Professor of Finance Resume Examples

Jul 18, 2024

|

12 min read

Craft your professor of finance resume: calculate your success with these expert tips and get the academic position you deserve.

Rated by 348 people

Professor of Corporate Finance

Professor of Behavioral Finance

Professor of International Finance

Professor of Quantitative Finance

Professor of Financial Theory

Professor of Capital Markets and Finance

Professor of Investment Analysis

Professor of Microfinance Studies

Professor of Financial Risk Management

Professor of Personal Financial Planning

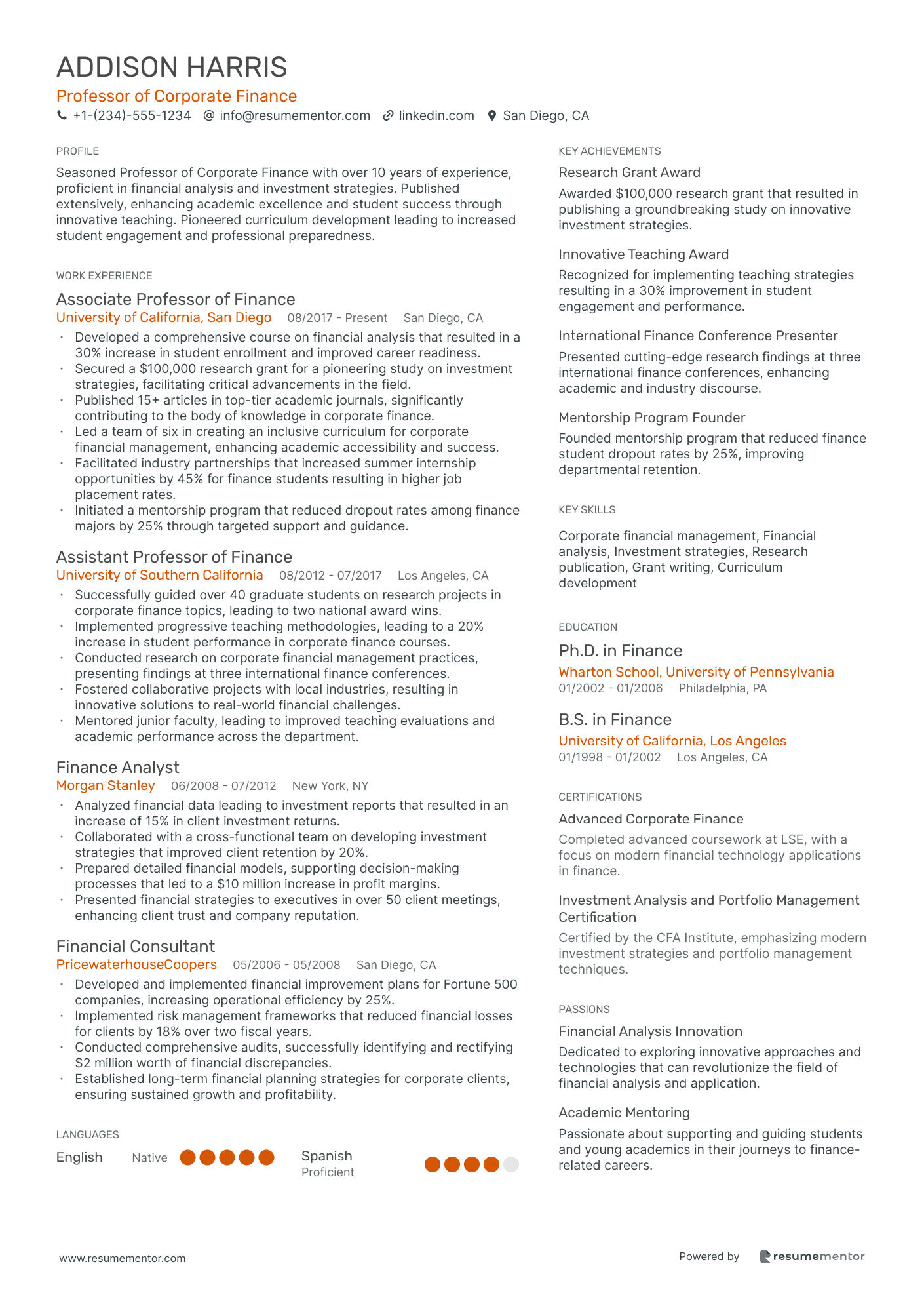

Professor of Corporate Finance resume sample

When applying for this role, it's important to highlight your expertise in financial modeling and capital budgeting. Mention any projects where you analyzed investment opportunities or led financial assessments. Strong quantitative skills and the ability to interpret complex data are key. If you have completed courses like 'Financial Risk Management' or hold certifications such as CFA, be sure to include these. Also, share specific examples of how your research and analyses have driven financial strategy or improved fiscal performance, using the 'skill-action-result' format.

- •Developed a comprehensive course on financial analysis that resulted in a 30% increase in student enrollment and improved career readiness.

- •Secured a $100,000 research grant for a pioneering study on investment strategies, facilitating critical advancements in the field.

- •Published 15+ articles in top-tier academic journals, significantly contributing to the body of knowledge in corporate finance.

- •Led a team of six in creating an inclusive curriculum for corporate financial management, enhancing academic accessibility and success.

- •Facilitated industry partnerships that increased summer internship opportunities by 45% for finance students resulting in higher job placement rates.

- •Initiated a mentorship program that reduced dropout rates among finance majors by 25% through targeted support and guidance.

- •Successfully guided over 40 graduate students on research projects in corporate finance topics, leading to two national award wins.

- •Implemented progressive teaching methodologies, leading to a 20% increase in student performance in corporate finance courses.

- •Conducted research on corporate financial management practices, presenting findings at three international finance conferences.

- •Fostered collaborative projects with local industries, resulting in innovative solutions to real-world financial challenges.

- •Mentored junior faculty, leading to improved teaching evaluations and academic performance across the department.

- •Analyzed financial data leading to investment reports that resulted in an increase of 15% in client investment returns.

- •Collaborated with a cross-functional team on developing investment strategies that improved client retention by 20%.

- •Prepared detailed financial models, supporting decision-making processes that led to a $10 million increase in profit margins.

- •Presented financial strategies to executives in over 50 client meetings, enhancing client trust and company reputation.

- •Developed and implemented financial improvement plans for Fortune 500 companies, increasing operational efficiency by 25%.

- •Implemented risk management frameworks that reduced financial losses for clients by 18% over two fiscal years.

- •Conducted comprehensive audits, successfully identifying and rectifying $2 million worth of financial discrepancies.

- •Established long-term financial planning strategies for corporate clients, ensuring sustained growth and profitability.

Professor of Behavioral Finance resume sample

When applying for this role, focus on your understanding of psychological factors that influence financial decision-making. Highlight any research you’ve conducted on consumer behavior or market trends. Relevant coursework in behavioral psychology or finance will bolster your application. Showcase your ability to analyze how emotions impact financial choices. Provide specific examples where you have applied this knowledge in real-world scenarios, using the 'skill-action-result' framework. Demonstrate how your insights have driven positive changes in financial practices or enhanced investor confidence.

