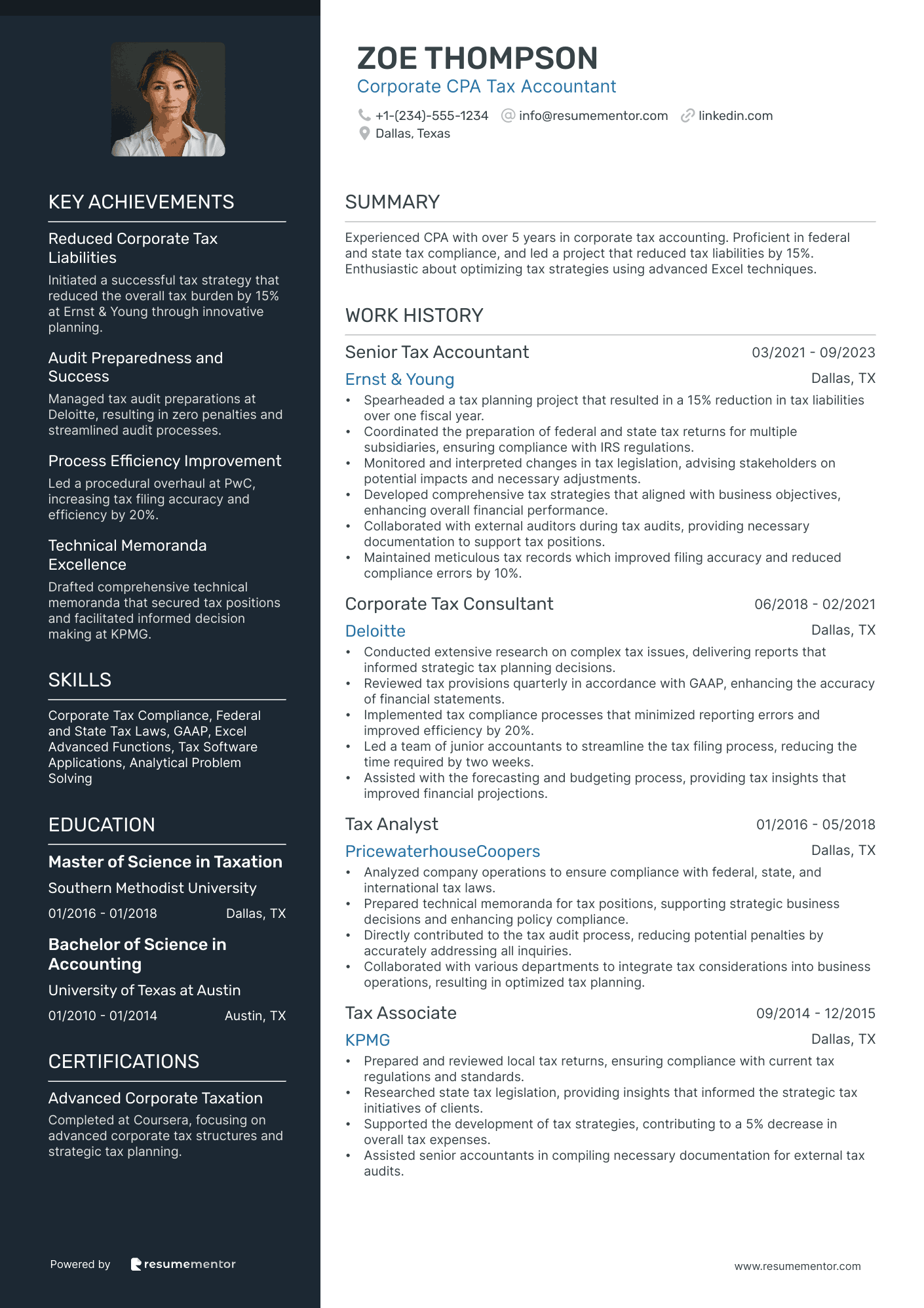

Corporate CPA Tax Accountant

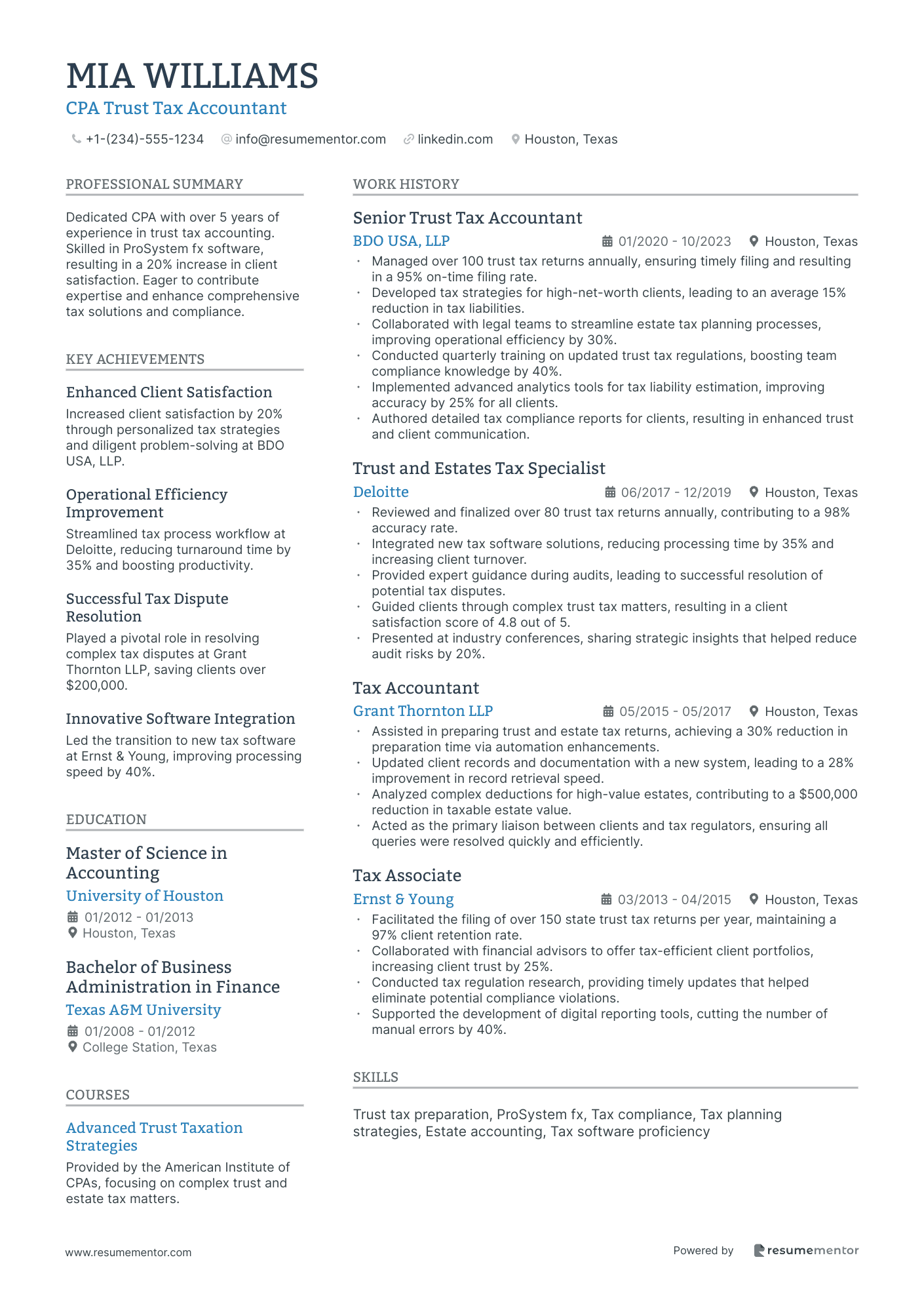

CPA Trust Tax Accountant

CPA Estate Tax Accountant

CPA Sales and Use Tax Accountant

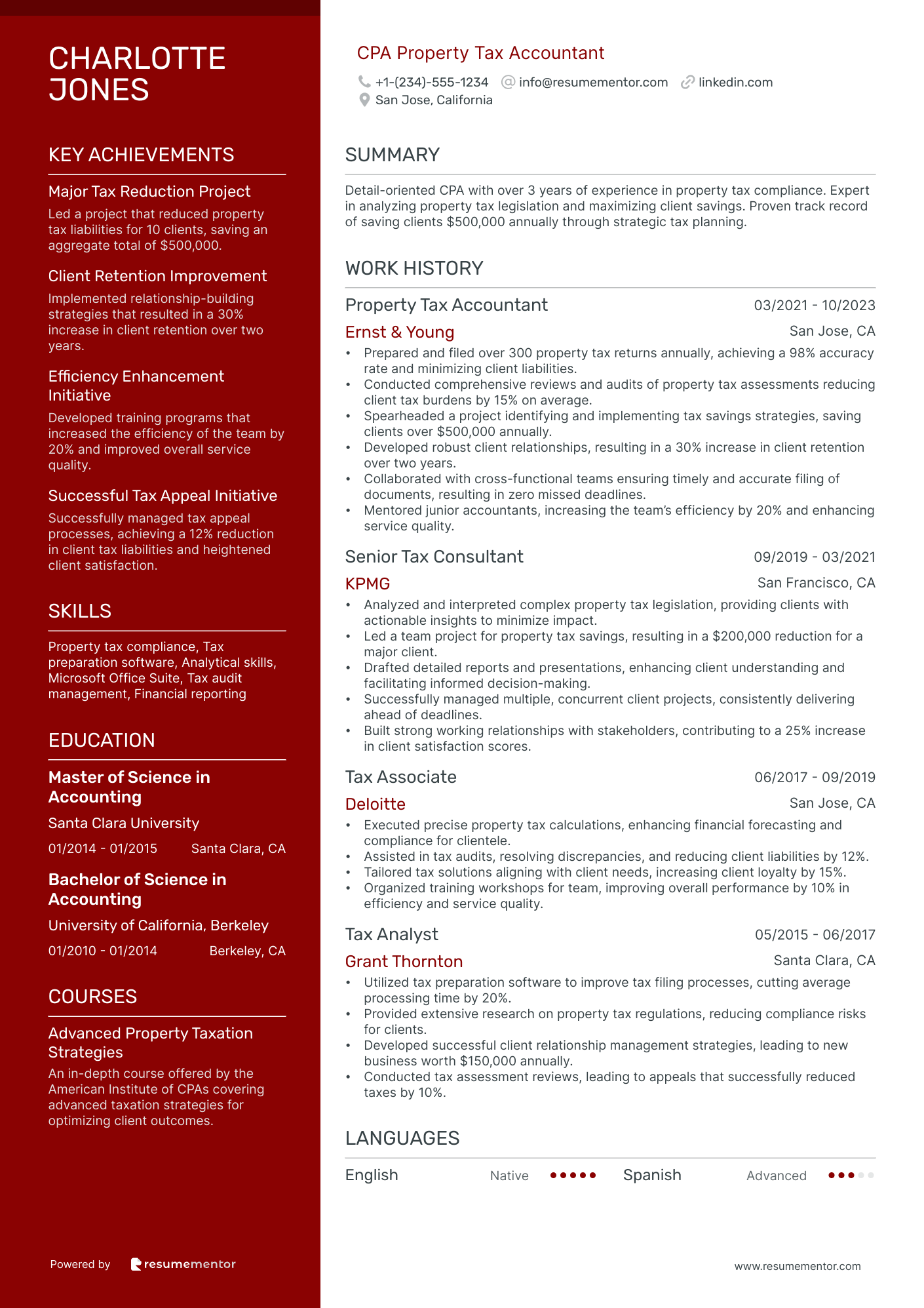

CPA Property Tax Accountant

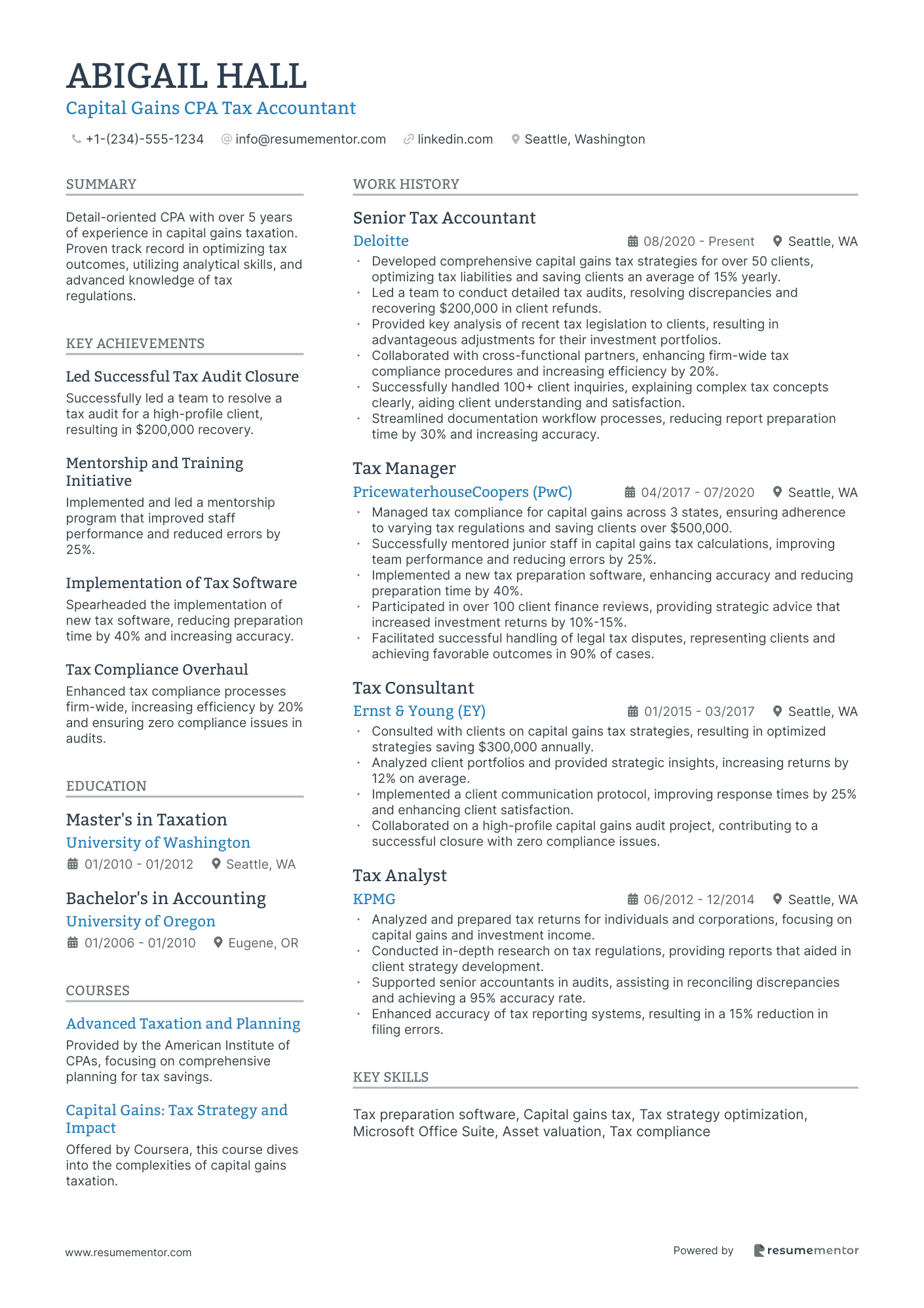

Capital Gains CPA Tax Accountant

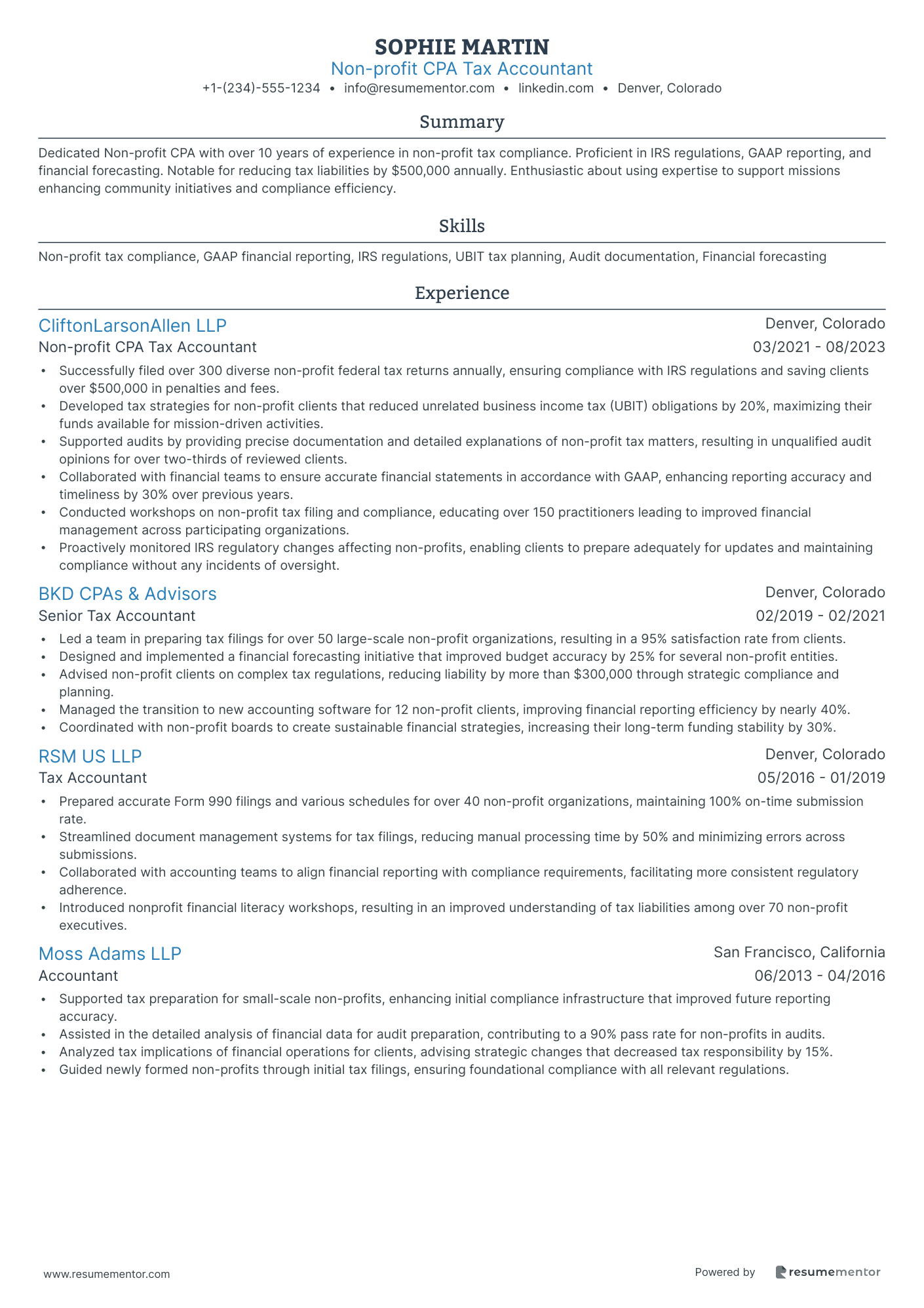

Non-profit CPA Tax Accountant

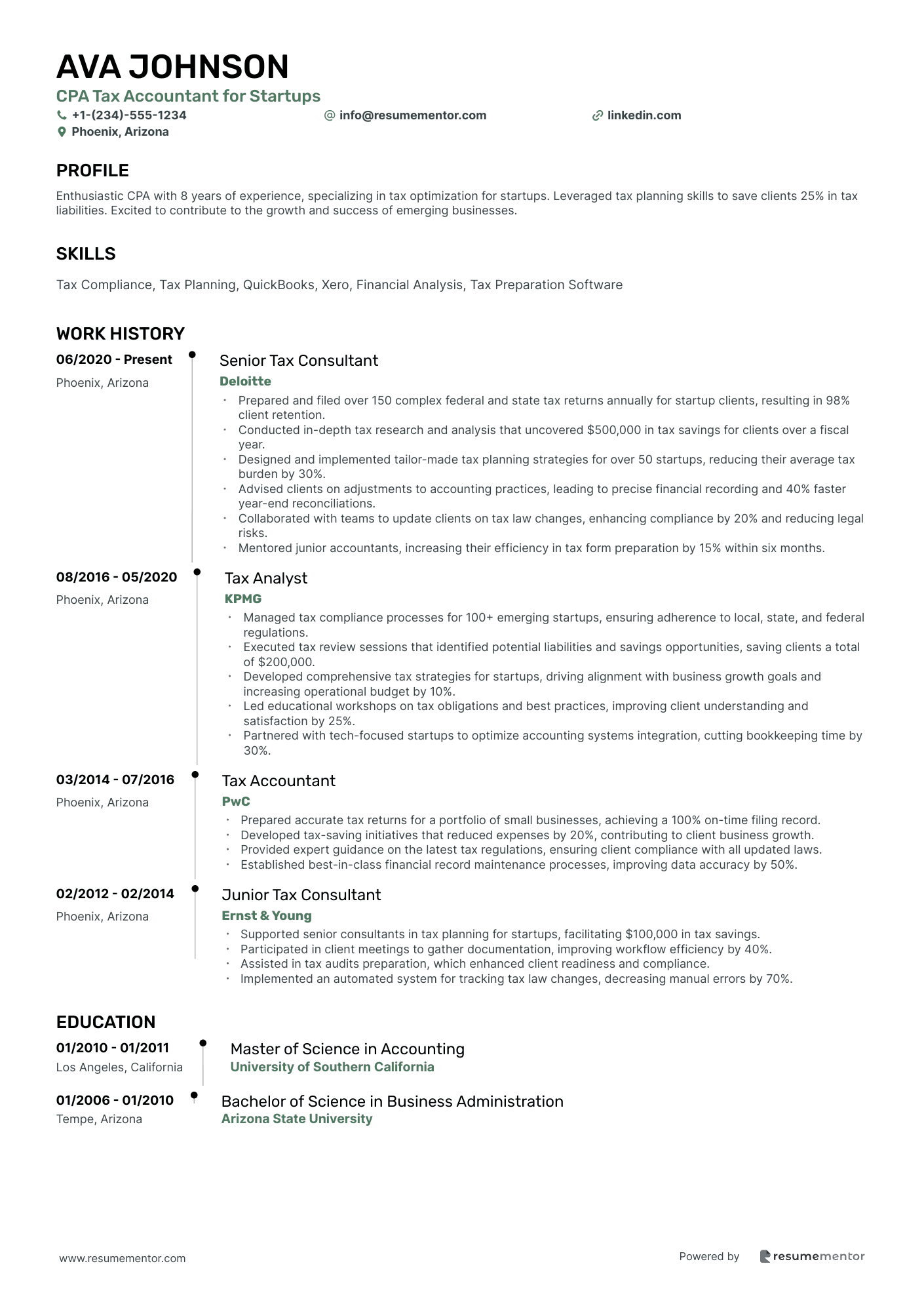

CPA Tax Accountant for Startups

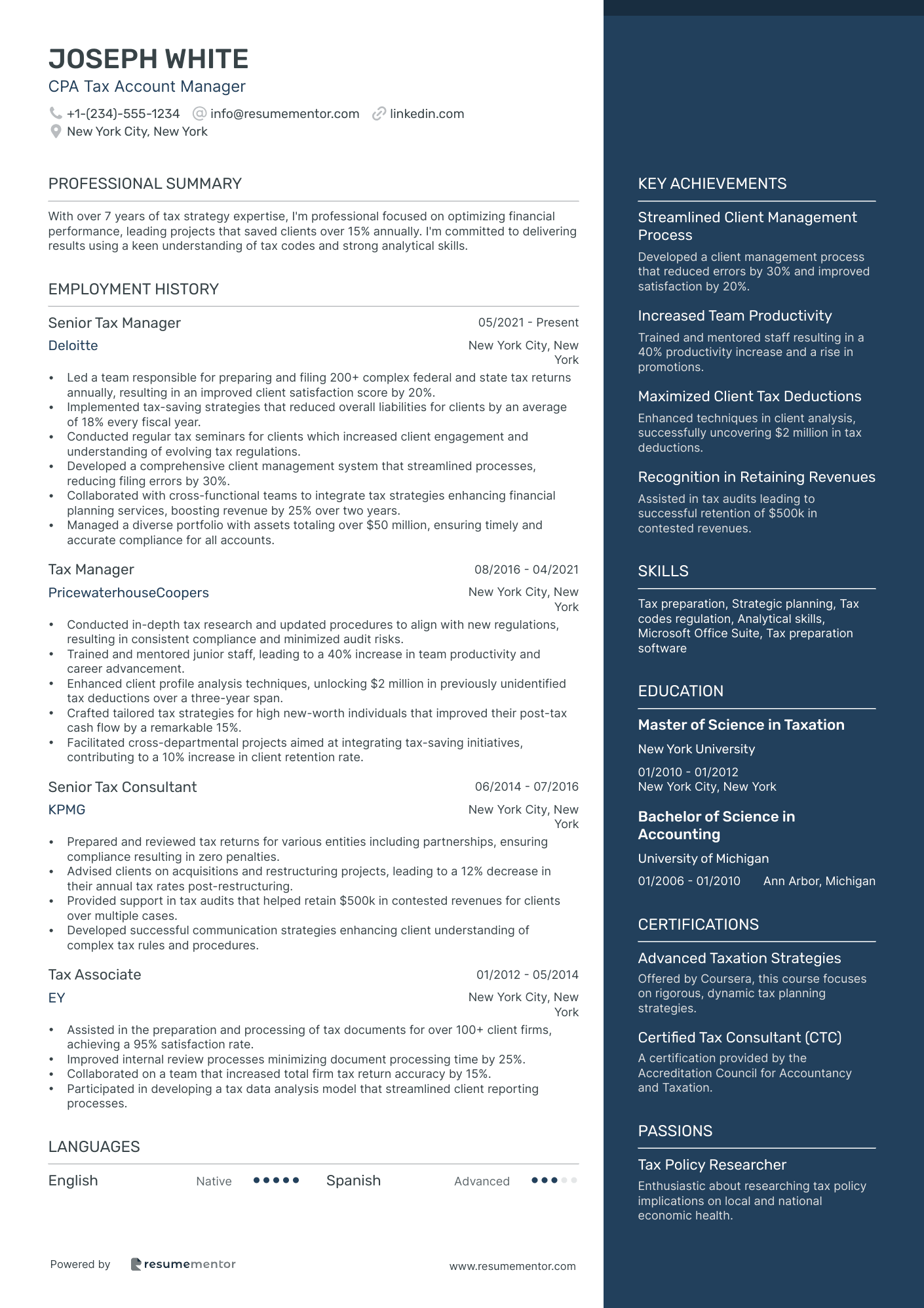

CPA Tax Account Manager

International CPA Tax Accountant resume sample

- •Managed comprehensive international tax compliance for multinational clients, implementing strategies to save over $1 million per year in tax liabilities.

- •Developed and conducted in-depth research on complex cross-border transactions, advising clients in over 30 countries on potential tax impacts.

- •Streamlined the international tax return process, reducing filing times by 40%, leading to faster client service and higher satisfaction rates.

- •Represented high-profile clients during audits, achieving positive outcomes and minimizing financial exposure in 90% of cases.

- •Maintained up-to-date knowledge on changes in international tax laws, ensuring continual compliance and best practice implementation for global clients.

- •Collaborated with senior leaders to enhance service offerings, contributing to a 15% increase in client retention rates.

- •Led international tax planning projects for Fortune 500 corporations, resulting in a 25% reduction in global effective tax rates.

- •Conducted detailed analyses of foreign tax credits, leading to optimized tax positions across multiple jurisdictions for diverse clientele.