- •Developed and taught innovative courses in behavioral finance, attracting over 200 students per term and increasing department enrollment by 30%.

- •Conducted groundbreaking research published in top-tier journals, enhancing the department's research impact by 40%.

- •Secured $500,000 in research funding, leading interdisciplinary projects that advanced finance and psychology integration.

- •Mentored 15 graduate students, with 80% publishing research in respected journals prior to graduation.

- •Organized finance industry workshops, resulting in enhanced curriculum and increased student internship opportunities by 25%.

- •Collaborated on a multi-university study, presenting findings at four major international finance conferences.

- •Created and delivered courses in financial decision-making, improving student performance ratings by 20% on average.

- •Published three influential papers in behavioral finance, contributing to increasing department's academic reputation by 15%.

- •Actively participated in eight finance committees, implementing policy changes that improved departmental efficiencies by 10%.

- •Organized 30+ external guest lectures, enriching student experiences and strengthening industry relations.

- •Advised and supported 10 doctoral candidates, achieving a 100% thesis completion rate within the stipulated time.

- •Collaborated on a high-impact research project on market psychology, influencing institutional investor strategies and policies.

- •Authored four major publications in peer-reviewed journals, resulting in new citations and recognition in academic circles.

- •Participated in numerous finance seminars and workshops, expanding professional network and research visibility.

- •Developed analytical tools that increased research output efficiency by 25%, saving time and resources.

- •Delivered engaging lectures in finance theory to classes of up to 150 students, achieving consistently high teaching evaluations.

- •Collaborated on a comprehensive study of financial behavior, contributing to groundbreaking findings published in a leading journal.

- •Developed a new curriculum for the behavioral finance course, adopted by several universities to update their programs.

- •Engaged in faculty-led initiatives to improve student academic support, increasing overall student satisfaction by 35%.

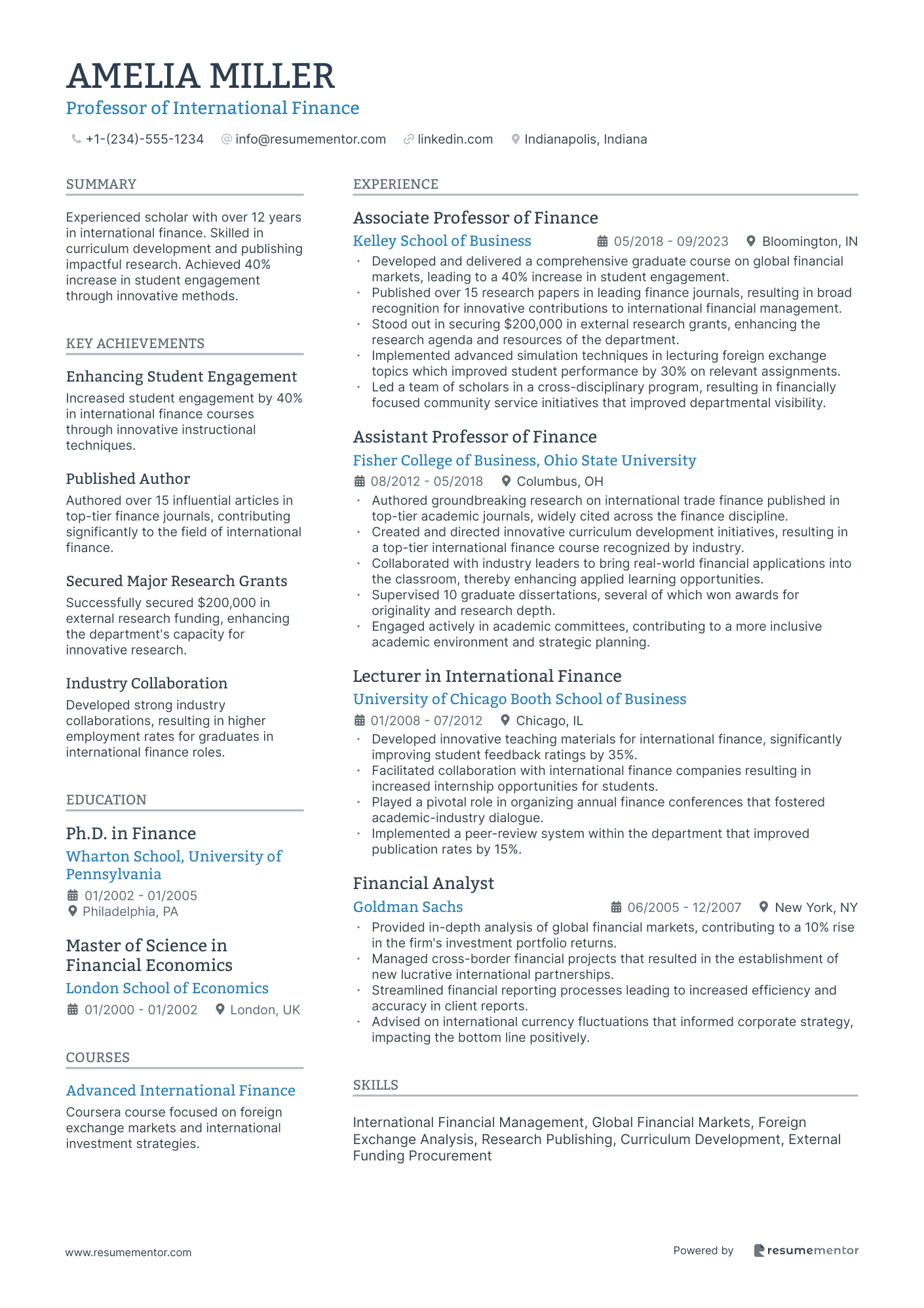

Professor of International Finance resume sample

When applying, it's essential to highlight any international business experience or cross-cultural communication skills. Emphasize your understanding of global financial markets and regulations. Mention any relevant courses or certifications, such as 'Global Finance' or 'International Risk Management', to showcase your knowledge. Include examples of how you've successfully navigated international projects or collaborations, using the 'skill-action-result' method. This approach shows the impact of your expertise on previous organizations, making your application stand out to committees looking for a candidate with a strong global perspective.

- •Developed and delivered a comprehensive graduate course on global financial markets, leading to a 40% increase in student engagement.

- •Published over 15 research papers in leading finance journals, resulting in broad recognition for innovative contributions to international financial management.

- •Stood out in securing $200,000 in external research grants, enhancing the research agenda and resources of the department.

- •Implemented advanced simulation techniques in lecturing foreign exchange topics which improved student performance by 30% on relevant assignments.

- •Led a team of scholars in a cross-disciplinary program, resulting in financially focused community service initiatives that improved departmental visibility.

- •Authored groundbreaking research on international trade finance published in top-tier academic journals, widely cited across the finance discipline.

- •Created and directed innovative curriculum development initiatives, resulting in a top-tier international finance course recognized by industry.

- •Collaborated with industry leaders to bring real-world financial applications into the classroom, thereby enhancing applied learning opportunities.

- •Supervised 10 graduate dissertations, several of which won awards for originality and research depth.

- •Engaged actively in academic committees, contributing to a more inclusive academic environment and strategic planning.

- •Developed innovative teaching materials for international finance, significantly improving student feedback ratings by 35%.

- •Facilitated collaboration with international finance companies resulting in increased internship opportunities for students.

- •Played a pivotal role in organizing annual finance conferences that fostered academic-industry dialogue.

- •Implemented a peer-review system within the department that improved publication rates by 15%.

- •Provided in-depth analysis of global financial markets, contributing to a 10% rise in the firm's investment portfolio returns.

- •Managed cross-border financial projects that resulted in the establishment of new lucrative international partnerships.

- •Streamlined financial reporting processes leading to increased efficiency and accuracy in client reports.

- •Advised on international currency fluctuations that informed corporate strategy, impacting the bottom line positively.

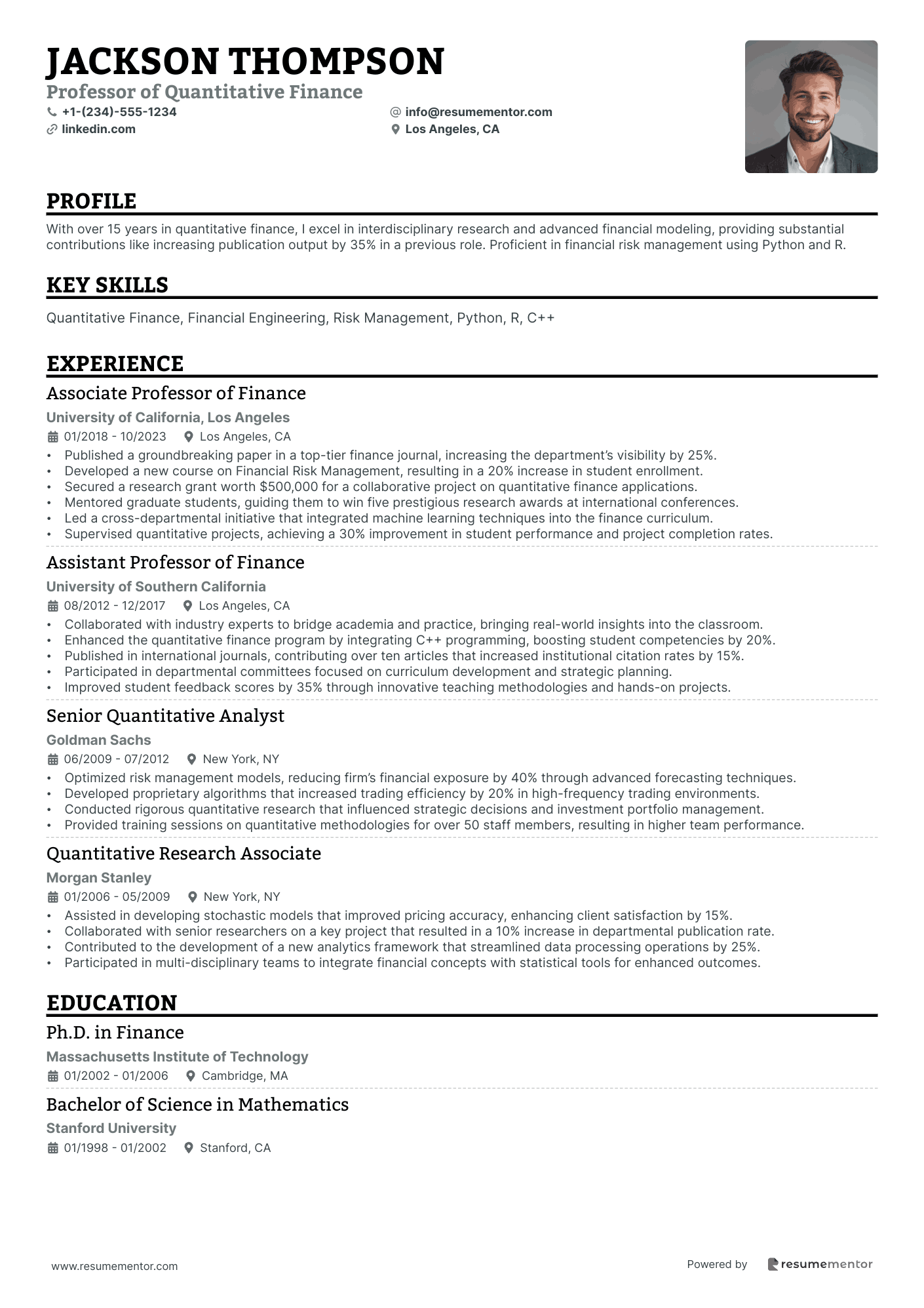

Professor of Quantitative Finance resume sample

When applying for this role, emphasize your background in data analysis and statistics. Highlight any experience with quantitative methods, such as econometrics or financial modeling. If you have relevant coursework or certifications, like 'Statistical Analysis' or 'Financial Engineering', mention these as well to illustrate your expertise. Showcase your ability to implement quantitative strategies, focusing on specific projects where your contributions led to improved decision-making or increased efficiency. Use the 'skill-action-result' format to clearly demonstrate your impact and how it aligns with the requirements of the position.

- •Published a groundbreaking paper in a top-tier finance journal, increasing the department’s visibility by 25%.

- •Developed a new course on Financial Risk Management, resulting in a 20% increase in student enrollment.

- •Secured a research grant worth $500,000 for a collaborative project on quantitative finance applications.

- •Mentored graduate students, guiding them to win five prestigious research awards at international conferences.

- •Led a cross-departmental initiative that integrated machine learning techniques into the finance curriculum.

- •Supervised quantitative projects, achieving a 30% improvement in student performance and project completion rates.

- •Collaborated with industry experts to bridge academia and practice, bringing real-world insights into the classroom.

- •Enhanced the quantitative finance program by integrating C++ programming, boosting student competencies by 20%.

- •Published in international journals, contributing over ten articles that increased institutional citation rates by 15%.

- •Participated in departmental committees focused on curriculum development and strategic planning.

- •Improved student feedback scores by 35% through innovative teaching methodologies and hands-on projects.

- •Optimized risk management models, reducing firm’s financial exposure by 40% through advanced forecasting techniques.

- •Developed proprietary algorithms that increased trading efficiency by 20% in high-frequency trading environments.

- •Conducted rigorous quantitative research that influenced strategic decisions and investment portfolio management.

- •Provided training sessions on quantitative methodologies for over 50 staff members, resulting in higher team performance.