- •Pioneered an educational initiative on expatriate tax implications, training over 200 C-level executives and decision-makers globally.

- •Collaborated with cross-functional teams to identify and capitalize on tax incentives, generating $500,000 in additional savings for key clients.

- •Performed detailed compliance checks ensuring complete accuracy and timely filing of international tax returns, which led to zero penalties.

- •Assisted with tax consulting for high-net-worth individuals, effectively advising on cross-border transactions and foreign investment opportunities.

- •Regularly interfaced with tax authorities worldwide, resolving complex issues and significantly reducing compliance risk.

- •Played a key role in developing tax-saving strategies for multinational clients, which reduced tax liabilities by 10-15% annually.

- •Contributed to the enhancement of internal tax processes, leading to improved accuracy and efficiency in tax service offerings.

- •Performed rigorous tax analyses for international acquisitions, ensuring compliance with foreign tax regimes and minimizing risks.

- •Utilized tax software to prepare and file international tax returns, leading the team in error reduction and process improvement.

- •Assessed tax implications for expatriate assignments, advising on more than 100 cases with zero compliance issues.

- •Participated in client meetings, providing insights into international taxation principles and strategic tax planning.

Corporate CPA Tax Accountant resume sample

- •Spearheaded a tax planning project that resulted in a 15% reduction in tax liabilities over one fiscal year.