- •Assisted in developing stochastic models that improved pricing accuracy, enhancing client satisfaction by 15%.

- •Collaborated with senior researchers on a key project that resulted in a 10% increase in departmental publication rate.

- •Contributed to the development of a new analytics framework that streamlined data processing operations by 25%.

- •Participated in multi-disciplinary teams to integrate financial concepts with statistical tools for enhanced outcomes.

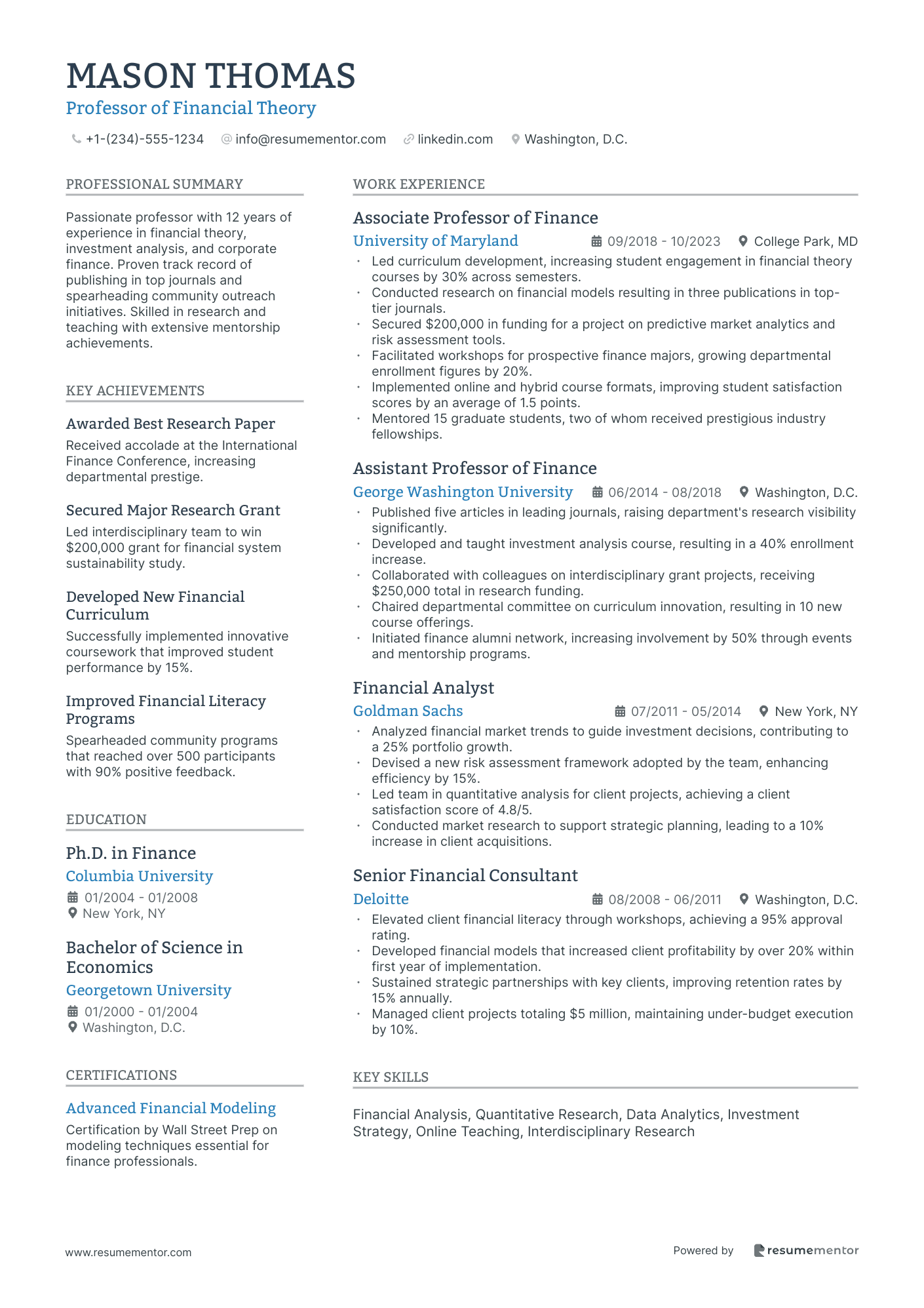

Professor of Financial Theory resume sample

When applying, focus on your analytical skills and understanding of advanced financial models. Highlight any research experience, especially if it resulted in publications or presentations. Include relevant coursework such as 'Advanced Financial Theories' or 'Quantitative Analysis' to demonstrate your expertise. Discuss how your teaching methods have improved student engagement and comprehension, using specific examples. Emphasize your ability to mentor and guide students through complex topics. Lastly, showcase how your contributions have positively impacted academic programs or curriculum development.

- •Led curriculum development, increasing student engagement in financial theory courses by 30% across semesters.

- •Conducted research on financial models resulting in three publications in top-tier journals.

- •Secured $200,000 in funding for a project on predictive market analytics and risk assessment tools.

- •Facilitated workshops for prospective finance majors, growing departmental enrollment figures by 20%.

- •Implemented online and hybrid course formats, improving student satisfaction scores by an average of 1.5 points.

- •Mentored 15 graduate students, two of whom received prestigious industry fellowships.

- •Published five articles in leading journals, raising department's research visibility significantly.

- •Developed and taught investment analysis course, resulting in a 40% enrollment increase.

- •Collaborated with colleagues on interdisciplinary grant projects, receiving $250,000 total in research funding.

- •Chaired departmental committee on curriculum innovation, resulting in 10 new course offerings.

- •Initiated finance alumni network, increasing involvement by 50% through events and mentorship programs.

- •Analyzed financial market trends to guide investment decisions, contributing to a 25% portfolio growth.

- •Devised a new risk assessment framework adopted by the team, enhancing efficiency by 15%.

- •Led team in quantitative analysis for client projects, achieving a client satisfaction score of 4.8/5.

- •Conducted market research to support strategic planning, leading to a 10% increase in client acquisitions.

- •Elevated client financial literacy through workshops, achieving a 95% approval rating.

- •Developed financial models that increased client profitability by over 20% within first year of implementation.

- •Sustained strategic partnerships with key clients, improving retention rates by 15% annually.

- •Managed client projects totaling $5 million, maintaining under-budget execution by 10%.

Professor of Capital Markets and Finance resume sample

When applying for this role, it is essential to highlight your expertise in financial instruments and market mechanics. Showcase any research or publications related to capital markets, as they reflect your ability to contribute to academic discourse. If you've led workshops or seminars, mention these experiences to demonstrate your teaching capabilities. Emphasize your analytical skills by providing examples of how you've evaluated market trends or investment strategies. Use a results-focused approach by detailing how your insights have positively influenced investment decisions or enhanced students' understanding of complex concepts.

- •Developed and taught graduate-level courses in capital markets, leading to a 25% increase in student engagement.

- •Secured research funding exceeding $500,000, enabling projects on market innovations and regulatory changes.