- •Coordinated the preparation of federal and state tax returns for multiple subsidiaries, ensuring compliance with IRS regulations.

- •Monitored and interpreted changes in tax legislation, advising stakeholders on potential impacts and necessary adjustments.

- •Developed comprehensive tax strategies that aligned with business objectives, enhancing overall financial performance.

- •Collaborated with external auditors during tax audits, providing necessary documentation to support tax positions.

- •Maintained meticulous tax records which improved filing accuracy and reduced compliance errors by 10%.

- •Conducted extensive research on complex tax issues, delivering reports that informed strategic tax planning decisions.

- •Reviewed tax provisions quarterly in accordance with GAAP, enhancing the accuracy of financial statements.

- •Implemented tax compliance processes that minimized reporting errors and improved efficiency by 20%.

- •Led a team of junior accountants to streamline the tax filing process, reducing the time required by two weeks.

- •Assisted with the forecasting and budgeting process, providing tax insights that improved financial projections.

- •Analyzed company operations to ensure compliance with federal, state, and international tax laws.

- •Prepared technical memoranda for tax positions, supporting strategic business decisions and enhancing policy compliance.

- •Directly contributed to the tax audit process, reducing potential penalties by accurately addressing all inquiries.

- •Collaborated with various departments to integrate tax considerations into business operations, resulting in optimized tax planning.

- •Prepared and reviewed local tax returns, ensuring compliance with current tax regulations and standards.