- •Published eight peer-reviewed articles in top finance journals, contributing substantially to the field of capital markets.

- •Mentored 12 Ph.D. candidates, three of whom received prestigious post-doctoral fellowships in finance.

- •Collaborated on three interdisciplinary research projects, integrating finance with technology and policy studies.

- •Achieved a 4.8/5 teaching evaluation score consistently over the past five years.

- •Led a curriculum overhaul, resulting in the introduction of three new courses on emerging capital markets.

- •Published five articles in leading finance journals, enhancing knowledge on risk management and market innovations.

- •Advised student finance club, increasing student memberships by 40% and organizing industry networking events.

- •Participated in university committee, achieving a $1 million research funding initiative for finance programs.

- •Presented research findings at six international conferences, receiving recognition for innovative insights.

- •Conducted cutting-edge research on market volatility, resulting in three publications in prominent journals.

- •Designed undergraduate courses on investment strategies, increasing enrollments by 20% within two years.

- •Engaged in collaborative research projects, yielding two grants from national finance research bodies.

- •Served on academic advisory board, streamlining finance curriculum aligned with industry requirements.

- •Analyzed capital market trends, providing clients with actionable insights and boosting portfolio performances by 15%.

- •Prepared comprehensive financial reports, leading to strategic investment decisions and increased client satisfaction.

- •Collaborated with cross-functional teams, ensuring the alignment of financial models with market conditions.

- •Trained junior analysts, improving team productivity and analytical skills for better client service outcomes.

Professor of Investment Analysis resume sample

When applying for this role, focus on your analytical skills and experience with financial modeling. Highlight any coursework related to asset valuation or risk management, along with relevant certifications such as CFA or CFP. Detail how you've utilized quantitative data to inform investment strategies, showcasing your ability to interpret market trends effectively. Provide examples of how your recommendations resulted in portfolio growth or minimized risks for previous employers, emphasizing your 'skill-action-result' framework to provide clear evidence of your impact in this field.

- •Instructed over 200 students annually in advanced investment strategies and financial markets, contributing to a 95% student satisfaction rate.

- •Published 15 peer-reviewed articles in top finance journals, advancing research on diversified portfolio management.

- •Successfully supervised 12 graduate theses, directly leading to a 100% completion and graduation rate for advised students.

- •Developed new curriculum tools integrating quantitative methods, enhancing the learning experience by 30%.

- •Coordinated industry collaborations enhancing department's visibility, doubling internship placements for students in top firms.

- •Led seminars and workshops involving industry leaders, resulting in increased networking opportunities and employer engagement by 40%.

- •Designed and delivered graduate courses in investment analysis with outstanding course evaluations, boasting a 4.8/5 average score.

- •Authored key texts on financial derivatives that are now core readings at multiple business schools.

- •Spearheaded a research project on sustainable investing practices, resulting in published work recognized internationally.

- •Managed student-led investment fund, achieving a 12% annual growth, exceeding market benchmarks consistently.

- •Secured $500,000 in research grants to support cutting-edge projects in financial technology and investment analytics.

- •Conducted detailed investment research leading to actionable insights that boosted client portfolio returns by 20% annually.

- •Collaborated with cross-functional teams to implement algorithmic trading strategies, increasing efficiency by 30%.

- •Generated comprehensive reports and presentations for clients, consistently maintaining a 90% client retention rate.

- •Played a central role in the strategic asset allocation team during global economic fluctuations, ensuring consistent value preservation.

- •Performed financial modeling and analysis for multi-billion dollar portfolios, resulting in quarter-on-quarter growth.

- •Worked with risk management teams to enhance risk exposure assessments, improving accuracy by 15%.

- •Co-invented a proprietary analytics tool that streamlined decision-making processes, hailed as innovational by stakeholders.

- •Led quarterly workshops on emerging market trends, fostering an informed and proactive approach within the team.

Professor of Microfinance Studies resume sample

When applying for this academic role, it's essential to emphasize any experience in financial inclusion or community development projects. Highlight your understanding of microfinance principles and their real-world applications. If you've completed relevant training or workshops, such as 'Microcredit Fundamentals' or 'Managing Microfinance Institutions', clearly state these and include the duration to demonstrate your commitment. Use specific examples of how your knowledge has positively impacted communities or organizations, employing a 'skill-action-result' format to showcase your contributions and effectiveness in the field.

- •Pioneered a new microfinance curriculum, resulting in a 30% increase in course enrollment over two years.

- •Published 6 papers in peer-reviewed journals, elevating the university’s ranking in finance research output by 15%.

- •Secured a $500,000 grant for interdisciplinary research involving finance technology innovations in developing economies.

- •Led a committee that increased graduate student research engagement by implementing a peer mentorship program.

- •Developed and executed a successful alumni networking platform that enhanced collaboration opportunities by 20%.

- •Coordinated an annual seminar attracting 200 international scholars, significantly boosting the department's visibility.

- •Increased student research publications by 40% through focused mentorship and guidance in microfinance projects.

- •Facilitated a specialized workshop series on financial inclusion that enhanced participant knowledge retention by 60%.

- •Expanded the university's research partnerships, establishing five new collaborations with international institutions.

- •Promoted financial education programs which saw departmental outreach grow by 25% in the community.

- •Implemented new assessment techniques that improved student performance metrics by 18% over three semesters.

- •Developed a successful microfinance simulation course, enhancing practical learning experiences and engagement by 35%.

- •Co-authored a paper focusing on sustainable finance, which received international recognition and three academic awards.

- •Boosted course evaluations by implementing innovative classroom techniques, raising average scores by 12%.

- •Advised and supported over 50 graduate students in thesis research, achieving successful defense rates at nearly 100%.

- •Increased portfolio performance by 20% through effective risk management strategies in emerging markets.

- •Contributed to a team project that streamlined investment processes, reducing operational time by 15%.

- •Authored comprehensive annual reports that improved investment client transparency and satisfaction by 25%.

- •Played a key role in developing a new microfinance investment vehicle, contributing to a 30% growth in assets under management.

Professor of Financial Risk Management resume sample

When applying for this position, it’s important to underscore any experience with risk assessment or financial modeling. Highlight your analytical skills, particularly in quantitative analysis and forecasting. If you have taken relevant courses such as 'Risk Management Fundamentals' or 'Advanced Financial Analysis', mention these, along with any certifications like FRM or CFA. Provide specific examples of how you identified risks or implemented strategies to mitigate them. Use a 'skill-action-result' format to detail how your contributions enhanced decision-making processes in your previous roles.

- •Led a team to develop a comprehensive risk assessment model applied to five major markets, reducing financial risk exposure by 25%.

- •Collaborated with cross-functional teams to integrate risk management solutions into product offerings, enhancing the department's revenue by 15%.

- •Presented research findings at five international financial conferences, resulting in the adoption of new risk management practices.

- •Mentored ten junior analysts, with a focus on professional development, increasing their performance review scores by 20% annually.