- •Researched state tax legislation, providing insights that informed the strategic tax initiatives of clients.

- •Supported the development of tax strategies, contributing to a 5% decrease in overall tax expenses.

- •Assisted senior accountants in compiling necessary documentation for external tax audits.

CPA Trust Tax Accountant resume sample

- •Managed over 100 trust tax returns annually, ensuring timely filing and resulting in a 95% on-time filing rate.

- •Developed tax strategies for high-net-worth clients, leading to an average 15% reduction in tax liabilities.

- •Collaborated with legal teams to streamline estate tax planning processes, improving operational efficiency by 30%.

- •Conducted quarterly training on updated trust tax regulations, boosting team compliance knowledge by 40%.

- •Implemented advanced analytics tools for tax liability estimation, improving accuracy by 25% for all clients.

- •Authored detailed tax compliance reports for clients, resulting in enhanced trust and client communication.

- •Reviewed and finalized over 80 trust tax returns annually, contributing to a 98% accuracy rate.

- •Integrated new tax software solutions, reducing processing time by 35% and increasing client turnover.

- •Provided expert guidance during audits, leading to successful resolution of potential tax disputes.

- •Guided clients through complex trust tax matters, resulting in a client satisfaction score of 4.8 out of 5.

- •Presented at industry conferences, sharing strategic insights that helped reduce audit risks by 20%.

- •Assisted in preparing trust and estate tax returns, achieving a 30% reduction in preparation time via automation enhancements.

- •Updated client records and documentation with a new system, leading to a 28% improvement in record retrieval speed.

- •Analyzed complex deductions for high-value estates, contributing to a $500,000 reduction in taxable estate value.

- •Acted as the primary liaison between clients and tax regulators, ensuring all queries were resolved quickly and efficiently.

- •Facilitated the filing of over 150 state trust tax returns per year, maintaining a 97% client retention rate.

- •Collaborated with financial advisors to offer tax-efficient client portfolios, increasing client trust by 25%.

- •Conducted tax regulation research, providing timely updates that helped eliminate potential compliance violations.

- •Supported the development of digital reporting tools, cutting the number of manual errors by 40%.

CPA Estate Tax Accountant resume sample

- •Led the preparation and review of over 150 estate tax returns annually, effectively optimizing tax savings for high-net-worth clients.

- •Developed comprehensive tax strategies that reduced tax liabilities by 20%, supporting asset valuation and financial growth for clients.

- •Managed IRS audits with a 95% success rate in resolving inquiries, maintaining strong compliance across all client matters.

- •Collaborated with a network of financial advisors, effectively coordinating a holistic approach to estate planning.

- •Continuously researched and integrated federal and state tax law changes, ensuring compliance and strategic client guidance.

- •Implemented process improvements that increased operational efficiency, leading to a 30% reduction in return preparation time.

- •Crafted tailored estate plans and managed the distribution of assets for over 200 trusts and estates annually.

- •Instrumental in advising clients on tax-efficient gifting strategies, cumulatively saving $2 million in taxable income.

- •Engaged in asset valuation and liability assessments to ensure accurate estate tax filing and reduce audit risks.

- •Facilitated client-advisor communication, improving client satisfaction scores by 15% through enhanced collaboration.

- •Pioneered the implementation of new tax preparation software, increasing accuracy and reducing processing time by 25%.

- •Successfully prepared over 100 complex trust tax returns annually, ensuring compliance with ever-changing tax laws.

- •Developed innovative strategies that deferred client tax payments by $500,000, fostering long-term client relationships.

- •Led training sessions for junior accountants on trust tax regulations, elevating team productivity by 20%.

- •Systems-enhanced client data management, resulting in a 20% increase in data retrieval efficiency.

- •Assisted in the preparation of trust tax returns, contributing to a team that handled over 300 returns per year.

- •Performed meticulous tax law research, resulting in savings of $100,000 for clients by eliminating unnecessary liabilities.

- •Enhanced client engagement through personalized service, improving client retention by 10% within two years.

- •Streamlined tax document management processes, decreasing errors and retrieval time by 15% for better compliance.

CPA Sales and Use Tax Accountant resume sample

- •Led the preparation and filing of sales and use tax returns across 20 jurisdictions, reducing errors by 20% through streamlined procedures.

- •Implemented a comprehensive compliance framework that enhanced adherence to evolving tax regulations, resulting in a 30% reduction in audit risks.

- •Partnered with internal stakeholders to address complex tax inquiries, improving response time by 25% and ensuring satisfactory resolutions.

- •Regularly conducted detailed tax research and provided strategic recommendations, leading to successful management of intricate tax scenarios.

- •Orchestrated training workshops on tax compliance, which increased departmental efficiency and understanding by 35%.

- •Ensured accurate sales tax determinations and reporting, significantly enhancing the accuracy of tax obligations.

- •Managed multi-jurisdictional sales and use tax filings, achieving a compliance rate of 98% through meticulous review processes.

- •Developed automated tracking systems, which cut down reporting time by 40% and improved data accuracy.

- •Provided expert guidance during state audits, effectively reducing potential liabilities through comprehensive documentation.

- •Maintained up-to-date knowledge of tax laws, ensuring business activities were compliant and minimized exposure to penalties.

- •Enhanced communication channels with accounting teams, resulting in seamless reconciliation of sales tax accounts.

- •Assisted in the filing of sales and use tax returns for multiple states, maintaining a 95% accuracy rate over three years.

- •Analysed tax trends and prepared in-depth reports that aided strategic planning and decision-making.

- •Supported cross-departmental projects, enhancing awareness and knowledge of tax implications and requirements.

- •Maintained comprehensive records of tax compliance documents, improving accessibility and retrieval for audits.

- •Processed numerous tax documents efficiently, reducing processing errors by 15% over two years.

- •Collaborated with senior accountants on research projects, gaining insight into complex tax legislation.

- •Played a key role in the implementation of a new software system, enhancing data management and compliance workflows.

- •Supported tax audits by preparing and organizing essential documents, ensuring a smooth audit experience.

CPA Property Tax Accountant resume sample

- •Prepared and filed over 300 property tax returns annually, achieving a 98% accuracy rate and minimizing client liabilities.

- •Conducted comprehensive reviews and audits of property tax assessments reducing client tax burdens by 15% on average.

- •Spearheaded a project identifying and implementing tax savings strategies, saving clients over $500,000 annually.

- •Developed robust client relationships, resulting in a 30% increase in client retention over two years.

- •Collaborated with cross-functional teams ensuring timely and accurate filing of documents, resulting in zero missed deadlines.

- •Mentored junior accountants, increasing the team’s efficiency by 20% and enhancing service quality.

- •Analyzed and interpreted complex property tax legislation, providing clients with actionable insights to minimize impact.

- •Led a team project for property tax savings, resulting in a $200,000 reduction for a major client.

- •Drafted detailed reports and presentations, enhancing client understanding and facilitating informed decision-making.

- •Successfully managed multiple, concurrent client projects, consistently delivering ahead of deadlines.

- •Built strong working relationships with stakeholders, contributing to a 25% increase in client satisfaction scores.

- •Executed precise property tax calculations, enhancing financial forecasting and compliance for clientele.

- •Assisted in tax audits, resolving discrepancies, and reducing client liabilities by 12%.

- •Tailored tax solutions aligning with client needs, increasing client loyalty by 15%.

- •Organized training workshops for team, improving overall performance by 10% in efficiency and service quality.

- •Utilized tax preparation software to improve tax filing processes, cutting average processing time by 20%.

- •Provided extensive research on property tax regulations, reducing compliance risks for clients.

- •Developed successful client relationship management strategies, leading to new business worth $150,000 annually.

- •Conducted tax assessment reviews, leading to appeals that successfully reduced taxes by 10%.

Capital Gains CPA Tax Accountant resume sample

- •Developed comprehensive capital gains tax strategies for over 50 clients, optimizing tax liabilities and saving clients an average of 15% yearly.

- •Led a team to conduct detailed tax audits, resolving discrepancies and recovering $200,000 in client refunds.

- •Provided key analysis of recent tax legislation to clients, resulting in advantageous adjustments for their investment portfolios.

- •Collaborated with cross-functional partners, enhancing firm-wide tax compliance procedures and increasing efficiency by 20%.

- •Successfully handled 100+ client inquiries, explaining complex tax concepts clearly, aiding client understanding and satisfaction.

- •Streamlined documentation workflow processes, reducing report preparation time by 30% and increasing accuracy.

- •Managed tax compliance for capital gains across 3 states, ensuring adherence to varying tax regulations and saving clients over $500,000.

- •Successfully mentored junior staff in capital gains tax calculations, improving team performance and reducing errors by 25%.

- •Implemented a new tax preparation software, enhancing accuracy and reducing preparation time by 40%.

- •Participated in over 100 client finance reviews, providing strategic advice that increased investment returns by 10%-15%.

- •Facilitated successful handling of legal tax disputes, representing clients and achieving favorable outcomes in 90% of cases.

- •Consulted with clients on capital gains tax strategies, resulting in optimized strategies saving $300,000 annually.

- •Analyzed client portfolios and provided strategic insights, increasing returns by 12% on average.

- •Implemented a client communication protocol, improving response times by 25% and enhancing client satisfaction.

- •Collaborated on a high-profile capital gains audit project, contributing to a successful closure with zero compliance issues.

- •Analyzed and prepared tax returns for individuals and corporations, focusing on capital gains and investment income.

- •Conducted in-depth research on tax regulations, providing reports that aided in client strategy development.