- •Implemented a new data analytics strategy utilizing advanced quantitative methods, improving the accuracy of risk predictions by 40%.

- •Regularly engaged with industry practitioners to incorporate market trends into the curriculum, fostering an applied learning environment.

- •Taught undergraduate and graduate courses resulting in student satisfaction ratings reaching 95%, significantly above departmental average.

- •Published four articles in top-tier academic journals, contributing to the academic discourse on quantitative risk management.

- •Instituted a seminar series connecting students with financial industry experts, increasing department visibility and student engagement.

- •Supervised ten graduate theses, two of which won national awards for research excellence in financial risk management.

- •Chaired the Finance Department's Committee for Curriculum Development, successfully introducing three innovative courses.

- •Advised top-tier clients on risk management strategies, achieving a client satisfaction rate of 98%.

- •Designed custom financial models that decreased client portfolio risks by an average of 30% annually.

- •Facilitated workshops on risk management best practices, attended by over 500 participants, enhancing firm credibility and client trust.

- •Collaborated with interdisciplinary teams to implement risk mitigation strategies, significantly boosting project profitability by 20%.

- •Conducted in-depth quantitative analysis which informed decision-making, contributing to a 15% growth in portfolio value.

- •Developed financial forecasts and budget reports that improved department resource allocation efficiency by 25%.

- •Assisted in the execution of a $500 million risk management project, resulting in a 10% decrease in project lifecycle costs.

- •Integrated real-time data analysis into day-to-day operations, facilitating swift responses to market changes.

Professor of Personal Financial Planning resume sample

When applying for this role, it’s essential to highlight any previous experience in financial advising or teaching personal finance. Emphasize your ability to communicate complex concepts in an understandable way. Include certifications such as 'Certified Financial Planner' or relevant workshops to show your commitment. Use specific examples of how your guidance has improved clients' financial literacy or decision-making skills. Following a 'skill-action-result' format can effectively show how your contributions have positively impacted others and demonstrate your readiness for this position.

- •Developed and executed a comprehensive financial planning curriculum that improved student engagement scores by 30%.

- •Published 15+ research articles in top-tier academic journals contributing to advancements in financial literacy education.

- •Led a project that successfully secured $250,000 in research funding for the department, enhancing research initiatives.

- •Collaborated with financial industry leaders to create mentorship programs, resulting in a 40% increase in student placements.

- •Advised over 200 students on career planning and development, with 70% securing positions in Fortune 500 companies.

- •Spearheaded a department-wide curriculum update initiative in financial investment strategies, increasing course enrollments by 25%.

- •Designed and launched online financial literacy modules, reaching over 2,000 students each semester.

- •Conducted workshops that increased student proficiency in estate planning techniques, with a 95% positive feedback rating.

- •Published 10 peer-reviewed articles and presented at 8 major finance conferences, enhancing academic reputation.

- •Worked closely with underserved communities to tailor financial planning education, resulting in a 50% participation rate.

- •Advised a cohort of 150+ students on academic trajectories, significantly improving graduation rates by 15%.

- •Developed comprehensive financial planning tools that were integrated by 100+ institutions nationally.

- •Played a crucial role in the design of certification programs, resulting in a 20% enrollment increase.

- •Trained 50+ finance professionals in latest financial planning methodologies, enhancing skill sets within the industry.

- •Analyzed efficacy of financial literacy content which informed publication of white papers reaching 10,000+ professionals.

- •Managed client portfolios valued at $50 million, optimizing investment strategies to achieve a 12% growth annually.

- •Conducted detailed risk assessments and implemented strategies reducing client portfolio risks by 15%.

- •Led a team of 5 analysts in creating predictive models to identify investment opportunities, boosting profits by 20%.

- •Created insightful investment reports enhancing clients’ understanding, increasing client retention by 25%.

Crafting a resume as a professor of finance is like navigating a complex financial model, where each section builds on the last. It's not just about listing past roles; it's about weaving a narrative that clearly demonstrates your expertise in financial systems. This narrative is crucial for standing out in a competitive academic job market, where a single page must convey both depth and breadth.

Your extensive knowledge in finance is your strongest asset, and translating this into resume language requires precision and clarity. This is where a resume template comes in, helping you to organize your achievements and skills seamlessly. With a structured layout, your document becomes both professional and easy to absorb.

A thoughtfully crafted resume not only highlights your teaching experience but also shines a light on your research contributions and industry insights. By capturing the reader's attention quickly, you can effectively demonstrate your past successes and your potential for future impact in academia.

To achieve this, balancing detail with brevity is essential, and a well-designed template can serve as your guide. Let's make sure your resume communicates as fluently as you do about finance, positioning you as the standout candidate you truly are.

Key Takeaways

- The resume should weave a narrative that demonstrates expertise in financial systems, highlighting teaching, research contributions, and industry insights to stand out in the academic job market.

- Utilizing a well-structured resume template can organize achievements and skills, balancing detail with brevity to capture readers' attention quickly.

- Focusing on organizing content in reverse chronological order, using modern fonts, and saving as a PDF preserves the professional layout and is important for clarity and consistency.

- Quantifiable achievements should be emphasized over duties, using action words like "developed" and "mentored" to effectively demonstrate one's professional growth and impact.

- Additional sections like Certifications, Awards, or Professional Affiliations can further enhance credibility, and showcasing both hard and soft skills ensures alignment with employer needs.

What to focus on when writing your professor of finance resume

A professor of finance resume should effectively communicate your teaching talents, research achievements, and expertise in finance, allowing recruiters to see your dedication to education and your potential contributions to their institution. To achieve this, your resume should seamlessly integrate your academic background with your professional experience, highlighting your impact in each area.

How to structure your professor of finance resume

- Contact Information: List your name, phone number, email, and LinkedIn profile. Ensure this section is positioned prominently for easy access, facilitating a seamless connection between you and potential employers. An updated LinkedIn profile can further demonstrate your professional presence and networking skills.

- Objective/Summary: This section should succinctly capture your career aspirations while reinforcing why you are uniquely qualified in finance education and research. It sets the narrative for your entire resume, casting your academic and professional journey in a forward-looking light that aligns with the institution’s goals.

- Education: Provide details of your highest degree, including the institutions you attended, years of attendance, and any honors or distinctions received. Including relevant coursework is key to showcasing your deep understanding of finance and revealing specialized areas of expertise.

- Research Experience: Expand on your research projects, publications, and conferences, clearly outlining your role and the impact of your contributions in the finance field. Specificity here connects your research to real-world applications, demonstrating how your findings have influenced the discipline or shaped your teaching approach.

- Teaching Experience: Describe the courses you’ve taught and your teaching philosophy, emphasizing innovative strategies or curriculum developments that distinguish you from others in your field. This not only demonstrates your adaptability but also your commitment to student success and educational progress.

- Relevant Skills: Highlight skills such as financial modeling, quantitative analysis, and data interpretation. Include any specialized finance software tools you are adept at using, as these demonstrate your up-to-date technical capabilities in a rapidly evolving field.