- •Supported senior accountants in audits, assisting in reconciling discrepancies and achieving a 95% accuracy rate.

- •Enhanced accuracy of tax reporting systems, resulting in a 15% reduction in filing errors.

Non-profit CPA Tax Accountant resume sample

- •Successfully filed over 300 diverse non-profit federal tax returns annually, ensuring compliance with IRS regulations and saving clients over $500,000 in penalties and fees.

- •Developed tax strategies for non-profit clients that reduced unrelated business income tax (UBIT) obligations by 20%, maximizing their funds available for mission-driven activities.

- •Supported audits by providing precise documentation and detailed explanations of non-profit tax matters, resulting in unqualified audit opinions for over two-thirds of reviewed clients.

- •Collaborated with financial teams to ensure accurate financial statements in accordance with GAAP, enhancing reporting accuracy and timeliness by 30% over previous years.

- •Conducted workshops on non-profit tax filing and compliance, educating over 150 practitioners leading to improved financial management across participating organizations.

- •Proactively monitored IRS regulatory changes affecting non-profits, enabling clients to prepare adequately for updates and maintaining compliance without any incidents of oversight.

- •Led a team in preparing tax filings for over 50 large-scale non-profit organizations, resulting in a 95% satisfaction rate from clients.

- •Designed and implemented a financial forecasting initiative that improved budget accuracy by 25% for several non-profit entities.

- •Advised non-profit clients on complex tax regulations, reducing liability by more than $300,000 through strategic compliance and planning.

- •Managed the transition to new accounting software for 12 non-profit clients, improving financial reporting efficiency by nearly 40%.

- •Coordinated with non-profit boards to create sustainable financial strategies, increasing their long-term funding stability by 30%.

- •Prepared accurate Form 990 filings and various schedules for over 40 non-profit organizations, maintaining 100% on-time submission rate.

- •Streamlined document management systems for tax filings, reducing manual processing time by 50% and minimizing errors across submissions.

- •Collaborated with accounting teams to align financial reporting with compliance requirements, facilitating more consistent regulatory adherence.

- •Introduced nonprofit financial literacy workshops, resulting in an improved understanding of tax liabilities among over 70 non-profit executives.

- •Supported tax preparation for small-scale non-profits, enhancing initial compliance infrastructure that improved future reporting accuracy.

- •Assisted in the detailed analysis of financial data for audit preparation, contributing to a 90% pass rate for non-profits in audits.

- •Analyzed tax implications of financial operations for clients, advising strategic changes that decreased tax responsibility by 15%.

- •Guided newly formed non-profits through initial tax filings, ensuring foundational compliance with all relevant regulations.

CPA Tax Accountant for Startups resume sample

- •Prepared and filed over 150 complex federal and state tax returns annually for startup clients, resulting in 98% client retention.

- •Conducted in-depth tax research and analysis that uncovered $500,000 in tax savings for clients over a fiscal year.

- •Designed and implemented tailor-made tax planning strategies for over 50 startups, reducing their average tax burden by 30%.

- •Advised clients on adjustments to accounting practices, leading to precise financial recording and 40% faster year-end reconciliations.

- •Collaborated with teams to update clients on tax law changes, enhancing compliance by 20% and reducing legal risks.

- •Mentored junior accountants, increasing their efficiency in tax form preparation by 15% within six months.

- •Managed tax compliance processes for 100+ emerging startups, ensuring adherence to local, state, and federal regulations.

- •Executed tax review sessions that identified potential liabilities and savings opportunities, saving clients a total of $200,000.

- •Developed comprehensive tax strategies for startups, driving alignment with business growth goals and increasing operational budget by 10%.

- •Led educational workshops on tax obligations and best practices, improving client understanding and satisfaction by 25%.

- •Partnered with tech-focused startups to optimize accounting systems integration, cutting bookkeeping time by 30%.

- •Prepared accurate tax returns for a portfolio of small businesses, achieving a 100% on-time filing record.

- •Developed tax-saving initiatives that reduced expenses by 20%, contributing to client business growth.

- •Provided expert guidance on the latest tax regulations, ensuring client compliance with all updated laws.

- •Established best-in-class financial record maintenance processes, improving data accuracy by 50%.

- •Supported senior consultants in tax planning for startups, facilitating $100,000 in tax savings.

- •Participated in client meetings to gather documentation, improving workflow efficiency by 40%.

- •Assisted in tax audits preparation, which enhanced client readiness and compliance.

- •Implemented an automated system for tracking tax law changes, decreasing manual errors by 70%.

CPA Tax Account Manager resume sample

- •Led a team responsible for preparing and filing 200+ complex federal and state tax returns annually, resulting in an improved client satisfaction score by 20%.

- •Implemented tax-saving strategies that reduced overall liabilities for clients by an average of 18% every fiscal year.

- •Conducted regular tax seminars for clients which increased client engagement and understanding of evolving tax regulations.

- •Developed a comprehensive client management system that streamlined processes, reducing filing errors by 30%.

- •Collaborated with cross-functional teams to integrate tax strategies enhancing financial planning services, boosting revenue by 25% over two years.

- •Managed a diverse portfolio with assets totaling over $50 million, ensuring timely and accurate compliance for all accounts.

- •Conducted in-depth tax research and updated procedures to align with new regulations, resulting in consistent compliance and minimized audit risks.

- •Trained and mentored junior staff, leading to a 40% increase in team productivity and career advancement.

- •Enhanced client profile analysis techniques, unlocking $2 million in previously unidentified tax deductions over a three-year span.

- •Crafted tailored tax strategies for high new-worth individuals that improved their post-tax cash flow by a remarkable 15%.

- •Facilitated cross-departmental projects aimed at integrating tax-saving initiatives, contributing to a 10% increase in client retention rate.

- •Prepared and reviewed tax returns for various entities including partnerships, ensuring compliance resulting in zero penalties.

- •Advised clients on acquisitions and restructuring projects, leading to a 12% decrease in their annual tax rates post-restructuring.

- •Provided support in tax audits that helped retain $500k in contested revenues for clients over multiple cases.

- •Developed successful communication strategies enhancing client understanding of complex tax rules and procedures.

- •Assisted in the preparation and processing of tax documents for over 100+ client firms, achieving a 95% satisfaction rate.

- •Improved internal review processes minimizing document processing time by 25%.

- •Collaborated on a team that increased total firm tax return accuracy by 15%.

- •Participated in developing a tax data analysis model that streamlined client reporting processes.

Navigating the job market as a CPA tax accountant can feel like deciphering a complex code. While your expertise in tax laws is impressive, turning that expertise into a compelling resume can be tricky. In such a competitive field, a polished resume is key to making your mark and landing the job you want.

Here’s where a well-crafted resume template can make a difference. It helps you organize your information and highlight your strengths in a clear, visually appealing way. Using a resume template simplifies the process and ensures your skills stand out to potential employers.

Condensing your extensive experience into a concise format is the real challenge. You need to strike a balance between being detailed and succinct. A great resume should reflect your ability to solve problems, your analytical strengths, and your meticulous attention to detail—all traits valuable to employers.

By effectively communicating your skills in handling complex tax situations and keeping up with changing regulations, you make your resume a clear representation of your value. Bringing all these elements together shows why you're the perfect fit for any accounting team. This guide will help you leverage your expertise to craft a resume that advances your career in the world of CPA tax accounting.

Key Takeaways

- A well-crafted resume template is crucial for CPA tax accountants to organize and highlight their expertise effectively.

- The reverse-chronological format is recommended for CPA resumes to showcase recent and relevant experiences clearly.

- Quantifiable achievements in your experience section, using action verbs and metrics, enhance the effectiveness of your resume.

- Hard and soft skills relevant to CPA roles should be featured prominently to catch recruiter and ATS attention.

- Educational background, relevant certifications, and extra sections like language skills and volunteer work boost overall resume appeal.

What to focus on when writing your CPA tax accountant resume

A CPA tax accountant resume should effectively highlight your expertise in tax accounting and demonstrate your ability to manage complex financial data with precision. It's important for recruiters to immediately recognize not only your problem-solving skills and attention to detail but also your capability in communicating financial information clearly. Your resume should paint a picture of reliability and efficiency, showcasing a proven track record in preparing tax returns while ensuring strict compliance with IRS regulations.

How to structure your CPA tax accountant resume

- Contact Information — Your contact details are the starting point, enabling potential employers to reach you easily. Include your full name, phone number, professional email, and LinkedIn profile. This section should be straightforward; an up-to-date LinkedIn profile can enhance your professional appeal. The accessibility of your contact information is key in setting the tone for follow-up communications.

- Professional Summary — This section briefly introduces your credentials and career highlights. Craft a summary that emphasizes your CPA certification, accumulated experience, and significant accomplishments in tax accounting. A well-written summary will capture the essence of your professional brand and set the foundation for how you are perceived by potential employers. It's a snapshot that leaves them wanting to know more about your contributions in the world of tax accounting.

- Professional Experience — Detailing your experience involves listing your previous job roles, mainly focusing on tax-related responsibilities. Use bullet points to illustrate your duties and achievements. Highlight experiences that involved tax return preparations, audit support, and compliance initiatives. Concrete examples of your work help portray your effectiveness in addressing complex financial challenges, adding depth to your narrative of professional growth.

- Education and Certifications — Your formal education and certifications are crucial in establishing your credibility. Detail relevant degrees in accounting or finance and certifications such as a CPA. Do not overlook additional qualifications like the Chartered Global Management Accountant (CGMA), which can set you apart. This section offers tangible proof of your qualifications and commitment to professional development.

- Skills — The skills section should reflect competencies directly related to tax accounting. Include tax compliance, tax planning, and proficiency in accounting software like QuickBooks or SAP, accompanied by strong analytical abilities. Superior communication skills are also crucial in effectively conveying complex financial data.

- Achievements — Enumerate any awards or recognition that highlight your effectiveness and innovation in your role as a CPA tax accountant. Whether these are successful audits or projects that improved processes, these achievements narrate your unique contributions and impact. This section underlines your value and relevance, showing tangible proof of success.

These elements form a comprehensive picture of your qualifications and expertise. It's essential your resume adopts a format that allows these sections to shine. In the following sections, we'll cover each aspect of the resume in greater depth, offering insights into crafting each part to emphasize your strengths as a CPA tax accountant.

Which resume format to choose

As a CPA tax accountant, crafting a strong resume is essential to highlight your expertise. The reverse-chronological format stands out as the most effective for your field. This format places your latest and most relevant experiences at the top, allowing potential employers to quickly grasp your career trajectory and most recent accomplishments, which could be crucial during tax season or fiscal year-end evaluations.

The choice of font can impact how your resume is perceived. Opt for modern fonts like Raleway, which provide a clean and refined look, suitable for the financial industry. Lato offers a balance of professionalism and warmth, creating an inviting yet serious tone. Montserrat combines modern aesthetics with legibility, ensuring your resume feels both current and accessible. These fonts maintain clarity, ensuring your detailed accomplishments remain easy to read.

When finalizing your resume, saving and sending it as a PDF is non-negotiable. This ensures the format remains consistent, safeguarding the integrity of your carefully crafted document across all devices and software. In a field like accounting, where precision is crucial, consistency in presentation underscores your attention to detail.

Don't overlook the importance of your resume's margins. A one-inch margin on all sides provides a clean, professional appearance, allowing your content the space it needs to stand out and be digestible. This simple design choice reflects the meticulousness expected of a CPA, making it easier for hiring managers to focus on your qualifications and skills. By integrating these elements, your resume becomes a compelling reflection of your capabilities as a CPA tax accountant.

How to write a quantifiable resume experience section

Every CPA tax accountant resume thrives with a strong experience section that highlights your achievements and impact. Start with your most recent job and work backward, keeping it within the last 10-15 years to maintain relevance. Include job titles that reflect the skills needed for the position you're aiming for, tailoring each resume to the specific job application. Emphasize roles and successes that align with the job ad, using impactful action words like “led,” “improved,” “achieved,” and “reduced” to bring your contributions to life. This approach helps clearly communicate your value to employers, showcasing your capability as a CPA tax accountant effectively.

Here's an example:

- •Reduced annual tax liability by 15% through strategic tax planning and optimization.

- •Led a team of 6 accountants to streamline tax processes, resulting in a 20% increase in efficiency.

- •Implemented a new tax software system that decreased filing errors by 30%.

- •Conducted audits and negotiated settlements, saving the company $500,000 in potential liabilities.

This experience section stands out by weaving quantifiable achievements into your job responsibilities, creating a cohesive narrative of impact and leadership. By using strong action words such as “reduced” and “led,” you highlight significant contributions that reveal your skills and effectiveness. The clear structure naturally guides the reader through improvements and economic impacts, which are crucial for a CPA tax accountant role. Tailoring becomes apparent through specific achievements like tax reduction, demonstrating your alignment with job ads seeking expertise in cost savings. This integrated approach ensures your experience remains engaging, relevant, and aligned with what accounting employers seek.

Technology-Focused resume experience section

A technology-focused CPA tax accountant resume experience section should showcase how your tech skills enhance your role. Start by highlighting your ability to use software that boosts efficiency and accuracy, making tasks easier and clients more satisfied. Mention specific tools you excel in and demonstrate their positive impact on your work. By sharing real-world examples where your tech expertise shines, you show the distinctive skills you contribute.

Include job titles, workplaces, and time frames for each role. Craft bullet points that clearly and concisely outline your key achievements, connecting improvements directly to the tools you've used. Use concrete metrics to illustrate the results of your efforts, reinforcing your statements. Tailor these descriptions to align with what your prospective employer values, ensuring your language stays precise and relevant for maximum impact.

Senior CPA Tax Accountant

Innovative Tax Solutions

January 2020 - Present

- Implemented cloud-based accounting software, boosting efficiency by 30%.

- Streamlined tax filing to cut errors by 40% using automation.

- Led development of an app for tracking expenses, enhancing client satisfaction.

- Trained team on advanced financial software, improving tax analysis accuracy.

Growth-Focused resume experience section

A growth-focused CPA tax accountant resume experience section should clearly show how you've contributed to increasing efficiency, revenue, or client satisfaction. Start by identifying a focus area, such as enhancing client retention or optimizing tax processes, and use specific achievements supported by numbers, percentages, or client feedback to demonstrate your impact. This not only highlights your results-oriented mindset but also connects your accomplishments directly with the company's goals, making your resume more compelling to employers.

Additionally, it's important to showcase teamwork and initiatives that led to significant growth, as these demonstrate your ability to collaborate effectively and drive positive changes. By writing in a clear and straightforward manner, you ensure your accomplishments are accessible and impressive to anyone reviewing your resume. This holistic approach helps your resume stand out to hiring managers by emphasizing both individual and collective achievements.

Senior Tax Accountant

Financial Solutions Inc.

June 2018 - Present

- Developed a client monitoring system that improved client retention by 20%

- Streamlined tax filing processes, reducing turnaround time by 15%

- Led a team initiative that boosted client satisfaction scores by 30%

- Collaborated with a cross-functional team to identify and implement cost-saving measures, achieving a 10% reduction in company expenses

Project-Focused resume experience section

A project-focused CPA tax accountant resume experience section should emphasize your ability to manage and deliver successful outcomes on complex tax projects. Begin by showcasing your job title and workplace, followed by the duration of your employment. Use bullet points to present each task or achievement in a clear and concise manner, utilizing action verbs and quantifiable results to highlight your contributions effectively. This approach ensures you demonstrate your expertise in driving tangible results.

Illustrate how your projects brought financial or operational benefits to the organization, with numbers to underscore your success. This strategy allows potential employers to quickly grasp the value of your skills and how they translate into benefits for their teams. Focus on recent, relevant projects to amplify the impact of your experience section. Your goal is to weave a narrative that consistently underscores your involvement and achievements, maintaining an engaging and coherent flow throughout.

CPA Tax Accountant

Accounting Solutions Group

June 2019 - Present

- Led a six-month project that resulted in a 15% reduction in tax liabilities for a major client.