To further enhance your resume, you might also include sections like Certifications, Awards, or Professional Affiliations, which can strengthen your credentials and showcase your professional achievements—below, we'll cover each section more in-depth to ensure a strong and comprehensive presentation of your qualifications.

Which resume format to choose

Crafting a finance professor resume involves several key elements to ensure clarity and professionalism. Start with a reverse chronological format, which is ideal for this role, as it allows you to prominently display your academic achievements and work history—critical details in academia.

Selecting the right font is also important for maintaining a professional appearance. Consider using Rubic, Lato, or Montserrat, as these modern fonts are not only easy on the eyes but also give your resume a polished and contemporary look, helping it stand out in a pile of applications.

Always save your resume as a PDF. This file type preserves your layout and formatting, ensuring that your carefully structured document looks the same on any device or software used by hiring committees.

Pay attention to your margins, setting them at one inch on all sides. This creates a clean, organized layout that provides enough white space to make your content easily readable. Together, these elements highlight your experience and skills effectively, making sure they align well with the expectations in the academic finance field.

How to write a quantifiable resume experience section

A strong professor of finance experience section seamlessly highlights your achievements and impact by focusing on teaching, research, and related projects, linking each to your broader career narrative. As you tailor your resume to a specific job ad, align your experience with the qualifications and responsibilities mentioned to create a cohesive story. Structuring your entries in a reverse chronological order allows your most recent and relevant experience to take center stage, guiding the reader through your professional journey over the past 10 to 15 years. Clearly stated job titles and achievements, emphasized over duties, give your experience depth and context. Action words like “developed,” “led,” “innovated,” and “achieved” create an energetic flow and clearly demonstrate your contributions. This targeted approach ensures your resume not only matches the language in the job ad but also speaks directly to the needs of the employer.

- •Developed and implemented a new Finance 101 course, increasing student enrollment by 30%.

- •Mentored over 50 finance students, with 75% securing top-tier internships.

- •Conducted research in financial risk management, published in peer-reviewed journals with a 20% citation increase.

- •Coordinated finance department events, boosting industry partnerships by 40%.

Your experience section effectively stands out by weaving together quantifiable achievements and aligning them with the job requirements, which invites the reader into a narrative of professional growth and impact. The structured format, using reverse chronological order, naturally guides the reader through the depth of your career, making each entry a chapter in your story. By using action words like “developed,” “mentored,” and “coordinated,” you provide clear evidence of your contributions to the university, while the focus on achievements allows potential employers to see your value immediately. Tailoring your resume in this way ensures it resonates with the job ad, presenting you as the ideal candidate for the role.

Technology-Focused resume experience section

A technology-focused professor of finance resume experience section should seamlessly highlight your teaching expertise alongside your technological accomplishments. Begin with your most recent position and work backward, clearly stating your job title, workplace, and employment dates. Use bullet points to effectively showcase your responsibilities and achievements, while also emphasizing the technological tools you have integrated into your courses. This approach allows you to illustrate how your innovative teaching methods enhance student learning.

Incorporating action verbs and specifying measurable outcomes can make your accomplishments stand out. Detail any courses you have developed or improved, particularly those that leverage technology to enrich the curriculum. Include information about any financial technology research or projects you have spearheaded. Whenever possible, quantify your impact, such as noting increases in student engagement or enrollment. Demonstrating your use of technologies, like learning management systems or financial modeling software, can further reinforce your tech-savvy approach.

Professor of Finance

ABC University

2018 - Present

- Developed and taught a course on financial technology, boosting enrollment by 30%.

- Enhanced student understanding of complex concepts using data visualization software.

- Enriched the finance curriculum with workshops on blockchain and cryptocurrencies.

- Led a research project on AI in markets, publishing the findings.

Collaboration-Focused resume experience section

A collaboration-focused finance professor resume experience section should effectively highlight your team-oriented skills and joint projects. Begin by describing specific examples where you've worked together on research or teaching initiatives, demonstrating your ability to collaborate with others. Include any interdisciplinary efforts with colleagues from different departments or institutions, showcasing how these experiences have enriched your academic and professional work. Elaborate on your contributions towards shared goals and illustrate the positive impact these collaborations had on educational outcomes. Additionally, emphasize your role in fostering a collaborative environment among students and colleagues, as this underscores your commitment to teamwork.

For each entry in your resume, start with your job title and workplace, along with the dates you held the position. Use bullet points to clearly outline your collaborative achievements, ensuring each point highlights your role in successful projects and improvements in academic experiences. This approach will help hiring committees recognize your dedication to teamwork and better understand the depth of your experience.

Professor of Finance

University of Global Studies

August 2015 - Present

- Led a team of 5 professors across multiple departments to secure a $1 million grant for sustainable finance research.

- Developed and co-taught an interdisciplinary course on ethical investing, aligning economics and environmental science.

- Organized annual workshops bringing together industry experts and academics, fostering networking and knowledge exchange.

- Mentored a group of 10 graduate students on collaborative research projects, enhancing their teamwork and analytical skills.

Skills-Focused resume experience section

A skills-focused professor of finance resume experience section should highlight your teaching achievements, research prowess, and community contributions in a cohesive narrative. Detail how each accomplishment demonstrates your expertise and aligns with the employer's needs, ensuring that each bullet point clearly shows the impact of your work. Start with clear language and prioritize experiences that exemplify your ability to engage students, contribute to research, and support your institution.

List your most relevant positions to weave a story of your professional journey. For each role, share specific tasks and achievements, focusing on your leadership, teamwork, and innovative contributions in the finance field. The experiences you choose should showcase your unique impact and growth, demonstrating that you are a proactive educator committed to enhancing the academic experience for both students and colleagues.

Professor of Finance

XYZ University

August 2015 - Present

- Developed and taught graduate and undergraduate courses in Financial Markets and Investment Analysis, resulting in a 20% enrollment increase.

- Published over 15 peer-reviewed articles in top finance journals, advancing understanding of financial modeling and risk management.

- Mentored over 30 graduate students, guiding thesis projects that were later showcased at national conferences.

- Chaired the Finance Department Curriculum Committee, overseeing the implementation of a modernized curriculum that boosted student learning outcomes.

Achievement-Focused resume experience section

A well-crafted achievement-focused professor of finance resume experience section should highlight the specific results and impacts of your work. Instead of just listing duties, emphasize accomplishments that illustrate your ability to enhance learning, advance research, and support institutional goals. Use action verbs to start each bullet point, ensuring that each one showcases a different skill or achievement. By keeping your descriptions clear and concise, they remain easy to follow and impactful.

To provide context to your achievements, mention the scope of their impact, like the number of students influenced or improvements in exam scores. Include innovative teaching methods, successful research projects, or publications in respected finance journals to demonstrate your expertise and tangible contributions to the academic community. Present a balanced mix of your teaching, research, and community contributions to offer a comprehensive view of your professional experience, emphasizing your role in fostering an enriching educational environment.