- Worked closely with a team of five to streamline auditing processes, reducing review time by 30%.

- Implemented a new tax reporting software, enhancing data accuracy by 20% and boosting client satisfaction.

- Developed a training program for junior accountants, increasing their project turnaround time by 25%.

Responsibility-Focused resume experience section

A responsibility-focused CPA tax accountant resume experience section should clearly convey your skills and accomplishments in a cohesive manner. Start each bullet point with a strong action verb, emphasizing what you’ve achieved in your role. Highlight duties that illustrate your expertise in managing tax issues, ensuring compliance with regulations, and guiding financial decisions. Where possible, use numbers to quantify your successes, providing concrete evidence of your impact. This approach not only shows how well you handle challenges but also highlights how you contribute significant value.

Keep the language simple and direct, avoiding the use of excessive jargon. Focus on responsibilities that are directly relevant to the CPA position you’re pursuing, such as preparing tax documents, analyzing financial data, and maintaining compliance. Create a logical flow in your resume so potential employers can easily see the connection between your past experiences and the role you want. By interweaving your duties with your achievements, you’ll create a powerful resume that stands out in the job market.

Senior Tax Accountant

ABC Accounting Firm

January 2018 - Present

- Prepared and reviewed over 250 tax returns annually, ensuring 100% accuracy and compliance with IRS guidelines.

- Led a team of 5 junior accountants, providing training and support which improved departmental efficiency by 20%.

- Conducted thorough tax audits and resolved discrepancies resulting in a 15% reduction in client tax liabilities.

- Implemented a new filing system that streamlined document retrieval, reducing retrieval time by 40%.

Write your CPA tax accountant resume summary section

A CPA-focused tax accountant resume summary should capture your professional identity and highlight your top skills and achievements. It's essential to think about what sets you apart. Take this example for inspiration:

This approach works well because it quickly shows your extensive experience, building trust right away. By mentioning key skills like tax compliance and financial analysis, you tell employers you possess the necessary expertise. Highlighting achievements, such as reducing tax liabilities, paints a clear picture of the value you bring. Mentioning your software skills not only indicates your technical savvy but also aligns with modern demands in accounting roles. Words like "proven track record" and "expert" convey confidence, reassuring potential employers of your capabilities.

Understanding the difference between a resume summary and a resume objective is crucial. While a summary highlights past achievements and skills to provide a snapshot of your qualifications, an objective focuses more on your career goals and is typically used by less experienced applicants. A resume profile combines elements of both, adding more personality and aspirations. In contrast, a summary of qualifications offers bullet points of skills and achievements for a quick overview. For seasoned professionals like a CPA tax accountant, a summary is often the best choice. Ensure it is both engaging and concise to captivate employers and encourage them to learn more about you.

Listing your CPA tax accountant skills on your resume

A skills-focused CPA tax accountant resume should emphasize clarity and relevance across its sections. The skills section can stand alone or be integrated into your experience or summary areas, highlighting your technical and personal abilities. Your strengths often include soft skills like effective communication and interaction with others, while hard skills represent your technical prowess, such as mastering tax software—a crucial element for this role.

To make your resume stand out, the skills you present should serve as keywords that align with job postings, ensuring your resume captures the attention of recruiters and automated systems alike.

Here's an example of a standalone skills section:

This example excels by listing specific, essential skills that are crucial for a CPA tax accountant, making them easy to spot. Each skill is relevant to the field, enhancing your resume's appeal and ensuring it is recognized by both human reviewers and computer systems.

Best hard skills to feature on your CPA tax accountant resume

Highlighting hard skills in your resume conveys your technical expertise and ability to handle intricate financial data. These competencies demonstrate your readiness to tackle complex accounting duties efficiently.

Hard Skills

- Tax Preparation

- Financial Reporting

- GAAP Knowledge

- Tax Software Proficiency

- Financial Auditing

- Cost Accounting

- Budget Management

- Risk Assessment

- Financial Forecasting

- QuickBooks

- Excel Spreadsheet Manipulation

- Regulatory Compliance

- Internal Controls

- Data Analysis

- Financial Strategy

Best soft skills to feature on your CPA tax accountant resume

Emphasizing soft skills showcases your ability to collaborate effectively, manage time, and solve problems. These traits illustrate your capacity to maintain a harmonious and productive workplace environment.

Soft Skills

- Communication

- Attention to Detail

- Problem-Solving

- Time Management

- Critical Thinking

- Leadership

- Collaboration

- Adaptability

- Client Relationship Management

- Multitasking

- Decision-Making

- Analytical Thinking

- Integrity

- Teamwork

- Organizational Skills

How to include your education on your resume

The education section of your CPA tax accountant resume is crucial as it showcases your academic background and qualifications. Tailor this section to match the specific job you're applying for, omitting any education that doesn’t support your candidacy. Including your GPA can demonstrate your academic performance, especially if it's a 3.5 or higher; simply list it as "GPA: 3.8/4.0." If you graduated with honors, note "cum laude" directly after your degree, e.g., "Bachelor of Science in Accounting, cum laude." When listing a degree, start with the degree name, then the institution, followed by the location and date of completion.

Here's a poor example of an education section:

- •Participated in literature club.

Here's an effective example of an education section:

This good example is clear and focused on relevant accounting qualifications. It highlights a degree pertinent to the CPA tax accountant role, showcases a strong GPA, and notes the cum laude achievement. The absence of unnecessary details keeps this section concise and professional, perfectly aligning with the job.

How to include CPA tax accountant certificates on your resume

Including a certificates section in your CPA tax accountant resume is crucial. Certificates demonstrate your qualifications and specialized knowledge, making you stand out to potential employers. Follow these steps to create this section effectively.

List the name of the certificate first to grab attention. Include the date you obtained the certification to show its relevance. Add the issuing organization to lend credibility. You can also integrate certifications into your resume header for immediate visibility.

Example of a resume header with certifications:

John Smith, CPA Certified Public Accountant Licensed CPA (AICPA, 2015) Certified Taxation Specialist (CTC, 2020)

Example of a standalone certificates section:

The example is strong because it clearly lists pertinent certifications for a CPA tax accountant role, including both the title and issuing organization. This level of detail assures hiring managers of your verified expertise.

Extra sections to include in your CPA tax accountant resume

In today's competitive job market, crafting a standout resume is crucial for any professional, especially a CPA tax accountant. A well-rounded resume not only highlights your technical skills but also your diverse experiences and personal interests. This can help you stand out to potential employers and demonstrate that you are a well-rounded candidate.

- Language section — Highlight fluent languages to show your ability to communicate with diverse clients and coworkers. This can make you a valuable asset in global or multilingual environments.

- Hobbies and interests section — Showcase hobbies that align with your professional skills or demonstrate qualities like leadership or attention to detail. This gives your resume a personal touch and helps employers see you as a well-rounded individual.

- Volunteer work section — Document volunteer activities to illustrate your community engagement and ethical commitment. This can highlight your interpersonal skills and willingness to contribute beyond your job.

- Books section — List influential books you've read to reflect your continuous learning and intellectual curiosity. This can spark interest during interviews and show employers that you are always seeking to grow.

In Conclusion

In conclusion, creating an effective CPA tax accountant resume requires a careful combination of structure, clarity, and personalization. By using a structured template, you can ensure that all crucial elements such as contact information, professional summary, experience, education, and certifications are presented in an organized manner. Highlighting your skills, both technical and personal, with specific examples and metrics will help you stand out in a competitive field. Tailoring each resume for the specific job application by aligning your past experiences with the job requirements showcases your attention to detail and dedication.

Additionally, choosing the right resume format and font can further enhance the presentation of your qualifications, making them easy to read and professional in appearance. Including extra sections such as language proficiency, hobbies, or volunteer work can add a personal touch to your resume, showing employers that you are a well-rounded candidate with diverse interests. Remember, every detail in your resume counts toward making a lasting impression on potential employers. By strategically crafting your resume, you not only highlight your technical expertise but also your unique contributions to the field of accounting. This thoughtful approach positions you as the ideal candidate, ready to tackle the complexities of CPA tax accounting with proficiency and enthusiasm.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.