Professor of Finance

University of Global Studies

September 2015 - Present

- Developed a new curriculum that increased student engagement and success rates by 25%.

- Published over 10 articles in renowned finance journals, pushing the field's knowledge forward.

- Mentored more than 50 students, helping them win first place in national finance competitions.

- Led a conference on global financial trends, drawing over 300 participants from around the world.

Write your professor of finance resume summary section

A finance-focused professor resume summary should highlight your unique expertise and strengths. Begin by identifying what makes you stand out, perhaps your ability to connect with students or your extensive research experience. Then, express these qualifications clearly and succinctly to make a strong impression.

Your resume summary is a chance to quickly show how your skills align with the professor of finance role. Emphasize how you bring finance theories to life with practical examples from your industry experience. Use straightforward language to convey your passion for teaching, research accomplishments, or ability to foster collaboration. This strategy not only showcases your qualifications but also engages the reader's attention. Consider this example:

This summary is effective because it clearly outlines important aspects like teaching experience, research publications, and teaching philosophy. Steer clear of overused phrases and complicated jargon; focus on clarity and relevance.

It's helpful to differentiate between a summary and other resume sections. Unlike a summary, a resume objective shares your career goals, often used by newcomers to a field. A resume profile, on the other hand, blends skills, experiences, and goals into a broader statement. Lastly, a summary of qualifications offers a quick list of your top skills and achievements. Customize each section based on your career stage and the specific job, ensuring it connects with potential employers.

Listing your professor of finance skills on your resume

A finance-focused professor resume should effectively present your skills, which can be a dedicated section or integrated into your experience or summary. Your strengths and soft skills reveal your ability to connect with others, while hard skills highlight specific capabilities you can teach and measure. These skills and strengths play a crucial role as keywords, which makes your resume more discoverable in digital searches and appealing to hiring committees.

Choosing the right skills helps showcase what you excel in, making your resume memorable. It's important to focus on quality skills that relate directly to the role you are aiming for. Here’s an example of a well-crafted skills section:

This skills section excels by focusing on the key competencies needed for a finance professor, merging both academic and practical abilities. This not only helps your resume navigate digital filtering systems but also establishes a connection with hiring managers.

Best hard skills to feature on your professor of finance resume

To demonstrate your expertise in finance, it's important to highlight hard skills that reflect your ability to manage data, teach effectively, and apply analytical tools.

Hard Skills

- Financial Analysis

- Quantitative Research

- Statistical Software Proficiency

- Financial Reporting

- Accounting Principles

- Data Interpretation

- Risk Management

- Portfolio Management

- Econometrics

- Teaching Methodologies

- Financial Modeling

- Strategic Planning

- Investment Strategies

- Budgeting

- Spreadsheet Software Mastery

Best soft skills to feature on your professor of finance resume

Equally important are soft skills, which build strong relationships with students and colleagues. They show your capacity for effective communication, teamwork, and leadership.

Soft Skills

- Communication

- Adaptability

- Problem Solving

- Teamwork

- Creativity

- Time Management

- Emotional Intelligence

- Conflict Resolution

- Public Speaking

- Empathy

- Motivation

- Leadership

- Patience

- Project Management

- Networking

How to include your education on your resume

The education section of a resume is a crucial part for a professor of finance. It highlights your academic achievements and provides a foundation for your qualifications. To make it relevant, tailor the section to the job you are applying for, excluding any education that doesn't support your finance expertise. When including GPA, make sure it's impressive (typically above 3.0) and specify it as well as cum laude honors, if applicable, directly after your degree. Clearly state the degree you have earned, followed by the institution and the year of graduation.

Consider this example:

In contrast, a good example for a finance professor:

The second example stands out because it is specific and relevant to a career in finance education. The listed degree from a prestigious institution, notable GPA, and honors like "magna cum laude" underscore academic excellence, which is crucial for a professorship. Such details demonstrate your credibility and fit for the role.

How to include professor of finance certificates on your resume

Including a certificates section in your resume is important for a Finance Professor. Your certificates show your expertise and commitment to continuous learning. To include certificates, list the name of the certificate, include the date you received it, and add the issuing organization. You can also include certificates in the header of your resume.

Example for header: "Dr. John Doe, PhD. | Certified Financial Analyst | Chartered Financial Consultant"

Here is how to structure a standalone certificates section effectively:

This example is effective because it highlights certifications directly related to finance and risk management. It shows dedication to the field and enhances your credibility as a Finance Professor. Including the issuing organizations adds legitimacy and context. This concise format ensures that the reviewer quickly sees your qualifications.

Extra sections to include in your professor of finance resume

Crafting a compelling resume is an important step in securing a position as a professor of finance. Your resume should showcase not just your educational background and professional experience but also highlight additional skills and interests that make you a well-rounded candidate. Consider incorporating the following sections to enhance your resume.

- Language section — Highlight your proficiency in multiple languages to demonstrate your ability to engage with a diverse student body.

- Hobbies and interests section — Showcase your interests outside of finance which provide a more complete picture of you as a candidate. This can also reveal transferable skills or passions that align with your professional goals.

- Volunteer work section — Display your commitment to community service and your willingness to contribute beyond your academic duties. Detailing relevant volunteer experiences shows your dedication to societal impact.

- Books section — Share any publications or books you have authored to underline your expertise and thought leadership in the field of finance. This reinforces your profile as an authority and can influence your reputation positively.

Incorporating these sections will help set you apart, demonstrating not just your qualifications but also your multifaceted character. This comprehensive view can be beneficial for hiring committees looking for candidates with a broad skill set and various interests. Tailoring each section thoughtfully ensures they enhance your professional narrative effectively.

In Conclusion

In conclusion, preparing a finance professor resume is a strategic process that blends your academic achievements, teaching practices, and industry expertise into a cohesive narrative. Your resume acts as your professional story, highlighting your experiences and skills while emphasizing the unique contributions you can bring to an academic institution.

Each section of the resume, from the education background to the skills list, plays a crucial role in showcasing your ability to engage students and advance financial knowledge. Using an organized format helps convey your qualifications effectively, making your resume stand out to hiring committees. Integrating real-world examples from your career and quantifiable achievements can amplify your credibility, demonstrating a seamless link between theory and practice.

Furthermore, extra sections like language proficiency, interests, and volunteer work can enrich your resume by adding depth to your professional persona, reflecting a holistic approach to your career in finance education. Selecting the right format and maintaining clarity throughout ensure that your document is not only professional but also accessible to readers.

Ultimately, your resume should be an accurate and engaging depiction of your professional journey, aligning with the values and expectations of the academic finance field. As you prepare your application, remember that every detail counts, and each section of your resume is an opportunity to highlight your potential as a standout candidate. By focusing on these aspects, you can present yourself as a well-rounded, informed, and passionate educator capable of making impactful contributions to the field of finance.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.